California government benefitting from rising property values: Low rates and higher home values increase property tax collections. Who pays tax bill on foreclosed properties?

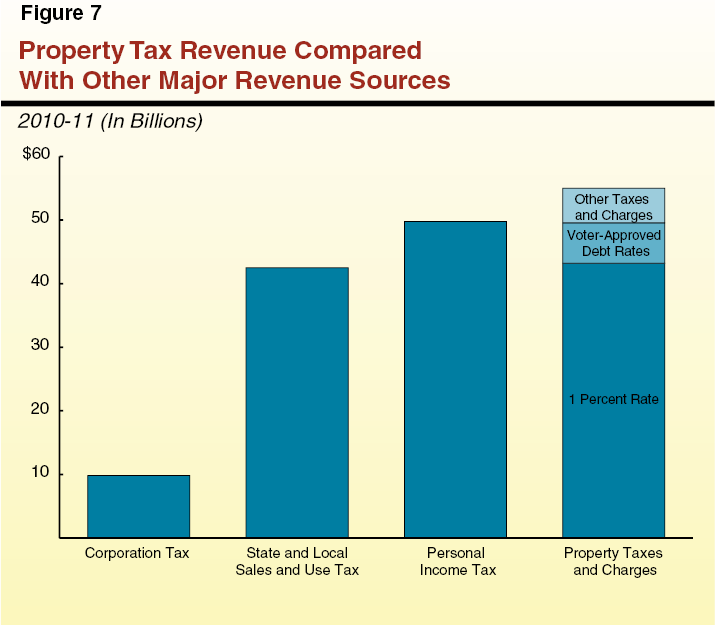

Home owners have a vested interest in seeing their home value increase. This is probably no shocking revelation. But local governments may have an even bigger interest in rising values. Property taxes are on the uptrend with higher home values. Property taxes are a major source of revenue for local governments and go to various things including school districts, community colleges, counties, and cities. Certainly the big jump in real estate values is causing these local agencies to cheer on the real estate market. Even with the 1 percent property tax rate in California, local governments collected well over $50 billion. There is another $4 to $5 billion in additional property taxes levied to pay bonded indebtedness and many in Orange County and Los Angeles County get a taste of this on an annual basis. Many local governments I’m sure love the fact that many properties are being sold at a much higher reassessed values. Let us examine the trend with property taxes.

The largest source of tax – property taxes

In spite of having one of the lowest property tax rates in the nation on a percentage basis, property taxes collect a large amount of money for local governments:

Source:Â LAO

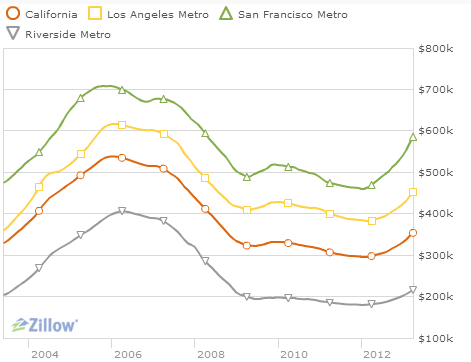

Roughly $55 billion in property taxes were collected in 2010-11. This is even higher than the amount collected through personal income taxes. Of course this rise has moved hand and hand with rising real estate values:

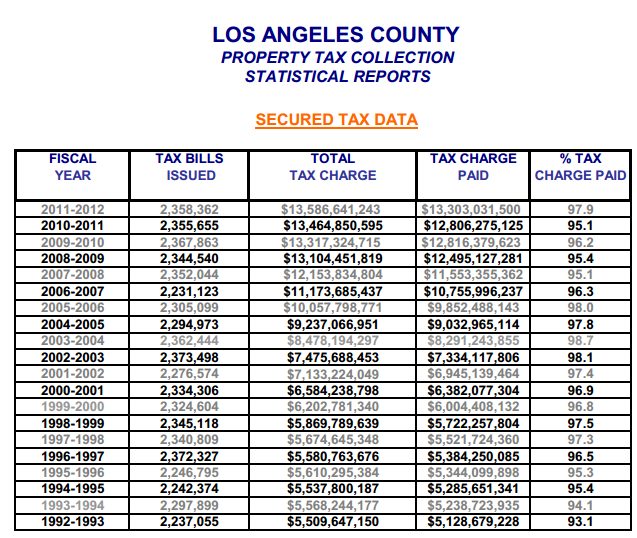

The rise in home values and the steady churn of sales causes properties to be reassessed at higher levels. While the Federal Reserve is on a mission for low interest rates, the fever it has caused in housing is coming at the cost of higher home prices and more money being diverted to other items like property taxes. Take a look at collections in Los Angeles County:

Property tax collections went up by 35 percent between 2006-07 and 2011-12 for Los Angeles County. In fact, property taxes are fairly stable on the upside (you’ll notice the bubble didn’t do much here). What is interesting is that while some home owners avoided paying their mortgage on underwater homes, they definitely paid their tax bill. Many banks certainly kept the tax bill current. While this might be true in more prime areas, the case doesn’t apply in all areas of California:

“STOCKTON (CBS13) — Some of the same banks that foreclosed on homes up and down the valley are now skipping out on paying their property taxes, a Call Kurtis investigation has uncovered.

While local counties lay off workers — unable to pay for the services they once could — Call Kurtis found more than $3 million dollars in back taxes and penalties on properties owned by the banks, according to tax collectors in six Northern California counties.â€

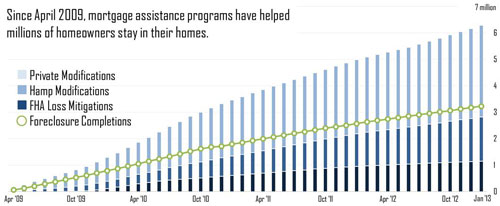

Of course you would like to believe that local governments are setting aside some of these funds but knowing how things operate in California, that is unlikely the case. It is definitely hard to predict where things will go when so many programs are taking us into uncharted territory. Just look at this chart showing all the intervention into the mortgage market:

Millions of various types of modifications have occurred and many have lost their homes. The Federal Reserve has jumped into the deep end of the pool by using QE to purchase up mortgage backed securities. One thing is certain and that is any kind of savings has been discouraged and there is a definite undertone to spending here, especially when it comes to real estate. The Fed has unlocked the animal spirits of the market in the short-term. Even reading the very thoughtful comments many are capitulating and have already bought or are planning to buy while they share reservations on how much footing this recovery may have. Many even acknowledge the manic like behavior now in the market when it comes to buying a home and the fierce competition for the record low inventory.

You have to wonder if the Fed also intended for low rates to be a backdoor method of getting more taxes to local government agencies in a cash strapped environment? After all, most are only focused on the monthly payment and so what if more is going to taxes versus principal or interest. In California however you might have someone paying $1,000 a year versus a newly moved in person paying $8,000 a year and both enjoy the same level of service and government programs (i.e., good public schools, community colleges, etc). The current housing market is basically shifting a large portion of the hidden costs to new home buyers. Don’t expect to hear local governments say a word when it comes to these new found revenue streams.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

35 Responses to “California government benefitting from rising property values: Low rates and higher home values increase property tax collections. Who pays tax bill on foreclosed properties?”

Figure 7 makes a good case for abolishing the Corporation Tax.

with this new found revenue, it will take the pressure off the government workers for give backs. this is great news to use at the bargaining table. thank you federal reserve.

There will less and less bargaining and the reality that more effectiveness and efficiency will be required of local and state government with less employees.

It will be interesting what happens when/if the mother of all stock market bubbles pops.

Well duh, this is the real reason for boosting property values in the first place. Low property values and mortgage payments are good for a consumer society as it boosts consumer spending. High values (taxes) are clearly good for Big Gov and their greedy coughers.

On the other hand, low property taxes are one of the principal causes of high Calif. property values. Many other states with otherwise low taxes have high property taxes. My friends in Texas pay about 2.5% of assessed valuation, about twice what I paid here in CA. Whatever the total tax load is, high property tax rates put a lid on property valuations. You can see the effect on prices here in Ventura County in areas with Mello-Roos taxes vs. no Mello-Roos taxes.

I disagree. TX is not a good comparison, they have no state income tax. The “low” property tax in CA is not one of the principal causes of the high values. The states that I am familiar with: NV, UT, MT all have rates of ~1% but property valuations are nowhere near those in CA. When I owned a home in UT (and it was my only residence), the property tax was significantly less than 1% due to a law there where there was a 40% discount on property taxes if the home was your primary residence.

NV has property tax of about 1% and does not have tate income tax, but that’s due to taxes on gambling.

No doubt you meant coffers. Although these taxes will surely make us all cough, or even choke to death!

One of the biggest lobbying groups in Sacto is from cities. Why? because most cities get about 20% back from property taxes.

The most interesting thing about your chart is not real estate taxes. It is the criminally low corporate taxes. Just between Google and Apple tax evasion, you have tens of billions.

For those who think real estate is out of the woods, I offer this from Spain. In Spanish, but I will translate:

La compraventa de viviendas cayó un 21,5% en el primer trimestre del año en comparación con el mismo periodo de 2012, hasta situarse en 54.512 unidades, según la estadÃstica de transacciones realizadas ante notario publicada hoy por el Ministerio de Fomento.

El 15% de las operaciones fueron realizadas por extranjeros residentes en España, el mayor porcentaje de toda la serie histórica.

This quote is from El Economista of Spain, the WSJ of Spain. First, keep in mind that we are in year six of the “little” depression. Spanish home sales fell 21.5% in the first quarter YTD. And, 15% of the purchases were by foreigners, which makes the Spanish numbers even more horrific. Here you have it, only 54,000 sales in three months in a country of over 40 million people. The approximate population of California. However, California sales of single family homes were over 100,000 in the first quarter. Two things, the Spanish sales include condos and 15% are second homes for foreigners.

Just curious, do you know what the interest rate on mortgages is in Spain. And the mortgage market in general?

A rough guide is around 5%. However, mortgages rates and terms are all over the map. They are generally adjustable and a lot depends if you are a resident of Spain or the EU. And, loan about 70% to value. I would not recommend buying anything in Europe now. It is very likely to fall apart and then what do you do with a mortgage and values dropping? Who wants to live in an environment of economic doom regardless of how cheap the real estate? After the September election in Germany, things can move very fast. See the cover of the Economist magazine, it says it all.

http://s01.s3c.es/imag/_v0/225×300/3/9/6/Economist-Sonambulos.jpg

Note the two markets mentioned in this article (and pretty much every other one) as overheated, LA and SF:

http://www.cnbc.com/id/100759004

Also, for those that keep mentioning QE forever, like cnbc bible thumpers, any thoughts on yesterday’s fed minutes?

Interesting. What are home prices doing in Modesto, Fresno, Bakersfield, etc…..?

Housing is going to continue to go up nation wide. The fed will not raise rates significantly, the banks will continue to trickle out their inventory, causing low inventory like we are seeing today.

Anyone that has bought or attempted to buy real estate in the past few years knows how difficult it is. Credit has to be great, debt to income has to be great, down payment etc. People that are buying in todays market are good buyers, and they can actually afford what they are buying. I do not see a scenario where everyone walks away like they did in 08.

The only problem with your scenario is that a fair number of those same buyers today aren’t individuals at all, but investments groups and/or hedge funds. So if their returns start heading south, you better duck and hide or else get stampeded by all of the rats running for the exits.

The other problem with his assessment is that there is an implicit assumption that the Fed will not raise rates. First, we don’t know what the Fed is going to do. Second, the Fed doesn’t know what it is going to do.

For many urban areas of CA, the cost of housing per square foot is about 2.5 x other regions. This translates into an effective property tax rate close to 2.5%. Add in the income tax and innumerable user fees in a time of stagnating/declining incomes and it makes it very difficult for the average family to survive in urban CA.

When my wife and I were renters and DINKS in West LA the cost of living was a non-issue. When kids arrived and a housing upgrade was required, LA was no longer the best economic choice for us.

Those FOMC minutes caused Nikkie down 1,100 points! Yet US Stocks up +15 today??? Give me a break. This thing is coming down hard. They are do everything imaginable to prevent the inevitable.

Why on earth would you want your property to go up in value? That’s insane unless you’re planning to sell. If you’re planning to stay, however, you want it to be worth as little as possible so both taxes and insurance are much less. I think the mentality of people in this country is just completely nuts because they seem to believe that, living hand-to-mouth because they pay so much on a mortgage, property taxes and insurance, is normal, heck, even good.

Can’t agree more Tad!

Tad, to answer your question “why would anybody want their property value to go up unless you are planning to sell?”

Very simple, you are forgetting about a common practice that was all too common during the oughts. Cash out refinancing. Remember, people bought places for 300K and a decade later they were valued at 900K. Refinancing at ever lower rates and taking out 200K in “equity” was going on all over the place in Socal. Fancy cars, fancy vacations, shopping sprees, 5 star dining was happening quite a bit. I personally saw this when I lived in OC during the housing bubble. And remember Prop 13 tax basis is not affected by refinancing whether you take cash out or not (I think Texas is different and this prevents this type of behavior).

Yes, it is a mentality that special interests have worked hard to instill over the years. Fortunately, not all of us believe just about everything that we’re told.

Let us count the reasons:

1) because in CA housing rises faster than inflation and prop taxes rise slower than inflation (Prop 13)…ie you accumulate wealth faster than its taxed

2) because insurance is inexpensive and rates are falling

3) because when you sell it’s tax free up to $250k profit single and $500k couple

4) because for most Americans their home is by far their biggest asset

5) because boomers haven’t saved for their retirement

You left out the most important reason an owner should be happy when his house value sky rockets. The banker, reinter class makes a ton of money on the refinancing and accumulated debt. Debt is real money, don’t ever forget that and you will be a slave all your life.

I just listened to an interview on FSN (Financial Survival Network)

with Karen Simpson-Hawkins – “Secrets of a Mortgage Insider.”

This was encouraging to hear (for those of us who want to buy).

Some are saying that the recent news of fed raising rates will pop the current housing bubble. I disagree. The fed just spent the last five years propping it up and would be out of their minds to reverse it.

Raising rates is to attain price stability which will helping housing more. The recent housing price spike is not something the fed wants. I think price stability is just as important in terms of saving housing.

While ZIRP might be helpful to certain areas of the economy such as the housing sector, it can also cause other problems. We don’t yet know if the Fed can have its cake and eat it too on this. They also don’t know yet. Most likely, they can’t and could make the decision to eschew free money in order to contain other variables should those variables become more critical.

By the way, they aren’t trying to save housing with ZIRP, they are trying to avoid systemic failure and housing is but only one attribute out of many.

An article that says what those of who have been following this blog and paying attention, already know…..

http://theeconomiccollapseblog.com/archives/will-the-new-housing-bubble-that-bernanke-is-creating-end-as-badly-as-the-last-one-did

Another interesting article about accidental landlords; essentially those that are underwater on one home so can’t/don’t want to sell it for a loss so rent it out and then purchase a second home for whatever reason (relocation, upgrade, etc). I know my friend did this in LA a few months ago and he is an accidental landlord currently. Article shows how many plan on selling one of these homes as soon as they are no longer underwater, which will increase supply as prices rise, but also shows how hard it is to be a landlord at times, which is something I’m not sure funds properly accounted for in their own to rent modeling.

http://www.cnbc.com/id/100764601

Higher housing prices make American businesses less competitive, as higher wages need to be paid to cover rents and mortgages.

Housing Prices are a symptom, not the problem. The issue is our fiat money system that allows the FED to manipulate nearly every facet of this economy. Crony capitalism has destroyed what was once a (mostly) free market economy that brought prosperity to all.

NihilistZerO

“…Housing Prices are a symptom, not the problem…”

You are exactly 100% correct.

Short of total financial collapse, can this situation be fixed?

Rising realestate valuations may be correlated to the dollar’s on going devaluation.

$85 billion printed every month tends to dilute the purchasing power of the fiat pool over time.

I guess this would be a win-win situation.

Leave a Reply to DebtFree