Half a million dollars for a 2 bedroom home in Compton: Hipsters and gentrification lovers unite!

In the last housing mania, people drank multiple rounds of the Kool-Aid and lost all perspective. That is to be expected when we live in the land of Hollywood and living in a world of make believe is pretty much par for the course. In fact, faking it until you make it is now a legitimate way to make a living. Doctored up photos with so many filters you would think you are purifying water to drink out of the L.A. River. SoCal is the land of rental Armageddon and delusional Taco Tuesday baby boomers who run around with their ugly looking dogs in “baby†strollers and think their crap shacks are worth one million dollars. So in the last mania, areas that were legitimately tough somehow carried ridiculous price tags. The pitch was that an area was going to gentrify because “no more land is being made!†or that it was in the county. We are now seeing some outrageous prices in areas that still have legitimate struggles. Today we go back to Compton.

SoCal living and the slow pace of gentrification

I was browsing through my weekly feed of properties. I like looking at espresso happy areas like Santa Monica and also places like Compton. Unlike most house humpers that enjoy staying in their tiny confined zip code echo chamber bubbles, I like venturing out to the ultra-wealthy enclaves and to areas that are less desirable, at least to the Taco Tuesday crowd.

Compton is one of those areas. Location wise, it should be a hit given its vicinity to the core of L.A. Of course it has its struggles like any working class area. But I saw this multi-unit property being sold for half a million dollars and was left scratching my head:

910 N Tamarind Ave

Compton, CA 90220

2 beds 1 bath 1,862 sqft

“What I love about this property is it serves multiple purpose. A place where you can live in one house and operate your business out of the second building. Great set up for beauty shop or local barber shop. A MUST SEE!!! VISIT TODAY!â€

Let us look at how thriving this street is:

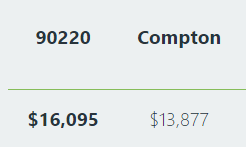

This place is going to need a ton of work and what is the business plan here? So you live in one place and operate your business in the other place. Does that mean this place is worth $499,000? Well that is exactly the price they are asking for. Here is your per capita income for the area:

I bring this up because if you are to run a business, you want to ensure people have disposable income to pay for whatever goods or services you are selling. However this place being priced at nearly half a million dollars should tell you something.

Okay, let us look at another home:

4933 E San Juan St

Compton, CA 90221

2 beds 1 bath 728 sqft

“Now it can be yours! Home features 2 bedrooms, one bath, iron fence in the front yard. Two car detached garage, plus drive way/RV Access to park additional automobiles. Close to public transportation, two minutes to major freeways. Block away from Middle school and shopping.â€

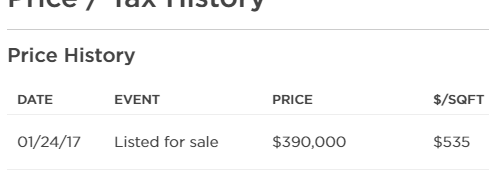

Here is the current list price:

The current tax assessment here is $87,439 so at the current list price someone is going to be paying roughly 4.5 times the amount in taxes per year for the same services. From what you hear from the house horny crowd, this is a great deal! Don’t wait and give your mortgage broker a call! Don’t miss out on this boom. Trump is a real estate guru therefore all real estate is going to go up in their mindset (as if Trump is concerned about Compton or California for that matter).

The mania and Kool-Aid is running freely at this point.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

179 Responses to “Half a million dollars for a 2 bedroom home in Compton: Hipsters and gentrification lovers unite!”

The first house would be pretty reasonable for greater LA if the neighborhood were gentrifying. Unfortunately drops in violent crime usually precede gentrification and Compton is going the wrong way. The second place seems senseless unless it’s zoned to allow a teardown.

Trump will make sure those 2 homes get to 1 million. Rush to buy them today before JT gets there first! …:-)

Sarc. off

As the saying goes — those who can’t, preach.

California is going to add 1 million illegal immigrants fleeing from TRUMP IMMIGRATION POLICIES IN OTHER states. Housing and rents will go up in California.

What about the policies of California Democrat’s who want to turn all of California into a sanctuary state?

In testimony provided for a hearing held on SB54, a California Senate bill that was introduced by Senate President Pro Tem Kevin De Leon (D-Los Angeles) that would make the entire state of California a “Sanctuary State,” he admitted that “half of his family” is residing in the United States illegally and with the possession of falsified Social Security Cards and green cards.

http://www.breitbart.com/california/2017/02/05/california-state-senate-leader-family-illegal-false-documents-deportation/

I’m all for a dose of reality and knocking off the rose colored glasses through which many gaze upon these blighted LA neighborhoods they call home, but it is likely that all these places will gentrify with time. Compton will gentrify, it may take 50 years but it will happen just due to it’s location and pricing. Hell look at Inglewood, I never thought it would improve but now has a new stadium being built as well as luxury condos and other large projects in the works. So it’s not crazy to think that Compton could be next. That being said IMO these example properties are not priced to sell in the area’s current condition.

Compton has gone through many transformations.

The area now known as Watts is located on the 1843 Rancho La Tajauta Mexican land grant. As on all ranchos, the principal vocation was at that time grazing and beef production.

In the 1870s, La Tajuata land was sold off and subdivided for smaller farms and homes, including a 220-acre parcel purchased by Charles H. Watts in 1886 for alfalfa and livestock farming.

Compton was once a separate city but was consolidated with Los Angeles in 1926. As a major junction of railroad lines, Watts attracted many railroad workers as residents.

https://en.wikipedia.org/wiki/Watts,_Los_Angeles

Until the early 1950’s, Compton was almost entirely Caucasian. The Bush family lived in a now-demolished apartment complex at 624 S. Santa Fe Avenue from 1949 to 1950.

http://gizmodo.com/when-george-bush-lived-in-compton-1576116422

http://gizmodo.com/when-george-bush-lived-in-compton-1576116422

Compton was once a separate city

Compton still is a separate city: https://en.wikipedia.org/wiki/Compton,_California

sweet looking house

your ignoring possibilities, this is a great casket its roomy and may collapse on owner user to send them on their way to the afterlife.

thank you orange county for making murrieta home prices increase. lets see that bullet train making rounds form murrieta to irvine. you rule gov. brown

The only thing that will fix Compton will be a fire or if the Federal Government finally pays reparations other than that nothing.

http://www.dailymotion.com/video/x2pveof

You watch, if this place sells, it will be to a Latin American or South East Asian family that are so desperate for the American dream they will buy in these areas. They will then have a ton of extended family live with them and help pay the mortgage, compared to a shack with a dirt floor this place is a palace and there is room for chickens.

Once you’re east of the 110, the summer weather is just hotter and the smog is that much worse. The whole point of LA is the weather premium. I think even five or six miles inland is hot, and I guess Compton weather is still paradise compared to San Bernardino. But still.

But it amazes me that parts of LA that are gentrifying that just bake in the summer. The valley for instance. Thick wallets should have thick marine layers.

Lots of wealth in the Valley. Hidden Hills has mansions at over $10 million. Valley summer heat isn’t so bad if can afford swimming pools and unlimited air conditioning.

‘Thick wallets should have thick marine layers’!

Best. Comment. Ever

I was born and raised in the Bay Area. I just got back from visiting family there and in SoCal. California still retains its natural beauty, but the rest of it (the crowded/sprawled cities, the Third-world populace replacing Americans) is a heinous mess. I was so happy to leave it and get back to Texas. Would someone please tell me what the attraction is?

I’ve ridden my mountain bike probably 2/3rds of the days in January (some of the days I missed were for a skiing trip on fresh powder in the nearby mountains). It’s not supposed to warm up above 65 (brrrr) until 10 tomorrow so I might wait for lunchtime for my ride then. Downtown LA traffic is certainly something I try to avoid, but life out here in the Ventura County suburbs these days is genuinely not sucking.

+1

California MTB ftw !!!

I along with most of my friends dont surf or do mountain biking or other outdoor activies all the time but once n a while…

wondering if it is stupid to pay such a price.. for being in socal

As long as you get out in the SoCal weather it’s worth it.

However for people who just stay inside and watch movies, etc… I don’t get why they are in SoCal.

Agree. I have been able to mountain bike and hike pretty much all January, and I’ve gotten acclimated to where below 60 degrees is cold. Keep in mind I was either able to walk, or bike from my front door to pretty much everywhere I took a picture this month ;

https://www.instagram.com/jbot747/?hl=en

So while I like to visit, I could never move back to Alaska, even though RE prices have collapsed there, and some homes are getting close to $200sqft for places with ocean views on 1+ acre lots;

http://www.zillow.com/homedetails/12621-Hillside-Dr-Anchorage-AK-99516/49778_zpid/

And in some cases, a lot closer to $100/sqft-

http://www.zillow.com/homes/for_sale/Anchorage-AK/54705_zpid/23482_rid/1-_beds/135000-1703000_price/513-6467_mp/globalrelevanceex_sort/61.114018,-149.688378,61.050932,-149.872914_rect/12_zm/

That being said, I was about to blow my head off the last winter I lived there in 2010-2011, and figured I would be happier selling fruit on the freeway. What I would rather not do, is be mortgaged to the hilt to the point where even a modest correction (like when interest rates go back up, or FCB’s stop buying in droves) would put me underwater

60 degrees? Jealous, bay area has been 50s, but worse than that Mud…… Mud Mud

#spoiled

Texas the land of Right Wing Jesus Freak Republicans now that is a big improvement over the Bay Area. I hear that if Mexico pays for the wall they will get Texas back. Dude, you have a Senator that looks like the bastard child of Dracula and Joseph McCarthy, but, hey, different strokes for different folks, I’m not here to judge.

Tejas < Tel Aviv but yeah, sitting around in a dead-end field like electronics is getting pretty old. I'm working on a location-independent business so I can, someday, have running water and a flush toilet again. I'm actually thinking of leaving California because the last time I checked, California is still part of the USA and with Emperor Caligula in charge, I don't see the story ending well. I think for the average person, Tejas might be an OK place to live. Not great, but OK. Basically don't feed or annoy the locals, keep to yourself, and I hear the "Hill Country" is OK.

Yeah, another Bay Arean here. Our cities are overcrowded, over-priced messes at this point. But Cali’s a big state, with a ton of coast and huge wilderness and mountainous areas with plenty of small towns. Not sure which one I’ll move to, but I’ll only stick around the Bay while my parents are still alive and kickin’…

I tend to agree. I always thought I’d move back into the house I grew up in one of the nicer neighborhoods, 20 minutes from the beach and a view. But after spending lots of time in So. Cal. helping my Mother in the final couple of years of her life, I concluded that the negatives, including my Mother walking into her house while it was being robbed, outweighed the positives and that So. Cal. wasn’t anything like the warm beach days of my teenage years! The icing on the cake was a drive from San Pedro to the San Fernando Valley to visit my Grandparents graves on surface streets … very few neighborhoods that had english signs on storefronts, trash on the sidewalks, bars on most windows, streets in disrepair, lots of traffic … it was like I had been transported to a third world. I sold the house for 7 figures, with no regrets! Over the years, I’ve visited enough beaches , shore lines, etc., to know there are plenty of really nice places, so choose to vacation at various spots instead. And, I found my dream place, a couple of acres, a nice house, near a huge lake in the inland northwest. For a relatively low prices, I found a nice house, a great view, bought a boat, have plenty of wildlife wandering across my property daily, and that is where I spend my summers! Quite honestly, no one can convince me that So. Cal. is anything but a dump anymore!

>> including my Mother walking into her house while it was being robbed, <<

Is there any city, town, or rural area in the U.S. that doesn't have burglaries?

If you want to avoid burglaries, your best bet is to move into a gated community or, even better, a security building with cameras and 24/7 doormen.

I live in such a condo. Much I don't like about it, but I do feel safe. I can travel for months at a time (as I've occasionally done), and not worry about burglars. I can even phone the doormen and ask if everything's okay — any water leaks or problems with the building? — and if I've received any packages.

That said, I'd prefer a nice house in a safe area, even though I realize it wouldn't be as safe as living in a security building.

Rural areas tends to get the really scary robberies, home invasions, torture, etc. I lived in a rural area and I feel living in a large city in a not-too-great area is actually safer.

Well, I would not lived in Texas either, it has a lot of immigrants as well and not just Latino. Houston, Dallas and El Paso, make Anaheim look good. You lived in a nice burb in Texas not the gang cities mention above.

I grew up in SoCal, but have since lived all over Texas since (for work). It is not SoCal in any way shape or form.

-Texas has no income tax but horrific property taxes. My $320k house averages about $8100 per year in property taxes….and that is about average.

-House prices is most areas are infinity cheaper here, especially for what you get, but you pay for it….big time in weather.

Ah Texas weather….*violent* is the only word I can think of. Since I have been in Texas I have:

1.) Evacuated from 3 hurricanes (hit by one)

2.) Had my car destroyed by softball size hail 2 years ago. And when I say softball, brother I mean softball. If caught outside you would be killed almost instantly.

3.) At work when I tornado hit 10 miles from us, which ended up destroying the home of one of our employees.

4.) Had to spend $5k on a tornado shelter just to feel safe in the DFW area.

5.) Ice storms that make driving utterly deadly. I’m not talking snow, but sheets of ice.

6.) Hot and humid. I lived in Houston for years…the heat and humidity was stunning. 4 years ago we moved to DFW, while not as bad as Houston, it is still horrific compared to SoCal.

7.) Mosquitos here are terrible and don’t get me started on fire ants….

So why after all these years do we live in Texas still? I simply can’t afford to buy a house in a decent area in SoCal. Why I read this blog and enjoy Dr. Housing bubbles articles. It’s very sad that even on a 6 figure income, housing prices out there have priced us out of the place we grew up. Heartbreaking.

I’m glad someone pointed out the issue of property taxes in Texas. No-income-tax states like Texas sound great, but the enormously higher property taxes can often offset the state tax a middle-class earner would pay. When it comes to getting gov’t services, you’re going to pay one way or another.

I live in the South, but I’d move to CA, Orange County in a heart beat. It’s cool, beautiful, surf, ski in same weekend, weather is great 80% of year. If you havent experienced a summer in the South, you dont know humidity. Love it out there, but the cost of living and housing, FORGET ABOUT IT!

Growing up in OC in the 70’s and 80’s was great. Now, not so much. The weather doesn’t make up for all the other crap you have to put up with living in Orange County. You can no longer surf and ski in the same weekend without sitting for hours in horrific traffic.

OC? FORGET ABOUT IT!

Certainly, Trump policies will lead to substantial inflation ahead. Homeowners will be big winners, as long as they purchase a quality home. Compton is not something you want to own

I have no doubt that you would have said the same thing about Hillary Clinton had she won instead.

Actually, no, most analysts would not have predicted the same level of inflation with Clinton. The reason being, Trump’s policies revolve around anti-globalization and trade barriers, which most major analysts predict will lead to inflation.

@Entity

I was commenting on JT’s blind faith about RE price inflation regardless of the facts.

The Great Depression was worsened by trade barriers. Back then, the global economy was far smaller than it is now. Its title suggest the polar opposite of “inflation”.

I know one thing for sure… the home prices in socal are way out of line with the salaries.

In san diego median home prices are completely unaffordable for a household earning median household.

If the inflation increases it’s gonna make houses even more unaffordable thus forcing people to spend less on housing…

Clearly!!! So buy now JT. Don’t miss out!!

Only buy now if your employment picture looks decent and the property could be rented at a price that will cover most of its payment just in case you need to move far away for a job. You can make a lot of money buying and holding on to decent property over a 10 to 20 year period, even if the property is rented out for some of that time.

@JT – And there in lies the @#^ problem. You think places like this, where your tax bill will go up 10 FOLD have rental parity?

https://www.redfin.com/CA/Irvine/15411-Alsace-Cir-92604/home/4680402

Think this is a million dollar home?? Quick numbers show you’d have to be holding this property for over 7 years, and renting it at 5,000/month before it became cash flow positive, and that assumes it will continue to go up at 3% a YoY and only have 0.2% annual maintenance costs.

http://www.calculator.net/rental-property-calculator.html?cprice=1000000&cdownpayment=20&cinterest=4.5&cloanterm=30&cothercost=6000&ctax=12500&ctaxincrease=1&cinsurance=1600&cinsuranceincrease=3&choa=0&choaincrease=3&cmaintenance=2000&cmaintenanceincrease=3&cother=200&cotherincrease=3&crent=5000&crentincrease=3&cvacancy=5&cmanagement=0&cknowsellprice=no&cappreciation=3&csellprice=200000&cholding=20&csellcost=8&printit=0&ctype=&x=65&y=10

That house and commercial building in Compton works if you set up a barbershop. For some reason, people will pay a premium (in Compton that might be $15 as opposed to $10) for a haircut in a real barbershop. It looks like the people in Compton make just a tiny bit more than I do, and even I get at least 12 haircuts a year.

I cut my own hair. Just spread some paper towels along the counter, and use scissors and an electric hair cutter while looking at myself in the mirror.

My hair always comes out okay. Nothing special. Maybe a bit rough, and a bit different every time, as I have no training. But it looks okay.

I did that for years, and I was even sporting a haircut that took clippers *and* scissors. Until one day, RRROWW! I clippered a part I did not normally clipper, hopped on my mo’cycle down to a local barber shop and had ’em give me a legit crew cut.

I agree, you can cut your own and it’ll come out OK. Strip down naked, spread newspaper out, buzz away, then jump right into the shower because those little hair bits have to be washed away. But for $10 I can have a nice Vietnamese lady cut my hair, the actual cost is $8 or $9 and I tip at least a buck, think I tipped about $3 last time because I’d let it grow a while, and well, it’s no fuss no muss and they do a far better job than I can with a mirror.

But yeah, if utterly flat-broke, doing your own is a definite option.

The problem is, I’ve been on the street or nearly so, and I know there’s always an odd job to be done for a few dollars, always some handicraft I can make and peddle, etc. so I don’t mind forking over a little money for a hair cut.

I found a barber that has a partially homie clientele who cut my hair better than it’s ever been done before. Horrified I got the “senior discount”, but for the meticulous haircut every single time I’ll give them $20 : $10.00 for the haircut and $10 for the tip, they’re that good’

Tried cutting my own hair a couple of times and wound up using an eyebrow pencil on my scalp to hide my mistakes.

Dweezil – right on. Basically, you want to stay away from places that cut the hair of very many … white people. You know those jolly TV ads for places like Supercuts/Stupidcuts? Yeah, avoid that whole scene. When Joe Homie or Joe Cholo get their weekly pay packet and are gonna kill some 40s or some tequila on the weekend, you know they wanna look *sharp*. A sweet fade’s where it’s at. The barbershop I go to these days is literally between a pinata shop and a storefront church.

Hilarious….

Housing bubbles-the other white meat

And, according to current RE cheerleaders, the potential max downside is a mere 15% while the ultimate upside is infinity.

…. but only before it goes up another 10% LOL

I would expect a double of house prices by 2027.

I’ve heard the same thing.

Does it matter though? What’s the equity upside to renting?

@Realist

Upside? How about more money in investment funds and other liquid assets?

Why so bearish jt and notankin? Housing will go up by 15-20% each year forever. Buy all the houses you can and be filthy rich soon! It’s so simple, I don’t understand why people are crybabies and don’t just buy!

JT – I do, too. But I also predict bread will be $10 a loaf by then.

@Alex

I think your estimate is half glass full. More like $10 per slice.

And a few years ago, people laughed at me when I suggested that they purchase a home in the Western edges of Mid Cities (using LaCienega as the Western boundary) if they could not afford Culver City or Beverlywood. There were many good deals to be had between LaCienega and Fairfaa; North of the 10fwy and also between La Cienega and Hauser; South of Jefferson all the way to Hahn State Park. These areas have gentrified rapidly. 4bedroom 2 bath mid century homes (not pre-war) homes were selling for $450K – $500K. Crime along these western edges of mid cities is of course a little higher than Culver City or Beverlywood but nothing compared to Inglewood or Compton.

California. Back in the early 50’s talk of reducing migration to the Golden State because it was evident the climate, natural beauty, endless business opportunity would bring a host of social problems. Of course in America you couldn’t restrict what people wanted dream life in Ca.

Now 40 million people later and a war and peace book on its present state of mine. it is either love it or leave it, never going to be a paradise for dreamers just a out of control travesty of very liberal thinking and policies ?

We always hear so much about Cali’s climate as being why people move here and why it’s so expensive- but look at New York or London. I’m sure its part of the equation, but these other cities have crap weather most of the year, no nearby mountains and are still outrageously expensive.

Just imagine what Commiefornia will be like after Gov. Moonbeam Brown and La Raza Democrats make it a sanctuary state with wide open borders and generous welfare programs.

California is going to be flooded with 1 million illegal immigrants that will flee the other states because of TRUMPS immigration policies. CALIFORNIA A SANCTUARY state.HOUSING AND RENTS WILL GO UP IN CALIFORNIA.

That’s funny since the Red States have the highest rate of Welfare recipients.

freeway rick ross could make some money here

This gives me flashbacks to EXACTLY ten years ago. However, what is particularly troublesome is that incomes are no greater (many lesser), the distribution of wealth has polarized the populous, and a dictator is in the White House. For those who live in their make believe world of “everything is okay” (given the harsh realty things are not for more today than ten years ago), I would say, “continuing to ignore reality will only result in hardship for you in the future. Now who wants that?”

“the distribution of wealth has polarized the populous, and a dictator is in the White House”

Why “dictator”? Last I checked we are still a constitutional republic where the president had the largest number of electoral votes. We were NEVER a democracy and when Obama had the whole congress on his side he did not try to change the form of government or the constitution. Nowhere in the constitution it says that you have to win the popular vote. These are just facts.

In terms of executive orders, Trump did not signed yet not even 1% of those signed by Obama. He might exceed him, I don’t know, but he is far from being a dictator. 4 years from now, I might change my opinion, but so far he did not give me any grounds for it.

I agree with the distribution of wealth, but that is due to the FED not Trump. For Obama’s terms, all the graphs show that the distribution of wealth was exacerbated. Most of the gains went to the 0.01%. However, instead of using jerk reactions and go by feelings, I state the truth – the FED and the globalist policies are to be blamed. Obama, like Bush where just puppets for the globalists. Maybe Trump will be the same – remain to be seen. For now he is the only president in decades who doesn’t come from than den of evil thieves called CFR (Council of Foreign Relations) or globalists.

Globalists outcome = dissappearance of middle class, all wealth to the 0.01% and all the rest EQUAL poor

Well said! Thank God we’re off that globalist bandwagon! We finally have a REAL LEADER IN DONALD J. TRUMP!

Flyover, I wish I could share your optimism, but so far, Trump’s actions have only confirmed my suspicion that not only will he do little to nothing to reverse the monetary policies that have driven inflation and debt creation, but will in fact double down on these destructive policies that benefit the top 0001% while decimating everyone else, mainly because he makes his money from real estate and benefits tremendously from asset inflation- and has shown great unwillingness to resolve his own flagrant conflicts of interest.

Worse, though, Trump is not the person really running the show. Our true president is the malevolent White Nationalist Steve Bannon, who has been outspoken in his desire to totally destroy the state, and who is flat-out advocating economic “super stimulus” in the form of negative interest rates. In other words, he not only will not reverse our current destructive course, but wants to double down on it, and promote policies that will drive rampant inflation and the complete destruction of savers, seniors and wage earners…. and the ultimate destruction of our currency. And unlike Trump, Bannon is intelligent enough to know what the end result of all this will be, which is Wiemar-style hyper-inflation, and the total destruction of the wealth of the population to the point where even people who were millionaires on paper found themselves unable to afford a meal, and there was mass starvation and destitution. When this happens, a strong-man dictatorship is not far behind, which is what Bannon is no doubt trying to achieve, and the strong man sure as hell won’t be Trump. He is just a tool.

Laura,

You are talking about my optimism since Trump election, but my posts lately were anything but optimistic. Some call me a pessimist and some gloom and doom. I see myself as a realist. When people here were ready to buy because Trump won I poured cold water over irrational exuberance and I suggested to them to wait at least a year till all this euphoria dies down.

That being said, FYI I did not vote for Trump but I am very happy that Hilary lost. Not only that I don’t like her as a person but I hate those globalists behind her and the agenda they push. You expressed your opinion about the future under Trump and I respect it. Since I don’t know the future I restrain myself from predicting something with thousands of variable interacting one with each other. In a year or two I might agree with you. For now I am just watching. I already disagree with him on the wall. I know why he wants to do it, however, the bigger issue is the total disregard to our immigration laws who are not enforced. In Russia, decades ago, even with thousands of miles of borders, a fly could not cross it without the government permission. And that with decades old technology.

You are concerned with the inflation. However, what is the higher minimum wage in most states doing to inflation? Those are not for the poor people – they will find less jobs and after paying more in SS and Medicare taxes they will buy less than before because of loss in purchasing power. The purpose is to offer the banks higher nominal value for their assets. The MSM which is hand in hand with the globalists do a scorch earth policy to demonize Banon and Trump because they hate nationalists and populists. Banon was accused by US MSM of antisemitism but his prior magazine was perfectly accepted to be published in Israel and Netinyahu does not see any problem with Trump choosing Banon.

Flyover, I agree with you on most of your points. I could not support Clinton, either, for the reasons you have enumerated and wasn’t sorry she lost. I voted Libertarian, which was really just the same as not voting at all, and think now that I should have written in my true first choice, David Stockman, just to make a point.

Completely agree with you in the matter of the minimum wage, which has always been inflationary and has done nothing to elevate the standard of living of those at the bottom of the ladder.

And agree on the matter of globalization, which has devastated lower-tier workers everywhere, and destroyed our smaller cities and towns as well as our manufacturing base. Worse, it has weakened us as a country and left us less able not only to compete and support ourselves, but to defend ourselves. What is truly frightening is that our manufacturing is so decimated that we could no longer mobilize for a wide-ranging war, which is something Trump and his team need to think about when they go sabre-rattling at the country to whom we’ve handed not only our markets but much of our more sensitive military technologies, which I consider to be treasonous.

We had a truly terrible choice in the past election. It was either a dislikable and untrustworthy woman known for her venality and allegiance to global elites who are determined to reduce 99% of their countries’ populations to shanty town poverty, vs

an equally venal and unprincipled con-man with absolutely no skill or finesse, who is a bull in a china shop in his manner of handling relationships we have spent decades building, and has even less respect for our rights than his opponent. Both candidates were heavily influenced by foreign governments, and both are warmongers with zilch respect for individual rights. Both are known by people who have dealt with them closely to be vile human beings. So, while there was no way I could bring myself to favor Trump, I can’t be too hard on anyone who did, especially the millions of small business owners whose businesses have been gutted by draconian regulation and confiscatory taxation. I decided that since I am Libertarian anyway, and there was no real choice, I might as well cast my meaningless third party vote for someone who at least possesses human decency, even if he needs a crash course in foreign policy and global relations.

Exactly 10 years ago was when people were losing $50k – $75k by hanging onto their houses instead of selling them (instead of, just a year before, being paid $50k – $75k to stay in them) and there were jokes about living off of the stale sandwiches that were put out (and put out again a week later) at Open Houses and well, a certain web site was getting lots of laughs with comments about “mawbul cawlums” and the “DHO” index (for Dudes Hanging Out, the number of family members and/or random people showing up in RE photos) and the ever-present red arrows.

There is a possible future that may be very troubling for many. It’s a safe bet that inflation will skyrocket under a Trump administration. The few will reap the vast financial benefits of decreased regulation and increased interest rates, while the many will suffer from higher costs of living and insufficient wage increases to keep up with inflation. So the music plays on while the huge gap between the haves and have-nots widens further.

Depends on whether or not the current credit cycle can continue unabated. Most inflation in the past 2 decades has been caused by financial engineering (low rates and easy borrowing terms) rather than by consumer demand.

Where does this inflation come from that everybody insists is happening? Higher wages or even more debt issued? We’ve had over 30 years of credit expansion that resulted in massive inflation. See house prices for an example.

But on and on we go with this narrative of inflation is coming. Meanwhile the FED leaves rates at historic lows for a decade and jobs pay less wages than years past.

You want to get the economy going and get some inflation? Let the housing market crash and burn to the ground so people don’t have to spend every last cent on shelter.

Inflation is already really high on everything that matter for the middle class: house prices, high rents, high medical cost, high education costs, high food costs. Who cares about computers and TV!….they will continue to drop in price due to technology.

Wages can not increase at the same speed because of globalization and immigration to keep competition for jobs high – high supply of labor means lower cost for labor – ECON 101.

The end result of globalization pushed by democrats and RINOs is lower standard of living for everyone (99.99%). That is why the populists in the west win everywhere. It is not a phenomena happening in US only. This is why Trump positioned himself to use all the range to be pushed in the WH. He is an opportunists who correctly understood what is happening and he didn’t have to report to the party for what he wanted to say. That is why he won.

The democrats can deny this phenomena all they want to their detriment. The people standard of living will continue to plunge and the rage eventually will vote out all the globalists. You can not have socialism and open borders at the same time. It is a mathematical impossibility. The democrats have to chose – one or the other. It is very logic and it doesn’t have anything to do with ideology.

That is my point Flyover. We’ve already had a ton of inflation in every single thing that can be financialized. So to claim there will be dramatically more inflation suggests either a bunch more debt issued or huge wage increases. We know wages are decreasing and even if they did increase, there is still already a massive debt load to service that would sop up those gains before we see inflation.

As far as issuing more debt than is already out there, we are already close to complete loss of confidence in debt, which we already saw in 2008. If the FED ever stops buying debt, reality will return and defaults on all this fiction will begin. We’ve pulled all future gains forward. The demographics combined with globalization don’t look good for wages. How do we get even more inflation than we already experienced?

Assets will need to return to real world wages.

Inflation does not just apply to housing. Yes housing in LA, San Fran, San Diego, etc. is expensive, but you can still buy a home in San Bernadino for less then 200K. But of course most people here don’t want to live there. If you’re waiting around for a monumental crash or wishing for the repeal of prop 13 thinking that you’ll be able to swoop in and get your dream home on the coast in the best school district within walking distance to the trendiest shopping for 40% of today’s price, you’re going to be waiting a LONG time.

Back to inflation. Inflation also applies to the cost of goods and services not just housing. The US has been on a steady diet of cheap crap from China, Japan, Korea, for years, not to mention produce, vegetables, cars, auto parts, and labor from Mexico. What happens if Trumps so called tariffs come to pass and the costs of goods and services increases? Are people going to do with less? Fix things instead of throwing them out? Or just maybe they will simply do without because they have no choice and can no longer afford it. On top of that we have strong signals that interest rates are going to increase at an accelerated pace. That means more people being squeezed by higher mortgage, car, and credit card payments. I would think higher mortgage rates will also drive up higher rents. Hopefully businesses and wages grow to offset these increased costs, until they don’t… and that’s when things start to get interesting.

That was my point for the future – way lower standard of living for 99.99% of people due to globalization.

People looking to the past to predict the future will be sorely disappointed. When you have MASSIVE immigration into the country (legal and illegal, educated and mostly uneducated) and already 100,000,000 people of working age without a job and expect wage increase, you will be sorely disappointed. Due to the dollar as reserve currency you can not produce as a nation enough jobs for the average person. Add on top of that massive taxation on everything to support that mass of unemployed humanity and you end up with 99.99% EQUALY poor and 0.001% SUPER rich. That is what the democrats delivered to the US voter regardless if they see it or not – force companies to move overseas through mass regulation and taxation, tax middle class into oblivion, promote mass immigration (legal and illegal) and help the top bankers from the FED to conquer the world through imperial wars supported by the middle class. The RINOs like Bush, Romney and McCain are just as guilty.

See Brian? You set off the nuts.

I noticed that prime area pricing has increased dramatically in 2016. I’m checking area like San Mario and Manhattan Beach etc. Can you write an article of what do you predict the housing pricing in prime area? Thank you.

Ultra prime areas like Manhattan Beach defied gravity during the last blowout. Prices only went down 15-20% from the peak of 2007. The amount of wealth that has moved into Manhattan Beach during the last decade is mind blowing. New McMansions are being built on almost every street. Many long time owners (whose house is NOT for sale) are given offers they can’t refuse and end up selling. And we have another NFL team in the South Bay that will further drive up prices.

I remember seeing MB Homes of Genius articles 6 or 7 years ago on this site with an old shitbox with trashcans sitting out front, I think the house was around 600K. The sucker who bought that house won the lottery. The value of the house (or should I say land) has doubled since. There were smoking opportunities to be had, many people will be kicking themselves for not taking action.

This bubble is the best entertainment. If you want me to live in Compton you have to pay me money. This ad is clearly a typo. No one with a brain would pay more than 50k for this piece. Crapshack is a compliment for whatever this box represents. This market will crash so hard it will make 2008 look like Christmas. And if it doesn’t crash this year we enjoy this entertainment until the next year or longer.

Good luck….

Eventually a recession will happen and you will see prices in prime areas go down 10-15% as per usual and stagnate for a few years.

You won’t see 2008 again.

Not unless Trump dials up … or should i say dials down the regulations for no documentation negative amortization loans again. If that happens you’ll really see prices rise for 4 years just like 2003-2007 until the “epic” crash occurs.

I think you are going to be quite bored for the next 7 or 8 years. You’ll probably see a 15% drop in 2 years… then you and many others will sit on the fence when your epic drop never occurs…. hell that happened in 2008-present… many fence sitters missed that boat too.

It’s called “NORMALCY BIAS”. The future is not always like the past.

Kinda like “CONFIRMATION BIAS”. The news agrees with our beliefs isn’t necessarily the news that’s accurate.

I agree completely. It’s like the stock market. Sure, stocks could tank and lose 40% value next year but I’m up about 250% since 2008.

@NoTankin, Are you able to give us just a couple of reasons why the market will only go down by 10-15%? Enlighten us please.

You’re partly right.

“You won’t see 2008 again.” – Agreed, waiting for a market to reach a previous bottom is foolhardy.

“prices in prime areas go down 10-15% as per usual” – “Usual” only if you’re not talking about a bubble. Manhattan Beach saw prices fall ~30% when the last bubble popped. LA overall saw prices fall 40%. The inland empire saw 50%+ drops in some places.

An El Segundo house that was a complete rip-off at $850k in 2005 will be a smokin’ deal at $1.1m in a few years. Anyone who doesn’t see that will lose out.

everyone is saying prices are going to go up but the flight of high paying jobs and no increase in wage, how can people afford these prices ?

If the wage increase from $12/hr to $15/hr, the houses are still not affordable.

Dude that first place is the shack from Fridays .. where they’d hang on the stoop.

Westside “Tree Top” Pirus vs. Eastside “Santana Blocc” Crips…Gentrification Beef

Blame California’s Proposition 13. If you keep your house, your property taxes barely ever go up. So most in California that want to continue living there have no reason to sell when prices go up, causing chronically low inventory levels. Normally prices go up, property taxes go up, and some people have to sell because they can’t afford to live there anymore. Not in California.

Because of Prop 13, you can’t compare property prices in cities outside of California (like Seattle, Portland, Austin, New York) to cities in California, like San Francisco. The economics are entirely different. So when people say stuff like Portland or Seattle are the next San Francisco (real estate wise), I can’t help but shake my head.

Example of the ridiculousness in California: In 2003 financier Warren Buffett announced that he pays property taxes of $14,410, or 2.9 percent, on his $500,000 home in Omaha, Nebraska, but pays only $2,264, or 0.056 percent, on his $4 million home in California.

Yet another reason to wait until higher interest rates cause lower home prices. I don’t want to pay 1-2% taxes on a million dollar home worth about $500-$800k. You also can’t easily sell / refi once interest rates cause home prices to drop.

Also, Prop 13 owners can do a one time transfer of prop 13 status so the game is always rigged.

Prop 13 owners can do a one time transfer of prop 13 status so the game is always rigged.

The rigging is limited. The owner must buy a property at the same or lesser value than the one they’re selling. If they upgrade to a higher-priced house, then no Prop 13 transfer.

And the owner must be older than 55.

http://www.dansuich.com/files/TransferringYourProp13TaxBase.pdf

My parents bought 2 homes is L.A. on the same block in the 1960s. I live in one of the homes valued at approximately 1.1M. I paid roughly $700 last year in property taxes. Without prop 13 my parents would have been forced to move out years ago. We plan to keep the properties in our family forever. One day when they pass on, I’ll turn it into a rental and that will be my retirement income or pay for my son’s college.

People who are renting apartments in your neighborhood are paying the property taxes for your sons public schools!!

$700 is like a sneeze

Blame it all on Proposition 13? No.

There are other factors that cause a housing shortage in California’s coastal communities and prices to be so high:

* Limited land available for new construction

* Restrictive zoning laws that limit new construction

* Draconian building restrictions caused by the California Environmental Quality Act (CEQA)

* Unlimited immigration from around the world

* Ability of non-citizens to buy homes

I bought my first condo on Tamarind. In Hollywood up the hill from Counterpoint Books.

Now I know the true meaning of “below Franklin”.

PER CAPITA INCOME IS ONLY THE TAXABLE INCOME…..YOU FORGOT THAT MOST MAKE OVER SIX FIGURES SELLING DRUGS…..NON TAXABLE INCOME

SO THIS HOUSE IS RIGHT IN LINE WITH THE PRICE… 🙂

–Update– Post Executive Order to repeal Dodd-Frank

I have been following this blog for the last couple of years and can definitely see that most contributors tend to side with the “wait†don’t buy yet, wait for the bubble to pop folks. I tend to side with these folks myself…

Now, after the repeal and/or major deregulation post Dodd-Frank, I am beginning to question my own position…

Any more educated, smarter people here have any reasonable and viable opinions?

If I can afford to buy a condo now, should I just do it and wait for deregulation to continue to inflate the bubble? Last time it took over 4 years to finally pop the non-regulation bubble.

I don’t know if I can wait another 5 years in Los Angeles County to see “if†the bubble pops.

Would love to hear other’s opinions… do you still think there can be a pop in the short-term?

Buckle up and hold onto your panties……here comes housing bubble 2.5!

The bottom line is this, you have people out there who are smart, who can’t really be bamboozled, and those are the ones who had safe and sane mortgages even during the crazy time. Then you have the other people, ARMs, HELOCS, 125 loans, you name it.

It doesn’t matter what the regulation is, Dodd Frank was to make compliance people rich, so PWC and EY could donate a few more million to the Democrats in return, which they did. It’s nothing more than a compliance toll booth.

What matters in all transaction in life, from love to money, is the question “Is this fraud?” Is this loan fraud? The banks should never have been bailed out. They should have been unwound by the FDIC and closed. BUT. The same people who bought 600k bungalows in Watts would have lost their money buying magic beans from Jack the next day. They were destined to be sheared like sheep.

Whether the bubble stops here or continues for another year, it will eventually unwind to a point where you have no equity anyway. If a tomato in the grocery store was $10 or $12 would it make a difference or would you let it rot? Let the tomato go to $15. Let some hipster buy it.

If they repeal Dodd-Frank we will finally have a bubble this blog can write about and you will finally see 30-50% drops.

Unfortunately it will cause a 30-50% bubble increase first…. with fog a mirror negative amortization loans. However a 50% increase followed by a 50% drop is still a 25% net decrease from current….. that should take 4-6 years to happen.

Please pass the bong, you have no idea how inflation works and rates going up will effect the market greatly…but they won’t because the US is broke….

enjoy your fruit now, it will get moldy and be trashed

I love your enthusiasm though….

Huh…The bubble reflation began 8 years. Dodd Frank was just applying lipstick on a debt-gorging hog. Hint: prices going higher due to speculation rather than real demand.

No real demand?

WTF are you smoking

We were at below rental parity from 2010-2014 and at rental parity after that….

No demand? CD pass the bong to Prince.

I don’t think Dodd-Frank will be repealed, but if it does… watch out.

@NoTankinSight

No real demand?

“WTF are you smoking”

Not the real estate “hopium” you’ve been inhaling…

“We were at below rental parity from 2010-2014 and at rental parity after that….”

Huh…rental prices are in a bubble due to over-speculation in the rental market. Ever heard of buy to rent landlords who are desperately trying searching for investment yield to counter the abnormally long period of interest rates? And you must have meant rental “parody”: 100K as down payment to somewhat make bubble mortages equivalent to bubble rents.

“No demand? CD pass the bong to Prince.”

So why are you here on a bubble blog instead of buying properties hand over fist?

“I don’t think Dodd-Frank will be repealed, but if it does… watch out.”

How so? Cheap and easy credit have already made their mark on the real estate market in the past 8+ years.

You may love the man. You may hate him. But the fact is, President Trump has been dealt the worst hand of any incoming U.S. President since James Buchanan – or maybe ever.

He’s taking over at a time when the national debt has experienced exponential growth for over 45 years. The national debt was under $400 billion when Tricky Dick Nixon closed the gold window in 1971. Today it’s nearly $20 trillion.

In short, the debt curve is entering a hyperbolic state. No amount of monetary gas will be able to propel it straight up forever. Of course, when you tack on unfunded liabilities, like social security, prescription drugs, and medicare, the debt runs up to a breathtaking $104.6 trillion. Each taxpayer’s on the hook for over $874,800.

At the same time, the stock valuations are at nose bleed heights. The Shiller’s Cyclically Adjusted Price Earnings (CAPE) ratio, for instance, is currently 28.5. That’s 70 percent higher than the CAPE’s long-term historical average.

In addition, there have only been two occasions over the last 100 years that saw the CAPE at a higher valuation than today. One was during the late 1920s, right before the stock market crash. The other was the late 1990s, just prior to the popping of the internet bubble.

Similarly, the Buffett indicator, which is a ratio of the total market capitalization over gross domestic product, also shows that stocks are significantly overvalued. The ratio currently stands at about 126 percent. A fairly valued market is a ratio somewhere between 75 and 90 percent. Anything above 115 percent is considered significantly over valued.

The point is a century of scientific mismanagement of the currency has pushed the economic, financial, and social order well past any rational limit. Total government debt and stock valuations are at all-time extremes. Something big is coming. You can guarantee it.

But don’t blame Trump when the world ends. There ain’t a doggone thing he or anyone else can do to stop it as long as we have the current debt money system. However, if you see value in SoCal RE, go ahead and buy – the fool and his money are soon separated. After all you can lose only 15% according to some pundits! … What happened in the last decades with our money system does not have anything to do with prices increases in SoCal. It is all about the weather and the high household incomes… and… Chinese… and…I forgot – ski and surf on the same day:-))))

Agree 100%.

Stocks are overvalued by at least 20% at this point. I’ve heard pundits say it’s because ‘where else are people going to put their money..’ Which is precisely the point/plan, to ravage savers / fixed income people, and force them to participate in this high stakes game of musical chairs. The stock market hasn’t been in a bear market for over 7 years now. When the correction comes, it will kick off another recession, and I am not sure people will run to commodities like they did last time, or housing the time before.

I am long silver coins, and energy stocks, but am looking at hedging a bit for when the proverbial sh!t hits the fan, and exchanging about $1K USD for GPB, CAD, and maybe some Peso’s. I would buy BTC if it wasn’t at any all time I high, and I didn’t think it could collapse or be stolen at anytime. Kicking myself for not buying 100 BTC back in 2011-2012 when everyone at my work was talking about it. Could have taken $500 and turned it into $100,000.

with Trump 10% corporate tax break SNP fair value would be near 2450

So let me get this straight. You are long on silver when we have been in a falling interest environment for 34yrs. In a rising interest environment to combat inflation (where we are heading) precious medals usually do poorly. Also, energy stocks (oil specifically) gets whacked. If you invest in energy I hope you are putting money into companies that consume oil not produce.

Also, rising interest rates=stronger dollar because it attracts foreign investment into t-Bills / bonds. But if the sh1t hits the fan you want to put your money into pesos? If we tank in some sort of financial Armageddon, you think Mexico and the peso would survive?

If you have a financial advisor you should fire him. If you don’t have one, hire one. Otherwise, take Warren Buffet’s advice. You along with 90% of Americans should just stick to low cost index funds and ride the wave.

The key is to have long enough of a time frame to stay in the game and adequate reserves so you aren’t forced to sell when the market is down. The same with real estate. Yes, it may “tank” (20-30%) correction next year or it may not. In 10-20 yrs after that, it will not matter. Just ask the people who have been sitting on the fence since 2012. They are just upset because they missed out.

@SoCalGuy

These aren’t my primary investments. They were hedges. As for energy stocks, BP is paying 6-7% dividend. I only have one other thing that comes close to that, and that is through my work place, which pays 5.5% interest on a tax deferred retirement account for people that reach their annual 401k limit.

Flyover: if you see value in SoCal RE, go ahead and buy – the fool and his money are soon separated.

Considering the dire economic picture you paint, where should a non-fool place his money?

* Cash — Hyperinflation, due to printing money to pay off the massive federal debt.

* Treasury Bonds — Feds might renege, paying pennies on the dollar, due to massive federal debt.

* Stocks — Might tank due to economic crisis from massive federal, state, city, and private debt.

* Real Estate — Property tax hikes, and end of Prop 13, due to massive state and city debts.

Good questions SOL! I ask myself the same questions everyday.

I can tell you that in this environment there are not too many good options. In general (my whole life) I am bull on RE and that is how I made most of my money. I am a bear at the present time (although I was a bull 2010-2014). I was never a bull on stocks, bonds and T-bills. For stocks there is too much info I need and don’t have (I feel like driving with my eyes closed). For bonds I am not as excited as with RE. With RE I get appreciation plus cash flow, at least so far, with interest going lower. That is going to be reversed going forward and interest trending back to historical averages. Once in a while I do get a “bond” by default when I sell with seller financing and that because it facilitates the sale of RE for a good price.

Most of my money at this point are in RE but I divested constantly since 2014 and consolidated my positions. Because I have lots of equity, my debt level decreased to 5-10% of total and that on my own home for tax deduction. All my income producing properties (commercial and residential) are paid in full. I will continue paying my debt down to zero. If I borrow I want to make sure that it is for a super deal when that comes along. Historically there are more deals that we have money to invest. I bid my time.

The IRA money I prefer to keep more than 50% in cash and some in energy stocks with nice quarterly divident, just in case we have inflation – hedge for the cash position. If the market tanks, I can use the cash for more stocks buying (if they are attractive). The cash also can be used as emergency fund after a 10% penalty for few more years till retirement (still less than the tax I saved). If the RE tanks, then I will have more HELOC money available for investment and some cash.

The low amount of debt and very high passive income gives me peace of mind regardless of what the market is doing. For me it is not just ROI. The return of the capital and stress/peace of mind factor are equally important. For retirement I already have very good passive income.

I can not eliminate risk, but I try to manage it to the lowest level. The printing of money in our debt based system is improperly called so. It is not so easy to do like in Venezuela or Zimbabwe. Every single dollar is created through debt. For money “printing” somebody has to get a loan: Individuals, businesses or the government. That is done based on the ability to produce (for government to tax). I believe that at this point in the cycle, pretty much everyone is maxed out. There are tremendous consequences for each of the 3 groups if they continue to do so indefinitely, but that is another subject.

Ian tell you..

wages are not increasing…

we need to see how long the music plays…

Assets will need to return to real world wages.

“But don’t blame Trump when the world ends.”

There will no shortage of terrible things to blame Trump for. And deservedly.

Flyover, I see you’ve done a good job of reading ZH and a few other sources and have combined them into the typical non-MSM generated worldview. And you come here and espouse your viewpoint multiple times per day. Which is great, and a “fresh perspective” for those who haven’t bothered to read alternate news sources and critically think for themselves. But for those of us who have been around since the first bubble, your drivel is quite trite.

“Something big is coming. You can guarantee it.”

Really? Isn’t the deck stacked exactly like 2006? Minus the liar loans, option ARMs and CDS? Do we not now have an administration taking office pledging to shred consumer protections and further deregulate markets in the name of “doing the people’s work?”

Those calling for the end of the world in 2006, 2010, 2012, 2016 were sorely mistaken. Learn from history, think a little harder, and don’t just be another false shepherd here trying to lead the sheeple astray.

What consumer protection are you referring to? The corporate and financial bailouts at taxpayer expense? The looting of savers and conservative savers through QE and ZIRP to benefit the elite .00001%? Giving cheap and easy credit to investors to that they speculate on RE, stocks, and other assets while driving up consumer costs when incomes are stagnant? All this under both previous administrations.

I’m skeptical that Trump may be any better. But he isn’t dismantling any protection that we already don’t have.

SoCalRulez,

I don’t understand what is your problem? You bring in 2006. What for? Did I ever write anything to support Bush and his imperial wars????…I don’t understand your jerk reaction to my comments. We are supposed to talk about prices in SoCal, but those do not exist in a vacuum. They depend a lot on what I am writing about than you want to admit. I want the good of the middle class and I do not believe that the globalists care about the US middle class or any middle class.

I was saying many times and I will say it again till you understand well – the problem is not with Obama or Bush alone. The problem is with both Bushes, Clinton, Obama and all the globalists coming out from CFR. I was saying the problem goes all the way 45 years back when they removed the dollar completely from gold standard. It was all downhill from there for the middle class. Since then, the FIRE industry became a cancer/tumor for the main street economy (over 40% of the GDP).

Like you, I don’t want to live in a country resembling Brazil, China or Russia where few oligarchs control the peasantry made EQUALY poor.

Your jerk reactions, slogans and ideology and lying to yourself are not going to help you or I or anyone in the middle class.

^ smh. Exactly what im talking about.

Blert, we miss you!!

“Really? Isn’t the deck stacked exactly like 2006? Minus the liar loans, option ARMs and CDS?”

But an exponentially higher amount of Fed and government-induced debt sloshing around the economy and creating bubbles across multiple markets in the economy, not just in real estate.

“Do we not now have an administration taking office pledging to shred consumer protections and further deregulate markets in the name of “doing the people’s work?â€

What consumer protections are you referring to? The past 2 federal and Fed administrations have been giving away the farm to the elite .0001% at the expense of mainstreet. Bailouts for financial institutions and corporations. QE and ZIRP to loot savers and prudent investors for the benefit of re-inflating the assets for speculators and those who took risky bets. These actions artificially drove consumer prices up while personal incomes stagnated. In effect, Trump isn’t dismantling what was not already there.

Sigh.

Meet tip of iceberg.

http://www.denverpost.com/2017/02/03/trump-bank-financial-regulation-consumer-protection-rule/

Attack Dodd-Frank all you want but it doesn’t take a genius to see what’s coming next.

@SoCalRulez

Perhaps you didn’t understand or thoroughly ignored my original post. Time to check the facts rather than reading empty headlines. Dodd-Frank hasn’t prevented the subprime lending has been going strong in RE and the auto markets for a while now. It has done nothing to discourage the over-speculation in the RE market (house flipping is coming back with a vengeance) because it doesn’t control Fed policies of abnormally low interest rates. As a result, private (consumer) home ownership is at an all time low while housing costs are historically high.

Forest for the trees, man.

You seriously think Dodd Frank had no impact on reducing risky and fraudulent behavior by lenders? That kiboshing the implemention of a fiduciary responsibility will not heave us backwards to the days of liar and stated income loans?

“..housing costs are historically high”

^also not true, when taking into account inflation, interest rates, and 2006/7’s market highs both for CA and nationwide.

Perhaps you weren’t around to experience the market heydays of 2002-07. But I’d be remiss in not mentioning that it’s you who needs to check facts, buddy.

Actually let me spell this out in simpler terms…

1) Per your super insipid comment, subprime home and auto lending currently exist (duh)

2) Interest rates are low (ibid)

3) Remove Dodd Frank and potentially other consumer protections from the current situation

What happens next? Such a mystery! Anyone? Bueller? Bueller?

“You seriously think Dodd Frank had no impact on reducing risky and fraudulent behavior by lenders? That kiboshing the implemention of a fiduciary responsibility will not heave us backwards to the days of liar and stated income loans?”

I get it now. You’re one of those simpletons who continues to buy into the delusion that it was fraudulent loans, not high prices, that caused the meltdown. I asked others before, why was there a global RE meltdown when toxic loans were primarily an American product?

“..housing costs are historically highâ€

^also not true, when taking into account inflation, interest rates, and 2006/7’s market highs both for CA and nationwide.”

In the most overpriced markets (Orange County, Los Angeles, New York, San Francisco, etc.), they are well above the previous high. If inflation is indeed ~2% annually, then it doesn’t explain the exponential YOY price growth. And it is simply ridiculous to use a bubble peak to rationalize today’s prices when both have shattered the long term price trends.

“Perhaps you weren’t around to experience the market heydays of 2002-07. But I’d be remiss in not mentioning that it’s you who needs to check facts, buddy.”

Yeah, coming from someone who continues to blame subprime and toxic loans for the meltdown. Just repeat to yourself, “subprime is contained”.

1) Per your super insipid comment, subprime home and auto lending currently exist (duh)â€

Hence, Dodd-Frank does nothing to legislate against what is basically human nature — greed. Duh!

“2) Interest rates are low (ibid)â€

Hence, the speculation and high prices.

“3) Remove Dodd Frank and potentially other consumer protections from the current situationâ€

Those were removed a long time ago (ever heard of Glass-Steagall?). But simpletons like you prefer to be spoonfed headlines and soundbites.

“What happens next? Such a mystery! Anyone? Bueller? Buellerâ€

I’m betting you’re waiting for the next headline to answer your question. I do note that you couldn’t elaborate on the claims about the doomsday Trump policies from that article.

The most expensive home is Los Angeles is, apparently, a new $250 million mansion built in Bel Air: https://www.nytimes.com/2017/02/03/business/americas-most-expensive-house-times-two.html?_r=0

The article profiles the man who specializes in building mansions for billionaires.

What’s the upkeep alone for such a mansion, assuming he pays cash? Between 3 and 4 million a year?

A few years ago Blert posted that one sign of an impending economic crisis is lots of mega-mansions being built for the super-rich. Because in the late stages of a boom, just before the collapse, the super-rich are the only ones who can afford houses.

Blert said that there were lots of mega-mansions being built in the late 1920s, in the years before the Depression.

I thought that was an interesting theory.

I see lots of huge mansions being built in Santa Monica and Brentwood, north of Montana. Small houses torn down, with some of the new mansions occupying two or even three plots, displacing two or three houses for mega-mansion.

A few historians have observed that civilizations build their most grandiose monuments at just the point when they begin to unravel. The world is stuffed with abandoned palaces and mansions of great beauty whose original builders found out that it was a lot easier to blast a fortune on a monument that it was to maintain and staff the thing. In the past 20 years, we’ve seen more insanely over-the-top mansions, and ridiculously extravagant commercial structures whose limited utility doesn’t begin to justify their cost built, than in Gilded Age of 1890-1918, and France under the Bourbon kings, combined. Never mind the sheer amount of concrete we’ve poured into road and water infrastructure that we are not going to be able to sustain, in fact are not sustaining even now. Historians 1000 years from now will wonder what we were thinking of.

Yep. Many markets are becoming over-saturated with high end luxury housing for which there is little or no demand from investors and the local population. It’s a modern day tribute to gluttony, greed, and pride.

It would be interesting how this is going to evolve – a fight between the international banking cabal represented by the FED and Trump. It looks that they don’t have too much room for both camps in charge. In the past the FED won (see JFK). We’ll see this time around. The gloves are off. How is this going to affect RE? Hard to say when everything is opaque.

https://mishtalk.com/2017/02/03/end-of-fed-independence/

Hello everyone,

Long time reader and recent participant. I would appreciate an educated opinion on a short synopsis below. My wife and I live in Los Angeles (Studio City, Sherman Oaks) area, have a sizeable down payment saved up, have secure jobs ($100k+ – which is not as much as it sounds in LA) and have been waiting for housing prices to either pop or at least regress to a reasonable valuation.

We just received another rent increase letter from our owner (4th increase in 5 years) and are seriously considering a change to our 1-2 year plan (Plan B). I am very skeptical of waiting indefinitely, when Trump is loosening regulations and making it easy for people to jump into the RE market. The loosing in regulations effectively negates any positive effects an increase in interest rates may have provided.

I completely understand that this will further increase the bubble and will mean that 4-6 years in the future a pop is guaranteed. We don’t have 6 years to wait (already waited 4 years). We would like to have kids in the near future and have been eyeing a house, in a good school district, around the same geographical area (maybe venture out to Encino, Tarzana, or Woodland Hills if me must).

Current variables:

Rent 1800 (after increase)

$100 for gas and power

20% of net income towards housing

do not pay property taxes, water, trash, etc.

INITIAL PLAN A:

650,000 house (IF the prices ever come back to reality – HUGE IF – currently house value 900,000)

20% down

1.25% property tax (Prop 13 in CA)

2.5% per/mo set aside for earthquake insurance, homeowners insurance, and repairs fund

$600 for water, power, gas, grass, etc, etc, expenses

No PMI

Most likely would be Tarzana / Woodland Hills area for this $

Considering a change to PLAN B:

325/350k condo or townhouse

10% down (want to leave a decent chunk of $ and continue to add savings for an opportunity for a house). Also if the market collapses after we buy, which with my luck is completely possible, I would only lose 10% in the short time, I know I don’t lose anything until I sell, and pay those ridiculous broker fees :).

2.5% per/mo set aside for earthquake insurance, homeowners insurance, and repairs

Pay PMI

Pay HOA ($400 roughly, but less than the $600 in plan A for similar expenses)

Pay property taxes

Expect to live there at least 3 – 4 years, plan to rent it out and not sell (unless the market continues to go bunkers and I can flip for a nice return). I would sell, rent, with the expectation that a pop is closer and closer.

ALSO HAVE A TAX DEDUCTION. Generally speaking the tax deduction for us would roughly offset the HOA payments we would make monthly. We are not buying strictly to reap the tax rewards, so if Trump ever goes away from the tax deduction and implements 15k per person for a standard deduction, it would not affect us at all (actually better for us).

Most likely would be Sherman Oaks, Encino, Toluca Lake, Valley Village)

Should we just keep renting and saving money for an indefinite amount of time. If housing does not go significantly (not just 10/15%) we can be priced out for a very very very long time. In the meantime burning rent money with years increases and no tax benefits.

Or should we go with PLAN A or PLAN B? If so, please provide a brief narrative of your thoughts…

Thank you everyone!!!

Without kids you have time.

Your $1800 a month rent is for a 2BR?

The townhouse is a nice 3BR presumably where you might even get some small outdoor space?

For $325K you should buy and go with Plan B. You will be well below rental parity.

I would only go with Plan A if you already had a kid with another on the way.

However if the $650K home rents for about $3000 it is a good purchase.

I would purchase this home:

https://www.redfin.com/CA/Torrance/19522-Donora-Ave-90503/home/7714005

jt, that home will likely go sale pending in a few days. Nice parts of Torrance are NOT cheap.

I had my eye on this baby below. Awesome location with tons of potential. I called the listing agent and they had several offers on the first day. You need to have all ducks in a row and a little luck to land gems like this.

https://www.redfin.com/CA/Redondo-Beach/421-Via-La-Soledad-90277/home/7708207

We need a little clarification.

Do you both have a 100K+ salary or is that number combined?

Is the Plan A house 900K or 650K today?

I have owned many homes and your $600/month for utilities is WAY too much. It’s likely half if not less. I think either plan would work…here are some thoughts.

Plan A: Much more expensive but if you plan on staying put for the long term and having a family soon, it may be your best bet. SFRs hold up much better than condos during the downturns. As I mentioned, your expenses you listed are too high. Additionally, you can save lots of money by doing things yourself (basic maintenance, yard work, etc). Every first time home owner should plan on doing this anyway.

Plan B: Sounds like well below rental parity. You could buy this simply as a hedge against future rent increases and inflation. This is also a property you likely could easily rent out in the future if need be.

I don’t think you could go wrong with either one. I would personally buy the cheapest SFR in the nicest neighborhood you can afford (you can slowly renovate the house to your likings over time and as budget permits). Trying to time markets is futile. And if we have another giant RE meltdown, it will come with a nasty job loss recession. You may get your housing correction but may not have a job to qualify for a loan. All things to think about. Good luck.

In what decent LA neighborhood can one buy a condo/townhome for 350K today? I only see condos in that price range in crummy Van Nuys and way South of the 10 in boogie-town.

If you are making the call on account of raising a family, do not compromise. Get what you want/need and don’t look back. Once your family starts churning you will lose the luxury of pontificating, timing the market, heck even moving for the right deal will make less sense at that point. You will be entrenched so pick a good trench 🙂

my house is worth way more than $320k in the heights area in houston and my mortgage is only $569.00 a month and that includes taxes and insurance.i have my homestead.i learned my property taxes will go up again,but i dont care since i have my homestead.since many people are moving to texas soon texas will also have prop.13.

Top least affordable cities for teachers to buy homes.

From the top 10, half are in California

(SF, LA, OC, etc)

http://www.motherjones.com/politics/2017/02/buying-house-nearly-impossible-teachers-these-cities

Mother Jones is no more objective than is Fox News.

Teachers will have bigger problems to worry about once Trump’s pick for Secretary of Education breaks up the Teachers Union through the use of privatization and more charter schools. Then teaches will really have something to cry about.

Anyone have an opinion on this?

http://www.yescalifornia.org/

They lost me on immigration. Look at how they’ve worded it. They basically want to have California have its own immigration law allowing even *more* foreigners in to steal jobs.

It’s not “Make California Great Again”. The old California used to have affordable colleges, the Cal Grant Program which meant if you were in the top 10% of your HS class, college was paid for, had manufacturing jobs, had a vo-tech school system for all kinds of things from sign painting to motorcycle repair, and immigration was handled sensibly which is why we’re not a subsidiary of China now.

It’s silly and pointless. The Civil War settled that states cannot secede from the union.

Nor do the Lefties signing this petition really want to secede. They’re just throwing a hissy fit.

The Left often throws hissy fits, figuring they can get away with it because no one takes them seriously. The Left engages in vandalism and violence, assuming they’ll be treated like spoiled children, and not called to account. No serious prison time. No strong-arm self-defense.

This Calexit is another Leftie hissy fit. It’s to rant and feel self-important, secure in the knowledge that nothing will come of it, so they can safely support it.

SOL, I agree with you. However, if they want to separate, even if I don’t live there, they have my blessing. At least they will have one guy who doesn’t oppose :-)))

Not trying to make this political but it just seems this state wants to keep shifting the needle toward no restrictions for immigration and essentially saturate the entire state to the point where nothing can be done to stop it from potentially changing the dynamics of the states government policies and mandates. With respect to what home values will look like down the road this may end up looking like a noble and feudal world. At that point you probably want to hope on what side of the line you want to be on. – all imo

I’m not arguing about Hissy Fits. TX had its conservative Hissy Fit and voted to secede when Obama was elected but realized it couldn’t support itself without high oil prices. Currently, TX takes more from the federal government than it give back due to low oil prices. CA has oil, agriculture, weather, and the high tech industries. It has the 6th largest economy in the world behind France. CA has always paid more to the federal government than it has taken back. CA could do very well if it seceded and it would hurt the rest of the US.

The funny thing is that the righties don’t see this and would love to get rid of the CA voters at any price.

Seen it all Bob,