Stuck in the housing middle with you: Americans moving less and inventory near record lows.

One of the dirty perceptions put out there is that home buyers stay put in their homes for many decades counting their days until the mortgage burning party arrives. The real estate pitch is always built around longevity. Think about your future kids, dogs, and the ability to paint your walls hot pink. In reality however, the average home owner was staying put for roughly 6 to 7 years before the housing market went off the edge. Many current owners are staying put because they still want those juicy peak prices and many were underwater. Others are staying put because they leveraged the daylights out of their properties. The latest figures show that current owners are staying put for longer because of the economy and this has had a big impact on the available inventory on the market. This is why those in the market to buy today are largely relegated to competing for crap shacks in areas where schools are subpar and construction is shoddy. There is an odd sort of capitulation going on today. It is speculation masqueraded as prudence. Even though momentum has stalled as smart investor money pulled back in 2013 and 2014, you have some ready to dive in just because “you only, live once†as if this was reason enough to plunk down a crazy amount of cash for house that looks like it belongs in a Hooverville. But for most of the country, real estate is priced to move. So why is inventory so low?

Inventory and being stuck

When the housing market is moving along a predictable path, you have a steady amount of buying and selling. For each home that is sold, you are likely to have a buyer moving in and a current owner moving into another property. Two transactions versus the massive amount of one-off transactions conducted by investors. You had 7,000,000+ completed foreclosures since the crisis hit where many people moved into rentals and big investors bought a property to rent out. A one-off transaction. This also explain the massive decline in the homeownership rate.

If we look at current inventory of existing homes for sale they are at a pathetically low level:

During the bad years of the crisis, we had something like 3.8 million existing homes for sale on the market. Today we are closer to 2 million. With investors chasing yield and supply shrinking, prices got pushed up and we saw this hit strongly in 2013 and 2014. But this wasn’t driven by massive sales volume or your traditional channel of typical home buyers. This was largely done by a low rate environment, investors, and low inventory.

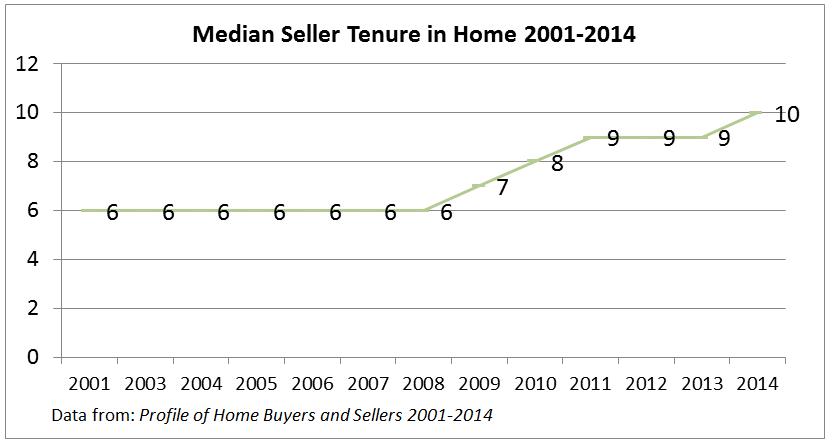

This brings us to our next figure that shows many current owners are staying put longer:

The idea of staying put is virtually a myth when it comes to homeownership. This might have been the case for previous generations but for current owners many are moving on a shorter timescale and are eagerly chasing their property ladder fantasies. This is why we have many older Americans chomping down on Purina Dog Chow while still paying off a mortgage or HELOC. I find it interesting that the National Association of Realtors is trying to encourage more volume since this is where their money comes from:

“(NAR) The underlying economic conditions for vehicle sales and home sales are the roughly same. Homes, however, have other special factors. Namely, the housing market crash had put a sizable number of homeowners in an underwater status and a good portion of them did not want to bother with the frustrating short-sale process. They have been waiting for home value to turn higher. Well, home values have been turning for the better, up 25 percent over the past 3 years on average. Therefore, there are likely pent-up sellers who had to wait in a better position to make the next move in 2015.â€

In other words, more supply should be hitting the market. But will regular buyers come back in droves to fill the void left by investors? Younger buyers are not in great shape to pick up the slack and we are seeing this with many kids moving back home with their parents.

The market seems largely stuck. The national median home price is $208,000. That is certainly a reasonable amount and with very low mortgage rates, you would expect more buyers to be out on the hunt. But as we discussed, 6 out of 10 Millennials prefer renting over buying and this would be your next target audience to take the baton from the aging baby boomers. This is where the clash also occurs. Baby boomers seem to assume that their offspring have the same desire to own property as they do and that this applies to everyone. That isn’t always the case and also, desire and incomes don’t always align.

The fact that inventory is so low and current owners are staying put longer simply speaks to the lingering impacts of the housing bust.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

93 Responses to “Stuck in the housing middle with you: Americans moving less and inventory near record lows.”

There are many in cali that moved to houston that bought a home in hoods that were cheap like the heights,west u,bellaire and other prime areas,now these hoods are popular.they are so equity rich that they could move back to cali and use the massive equity to live in nice prime hoods in cali.although oil is down,houston economy is so diverse.many rich foreigners are moving here along with many people from cali and nyc.so the rest on this blog should join them.

I say Kerrville is the place to be in Texas. That is where Kinky Friedman hangs. One of the greatest Texans of all times.

I’m familiar with Kerrville so after I saw you mention it about 6 months ago I decided to look up a 3/2 in a nice area. Found one for $159,000.

As prices continue to go up in Southern California–not just in housing but in other areas as well–it’s getting harder to ignore what other states may have to offer.

Hell, if Kinky Friedman hangs there, count me in! Yeehaw Y’all!!

Texas has got to be the worst place to live south of I-40. The attitudes there are atrocious and the ego’s second to none. California will always be superior.

Nothing like deadpan self-referential irony to wake me up on a Monday morning. Nearly inhaled my latte. We do meta betta in SoCal.

LOL, Apolitical. I thought the same thing before I read your comment. Bravo.

“…and the ego’s second to none. California will always be superior.”

In one sentence you contradicted yourself – the ego of Realist about CA superiority is second to none.

I tried Houston… lived in the Heights, Montrose and Sugarland. The no-zoning mess, humidity, bugs, Christian Cultists and the worst-smog-in-the-nation drove me to California.

Chris, you should have tried “River Oaks” zip 77019. But then again, you probably would not qualify. I use to live there years ago, but I like the folks in Kerrville better.

Houston is Houston River Oaks to Sugarland..

Texas and California are completely different..Texas housing is cheaper and their are some beautiful ladies to boot but not much comparison natural beauty wise to California. This would be important to me, not others..

Great to have a place to live that you like no matter where you live. I would move further north in the coming years not east…

Seriously, home prices in California once you get away from the major urban areas of Los Angeles, Orange County, San Diego and the Bay Area are virtually identical to U.S. median home prices and very similar to the midwest and Texas.

Home prices in California in the areas not listed above are in the $100K to $300K range. Stay out of the nose-bleed bubble areas and California is as affordable as most of the U.S.

The typical American working slave earns $20 an hour, and an unskilled one earns $10 an hour. A husband and wife team earning $10 an hour each earn about the same. This is the typical candidate interested in single family homes in the lower income neighborhoods. Annually, $20 an hour is about $42,000, and 1/12th of that is $3500. 25% of gross income is around $870. This is the rent they can afford and this is the monthly payment they can afford if they buy a house. Plugging this into a mortgage calculator tells us they can afford a $160,000 house. For Las Vegas, at least, this is exactly where we’re at. A brand new house in a bad neighborhood will set you back $170,000 for 1600 square feet. The used version of the same house will be $150,000, and the rent will be around $1000. The SFR market in lower income Las Vegas is about where you’d expect it to be based on these back-of-the-envelope calculations.

In my opinion, the proper response to the housing bust would have been for the masses to demand “No More Mortgages!” Home mortgages don’t benefit those who use them to buy a place to live in. If you move after 7 years, you will have spent 7 years paying a lot of interest even at these low rates, and your equity gain will be depressingly small. What’s keeping this system of slavery going is the belief that if you invest in a house, the value of the house will rise every year at a rate that’s roughly 1% above inflation.

And… that’s the exact average mortgage length, 7 years :). So, is it still a smart decision to buy?

Depends on what’s trending. Right now the trending is toward buy.

Mortgages are not the problem, the length of mortgage is the problem. Without the ability to get a mortgage, homeownership would be virtually impossible for most people to achieve. 30 year mortgages are too long and should be outlawed. fifteen years should be the maximum mortgage length allowed for single family residences. Payments would be higher, or people would have to buy smaller homes to get their payments down, but they would see a tremendous difference in equity gain. With a 4% loan amortized over 30 years, you will still owe over $64,000 for every $100,000 borrowed after 15 years of making payments. If you chose a 15 year loan instead, you would owe nothing. Even if you don’t stay for the full 15 years the equity gained over the short run is far better with the shorter loan.

I’ll guess declining RE turnover in CA. Boomers=Prop 13, people who bought RE decades ago living cheap in hoods they couldn’t afford, many 40+ people lost jobs, divorce, BK moved back with retired parents; many Millenials don’t mind living with parents/relatives, won’t marry/no kids, many females birthing babies have low wage babydaddys, not husbands; live w/parents. Influx of low wage, low skill immigrants continues. Far more bodies per residence. Middle class jobs continue to disappear. Many with high paying jobs will live in fear of losing job at any time. Low skill/older workers increasingly compete w/immigrants for low wage retail, hospitality, etc. jobs. They’ll always be a slice of high wage earners, wealthy whale buyers and the trust fund set, but majority of the SoCal population will take home $50k/annual, or less.

The future might be bleak for many CA Realtors, unless dealing with the one percent crowd or a niche market. Just my humble opinion.

Very good observation and explanation!

You should change the handle to “Realist”. The other “Realist” is un-realist.

The banks and builders know exactly what they are doing. Keep the supply short.

Yikes! The horrors!

https://www.redfin.com/CA/North-Hollywood/12317-Collins-St-91607/home/5167800

Staying in my 2bed/2bath rent controlled apt.

so, basically, you have to be an upper middle class with HH income close to $200K, which we established in the previous topic is only matches 5% of the LA residents, just to afford a crap shack like that? Is it just me or something is wrong here?

That’s what’s trending, this is SoCal.

Yes, something is wrong and that’s why this blog is still going strong after 2008. We all know it’s wackadoodle and the difference is between those who place all their bets on it staying stuck on stupid forever versus others who are content with renting for less. Everyone else who wants a house already owned before 2008 and many of those people are stuck without any useful net equity or if they do have any, a market full of overpriced replacements.

But let’s defer to talk about the smog ringed sun and taco trucks.

I’m willing to bet dollars to donuts that the majority of these and other moronic flip buyers in areas like this stretched and leveraged to the max only to barely mortgage their way in. Think borrowing from 401k, high LTV FHA type of stuff. The reality check will come when they get bored and want to move in a few years but by then the market will have turned against them. In typical SoCal fashion, it’s a big mirage of appearances over substance.

The rate of delinquencies has only receded since the 2008 wipeout. It’s still way higher than ‘ normal ‘

http://www.acting-man.com/blog/media/2015/02/delinquency-rates.png

Re: Sleepless – If you make 200k in Los Angeles you don’t have saving to put 20 percent down on a house on a house and likely can’t afford the monthly payment with around 5 percent down

That’s some of the nastiest HDR processing I’ve seen. Housing costs are sucking the life out of our economy. The Fed wanted high prices to keep banks stable. Now, they’ve destabilized the rest of the economy.

I’ve been saying this for years, ever since I noticed the bubble begin to inflate in the early 2000s.

The official reports are that inflation isn’t happening, despite all the FED pumping. Well I disagree – College Tuition and Housing Costs have inflated, sucking up a big portion of household spending (especially for younger folks) leaving little money left to spend elsewhere. That can’t be healthy for an economy that is primarily driven by consumer spending. Cheap housing means we might spend all that extra cash on junk/toys/restaurants/bars/cars/etc.

Inventory is low and prices appear to be right around their last peak, yet they still sell rather quickly. My only guess is that the new buyers have some bubble equity from their old house that they used to trade up. Another thing I’ve speculated on and recently confirmed with an acquaintance is that many younger couples are getting help from their families with down payments. I’m not talking about a few thousand, but in this specific example he received over $200K from his parents as a wedding ‘gift’. With that kind of down payment, a $800K house doesn’t seem too bad especially with a 3% interest rate and no PMI.

Are we just seeing lots of bubble trade-up equity and wealthy families driving current sales and supporting current pricing for now?

Southbaypirate – im in the boat youre referring to and have reached that point in life in which all the crosscurrents are merging to birth a likely crap purchase. mid 30s, saved my whole gd life by staying in my rent-controlled apartment for 15 years and now am married for a year and my wife is killing me. i am the biggest pessimist on this whole freaking fed-manipulated economy, but life has a way with messing with one’s rationality

Southbaypirate – It is what it is, prices are where they are and if someone wants to buy, they buy based on the monthly payment. Most likely in so cal, that buyer is a two-income family, both college degrees with a HH income over $100K. However they saved/got that 20% down, good for them. They want to plant roots and most likely have a kid on the way and want a yard for their kid to play in with good schools nearby.

Paul, this just might the flagship crapshack of the crapshacks

It’s a contender for sure. Valley Village is where I live and would prefer to remain as it’s central for my work.

It’s also depressing that our downpayment is in the credit union earning .5 instead of 5 percent. I kept thinking we’d be in something, but alas. So instead of getting $7500 a year we are getting $750. Thank you to all who made that possible.

Why would you let your money sit in a bank account at 0.5% interest? If you have a decent amount of money lying around ($50k-$100k or more), you can easily get 2% or more in a CD at a credit union- still a pretty bad ROI, but much better than 0.5%. That’s what we did. We put our money in a 5 year CD at a 2.18 (or something like that). Early withdrawal penalty is only 6 months of interest, so there’s really not much to lose if you take it out early, especially if you’ve had it in there for more than 6 months.

Looking back, I obviously wish we would have invested in the market (just a nice and simple S&P 500 index), but we then there’s the risk of our down payment money evaporating in the near term (or long term).

So, less inventory = higher prices. The FED will remain “patient” in 2015, so… no rate hikes on the horizon. As far as I can see, no housing tank will occur in 2015. Look forward to 2016 🙂

My RE agent (who is also my neighbor) has been in the business for decades. She specializes in West LA properties. She’s worried that there’s a RE crash coming in the next year or two, mainly because houses and condos are not affordable for the average person.

I put a little more weight on her opinion, because she tried to get me to buy a property back in 2002. I was convinced that the bubble would burst within a couple of years. She said we were going to be in it for years. I didn’t buy but she bought a similar place and sold it for a sizable profit a few years later.

People with no experience in this game are trending.

I dont think less inventory means higher prices, in general, unless wages goes up. I think less inventory, the seller has to wait longer to sell or drop the price. I think most sellers will wait rather than drop the price.

As always I’m referring to where people actually live and not Santa Monica or Newport Beach..

I’m thinking 10% or so drop this year as those that have to sell capitulate. Listings seem to be increasing but in the absence of wage increases prices must correct lower. Higher mortgage rates by years end mean the real action is in 2016. I expect all Housing Bubble 2.0 gains to be wiped out within 2 years. Conversely lower fixed residential costs could be a real boon for consumer spending. The S&P can only run on Unicorn and Rainbow valuations for so long. Something has to bring those PE ratios down…

I don’t believe that, moving back to the city is trending for Millennials.

The millennials are more then broke most actually have a negative net worth. You must think money grows on trees.

The pressure is on for the organic sellers at this point. It’s hilarious to observe those sellers asking the same as comparable flips in the neighborhood. Many of those flips with asks dropping like rocks.

@NihilistZerO – Higher mortgage rates by years end mean the real action is in 2016.

As much as I want to see rate hikes this year, I just don’t see this happening…

curious why you forecast rate hikes

Because the FED has no choice but to raise this year. Everyone says “Don’t fight the FED”. Well they’ve telegraphed every move since the beginning of the Greenspan era and always come through. They’ve been telegraphing raises around mid year, they’ve gone to fantasy employment metrics to help justify it. It’s gonna happen…

Once the FED funds rate starts rising and Housing Bubble 2 continues deflating I can’t see the MBS market having an appetite for these miniscule rates. It was only 7 years ago we had 5% mortgages. We almost got back there and then the FED came to the rescue. But that was because the transfer to the specuvestors wasn’t complete. This cycle is done. The FED is going to let things run their course. The Big 4 Banks NEED things to correct as they’ve got no mortgage business.

This whole thing is beyond unsustainable and if the FED doesn’t start the wind down soon (and they already have by killing QE when many said they wouldn’t) the whole confidence game is shot. I mean they continued raising rates in 2007 as everything was beginning to collapse. Why do you think they’d hesitate to do it again if it serves their interests?

the flattening of the us bond yield curve …… what does it mean?

It means deflation is trending, yet home prices are still on the rise. Not enough SFR’s to go around will equal moderate price increases.

deflation? are you fn serious?

I do home loans for a living and have for 30+ years. At no time can I remember prices taking so much income to qualify. Take a home for $450k, 10% down and financing $405k at 3.5% for 30 years. P&I = $1,818.63 + taxes $469 + pmi $132 + insurance $80. Total is $2500. Add in a $350 car lease, a $100 a month on credit cards and a $100 student loan payment and your up to $3,050 to qualify for. Divide that figure by .45% and the monthly income needed to qualify is $6,800 per month or $81,400 per year. That is living pretty darn tight. A dti of 36% or $101,700 is a lot better. Honestly, for two working professionals, that is do-able, but still a lot of money.

Also, that $450k property is in an out lying area, so there is the extra burden of commuting, gas and additional car maintenance.

It is hard to justify this to many younger people, so they rent. I don’t always agree with that decision, as rents have always gone up and if your disciplined, the mortgage doesn’t. Yes, I know taxes and insurance go up a bit.

Still, even if the property appreciates 1% a year over 10 years, the value is up to $497k and the loan is down to $313,600. What did renting for 10 years get you? I know, you invested in the stock market. Ya right, you want to talk about bubbles that always blow up and take your money? The stock market is the rabbit and buying RE is the tortoise.

In my opinion, if you can afford it, have solid jobs prospects, do it. You really think stuff is going to be cheaper 10-30 years down the road? And ya, having a paid off home is nice. Think of it as part of your financial planning for when you want to retire.

I would love home prices to come down 50%, so my children could more easily buy, but I just do not see that happening short of a Zerohedge full on financial meltdown. And honestly, I would rather have the present economy than that happen.

Great post, Jim. Very sobering and even-handed.

… and $450k will not buy you anything in SoCal…

It will east of the 57 Freeway

There are thousands of homes in SoCal that are under $450K.

The problem? They have really horrible schools and are in places no one wants to live: Compton, Paramount, Lynwood, South Gate, Inglewood, east Gardena, Hawthorne, south Los Angeles, East Los Angeles, Pacoima, Van Nuys, Canoga Park, north Long Beach, Dominguez Hills, Sylmar, Carson, Hawaiian Gardens, etc.

ernst blofeld, that’s only the area around L.A. proper. Like I said, east of the 57 there are many desirable places well under $450k. Well under.

can you imagine prices dropping 50%? just the frenzy of thousands of other buyers running around betting prices up 10 fold would be great for RE agents and banks and of course the sellers to.

Buy now or be priced out forever is trending.

check

not too many solid job prospects for 10 years unless the govt. can somehow keep servicing the debt at low rates…

Rates won’t rise for years…a token .25-.50 increase is just that, a token…throw it in a machine and see if you can dealt a joker….America is just the prettiest lady in a lot of ugly country contests…….if Saudis or China depegs from dollar, good luck….

Is that 81K gross or net? Because anyone on an $81,000 gross yearly salary has no business being in a $450,000 home.

@Shoeguy, actually with a gross income of $81K, a $450K mortgage and interest at 3.75%, this is doable. It is insane but technically the loan will get funded because the principal and interest would be under 33% of gross income. This would be living on the razor’s edge. I would not do this but to the house horny they do irresponsible things.

You have to do higher DTI ratios around here because of the competition, same as any big city, and than factor on the weather and entertainment capital of the world is going to be even more special. It’s tight, but doable and will pay off in the end. And if you ask any resident that has done it, they will tell you that’s 100.

Home prices come down 50%???? Lol yeah and then the baby boomers will lose everything in their retirement and pensions and go crying to the government! Young people have been indebted by their parents generation with no foreseeable way out. Young people can’t only not afford a house they can’t afford to rent! Where all the jobs are in cities young people can’t find good jobs. It’s a paradox of debt servitude!

not inaccurate

“You really think stuff is going to be cheaper 10-30 years down the road?”

Yes. In inflationary terms for sure and in real dollars 10 years from now. With my usual disclaimer that I’m talking about where people actually live and not Newport beach or Santa Monica. We have a demographic and income based deflationary period beginning that is unavoidable. the idea of “paying off” your home is a joke in SoCal. It’s incredibly rare because consumers love HELOCs and ReFis. it’s greater fool level stuff and the decline in wages means your steady 1% a year appreciation over the next 10 years is optimistic. The World Economy is being held together with scotch tape and staples. SoCal is home to some extreme affluence, but that is NOT the majority of it’s residents or properties, not even close. To price every property as if we have multiple 50K earners in every homer is ludicrous.

We are nearing peak prices of what was universally acknowledged as a bubble. We got here by the same reckless lending and lack of fundamentals as the last time, just to a different group. So how the hell are we not in another bubble?

jim – As somebody who has watched so cal real estate the past 25 years, i couldn’t agree with you more. You hit the nail on the head. Good post.

Jim,

Housing will revert to the mean. Assuming you are not math impaired, It is impossible to justify these prices. If things were going so great why would the government be revising 3% down payments. I love the commercials encouraging refinancing with cash out. 2007 anyone? I smell despair.

michael, the housing can only revert to the mean if the .gov and the FED will stop interfering with the markets, which means no .gov backed loans, no Freddy and Fanny, no 30 years mortgages, etc… Stop all that nonsence and you will see what the prices would look like. What? we don’t have in this market is the real price discovery. The same applies to bond, stock, student loans markets. We don”t need the .gov to “help” you to buy a house, we need it to stay the f… away from it!

Government intervention has been trending for well over 30 years now, I don’t see it stopping any time soon. If anything, it will only increase. People are too soft these days, nothing like the WW2 generation.

michael – for most people, its not the price but the monthly payment that matters. I believe most forum posters are actually more intelligent than the people who actually read and post on forums. But were the minority, the majority will buy based on monthly payment, so the overall price is not as important to them as it is to us.

JIM are you saying people must have more income for the 450k home or are you saying it takes less income to get a 450k loan that you’ve ever seen. Please explain it a bit more elementary 🙂 I just applied for a home equity line because I want to pay off my home yet have access to money. I was wondering in a nut shell if today is harder to get loans or easier ????? I reread your post a few times and it seems you believe banks allow more debt and more income to go to debt and still qualify people. like 50 percent debt to income works but 36 percent is safer for the borrower ?????

let me know Jim, Thanks, by the way

I’m in thousand oaks, ca… house worth 1.1 million , no debt or credit cards. I show 50k income but not debt, will have 600k saved after house is paid off and HELOC is continguent on me paying off home before set in place. I know low income but high asset and no debt. THANKS JIM

Heard on KFI-AM today that this was another dryer than normal January, and that “experts” predict a fourth year of drought for California.

I think housing prices should remain stable, or even increase, barring any serious crises. But I DO seem potential crises on the horizon: drought, earthquake (the Big One, reputed to be over 9.0), and severe state & city financial deficits.

We can sit around and “what if” all day, but what about maintaining our current lives?

Have a flashlight, lots of water and some food…for earthquakes of course..

For Drought, MOVE…

We need 2 years of rain to make up for the 3.5 we lost….keep playing the wheel and black 00 shows up….The desert of California or Southern California that many live could have an exceptional type drought forcing people to move….everyone is to non-chalant…especially the water wasting lawn lovers of the desert of LA, OC sheeple

The great thing about being a urban pioneer is that u can use all that equity to buy the home of your dreams.i read a story that low income but equity rich people from cali are coming to Houston,since they could get more house.many see a 1,000 sqft house in the heights sellin for $500k as a bargain,even though longtime houston residents think its a high price.2008 was the best time to buy real estate in cali.the only way cali real estate prices to have. Low prices if it was in low demand,and thats not going to happen.cali is a very popular place.people. have two choices make more income or become a urban pioneer in cali or a different city and use all that equity to buy in a prime area in cali.

Dude, there’s this thing people use to separate sentences, it’s a space after the period. Your run-on looks like a third grader wrote it, and obscures your otherwise interesting points.

Yeah, that was hard to read. LOL! But it made sense.

Housing to tank hard in 2015 is what’s trending.

Would you knock it off with the ‘trending’ nonsense? We get it, you like the word!

😉

NO WAY!!!!

If 10% of last years peak is a tank I’m in agreement. Closing prices are already down 2-5% from what I’m observing. In the where people actually live areas of course 🙂

Wondering what the actual distribution of the data looks like. If there is only one peak, the median gives a good picture of what is going on. But what it the distribution is bimodal, with one peak for long-termers and another for short-termers?

Wait for housing correction wheN rates go up. Don’t buy now, you will be buying at thE peak

The world economy and probably the U.S. economy may very well be in a recession at this moment. Oil prices tanking, commodity prices tanking, the Baltic Dry Index at 28

year lows, are all signs of an economic slow-down.

Housing prices usually follow recessions by a few years or so.

Anybody buying to day in so cal is already buying at the peak. If rates go up, I dont expect values to drop dramatically, but they will a little. It will just be easier to get an offer accepted since their are less buyers.

I was browsing the news sites and came across a couple of articles that must be wrong because the most amazing city on earth was not on any of the lists. http://money.cnn.com/2015/02/03/news/economy/advanced-industries-cities/ http://money.cnn.com/gallery/technology/2014/10/07/most-innovative-cities/index.html

Since some rich people from cali,east coast,rich foreigners and pro athletes are buying up million dollar and up masions in houston because they could get more house along with the middle class people from California that couldnt buy nothing at all since they missed the opportunity to get a good deal on a house in cali,are now able to live in a bigger house in houston.unfortunately some on this blog will have to do the same.even though some of you wont be able to afford to live in the popular hoods such as montrose,the heights and other hoods inside the loop.but there are some houses in hoods you could buy cheaply,but housing inventory is very low.houston isnt as cheap it use to be,so buy now because the population of the city is growing fast.cheap housing in Houston,dallas and austin is becoming a thing in the past.east austin is now expensive and not long ago east austin was dirt cheap.my advice is buy now in housto, dallas and austin.

@cheri

“JIM are you saying people must have more income for the 450k home or are you saying it takes less income to get a 450k loan that you’ve ever seen. Please explain it a bit more elementary 🙂 I just applied for a home equity line because I want to pay off my home yet have access to money. I was wondering in a nut shell if today is harder to get loans or easier ????? I reread your post a few times and it seems you believe banks allow more debt and more income to go to debt and still qualify people. like 50 percent debt to income works but 36 percent is safer for the borrower ?????

let me know Jim, Thanks, by the way”

Your right Cheri, that is hard to understand. To be clear, because prices are so damn high, it takes a bunch of income to qualify. However, from a DTI stand point, most lenders will allow up to 45% and if you have 12 months PITI in the bank, up to a 50% dti. So in that respect, the dti allowed today is much more lenient than when I got into the business in 1984, when fixed rates were 14% and my home cost $200k. 30 years later we are at 3.50% but the price is $1.2M!!!!

jim is right, it’s not easier to qualify, it’s just lenders are more lenient with the higher DTI ratio. They were much tighter back in the day. But to get that higher DTI ratio you got to have that 740+ FICO.

With prices in the stratosphere in LA and the Bay area,

You still can get find a few good deals the inland empire, Riverside and Ontario or Stockton and Modesto. But the commute is a killer.

These areas don’t appreciate much in value compared to San Jose and Anaheim, Torrance or Fremont.

I blame the high prices on the HB-5 visas.

I went to an open house here in Fremont several months ago.

The listing Realtor was telling another Realtor who that he had 15 offshore Chinese investors that he was working for.

This is fueling the feeding frenzy.

This program was started to save the Banking industry during the crash.

But it brought over the corrupt money with it. Check out this article in Yahoo News today.

http://news.yahoo.com/whistleblowers-us-gave-visas-suspected-forgers-fraudsters-criminals-152937215–abc-news-topstories.html

But look at the good side.

High prices mean lots of money in property taxes for California Cities in financial trouble.

Even though their problems were from bad management like the city of Stockton.

Realtors love the high prices, though they bemoan the lack of inventory.

Flippers with cash money are busy putting lipstick on those 1952 (950 Sq. Ft.) Crapshacks in Santa Ana and Hayward and asking 500K.

Meanwhile, the rest of us rent.

On the Bright side, the weekends are ours, no big tax bills, if bad neighbors move in next door, tell the landlord were moving.

William fulton who spent 30 years in southern California now living in houston wrote a article (houston’s suburban past meets its urban future inside the loop)governing.com,he mentions these innerloop hoods in Houston have California prices,getting more dense etc. Another article(how oligarchs destroyed a major American city)salon.com.it mentions people being displaced due to gentrification in the innerloop hoods and the victims are the middle class,who pushed out the poor.now the rich are getting rid of the original gentifers in montrose, the heights etc.also the rents in certain parts in houston getting pricey,one bed room apt in some places will cost $3,000 per month.the Houston chronicle did a story on the rise in rents,one couple couldn’t take it anymore and moved to Portland.read whole story(houston chronicle Stephanie powers).

Housing market overall very weak at best. Agents continue to prop up a dying business. To start with change the way you buy and sell, the 6% commission is a killer and for most simple paper work, inspections, title companies should perform all that is needed for 2%. This gives the seller a chance to move the property without worry of paying such a ridiculous fee in the 21st century 6% should be history.

Buyers get a better deal, like buying a car pretty much make a del with the internet manager, go to the dealer and the sales person gets a fee for filling out the paper work.

RE cartel want to complicate the business, all you get is poor service from very non-qualified people who have no idea on buying and selling, all they want is a sign up and all the public gets is very unhappy buyers and sellers?

I agree, 6% is too much at today’s so cal prices to justify the work an agent puts in. Especially when listings are going pending in 30-60 days.

Curiously, how many years have the vast majority of you (who don’t currently own) been waiting on the sideline? Was it worth it? Don’t get me wrong – I’m with you but I couldn’t wait anymore I jumped in 6 years ago and didn’t look back. At some point you can’t beat them, you have to join them. It was the best decision I ever made and it still enrages me to think of the bubble and who’s creating them but you can’t change reality you can only change yourself.

That’s actually a healthy of looking at buying. Good for you. Honestly, if you buy today, you are buying at the top of the market. If you expect some type of bubble to burst, you are sadly mistaken barring some catastrophic economic event. Historically, real estate values always trended up over the long-term. If you were to remove the 2007-09 meltdown anomaly of real estate values, the trend would have been exactly the same for real estate values for the past 30 years, up. Sure the prices are high, but people buy based on monthly payment. Can I afford that payment? Who typically buys homes? Families. Who runs the family? The wife. Happy wife, happy life. What father doesn’t want to provide the best for his family? Thus, they buy. As long as they can afford the payment. Luckily, the interest rates have stayed so freaking low.

Leave a Reply to Bora Horza Gobochul