The future of the American housing market just became more complicated: The impact of the mortgage settlement and financial tectonic plates shifting.

Buying a home is something embedded in the American economic DNA. Purchasing a home is the biggest financial decision most households will make in their entire lives. In the past the act of buying a home was more of a ritualistic rite of passage; you scrimp and save for the down payment, you purchase a home where your family will set roots, and eventually you will aim for that mortgage burning party. The entire process was accelerated in the last decade to create a perpetual churn. A mortgage was merely a temporary tool in the non-stop property ladder progression to the top. The equation did not leave room for falling home prices or a weakened economy. So we are left with a battle for the soul of US housing. Do we go back to more tested ways of a boring housing market where banks actually verify financials or do we juice up the machine again? The only issue is that the market no longer believes in the new way of financing housing and the government now has to step in to soften the withdrawal with loans such as FHA insured products.  Yogi Berra once said it’s tough to make predictions, especially about the future. But the past is set in granite stone. What will the future look like for the American housing market?

The future of American housing

There is little question that the trend to city centers is here to stay:

Source:Â US Census, Washington State DOT

Yet the entire mission of the suburb does not sit well with a growing population. It does not offer the economies of scale of higher density housing. I find it fascinating that people are willing to commute two horrid hours each way in Southern California traffic just so they can have a giant home out in what is essentially the desert. The fact that oil is getting more expensive is also likely to change the perception of how people view living in a suburb far from their source of employment. With stagnant wages and rising costs of other items like food and energy, people are starting to ask more important questions simply to maintain their current economic state.

The question is complex because even building high density does not guarantee success. What comes to mind are the condominium projects in Miami and Las Vegas. The growth has to be sustained and complicated local economies take years to grow and diversify. Relying on one industry or chasing hot money is destined to produce issues. We are facing this on a nationwide level. The suburb might have made sense with 130,000,000 Americans back in 1940, absurdly low fuel costs, a competitive advantage in global manufacturing, and good jobs for most even high school graduates (1952 unemployment rate of 3 percent). With 313,000,000 people today it might be different.

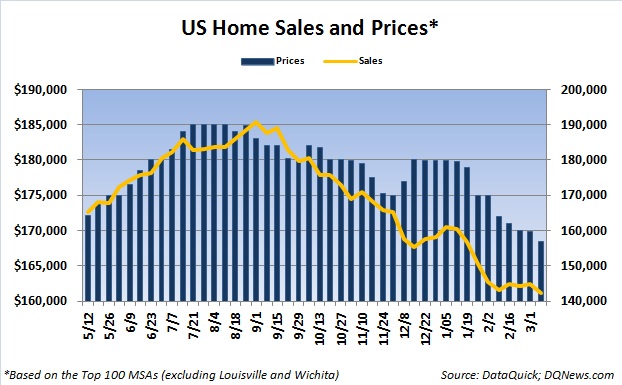

Low interest rates and a growing population do not guarantee higher home prices or more sales. This is critical to understanding where we may go forward with the housing market:

Source:Â DQNews

Data Quick provides a nice up to date trending of many of the biggest markets in the US. The chart above reflects a record low in nationwide home prices and home sales remaining relatively light:

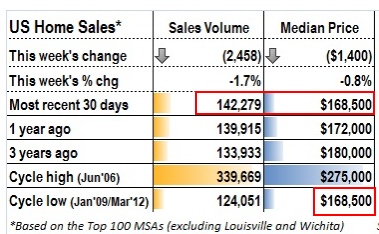

Source:Â DQNews

The cycle low for home sales occurred in January of 2009. The cycle low in price occurred this month. I’m fascinated by data like this because it tells us something that goes beyond basic economics. You would assume that with lower prices, the Federal Reserve artificially keeping rates low, and a growing population that somehow sales would be increasing in a significant fashion. It is hard to have price increases when household incomes are stagnant. It is hard to increase home prices when a sizeable portion of jobs are coming from lower wage sectors. That is the danger of pushing rates that are below market levels. It is unsustainable and may not even result in a desired effect because of wider trends.

Mortgage settlement impact

The mortgage settlement may actually push prices even lower.   Let us first put the mortgage settlement in perspective. Although $25 billion is a good chunk of change the amount of negative equity in the US currently stands at over $700 billion. The settlement does address some of the issues that caused the shadow inventory to build up over the years. I would like to address a few of the key sticking points in the settlement and my thoughts on what impact they will have on prices.

Point 1 – Reducing principal on loans for borrowers that are delinquent or at imminent risk of default and underwater on their loans.  The obvious point here is that this will lock in lower prices but help some home owners stay in their home. The impact will be minimal in my opinion. Keep in mind that of the 2 million active foreclosures, over 40 percent have made no payments in over two years. Will a reduction of say 5, 10, or even 20 percent suddenly cause many of these people to become current on their mortgage? How will they remedy the payments in arrears? Many will not be helped and as we are seeing, banks are starting to move on foreclosure starts to clear out the shadow inventory (although at a very slow pace).

Point 2 – Refinancing loans for borrowers who are current on their mortgage but underwater.  Again this will have a minimal impact. 11 million homeowners are underwater so this will free up some money to spend in the economy. But how far will that $25 billion go? As we mentioned, homeowners are underwater by $700 billion.

Point 3 – Short sales. By definition a short sale is a sale that happens when the home is being sold for a price lower than the original balance due. If we use a metric like the Case-Shiller Index that looks at same home repeat sales, this by default will lower prices.  For example a home that sold for $500,000 at the peak with a $450,000 loan now sells for $350,000. Impact on prices is likely to push them lower.

Point 4 – Forbearance of principal for unemployed borrowers – reading the settlement it looks like the principal will simply be tacked onto the end of the loan in some form of a zero-interest balloon. This is basically a delaying the inevitable strategy. My guess is this is an attempt to slow down the flood of shadow inventory that at some point will come to market.      Â

These are some of the key sticking points in the settlement. How is this beneficial to pushing prices even higher? I just don’t see it and the current data with post-bubble price lows simply reflects this trend.

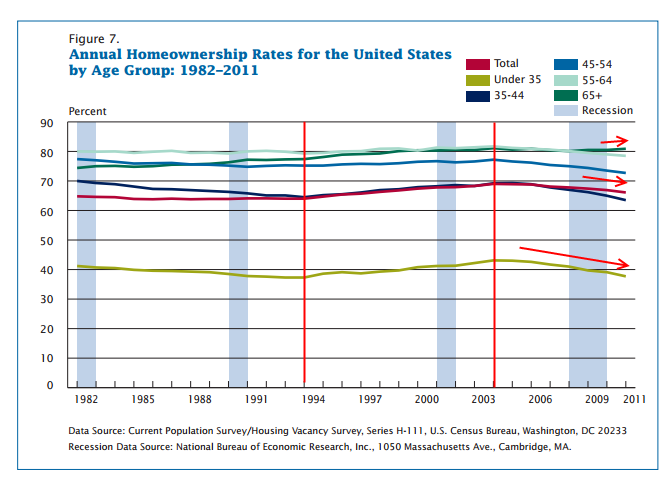

Another major factor is how financially stable young households are since this is the juice that keeps the market going:

Source:Â Census

This is a somewhat troubling trend. The overall nationwide homeownership rate is 66 percent, back to levels last seen in 1998. The rate of homeownership of those under 35 is 37.6 percent. The peak was 43.1 percent reached in 2006. This is a decline of 12 percent in a few years while the overall rate has fallen by 4 percent. So what is happening here? I think a few things are hitting for this cohort:

-Lower wages

-Delaying marriage and starting families (for economic or personal reasons)

Overall I think we are going to witness a very different housing market going forward. It is hard to see why prices would be increasing in the next few years given all the above data. A white picket fence loses its luster when you are paying $100 each time to fill-up your gas tank. What the mortgage settlement looks like is a platform to begin moving and clearing out the shadow inventory. How some saw this as a method of boosting prices is hard to understand.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

80 Responses to “The future of the American housing market just became more complicated: The impact of the mortgage settlement and financial tectonic plates shifting.”

” find it fascinating that people are willing to commute two horrid hours each way in Southern California traffic just so they can have a giant home out in what is essentially the desert. ”

You mean the 210 going east to San Bernadino? 🙂 A horrible commute to what is essentially a desert. It is amazing.

Just my 2 cents but I used to think the same way as you. I used to live in Palos Verdes, slaving away with my huge million dollar mortgage while living in a 1200 sq ft ~100 year old house (that constantly required $$ repairs to keep it livable). I decided I was tired of the rat race, bought a house in Murrieta for about 1/4 the price in cash and never looked back. Sure, commute can be terrible but fortunately now I have financial freedom I don’t commute and just work out of my home. Afterall, I can now live off of far less than what I had to while living in RPV. It’s called financial freedom. For the first year, I had tried the commuting to my office in downtown LA and used public transport. Took a express bus up to the Metrolink station that took me to LA. That took about 1hr 45 mins each way total, but I was sleeping most of the time or playing on the laptop. It cost only $275 monthly to do so. Extremely relaxing compared to having to drive 1.25-1.75 hours each day in gnarly 110fwy traffic when I was living in RPV. Murrieta is in the middle of the desert. It has its shortcomings but for a family it is pretty damn good. The house is 4000sq ft brand new and sits on half acre. Everyone around us is not rich but they’re a far better cut of people compared to most of LA (although RPV demographic is still better). They are unpretentious, family oriented, down to earth. My kids can run around outside without fear of being run over among other dangers of living in dense LA. Traffic is wonderful. Safety? In 2009 Murrieta was listed as the second safest city (over 100,000 in population) in the United States, behind Irvine, California. This is what life is about. That said, if you’re filthy rich, or young and single and or ambitious, I wouldn’t live in Murrieta. Just saying, for those of you who are closed minded and not rich, you shouldn’t be so closed minded you never know what you’re missing out on.

Thanks for the input BlahOne. I always wonder why people choosing 2 hrs commute in a horrible parking system that only America can make (or pioneer) during rush hours. There must be a reason that human as a rational actor always trying to pick the most beneficial outcome perceived to them. People who wants to live close to their works have their reasons and people wanted to commute also have their own reasons. Those who blast other people lifestyle w/o knowing the other’s circumstances is just robotic in their thinking process and that’s I am pretty sure is the norm in this world (not just in America). Push their buttons, and here come the response. Never fail.

Who the hell needs a 4000 sq ft house????

@VicenteFox – Don’t knock it till you tried it.

Props to you, i think you made a good move, and I’d consider it as my plan C if shiit hits the fan, but I have 2 questions: How’s the surf in Murrietta? Hows the weather in August?

Thats because we cant afford a 1926 house for $600k so we have no option but to drive until we can find an affordable area to live.

The current scam is low inventory. Patrick.net cites a 33% drop in Orange County, and I think LA County is down over 15% yoy. So this means there is “artificial high demand” generated on any home that is in a reality based price range. The rest go to well healed buyers who can afford over list. Foreclosures, are dumps here in Burbank, so they are being bought and flipped into a market with low inventory by cash investors who know they will sell due to many buyers chasing too few properties. The game has been well played by banks who know how to manipulate the market. They may miss a couple years of payments on some of their properties, but they are keeping a floor on the market, thus protecting the bulk of their assets. Two to three years of no payments on multiple properties is nothing to them if they can keep the median price up 50 to 100K. We are screwed if we are trying to be sensible buyers. The younger generations better get used to renting , or living with the folks.

The Housing bubble was made by ‘permitting’ subprime lending standards. These were regulations created in Congress. Repsonsible banks who did not make these junk loans quickly lost lots of business to their competitors. The game was rigged from the start. Not by greedy bankers (except those greedy bankers who may have conceived the scheme). But there’s a more ominous demon in the mist. Fiat money. Your government can adjust the octane of your purchasing power because they own your fiat money. They could never do this with gold or silver backed money which you might bury in your back yard. This money is only as valuable as your government permits. They have the power to reduce it’s value rather than go bankrupt. They just might reduce its value to the extent that the trap is made perfect. Consider: 1.) Entitlement program funds will be paid in increasing amounts, starting NOW. 2.) America will continue to borrow more and increasingly more money to pay these promised benefits. 3.) Without a One World Government to contain that coming economic disaster by fending off nations who would properly demand parity in payment or trade, the U.S. dollar shall have no high ground from which to protect the dollar. That is to say, YOUR dollars will lose purchasing power. The BEST our stupid economists can do will be to let your dollar die a slow miserable death. Your ‘stuff’ will be more valuable to you if it is sold. You need to really think this through. Listen: your government has done much and will continue to do more to destroy the spending power of your dollars. Once you fully grasp that you can begin to make sound personal decisions. This economy, with this fiat currency, in this political environment, will crash before people will know enough to demand political change. Meanwhile only some individuals can, if the will, act.

picomanning’s rant about “fiat money” has some slight basis in fact, but seems to have come from beyond the looking glass.

For example: “Listen: your government has done much and will continue to do more to destroy the spending power of your dollars”… In other words, government issuing “fiat money” has insured inevitable inflation…

Except…where is inflation s/he promises? The recent, first-ever Fed audit disclosed that the U.S. central bank issued $16 – $29 trillion to bail out the Finance / Insurance / Real Estate sectors in the wake of Lehman Bros’ collapse — *way* more than “TARP.”

To give a little perspective, expressed in trillions, one year’s GDP is $14-15, all mortgages in the U.S. are $9, and the entire Federal budget is less than $2.

SO WHERE IS THE INFLATION if we “printed” more money than an entire year’s GDP???? WHERE????

Answer: People are busy paying off debts and hoarding their money. These are symptoms of *deflation*… And the bond market confirms this. So do government and non-government (e.g. shadowfacts.com) inflation reports.

There is actually a school of economists called “Modern Monetary Theorists” who go into the details. FYI, Hicks repudiated IS-LM, and so do they. See Steve Keen, or Marshall Auerbach for more about this.

For more, I highly recommend Michael Hudson’s talk about this here: http://michael-hudson.com/wp-content/uploads/2012/Renegade%20Economists%20radio%\

2007.03.2012.mp3

Bigger questions:

1. If FIRE can get a multi-trillion-dollar bailout instantly, why do grandma and her Social Securty and Medicare have to suck wind? Why are we all of a sudden out of even fiat money? Could it be that the entire point of this deficit hysteria is not that there’s a deficit problem — after all, the Treasury could mint a few trillion-dollar coins and pay the entire thing tomorrow — there can be no problem unless government willfully refuses payment of its obligations. The U.S. is not constrained, as Greece is, by treaty to limit its dollar issuance.

No, the point of deficit hysteria is to attack the public realm — including social safety net programs. Look at what Greece has to contend with now. Its bankers are suggesting it privatize the ports and Parthenon, making the entire society into a series of tollbooths to pay its creditors.

Incidentally, deflation favors creditors. That’s what we’ve got now. And that’s what reinforces the income inequality in the U.S.

2. Won’t printing lots more money be inflationary some time? Yes, but … We need a little inflation now. It would ease the debt burden and speed up the “de-leveraging” that has to happen before the economy revives.

As for the feared hyper-inflation…we’re far from there, and recent historical examples (Zimbabwe and Weimar Germany) demonstrate impaired productive capacity, not overactive printing presses, were at the root of these hyper-inflations.

See Marshall Auerbach’s talk about this here: http://www.netrootsmass.net/fiscal-sustainability-teach-in-and-counter-conference/marshall-auerback-inflation-and-hyper-inflation/

There’s more to say, but let’s say picomanning needs to check this little thing called “reality” before asserting government is destroying the spending power of your dollars. On the contrary, if anything government has been too much in favor of deflation to enrich creditors, and too little in favor of debtor-favoring inflation.

Adam Eran, perhaps you should look into the real reality. Consumers aren’t paying down debt. Their debt is being written off. Read this: http://www.theburningplatform.com/?p=30405

Adam, you have been duped.

“where is the inflation?”

It is pretty much everywhere that doesn’t involve manufactured goods. It is medical care, car insurance, car repairs, health insurance, utilities, housing (not calculated in CPI), haircuts, gasoline. medication and ALL OF IT offset by manufacturing that has been able to produce things for less due to moving off shore and productivity gains.

In the simplest example, in 1980, during a period of high oil prices, my minimum wage high school dish washing job paid me 3.15 an hour, enough to buy about 4 gallons of gasoline. That minimum wage job also gave me full medical and dental insurance and I opened my first checking account that had zero fees what so ever.

Today, a minimum wage job earns you about 1.5 gallons of gas per hour now. and medical or dental you can pretty much forget about if your minimum wage along with a no fee checking account.

They can manipulate the CPI to their favor and you can’t argue that fact comparing now with 30 years ago. Inflation is everywhere. http://www.shadowstats.com

You are 100% accurate! Here in Las Vegas with near 500,000 underwater homes we are experiencing a shortage of correctly priced homes right now too! Ludicrous. If the banks would complete their foreclosures and release them to the market, we could then know the real market value of these homes and my guess is everyone could afford to buy because a house would cost about as much as a car. Also the settlement is a bad joke.

YES…The ones who are buying are cash investors, and they are getting foreclosures on the cheap, rehabbing and flipping them. I have gone out to look at properties here in Burbank, and I can’t tell you exactly, but it’s probably close to 60-75% cash investor flips. They have contractors come in, and after putting 30K into a dump they can reap a big return on the property. If your connected, 30K can go a long way into making a place look sale-able. You can tell when you see these places that they haven’t been owner occupied. They are keeping a floor on the market. I have seen a rare foreclosure property, and you know why they are rare on the market? Because they are so hideous that an Investor with a lot of cash looked at it and said “No matter how much money I put into this place, I will never make a decent profit.

@Lynn, I think this is from AB284 here in Nevada. If you robo sign in Nevada it is now a felony.

I do hope you meant well-HEELED 😉

Lol…All that money will “Heal” anyone of their ills.

Sure the banks are manipulating the market. But we are screwed regardless of what they do.

CC

Your observations fit what is going on in east Ventura County as well.

(Thousand Oaks/Westlake Village/Simi Valley/Moorpark & parts of Agoura)

Adding to lower price pressure are Baby Boomers looking to downsize into retirement communities or moving in with their children. They’re the largest demographic in the U.S and for the next decade a lot of them will “cash out” Most of them own their houses outright. You see more listings these days with comments such as “First time on the market in 30 years”…

I’m glad I have commercial rental property, paid off too – – not a house. I can continue to live in one of our apts into old age and still have rental income coming in…I’m a “boomer”, born in 1964..

Homes that say “first time on the market in XX years…” are usually in need of updating and deferred maintenance. We just past on one of those. We estimated $60K minimum, and the house was priced as a turnkey. Screw that noise. (We’re a cash & close for a final home. We are dealing with an eye disease, so we need a paid off home. Our future is a big unknown.)

I want access to the same drug being used by the person(s) who believe that there is a big group of Baby Boomers who own their homes outright and will be cashing out to move in with their children (???). Let’s post photos of those kids, waiting with open arms to give up the master bedroom to their spendthrift parents and take time off from work without pay to shuttle the parents for Welfare/Medicare/Social Security.

I don’t see a big public movement to welcome parents back home (perhaps a cot in the garage?) so they can enjoy a rockin retirement free of rent. From what I have seen the percentage of Americans who own homes outright is between 20-30% (would love to see the breakdown of this stat by income and assets, don’t think the scrimpers who paid double payments on their loan for 15 years dominate the stats).

When is the last time you saw a mortgage burning ceremony? (Archie Bunker?)

If another 40% are underwater that would leave 30% with some equity. What I see in my daily work is that people beyond the 1% (people who must work to have an income) are blowing and have blown every asset they owned during the real estate bubble. There is nothing left for most and most of the people who are not making payments on a home for more than two years are blowing that money as fast as it comes in to maintain the fiction of an upwardly mobile life style. I would love to know how many people are really paying down debt and downsizing. I would love to know the differential between what people are supposed to be paying on the home loan they have defaulted on and the rent they start paying once they have finally been forced to hit the street after a foreclosure or short sale. In percentage terms I would guess 1/2 to 2/3 less because the new payment must be something close to what they can actually afford.

My experience in the real world with the mass of people is that they change nothing, improve nothing, risk nothing and give up nothing, even if they did not work for it or “earn” it by existing. Nothing changes until there are no alternatives left (no more credit, no more income or less income due to death of wages since the ’70’s and inflation everywhere you look. I see marriages and families destroyed because of a fierce refusal to downsize or reduce spending even in the face of radically reduced incomes, the death of false home equity, fear of what the neighbors will think, etc. I see families destroyed by the need to commute from the suburbs to work centers with rising gas prices that will never go down.

Where is the recently built, planned urban community that includes a solid employment base, meaningful mass transit, medical care etc. designed to meet what any rational person can see coming with the death of cheap oil? You can see a few markets afloat on Govt. Employment like DC, but point out some others for the less informed please.

We are far from done with this correction in most markets. The shadow inventory must be absorbed and appears likely to correct through redefaults on government guaranteed (tax payer bailed out) loans. How long this will take is anybody’s guess.

Thank you, Doctor, for your continued coverage of complicated issues. Complicating matters even further is the Baby Boom Generation — those born from 1946-1964. This year, these boomers turn as old as 66 or as young as 48. According to the charts above, this group owns the highest proportion of homes. If they want to downsize into a condo or assisted living center, how many younger buyers will step up to buy? There are just so many fewer of these younger folks!

Boomers’ kids — some of whom have returned home to live in their parents’ garage turned into an unpermitted “bonus” room — may inherit these homes. Over time though, these Boomer homes will probably be joining the already existing shadow inventory, increasing inventories even more and lowering prices even further.

IMHO It will always cost more to live in the best weather with the lowest crime. The Liberals have guaranteed it. Don’t expect to find bargains there.

The problems are not, as you suggest, caused by liberals–or for that matter conservatives either. They are mostly rooted in our corrupt political system. We allow politicians to take bribes–campaign contribution cash–and its all downhill from there. The laws which get passed are those which have been bought and paid for–and then they are written by the industry/lobbyists that purchased them. That is no way to run a country. Just look at all the failed corrupt regimes that litter history to be sure.

Do you even know what liberal means? I’ll tell you who guaranteed it. Conservatives. Ha. What bull. It is guaranteed by supply and demand. If you have the means you pay more for more amenities. That is what a free market is. They only make so much beach and sunshine a year. With a population explosion of double, coincident with the largest technological, business, income growth in history, over the last 60 years the price of location location location went through the roof. While it may and should correct some don’t expect those areas to go back to what they were in the 60s. Palo Alto was already pricey in the 50s long before tech.

The Boomer generation, of which I am a member, has pretty much run this country since the late 1970’s. Their going to start cashing out in a big way as they retire. Their kids don’t have money. I know many of them. Who’s going to buy all these houses built for a family of four when they’re broke and/or having one or two kids??? Most homes are being bought by investors now, not first time buyers. So there won’t be any “move-up” buyers either. The only positive I see in the real estate market is very low interest rates. Everything else spells future downward pressure. From the banks shadow inventory to the lousy demographics.

Agree. There are simply no fundamental tail winds here.

If you can’t continually lower interest rates and increase incomes to provide move up buyers with an entry point to jack up everyone else’s equity (and that is OVER for at least a decade or more), you will see supply/demand and price/income equilibrium. They are working hard to slow and prevent it but the trend is set in stone and they have never successfully diverted it other than a quick blip here/there with reversion to downtrend taking hold shortly after.

It’s just going to take awhile. I mean really, who thought in 2008 that banks would sit and hold property for 2-4+ years without selling or marking it to control inventory on a pseudo-market. The fact that mark to market was suspended, government has financed the hell out of the economy (getting only meager growth), and all these games are being played (and not fundamentally helping much at all) tells you the severity of the issue and how unlikely it is that this will radically change through organic means any time soon.

People are getting squeezed buy paying more for food, energy and housing. All the things that are NOT counted in the headline inflation number. Truth is, there isn’t much disposable income left over to stimulate the real economy. Smart builders are just building apartments now as they can see the writing on the wall for single family homes. Very sad.

http://Www.westsideremeltdown.blogspot.com

“I find it fascinating that people are willing to commute two horrid hours each way in Southern California traffic just so they can have a giant home out in what is essentially the desert. ”

No offense, but have you considered the psychic expense of being relentlessly surrounded by the ugliness of LA?

Further, most folks cannot afford private schools for their children but can afford a house in the sticks far from the ineducable peasant NAM population of California.

Public schools in LA were over 90% white folks in 1960 when schools communicated the culture and values of the student population. Now they are perhaps 10-15%.

Anyone who can is escaping the nightmare and the desert is (was?) the closest they can get and still raise their children in America and not in Shanghai or Oaxaca.

But you know all this. You hear the code words of “good schools” and “safe neighborhoods” and know what they really mean. So why the wonderment?

I prefer my good parts of Rancho Cucamonga and Riverside, to absolutely ANY neighborhood in L.A. County, anyday…

eh, I wouldn’t go *that* far. I grew up in the R.C. and parents still there. I now live in Murrieta. If I were rich, I’d by far rather live in Torrance, Hermosa, Redondo, RPV, Manhattan, MarinaDR, El Segundo in a heartbeat. Don’t get me wrong… R.C. and Murrieta/Temecula is good but let’s not get delusional. The rest of San Bernardino and Riverside Counties, for the most part, are the armpit of the world.

Much of San Bernadino seems to be the meth capital of the world.

I live about an hour’s commute (in traffic) from downtown LA and I get flak from snotty co-workers who live on the Westside or in mid-town Los Angeles. They enjoy pointing out that they have much less of a commute than I do, and that they’re living in trendy urban areas or near the beach.

They don’t talk about the fact that they all purchased midcentury 3 bedroom dumps for $600K-$700K or that both husband and wife are each chained to 6-figure jobs to support the lifestyle, or that they pay the equivalent of a new car every year in order to put their children through private schools. After all, we can’t allow the kids to go to LA Unified, can we? They also don’t talk about having to take an ice chest with them to the grocery store, because it takes so long to get to the nearest supermarket (either because of traffic and/or distance) that food will spoil on the car ride home.

So, yeah, I live in the IE. I live in a nice house with lots of open farmland in the area. The school system is decent. The grocery store, good restaurants, and new shopping centers are literally right around the corner. My wife and I are taking a trip to Europe in a couple weeks, to the incredulity of my co-workers. There’s also a reasonable possibility that when my wife and I have kids in a couple years, she’ll be able to quit her job (or at least work 1-2 days per week) and be a stay-at-home Mom the rest of the time.

My wife is a teacher. My salary is respectable, but nothing special for Southern California. The difference is, in exchange for a little longer commute, I don’t have to live in the middle of urban sprawl, I get to save quite a bit of money, and I get a better life.

If you live only an hour from LA (in rush hour), then you live less than 15 miles from LA?

The schools in the IE are decent? LOL.

Urban dwellers have to travel far to the grocery store? Um, no. We walk. It’s four blocks. In fact the only time I drive anywhere is to work and back. Everything else is within walking distance. But nice try justifying your long commute. I hope you at least purchased a car with good gas mileage.

My son, mid 30’s, wife and three children live in a town called Redlands, Calif. It is a town of approximately 60,000 (twice the population of our ancestral hometown in Ill.) He rides his bike to work at a local tech firm. (10 Min). He has no complaints about the local public schools, including those for a special needs daughter. The neighborhood is clean safe and his neighbors are nice middle class folks. Mortgage is affordable even with the modifications to make the home ADA compliant due to the special needs child. When I visit, we make the drive into the city to take advantage of its activities. However this is not an every day occurrence. They do not seem to have any complaints about their lifestyle. Why is it that a never read of Readlands, Calif. on these boards?

Redlands ‘local tech firm’. LOL. That’s like working at a local hedge fund in Fargo N.D.

I live in the San Fernando Valley.

I intentionally live close to my office and my clientele. People who CHOOSE to live in Lancaster or Riverside and work in downtown L.A. took for granted cheap gas as their American right, ignoring any environmental or quality of life considerations that are affected by being in their cars 2 + hours per day. I have no sympathy for them. They ignored the social and environmental costs of their behavior and now that they are being asked to pay for what they took for granted they are upset. Just another example of Americans in general living beyond their means — this time in an environmental and gas price sense.

Some of us dont commute, but I do agree with you. What shocked me was that not only do a lot of the people out here commute, they all do so in huge gas guzzlers. It’s the complete opposite of what you’d expect when I lived in RPV everyone drove Prius. I have yet to see a Prius out here in the IE.

If this is true, and Los Angeles is an abysmal ghetto with horrible public schools, then why can’t a child-free/non-racist like myself find a decent deal on a crummy little house here?

Also – taking an ice chest to the grocery store? Never heard of such a thing. This is L.A., not Louisiana!

Greetings from another childfree by choice urbanite 🙂

Easy. Because even though the Emperor has no clothes, there are still thousands of people who are convinced he does. And those who’ve already bought into the foolishness cannot lower their asking price because they’re unwilling to consider even the slight possibility that they may have been party to the biggest con of the last 30 years. “Oh NO! Housing prices always go up! Suzanne totally researched this before I bought it!!!”

White desert towns aren’t known for their great schools. The areas for schools in LA, right now, are the south bay beach cities, parts of the SF valley, and a few areas in the SG valley.

Researched a condo complex in Portland Oregon called Waterside & discovered that in order to boost sales, it took both a $100,000 price reduction & an auction on 30 of the 84 units. Keep in mind these condos are anything but small & are either 2/2 or 3/2 bed/bath.

This complex is located on Hayden Island, in the middle of the Columbia river off I-5. The interesting thing to note is that despite the location, these condos are afordable by Portland standards & yet you aren’t isolated from downtown or Vancouver Washington even if you are transit dependent.

This is atipical for most suburbs since a car isn’t required & with oil prices projected to keep rising despite screams from polititions, these types of complexes near transit will thrive in the longterm.

“Do we go back to more tested ways of a boring housing market where banks actually verify financials or do we juice up the machine again?”

The stock market has been buoyed to “fresh new highs!” by cheap dollars falling from the sky. It has worked…media happily reports inflation is tame ($4+/gal gas, smaller sized packages/higher prices, etc. irrelevant…people don’t notice it/get used to it, keep spending as long as credit cards work). I believe the housing market will be the next focus, govt will fashion easy loan programs to get mirror foggers back into home ownership, shift shadow inventory off the banks books (everybody wins). Should be soon, election at years end. Looking forward to TV commercials featuring cheerful, broke Mom standing on the front porch, foreclosed Dad and Junior throwing a ball in the front yard…the commercial concludes with BK family piling into their new SUV, heading out to a restaurant to celebrate. Cue to the the announcer stating “The American Dream, it’s still within reach with Home Ownership. Maintain the Lifestyle You Deserve” Hope I’m wrong, but it seems as long as endless cheap money flows, we’ll all be fine, everything will work out. I’m starting to believe it myself. There’s no end game, no day of reckoning for the absurd, no level playing field. Enjoy the ride, don’t worry anymore!

You make a very valid point. The only question I ask myself is “what about capital formation?” Basically instead of private funding, the Gov is creating the funding. Controlled economies never historically end well, the magic question is ‘how long can they kick the can for’. Could be months, could be decades. Sucks living in this environment of unknowns, the post WWII’ers (my grandparents) had the perfect life. #1 in the world, 30 year job security, pension…todays kids have scraps.

Brilliant work, Dr. HB, as always. I love your blog and look forward to your insightful analysis.

Thank you very much indeed for your great service to the society.

Baby Boomers better beware because all of this movement is geared at making them part with their hard earn savings. Lucky, my culture makes it ok to live with my parents. Now if only I could get a cow and some hens I will be hedged against some of the highest priced commodities (milk, cheese, & eggs). And this leads me to my final point: maybe the urban swing is over… maybe the pendulum will swing back towards the rural and the self sustaining? Comment’s please

I live 8 miles from work. In LA that can still mean a 50 minute commute each way. Cannot wait for construction on La Cienega to be finished so that commute is back to 35 minutes each way. Great post as always…

When I lived 8 miles from my job in LA I parked my car for weeks at a time. I walked less than a mile to the train station and less than a mile to the office. Then I bought a bike and my commute time dropped another 15 minutes (both ways) to approximately 45 minutes a day. The town I lived in was diverse in race and job level, clean and also an easy walk to everything. Crime was low. No or few helicopters. No one should live more than 15 miles from their job and the govt should create tax incentives to make that happen. Take the subsidies from the oil companies and give them to the people. Less oil dependency, less pollution, less warming and a less stressful life. Concurrently tax incentives should go to those who use shared or public transit to work commute. Americas love affair with mega-builders creating mc mansion bedroom communities needs to end.

We live in So. Pasadena, work in Santa Monica and Studio City. Not far as the crow flies, and if you can time your commute, it ain’t too bad..

Rhiannon

Wow, you live in So Pasadena. I envy you. I love it there. We take the GoldLine and so enjoy the above ground journey, and get off at each stop. We would love to live there, but the house we liked (a 2nd tier house, nothing grand) was $1.4M. We want to pay cash for our toe-tag home, and could basically afford yucky Pasadena. What an area (So Pasadena), what great folks, what a life. Suburban with a sprinkle of Urban. OK, I’m jealous. (I grew up in Valley Village & Studio City.)

I grew up here. I now own property that my dad bought in 1963 – – apts and business spaces. I have no need for a house. Yes, houses here are crazily overpriced. If I had that much money, I’d live by the ocean..

Rhiannon

Lucky Ducky. We’re childfree (by choice) in our 50’s & 60’s, and find east Ventura County is not our “flavor”. Child-centric isn’t our thing. So Pasadena is great. Can we come visit for the weekend? LOL

NASA/JPL Open House every year, National Train Day (May 12th, 2012) every year at Union Station, China Town, Jazz In The Park (“Mission” subway station exit So Pas)- I love the beat of the city and So Pasadena.And talk about interesting people. Oh, and the Library by the Mission subway station w/ the tree tunnel is beautiful, along with the old Churches (and I don’t even like organized religion). You are a Lucky Ducky! You grew up there? I am turning green.

Hey, great to hear. Sadly, So. Pasadena is VERY child-centric; it is one of the things we can’t stand about it. People come here for the schools. Case in point: an Irish pub will be opening on Mission St. this Spring, and residents are already asking if it will be family friendly! Can’t there be at least one night-spot for adults? Don’t parents need a break as well? Wish I had room to put you two up but I only have a one-bedroom apt. lol!

Rhiannon

OK, we’ll get a room. LOL

I had no idea your area was child-centric, too.

What is wrong with our society that adults have to

worship children 24/7. That Mission area is

fabulous. One thing we love about it was the adult

“vibe”.

Last time we went to the Hollywood Bowl (tickets “aint” cheap)

someone had a screaming baby with them. I wish I had a sock.

Thanks for the schools in demand info., should we still dream about

living in So Pasadena.

Oh boy that is a horrible horrible commute.

I live in the City of Alhambra which is about 7 miles East of Downtown LA. We have excellent schools and a very nice community to raise a family. We bought a house here 10 years ago. This is truly a hiden gem. We are close to everything and we always go against traffic. The homes are small.

North Alhambra is nice, not sure about some of the other parts.

Sometimes you don’t choose a commute, but it sneaks up on you. When I bought my tiny house in East Ventura County it was a 2 minute drive to work (that I often turned into a 10 minute bike ride). 5 years later that job vanished and the best I could find was in the West San Fernando Valley – about a 30 minute commute, but still reasonable. Then my company’s division in the Valley shut down in early 2010 – when few alternatives were to be had. I was one of the “lucky” 20% who got transferred to beautiful El Segundo rather than simply axed. Now I have an hour commute (if I’m lucky and leave at 5 AM).

I think a lot of folks are in my boat: commuting out of necessity rather than conscious lifestyle choice when we shopped for a home.

That’s exactly what happened to me, years ago. Worked at one company near Culver City for ten years, bought a condo in Culver City in 1990, had a 5-mile commute. I couldn’t understand how people could manage a long drive. Five years later the company was sold, and I too was one of the “lucky” few who got a job with the new owners — in Irvine. By then, of course, my place was worth far less than I’d paid for it, so I was stuck driving 100 miles a day. Eventually I found a job that was “only” 20 miles away. It happens to a lot of people.

apolitical scientist , Marie Marie & others

I hear ya. We are toe-tag house hunting paying cash, and I get this feeling I will be living in my car as time goes by. I guess I should think in terms of a park and ride job, or when a good EV comes out, replace my wheels. (17 yrs old) I love audio learning, so I could use the time to grow. You guys woke my spoiled tosh up. Thanks.

We’re not able to design our lives anymore, the nefarious ptb are.

Yes it’s also another argument against ownership IMO. In other words even when ownership makes sense economically, the quality of life cost can be high.

“Justify” a commute? I laugh. People choose to live in a place that they, for whatever reason, found appealing.

I find that many people west of the 5 have attitude problems. “BlahOne” is the very definition of pretentious and smug.

I work for a huge company in the South Bay. Every day the train pulls up, the van pools, bus pools, etc. I know people that live in Manhanntan, Torrance, Lawndale, The Gundo, Inglewood, Long Beach, PV, Culver, Santa Clarita, Simi Valley, Lake Forest, Anaheim, Cerritos, Norwalk, Lakewood, Chico Hills, Corona, Riverside, Pomona, Rancho, Fontana, Rialto, and Temecula. Yes gas and time can suck, but you like what you like and that’s it.

I agree with you. The indignantly righteous claim of moral superiority of those with a short commute is very amusing. As is the claim the that “suburban experiment” has failed. LA used to have suburbs–as in sub-urban. LA really did have a downtown at one time during the fifties. Since LA really no longer has an URBAN area to speak of, claiming that there are suburbs at all is nonsensical.

West LA people used to commute to downtown LA, then industry moved into West LA in the 50’s and 60’s. Then people moved to the valley and commuted to jobs in West LA. They also moved south to the OC to commuted to these same jobs. Then industry moved into the valley and the OC–and another cycle occurred with people moving to the west valley and southern OC.

High-density owner-occupied dwellings only work in areas where significant job opportunities exist co-located with those dwellings. That simply is not the reality of the job situation in SoCal. Manhattan & Chicago, yes–LA no.

People have voted with their feet for 75 years here following WWII and I don’t see anything changing it, despite the rancor of the morally superior punditry.

I just looked at this months fresh stats on the DQ News chart. The rich areas of Riverside and Rancho Cucamonga are rising in price, yet the rest of the IE is still falling. Does that signal a bottom if the rich are buying? Does it also signal just how poor the general population really is (without access to credit)?

I’m fascinated by the graph you included on urban vs. rural population trends. Remember the 1970’s, when ‘back to the countryside’ was the mantra? Didn’t really happen. Only the migration to the cities slowed.

I read an interesting piece on a related subject. Folks in the country tend to have low mileage vehicles: trucks, 4X4, or any vehicle that can double for farm use. But high gasoline prices will make any significant commute prohibitively expensive. So I think the trend away from rural living will continue.

But with the suburban experiment an obvious failure, that doesn’t leave many options, outside of inner city, high density housing, and the potential crime problems associated with it. Without very careful planning, I see the quality of life in this nation dropping dramatically over the next decade.

High density did not mean higher crime until our cities starting losing their middle class populations to the suburbs after WW2, thanks to the atrocious public policies of the post-war era that deliberately murdered our public transit, our railroads, and our cities by massively subsidizing suburban sprawl building (FHA), auto ownership, and flying, while redlining perfectly beautiful, intact city neighborhoods and destroying railroads and transit companies with insane regulation and punitive, discriminatory tax policies.

I remember St Louis’ wonderful middle class and working class neighborhoods, and Chicago’s. People who never lived in one of these old fashioned high density urban nabes before 1965 or so, when the exodus became a real flood outwards, have no idea how incredibly comfortable and convenient they were. But you can get an idea from living in one of Chicago’s old nabes, as this city still has many intact, safe, livable urban neighborhoods. When I was a kid, I could walk to school, and the bus at our door ran all night until 1965. There were other bus lines running frequently within a few blocks. You could get downtown to all the shopping there in 20 minutes and never had to wait more than 10 minutes for a bus. We were within walking distance of a nice smaller supermarket, a butcher, a shoe repair, a laundromat, a couple of small retail districts with shoe and clothing stores (including a Sears, that ubiquitous neighborhood fixture of old), several schools and churches of almost every denomination, two public library branches, three hardware stores run by guys who knew everything about how to do a household repair or fix the lawnmower or whatever, dozens of professional offices of dentists, doctors, accountants, and lawyers. In cities like St Louis and poor Detroit (formerly so beautiful!) this was almost all gone by the early 70s, when the outer-suburban buildout began in earnest. Only a handful of cities- New York, Chicago, Boston, San Fran, and maybe Philadelphia, have neighborhoods left where you can live your life within a few blocks of your place without traveling by car for every darn thing you need.

Now we have to start almost from scratch in most places in this country. St. Louis and Detroit look almost like they never existed, whole blocks and neighborhoods being replaced by grasslands. I’m seeing some hopeful developments, as suburbs rebuild areas adjacent to commuter rail stops as small-town-style “downtown” areas complete with multiuse buildings and good-quality high-density housing, and a variety of retail close by. Areas planned this way will become very valuable as “sprawl” type developments featuring cul-de-sac developments off huge collector roads, with houses on one acre lots, lose value quickly.

Ray Suarez wrote a book about exactly this over a decade ago:

http://www.amazon.com/The-Old-Neighborhood-Migration-1966-1999/dp/0684834022/ref=sr_1_1?ie=UTF8&qid=1332256226&sr=8-1

If the cost of fuel keeps this rise, living in the suburbs will become much less appealing. Most people need a job. They figure out the house part after employment. If getting to work is too expensive, they’ll have to move.

I’m still amazed at how many companies will not let their employees telecommute. Maybe this will force the issue.

CAE said, “I’m still amazed at how many companies will not let their employees telecommute. Maybe this will force the issue.”

The economics of your suggestion seem irrefutable. My guess is that computers in general, and the internet in particular, are bigger wastes of time than any savings derived from telecommuting. Just look at how many people, such as you and I are wasting away our lives on the many millions of message boards across the cyber landscape.

If someone has the discipline to manage their time, they have probably already started their own business.

I had a look at this once for a company I worked for.

Apparently the biggest drawback/fear for comapnies considering increasing outworking isn’n lazy employees chatting all day on the net, its the fear of security leaks, that competitors or fraudsters can easilly get hold of valuable data.

we live next to a foreclosure and the windows are broken and it’s pouring rain right now. no doubt this house will be destroyed by mold. and this is a nice house (zillow says it’s worth over 600k). is there a plot to destroy housing stock as a way to raise values on what remains?

Yeah there’s something to this gas price and commuting situation. Say you live 40 miles from work and spend about 350 bucks per month, just traveling to work. That 350 bucks/month represents about an extra 70 or 80 thousand dollars one could afford to pay on a mortgage if they lived across the street from work. In this example one can see that at some point, as gas prices go higher and higher, it makes more sense to pay a bit more on a mortgage to live near where one works, to offset that loss due to gas money. I assume gas prices will continue to climb as China and India and other emerging economies continue to grow (and grow huge, gas guzzling, middle classes). Thus, a young fellow, who will probably see 7 dollar, 10 dollar, 13 dollar, etc. gas prices, might want to factor in that extra cash when deciding to purchase a place to live closer to work, grocery, schools, etc., unless it can be relied upon that fuel efficiency technology will always be able to offset price hikes (and of course they must also factor in the cost of having the latest fuel efficient car, always on hand (give or take a few years)).

In the future, walkable neighborhoods (stressing fuel and time efficiency) will come into vogue as oil prices rise and energy efficiency and sustainability become more important. Who knows, maybe future cities/counties/states, trying to comply with stricter and stricter CO2 emissions standards (what’s our pact with other UN countries? Something like an 80% decrease in emissions by 2050?) may start taxing gas similar to Europe (not only to reduce emissions but to pay for state and federal deficits).

These are the things I would be thinking about, if I were buying something right now.

Sorry – that last missive was a big jumbled, in terms of readability, and idea presentation. But I think my points can still be extracted from my ramble.

I have to say that I’m glad I’m renting. We live in Ventura county and have friends in LA county. We were sweating it with rent prices increasing till about 2010. Rents have been coming down slowly and steadily in both LA and Ventura counties, especially since late last year. Compared to a few years ago, many landlords are now willing to negotiate and the properties that are priced right for rent are rented out in a few days.

This may sound crazy, but I had a thought a while back. We spend so much money on wars and bailouts and the like. What if each person was given a get-out-of-jail free card? I know again this may seem stupid, but what if instead of everybody foreclosing, they were allowed to refinance with the bank to where their payment was say cut in half. This would allow people to stay in their house, and still contribute to the economy. I don’t believe in flying unicorns or world peace, but I also don’t believe in corporate bailouts and massive wars that don’t accomplish anything. Oh and NASA, what is actually still the point of that?

Needless wars and bailouts are not necessary, and have bankrupted us. But at the same time, giving everyone a free house won’t solve the problem either. Who will pay for it? There is no free lunch, and someone somewhere will have ot pick up the tab. Who will give the banks the money they lost in lending, or subsudize the millions who already paid off their homes over the 30 years they paid on it? Who will finish paying the construction workers that are building (what few) new homes there are? The trickle down ramifications from this would be enormous and cause chaos, bringing on much more trouble than anyone wanted/ bargained for/ hoped for.

Speaking of NASA, your comment is sort of Star Trek-ish where they all work for each others common good. That’s communism/socialism and only works well on a spaceship where everyone agrees to it in the beginning of the mission. Far from every American would agree to that housing plan. And NASA’s accomplishments? Yeah they didn’t do much for America. The only things NASA ever did were…

Satellites

Computers

Cell phones

Microwave ovens

MRI technology

Fuel cells

That’s just to name a few. As in they INVENTED those things.

Leave a Reply to Heathen