Dear Prospective Buyer, You Don’t Deserve to Own a Home!

RANT ALERT: I’m surprised I haven’t seen an article devoted to this subject but I think it is one of the primary reasons we are in this current mess. People do not have a right to own a home. Owning a home is a privilege. I’m going to level with you. The idea of an ownership society is the most nonsensical load of crap I have heard and frankly is the main reason we are in this deep abyss of credit (DEBT) sludge. Somewhere in our collective societal psyche either through pop investment books or television shows people got the impression that real estate was the quickest way to turn a fast buck (that or hanging out at the corner pulling tricks).

Somewhere along the line society got this Newtonian idea that giving loans out to anyone to purchase a home with no collateral was somehow a smart financial move. The rosy red idea was that everyone should participate in the American dream of homeownership regardless of whether you actually deserved it. Basically many people arrived at the conclusion that owning a home was the equivalent to a free lunch. At the rates that homes were appreciating, it looked like to the masses that the fountain of free money had been discovered. As it turned out, it is one of the most boneheaded financial moves we have witnessed in the last century.

You really have to cut through the financial jargon of the peddlers to realize how fundamentally unsound this was from the beginning. Make no mistake, they bet on the public’s ignorance of never digging deeper. “Trust me, I’m a [realtor, broker, i-banker, hedge fund, politician, etc] so what I say is correct.” To think, that somehow a $500,000 mortgage made to someone making $25,000 a year was going to turn out well is an exercise in financial stupidity that goes beyond the realm of anything many of us have seen even in Hollywood! I’m not sure if a script writer could have thought of a plot so financially arrested in development. “Tonight you will be amazed with the next Hollywood blockbuster that is sure to tickle your fancy. Watch as a society is confronted with unlimited credit. What will they do? Build for the future or develop new technologies? NO! They’ll blow it on granite counter tops, clear paneled showers, and central professional grade kitchen islands where they’ll sit their KFC. Come watch Free Money the Movie” Somehow as the decade went along, people collectively thought that homeownership wasn’t a privilege to those who prudently saved and managed their finances wisely but suddenly became a speculation pit similar to trading pork barrel futures.

Many don’t deserve to own a home. You will not hear any politician ever utter those words but there it is. That is a fact and the current foreclosure disaster on our hands is simply proving that theory out. There is a reason for standards and the idea that combining a boatload of toxic mortgages into a security and somehow selling the tranches off is as stupid an idea as in the early 1900s when holding companies would buy company A and B and suddenly the combined stock of AB was worth more by some magical joining at the hips. The formula looked something like:

Crappy Loan #1 + Mediocre Loan #2 + Prime Loan #3 = Mediocre Portfolio

The bailout of Fannie Mae and Freddie Mac is simply an extension of this idiotic mentality that everyone should own a home. I have a newsflash for many of you.  You can get a good mortgage with historically good terms if you have a down payment and good credit! Sound banks will lend to you even today but here is another revelation…there are very few people who qualify under these terms. Take California for example. Let us assume that you need 10% down to purchase a home in Los Angeles County:

July 2008 Median Price:Â Â Â Â Â Â $400,000

Required Down Payment:Â Â Â $40,000

2 Year Monthly Saving Rate for Down Payment:Â Â Â Â Â Â Â Â Â Â Â Â $1,666.67

This simple qualification has exposed the sham which is the California housing market. That is why California now as a state is down by over 40% from its peak price point reached last year. Yet think about the above person or family above that needed to save $40,000 for a down payment. What this means to a lender is this person or family had the discipline to focus and save a substantial amount of their money towards a goal which is a home. In addition, this person is less likely to walk away from a home given that they had to save diligently for 2 years and are exposed to losing a nice chunk of change. Yet lenders were just as irresponsible since they were playing with other people’s money (OPM aka your money) and didn’t care whether you could sustainably maintain the mortgage.

The bailout is simply a misconception of this housing entitlement mentality. People don’t deserve homes. You EARN a home. You WORK for a home. You SAVE for a home. It would appear that this must sound like a foreign language to many like Hank Paulson and Ben Bernanke who are simply perpetuating this Ponzi scheme for all. It wasn’t always like this. In fact, there was a time when the majority of Americans didn’t own their home and this wasn’t too long ago:

For nearly 30 years from 1900 to 1930 the homeownership rate remained steady at about 43.6 percent. It dipped a few points during the Great Depression but then sky rocketed upward during the baby boom era. Guess what was created in 1938? Fannie Mae. Initially Fannie Mae was created to provide liquidity to the mortgage market and morphed into the toxic mortgage hideout that is now in conservatorship. The subsequent boom sent the homeownership rate over 60% and has remained above that level ever since. The homeownership rate peaked in 2004 at 69.2 percent which in hindsight was an idiotic aspiration to have without any standards or regulations. It was an obsession to increase the homeownership rate at any cost which now we realize is a horrific financial move.

The current bailout is wrong on so many levels. First, it reinforces the idea that a high homeownership rate is good. This is not always the case. Let us look at some other countries and see their homeownership rates:

Ironically some of the countries with the biggest housing bubbles like Spain, Ireland, and the UK have similar or even higher homeownership rates than the United States. Want to take a guess how their economies are going to do for the next few years? In addition, it is not a requisite to have a high homeownership rate to be a “successful” economy. Look at Germany and France for example. Don’t like France? How about Japan at approximately 60%. If a high rate of homeownership was the pinnacle of an economy, then Serbia would be number one with a homeownership rate of 88.2%. The point of course is that simply chasing a high homeownership rate with no sustainable goal is counterproductive. The current homeownership rate is 68.1% for the United States which is off from the peak point.

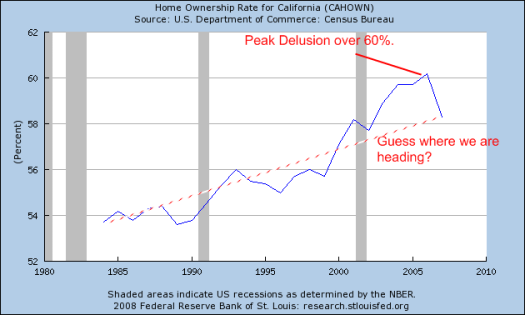

Or take a state like California for example. For the last 28 years, the homeownership rate for the state has hovered around 55 to 56 percent. All of a sudden in 2000, the rate bounced over 60% on this massive speculation:

Now we are quickly correcting back to historical norms.  In fact, Los Angeles County with approximately 10,000,000 residents is a renting majority county. The homeownership rate in Los Angeles County is 47.9%. You can pinpoint this bubble to the moment people started eliminating down payments and went for all the blazing glory with interest only, option ARMs, and every other hybrid mortgage.

The bailout of Fannie Mae and Freddie Mac is also based on some Pollyanna notion that somehow we are nearing a housing bottom, which we are not. Supposedly, common shareholders were going to get no protection but should things improve, they may have something left over. What did the market think of that today?

The market is having none of it. This idea that the taxpayer will have first shot at any profit is absurd and disingenuous. If the estimated cost was only going to be $25 billion as stated by the Congressional Budget Office, then why does Fannie Mae and Freddie Mac each have a lifeline of $100 billion individually plus wacky restrictions that will actually grow their housing exposure in the short-term thus putting them under further risk? You can rest assured that it will cost at least $200 billion but I’m venturing to guess that when all is said and done, we are looking at close to $400 billion. The most costly bailout known to humankind. No hyperbole needed.

Bill Gross should be kissing and washing the taxpayers’ feet since this bailout directly helps him since it buffers the bonds of Twiddle-dum and Tweedle-dee which he holds:

“(OC Register)Â Before Sunday, Gross says his guess is that the home market might have had as much as 15 percent more price declines left. Now, it may be no more than 10 percent.

Gross admits it’s hard to explain to the typical taxpayer why maybe $300 billion should go to prop up two stockholder-owned mortgage insurers.

“But Mom and Pop should be pleased,” Gross says. “Not that their tax dollars are going … but that this money will be used to lower mortgage rates.”

While Gross Sunday afternoon was making his rate forecasts without the aid of major trading markets being open for business, his guess is that loan rates should be between half a percentage point to a full percentage point below where they would have otherwise had been without the rescue.” [my emphasis added]

Think of how moronic this is! Basically we shelled out god knows how much of taxpayer money to help the market go down only 10 percent instead of 15 percent? How does he know that? He doesn’t. And the reason it is hard to explain to taxpayers is that you are trying to feed them manure and tell them that it will taste like prime rib with A1 Steak Sauce. The money will be used to lower mortgage rates WHICH are already at historical lows. They really think the public is this stupid. Instead of the ridiculous equity sharing plan which Paulson put in place for Gross and foreign investors how about we get a piece of the $800 billion in fixed-income assets that Gross has his hands in? When it comes down to it, people look out for number one and you aren’t part of that crony capitalistic model so sorry my friends. Â

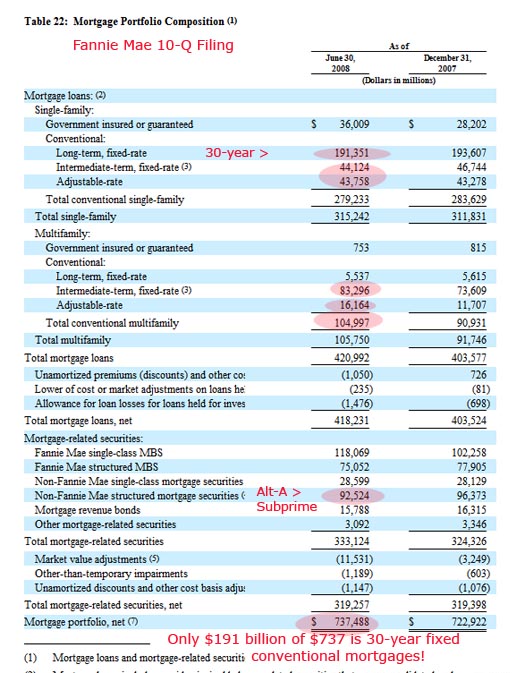

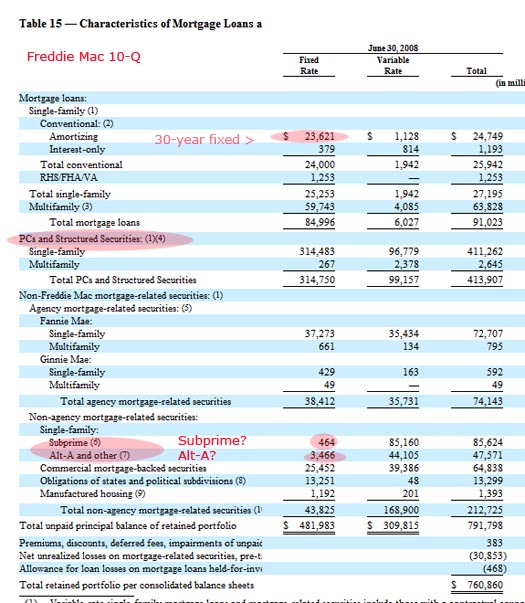

Now long time readers know that this bailout doesn’t come as a shock to me. In fact, it was expected. I just didn’t think that they would bailout these two without slapping the living crap out of them or setting a stern example for the market. At least give us a “we are going to make it illegal to ever bring back option ARMs or interest only mortgages.” Give me a break about the doctor with side income or the business owner with a 1099. They can go to their local bank and get a loan from them directly with no federal backing. If the bank wants to lend their own money so be it. But for the government to fund the insanity that got us here is simply astonishing. And make no mistake, Fannie Mae and Freddie Mac have questionable assets in their portfolios in the billions. Forget the idea that they only have fixed 30 year conventional mortgages. They have:

30 year fixed

Adjustable rate mortgages

Multi-family unit mortgages

Mortgage Backed Securities (some backed by Alt-A and subprime mortgages)

Don’t simply take my word for it. Pull up their most recently filed 10-Q. I’ve highlighted some of the key points:

Fannie Mae 10-Q:

Freddie Mac 10-Q:

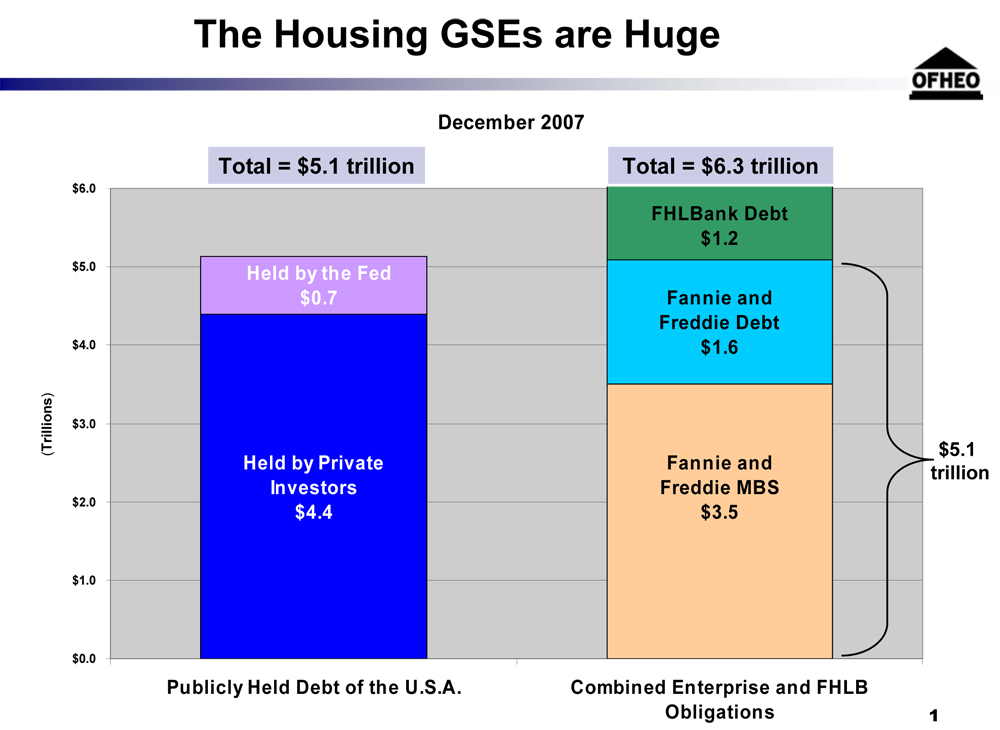

I’ve consolidated the image for easier viewing from the public Edgar Online filing to drive the point home. So both Fannie Mae and Freddie Mac have a combined mortgage portfolio of $1.5 trillion in which only $214 billion is what the public would think is your typical 30-year fixed single family residential mortgage. Everything else is a concoction of mortgage backed securities, multi-family loans, adjustable rate mortgages, Alt-A/subprime products, and everything else you can imagine. Losses on this are only going to amount to $25 billion? Give me a break. Here is the chart to give you a better sense of these two beyond the mortgage portfolios:

I haven’t seen anyone come out and say on the blog world, “many don’t ever deserve to own a home” but that is truly what needs to be said. This isn’t like eliminating insulin for a diabetic with no substitute. You can rent! Heck, nearly 50% in California do that and many do it because they rather rent/lease a nice home in a good area instead of buying a Real Home of Genius simply to play the housing blackjack game. Choices. Do we even have the desire to bring back fiscal responsibility to this country? Maybe that is why there is such a whimper in protest regarding this bailout. People frankly don’t care. The ownership idea is very apt because many just got owned royally and no one seems to mind.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

32 Responses to “Dear Prospective Buyer, You Don’t Deserve to Own a Home!”

OMG!!!

What next? That we don’t have a “right” to healthcare or education?

Possible typo alert:

(between Freddy Mac 10Q and Housing GSE’s are Huge images)

” So both Fannie Mae and Freddie Mac have a combined mortgage portfolio of $1.5 billion in which only $214 billion is what the public would think is your typical 30-year fixed single family residential mortgage. ”

Me thinks total should be $1.5 trillion, I guess…

~fini~

I don’t deserve to own a home? Whwhwhat? You’ve really hurt my feelings Dr. I think I’ll go to the mall and buy some bling to make myself feel better.

We are witnessing the fall of an empire due to our own arrogance.

“They really think the public is this stupid.”

Stupid, no, but the general public is extraordinarily ignorant. Enough said.

I wonder, now that the Gov is responsible for the majority of home loans, if we will now see a type of “affirmitive action” for home loans. In other words, if some type of “protected class” is seen as being “under represented” in the loans being issued by the Government (FNMA, Et Al). Would the agency then be required to “co-sign” for the loan? Each by his/her needs, rather than by their ability to repay? Taken further, if the government discriminates on the “amount” of a loan given, isn’t this now a “actionable” item for a law suit?

The “ownership” society is code for don’t have any expectations for Washington to help you when you are in need. You want health insurence? You pay for it. Saving for retirement? Don’t expect any social security or medicare. Cant aford to? To bad, you’ll just learn to live with out it.

What this leads to is the haves & the have nots so to speak. Just the republicans want it to be, reguardless if you realize it or not.

You nailed it again, doctor. Didn’t someone say, “Rights without responsibilities breeds tyranny”? Every time we accept that people have a “right” to something that someone else has to pay for, to some degree we enslave those who have to do the paying to those who do the consuming. The rights to “life, liberty and the pursuit of happiness” cost no one anything. But where do these rights like “the right to health care” come from? Someone else has to pay for that. We stack up more “rights” like the “right” to affordable housing, or the “right” to health care, or the “right” to public education, or the “right” to foodstamps and welfare. And of course, nobody wants to assume any responsibilities, like saving a down payment or security deposit, living a healthy lifestyle, doing their homework and obeying the teacher, or working at a menial job for low pay. So we put it on the tab for the next generation, or we call on “the rich” to pay for it all. I went to UC Berkeley in the late 60’s when they chanted, “tax the rich, feed the poor, till there aren’t no rich no more.” Under that plan, like in Zimbabwe, pretty soon you have no rich, but lots and lots of very poor.

I don’t disagree with a gist of the article, but you are understating the “conventional” loan numbers. Intermediate-term fixed rate mortgages are fixed rate mortgages 15 years or shorter in term. For example, my single-family home mortgage is a 10-year (with 6.5 year sto go) owned by Fannie.

People may say they, or you, have the right but until they give you money its just talk. The facts (the math) will tell you if you can afford to be a owner. I’ve yelled and screamed at the facts…… nothing. The owner/renter ratio is correcting. The facts/math/truth is bad mutha, shut yo mouth.

Maybe the best I’ve ever seen from you, Dr. I respect anyone who tells it like it is and isn’t worried about how popular that truth may be. Too few have the guts these days to do it; you stand in a minority, and should be proud of that fact. Disdaining to join the merry band of pranksters leading the townsfolk down the path to ruin may not make you very popular or wealthy, but to those you manage to save by doing what you do, you will always be appreciated.

The truth is that the whole system is rotten to the core. It has been steadily rotting since the mid-70s.

The standard of living has been declining since. So has quality of life.

The cause? The almost total control of society by finance capital,

Parasitical finance capital is a dead weight on society. There is no housing problem. There are plenty of houses. In fact, there has been a huge production of houses over the past decade or so. Hooray!!

Shouldn’t that be good? More houses, newer houses, improved housing stock? Ina rational society, this would be celebrated. But no. Under the rules imposed by finance capital, this is bad. Kicking people out to camp in front of the empty houses makes sense. In fact, according to the rules of finance capital, it would be good if a couple of million houses were wrecked by hurricanes.

Same with jobs. Dynamiting factories here in the good ‘ol USA is good. Giving tax dollars for doing it makes sense. Rebuilding the factories in China and shipping the products to the US and lending their former producers the money to buy them also makes sense.

People are “working” in jobs which produce to value. Especially FIRE. We are taking in each others laundry. Like a third world economy.

All of this makes sense because finance capitalists frame the discussion. They create the axioms, the givens. They turn reality upside down, like the people in their upside down houses.

Time for a revolutionary overhaul of society.

Nationalize all credit and most land. Like in China. Grand 100 year leases on land.

Rebuild factories and infrastructure. Levy high tariffs.

Rebuild the cities.

Raise wages. Slash the workweek. Put everyone to work. Eliminate parasitical occupations in FIRE. Free health care. Free education up to graduate university level.

Get the fluff out of GDP. Run the real GDP at about 10% or more.

Cancel all mortgages. Slash rents to maintenance and replacement levels.

Tax away all mega-wealth. No more finance capitalists. They can go to work at high wages rebuilding the country.

There’s your outline for a new paradigm. The old one cannot be repaired. As Marx said, a revolutionary situation is when the people can no longer live in the old way and the ruling class cannot rule in the old way.

We are there.

Many will think me crazy for thinking like this. Just try thinking outside the box. The box most people don’t realize exists.

OT: Real home of genius (east coast edition)? Off 25% from 2003. Please, no racist jokes.

http://sports.yahoo.com/nba/blog/ball_dont_lie/post/For-sale-Allen-Iverson-s-six-bedroom-home-in-Vi?urn=nba,106478

On Topic: in the same vein, this country promotes automobiles. But remember driver’s ed? “It’s a privilege, not a right.” At least the DMV has a minimum testing requirement for obtaining that privilege. OK, very minimum.

With liar loans, there wasn’t even that minimum barrier to entrance.

And I think the younger set calls it “pwn3d” now, Doc.

Correction:

The above post should read:

People are “working†in jobs which produce to NO value

Deserve has nothing to do with it. Everyone wants a home, that’s natural. The real question is how things were allowed to get to this point. People en masse are easily manipulated, susceptible to mass hysteria, and tend to believe what they hear from perceived authority figures.

The housing bubble is only the latest and greatest in line of bubbles. In a profit driven economy short term gains will tend to overrule concerns about long term repercussions. That’s why there are a number of regulatory safe guards, to prevent situations like this from happening. In this case there was a complete systemic breakdown. As much as I hate to say it, bailing out Fanny and Freddy was unavoidable. Yes, the tax payers will foot the bill, but the tax payers would carry the economic burden of letting them fail.

What we should be asking how things got here, who can be held responsible, and what need to be done to prevent from this happening.

It worked really well for the soviet union eh Marx?

The four European countries mentioned in the above article each have a huge amount of good quality social housing. Unlike the U.K., these countries weren’t stupid enough to sell off their social housing and create a housing bubble, as happened in the U.K. As an advocate of social housing, I agree that someone doesn’t deserve to pay these ridiculous prices we have been seeing recently. Like clean water and uncontaminated food, shelter is a necessity, not a luxury. Privatizing Freddie and Fannie was the outcome of the Freidman or Chicago School economics theory of the free market. What was a successfully regulated government entity was gutted for personal greed. Good government is possible, we have seen it, but as soon as we allow undemocratic sytems of economics to dictate we end up in messes like we have now.

John:

“good quality social housing”, do you mean “The Projects”? WE got those in USA, lots of folks live there. There are some just a few miles away from my (million dollar So-Cal) house. As a matter of fact, we had too many, as they tore-down most of them in my area a few years ago, and put in gated community condos!! We got food stamps too, not to mention 2 Million folks in prison who in addition to shelter, get fed 3 squares a day. Taxpayers foot the bill for all of this. Im not sure how much longer we can & will pay for all this before there is a revolution. Anybody wanna wager when this apocolypse ocurrs?

I have occasionally come out on my own blog and said that homeownership is not a universal good.

Yes, some people don’t “deserve” to own a home. It’s really much more than that. Fact is, home ownership doesn’t serve certain people, including many who “deserve” it, but are simply not up to the burden, responsibility, and commitment of it. I have many friends who are prime examples of people who would be damaged by ownership, and many of these people have ample funds. One woman has quite enough money, but she is a dreadful housekeeper who can’t even organize a kitchen and is too frail to climb a ladder. Should she be burdened with exterior maintenance and constant repair hassles just because everyone thinks “ownership” is so great. Another person is starting a new business, and needs every dime and every minute available for that person.

You can still borrow easily if you are even marginally qualified. I’m discussing loans with lenders right now- good, conservative lenders who lend to get 6.5% interest reliably. 5% down on a 30-year fixed, with a FICO of 680, on a loan 2.5X your income will get you in the door right now- if you really want in that badly in a time of declining values. I really believe the qualifications I’ve just enumerated are pretty much the baseline for qualifying for a loan, and if you can’t meet these benchmarks, you have some work to do before you can comfortably by.

Unfortunately, because of this tragic bailout, the Righteous will die just like the Wicked. People who would qualify to buy and who would find something decent in their price range will continue to be priced out, and, worst of all, everyone in the country will be endangered by the ballooning government debt.

This bailout places the treasury that much closer to total insolvancy.

You can’t criticize the shortcoming of capitalism without someone popping up calling you communist, or citing the fall of communism to discredit you. It’s a deliberate misinterpretation. Truth is that capitalism and communism are two sides of the same coin. They both promise a perfect system and they both fail by disregarding the human factor, greed. A more efficient (not perfect!) system would lie somewhere in-between, with a combination of free market economy and governmental involvement. Unfortunately mentioning governmental involvement makes people see red. It’s a completely illogical reaction, product of generations of conditioning. Strangely many people are in favor of predatory capitalism, and even when it comes back to bite them in the ass, like now, they still fail to see the shortfalls of the system.

In the brave new world “own” means “owe”. There is nothing wrong with owning something. That is precisely what people used to do when they build (themselves or in a group – aka barn raising) their own houses. Without crazy financing we would be a lot closer to using technology to reduce the cost of housing instead of increasing it. Living within your means could be the next big thing.

A house is a place to live in and make a home to raise your family. It should not be used as an ATM. Greed is the real problem, that we got into this housing mess. Flipping houses to make profit. We had shows on how to flip houses and make money. Now the responsible must pay for the irresponsibility of greedy people.

You have missed the point of the bailout entirely. The government could care less about bailing out the poor American sucker who was lured into taking on far more debt than they could ever hope to repay in order to become a homeowner. Their votes can be offset with electronic voting machines. The real reason for commiting the American taxpayer to another $5+ trillion of debt was to try to save the economic system that keeps the ruling elite “in the fat” for a little longer. If this step had not been taken, foreign governments (i.e. China, Japan and others) holding huge amounts of GSE bonds, which would have collapsed in value, would have dumped their bonds resulting in a total collapse of the Western economic model. Credit markets would have completely seized, causing economic crisis around the world. The global economy might suffer decades of depression until it could develop an alternative to dollar hedgemony. The bailout will buy a little more time for the ruling elite to plan for their next step.

Thanks Doctor for another good post.

>

Was talking to a friend the other day. Said when he was a kid, only those families with better than average incomes owned houses.

>

Problem with a democracy, we can vote ourselves a raise… and we have!

Nice post. Linked you here:

http://wcvarones.blogspot.com/2008/09/u-of-wisconsin-prof-menzie-chinn-i.html

Pretty soon, the conversations at party will be about who doesn’t own a home, or who unloaded their home. Fact is, home ownershipt has and will be a rapidly depreciating assett or in many cases a liability.

I feel a big haircut due any time now for the Westside of Los Angeles and other “immune areas”.

50% peak to trough….

http://www.westsideremeltdown.blogspot.com

Dr.HB,

I have seen that the prices in my area, Santa Clarita, CA, have dropped below the 2004 level. By the time we hit bottom in 2011, what level do you think the prices will be? I know different areas will decrease at different rates, but I would like some guideline so, while we’re looking for a really good deal, we’ll know whether we’re getting one or not.

“Property is theft.”

“Who can own the land?â€

2015: RE cycle bottom; median price – single family residence: $75,000.00

2015: National average hourly wage: $7.00.

2015: Primary national industry: Alternative energy technology production/export/infrastructure rebuild.

This is a great, detailed article.

The American Dream is not just about owning a home. It’s also being able to live and stay in this country. We are so privileged and fortunate to have the rights that we are offered, but are still so unhappy about a whole lot of other things. We take for granted what we have when people around the world could only dream or imagine the kind of lifestyles we have. Some of our homeless people are richer than many people around the world who have no means of getting food for several days at a time.

Yes, not everyone deserves to have a home. But unfortunately, because of the expectations and drive to live the “American Dream,” many people try to have what they can’t.

Posted your article here: http://www.loanmods.blogspot.com

Also find additional mortgage information here: http://myloannegotiator.net

Very true. Owning a home is not some kind of right that everyone deserves, but don’t tell that to the people who want one. They have been fed so much crap that they believe it is every ones right to own a home and their expectations have drastically changed. You better believe the politicians are going to make sure they get that damn home!! Remember years ago when women weren’t allowed in the military; or you stayed in the closet if you were gay or could light up a smoke wherever you wanted? Shit changes, and I’m afraid it changed as far as expectations of home ownership. And I’m afraid its here to stay. I would be very surprised if we went back to the “old way” of doing business by actually saving and qualifying for a home.

While we’re at it, employment is also a privilege. Who are these entitled morons who think they have the right to a decent wage??

Leave a Reply