Flipping and gentrifying: The art of flipping homes in lower income areas. If you remodel it, will the people come? A case study in Inglewood.

Flipping is only lucrative on a large scale when you have a strong uptrend in real estate. It is hard to make a sizable profit when markets are more fluid especially when appreciation rates are tied to more historical standards. But California is destined for at least our lifetimes to be a boom and bust state. Given the harder to find deals and the blocks of $700,000 crap shacks in pseudo wealth areas, many would be flippers are inching deeper into the inner city. Time to make those profits in Compton. I’ve noticed that flippers have pulled back for the most part but we still have those chasing profits in many areas across the Southland. I’m sure you have many Friskies eating boomers living in these old areas saying “you are willing to pay what for this place?!†Some are likely to take the golden ticket. Most will live out their days eating gruel and looking at their 30-something or 40-something kids counting the days until they kick the bucket and finally can afford a piece of California housing via inheritance. Yet housing is a live action market. You are either paying rent or buying a place. That is it. So let us look at Inglewood today and a flip that is happening right now.

The flippers in Inglewood

According to the latest IRS tax data, the average adjusted gross income for the 90304 zip code of Inglewood is $26,344. According to Census data, the median household income is $44,558. 20 percent of the population here lives below the poverty line. I’m putting this out there because this is not a high income area by any stretch.

Yet apparently, this is a good market to flip in. The bet that some flippers are making is there are plenty of lemmings out there willing to stretch their budgets to purchase this place even though it is clear incomes in this market are not high.

Let us look at our case study:

11144 Dalerose Ave, Inglewood, CA 90304

3 beds, 3 baths, 1,244 square feet

I like the drought resistant front lawn. Let us look at the ad:

“Beautiful completely remodeled ready to move in home on a cul-de-sac. This standard sale residence features a fireplace, recessed lighting, new central heating and Air Conditioning, separate laundry room, new laminate Hardwood floors, custom self close kitchen cabinets, copper plumbing. Garage conversion without permits with direct access to bathroom in the back.â€

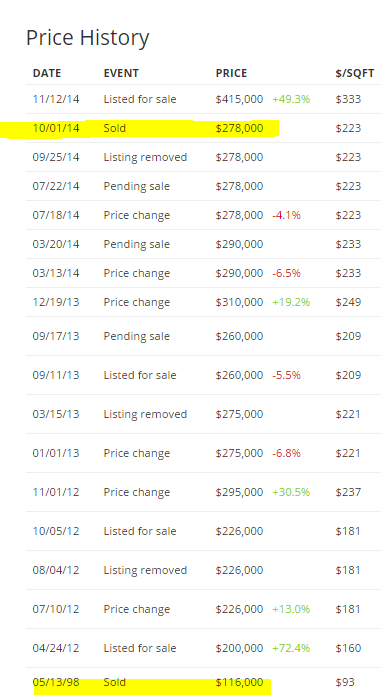

This place last sold in October of 2014 for $278,000. It went back on the market in November for $415,000. Talk about a quick one month turn around. The listing history shows a sordid track record. We see a default notice issued in 2014 so I suspect an investor took this off of the hands of a family that over reached here:

What we also know is that a loan was issued on this place in 2007. What we suspect is that someone HELOC’d their way out of their own home. But thanks to a rising market, all past sins were covered up and the recent investor took the place off their hands. But keep in mind they paid $278,000 just in October. Now they are asking for $415,000 for whatever magic they did in one month. HGTV all over this place:

Let us take a look at the street:

Here is you cul-de-sac:

I love how people try to pitch this and try to get people to over extend. This city has a lower median income than the rest of the United States yet you want $415,000 for a fairly standard property (10 times the local area median income). This initial family that bought for $116,000 in 1998 and HELOC’d the place couldn’t make it in this area. They had to sell and get out as witnessed by the starting of the foreclosure process. They were missing payments. These marginal markets are where big investors are pulling back given rents don’t justify these prices. So you are left flipping to families that actually will live here. So of course you have to look at what people can afford. That is where mortgage magic can happen.

I was listening to AM radio this weekend and of course, the “mortgage†advice shows are now back. This one women was talking about buying a home in L.A. but had a property out in Lancaster. She clearly did not have a good income. How do we know? She told the host “I don’t make enough.†Of course, instead of saying “you can’t afford†the host told her to either sell the current place in Lancaster and pre-qualify without carrying two mortgages. She mentioned her son was living in the place but he too did not make a good income. Of course it was all about squeezing in. The advice was to try to pre-qualify with the son or the mother’s own credit. Another caller had a recent foreclosure but hey, it was getting near to the anniversary of it falling off the credit report so time to buy again! It is never a bad time or good time to buy on these shows. And of course, the host was saying that he knew from “inside sources†that rates would be going up in the spring so buy now. I’m sure in the spring it will be something along the lines that rates will rise in fall/winter/future or whatever else is the selling sauce of the day. I rarely listen to these shows but it brought back memories of 2005 and 2006. I suppose this is like asking a barber if you need a haircut.

Even if this place sells, the financial burden on those moving in will likely be razor thin. The next recession hits and once again, another foreclosure. But the flippers are out, the mortgage companies are out, and you are in. See how this works? Also, the schools in this area are incredibly bad. Then again, you have hardwood floors and recessed lightings so who cares if your kids are falling behind academically. It isn’t like the world is competitive right?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

75 Responses to “Flipping and gentrifying: The art of flipping homes in lower income areas. If you remodel it, will the people come? A case study in Inglewood.”

I heard the poverty rate in LA county is larger than CA which in turn is larger than the USSA – recent LA times article

LA metro has the highest child poverty rates among major U.S. cities.

LA metro has one of the lowest median household incomes among major U.S. cities.

The LA area has one of highest EBT (food stamp) rates in the U.S.

The LA area has one of the lowest reading comprehension levels in the U.S.

If it weren’t for Orange County (and sometimes San Diego) getting rolled into SoCal statistics, the LA area would mostly resemble a third world city.

I have to commute near downtown LA for work from OC but it was worth it. No way do I want to live in LA with overpriced homes and underperformed (gang infested) schools/neigbhorhood with the “valley of the shadow of death” vibe and dealing with City bureaucracy. For 460k, I bought a 1500 sf home near huge parks and schools ranked 9. OC is a much better place to raise a family especially if you’re sending them to public school.

Good summary, Ernst.

I was saying the same thing for years. That is the reason I moved out of SoCal.

For my comments, all I’ve got in return was total non-sense: i.e. “rainy” easter Washington, radiation from Hanford, lack of “diversity” (whatever that code word is used for), lack of variety of restaurants, etc., etc.

It did not matter how much I was trying to refute this non sense (myths), the bloggers still keep saying how much I miss for not being in SoCal, the center of the world, where everyone is dying to move to. In the end, it doesn’t matter what you say, it doesn’t mater what I say, or what the doc is saying – each person lives in his own matrix and believe only what they want to believe. I just find it amusing that they don’t enjoy the consequences of their own decisions and they don’t do anything to change their views. They will just continue on the same course expecting different results.

@ BenShalomBernanke: Where and when did you buy? That’s cheap…

@flyover: That’s great that you love Walla Walla or wherever you live in eastern WA. It’s not for everybody, and many people prefer OC/LA, even if they live in a comparatively smaller house. It’s not always that people are brainwashed to want to live in So Cal. It’s also possible to simply like living here more than other places, however much you don’t wish to believe that. Different strokes for different folks and all that…

@ flyover

Most people I’ve known who lived or live in California (San Fran & SoCal) did so primarily because it was the best job prospect for their career… though some have also very much liked California, additionally.

Clearly some people like it for some other reasons, though I may not get it.

But an important thing is that these are not people who were living in poverty.

I’d be surprised if many of the people living in & around LA, in or near poverty, or seriously financially struggling, are reluctant to move because they like the restaurants & weather in LA.

More likely that because they’re poor, they lack the means to move out, right?

I paid less than that for a 4 bed/2bath 1700 sq ft pool home in Porter Ranch in 2011. Schools are all 8,9, 10s and while it’s definitely a L.A. suburb… and probably a frustrating commute for WESTSIDE works… I’m not sure who would rather live in Iglewood even with the longer commute.

wow… that size for 400K in PR? that’s a steal!!

I paid (in 2012) 13% higher than that asking price in Inglewood for 1,800 sqft; 4bd, 2ba home on 7,000 sqft land in Baldwin Hills.

While we may scoff at these flips, I think many flippers out there know darn well what they are doing and are making money hand over fist. Time will tell on this one in Inglewood if the flipper makes money.

HI Doc. I see that the street Dalerose is written in big block letters in the middle of the street. My guess is that crime is so high in the area that police helicopters need to be able to read which street they are hovering over.

QE Abyss:

The word ‘Dalerose’ is likely from the screengrab the good doc made when he used google street view.

https://www.google.com/maps/place/Dalerose+Ave,+Inglewood,+CA+90304/@33.9331819,-118.3601267,94m/data=!3m1!1e3!4m2!3m1!1s0x80c2b6ed1988c657:0x6cff85d373c9b198

“Freeway close” as in backyard close. Great place to live if you’re a plane spotter, too, because it’s almost under the flight path of jets landing at LAX.

My uncle owned two houses about three blocks west and a few blocks north. This area was fairly nice middle class area in the 1960s -1970s and maybe even into the early 80s, but it was hit hard by the ghetto stick after that. My uncle sold the last house in the 2000s. He said it sounded like a war zone around Christmas, New Years and most Mexican holidays.

“Most will live out their days eating gruel and looking at their 30-something or 40-something kids counting the days until they kick the bucket…”

Don’t try to sugarcoat it, Doc.

i can not tell you how many people i know that are in this boat they are just waiting out the days till they get the “$1,000,000 house” most have no jobs and don’t plan on ever getting one. Those that do wanna work ONLY wanna work for the city, state our county cause they are the only places paying more than $10/hr with any kind of benefits.

the smoke and mirrors economy rolls on….weird.

i’m one of those people. i work for the state, planning to retire at age 56 with 50% pension. in the meantime, i buy my parents $20-$30 per person meals a couple times a week and pay All utilities. internet cable cell phone etc

@ben: In the meantime? As in, you’re going to live with your parents until you retire?!! If so, you’re going to waste your life away living with mommy and daddy.

responder – assisted living arrangements are more expensive. i don’t mind. my dad is almost 80 and my mom is almost 75. i do have a social life with 30 something singles. i am odd in that i prefer a chill boring lifestyle over marriage with a 50% divorce rate.

Doctor, doctor, doctor… You are still ascribing to the false religion of supply and demand. Your first mistake is believing that there is a housing market. Your second mistake is believing that incomes matter. And your third mistake is that you believe that there are non prime So-Cal housing “markets”. Lord Blankbrain has told us over and over again that incomes/cash holdings of the residents does not matter. Income/cash holdings of the BUYERS is what matters! Well, since money is free for Wall Street banks; these buyer’s income/cash holdings is limitless…

It’s all about the NFL. Once Stan Kroenke builds his palace and the Rams and Raiders have returned the economic engine that is NFL game 20 times a year (between the 2 teams) will propel Inglewood into PRIME status! /sarc

I will say I have shifted more in the direction of some here who acknowledge the bust is coming but think it will be more of a slow motion train wreck than that of Bubble 1.0. I could be projecting here, but I’m getting a 1991 vibe. From the end of the Cold War and deficit defense spending (the monetary meth of its day) it took us almost 5 years to reach the trough in SoCal RE and it was relatively flat for the following 4 years. I think we’re about to see a repeat.

I’ve accepted enjoying my rental for the next few years. The upside down owner ain’t moving back from Texas anytime soon and he obviously doesn’t want to take his losses if he wasn’t willing to sell into the momentum of the last 2 years. I’ll keep posting with you guys until I buy. It may be as late as 2018, but I waited out Bubble 1.0, i sure as hell can wait out 2.0!

And i did buy my brand new sport truck 12k off of MSRP and I financed the whole thing plus tax/title for 1.49%. Thank you Yellen, Bernanke and everyone at the FED LOL!

http://www.latimes.com/business/la-fi-income-inequality-20140812-story.html

This article points out how job growth will proceed in LA. This is how it’s been for at least 20 years now – low wage jobs, higher prices in SoCal. A bust must happen. I can see previously gentrified sections becoming run-down again. I guess that’s how gentrification reverses itself.

“I could be projecting here but I feel a 1991 vibe.” So do I, but most of the decreases happened in the first three years, summer of 1990 to summer of 1993. The trough did last about five years; and most zip codes had lower median prices in 2000 than in 1990.

OOoh! Sports truck! Which one? I’ve been looking and I’ve only seen $3K below MSRP. Care to share details??

RE: Dennis

My step dad got his SGValley place in 96 (fucking lotto winner asshole) for less than asking. Maybe LA proper was different, but the suburbs were still trending downward mid decade. Either way, as you agreed,things were flat through 2000. The absence of flippers and specuvestors this year and going forward combined with increasing inventory could mean a relatively sharp decline. However I think the REITs, Underwater Home Debtors and leveraged specuvestors won’t quite fail in unison and we could see a stutter step correction of large then small YOY price drops. Should be interesting. For those of us here waiting patiently I think 2016-18 is a reasonable target window. I still think we go back to, or possibly overshoot in some areas, whatever the 2010 monthly nut was for a given property. So my prediction is: In 2018, Price+Interest Rate = 2010 Monthly Nut

The pressure to buy a house and the stigma we’ve associated with renting has fueled bad decisions. I know very few people that admit to this, but, I have a few friends that bought during the last frenzy who are horribly underwater. So I’m an idiot for not buying and I should feel compelled to jump in now. Not buying it. 🙂

I don’t think we’ll be able to recover anywhere near as (well) as we did after 2008. This next run up is all but inevitable and the subsequent crash will come fast and strong. I can only guess that 2016 is the year of reckoning. No consolation for all of us waiting on the sidelines. We’ll get the prices we lust after but many of the jobs required will also be gone. Sigh.

“No consolation for all of us waiting on the sidelines. We’ll get the prices we lust after but many of the jobs required will also be gone. Sigh.”

It’s the price we pay for our instrument brother. We save when the economy is good and make our asset purchases when it’s bad. You have to play the game as the ever changing rules dictate.

Totally agree NZ, and we learned our lesson from the 2009-2012 downturn. We passed up multiple places in 2011-2012 for totally frivolous reasons (the flooring wasn’t perfect, etc) and now regret it. To make matters worse, we stupidly kept our money in 2% CDs, meaning we’re effectively losing money while we’re saving due to inflation (lost out on housing AND lost out on the stock market). At least we still have our $$, I suppose. However, if the next downturn takes 2+ years, we might lucky enough to be a cash buyer if prices get low enough… Hopefully we’ll have enough money to also buy a sizable chunk of S&P 500 if things get really bad.

Good reply NZ.

The collapse in oil prices may feel good but something wicked this way comes.

A collapse in oil prices is due to demand plunging. This usually only happens during recessions or periods of economic weakness.

While the Red Chinese government claims GDP growth of 7.5%, Chinese electricity consumption is down 1.5% year over year. Electricity usage is also down in the United States as well.

All I can say is if you can buy a house for $278k, do make over, and sell it for $478k, good for you … there are suckers born every minute! On another note, saw a news segment on L.A’s lack of preparedness for a big earthquake … seems there is a call to get some local legislation to REQUIRE retrofitting of older buildings. I always chuckle when I see some California official talking about all the unfunded liabilities and how they need new taxes to cover these things. I wonder how a region that has the lowest housing affordability and already high taxes will afford that? On-the-other-hand, I also read that 88% of Californian’s don’t have earthquake insurance. I guess they’re expecting the U.S. taxpayer to just cough up enough to rebuild L.A. and their homes when the big one happens.

Hello JN. I am one of those 88% of CA homeowners with no earthquake insurance. I think in many parts of CA, there is no need for earthquake insurance (most of the areas more than 50 miles from San Andreas?)

In any case, I elected not to acquire earthquake insurance for the following reasons:

a) the deductible was very high in order to get affordable earthquake insurance

b) my home was built in 1952 – it has survived the 2 major quakes without a crack in the walls (The 1971 Sylmar quake and the 1994 Northridge quake). were there other major quakes that I missed?

c) the home inspector showed me photos of my foundation which indicated it was strengthened beyond the requirements for that time (house was built be an engineer for SoCal Edison who designed in stronger walls and foundation that code required).

Homes built up to the early 1940’s are the most prone to disaster. That being said, I am sure my home would be in trouble if a 7.0 or higher hit LA in an area close to under my home.

Enjoy the ride my friend…

http://gsabulletin.gsapubs.org/content/112/5/693.abstract

Uh, so this engineer shear walled the whole place…Good luck.

When the big earthquake comes, call the insurance company, I’m sure someone will pick up the phone, and rush over with a check. Fire insurance works because 1 out of 2000 policy holders make a claim.

“Inglewood: It’s where I live, but do I belong?

Although I hate the stigma of Inglewood as black urban failure, there’s some truth to it.” http://articles.latimes.com/2010/jun/13/opinion/la-oe-kaplan-20100613

Oil is getting interesting. I think OPEC is going to let it drop far enough so that shale is no longer cost effective. Surely the US, Europe, and China are going to be filling reserves. The wells that are no longer cost effective will shut down and the trend will swing the other way. Once that happens real estate in the suburbs will take a nasty hit. Buy a hybrid while oil is underperforming and most folks are buying gas guzzlers with reckless abandon.

Its not OPEC, its the Saudis specifically turning up production at the request of the US. Russia and China just made an agreement that China would buy a more Russian oil, along with a previous agreement this would make Russia Chinas biggest supplier of oil/natural gas by 2020. The US Gov is not happy about its banker getting its natural gas elseware, it will kill our nashale gas boom. Why would China continue to buy our bonds? Russia needs oil to be $105 to be profitable, the Saudis need it at $35. The crash in prices by the Saudis actions greatly affects the Russians. The whole story can be found here. http://www.salon.com/2014/11/13/what_really_happened_in_beijing_putin_obama_xi_and_the_back_story_the_media_wont_tell_you/

I suggest everyone read this book if you are interested in how this energy thing is going to play out. Very interesting read: The Colder War – How the Global Energy Trade Slipped From America’s Grasp. You can find it at Amazon here:

Very interesting article! Thanks for sharing 🙂

Thanks for posting the link to that article. I have no data to support this, but I’m guessing the Saudis have gone “off the reservation” and are doing this oil dumping all on their own. They’re going to kill the US shale industry (by design) and that’s going to show up at the polls come voting time. Without the energy industry’s profits the last few years, the US GDP will look like crap, which is what’s now on the immediate horizon.

The Saudis are pissed that Obola didn’t wipe out Assad… Thus from the Saudi perspective, the US is no longer acting in the interests of the Saudis.

Interesting article. Also Russia and China formed an agreement they no longer need to purchase petrol dollars in order to buy their oil. So the US dollar is no longer useful to them as they don’t need to buy it in order to get their oil.

The Saudis want to drive down prices so US fracking companies don’t have profits and have to withdraw or slowdown. This is balls to the wall business at a high level of expertise. The Saudis ARE oil. They will not give up control. Projections have US as the major oil producer in 20 years UNLESS the Saudis choke the fracking industry now.

I know there’s a sucker born every second but how can anyone stomach paying $415k for something that sold over $100k less a month ago?

I’m in the “waiting for the next bust” camp. My wife and I make an honest living, $130k combined salary, and can’t afford a decent house in orange county. By afford, I mean I want to still have a life after my mortgage has been paid. Silly market we are in.

You have a great point. My wife and I make a tad more than $130k combined, but we’re in the same ballpark. I think there are a fair number of people like you and I that are unable or unwilling to afford a decent place to live despite making halfway decent money (not rich by any stretch of the imagination, but nowhere near struggling). Unless foreign money and rentiers continue to make up the demand side of the equation (though some people seem to think such demand is sustainable), it would seem unlikely that prices will remain high. I’m also in the waiting-for-the-bust camp.

Count me and my wife in there too. We currently have a rent but have a rental property (live closer to work so we rent). We are up there too and refuse to jump in this insane market. It seems as though bubble 2.0 is going to be pushed further down the tracks as people are buying real estate with 3% and below again (If these Yahoo articles are true). This means that bubble 2.0 may actually be worse than 1.0. If so, we will be back in it.

22 days left to… Tank Hard in 2014!

I think I spotted a couple of flippers at this house’s showing two weeks ago: https://www.redfin.com/CA/Woodland-Hills/21560-Iglesia-Dr-91364/home/4307516

I and this couple were the only ones at the open house. The couple appeared to be around mid-50s to early 60s. They were very loud and animated, like stereotypical ugly American tourists. The husband was rushing about, trying out chairs, asking where one would put the TV.

I overheard a few of their remarks. They expressed confidence that they could “resell” the house in a year. (I don’t know if they meant to flip it, or simply to resell if they didn’t like it.) And though the house looked modern and pristine, the wife remarked that the kitchen was small but that there was room to tear down a wall and “expand the kitchen.” I think she was looking for ways they could improve upon it.

Actually, the kitchen looked nice and clean, albeit no granite tops.

As they left, they told the realtor that they “were leaving for Palm Springs tomorrow (Monday) for a few days” and they’d let the realtor know of their decision in a few days.

Of course, I don’t know who eventually bought the house, or how much they paid for it.

“I overheard a few of their remarks. They expressed confidence that they could “resell†the house in a year. (I don’t know if they meant to flip it, or simply to resell if they didn’t like it.) And though the house looked modern and pristine, the wife remarked that the kitchen was small but that there was room to tear down a wall and “expand the kitchen.†I think she was looking for ways they could improve upon it.”

You obviously didn’t see the cameras or the boom mics. You were witnessing the taping of ‘Flip or Flop’. I saw that episode. They ended up buying the house, flipping it in four weeks, and walking away with a 30K profit at the end of the episode. You missed your chance.

My nephew is a flipper in San Diego. He has a money man that he splits the profits with 50/50. The money man doesn’t lift a finger except to put up the funds. My nephew recently brought in another family member to track down potential deals. They make lowball offers on POS properties knowing the offer will be rejected. When a home he offers on falls out of escrow, and many do, he hits up the seller as his offer is still the backup. He pays cash, 45 day turnaround after putting in $50k of rehab. Apparently the system is working. They make dough. The theory is people in San Diego will always want homes and buyers will generally buy the house with new granite, new roof, fresh landscaping etc. over slightly cheaper properties without fresh paint for a few bucks less.

“My nephew is a flipper in San Diego”

Haha. Hope he has a backup plan.

I know at least 10 people that were “flippers” back when the flipping was good in 2009-2012. All of them made out like bandits and have been out of the market for at least a year.

There are so many things wrong with your nephew’s theory that I’m not sure where to start… but I’m certain that only a small percentage of flips actually drop $50k in materials and labor. Average runs more like $10-20k in Home Depot closeout materials and $10k in undocumented labor. No permits. Anyone with experience in construction can look at the majority of “flips” in San Diego and confirm this. Putting $50k into any flip right now and hoping for a large enough ROI is not for the risk adverse.

Check out 1832 Malden for what happens when you go big on a questionable flip just as the market sours. Ouch.

Ouch indeed.

Was 1832 Malden a tear-down and build new? Google Street Map shows new framing under construction. If so, the last sale price of $705k in 12/13 was for… a buildable lot?

Steep.

The challenge for flippers going for the “modern contemporary design with exquisite details & high-end finishes for the most discerning buyer” is that half those “exquisite” details, like the “sleek glass back splash” and bathroom tile, are available at Home Depot and Lowe’s for bargain basement prices. That Carrera marble kitchen counter can be bought pre-fab in LA for less than $2k. Even the most “discerning buyer” can’t tell the difference.

But that hideous quarter round used to cover the gap in the floor between the “custom cabinets” and “distressed white oak floors” is a pretty good tell about the overall quality of construction of this place.

Congratulations to your nephew for being a big part of the problem in San Diego.

I was in my late 20s-early 30s during Housing Bubble 1.0. I watched from the sidelines, as my average salary – which barely increased from 2004-2009 – was eaten up more and more each year by insanely increasing rent in San Diego. Yet I scraped by, not quite on Friskies cat food as the Doc suggests, but almost. It wasn’t the free-spending California lifestyle by any stretch. Finally I had a nice nest egg saved up and ready to put into housing in 2009.

With a stable job and almost 50% cash down, I made offer after offer on distressed properties from Oceanside down to La Jolla. At least 40 offers over 3 years.

Not a single one accepted. Every offer was beat out by all cash investors or flippers.

I can’t even count how many of my friends in San Diego are in a similar boat.. some actually got to enjoy their 20s and 30s and didn’t save as much money as I did. But all of them would jump at the opportunity to purchase a “fixer” home in San Diego county and spend some sweat equity fixing it up.

But we can’t – because since 2009, the all cash flippers have effectively blocked us from entering the market. Previous generations were able to enter and move up in the housing market through the hard work of sweat equity. That option has been stolen from our generation.

So congrats again to your nephew. For basically joining the dark side.

I don’t know how people expect the housing market to sustain itself when all valid entry points for first time buyers have been effectively eliminated. It probably won’t lead to a good end. But I’m sure there will be more flippers waiting on the other side.

As stated earlier, I’m one of those on the sidelines waiting for “the burst”. Once it does, what’s stopping these flippers and investors from coming back in, leaving people like me and you getting outbid again and again?

The way it’s shaping out, it seems like we must either rent a crap shack or live w/ our parents till one day we save enough to be a cash buyer. I guess there’s always the relocate to a less desirable lcol area.

I’m honestly not sure how it will be different if/when Bubble 2.0 pops.

If the bubble is allowed to pop without government interference, I think the fall in housing values and lack of housing demand (due to the crappy economy which would accompany a major housing crash) would scare the flippers enough to keep them out of the market for a short time. (At least while public sentiment is turned against housing, like occurred in 2008-09.)

But of course the government probably will interfere just like they did during the crash of Bubble 1.0.

Based on what I learned from 2009-12, in order to beat all cash offers:

1) Offer over asking / over value on distressed properties. This negates the discount you’d be getting by buying a distressed/fixer, but it’s the only way to get a bank to lol at your offer instead of an all-cash offer at asking price.

2) Adjust expectations. Start making offers on less desirable properties earlier in the game. I started making offers on I-5 freeway adjacent homes in 2011 (west of the 5 is desirable coastal in North County San Diego, but lots immediately adjacent to the freeway are not normally desirable!). But by 2011, the flippers had infested the market. In 2009, I would’ve been the only offer on these properties on less desirable lots.

3) Make friends with players in the mortgage and distressed lending industries… seriously. Sweetheart deals were the main way to get in last time.

4) Save more cash. This seems intuitive, and folks on this blog advocate this a lot, but no matter how much cash you have, there’s no competing with institutional investors and sweetheart deals.

* get a bank to “look” at your offer, rather than “lol”

(Freudian slip!)

It is NOT a “few bucks less”, the typical markup on a flip is about $100K + like the example in this post. 100% cash flippers and speculators shut out those that need to buy with a mortgage and are trying to buy a house for the right reason…TO LIVE IN IT. I experienced this first hand in 2011 and 2012, gave up after a year of my offers being ignored. The 60% price run-up since then makes renting a better choice for me.

RE: “He pays cash, 45 day turnaround after putting in $50k of rehab. Apparently the system is working. They make dough. The theory is people in San Diego will always want homes and buyers will generally buy the house with new granite, new roof, fresh landscaping etc. over slightly cheaper properties without fresh paint for a few bucks less.”

This works because most homebuyers are stretched at 80% LTV and cannot afford even the simple upgrades. They will spend the $500 more monthly payment for the overpriced house. Either that or live in a house that is basically uninhabitable. Banks don’t loan money for improvements

Let them eat Friskies!

Here’s a flip that sold earlier this year in my neighborhood. Looks like the flippers grossed $200k. Had to tent the place twice during the remodel, though.

https://www.redfin.com/CA/Los-Angeles/4447-Collis-Ave-90032/home/7001018

I personally like the taxes, sitting at $625 a year, which should head up to around ten times that for the new owner.

Mind you, this is $580k for a small “starter” house in a neighborhood with a $45k median household income and terrible schools.

Los Angeles: Own a house, send your kids to a decent school, and save for your retirement and your future. Pick any two of the three…and that’s why we live with my Mother-in-Law.

As a housing bear for the past 15 years, I may be throwing in the towel next year to buy property in CA. My parents bought a townhouse in the SF Bay Area in 2001 and I implored them to sell it in 2006 as I saw the bubble was ready to burst, they finally did in 2007 and make a little profit. I thought like all the other bears, that the market would continue to correct and after bubble 1.0 burst and that prices would become reasonable. Extremely low interest rates, specuvestors, flippers, hedge funds, changes to bank accounting laws, lengthy foreclosure process, manipulation of inventory, etc. has created a false market.

***

I plan to buy for the following reasons:

1. I don’t believe a prolonged housing bear market will occur because the market is manipulated. It is not the same market as in the 90’s; laws have changed, wealth inequality has grown, foreign investment has changed.

2. The top 10% have more wealth than ever and will come in to buy properties during a recession or if interest rates rise and prices fall.

3. Coastal CA is a top location for foreigners and they will pay prices locals/natives think are irrational.

4. I realistically plan to keep the house forever. I plan to live in the house for at least 10 years. If I do move, I plan to keep it and rent it out.

***

The thought that middle class Americans will be able to buy coastal CA real estate at fair valuations moving forward is false. Unless the banking cartel loses power and the laws change, I don’t see this housing manipulation changing.

***

Warning: I may be one of the last bears to throw in the towel, so next year may be the market top once I buy 🙂

Number 2 is the sleeper. There are more people with more money than the on-the-books statistics would have you believe.

That’s a retarded thesis. There are only so you truly wealthy and they tend to collect cars more than houses. Wealthy people don’t stay wealthy by being stupid. If they can’t flip those said houses into momentum then the only reason to buy would be as an inflation hedge. But without said momentum the houses will face deflation. There’s a thousand other more liquid ways to protect wealth. The idea that money on the sidelines is ready to swoop down like angels and stop RE deflation is foolish.

i enjoy this site doc…thanks for the good reads every week!

i live in long beach 90815. i rent and pay 2,500.00 a month. been in the same rental since i lost my purchased home in 2008, and about $175K in down payment and improvements on that house. basically started from scratch at 38 years old.

i want to buy again, i’ve made a few offers, but it just keeps going up. i have saved $200k for a down payment, but just can’t justify the cost of ownership anymore.

why would i take on $500k+ of debt to move laterally from what i have now for 2,500 a month total with no stress and risk losing my down payment if the market tanks again?

i’ve busted my a$$ to save this money, and now i don’t know what to do with it. it’s sitting in a credit union savings acct. making .80% interest.

houses on my street are selling for $675K-$850K. just the property taxes alone at those prices make me laugh.

i hope prices have some sort of correction soon. i like where i live, and want to stay here till my son finishes school(10 years), and i’ll be close to retirement, and i’m most likely out of so cal for good at that point.

Welcome to the club! We’re in a very similar position currently (though we’re fortunate enough to also own a rental). At least get your money into a CD at 2% to hedge inflation a bit more than at 0.8%. At our CU, you only lose 6 mos. interest if you pull your money out early.

450grip: I’m in the same boat. Short sold the house in 2011 we bought in 2004 and lost the $170k down payment. Had to offload it due to divorce. I stayed in the same neighborhood and have been renting a nice (much smaller) house since. The rent is reasonable, same school district my special needs child attends on an IEP, and still have my friends nearby. I can’t move out to a cheaper area because it is critical my child stay in the school system he has been in since kindergarten.

Sometimes I want to be a homeowner again, just so I can do whatever I want to the house, but with what I pay in rent being 35-40%% lower than what it would cost me to buy, I just don’t want to do it. Also, I’m terrified of buying then the market tanking again and being upside down if I need to sell.

The upside of renting is: landlord is not stupid or greedy and doesn’t raise the rent on an excellent tenant (me); no repairs, no property taxes, no bank issues, no maintenance issues. The downside is its not mine and if my landlord decides to cash out, I need to find another place to live.

I’ve saved a pretty decent down payment and my income is $90k a year. I am frugal and manage to put a good chunk of that away. The house across the street went on the market last week, they had an open house Saturday and every single carload was Indians. They come in on H1B visas and seem to be flush with cash, and don’t care what they pay. Drives the prices up, sort of like the Chinese in So Cal. Just about every house sold around me is bought by Indians.

I have 7 more yrs until my child finishes high school. At this stage I can’t tell you if I’ll be selling up to move out of CA or just giving 30 days notice to move out of CA.

I’m not Indian but am married into an Indian family. The good news for you is that Indians (and most Asians) value education very highly. The scores in your local schools will shoot up pretty soon and property values may go up as a result. Most Indians also try to integrate into western society as well hold on to their cultural values. Stereotypical jokes aside, most make pretty good neighbors.

Janum, please do not generalize about Indians. As you know, there is a caste system, like in any other country. The Namboodiris and Nairs are certainly welcomed, those of Other Backward Class (OBC) category would be better to stay where they are and performed the necessary services.

Janum…I live in a upscale location and we have two Indians families who are doctors and one wife who also is a doctor. These are fine people and neighbors, unlike many in our neighborhood who think the world revolves around them these families are down to earth and their children well mannered and very sharp.

Something new – check out the description of this listing:

https://www.redfin.com/CA/Thousand-Oaks/2924-Camino-Del-Zuro-91360/home/4668426

The wording: “The List Price is the minimum acceptable bid price.”

First time I’ve seen this.

nonsense

Janum…This why we all know the market basically is dead. List Price is the mimimum is like fuzzy math, who are these agents kidding, list the house where it will get a offer or don’t take the listing?

Ah yes, the AM radio shows!

Probably a good barometer…

of how much fraud is taking place, no doubt!!

Of course whenever I hear of real estate related “radio shows” I think of Scott Binsack!

Northeastern Pennsylvania’s notorious building contractor villain, who’s been at all kinds of dubious & criminal behaviour in various parts of NE PA, and in & out of jail for 15 years.

AFTER having served time for swindling as a building contractor in the Poconos, he set up shop again just west of Scranton, and was paying the local AM radio station to run a radio show about high-end real estate… and the radio station web site listed this guy alongside their actual real radio show hosts… with very little indication that it wasn’t a real radio show, but a paid advertisement radio show.

This show apparently went on for a year at least.

http://www.watermelonpunch.com/wppb/the-appearance-of-complicity-w-binsack/

He went to jail twice more since, was a fugitive at one point, having gotten up to more dubious business ventures like trying to pitch a building investment scheme to a small town in PA, that was illegal under securities laws.

After watching that insanity parade of repeated fraudulent criminal behaviour of one building contractor, even after having gone to jail…

I would NOT be surprised if the same people now on AM talk radio pushing real estate are the very same dubious characters or bad actors from the mortgage & housing debacle from decade ago.

After all, many of those bad actors never even went to jail.

True, about Orange County, I heard about a micro brewery in Anaheim and Santa Ana while both have a lot of latino gangs they have lower crime rates than LA cities or Texas cities why because Orange County has very low Afro-American populations. Afro-AMreicans commit more crimes than Latinos and Asians. Most Afro-Americans don’t committed crimes but the group that does is more so. So, I think Central and Northern OC will have more redevelopment in the future. You see looks of results now with whites and Asians in the northern and Central OC cities as well as families OC has now less kids than La on the average the population is older. So, it isn’t just for families. CHildren 18 and under are higher in La county than Orange County, one reason is OC is still more white while LA is still more Latin.

I mean resturants now more so having whites and Asians in Anaheim, Santa Ana and Fullerton.

Leave a Reply