California housing looks cheap in comparison to some Chinese Cities: $25.5 Billion Invested into California by China since 2000.

Foreign money has been a key ingredient in propping up home values in many cities across the United States. There is no doubt about this. If you look at places like Irvine, many new home communities are being sold largely to investors from China. This also applies to house mania happy San Francisco. Yet even if you question your own sanity regarding California crap shack prices, things may look affordable to certain people abroad. The amount of investment flowing in from China into the United States is amazing. A large part flows into real estate. This is how you get lower homeownership rates and also a drop in mortgage application volume yet somehow, you see home prices surging on low inventory. In a global market money can flow in and out of systems easily.

The Chinese Connection

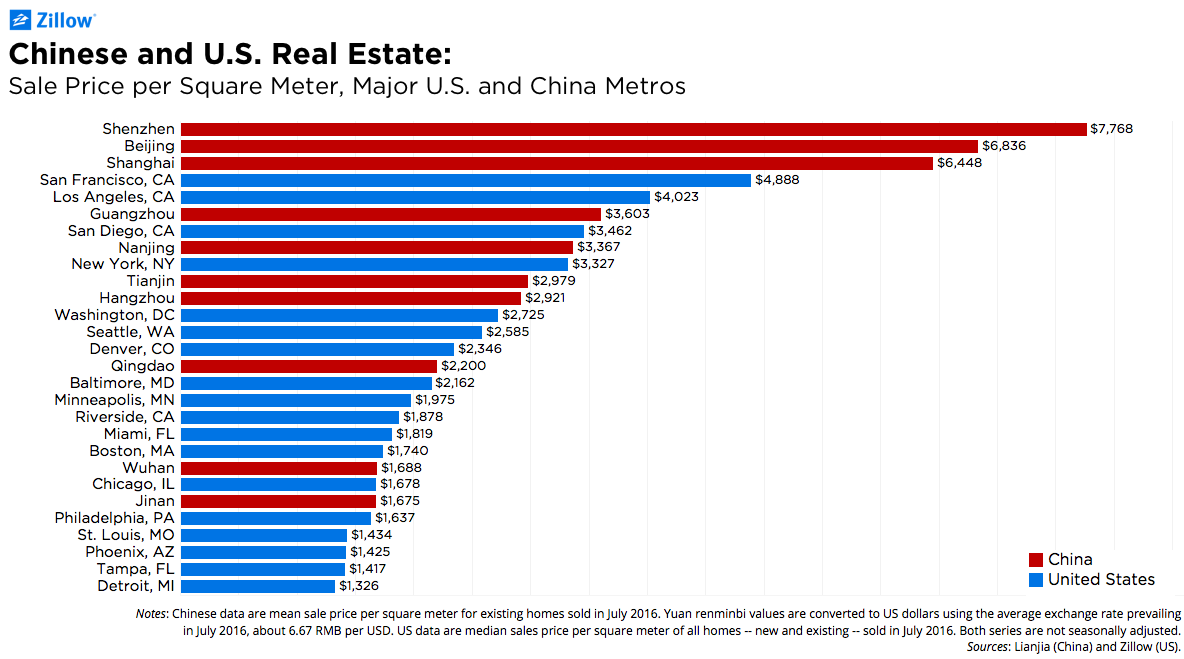

There is a global compression of the middle class and this is impacting people in all corners of the market. While San Francisco and Los Angeles home prices seem wild, just look at prices of real estate in some cities in China:

The market is going bonkers and as we all know, things are relative. This is how you get people suddenly thinking a 1.5 or 2 hour commute is normal just to live in a crap shack. This is how people justify certain prices on poorly built junk and ultimately reconcile their own cognitive dissonance on being mortgaged for life. There is also the pressure that comes from starting a family but many largely don’t factor in the unforeseen expenses that are associated with this. But house horny buyers are simply fodder in this game.

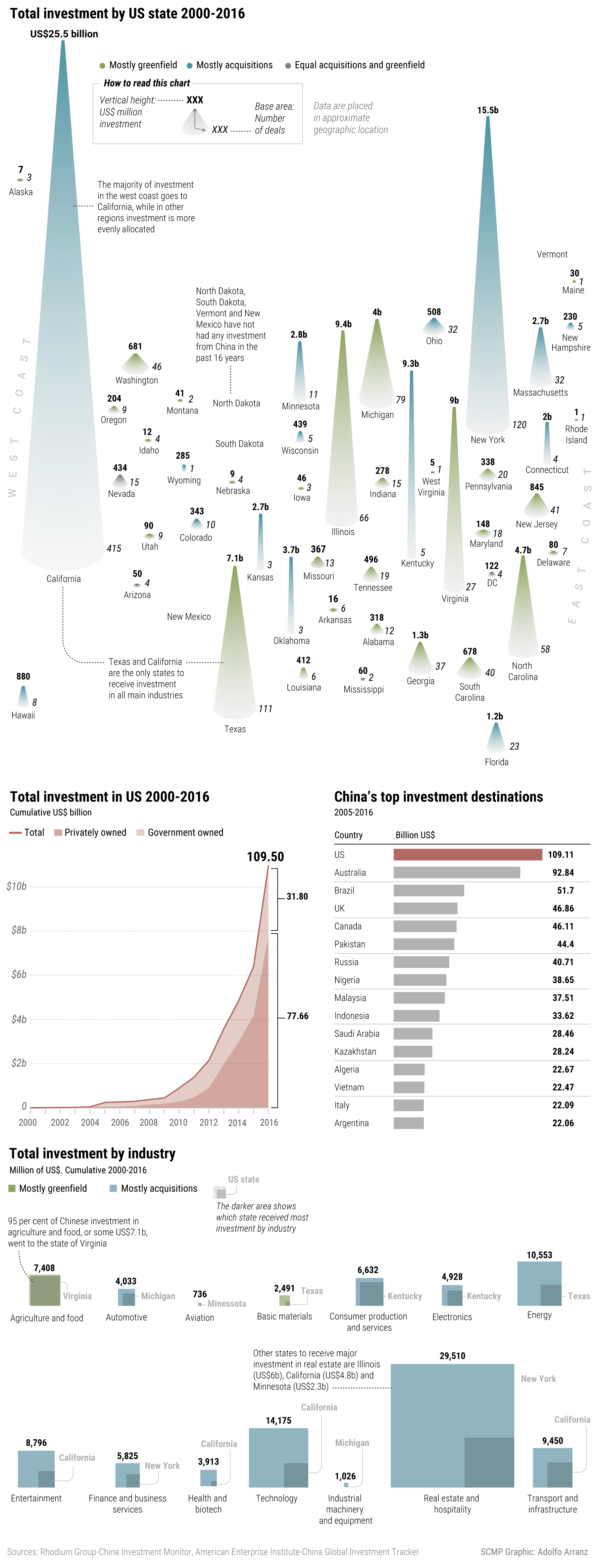

What many don’t see is that real estate markets are now global and will boom and bust with some level of connection. The house humping brigade is now a worldwide phenomenon. “They aren’t making any more Earth!â€Â And right now for California, the biggest source of foreign money is China:

This shouldn’t come as a surprise. Some markets like San Francisco, Palo Alto, Arcadia, San Marino, and Irvine to name a few have massive amounts of money flowing in from China into local real estate. Many professional families let alone middle class families in these markets don’t stand a chance in buying a home short of them buying a crap shack and committing to an insane down payment and a massive mortgage for 30 years. 30 years in this fast changing world where technology is disrupting markets and employment sectors so quickly is telling. Yet somehow you want to chain yourself to a crap shack for 30 years.

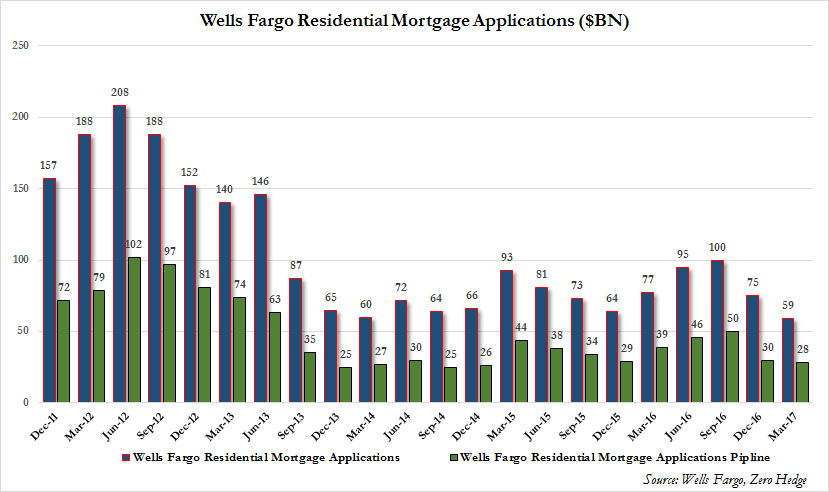

And most Americans are too broke to afford these homes. Just look at mortgage volume from the largest mortgage dealer, Wells Fargo:

That sure doesn’t look like Americans are going bananas for buying homes. But you have low inventory and global capital flowing out of markets in massive ways. Who needs a mortgage when you have a suitcase of cash?

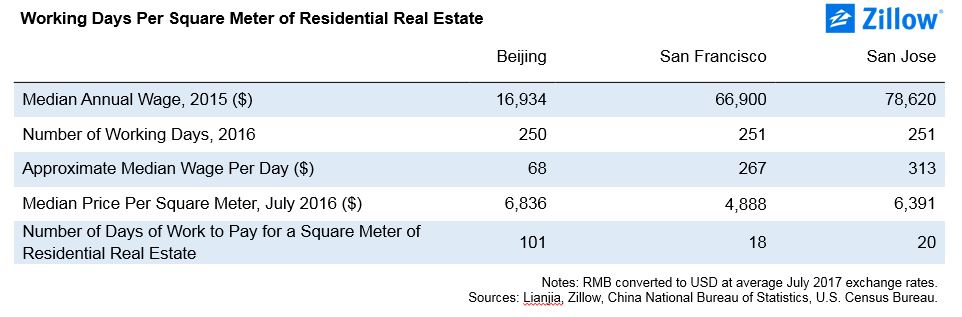

Zillow summed up the numbers for the average chump:

Not exactly the best way to go about living your life being chained to a crap shack. But real estate chumps live in various countries. And then you have places like Vancouver that have enacted taxes on foreign buyers:

“(Zillow) In August 2016, the government of British Columbia, Canada, enacted a 15 percent tax on foreigners buying homes in the rapidly growing city of Vancouver. Most now agree that the Vancouver housing market has slowed substantially since last summer, but the data remain inconclusive as to any specific effects on international buyers of Vancouver homes. And there is less agreement on whether the tax has pushed would-be buyers of Canadian homes to instead consider U.S. homes south of the 49th parallel, especially in nearby Seattle.â€

Capital is going to flow where it wants to flow. The middle class of California is already priced out and many are leaving to places like Texas. That is why California is now a renter’s paradise.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

259 Responses to “California housing looks cheap in comparison to some Chinese Cities: $25.5 Billion Invested into California by China since 2000.”

Meanwhile #FakePresident wants to gut the Consumer Financial Protection Bureau:

http://www.marketwatch.com/story/as-republicans-look-to-neuter-cfpb-mortgage-complaints-for-the-most-vulnerable-hold-steady-2017-04-19

As the Consumer Financial Protection Bureau, an agency established in the aftermath of the financial crisis to protect ordinary Americans from bad behavior by companies, comes under fire from the Trump administration and Congressional Republicans, a new analysis shows a steady drumbeat of consumer complaints about mortgage products – especially those that touch the most vulnerable Americans.

Lol you DemocRATS do nothing but whine, no wonder you can’t stop losing.

So other than insults, you got nothing? Good job comrade!

So other than tears you’ve got nothing? SAD!

I am holding out my breadth for when they pass the Citizen Protection Act.

The subject is Chinese massive investment in the US housing market and it’s impact on US citizens who want to buy homes, why would Gibbler try to hijack the posting threads by posting something that is entirely unrelated?

The CFPB is not a governmental agency and doesn’t receive it’s funding from Congress. It receives its funding from the Federal Reserve which is private bank and not a government agency. It has enormous power to damage major portions of the U.S. economy. The CFPB often acts in an arbitrary fashion, ignores due process for businesses and industries that it targets, and has reversed long-standing policy and procedures. More importantly, the establishment of this agency sets an extremely dangerous constitutional precedent. The CFPB’s director can only be fired by the President for specific causes, rather than at will. The CFPB is also not subject to Congress’ “power of the purse†for its annual budget. This vast amount of power centralized in a single agency would be dangerous under any circumstances, but its lack of accountability has allowed the CFPB to abuse and expand its authority in an especially reckless manner.

Leave it to corrupt authoritarian, dictatorial, totalitarian Democrats like Lizzy “Fakahontas” Warren to push an unaccountable and unconstitutional agency like the CFPB.

Please read and educate yourself.

Although it has some private characteristics, the Federal Reserve is an entity of the US government. The Federal Reserve is an independent government agency, much like Amtrak and the Post Office. Yes, they have the ability to make profit but are created for the public good, nothing more. In essence, created for the people. The President appoints Federal Reserve Board members and Congress approves. Profits are sent to US Treasury. No one can buy and own a Federal reserve bank. Employees at these banks are paid government employees.

The CFPB was created much in the same way as the Consumer Protection Agency to protect morons (like those who may not understand their government) from allowing wealthy/savvy bankers to abuse the powers they have with their knowledge of financial markets. It was created by Congressional law like other government agencies have.

Please make your points without ignorance

JB, make your points without displaying ignorance.

Please read and educate yourself. As a starter, begin with “The Creature from Jeckyll Island” by Ed Griffin. You may find at Amazon. There is more to read if you don’t rejoice in your ignorance. Ignorance is not bliss.

You said “Although it has some private characteristics, the Federal Reserve is an entity of the US government. ” WRONG! NONE of the employees is a federal government employee. It is a private corporation – as federal as “Federal Express”. Just because they use the name “FEDERAL” does not make them government. It is a private corporation owned by the largest banks in US. To make it “appear” more “federal” they ask the blessing of the president for the one of their choosing, or they present 4 of their own employees and tell the president to bless one of them. In the end, the president is ALWAYS a puppet of the FED. The president and Congress don’t have a clue what the FED is doing. Most of them are pure puppets of the FED. They never audit the FED.

They create money out of thin air and demand interest on them. ONLY PART of the interest is returned to the Treasury which is also controlled by the FED for all practical purposes. There is a revolving door between the FED and Treasury and only members of a certain tribe have access to those positions; I know it is just a coincidence. Large part of our taxes go to enrich the FED with interest for money created out of thin air.

Before you spew your ignorance for all to see, read something, and forget the propaganda.

The Federal Reserve is an independent government agency, much like Amtrak and the Post Office. Yes, they have the ability to make profit but are created for the public good, nothing more. In essence, created for the people. The President appoints Federal Reserve Board members and Congress approves. Profits are sent to US Treasury. No one can buy and own a Federal reserve bank. Employees at these banks are paid government employees.

The CFPB was created much in the same way as the Consumer Protection Agency to protect morons (like those who may not understand their government) from allowing wealthy/savvy bankers to abuse the powers they have with their knowledge of financial markets. It was created by Congressional law like other government agencies have.

Please make your points without ignorance

I’ll believe all of the propaganda I can before I listen to your Far Right idiots

From the Fed Reserve website:

The Board of Governors of the Federal Reserve System is a federal government agency. The Board is composed of seven members, who are appointed by the President of the United States and confirmed by the U.S. Senate. The full term of a Board member is fourteen years, and the appointments are staggered so that one term expires on January 31 of each even-numbered year. After serving a full term, a Board member may not be reappointed. If a member leaves the Board before his or her term expires, however, the person appointed and confirmed to serve the remainder of the term may later be reappointed to a full term.

Go to https://www.federalreserve.gov

When you start delegitimizing your own government might as well start moving up in the farthest reaches of the Appalachians and keep to yourself

The bottom 2 paragraphs were copied and paste from JB. I did not write those.

@JB:

Your objective source about the Federal Reserve is to actually source the FED’s own website? LOL

Please. Here’s one of these “Far Right Idiot” as you call them named no other than Denis Kucinich (D-Ohio) laying down in simple terms what the Federal Reserve is really all about:

https://www.youtube.com/watch?v=u2KBpqiORkU

The truth has nothing to do with partisan politics (I’m a registered democrat myself) and calling us “far right”, “racist”, “Appalachian”, “conspiracy theorist” or whatever won’t change the FACTS my dear.

Consider the following scenario. If #fakepresident starts a war with China (trade or real), much of the money flowing in from China will dry up quickly. This will cool down the housing market in the U.S. substantially. On the other hand, consumers will pay higher prices for items typically imported from China. This could cause inflation, which in turn would mean higher interest rates.

Question to ponder: How would U.S. employment be impacted in this scenario?

A good 50% (at least) of what we buy from China is stuff most Americans could easily do with out, or do with much less of. I’d rather pay 50% more for an electronic gadget made here, and get a 50% break from current prices on my house purchase, than pay a 300% premium for a shanty over what it’s worth in a less popular location, just to have more rapidly-obsolescing electronic and plastic trash.

I agree with you Laura. The problem is that many Americans live paycheck to paycheck and a significant rise in prices for everyday items will hurt them a lot. They would like a house but just buying basic necessities is a big part of their income. Their main worry in life is just survivng till the next payday. Although they complain about high home prices, their needs and spending are much more focused on fundamentals.

Then there are the ones that are obsessed with the latest toys, fashion, etc. Reminds me of the movie Wall-E.

Agree with you Laura!!!

“I’d rather pay 50% more for an electronic gadget made here”

I would pay double for almost anything if it would last.

A vacuum seems to last about 12 months at my office.

Yep. We all live in an instant gratification society.

People spending money they don’t have to buy things they don’t need to impress people they don’t know.

BUY ANYTHING IN SANTA MONICA….!

What are you guys talking about with material goods inflation?

We’re already in a positively absurd level of inflation, living costs. You take most people’s mortgage or rent… add in health insurance and possibly student debt… and what’s left?

Yes, you can still get a can of beans for 80 cents. Perhaps that could inflate. But who cares? It’s the living costs that are already so inflated that the disposable income for cheap crap from China is near irrelevant.

Does anyone really believe the local politicians in CA have the political will to do anything about this? What a public policy nightmare those of us who live in California have been placed in. Foreign “investment” in local real estate drives up the prices of homes to insanity, and dragging rents sky-high right behind it.

Politicians like to raise cash. Higher Home Prices lead to higher Property Tax Income. 1% of $450K or 1% of $800K crap shack? They let this run as long as market will bear. If the tax income starts to falter and/or people start to foreclose hence tax revenue decreases we will see a politically driven adjustment quickly.

Good point. California has embraced a very bizarre ideology that placates foreign takeover and frames it as ‘healthy investment’, but when it comes to exercising personal freedoms like deciding which foreign agents are to be injected in your child’s body, it is one of the most repressive. What the Dr. says about low inventory is true; but could it also be that the surge in housing prices is a reflection of the FED expansion of the monetary base over the last few years, and that housing is priced normally because it reflects the inflation that has not shown up in other sectors yet? The first two needs on Maslow’s hierarchy, food and shelters, perhaps show these inflationary figures first…

Sorry, but in my view, you guys have this backward.

Property taxes are way too low! Yes, you read that correctly. It’s mortgages that are way too high. It’s prices that are too high.

People are so ridiculous when it comes to the mortgage interest deduction. “Yay, I get it back at the end of the year!” You don’t get anything. When you follow the money, you’re just the middle man. You pay the bank and then the IRS makes you whole. So what’s really happening… the IRS is subsidizing mortgages.

The FIRE sector runs our economy.

Instead of the massive amounts of interest money going to banks, (how they make money), would you prefer the same amount or even much less going to better schools and infrastructure? That’s how the whole thing is supposed to work. Stop worrying about taxes… and focus on the FIRE sector that’s causing all of the massive income inequality.

And when you find yourself talking about “The Fed”… keep in mind that the Fed is just another name for the banks. Goldman, Citi, Chase, etc… run the Fed. (Sorry, it’s just a pet peeve of mine when people refer to the Fed instead of the banks.

Quite the opposite….local zoning boards in Arcadia (now known as ArcAsia) are deep in the pockets of developers and realtors, and can’t re-zone quickly enough to allow the “McMansions” that newly arrived Chinese buyers demand. No end to this in sight.

Oh, come on, st63. Any city of Arcadia folks are making peanuts compared to the banking world.

And it would be good if property taxes were higher and it drove costs lower.

San Francisco’s at $4,888! Look at all those 8’s! That’s lucky!

Sure would be nice if our politicians gave a sh*t about Americans being able to afford homes and would actually clamp down on this nonsense with a large tax for foreign buyers i.e. what Vancouver did.

We should also do away completely with birthright citizenship but of course that would destroy Democrat’s voting base so the leftist scumbags of CA won’t ever let that happen even if it became federal law.

Whatever. Our opinions don’t matter in this country. I sure hope one day I can be wealthy enough to hire lobbyists so politicians will actually value my thoughts!

It will never happen. Trump needs rich foreigners to buy his properties. Trump needed a rich Russian to buy his mansion to launder their money. This administration will not clamp down on foreign buyers. Too much to lose. The Chinese government is trying though. Without much success apparently.

It will never happen. DemocRATS need foreign money to bolster false economic numbers just enough continue to prop up their failing welfare and entitlement spending aka vote-buying system. Thank goodness Corrupt Hillary Clinton has been sent back to the woods before she could sell out our country anymore than she already did.

“It will never happen. Trump needs rich foreigners to buy his properties. Trump needed a rich Russian to buy his mansion to launder their money. This administration will not clamp down on foreign buyers. Too much to lose.”

I agree with this. The U.S. economy is highly dependent on foreigners, whether to make goods or to buy our debt. What will most likely happen is that many of foreigners will be shellshocked when they, like the Japanese, learn that American real estate can go bust.

“The Chinese government is trying though. Without much success apparently.”

Not from what I’ve read. Many Chinese buyers have had trouble settling foreign purchases because of increased government scrutiny. If a relatively open and “free” economy can be manipulated by the Fed, why couldn’t a closed society be cowed by its authoritarian regime?

I think although Trump ran on a nativist/populist message of America first, that it will be impossible to implement based on the people he has surrounded himself with, who generally believe in propping up the military industrial complex and drinking from its expansion. The jobs are not coming back. This is neoliberalism/globalization in action: it serves the rich. When 300 million goes to one MOAB in Afghanistan and 200 million can solve Michigan’s water crisis, the priorities of the administration become undeniably apparent to anyone one the fence. That said, the dems are so flawed with their gender crusades and neoliberalism that they pose no serious threat to the status quo.

So who was the 2016 Presidential Candidate who would have been most likely to put a tax on foreign home buyers? Someone who hasn’t made millions on foreign money? Most likely it would have been Bernie. Bernie was the only serious candidate who hasn’t made millions by being in a public office.

And, California can’t survive without ever increasing real estate values, which drive up property taxes, which only rich Chinese can afford, which makes Jerry Brown Jr., County Boards of Supervisors, etc., smile from ear to ear! Certainly Prop 13 isn’t doing much for those coffers!

“Seen this all before, Bob” sounds like a typical low information Democrat who believes all the fake news fed to him by the LGBTQ hacks on CNN and MSNBC. No doubt he also lives on the Democrat’s bankrupt welfare plantation in a Section 8 apartment subsidized by taxpayers?

Like I said, Bernie was the only serious candidate who wasn’t receiving large sums of money from foreign nationals. Trump constantly receives money from foreign buyers for his real estate and the sale of his mansion to a Russian Oligarch for nearly 2X value with suspected laundered Russian money won’t make Trumpo eager to enact taxes on foreign money. Hillary’s dubious foreign donations to her charity won’t make her tax foreign money. Both Trumpo and Hillary continue to make millions on foreign money. Neither would likely tax the Golden Goose. Meanwhile, Bernie has a net worth of 450K? He isn’t being paid off and would have been our best hope as President. Please respond with an intelligent argument from your Section 8 abode. Incoherent ranting never helps convince people.

There are no democrats or republicans, just “progressives” (more like regressives) and neocons, aka NWO (new world order, same like the old world order):

http://www.zerohedge.com/news/2017-04-24/real-new-world-order

LA/OC is turning into survival of the fittest. The smartest with the best educations from the right school are able to land big salaries and pull down a blue chip property. For them, LA/OC is a lottery ticket.

For the less smart who only achieved state college are fighting over homes in less desirable areas. No lottery ticket for this group.

And, those without a college education are fighting to avoid homelessness.

This is the future. The entire country will witness this pattern in the next decade.

Basically the coastal California region is becoming a place only the wealthy can afford to live in. The wealthy will require certain occupations to be preserved here. These include teachers, police, restaurant workers, and a few more. Most likely there will be “workforce housing” for these occupations that will be subsidized. But if you aren’t in one of these “essential” categories, you will be out of luck. That’s why companies like Toyota are bailing. 70k job is jack diddly squat here, and the wealthy do not need accountants.

Yup, and democRATS still want to keep bringing in more and more people even as it erodes the quality of life for those of us here already. Sad!

The democrats pursue two mutually exclusive goals:

1. Have open borders to bring all immigrants legal or illegal

2. Promise everyone free everything even if it is not possible to provide everything and have open borders at the same time.

The end result of that will be 1% overlords and all equally poor like in feudalism. CA will change to that before the rest of the country but they want the whole US to look like that. They are almost there.

Once you realize the borrow, tax and spend like crazy philosophy is designed to crash the system so they can try and create their marxist utopia, all their insane moves make sense.

Expensive trains that go from nowhere to nowhere? Check.

College education up 1000% in 30 years? Check.

Offshoring jobs while importing millions of unskilled people? Check.

Instituting and promoting monopolies (like healthcare and every other industry) to ensure cost inflation of 100%+ per decade? Check.

Its destruction of the culture and country that the ((locust)) seek, and their doing it all over the world currently. They build nothing and destroy everything. But dont worry, they’ll fix everything by having bathrooms for all 67 bizzaro genders theyve conjured up in their twisted brains.

What’s with all of this irrational Democrat-bashing? Are you pro-Republican or something?

They’re both the same, owned by the banks. Wake up.

Your probably right. Unfortunately blue collar workers making less then 100K are not going to cut it in any halfway desirable area of LA, SD, or the OC. Southern Cali is truly becoming a society of “Haves” and “Have-Nots”.

In my opinion, those with money move outside of CA where they can have a much nicer a home for a fraction of the cost in a gated community or the golf course. Then they have various paid off investments allowing them to travel all over the world rather than being stuck in traffic bumper to bumper, inhaling smog all day long, work all day for the wage of 8 hours and being afraid that the job may be gone and the house along with it.

Sorry if you associate a 30 year millstone (of debt) around your neck with winning the lottery. Life of a debt slave sucks. If the “smart” person considers that winning the lottery, I would suggest he goes back to school and ask for a refund; they did not teach him critical thinking.

I went to school to Cal State for Bachelor Degree and further overseas for MBA but I learned what is important in life. Shaking in your boots for 30 years for fear of loosing a crap shack is not winning the lottery. Money are good only if they provide freedom and high standard of living. About 99% of those in SoCal have neither at current prices.

Many wealthy work mostly from home. I know several like this. This insulates you from the biggest negatives of LA (traffic, dirty areas, dangerous areas, etc.). You pick a nice spot with great weather maybe close to the ocean and enjoy life.

Oceanbreeze, I did not talk about the wealthy 1%. I was talking about life in general in SoCal for the rest 99%. The 1% in SoCal have over 5 million in assets.

I said many times on this blog – if you have over 5 million in assets/equity go ahead and buy. You can buy with cash (no risk to lose the house to the bank) and regardless what the market is doing you are covered. You can live close to the ocean for clean air, you don’t have to be stuck in traffic because you can also live off of investments, also paid in full. Or, you can do the same thing in flyover country with less (1.5-2 millions instead of 5 millions). The point is in both cases you are not a debt slave. Having freedom means a lot to me.

I agree with Flyover

JT,

I am curious, what do you consider to be a big salary and/or household income?

On the Westside, close to the ocean based on JT recommendation, you need minimum $400,000/yr, or you are poor. In SF, you need minimum $500,000 or you are poor. That based on the purchasing power for house prices in particular or cost of living in general. Assuming you don’t have any inheritance or gifts from parents, that income is just to have a middle class standard of living, not to be considered rich. That is the equivalent of $80,000 in flyover country. Actually, similar house in similar neighborhoods in flyover country are less than 10% what they are in SF.

Flyover, you are about right!

I sold the So. Cal. family home, and fell back to a Denver property and one in Montana. In Flyover country, I can live quite comfortably, am in a good financial spot, and can do things like travel pretty freely! I have a higher quality of life than 90% of Californian’s who don’t live near the beach … I happen to live on or near lakes and outdoor recreation opportunities in each location, so don’t really miss the California cold water beaches!

Came here from Mish. Nice blog you got here.

I just purchased a home in Orange, CA for what I feel is a fair market price, perhaps even a few thousand below. I am basing that on a rent vs. own comparison in which I will come out ahead owning assuming a modest rate of appreciation, say 2%-4%/year. It’s definitely not a crap shack but of course I could have bought a house in Nashville and a house in Waco and a house in Boise all for the same price. Whatever.

The margin is definitely sliding away from unskilled/uneducated people in OC. You should read the comments, never seen such an entitled bunch in my life, as if SoCal living were an entitlement. Survival of the fittest indeed! I am living that dream. Wish me luck, hope to extinguish the mortgage in 20 years.

After your purchase you started living the “American Dream”….but the reality is you are visiting an online blog to gain affirmation? Here you go: Great job on buying that overpriced house during bubble peak. Clap, clap, clap. I’ll wait for the crash and purchase 50-70% below today’s prices. I’ll make sure to let you know once that happens. Good luck.

“The margin is definitely sliding away from unskilled/uneducated people in OC. You should read the comments, never seen such an entitled bunch in my life, as if SoCal living were an entitlement. Survival of the fittest indeed! I am living that dream. Wish me luck, hope to extinguish the mortgage in 20 years.”

Perhaps you should expand your definition of groups being priced out of OC. At a median RE price of 600K, OC RE requires a family to pull down at least 170K/year (good luck if one of you takes time off of work). To reach rental parity (which itself is a bubble), said family would have needed a down payment of ~200K. That is why buying RE in over-priced markets has never been riskier.

@Millenial_Crapshackbuyer,

Let me know when we have 20% off prices in the beach cities, that’s when I buy another property. My suitcase full of cash will be ready, I hope yours is too.

Last sentence should have read:

“That is why buying RE in over-priced markets has never been riskier for even college-educated households.”

@Lord B

“Let me know when we have 20% off prices in the beach cities, that’s when I buy another property. My suitcase full of cash will be ready, I hope yours is too.”

I cant recommend that. 20% price deduction would be a soft landing. There are no soft landings when bubbles burst. I will certainly let you know when i make offers that are 50-70% below today’s prices though. I will probably be able to buy in cash after the crash. Also, I cannot recommend carrying cash in a suitcase…..better to have it in a safe or in the bank like in my case.

“I cant recommend that. 20% price deduction would be a soft landing. There are no soft landings when bubbles burst. I will certainly let you know when i make offers that are 50-70% below today’s prices though. I will probably be able to buy in cash after the crash. Also, I cannot recommend carrying cash in a suitcase…..better to have it in a safe or in the bank like in my case.”

OC is not going to correct 50-70%. You’ll be waiting a VERY long time before that happens. Inland Empire? Sure.

Millennial, Why keep it in the bank if you are so sure the market is going to crash? Take all your cash and buy options to short every REIT. Better yet, short the entire market. I suggest a 3X inverse ETF. You’d make millions! Why are you even even wasting your time on this blog? With your crystal ball you should be on Wall Street managing a hedge fund. I’m surprised headhunters aren’t beating down a path to your door for your insights alone.

Not everyone is looking to time the market. You are praying for the market to collapse because you have no hope of owning anything unless it does. Why didn’t you buy in the last downturn?

I bought my first town home in Huntington Beach in the late 90s at 8%. I refi’d every time rates dropped. I have less than 10 years left on that mortgage. I’ve been through the dot.com crash, Great Recession and will survive whatever is next. I could care less if the market crashes 50% tomorrow. I have no intention of ever selling. It currently rents for 2X my PITI and I’m below market.

I’ve owned my primary residence for 3 years. It may crash in value but again, it doesn’t matter. You’ll never have to worry about buying my crapshack.

James, sounds like you made a rational purchase. Congrats!

“OC is not going to correct 50-70%. You’ll be waiting a VERY long time before that happens. Inland Empire? Sure.”

Dont care too much about OC and IE. Sure, i’ll wait. Does not matter if i wait 2 years or 20. I am saving monthly by not buying an overpriced crapshack.

You have a point. OC got a New Zealand company called rocket lab. New Zealand like OC has a lot of foreign investors buying real estate. In fact I found that Mission Viejo had 18 percent of their foreign born from Canada. Aussies like LA and Ca is more of the cost of New Zealand, parts of Canada, United Kingdom where the Chinese also drove up real estate. Solution is to get these people to come to California to buy housing, so Ca is not all Latino and Asian.

I, for one, welcome our new Chinese Overlords.

I see what you did there Jed.

https://www.youtube.com/watch?v=8lcUHQYhPTE

“God money I’ll do anything for you. God money just tell me what you want me to. God money nail me up against the wall. God money don’t want everything he wants it all.”

As a Chinese we know that california is the best place to invest in real estate Politicians are dumb in this state. Be afraid, most of the big apartments in west Los Angeles are owned by Chinese investors. Americans are renter in this nice location. Go around bentwood santa monica and you will notice that most of the owner are foreigner. Canadian politicians are more smart than American politicians they imposed a high taxes for foreign buyer. But Americans politicians they just want tax money money money hahaha

Fatima, I doubt you are Chinese. You probably speak as much Mandarin or Cantonese as my dog. The ratio between rich and poor is in China is about 1:1000. And these 1000 “slaves” have no rights and terrible work conditions. They will never make it to the US. The political conditions, corruption, pollution etc. drives the rich guys to park their money in a safe spot like the US, Canada, NewZealand, Australia, etc. China is in the biggest bubble in history. Wait until the global bubble crashes….There won’t be anymore talk about Chinese driving up RE prices in California after the crash.

NIN – Head Like a Hole

@Dean

Used to listen to that great song during the 90’s. Surprised that it was released in the 80’s.

Most people under 50 don’t remember or know about the real estate crash that started in 1989. Just before that, Japan was pumping billions into high end penthouses in Manhattan and Miami and buying up choice commercial properties like Rockefeller Center. Before the ink was dry on the contracts, the real estate market crashed and the Japanese lost a metric shitload of money.

Of course, nobody under 50 knows about this, so they think the situation with the Chinese is unique.

Sony buying Columbia topped it off. Before it was Columbia that was the MGM lot. Most beloved scoring stage in all of LA. Once Sony bought it all of the big shots refused to record there.

Not sure if this will repeat itself but I have taken note of the same over the past 10 years or so.

I remember the news shows where the Japanese were spending millions on racing horses and buying Pebble Beach Golf Course as well. I think the crash will be quite bad when the Chinese market collapses.

I think that something as simple as common sense will convince you that things aren’t really different this time. Unfortunately, greed has overcome reason for many.

I graduated from college in the early 1990s. That is when I purchased a handful beach close total fixers … some called them teardowns, but I screwed them back together before renting them out. For the first 7 or so years, they were negative, meaning the payment was greater then the rent, so I worked overtime at my contract programming position to make enough money to cover the gap between the payment and rent.

They were cheaper than the going prices on nearly everything in South Central. East Manhattan Beach on a large lot for 250K. No problem. Manhattan Beach sand section 300K. Now, well maintained original homes in the sand section are pusiing 4M.

Back in 1995, many said 300K in the sand section for a fixer was too expensive and I would lose my shirt. They said prices would crash because back in the 70s, the sand section homes were less than 50K. The boomers were pissed off at the WW2 generation for running the prices up. This is the same story playing out today.

But, a huge difference in the 90s. Back then, if you had saved 5K, you could call First Federal bank on Wilshire Blvd, and a loan rep named Jesse could land you a loan in the sand section. But, Jesse would first send someone down, sometimes himself, to look at the property an determine if he was willing to take on near zero down mortgage. If he did not like the property, he would say no and I would find another. That is how I obtained properties. Jesse vetoed about half of the properties I found.

What happened is these low down lenders would only loan money in areas they felt would hold their value. Soon, lawyers called such practices redlining, So, what the industry did was write these subprime loans on all areas … including areas only a fool would invest in. This caused real problems for everyone. Now, the current generation graduating from college are unable to pull down that 1M starter home in a good area with a small down payment.

Yes sir, the redlining lawyers have stolen the opportunities I had twenty years ago. I feel sorry for those in their 20s and 30s who have to save a massive down payment just to get in. People in their late 30s and 40s where the last generation who had the opportunity to get mortgages on great properties without a huge down payment.

Twenty years from now, I will be in my 60s, and the generation behind me will be a bunch of renters. But, time is everything. I would happily give all my homes away if I could be 22 again. Time is everything.

When I said:

They were cheaper than the going prices on nearly everything in South Central. East Manhattan Beach on a large lot for 250K. No problem. Manhattan Beach sand section 300K. Now, well maintained original homes in the sand section are pusiing 4M.

What I mean is the current prices in south central are higher than fixer prices in MB 20 years ago. This will happen again. 20 years from now, you will see south central prices higher than today’s beach prices. The big assumption is the world does not drift into war.

Great post. Very interesting perspective. I’m in my 20’s and feel that way. I have 55K saved, Earn 65K a year, and can hardly afford a decent home in a decent area in Corona. Going through the typical rent vs buy scenario right now.

I remember. Japan hasn’t recovered since that crash.

What’s unique is that the Japanese never wanted to live here.

The Chinese want to live here.

There are 10 people in China who want to take your place here.

They view this as an escape hatch from their horribly polluted and corrupt country.

It’s not just an investment it’s an escape pod.

Chinese and Japanese are not the same. Therefore, buy now!! And, make sure you offer 51% over asking price! So you bid out the Chinese! Great time to buy! You win!

Many of these Chinese acquisitions are not even occupied but are rather used for money laundering. Their primary income stream is still based in their home country; what else is going to fund their expensive lifestyles? So yes, American RE is very much an investment.

Our country won’t be a good place to escape to for the Chinese, if we nuke China. Seems to me that Trump is getting slowly ready to nuke China, since we put anti-missile systems near South Korea. It’s not because of North Korea. Trump’s administration is just making sure China won’t be able to do anything when we nuke them. But, then there is Russia. Their missiles and Air Force can do something about all this. I hope wars don’t happen though.

The Japanese went on a similar monster US real estate buying spree in the late 80’s with all the money they made selling the world electronics and cars. Sony, Toyota, Hitachi, Toshiba etc were set to rule the globe. They over leveraged themselves and are still trying to recover. The Chinese will likely do the same.

I have hit the jackpot with this shitbox. This may be the grand champion of real homes of genius. ONLY 600K, located in a “DESIRABLE” part of Torrance. I can’t wait to see what it sells for…

https://www.redfin.com/CA/Torrance/812-Crenshaw-Blvd-90501/home/7650841

Lord, please let us know what this crap shack eventually sells for. I would guess that it will sell for about $400,000 which is probably the value of the land minus the cost of tearing down the present home.

Guys let’s pause for a second. The value in all of this overinflated property is in the land. It’s the proximity to jobs. Proximity to our great weather and the beaches with freezing cold water.

Is the house a dump? Yeah. But what’s the comp on the land? Obviously someone would buy, tear that thing down, and build.

Yes this is a tear down. However, do you really want to replace the house with upscale home or build within the same design as the other buildings?

Hi Homerun,

I’d simply prefer that our focus be on, “Why are land values this high?”… than on, “Gosh, what a piece of junk for $600K!”. I find the latter to be less relevant.

Asking price is now…

$1.1M. Woooooooow.

82% of Chinese do not pay a mortgage or rent-they own their home outright. Most new home sales and resales are made cash, not with mortgages. The amount of mortgages is increasing, but that is a fundamental difference between Chinese and American home buyers.

It is tradition for a Chinese family to buy a home for the son when he gets married, usually about age 30. They have 30 years to save up for this purchase. The average Chinese worker saves 36% of his income. The son and his future wife have had 8 to 12 years since high school or college and they save money while living at home. The grandparents most likely live in the same house and they often donate to the cause. It is easy to see how a modest blue collar family can come up with over $200,000 cash for a home purchase. You see articles about a young single person or recently marrried couple in Beijing or HK who can’t qualify for a mortgage based on their income. Their biggest problem is that they live in China but they have gone outside then established Chinese system for a young couple to purchase a home. They are using the American system, and it isn’t working in China. One is based on savings and one is based on debt and cash flow.

Of course, HK, Beijing, Shanghai, etc are huge bubbles and are just as unaffordable as the Bay Area in San Francisco or Park Avenue in Manhattan. It makes good ink for Doom and Gloom articles, but they do not represent the market in general.

I don’t think it’s crazy for a family of 6+ adults (adult children, parents, grandparents) to save 200,000 cash in US$ but to save 1+ million $? Seems like a stretch for a middle class/upper middle class Chinese family. How are they getting such large sums of cash to be able to come to CA coast and buy up all the most expensive properties?

The Chinese coming to America and Canada are not the middle class or upper middle class families. They are the millionaires and billionaires. Percentagewise, they are a tiny part of the Chinese population. Many of them are fleeing the crackdown on corruption,

China has blow the biggest credit bubble in the history of humanity and you somehow think they are using all cash?

All cash no. But A LOT of cash because their savings rate is through the roof compared to the savings rate in the United States. Only 18% of homes have a mortgage, compared to half of all homes in the U.S. That means China’s problem is not a foreclosure crisis. China’s problem is that people are parking a HUGE amount of their savings in real estate without understanding the risk.

China’s housing value as a percentage of GDP is around 3.27 times GDP last time I looked. The United States was 1.75 at peak.

If real estate falls 60% (like Japan), that would mean $12.2 trillion in wealth would just disappear.

The reason for the bubble is that real estate is a popular investment and people are speculating like crazy. I think it’s as simple as that. They often buy empty properties for the future, or even for pure investment. They don’t actually even use the properties. “An independent firm monitored homes that were using no electricity and found a 27% vacancy rate.”

Spot on Roddy

People buy the old homes for 750K in the city so they do not have to commute the long hours. This is called freedom, maybe not fair, but free trade.

I know I am going to get major hate for saying this, and i am disappointed in myself but… I think i am going to talk to a realtor about buying a house.

I really don’t want to spend over $400K (i am only 26 and am single). Living in an apartment and renting all your life is no solution to expensive housing. A boss at my last job was 38, a finance director and lived with roommates just so he could live in “WEST LA.” I think it would be wrong for a financial planner to say “keep renting because housing will crash.” It just doesn’t make sense to me. It’s like saying “don’t invest in stocks because someone on a blog said stocks are going to crash.”

I am not planning on being a landlord or even speculating on the market going up. I am just a guy who is willing to make sacrifices so I don’t have to rent my entire life.

My question to you readers is, where should I look? I can pretty much live anywhere considering I am single and don’t have family here. I work in Commerce and would not want over an hour drive (during normal rush hour traffic). I really like Sunland but am open to suggestions. Also it has to be a house with any kind of yard (no condos, no townhouses). Does not have to be big (its just my dog and I).

Sunland is not cheap. Homes priced near $400,000 are crap shacks. Take at look at this $415,000 bargain: a small, 2- bed., 1 ba. fixer-upper in a dumpy neighborhood.

10535 Oro Vista Ave,

Sunland, CA 91040

My girlfriend recently sold a similar-sized home there, in better condition, for $490,000. She is moving to Riverside Co. where home prices are reasonable. My advice: Don’t buy at all; Sunland is just as overpriced as the rest of L.A. Co.

This 1 bed, 1 bath Sunland house actually looks interesting with an asking price of $389,900. I am actually tempted to make an offer around $370,000. At Google maps, the neighborhood actually looks nice.

10307 Eldora Street

Sunland, CA 91040 — Los Angeles County

https://www.redfin.com/CA/Los-Angeles/10307-Eldora-Ave-91040/home/8149625

Gary

Thanks for the advice Gary. I actually was talking to a co worker who lives in Riverside and she said she takes the train and there is a shuttle bus to our office. So that would be nice to just ride along and work on other stuff instead of driving. I think Riverside/Corona will be my best bet as a young first time homebuyer. I will be going out there this weekend to meet with a realtor and tour some homes.

As far as Anaheim area i could not see anything under $400K lol and I’ve been there once or twice and really don’t care much for it. I want a place close to nature, with a real yard and not just an extended patio/grassy area.

390K, $605 per sq ft. for a 1/1 644 sq ft. shoebox built in 1922 with no central heat or central AC in Sunland. This is what it has come to? I’ve seen garages bigger then that house. I would go stir-crazy there. That is if the summer heat didn’t kill me first. Besides, one bedroom properties are more difficult to sell.

I looked at Garys link below, not being familiar with sunland. That. Is. Insane. Tiny place for an insane amount of money in a crummy area – have at it, I’ll pass.

People like Gary are the ones who allow the bubble to grow.

I live in N. Orange County and commute to the Whittier area. 30-45 min commute depending on the traffic du jour. There are OK places in Anaheim, Orange, Fullerton, Brea, North Santa Ana that you could consider. With a better job scene in Orange County, the morning commute on I5 is worse coming into OC than leaving it. And that’s with all the construction on the I5 from the border the 605. That will be done in a couple of years. 2/3 of my drive is in OC and half the time is spent in LA Co. My drive is about 22 to 25 miles depending on the route. When the construction is over, I’ll get a big break as to picking a single route that usually works. Commerce is about 5-10 miles beyond the 605, right? The Citadel is right on I5. I know people who live in Sunland and I don’t think their area is as nice as mine.

“the I5 from the border the 605.” should read “the I5 from the border TO the 605.”

Yes, I work off Eastern Ave so I would probably exit near the Citadel outlets. Right now I commute from Hollywood and each day I take more and more side roads just to avoid that parking lot that is Route 101. I would say a good day I get home in 45 minutes, a bad day 1 hour 15 minutes. Getting to work is always pretty easy, maybe 40 minutes tops.

Hollywood wears off quick, everyone is trying to out-do each other with cars, drinks, fancy apartments. Most of my friends live paycheck to paycheck and have admitted that to me. It gets exhausting hanging out with a bunch of nobodies who think they are somebodies.

My commute is pretty much the same both ways, with the LA County traffic being worse. The current traffic problems between the LA County line and the 605 may get a lot better when the construction is done in a couple of years. You might think also about parts of La Habra and also East Whittier (a little known LA Co. area with a lot of loyal residents). La Habra Heights(La Co.) is pretty expensive and has 1 acre lots. La Habra (OC) has good and bad areas. You can take Lambert to Washington Bl to get to a freeway, or go down to Slauson once you’re in Whittier. Whittier itself may have some gentrified areas near the college, and may have your Hollywood hipster vibe without the serious problems of the real Hollywood.

Unfortunately, if 400K is your budget, you’re probably toast in the places I mentioned. $500K might get you in. My place is 1500 sq ft on a 7700 sq ft lot. My Daughter’s place is 2600 sq ft on an 11000 sq ft lot. We live 1/2 Mi. apart. Something like mine could be found for $500K if not flipped. My Daughter’s place is probably $200K more. But it wouldn’t hurt to search some of the towns on a Real Estate site. Maybe Orange, Fullerton and Brea (all of which I like better than Anaheim) plus the LA County areas I mentioned in the second list. Our friends who live there like Tujunga but I don’t. To each his own.

I would increase my budget a little, and buy this torrance prop:

https://www.redfin.com/CA/Torrance/1437-W-222nd-St-90501/home/7646629

That is a sketchy part of Torrance, but better than Sunland. And, it is improving. It is better to be on the other side of Western, but the prices jump. This could be the perfect starter.

Quiet street, big lot, Torrance PO. In the mid 400s. Buy, Buy, Buy.

Actually, Tujunga-Sunland area is a great place to look. It, very quickly is going from a meth-biker town to the next Eagle Rock. Already there are large sections that are ‘done’ – (the secret is out and the prices are high.) – like the Crystal View area. But there are still sections that are ripe for a great buy. The area is still a secret to a lot of people (not the Armenians in glendale — they figured it out) Any day now some LA Curbed article is going to talk about it being the next Eagle Rock and then… it’s too late.

Manbearpig4lfe,

You won’t be getting any hate from me with your decision. If you have a downpayment, can comfortably afford the monthly payment and have some stability (job, plan on owning for the long term, etc)…there should be nothing stopping you from buying. Other than taxes and death, there are a few more guarantees in life:

1. Nobody can predict the future. Home prices can go up/down/sideways from here on out. Your guess is as good as anybody elses.

2. Long term renting in places like socal is a horrible idea. It will be a financial death sentence to most who can’t save a dime.

Good luck with your home search!

Buena Park, Fullerton, La Habra

Don’t buy. There are many fixed costs to owning a house such as taxes and maintenance. You are young and single and will likely move often. When you marry, you’re likely going to move out-of-state. It’s expensive to sell a house and move.

The stock market is not the same as the real-estate market. In real-estate, you make money when you buy. The market does not necessarily keep trending upward. Neither does the stock market, but stocks can reasonably be expected to grow with the world economy and productivity. To make money in the stock market, you need to get in and stay in. Housing is not a way to make money but a place to live and an expense.

Corona ain’t bad. Just like any place it has it’s good parts and it’s not-so-good parts. The problems with Corona IMO is that there are no jobs, it’s hot as hell, and you generally have to travel on the horrendous 91 freeway to get anywhere. With that in mind, I would much rather live in Corona then say City of Riverside, or San Bernardino. Norco is supposed to be nicer and more rural than Corona.

I’m in your same boat man. I’m 28. Been waiting so long for this thing to crash again but it just refuses to. Wish I had been ready in 2014 to buy. In hindsight, that would’ve been a great time to buy. I don’t want to get to 2020 and think the same thing about 2017.

I could live in Corona and buy a decent 1500 sq ft home for 430K. Or rent a really nice apartment for $2K. I just might bite the bullet and purchase a home even though I feel like I’m buying at the top.

Brian,

“I just might bite the bullet and purchase a home even though I feel like I’m buying at the top.”

I think that’s a great idea. If you buy now its impossible for Brian to outbid Brian. Because as soon as you buy you are locked in. I might be you neighbor in 2020 if the crash happens then. Every time we’ll meet on the front lawn it will sting you since my mortgage will probably be half of what you have to pay for the next 30 years. My excess cash will go towards vacations, nice cars and upgrades. At some point it will be unbearable for you to watch and you walk away from your house. That’s when i come in again and scoop it up for a bargain. You will never get off losing all your equity and it will haunt you forever….”why did i not just wait a few more years…..why”. So by all means, I encourage you to buy now.

Americans (households and entrepreneurs) at least have the option of moving to Texas, or one of the several dozen cities in the south and the heartland that have sufficiently elastic supply of land for housing, that their median multiples never reach 4. While you read articles about “house price inflation in Texas”, it is all relative; the median multiple inflating from 3.2 to 3.6 might sound impressive, but consider Californian cities, and Vancouver, and Australian cities, where the median multiples are in the range of 8 to 12, and inflation from 8 to 9, or 9 to 10, or 10 to 11, in a single year, is “normal”. The latter is where the real issue is.

When you have the “elastic land supply” conditions of the perennially affordable Southern / heartland US housing markets, the inflow of foreign capital actually helps with the financing of infrastructure for growth, and helps with economies of scale in the supply of housing and infrastructure. The conditions in which foreign investment pumps a bubble in unimproved land values, and does nothing to help the supply side, are a consequences of self-inflicted policy choices regarding land for urban growth.

Spare a thought for Australia (and New Zealand). In the chart provided above by the good Doctor, for “China’s Top Investment Destinations 2005-2016”, note the USA in number one place with $109 billion, and Australia in number two position with $93 billion….. 15% less, for an economy 90% smaller!

Australia has “open space” to burn, and could have chosen to be like Texas with its urban growth policy; it could have had systemically affordable housing and been an attractor of productive, value-added urban industry. But one day in the future, the people writing the history books about all this will be discussing Australia as the ultimate case of the economic insanity that has swept the once-enlightened first world to varying degrees. “The USA” as a whole, will suffer a lot less because it has wide regional differences in policy, and internal rebalancing relieves a lot of the worst effects and claws back benefits in some areas (Texas etc) to ameliorate the ruination that is mounting in CA.

This is also an object lesson in human incapability of “learning the lesson” – after 2008 one would have assumed that sane, enlightened people would have avoided a repeat of the previous cycle’s trajectory in their particular region, especially given that “good examples” were evident, on which policy reform could be based. Australians are under a mass delusion that “we are different”; Californians must be under a mass delusion that “this time it’s different”.

Of course the good Doctor’s point is that the investors driving the price inflation this time, are Chinese who have a different angle of view; but you would hardly believe the speculative frenzy gripping a segment of the population of Australians themselves; insanely leveraged portfolios and all the rest of it. Are Californians themselves immune from this, this time around?

There will be some clever investors who cash out at the right time, but they are keeping their opinions to themselves. The mainstream narrative is that “property capital gains is a path to wealth, that enlightened people have discovered (and everyone else are just losers)”.

Australia doesn’t really have space to burn. I will agree it’s under crowded, but it’s water problem is enormous. Having lived in NZ you have the problem of high demand and a small population to produce it or import it. Outside of Victoria and the narrow coastal areas in East up to Adelaide, then a tiny area around Perth, Australia can’t support many people and everything needs to be shipped over.

That’s why Chinese are richer than average American Joe lol

May I add Fatima we are the landlord of middle class American lol

LOL someone is having fun here….

Hey Wang Butt, you’re not my landlord! So put that in your opium pipe and smoke it.

Foreign investors today are so different than eight years ago. Chinese love California, both living and investing in here. If you look from a global perspective, properties in Southern California is cheap compared with Beijing, Shanghai, Northern Cal, New York, Vancouver, etc. A lot of the rich people in China already transferred their wealth overseas in the past few years. Buying properties with cash is not an issue at all. A lot of those people are looking for a safe harbor to park their money. A 6% return in U.S. is much better than a 15% return in China, considering the inflation rate. With limited inventory, even mortgage application is dropping, the price will still go up.

DH, I can’t blame anyone looking for a legal safe harbor for their money. I work with many hard-working Chinese nationals in the engineering field. The are nice people and just like us, they looking for a conservative safe place for their money. The problem is how the US government treats US citizens. Trump got elected under this assumption, but so far based on Trump’s cabinet, Bernie would have been a better choice.

Globalists love it! One world, all holding hands singing ‘cum-ba-ya’, except its the Chinese living in the nicest homes in the nicest neighborhoods with all the money, and American’s barely making ends meet! There are no excuses and no one else to blame except for the person staring back in the mirror!

We should have all voted for Bernie. He lived as the most FDR-like candidate. When Hoovervilles were being built on the White House lawn in the late 1920’s, FDR saved them. When Rockefeller was asked by Hoover to save jobs and raise wages, Rockefeller said no way. I see a parallel here with Trump. He can’t asked nicely to save America, he needs to enact laws to save America. So far, nothing. FDR was a 1%er but still managed to push through reforms. I think we need a Democrat Congress to repeat this. Of course the Hitlery Clintons and Bernie (Mor Free Stuff) Sanders voters will prevent this against their own best interests. Trump hasn’t shown any inclination to help us, despite a lot of hot air to get elected.

Sanders is a career politician who has accomplished nothing and all he offers are false hope and economic illiteracy. He is also complicit in the theft of the more than $230 million his supporters gave him, considering it was rigged so he couldn’t win and he STILL endorsed Hitlery even after finding this out. Shame on him, and a bigger shame on the morons who thought he was anything more than a snake oil salesman.

Bernie’s net worth is about 450K according to the tax returns that he released. None of that is from foreign sources. How many lies can Fox news dish out that people actually believe? 230M, really? This should be considered slander. People will continue to vote against their self interests as long as they believe the stuff Trump is dishing out. I fear for our great country. Bernie would have enacted a tax for foreigners buying houses in the US. He is not collecting millions from this unlike Trump and Hillary.

How do you get net worth from tax returns? Anyway, Bernie was and is a fake. Charles Hugh Smith from OfTwoMinds blog is the real deal, identifying the problems and offering real solutions. Bernie just wants to remake society into 1930s soviet union.

This has little to do with Democratic or Republican policy, and everything to do with our long standing trade deficit with China. When we buy 10s of $B more stuff every month from China than they do from us for decades what do you think happens to all those dollars? They all eventually have to come back here and buy something. Sure China may buy lots of our debt, but that simply delays the issue. All those dollars eventually must be repatriated as purchases. We’re seeing some of that in foreign real estate investment.

Short of the sort of massive financial apocalypse the doomsayers here like to predict I see no way to avoid more of the same in the future. More to the point I think TPTB (either Red or Blue) are far more likely to permit a slow bleed out of America’s resources to foreign interests than the sort of catastrophic debt default and/or currency collapse that might stop it.

Here is a quote from author Jared Dillian:

“So, what is the difference between something being overvalued and something being in a bubble?

Since you asked…

A bubble is a psychological phenomenon that occurs when an asset class becomes overvalued and is accompanied by an obsession or preoccupation with that asset class. For example, you probably heard that the Dow just hit 20,000. It is not a bubble. Nobody is obsessed or preoccupied with the stock market. You don’t have Coast Guard guys day-trading it like when I was still in the service in 1999. That was a bubble. In fact, nobody really gives a crap about today’s stock market. Usually they have CNBC on in the locker room at my gym. Nobody pays any attention to it.

By that standard, there are very few bubbles in the world right now. But there is a bull market in people running around calling everything a bubble. Please ignore those people. The only real, honest-to-goodness asset price bubbles out there are in residential real estate in Canada, Australia, and Sweden. They are going to end up in the landfill in New Mexico with all the Atari E.T. cartridges.”

I’d say that the cause of Australian and Canadian real estate bubbles probably has the same source as the Bay Area market, and there is probably an “obsession or preoccupation with that asset class”. Whether we wind up in that boat is yet to be seen. Our blogosphere is not necessarily mirrored in the real world. But unfortunately, the “real world” includes Chinese desperate to have holdings outside of China, and that is not an infinitely large group of people. Furthermore, the Chinese government could end that supply with a new round of Maoism (or Maoism lite).

This RE bubble in the US and the rest of the world (excluding 3rd world countries) is the biggest in history. Housing prices in California will easily be 50-70% less after the crash…the stock market will probably be cut in half as well. Its going to be a joyful event for the ones that waited. For boomers that are not prepared and heavenly invested in the stock market and RE market it will be very painful. Most people have no clue. They don’t understand how a house itself is a depreciating asset. They confuse value with price and have never even heard of a rent vs buy analysis. But that’s all good news….you just wait until the herd gets burned and invest when the markets crash.

Bob said: Housing prices in California will easily be 50-70% less after the crash…

I’m not disputing this but suppose it is true, if the prices are $500,000 for a house, but few people can even come up with $250,000 how much of a relief will it provide. For a few more yes, but then the prices goes up again, rinse and repeat.

“I’m not disputing this but suppose it is true, if the prices are $500,000 for a house, but few people can even come up with $250,000 how much of a relief will it provide. For a few more yes, but then the prices goes up again, rinse and repeat.”

Why would organic buyers need to come up with 250K? Getting in with a 10-20% down payment should be sufficient enough. In the same scenario, quite a few investors buying on margin (borrowing) in the current cycle would be flushed out and not quite ready to jump back in yet.

JoeR, just because the author Jared Dillian doesn’t see it or specify it, doesn’t mean it isn’t true. My examples are the LA housing market that has reached beyond historic peaks with crap shacks or the stock market that has reached historic P/E ratios. It may not be the same as the Dutch Tulip bubble but when prices reach historic highs and people are driving prices over asking with multiple bids on a house, it is a near frenzy.

I consider that a bubble. In fact with my conservative opinion, I would NEVER buy a house over asking price. Too much emotion over reason involved with that.

” In fact with my conservative opinion, I would NEVER buy a house over asking price. ”

Exactly! I will never understand why people bid above asking price?! I would only offer way below asking price. When you buy cars or used stuff you bargain and low ball the seller. You want to do the same with housing….unless you are not the sharpest tool in the shed….

Brian: I will never understand why people bid above asking price?!

To finally get a house, you might have to bid over asking.

I made offers on two Woodland Hills houses last year. Each time, I offered the asking price and refused to go over. Each time, I was outbid and the house went to people who bid over asking price.

I wouldn’t offer over asking now, but during a dip in the market, if you want a house that isn’t falling apart, in a nice area, sometimes you have no choice. We bought in 2009, a time when 15+ offers on every property was common. We looked at 30+ houses, most with terrible layouts. Like you, my wife liked to lowball, so of course we were outbid every time on the ones worth buying. Finally a house came along that was the best we’d seen – so we offered 2% over asking and got it. Seven years later we turned that $5k overage into $140k profit.

Bidding over asking price means too much emotion over reason for me. While it may true that you are right and could make 100K+ (30%) from it, if the market is right, BUT you have to sell it first to realize it. It is part of the same lunacy that is driving up home prices IMHO. Mom and dad are sitting at home watching the value of their house rising 200% and buying more expensive tacos from the refi funny money.

I sold a house in Jan to a Chinese buyer for cash. It was slightly under asking. I was told by the real estate agent that Chinese buyers:

1) Rarely bid over asking

2) Drop out of bidding wars quickly.

I consider that smart.

Son of Landlord, “I made offers on two Woodland Hills houses last year. Each time, I offered the asking price and refused to go over. Each time, I was outbid and the house went to people who bid over asking price.”

Well, of course. Why would you bid during the worst time in history to buy a house?? You want to buy a house when no one else is buying….after a severe crash/when the bubble bursts. Is that the first time you hear buying is all about timing? Come on now….you have been on this blog for a while…don’t play dumb.

“I sold a house in Jan to a Chinese buyer for cash. It was slightly under asking.”

We did the same, but only because they were willing to rent back to us while our new house was being built. We had several well-qualified 20% down offers over asking that could not, or we would have taken one of those over the cash offer in a heartbeat. The fact that the Chinese offer was all-cash made no difference to us.

“I consider that smart.”

Not if it’s an investment, bought in an inflated market, it isn’t. A smart investment isn’t bought anywhere near a peak, lower than asking or not. A dream home that you can afford, is hard to come by, and that you’ll be in for 20 years, is a good buy in any market – over or under asking. In that case it isn’t about the money.

Based on that, the bubble in SoCal is in stratosphere. Everybody talks only about houses and the only private sector economy left is flipping houses.

Good luck getting rich flipping houses. When the music stops…..

JT is telling us how he bought houses in early 90s but he is not saying how much was the interest back then; 12-14%???!!!….

It was the lowering of interest from those level to a little bit over 3% which pushed prices up. Try pushing the interest back up and see how rich you’ll be in 20 years. Or is JT suggesting interest MINUS (-) 9-11% to replicate his performance???!!!!….

During the same time I made millions without investing in fixer uppers close to the beach for the simple reason that interest went down everywhere. In SoCal, if ONLY those houses close to the beach had that performance, that tells me that SoCal in general is changing into a third world country and only those areas of millionaires are holding up.

I don’t even read JT’s fantasies anymore. I strongly believe he is a bitter Realtor who cant find any clients and has too much free time. He spends all his free time complaining about these Millennials not buying that overpriced crap shack. I enjoy it. One of the reasons why I like reading here is these posts by realtors and lenders who fear the upcoming crash.

Brian, I am a retired in my 40s person who spent the last 20+ years investing in beach close fixer homes. I spent every last penny I had on them, and spent most weekends fixing them. I drove old cars and went on no vacations. This was no get rich quick scheme. Fortunately, my wife went along with this. Now, I am happily retired near the beach. I encourage millennials to buy but only if they can afford a home in the right area that makes a good investment. I encourage them not to buy if the home does not look line the right investment. And, I think the millennials have it tougher than my generation X because of the Obama era mortgage rules which often lock millennials out of areas which make good investments. Millennials are kind of screwed … it now takes a solid 50K down payment to get into good investment. No fantasy here. Just reality.

sure, sure…yawn

Brian … you can do it to. It only takes hard work, taking risk and time. Too many in the generation behind me want everything without any effort. That will not work.

I email weekly with a bunch of different realtors and I tell them the same thing after they keep asking me to physically look at a house: You have to work hard for it!

Literally, I tell them: “I am waiting for a crash. Until RE prices crash to 50-70% below today’s prices i am not visiting open houses, etc. However, if you find distressed property/foreclosures/whatever that is in good condition/good location/good school district and 50% below today’s market prices I will promise to look at it physically.”

So far they were not capable of presenting this kind of property. Or, they are simply to lazy. If realtors want my business they have to work hard for it.

Author Jared Dillian probably gets paid pretty well being a permabull.

His conclusions are all wrong as wage increases and real job data (not shadow stats) are very poor.

It’s a massive bubble with a deep underbelly of giant chunks of debt. Same holds true for China.

Actually, he is NOT a permabull. His examples of current bubbles are ALL real estate. Just not in the US. He says the US stock market is overvalued, but not in a bubble. It is obsession or preoccupation that makes something a bubble. I think he’s an East Coast guy and may not be interested in researching the degree of obsession that is on the West Coast. I personally am not hearing about the kind of obsession out here in Orange County that we had before 2007. This board has a lot of people for whom a (negative) obsession with real estate beyond that of the greater public may cloud their judgement as to whether or not a bubble currently exists here. I do see overvalued Real Estate based on wages and the economy, but I agree that isn’t necessarily a bubble. So I’m not a buyer, and if I didn’t want to stay, I’d be a seller. I wish I had figured out a way to short Thomas Kinkade artwork when he died. Now that was a bubble!!

I don’t understand why Americans living paycheck to paycheck but still living in shitty California, there’s a lot of state where they can have a good standard of living, can afford to buy a house,like Texas, Oregon to name a few. I have a friend who move to Texas and he own a good size homes and a duplex that have a good passive income. I don’t understand Americans that keep on whining but they don’t want to change their lives. California is out of whack right now the housing situation here is not going to improve price wise,. Everybody in California looks at their homes as ATM dumb sucker

Hey Wang,

There are many benefits to taking an open online course! Improve your English language skills. It is free. The best thing is: People will understand what you are trying to say.

wang wang i dont care with my english as long as i have the money and my tenant are paying me. If you dont get it your an idiot and a dumb hahahaha

Everybody wang bu tonight

…as opposed to living in shitty Texas or Phoenix? I looked in to moving to Houston. Housing was cheap. Wages were low (unless you’re in oil and gas during a boom), but you have to spend your life indoors in air conditioning to avoid the heat and mosquitoes. They have underground tunnels in the city so people can walk between buildings and keep out of the scorching heat. Or you can be in your car stuck on a highway – and without strong zoning regulation you have no guarantee a gas station won’t crop up right next to that new house you just bought.

THAT to me is crappy living. In nicer areas of the country, either urban or suburban, a tiny apartment isn’t so terrible because being in public spaces or outdoors is free and very pleasant. The appeal of bigger houses in places like Texas is partly for people who don’t like public spaces or the outdoors and don’t know how to streamline their junk – making them feel cramped. It’s a life-style choice between imperfect options.

Case in point…My niece neighbor sold there house $100k below market thanks in point to there friend realtor (???). Now they can’t buy a home, every deal is bought up by a Chinese cash buyer. They are desperate and now living in a kitchen/motel with 2 kids.

Here is the mind blower, this man is a dentist, he has most his money invested in his practice, lot of income cash poor, thus he gets no chance to bid, a Chinese buyer shows up, than another, than another, all cash buyers.

Welcome to America 2017, or should I say, AMERICA is a suburb of China now?

California has a carries a democratic super majority which means that they can essentially move legislation through in fairly short order.

There is serious talk of sanctuary state status.

Forget about the cost of housing, the state itself is on a collision course with 3rd world status.

There will be a 1% club, a 10% club and a 23% club, the remaining 66% will be sucking the state dry, not paying any taxes and using the same services you use such as the freeways and hospitals.

If sanctuary state status is approved everyone from Central America, Mexico and other US states will pour into California like they are giving away free money.

Actually they are…your money.

Living in a Million+ dollar home which is nearly paid of in OC right now, but cashing out this summer and moving to a more sensible location.

We are looking at Irvine, but with my luck the minute I sign the mortgage, the market will collapse.

“We are looking at Irvine, but with my luck the minute I sign the mortgage, the market will collapse.”

Then, go ahead and sign. There are lots of people waiting for the market to collapse:-))))…….Neah, forget that; I don’t wish that not even to my enemies.

There are no signs of a top in California real estate prices. The current housing bubble may have another year or two to go. I certainly wouldn’t sell my home and rent at this time. The upside potential for California real estate could easily be another 10-15%.

When the top eventually arrives, it should be easy to identify. Personally, I am getting more bullish on real estate. All I see are rising prices everywhere.

Yawn….same old story….no bubble, no crash….buy now….mhm….why waste your time here….go out and buy 😉

It’s funny to see these anti-bubble guys come visit a “housing bubble” blog and act so confident and tell everyone that there isn’t a bubble. If you were so confident and real estate rich, why even come here and try to argue your point? That’s a sign of insecurity.