Where did all the housing inventory go? Listed inventory down over 20 percent from last year and at lowest levels since January of 2001.

This might sound like the start of a riddle but really, where did all the housing inventory go? In the latest piece of data we find that listed inventory is now at levels last seen in January of 2001. That is right, today we have the same number of homes listed for sale that we did 12 years ago. This continues to be the biggest underreported story in the housing market. A large part of this has to do with the external forces interacting with housing. One has to do with banks holding on selectively to distressed properties while another is the dragging out of the foreclosure process. Next, you still have roughly 10 million Americans that are underwater on their mortgages. Think of that when you realize that only about 1.8 million homes are listed for sale. Those 5 million homes in distress either because of foreclosure or missing payments sure would relieve some of the pressure current buyers are facing.

Inventory keeps moving lower

The reason we have yet to see a massive boom in building similar to what we saw in the 2000s with the first housing bubble is that builders realize these underlying dynamics. In fact, about one third of new building projects are going to multi-family units to meet market demands for a less affluent young generation. Remember those 2 million younger Americans living at home because of the recession? Their first step is likely to be a rental before buying a home.

The fact that roughly 1.8 million homes are listed today, nearly the same as we had in January of 2001 is stunning. We’ve added over 33 million people in that time to the country. The inventory pressures are larger in certain markets like California where some areas have seen inventory decline year-over-year by 50, 60, and even 70 percent:

I found myself laughing when I saw that Silver Lake was voted America’s Best Hipster neighborhood. It is also likely to be the hottest for flipper activity. The fact that inventory is so low coupled with low interest rates has caused some mania like behavior. For example:

-Over bidding listing without really examining fundamentals

-Bidding wars

-Buyers offering additional items like personal letters or PowerPoint presentations to win over sellers

-The fear that people need to buy now or risk missing out on future appreciation

Because of this, there is a big rush to buy but we are also missing out on the bigger economy. Yet the rush is not as big as you would think in the bigger picture. You basically have a feeding frenzy for the few properties hitting the market. Banks are addicted to leverage and nothing provides higher leverage than housing.  Unfortunately, since the late 1990s the US has been obsessed with subsidizing the housing market to the next level. So it is no coincidence that during this time we saw the biggest housing bubble in our nation’s history. Yet nothing has really changed underneath it all. It is also no surprise that we are facing an unprecedented crunch in regards to housing inventory. Massive market manipulation usually leads to unintended consequences all over the place.

Inflation and more money sent to housing

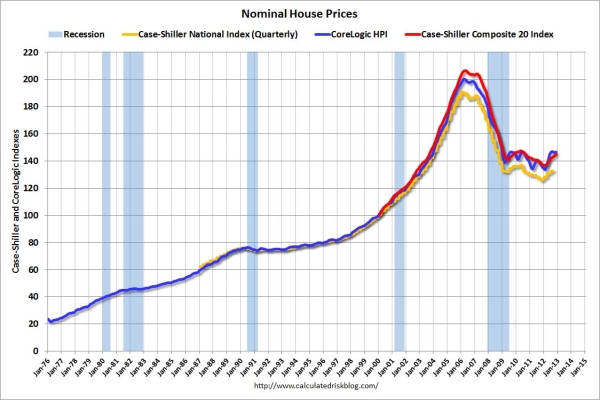

Home prices in the US are up over 40 percent since 2000 on a nominal basis looking at the Case Shiller Index:

Over this time, nominal household income is up about 25 percent. Let us not even look at inflation in healthcare or higher education but what you find is more money is being yanked into these other areas as incomes are not keeping pace. This is why FHA insured loans have been such a popular alternative since 2007. People were knocking those no-down payment loans but here we are basically offering 30x leverage with these loans and the default rates are atrocious.

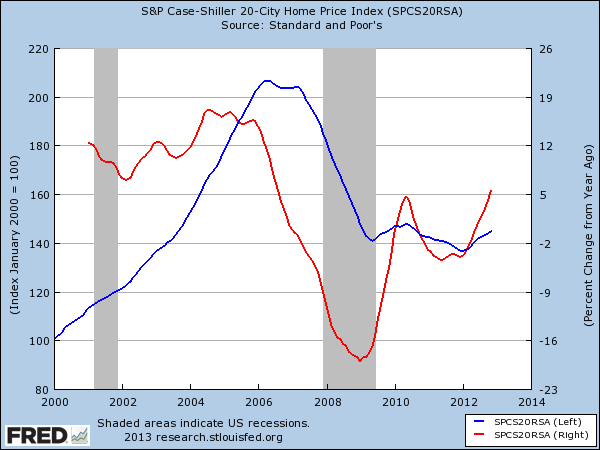

These factors combined have caused the Case-Shiller Index to have a 5.5 percent annual increase:

There will be some adjusting with the winter data but there is momentum in the market currently. A large part of this is from investment funding and the yields are not looking good anymore. So that money will be the first to exit. Given that this group of buyers was making up roughly 30 percent of purchases on an already low level of inventory, it will be interesting to see how the market will adjust. Obviously flippers will only keep flipping if these types of gains continue and investors will only dive in until rental yields seem attractive. The general public will buy no matter what as long as a lender gives them the money and banks will lend money out as long as it is government (aka the taxpayer) backed. Have we not already proven that?

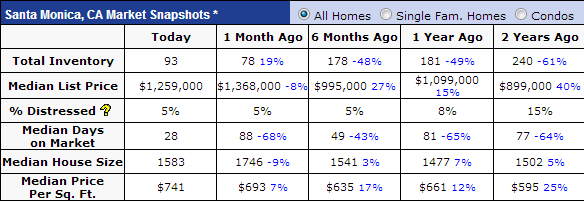

Just look at what is going on in a place like Santa Monica:

Inventory is down by over 60 percent from 2 years ago and the median list price is up 40 percent and the median square foot price is up 25 percent. This sure seems sustainable.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

129 Responses to “Where did all the housing inventory go? Listed inventory down over 20 percent from last year and at lowest levels since January of 2001.”

A large part of this is from investment funding and the yields are not looking good anymore. So that money will be the first to exit.<<<<<

Maybe, maybe not.

Seems to me what is different this time is, there is much cash around, the wealthy (people and corporations) are richer than ever, plus with the global economy, good homes in good locations will continue to do well (look at Hawaii,million dollar homes are plentiful. Sure, some flippers, but they just provide liquidity….it would be different if the recovery was long in the tooth, but not yet. I do think banks are holding onto homes for two reasons, they would have to reduce the value of the homes on their books, so less bonuses for executives, plus with interest rates so low, not a great time to be a lender.

So, I think many of these "investment homes" are in strong hands. I see the worry like you present, valid, but also a good thing since budding booms always climb a wall of worry. Worry is a necessary ingredient. And, always location, location, location are so important with RE, just that I think it is even more important this time.

ah, Joesph, the banks are passing off, what 90-95%, of all mortgages to the FedGuv? so they’re not exactly in the lending business, more like the servicing business. and they’ve already got their loan loss reserves estimated for x quarters out and still have quite a giant inventory on their books waiting for the call to the listing broker.

as far as your wall of worry is concerned, wake me when the Case-Shiller 20 city crosses 150 and sticks it for a quarter. until then, your pom-poms will be hitting a glass ceiling.

Banks, in”servicing” loans, still would earn more on loans if interest rates were higher. So, not a great incentive at this time.

Case-Shiller? Pretty much a lagging indicator, as it reports past sales……it’s main importance at this point is that it does confirm a bottom has been hit and a rising trend is in place. Waiting too long for fantastic readings guarantees being too late. Real money is made when there is still some obvious risk, just that wise people recognize early signals of future strength……AND history NEVER repeats exactly…it is mathematically impossible………negotiating financial markets is an ART, not a science.

point taken on servicing Joseph, though how many of those interest rate losses have been offset by the tax escrows due to the meteoric rise of property taxes over the last 3-4 years? would be an interesting chart to see to settle the matter.

the problem with rising interest rates would be that, at this juncture, they would cause several of the banks and numerous governments to implode and the societies which underpin them to crumble. if that were to happen, most people would not be too concerned with house flipping at that point.

as far as C-S, if you look at the graph: http://tinyurl.com/ac5kh56

don’t know about you, but that looks like it go either way to me.

is the 4th time a charm or is it another fakeout?

it probably doesn’t matter as long as you pay a reasonable price.

paying a reasonable price means not falling victim to a squeeze.

hence the caution.

most people buying (outside of those gifted with funny money tricking down from the central banks) are making multi-decade commitments to go into debt at a time where there’s a possible case to be made that they could be strangled by their decisions. is three months too long to wait for a confirmation after the biggest bubble blown to date in real estate? not if you’re looking to build on a solid foundation. but yes, if you’re looking to take a ride on another bubble, then sometimes you gotta roll the dice. but you know about those bubbles, when they run out of steam, they go POP!

i agree that playing the financial markets is an ART, but you should understand that not all of us wish to play the markets for its own sake, but to create &/or store wealth. and the ART in creating wealth is in not confusing the menu for the meal.

The obvious purpose for low inventory is that it pushes up prices, which reduces the number of homes under water, thus reducing foreclosures and halts the deflationary spiral. We know that’s what the government wants, but it’s not clear that banks have been deliberately withholding foreclosures to that end. On the other hand, it would seem to benefit them, so can’t be ruled out. The only way to point the finger is to measure the trend of REOs to organic sales.

If there was only one home left, some sucker would buy it boasting the billions he paid. So trying to convince buyers to hold out until more sales listings appear is a hopeless cause. Common sense has become unfashionable.

Banks know the foreclosure wars are not over yet. Titles are clouded. States and recordation officials are still suing – not a good time to dump inventory on the market. Moreover, smart investors are staying away from the karma of bad real estate. The horror stories of buying foreclosed homes only to find out the foreclosure was void, not to mention the unexpected costs of defending the purchase – just isn’t worth the ride at this point.

Furthermore, banks need the asset inventory to help balance their insolvency…property, is the new gold standard until forking over HOA fees, maintenance and taxes start to catch up.

It would be interesting to hear some of the horror stories of investors getting burned. It is a jungle out there, and the main players are …? Animals! My faith in mankind has taken a huge plunge as I continue to witness activity that is either criminal, or beyond the pale in terms of social behavior. Real Estate has become a one way ticket to hell. Due diligence means nothing anymore, as the relentless scramble intensifies to make money from RE after the collapse, drawing in innocent money, that is so often just siphoned off by professional negligence, and fraud.

I know several large REIT and hedge funds that have stopped buying in CA. , Az and Nevada and moved to other areas the market is done and over saturated with fools buying(aka Chinese). But keep pumping your BS.

Classic. The hedge funds get in first and when they’re through scooping-up what they want, they leave. And then the retail buyer is finally able to start buying and keep the buying pressure raising the prices. And the retail buyer may get so worked-up that they will keep pushing the price up past rent parity and beyond.

The one thing I’m seeing is that homes above the rent parity level have much less buying pressure on them. So this recent rebound in prices may not last more than a year or two.

There might be cases for “rent parity” out in BFE but show me where it exists in the more desirable areas.

I live in a little town in NorCal and we have some decent homes selling for $400K to $500K. A $400K loan is $1,770/month. And this would be a 3/2. Rent for this same place would easily be $2,500/month here. $500K would be $2,200/month. So, even with PITI, it’s pretty close to parity.

You just proved my point. Small town in NorCal = BFE

I should clarify…..I can drive into down town San Francisco in about 20 minutes. And it’s not West Oakland. I just looked on Redfin and I found several homes 2/1 and 3/2 that were in the $500K range. Good schools. Not crime ridden , etc…

Last year, I could have found 20 of them, now there’s 3. But still some available.

CAE does not live 20 minutes from San Francisco with $400k houses available unless he lives in West Oakland (high murder rate). Houses this close to SF typically are a million. I live in Petaluma (40 miles north of SF) and houses are commonly $400-$600K.

Novato, Ca seems more or less what Joe describes. I see 3/2s there for $550k, so a smaller house perhaps would be in the 400s. North bay is a lot emptier than the peninsula or east bay.

“-The fear that people need to buy now or risk missing out on future appreciation”

Beg to differ. What I see on billboards, hear on the radio, see in realtard newsletters is, “Buy now and take advantage of historically low interest rates!”

Are we back to flipper mania a la 200-2007? Yes

Are we back to HELOC mania/move-up mania/Paper gain mania? Hell no.

Why not ask Pappa!? Is he claiming to get rich off his deal? Nope, he’s just sick and tired of waiting and see’s rental parity and he’s getting on with his life.

This is a subtle difference, yet a real one. Why? Every 1% gain in interest rate equates roughly to 10% less purchasing power, i.e., 10% lower prices on the asset resulting in the same monthly nut.

For some reason we can’t even see the interest rate bubble. 3% is the new normal. Ha!

People seemed resolved to the fact that America is in store for a Japan-like 30 year interest rate slow crawl.

The big difference is unemployment. In Japan, it’s hidden and insidious. In America, it’s less hidden and less insidious. Plus, about 11 million illegals (i.e., “hispanics”) are soon going to become full-fledged citizens (shout-out to Cynthia)

Athough the economy continues to skid along, the employment picture continues to improve. The Bernanke has telegraphed the end of MBS purchasing will happen when employment improves.

What happens when the proverbial rug gets pulled out from under the remaining shell of our financial institutions? The days of higher interest rates may not be far behind.

Some people here think higher interest rates will mean nothing to home prices, pointing to a few historical time points.

DRB and others believe that it’s all about the monthly nut.

You bring up some valid points, but I’m not sure the economy is recovering at all at this point, and may in fact be headed into another recession:

http://www.bea.gov/newsreleases/national/gdp/2013/pdf/gdp4q12_adv.pdf

So they’ve just revised the Q4 GDP downward (to -0.1%), and it’s now down over 3% from the Q3 GDP. I don’t believe that’s going to convince Uncle Ben to stop the money spigot flowing anytime soon. Regarding the unemployment numbers, I believe most economists think that the US gov’t numbers are typically understating the real figures by half, since they don’t include anyone who’s basically stopped looking for work completely. Additionally, they also don’t mention the incredible increase in people who’ve gone on SS disability over the past few years (perhaps permanently), as a result of not being able to find work.

I should add that Federal spending in Q4 topped 312B while the GDP reduced that added deficit by…well, nothing. I hope that the real sequestration process will begin in earnest quite shortly.

U.S. corporations are flush with cash like never before. “If” the uncertainty surrounding taxes and spending can be eliminated by theses cowards in DC actually doing the People’s work for once, then we stand a good chance of business turning on the hiring spigot and real employment growth happening in America.

Let’s also not forget that there’s a certain amount of “job growth” that needs to be there just to keep up with population growth. MSM never makes mention of this.

There is one reason this blog even exists, and it’s the same reason no one knows what’s going on. Even though every Armchair Economist does, lol. It’s the same reason home prices are out of whack. That reason is…

The GOV broke the rules. They re-write the rules. They enact hybrid fascist socialism when in a capitalistic society, that’s not supposed to happen. Thus, you get markets that history can not be looked at historically nor predict what will happen.

“We’re following Japan”

“We’re following Greece”

Blah blah. We have similarities but many differences. We are writing our own history books as we speak on this one.

Here’s my bottom line. I’m buying a house and I quite frankly don’t care what the end result ends up being. Why? Because I’ll be PAYING EQUAL RENT anyway.

Queue the sound and fury…

I totally agree with you. Not that history should be ignored but it’s a fallacy to assume there is such a thing as “normal” or that we will return to any prior recognizable state economically. We are entering a new era, globalization is changing all the rules. I keep saying this on here, what if 50% of your income on housing is the new normal? Lets not all pretend we don’t live pretty cushy lives. I’m in LA, a family of four on 70K, doesn’t sound like much right? We still live pretty good!! When you shuffle out a world economy the US is going to fall a couple pegs. Sometimes people need to get their heads out of the books and look around. We are all mortal and time is a ticking. I bought in Sept 2012, best of luck to you, it’s sucks inventory is so low, I hope you find something. I love CA and I will never leave, at least I don’t have to listen to the yammering of some idiot landlord anymore, that is priceless.

It’s a free country and that’s the beauty of the system…even if you are staring at the abyss and willing to jump, you have every right to do so. But when the system is so rigged…IMO it’s not worth getting entangled with by making the largest purchase of most people’s lives. Bankruptcy is not the end of the world, so you have that backstop if things go south. And if it’s a non-recourse loan you take, even better, smaller credit downside if things blow up. However, I can’t see how “equal” rent and mortgage payment seems like a good idea. Ever consider what a new roof or HVAC system costs? Maintenance like the pool, lawn, etc.? Replacing appliances? Slab leaks? Remodeling kitchens, baths? New driveway? Even little things like getting drains snaked aren’t free (as they are in most renting situations – -mine at least). Not to mention taxes, insurance, HOAs, Mello-Roos, etc. Think about how much equity you will have to have to even break even if/when you sell in 10 years. A house I bought in ’99 for $315 had been owne for 9 years…and the guy had paid $275 for it. After having to pay ripoff RE commissions to door openers, and transfer taxes, etc. he barely broke even. He got his down payment back, but 9 years of inflation with no appreciation sure took its toll. So by all means, jump in, and hopefully you’ll have timed it right.

Maintenance – yes. But I’ll take that for the freedom I am paying for.

As far as taxes and insurance, my PITI target is $1500 to $1600, and thats rental parity in my Inland area. Then I’ll get the deduction in April, which wouldn’t happen with rent.

HOA and Mello-Roos? I’m not even in the market for a home like that. I’m looking north of the 210 and east of the 15, I won’t get any more specific than that.

P.S. I know it gets windy there. lol.

You raise a lot of points, but I basically agree….only BUY if you want to OWN a home. Renting has both advantages and disadvantages as does owning. I see it as basically a life style choice. Maintenance costs of owning a home are rarely factored in….and you didn’t mention termites.

Nationally, a homeowner can expect to pay 1% / year in maintenance costs. Less than 1% when it comes to more expensive homes where the majority of the value of a property is in the land.

No matter what happens to housing prices the most likely scenario in 10 years is that Papatobe:

1. will have 25% of his 30 year loan paid off with 20 years left.

2. will no longer have to pay PMI (his monthly payment will be less in 10 years than it is now.

3. If rents average the historical 3% annual raises, rents will be about 30% higher.

No sound and fury from these quarters – at some point, everyone has to make what they feel is a reasonable decision on whether or not to buy. You ran the numbers and came to your own logical conclusion – makes sense to me.

Lord are people stupid. They’ll buy a house no matter how bad a deal it is. This is all foolish rationalizations. Renting is the only smart way to live. You’re a fool if you buy now. Throughout history it’s been a pretty crummy deal anyway, but to buy now? Knowing what we know? Suckers!!!

I’m going to assume that this post was a parody, right, Cat? For if not, sheesh.

I am not sure exactly what you are trying to say, but I do agree that the important thing is if buying a home makes current sense, it should be done…..trying to predict the future is not wise. In fact, I just have done a RE home buying deal…….it makes sense no matter what happens in the future, or almost anything…..there is always some risk in doing anything.

Joseph, what I’m saying is that Papa’s other non – financial factors for buying really cannot be measured. Not having to deal with a landlord, having a child that will eventually need decent schools, etc. – difficult to put a hard number on any of those realities. I lived in two condos for over two decades in Chicago, lost money on my first one (bought at the top of a local boom in ’90, sold at the bottom in ’98), and made a little on my second (sold last year). When I factored in all of the ancillary expenses as well as the large ones (i.e huge increases in property taxes as well as replacing roofs), I came to the conclusion that I probably broke even after all those years. Now I rent, but hope to buy again in the near future – but I’m in no hurry.

That’s wonderful that you have decided to buy. However, many people have careers that don’t keep them in the same city for more than 3-4 years. If you know that you are not going to move in 5-10 years then by all means you should buy. I agree with the whole “monthly payment nut” (payment) thing. People will buy however much they can afford – or feel comfortable paying – per month as opposed to what the total cost is.

Well, OOPS, that is one reason I continue to say, location, location, location is SO important…..the ability to rent the place out at a decent rent helps protect a homeowner who is forced to move earlier than expected. Plus, a great location also can make the home easier to sell. A home with a nice view can add to saleability, also….so a reason to want a home with a view, not just because of the aesthetics. Location is so important, I think unless a home has a good one, buying is a bad option, period.

Unless one is very lucky, being a landlord sucks. Every accidental landlord is just one shitty tenant away from eating it on P&L.

No one here is stopping you from leveraging up. Why the need to constantly remind us of your personal situation?

If you’re that content with it, why come here to repeatedly mention it? You must have some concern, otherwise what would even be the point of reading this blog?

@Joe…

It’s sock puppetry. Why else would people who (supposedly) already bought feel the need to convince the fence sitters that now is the time to buy?

@clearasmud, my thoughts exactly

Entertainment.

Well if it’s simply entertainment for you to come here and constantly tell us about your personal situation, far be from us to judge how you spend your time whilst van pooling.

You were instructed to STFU until you understood exponential functions and finance, which you failed. Yet another one of life’s tests that you fail. Shocking!

And what happened when a very limited number of people were screaming in 2006, that housing is in a bubble, and shorted the very asset classes that you and your ilk were screaming “it cannot go any lower, it’s only going up…I need to get in at all costs…no one can predict the future…rent and buying are at parity….â€

These are the very people out there that made an ass load of money during the collapse and afterwards. People made on the order of 75%+ REAL returns during 2009-’10, let alone the money that was made shorting the stupidity of your kind. Which begs the question, if according to you, no one can predict the future, then why did people make these bets and how are they so wealthy in the aftermath? It should be painfully obvious to anyone with an IQ over 75 – the writing was on the wall, in plain sight if you know what to look for, which you obliviously do not.

There are lots of measures of stupidity. A very popular metric is the person’s inability to correlate actions with consequences. In your language, stupid is what stupid does.

Unfortunately, due to the Downing Effect, your kind who latchs onto these housing dreams cannot discern the credibility of those who authoritatively dismiss them.

DFresh said, “The days of higher interest rates may not be far behind.”

We don’t really know. One of two things will happen. Either interest rates are going to rise or the dollar will get marked down, as part of the coming hyperinflation.

If rates rise, we are going to fall into a deflationary spiral with housing prices collapsing. Far more likely, the dollar wins the race to the bottom, QE-x continues, and the price of everything, goes way up. This is a the probability outcome.

The deficit figures you hear on the news are just the cash deficits, about $1.3 trillion per year for the last five years, at the federal level. The actual 2012 federal deficit, on a GAAP accounting basis, was $6.9 trillion, according to John Williams of Shadowstats.com. That is 45% of GDP and represents money creation on a historic basis. We are going to have hyperinflation within a year or two. My guess is that food and energy will be going up a lot faster than housing, though.

Inflation is no longer measured in “prices”. It is measured in available credit. Prices can go up all they want and squeeze everyone, but we are a credit/debt based economy. Last I checked, credit was still contracting therefore I don’t see hyperinflation.

Another reason is the $600 Trillion in total credit, derivatives, swaps, and any and all other B.S. “financial instruments” floating around the world. Yes it’s that much. A trillion here and trillion there is smoke and mirrors for us lemmings of the world, and will have little effect on the macro picture. Again, no hyperinflation.

Papa I’ll second that. $600 trillion in floats.

And fact is $16 trillion does look pretty small against $600 trillion. And I believe that number. But why do we float?

My answer reflects what is stated in the article posted by WEDon’tDrinkAnymore.

If we were still on a gold standard our enemies would have an ability to manipulate our currency. We float to survive. Nixon took the upper hand then and threw a sack of American Exceptionalism in Chairman Mao’s fuel tank of hope and change.

The US Dollar is backed by American Exceptionalism and the communists know it.

An article I found interesting, you might enjoy…Bill Gross on the Credit Supernova!

http://www.pimco.com/EN/Insights/Pages/Credit-Supernova.aspx

Artificially low mortgage rates and contrived inventory equal price squeeze. This is a lot like a classic stock short squeeze, fast but short term rise in price. Please keep in mind the overall picture, energy is no longer cheap and that is what created the US growth after WWII until recently. We have high energy prices and tremendous debt and social obligations as far as you can see with little or no possibility for real growth. It’s the luck of the draw, sorry, hipsters.

Energy is relatively cheap. If you priced it in 1999 dollars 🙂

We can have standard of living growth as technology makes items cheaper and cheaper and housing resumes mild deflation in a couple of years. But wage growth (real or nominal) ain’t comin’ to the masses anytime soon.

this game wont last 2 more years, it would be wise to live well below your means

King Obama gonna get rid of the debt ceiling. Get ready for a major bull run. Of course the end result will be utter disaster, but the next 4 years of his are going to “look” pretty good. This guy doesn’t think like normal presidents. And I’m hardcore right wing, you have ot look through the bias confirmation everyone wants.

Papa, I gotta agree with you on this one. No hyperinflation. How can we have hyperinflation when the money isn’t making it’s way to the masses? How can milk go to $10 a gallon or whatever if wages don’t increase? I love the nonsense comments on here that are completely contradictory to themselves.

Release the Kraken! Raise the debt ceiling to infinity for all I care. Just give me a bigger slice of that good old fattening American Pie!!!

Yummo!

RE: Balls

That’s the point most are making. You can’t have hyperinflation without a rise in wages. That also means that you can’t continue to buy MBS and destroy the dollar in a global economy. Something has to give. In this case most of us think it will be housing prices and rents. They aren’t going to collapse but this current run is an illusion. take 2010-11 prices and shave off about 5% with mortgage interest rates going backup to the 4.5-5 range. That’s most likely the bottom we’ll reach in 2014 or 2015.

With the coming global second or third dip into the recession area — Depressions are serial recessions — I see another decline in US house of 30% as being possible.

A bottom in housing will occur when no one cares about buying a house, and interest rates are much higher than they are now.

This crisis we have been experiencing was caused by Wall Street’s deregualtion and by Washington’s eagerness to climb into bed with the billionaires on Wall Street whose money perverted our democracy into a Plutocracy.

The solution: spending cuts AND more taxes on the rich, for the paying down of debt. I am a fiscal conservative — but everyone has to pay for the DEBT BUBBLE HELL we have brough upon ourselves, through our Religion of Greed (note: Capitalism and Christianity don’t have the same values) and through our undisciplined spending (our military spending is obscene). WE need to pop bubbles wherever we find them: health-care, higher education, bond market, stock market, housing. Higher prices without higher wages is suicide for our culture. Higher wages is infaltion. Some prices must come down.

Thank you, Wisdom! “A bottom in housing will occur when no one cares about buying a house, and interest rates are much higher than they are now”

I now have my contrary indicator.

When DHB posts dip below 10 comments per article…I’m buying!

Seriously, there’s way too much fear/greed in the current real estate market to clearly see today’s real estate picture. I remember when I first bought in 1998, buying a house had nothing to do with getting rich, HELOC ATM’s, timing the market, taking advantage of 3% interest rates…it was just a mundane thing to do.

I am *SHOCKED*, absolutely *SHOCKED* that Dr. HB, and all the readers of this blog, missed the following press release from the Federal Reserve Board:

#1: From April 5, 2012: http://www.federalreserve.gov/newsevents/press/bcreg/20120405a.htm

“…in light of the extraordinary market conditions that currently prevail, the policy statement explains that banking organizations may rent residential OREO properties within legal holding-period limits without demonstrating continuous active marketing of the property for sale…”

Summary: Banks are now allowed to become landlords. The old policy forbade banks from renting out foreclosures. Banks do not have to list foreclosures for sale either.

#2: The legal holding-period limits (referenced in #1) are defined by: Federal 12 U.S.C. § 29

http://www.gpo.gov/fdsys/pkg/USCODE-2011-title12/html/USCODE-2011-title12-chap2-subchapI-sec29.htm

“…the title and possession…of any such real estate by such association for a period longer than five years, but not to exceed an additional five years, if (1) the association has made a good faith attempt to dispose of the real estate within the five-year period, or (2) disposal within the five-year period would be detrimental to the association.”

Summary: Banks are allowed to hold on to foreclosures for 5 years, and up to 10 years if selling the property would harm them in any way.

Those are the two reasons why inventory is disappearing, not some mysterious hedge fund or REIT buying up foreclosures.

Thank you for confirming why I think inventory is low (5 years to foreclose, plus another 5 if the bank can show cause as to why foreclosing will harm them – easy to do). So, we’re looking at 5 to 10 years for foreclosures to hit the market. Then, consider that this only applies to homes that have been served with foreclosure docs (so much shadow inventory can remain). Bottom line is that banks can put toxic assets on the market when it is best for them to do so.

And then, we’ve got QE3 which is the Fed buying toxic assets to the tune of $40 billion per month (until unemployment reaches 6.5%, aka “until pigs fly”). So, essentially, why would housing prices decrease?

And then, when you think about it, the situation must be bad, very, very bad. I mean these are drastic measures, and yet all it’s doing is keeping housing prices from dropping. You’d think this magnitude of measures would be enough to double housing prices, hence, as I said, it must be very, very bad.

“So, essentially, why would housing prices decrease?”

Because just like the last bubble you run out of greater fools while the first group of fools leveraged to the hilt go belly up. This extend and pretend RE market is in play because the FED knows there will be cyclical foreclosure waves from her on out! There is no more job security so you move the asset from fool to fool. Perpetual boom and bust and the over leveraged borrower just get’s right back in line after his foreclosure.

If government buys mortgages, won’t THEY be foreclosing on everyone soon rather than the banks? I know people with Bank of America loans that have been living in their house free for six years now. There are vacant bank owned homes in the neighborhoods that have been vacant for five years now. The government could turn over the homes to say Chinese and foreigners to pay off our debt, or resell the mortgages to Chinese and foreigners and let THEM foreclose on US homes.

Sadie you’ve got it right. Resolution is not yet arrived.

I well remember when Orange County retirees had to sell because they could not afford the property tax increases. Many were moving to Bakersfield just as I was selling. Good for me!

Now I may be looking at the other side as counties and states are desperate for new cash. Just ongoing cycles. No resolution yet.

I should add (to the comment I just made about reasons for low inventory) that somehow we (the people) will pay for it all. The problem is that we don’t know the form of payment. Will it be hyperinflation of costs of goods/services? Will it be massive taxes? Will it be human lives, such as a major war? Will it be slow and gradual or sudden and depressionary?

Dunno. All I know is it that it won’t be the financiers that suffer. It will be us, unless we somehow take down this system of finance.

Those who guess the way in which we’ll pay correctly might make it through. Let me know when you have the answer. I want to make it through.

Shrink goverment

Some claim that the housing bubble has completely deflated from these graphs…

http://www.jparsons.net/housingbubble/

If home prices rise for lets say another 2 years, at 5% per year, and then in the 3rd year they drop 10% then that is not much of a reason to wait. If prices rise 10% per year for 2 years then drop 20% that is not a reason to wait either. The only reason (for me to wait) is it prices rise 5% a year for 2 years then drop 20% …. and I am wagering that wont happen. And no one can say with any meaningful data that inventory will be any better in 2 years either. Ergo, I am buying a house but for sure I will at least keep the purchase price less than 3X my wife and my salary and purchase a home to live in the rest of our lives (we are both self employed and are much less susceptible to forced relocation). good luck to all!

Those are national numbers, though. Most here are interested in the micro-market of Southern California, which was not only the epicenter of the buy-side and supply-side shenanigans leading to the bubble, but the area that stubbornly clings onto mid-bubble prices.

One of those graphs proves that we’re in a 30-year bond bubble.

Here’s a cool story bro.

My wife’s brother had a business selling gloves to medical offices. He borrowed a bunch of his parents money to start the business. The business failed. As it turns out the parents needed the money back, but guess what? It was gone. So, the brother sank the business, and in the stress of it all have the keys to the warehouse full of unsold gloves to the parents as payment. The parents needed to pay taxes on their business and had to take money out of the family business to pay reducing their capacity to make money, and therefore future spending power.

Those gloves are still sitting in public storage running up a fee each month.

As long as the US government is providing cheap capital to the banks, those houses are just going to sit and rot.

Think for a second about the pent up demand that will explode if prices were to become more reasonable. All these people living with their parents and siblings! No thank you. I’d rather scrimp every month for independence, but that’s just me.

This blog is funny, such speculation, I’m not an economist and with the state of education in the US I assume most people are not, therefore I don’t understand how you can attempt to predict behavior when no one is playing by the same rules. If this is about lending and approvals, inevitably someone will fill the vacuum left by the big banks, if there is money to be made off lending money someone else will do it.

Maybe we are going back to the days of wealthy land owners (land LORDS), I don’t know, I’m just glad I’m not renting and it will be a long process to evict me from my house, if I ever can’t make the payment.

that’s the spirit!

We are alreday there. Our corrupt govt is the Lord of the land. Don’t believe me? Stop paying your property tax. Anyone holding rulemaking power is merely a puppet for the banks/Fed. Property rights are the foundation of liberty and freedom which evaporated slowly over the last 75+ years. Sorry America, the party was fun while it lasted.

Candace, don’t worry about not being an economist……so many economists are always wrong. It is less science than art…..plus, the wealthiest people aren’t economists…..that said, there are some things about economics which are helpful, but I think one can get a decent knowledge about them on their own by reading. Probably, the most important thing is in selecting which economists are worth listening to….basically two types, neo-liberal (free market types) and traditional (Keynesian types)…..personally I favor traditional, but do think some neo-liberal things are worth factoring in…..so, basic knowledge of both I think worthwhile.

Papa Now, you’re hard core right wing? I’m so happy you just bought a house!

Wait until the new parent hormones wear off. Your decisions will look very different. But then it will all be Obama’s fault, anyway.

Hey guys,

Long time reader, first time poster. I found this site after getting frustrated with terrible data and reporting from major news networks painting a great picture of the housing market when I knew it was clearly not. I’m not in the finance or real estate industry, but have recently become more interested in these areas as a prospective home buyer. I quickly found the rabbit hole and stopped myself when I found this site.

A little about myself: I’m 30, married, and live in the suburbs of Chicago, renting a one bedroom apartment. Between the two of us, we have no debt, are both employed, and have a very nice chunk of change saved up. We met with a bank about six months ago, and they were willing to give us a loan much higher than we were looking for; one that would stretch us to payments near 50% of our gross income, which is much more than we want.

The question we keep asking ourselves is: when should we buy? Most of what I read here points to waiting a few years until the foreclosures all get on the market and bring prices to its actual level, instead of its current (inflated) level due to held back inventory/foreclosures. However, a few years from now we will have different problems and another reason to wait, such as potentially higher interest rates, inflation, or something else. At the end of the day, I believe the answer will always be to wait. Meanwhile, I’m living well beneath my means in a one bedroom apartment and am sitting on enough money to buy multiple one-bedroom condos in cash. Technically not a problem, but the money is a waste if it’s sitting there doing nothing. And I’m too conservative to do something crazy like invest in metals, foreign currency, or stocks.

My thought is that now is the time. Prices don’t seem to be dropping, because the availability is kept low and will continue to be kept low until the foreclosure quantities are gone. The advice I have been given is to wait a couple years until I really need a house, AKA when we start a family. In the mean time, get a bigger apartment just to make us happy, since we can afford it.

Any thoughts are appreciated, since this crowd seems to be fairly knowledgeable, at least compared to most internet sites.

“The advice I have been given is to wait a couple years until I really need a house”

Agreed. Buy when you are ready to buy. There’s no point in buying a 1 bedroom condo if you’re going to need to sell it in 2 years to buy a house.

Down the line when you need the house, if rents are comparable to owning the house, buy then.

MB, I apologize if my initial message was unclear. I am not considering buying a 1-bedroom condo, I was simply using that as an expression. We currently have enough saved to put down a healthy % for a house.

I understand and appreciate the comment to wait and save more to get something even better. This is always a good positive and a great argument to save. That, and I realize that when you ask five people (who know what they’re talking about) and they all agree to rent, they’re probably not all wrong. Even if I want them to be.

I suppose my rant would be that right now, we are doing very well for ourselves and our “quality of life” is not that great because we’re renting a 1-bedroom. Why do we have to wait until we have kids to have an awesome home? I would like to have a basement to set up a golf practice area, and maybe have a little back yard with a putting green or soccer goal.

If you guys were to get kicked out of your lease tomorrow would you look for a nice home with a yard to rent?

If that answer is yes and you’re going to stay longer than 5-7 years, and PITI is comparable to rent, buying seems like a no-brainer.

Yes on wait a few years for prices to fall (and interest rates to rise) while saving more cash for a bigger down payment on a bigger house that will (might) become your first and last house.

If the family starts to grow (then even if housing market timing is not ideal) jump at the best opportunity available; the family needs a home for a better quality of life.

Prices in the Chicago market mostly make sense whereas they mostly do not make sense in SoCal, which is the focus of this blog.

Sorry to burst anyones bubble but buying a home will never be a better deal than renting in your lifetime. The truth is it never was a good deal. Americans are just brainwashed. If you want the benefits (freedom) of owning a home you are going to have to pay a premium for it. You’ll pay in money OR in risk of loss, or both.

I know you’re a troll but I’m going to play anyway…

So my grandparents, who spent $55k in 1979 building their house, got a bad deal? They have been mortgage free since 1994, and the property is worth around $200k.

They really got the shaft. Too bad they aren’t renting the good life, as you say. Just think, they could be living it up paying $1200 a month right now!

My answer to “When should you buy?” is simply: Not before you read The Housing Trap, by Patrick Killelea.

If you’re sitting on enough cash to buy “multiple one bedroom condos”, why would you be concerned about higher future interest rates?

Think about what’s most important to you. I mean, why the “need” to buy a house? and how expensive does it really need to be? Probably not the most you can afford, but perhaps something that would be the price of 3 on bedroom condos.

Here’s some random thoughts about it, to consider. Sounds like you have a lot saved, which can be great for retirement, vacations, hedging for the future. And if you have been able to save that much and you live below your means, just think what you could save in the next few years. Also, when it’s all in the house, it’s not liquid. I am quite sure there will be times in the next few to invest in CD’s and some regular stocks that aren’t as risky as they are now. With all that savings, consider keeping 50% of it and then buying with the other 50%.

I would buy right now if you can swing the loan and have a good down payment. The trend upward has some time yet to go. But don’t be afraid to sell should the house go up 20% to 40% in the next year or so. If you sell in 2 years, you get the $500K tax free profit deal as well. You can’t get that almost anywhere anymore.

You have to wait because if the price you pay for your house (if you purchase now) is artificially too high and the market suddenly drops, then you’re stuck with an underwater house. Therefore, you would lose your down payment (if you needed to sell) because you would sell at a loss.

On the other hand, if you buy now and it becomes underwater but decide to live in it underwater (meaning you can make the mortgage payments) then live on.

Living in an underwater house is no problem as long as you can afford it and it meets your family’s current and future needs.

Aaron you might be interested in this:

http://www.demographia.com/dhi.pdf

Your market seems more achievable for a middle class person than our market.

buy a home at 30% of your gross and continual saving your money if you are saving now as a renter you will save as a home owner. if by chance home prices drop buy yourself a bigger home at the same 30% gross. you sell your current home or you rent it.sure your taking a risk but at the end your will have a bigger home.it worked out for me.

I am renting a condo with 7% of my income, and spread the rest of my saving in index fund, Fortune 500, Developed market, developing market and corp-bond. Annual return for 2011 was only 10% but for 2012 was 20-30%. A house might have given me that much appreciation over time, but I’ve already got mine. When the stock market crash, I can get out without paying tax, fee and broker. I can get it done in 1 minute instead of multiple open houses.

Aaron, if you are still reading I have some questions and some words of advice.

First I’ll start with the advice. The advice isn’t anything you’ve never heard before, but it’s probably something you’ve ignored, laughed or as old-fashioned, or flies in the face of other advice.

1) DO NOT PUT ALL YOUR EGGS IN ONE BASKET. Sounds like you have all your wealth in bank accounts or whatever can be considered high-liquidity, low risk, low-yield. You SHOULD have SOME of your wealth in that, and since you are 30 it is very understandable. You are now getting to the point where it is better to put some of that wealth to work for you.

2) DO NOT PUT ALL YOUR WEALTH INTO HOUSING. This is the number 1 mistake people make. Banks will NEVER tell you anything other than “buy the most you can afford” but that is banker advice, not financial advice. Even if you WANT to buy as much house as your wealth will afford, you should STILL keep an emergency fund of at least 10% which is highly liquid for any housing related emergencies, car emergencies, etc.

3) At your age, DO NOT BUY BASED ON YOUR PRESENT SAVINGS, buy based on your current and near-term expected INCOME. My advice – buy a house that is priced at 3x your present household income. That is the house PRICE, not the MORTGAGE AMOUNT.

Do you know exactly WHERE you want to live? This is more important than WHEN to buy. If you know where you want to live and you can afford it then now is an ok time to buy (assuming your household employment income is expected to be steady). You have a very good advantage in that most of the Chicago area is fairly priced right now though some areas are still very expensive (North Lake Shore) and some areas are loaded with foreclosures and should be avoided (2nd Congressional District).

So, if 3x your annual household income can buy you a house you will be happy with for the next 5 years in a neighborhood you will be happy with today, tomorrow, and ten years from now, then don’t be afraid to buy. With the wealth you say you have you should easily be able to afford a 20% down payment. Make a higher down payment if you can, but don’t put more than 80% of your liquid wealth into the house purchase. If this means you can’t do 20% down, then you are looking at a house you can’t afford. Do NOT buy with the intent of making renovations within the first 24 months UNLESS you are calculating those renovations into the purchase price.

If you can do that, I would suggest that after two years you will rebuild your liquid wealth again rather quickly. The only obstacle to that would be a spike in real estate taxes or a personal employment downturn. By NOT buying the most your wealth can afford but rather what your income can sensibly afford you can weather a couple years of “rainy days”. Now, once you are able to rebuild your liquid wealth, you can consider moving up to a larger house, doing renovations that suit you, or – if you bought something that suits you just right – , you can look to put some of that liquid wealth into less-liquid, better yielding areas. Don’t be so conservative that you ignore precious metals (10% of wealth in pm’s is a decent rule of thumb) or stocks and bonds (you can be conservative in these markets as well).

You seem to have any greedy tendencies well in check, which is to your credit. Don’t ever lose that tendency! And I think that conservative tendency includes the first piece of advice again: do not put all of your eggs into one basket. Don’t forget that having all your money in typical bank accounts is ALSO having all your eggs in one basket. A house is one mighty big basket, but if you resist the urge (and urgings of others) to get the maximum house you can afford, you will have done yourself a financial favor.

For everyone who claims to be buying a house, I have some numbers for you. Overall, in the US, only 29% of “homeowners” have no mortgage. Of this number, 39% are over 65 years old. Meaning that only about 18% of “homeowners” under 65 own their homes free and clear. The average person is very unlikely, especially now, to ever end up with a home free and clear.

http://bucks.blogs.nytimes.com/2013/01/16/owning-a-home-mortgage-free/

I don’t really understand this obsession with “owning your home free and clear”. If I have a 4% mortgage that nets out to about 2.5% after the tax deduction. But I can make 3%+ on decent tax free munis. I could pay off my mortgage tomorrow, but see little point.

hmmm, let’s see, because you’re giving money to the banking system (albeit partially subsidized), the same banking system that has a strangehold over the global economy, in return for free capital to give to municipal governments, who by and large, are nowhere near the beacons of fiscal responsibility and who in turn, raise property taxes in order to pay you the interest back in order to maintain their spendthrift ways.

all for a whopping 0.5% net return more or less.

There is no point in paying it off. If you have an earthquake and it destroys your house, you think the insurance people are going to pay for a new one?!

LOL!!!!!

It’s just like the little student loans that I have left at 2.7%. You think I’m in a rush to pay those off? Nope. Why would I? It’s income based now baby! I’m thinking like a regular old baby boomer.

Buy NOW! Pay whenever you feel like it!

Free and clear is more about having a fixed or no income situation. Which is what being retired may be all about in the future. Tax deductions are great if you have income to protect. But a free in clear house is cheap to live in and can also generate very nice cash flow as a rental.

Unless you are a financial wizard market timer, I still follow the old line: rich people collect interest and poor people pay interest.

Also don’t forget that, depending on the mortgage, a loan can be called at any time. Just because it isn’t typically done today doesn’t mean it won’t ever happen again.

Where is the money coming from?!! I just talked to a real estate office in Ventura County and asking her why there are so few homes and everything is pending. She basically said there is low inventory, most offers are for cash and each home will have about 8 offers on it. Prices are going up! She seemed excited and I was depressed!!

I just feel like our family has completely gotten screwed by this whole housing thing, In the early 2000’s prices were going up and we couldn’t buy, they start coming down and it starts to look like maybe we can and than this happens. Banks holding on to properties and driving prices up and investors buying cash and than flipping. Basically, regular families who don’t make tons of money but are responsible with their money are just completely squeezed out of this!! My husband and I married late and we have two kids and are now approaching our 40’s. I stay at home with my children and it just looks like we won’t be able to have a home. I just don’t see it as being possible.

This is just so ridiculous!

A couple of things struck me about your post. “Squeezed out” and “won’t be able to have a home”. I think about it and it shouldn’t be that we have to feel like this about it all.

Nancy Ann-

My husband and I sympathize with you. My husband is 42, myself 37. We have two young children, 6,2 years. We have been renters and recently moved in with Mom in law to accelerate saving for a down payment as we cannot compete with the cash buyers. It is frustrating to see the banks manipulating the markets just so they don’t take a hit. Meanwhile, the quality of life for our children is below what I experienced as a kid and we lose precious time. –From the San Fernando Valley

I agree too, I think kids deserve a good life. My grandpa didn’t help win WW2 for nothing.

Nancy, it’s nuts in Santa Barbara too. My wife and I have been looking at homes, and everything we’ve seen has had anywhere from 5 to 19 offers. We looked at a house listed at $565,000 — it sold for $625,000. We just looked at a condo listed at $409,000, and our realtor thinks it will go for $450,000!

What to know why inventory is so tight? I did it. Yup, it was me. Well several homes anyway. Kept 3 more off the market just last week. Got them into loan modification less than 24 hours before trustee sale. Sure, they’ll probably come to market, eventually, when I do the short sale, but they’re off the field for now.

… And I’ve got a BIG pile of loan mods I’m working on. Sorry guys

Another way the shadow inventory is being delayed. Thanks for the insight.

It bothers me that people want to buy a big house “because kids need room”. They need more money than room after 10 year-olds and if you have to lend money for house, you won’t have both.

Having teenage kids and large mortgage payments (related to income) isn’t a winning combination and 30 year loan means that you will stay (relatively) poor until kids are grown up and have moved away: Kids cost a lot of money.

To me that doesn’t look like a good life plan.

I think part of it is conditioning to think this way about needing a big house. I think we’ve been duped by the Edward Bernay’s PR machine, when it comes to housing.

Before WWII the average house was a 2/1. How did most people cope? Seems like they came out ok. Track consumer behavior for the last 100 years and you can see that it’s pretty obscene.

I am not sure anyone is saying Big House. Maybe some are, I do know people who wish for that. For me a house means a place to stay put, it’s a nesting instinct for me, it’s a feeling of security. Maybe it’s a female thing…I don’t know. Also, more than a big house I want a yard and green space around me. Condo living and apartment living is not for me.

Considering the namesake of this website and the denizens of advice here, i am confused. This site in its commentary sounds like a mouth piece for NAR. No fire, no vigor…just bad free advice…..if anyone asks for advice about buying a house here, on this site….they are hopeless…ly…..lost

Did you have a specific question?

Happy DOW 14,000 everyone!

Too bad a lot of ya’ll doom and gloomers are still on the sidelines from 6,500.

Your basic message is correct, stockpiling gold and guns in one’s doomsday shelter hasn’t been a good route to wealth over the past few years, but there is a middle path. I was pretty strongly in stocks (~80%) when the 2008-09 crash hit and, like many, lost piles of money. I held my breath, didn’t panic, and rode it back up – for a while, but began a strategic exit around S&P 1050 and had reduced my exposure down to about 50% by the time the S&P hit 1300.

So I’ve left a good down payment or two on the table in potential gains that I won’t reap, but as someone within 5 years of retirement I sleep a lot better at night knowing I won’t be totally ruined if (when) another equity debacle occurs.

Apolictal,

I was in the doom and gloom camp for awhile. Then I grew up. Luckily, I sold all of my silver coins to the greater suckers back in 2010/2011. It kept me afloat after I got laid off.

I’ve been sticking with stocks. I buy mostly large cap dividend payers. Other than that, I’ve been stashing as much cash as I can. I keep the cash to pounce on good deals on stocks/cars/houses.

I’m sorry you took a hit back in the crash. It blind sided most people. I set up “sell rules” to keep me from loosing too much money. My rule is if I’m down 10% on a stock I think about selling. I ask myself why did it go down 10%?

There’s a few times where I’ve had a stock, it goes down 10%, I sell, then it goes right back up. BUT, what if it didn’t? I could be down another 20% or more percent.

Either way, I loose a few bucks, but I don’t loose everything.

I never buy on emotions. That’s where people get into big trouble. They have this political believe or some crap that clouds their judgement and they make stupid mistakes.

I gotta be honest though, that whole silver/gold scam made me a lot of money old school style. I’ll buy it back when it’s below $10 an ounce for silver. I’m waiting for it to hit yard sales and these cash for gold fly by nights go away from the local strip malls before I buy in again.

I used to wait every two weeks to buy a small amount. I just kept buying every two weeks, put them in a bank vault, and forget about it. My goal was to buy silver under $20 an ounce. then when it went over $20 an ounce, I’d start to sell. Worked for me!

People have to learn SELL RULES. How much are you willing to loose? How much are you willing to gain w/o pigging out?

Huh?

Looks like someone doesn’t understand the difference between the concept of “trading” and “investing”.

Things are actually worse than this site hints yet I’ve been invested in the market.

DHB is over your head. Try some reference material about “greater fools” and “suckers born every minute”…………..then come back.

There’s the inflation:

http://www.macrotrends.org/1378/dow-to-gold-ratio-100-year-historical-chart

That’d be me.

I hope the surf picks-up in the meantime….

PERFECT example of a fraudulent south pasadena flip, a house that was sold to an insider before it even hit the MLS for what it SHOULD be priced at ($300K)

Then throw some new countertops on it and sell it for the AMAZING deal of only $499k!

http://www.redfin.com/CA/South-Pasadena/607-Fremont-Ave-91030/home/7005383#property-history

Nice $120k Profit in less than six months!

THIS IS A CRIME!!!

HOW DO WE STOP PEOPLE FROM DOING THIS????

WHY DO NORMAL BUYERS NOT GET THE OPPORTUNITY TO BUY FIXERS LIKE THIS?!?!??!

607 Fremont Avenue should be protested!!!!!

Hi JackB

I hear ya Bro. I spent several months looking at homes and did my homework on homes for sale. Often times looking at the ‘price history’ on any of the MLS sites, you often times see this scenario: house sold for 200K in 2003 then sold for $450K in 2007 then sold for $225K in 2011 then a few months later sold for $350K with new floors and new kitchen. It is a sickening fact in the market today. I dont know if it qualifies as fraudulent but my broker said that these underneath the table or backdoor deals are even out if his reach after 20 years as a realtor with all cash buyers himself.

I want to know who is buying them. It seems shady and if realtors w/20 years experience don’t have access. who is getting the inside track?

My time is limited, but if you have a plan to shake things up-let me know!

I’ve seen plenty of short sale scams, but this (fremont listing) is not one of them. We actually live a stones throw from this house. It was a standard sale, original owner, that sat due to condition and location (train/busy street). Went pending once, relisted, sat and then sold for 300k. I contemplated putting an offer in, but never thought it would go for that low of price.

There are definitely some skeevy deals out there, such as short sales that sell for below market when your offer is well above sale price, and agent just never respond to your offer, and it goes pending after 12 hours listed. (I’ve had this happen to an offer or two). But this was not one of them, flipper just got a good deal. The place isn’t flying off the market either.

I agree and said this in a earlier post – how I want to be the one buying the fixer, putting in the $50 to $75K and living in it. I want the dump at $300. I do not want to buy the flip at $499.

EXACTLY – I want it at 300k and I want to LIVE in it…

and fix it up over time

too bad that isn’t allowed any more and we are forced to pay for other peoples flip profits due to insider scams

I will be buying myself at auction only, that is the only way it seems

@3:30 3rd Qrtr 2012

http://goo.gl/iojbK

70 Foreclosures–

L.I. (3 Million People)

ENEN:

Manipulated/Illusory–Banks’

Hands’ Helped In Not Presenting

Losing Collateral (At Your Expense)

Jurow Vs. Wachter (Wharton)

/Bloomberg TV 1/25/2013

http://goo.gl/81xPl

Historic Credit Bubble Burst;

Ocean Of Delinquencies, Massive

Portion Of Market; High Re-Default

Rate

What Jurow Is Much More

Consistent With Than Is

Wachter, And, For Me, How

We Best Know The Real

Estate Crash Is Sill On:

Remember:

You Would Be Getting More

Than Nothing On Your

Safe Money

(Remember?

When You Wake Up, And

Go To The Bank, You’ll

Learn Your Safe Money’s Is

Earning Nominal Interest

And Negative Real

Interest) If The Banks Didn’t

Need Bernanke’s Carrying

Of Their Own Self-Created

Bubble (Still.)

(4 Years Of That Now. It

Looks Like Wake Up, Go To

The Bank, Find No Interest

On Savings This Year Too.)

Do You Remember More Supply Down-Pressures

Prices? And Foreclosures Should Down-Pressure

Most Of All? (But They’re Still Lurking Behind

The Curtain:)

http://pages.citebite.com/y9b2m0d5frpp

Six Month + Delinquent Mortgages

Amount To More Than Half Of Bank

of America’s Market Cap

(not independently verified)

http://goo.gl/T7QFk

And The Cheap Money That’s Also Supported A Window

Of Opportunity As To Properties Not Competing WIth

That Shadow Inventory Is Changing Over

http://goo.gl/8w3VW

http://www.multiurl.com/ga/

TheManySignsOfShadowInventory

http://www.multiurl.com/ga/Illusions_R_Us

New Delinquencies “Incredibly Highâ€

http://goo.gl/Clczi

@1:40 the Chairman of the NY Realtor Society

says COMPARE PRICES PER SQ. FT., NOT CASE

SHILLER AVERAGE SALES PRICES!

http://goo.gl/nuzmo

Key Component/Patient Explanation, How Price

Averages Are Misleading

http://www.ritholtz.com/blog/2012/08/

understanding-price-dispersions

http://pages.citebite.com/p4v3h4u5ukuk

http://pages.citebite.com/b8i3v2s7trsw

http://www.nakedcapitalism.com/2012/10/some-smart-money-is-already-exiting-the-single-family-rental-landgrab.html

http://soberlook.com/2012/11/borrowers-with-modified-mortgages-re.html

http://www.youtube.com/watch?v=PEqkO_GENHA

Gary Shilling on the Housing Market

http://www.ritholtz.com/blog/2012/04/foreclosures-a-decade-long-overhang-part-4-of-5/

Dated But Applicable

http://realestate.aol.com/blog/2012/07/13/shadow-reo-as-much-as-90-percent-of-foreclosed-properties-are-h/

http://www.nakedcapitalism.com/2012/07/realtytrac-corelogic-confirm-housing-bear-thesis-85-90-of-reo-being-held-off-market-meaning-tight-inventories-are-bogus.html

Not being an expert, my experience was to purchase a modest home in ’01 in Ventura County with a 240k loan. I paid mortgage down to 29k in past 11.5 years contrary to expert advice. I paid off mortgage with 3.25 percent HELOC and now I can live much cheaper than any rental in comparable 4/2. So, for me the issue is: Is my house primarily an ‘investment’ to use for leverage purposes or is it primarily a low cost place to live?

Do you like it? Then I guess live in it. Do you want something else? Then consider leverage for what you want. Really, you are in a good position. You can wait a long time to find the right home, if you don’t want the one you have. It’d be tough though to leverage the almost paid for house, unless you can wait and buy something you really want for really cheap – and are up for paying a bigger mortgage again. Big problem is the leverage from the first home will be a recourse loan.

move to Texas, leave this crazy town.

Leave a crazy town for a crazy anti-science, anti-education state? No thank you.

So open minded and inclusive of you.

Rhiannon, don’t complain about living in Northern Mexico. The southerners that come here to work also expect big government services that you will have to pay. Your taxes are just starting to go up. When undocumented soon get the right to vote(and each can bring in four family members), say good by to prop 13 and etc. Why should you live in a big house with a small family when we have those who have a big family live in a small dwelling? That is not fair. Rhiannon, there is a dollar price to pay for “liberalism’, so stop your complaining, or you will be sent to Texas where there is no income tax and government services are not unlimited.

IMO, public MLS inventory is the key to determining if prices are going to be ‘relatively’ stable. If we can get back to pre-2012 inventories and regular foreclosures on market, it will be less insane for regular buyers. But this game seems to be popular with price manipulation via inventory shortage.

No money down mortgages are back! (as long as you have “sizeable assets”)

http://www.marketwatch.com/story/no-money-down-home-loans-are-back-2013-02-01

Million Dollar + home sales in California is the highest in 5 years.

Reasons outlined are: Cash buyers, an upturn in home prices and the recovering economy played a role in the increase, and a year-end rush among the wealthy to take advantage of lower capital gains taxes by closing before year end.

http://www.latimes.com/business/money/la-fi-mo-million-dollar-home-sales-20130130,0,6066088.story?track=rss

Good article in Financial Times about the shaky RE market with flippers & hedge funds waiting in the wings to sell.

http://www.ft.com/intl/cms/s/0/44f1d746-6c56-11e2-b774-00144feab49a.html

Thanks, Chrys.

The article touches upon the reception of securitized REO to rentals instruments:

“The hedge funds and private equity firms who have bet on the REO to rental market had a more sophisticated exit strategy in mind than simply flipping their properties to the next sucker. The plan has been – and still is – to sell the cash flows from rental income and property sales, by using them as collateral for bonds.

Investor appetite for such REO to rental securitisations, though, may have been overestimated, not least because the bonds are riskier than Wall Street claims. Rating agencies say the dangers include not just another economic downturn, but also failures on the part of the rental property managers, and risks associated with the lack of historic precedent for the REO to rental market.

The American Securitisation Forum’s annual conference in Las Vegas this week was a hugely bullish affair. Investors have been clamouring for securities built out of everything from car loans and credit cards to horse semen and the rights to Snoopy, yet there was a decidedly cool reception for the idea of REO to rental securitisations.”

Chrys, you cannot access that article without registering first.

Leave a Reply to gte343z