Is the condo market a leading indicator of lower home prices in cities? Culver City condo selling close to 1989 price. Culver City condo market shows dramatic price decreases.

Trying to read the housing market tea leaves is a challenging exercise but one indicator that seems to indicate changes in future prices is the condo and townhome market. It was interesting to see the action in the condo market here in Southern California where builders converted many large buildings into a readily available supply of condos. At times this came at the expense of converting apartments into this new lucrative venture. What is interesting is the quick changes in condo values indicating an oncoming bubble or crash. This occurred in the previous housing bubble since it is easier to qualify for a condo than a home because of cost. Of course this bubble was an anomaly since checking income became an optional endeavor in purchasing a property. The condo market shows us an interesting preview of quick changes as the Inland Empire condo market imploded faster than that of single family homes. Today we are seeing major cracks in the Culver City condo market.

Culver City condo market

Condo prices in Culver City have completely collapsed in the last couple of years. In fact, there are condos to be had that are likely to cost less than renting. Take this place for example:

5870 GREEN VALLEY CIR 214 Culver City, CA 90230

1 bedroom, 1 bathroom, 1 partial bath, 557 square feet, CONDO

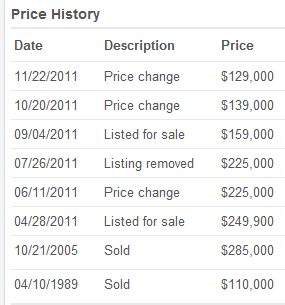

This is an interesting and small condo in Culver City. Some people are extreme zip code chasers so this might fit the bill for those trying to stretch their income to live in a prime L.A. location. The above condo is listed as a short sale. The current list price is $129,000 which is one of the lowest priced properties I have ever seen in Culver City and I have tracked this market for well over a decade. Let us take a look at the price history here:

This is incredibly fascinating. This Culver City condo is selling for a price close to that last seen in 1989! I remember getting countless e-mails of people looking to buy something (anything) out in or near the Westside in 2005 and 2006 even if it meant cramping into a tiny condo. Well here is your chance and it is likely to cost you less than renting.

Care to see another example?

5625 GREEN VALLEY CIR #104 Culver City, CA 90230

1 bedroom, 1 bathroom, 0 partial bath, 804 square feet, CONDOÂ

This place is bigger being listed at 804 square feet. Another short sale and it is listed at $150,000. Did I mention we are talking about Culver City here? You know, the once untouchable homeland of never falling home prices here in SoCal? Well apparently the housing correction is hitting in full swing in the condo market here and if other U.S. housing markets are any indication the single family market usually follows.

Culver City homes

Culver City home values are still nicely inflated but prices are coming down. Take a look at this home:

4415 Corinth Ave Culver City, CA 90230

2 bedrooms, 1 bath, 810 square feet

This single family home was built in 1946 and is listed as a short sale. You can find some chasing the market lower action here which is part of the status quo with shadow inventory properties:

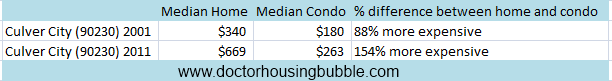

Not many people jumping on this one since it has been listed on the MLS for well over 250+ days. But its Culver City right? You are seeing a massive gap between condo values and home values in Culver City. This gap is always present no matter the market but the gap here is incredibly distorted. Let us look at the 90230 zip code in Culver City and take a snapshot of today versus one decade ago:

What we are seeing is the condo market quickly adjusting to the new realities to the overall economy and large shadow inventory while the housing market remains in a bubble. This seems to be a common pattern where condo markets contract first followed by single family homes. Why does this pattern unfold?  First, it has to do with the inability for inflated prices to stay high for a very long time. Next, the very low prices on condos will likely entice some people to jump into these properties away from single family homes. The current price gap between houses and condos is simply too large.

Culver City’s condo market seems to be facing a large cut in prices. Home prices seem to be adjusting much slower but given the large shadow inventory it is hard to see it not correcting further in 2012.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

32 Responses to “Is the condo market a leading indicator of lower home prices in cities? Culver City condo selling close to 1989 price. Culver City condo market shows dramatic price decreases.”

This article illustrates an important point. The properties that might be entering reasonable price territory (debatable) have things desperately wrong with them. The Corinth house is right next to the fourth busiest highway in the U.S. Sentient beings should not have to live so close to the noise and air pollution.

The properties near Santa Monica Airport are another example; the jet noise is deafening and you can even smell the fuel from many blocks away. Why do we allow jet traffic in residential areas?

The Westside market is driven by emotion, not common sense.

A better question is “why do we allow houses to be built near airports that existed long before the housing did, then have to listen to people bitch about airplane noise for the next couple of centuries?” The Santa Monica airport is one of the oldest airports in California; Many people forget that a short time ago, Santa Monica was not the uber-pretentious west-side destination it is today. It was fertile farmland and rural! There’s a great history of the airport available here: http://www.smgov.net/Departments/Airport/Airport_History.aspx

Completely agree. Lived on the Westside (Santa Monica) since the 1980’s. It is driven by emotions, not common sense as you stated. I will never own again there, not worth it, nor can I justify the prices, also not to mention the ridiculious increase in sales tax in the city of Santa Monica.

HOA fees drive up condo/townhouse cost to own.

exactly.

Out in the IE, you come across nice units in decent neighborhoods where payments would be 300/400 a month with 20% down, but then when you add in HOA at the same amount, you can get a house for the same price and have a larger interest write off on your income taxes, HOA are just money down the drain.

Property taxes and inflated maintenance costs drive up the cost of owning a house. But, at least you don’t have to cut the grass or clean the pool at the condo.

Ancient Chinese Proverb quoted by a certain Sheppard of Tarzana ilk say, Watch out! Woman who fly upside down in airplane surely have a crack up. Watch out Culver City!

Condo prices are also down in Sacramento and close to 1989 prices, however, check the HOM fees and you see they are almost double what they were three years ago in that the banks and those underwater are not paying the dues. $320

a month in a nice complex of two story condos with a pool and clubhouse. Almost

as much as a monthly house payment including taxes and insurance.

In markets where condo’s are the unusual product, they’re the canary in the coal mine. As people only tend to buy them when they’re desperate to buy a home.

“desperate” I think is overstating things. I think there’s a market for condos with seniors who can’t or don’t want to maintain a house. Not all of us have children who need a yard too. I think CAE’s biases are showing.

It’s about time. The condo prices are approaching the price level they should be at. Currently the condo prices are 46% above where they were 10 years ago. Inflation in the past 10 years was about 30%, so the prices need to drop only a little more to start making sens. Of course, it would be much better for buyers if the prices drop to 1996 levels.

The one bedroom condo market is truly a separate, all to itself portion of the overall housing market. The one bedroom unit generally appeals to eventual move up buyers, who want to have a place to live, make good money on resale, and be able to sell readily. Other than that, it appeals to those who are confirmed singles who plan to settle into cheaper housing, basically. Well, the mobility loss and overbuilding for singles who now know enough not to buy and get trapped in a losing proposition, means the one br. condo is now a well known and defined disaster for the young, wannabe mobiles. That is not new; there were condo busts of all magnitudes several times since 1972, all for the exact same reason, but especially as to the studio/1br types. I reviewed condo prices in many markets, even such places as skokie, ill…disaster everywhere. Look at Vegas, too, especially for the one br. condo’s. Add to that the factor that if a certain percentage of the units are leased out, FHA financing is no longer allowed…that both scares buyers and where leasing is restricted, cuts off investors. Investors are a huge piece of today’s market action, as they are willing to buy to rent out (thus trapped) to those who want the mobility. Once there is a surplus of condo’s, that aren’t moving, the next group of buyers sees the trap develop and step back in unison, and that’s the end of that market! Wait until the factor of young singles with big debt to their education loans fully hits, in about three or four years and see if it gets worse, much worse, in most cities, as to all these condos. As to the two br. units, they are harmed by the plummeting values of the one brs in their building, there is some crossover, etc, thus they also get slammed for/by the same factors and more.

The stories out of Florida are also endless as to how this is all playing out, but one bedroom condominium units stand out as disasters time and time again. Studio units too, of course. The monthly fees/reserves apparently can also get hugely out of control at some buildings, compared to rentals let’s say. Now, the good news here…well, there isn’t any. Avoid these like the plague, either as investment or a place to live, for at least the next three years. ESPECIALLY for the resort type units.

One of the best investments I ever made was a one bedroom co-op in Bronxville, NY, during the last housing crash there (NY metro) in the early ninties. Bought it for 65 grand (prime building), and it sold for 310,000three years ago.

I do agree that the young buyer may not be there this time to send the price back up. Still, if it drops to an affordable level, one has to compare the rent/price ratio.

Ummm….I daresay that the condo you mentioned will be one of the best buys you EVER make. The $65k – $310k appreciation in that time period will never happen again and we all know it.

That capital gain was based on nothing but delusion, wishful thinking and widespread greed.

Yeah, well, I’m pretty much an RE bear, but, never say never. When I offered that lowball price I was surprised at how quickly the owner jumped. We were at the bottom, but, the ex and I thought, wow, maybe we could see another 30% drop from there. My guess is that there are a lot of smart and/or lucky buyers in Miami and Vegas and some other locales who will make a ton of money over twenty years on the very cheap RE they are buying today. Not many, but, some.

Hi Doc, I think it might be helpful to also include the HOA fee, if any, for the listings you used. Everytime I became interested to a condo/apartment listing I was turned off later by the hefty monthly HOA fee.

I always enjoy reading your posts! There’s something odd going on with those condos though and it’s been going on for a very long time. They’re always super and memorably super cheap. I’ve seen them popping up for over five years and they’re always far, far below anything else available. It might be interesting to look into if I have a chance. I originally assumed that they had a huge assessment levied, but it’s been at least 6 years and they remain the lowest of the low.

1989 was a bubble. $110,000 would be too much to pay for this shoebox. Using super low interest rates combined with bubble rents to purport affordability based on “rental parity” (the newest (r)ealtor manipulation tactic) is disingenuous at best and downright manipulative at worst.

Let’s see what these units were selling for in the mid 1990’s shall we?

1995…

1054 sf 1BR…$74,000

http://www.redfin.com/CA/Culver-City/5870-Green-Valley-Cir-90230/unit-321/home/6653944

1996…

901 sf 1BR…$64,000

http://www.redfin.com/CA/Culver-City/5870-Green-Valley-Cir-90230/unit-117/home/6653771

1997…

909 sf 1BR…$75,000

http://www.redfin.com/CA/Culver-City/5870-Green-Valley-Cir-90230/unit-118/home/6653775

1998…

882 sf 1BR…$80,000

http://www.redfin.com/CA/Culver-City/5870-Green-Valley-Cir-90230/unit-315/home/6653922

Care to see more?

Always do your research, future homedebtors. This home is far from being a bargain.

The downside risk in a one bedroom is minimal at these price points compared to rents… I could have bought and paid off this condo at this price point, if i hadnt rented from 2002-2011. The biggest risk lies in the HOA fees and trouble finding buyers.

But no renter is gonna to live any cheaper without roommates. I personally dont like condos due to hoa fees though.

My cousin was assessed $5,000.00 on her one bedroom condo in Brentwood. You have to keep in mind that if a roof needs to be replaced and there is not enough money in the coffers then the association can assess all condo-debtors….

There are several good thoughts on this topic upthread. One more: I think you have to be super careful about condos built in the 70’s. I used to live in LA, where the climate is a tad easier than it is up her in No. CA, but I am very wary of 70’s construction. It occurred during a prior mania in housing, and it predates many of the current building code requirements. Up here, I have seen condos built in the early 70’s get smacked with $40,000 assessments for deferred maintenance. How’d you like that to happen to your ticky-tacky condo?

Another factor affecting these properties is undoubtedly the great difficulty financing them, and the high HOA dues. Especially dangerous if lots of folks suddenly or gradually move out, and now eight people have to pay 20 peoples’ dues. Or worse. It is true that properties such as this could be cheaper then renting, but renting always has that 30-day exit strategy and that, as far as I’m concerned, is worth something in an unstable RE market. Nice article, Doc!

Yet Another excellent reponse from the informed readership of DrHB. Pretty much the same story here in So-Fla, with thee absolute worst, most corrupt construction having been done in the 1976-83 period, though pretty bad in general from 1972, up until the acid test known as HURRICANE ANDREW, 1992.

You can look at the aerial photos from Andrew’s aftermath, and clearly tell the decade built by level of destruction, verified by cross-ref to property appraiser records, lol.

What actually happens is the Hoa is underfunded and you get wolloped with a big assesement, not necessarily an increase in monthly fee’s

People always complain about HOA fees, but home buyers never factor in maintenance cost for a single family property. Need a new roof, sewer line, copper piping, electrical? People need to budget maintenance cost with the PITI. Do they even budget the gardener? I doubt it. So all of a sudden something goes wrong and they are screwed, when they are putting 60% of their total income into the PITI. Then don’t forget the hours and inconvenience of having a major repair done.

I’m not arguing for HOA’s, but I’m saying it is part of every budget for ownership whether you like it or not. It is a major consideration of mine, especially with these houses built in the 30’s and 40’s.

Looked up Burbank Condo’s and Townhouses on Trulia for curiosity. Lot’s in the foreclosure process but the resales, and short-sales are still stupid high. Guess Burbank has a long way to go.

Condo/Townhome prices in Orange County down 13% year over year. Condo cracks are everywhere now.

Well condo prices are down but in cities like Irvine they are still very high…condos selling for $500000…Now I have started thinking that prices wont go down in Irvine because of Asian community who is ready with cash all the time….

The two condos listed are in the Fox Hills region of Culver City. This particular area of Culver City is medium to high density condos and apartments. The Fox Hills region is mostly African-American. It is adjacent to Ladera Heights. Ladera Heights is about 75% African-American. Ladera Heights is part of the Inglewood School District. Parking for visitors to Green Valley Circle can be very difficult due the medium to high density housing situation.

Historically, since most of the buyers in the Fox Hills area of Culver City are African-American, what may be driving the condo price plunge is a lack of prospective African-American buyers.

The Manhattan condo market got through tlelast 4 yeras unscathed for the 1%, see this weeks NY Times article.

In any other week, in any other city, in any other building, the sale of a three-bedroom apartment for $24 million — the most expensive transaction of the week, according to city records — would not go unnoticed.

But in the same week, in this city, the reported sale of a penthouse in the same building, 15 Central Park West, for a record-shattering $88 million, to the 22-year-old daughter of a Russian oligarch, dwarfed the first deal and made all others seem rather ho-hum.

The 6,774-square-foot apartment, which fronts on Central Park, was being sold by the financier Sanford I. Weill and his wife, Joan, who paid $43.7 million for it in 2007.

The sale is still in contract, and the records of the transaction have not been made public, but if completed it will become the most expensive New York apartment deal ever, crushing the $53 million paid by the investor Christopher Flowers for the town house at 4 East 75th Street.

Word recently leaked out that Mr. Weill and his broker, Kyle W. Blackmon of Brown Harris Stevens, had found a buyer willing to pay full price. This week, Forbes confirmed that the buyer was Ekaterina Rybolovleva, the daughter of a Russian billionaire, Dmitriy Rybolovlev, obtaining a statement from her representatives.

“Ms. Rybolovleva is currently studying at a U.S. university,†the statement read. “She plans to stay in the apartment when visiting New York. Ms. Rybolovleva was born in Russia, is a resident of Monaco, and has resided in Monaco and Switzerland for the past 15 years.â€

Ms. Rybolovleva’s father, whose worth is put at $9.5 billion and who is ranked by Forbes as the world’s 93rd-richest person, began to build his fortune in the early 1990s, in the chaotic days after the fall of the Soviet Union. He bought interests in industrial companies, eventually controlling one of the country’s largest potash fertilizer businesses. Like other oligarchs, he fell afoul of the powers that be; in 1996 he was accused in the murder of a businessman and spent nearly a year in prison. Ultimately he was acquitted for lack of evidence.

This is not Mr. Rybolovlev’s first foray into mammoth real estate deals in America. In 2008 he paid nearly $100 million for Maison de L’Amitié,Donald Trump’s 33,000-square-foot estate in Palm Beach, Fla.

The sale of the other apartment at 15 Central Park West, on the 31st floor, attracted little notice, though it further solidified the building’s reputation as a property that can do no wrong.

George Logothetis, a shipping magnate, and his wife, Nitzia, had owned the apartment, which they bought for $12.93 million in 2008. The new owner bought it under the name of a company called Mac Holdings, according to city records.

I would not buy a condo. Some cheaply built with thin walls, skimpy floors; it’s not as simple as giving a sixty day notice to the landlord when a lease is up to forever escape the two families living in the two bedroom next door, or the couple living directly above that are up all night exercising, fighting, or practicing wrestling moves.

Dear Doctor,

The house at 4415 Corinth Ave Culver City, CA 90230 is technically not in Culver City but in the City of Los Angeles. The house share the zip code as Culver City. The house is located in an area west of the 405 freeway known as Del Rey.

http://navigatela.lacity.org/common/mapgallery/pdf/neighborhood/70.pdf

$400K + seems like a bubble price for this tiny old house on Corinth, even if it happened to have recently been renovated. Lots more downside price potential exists.

Here is what I have experienced in the prime San Diego zips. Buyers are replacing investors. Why? because investors know prices are too much of a moving target downward, so they’re on the sidelines watching over exuberant (buyers) thinking they’ve seen the worst, jump back into the market with both feet. Here’s a question for everyone; do you think things are more stable then they were a year ago worldwide. Is our economy better than last year, what about all those people in the streets worldwide. How about the shaky Middle East? Does all of this portend a brighter future? Sorry, I think not. As for real estate, of course it’s a good deal, just ask your agent for his/her opinion…

Leave a Reply to wwang