Gentrification of Southern California: Price-to-Income charts and mortgage payments as a percent of income. Are some spots in SoCal becoming like New York?

One of the recent interesting studies that came out from the Census revolved around long commutes. The study found that 8.1 percent of Americans have one way commutes of 60 minutes or more. More impressive was what the study found with “megacommutes†or those that are 90 minutes or more each way. The study is an interesting one and is called Out-of-State Long Commutes in case you would like to read it. There are two major points that have come up in recent comments that make a lot of sense in regards to current niche markets. One point is, desirability for certain areas coupled with increased buying power and low inventory has essentially gentrified certain California markets. We’ve seen this with hipster areas of Los Angeles. What I’ve also noticed in the comments is that most acknowledge our unsustainable path forward but the thought process is now “ride it until the wheels come off†which is an interesting perspective. In many cases people are seizing onto the current housing market trying not to miss out. Obviously the Fed with a $3 trillion balance sheet and our national debt higher than 100 percent of GDP should cause for some pause but most see this as a battle for another day. Is Southern California gentrifying out?

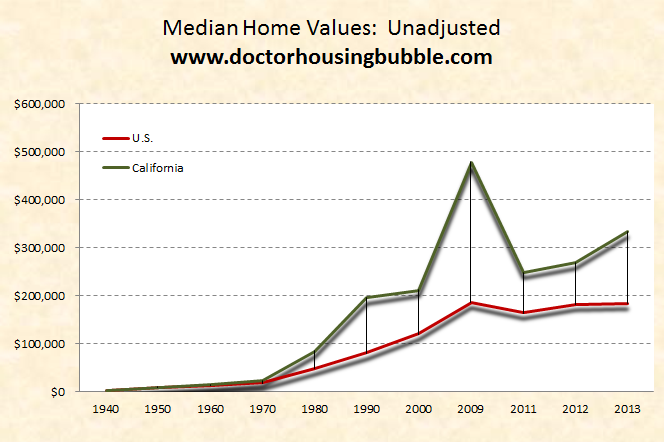

California diverges from nation

No need to reinvent the definition of gentrification but here is what Wikipedia has to say:

“Gentrification is a violent dynamic that emerges in poor urban areas when residential shifts, urban planning, and other phenomena affect the composition of a neighborhood. Urban gentrification often involves population migration as poor residents of a neighborhood are displaced. In a community undergoing gentrification, the average income increases and average family size decreases. This generally results in the displacement of the poorer, pre-gentrification residents, who are unable to pay increased rents, and property taxes, or afford real estate.â€

Clearly many cities in California have seen this occur. California was never always this expensive. In fact, it looks like the divergence occurred back in the 1980s:

Sources:Â NAR, Census, CAR

These are annual prices so only use this as a brief point in time reference (a better chart for price trend changes on a monthly basis would be Case Shiller data). Yet the point remains, from 1940 to 1980 California housing and US housing did not diverge too much when it came to price. You can see even now, as the market is heating up, California is pulling away from the national median home price. One point that does stick out is that certain areas simply have not seen populations rise or new homes built so you have competition for the same amount of homes with more money.

Population of desirable areas

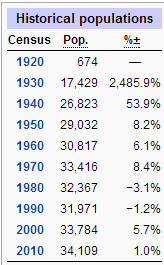

Let us take a look at an upper-tier area and a mid-tier area:

This is very telling. The population of Beverly Hills today is almost the same as it was in 1970 (or even 1960). This area has gotten more desirable with time. So with added leverage of low rate mortgages, you are very likely to have more demand on the little available homes on the market. This view on housing is exactly what is occurring today. You have big money chasing a relatively small number of available homes. Supply and demand.

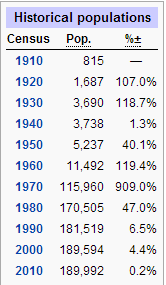

Let us look at a mid-tier area with Huntington Beach:

This is another interesting point. The population of Huntington Beach has remained fairly steady since 1980. Yet demand for housing has increased. So you do have a gentrification of many markets as people are seeking out more prime location in Southern California. Yet gentrification in California is more like pushing out the middle class (as defined by the median household income for an area) for upper-class residents since many of these markets are already at the higher end. Add more leverage to the mix and prices get pushed up. Incomes do matter for a couple of reasons. First, these will determine going rents and half of Los Angeles County rents. Many of the current purchases for all cash are from investors looking to rent places out. So you have a new dynamic in the mix. Yet lower rates undoubtedly are adding fuel to markets with already low inventory.

Price-to-earnings ratio and Mortgage data

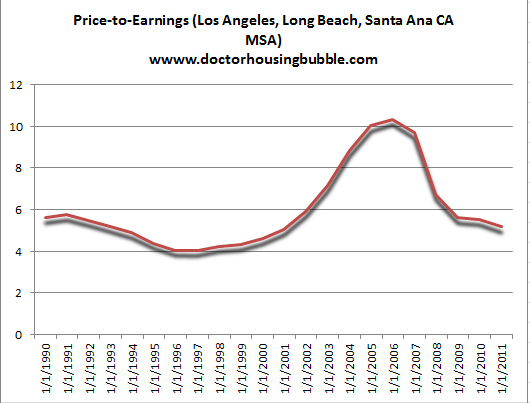

A commenter MB pointed out a Harvard housing study with excellent data. This data included price-to-earnings ratios for many markets and also, mortgage data. I went ahead and constructed two charts from the data:

The first point I would like to make is that above is looking at giant MSA subset of data that includes LA-LB-OC (basically LA and OC counties with nearly 13 million people combined). The median home price in Southern California is $320,000. Most readers here are probably not looking at $320,000 properties (at least not in LA or OC). So a large amount of buying as defined by the median price is still for more affordable homes. Many are willing to become part of the megacommuter culture and will purchase out in the Inland Empire where the median price is $228,000 for Riverside and $175,000 for San Bernardino (that with low rates is affordable).

The chart above shows a peak of 10 in 2006 and a current rate below 6. The trough was around the 4 range. This data only goes back to 2011 so with the massive run-up in 2012 we are very likely at 6 or higher for the region. The point I will make here is that this is for a giant region of data. Even for Southern California, the last month of sales data shows that buyers committed to a typical mortgage payment of $1,154 (source: DataQuick). That almost seems unrealistic but this is what the latest figures show. When I see data like this I wonder, does this include an average with the massive amount of all cash buyers? After all, if three buyers buy homes, two with $2,000 mortgages and one with all cash ($0 mortgage) and we count this in the figures, the average mortgage payment is $1,333. This is pretty much the story for the last few years where 30 percent of all buyers are coming in with all cash offers.

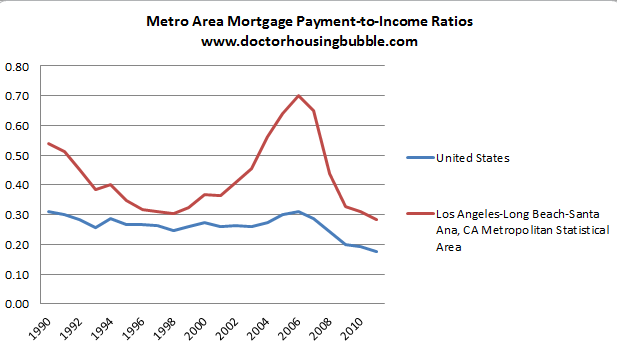

The next chart that I constructed from the data is the mortgage payment-to-income ratio:

In regards to overall mortgage payment-to-income ratios, this is the most affordable the LA-LB-OC area has been in over 20 years. One question I would have on this is how does the all cash buyer market impact this dataset? Is it simply ignored? Either way, the chart is very telling. Buyer leverage has increased dramatically and even with FHA insured loans buyers can get 30x leverage.

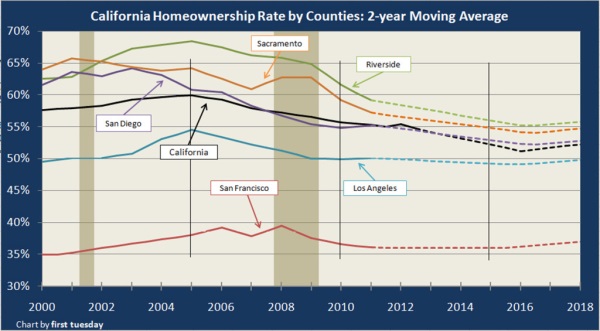

California homeownership rate

With all this affordability you would expect homeownership to increase right? Not so fast:

Ironically the California homeownership rate is at a low not seen since the early 1990s. What is going on? For one, a massive gentrification has occurred. While you do have a subset of the population that is doing much better, California now holds the highest unemployment rate of all states. Nearly half of the state rents, many cannot buy today even with record leverage being provided. Even if you manage to get a FHA insured loan, good luck trying to buy a place with this in certain markets. You need 20 percent down to be competitive in desirable markets. Is this a big part of the market? Doesn’t seem like it. The bulk of sales are all cash investors and FHA insured buyers. The conventional buyer is not the dominant group here as it is in most typical markets.

For these reasons, this is why we see the median price in Southern California up over 20 percent year-over-year but sales up only 1 percent. Like in New York, some areas are gentrifying to a very high degree. San Francisco is a prime example. People are smart but think in the short-term. The bubble bust is now a distant memory. This is an entirely different ballgame today.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

72 Responses to “Gentrification of Southern California: Price-to-Income charts and mortgage payments as a percent of income. Are some spots in SoCal becoming like New York?”

For anyone with high paying salaries who live in these “prime areas” why not live well below your means for a few years, save the extra money and then get the hell out of dodge??? So many people crap on the IE but if you can buy the cheaper house and have a significant equity position the downgrade in pay when you move isn’t as much of an issue. And you’re still only an hour away from OC and LA if you want to enjoy the “prime” area amenities.

I can’t see why anyone who is not already rich would try to raise a family in these expensive, crowded and overrated prime areas. What quality of life can they offer if your to busy working to HAVE a life?

I can picture it already…Honey, let’s sell our Manhattan Beach home so we can move to Fontana and live like true kings and queens. We won’t even have to work anymore! The kids will have to come out of their top ranked public schools in Manhattan Beach, but I’m sure they won’t mind. We can always buy a treadmill to put in one of our air condiitioned rooms to replace our nightly walks on the Strand. Just think, our friends, family and everything we know is “only” an hour away on a good day. That sounds like a swell idea, let’s call Suzanne the realtor so we can make this move happen. 🙂

Something tells me that 99.9999% of people who live in these premium areas would never agree to something like this!

RE: Blank

Since when did a majority doing something make it the smart play? I’m merely proposing a way out of the rat race for many. I’ve lived in West LA (though admitedly not the best area of it) and Riverside. When I was in Riverside I had much more disposable income AND time. I still made it into LA for concerts and weekends out. As far as kids I think a weak school+parents who have time for their kids beats a strong school+”Daddy’s working overtime, maybe you can see him Sunday”.

This consumer culture+hipster lifestyle has the serfs viewing their slavery as freedom.

I’d rather buy a house in the IE and get a motel in LA or the OC every other weekend for entertainment. If you aren’t already a part of the entertainment or RE machine, you’re nothing but a hamster in the wheel if you chose to live in LA or OC prime. I’ll take the freedom of living with the undesirables in the 909 and the 951. But hey, to each his own…

As part of a couple who does take nightly walks on the strand (but rents from a family member) I can tell you that those “we can get so much more, for so much less!” conversations are about as fun as a sunburn (maybe a third-degree one if a commute is involved).

I’m kinda ‘meh’ on beach life (too many people for my taste) but if your spouse gets used to it I guarantee it’ll be stuck in her head forever.

Exaggerating much?

More like. Gee, honey, let’s move to someplace a little less expensive, like say Chino Hills or Rancho Cucamonga. We can live in a small palace with a big yard and fruit trees for the same price as our dumpy,mid-century, close-to-a-million dollar, Westside 2 bed, 1 1/2 bath hovel. Our children can attend free public schools that rival some of the private ones in LA County (especially if we’re talking LA Unified or Santa Monica). At night we can go walking along some of the tree and greenspace lined walking trails that run through all of these newer planned communities, and if during the months of July and August it gets too hot…well, then we can go swimming in our beautiful backyard rock lined pool with the waterfall (’cause we got plenty of room in the backyard for that sort of thing). Worried about the commute? I’ll just jump on Metrolink every morning, so instead of wasting an hour in traffic on the 405, the 101, the 110, the 10, Wilshire, LaBrea, or Sunset to drive 10 miles, I can read, check emails, or watch last night’s TV show on the train.

You’re right, sounds like crazy talk to me!

“..What quality of life can they offer if your to busy working to HAVE a life? …”

That’s a very fair question. Two professionals married to each other are working a lot of hours. You really only have the weekends (and maybe just half of those?) to enjoy life outside of work. Then you have to remember that a $150k+ salary on top of another $150k+ is taxed at nearly 40% (IRS, FTB, payroll taxes). I know quite a few couples where one highly educated spouse is staying at home with the kids, not maximizing their household’s earning potential. They can always get a job if necessary…

Well from the point of view of a Californian who moved to Austin and moved back few years later. There is a reason why some places are cheap, Austin being the example here.

We moved out of Cali to Austin when my dad got sick (moved back after he passed away). It was nice, but it was not Ventura county. Even though housing was cheap we were not saving much more at the end. The problem was we started taking expensive vacation to compensate for the fact that it was bloody hot in the summer, and cold in the winter, with every bug we could ever imagine which made it harder to enjoy time with the kids outside of the house.

We are back in California, kids love going out, they are getting used to walking, hiking and out doors again.

What we learned: Cheap housing is not everything.

Peter, you are totally correct about Austin. People stay in their AC(big monthly bills) homes in summer and get fat. In Ventura, God’s county, you can go to the Seaward Avenue beach, and the one by the pier, and surf the point. It comes down to what one values in life. The beach life in God’s country, or a cheap house. But stay out of Oxnard,next door.

What’s the point of denigrating where people choose to live?

Someone may value having a 3000 sq ft house on 3 acres of land and choose to live somewhere where land is cheap. Someone may value a nightlife and live near Hollywood. Someone may value the beaches and choose to live in a tiny studio near the ocean and spend most their free time at the beach. Maybe they don’t want to be too far from their friend or family, or from their favorite restaurant.

I’m sure there are plenty of people living in North Dakota that wouldn’t move to Beverly Hills even if the house was free.

If a home is more expensive in xxx city vs xxx city it’s a product of supply and demand. That’s it. If you happen to enjoy North Dakota more then Beverly Hills, just count yourself lucky that you’re in the minority and enjoy the less expensive price of shelter.

My Brother did move to North Dakota from a rural home outside of one of Oregon’s University towns. He traded contract employment (1 year contracts) at a big national company for a permanent staff position at another big national company in a North Dakota University town. His recent college grad Daughter who doesn’t have a real job has been doing everything she can not to move there. His Wife and Son aren’t so lucky. His brave facade was beginning to crack when out of the blue, an opportunity to teach a graduate course at the U. appeared (oh Boy!). He would NEVER have gotten such an opportunity in Oregon, but in ND he’s a big fish in a little pond. His big employer pays him to live his dream, but the rest of the clan is up the creek.

That’s basically what I did. Had a very expensive house in a very trendy and affluent area. Sold it after 4 years and used the profit to buy a house in a rather remote area, all cash. No debt. But it was easy for me because there was no wife to fight on it and I was just sick of living around tons of people. For me, space, cost and quiet were a much better trade-off for crowded, expensive and noisy. And oh, did I mention the part about not having a mortgage to pay…..

Yup, they’re not making more real estate. CA’s population has grown a lot over the last couple of decades.

Interesting to note: I have a friend trying to sell a house in a $1M area and last summer he tried to get $1.2M but got no bites. He’s putting it back on the market next month and has recently done a bunch of comps…he says he’s going to list it for $1M because people are just not paying any more. So the higher end may be static.

California’s population has actually started to decline:

http://www.nbclosangeles.com/news/local/Californias-Population-Moving-Out-182914961.html

According to this news report, California is losing 100,000 people (net) to other US states. However, there are 270,000 moving into California from other countries. The article doesn’t say how many move out of the country, but California’s population is clearly increasing.

Looks like CA’s losing population overall –

http://www.manhattan-institute.org/html/cr_71.htm

To those saying that CA’s actually gaining in population – that’s entirely possible, given the many different research sources one can cite. However, just what kinds of people are moving there? The upwardly mobile, looking for high – income jobs and opportunity? The middle class? Given the increasing outflow of companies moving away from CA and the ever – increasing cost of doing business in the state, that seems unlikely.

As a NYer, let me say that comparing the big apple to the big orange is just that. NYC is more like SF with it’s corporate base, walkability & transit access. LA on the other hand centers around the entertainment & tourism industries wich can be fickle.

Sean, that may have been correct a few years ago, but given the increased taxation of financial firms based in NYC, many of their mid – level jobs and the revenues that go with them are moving out of the state at large, and they’re not coming back.

http://www.nytimes.com/2012/07/02/business/finance-jobs-leave-wall-street-as-firms-cut-costs.html?pagewanted=all

Bloomberg was much more concerned about the size of Slurpees than about his own city’s shrinking tax base (not to mention bedbugs), and the bills are now coming due. Don’t kid yourself, I remember NYC back in the early 80’s when it was a living hell – hole; it could easily happen again.

Having transit is nice, but when your company can’t afford to do business there anymore it doesn’t count for much.

Goof on the soda size thing if you want, but there was a bigger message behind it & that was the health crisis related to america’s waisteline & the costs to society as a whole.

Although New York as a state has been losing population, the NYC area has actually been growing in population & unlike the past, more are staying than leaving. Check the NYT or other news sources.

Many school districts in the NYC burbs are bursting at the semes & I can name a few… Mamaroneck, White Plains, Nanuet, Clarkstown amung others. This is tied to the fact that schools sell houses around here. I’m not sure if the same holds true in So. Cal in the same way, so I won’t speculate. climate did play a factor at one time & I don’t think that holds true today.

NYC is far more than the finantial sector & many of those jobs by the way are in Greenwich & Stamford CT anyway.

There is also a growing tech sector (Silicon Beach). A colleague just bought a townhouse in Venice (downpayment from profits due to selling in 2005). I actually think it’s an excellent buy, despite the huge cost. He can rent one of the rooms (separate entrance) and there are a huge number of young wealthy tech kids flooding the beach cities who want a place near the beach. There’s an economic diversification in SoCal that outsiders aren’t always aware of. We also import 40% of the nation’s goods through the Ports of Long Beach/LA – a lot of that money is concentrated in South Bay/Long Beach, though the Inland Empire warehouse regions also profit. We’re a lot more than entertainment and tourism, though I won’t discount those economic engines.

Good mention on the port industry. Once the Mexican ports in Baja and associated rail infrastructure complete expansion, I expect the LA/LB ports to take a major hit in traffic. Add in the Panama Canal expansion and SoCal is going to lose revenue one way or another. All of the sunshine in the world won’t save those jobs and businesses in SoCal that benefit from the existing setup.

Time is a tickin’

NYC is the the US’s primary gateway to Europe, while LA is the US’s primary gateway to Asia, which means a lot of money and diversity funnels through/to both cities.

If either were a country, both would be Top 20 if measured by GDP.

The large amounts of wealth and the international-flavor of both NYC and LA are a big reason why the income/price ratio has been high.

I might be getting a little adventurous here, but there are still huge chunks of SoCal that are affordable AND offer a reasonable commute.. I don’t think most of us have put these areas on our radar because they have been traditionally considered the ‘bad’ parts of the city.

BUT if this gentrification is true (I think inward, not outward as suggested here) and you’d like to suspend the reality of today’s crime reports for a second, these might be the new ‘it’ spots in ten years. If Google street view is accurate, I’m seeing some reasonably maintained homes and neighborhoods (no bars on the windows!) located between the 110 and 405 for under 300k:

http://www.redfin.com/CA/Los-Angeles/10017-S-Harvard-Blvd-90047/home/7309033

The sales history on this home is interesting because it’s been all over the map over the last ten years- which, if played out enough over an area, could indicate all sorts of new owners within a given neighborhood. It might be the case that many long-term ‘bad elements’ were displaced during the first bubble/cash grab and nobody has noticed yet (or the stigma is just that strong).

The above is just a theory though. Anyone have any boots on the ground in South LA?

Hello Chris. You are correct, there are parts of LA that are lower in price and not in scary neighborhoods but not near Hollywood Park in 90047. If you wish to see decent homes and neighborhoods for under $500K I would look at parts of 90016. For example, in the 90016, look at the areas from LaCienaga to LaBrea then Exposition down to Colesium. Most home in this area are without bars in the windows and the cars on the street are nearly as nice as on the Westside. Also portions of the 90019, from LaCienega to LaBrea from the 10 freeway up to Venice blvd. There are pockets of nice streets just east of Fairfax North of the 10 fwy. However, if you look at the West Adams area from the 10fwy south to Exposition, these are close to Culver City and under $400K but quasi-barrio. My recommendation is to drive these neighborhoods at 12 noon, 5pm (during rush hour) and at 10pm at night. that will give you a better feel. Also, you can look at Park Hills Heights, Ladera Heights, Windsor Hills and be 15 minute drive from the beach on a weekend morning for under $500K.

Also look at http://www.crimereports.com and check the zip codes you are interested in. Good luck

I currently live in 90019 and would be happy to buy here (in select areas). New shops, the new Lowes, and the (somewhat uneven and slow) revitalization of the Pico Corridor all show it’s a neighborhood in progress. What I’m seeing is that the reasonable areas are already $800K+. I’ve also seen some nice starter homes for $400K (post-flip), but those schools are awful. But there are certainly deals to be found, and the area is very much in the process of being “discovered.” I saw a DOUBLE flip here from $500K to $575K to $675K in under 4 months (that’s when I knew I’d missed the local bottom). Now homes on that street are now $775K. Adjacent areas may still have deals, but the inventory is very tight. 90016 also has some pockets, but you have to be prepared for a very mixed neighborhood (to me, that’s part of the charm) and you’ll have to aim for a charter, magnet, or private school (more of a problem for me). But the homes tend to be well made and in pride-of-ownership neighborhoods. I’ve been casually looking for a while, but the inventory is so constrained that we’ve never had a chance (close in 4 days before showings even happen, set.)

Just so you know … “under $500K” is NOT affordable. $500K will get you into many decent neighborhoods in Los Angeles. It’s the under $300K price point that’s cause for moving to the edgier parts of town. I’m pretty sure that’s where I’m going to be buying some day. Having no kids gives me that option.

@Chris,

You are correct. There are many pockets of affordability in the Los Angeles basin. The problems with these pockets of affordability in the Los Angeles basin is the Los Angeles Unified School District. So if you don’t have school age children, these areas, although not for hipsters, are perfectly fine for single people or childless couples.

When you factor in L.A. Unified SD and the cost of sending kids to a private school because LAUSD is horrendously awful, it is actually less expensive on a monthly basis to buy a home in the mid-tier areas of El Segundo, Torrance, Burbank, Culver City, Glendale, Pasadena, etc. and get a good school district with the deal.

Interesting. This confirms what I am seeing in the SF East Bay, old houses in the 300-400K range, but generally outside of the SF-city wannabe hipster radar. Parts of Oakland, San Leandro.

There are TONS of affordable areas in metro LA but people don’t want to take a chance. If the neighborhood is already gentrified or was never bad that’s where “families” want to live. I say if you want the So Cal life you need to adapt in order to get it. Think about alternatives to crappy schools, live with extended family, research the potential in any given area, try and see five years down the road.

It’s obvious all the rules have changed (not just with housing) from what things were like in the 60s and 70s. This city IS amazing, not exactly like NY but NY is COLD, and that matters to alot of people. Again, I mention it on here a lot but last year I bought a HUGE home in San Pedro for 550K, it has a separate suite for my mother who helps pay the mortgage until she retires so I can stay home with my kids while they are small. Creativity is all it takes!

I’ve been keeping an eye on San Pedro as well- it’s still rough in some areas (anything not close to the water or on the hill) but with the redevelopment going on it’s certainly on its way up.

The best part is that a lot of those older homes are nearly original and the 70’s condo/townhome redevelopment thing never really took off there (unlike here in Redondo where every other street address is some hideous brown triplex).

Yes, you do constantly drone on about it to the point that I would have thought by now you no longer have a need to try to convince the rest of us of how awesome you think it is to settle for San Pedro.

@Candace

The only problem I have with San Pedro is San Pedro is within the Los Angeles Unified School District. Now, if San Pedro could somehow break away from Los Angeles and join the Palos Verdes Peninsula Unified School District, San Pedro would be a serious mid-tier contender.

Until that day happens, probably never, San Pedro is a good selection for people who don’t have school age children.

Blofeld spends too much time stroking his white long-haired cat. An excellent K-12 education can be had in Pedro.

I agree that gentrification is happening in these areas, but i would argue that the wealthy are still a small percentage of the population in these areas, as shown by the census income statistics. Prices are increasing because there enough wealthy folks to create competition for the small # of properties available now. But will this last in the long term? Eventually higher prices will bring more sellers of the fence (not mention baby boomers wanting to downsize) and also more home building to satisfy market demands, then inventory will increase back to long term trends. An increase in interest rates could hasten this. Will there be enough wealthy folks and investors to maintain these prices in a few years when inventory and interest rates are higher? It is not a something that i am willing to risk a few 100k of down payment money on, that is for sure. Others out there obviously feel differently.

Yes, if you want to live in a liberal neighborhood like NY, or the westside, you will pay for it. Otherwise, move to Texas(or the Inland Empire, but good luck on finding a good job) where the home prices are affordable, per Rick Perry on his recent trip to California to raid us for employers and trained employees.

Well, just lost a house I though for sure I would get.

Was in a low end S.D. hood of Serra Mesa 92123. Listed at 429K, comps showed it to be priced fair to aggressively.

We offered 440K all cash.

Just found out there were 34 offers, several above 450K and our offer would not be countered.

It is crazy out there.

Martin, if you’re really all cash in that range you may want to consider side-stepping the normal RE sales process by sending out some pleasantly worded inquiry letters to long-time owners in the same neighborhood. Most people don’t pay that much attention to recent sales, and maybe you could save yourself some dough by going FSBO.

You may not get a freshly remodeled kitchen, but you can certainly cut out a lot of BS.

I remember stories of people getting unsolicited offers to buy their homes in the mailbox back in last decade’s bubble. Your suggestion reminds me of that.

Yes it does Joe, the only (big) difference here is that Martin won’t be looking down the barrel of an ARM in four or five years.

Interestingly I did receive an unsolicited offer on my parent’s house back then (after I claimed it on Zillow).

The ARM was but one area of many that can be attributed to the bubble bursting of a few years ago. There are probably plenty of folks who foreclosed or are stuck upside down on 30 year notes.

It doesn’t matter though. Creative lending whether through the ARM or heavily subsidized rates is an attempt to counter normal balancing market forces.

people from out of state who read these comments must think we’re absolutely crazy

YEP. It is crazy. We had a FC 2 yrs ago and we’re now ok to buy again using a VA loan. We want to retire to AZ in about 5 yrs and the housing market in the Sacramento area is so rediculous and getting worse. ie: each new listing higher $$ p. sq ft than the last comp, selling in 2 days with multiple offers. I do not see any value whatsoever in buying in this area again.

We pay very little in rent for the great area we live in, so we’ve decided we’re going to buy a house we want to retire in, in Phoenix in the next few months. We’ll rent it out 16 wks a year as a vacation rental to help offset the carrying costs then we’ll move into it in 5 yrs time and remodel if need be. We will also use it as our own vacation home during this time.

I don’t see the oversupply of rental homes in the Sacramento area easing up any time soon so it makes sense to us to keep renting and buy in AZ for $230,000. Rental parity is non existent where I live. We’d be paying about $600 a month more to buy the home we rent and it makes absolutely no sense whatsoever to me to buy it. Because I think currently the Sac area is overpriced due to unemployment and wages in this region. I cannot see how these prices are being supported by the low average wages here.

If this person’s story isn’t proof positive that moral hazard is back in vogue, then I don’t know what is.

Two years out from a foreclosure and all ready to jump into an over saturated investment property market.

Wow, so many errors in the comments on this thread. About the only true thing I see is some people’s comments on choice. Yes, some people choose to live in a dump by the beach, some choose a McMansion in Corona. That’s about it.

As far as ripping on a neighborhood, give us a break. Fontana specifically, I guarnatee you it’s not your momma’s Fontana. Anything in the north 1/3 of the city, north of Baseline, was built after 2003 and has schools just as good as anywhere else. Same is true for the southern borders of the city as well. And yes, driving to a suburban lifestyle with close proximity to Victoria Gardens is appealing to some.

As far as schools – I know parents and children that attend(ed) Manhattan Beach and Cerritos, as well as Fontana and Rialto. It is far more important how involved a parent is in a child’s life, than what school they go to. All schools are mandated to teach roughly the same curriculum, and over the next couple years it’s only going to get worse.

http://www.corestandards.org/

This is the new national program. Manhattan Beach will teach the same thing as Compton, and vice versa. Does the school matter? No. Does the parent making sure the student completes his/her work matter? Yes. Of course as a caveat, we have Obama to thank for this!

But to think some dude living in Echo Park with his “murse” and thick ring glasses is better than a suburban family man cracks me up. Quite frankly, the only contribution L.A. County and it’s denizens get from me on a daily basis is whatever I flush down the toilet at work, lol.

I had calculus 1 as a Jr in High School. Calculus 2 in college while attending both College & High School. Engineering Calculus as a Freshman & Business School Calculus as a Sophomore. If the schools stop teaching “junk” like this and focused on Business in a private school (age 11-18), the kids would be Millionaires by 20 and Multimillionaires by 25 and possible Billionaires by 30. Too hell with the basics….. IRR NPV IRS & Wall Street should be the focus if the kids want to be rich….

That last line is hilarious.

PapaNow you honestly think Compton schools are going to be equal to MB because of a web site link and a plan to teach the same things? I highly doubt you would last one day in a Compton school before you get beat up. I am sure your walk home will be safe too.

If I misses the sarcasm in your post sorry. But it’s not all about what is taught in school, it’s who is teaching it and the students who surround you.

Sean, clearly you lack the MB education yourself in failing to comprehend what I said. You also missed the implications. Let me help refresh you, the rest is up to you.

“It is far more important how involved a parent is in a child’s life, than what school they go to.”

PapaNow you have an idealistic view of how parent involvement is going to revitalize Compton or any other worthless school district. I guess you are serious. Are you really that naive? I may not have attended MBHS, as I went to a private school. And many friends with involved, loving, and intelligent parents went to underachieving schools. Guess how they turned out? They were not ready for college and for me college felt like a cake walk compared to HS. Other friends were running with friends who were in gangs and were drawn in by association.

Do you even remotely comprehend how dangerous some of LA is? If you don’t understand the streets and e culture you are a future victim. Wearing the wrong color or driving the wrong color car can get you killed in some areas.

Parent involvement in Compton is laughable. Many kids parents are on crack, kids live with aunts, uncles, friends, foster homes, etc. Do you really want your son or daughter in this environment if you can afford anything better?

I really disagree with you on this. It seems you are posting from a text book example and you have no real experience with anything you are talking about. Let me know when you get to the chapter that deals with constant fear of gangs and drugs. Let me guess what your book says… “Just say no to drugs. Gangs are bad, walk away.”

For argument sake, pretend you were wrongly convicted of a crime and you are going to a max-security prison. How well do you think you are going to do? I personally know I will get killed is exposed to general population, I am no where near tough enough for that. And if by the sake of God I live do you think I am going to come out after 12 years the same man I went in? That’s why the lesser schools are bad, it’s why you attend with. Just as if you went to Harvard, it’s about e connections you make not entirely the education.

I still like all of your posts. You always have good insight. But I feel it’s a disservice to have anyone here move to a poor school district thinking they will be involved enough to navigate their children through safely.

Sean, the jist of my post was meant to mean that, as always in society, instead of everyone getting “lifted” from socialistic practices, usually the opposite happens. The top gets dragged down in the fray. Meaning top schools will probably suffer, trying to pull up the lower end. I filly advocate independent schools, let each area (nationwide) teach the best they can. Low income? Too bad so sad.

I have more experience with Chicago gangs than I care to remember about in my youth. I was a textbook suburban (with loving and perhaps now niave parents?) kid but in the early 90’s, everyone had to have subs in the trunk, a Nissan Sentra with 13″ baby-daytons, and every white boy in HS wanted to run down to the hood and be with the “HNIC’s”. Find and watch the movie Whiteboys and laugh but there is truth to it. So I’m pretty aware what to keep my kids away from, what it’s like to be chased with weapons, arrested, etc. Luckily instead of being a flat out stupid kid, I was merely foolish. To reiterate what you said, you know the types that ended up in gangs, locked up, etc as well. My parents made sure I stayed in school, did extracurricular work, and went to college. They didn’t pay for it, they just made sure I went. The biggest difference I have with my kids is knowing where they are at ALL times instead of getting to run free like I did. Then I wouldn’t have gotten into all my s**t and I know I would have went to a 4 year private institution if I didn’t discover what it was like to be so damn fly in those teen years 😉

I think they all suck and have for many decades which is why I choose to unschool my boys. Voila! School system is no longer a factor in my home choice. How far is any given child going to get learning what it takes to be a cog in a rat race? Out of the box thinking is what the future will take, and NO schools teach that. FYI- twelve years of school math can be learned in one year at home- when the child is mature enough.

In my opinion, there are 3 primary factors that influence how well children learn in school, all other factors being equal:

1. Parents

2. Teachers

3. Peers

How much each of those 3 categories influence a child is different depending on each child. You can have parents that are involved and a great teacher, but for some children the influence of peers that don’t take academics hampers their academic development.

I do think parental involvement is the most important aspect, but to disregard teachers or peers seems misguided.

.. and by the way I am not in any way implying that a MBUSD school will have better peers than a RUSD, that’s completely subjective and for each parent to decide.

I don’t think there’s a particular school that’s best suited for every child. Some children with great academic potential need an environment where there’s academic competition to fulfill their capabilities. Another child that’s a little slower may start tuning out once they start getting left behind. I guess it takes the involvement of a parent to determine which is best for their child.

If the school doesn’t matter what why are you living in the fancy IE then? Get a place in the hood near your job then. Of course the school matters. Like you allude to in your post, it’s ALL a matter of culture. Macho man culture in CA is the main reason my kid goes to private school. I’d like him to grow up with other kids who find value in things other than bro trucks and tats. He learns Spanish and violin and art and I really am hoping he can afford a murse when he grows up. I’d die if he ended up like the tatted up rednecks you see around OC.

Funny… a home is considered a consumer item in Big IRR finance. Consumers are driving up the prices in California. Just like the years 2000-2004. Wall Street considers “liquid computer items” investments, but they bounce around too much. Great for 20-50% returns on covered call portfolios. From 1990 to 2013 I bought and sold 23,000 acres. Bought 9000 acres (1990-1999), then sold 8000 acres (1999-2008), then bought 6000 acres (2009-2013). Avg. gross profit per acre 1167% (1999-2008). Average net net net after all costs is 27.12% IRR/month! Average cost of goods-acre 1990-1999 was 8.7cents. Average cost of goods-acre is 2.7cents for 2009-2013 so far!

Estimated gross return about $2 per 3 cents. That’s a 6667% gross profit per acre.

FINALLY!!! After reading this blog and hearing that all areas will see the price drop because they are not different, dr. Housing bubble, has now provided an article saying they are different. Incomes don’t really matter in the areas since this is where the rich live.

I can’t believe is web site is now sounding more like a realtor site. 🙂

I am glad we are now facing the music. If you can’t afford an area then get a better job, work harder, or do something else besides whine how expensive it is. Because if you can’t afford it you are out of luck as someone else can. And they aren’t making more beach front property or fixing the bad schools.

The bottom line is, we are in a new bubble era with stagnant wages, where FHA is the new subprime, and people over extending themselves into homes they can’t afford. This is the same crap that we just got out of but hey the stock market and everything is on the up and up and there’s no end in sight. Man, this all sounds eerily similar to the attitude leading up to oh no….

I am guessing in 2014 or 2015 this will all come crashing down again. Some condo in South OC isn’t ever going to be worth 750,000 or a million dollars. Sorry market bulls.

What? They already sell for that, so your argument is already null and void. It’s worth that today and isn’t today part of ever?

My grandparents still can’t believe an average car can cost 50k. That’s more than they paid for their home. Bla bla bla.

The downside is another 7 to 10 years away. By then the drop will probable be to a price point higher than today. LOL

1 Million isn’t that much in OC. Many couples earn 100,000 each before tax per year. That means if they saved up they could earn 1 million in 5 years. Pre tax. Post tax it will take 7 to 8. So a 1 million home isn’t all that much.

You’re actually starting to sound a bit like a RE, to be quite honest.

Sean, clearly you’re talking out of your ass because there are no condos in that price range, I was exaggerating and you didn’t get it. Even at the height of the bubble they didn’t get there.

Also, if your claim about couples and earning is correct, how come homes in the million dollar range currently aren’t moving? There are plenty of those. I know plenty of people making over 200K who aren’t buying million dollar just because they can.

Stopthemadness – one search finds many condos over 1MM in SoCal.

http://www.redfin.com/CA/Irvine/8152-Scholarship-92612/unit-1208/home/12252795

http://www.redfin.com/homes-for-sale#!lat=33.63254513817674&long=-117.7701322450439&market=socal&min_price=750000&uipt=2&v=8&zoomLevel=12

The frenzy is back! Just watch the video and see the herd walking in and out:

http://www.calculatedriskblog.com/2013/03/jim-realtor-here-is-what-it-looks-like.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+CalculatedRisk+%28Calculated+Risk%29

If you missed the first mania, here is your chance to get in on the action in San Diego.

Gentrification is somehow a cuss word to some. I grew up in the Hermon District of Highland Park. The street and hill I grew up on are a lot wealthier today than they were then. The main part of Highland Park across the Arroyo on the flat areas is a hole. My Son-in-Law works over there for LA City so don’t tell me I don’t have good information. I hope that all of Highland Park may some day be a decent place to live. The Lumpen belong in Jail or back in the swamps.

This is to all you people buying into the “California Lifestyle” for the cheap price of around $600,000. What you do not understand is that for every hipster with rich parents or movie star there are around 100,000 poor old peones who do not have the pull to pay the debt.

http://news.yahoo.com/report-teacher-pensions-4-5b-004735641.html

Buying into a gentrifying neighborhood today is a highly speculative proposition. It’s more like a call option than a outright purchase. Will you choose the next Culver City or the next Lawndale?

Well, I agree with Sean so you pay more for a better side of the North County cities of OC away from the heavily hispanic areas. However, some buy into the colony so there kid can go to Oxford academy which is basically asian and one of the top scorers in Calfornia. Also, most of south OC is ok with the exception of the heavily Hispanic side of San Juan Capistrano and Lake Forest Also, the new Rancho Mission Viejo is coming maybe its far from the job.

Huntington Beach is mainly white and only has a Hispanic section on beach blvd. Whites tend to be older on average than Hispancs and are more likely to not have school age children. The average age of Huntington Beach is about 36 and the white average is around 42 years old which explains why population is not growing. Huntington Beach school district had the largest high school Fountain Vally in the 1970’s when it was attracting a lot of families from other states but OC has not been doing this since around 1990. Huntington Beach is probably not so much genfrication but aging.

HB is the ass end of the world. I have never lived in such a depressing place. Our neighbors are mostly old and run down like their houses. The rest have confederate flags in their garages and skull and nazi-esque stickers on their bro trucks. Our local school is a 5. It was a 7 last year. Look at the test stats and the white kids have lower scores than both the socio-economic disadvantaged group and the English language learners. That’s pretty bleak. I don’t know at what point these bro’s finally acknowledge that their beliefs and way of life maybe aren’t the best way forward. But they must be doing *something* right. It costs a minimum of half a million dollars to buy into this neighbourhood. It looks like what I imagine Kentucky would look like *if* they allowed a few hispanic people move in :p

They need to bulldoze the city and build more density here. Same with Westminster and Garden Grove. They really are very depressing places, on prime land. Can you pull down a house in HB and build duplexes or strata title type housing on your land? They changed the land laws 15-20 years ago in Sydney and gained at least a little more density in good locations near transport. It got rid of small run down old housing on large lots and created 4-6 townhouses on the land. There is so much under utilized space in OC.

To those who think higher interest rates do not cause home prices to drop, jump right in.

Hong Kong Homes Face 20% Price Drop as Banks Raise Rates

http://www.bloomberg.com/news/2013-03-21/hong-kong-homes-face-20-price-drop-as-banks-raise-rates.html

As an aside, Ms Curran’s racial distinction between “whites” and “hispanics” indicates a level of ignorance that could only be surpassed by her degree of bigotry.

CA has around 40M residents. 30 years ago, it was around 20M.

People complained about the high price of RE in desirable locations 30 years ago. I remember quite well. So do the math. The population has doubled and the availability of the desirable homes has been static.

Exactly. IMO, this has been the biggest achilles heal of DHB’s main thesis over the last couple of years…the over-emphasis of “local income” metric and the under-appreciation of supply/demand metrics caused by population growth and gentrification.

Culver City was often used as the classic DHB example of a mispriced market due to local incomes and listing prices being out of wack. What was underappreciated was the gentrification of CC having to do with desirable location, limitation of new, buildable space for SFR’s, new job creation (Sony, etc.), downtown revitalization, new cache (art galleries, etc.), Prop 13-limiting inventory element, etc.

As an aside, Ms Curran’s racial distinction between “whites†and “hispanics†indicates a level of ignorance that could only be surpassed by her degree of I guess bigotry. Studies in Orange County show Hispanics behind Whites in Orange County and the rest of US. Mexicans according to the New York Times are behind other groups in terms of education and income in New York , so being behind behind Whites in terms of income and education in Huntington Beach and the rest of OC not usual. The Sarc scores for Huntington Beach schools show Hispanics have the worst scores and Asians the best score, so Westminster is not that bad either. A few nazis does not make up all the white kids in Huntinton Beach.

I grew up in Fargo ND and think it’s a wonderful place to live and have a family. I would take mini weekend vacations to the Twin Cities which is an excellent place, the lake country in Minnesota is gorgeous, lots of fishing, camping, swimming etc.. I love the snow and in some ways the winters make you love and appreciate the spring and summer more. A home is what you make of it. You don’t FIRST find a place to be a home….you find a place and MAKE it your home!

I married and moved to California in beautiful Ventura County, been here for 13 years and still believe that Fargo is a wonderful place to live and I would love to move back but my husband has a secure job of 20 years so probably not wise. I love it here too for different reasons. Home is what you make it. We live in a mobile home and sometimes it makes me angry about these house prices and about people who have so much more and complain. But, we are doing very, very well because my expectations are not the same as others. We live a simple life, I stay home with the kids, we homeschool, we spend a lot of time together, our mobile home park is beautiful lots of great families and kids to play with and a great pool! My husband does not get paid boat loads but he is home every evening at 5 pm and has 5 weeks of vacation a year plus sick time and other great benefits.

I think people need to start looking outside the box for what will make them happy. We don’t have a big home in California, but we are paying less than most people are paying for a cheap two bedroom apartment. We are close to the beach, we can afford to go to Disneyland once in awhile, we do lots of things and live our life. The key word is we are living. How you live is WAY more important than where you live.

I sell and own real estate in St. Louis MO. Plenty of rental property, from zero cap all the way to thirty, not horrible dangerous slums. Many singles and multis, many in move-in condition. Closing on an 8 sold for $265K, income $44K. That 2.8 return on the half million house…Yikes!

Leave a Reply to ernst blofeld