The drawn out impact of quantitative easing on real estate: Japanese real estate continues to struggle while Bank of Japan expands monetary base. Federal Reserve and Americans style quantitative easing.

Quantitative easing is unlikely to get any airtime on the local press but this is the overarching policy that the Fed has enacted to pull us out of the recession. What many people do not know is that Japan is ahead of the curve when it comes to enacting quantitative easing to deal with a collapsing real estate bubble. The Bank of Japan has made news this year by aggressively expanding their monetary base to spark some sort of inflation in their underlying economy and subsequently weakening the Yen. The Yen has gotten weaker relative to other currencies and the Nikkei is up 30 percent for the year. One of the bigger questions around quantitative easing and Fed policy is the longer term impact on our economy. Housing prices have moved up because of three major reasons; investor demand, low supply, and historically low interest rates. Each one of these reasons can be traced to the Fed either directly or indirectly. Can an aggressive central bank with a low rate environment re-inflate asset prices?

Japan real estate prices

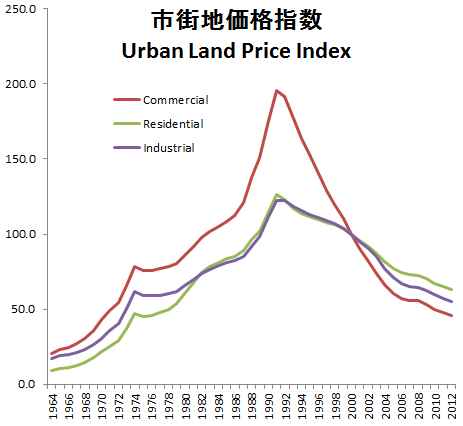

There is an interesting chart showing land prices in Japan:

The real estate market popped in Japan back in the late 1980s. You can see what has occurred over that time. The Bank of Japan has struggled to revive the real estate market since that time. This isn’t because the Bank of Japan has acted cautiously. To the contrary, the Bank of Japan has been very extreme when it comes to using their central bank as a means to revive their economy. Yet the struggle is still with deflation.

Inflation rate in Japan

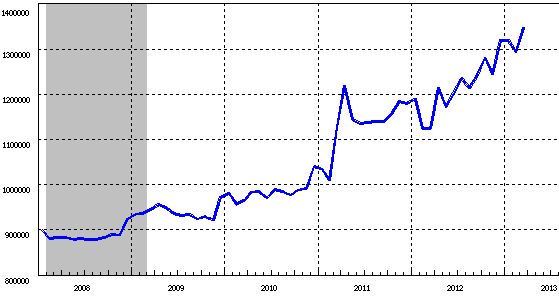

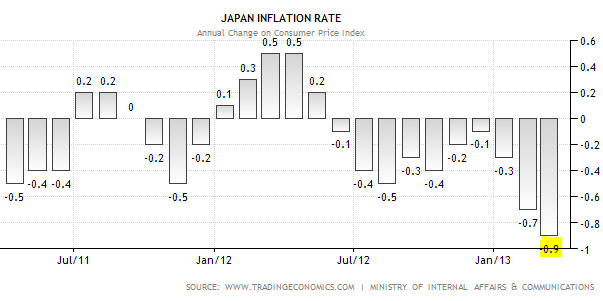

In spite of what is going on, with the monetary base, Japan still struggles with deflation. First take a look at the monetary base expansion:

The Bank of Japan has aggressively increased their monetary base since the global recession hit and this is on top of all their other aggressive quantitative easing measures that created zombie banks and other economic sinkholes. While the Nikkei has gone up strongly this year, deflation is still a major struggle:

What gives? Well first, economic growth has been weak and so has household income growth. This typically goes hand and hand. Over a longer period of time, incomes do matter. So real estate can only increase by so much even with mortgage rates that are lower than those we currently have in the US. Next, Japan’s savings rate has been falling for a couple of decades. So in spite of the Bank of Japan flooding the market with all these measures, prices are falling in many categories.

What was accomplished in Japan? There has now been multiple lost decades and overall households in Japan are not better off. The Bank of Japan has had to get more and more aggressive with their monetary policy. So where do we stand?

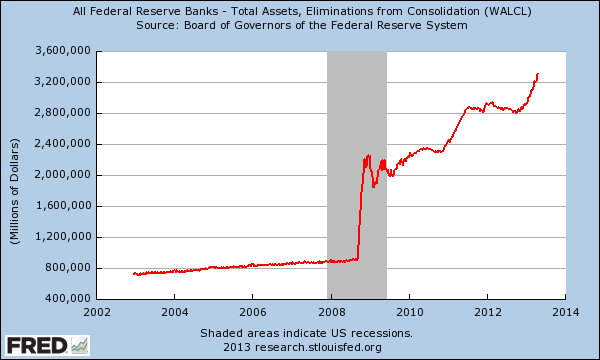

Fed Balance Sheet

There is little doubt that the Fed has thrown everything at our own real estate bubble bursting:

If we are in a solid recovery, why is the Fed balance sheet looking like it was still 2009? In fact, the Fed balance sheet continues to grow and will continue to grow with QE3. The balance sheet is now over $3.3 trillion. A big part of the holdings are mortgage backed securities that no one in the open market will buy. Is there a consequence for this? No one can really answer that because we’ve never gone into this kind of aggressive monetary policy. But to think this is a clear cut case of reviving the economy, just look at Japan and see that it isn’t as easy as using quantitative easing and expecting the economy to jump back up.

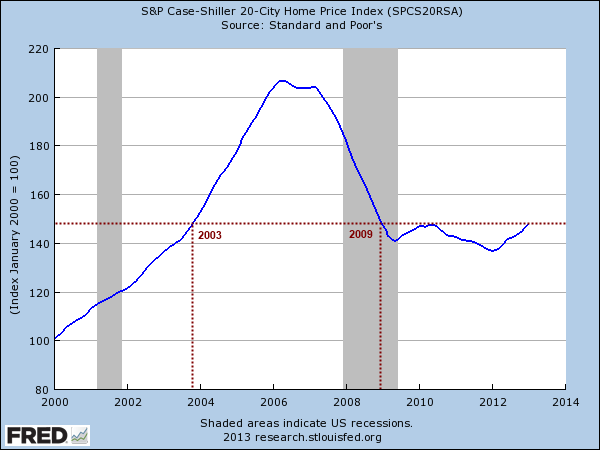

Case Shiller

Home prices are essentially where they were in 2003 across the US. It is clear that in the last year prices have picked up steam. Low rates, low supply, and massive amounts of investors are definitely having an impact. Low supply is going to adjust if prices keep moving up spurring more people to sell and more home builders to dive back into the market. Investors are already pushing cap rates beyond normal levels.

In this area, the US is looking different from Japan already. It is still too early to tell how much momentum this trend will have.

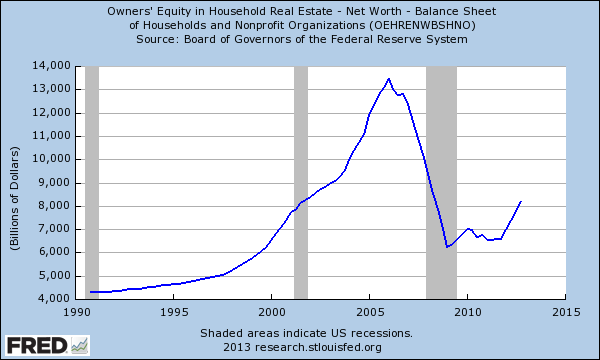

Equity in real Estate

While home prices are picking up, owners’ equity in real estate is still back to levels last seen in the early 2000s:

American homeowners are still over $4 trillion short in equity from the peak that was reached. As home prices rise the equation shifts but much of pressure going forward will depend on economic growth coupled by actual income growth.

Household incomes

Household income growth has been incredibly weak in the 21st Century:

In this regard we are very similar to Japan. While the stock market is at all-time highs and real estate prices continue to move up, the same cannot be said for overall household income growth. You can see the big drops above and most came after the recession was over.

It should be obvious that the rise in stocks and housing prices are not coming from household income growth. Much of it is coming from low rates brought on by the Fed, investor demand, and very low supply. Japan isn’t exactly evidence that we should be going full steam ahead with quantitative easing but that is the path we have taken. Even with mortgage rates in the 1 percent range Japan’s economy is still stuck in the mud. While there are similarities and differences, one thing is clear and that is both the BoJ and Fed have gone into uncharted central bank territory.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

54 Responses to “The drawn out impact of quantitative easing on real estate: Japanese real estate continues to struggle while Bank of Japan expands monetary base. Federal Reserve and Americans style quantitative easing.”

Prevailing attitude…as long as Fed continues printing, stock market, home values rise no matter what the economic realities; bad news is now good news. The poorer the data, more assurance QE continues infinitely. Maybe there is no end game; a new economic model…just keep printing money, soon we’re all millionaires. Will SoCal boomers be able to sell their 500K+ houses to a younger generation, although the majority of SoCal job opportunities seem to be sub $15/hr jobs? A record number of US pop on food stamps? Maybe Cashier Connor and Barista Madison can save up a 200K down payment for a 1200 sq ft. SoCal dream box living at Mom and Dad’s until age 40? Better hope that gubmint money keeps flowing and those suitcases of cash from Asia keep coming.

“Just printing money” (actually typing it as electronic entries in bank accounts) has not produced inflation yet. Yes, I know you spent 30¢ more for a loaf of bread last week, and anecdote always trumps statistics, but no statistic indicates a surge in inflation since the 2007-8 interventions. None, not CPI, not Shadowstats, not MIT’s billion-price index, none.

In fact, QE is an attempt to fight financial asset *de*-flation, propping up prices.

Unfortunately, according to Warren Mosler, QE simply changes the composition of the public’s balance sheet, it does not add to the economy. Read some of the Modern Monetary Theorists about this, for example http://neweconomicperspectives.org/2013/04/modern-monetary-theory-overview-part-1.html.

Yep, what’s needed is some actual stimulus, not the lame, weak-tea, half-assed Obama stimulus, condemned early on as half as much as necessary. A job guarantee program funded by Federal spending.

Yes, I know, politically impossible.

One of the problems is the public’s misconception about what provisions the federal government. Taxes and borrowing (obviously) do not fund government. Where do tax payers and lenders-to-government get the dollars they use for these activities if government doesn’t first spend them into the economy.

Taxes do not fund government. They make the money valuable, and ideally regulate the level of demand and/or provide an incentive for productive activity. We do not have the ideal now.

So government creates a dollar of “debt” with each dollar it spends. The “debt” is completely unlike household debt, and the “debt” exactly equals the dollars in the economy. Actual equation: Government “debt” = non-government financial assets + net exports.

See http://rooseveltinstitute.org/new-roosevelt/federal-budget-not-household-budget-here-s-why

I don’t know anything about that, but what I do know is that: 1) cheap oil production peaked in 2006 or so, but the demand from China, India, etc. kept on going up (aside from the 2008 reduction in demand). Did production rise to meet demand? Nope. So cost for oil had to rise to satisfy this imbalance; 2) Russia had a huge drought, TX had a huge drought, and the American breadbasket had a huge drought recently and the amount of food reserves the world has left are I believe quite low compared to average. Demand for Western type food is growing in Asia. With supply for food down, the prices rise to satisfy this imbalance. 3) Huge storms like Katrina and Sandy are raking havoc on insurance premiums on coastal property; Munich Re is sharking its head as it thinks about the future; 4) Folks in the pharmaceutical and medical field are in a good position to continue to raise their prices year after year. Dentists have turned into salesmen for 1000 dollar ‘deep cleanings’ and teeth whitening junk.

I see a lot of excuses why things should be getting more expensive that are marginalized when folks start talking about inflation. Part of the problem is that certain political folks in America are ‘in denial’ of climate change and peak resources.

@ Adam Eran, I have studied Modern Monetary Theory and I find it even worse than the current Keynesian / Monetarist status quo, as it takes the systemic perversion to even further extremes. I cannot think of a system less in accordance with the American principles of limited gov’t.

In the past century, the gov’t has already:

1) created an “off-balance sheet” entity to “create” new dollars (i.e., the Federal Reserve System)

2) severed the historical & CONSTITUTIONAL tie between (and fundamental value undergirding) “dollars” and the precious metals (because it spent too much and didn’t have the bullion to back up those fresh greens)

3) embraced a macroeconomic policy that encourages debt for all levels of gov’t, corporations, and the population while expanding gov’t power to ridiculous levels (Military & “Health” Industrial Complexes, Federal “entitilements”)

4) allowed banks to Mark To Model (or Fantasy) even when market-prices are available as comps [so as to prevent them from facing reality & failing]

5) become beholden to the Financial Oligarchy (remember TARP passed Congress on a 2nd attempt even though 98% of calls to representatives were AGAINST it?)

… and I could write far more. In short, my point is: given a history of the gov’t abusing their promises and claims, WHY WOULD WE WANT TO GIVE IT THE FULL, UNADULTERATED PRINTING PRESS?

If you think politics are dirty now, imagine what they’d be like when Congress had the power to create moolah outta thin air with absolutely no restraint (and their voters know it, and insist they do so), and also the ability to shape citizen behavior via tax incentives or penalties as It Sees Fit? Granted, we’re already 95% of the way there, but the heights of gov’t power in the last 5% make me quake at the prospect of incivility we’d witness as Large Powers wrestle for gov’t control … kinda like the late Roman Empire…

The problem is that Fed is not concerned about 60% of the population in CA. It only sees 40% which is into IT….most of the properties in CA are owned by people working in such cos or immigrants who have shit load of money. I don’t think prices are coming down here as still there are many who want to buy property in CA….I had a collegue joining in a month back…reason for getting H1 was that he could buy a home….home prices in his country are ridiculous and everyone in his country wants their child to be in USA….moreover even at these prices they think homes are cheaper here….in their country they won’t get anything for half a million…

“most of the properties in CA are owned by people working in such cos or immigrants who have sh*t load of money”

Really? Any links or data stating the majority of CA RE is owned by wealthy immigrants or people who work in IT?

Working in IT, being an immigrant and/or Asian does not magically guarantee RE success. I know plenty of nice folks of pretty much all races (yes, immigrants, Asians, heck, some even work in IT!) who bought SoCal, Vegas and Phoenix RE during the mania. Many properties went back to the bank; many still licking wounds, still underwater.

@Ken “reason for getting H1 was that he could buy a home”

Speaking as a former H1B holder: banks handing out mortgages to H1B holders is a sign of a bubble. H1Bs are temporary, a green-card is a long expensive process and there is no assurance of an application being approved. So in a normal market, banks would not be handing out 30-year mortgages to people who are in the US, by definition, on a temporary basis, and locked into a specific job with a specific company unless they can change their visa.

Drinks, Cashier Connor and Barista Madison will likely be liftetime renters in Socal unless they want to live in the not so trendy areas. There are plenty of young “professionals” clamouring to get a piece of the real estate pie in the “desirable” areas. It comes down to supply and demand again. These areas are built out, have limited turnover and lots of qualified buyers (said young professionals, foreign money, trust fund babies, move up buyers, etc). I don’t see this dynamic changing anytime soon; thus, I doubt prices will go down much in these areas. All my 2 cents of course. 🙂

Connor and Madison are rooming with 3 other people in a 2 bedroom. Out of the 5 one of them bunks on the couch. The dream for Connor and Madison is to one day be able to afford a single bedroom apartment of their own. I can hardly believe there is even a spark of home ownership in either of their heads. Dad and Mom are going to cover fixing the Connor Mobile cause they feel so dam sorry for them..

There are plenty of young professionals who do want to come to so cal for sure, but your recent comments seem to be quite ‘salesy’ lately, lordb. Every single person I know in LA that is looking to buy in prime or semiprime LA between $800k-$1.4mil has already stretched their potential budget at least twice since they started looking as prices have risen in the past 6-9 months and still haven’t found anything. At some point, they just won’t be able to stretch anymore and drop out and say f this, might as well wait til prices go down bc they all feel after an extended period of looking w/no success that the constant increases are too quick too fast, and rent. For someone that claims he used to be such a housing bear, and seems educated, its odd for you to ignore the tipping point where people won’t or can’t pay the new highest price.

I am one that has studied LA semi prime hardcore since right before thanksgiving, which is just 5 months, and I watch it get uglier every week in terms of less organic supply PLUS higher costs PLUS flips of 1-6 months with HUGE premiums built in. There is no WAY this will last in MHO. I can’t say exactly when it will go down, but I don’t even think it will take an interest rate rise or QE to bring em down, but of course that would be enough. Now I’m not saying it will crash, but there is a ceiling at income levels, and the quicker and more things go up, the worse the down. That being said, bc LA is LA and demand will never leave, there is a floor here where prices will never go below….minus something nuts like an earthquake, nuclear bomb or ridiculous taxes.

To be clear, I still believe buying now is not a bad deal depending on the market and at what level the home prices are at. No one can predict timing before the fact (without being lucky and of course being annointed a genius after the fact) of ups and downs. I am looking to buy where economies are stronger, like austin, now after recently quitting my LA search. if you can find the right house WITHOUT stretching your budget, have too much deflated cash, hop in the market because of the rates, but realize the odds are more likely than not real estate will go down almost nationally in the next couple of years simply based on real estate cycles regardless of the horrible fundamentals, but with the depth of down depending on area, so know your hold time should be longer or, ethics aside, you can play the interest only loan/willing to do strategic default as a hedge against a housing disaster.

FTB, trust me I’m not a housing cheerleader drunk on the kool-aid. Buying only makes sense if certain criteria are met (you plan on owning for the long term, be at rental parity, large down, DTI around 25%, etc). I do agree with you that we are nearing a tipping point where sellers are getting too greedy. I have witnessed this in my neighborhood, prices have seemingly been ratcheted up 75K-100K in the last 6 to 12 months. As a result, the houses no longer get multiple offers the first day they are on the market. Nobody has any idea how this will end up, but most here agree that there definitely is a floor where prices in certain areas simply won’t go under.

Like you said, sit back and be patient…that’s probably the best plan for now. Prices won’t go up much more and the mania will hopefully die down. Keep your ear to the ground because you never know when an opportunity will present itself. Good luck.

I got preapproved for the loan (350K) just a few days ago. But I don’t have the money for 20% down. Initially I asked for 200K because I do have 20% for this amount. However, I got preapproved for 5% down for 300K! Good news, right?

Wrong. I decided not to take the loan. I see another “echo” bubble forming. I see that in a year or two, when prices fall again, I will lose my equity and be stuck with high monthly payments.

But I see properties flying off the market. I am shopping in Murrieta/Temecula area and houses are going in just a few days, few weeks at the most. Seems like bidding wars are back.

Interestingly, it’s the low-priced properties that are being bid up. Higher priced properties are not. So for example, a house that was 200K just 3 months ago now is $300K. But a house that was 400K is still 400K.

My guess is that pretty much everyone is buying either FHA, or 5% down. This means the downpayment is at most 15K plus about 8K for closing. So you gotta have 23K to buy a 300K house.

It seems that about 25K is the magic figure. No one has saved more that that. Of course I exclude all cash investors who have cashed out equity in their other properties. “All cash” investors do not have much cash either. What they do is they get low-interest (at the moment) variable rate equity loan on their other properties. When interest rates rise, these “all cash investors” will be selling in droves. That’s one kind of “all cash investors”. The other kind is companies like Blackstone who buy with cash pulled from many smaller investors. They buy so they can rent out homes, and if prices go up a lot, sell them. Companies like Blackstone are the question mark. They can’t buy properties to rent them out if the price is too high, the ROI gets clobbered. But they can buy to flip. Depending on what happens they may dump their properties or not in the near future.

Overall, it seems the reckless lending is back. On one hand, there is a comeback in loose lending and lax appraisals. Government has opened the loan spigots. On the other hand there is a new “judicial” foreclosure process, where repossessing a home now takes 16 months, and this is the reason for lack of homes on the market.

The brokers I spoke with were shaking their heads and they said that “people never learn”. I didn’t get the impression they were saddened by this. They make good chunk of money on anyone buying a home.

It will be interesting to see what happens. In June FHA rules are changing and it will be more difficult to get an FHA loan. I think part of the “rush” right now is because of this.

I think latter this year the home prices will starting going down again. Something will have to give. The salaries are falling and the purchasing power simply isn’t there. This is all another bubble being blown. I see lots of people jumping in, but they will get burned by this market (again).

So I will wait another year or so before trying again to buy a home.

smart girl! You must anticipate and act accordingly. I sold all my RE in late 2005, except for my home in Bend, OR. I think you should probably wait more than a yr–it will take time for the policies to fail. Incomes will not sustain current prices.

Thank you for your post. I found it very informative.

I am not extremely savvy when it comes to real estate but I use common sense. In 2005, when my neighbors’ houses doubled in price in a not-so-hot part of town, it was not hard for me to see that the market was going to crash. I’m getting the same sense now.

I’m saving my money now. I’ve got $20K set aside for a down payment. I’m not going to get caught up in the frenzy either. I will wait patiently for another 1 to 7 years. I will save, save, save. When the interest rates rise again -and home prices fall- I will need smaller loan, thereby diminishing the effects of the higher rate.

People never learn. They let their emotions dictate their actions.

If I’m reading your last graph correctly, USA households have 8% less buying power than they did on 1/1/2000. This lack of wage growth is what is holding back inflation. It gives the fed cover to expand their balance sheet to infinity.

Bernanke has said that they have an exit strategy, but I doubt it. They have passed a financial Rubicon, of sorts, and there is no turning back. We’re stuck in the same low growth/no growth rut that Japan has been in for 23 years.

I 2nd that notion, except I add that Americans won’t tolerate the status quo for so long as the Japanese have … the cultural norms are far different. It’ll be a race to see which nation gets first forced into radical change.

Yes the chart shows that house hold income is down 8% or so, but are these the house holds of the upper 50%, the Romney voters, those with income to buy a house. We are interested in the financial well being of potential buyers, not the renting class. In California, we have a number of different economies.

“If we are in a solid recovery”, of course we are NOT in a solid recovery. The economy fell down the stairs, and it hasn’t got up. The real economy is down 10-20%(not the stock market financial economy). This increase in home prices is only intended to help the banks unload the bad loans and REO property, if it helps others, so be it. Once the banks get rid of the bad loans and REO’s, the Fed will pull the plug. Until then, party on.

I’d be willing to bet that the incomes of the upper 20%…aka people living and able to buy in premium areas have definitely gone up in the last decade. When everybody is included in the equation, things get murky. Like was said, many people are in the perpetual renter class, they won’t ever be owners. I would love to see what incomes have done in the last ten years for the premium areas, that is what this blog focuses on.

I am not a renter and have bought and sold properties in the last few years. Your comments are childish and ignorant. And FYI I talked to managemant at a large REIT that has has purchased thousands of Single Family Homes in Ca. Az. and Nevada and they have stopped buying in California and moved to other areas of the country because they feel the market in California is overbought with little return. For you to try and sucker more people into an overheated market reflects on your morals as a person.

Im not sure why most folks looking today to buy would care about their income over the last decade. i think many people look at the world pre and post crash so view their income from that ‘magical’ point a few years ago, or perhaps they just view it from today (and predictions for the future), but income 10 years from now is an unlikely reference point and irrelevant (and likely not even remembered by the person).

I know that lawyer base salaries at the top 200 law firms and within corporations have not risen since the crash and all-in compensation with bonus, is down (and I’m not including inflation…which doesn’t exist per bernacke). I seriously doubt the level of VP or middle manager within a corporation we are talking at these home price levels have seen their salaries increase nearly as fast as home prices have in so cal as of late. I don’t think general doctors (plastic surgeons are not looking at these price levels) have had their salaries increase. So its tech (most in northern Cali, but with a bit here), traders (mostly NY) and bankers (mostly NY) mostly and I’m sure other folks, like building owners, classic car sellers, pawn/gold shop owners and some complete professions I’m blanking on for sure. I still see more down incomes than up at those price levels. Counter would be many of these buyers own stocks which are up, but many do not as well as finance is less LA than NY and many individual investors haven’t been back in the market since the crash.

J Mac, you might not agree with my comments, but they are pretty hard to argue with. The upper crust of society was for the most spared during the Great Recession. The pain was not evenly spread. The true middle class and working poor definitely took brunt of the pain. If you don’t believe me, take a trip down to your favorite wealthy enclave this weekend and let me know if things look bleak financially. The truth hurts sometimes…

“If you don’t believe me, take a trip down to your favorite wealthy enclave this weekend and let me know if things look bleak financially.”

That’s a great idea. Lots of vehicles with Fireman stickers; many retired govt/safety personnel live in said enclaves. A big pension check arrives whether its the economy booms or busts. Most homeowners bought decades ago, they’ve benefited greatly from Housing Bubble 2.0 , Ben’s Stock Market, courtesy of QE. Young professionals who make sub 200K/yr? Most are lifetime renters. Talk to people in the enclaves, especially those over 65. Ask how their adult kids/grandkids are doing…adult kids living in properties Grandpa/Grandma have owned for decades rent free so they can stay in town…some adult kids moved back in with Mom and Dad…could never afford to live there otherwise on their SoCal salaries. Their grandkids? Meet Cashier Connor and Barista Madison.

We don’t make drinks anymore,

Yes, retired government firefighters making about $200,00 guaranteed pensions are rubbing shoulders with rich bailed out banksters in Beverly Hills and Manhattan Beach. Why do you hate government employees so much? Wouldn’t you at least defend government employees making measly amounts of money and instead bash banksters that gambled trillions of dollars and lost and we then bailed them out with trillions of dollars and gave them billions in bonuses?

You just hit the nail on the head. The Federal Reserve’s job is to protect the banks at all cost. Why don’t people realize this. They were never intended to run the country, but now they do. Since we don’t manufacture anything, our economy IS finance. Debt drives our economy and the banks have carte blanche at the expense of everyone. Unless people stop buying (debt) things, nothing will change. Like you said, watch interest rates once the banks are fat and happy again after unloading the crap on their books.

http://Www.westsideremeltdown.blogspot.com

@Latesummer2009: Yes, it is the job of the Federal Reserve to protect member banks.

The Fed obliquely mentions this: http://www.federalreserve.gov/aboutthefed/directors/about.htm “..Each of the 12 Reserve Banks is subject to the supervision of a nine member board of directors (board). Six of the directors are elected by the member banks of the respective Federal Reserve District (District)…”

Plain English version: 6 of the 9 members of each regional Federal Reserve bank’s Board of Directors are selected by the banks themselves. The bottom line is that the Federal Reserve is run by the member banks: i.e. Goldman Sachs, Bank of America, Wells Fargo, U.S. Bank, Citi Group, etc. They call the shots.

@Benson, the unstated purpose of QE3 is to take mortgage backed securities that no one wants off of the books of banks and transfer these to the balance sheet of the Fed. For the uninitiated, 30 year mortgages are typically chopped up into 10 year securities that are sold to investors. The most toxic of mortgages were issued in 2004, 2005, 2006, 2007 and 2008. The first of these garbage MBS’ are set to mature in 2014.

If 100% of the principal is not returned to the bond holders of these crap MBS’ when they mature then all hell would break loose and interest rates would sky rocket and home prices would plunge in the bubble prone areas. Banks cannot issue currency, but the Federal Reserve can. So in steps the Federal Reserve with QE3 to kick the can down the road.

In terms of home ownership, the US definitely has a bias to the effect that it glorifies and correlates home ownership with some sort of magical opulence. Take note: Mexico has 84% home ownership rate, Germany 42%. Dwell on that for more than two minutes.

That bias was basically put on Steroids when Barney Frank and his protege (Raines) took the limits off of Fannie. Not that he was the only guilty one – Congress went along with his mantra that everyone should own a home, regardless of their ability to pay for it.

You conveniently leave out the guy you voted for twice, DMAC:

President George W. Bush addresses the White House Conference on Increasing Minority Homeownership at The George Washington University Tuesday, Oct. 15, 2002

THE PRESIDENT: Thank you, all. Thanks, for coming. Well, thanks for the warm welcome. Thank you for being here today. I appreciate your attendance to this very important conference. You see, we want everybody in America to own their own home. That’s what we want. This is — an ownership society is a compassionate society.

I didn’t vote for Bush, but as always thanks for playing.

You also missed this line – “Not that he was the only guilty one…”

Reading = comprehension.

Federal Reserve’s new motto: “Theater of the Absurd”

Put these facts together and tell me that most middle class people (or families) who can break even on their bills can’t buy a house somewhere for cash in 5 years:

– A married couple can borrow $50k/yr. in student loans taking 1 masters class at a time each online (a single person half that). Cost: 12-15 hours a week. Synthetic pay rate: $40-50/hr. un-taxed.

– While in school no payments need to be made.

– Exhausted Stafford loans? GradPlus has no borrowing limit. Do as many degrees as it takes.

– Consolidating resets the 3 years of forbearance you get when not in school. Hint: you can probably re-consolidate if you take another degree and get more loans.

– If married filing separately, you get a deduction of 150% of federal poverty level twice (each person gets it), and both times with household size 2. This is better than filing jointly (at least for the IBR calculation). In CA or NV, community property rules means it doesn’t matter if one spouse makes all the income. Thus, IBR payments are your combined AGI minus about 46k, times 15%, divided by 12 (monthly). If you got your first loan after a certain date, it’s a 10% basis instead.

– If you invest it wisely in rentals and can live off rental net income up to 46k (run it as a business using an LLC so you can get all the write offs), you basically financed your properties for free. Your income needs should be much lower if you own your own house.

– If you lose your job or have minimal income, IBR drops to zero usually. Thus you will not lose your properties (the loans are not secured by the property anyway; the DoE policy is generally only to garnish wages, they can do liens but if it’s “owned” by an LLC what can they do? Anyway, it’s pretty hard to default).

– If you lose your job because the economy sucks, you can just go get another degree to pay for your expenses. You don’t even need to leave the comfort of your home with cheap online schools. See: http://collegestats.org/colleges/online/lowest-outofstate-cost , pick one under $6k / yr. Most of them use the same programs and blackboard system; if you can write essays and BS, you can pass most of them.

Finally, not fact but an observation: the banks, the elite wealthy people, and the government officials they basically own … do you think they don’t take every opportunity presented to get ahead (whether it screws everyone else or not) ? Here everyone is being given the opportunity to borrow as much as they need to get ahead, with a very reasonable contingency plan in IBR. If you are already maxed according to the IBR calculation, you might as well get more benefit than the half-worthless education provided by schools these days – use it to get a house and/or rental units.

Any comments on this new article from zerohedge re: cali housing? MUST read. Comments LordB and LA housing bulls or is everyone a sucker renter?

And now with the link; sorry!

http://www.zerohedge.com/news/2013-04-29/presenting-housing-bubble-20

Here is another good article on the 2nd housing bubble from Biz Insider

http://www.businessinsider.com/the-second-us-housing-bubble-continues-to-inflate-2013-4

I started learning about economics and the FED in 2005 when I learned of the first housing bubble. Here we are 8 Years later and I still don’t feel comfortable buying. I’ve wanted to be a Foster Dad so getting a McMansion type 5 bedroom is part of the plan. I want to help as many kids as I can. Raise my own tribe of independent thinkers, see if I can make a difference in some lives. 2010 was close to my price range in SoCal’s Inland Empire. Now Ben and his overlords have pushed my goal back for another couple of Years while Bubble 2.0 plays out. Thanks for f’ing up my dream of helping kids Ben. I spent my teenage years homeless and buying a property means more to me than Blackstone you piece of trash.

Why didn’t you purchase in 2010?

You probably could have had your pick of McMansions in the IE, lowballed the one you picked, waited another 30 days for the sellers to get nervous and lowball again. Then you could have refi’d a year later and really saved some coin.

Didn’t find the right property… Unlike most people I actually plan to, you know, LIVE IN THE FRICKIN’ THING, so I was waiting until I saw a property I really liked. Couldn’t fathom they’d blow another bubble this quickly. Thought 2012-13 was going to be similar to the 2009 bounce. Instead it looks like were in for a ride until mid 2014 at the earliest. Oh well, 2 more years of prudence and I’ll have been watching housing from the outside for a decade. At least it’s a nice round number…

I stand by my belief that the mortgage interest rate may actually come down in the next 12 months. Just about every single economic indicator we have is screaming deflation right now. What will the Feds response be???

Front running the Fed, it’s the new economy.

Agreed. The liquidity trap has been set.

The liquidity trap is already here. If mortgage rates come down it will only accelerate the crash. More greater fool flipper/landlords will jump in and exacerbate the rental inventory problem causing the big players to exit or rent at obscenely low cap rates. I HOPE the mortgage rate goes down as this will speed up the only process the FED cares about, clearing the banks of “assets”. Once this is accomplished the crash can commence. The FED will not continue QE forever. It would destroy the very system they control. Why would the FED run the US into the ground with hyperinflation??? When’s the last time you saw a billionaire piss on his Pershian Rug or crash his Lamborghini for the hell of it? They are merely playing the game they always have. First inflation then deflation, always to maintain control.

I really hope that deflation comes in the form of lower prices for basic goods and rents and not just housing crashing again… but somehow I don’t think it’s going to do much good.

What indicators ? I don’t really know.

The commodities sector has been selling off for a while and employment participation is at 1980 levels. Europe is in the dumper. This is recessionary by all measures.

What we’ve got is the Fed blowing furiously into the stock market and the real estate market. They are diverging from the real economy. The Fed will need to do more in the coming months to keep this trend in place.

The most important indicators are pointing to hyperinflation, not deflation. The biggie is the federal deficit. If you use GAAP accounting, it was $6.9 trillion in 2012. The headline, cash deficit is a little over one trillion, but that doesn’t include off budget items, under funded pension plans and Medicare, and interest due on past under fundings.

Ironically, when hyperinflation hits, the people are so preoccupied with finding enough food to eat, nothing else matters all that much. There isn’t anything the fed can do to prevent it at this late stage. Get real, the annual federal deficit is 40% of GDP!!!

Lotteries for new housing already? Wow.

http://money.cnn.com/m/#!/2013/04/30/real_estate/home-lotteries.json?category=Latest%20News

I’m with Doctor Doom on this one but I think the asset (especially housing) bubble will pop sooner:

http://money.cnn.com/2013/04/29/investing/roubini-stocks/

we do not live in a supply and demand economy, corporate monopolies rule.

lets face it, prices are rising for many reasons (all fake) but one must certainly realize that oh so many know that so what of prices fall? just stop making payments and pocket the difference, if/when the bank comes for the house (the longest squat stretch i know personally was 48 months!!!!! 48 MONTHS OF RENT FREE LIVING, and that couple just went and bought a condo) just leave and buy something with your big fat downpayment…..what a sucker are those who pay their bills.

and i suspect this will happen all over again, so why not just pull the trigger? heads i win and tails the tax payer takes the loses.

one last thing, and it’s been overlooked here for a long time since this issue has been dormant for the longest stretch i can remember, but a nice big fat earth quake will cull the herd considerably, i remember the 1994 northridge quake had quite a few running for the exits….AND yes the big one is coming. and once the pattern gets back to normal we could be having big to moderate quakes for 10+ years… keep that in mind bulls…….this first thing that comes to mind when the earth starts shaking is GTFO

And this is the REO to rental exit plan…

http://www.bloomberg.com/news/2013-04-19/deutsche-bank-loan-signals-rental-home-bond-dreams.html

Just brilliant, this should end well.

Great article Joe. Aside from it all making me ill, the way it is written tells me that investing in these funds is a bad idea and that it’s just a way for the banks to kick the can down the road. I especially love the comment by Zero Sum on that article – it sums up what is being done (poor Jack).

isnt this an analog of sorts to what got us to 2008 in the first place? we’re just repeating the circle again? lol

Despite the ridiculous increase in prices over the past year in a half in LA County, prices will probably still continue to increase over the next 1-2 years at least. With mortgage rates at record lows, inventory at a fraction (20-25%) of what it was a few years ago, and buyer demand coming back in a big way, it’s hard to see this ship crashing any time in the immediate future. The way I see it, once momentum gets going ( in either direction) it usually goes for at 5-6 years. This swings both ways, of course. Back in 2010-2011 you couldn’t convince anyone to buy a home ( that certainly applies to many people on this blog). Now that housing is back in a big way, there will always be fools who will purchase at prices above what they should pay, and it will continue for years before the market eventually reaches a point of collapse. Unfortunately, the game is either 1) stay put and be a renter forever or 2) take some risk, buy a house, and hope your not on the sucker buying at the peak making everyone else money.

@ Housing Guy;

Unfortunately, the game is either 1) stay put and be a renter forever or 2) take some risk, buy a house, and hope your not on the sucker buying at the peak making everyone else money.

Hahaha the 2005 realtor mantra is back with the addition of a disclaimer.

Leave a Reply