The four ponies of the Southern California housing market – FFBB. A new real estate mania is in full force. How long will this last?

The Southern California housing market is tearing a path into the fall real estate season. As we detailed in a previous post many families will have a hard time saving $100,000 for a down payment so the market is being flood with foreign investors, flippers, baby down payment buyers, and big pocket investors. Let us call this the FFBB crowd. Since foreclosure resales are making up a smaller part of the selling mix the median price is ripping a path across the mainstream press creating a self-fulfilling vortex feeding into the real estate money piranha machine. It is an interesting mix because household incomes are stagnant yet a tremendous amount of subsidies and interest is causing prices to move up. Let us examine the latest sales data for Southern California.

Long live the jumbo loan market

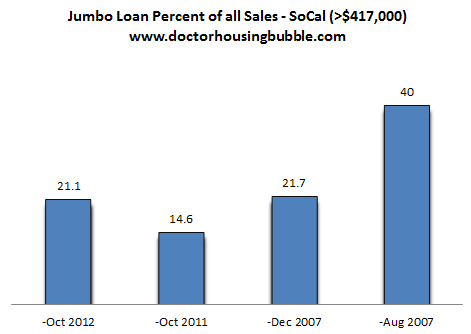

The jumbo loan market is picking up steam. Jumbo loans as a percent of all sales are now back to levels last seen in December of 2007:

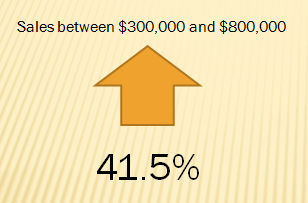

Why the heavy usage of jumbo loans? Prices are running up because of scant inventory and the low interest rate environment. Foreign money is flowing into targeted areas while domestic big pocket investors are purchasing up other properties. Higher priced properties are making a big move:

Sales between $300,000 and $800,000 are up a stunning 41 percent over the last year. Sales in October for properties priced above $500,000 went up by 55 percent. These are actual sales and this is occurring in the fall when sales typically edge lower.

A quick preview looks like this:

All cash buyers:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 32 percent (near peak)

FHA insured buyers:Â Â Â Â Â Â 25 percent

Jumbo loan buyers:Â Â Â Â Â Â Â 21 percent

Welcome back to the California housing market. Foreign money and big pocket local investors make up the all cash segment. The resurgence of flippers is now in full force:

Homes sold twice within six months:

October 2011:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3.7

October 2012:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 6.1Â (increase of 64 percent)

And we are seeing this flipping activity in many hipster neighborhoods. I know many people are shocked since they will look at local income figures but keep in mind this is happening because a large pool of money is coming in from outside forces. This is also happening in many prime cities of Canada. This hot money will continue flowing as long as the host nation continues to boom.

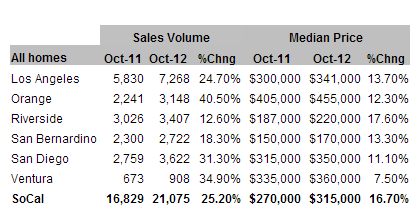

Since foreclosure resales are now a much smaller part of overall sales, we are seeing the median price move up sharply:

Source:Â DataQuick

SoCal home sales are up 25 percent over the year while the median price is up 16 percent. Keep in mind this is happening at a time when household incomes are stagnant. As we have mentioned, the FFBB group is the current herd running through the 405 and 101. To try to personalize:

-Foreign money – current prices are cheap relative to domestic markets (weak dollar adds even more leverage as a hedge). Interested in targeted markets (not all of US).

-Flippers – prices are going up so selling into momentum (musical chairs game starting up again)

-Baby down payment  buyer – FHA insured going to more local families trying to jump in and play this game. Paying via much higher mortgage insurance premiums.

-Big pocket investors – buying up places in areas like the Inland Empire for rentals or flips (yields are being squeezed thanks to competition)

Not exactly the bubble of the 2000s but this is certainly a market fueled by speculation and hot money. Throw in the Fed’s push for low interest rates via QE3 and you have local families levering up to compete with all these other groups. The result? Big jump in sales and prices. But does this have momentum?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

33 Responses to “The four ponies of the Southern California housing market – FFBB. A new real estate mania is in full force. How long will this last?”

Gotta give the govt credit. They look to be getting some traction for another real estate bubble. At least in parts of CA. I’ve heard most of the country is still cratersville.

I miss Iowa, none of this financial b.s. goes on there. The housing market is still normal.

No, you can’t compare weather or entertainment, but you can compare sanity and standard of living. Those 10 minute commutes are rough in IA.

I digress…

Boooyaaahhhh!

Flip that house!

Why o why are americans having trouble saving a down payment? Is it because so much money trickled down they don’t want to be burdened with a house payment? Is it because my children work for the same hourly wage I did 20 years ago? Is it because it is a race to the bottom where no man deserves a living wage for any job outside FIRE activity?

Any bitching I hear is music to my ears. Each and every american deserves everything they have coming…in spades. When I hear people saying “WalMart rescued america”, or “tha capital gains tax increase will kill us” when they have no hope to retire, and have NEVER had to declare capital gains. Like I said…WE all deserve it. And social security…that thing you PAID for but is called an “entitlement”, well maybe they will take that away as well because none of you useless eaters deserve it….right?

I am starting to hear the phrase “means testing” a lot these days. SS and medicare are the obvious targets. What we all paid for was “insurance” against not having enough money for retirement. You know it’s coming.

I’d rather the tax be low (6.2% employee’s SSI share) and the benefits be means-tested on the back-end if I’m doing well then, than have the tax be high (10%+ employee’s share) and the benefits low or uncertain.

Awe………I can sense Boomer frustration here. Kept all your nickels for yourself and now when you want the gov to give you money you get angwee. awweeeeeeeeeee

Your comment stripped of it’s nonsensical logic only makes sense as bullying. So bugger off. Cause what goes round comes round.

About saving for a down payment.

Well in the present market, (starter homes that in a normal LA market would be 150 -225k are presently being sold for 500 k. There is a significant difference in down payment if you are talking 20%. 30 – 40k is relatively reachable if you are prudent or have in-laws that can help a little. 100K is a lot of money and time saving for most people especially younger first time home buyers.

Now 3.5 % on that 500k house is 17,500. That is obtainable and easy, and hey, well just sell our starter house in 5 years and use our equity to upgrade to a house we want to live in! Sure, what can go wrong? say the sheeple.

It had taken all of my persuasive powers to keep my wife from crawling out of her skin that that we still rent and don’t own a house like some of her friends. She finally gets it now that she sees her sister stuck in her 2 bdr starter condo in OC that they purchased in 2008 for 325K, and is now valued at 200k with a set of 1 year old twins and no room too move your arms..

So we save and invest thank our lucky stars that we got our larger 3br rental in 2009 when there was a dip in the rental market that accommodates our suddenly larger than planned family (wife pregnant with twins). Which is $2200 a month, still not cheap.

Someday it will be LA normal again (which is still expensive) and our 65 k saved for a down payment will buy us something worthwhile.

Viva la Bubble!

The full story can be viewed at:

http://www.latimes.com/la-fi-rebound-buyers-20121114,0,832219.story

I hear you !!

My brother just sold his condo that he owned since 2009 for a 15 % profit (in Los Angeles)

A flipper I know just sold a house in TN for a $10,000 profit, for a small house !!

A report in the wall street journal shows this FHA practice heading to a taxpayer bailout in excess of 16 billion dollars. Gives one a warm and fuzzy feeling after reading your linked article about serial defaulters. Wall Street Journal

Before jumping into the frying pan waving around your newly printed bernanks, you may also find it helpful to use this tax calculator.( may not be useful to house flippers)

http://www.totaltaxinsights.org/Calculator

Give it to me! Give it to me now! I want it! Oh yea baby! Give it too me! Oh yeeaaaaaaahhh!!!!!!!!

The new Zillow Foreclosed and Pre-foreclosure listings are truly humbling for most So Cal zip codes. It provides a true picture of everything still to come, and the pipeline stuffing by the banks who continue to hope for the current price trend to continue.

92880 (“Eastvale” portion of Corona, major housing bubble area) = 519 homes in some stage of foreclosure! It totally eclipses the 187 homes listed for sale in the zip code. I’m renting, and patiently waiting…

The correction is in remission. The cancer is still with us.

Agree. Renting in OC. I am a S Cal Native. I actively enjoy the resourses of this area, unlike many of the people that are creating this crowding out in OC Housing. Don’t want to leave what I love, so just sitting tight until I end up on a boat or an RV

Artificial market has everyone hot and bothered. It can’t go on forever and watch out once the music stops. Still seeing some rediculous price declines in Malibu and Beverly Hills via short sales though.

How are people getting their hands on these IF the market is so hot?

http://www.westsideremeltdown.blogspot.com

More high paying jobs exiting Cali. Bye Bye Boeing.

http://articles.latimes.com/2012/nov/08/business/la-fi-boeing-cuts-20121109

“On average, an aerospace employee in L.A. County makes $88,100 a year. That’s 66% more than the average worker.” said Robert Kleinhenz, chief economist for the Los Angeles County Economic Development Corp.

No worries. Retail and hospitality hiring, retired firefighter’s wife could launch another remodel project, maybe bought a second property to redecorate, shop til she drops, stimulate the economy. Gobble up a SoCal property soon, they’re not making any more land, weather’s great, everybody culturally enlighted, maybe see a celebrity at the mall!

I’ve also read that now that the Democrats have a super majority in Sacramento, they’ve wasted no time in reviewing repealing PROP 13 as it relates to commercial property tax protection.

Long live one party rule in California (joking).

Who knows we’d be getting a Dead Cat Bounce 4-5 years after the PoP.

The cat is still dead. He has no blood (personal income) nor air to breath (sales volume). The cat’s zombie bounce is FED money and the Flippers + Their Victims.

good times are here. Thank you Mr Obama and Ben.

And the fed thinks we should make lending even easier:

http://www.marketwatch.com/story/mortgage-lending-standards-are-too-tight-bernanke-2012-11-15

@Janum

lol, those lending “standards” in effect during 2005-2006 worked out real well!

The economy can only improve via fiscal stimulus and Congress wants nothing to do with that, or an increase in private debt. Since 80% of all loans are real estate related the housing market is very important. Bernanke is hoping the private sector starts levering up with real estate in order to create the money necessary to get the economy going again.

Have I got this right?

Bernanke wants the govt to ease lending standards so that more defaulters (referenced in the link from WP) can purchase houses pushing them up to the pre-crash levels per Bernanke; “But construction activity, home sales and home prices remain much lower than they were before the crisis.”

Then the FHA can make good on the newly defaulted loans and get bailed out by the government as the Wall Street Journal article states is about to happen for the first time ever.

Meanwhile the Fed and the banks keep getting the money. Then it’s rinse and repeat as others have said before.

Is that it? Dang doc I hope it’s not sustainable.

I just bought a house that had no stove, so I didn’t get much competition – apparently most bidders are FHA. It’s in Mar Vista.

I started having my doubts about the rental parity argument when I saw what my actual mortgage payment would be.

Then I gave my notice.

I live in Venice where the rent is already high, but I just found out my landlord is asking for my current place. It is $300 more than what I paid upon moving in just TWO years ago. What’s even more crazy is that she could probably ask even more…

I should also point out that my rental is just a tiny 1-bedroom.

I will point out that Venice is a dump that plenty of people are *currently* willing to overpay to live in because of Westside job proximity and the present fad of cultural blight.

There’s two parts to Mar Vista, the nicer part north of Venice Blvd and the tenement flats south of said thoroughfare with smatterings of SFRs sandwiched between such. I’m not trying to make you feel bad but my instinct tells me that most folks posting about rental parity being in favor of buying are either self deluding about or unaware of the real costs involved.

Let’s see how you feel about rental parity in the next few years if the trend of stagnant local wages and net outmigration continues. The increasing forces of globalization and mobility aren’t a feather in Los Angeles’ cap.

In some areas of CA rents are dropping, or vacancy rates are rising for this exact reason…renters that can–are buying homes.

Agreed. Rents are down about 15% since Jan in Thousand Oaks and most of Ventura County.

i think if you can put 20% down, given today’s rates, it makes sense to just buy a home. however, this is assuming you are ok with living there for a long time. selling your home will depend on market conditions and the prevailing rates. as long as you’re not moving out during a downward slide, you’re good to go.

although, for sake of argument, mar vista is no venice. something to consider if you want to compare apples to apples 😉

It seem to me that prices are starting to fall a little in my area of LA County. I’m actually seeing a few properties priced attractively, by that I mean lower than late 2011 prices.

I don’t know if this is just the usual market dip that happens in the late fall and winter, but it could be that the election is now over and there is no reason for the government/banks to prop up real estate prices and equity and asset prices on Wall St.

Real estate is now a game of smoke and mirrors, we are all being played by the government/banks. Don’t fool yourself into thinking this is a free market.

The casino is again open for business. Funny stuff. Next time the flip that house crowd needs a bailout, I hope they get the flip the bird treatment.

Leave a Reply to ed