Home Prices Need to Fall 50 Percent from Peak Nationwide for a Market Bottom: Case Shiller Data and Predicting the Ultimate Bottom. 5 Charts Showing we are far from a Bottom in Housing.

The S&P/Case-Shiller monthly home price data was released on Tuesday and showed another abysmal month for home prices. The Composite 20 index is off by 27% from the peak and the Composite 10 index is off by 28.3%. Yet even with these dramatic price drops, we are still nowhere near a bottom. We need to reach a 50% drop from the peak given our current economic conditions. That is the troubling nature of this current bubble. It grew to such a level that even 28% nationwide drops still keep us at overpriced levels. This isn’t even considering regional markets like Southern California that are now off by 50% from their peak levels.

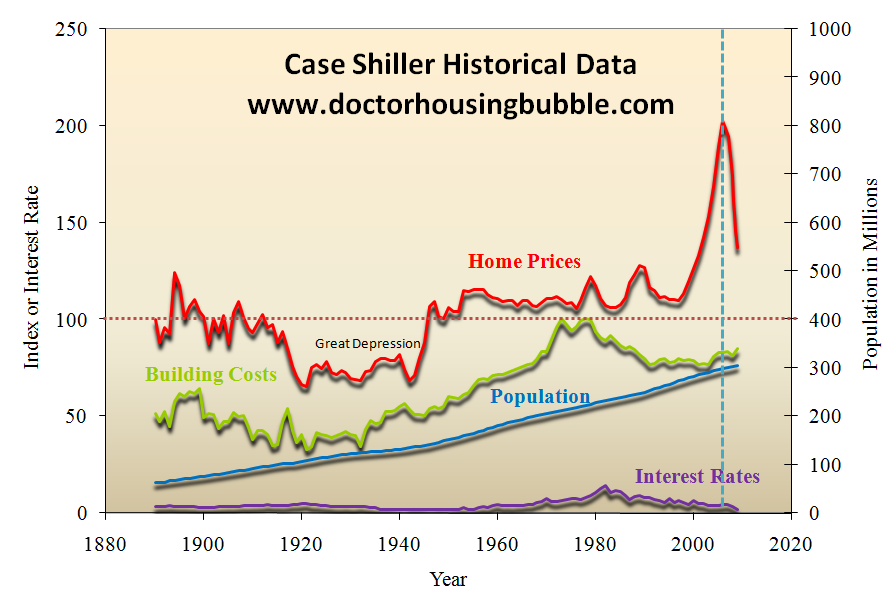

Today I want to examine a few key data points as to why housing is still very much miles away from a bottom. The first chart I want to look at is the Case-Shiller data dating back to the late 1800s. This chart really helps to put things into context but also the magnitude of our current housing bubble. In fact, we even see in the chart that prices can even undershoot historical measures if things get really bad like during the Great Depression:

Chart 1 – Case-Shiller Historical Data

Click for sharper image

This is really a beautiful chart to look at because it really encapsulates the mania during this current housing bubble. Even in more recent peaks and bubbles, we have seen prices go up 30 or 40 percent above the 100 baseline. Yet starting in the late 1990s this housing bubble took off and went into the 200 range. That is home prices doubled in less than a decade. Now this would have made sense if incomes had doubled during that time as well. Yet that is not the case. Incomes remained stagnant and now given our raging unemployment rate, are now facing a pull toward the downside.

You’ll also notice that interest rates are now at historical lows. Normally, in previous recessions any sign of a market struggle or credit drying up, the Fed would simply lower rates and flood the market with easy money. They do not have this option in their arsenal anymore. In fact, we are now realizing that the Fed and U.S. Treasury are nothing more than big debtors.

What the chart above tells us is that prices still have a long way to go on the downside. And we are talking potentially beyond the 100 baseline. If you look at the period during the Great Depression, home prices were actually under the 100 level for many years. Do not fool yourself, this is a deep crisis and to think we’ll trend easily back down is too optimistic. Major market moves on the upside usually have equally feverish moves on the downside.

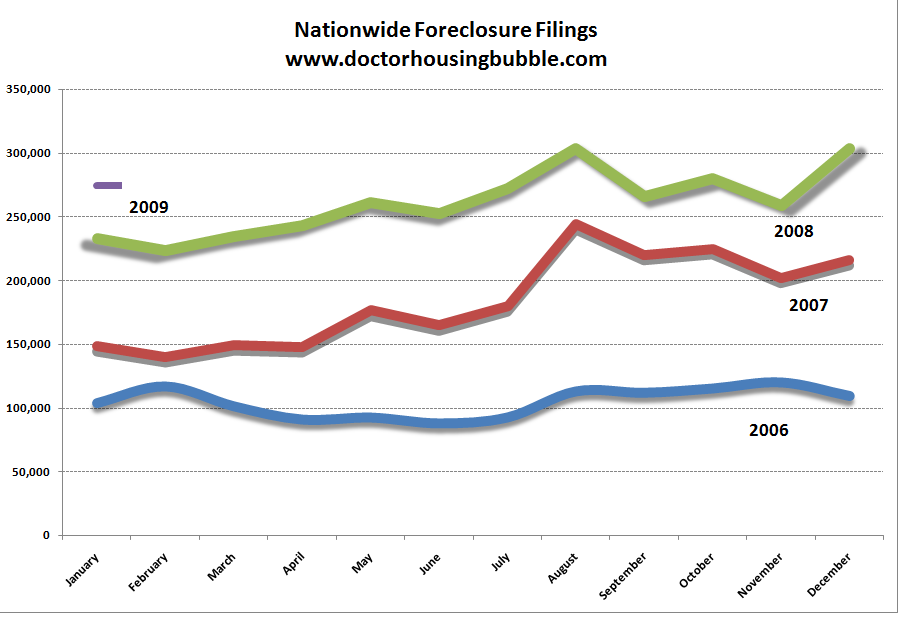

Chart 2 – Nationwide Foreclosures

As you can see from the chart above, right out of the gate we are starting out with record monthly foreclosures. You also have to factor in that we have multiple foreclosure and loan modification programs in the market yet this chart shows how much of an impact they are actually having dealing with keeping foreclosures at a lower and more manageable rate. Until we start seeing foreclosures decline, there is absolutely no reason to believe we are nearing a bottom. Recent figures put nationwide foreclosure resales at 40 to 50 percent of the entire market. In California, the number is approaching 60 percent. So with that factored in, only half of sales are happening without some fire sale or distressed history. That is not a good and healthy market.

When we see the above numbers trending down significantly then we’ll know we are starting to see a bottom but until that time, any bottom talk is foolish.

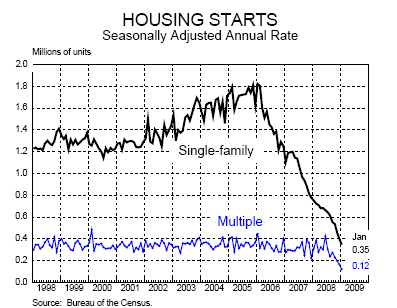

Chart 3 – Housing Starts

Another sign of major market distress is with housing starts. Back in December I was talking about the 80 percent drop in housing starts during the Great Depression and how this played out in the housing market overall. At the time only a few months ago, the current fall off rate for us was 70 percent. Well guess what? We are now at Great Depression levels. Housing starts have fallen by 80 percent, today. This is simply stunning.

Now why is this even significant? Well first, it demonstrates the massive glut of housing that we had in our current market. We built for a decade in a few years. Much of our economy was built around real estate, finance, and insurance. So now with fewer housing starts a large part of the economy will sit passively by because we simply do not need more product. With all the foreclosures hitting the market for the next few years, this only ensures a steady stream of inventory onto the market. No need for new homes. Also, there was a high vacancy rate on many properties so until we start seeing these properties filled up with renters, then we are still nowhere near a bottom.

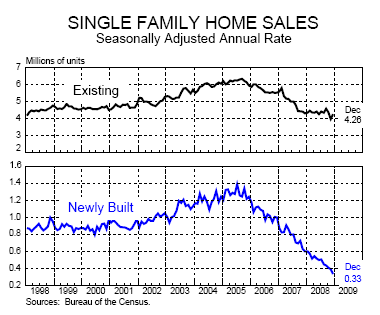

Chart 4 – Home Sales

Nothing really drives this point deeper than the above chart. What you’ll notice is that existing home sales although they took a beating, have suffered nothing to what new home sales have faced. Existing home sales are off their annual rate by approximately 30% and keep in mind this also includes the fact that nearly 50 percent of all these sales are distressed properties. These are horrible numbers.

Yet what is more troubling is the pounding taken by newly built homes. Newly built home sales are off by a stunning 75+ percent annual adjusted rate! This above chart correlates directly to the 80 percent drop in housing starts above. Until we see any movement here, again there is no reason to believe we are at bottom.

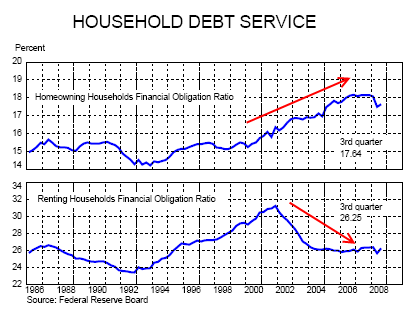

Chart 5 – Household Debt

Some charts sum up the credit crisis so perfectly.  Here, you can see that starting at roughly 2000, renting households saw their debt service burden decline while homeowners saw their debt burden shoot up. You can argue this has to do with merely being a homeowner but this chart goes back to 1986. What occurred is homeowners massively over stretched themselves. Basically, some were never meant to be homeowners yet were sucked from the renting category to the homeowner category.

We had this cultural obsession where everyone deserved to be a homeowner. Nothing could be further from the truth and more financially destructive. No one deserves a home like no bank deserves a bailout. You deserve to own a home if you are prudent and have savings to back you up without going into massive debt. Yes, this goes for all those “prime” borrowers that over extended their household balance sheet because they couldn’t resist the granite countertop siren call. In fact, that group is the most irresponsible. After all, these are the folks taking out HELOCs to add $50,000 pools and going on $20,000 vacations.

So anytime someone tells you we are near bottom, just look at the above data and see if there are dramatic changes in the trend. If there isn’t, then you know full well we are not even close to having that debate.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

25 Responses to “Home Prices Need to Fall 50 Percent from Peak Nationwide for a Market Bottom: Case Shiller Data and Predicting the Ultimate Bottom. 5 Charts Showing we are far from a Bottom in Housing.”

Another brilliant post doc! Here is Southwest Florida, it seems like we are just getting started. Next shoe to drop will be continued lower rental costs which put further downward pressure on prices.

I think you have to ask where as well, In the Temecula Valley CA for example, you cannot build homes (even if you have the cheapest labor, free land and cheapest materials ) for what the homes have been selling for in the last year.

and believe it or not the population is still growing in Temecula. So who is going to build these home below cost ???

I think you have to ask where ???

In Temecula Valley CA for example you cannot build homes for what they have been selling for in the last year (even if you have the Cheapest labor , free land and cheapest materials ) and believe it or not the population is still growing in Temecula.

So who is going to build these home below cost ???

Just my two cents

The Westside January (YOY) numbers from Dataquick are anything short of dismal for the Westside. Median prices dove deep into double digit losses as the number of sales continue to dry up. Jumbo loans to finance Westside purchases are almost non-existent fas credit is tighter for most buyers, and now prices are seriously adjusting.

This summer is a wake-up call for sellers, as buyers continue waiting it out.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

@Nor: interesting anecdotal and highly specific comment, but what are your numbers? What does it cost to build a house there? And since when does an economic good need to be sold above its replacement cost? I think your assumptions about land prices, labor, and building materials are probably wrong in any case. Just my three cents.

In any case, and not pointing the finger at NOR, RE bulls won’t give up. Every move down is simply the bottom. No amount of rational discussion, charts, graphs, or economics will convince them that real estate will fall farther. It’s like discussing evolution with a fundamentalist christian; facts just don’t matter.

Well, don’t let facts get in the way of doing nothing, folks. Let it slide. The house of your dreams will be much, much cheaper in three months. And in six months. And again in a year.

Great point, Nor. A myriad of factors will dictate the temporary bottom, but in the long run, price to build per sq ft is king. And in locals where new builds are high density, expect to pay a premium per sq ft for used SFH’s.

Nor,

People will build sooner or later when prices drop and they are starving. Your city might might be growing, but there is little money out there to buy and incomes are presently far lower to service realistic mortgages at today’s prices. This just the beginning of the economy and housing falling off the cliff. I had a neighbor years ago buy a house in Glendale at the close of the depression for 10K in 1941. She said the house sold for 36K in 1929. How’s that for a bottom after 12 years!

My father grew up in Glendale in the 1930’s and he recalled that only (2) people on his block owned their homes while everyone else could only rent. The banks could not sell their inventory. Sound familiar? He said for over 20 years that we are living in a depression sugar-coated with credit cards and he turn out to be quite right. Now the credit is no more. Let the reality begin………..

With the cost of parcels dropping in Temecula they can build and sell new homes for $75 per sq’ foot all day long. A 2000 sq’ new tract home was selling there for $150k at the start of the bubble, and it will end below that price at the end of this bubble.

I have a slightly different version of the Case-Shiller chart, sourced to Shiller’s book Irrational Exuberance 2nd Ed. The foot note to the chart explains the prize drop from ~1920 through 1945 partially due to mass production techniques reducing costs and the following spike to the pent up demand after WW2.

Chart name: saupload_case_shiller_chart_updated.png

Nor – easy. Nobody will. Not until the surplus is used up and houses can fetch prices that make building new homes economically worthwhile. That can easily be 15-20 years or more, if it ever does. Without all those fat real estate jobs or the steady construction work, I don’t see a whole lot to support the economy of Temecula, unfortunately. And with gas prices creeping up again and real estate and rent coming realigning with fundamentals, the commuters might just start moving back to somewhere closer to where they work.

Look, it’s just simple math. There’s not a home I’ve seen for sale in any area I’d live for less than 1.3 million dollars even in Feb. 2009. So you say, well live somewhere cheaper than Venice or Santa Monica. But I’m not talking about buying in Beverly Hills or the Hollywood Hills or a place right on the beach. I’m talking about buying a modest 1600 sq ft 2 bd./ 1 bath house.

_

I can’t afford to put much more than $100,000 down on a house. And if the market falls any more, I won’t even have that. If loans today require 20% down (going back to the old days of simple fundamentals), that limits me to $500,000 for a house. Aditionally I wouldn’t WANT to put down more than $50,000 for a house. That would limit me to buying a $250,000 house. But I can’t even get a closet in Santa Monica for that. So needless to say, I won’t be buying until homes lose 75% of their current value. Which they will, because they have to, because we make more than $300,000 a year and can’t afford a simple 1600 sq ft house. We make enough that living in Santa Monica shouldn’t be impossible.

_

And think about this: how many people have $260,000 to put down on a $1.3 million home? It’s really so elementary I laugh at people who say, “no one could see this coming! Who would have thought toxic debt would drag down the economy? I just can’t believe it!”

:

“And think about this: how many people have $260,000 to put down on a $1.3 million home?”

The key is how many of these people exist compared to the number of homes in good neighborhoods. Everyone knows LA is officially bipolar on the wealth scale. Medians are meaningless. There are only a relatively small number of close in, safe neighborhoods with good schools. I have been looking at La Canada prices on Redfin and see sellers marking up their properties 30% from 2005! When I mention this to people who have lived here longer (and bought in the 90’s when it was affordable and therefore have no dog in the hunt), they merely respond that this is not surprising because there are simply a lot of people with a lot of money in Southern California. True, the homes are sitting unsold at the moment, but there’s no real foreclosure market there so I wonder to what extent the fallout will really hit that area and similar ones?

I joked not too long ago that TLC, the channel that brought you Flip This House, Flip That House, Property Ladder, Real Estate Pros,… all these flipping programs, that they should start a new TV program called, ‘Foreclose this House,’ well, it wasn’t far from the truth.

They now have a new show called “Deals on the Bus”, in which bus tours go to residentially devastated areas to look at foreclosed homes.

So far they’ve been to San Diego for two of their shows, and Stockton for the other.

There are some houses that are actually down by a half a million bucks.

Most of the homes are down by hundreds of thousands of dollars.

And the people on the tours are so happy, now that they can afford a house in California, when it was off limits, just a short year ago.

Leave it to TLC, to try to make money off of other people’s misery.

Ohh,… they’re good.

Great Post.

–

My wife and I have been seen closing prices on SFR’s down a lot over the past year. We were in escrow earlier this summer at 693K on a home and pulled out and it recently sold for very low 600’s. Recently we had an accepted offer on another property but got cold feet and pulled out because of what we started to see over the past few weeks (speaking about South Redondo Beach). Their are many more “For Rents” and I am starting to see a lot more moving trucks in the neighborhood. It’s pretty depressing. As much as I want to get an affordable home, all the signs say they are going to be a lot lower in the future but watching it happen is very sad. I think of how easy it could have been me who bought in 2006 and that I could be in a terrible position.

–

I feel like I am Neo in the movie The Matrix and I can see the machines that controlled the public into believing prices should be 850K for a starter SFR when in reality they should be in the 500K area or less.

–

This blog and all who post comments has helped me out a lot. My wife and I are going to sit tight and wait – we may in the meantime upgrade our rental from 4-Plex living to a SFR – lots to rent in the area and landlords sound pretty desperate when I call them and willing to wheel-n-deal on rents.

Try-100%.Societal-collapse,dollar-collapse,US-Debt-default.Starvation.

Why buy now? When the bottom is reached everyone is going to know it. Because its going to be flat for many years. I think this flat bottom is coming pretty quick. I’m just looking at OC. It should be 50% (about 320K) off peak by summer. Its dropping so rapidly, what’s it going to be by years end? Off the top of my head, 55% off peak would be about 278K and 60% off peak would be under 250K for the median home price here in Orange County. There might be a point in the middle of the Pay option arm resets that the median home price is low and stable even thou the numbers of foreclosures coming into the market is increasing……..Ah who the hell knows?

Another brilliant post doc! Here is Southwest Florida, it seems like we are just getting started.

I feel like I am Neo in the movie The Matrix and I can see the machines that controlled the public into believing prices should be 850K for a starter SFR when in reality they should be in the 500K area or less.

Try-100%.Societal-collapse,dollar-collapse,US-Debt-default.Starvation.

Real estate is local but all places have the same disease to one degree or another.

–

Recently moved from Kansas City, MO to Raleigh, NC and see very different things in the local real estate. It looks like in Kansas City, they are close to a bottom with median house prices about 3x median income. This is looking at what houses are really selling for – don’t think this has made it into the data yet somehow. Builders are still trying to sell at bubble prices and Zillow estimates up to 3x what a house has recently sold for.

–

I’m looking in Raleigh, NC and prices went up last quarter. But median house price still over 4x median income. It seems prices went down a little middle of last year so people called a bottom, started buying and drove the price back up! Crazy. I think lots are in for a rude awakening in the next year – unemployment is higher than national average even. But rental market is definitely in the renter’s favor – people are desperate, especially in higher end houses few can afford now.

–

My background – I’m one of the evil subprime borrowers who destroyed the economy. Bought in 2007 at the peak in Kansas City. Moved from out of state for a new job, was told had a loan at fixed 7% until moved down to start new job with family staying in a hotel waiting to close. Then told terms changed to over 10% adjustable. But promised would be able to refinance in a year to 6% and putting no money in myself so took a chance (not much of a gamble when you have no skin in the game). Of course no refinance and Citi refused to lower my rate because I could afford the higher rate but got tired of overpaying for a decreasing house so moonwalked to renting a house twice as big for 1/4 less back home on the east coast in Raleigh, NC. Have to wonder if Citi might have seen it in their best interest to work with me if the government hadn’t guaranteed their bad debt. Seems like it would make more sense to work with those that can afford their house than those who can’t.

If you look at the chart, home prices actually went up during the depression!

One thing I’d like to see factored into into this discussion is the recent rapid surge of converting rental housing into condos.

I often hear much blame of folks who “shouldn’t” have considered ever buying a home because they were not loan-worthy candidates.

But, what if- as in my city- rental housing was virtually eliminated?

People (especially families) were left with no choice but to accept bad loan conditions, simply to have a roof over their heads.

Many of us are being exploited from both ends, by both the developers and the banks.

I rarely hear this talked about.

In 2005 I observed as the condo-conversions sped up. One week the building would be all rental units and- literally- the very next week, a sign would be up announcing “luxury apartment homes” for sale.

Installing granite countertops in the kitchen (what IS it with those, anyway?) and a giant stainless steel fridge could ensure that the place would sell for maximum dollar- no matter the tiny size of bedroom or lack of closets. $499,000 for a small one bedroom condo?? Are you crazy? And that’s in a less expensive housing market (ie. not California).

There has been so much greed going around that it makes complete sense that the housing market could not continue forever on this path.

American buyers have been conditioned to want only “luxuries”, without the slightest care of what’s appropriate.

Think of all the McMansions that were built in the last decade.

Who REALLY needs that much house? Or a three-to-five car garage?

Yet, these are often the houses I see pictured on the news, when there is talk of whole neighborhoods being foreclosed.

About time, I can’t help thinking.

Hi,

Curious to see what you guys might think of Rep. Speier’s amendment to make the housing bailout extend to those that took out larger loans, jumbos. I for one do not support this as I’d like to see the value of homes continue to drop, and I’m not in favor of helping out those that over extended and bought high.

Here is an article describing Speier’s plan:

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2009/02/25/MNSB165AQU.DTL&type=politics&tsp=1

I have really enjoyed reading this blog late into the evenings I “used” to spend trying to keep a “recession proof” business afloat. Unfortunately, I don’t have that to worry about after December 08.

My first comment though is about data and charts. They are all very interesting and can be helpful. But please remember an old saw that says “data is like a prisoner..it will say anything you want it to if you torture it long enough”.

Case-Shiller is widely respected. I give you that. But alost insisting that prices “need” to drop another 50% (even in non-California markets)” might not be realistic.

I live in Metro Atlanta, GA It is a very vast and diverse metor area of some 5 million people. There has been intown (flip this house type) speculation of 1930’s bungalows, rampant builder-kickback frauds in very upscale golf communities, ALT-A daydreaming fanatasy buying in caucasian heavy McMansion laden exurbs, etc. But as always, real estate is still local. In many parts of this city, owing to the lack of natural barriers for development, many SFH prices in existing neighboorhoods barely appreciated at CPI. (I know CPI is baloney, but our house averaged the typical 2-3% tops per year)

And this is sensible. Buffet likes to say that a house has no intrinsical value. In other words, the same three bedrooms and 2 bathrooms are only as valuable today to a family as they were 20, 30, 40 years ago. No more no less, after inflation. Like the 50 cent gallon of milk in the 40’s, the only reason they appreciate or should appreciate, is to keep pace for inflation (income growth etc) . After that, the more esoteric elements such as schools, transportation access or lack of, architectures, etc etc can come into play for any additional value-add.

To think that almost ALL housing or areas “need” to drop by another 50% doesn’t reconcile to some or many areas and neighborhoods.

The principal and almost exclusive reason SFH’s in my area (an area in the 200K range) have dropped is the significant number of bank-owned foreclosures. Fire selling. 50% are REO’s and the other poor 50% have to compete against them. This gives a very false image of the actual state of affairs, other than the obvious which is that a bunch or actually a few dolts took on craptastic term mortgages. This won’t last forever and these REO houses will eventually get sold at these fire-sale prices.

One thing I do appreciate is the recognition that when the foreclosures start to decline, and significantly, I think you will not only see a so-called bottom, but a meaningful uptick in pricing, since people who either bought at fire-storm price levels, or the avg Joe, will or can now sell for a realistic price.

I also appreciate how Doc has sometimes tried to apply some sort of SWAG factor to ferreting out the Big 4 (CA, FL, NV, AZ) I think it would be great if Case could not only start to report two headlines, but MSM et-al report the two sets of numbers. We should all start to take a deep breath and consider that even in a local 20% down “overall” market, thereare a “few” pockets and idiots responsible for the destruction.

Now as to this Renting vs Buying. I’m sort of this type who adheres to the “can’t make matter from nothing” type thinking. Matter to energy, vice versa, but it has to go somewhere, in some form. So, if some or many people turn into renters, SOMEONE or SOMETHING must own the SFR that they rent. I really doubt the banks will turn into giant REITs or landlords. Nope, some-one, usually private investor, will buy these houses and if necessary rent them for the short or long term. But to say, “well there was time long ago in land far away where only two people owned their house” is not coming to grips with the fact that someone (ok or something) owned the renter occupied houses. They were in fact ALL owned.

AND..this nonsense of misusing the word “OWNED” or “OWN”. How many times have you seen that used in the blogs, on a credit application etc? 2 out of 20 “owned” their own homes? Free and Clear? Had a mortgage burning party? (Anyone remember those?) Don’t know, but I personally think we should start to make a distinction in the way this word is used and mis-used. (Yes I OWN my own home, not “buying” my own home) There should be “OWN”; “PURCHASING” and “RENTING”. Unless you live with mom and DAD.

And last but not really least. I’m not a flamer. But when some write “Try-100%.Societal-collapse,dollar-collapse,US-Debt-default.Starvation.” is that really helpful? Do you really BET against the house on this one? I wouldn’t. Do I like this situation. NOPE. Do I beleive we’re headed for “100%.Societal-collapse,dollar-collapse,US-Debt-default.Starvation”? Not in this country. Anecdotal as it is, I still have to sit in almost grid-lock like traffic moving around a very typical exurban county. Yes, it’s a “downturn”, a “recession” “worse” if want, but societal collapse and starvation do’t look likely to me while I’m waiting through 3 traffic lights behind tens of relatively shiny cars jockeying for the correct angle to enter neighborhoods, shopping centers, schools ballfields, etc

All the end of the world talk to me is over the top cynicism and shows a slightly paranoid schitzophrenic propensity that is alowed to emerge in these admitedly very trying times. On the flip side, I laugh when guys on CNBC like Cramer profess that “one day things will get better”. Ha! Of course they will. Will they get worse? Who knows. How long? Dunno. Tommorow? Ain’t likely. Next month..naw. This year..can’t be sure..Next year? Hmm..now maybe.

But my point is eventually these things work their way out. If it were a worldwide plague of say Influenza or disease sweeping the planet I might be a little more pessimistic, but this is more or less monopoly paper we’re talking about here.

I know this was not the most intellectual post or supported by lots of facts or figures. Much more of a rant I grant you. But so many of the blogs are becoming so dark and so gloomy my fear is that they are self-fulfilling.

I used to like a car oriented blog called “The Truth About Cars’. It was filledwith a little or a lot of tell it like it is factoids and such. But in the last 6 months, it has turned into a viscious viceration of anything GM or Big 3. There seem to be scores of people (usually the posters) that are almost salivating for a bankruptcy / collosal meltdown. I sometimes sense a little of tis on some of the replies on Doc’s blog. I see he is quite passionate about his reporting and blogging, but always remember the top banner ” How I learned to Love So Cal and forget about the housing bubble”

There are still a ton of people (like me) who will just hunker down for a little while, years or whatever, and let all these storms rain themselves out. Trust me, eventually they will.

Well said Boy Wonder. I am amazed by the amount of glee shown by people on many websites at the downturn of our economy. They seem to enjoy the thought that our econonomic world as we know it could come to an end. I am like you and believe we will come out of this, but its frustrating to try and reason with the madness out there.

Great posts Housing Bubble. I’d love for you to touch on Colorado housing prices at some point.

Re: 2/25–Heidi, your points are well taken in my view. In our current Left Coast area (not in CA), we knew when we came here in 2001 that trouble was a-brewin’ by the number of rental units in the new housing developments. Incomes simply weren’t keeping pace with housing prices even then. So all the run-ups after that were sheer speculation, as well as the inflow of CA retired boomers.

~

We lived in one of those houses while preparing to buy and caught the market in a short downturn. Sixteen weeks later the market took off, and we would not have been able to buy at our fundamentals. I.e., we would have been renting between then and now.

~

The house we rented was reasonable only as an interim choice for us. If we had had to rent long-term I’m not sure what we would have done, because the rental stock is very poor here. Mostly desperate flippers and speculators, then as now. When we were in the Bay Area, the condo/TIC conversion rate drove many people away from neighborhoods, the city (SF) itself, or the Bay Area entirely. I saw this on the East Coast in the 1980s, and again in the current bubble. There is nothing tying incomes to housing. It’s all mark to mania.

~

Boy Wonder, what Doc said was that the national median would have to fall 50 percent off peak. A median by definition leaves plenty of room for dispersal around that particular central tendency: houses in Riverside will fall more than houses in Indianapolis. (I don’t know about Atlanta; yall are growing one hecka water problem down there.) Without affecting the median, which by definition allows for more dispersal than, say, a mean.

~

I know there are some doom-lovers in the world, but I also see a lot of people who saw what madness was unfolding all around us–the luxe culture of Reaganismo–and no one listened to them. Of course they are glad that things are going to get back to more normal.

~

It didn’t have to be this hard, but we all know, for instance, how Greenspan propped up the housing bubble because he didn’t want to be left holding the bag, nor drop that flaming sack of doo on George W.’s election-year doorstep. That’s my entire frustration. Deferral of reckoning scares me far more than any actual reckonings.

~

rose

I’m about an inch away from walking out on my mortgage. So I have bad credit for a few years… i can fix that. What I can’t seem to shake is being 200K upside down on my mortgage.

Leave a Reply to Cris R