When the economy becomes a financial circus based on debt fueled acrobatics: Lessons from the Great Depression Part 34. Tracking housing values from 1940 to 2011.

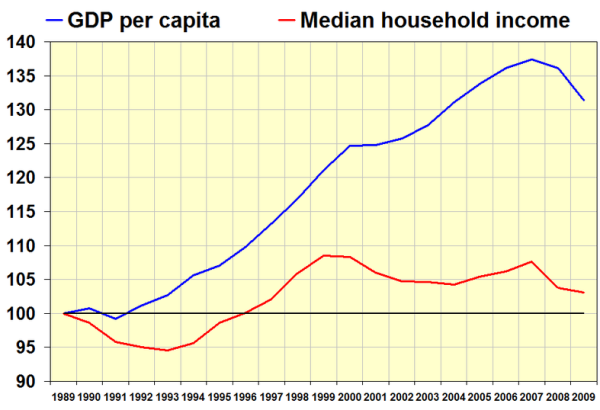

“Facts do not cease to exist because they are ignored.†-Aldous Huxley.  The global economy is undergoing a metamorphosis of historical proportions. For many decades we have built a system highly leveraged on debt and the real estate bubble has become a worldwide sensation. We do live in interesting times and the following decade will prove to be a dramatic change on the current financial order. For every decade since 1940 household income has gone up in tandem with housing prices. This makes logical sense since inflation eats away the purchasing power of money and you would expect goods would adjust to new income levels. The housing bubble of the last decade superseded this trend where incomes actually fell yet home prices went into a mania. Not only did home prices inflate but also the cost of a college education, automobiles, and a variety of financed items entered unsupportable price ranges only because of their access to easy money. As the 1920s taught us, unbridled greed and gambling does provide enough fodder to shut down the global system. The fact that home prices now enter new post-bubble lows even after trillions of dollars in banking bailouts demonstrates the futility and graft of the current financial system.

This is part 34 in our Lessons from the Great Depression series:

29.  New home sales fell 80 percent from 1929 to 1932 and fell 82 percent from 2005 to 2011.

30.  Economic déjà vu from the 1937-38 recession

31. When government and financial institutions become one.

32. Housing prices continue to fall as other costs eat up disposable income.

33. The McDonald’s and paper-mill education economy funded by a too big to fail bank.

When numbers cease to matter

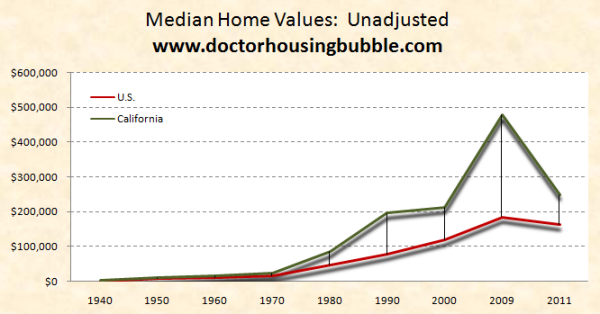

You can dip a rotten apple in caramel but once the caramel is eaten you will still have the taste of a bitter fruit. That is an apt description of the bailouts given to the banking sector. The caramel has fallen off into the coffers of the financial system and now that the trillions of dollars are stripped off, we are still left with the glaring reality that home prices simply do not reflect underlying income trends in our country. The last time housing values fell on a nationwide basis was during the Great Depression. It should cause you to pause that the crash in values today is more dramatic than during the darkest time in our nation’s financial history. I wanted to look at home values after the Great Depression since we have more accessible data from 1940 on:

*Census Owner occupied data (From 2009 ACS), Data from NAR and CAR for 2011

From 1940 to 2000 home values seemed to move up in significant ways but so did household income. From 1940 to 1950 the median home price more than doubled. This happened yet again from 1970 to 1980. From 1990 to 2000 home prices nationwide went up by 51 percent. The more important factor to remember is that household incomes were going up during this time as well. That is something that cannot be said for data from 2000 to 2010.

Take a high priced state of California who underwent two housing bubbles in the last two decades. According to Census data the median price of a California home went through these motions:

1990:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $195,500

2000:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $211,500

2009:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $479,200Â Â Â Â Â Â Â Â Â Â Â Â Â (data from the 2009 ACS)

2011:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $249,000Â Â Â Â Â Â Â Â Â Â Â Â Â (current May 2011 data, DataQuick)

After all the tumultuous ups and downs in California home prices are close to their 1990 level. The caveat of course is that California was in a bubble in 1990 similar to the price point in 2009. Yet in all of this information we need to remember that incomes have gone stagnant. The only reason home prices went into the mania that they did was access to easy financing brought on by the Wall Street machinery and the government loan apparatus. The 1920s setup a nation with speculators and snake oil salesmen conning the American public into a false sense of prosperity (by the way even at the peak in 1929 60 percent of Americans were still living at or below the poverty line). And of course the Great Depression quickly followed once the facts were acknowledged:

This week we found out that foreclosure filings came in at a low figure not because things are improving, but because banks continue to manipulate the system and continually ignore the reality of the market. The reality is that Americans are only in a position to afford cheaper homes. Of course the banks would love nothing more for one more round of musical chairs. They would love the tune to go on long enough to unload their inventory, wipe their hands off, and let the market have its way with the public. Home prices can only be supported by a system that provides adequate income to its workers. How else will mortgages be serviced? Has this side of the equation been erased?

The investment banks on Wall Street have forgotten what it is to work for an honest living so to them, there is nothing unusual about derivatives, CDOs, speculating on failing countries, or home equity loans and going into massive debt to finance spending. This is the way they make their existence. They are the modern day P.T. Barnum held up on an altar even though the typical American has seen their financial situation deteriorate significantly over the last decade. We would have to go back to the Great Depression to witness such destruction in financial wealth.

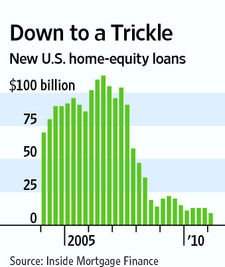

The home equity carnival machine

Source:Â WSJ

The second mortgage craze always struck me as odd. Why would anyone want to borrow against the equity built up in their home? It wasn’t like the money came without strings attached because it was a loan that had to be repaid but also increased the overall debt on the home. From 2004 to 2006 homeowners took out an astounding $2.69 trillion from their homes. This money was used to finance renovations, vacations, and a tremendous amount of conspicuous consumption. By the way, did I mention that incomes did not go up in the last decade?

This is the startling revelation of our current crisis that probably flies in the face of the Great Depression. As incomes collapsed so did household consumption with home prices right behind it. We were entering a less dramatic shift in the last few decades but each time the Federal Reserve stunted these corrections with easy money and allowed the party to go on (at least long enough for banks to square away their finances by taxpayer bailouts). Every little lie eventually led to the biggest lie of all which ignited the biggest housing bubble ever known to humankind. Home prices doubled and tripled in many areas at a time when incomes were falling. The circus became mainstream and everyone wanted a chance to jump on the housing trapeze.

The tide recedes and incomes go with it

As the tide is receding we realize that much of the housing market over the last decade has been one giant farce built up only by financial hucksters trying to sell the American dream and extracting every ounce of money along the process. Household income, the most vital and key component of the housing equation has moved lower over the last decade:

Do you ever wonder why there is never a full analysis of income on the popular press or all those cable housing shows? You would think this is something that would be mentioned since it is the most vital component. It should be no surprise then that home prices are now entering a lost decade with little fanfare in the press. Home prices are merely reflecting weaker incomes. I’ve seen the argument made countless times that “this time things are different because interest rates are so low.â€Â Interest rates are the elixir of the huckster financial graft expert. Keep in mind that the interest rates you see today are juiced and artificially built up by trillions of dollars of Federal Reserve financial wizardry. These rates are also low because the Fed in conjunction with Wall Street investment banks and our government have allowed banks to suspend mark-to-market accounting and flat out create a parallel financial universe where typical laws of economics do not apply. Of course when you have a financial system like this you might as well have King Henry as your central banker making up laws that suit the interests of the banking system. How well is that working out for the over 6 million homes in foreclosure or distress? How well is that working out for the nearly one-third of mortgaged homeowners underwater? How well is that working for the crowd that is still unemployed?

What we have here is a throwback to the days of the 1920s when we had Charles Mitchell running National City Bank and other salesman titans of Wall Street making money on massive speculation. It is amazing how the too big to fail banks define capitalism through their actions. They want the free market when they can rip off the poor with hidden bank charges or convoluted credit card statements. Hey, if you don’t like those fees feel free to switch banks, they will tell the public. In the same breath they want taxpayer handouts, the same folks they are ripping off, to pay for their grandiose speculation that made many of them wildly rich. Even if you look at the shadow inventory this is the absolute antithesis to capitalism. The too big to fail banks have flat out suspended accounting rules and regulations to simply benefit their own greed and corruption. The market is demanding lower priced homes to go with lower household incomes. This would decrease the financial burden on the American family. Yet banks do not want this to happen so they get their connected politicians to suspend standard accounting rules, not from the days of “talkies†and speakeasies, but from the recent Enron fiasco. These were rules to protect the ordinary investor from lopsided insider driven systems.

Japan followed a similar path by bailing out their banking system and little demand for actual reform came from the people. So here they are experiencing two lost decades. What happens when banks do not acknowledge the facts is an odd form of financial kabuki theatre. We now hear of multiple cases of blocks of REOs being sold to select investors without properties being issued to market. In some cases properties are sold off the MLS to individuals who then quickly sell them for a fast profit. How can we tell? The same people that doctored financial statements and lied about practically everything are here running the system still. The circus goes on and American households are facing lower incomes and home prices still continue to fall even in the face of all the bailouts. Those putting on the financial circus still seem to have enough to put on a spectacle and try to obscure folks from paying attention to what is really going on.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

63 Responses to “When the economy becomes a financial circus based on debt fueled acrobatics: Lessons from the Great Depression Part 34. Tracking housing values from 1940 to 2011.”

Classic.

Following in the footsteps of Dr. HB, here is a look at a home in Chatsworth listed less than its 1989 transaction price.

http://www.sfvalleyblog.com/2011/06/chatsworth-home-prices-lower-than-1989.html

Another thanks for the hard-hitting analysis. The Dr.’s statement about a graft ridden financial system of complicity between government and market makers rings frustratingly true. However, I am not sure the 1920’s have taught us anything. By us I mean the U.S. populace, financeers, and the federal reserve. In addition, I would cast suspicion on the knowledge gleened from the Great Depression by the “Depression Scholars”- the Grand Pooh-Bah Bernanke and the the Monetarist Mensch Milton Friedman.

“As the 1920s taught us, unbridled greed and gambling does provide enough fodder to shut down the global system. The fact that home prices now enter new post-bubble lows even after trillions of dollars in banking bailouts demonstrates the futility and graft of the current financial system.”

Fantastic article, Dr. H! Freaking fantastic!

Wait…Wait…Wait… Facebook, LinkedIn, and Pandora have IPO’ed. The housing industry is saved with all these newly minted millionaires. Prices will rise as they start bidding wars buying property after property showing that this time is different.

{Enter DHB}

Time to wake up and smell the coffee.

{Ryan wiping sleep from eyes}

Couldn’t you let me dream a little longer.

If that article doesn’t wake you up with a good dose of angry piss and vinegar, you’d better start shooting speed.

Pandora’s box – classic “eyeball/ear” tech valuation to give some random number somehow related the number of users to a share price. The company has never turned a profit. How do you analyze that financial statement. Didn’t we already IPO a bunch of internet stocks that were going to have great future profits during the dot com bubble? Maybe Pandora has a great business model based on advertising or GoogleAds click through profits similar to all the social networks ?

Silicon Valley: Housing Bust? What Housing Bust?

I think you may have read this article or something like it. The language in the article sounds so familiar to that which listing agents utter to me all the time. “Inventory low”, “prices rising”, “market returning”. Ug.

Normally, I respect Dan Levy and some of the work that he’s done. That particular article is complete utter BS. It is a superb example of how one can lie with statistics.

To see what I mean, just go to Redfin and search in Palo Alto. That will give you a link to their housing statistics page. Go there, select “homes” (not homes and condos) and you can see the graphs for yourself.

For the April, May timeframe, you can get a number which shows that it’s up 20%, or down 3-5%, IIRC. Dataquick obviously decided to tout the big numbers, and the BS artists decided to publish them. You could just as easily write an article that prices are going down in PA, but that wouldn’t get the Real Estate advertising dollars.

If you take a look at Redfin’s graph, you can see what’s really going on. Things are generally flat over a longer time period, with occasional spikes.

Granted, those are Redfin’s numbers. And they have a serious problem with their statistics, in that the table graph doesn’t (if ever?) match the chart. So take them with a grain of salt. But my experience has been that the graph is accurate, and Redfin’s table graphs are off, sometimes seriously so.

But that’s Redfin, and it’s what one gets when one hires the cheapest talent you can get. They are the Walmart of Real Estate.

U t u b e

2012 – The Crash of the U.S. Housing Market?

P.S>”Look at the charts”My thoughts 2013 willl be the Crash because they stoped foreclosures for about 8 months.

After election year

My thoughts 2013 willl be the Crash because they stoped foreclosures for about 8 months because of the Robo-signing.

The bubble was pumped up by the real estate industry.

Why do we need real estate agents at all?

With the internet, we no longer need travel agents.

Why can’t the same happen with real estate?

Why can’t the same happen with health care?

It CAN if the we/ the PTB let it!!

Greed is the problem

Doc,

Thank you for translating our impressions and intuitions into facts. You are truly “the smartest guy in the room.”

“Facts do not cease to exist because they are ignored.†-Aldous Huxley.

Spot on Doc. We really appreciate all the work you do.

A couple of interesting points…

First of all, I am glad that you brought up the fact that in the last decade, income has fallen and home prices shot through the moon. A total disequilibrium brought on by the easy financing that gripped that US. (Especially the bubble states) Not only the 3.5% down bullshit, but also, the option ARM and alt- A financing, which inherently is ONLY feasible in bubble states.

It is important to note that when you look at the GDP for those years, is that not only were people’s home values skyrocketing at 25% a year, they were simultaneously taking out HELOCs. The real issue is that once they got these HELOCs they were blowing the money straight into the economy, which inflated GDP. So much so that, had it not been for the HELOC and re-fi money coming into the US, we would have been in a state of negative GDP.

I remember being down in Temecula about five years ago, sitting at a stoplight, being completely surrounded by champagne colored SUVs. There were eight of them, and they all had that HELOC smell.

It wasn’t HELOC smell, it was the smell of someone who sold and had the CASH to buy a new home and cars, but that is OK, they timed it well, they are heroes, the people who got burned, well, they suck and are bums.

Gotta luv So. Cal mentality. Only winners and rich are good, doesn’t matter how you got there, if you aren’t rich or win, you suck, and people will “smell your poverty”. Gawd forgive me, sometimes I hate the people who live here.

Housing prices in Temecula are incredibly awesome compared to here in Burbank. Actually thought of buying there for a bit, but the distance to good work if I lose my current job is the major drawback. Maybe a good spot for retirement. Will definitely keep an eye on that area now just to watch it waffle through this economic environment.

Absolutely! GSP numbers were all bogus, inflated by fake income and fake wealth. The equivalent of a company shipping empty boxes and recording fantastic revenue, except that there are laws against that.

Absolutely! GDP numbers were all bogus, inflated by fake income and fake wealth. The equivalent of a company shipping empty boxes and recording fantastic revenue, except that there are laws against that.

Not only that, but all the realtor commissions, appraisal fees, home inspection fees, mortgage underwriting, etc that took place during the bubble contributed to GDP. It was a perfect example of “phantom wealth”.

If you strip out all the “phantom wealth” from the government’s highly flawed and intentionally misleading GDP statistics, the sad fact revealed is that the nation’s real output hasn’t increased since 1998. The whole thing since 1998 has been smoke and mirrors made possible by tens of trillions in additional debt.

Correct

People are renting homes for more than it would cost to buy them because a home is now a liability when it comes to going where the jobs are. Investors do buy homes and then rent them out. Now it is cool to be a renter. It is dumb to be a home owner(except in Texas, of course).

+1 insightful. It’s a great feeling to be free of debt.

Pandora’s stock price just tanked today – 20% less than it’s IPO opening…

Jobs are not what they used to be . Either is service in a store. In my local Safeway, when the deli workers go on break, no one is behind the counter for 15 minutes.

When I complained to the manager, he just shrugged his shoulders and walked away.

I have a realtor pushing me to buy a home even though he won’t do the same. He has moved in with his parents and postponed his wedding. So when he tells me it’s a great time to buy, I say, “you first”.

WOW… what a pointed/poignant tale of NAR hypocrisy! Perhaps there’s a bus out there with his name on it… not a killer bus… just a crippler bus… a lightning-bolt-from-God type of thing… lol. ;’)

If he was honest – a severe handicap in his line of work – he would tell you “I need the sales commission so I can move out of my parents’ basement”.

Thank you Dr. HB!

You made my day Dr. Fantastic language ! Right use of words and references.. This article is worth a thousand salutes !

So the big news today, ” Wells Fargo stops originating reverse mortgages”. Why should we pay attention to this as it only represents 1.2% of their business. Let’s consider for one moment the reason given for their abrupt reversal. To quote…”the amount of defaults(owners not paying property taxes and insurance) and declining values (properties underwater)is making this product to unstable and more risky”. Remember, Well Fargo assumed Wachovia’s portfolio of sub prime crap. Wells had limited exposure

to the sub prime market because of higher lending standards. Is Wells on to something?

Does anyone smell the smoke? Is Wells the carney in the coal mine? My senses tell me we are going to begin to see more seniors thrown into the streets….. they are

tapped out…..nowhere to turn, game over. 2013 will become the Armageddon of the housing bubble crisis once the banks are freed to begin foreclosures again.

I went to a county community meeting the other day about raising the millage rates for our property taxes here in St. Johns county Florida. County is tapped out of funds…no secret there…what was most alarming was a comment made to a question about tax collection and defaults. The county manager admitted that the outstanding default rate for uncollected property taxes was near 90%. ……….the air is getting a little thin in here.

I love the word play off of Docs Circus simile. Carney in the coal mine. Is that what you intended? Don’t send in canaries send in knife catchers and carney banksters. When they tank it will be time for us to go in the mine not out as in time to buy.

“carney in the coal mine”

You meant canary in a coal mine, but given the current market, carney is entirely appropriate.

Yes, another accurate article on the housing mess. Unfortunately, as alluded to, this problem, of stagnant wages and high prices, resonates throughout our current economic system. It is true that for years wages matched price increases fairly uniformly. This is not the case any longer. Our entire economic system has been convoluted to service the few who have political and financial power. There is now a great huge gap between the haves and have nots. So what has changed? A good place to start would be with the repeal of the “Glass–Steagall Act” of 1933. This law stopped the separation of Wall Street investment banks and depository banks. This is a BIG deal! For those of you who are locked into the Democrat/Republican blame game, I assure there is plenty of bi-partisan blame to go around. Phi Gramm (R) and Alan Greenspan (R) among others authored it, and Bill Clinton (D) signed it into law. Thus was the end of a law that had served us well since the Great Depression. Wall street now had carte blanche to screw the depositors and investors and to reap huge profits with new financial manipulation which led to outright criminal acts of the “Too Big to Fail” institutions. This housing collapse is part of the fallout.

For those of you truly interested in what really happened, there is a documentary titled

“Inside Job”. This work documents the global economic crisis of 2008 and how it happened. It is so very informative. If you have the slightest interest in what really happened do yourself a favor and take an hour to view this film. You’ll have a better understanding of how truly dirty and corrupt our entire financial system has become.

Curt

Curt,

I could not agree with you more. The pivotal turn was the bipartisan repeal of Glass-Steagall. There have been so many small steps that lead us to where we are now. Richard Nixon taking us off the silver standard. LBJ’s great society with a vast increase in entitlement. George H.W. Bush losing re-election when he felt he had to raise taxes for the good of the country. This taught every politician not to raise taxes, just borrow more. Each step a relatively small one. Each had good arguments in their favor. But taken as a whole they lead to financial ruin.

Step 1. Reinstate Glass Steagall.

I’m seriously considering pulling the plug on my bank accounts with Chase, and taking my business to a smaller local bank. I just have to figure out which? Any ideas? Why should I support any bank that has been involved in causing this mess? Why should anyone?

ABSOLUTELY! It’s our MORAL DUTY! I pulled out of Wells in Oct. 2008, transferred to a local credit union, after checking their financials (via Weiss Research, IIRC…) Credit Unions tend to keep their “skin” local, and in the game, all checks and balances sane and intact.

Way past time to convert Too Big To Fail –> Too Small To Survive ;’) Fook Wall St… take away their toys, and they can’t hose you anymore.

Two words: credit union.

Credit Union – if you don’t have an affiliation relationship, Pentagon FCU is a good choice with excellent rates. You have to learn a different style of banking, no branches on the West Coast and very few partner branches, but there are a few.

I closed both of my business and personal accounts with Chase. They are not people friendly. They charged a fee twice on our hard earn money for an overdraft in our account, once in the checking and another one in the name of transferring money over from the credit card to cover it. Then they started charging a $10 fee if you account balance is under $500. Your friendly credit unions don’t do this… Why support the blood suckers. My husband used a BofA account exclusively, but after numerous accounts of being denied access to his money at grocery stores, international travels, department stores in the name of security, he now has his deposits going to a local credit union. We both use our credit unions, the best way we can support our local economy and saying no to greedy giant banksters.

Check out your local credit unions. I pull all my money out of Wells Fargo last December and went with a community oriented credit union.

You shouldn’t use banksters, period. Join a Credit Union, there’s one for people who live in OC. Stop using plastic cards and use CASH. That right there is a 3% hit on EVERY transaction. Don’t use a credit card to buy anything, buy in cash or don’t purchase.

It’s easy to squeeze the banksters sac, but too few use the discipline and effort to accomplish it. I’ve been credit card free for over 12 months now.

Just made a similar post a couple of DHB articles ago. I’m with you. The only reason I’m not switching now is to keep my credit stable for when I decide to buy a house. Once my purchase is done, I’m ditching Wells Fargo, and my annoying credit card. Let’s pull out on these punks so they’re no longer too big to do anything.

First, avoid the TBTF Banks. That goes a very long way. Second, if it’s really a Bank you want, here’s the best resource for finding a stable one:

http://banktracker.investigativereportingworkshop.org/banks/

Avoid any Bank with a high Troubled Asset Ratio (TAR). Try to stay well below the mean, if you want a stable Bank.

Third, use a Credit Union. These are generally in much better shape. The link above also provides ratings for CU’s. Again, try to stay well below the median TAR.

Bauer Financial and Bankrate.com have online search mechanisms for screening out questionable institutions:

http://www.bauerfinancial.com/btc_ratings.asp

http://www.bankrate.com/rates/safe-sound/bank-ratings-search.aspx

~Misstrial

The aging employed and those approaching 65 appeared to be faced with a double whammy, purchase of over valued real estate, and the diminishing high value jobs. I believe there are no quick cures for US economy, it will be a challenge for all of us.

I have to say I never get these assumptions. If you are approaching 65 you may well be beyond the mess. If you 65 and bought your first house at 30 (after saving 20% down) worked at a career or one job with a good pension or built a 401K and managed your money well you would be in the cat bird seat. Ready to retire with a house free and clear (30% or more of all homes), money in the bank and a retirement income. Many near 65 year olds could sell for under market with a profit and buy in a good retirement communities (look at St George Utah for one and plenty of places in Florida) for cash or small mortgage with low rates and live the good life.

Dr. HB – You continue to astound me regarding depth of your analysis and the keen insight. Absolutely brilliant work.

Thank you for posting. Always look forward to reading your post. I wish mainstream media would refer to your work, but I suppose you are too honest for their machines.

Why do the prices of houses have to go up and keep up with inflation? This is total garbage. Can anyone give me an exemple of another asset that does that? This garbage was fed to us by the banks, because they didn’t have any skin in the game. They sold most of their mortgages to Fannie and Freddie (and later to idiots who were trying to compete with FNM and FRE). That’s what happens when the Gov. gets involved in private biz. Stupidity (gov.) and greed (private biz.) is what you get.

P.S. I can hardly wait for the FHA fiasco. You haven’t seen anything yet.

inflation makes housing prices go up because the stuff you need to build, repair and maintain homes goes up in prices. And people eventually demand higher wages when faced with inflation. So you have to pay people working on your house more, and potential buyers also earn more, so eventually they will be able to afford more.

so that is why inflation makes prices of houses go up.

whether or not the asset keeps up with inflation is simple: is the inflation causing a fall in economic activity (BAD), or is there inflation because the economy is booming and everyone is competing for resources?

I am noticing a very bizarre and scary trend in home sales. I am now noticing that real estate agents are reporting on the MLS that they sold a home for let’s say $150,000. The MLS listing also says they represented the seller and the buyer. This $150,000 is in line with what the house should have sold for. I then check the tax records to see what the home sold for and the document numbers of the sales transaction to include in my appraisal report. Well I then notice that the home was never actually sold to an end buyer. These homes were actually bought by another bank from the bank that had them listed for sale in the first place! Nobody bought the house, one bank just sold it to another bank, and recorded the sale on the MLS. One house I saw sold for $150,000 on the MLS, but on tax records it actually sold for $96,530. Buyer and seller were both banks. It appears banks are buying and selling homes to each other and telling the listing agent to record the sale on the MLS to give the appearance all is well and the home sold for at or near the asking price. I have seen this quite a few times in the past few weeks. When I call the listing agent to ask them if the house sold to a buyer or another bank and what the house actually sold for…..I either can’t locate the agent (wont take my call) or they refuse to call me back after I leave them a message. I’ve been appraising for over 6 years and I have never seen this happen before.

PH, Let me solve the mysery for you. The properties are not being listed and resold to another banking institution. I can guarantee that. What you are seeing is flaw in MLS data collection. What happens is a homeowner lists their home for sale. It then sells and is entered into MLS as a pending sale. When a property is entered as “pending” the agent must include a scheduled closing date. At some point during the escrow period the sale fails most typically, because a short sale is denied; and the lender forecloses. Many times the agent fails to cancel the listing, and MLS is set up to automatically go from pending to sold based on the closing date previously entered by the agent. The foreclosing lender then gets the property as part of the foreclosure outcome, and relists it short thereafter. The property is then sold to a real Buyer at a real price and reported correctly. MLS shows this as a property selling twice in a very short period of time, but that’s not actually what happened. This auto-close feature in MLS drives me crazy. It was adopted many years ago to prevent agents from forgetting to report their closed sales, so the system would do it automatically. I dont think they realized what a mess this causes in distressed markets where you have a lot of failed short sales for example. I am an REO broker who completes many BPO’s every month for my listings and in some markets I need to double check the MLS data against another source to confirm the sale for exactly the reason noted above. The agent is not callign you back because they never sold the property as it went to foreclosure. As such there is no reason to return your call.

+1, TB. And a VERY big “thank you”. I have seen this many times on the MLS, and have always been curious about it.

Wow… We have definitely turned Japanese. TBTF Zombie banks rule, while the American Public gets fleeced. Are we so stupid? Or is the governemnt/capatilist model so corrupted? Or BOTH. People should stop buying anything big and bring these crooks to their knees. These banks are not to big to fail, that is just the kool-aid. Time to purge these bastard,s as painful as it may be. At least we might have something left, to rebuild. The American Dream is nothing but a nightmare anymore.

Boycott high end properties on the Westside and stop the music.

http://www.westsideremeltdown.blogspot.com

With regard to incomes, let’s not forget that through this greed, and corruption we have more income disparity than ever before in this country. If the rich are getting much richer, then median income of middle class is skewed even further down, and god save the poor. The richest one percent now control 24% of the nations wealth, yes 1/4! So, the middle class is in even more trouble than median income might have us believe.

I just think of how my wife and I make over 100K, and cant afford a home in Burbank. A house listed up the street from us at 549,000 (modest home 3Br, 2 Ba). If we bought that home it would be 1300 a month more than our rent of a 3 br, 1 ba. down the street. That’s a lot to pay each month for another bathroom to take a dump in. Let’s not forget all the other associated cost with ownership. Really, either someone is completely delusional, or Burbank is the Beverly Hills of the east valley, and I should be grateful for the roof over my head that I am allowed to rent in such an affluent area.

The median home price chart doesn’t reflect the correction in the early 1980s when interest rates spiked. It would also be helpful if an inflation-adjusted chart could be shown as well.

San Francisco City pension pays more than average worker earns

The average retiree from San Francisco city government earns an annual pension of $46,272, according to the San Francisco Employees’ Retirement System. The average retiree who worked at least 30 years in city government earns an annual pension of $76,981.

Per capita income is $44,373.

America’s Debt Crisis

Dr. HB on RT’s Max Keiser show. Link will take you to the time mark.

.

Keiser Report: Greece Resistance Special (E158)

.

Cheers!

Note on video link: Ad inserted at the start of the video screws up the move to the correct time.

Go to 9 minute, 20 second mark for Dr. HB references.

Leave a Reply to sleepy