Real City of Genius – Culver City has a More Expensive Income to Home Ratio than Beverly Hills. Inflated Markets set to Adjust. $925,000 Home can be Rented for $4,500.

One of the major stories of 2010 will revolve around how governments, local and statewide deal with massive budget gaps. The solutions are simple at least on paper but people don’t want to hear them. You either cut spending or raise taxes. That is it. Unlike the federal government states and local governments don’t have printing presses and need to raise money in other ways. Yet as obvious as the solutions many are still clinging to their own delusions and are clouded by their own perception that certain markets are still immune to the laws of economics. They are not.

For those investors that were planning on having an easy rental market, we found out in a report that 1.2 million households have disappeared during the recession. That is why rental prices have fallen in this current market. And it makes sense. Those young college graduates that would have gotten their first apartment or small rental home are now moving back home or doubling up. You also have many that have lost their jobs consolidating households. The number only confirms what many of us are witnessing with our eyes.

But I wanted to bring this data closer to home to show how outrageous prices are in certain markets. Areas like the Inland Empire have found out how to solve the crisis. The solution is to cut home prices to levels that reflect the actual incomes of those around the area. An area I have covered extensively, Culver City has been unable to adjust to this reality. In fact, Culver City has income to home price ratios that make it even more expensive than Beverly Hills. Today we salute Culver City with our Real City of Genius Award.

Getting Incomes and Prices Right

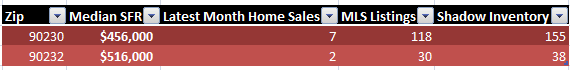

Culver City has seen the median price of a home come down since the peak. Yet prices are still out of sync with local area economic fundamentals. Let us first look at the current landscape of the city:

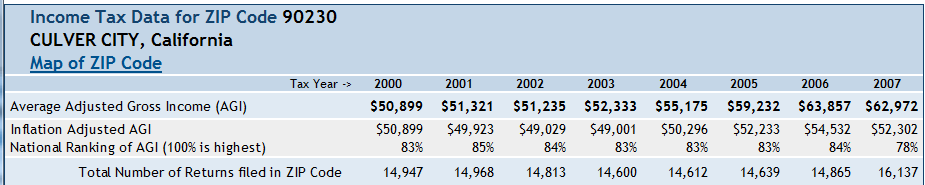

This area still has a much larger shadow inventory than what is listed for public view. As we have been seeing, more inventory is making its way to the MLS but it is slow and drawn out. At one point, both zip codes had median prices over $600,000. That is now not the case. But let us take that 90230 zip code and pull tax filing data:

Even with the early crash, the 2007 income already reflected the new economic climate. Now using the adjusted gross income data and home price data we can get a rudimentary ratio:

(90230 median price $456,000 / $62,972) = Â Â Â Â Â Â Â Â Â Â 7.2

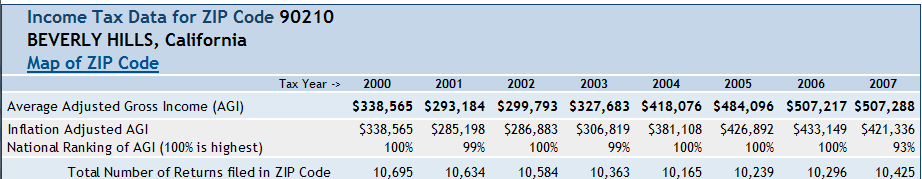

Now ironically, this ratio is higher than the famous 90210 Beverly Hills zip code:

The latest median price for this zip code is $2,359,000. So let us run those numbers for this zip code:

(90210 median price $2,359,000 / $507,288) = Â Â Â Â 4.6

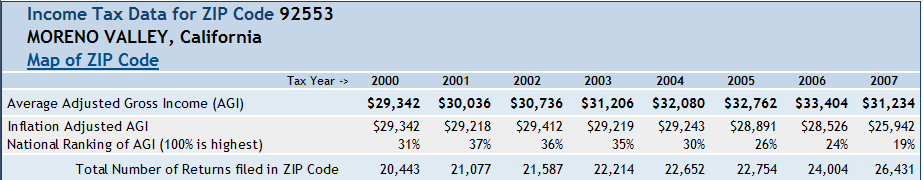

This is why it is so important to look at local area incomes to actually find out if a market is healthy. Take a look at some areas in the Inland Empire as a contrast:

So even though incomes are much lower in Moreno Valley, home prices have fallen to a point where ratios are now starting to make more sense:

92553 median price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $122,000

(92553 median price $122,000 / $31,234) = Â Â Â Â Â Â Â Â Â Â 3.9

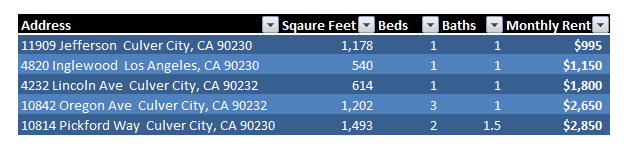

Like in golf, the lower the number the better here. Some cities like Culver City are still over priced for what families make. That is why I get many e-mails from working families with incomes over $100,000 to $150,000 (and higher) that still don’t want to buy because the metrics don’t make sense. Yet for those people I say go out and find a rental. For example, let me list a few rentals out there on the market:

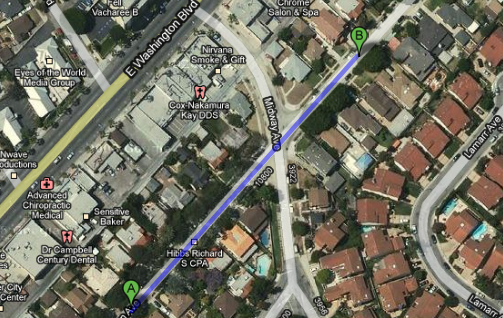

Some of the places are smaller but let us examine the last 2 because we can pull up some home information and compare. In fact that rental on Oregon is close to a home that is scheduled for auction:

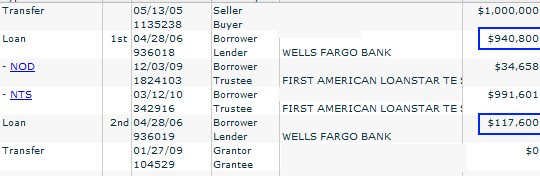

The home that is scheduled for auction is much larger but this just highlights that even on the same street, people have no idea what is going on with their neighbors. The story seems common when we pull up the data:

It looks to have over $1 million in loans including an $117,000 second mortgage. The auction is scheduled for May but who really knows what will happen since nothing happens on schedule with the foreclosure process anymore. Yet we know that a rental on this street is going for $2,650 (the 3 bedroom). So in essence you can rent in a million dollar neighborhood for $2,650 a month. This is California for you and this is why in areas like Culver City something will eventually give.

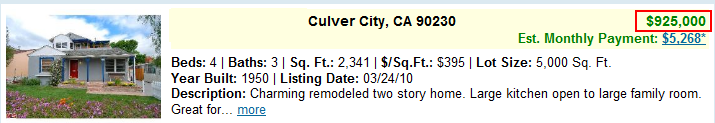

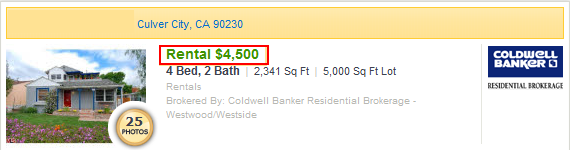

In fact, there was an interesting case of seeing a home for sale that is also up for rent. I spotted this home on two different sources:

The home is for sale for $925,000 and is a good sized place. But what are they asking for in rent?

This is the first I’ve seen of a home being listed on the MLS for sale and also on a different site as a rental. As a simple rule of thumb, you usually would like to get a 1% monthly rent from the property if you were an investor:

$100,000 x 1 percent                 =            $1,000 monthly rent

Like most rules, this is just a way to get an idea if a property is valued accurately. For example, the above home at $925,000 should yield $9,250 in monthly rents. Yet the actual rental is half that. These kind of massive discrepancies tell us that either prices will come down or incomes will boom up to reflect the current prices.

Today we salute you Culver City with our Real City of Genius.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

46 Responses to “Real City of Genius – Culver City has a More Expensive Income to Home Ratio than Beverly Hills. Inflated Markets set to Adjust. $925,000 Home can be Rented for $4,500.”

I have come to the conclusion that prices will not reset in these “prime areas” until interest rates start to move up.

The banks, with zero cost money, are not acting rationally with delinquent borrowers, allowing them to live for years payment free.

This will end when allowing people to live payment free actually begins to cost the banks money.

Will it be 1%, 2% or 3%? I don’t know, but it is in there somewhere.

Cities will deal with budget shortfalls by raising taxes,primarily through parcel taxes. Cities always threaten to close libraries, little league ballparks, and other highly visable facilities.

By always presenting parcel taxes as “it’s for the kids”, it has a great emotional appeal to the public. And since many people who have multiple kids, live in apts., they do not have to pay this increased tax.

Only landlords do.

This allows teachers in Calif.(average pay over $70,000 per year, per State of Calif . official numbers) to continue getting pay raises, on top of cost of living raises. Drive past any school in a decent suburb, and the teacher’s parking lot is filled with Mercedes and Lexus SUV’s.

The rent on the house is much cheaper than the purchase price, but the rent is still too expensive. If you are going to pay $4500 a month in rent , you need to make $200,000 per year. Most people in that neighborhood don’t make even half of that.

Can’t argue with your logic doc. In a perfect economic model it all makes sense. However people like myself who make 100-150k and are solidly middle class with 2 kids a wife and dog are not looking to rent a house that is also on the MLS for sale. We want stability for our family and not the uncertainty that comes from know the house you are renting could also very well be headed toward foreclosure a the same time.

There are more than just economic varuables at work here. If I was back in mý single days and could pick up and move every year or less this would make sense. But for family orientated folks it doesn’t work. This is why people like me jump when prices start to dip in desrable neighborhoods. I myslef just picked up a short sale house that took us over a year to find and 6 months to close on. But guess what? It may not be the bottom of the market but my family is solidy grounded in a great house good neighborhood and a 5 percent fixed rate. We aint moving for a looong time and when we do I will have paid down debt on a real asset that also provided shelter for my family.

I have no doubt prices will continue to sink or stagnate for many years to come, but people with kids are willing to stretch to put their family in the best situation possible.

Until the government stops propping up these markets and the buyers themselves there will be buyers willing to overpay.

I’m with nickhandle on this one dr housing bubble. If someone making substantially above median income- say $120000 a year- would be paying around 65% of their after tax income for this rental. Most likely, the tenants would probably move in multiple adults as subleters to lessen their load. This is very commonplace up here in San Jose. You will see a house with eight or ten cars. Imagine the wear and tear on these places. Seems to me there are a lot of folks living in a dreamworld where they decide what a house or rental is worth and that people will automatically accept and pay that amount. The biggest flaw in this thinking is that when faced with prices like these, human nature leads them to find ingenious ways to get around them. Doubling or tripling up, moving in with parents, those with fewer options may try squating, moving to other areas, buying a motorhome, or bunking at a homeless shelter.

Heard a fascinating piece on NPR today about Mangetar hedge fund, perhaps the epicenter of the housing bubble and the death spiral the world economy is in right now. They bought the lowest tranche of the CDOs (40B worth), then bought much larger CDS’s on the upper tranches, knowing that the entire CDO was worthless. They were built to fail because the CDS was worth way more than the CDO tranche. Without a buyer for the ‘Equity’ tranche (riskiest) the CDO would probably never have been created in the first place.

Citibank and the others created the CDO and SOLD IT TO THEMSELVES! The creaters and executives then collected huge commisions and bonuses for selling the CDO’s, knowing that if they failed, they got to keep their bonuses and the government would bail out the too-big-to-fail banks.

I know some of the readers don’t believe the Good Doctor, but this is all a giant pile of shit that WILL come crashing down. There is no valid financial infrastructure supporting this and all of these areas are still in delusional, criminal price-support by a complicit congress, a farce of a banking system, and a million Californians that don’t care if the bedroom’s on fire because they’re sitting in the living room.

Think about this for one moment: Nobody went to jail, Magnetar is still in business. Coutrywide DBA BOA, Wachovia DBA Wells Fargo. Tell me what the hell do you think got fixed? Nothing! That’s what. We are still falling into the abyss, but they put a giant safety net up that will break sooner or later, so some think we’re right back on the gravy train. They haven’t even stopped doing business as usual.

http://www.npr.org/blogs/money/2010/04/americandream.html

And don’t forget the biggest fiasco of them all, JPM and the lucrative deal they got for taking WaMu and their “$323 billion of assets” (They booked the bogus mortgages that made up the CDO’s that Magnetar built)

From Seeking Alpha, Troy Racki:

In its early chapter eleven filings WaMu’s parent company listed over $32 billion in assets and $8 billion in liabilities. Unfortunately most of those assets never materialized. Now after eighteen months of legal wrangling, WaMu’s bondholders have decided to throw in the towel.

In the settlement offer WaMu will relinquish all claims against JP Morgan and the FDIC. In return WaMu will be allowed to keep a $3.9 billion dollar deposit it held in its own bank. Most of the $3.9 billion deposit was generated from the sale of preferred securities in 2006 and 2007. Additionally WaMu will be allowed to keep $1.8 to $2.0 billion of its own tax return created from huge losses in 2008. The rest of the projected $5.6 billion return will be split between the FDIC and JP Morgan.

Who went to jail? Who lost their freaking job, thier bonus? What makes you think it won’t happen again. What makes you think it’s not happening today?

We want stability for our family and not the uncertainty that comes from know the house you are renting could also very well be headed toward foreclosure a the same time..

I know people that have destroyed their families in seeking the “stability” you mention. The economic gravity of the situation will destroy those that aren’t thinking well ahead.

To each his own.

Sabin,

Yeah, but WaMu funded some of the most impressive yearly meetups ever seen here on Maui!

…until they didn’t.

Abruptly canceled.

Dr. HB

Are you aware of any long term studies or published data regarding this Median Price/AGI ratio that displays what had been historically reasonable prior to the bubble years and what these ratios achieved during the bubble years? If one wanted to set up a “reasonableness test” related to the median price for any particular zip code using this ratio, is there any literature one could point to indicating that a ratio of say 4 or 5 was the long term historic average prior to initiation of the mega-bubble of 1999-2007? – Thanks

Mr. Madguru:

If you are purchasing an overpriced house, I would suggest that you are putting your family at risk. You are not actually putting your family in the best situation possible

If you think that price to own will decline for many years AND the cost to rent is SIGNIFICANTLY cheaper than owning, why would you do it?

If you save the difference between renting & owning, that will eventually provide a nice cushion for your family. Your saved capital will offset the risk that you lose the rental…

If you have a house that is underwater, and you need to move because of your job, what will you do? You will have to come to the closing table with a pile of cash. What if some other event forces you to move? can you do it if you have to?

If you lose your good credit score, that will make employment in the future that much more difficult to obtain.

The other thing I would caution against (may not be applicable to your situation) is that it one thing to make a mistake on a house that costs $150K. It is another thing to make a mistake on a house that costs $600K! With the 150K house, you can probably pay it off and muddle through. With the $600K house, you have no margin of error. If your income goes down, you probably won’t be able to make it.

Good luck to you.

Roberto

@Doug,

I’m sure that you’re right. Maybe they had televangelaist Kenuth Copelund open with a prayer. One thing’s for sure, we are the prey and these basturds have night vision sniper rifles.

If only I didn’t have any scruples, morals or integrity, I’m sure I could be jetting off to see Tiger instead of trying to get a jump on next weeks work–thank God I have work. I know a couple million that don’t.

But at least the Manhattan Khazars will have more middle-class kabobs on the penthouse barbie this afternoon. Goes great with a boomer-bloody mary. The Chinese aren’t the only ones that think we’re all dumb SOB’s, Donald. You don’t even have to leave mid-town.

Well, obviously incomes are not going to spike; so houses will have to come down.

And to the liar commenting about high end cars in teachers’ parking lots…most of the cars are small economy cars, while a few administrators have expensive cars. Take your BS elsewhere.

This is so true. There are so many people here in Culver City who would be “upper middle class” or even better, in most other places in the US… household incomes of $150K, whether it’s one successful dad or 2 parents sharing the load. And they absolutely refuse to accept the fact that here in SoCal, they’re simply SOL when it comes to buying a home.

The problem is that even now, most people in their homes couldn’t afford to buy them. Mom and Dad bought that Culver home for $55K in 1972, passed it on to Jr. in 2001, and now it’s “worth” $750K, at least on paper, but neither Junior nor Mom and Dad have the income to make mortgage payments on a $750K home. But that’s OK, they don’t have to, they own the home outright right now.

The issue comes when Junior is transferred to Podunk, MO and must sell the home. Junior wants $750K, based on 2006 sale prices and house envy of his neighbors. But he can probably only get $450K if he’s realistic & motivated. So Junior swills bottle after bottle of Maalox as he attempts to reconcile what he wants vs. the reality of life.

I’d love to see Santa Monica exposed to the same cold hard light of morning like Culver City. There are so many yupped-out late-30s / early 40s couples living beyond their means, it’s only a question of time before the comet falls from the sky and obliterates their dream.

The disparity between market value and the bank’s book value documents the distortion caused by FASB accounting of mark to fantasy and not mark to market.

The banks will start to foreclose now that the Federal Reserve’s Quantative Easing has ended — the bank’s entitlement to inflated equity value is now over.

In fact the age of entitlement is over.

Credit Derivatives Research’s a report that while all eyes were on Greece’s financial problems, sovereign default concerns have been skyrocketing for some of world’s largest economies in just the last month. http://tinyurl.com /yb8akkh so the Governments of the world no longer are entitled to low interest rates on their national debt.

CNN reports 33 States Out Of Money To Fund Jobless Benefits … so an unemployed person can no longer assume he has the right of unemployment compensation

For the last 12 months the swapping out of US Treasuries for mortgage debt held at banks, investment brokerages, insurance companies and others under TARP and other facilities, has monetized debt, as well as stocks, and has depressed the value of US government bonds. The ETF, RWW, RevenueShares Financials Sector has increased 78%. The ETF, TLT, hares Barclays 20+ Year Treas Bond, has decreased 28%. With Quantatative Easing gone the entitlement to further profits is gone and the likelyhood of further loss of Treasury Bond value is likely.

This place isn’t in Culver City… but I believe the sellers of this place in Downey are on to something to keep prices propped up…lol

http://www.redfin.com/CA/Downey/7932-Farm-St-90241/home/7399302

First sentence tells all…..

I have seen a number of condos here on the far north side of Chicago listed both as rentals and for sale on the MLS, and a buyer should definitely make a habit of checking to see if a prospective purchase is also listed as a rental, because the contrast between the two will tell you right away if a property is overpriced. A condo that is renting for $1200 is not worth $200-250K, especially if you have a $400 a month assessment to pay utilities and a $3000 tax bill. Same thing goes for higher brackets- if it is renting for $4000 a month it is not worth $900K. Do the numbers- your rental is half what your payment would be.

Rentals are starting to slump because of the huge numbers of unsold condo conversions coming back on the market as rentals, and there would be a vast oversupply even if the number of households had not fallen. As rents drop further, so will prices.

“This allows teachers in Calif.(average pay over $70,000 per year, per State of Calif . official numbers)…”

O My!

The average pay of teachers in CA is 70,000? Firs,t I know several teachers in state and they make no where near that amount. (And even if they were all making 70,000 wtf is wrong with that? That is the minimum amount one would need to raise a family in Los Angeles. What? Teachers aren’t supposed to be able to raise a family? You think they are worth less to society? What would you pay them?) And second here’s the thing about those statistics quoting average pay: it’s usually a small handful of superstars getting excessive pay and the rest making far less. If one looked at the animation guilds statistics on the average pay for animators you’d think we all make an obscene amount of money. There are a couple animators intown making over a million a year, which skews those statistics and masks the fact that most make no where near that amount of money. So the statistic you are quoting is completely misleading.

But hey while we’re on the subject of what certain professions are worth, what do you do? How does it help the community, or better society? How much education was required for you to attain your job? Please share.

Kevin, wow! This is surreal! House in Downey (in my view middle-middle class city, almost pure Hispanic ghetto, with typical for CA bad schools) for almost $900 000! Listed with the same price for almost 2 years! And no idea of changing the price!? Wow! When God decides to doom somebody he takes away his mind first. Indeed “touched by God” in a wrong way.

I don’t believe anyone can afford Lexis and SUVs on a mere 70k a year average salary. You don’t live in L.A. do you? Because you sound pretty clueless about how much it costs to live here if you think that after rent, taxes and other costs of living, that kind of salary gets you into a an expensive car.

Js, most luxury cars here in LA are leased (I think I read that almost 90% of BMWs are leased). You don’t need to be rich to lease a BMW or Lexus, some of these leases are as low as $300/month. Even the girl who cuts my hair at Supercuts has a new leased convertible Beemer. Welcome to the land of make believe want to be rich poseurs. It’s all about status and pretend here, people love flashing those fancy cars, nice clothing and jewelry. Peek into their bank account or 401K account and it’s not pretty!

Gene Milton where are you getting your info?

Ha! Teachers make an average of over $70k/year. Really? My husband’s been teaching in So Cal for over 10 years and he’s not making $70k/yr. Nor has he received a pay raise or a cost of living raise (never received one of these) in the last 5 years.. Where the heck are you getting your information? Furthermore, if there are some districts where teachers are being paid over $70k/yr., you fail to take into account that most districts do not provide full medical/dental — so they are a lot of educators out of pocket for those expenses to cover their family. Not to mention all the cuts teachers have taken in the last few years.

I’m glad you find educators and education to be so worthless that making $70k/yr is outrageous to you.

Doc, I understand your concern of the health of the Culver City, bubble, but you can make a better point using Torrance – the Asian investors paradise. Median household income ~$74K median price (SFRs +condos) ~$684K. The ratio 9.2! Even plugging the average family income of 89K gives ratio 7.7. It is bad here doc, really bad if one feels that urge for homeownership, for renters like me it is wonderful. There is some houses for rent (you know like those with 684K price tags) for $2000 rent. I am not kidding it is so bad, well good – bad, kinda situation. I guess I am lost … ha-ha-ha.

Here is my data source – official census

http://factfinder.census.gov/servlet/ACSSAFFFacts?_event=Search&geo_id=&_geoContext=&_street=&_county=torrance&_cityTown=torrance&_state=04000US06&_zip=&_lang=en&_sse=on&pctxt=fph&pgsl=010

I’m afraid what is being pointed out here is a growing trend of the middle class getting squeezed out. Most of the SoCal region is more economically polarized than most other parts of the the country. Culver City is a great example of if you don’t already have some skin the game and you have what would be considered a decent income in most other places with similar housing attributes, you’re priced out. Even rents are still out of wack because most of those places for rent are junky. Welcome to the reality of Los Angeles.

I’d like to see the area suffer some more price declines because I think it would be just for a whole host of reasons but unfortunately I think there are enough middle class people who have skin in the game that are in a position not needing to sell. The rest of the middle class folks are left fighting for scraps.

I think Los Angeles is somewhat of a lost cause on this front. The city and region is just a mess from so many perspectives it seems insurmountable. I just hope this isn’t a preview of the standard of living to come that might spread to every corner of the rest of the country.

I would guess that the shadow inventory is also understated. Up here in Northern California (specifically, San Jose, Willow Glen, Los Gatos), I know first hand of many houses that have been put on the market in the last 1-2 years and didn’t sell. In addition to that, I’ve heard many people say they would sell if they could “get out”.

This can’t end well.

Average teacher salary in Calif. is $70,458.

SOURCE: National Education Association-

umbrella organization for teacher’s own unions.

Teacher salaries in Palo Alto, Ca

Starting salary (BA)-$51,422.

Top salary $103,836.

Source: Palo Alto School District

Have you guys heard of the Rent Affordable Modification Program?

KSLA:

Wish I could remember the name of the study I read a year or so back

that covered the Medium Price/Med.HI of Greater LA homes since 1970.

I do remember, clearly, that over the course of 3 RE mini-bubbles/corrections up to the 1996 bottom, the ration was from a low average of 3.2 to a high average of 4.6 and that the same areas measured 10.4 top price by the end

of 1st quarter, 2007. The national average was given at 2.85x, so the so

called “California Premium” was already factored in for decades. Saving

SoCal is different is meaningless.

If the medium house in Culver City is now valued at 7.5-8x household income of a given zip code, then prices should fall by half based on the historic

ratios. This only changes if the folks in San Marino suddenly decide

they’d all rather live in Culver City. Don’t think this is going to happen.

Hope this helps. I’m sure Dr. HB has some data to back the numbers

I’ve just quoted.

“Have you guys heard of the Rent Affordable Modification Program?”

Oh, you mean the Own-to-Rent program, where the banks turn the former “owners” of deep sea underwater houses into renters, offering them super low rents or even free rent for 6 months, a year etc. if they promise not to wreck the place? I remember reading about that nonsense mid to late last year. That was hilarious.

Teachers 70k – outrageous

Mozilla 70 Million and no jail time – commendable entreprenuer.

It is so f-d up right now.

Dow stalled at 11,000. Alcoa not seeing green shoots in US. The bear-market rally stalls here and it’s back down into the abyss again. Could be tomorrow. PPT better show up with their checkbook and they know it.

@GAEL – Good comment last topic:

“And having to please shareholders…privately owned companies are able to adapt faster and easier to changes in the market and tough times because they aren’t burdened by this. By allowing big corporations to buy up and drown out competition from smaller companies we have put our entire economy in a fragile situation where too big to fail endangers so many. Monopolies and mega corporations are unhealthy for any society that needs to weather economic ups and downs. Bigger is not always better.”

I concur that as soon as a company goes public, they are the property of Wall Street — not the shareholders. But it matters not. Shareholders only care about making money too. Long-term company growth takes a back seat (or the trunk) to unsrupulous practices, misallocation of resources, layoff workers for a quick stock-price blip. Most are so ill-informed they think it’s a good think when they raise capital by diluting common shares.

Housing is the same–if there is too much money flying around and the market is manipulated, it all gets skewed, and the regular folks get screwed.

I nominate Laguna Niguel for the next round of “Real City of Genius.” Here is the Zillow link to a 2 bedroom, 1400 square foot condo, circa 1960s (albeit remodeled), currently listed for $850,000.

http://www.zillow.com/homes/Laguna-Niguel-CA/31705-Crystal-Sands-Dr/2133922103_zpid/

The very next listing on Zillow offers a slightly larger condo on the same street, in the same complex, but it is a rental listing, and is only $2,300 per month.

(If the link doesn’t work, the two addresses are 31705 Crystal Sands Drive and 31679 Crystal Sands Drive.)

Sabin,

Tony Robbins was the motivational speaker of choice here:

Luxury Resorts were turned into Mini-Jonestowns for the

duration of his seminars.

Tony Zombies trying out their newfound skills on resort employees,

as Tony slummed at his $10K per night Suite at the Grand Wailea.

Stability, like character, cannot be purchased. Beware of those who claim to sell it to you.

~

rose

@Doug

How were the Kahlua Koolaids?

Kid,

The little umbrellas aided the sales pitch to the kids.

Thanks OT

I have been obsessing over promoting acceptance of a “reasonable index” or contrasting value to be used in conjunction with current market value for any specific home. Use of rental data is one way, use of area income data is another. When basing this on area incomes, being able to cite a study would be very helpful towards standardizing the incorporation of this factor or ratio. Appraised value (market value), while interesting, has limited use as a standalone value IMO and can be dangerous if relied on exclusively with regard to the collateral (house) as we have seen.

‘US Existing House Price / Median Family Income’

http://www.ritholtz.com/blog/2009/02/us-existing-house-price-median-family-income/

A graph showing ratios for the period 1965 – 2008 (ratios range approx: 2.2 – 5.2)

(Barry Ritholtz – February 20th, 2009)

——————————————————————–

Housing Bubble Why Do Houses Cost So Much?

(by Randal O’Toole) February 2006 Volume 20, Number 2

http://www.libertyunbound.com/archive/2006_02/otoole-houses.html

For decades, planners have worked at raising the price of housing. When prices go down, they may take the rest of the economy with them.

(excerpts):

– According to 1970 Census, housing in 1969 was affordable everywhere in the U.S. except Hawaii and parts of the greater New York metropolitan area.

– At a price-to-income ratio of 2, a family dedicating 25% of its income to a 5.5% mortgage would pay it off in eleven years, which is affordable. If the ratio climbs to 3, the period would be a marginally affordable 22 years, while at 4 it would be an unaffordable — because no lender will loan for that long — 55 years.

– In 1969, price-to-income ratios in Honolulu, which has very limited amounts of private land available for development, were just over 3, while they ranged from 2.4 to 3.1 in various parts of the New York area.

– But in 1969, San Francisco and other California regions such as San Jose, San Diego, and Santa Barbara all had affordable price-to-income ratios of less than 2.3, which is less than the national average today. Nationwide in 1969, the average price-to-income ratio at less than 1.8 made homes very affordable.

– By 2004, says the Census Bureau, the national average price-to-income ratio was 2.8, again mainly due to increases in those regions along with Florida and other states on the East Coast.

– By the 1980 census, price-to-income ratios in many California regions, including Los Angeles, San Diego, San Francisco, and San Jose, ranged from 4 to 4.5, and Santa Barbara was a staggering 4.8.

– As The Economist noted in early 2005, in many places “it is now much cheaper to rent than to buy a house.” In many places the differences between home prices and rents is greater today than it was in California in 1989, so a correction could easily see home prices falling by more than the 15–25% they declined in California by 1994.

– San Jose is the clearest case of a housing bubble. Between 2001 and 2004, the region’s employment declined by 17% and office vacancies increased from 3% to 30%. Yet housing prices in the same period grew by more than 20%. Clearly there is no support for such increases other than the expectation that prices will continue to increase indefinitely.

Laura Louzader- it is great to see a fellow Chicagoan on this message board. I know that primarily most of the people who post are from Southern California. But I would like to offer a bit of perspective from the heart of the Midwest.

As far as rents are concerned, I have noticed that a lot of people instead of selling their condo or house for a huge loss will just rent it out. But there lies the problem, other people who are in the same boat are doing the same thing.

Just as we saw housing prices take off during the housing boom, some would be landlords have no clue on how to properly price their rental units. At what point will these geniuses decide to lower their rents?

Per NEA, avg salary for a teacher in California is $65,808.

http://www.nea.org/assets/docs/010rankings.pdf

Just a note. The “1%” monthly rent mentioned in the blog post is not enough. Across the US, in virtually every market, multi-year studies have found that landlord expenses typically run about 45%-50% of the rental income stream. This number varies a lot from month to month, due to various circumstances but over time it tends to average out to that. Due to that investors that are looking to make sound investments and not take major chances of a certain property failing must typically seek at least about 2% of the purchase price per month in rental income so as to pay for expenses (including the mortgage and lost opportunity expenses on any cash laid out) and still make a profit for the trouble. Although always do your numbers, I found nice areas in western NYS requiring at least a 3%/month.

On a simple example on a 1%/month property you’d make about 12%/year.

Over that same year your expenses run:

6%/year – property operating expenses

6%/year – mortgage interest and lost opportunity costs on the purchase price

Oh well your now out of cash. 🙁 No payment for your trouble. And the above is assuming a really, really low rate for an investment property and only counts the interest. You will have to lay out payments towards the principle every month. Willing to do that on an “investment” with no profit? And btw, the size of the down payment does not matter. Whatever extra monthly income you make by having a larger down payment is lost in lost opportunity costs on that cash.

On a 2% property you have a decent investment, assuming you do not manage it badly.

On 2% you make a 24% income stream over the year.

12%/year – property operating expenses

6%/year – mortgage interest and lost opportunity costs on the purchase price

This leaves you with about a 6% return on the money you have at risk, with room for a reasonable interest rate, your principle payments covered, and breathing room in case something goes wrong.

More realistic example.

12%/year – property operating expenses

7%/year – mortgage interest and lost opportunity costs on the purchase price

~3%/year – approx average payment of principle payments.

~2% cash return on your investment.

Great post, FYI.

I read that the average salary for teachers is $57,000 but still not bad for a part time job.

Well it is a part time job!

I grew up in Culver City. It was an ideal 1950s type village in the heart of West LA up until the early 1980s. The schools were fantastic, actually the most desirable outside Beverly Hills at the time, now my understanding the tri-district is the same as LA even taking in LA just for money. The people in Culver City at the time were great. It was the real heart of Hollywood and to go around the old lots especially MGM was a dream come true for a teenager. We had no crime, the entire city was clean, no traffic and shopping was limited but a trip to Santa Monica or Beverly Hills was easy. A house on average was about $150K. I got out of LA in the early 90s. What I see has happened to Culver City, the loss of the grand studios that made the place famous, the crowding, the influx of all that expensive pricing is in my view just a bad joke. To see houses in Culver City today in this economy with ratios above Beverly Hills (our high school rivals btw) it sheer insanity. I’d rather remember the un-greedy, warm and ideal Culver City that WAS the center of Hollywood and the old MGM and Selznick/Culver studios as I lived around it all years ago. What this town has become in my opinion is one I don’t want to see.

Leave a Reply to Sabin Figaro