Welcome Serfs to the new Housing System: How all cash investors are distorting the housing recovery and taking over the primary vehicle for wealth for Americans.

When you turn housing into a hot stock packaged nicely with a red ribbon and newly installed granite countertops, you have added neon lipstick to the biggest purchase most will make but don’t expect it to act as some kind of button down conservative asset class. Wall Street since 2000 has found a new asset class to inflate and invest (gamble) on. No surprise then that housing has had a religious conversion into the church of Boom and Bust. This is exactly what you are seeing in some markets where ravenous speculators are essentially the largest players in the game. The wealth gains in housing are largely distorted because of the massive entrance of investors into the game. For example, millions are buying homes with 5 percent down or less. To keep it simple, someone buys a $150,000 home and puts down $7,500 that goes directly into the equity of the property. An investor buys the home with all cash. For each one of these purchases, you would need 20 of the conventional purchases simply to match up the level of equity. All cash means 100 percent equity from day one at least when it comes to data being reported on housing. This is why as we will discuss in the equity chart later on, that this has been incredibly distorted in favor of investors. And where are these gains really going? 5 million Americans have lost their homes (if you can call it that since many were in debt up to their eyeballs with little to no equity) since the crisis hit and a good number have gone to investors. With rates shooting up, you are going to see the appetite of many investors sour quickly.

The real homeownership rate

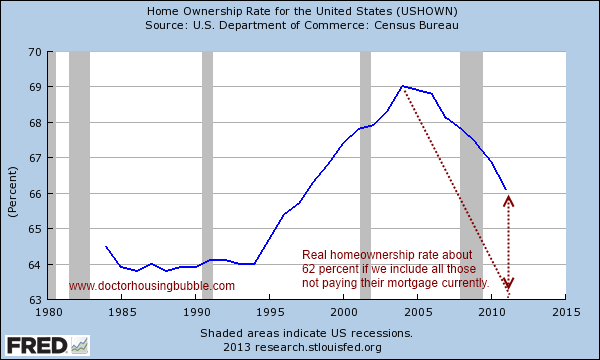

Homeownership has been the primary vehicle of wealth building for most Americans for well over a generation. Stocks for all the raucous hype they carry make up a tiny portion of the wealth portfolio of Americans. It isn’t that housing is a great long-term investment, it has typically been a hedge against inflation and a forced savings account. Given that overall Americans are poor savers, this has worked out well for many. Yet today, even after all the fancy mortgages and gimmicks that have hit in the last two decades courtesy of fancy pants banking, the homeownership rate is no better off:

Let us spend a couple of minutes on this chart. The homeownership rate peaked at 69 percent at the height of all the easy money in the market. 5 million foreclosures later, we are down to 66 percent. But I would argue that we are closer to 62 percent if we factor in all the Americans that are simply not paying their mortgages. Do you even own your home if you have zero to very little equity and flat out are not paying your mortgage? Would you consider someone delayed by three payments on their mortgage as truly a homeowner? You miss one rent payment and you are out on the street.

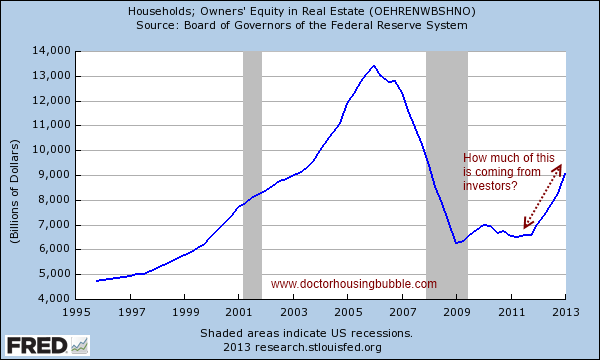

The idea that somehow this housing recovery is benefitting your average American family is hard to find in the data. Sure, equity is up but what does that mean? If you are a family looking for a rental rents have gone up with no subsequent rise in income. Is that a benefit? If you are looking to buy, you are being crowded out by investors in many areas. Is that a benefit? Supply is low because of every gimmick from suspending standard accounting rules to basically using the Fed as some pseudo-mega bad bank. Is this a benefit? And those all-cash purchases are distorting equity.

Equity but equity from where?

In no time in history have we had so many investors buying up this much property. In Las Vegas, it is up to 60 percent. In Arizona, the figures are close to that. In Florida we have about 30 to 40 percent. In California over 30 percent. This has been the game for a few years now. Now say 50,000 homes sold in the Las Vegas region alone last year (say an average of 50 percent all cash). That is 25,000 homes that were bought with 100 percent equity. You would need 500,000 equivalent 5 percent down regular home purchases to have an equivalent amount of equity from this investor deluge! In other words, nearly 10 years of regular home purchases. You can apply this to other large investor markets as well. So when you look at the below chart, we have been on a race to inflate equity quickly but how much of this is because of the cash crowd:

This is a new equation in the modern day housing feudal system. If you don’t have all cash, good luck trying to buy in these insanely manic markets. People in California are now groveling at open houses crawling on bended knee like a jilted lover begging someone to come back. The only difference is that this is a 1,000 square foot lover built in the Great Depression selling for $500,000 and in desperate need of a makeover. So the low interest rate environment since 2009 has largely benefitted banks and those with easy access to this money. Rising home prices have come for all the wrong reasons: speculation, high level of investors, and artificially low interest rates. The market went into full panic mode just because rates went from 3.5 to 4.5 percent! If you even have any sort of working memory 4.5 percent is ridiculously low. Even 6 percent is great in the longer picture but we now operate in a market with the attention span of a gnat. So the market panicked and people were rushing to lock in purchases or were walking away. This market is so fragile that a mere whisper from Bernanke was enough to send shockwaves in the mortgage markets.

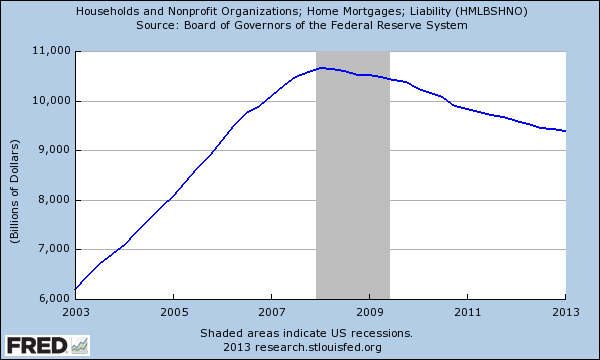

So why do I think this boost in equity has occurred so quickly? Because typical households finance their purchase and build equity slowly over time like slow cooking a pot roast. Where are those mortgages?

In fact, most households are still in the process of deleveraging since the crisis hit. So this recent jump in equity is coming from two large corners:

-Foreclosures:Â 5 million completed since the crisis hit

-Investors:Â Roughly 25 to 30 percent of all purchases have gone to this group since 2009

So are we going to get excited about hedge funds suddenly becoming the largest landlords in the US?

1 million more renter households

On the flipside, this is good business for hedge fund landlords. Rents have gone up because those 5 million foreclosed need to live somewhere. Rents in areas like Las Vegas however are reaching a threshold and the numbers just don’t make sense. You have a game of musical chairs now where investors are trading to one another simply for mere speculation on future gains. New home building has been invisible for half a decade. So we’ve added 1,000,000 more renter households in these last few years, mostly in depressed markets. The same markets flooded by hedge funds. So a normal family now looking to buy has to contend with all cash offers. What use is it that you have a 4.5 percent mortgage locked in when the sale is going to the all cash investor? Colleagues in the industry are even seeing 20 percent offers being ignored in place of the almighty cash buyers.

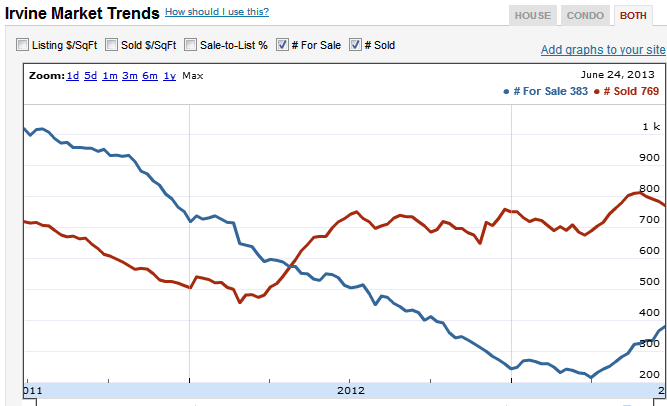

The mania is boiling over in California. Investment purchases stopped making sense over a year ago. Flippers are falling over one another to find the biggest sucker in the room at this point. And inventory is starting to increase. Look at the trends in sought after areas like Irvine that have local, foreign, and local family demand:

For the first time in a couple of years you are seeing inventory starting to increase and sales starting to reach a ceiling.

The idea that somehow the banking bailouts were for the middle class family is really being proven false. Ultimately these distortions hurt local families in these areas. If prices fell to reflect local family incomes would this have been so bad? For families looking to buy the answer is no. To banks the answer is a resounding yes. Now that home prices are back to near peak levels and people are stumbling over one another to fight for whatever inventory is left, we are left repeating a very similar scenario. We just saw that the Fed will need to go into QE infinity like Japan to keep this party going. In the mean time, make sure you take some Alka-Seltzer before entering the summer manic selling season in these markets. Some people enjoy acting like serfs at open houses begging mercifully that the seller will allow them to overpay for a home that needs much added work for an insane price. The crash hit in 2007 and six years later, it looks like the Fed is once again fueling insanity in the housing market.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

44 Responses to “Welcome Serfs to the new Housing System: How all cash investors are distorting the housing recovery and taking over the primary vehicle for wealth for Americans.”

Thanks Drhb

Just wondering if the banks of FANNIE

will just have to loosen their lending standards again to help

Out all this big time investors unload their stock.

Here in Miami buying as an owner has become futile.

But I will say I have seen a number of homes be relished after going into contract recently.

I think people are feeling a peak.

I’ve sene condos in Aventura FL sit on the market for years with no price movement at all. Buildings such as Aventura Marina, Artech Residences & Uptown Marina Lofts have enough unsold units that even renting them is problematic. The city is a great place to live, but it’s been overbuilt. This has resulted in buildings falling victom to the thirty year cycle in fifteen to twenty years.

On another interesting note, notice there was an open house in Forest Hills Gardens Queens this afternoon. This townhome was off the market for a year & a half & is $900,000, wich is $15000 higher than the last time I saw it. I don’t know if this is a second sale or a retry from the prior one. The location is great if one doesn’t drive or the buyer doesn’t want to deal with a co-op board.

Unfortunately I see a lot of this in Ventura County. House is listed, sits for months, gets pulled from market… and then reappears a few weeks/months later, but priced higher. Just a symptom of deep-pocketed sellers who believe they can wait forever to get whatever price they want. Until we see capitulation from this crowd I don’t see prices falling much (and sadly many of these folks are rich/stubborn enough that they may just die of old age before selling at a fair price).

The number of Courts in LA County processing evictions (unlawful detainers) has been reduced from 14 to a total of 4 courts (yes, 4 courts!) in ALL of LA County as of 2013.

Wages are stagnant or decreasing. Fired full-time workers who are now working at part time temp jobs are counted in employment data as statistical equivalents. Three part time (or temp part-time jobs) held by one person are counted as three jobs for statistical purposes. Self-employed people (many of whom used to be “middle class†income earners a few years ago but are now barely making ends meet) are not even accounted for in the employment numbers and data. It’s as if self-employeds simply don’t exist even though their ranks have been increasing as wage earning jobs have disappeared. So when I hear or read that the employment data and numbers are improving, I’m just thinking “the Hell are they looking at?!?

Add to that the decline in middle-class homeownership as all-cash investors and hedge funds squeeze out wide swaths of would-be owner occupants. In a society where tenants outnumber landlords, even if the investor-landlords succeed in evicting non-paying tenants (that is, in the 4 LA County eviction courts that are still open and operating), who will they rent to as replacement tenants? New tenants are not likely to be any better off than the last, and possibly worse. The reality is that Landlords are already taking $$ hits to keep their existing tenants in place to avoid the costs of vacancies, repairs, rental commissions, maintenance and eviction expenses.

Looking at the big picture, what’s been happening just seems like a big boondoggle of greed that deserves its comeuppance in the karmic scheme of things. Cause and effect may be possible to manipulate or delay (QE1, QE2, QE3) but ultimately it can’t be escaped.

Do you think the landlords will start to consider carrying the tenant essentially becoming the bank and then in the case of default, the investor evicts the defaulted resident stands to still make a marginal monetary gain. Starting the cycle over with advertisement owner will carry. The investor finds another questionable, previous home owner who believes he can do it this time, feeling lucky to have found this wonderful guy to take a chance on him and often times with 40-50% down on the table. Usually acquired by not paying their last mortgage for years at a time. Though they didn’t pay their mortgages they surely have been shopping putting money back into the economy, by purchasing disguises like very expensive clothing, cars and vacations true marks of wealth in todays society. Remember we can’t judge people by who they are, character, morals. The sum of a man is by the car he drive’s. So here we have this great guy smartly dressed sporting new wheels, just back from Europe with the wife and kids, starting fresh in a new area. They have found a buyer who they think can’t sell and is willing to carry.

These hopeful homeowners pay off the investors home for him if they begin to stumble, because the hard money loan interest rate was not in the equation when purchasing range rover. Honey like’s shopping and botox, the kids hobbies and the list goes on. The often times (lawyer/investor) send them on their way. In the case where they are able to stay a float with the hard money loan, provided for them by the investor then I guess you can call it a win, win!

Philosophical question: If someone borrows say 300k-500k of debt, buys properties and rents them out, and doesn’t have to make any payments, does that make them part of this “all cash buyers” group? It’s possible thanks to government policy.

Japan has kept interest rate at less than 1% since 1996 with current rate at near 0%, which equates to 17+ years of QE. I see the U.S. going a similar route. Therefore, home buyers in today’s market looking to purchase a house for their family should not panic. The mortgage rate may fluctuate upwards, whereby the 30-yr fix goes to near 5% perhaps. Beyond that, there is just nothing in the economy to indicate a 30-yr mortgage rate going higher than 5%.

On Bankrate, I see Greenlight Financial Services already offering 5.68% even for excellent credit.

I put in 20% down, 550k loan amount with excellent credit.

http://www.bankrate.com/mortgage.aspx

Time to tank this mother f**ker! F**k the housiing market.

Investors aren’t even FINISHING their flips anymore.

This house sold for $245 6 months ago. They stripped all the siding and interior, added plumbing and electrical and are now trying to sell it to another sucker for 100K more.

http://www.redfin.com/CA/Altadena/3010-Glenrose-Ave-91001/home/7254134

Do you know what this neighborhood is like? I’d call it the “hood”. Try reading the Altadena’s Sheriff’s crime blog to get an idea of what it will be like to finish off this project and/or live there. Think 24hr security, bullet proof vests, etc.:)

Actually. living above Altadena Drive is not so bad, it’s definitely a lot better above Altadena and east of Fair Oaks but still… It’s a complete joke to strip the whole house, put in plumbing and ask for 100K more. I’m seeing more and more of this stupidity… hopefully the end is near!

I drove by this property the other day and wondered what they would want to gouge for it. Now I know. Amazing. In the range of 6 times the median income for an original post WWII house that is completely stripped. By the time your done you could buy one of the fixed up houses that is larger for about the same money.

My guess is that this is the reverse of a loss leader. Pump the price way up and sell for what you bought it for. The wannabe flipper thinks he got a bargain and you bailed on your mistake with minimal loss. Sad thing is that in our culture it just might work.

Realistically the place is worth about $120,000.00. Stripped, old, small, mediocre neighborhood.

Definitely the case where I live in northern California, tried to buy for a year but it was basically hopeless as my bids on several houses were ignored when speculators or flippers offered cash, retired to the sidelines about a year ago (was looking for a 3/2 in a decent neighborhood…just like the speculators and flippers)…it will be interesting to see how this all plays out over the next year or two.

Bluto, I’m renting a 3/2 in San Rafael, in a largely 3/2 neighborhood. Two houses sold recently (in the last 2-3 months- -not much for sale near me), and both went to flippers/investors, not end users. Not sure if they will fix and flip or rent – -neither one has been occupied yet (one had a flurry of fix-up activity right after the sale but has been quiet for the loast month or so…ran out of investor money?). It is ridiculous, 800-900K for 3/2s on 6K SF lots. Old houses should be CHEAPER, not more expensive – -these are niot well-built houses…they all need major work. Insane. So I will rent until I don’t need to live in Nor Cal (3 more years). Then look elsewhere unless this insanity ends and houses are affordable again (where have the late 1990s gone?).

I’m up in Santa Rosa and two years ago there were lots of 3/2’s for $250-300K and I bid full price or slightly more on several but it was a waste of time when competing w/ cash, was ignored every time…and I had 20% down and a preapproved loan for more than I needed. It was indeed very different back in the mid ’90’s, lived in Ukiah then, looked at about 10 houses, bid on two and my 0 down GI Bill/VA bid was accepted on one. I naively thought that with a 20% downpayment this time would be even easier.

Plan to stay here for another year or too and see if Bubble 2.0 pops and buying is again possible but may move away at some point….

The prices are actually getting worse than they were back in 2005/2006. I would love to know when a 3700 sq. ft. lot started qualifying as “huge”.

http://www.southlandproperties.net/idx/mls-iv13125760-1861_walnut_street_la_verne_ca_91750

And not that history repeats itself, but more and more people I know either want to buy a house so they can sell it in a few years for more than they paid, or want to get their real estate license. These are people that lived through the last bubble and are confident that it won’t happen again.

A got a good laugh at that one. The amusing part wasn’t the lot size, it was the size of the house and price. 554 sq ft shack for 300K. I could see this in the beach cities, but La Verne. C’MON MAN!

ha ha! I get it! 😉

It doesn’t say the lot is “huge” it says the backyard is huge.

Well it is in comparison to that little 1 floor house!

(I live in a small house with a yard which everyone remarks on its largeness, so I immediately realized the issue. ha ha)

I live in a little 2story 900sqft house on a 7,500 lot at the edge of a city, and everyone remarks on how “huge” the backyard is. So I immediately recognized the issue. ha.

A hahahahahhahha – you Californians are funny. That listing is like an Onion article. If it weren’t real it would be hilarious. As it is real, it is just sad.

As fiat money becomes worthless all purchases will be cash. And then barter.

“As fiat money becomes worthless all purchases will be worthless” is basically what you’re saying. Cash IS fiat in terms of dollars…which even bitcoins are priced in…and gold…and silver.

USD is the world reserve currency. If this was Weimar Germany the USD would already be toast…that’s why nobody really knows how this is all going to end. No history to compare it to.

People have been decrying the end of this country generation after generation. Yet, the beat goes on. Inflation, booms, busts, deflation, they will come and go. What better way to whether the storm than with a real estate investment. Ask you parents how much their first house costs and how much it is worth today.

(To Dan) I would, except my parents are dead, and so is their era. Wake up to the new reality.

I have said it many times, but I don’t understand why high home prices are seen as a good thing. It ends up locking a large amount of income into one single asset that doesn’t have all that large of a benefit for the overall economy. Inexpensive home prices are something that allowed our economy to grow signifigantly for so long. Now that most people are having 50+% of their income either locked up in a mortgage or rent it will be hard for them to spend money on other discretionary things. Not to mention if these people go through any financial hardship they are either out on the street or in foreclosure. We need more affordable housing not more expensive housing.

Well put my friend

I second that. The US will be one big Britain now, a little manufacturing, the FIRE industry and housing along with wall street, otherwise known as US govt, being over half the GDP with a basket currency involved. The price collusion adopted by the feds, treasury, banks, FASB, the AG and congress etc. was grand wasn’t it. Price fixing created this bubble, with all the investor money from coming from the world to take advantage of the US RE prop. It will last 4 decades.. See our other teachers over there in Britain.. Those Libor guys will clue you in.

Anyone paying for the place I own what it’s supposed to be worth, Good luck, sorry about buying a top

This perplexes me also. And I’ve heard other people say the same thing.

Though I think there are 2 issues that are really the important things.

1) Wages have not kept up with inflation in general, and not the housing market.

2) The meaning of “investment” has changed from putting money into something worthwhile which may give you a return, to mean gambling to get something for nothin’ doing nothing.

In other words…

Rising home values (reasonable) would not be an issue if wages kept up with it reasonably.

And buying a house (or houses) as investment is not a bad thing if the investment is that you’re going to live in the house, or you’re going to rent the houses out as a part-time job (and that’s what it is if you’re a decent landlord – a part-time job).

But with people working at temp jobs with no benefits & low wages, and shitty or careless absentee landlords who’d hoped they could just do nothing & rent out their rat trap & sit back & soak in the money… Or just having empty houses used as nothing other than poker chips for large scale gamblers.

Well yeah, it’s not really working for most average citizens so well.

DG

I agree, and you said it well.

We paid cash for a modest one-story in

east Ventura County in 2012. A medical

hiccup changed our lives forever. We needed

to secure our housing issue. In the real world we

overpaid by $100K. NOW the neighborhood is in $500K’s.

More debt is a good thing? It took us 4 years of

disappointments to get this deal.

For goodness sake, in 1998 we paid

$394K for a 4,000 sq ft McMansion w/ all the bells

and whistles including a view of Thousand Oaks and

Simi Valley, when incomes were higher.

(7.5% fixed and we were happy w/ that)

Housing is a place to live, a HOME. I remember when FHA

deals could not be flipped for 90 days. I’m older, and want

the generation following mine to know homeownership.

Where were all these buyers when the housing market was a ghost town? Inventory has always been an issue but nothing like it is now. We all knew the housing market would “recover” we just didn’t know when or what it would look like. In our twitter paced culture, it’s no surprise that things are happening too fast.

Why do people wait to buy until the media says its time? By then it’s too late. We’ve had a 4 year slump in my area in California and the current run up in prices puts us back at 2009 levels. Sustainable? Sure, so far. But what about those 4 years when you could’ve had the tract house of your dream without having to write letters and beg?

I know people that told me they wouldn’t pay $370k in 2011 for a home that they could now sell for $500k. At the time $400k was reasonable but they wanted blood, and a 3.25% interest rate wasn’t enough (they were not cash buyers) to induce them to act. Simply put, buyers got a little greedy and cavalier… thinking not only that those prices would be here forever but that they would go lower. I can’t blame them for dreaming that the economy would cut them a break somewhere considering wages haven’t risen and the price of everything else in our society continues to be manipulated and inflated terribly. However, timing buying a house is not like timing a stock trade when you don’t have cash. The pendulum has officially swung.

I know things have gone too far to fast but NEWSFLASH… individual homebuyers and sellers do not control the housing market. Didn’t we learn that the last go round? There are big money players in this market and they control it — we are just along for the ride and hopefully a place to live.

We are prospective buyers and I can tell you that it was mere chance we ended up trying to purchase a home after the housing market was a bubble in full-swing.

We had been traveling around the country after we retired and were looking for a good place to land. When we did pick a spot to settle, it was too late.

Not all buyers are lemmings.

It look as though big money is starting to shy away from govt debt. This is problematic as the purchasing pressure will now go towards assets while the interest rates rise. We actually may see inflation in some real fashion now as capital flows head towards many things in our economy besides debt.

Can you expand more on this ?

What’s the one asset class that’s really gone up and off the charts in the last few years? Govt debt.!! It is so large many analysts are now portraying it as not only at the edge of a cliff as far as interest rate sensitivity , but it can never be repaid as well. So, look at where capital is flowing? I’ve NEVER heard of so many cash transactions for real estate purchases before. If capital is now shifting towards tangible assets, I think we’ll get classic stagflation as prices will rise but incomes will not. Add a rising interest rate of govt debt and we’ll have about the worst of all worlds in the coming years. I hope I’m wrong.

I think what he’s trying to say is that investors with lots of money to invest are not buying government debt such as bonds or treasuries (paper assets), but hard physical assets like real estate, etc.

I am not sure if the term “all cash” has a well defined meaning and believe there are many fewer true cash deals than one would assume reading articles like this.

Perhaps, in the statistics cited, it is well defined but I doubt it. In the marketplace, it is very common for people to use the term “all cash” when it is more accurate to say that the offer was written without a financing contingency (this usually means the earnest money is substantial to guard against someone walking.) As a seller, an “all cash” offer had an appeal on two levels. First, I was free to concentrate on whatever deal (buy a new home, make an investment) without worrying about the buyer’s finance finance problems (downside was keeping a $35k deposit if buyer reneged and we had back up offers.) Even bigger, the new “consumer” agency rules makes it a crap shoot as to whether even a very good buyer will get approved. For example, new rules make it next to impossible for an entrepreneur or independent contractor (people without 3 to 5 years of W2’s) to qualify for a conventional mortgage. Also, the new rules require appraisers to appraise in areas with which they are frequently only vaguely familiar and rely heavily of comps based on $/sqft even though neighborhoods and quality vary dramatically and lender liability makes low ball appraisals common. Additionally, the lender is required to make ridiculous “haircuts” to asset values of the borrower like ignoring half the value of a large 401K or 25%%+ haircut to liquid secuities.

As a buyer, making an “all cash” offer allowed for aggressive pricing (again, I financed the purchase of the new home but people talk about the offer I made as “all cash.”)

Flippers seldom truly pay all cash. The hedge funds certainly do not. Again, they tend to make extremely “clean” offers without financial contingencies and have lines of credit to support purchase and re-model. In the case of the hedge funds or institutional buyers, they have mortgage providers who will take a pool of properties and provide aggressive mortgage rates. Much of the increase in “flipping” in Nor Cal has been a result of the reappearance of lines of credits to individuals (last round in 2006-09, many flippers – often real estate professionals teamed with contractors) had HELOC’s and Credit facilities which in 2009 completely disappeared and added to the collpase.

Rather than looking at “flippers” and evil investors or exagerate “all cash”, the root of the mania is a ddomed policy that severely penalizes savers (virtuallly zero ST interest for last 5 years) and subsidizes mortgage takers who line up their financing independent of conventional “subject to credit” approval. The result is a pricing bubble but many of the buyers have locked in 30 years of payments and are willing to live with a downside of renting out the property if it isn’t their primary residence. This site is corect that many of the people expecting to make money by renting are in for a sad education but that is a different problem and would be true at lower prices – netting 3% after expenses, capex and vacancy s more common than expectations of 6% to 9%. The big part is that in order to build equity a substantial amount of cash flow has to be plowed ack into the property (at least2% of purchase rice and probably 3 to 4% to have low turnover and gradually rising rents.)

Wholeheartedly agree.

Current policy flaw is that it will create a short-term building boom and will ultimately put severe downward pressure on rents.

Current buyers are instantly minted under-water homeowners. This is the Faustian deal when buying with low interest rates. The payments may be low but so will the price appreciation as interest rates inevitably start to rise.

This leads to involuntary land lords as people try not to sell properties with low interest locked in and rather to rent the property. Ultimately, this lowers for-sale inventory and will lead to a new construction housing boom.

The problem once again is that while all this is good and true, you can’t make home owners or renters out of thin air. Someone will have to occupy all these units eventually. The above process will ultimately put a downward pressure on rents which will ultimately put a downward pressure on housing.

I’m pretty sure most people who read this blog are likely quite aware that “all cash” does not mean the buyers are not leveraging their purchases. Indeed, I think a “true all cash buyer” would be a very very rare buyer indeed!!

The point is that most ordinary individuals & families looking to purchase houses are NOT able to finagle that “all cash” offer.

In a way, I think that “all cash buyer” is sort of becoming a sort of name calling. It may not be all cash after all… But the term does have a connotation that brings up images of someone who takes your taxi cab that you actually called for by aggressively waving a $100 bill at the driver as he shoulders past you knocking you into an ice puddle, & leaves you shivering in sub zero temps at midnight after a long night of work, for another 20 minutes while you wait for the cab company to send out another cab to your location.

We made offers here in Reno for homes in the 300K-450K range and offered 50-60% cash.

We were CONSISTENTLY outbid by all cash offers. I did not check the bank accounts of said buyers, but from what we heard, they really did have 100% cash to put down. Most of these folks were here from California….

From what I’ve been told in my area (norcal) at least a down payment of over 20% but less than 100% has no real advantage as there will still be an appraisal, inspections, etc….I could have put 40-50% down when I was still looking but did not bother going over 20%…am waiting for bubble 2.0 to pop and will reenter the market if and when that happens….seems very likely according to the sources I’ve followed for years that correctly called the last one. (the housing bubble blog, of two minds, etc…)

Yes of course they “really did” have “all cash” – for the purchase. But where did it come from? And did they intend to keep all that cash locked up in the house until they resell it?

That’s what we’re talking about.

Some of these people are wealthy enough to get a line of credit to have all the cash.

Even more do the “Delayed Financing” to present all-cash initially:

http://themortgagereports.com/6336/delayed-financing-rule-cash-out

There are probably other methods, though I’m no expert on the matter.

Point is that these people buying with all-cash are NOT necessarily keeping that money locked up in the house they’re purchasing. Using the all-cash is simply a tool to they are using now, if they can manage it, to beat out other offers… because all-cash is more attractive to sellers.

Party on, uncle Ben. That is what my partner Jack Daniels says. He is cooking that corn mash as I talk. According to Stockman, we are all going down hill in the coming bubble pop, so, I just invited my other friends, Jack Daniels and Johnny Walker over. We are all going out in style.

For what its worth, Bruce Norris, gives a free 1 hr audio preview of his seminar in Ontario CA on the California RE investment market.

He seems to allude to another couple years of good times for investors of SFH and condos.

http://www.thenorrisgroup.com/training/tng-events-calendar/comeback2/

I got a ‘Special Invitation’ in the mail a few months ago for a ‘Private Pre-Auction Event’ entitled ‘Flipping Burbank’ hosted by the stars of A&E’s #1 hit show: Flipping Boston. At the event they would explain how to: Gain insider access to private pre-auction inventories; Get up to $500k in pre-approved funding; Access gov’ment guaranteed RE programs; and they’d go through some of their strategies. Somehow BAC, WFC, and Chase are in on it too, perhaps sponsoring the seminar or something.

Bringing out the ‘system’ sellers, yo.

The dude that rents one of the town homes in my complex lost his renters at the beginning of the year. Usually he’s pretty good about keeping vacancies down, bringing in all manner of broken families, chain smoking Euro clans that got foreclosed on, etc., but this time around he’s looking at 5 or 6 months of vacancy.

Leave a Reply