California Sending out Approximately 475,000 Notice of Defaults for 2009 yet Overall Foreclosures Declining. Shadow Inventory, Q3 Defaults, Toxic Loans. The State of the National Housing Market.

California is on path for a record 2009. By the end of the year over 475,000 notice of defaults will be sent to California homeowners. This of course is simply from lenders that actually even bother to send a notice of default. The shadow inventory is growing and we have some concrete data showing the mismanagement in the housing market. Banks for the most part are playing hot potato with bad mortgages like Alt-A and option ARMs. It is interesting to note that today, we have data showing a record number of notice of defaults for 2009 yet actual foreclosures are less than 2008. What gives? Well for Q3 we found out that the median months behind before a lender filed a NOD is 5 months. That is right, 5 months with no payment before the lender even notices.

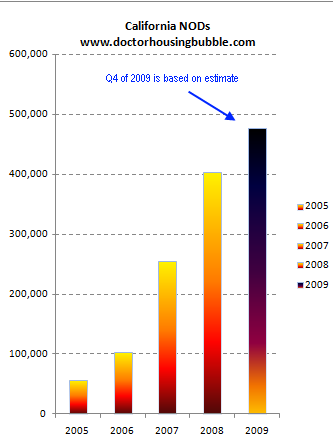

First let us look at this trend on a chart:

Source: Data Quick

The first key point is that 2009 saw more notice of defaults sent out than in 2008. In terms of housing distress, 2009 was a tougher market than in 2008. Sales have boomed but this is mostly due to the lower end of the market enticing investors and first time buyers. Throw in every incentive you can imagine and you can understand why it “feels†better. The data as you can see above shows otherwise. The Q4 data is an estimate but I lowered the number even below the current average. Given that many lenders are not even moving on some properties, we can expect NODs to probably fall again in Q4. Some lenders like Bank of America have stated that they will start moving and foreclosing on loans that don’t qualify for HAMP soon but we’ll see. I take what the banks say with a grain of salt.

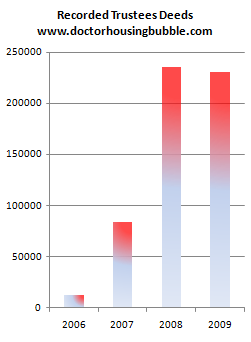

You would expect that with a high NOD and weak cure rate, that actual foreclosures would be higher this year for California. Not the case:

This is a fascinating trend. A loan that enters the NOD phase in all likelihood is going to be foreclosed. But banks aren’t moving through the process in full form. In many cases this is where the shadow inventory is being built. At this point, it isn’t the REOs on the books that are a problem but loans that are sitting in a sort of mortgage purgatory. Not paying but also no NOD. Given low cure rates and the abundance of toxic mortgages in California it is a major red flag that NODs are at a record but foreclosures are falling. We now know the average foreclosure timeline is 18 months to 2 years so some of these will become foreclosures in 2010.

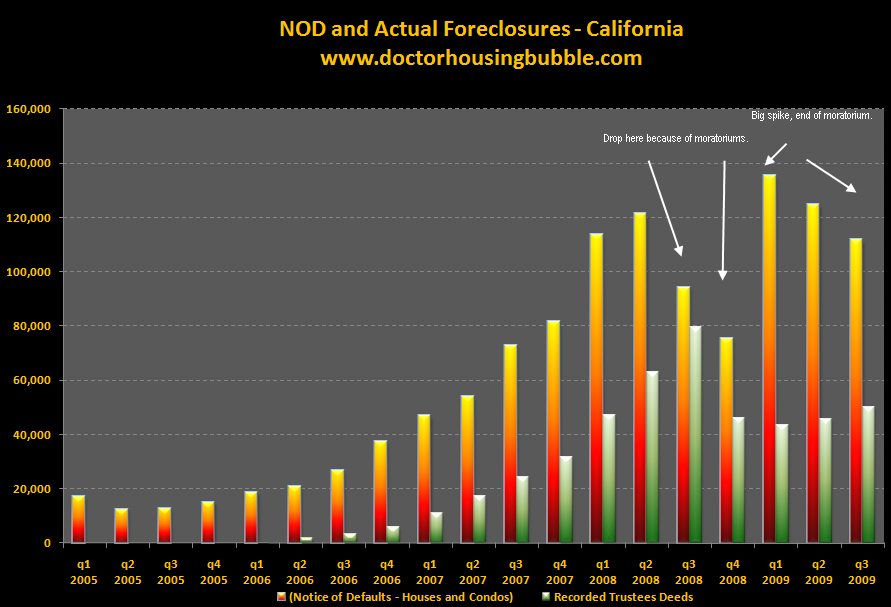

If we look at quarterly data, you can actually see this. NODs will spike followed by a jump in actual foreclosures:

You’ll see NODs spike in 2006 and 2007 followed by actual foreclosures. We see a dip in 2008 because of moratoriums but the trend emerges with one caveat. Foreclosures don’t seem to have a trend but move sideways. So what is the reason for this? Banks are largely operating with no system in place and many institutions are selectively ignoring certain non-payers. So in terms of actual data, they look fine in some areas. After all, if the bank isn’t pursuing the property why would the public care? The public should care because taxpayers now subsidize the entire banking and mortgage industry (hello FHA insured loans).

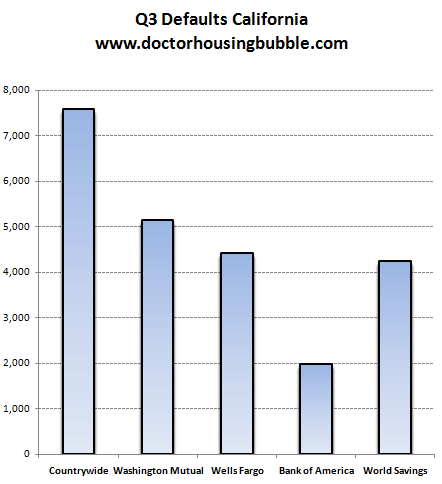

Many of our favorite toxic mortgage all-stars appear in Q3 of 2009. In fact, the largest defaulter in Q3 is now defunct Countrywide:

In fact, out of the top 5 culprits only two stand in 2009 and that is Bank of America and Wells Fargo. Bank of America swallowed up Countrywide Financial and Washington Mutual is now part of Chase (as if I need to tell anyone in California with Chase’s massive marketing blitz partly subsidized by the American taxpayer). The lenders are gone but the loans are still here wrecking havoc.

Yet that is only half of the story. If we look at some of the subprime outfits we get default rates for the period of:

ResMAE Mortgage:Â Â Â Â Â Â Â Â 73.9

Ownit Mortgage:Â Â Â Â Â Â Â Â Â Â Â Â 69.5

BNC Mortgage:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 61.4

Argent Mortgage:Â Â Â Â Â Â Â Â Â Â Â 59.9

First Franklin:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 59.4

These suckers are long gone but here are their mortgages clogging up the California housing market. Is anyone going after these people criminally? Look at those rates! You have fraud factory written all over them.

Nationwide Housing Market

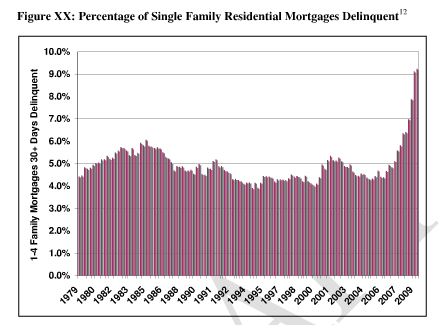

The nationwide housing market is still in deep trouble. The amount of single family homes in delinquency is an all time high:

Source:Â Congressional Oversight Panel

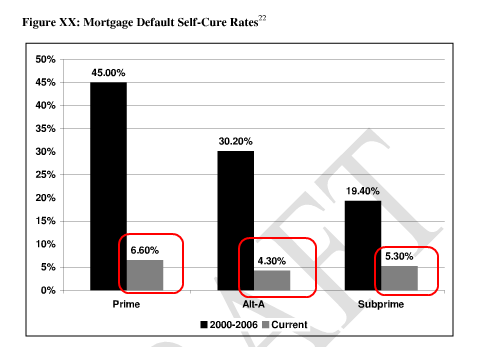

Now here is where the above California data doesn’t coincide. California has 5.3 million homes with a mortgage. Keep in mind California is in much worse shape than the overall trend. So using this data, you would expect some 530,000 homes in a form of distress. That nearly matches up with the 475,000 figure for NODs. But then, if we look at actual cure rates, we are left asking what is really going on here?

Most of the Alt-A loans and a ton of subprime is here in California. Meaning, of the 475,000 NODs we would expect only 23,750 to cure (assuming better nationwide stats). Yet actual foreclosures are trending more in the figure of 230,000 for 2009. In other words even by this data some 200,000 homes are sitting in the California pipeline. The number is much higher because we are not looking at many homes with non-payers or strategic defaulters that have yet to even receive an NOD. Can’t track something you don’t report but we know it is happening.

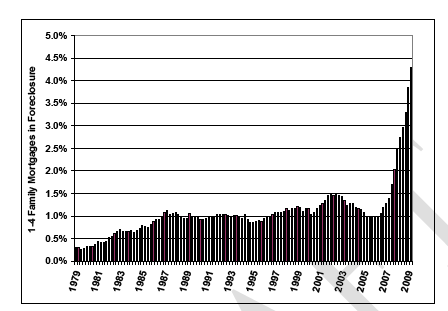

We have never had so many housing units in foreclosure:

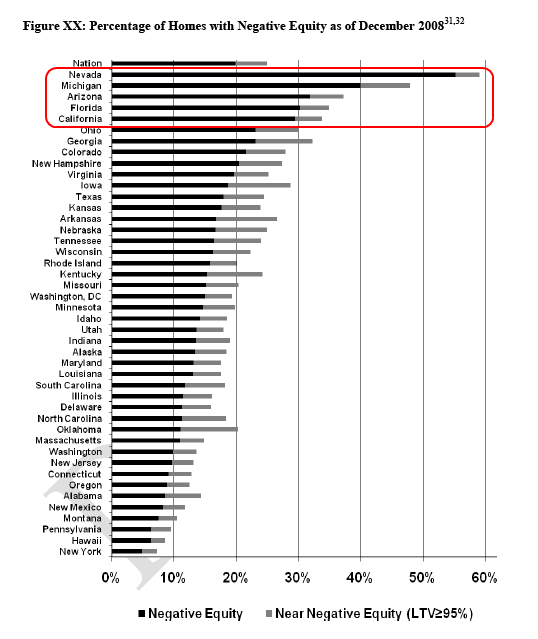

This is the trend that we should be following. So far, we have seen no major decline in actual foreclosures. Negative equity is a big reason for the defaults and California is one of the prime negative equity states:

Source:Â Congressional Oversight Panel

30 percent of California homes with a mortgage are underwater (equals 1.745 million home owners/debtors). 35 percent are near negative equity. That is why pushing the 3.5 percent down with FHA loans is such a losing proposition. If homes decline say another 5 or 10 percent, there goes another batch of people into negative equity positions which increase the chance of foreclosure. The data is right here but gimmicks trump good public policy. Nationwide 20 percent of mortgages are underwater. Not good.

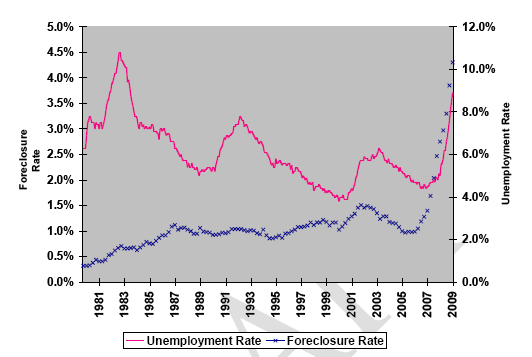

I’ve been searching for a chart that measured the overall foreclosure rate with unemployment for some time now. It would reason that higher unemployment would lead to more foreclosures. Yet that isn’t always the case:

You’ll notice in the early 1990s recession that as unemployment went up, foreclosures merely moved sideways. In the early 1980s, unemployment shot sky high yet foreclosures modestly increase. But during this decade, housing and employment coupled. Why? Our entire economy became dependent on the housing bubble. What this meant was that wherever housing went, unemployment was sure to follow. Now, foreclosures are busting through any historical trends.

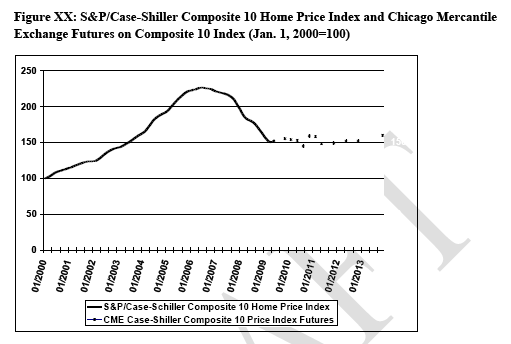

The Congressional Oversight Panel also doesn’t believe in the hype of another housing bubble:

If anything, the futures market doesn’t see any price increase well into 2013. So much for the housing shills pumping up the current market. They fail to see that the recent price increase is based on:

-Moratoriums

-First time home buyers

-Investors

-$8,000 tax credit

-Fed buying $1.25 trillion in GSE MBS keeping rates artificially low

These things can’t go on forever. Those betting with actual money in the markets don’t believe this either. Why? Employment is still weak. We have a glut of housing to last us through 2013. That is why you don’t see massive home building even 2 years after the bubble burst.

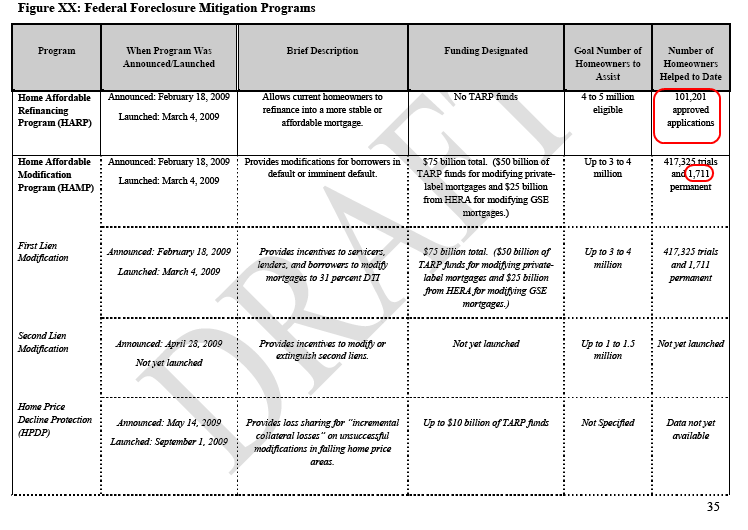

We also have an artificial amount of inventory on the market with government programs:

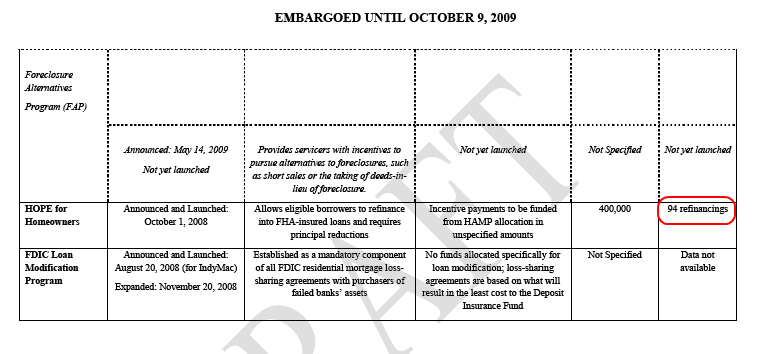

As I discussed before, the HAMP is largely a misguided program because it is based on the extend and pretend philosophy. So far, only 1,711 modifications have been permanent through HAMP. But you’ll love this data. Remember that HOPE program?

Bwahahahaha! 94 refinanced loans since the program launched in 2008! I remember talking about this back in 2007 when it was pre-launch. It turned out to be a bigger joke than even I could have imagined.

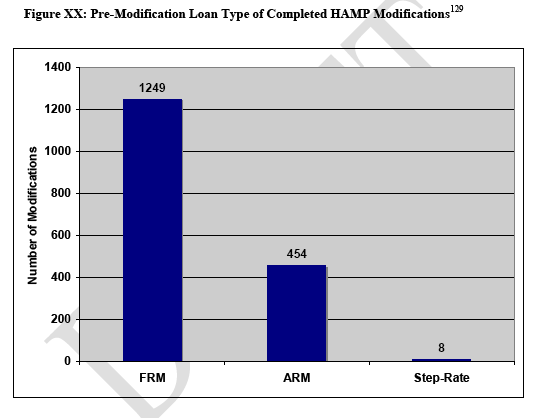

Even when we drill down in the 1,711 HAMP perm-mods, you will notice that the loans are largely fixed rate products:

So much for redoing those Alt-A and option ARMs here in California. By the way, good luck on getting a 31 percent ratio on some of these homes in mid to upper tier SoCal areas. These homes are underwater to the point of needing a scuba diving suit to refinance the mortgage. Plus, most people will strategically default on these places anyways. Banks on the other hand, will probably prolong the foreclosure process as long as they are sucking taxpayers dry.

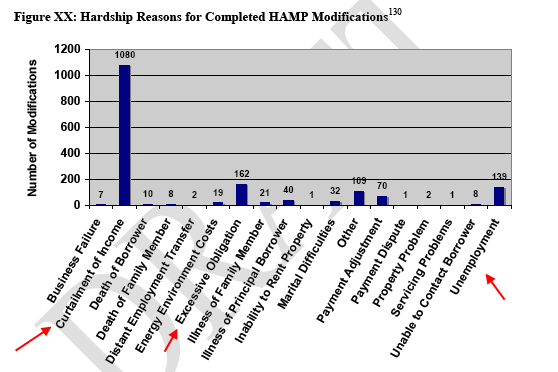

What were reasons given from the HAMP modifications?

The top 3 reasons include, loss of income, excessive obligations, and unemployment. Basically the job market! You will not solve housing without having a solid employment base. Some people have asked me why doesn’t Wall Street and the government see this? They do. They just don’t care. Their assumption is that if Wall Street is raining, somehow some little drops will sprinkle on the poor typical American. Ask the 27 million unemployed and underemployed how happy they are that the S&P 500 is now up 62 percent from the March low. Lagging indicator? To the point of lagging you out of a decade.

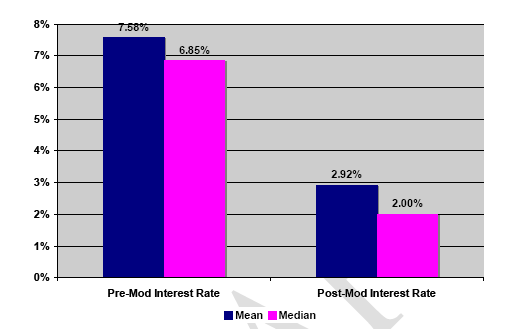

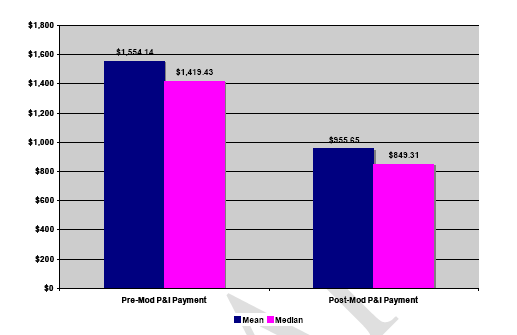

And let us look at the data of what is being done. This is the actual ruse of the HAMP mods. It is extend…

And pretend…

The loan rate is only low for a fixed time. The principal is fully intact allowing banks to claim these loans at full face value which is a crock. Without the HAMP government subsidy, these loans would need to be foreclosed. I have no problem working with homeowners only if the banks fit the bill. Yet they are so corrupt and cynical that they want the money for the mods to come from the government! Bail us out and then pay for the mods. What a load of insanity. Seriously? Enough of this and let the trials begin. It looks like a couple of hedge fund gurus are being taken down with more to follow. I’ve sent letters to Congress, called up representatives, and some agree but the sense I got from many is “what can I do?.”

Also looking at the extend and pretend, you can’t modify property taxes and insurance. These are based on the assessed value of the home which according to the bank is still up in the peak ranges. What horrible policy.

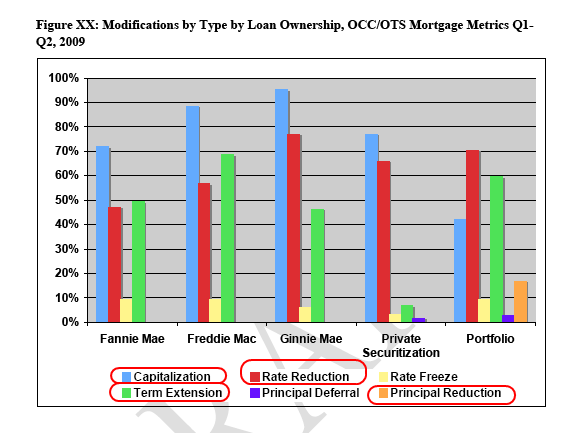

The OCC and OTS have some more data in other types of modifications:

The same kind of pattern emerges as the 1,711 HAMP mods. That is, extend the term and pretend to lower the rate for a few years. You can also capitalize some of the principal on the back end rendering many of these option ARM-lites. That is why the re-default rates are through the roof. I imagine the HAMP re-default rates will be equally high. You saw the reason for payment problems. You didn’t see, “because my payment was too high†but more employment based. For those that saw reductions in their income, what if they lose their job? This is basically underwriting ala 2005 again.

People ask then what is really the solution? I’ve said it many times but you can’t have an economy without job growth. This sounds obvious but it would appear to be off the radar for Wall Street and our government. If you focus on the job situation, then housing will right itself. Notice that 1991 recession and foreclosures? What happened? Well we had the technology boom and added 20 million jobs over the decade. That was a bubble and that burst but you can see that yes, you can have an economy that runs outside of housing. But this decade housing was the economy. And the government and Wall Street basically want that industry back. Well it isn’t coming back. They need to figure out what to do.

And there is nothing wrong with renting! In fact, it is a shame that there is no actual initiative encouraging renting. Some of these people in distress will do much better to downsize. They are even telling the HAMP mod survey that they are financially strained. Maybe renting a lower priced home will help. Nothing wrong with that until you land on your feet again. Yet this notion that everyone deserves to own a home is largely a reason we are in this mess. Wall Street exploited this “American” desire and people ate it up. In fact, the dream was no longer to own a modest home but to own some oversized McMansion and drive a gigantic V-10 tank that got 8 miles per gallon. When did the American Dream become a Marvel Comic?

Some suggestions are to bring back our industrial base to the U.S. Make ourselves more competitive. Flipping homes to one another while quant jocks play Halo on one screen and do billion dollar trades on another Bloomberg Terminal is not a real economy. It basically strips the value out of the real economy.  These banks posting record profits? JP Morgan making $3.6 billion last quarter. Really? Most of it was through their i-banking and private equity division. If they want to act like a hedge fund so be it but they have zero access to the Fed and U.S. Treasury. Instead, they are a primary dealer.

Healthcare is a big part of our economy and will remain that way with over 70 million baby boomers entering retirement age. Surely we can create some jobs in this arena. At least it is better than installing granite countertops in every home and adding Jacuzzis and pretending we are keeping up with technological innovations of other countries. In large part, housing has become a major distraction. It is a cultural neurosis like Tulip Mania or watching UFOs on TV taking away a kid but in the end, it is all fake. The equity in these California homes was fake. The Wall Street profits were a sham. So until we can return to a real economy, focusing on housing only serves as a form of therapy.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

33 Responses to “California Sending out Approximately 475,000 Notice of Defaults for 2009 yet Overall Foreclosures Declining. Shadow Inventory, Q3 Defaults, Toxic Loans. The State of the National Housing Market.”

2005 Upscale high rise living comes to the OC.

Ouch.

http://www.redfin.com/CA/Irvine/3131-Michelson-Dr-92612/unit-406/home/7211426

Amazing post Doc… Unfortunately, the recent drop in prices is primarily due to foreclosures, which means that someone had to lose their home for it to become affordable for someone else. And until foreclosures slow down, prices won’t stabilize. You can take advantage of foreclosed homes for sale by getting maximum bargains on your dream home.

Really interesting, that “reasons for needing a mod” chart. The number one reason is not unemployment, but UNDERemployment, the unemployment rate that is underreported — still working, but for less. Jobs, jobs, jobs… great work here today.

You are finally getting it! As the futures chart makes patently clear – foreclosures will be drip drip dripped onto the market. Prices will move neither up or down – we have in effect our own lost decade.

Only a fool would think prices are going up substantially. Conversely you are starting to realize that expecting big price declines is just as foolish. Welcome to reality doc – we missed you!

I’ll reiterate the comments from above: Phenomenal post!

Can’t thank you enough for all the work you put into the site.

Homes are going to continue drop in price people. Unemployment is going to continue to go up. It just all boils down to common sense. Let the banks slowly put the housing on the market while the weight on their shoulders gets heavier each month that passes by. There is so much weight you can hold. The Government will some to its senses that bailing out the bank industry is not good for the country. People are starting to take notice of the banking corruption. The shadow inventory will back fire on the banks. The people of this country will get sick of what is going on. Obama’s love affair and rating as president will sink down the drain.

If this continues, the country will be bankrupt. Foreign investors will own the U.S.A.

Home will continue to drop. Unemployment will continue to go up. Income for the American Family will continue to drop. There is no job market to rescue the economy. Shadow inventory will backfire on the banks. You can only hold onto so much weight. The Government is leading this country for bankruptcy.

The bottom line, we are screwed. The only way to save the country is to have homes fall in price to realistic pricing based on median income regionally. If homes don’t drop more in price by another 20% minimum the country will collapse financially.

The American dream of owning a house will become a nightmare to this country if homes don’t continue to drop!!!!

Please bring Alan Greenspan and Ben Bernankie back and let’s have another housing boom after this depression ends. We won’t be sitting on the sideline next time. People never learn from the past lesson. hehehe.

great post doc! just proves that the usa is nothing more than a self eating watermelon. since the fed, banks and our elected and appointed( awol georges) buddies are in charge now, i wonder how much bin ladens unemployment check is each week.

to Wizzy, mr greenspan is making millions off his books trying to rectumfy his own brainless b s. and mr bernanke is busy reading about the great depression, so he gets this one right for his spot in the history books. a great depression only comes along, only after the system works at it fo 40 years or more, so its bennys time to run the presses.

The L.A. Times had a front-page article today which essentially said that the banks and the government have reached a tacit understanding that the banks should hold off on foreclosures, modify, do whatever is necessary. The carrot is all the bailout money, the stick is the threat of passing cramdown legislation and letting owners vastly reduce the principal owed.

I suppose we should have all realized that the logical, the fair result of the insane housing bubble–that house prices should fall all the way to affordable levels–was not going to happen, given the government’s long-standing commitment to credit bubbles and bank profits. They are now letting delinquent homeowners skate for a year or so, and spend the savings on more frivolity; and they are using taxpayer money to fund ridiculous tax credits for homebuyers, trying to get more people to jump back on the merry-go-round. How can any of this end well? I don’t think it can, but apparently we have become so drunk on the endless borrow and spend intoxicants, that we can’t think of any sober way out.

Therefore, I can either wait another five years for prices to really collapse and then buy a nice house, or I could give up and jump in, and paid the still highly inflated prices. Guess what they are hoping I’ll do? Or I and others could become so upset at this immoral transfer of wealth to the greedy and the stupid, that we stop spending discretionary income, and see how the economy fares then. I don’t want the whole thing to collapse, because that damages all of us. But how long are we frugal and responsible people going to be paying for all the people who overbought and overextended and lied and flipped and walked away?

1000 points of darkness. I guess if feels better to submerge slowly than to go crashing into the abyss. We are indeed on our own. Perhaps you recall my suggestion that when the Dow hits the mythical 10,000 mark, it will stall and start pushing money into Oil Futures. In spite of dramatically reduced consumption, Petrol is closing refineries to squeeze supply and pensions are buying options again, knowing full well $100 oil will kill off anything that looks like a green shoot. think that Inland Empire re-surge will hold with $4/gal Cal gas? Think again. The only good news for them is that now they can live in their new foreclosing home for an extended period of time without paying the mortgage.

Charlton Heston has really got his work cut out in Planet of the Alt Apes. I hear the spooky music starting…Guess what next Thursday is the 90th anniversary of? October 29, 1929. We did however skate by the 22nd ann. of Oct 19, 1987. Hopefully with the unabashed government intervention in the markets there won’t be a crash this time around. Heaven help us all if there is. With all the blackness it will all be shadow inventory…

.

Report Shows Increase In County Foreclosures

The number of San Diego County homes slipping toward foreclosure increased by 23.2 percent in the third quarter of the year, compared to the same period in 2008, a real estate information service reported Tuesday.

Lenders sent default notices to 8,702 homeowners in San Diego County in the third quarter, up from the previous year’s third-quarter total of 7,062, according to La Jolla-based MDA DataQuick.

.

Hey Alpha Dog,

I concur with you, except for the fact that the majority of houses that will be dropping will be in areas you probably won’t prefer. I’ll bet they will be very affordable in time. All the junk that the bank can’t dump, they attempt to modify for the poor owners. They cherry pick good stuff, and rid the delinquent owner much quicker if they can, then off it for cash to, what did you say????…a foreign investor! I have seen it in my neighborhood. When the dollar was stronger in the 90’s, one could find a good deal a house in a desirable area. Tuff to do now.

I used to export classic cars all over the world and the “foreigners” know quality and will step up to pay for it, just like a quality neighborhood without boats and motor homes parked out front. Most of the nicest American cars are now parked in a garage in a foreign country. That’s why a mint condition ’57 Corvette still costs about as much now as it did a few years ago, or a ’57 “Stratocaster” guitar for that matter. Quality holds up well in tuff times, especially when the US dollars get cheaper. The majority of houses around the country will crash even further, but quality stuff will hold up. If the dollar gets stronger, it could be a different story. But will that really be on the horizon? The criminal banksters want the dollar to crash……..

We have created a 2 tiered system of renters. Group 1 includes myself and my bubble sitting friends who must pay each month. The other group pays no rent in exchange for “maintaining” a property for a bank. Every once in a while group 2 changes status from NOD to NOT to Trial Mod to whatever. The bank gets to tell the FED that they “doing” somethign. I’ll be glad when we get back to a single system again.

The Third World countries get pushed into austerity programs, like the one put on Germany after WW I, when they get duped by the international banks and become so indebted they can never climb out. We just print more money and the world sees our blatant fiat as a safe haven…reality is stranger than fiction.

Supply and demand means very little when the manipulation is so widespread and the helicopters keep dropping blood money into the hands of the banking families. Trillions are the current base. We will be talking Quadrillions in the next 10 years, extrapolating the exponential. “A Quad here and a Quad there, pretty soon your talking about real money”…actually we stopped talking about real money almost 40 years ago.

The American Dream isn’t owning your own McMansion–it is owning your own life and destiny. A house you can’t afford owns you. A bum on a DC bench has more freedom than someone indentured to a 600k RHG for 40 years taking home 70k.

William…

I hear your words and agree 100%. I am so disgusted and dismayed. I could have been living payment free for more than a year like other people I know.

The other really inconvenient factor is that none of these delinquent owners are paying property taxes. The local governments are sooooo screwed!

The country is going down a toilet bowl financially. We have one year to determine the destiny of this great country. What I mean is that if we keep bailing out the banks, we will be bankrupt as a country. Chaos will be happening all over the place. It is just a matter of time before the American people wake up and give the government pressure to not bail out the banks.

The survival of this nation is for housing to go lower in price to realistic levels. The weight on the banks shoulder is getting heavier every day, at one point the weight you carry will break you down. The bottom line is for the Government to let the banking blood suckers fail in respect to the housing market.

We will know the survival of this nation in about on year or less. If the Obama admistration bails out the banks some more, the great nation of The United States of America will no longer be a great nation. We will be destroyed financially. Our blood sucked out from our system. Can you say riots across the country, high crime, panic, etc… It is not a good picture.

We are in big trouble and the government knows it. After a while, priting so much money becomes as good as Monopoly money.

If I had to tell Obama about the survival of this nation it would be that the housing market has to crash and start all over again. Real Estate is the key to economic recovery and the survival of this nation. Real State must drop an additional 23% . We are screwing American society and values. Kids getting fatter, watch more TV and play less sport. Video games are more violent. The mainstream media is destroying our youth as well.

Good job with this article. I couldn’t agree more that the U.S. needs to restructure its economy to rebalance imports-exports, industrial production, support industries, commerce and service sectors, and, finally, the financial and insurance sectors which facilitate the efficient functioning productive enterprise. The FRB and the government, irrespective of political party, seem to be hell-bent to recreate the previously unbalanced, unsustainable excesses. Two areas need urgent attention. The first involves a concerted effort to modernize and grow one basic industrial sector. The target should be energy. Here is an extended quote from an Ambrose Evans-Pritchard article in the UK Telegraph recently: “The World Gas Conference in Buenos Aires last week [reported]… [a]dvances in technology for extracting gas from shale and methane beds have quickened dramatically… [P]roven natural gas reserves around the world have risen to 1.2 trillion barrels of oil equivalent, enough for 60 years’ supply – and rising fast. …As for the US, we may soon be looking at an era when gas, wind and solar power, combined with a smarter grid and a switch to electric cars returns the country to near energy self-sufficiency.” Yes, there are reasons to be optimistic… if the obstacles – legacy processes and industries, environmental Luddites, and control freaks in government – can be cleared away and investment, and job creation, can begin. And speaking of obstacles, somehow the U.S. now finds itself in the unenviable position of having one of the least competitive business investment and operation climates on the globe. For example, no other nation forces its businesses to provide health insurance to its employees. Yes, somewhere these costs are born by society, but the added cost directly to business makes a U.S. based company less competitive in the global marketplace. Further, the U.S. has the second highest level of corporate taxation. Again, this is a direct cost burden on that company in comparison to it’s non-U.S. based competitors. A reform of the U.S. federal and state tax systems is urgently required, even before arguments about the percentage of GDP that should be taxed. The roadmap towards a real recovery is out there. Can we find some real leadership, please.

LA-Architect

NOPE…..if local Governments were taking it on the chin with the banks sitting on foreclosures, well, we might see more foreclosures hitting the market because Uncle Sam wouldn’t allow it. The only people suffering from the banks holding onto foreclosures are people with savings, renters and responsible homeowners, which makes up 98% of the public when you include all 3 categories. All of this intervention is to help a very small minority of imbeciles and screw the vast majority of Americans.

Anyway, when the home owner stops paying the bank and therefore property tax, your friendly local municipality puts a lien on the property (with a nice interest rate and penalty) that becomes primary above any other lien. In other words when the bank does foreclose, someday, the local politicians will get their money, one way or another.

There are exceptions. In some palaces like Detroit, the property is so worthless the banks actually walk away without actually foreclosing, in those instances the local governments are up the creek.

Martin…

The local governments are in effect waiting years for this money. It still screws up their budgets and forces cuts in services. I do agree with your general premise that the responsible majority are being screwed to keep overinflated assets in the stratasphere!

We are so Japan’s Lost Decade, except we have debt as opposed to savings!

May I put on my conspiracy hat?

Why is it that the Dean Baker plan, as well as cram-down, suddenly look so acceptable, now that the houses at risk are in middle-class and upper-middle-class neighborhoods? Could it be racism and classism?

These two strategies should have been used when the Real Homes of Genius in Compton were being foreclosed. Those areas could benefit from an increase in home ownership. The stability and buy-in would help alleviate the problem of people constantly fleeing the area the first chance they have.

Slowing foreclosures and having cram-downs for the current crop of deadbeats is absurd. Their houses are overvalued, and, those that aren’t so overvalued can be serviced by the private market — they can renegotiate without government intervention.

To put some of the numbers that the Doctor cites in perspective I checked Zillow, and over the past several years about 300,000 houses were sold in California per year. So if all these 400,000+ Notices of Defaults hit the resale market, they would overwhelm the market. Maybe that would actually help the market find a botttom, but on the other hand it may be reasonable for the banks to try to spread the damage over several years. Foreclosure sales have increased the volume of total sales this year by about 100,000. Dumping 400,000 homes on the market would way exceed any normal demand.

Just trying to shake my memory here. If I were to try to pinpoint exactly when this entire economic debacle began, I would have to say about 1970 or so whe Richard Nixon took us off the gold standard.

Before that real estate prices were very stable and inexpensive. People at just about any income level could afford to become home owners- and most on a single income earners pay. But then again unions were stronger and business owners made less as a multiple of their employees pay. They made between 40 and 80 times the the pay of their workers as opposed to today’s 400 to 500 times multiple.

Very few people owned rental property because it was basically a long term deal that really didn’t pay off all that well plus it was a big pain in the ass unless you had deep pockets and a lot of units. But that changed once the baby boomers started hitting the Market.

Prices started to rise in response various stimulous- oil prices, lots of money being printed(no gold standard), lots of disposable income from baby boomers, rent increases from increased demand, etc. Young people were told by teachers to buy house as a hedge against inflation(boy were they right!). Real estate jumped as well. You could have bought an average house in San Jose for about 25000 in 1970. By 1980 the price of that same house would be 125000. That is a 500% icrease folks.

Inflation is really bad for one reason. Sellers can raise prices at will and generally people wind up paying them at some point. But wages on the other hand just take much more effort(and risk) to secure a pay raise. Your boss can just say no and put the savings in his pocket. There were reasonbly stony ways to get raises, quit for a better job, gain additional job skills, belong to a strong union(yes, threre were strong unions at one time).

Unions and their members worked hard to keep up with inflation but Ronald Reagan showed business how to deal with unions- just fire and replace them with obedience servants( remember air traffic controlers replced with military controlers?). Or move production offshore, GM, Ford, etc. Or cut down the trees and forests belonging to the citizens of the United States and practically give them wholesale to Japan so they can mill them and ship them back to us for our houses. Thousands of good paying manufacturing jobs were pretty much lost to America during that period. Some places have never really recovered, ever been to Detroit? Ever driven through Oregon and seen the raped forest lands and seems like 35 or 40% of those living ther work for the govt.

But you can’t blame everything on greedy businessmen and corrupt politicians. In part, business were seeing their costs in the good old USA going up relative to costs in other parts of the making them less competative. This is understandable although today’s unequal uber greed is a lot more distastful. In a real sense, real estate, rentals, and the unquenshable drive to to aquire that American dream at any(and usually the highest) cost is a huge part of what got us where we are today.

So in reality, this whole debacle started many years ago. Things got so bad that that companies aren’t even bothering to offshore anymore en masse anymore. They just bring educated workers from other countries just to let their American workers how easily an cheaply they can be replaced. They more or less open the Borders to illegals so lower tech workers can stay in the lower wrungs of the economic ladder. In the meantime they get welfare free education and free medical care at our county hospital. I dare any doubters to spend 4 hours at Santa clara county medical center and report the percentage of people are not speaking English. Well folks, that is where a lot of your healthcare dollars are giong. Paying for illegals to take jobs that supposedly Americans don’t want to do. Boy, that was the biggest lie ever told.

An so in the past decade we have few exports except food, some high tech gadgets, some that produce some absolutely outstanding products(boeing, caterpillar, etc.). We do export some other more dubious items though. We export plenty of raw materials(no value added of course), and of course the new exciting financial products we’ve been hearing so much about the past year or so. Oh, and we also export plenty of bombs, bullets, and aid to countries that hate us. Gee, maybe we could get some of thes countries to pay us not to bomb them- not a bad idea sort of like extortion- sorry thinking outloud.

It seems we are our best customer. We buy all the millitary hardware we produce, all the shopping centers we can throw up, all the houses we can build and sell to each other at ever increasing prices until recently of course. We have bought and spent some more. At least that something we are good at.

But now it’s likely this train is coming to its final destination. Ronald Reagan taught Amerca how it’s done. Just keep spending and get what you want now- on credit. Only thing he left out in the lesson was that in the end the bill has to be paid. Isn’t it ironic that 40 years after the American dream became the driving force in this country, it is becoming one of Amerca’s most hellish nightmares? Pay up suckas’.

Actually, it wasn’t Ronald Reagan but someone further in the near past that started this up. This article explains this clearly, and gives us numbers to contemplate.

I know this blog is about S CA Real Estate, but honestly folks, the boom is going to be lowered on ALL of us because of BOTH political parties making poor decisions.

Its been a massive collusion on a grand scale all in the name of greed.

And wether we like it or not, we are ALL a part of it.

http://www.shadowstats.com/article/depression-special-report

And read the one on Hyperinflation, that one will make your hair curl!

http://www.shadowstats.com/article/hyperinflation

Mr. ObamaNation wrote:

The American Dream isn’t owning your own McMansion–it is owning your own life and destiny. A house you can’t afford owns you. A bum on a DC bench has more freedom than someone indentured to a 600k RHG for 40 years taking home 70k.

I Say:

Very true, but why be a bum on a bench when you can be a bum in a McMansion?

Seems like you can have your cake and eat it too….

Working on getting my piece of government cheese – that 3.5% down FHA loan. Turns out that using the $8k tax credit for down payment or for closing costs requires that a local government or its agency (read: ACORN) has to handle the transaction. They get a piece of the action too. That makes it another way to subsidize leftists.

Here in Silicon Valley, a lot of first time home buyers WON’T be getting that full $8k. To buy a lower middle tier family home requires so much income to qualify that the $150k IRS upper limit will start cutting into the credit. By $170K, the credit is gone.

I fully expect to be underwater for a few years. Two things will re-inflate the housing prices. First, general inflation caused by excessive government money creation – already done, just has to work its way into the economy. Second, here in Silicon Valley as in many of the desirable areas, local “smart growth” ordinances have greatly reduced land availablity so we are largely built-out.

Just read Sowell’s book on the boom/bust.

http://www.amazon.com/Housing-Boom-Bust-Thomas-Sowell/dp/0465018807/ref=sr_1_1?ie=UTF8&s=books&qid=1256327879&sr=8-1

Recommended.

by Hunkerndown in San Jose

Just trying to shake my memory here. If I were to try to pinpoint exactly when this entire economic debacle began, I would have to say about 1970 or so whe Richard Nixon took us off the gold standard.

>>

________

>>>

Hunkerndown? Sorry but the US (and every other major country) went off the gold standard in the early 1930s!!! Britain went first and then everyone else. The asinine ‘gold standard’ was an idea only created in the late 19th century. Before that it had been silver, copper or whatever.

>>

If you want to blame something for subsequent events, at least make sure it really happened when you claim it happened.

What Was The Gold Standard?

The Gold Standard vs. Fiat Money

By Mike Moffatt, About.com

http://economics.about.com/cs/money/a/gold_standard.htm

(excerpt): The Bretton Woods System, enacted in 1946 created a system of fixed exchange rates that allowed governments to sell their gold to the United States treasury at the price of $35/ounce. “The Bretton Woods system ended on August 15, 1971, when President Richard Nixon ended trading of gold at the fixed price of $35/ounce. At that point for the first time in history, formal links between the major world currencies and real commodities were severed”. The gold standard has not been used in any major economy since that time.

Nixon Shock – Wikipedia

This article is about ending the gold standard for US dollars. … taken by U.S.

President Richard Nixon in 1971 including unilaterally canceling the direct …

http://en.wikipedia.org/wiki/Nixon_Shock

I hate to be the bearer of more bad news but…housing will never return to the price levels of before for these reasons. 1. Less young people and more old people: Old people live collectively and youngens live independantly. 2. By 2025 are population will begin to stabilize or even decrease due to falling fertility rates. In 2025 and beyond you will clearing out old homes to make way for assisted living facilities. These are the facts before us and homes will be virtually worthless.

hows this for a rude awakening? coupla days ago my 12 month old golden pup snatched a five dollar bill off my desk and proceeded to chew it up. before i could get it away from him, he had swallowed two thirds of it. kept a watch on his numerous craps, but to no avail. evidently his gastric juices are on overtime. the two thirds are gone, and im left with one third of an unredeemable fiat note. got to thinking in my non degreed mind that this could be a anology for the economy. think ill keep on renting. at least the landlord fixes stuff and when his name shows up on the nod realty trac list, i can be outa here in a heartbeat with joey the money desolving pup, instead of by order of a money desolving, depreciating investment……… like a cash for clunker,gubimint bailed out clunker.

The Doc’s post makes it abundantly clear that the real problem with the housing market is that it is not a free market – it is a market artificially upheld by the government bailout bucks and crony bank capitalism so that it cannot adjust as it should to meet current incomes, etc. We will now move sideways with neither higher or lower appreciation buoyed by the bailout bucks – keeping folks who gambled on there inflated mortgages in their McMansions while folks smart enough to not take the inflato-mortgage bet still looking into the California housing market from the outside.

Imagine if the government tried these shenanigans with a stock market crash!

Leave a Reply to Andy