Chinese buyers heavily focused on California real estate: 70 percent of purchases made by Chinese buyers are all cash purchases.

The amount of all cash offers being made across the country is deep into record territory. Once again, the real estate market is crawling into unchartered waters here. We all know about the flood of money coming from hungry Wall Street investors ravenously chasing yields in the rental game. What about foreign money floating into the market? Data on this is hard to come by but anecdotally we know that money from China is flooding into California. How much? Hard to say but some good data was recently released regarding the buying habits of foreigners. Some will remember when Japan lived through their boom and money flooded into California then as well. The big difference this time is that China has more than 1.3 billion people versus 127 million for Japan. In other words, the potential for a high volume of activity is now starting to be seen in dramatic fashion.

Chinese purchases focused on prestige locations

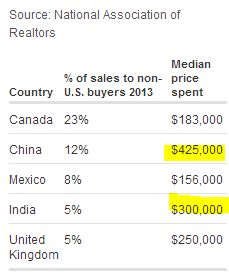

One of the most interesting figures regarding international demand is with the typical amount spent on a purchase:

Source:Â CNN Money

“(CNN Money) At a median price of $425,000, the Chinese are also buying more expensive homes than other foreign buyers, who spent a median of nearly $276,000 on U.S. homes. And nearly 70% of those pricey Chinese deals were made in all cash.

Nowhere is the influx of Chinese homebuyers felt more strongly than in California, where more than half of the homes sold to foreign buyers went to Chinese nationals.â€

A couple of points. You’ll notice that the largest percentage of international buyers come from Canada but the median price paid for a home is $183,000. Many are “snow birds†or retirees buying in areas like Arizona and Florida, hence the lower price. You’ll notice a similar trend from international buyers from Mexico although for different reasons and many are buying in places like Arizona, Nevada, and Texas. The median price here is $156,000. Yet for buyers from China, the median price paid was $425,000 which reflects a preference for more expensive coastal regions like California.

The data shows that half of Chinese real estate purchases were targeted in California. The flood of all cash buyers is still in full session. What I would also argue is that this is highly focused purchasing in areas like Irvine for example where some realtors actually have special services for this client base.

California all cash buying

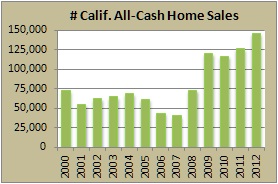

Last year California saw a record breaking number of all cash purchases:

“(DataQuick) Cash purchases accounted for a record 32.4 percent of California’s overall home sales last year, up from 30.4 percent in 2011 and more than double the annual average of 15.6 percent since 1991, when DataQuick’s cash statistics begin.â€

A large number of all cash purchases came from Chinese buyers. What is fascinating about this dynamic is the incredible volume of non-traditional buyers (i.e., those simply buying a home to raise a family and plant roots). In California, for the entire year, one out of every three purchases went to Wall Street investors, hedge funds, flippers, or foreign buyers. Compare this with the more typical 15 percent average going back to 1991. I would say this number is also a bit inflated given that in the 1990s you had many all cash purchases being driven by the tech bubble and in the 2000s, a lot of this was driven by the real estate bubble. Today, we have a different audience that is coming in with all cash offers.

What is interesting about the foreign demand especially from China is the direct targeting of prime markets:

“Most purchase the homes to raise their family and they pay special attention to the local school systems. Turley also has Chinese clients who buy homes for their kids. Last year, a family from Shanghai bought a condo for their daughter who was attending Stanford. The daughter has since graduated and now works at Google, he said.

Many Chinese buy homes through the U.S. government’s EB-5 Immigrant Investor program, which is considered a fast-track to getting a green card. To qualify, foreigners must invest at least $500,000 in a business that provides or preserves 10 jobs. This could be a home that is part of a bigger business project, such as a condo complex. Nearly 80% of all EB-5 visas went to Chinese nationals in 2012, according to the government.â€

80 percent of the EB-5 visas went to Chinese buyers even though they made up only 12 percent of all non-U.S. buyer purchases. It should be abundantly clear that the all cash flood of money into real estate is not one homogenous group.

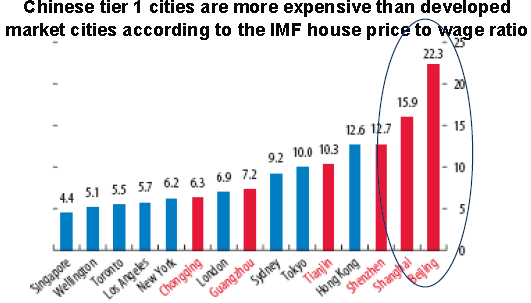

And while we may think that California real estate is manic just take a look at real estate prices in China:

Source:Â SoberLook, Credit Suisse

In relative terms, even the insane market in Toronto looks affordable when compared to large Chinese cities. Beijing and Shanghai are at levels beyond what we even reached during the apex of our own housing bubble.

So what longer term implication can we derive from this? I think that this will be large pool of all cash buyers that will depend largely on how well China’s economy does. High or low rates in the US might impact domestic buyers but this does very little for this group. Given the massive growth of the Chinese economy over the last decade, the trend is now being seen dramatically in foreign home purchases. However, this is very targeted to coastal California regions (little evidence showing buying in the Inland Empire or Central Valley for example).

Do you have any examples or stories of foreign purchases of real estate in California or other parts of the US?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

87 Responses to “Chinese buyers heavily focused on California real estate: 70 percent of purchases made by Chinese buyers are all cash purchases.”

Global capital is flowing into the US and it’s not buying govt debt. So it’s buying up all kinds of assets with US$. Driving up the DXY and any markets it’s going into despite the less than stellar economic data coming out. So interest rates are rising at the same time and this will take its toll as it climbs.

Half of the Fed wants to end QE this year:

http://www.marketwatch.com/story/half-of-fed-sees-qe-end-late-this-year-2013-07-10

Re-fis down over 50%:

http://blogs.marketwatch.com/capitolreport/2013/07/10/refinancing-plans-cut-in-half-over-past-two-months/

Mortgage apps down 23% last week:

http://www.marketwatch.com/story/us-mortgage-applications-down-23-last-week-mba-2013-07-10-94852252

FedEx and UPS warn of slowing GLOBAL demand:

http://money.cnn.com/2013/07/12/news/companies/ups-earnings/index.html

China is slowing drastically. What happens if their economy takes a dive?

Interesting read:

http://www.marketwatch.com/story/china-trade-data-disappoint-as-exports-fall-31-2013-07-09

From the article: “After China posted an April gain in exports sharply higher than estimates, many analysts attributed the performance to poor data-gathering, exporters logging fake orders to help their tax bill, and capital inflows being disguised as exports”.

Add to this the costs of massive population migration from rural areas to cities, and the new cities they are building just to keep these migrants busy, paid and happy. BTW, many of these cities are sitting empty.

If the Chinese start hurting financially, the effect will be disastrous for us but great for the housing market. Glass half full and all that…

So I have been reading about these local gov officials there who are paid a salary of $800 a month and yet can buy $1 million dollar houses in California? How does that happen? Where does that $1 million money come from? I read in China Daily newspaper about one local official there who they recently arrested who had purchased 20 apartments in Beijing and 10 in Shanghai on his $800 a month salary. Quite extraordinary!

Cornfusis once said ‘Woman who Fly Upside Down in Airplane have Really Big Crack Up”, sooo, an $800 a month salary as a party worker-crat is multiplied by the number of hats under the table.

I, for one, welcome our Chinese Overlords.

http://www.businessinsider.com/chinese-outlook-on-economy-worsens-2013-7

This might help slow the all cash purchases. Keeping my fingers crossed for finally being able to find a home early next year!

Just ask any Tibetian for their opinion on that subject.

Why don’t you ask the native Americans how they feel about you buying up their land.

Tibetans will reply, We want to fight for independance, as long as we can use that as excuses to get a U.S. asylum. We want a piece of U.S. housing market as bad as the Chinese.

Now that China’s economy is decelerating, those with money need to shift their investments not in the stock market but elsewhere. Probably wont see any correction in the San Gabriel valley for a long time.

Chinese stock market has been a joke for individual investors and not many made money there. Most wealthy people park their money in real estate, China or elsewhere.

I knew a woman who was born in Vietnam in the early Seventies. Her father was a high-ranking South Vietnamese officer. He kept buying more land and buildings with his money. His wife often argued with him and wanted to buy gold instead. One fateful day they took the last helicopter out of Saigon…without the real estate.

Think about it.

We rented for a year after selling our home in 2012.

The owner sold the Oakland hills condo when we finished our lease

The buyer was a Chinese national – no financial contingency on offer

Listing price was $567K for 3 BR condo with Bay view and purchase was over listing but not yet recorded (listing removed) – one open house and offer made/accepted

Probably closed around $625k – lousy school district, bankrupt municipality and growing crime problems – taxes/fees >$!0k, HOA > $5k, Utilities extremely high especially water sewer charges run .$150/mo with minimal water use (no yard or landscaping)

Peak price for property was $780k in 2006 and market bottomed out in 2011 at about $500k for this unit – tricky buy at this price, probably has $70k deferred maintenance items and upgrades (kitchen was circa 1990, bathrooms need upgrade at this price level), our impression was that crime and scool sitution were deteriorating rapidly although this complex more secure than other areas nearby. A car is needed for transport

This is becoming absurd. Big Ben wants to see better unemployment before tapering. He is not going to see it. So QE never ends. QE never ends dollar is destroyed. Dollar destroyed means GOLD and interest rates to the moon. GOLD and Interest Rates to the moon means no one can afford homes except investors. (Let this all set in)

Who do the investors sell to now? Us the peons can’t buy it because we can’t do all cash and now we cant afford a mortgage.

Don’t tell me they will rent them all out and we are serfs. I do not have the numbers but in SFR’s I would imagine investor ownership is way less than 10%. So that still leaves 90% of homes that need to price in the free market. Based on the above I think these prices come down. WAYYYY Down.

Please explain how cound gold price and interest rate both shooting up to the moon at the same time, with QE never end? I understand gold price could goes up due to currency devaluation effect of QE, but isn’t that also push the rate low?

I think that gold price and interest rates can go ‘up to the moon” simultaneously at the time when the government can no longer control the bond market. At some point bond market investors stop buying US bonds and lose their faith in American bonds. Government cannot repurchase them to infinity.

A nervous Big Ben seems to be thinking his QE taper teaser didn’t go off as planned and it seems like QE will likely continue. I couldn’t believe he admitted that the stats behind the labor nums were not as rosy, being that QE is so labor dependent. Could/should bring mortgage rates back down or level them off….I think. 😉 I mean it is blatantly clear there is no recovery (besides bankers n minor wealth effect for some) and the plan is extend our comeuppance and pray things get better during that extension. Good times. I normally love riding roller coasters, but I’m real f-ing tired of this one already.

I didn’t know that praying was a sound business (economic) strategy. Where is that statistic in the stock quote?

Seems like, for this minute at least, bernacke stopped the mortgage rate climb and actually brought it down a hair. Scary how the only indicator folks with skin in the game in mortgages, stocks, bonds, etc follow is the fed and not fundamentals. Good luck extricating oneself from QE without it all blowing up there Benjamin.

http://www.mortgagenewsdaily.com/consumer_rates/316221.aspx

The Chinese have been keen buyers of Pinal County,AZ properties and raw land according to their residents.

I am trying to wrap my head around this…I do agree these markets are crazy and I cannot see how this can be sustained…but if these purchases are done with all cash, isnt this a totally different animal than the 2008 bubble when there was no skin in the game? I only imagine a minor correction, if these hedge funds or chinese start pulling out…since no one will walking away from their homes this time. If prices come back down due to an influx of inventory, there will be a huge group of buyers ready to take them on…even if rates go to 5% but if values drop 10-20%….what am i missing here?

What you are missing is that the Chinese are buying a green card to come to the US. Once you bought a item unless you need to sell that item to get cash its value should be inconsequential. Unless you are planning on selling value shouldn’t even enter the equation. People worry so much about their house value because they NEED that value to go up this way they can either borrow against it to maintain some bs show off lifestyle, or they can use the profits to move up and maintain that showoff lifestyle. Too many people count on their house to “save” them in case of a financial crisis instead of budgeting and having money set aside. So when the house ” loses” value they flip out and its the end if the world. Chinese are smart. They are using a weak dollar to purchase property and fast track to a green card/ possible citizenship. They have dollars that are losing purchasing power every day might as well buy a property with that money. If their economy akes a dump they can come here live off of us.

Lol not only have we managed to sell our country from under us, we are selling green card/citizenship too. What could go wrong there.

They buy here because they think the status-quo will stay the same. I guess you could call it a habit bias. But for the Chinese trying to hold value to their fiat wealth it might not be easy. The locals in the San Gabriel Valley are cracking down on the anchor baby mid wife loop hole. The seriously rich will be ok. The USA will be a lifeboat for every filthy rich person not already here.

For the not rich enough Chinese nationals they will have a hard time holding onto any wealth outside of the control of the Chinese Mafia State. If they did not already bring a giant pile of US Treasury notes here to fund their extended exile they will lose their homes to the County Assessor or the local Chinese loan shark because cash flow will disappear back home in China real quick.

After the money dries up the LA County courthouse steps will get a lot of action. When will that happen … who knows… it is already been far to long after the middle class American was forced to give up and become a rentier serf to the fiat dollar.

I disagree. The folks overextended to maintain a lifestyle are a minority. It is the cost of real estate combined with the costs of living factored by stagnant wages and job insecurity. Most American families are maxed out on expenses to cover; homes that cost a large portion of net income, autos, transportation costs; insurance (medical, home, and auto), education and child care. In our economy they find themselves to tie up any liquid savings in a down payment and then scrambling to make the monthly net cover the expenses of life. Any financial crises will upset the apple cart. Think I’m kidding? Do a search on the inflation in the cost of autos over the last ten years. Like Malcom, Americans are caught in the middle.

Maxxed out for sure.

But how much of auto price increase is from increased computers, airbags, and required fuel management technology? Cars are bigger and heavier, notice the Corolla, Altima, and Fusion used to be the entry level sedan, now they are bigger and have new little buckets underneath them.

Let’s make air bags and seat belts and bumpers optional. Who wants to live in a nanny state and be charged an arm and a leg for basic transpo? Fuel efficiency standards? Emission standards? Blah. I’d rather bellow smoke wherever I drive across this green earth and save a few dollars on my leaded fuel and unmaintained vehicle. It’s my right! Might even find a city where street lights and stop signs are eliminated…think of the savings.

@marco t wrote: “…what am i missing here?…”

Read the comments by other posters below about the Chinese shadow banking system. The amount of leverage that exists in the Chinese shadow banking system would make Wall Street green with envy in 2006 as well as today. The leverage is absolutely staggering, and by most traditional banking standards would be considered horrendously bad and dangerous banking practices.

My big concerns are

1. They Chinese are those who have benefited under the corrupt Chinese system.

2. The money may all be BORROWED on shadow banking so when it goes belly up in China there may be some forced selling here, unless they somehow immigrate and we will see another bubble popping.

Well then just don’t sell to a Chinese person, simple solution. The seller can pick their buyer.

And here I thought it was illegal to discriminate in sales based on race. Silly me.

Not if you don’t tell that’s the reason.

It’s not racial anyway. It’s foreign national. I’d sell to any Chinese-American born into our culture and who loves the U.S. constitution and hates the Fed. Matter of fact I might even give them a discount.

How could I not sell to the Chinese when they pay with the best prices with all CASH?

Hello Doc.

I have some knowledge on one of these Chinese-purchased properties recently. I think it is common knowledge that Hacienda Heights is one of the communities dominated by Chinese (55% Asian according to Wikipedia). Here is a house which had not sold for nearly 40 years (ie was in the same family for 40 years when there were few Asians in the community). Then sold in early 2012 for $420K as a fixer upper. The caucasian sellers went to Texas. Then 1 year later sold to Chinese for $587K. There was some upgrading, perhaps $75K, (not sure if the flipper was Chinese but the owner/occupier now is Chinese).

http://www.zillow.com/homedetails/15411-Rojas-St-Hacienda-Heights-CA-91745/21460062_zpid/

I grew up on Facilidad in Hacienda Heights in the 70’s. No asians then!

The 4 Chinese buyers/investors on my street are not residents but landlords. Over 500k purchases qualify for that govt green card scam. The tennants don’t work but are paid to babysit property, are employed per the requirement squwatting is now a career ! No joke I am looking across the street right now, bums hang out, 3 of them, 100k cars, never go anywhere able bodied, let cars idle hours on end in driveway; does anyone know what that is all about?

talk about entitlements! Yes the rich get richer the poor get poorer its all designed so that the middle class pays to subsidize large corporations it pays to support those not willing to work, its all designed. even if they raise minimum wage it won’t matter one iota, they’ll just raise interest rates then we will have inflation and of course the continually rising taxes its all designed. we’re like candles that are burned at both ends and the middle class just get screwed!

I know very little of economic history, but it feels like the middle class is just an anomaly that has occurred secondary to a perfect storm of events all playing out in a small time frame: industrial revolution, cheap energy and boom in tech secondary to cheap energy, democratizing of society (somewhat; the masters are still at the wheel), the big boom a country goes through when it pulls itself out of third world status (incidentally, anybody that thinks China’s huge growth or any other country’s huge growth is sustainable, the trend has always been ’emerge then slow’), etc.

It feels more like the Feudal system is the steady state and that societies with middle classes are out of balance, and will eventually revert back to steady state. It further feels like, with the peaking of cheap energy, and peaking everything else on the horizon, the party is winding down and folks are scrambling to grab whatever they can before there’s nothing left to grab, which in turn causes a positive feedback loop, accelerating such.

All those waiting to buy houses: you will pray that there is NO deflation in China. (Or if there is, let it be a world-ending -50% deflation).

If it were just small inflation or small deflation, what happen is likely 90% of the people will be fine, the 10% will go to hell/starve. But what’s new for China.

For the top 1% (read: top 20 million people!) there will be no change in the regularly scheduled programming. There will be even more money going into their savings, instead of going back to fund their businesses or factories in China.

What are their savings you ask? It will be US treasury and as recently the good Doctor has written, US So Cal Real Estate.

Please pray the business improve in china so money doesn’t come here, or if it doesn’t pray for a utter catastrophe, the ones that will make Mao real proud!

They’re dumping those cheap U.S. Dollars which is very smart. Just think, just 1% of their population is approximately 10 million people and most likely very, very wealthy. In Diamond Bar many realtors will not even entertain an offer unless it is all cash. This is the result of selling all our manufacturing overseas for the past 40 years and unfair trade

practices. You can’t blame the Chinese. Blame the government and the corporations that sold us out.

Here is a flip bought by a Chinese in my neighborhood. They are already $150k underwater. Even overpaid. Chinese all cash buyers are typical where I live.

http://diamondbar-walnut.patch.com/groups/real-estate/p/diamond-bar-walnut-s-priciest-homes-2672-wagon-train-lane

Here is the zillow post for the above article.

http://www.zillow.com/homedetails/2672-Wagon-Train-Ln-Diamond-Bar-CA-91765/21673131_zpid/

Rock, paper, scissors….The revenge of the Native Americans and Spanish

handed to us compliments of the Chinese or Aseans.

I’ve heard similar rumblings from New York residents on another forum about an influx of Chinese ownership driving up prices there. So I’m with Marco T in that I don’t understand how prices can go down with so many buyers out there +QE not ending. Even if wall street pulls out, it seems like there is a back stop of a whole other kind to buy up properties when / if prices fall a little.

Such bullshit times to be a young adult with hard earned savings that can’t buy you anything. (Myself anything)

Be patient, young grasshopper. Your hard-earned cash will be useful at the opportune time. Don’t be in a hurry to fall into the same trap that ensnared so many before you. Watch and wait. Keep saving, clear your debts, and ready yourself when your opportunity arises.

Chinas GDP is artificial. They have huge ghost cities that would house millions but are virtually enough. However the way in which China counts its GDP is based on the construction rather than the sale of these homes. One such city is an exact replica of Paris. Gorgeous but empty. I am sure the cost to buy vs. wages in those cities is way worse since there are maybe 20 to 30 thousand people living in cities that would house millions and millions. So like everything the numbers are manipulated.

Yeah, that VICE episode was incredible. Huge, empty Chinese cities built to boost GDP. Crazy.

If interest rates keep trending upward for the next couple of years, the housing market is going to be gutted. The opportunity to lock in a 3.3% 30 year mortgage may go down in history as the lowest rate in US , ever.

As long as your payments stay at or below rent parity, you’re in good shape as we all have to live somewhere.

I lived in SE Asia for a while – and there were very stringent restrictions about foreign nationals being able to buy property (made it virtually legally impossible or such that a change in the law would wipe you out). The idea was to protect the domestic population from keeping property out of reach.

We should trade some of our tin pot dictators for their banana republic dictators…..

Irvine has a totally Feng Shui newly-built hospital that caters to the new “immigrant” residents

Many local developers built Feng Shui tract homes (e.g. no #4 in the addresses, stoves not directly across from sinks, etc…)

Irvine school district has the top elementary, middle, high schools in CA, as well as, within the top 1000 HS in the entire USA! UCI is nicknamed: “University of Chinese Immigrants”

Planned community close to “Chinese Birthing Hotels” scattered throughout LA & OC.

nuff’ said!

Lets follow this through.

These new millionaires from China are have often made their money through the Real estate pyramid scheme that is china.

They are often corrupt local govt officials who scam the US E5B visa system by using a corrupt middle man to “invest” in a business employing over 10 people.

Then they borrow money through the shadow banking system, which they know will go belly up in CHINA sometime soon, and then take their “hot” money to the US and buy as much real estate as they can.

They then leave the kids here with the grandparent. They kids cheat at school and get in the UC system through corruption and cramming.

They squeeze out the local Californians who have paid tax for years and bring their kids up to be well rounded.

Next the shadow banking system in China collapses. They lose all their main source of income in China ….but HEY they have spent a lot on money in the US which is out of reach of the Chinese shadow banking mafia who will come after them to collect their money.

So we will be stuck with this particularly unsavory group of people.

Brought to you by our own unsavory group of bankers, their need for cash, their corrupt visa system, and stupidity.

White flight ensues. No one wants to live next to these people.

The great suburbs sink. Their housing prices sink.

So in other words be VERY VERY careful buying into this market if its where the Chinese want to be. Look what happened to Vancouver!

What happened to Vancouver? Last I heard (a few months ago) – prices have continued to go up. That’s been going on for 15+ years, due to easy citizenship requirements.

I haven’t gone and checked to see what kind of appreciation is happening right now, but when I lived in Seattle from ’97 to ’03 there was exceptional appreciation going on in Vancouver due to a flood of people coming from Hong Kong. They like “monster houses” which a big pastel two story high boxes with roman columns on the front of the house, where the house looks to take up nearly all of the square footage on the lot.

They’re often in old neighborhoods with small (1100 sq ft) homes as neighbors and it’s quite funny/odd/jarring to see the dichotomy in size/style.

Jake, you don’t know what u r talking about. I believe real estate price goes up whereever Chinese purchases. The Chinese is the next Jewish, the legend said they can eye gold inside a rock miles away. With that said, I do believe many of those purchase are foolish purchases at the time. Yet the never ending QE makes the genius out of a retard.

I agree with you. I was waiting to buy a house in Irvine, but then realized that its a prime destination for these thugs (aka criminals that steal to buy all cash). Places like Irvine, Diamond Bar, you name it will soon become the next garbage neighborhoods of society. Not just white flight, but also traditional Chinese immigrants will move out. Who wants to live next door to criminals and prostitues anyway? Was just shopping in South Coast Plaza and my Chinese mother said what eyesores these ex communist party thugs and their mistresses were cuz you could quickly identify these criminals from the rest of the Chinese population by the way they act with no manners and look down on everyone else as if what they have was even theirs to begin with!

Jake, these Chinese money launders aren’t just unsavory to white people, hence your term “white flight.” Who cares where white flighf is heading to? These Chinese crooks are also unsavory to traditional Chinese immigrants who hate being around these crooks that flash their dirty cash. And says who that you can cheat into the UC schools by corruption? UC schools are public and students gain admission based on merits, which explains why UC’s are dominated by Asians. So stop being jealous of their success and making up stories that Chinese students cheat to get into UC’s. From whatI see, you are mixing up traditional immigrant Chinese who work their way into UC’s with offspring of these filthy rich Chinese criminals that buy their way into top motch universities with crap load of money. Stop confusing the Chinese Americans with these communist rejects! Chinese Americans contribute to good school districts, take example Arcadia and Irvine schools, so who cares about white flight? Its these crooked Chinese cash buyers that we should be wary of that will drag down safety and reputation of neighbirhoods

CONTACT YOUR LOCAL MEMBER AND TELL THEM

STOP THE E5B scam. It is destroying our cities.

E5B is sooo out these days. the new trick is got pregnant before belly shows, come to U.S. for visit, then stay illegally until the baby is borned. Then the mom can come back to state with the U.S. Citizen baby whenever she wants.The mom will bring the dad later, and live here happily here after, suckers.

Agree with you, Jake. These all cash buyers from China are not your traditional Chinese immigrants who work their way here the right way. The places that traditional Chinese immigrants live in are no longer what they used to be. Good neighborhoods in California will no longer be good with these Chinese nationals buying their way into housing with ill-gotten money. Look you dont want to live next door to someone who robbed the bank. Same thing goes with these Chinese crooks. Its enough that we have corruption hers in California, great now we have to deal with corruption from China. Hate how America doesnt give ear to this phenonmena of local citizens priced out by these wanted Chinese criminals.

The American Dream is no longer. We are entering a time of the American Struggle. Many educated working professionals making close to $100K, like me, can barely afford to buy a home with a single income. My 60-yr-old coworker used to work at a supermarket as a cashier back in the 70s and with that income he was able to afford a home in southern cal. I’ve been looking into buying but I lose each time to the all-cash-offer. Now, I don’t even bother anymore. I hope the tides change soon but I guess in the meantime, I’ll just save my money so I can afford a bigger down payment when houses do become affordable again.

Why live in California? In Texas you will live fine on $100k a year. On the space coast of florida you can live next to beautiful beaches with top schools for little money. The usa still looks like the 1970s in many lovely spots.

The xenophobia on this site is embarrassing.

What happened to Vancouver?

If the xenophobia is targeted against racist, corrupt Chinese immigrants what’s the problem. We are talking about a VERY specific subset of ethnic immigrants that have a total disregard for American culture and are actually attempting a soft invasion of our country. If war broke out in Taiwan tomorrow these freshly minted “Americans” would not be supporting the old US-of-A. I grew up in the San Gabriel Valley and seeing this portion of my Asian neighbors true colors is disgusting. They believe themselves inherently superior and their discrimination extends down to their poorer Chinese neighbors. I’m as xenophobic as can be when it comes to racists and class discriminators.

NihillistZero:

There is not ONE type of white people, either. I hate the bigoted patriot religious-type, to the core.

And I used to live in the east coast backwater, where I saw the true color of the WEALTHY white people who believe they are superior and their discrimination extends down to their own white kind who did not share their spoiled, often religious based, upbringing. Their numbers, well, dozens of times in excess of your california wealthy asians, to say the least.

Like you said, if a war broke out with Taiwan, I would love to see these white traitors be parachuted head first to combat and I hope they be butchered by the ChiCom. Why not – they are always the first ones to voice support to any war!

I see. If a Chinese person is doing better than an American, it is because he is “corrupt”. I imagine you have psychic powers that enable you to determine this. It must be sad for you, being on the deck of the Titanic that is America today.

I didn’t say that Roddy. I specified the Chinese immigrants who have used their communist party connections to exploit slave labor to build their wealth which they then park in SoCal RE. Your ignorance to this state of affairs doesn’t make it any less real.

The ones who are buying here are the corrupt class. Their main problem is that they have so much illegal money, that they do not know how to hide it. The hard working Chinese all live in dorms , work 7days a week and go visit their families a few times a year.

The corrupt politicians, bureacrats and their families are the ones buying. They don ‘t care about rental yield.

I live in a Chinese city of almost 9 million, and the only workers who live in dorms are the construction workers. The dorms are moved from job to job. These workers all own homes-they are farmers who send money back to their families every week. they make more than a recent college graduate. You need to stop watching Fox News and the local Christian channel. You are being duped by propaganda.

Roddy6667 sounds like a brainwashed puppet on the payroll of the Chinese Communist Party. If China is such a great country, then why are some rich Chinese Communist Party members fleeing China with millions of dollars that were often earned in questionable ways?

Roddy get out of that commie plantation. China, the godless country without any real values and yes… we wive our American Flag not because we are forced to it by our government but because we want to do it from the bottom of our hearts. We say what we believe in and we can do what we believe in. As long as there is a lot of us, God fearing, freedom loving Americans, our country would survive any invasion.

Hiya Lady_Economist, redneck there! If I could ever find a better suited speech for the Rednecks than what you have written, I’d buy YOUR house in cash for $600k no matter what a piece of rotten junk it is.

These rich immigrants bring in 3rd world practices. Asset or liability to society?

Interesting article..

Total foreign buyers – 3% of all purchases..

Chinese buyers in CA 1/3rd of all foreign buyers, so 1% of all buyers.

how much of an impact does it make? Virtually none.

I’m honesty shocked to read a number of the comments. Did I magically get transported back to 1960?

Americans have been snapping up foreign property in other countries (especially South America) for a long time.

Californians have been outbidding residents of the Northwest and Southwest since the 1980s.

Canadians are heavy buyers in Florida and the Southwest and that didn’t help those areas from being affected by the bubble.

NYC has long been a favorite of wealthy Russians and Middle Easterners while Miami finds investors from Brazil and Venezuela.

Is it no surprise that LA and SF would see an influx of Chinese buyers? and suddenly since California has a small bump in foreign purchases, people are suggesting that Americans stop selling to Chinese buyers?

People read sensationalist stories about fraud in China, and then they assume just because a Chinese buyer has all-cash, that the money must be blood money? Do those same people assume the same about Russians, Brazilians, Mexicans? Russian buyers must be part of a crime syndicate right? and South American buyers must be drug traffickers? Middle-Eastern buyers must be terrorists?

Newsflash: Many politicians and wealthy people are dirty no matter which country they live in. That includes members of the GOP and Dems. Should I be worried if a politician wants to move next door? What if Berlusconi made an all-cash offer?

150 years ago it was the Irish-Americans, 100 years ago it was the Jews, 30 years ago the stories were about Japanese buyers buying up Hawaii and commercial RE in the US. Now it’s China. 30 years from now it will probably be Africa. You’d think people would learn to be a little more tolerant as the Earth gets smaller.

In most countries around the world, only citizens can purchase properties. Foreigners usually are out of luck. Not so in the United States where foreigners can bring in boatloads of money and snap up properties without restriction. The reason that so many posters are reacting negatively to Chinese investors buying U.S. properties is because Chinese investors are driving up property prices and making it difficult for U.S. citizens to purchase properties. Many U.S. citizens lost their jobs and e lost their homes to foreclosure during the Great Recession. Many U.S. citizens that managed to keep their jobs have seen their real wages drop. Many U.S. citizens simply can’t compete with the all cash offers from Chinese investors. Also China is a Communist country and much of the money being brought here has been earned in a shadowy way–China does not play by the same rules.

I married a Chinese woman and ten years later retired and moved to China. On forums like this I hear a constant stream of venom and vitriol about China. It always from somebody who has never been to the country, and probably never out of his own. Where do they get this crap they confuse with information?

They are the people in Plato’s Allegory of The Wall who only see shadows cast upon the wall. They are unaware they are in a cave or that they are just watching shadows from a fire they have never seen.

I’ve read several articles on Chinese capitalists stealing intellectual property from the Western world for profit, with little regard for patent or copyrights.

There is a difference between the average Chinese citizen who is merely trying to survive and the corruption of the Communist regime in China. Criticism of the Communist Party line is not tolerated in China. There is no Bill of Rights. There is no freedom of thought or expression. Dissension is not allowed. If you like living in a totalitarian country ruled by evil brutal dictators, then China is the place for you.

Just because rich people have dirty money doesn’t make it right. I would prefer someone who made their money honestly to move in next door than one of these people.

And it doesn’t make it right for a bunch of outsiders to screw the locals regardless of country origin or destination.

When/if I ever sell I could care less who buys it. It’s purely a business decision. It comes down who has the best offer with the best backing to come up with the money. I wonder how many of you are willing to leave $5,000 to god knows how many thousands of dollars on the table for the new owner because some ” foreigner” wants to buy your house. And before people start spouting off I worry about my neighbors here is a hint, your neighbors could give a F about you when it comes time to sell. I’ve been in my house for 20 years and not one of the neighbors who sold gave a crap about who moved in. From all the neighbors who sold and moved, i have spoken to one and he was a weirdo. At one time I thought the same; when I move I will only sell to another american family. Lol nobody cares. It’s a dog eat dog world. The ONLY thing that matters is COLD HARD CASH.

My next door neighbor sold and moved out 8 months ago. The people that bought are from Vietnam. They were cash buyers. They keep to themselves. They look like a normal family, but they must be criminal masterminds since they bought cash. There are PLENTY of people who have American dollars or enough cash to buy property here. The ignorance and arrogance of assuming foreigners cannot afford to buy property here is laughable. We as a nation are debt slaves. Most people are too worried about the house they buy in what neighborhood, what the neighbors think or what appearance they want the neighbors to perceive about them, the type of car they drive, the clothes or purses they wear, the appearance of success all the while drowning in debt. ALL in the name of some BS I am more successful than you appearance people want to portray.

You don’t want to sell to foreigners? Nobody is forcing you to sell to someone you don’t want to sell to.

Living in China, I see a great work ethic, like America used to have. Education is sacred and kids study their asses off and LEARN something. I have rich relatives who got rich from hard work, and LOTS of it. Americans gave up a long time ago, and whine in discussion forums like this.

China has no safety net so it’s either work or starve to death. There is no welfare, no food stamps, no Obama phones, and no free medical care. No safety net makes for a great work ethic?

“Safety net” makes Americans lazy. Give a man a fish, you feed him for a day. Teach a man to fish, he feeds himself. Welfare, food stamps, Section 8, etc. = slavery in disguise. Yes, some genuinely make use of the system’s intended purpose (temporary stop). But most are trapped by their own choosing and stay for as long as they can.

I befriended and talked to some who lived in the “projects” (government housing). One time, they were trying to teach me how to take advantage of the “safety net” by telling me to buy the diamond ring but don’t get married (on paper). They know the formulas. There are some smart people in the projects (they learned exactly what they need to do and not do to get the most benefit from the government), but they’re trapped by their thinking and by the government’s incentive to stay qualified for “free money.”

Here’s how it works: The more you make, the less the government will give you. The less you make, the more the government will give you. “Safety Net” = No/Low motivation = Lazy/Idle = Up-to-no-good.

“A man who will not work shall not eat.”

If anyone is wondering why real estate in CA is so expensive now… well here’s your answer…

I’d like to know who exactly thought it was a good idea to allow non-citizens to buy US property. How does that make sense? Imagine if the US was buying up all the property in some other country, imagine the outrage! But it’s happening right under our noses and no one seems to care.

Leave a Reply to sneezy 67