The uneven housing market of Southern California – Middle tier of Los Angeles and Orange County down over 8 percent in last 24 months. Lower tier holding steady over 24 months.

Purchasing a home is a major decision and will likely be the biggest purchase a person will ever make. For this reason the vetting process to purchase a home in the past required due diligence and also a demonstration that the buyer had the capability of saving to purchase a large commitment. Owning real estate carries many unforeseen expenses. When looking at the rising default rates with FHA insured loans one has to wonder if buyers really factored in the true cost of owning a property. In Southern California many who bought in the last few years thinking the bottom was in were still speculating in the sense that the property ladder game would be back in vogue. That has not happened. What appears to be happening and this is clear in the figures is that the market is stabilizing but at the lower tier of the market. It always helps to look at the facts since there is a tremendous amount of noise in the media.

The story of L.A. and O.C. home prices Â

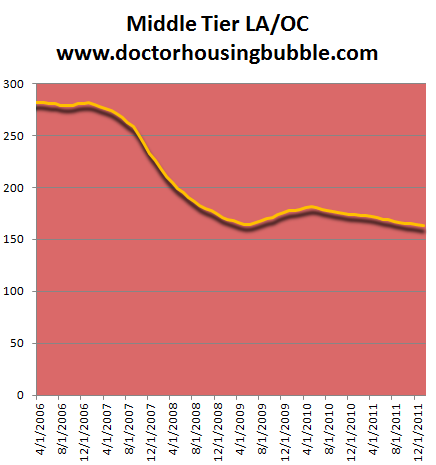

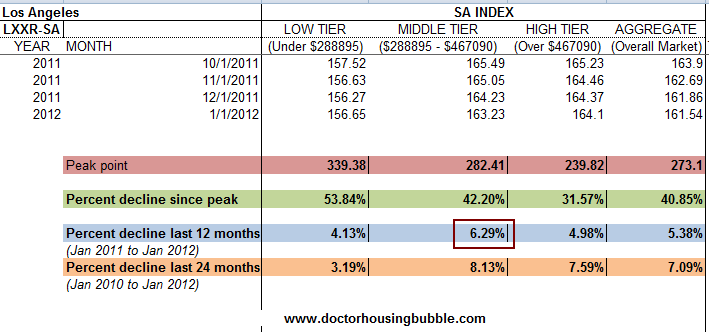

One of the most followed metrics on home pricing is the Case-Shiller Index. The index does one of the best jobs tracking real estate prices because it looks at repeat home sales. Karl Case developed the method to examine pricing behavior for the same home over time. Case-Shiller now offers tiered levels of prices and this is extremely valuable for diverse markets like Southern California. The figures tell us a fascinating story since the peak was reached in 2006. More to the point, the middle tier of the LA and OC housing market is in the middle of a double dip. The lower tier seems to be stabilizing. I went ahead and ran some numbers over the past two years:

First, let us clear something up. This bubble burst has hit every segment of the LA and OC markets. The lower tier, home prices under $285,895 has seen prices fall by 53.8 percent since the peak. The middle tier, homes with a price of $288,895 to $467,090 has seen prices fall by 42.2 percent since the peak. The high tier, homes with prices above $467,090 has seen prices decline by 31.5 percent. Every segment of the market has been hit hard.

Looking at more recent data, figures from the last 12 to 24 months highlight what we have been discussing for well over a year now. The middle tier of the market is now facing the strongest impact of the current correction. For example, the lower tier of the market has done the best in the last 24 months. Home prices in the low tier have increased for two consecutive months and 12 months and 24 months figures are only slightly off (3.1 and 4.1).

The middle tier is where most of the recent correction has hit. In the last 12 months this segment of the market for the LA/OC region has fallen by 6.2 percent. Over the last 24 months it is down 8.1 percent. This is significant given the large number of people jumping in with FHA insured loans that only require 3.5 percent down. The high tier has also corrected in the last 24 months by 7.5 percent and 4.9 percent in the last 12 months showing a similar pattern.

If you look at the middle tier data since the peak was reached, we are now at a post-bubble low:

The above chart shows the mini spike that really did occur in 2009 and went into 2010. If you remember the absurd tax gimmicks and the belief that the “true bottom†was now reached created a temporary frenzy. Much of that momentum has disappeared, even with the government virtually buying up every mortgage that is made and providing risky leverage with FHA insured loans. Many of those who try to deceive the public especially in the finance sector are quick to lend money that is secured by the government (aka the public) but would they risk lending out $500,000 at 4 percent with only 3.5 percent down if it came from their own account?

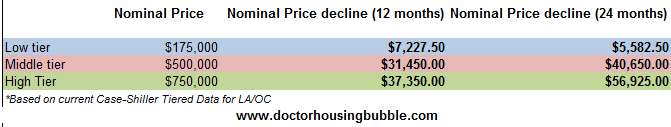

Let us try to put some actual figures to the decline over the last one and two years:

This helps to put a dollar figure loss over the last couple of years. I realize that $500,000 is slightly higher than the Case-Shiller middle tier cut off but the high tier goes from $467,000 up to multi-million dollar properties. $500,000 seems to be a price point many are looking at today so running the numbers might help out. Let us look at the low tier first. Someone buying a $175,000 home in say Lancaster or Palmdale might have seen only a few thousand dollars decline on the home value over this time frame. Given the low tier trend, the last 24 months have seen stabilization and a $5,582 equity cut in two years is very marginal.

The middle tier is where the shadow inventory coming online is having a larger impact. Take for example someone that bought a townhome or condo in Orange County or Culver City in January of 2010. Let us assume it was a quality place that was newer. The price tag of $500,000 seemed like a bargain given that some of these places might have sold for $650,000 to $750,000 during the mania. How have they done? Over the last two years the value of the property has dropped by $40,650. Let us assume they purchased with the minimum down payment of 3.5 percent ($17,500 plus closing costs). Not only is the value of the place much lower, but they are now underwater by a sizeable amount:

$500,000 purchase price

$482,500 mortgage

Loan balance after 2 years ($467,898)

$459,350 current value

6% sales cost $27,561

In other words the home is underwater in the equity department plus with the sales commission, this seller would need to come to the table with money to actually sell the property (over $36,000). I’m not sure where some people learned about finance but losing money like this is not exactly a wise financial decision.

Of course this is merely looking at the facts. We have the grim reality that household incomes have gone sideways for many years and the market is incredibly artificial with government and banking intervention. Rates of 4 percent imply little risk but that is absolutely not the case. Just look at the incredible rising defaults in FHA insured loans. Buying trillions of dollars in mortgages might keep rates low but what is the long-term repercussions? We’ll soon find out.

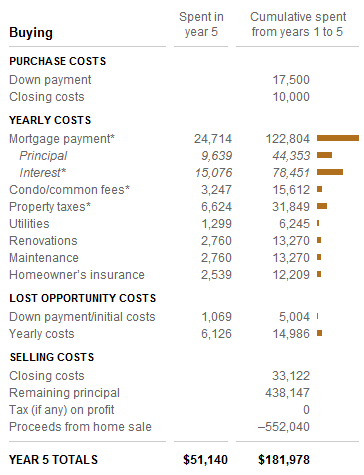

Let us run some more numbers. I know a few readers were sending over condos in Orange County that once sold for $700,000 now going for $500,000. These places would likely rent for $2,000 a month. Let us be generous and run the assumption that home values, starting today will increase by 2% annually and rents will increase by 2% annually as well. Let us look at a 5 year horizon here:

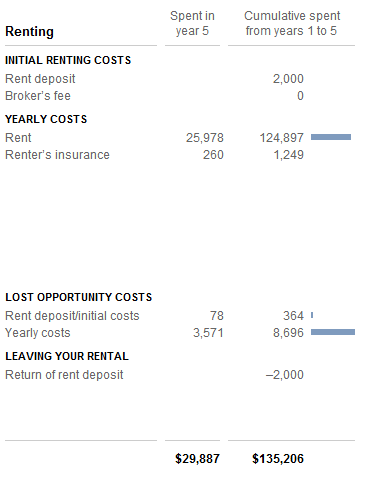

The above assumes a 3.5% down payment, a 4.25% mortgage rate, taxes (high for OC condos), an opportunity cost of 4% on alternative investments, and other miscellaneous costs that are likely to come from owning the place. After 5 years including a home sale the total amount spent was $181,978 (roughly $3,032 per month including tax benefits). Let us look at the renting side of the equation:

Over the same 5 year period including rent hikes the total spent was $135,206 (roughly $2,253 per month). Since those that bought in early 2010 were speculating (knowingly or unknowingly) just like those in 2006 (although not to the extreme) it is important to understand that buying and renting is not merely an easy equation. The above scenario assumes annual increases in home values by 2% when prices in the middle tier are still going down! The above figures that the $500,000 condo purchased today will sell for $552,000 in 5 years. Since no one has a crystal ball we have to look at macro economic data and try to look forward. What evidence do we have that household incomes will rise sharply in this time frame? Are we certain mortgage rates will continue to remain this low for years to come? FHA insured loans will be getting more expensive in the next few months, this is something we know. How will this impact the market? What about the now coming online shadow inventory where over 50% of all MLS listed inventory is now short sales?

All this suggests a couple of things. If you are buying in the low tier segment of the market it does look like some bottom may be taking place. Run the numbers to see if it makes sense for you. The middle tier has made a post-bubble low and only now are we seeing more quality inventory hitting the MLS showing banks are starting to move on shadow inventory. Anyone telling you should buy today because rates are low is missing the point. It is wiser for someone to take a higher rate with a lower home price. You have more options with a higher rate (i.e., pay down the loan faster with extra payments, refi in the future, etc). The fact that we have sub-4% mortgage rates by massive artificial intervention and FHA insured loans dominating the market tells us buyers are simply stretching to get into homes. The silver lining to this all is that people are realizing that housing is a big purchase and few are starting to run the numbers for themselves.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

73 Responses to “The uneven housing market of Southern California – Middle tier of Los Angeles and Orange County down over 8 percent in last 24 months. Lower tier holding steady over 24 months.”

We are looking at the 450 – 500 range in Ventura County (Westlake Village, Oak Park, Thousand Oaks). Inventory is very low, seems like the only way to get a house is to over bid and decide in one day. I am starting to feel buy now or forever be priced out, what do you think, buy now or wait?

“Buy now or be forever priced out” is what they were all saying in 2004-2006. How true did that ring? I don’t follow Ventura County that much but when Orange County was saying that last time, median prices were exceeding 10x the median annual wages. The important things to consider is that realtors and their pundits will always have some reason why you should buy, buy buy and do it now, now now. It’s their living.

You can find some info in Census data that can help your decision. You’ll have to do some “guesstimating” against it, however. what you want to try to find out is if the sales prices in the ‘hoods you’re looking at is less than about 5 times the annual wage. Normally you’d like to see 3x or less, but this *is* California and you’re talking about a prime area while rates are insanely low.

And that brings me to my final point: rates. Interest rates and APR’s are at an unprecedented low right now. This effectively lets people pay more than they would otherwise be able to. No matter where you buy, when rates do start to rise, prices will necessarily cool further. Since this should affect all prices, some would say that it shouldn’t matter (since if you decide to trade in, your next house will also be priced lower) but I believe it will be a big enough effect that it could push even a safe new loan’s equity (ca. 20%) underwater over the next several years.

The bottom line is, if it’s a house you like with a payment you’d be comfortable with and you could see yourself in it for at least 10-15 years (or more) then by all means, don’t hesitate. But if it’s in the spirit of “this is a starter home I will want to trade up against in the next few years” then you should definitely reconsider.

Wait. Patience, my young grasshopper.

“I am starting to feel buy now or forever be priced out”

Don’t just go with emotions. Look at the numbers. Do the math. Ask anyone you know who bought (mid-tier) in 2009/2010. Did they buy because they felt like they would be priced out? How are they *feeling* now?

“Anyone telling you should buy today because rates are low is missing the point.”

I have a lot of people around me who are missing the point. M-I-L says we should buy soon before rates go up. Rates can’t go up soon enough for me. Fortunately, my wife is with me on this one.

Japan rates have been kept low for 20 years

The argument about “when rates go up” is a good one but, I only get burnt big time once before I learn.

Never in my wildest housing crash dreams did I imagine the suspension of mark to market, zero rates and the purchase of trillions in assets by the FED to put a floor in, allowing for everything we see today from banks holding onto foreclosures in their best interest to allowing millions to say payment free because it is in the best interests of the banks.

So, now that I can imagine the unimaginable, I can now imagine 30 year rates at below 3% before they ever rise or 30 year rates stuck below 5% for decades.

When I hear people talk about, “when rates go up” I remember the lessons I have learned and remember that by 2020 our Federal debt will be some 20 trillion plus and how our government can’t afford higher rates and how accommodating the FED is to everyone, except to those who have saved their money.

Someday, people will wake up and the FED will not be able to exert unlimited control but my life span is only so long and I am beginning to wonder if I will live to see it.

@Martin:

Excellent point. There is little doubt that the Fed will do what it can to keep rates as low as possible. But, ultimately, running rates too low for too long will cause bigger and bigger segment crashes (i.e. blowing bubbles: stock, dotcom, housing, now treasuries?) until the whole damn thing gives way. The fallacy in reasoning that that the way things are today will be the way things remain forever is a large part of what blew up the housing bubble in the first place. Many thought annual double digit appreciation in prices was the “new normal.” One must approach this style of reasoning with caution, since the farther away this new normal is from a natural equilibrium, the harder the crash will be.

@ PapaToBe

Japan’s real estate is still falling. Interest rates staying low doesn’t mean that prices won’t continue to correct. Low interest rates & falling prices can go together, just like we’ve had for 5 years and counting.

Renter, you need to make yourself a really strong drink and relax. Add up all the fundamentals regarding the housing market and nobody is going to be priced out anytime soon.

1. We have artifically low interest rates, can these go on forever?

2. Can the FHA/Fannie/Freddie low down unqualified buyers go on forever?

3. Can the banks hold on to their pipeline of distressed inventroy forever?

4. The unemployment rate in CA is still over 10% (Read that again).

5. Wages are stagnant and will likely be from here on out.

6. Higher taxes are on the way whether you like it or not.

7. Gas is almost $5 per gallon here!

8. The under 30 crowd is in no position to buy houses anytime soon.

9. Most people who bought within the last 8 or 9 years have NO equity.

10. This is an election year, the media says everything is hunkydory.

11. When has the REIC ever said it was a bad time to buy?

12. Don’t forget about that national debt too…someone needs to pay that.

13. Boomers are retiring in numbers, this can’t be good for CA RE.

14. We are in the middle of the annual spring bounce for CA RE.

I’m sure there are many more that I left off my list. Relax, the market isn’t going anywhere. If you truly need to buy now, I would recommend waiting until the end of year. Save some more money for a downpayment and enjoy the summer.

Equity markets down today as Helicopter Ben’s language suggests a slowing down of his money rotors.

I don’t disagree a bit with what you say LB, but I have to play devils advocate.

#1. the Gov has managed to kick this can far longer and farther than anyone thought possible.

#2. Doom and gloom caused me to miss good portions of rallies.

#3. The Gov is the shot caller and mood setter.

Now that that’s out of the way, common sense says that mathematics never lie and the truth always has to come out. Not enough income = no promised outcome for Gov promises, which all ties into our economy, taxation, employment rate, thus the prices of houses. Greece is what happens when the Gov doesn’t pay it’s bills. But who foresaw ALL the bondholders taking a 70% HAIRCUT? No one! I don’t know how to explain or fathom those a-holes but somehow they pull it off.

I find RE horribly unpredictable right now. For all we know, they can decide to do another $8000 tax credit if they want too. They provided a bounce before. So you reply to that saying “it was just a bounce”. You are 100% correct. However, that bounce also took time and our time on this earth is limited. Someday, a person simply must ask themself the question “do I want a home and it’s free-er lifestyle or not”. And by that I mean wall painting freedom, not the mortgage slavery part of course.

In conclusion, I leave with the statement “of course America will crash.” Every society and empire eventually does. But we don’t know when, and the ultimate question is “how will we choose to live our lives until that moment?”

Good summary by LB here. I agree with a significant amount of your comments, although I would like to add two additional fundamental comments that could negatively effect housing:

15. Today’s students are paying exponentially higher college tuition than ever. I believe the cost for a typical UC education has gone up over 10% since 1980. That’s 300% more than inflation. With so much debt, household formation will be pushed back along with that home purchase.

16. What happens when the shadow bailout – free rent to underwater homeowners goes away? Eventually these people will have to pay rent and not live free for 3 years. Spending and the economy will suffer once a significant portion of their cash will be used to pay rent vs. save for a mortgage or buy i-pads. With a big hit to their credit score….I don’t think many in this situation is buying…unless you can buy a $80K unit in Las Vegas in cash.

Anymore we are missing anything else?

I have an observation that is concerning the student loan bubble and its effect on housing markets in specific areas. For obvious reasons I am renting a house and I have moved a number of times in the past 3 years. I live in Santa Cruz county and I have noticed that the rents go up dramatically the closer you get to UCSC. The rents are almost double for these run down houses with garages and dining rooms converted to bedrooms. I wonder what will happen to these places when the student loan bubble deflates…

I hear you. I lost out on a house just last week thinking the winning bidder was nuts and am begging to question my sanity for not being the winning bidder.

Prices can and will ( and are at least during this spring binge) go up if there is no inventory. The question is, will the banks release the inventory?

With zero rates for the banks and suspension of mark to market, there is absolutely every incentive to hold the inventory and just let it leak out.

Potential sellers are sitting in their California castles, watching the situation unfold, licking their chops thinking, knowing they are sitting on winning lottery tickets and are hearing about the lack of inventory and bidding wars. Why would they sell now? Why not wait for another 500K?

This too will end badly. The problem is, I may be dead before the FED loses its war against the working class of America.

Martin, you need a good strong drink too just to chill. Six months ago we did not have the lack of inventory problems. What has changed in those six months?

I think it is a combination of banks holding their supply back, squatters getting extended “stays of execution”, and you just don’t have that many organic sellers since the move up market is dead…very few people have any equity left to climb the property ladder. The time of year is usually the hottest regarding house buying/selling. So you will have plenty of competition for the limited supply out there.

If you absolutely need to buy, I would wait until later on in the year when this craziness subsides. Getting into bidding wars and overpaying for something non-optimal doesn’t sound like a good idea. Even if prices go up, how much could they go up realistically? Take a step back, you’re too close and your vision is clouded!

Don’t do it! If you’re happy with your rental then take your time. You should only buy if you really want to commit long term (10+ years) and don’t mind the thought of losing equity in the first few years.

I am in a similar situation in coastal Orange County. I really really want to own a house and I am tired of waiting and renting. But I know that when I buy in the next 12 months, I will most likely overpay, probably by as much as 20%. However, I will pay 50% down and do the rest on a 15-year mortgage. And at this point I am willing to pay the premium so I can own and remodel to my own liking, plant some fruit trees, put an in-ground spa into the back yard, and so on… I’ve rented long enough and I’ve moved around quite a lot so renting was the smartest choice for me. But now I know I want to settle down here and I know that I will not need to move for work again. It’s frustrating to see that some areas are still selling at 2004 prices (like Huntington) but other areas are at 2003 levels and those prices I’m a little more comfortable with. At this point I’d rather overpay by 20% than wait and rent another 5 years.

Don’ buy yet!! When interest rates go up, the values will fall even further.

We bought in Simi in 1996, 1800 sq ft 4bd, 2 ba, for 204K. We moved out of state in 1999 and sold for 259K…My neighbor became a realtor in 2001 and they bought our same model in June 2001 for 255K. They sold in May of 2004 for 525K…Yep, they made 270K in three years…THIS IS NOT NORMAL!! This was THE bubble. This house is now appraised for 325K. When prices fall to 2000 levels, then think about buying. Check it out for yourself on this website; realestate.yahoo.com/Homevalues

. 2136 Connell Ave, 93063

used2bnla

Thanks for that perspective. I believe you were in the New Monterey tract and you were in the San Franciscan model. I love those homes. Yeah, we almost bought for $425K in your former neighborhood and didn’t pull the trigger do to the size of the pool. It was the whole yard. (fixable for $15K-yikes) The home sold for $275K in 2002. That’s all it was worth, if that. Thanks for the link, btw.

used2bnla

What state did you move to and what is the quality of life and the value of real estate there? (If you would be so kind as to share.)

Simi is as pricey as Thousand Oaks.and the demographics are “different”. We use to live in Wood Ranch (mc-cr*p box 4,000 sq ft) and I hated it.

used2bnla

Before I met my Husband, he lived in Mississippi and loved it. He was a Mid-West transplant, Ca University guy, who still tells stories about the Miss. experience. Best seafood and great times. He worked for Litton and was part of their ship engineering staff.

You are lucky to get out of here.You’d think our town (renters in Thousand Oaks) was Van Nuys these days. Gang activity is going “gang busters”, and the quality of life has tanked. Hey, send some of that clean air our way. Sounds like you have found a good place and have a good life. I’ll raise my glass to you and your family’s happiness and health.

Hi Renter

We’re in your neck of the woods, and you’re right. Not only that, the properties stink, the condition of the homes are dreadful, and prices are just insane. I hear you loud and clear. We looked at a home on the way home tonight. We consider it a marginal neighborhood, and there is a pit bull living on the street. That is a deal breaker for us. I just don’t look at a home, a knock on doors and get the scoop. The house had a turn-key price for a lipstick on a pig in a marginal neighborhood. No thanks. We know what you’re feeling, we feel very depressed as well.

Hey Mad as Heck:

We were Texas transplants when we moved to Northridge in 1987. We were never able to afford a home then and two years after the earthquake we were able to buy in Simi. Once my oldest started driving I knew we had to get them out of LA, so we moved to Mississippi. Yep, the poorest state in the nation, but there are huge benefits, like more bang for your buck not to mention the great outdoors; hunting, fishing, fourwheeling, far outweigh the beautiful weather, which is all I miss about so-cal. We put 50K down on a 3800 sq ft home on four acres, for 225K. Sent two kids to Miss State and the semester tuition (each) ran about 2K… Can’t beat it!! Good Luck out there…

If you buy now, you could easilly lose 40-50 thousand in one year. Not even the most deluded hopium addict thinks prices are going to rise substantially during that period.

There are lots of potential upsides to being patient, and a whole bunch of risks around jumping in too early. It probably wouldn’t hurt to wait.

Renter: I am in Newbury park. We have been looking for 500 -580 range. We are having the same problems. We will NOT engage in a bidding war. I can not wrap my mind around purchasing a home for 1/2 a million dollars that was built in the 1970’s or 1980’s and backs up to a main street. (Lynn Road). Moving to Moorpark is out of the question. So we rent, sit and wait. I never thought this would go on for so long.

Valley Girl

I was raised from 4 yrs old to 21 in the valley (SFV) myself. We live in T.O. Moorpark (cr*proom) does have perfect climate, but I don’t like the town either. Newbury Park is ok. Simi is ok (excluding Wood Ranch -owned a luxury home on a hill-hated it- the people suck).

Yeah, prices are still $100K minimum over where they should be, and the homes back up to noise central that are available. You and I will leave the low quality of life homes for the idiots in the bidding war. We love So Pasadena. Just can’t afford $1.4M for an average, but really cool home on a really private paradise lot. Can you spare some change? LOL

We’ve kicked the tires on some many loser homes at ridiculous prices, I could blow a head gasket.

It’s just really sad we are forced to spend so much on housing out here. In the Midwest, it’s sort of the goal to spend as little on housing as possible, so there is more money to go out and do stuff. Here, you spend it all on housing and have less to go out, and then when you do go out everything costs so much it’s ridiculous. I’m convinced the only way businesses make it here is from overpopulation taking the place of real demand vs. lower density areas.

The words “lower tier” are a bit insulting, but no offense to DHB, he doesn’t make the rules he just writes the game. It’s sad to know college educated professionals are called anything “lower”. Frankly by mathematics, making $100k is the top end of “lower” and perhaps “mid” on a good day, but in the Midwest, Phoenix, etc…$100k is “upper middle”.

In the lower tier, (in other words Inland Empire) I’m seeing flat to slightly falling prices, with asking prices going up but I don’t know they are holding vs. sales price. I don’t see how comps can be $118/sq ft, then have someone down the street ask $145/sq ft and come through on appraisal. If I was an appraiser and bank, I would laugh. Time will tell how it plays out.

Right now we are looking in North Rialto, which are the Las Colinas, and Country Club Estates areas, zip code 92377. Homes are around $200k give or take $25k, with ‘decent’ schools and demographics of people, working families like ours. It’s not ghetto like south of the 210. The best schools are in Rancho and Upland, even south of the 210 there, but we are still priced out of those homes ($300k to $450k).

If all this is a “deal”, then SoCal is definitely overpriced. Kinda depressing vs. the world too, because L.A. is the 13th largest city in the world, yet comapred to NYC, Asian, Australian and European cities, the housing here is dirt cheap for an “alpha city”.

NO, do NOT move to Rialto. If I were you I’d look into Norco, Corona and if you can go further south check out Murrieta/Temecula. Murrieta was ranked the 2nd safest city in the entire country, after Irvine.

I love Norco but can’t do it. I absolutley have to buy off the 210 for proximity to family. I wish I could afford Upland or northern Rancho, but I can’t. Even older Rancho is too far for me, I already commute from the coast and have to run back/forth from schools when I am home in the I.E.

Long story short, for my commute and money, there is nothing better for $200k than northern Rialto. In all honesty, the little neighborhood parallel Sycamore Ave in front of the El Rancho Verde County Club, and anything in the triangle north of Casa Grande Dr are perfectly safe and fine neighborhoods. Google map them and “street view” them yourself.

2nd safest city, yeah I lived in one of the safeest cities before, I also have first hand knowledge of city police being instructed to not submitt reports all to keep crime numbers down.

@PapaToBe, to be frank, there is no such thing as ‘safe’ in Rialto. I grew in in R.C. and parents still live there. I wouldn’t even do Fontana. Just rent somewhere in R.C. prices will go down I’m sure of it.

You need to look at demographics and unemployment trends for San Bernadino county, on a site such as city-data.com, particularly unemployment and marriage trends (which are utterly dismal and some of the worst in the nation). Then measure the local and regional secretive “shadow inventory” of homes in or likely to be foreclosed or short-sold, as Dr. HB warns repeatedly; this can be done with realty trac (free for vague information) and even Zillow (free). ALMOST EVERYONE who has bought a home there in the last ten years with debt, is underwater; and those who are so far underwater are the highest risk to give up and dump even more (often damaged) homes back on the FHA. An area with extraordinary high unemployment is not a prime area in which to buy at all, especially if it is net overbuilt (the unemployed will LEAVE TOWN for employment elsewhere, eventually) unless the unemployment is rapidly decreasing AND there are more high quality, and high salary, permanent jobs being created. The methods of price-decline predictions through cautious and well-researched demographic investigation from DrHB has been 100% accurate for years when applied to San Bernadino County especially, and has stopped almost no young person from blundering on and into buying money-losing homes in the Inland Empire. You should also study why Stockton is trying to declare bankruptcy and what that means to the other Cities who are in the identical mess or soon will be.

You can try north Fontana too. I am curently renting there and waiting for lowper prices to buy. I have looked at both my area and north rialto and I believe they are comparable in safety, pricing, demographics, etc. The only thing is that etiwanda school district is rated better than rialto so that is why I am focusing there. Pull up etiwanda school district map and look for homes in that area south of 210 and east of 15.

Thank you DHB for reminding me why time is on my side.

Riverside County has a lot of places in the 150-200k range that rent out for $1500-$1800 /month. If that isn’t a bottom I don’t know what is.

Riverside is hard to tell. Why should Riverside be any different from Scottsdale, or Des Monies? Nothing special about Riverside except commuting proximity to L.A.

Most 3BR/2BA homes in America are $100k to $150k and rent from $700/mo to $1200 a month. By that logic, I could see Riverside falling further. Anything higher would be subjective “L.A. / SoCal” premium. And what’s that, 20% maybe?

It’s over, folks.

http://finance.yahoo.com/news/investors-looking-buy-homes-thousands-134405371.html

Stock market back to pre-bubble highs, thanks to QE…now its time to rocket the housing market to the sky again; FHA loans, investor groups snapping up homes, etc, foreclosed people get back into homes with lease to own options. The “fever” is back…buy now, or risk being priced out forever…the crowd surges forward, desperate to get into the game. It’s going to be different, this time…a new “paradigm”. History teaches us nothing.

When I hear of one of these “investor groups” in trouble, or liquidating, I’ll assume we’ve topped out again. The more things change, the more they remain the same.

Was going to provide a link to the same article from today.

The bottom in the lower tier hasn’t been set by folks looking for a primary residence, it has been set by speculators.

The group referenced in the article is buying 5 to 7 properties PER DAY, and they are certainly one group among many.

Folks that wonder why “reasonably priced” housing is selling like hotcakes needen’t look further than the article linked above.

The end game will be interesting when it plays out.

What are these investor groups going to do with all these homes? Hold them and artificially keep a floor on housing prices? Nope, they are going to rent them out. Which means more rental supply everywhere. That means rent prices go DOWN.

I’ll keep renting, thank you very much.

Spartan you would think rents would drop, right now they are rising. Whatever collusion tactics they are using, is working to inflate the rent prices. Everyone has to live somewhere and dish out what the asking price is. I wish rents would drop.

Papa,

The only reason why it appears that inventory is tight is because banks have been holding off on foreclosing. That is about to end. Even MSM is reporting that 2012 is going to be a doozy of a year for foreclosures.

http://news.yahoo.com/americans-brace-next-foreclosure-wave-210253440.html

Get ready for the second leg down in housing values.

For mid tier homes in southern California ($450k)you need to earn a minimum of 120k but you should earn more. What % of the population earns this amount of money? A few years ago I read that the annual household income in Irvine was $78,000 per year. For a basic home in an ok neighborhood you have to either have a great deal of savings or consistently earn a high income. How easy are the $100k+ jobs easy to replace ? Can you keep this income for 30 years? Will you always be healthy? How will you pay for the upkeep and at least one major remodeling job during that time frame?

The median household income in Irvine is $111k. Meaning 50% of the city earns more than that. There are 50+ major, highpower companies that have their HQ’s in Irvine. Bottom line, there is money in Irvine. All your other questions are subjective.

As for the remodeling, I know it happens but far from everyone does it. Very income and neighborhood dependent. My fathers kitchen looks the same way it did in 1985 for example. There are a lot of homes on the market with 1970’s kitchens. On the other hand, trendy neighborhoods and recent flips all have nice shiny new kitchens. But myself, being in the market, I don’t even think about future remodels. That’s something that, if down the line happens, will happen. And if not, oh well, as long as my stove still cooks food and the fridge cools it, I’m fine.

According to the census website it is $90,393. Where are you getting your information for median household income?

http://quickfacts.census.gov/qfd/states/06/0636770.html

Dr HB you have nailed it once again. The housing correction is moving like a pig through a snake. Pent up demand and the minimal amount of inventory of homes LISTED are beginning to fool those with weak hands this spring. The smart money is still patient as the middle and upper tiers still have a ways to correct. On the Westside of LA we are starting to see some homes listed in the $400,000s, which we haven’t seen in some time. I even saw the first one listed in Venice in the $300,000s (Auction). It will be interesting to see what happens after the presidential election, as the winner won’t have to play politics.

It’s great that more and more people are realizing that housing in middle and upper tiers that haven’t fully corrected is a huge gamble and FHA is just more government tricks. The economy for 99% of the people is still shaky at best and most cannot afford or willing to take a crapshoot on the Westside of LA. I am starting to list ALL of the monthly transactions now for the Westside of LA, so readers can do their own research and cut through the real estate industry BS . Knowledge is power.

http://www.westsideremeltdown.blogspot.com

DHB you nailed it again, thanks for all you do.

“It will be interesting to see what happens after the presidential election, as the winner won’t have to play politics”

I keep hearing this foolishness over & over again. As if the upcoming elections were scheduled to be the LAST ever held.

The truth is that the USA is I-N-S-O-L-V-E-N-T which means that after this election America’s can of woes will need to be kicked down the road AGAIN.

And again and again and again until the INEVITABLEmoment when everything COLLAPSES.

I give this country another 2 years TOPS.

Here is what you can take from the 3 what ifs of “tomorrow” in Rialto for example.

#1 It gets better, a possibility which would require that Ben Bernanke and the politicians, working for the Have It Alls’, are telling you the truth.

Solution to #1 Buy the place in Rialto and relax. Happy Unicorns will sprinkle Skittles on your manicured fully watered lawn. All is well in America. Upgrade to Rancho Cuca in 5 years.

#2 It stays exactly the same, which would mean everyone still continues to believe what Ben and the politicians say “might happen”, might eventually happen. Kind of like the last 20 years of life for the Japanese, going nowhere in no hurry.

Solution to #2 Buy the place in Rialto and pay a fixed rent to the government. Because, in reality you don’t own your house, you rent it from the County Assessors office for 1.25%. Give or take. Stagnation is bearable if you have a roof over your head that you are in charge of. Good luck to all the renters in an investors’ stale asset. Don’t mind the 5 20 foot container stacked up in the backyard, corporate needs more rental income.

#3 What If it gets worse? What if they can’t keep all the lies they are juggling up in the air at the same time.

Solution #3 Buy the place in Rialto. If things get worse do you really think the problem at the top of the list for the one’s in charge and with the most to lose if things go to pot is to tell FHA to clean up it’s books and do a fire sale on your house? I think not. Hunker down in your own castle in Rialto, pay the monthly nut if you can or if you can’t then don’t. What other choice do you have. It is a lot more manageable to run a country in a world spiraling into chaos if you don’t kick everyone out into the street and give them a reason to want you still running things.

We live in a make believe world. The shorter you make the chains that bind you to that the better off you are. In fairytaleland if the roof over your head depends on a landlord who depends on investment that depends on wall street that depends on controlling government, then how secure are you? If you shorten the chain yourself to the FHA it is you chained to government directly. no middle men to muck things up. If the government kicks you out of Rialto of all places, how bad did things get before that point is reached.

You have 3 choices; Control government or government controls you or you can leave for other pastures. If you didn’t make plans for leaving you are stuck here.

I’m NOT POTUS and this was a public service message, because the more you know……..

Two major things are going to happen after the election. One, taxes will increase and government spending at ALL levels will contract even further. Two, interest rates will increase. The Fed has kept long term rates, your mortgage, down by the famous TWIST, selling short term and buying long term. This is a formula for an eventual spike in rates as it is temporay and by its very nature cannot continue for long. Throw in China’s dumping of Treasuries and see what you get. You have to be crazy to buy until the results of the election play through. Additionally, it is highly likely that Obama will be re-elected. And, if he is, then things will get real nasty, real fast. Look for a FDR fireside chat right out of the blocks and it will not be about Santa Claus. Of course history and finance are linear, just like the realtor said.

http://www.pbs.org/wgbh/americanexperience/features/primary-resources/fdr-fireside/

With the Fed’s and ECB’s (and BOC for that matter) heavy hand in the markets, the era of Bond Vigilantes intervening in the market to provide some integrity to interest rates may be long gone. From the perspective of our National debt and the poor condition of Bank’s balance sheets, the policy of low interest rates will most likely remain intact for a long time. Remember, Ben himself said rates would be kept low through 2014. The current policies in place are designed to serve and protect a small but extremely powerful group of Finacial Oligarchs. Those hoping these policies will change with a different administration are likely to be disappointed.

Expect Banks to continue their slow release of inventory for at least another 2-3 years. House prices will continue at a slow descent until either supply/demand or income/price come into balance within the local market. Don’t belive the real estate agent hype of buy now before it is too late. Take your time and choose the property and neighborhood that best suits your needs.

The Calulated Risk home price index chart

http://www.calculatedriskblog.com/2012/04/corelogic-house-price-index-falls-to.html

“Today we have reason to believe that things are a little better than they were two months ago. Industry has picked up, railroads are carrying more freight, farm prices are better, but I am not going to indulge in issuing proclamations of overenthusiastic assurance. We cannot bally-ho ourselves back to prosperity. I am going to be honest at all times with the people of the country. I do not want the people of this country to take the foolish course of letting this improvement come back on another speculative wave.” FDR May 1933

An an interesting interview with an interesting man…

http://www.businessinsider.com/david-stockman-youd-be-a-fool-to-hold-anything-but-cash-now-2012-3?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+TheMoneyGame+(The+Money+Game)

I am looking in Northern ca and the westside of LA and Portland Or.. I have been trying to buy a house but there is always multiple offers on the properties. If you are in the right neighborhoods the inventory of good houses are low and I have been making offers and have seen the prices rising in each area. I don’t care what case Schiller says. I wonder if I missed the bottom sometimes.

Mike,

Go to this website ( realestate.yahoo.com/Homevalues ) and investigate the address you are seeking to buy. Look at the history of buying, listing and selling to get an idea of what home was worth 10 years ago, at least. Today goes down in history as the lost decade of housing, and 2002 is where the bubble Skyrocketed. Prior to 2002 is what the house is worth today. If you’re gonna live there and the hand house over to your kids or grandkids in 30 years, go for it then, at today’s interest rates, what do you care what the house is worth as long as you can make the payments for the next THIRTY YEARS!! Once we get through this election, no matter who wins, those interest rates WILL be going up, which means values will fall further!!!

http://news.firedoglake.com/2012/04/03/investor-purchases-of-foreclosures-face-lots-of-hurdles/#comments

Please ignore the man behind the curtain!

“One of the most important indicators of US economic health, the velocity of money, has hit a 50-year low, which risk consultants warn may mean the US economy is set for a sharp slowdown.”

http://www.efinancialnews.com/story/2012-03-07/money-velocity-all-time-lows-in-us

The U.S. economy is on the horizon of a deflationary black hole despite the CBs efforts (I mean very near horizon).

A deflationary collapse would mean debt default across the board. You’re talking sovereign, state, municipal, and corporate bond defaults. If that were to happen, the $800 trillion CDS market would implode, and the five largest banking institutions would experience liquidity events that would make 2008 look like a walk in the park. And since these five banking institutions own the Federal Reserve, I think they will have Bernanke printing faster than the speed of light (which is now possible).

I just heard that 25% of all student loans are now in delinquency. This is now over a $1T market.

CA unemployment, the real kind, is in the 20% bracket. Millions of homes are underwater on their mortgage. I still hear real estate investor groups saying this is the time to buy and hold due to positive cash flow on rental homes. And in the same breath they say not to buy if you can’t hold for quite a while. This is called the “Buy, hold and pray” method of investing. No thank you. I’ll take the cash instead.

Renter , The most important thing that you need to realize is that in California… The game is rigged, and it is rigged against you.

Just remember that there is no shortage of inventory, the banks take 2-3 years to foreclose, just to limit the foreclosure supply.

The inventory is rigged

The intrerest rates are rigged.

and it is all rigged against the buyers.

Renter don’t forget that there are always more properties coming on the market, and the banks just time the market the best they can to suit their needs not yours.

I wanted you all to see this place. We did an evaluation when it was a short sale at $380K before a few hair cuts. Now it is $400K as an REO. Look at the condition of this home. The Asset Mgr is on crack, imho.

http://www.redfin.com/CA/Simi-Valley/895-Bennett-St-93065/home/4630459

Bennett is a secondary street going into the neighborhood, btw.

Notice the cheap tries at upgrading the fugly bathrooms. A waste of money.

Even by English standards that place looks insanelly overpriced.

Surelly people aren’t paying those sorts of prices?

I’ve noticed that there seems to be fewer offerings on the “lower end.” The Fed’s help-the-banks/ ruin-the-people policies to prop up housing makes me so angry I could scream. My hate doesn’t grow less, it stays at the same level it was during the bailouts. It’s still hard for me to believe that the citizens allow these shenanigans to go on. The elites do whatever the hell they want, AND they get away with it.

How about if the minimum wage was raised to $9.00/hr.?

San Francisco raised the minimum wage to $10.00/hr. few weeks/months ago.

Would raising the minimum wage help and stimulate the economy?

What do you think?

$10/hour equates to roughly $20K/year, at full-time employment. Ask yourself if $20K/year would allow someone to do anything but survive in CA? Even at the generous loans available from the govt, I don’t think $20K/year will get you a loan.

Without much access to credit and a paycheck that must be entirely spent on essentials in order to survive, how can one create upward price pressure on something?

Oops, I think one could still get $100K in student loans…..And look what has happened to that sector…..without govt intervention, we’d be in a VERY different world right now.

Is this a troll?

SF businesses are laying off now thanks to the new minimum wage. Nuff said.

I used to work in SF. No one makes $10/hr. Well, maybe in food service. $60k is probably the bare minimum salary in SF. And that’s for kids just starting out after college and receptionists.

And rent prices for a one bdrm in SF start at $2000. It gets slightly cheaper in the Peninsula or East Bay, but not by much. The people that work those $10/hour jobs cannot afford to live in the Bay Area. There is a shortage or service workers here in the Bay due to these high rents pushing out lower skilled workers. I don’t think you could hire service workers for $10/hour here – no one would accept that wage.

High housing is most definitely pushing out a large segment of the population in the Bay Area. The 18-40 age group is disappearing in many areas. For example, it’s hard to find young families in Marin Country, SF and parts of the East Bay. Also, most of the high-paying jobs are for engineers only, which has resulted in the Bay Area being the mother of all sausage fests.

According to the US Census website for San Francisco: http://quickfacts.census.gov/qfd/states/06/0667000.html

Persons under 18 years, percent, 2010 = 13.4%

Persons 65 years and over, percent, 2010 = 13.6%

Female persons, percent, 2010 = 49.3%

Median household income 2006 – 2010 = $71,304

Median value of owner – occupied housing units, 2006 – 2010 = $785,200

These are the facts; draw your own conclusions…

We waited, patiently, heard the calls of reason and did not buy. Looked at charts, graphs, loan resets, the ARM fiasco, unemployment. We tried to save a little cash, lived in a mediocre house at 2200 a month, being prudent. For What???

Now the next round of “ifs” is coming…If Obama gets reelected, if Romney wins, if Ben does this or that…all a big joke. The government will go broke before they let banks lose money, and that means they will be pulling more cloak and mirror tricks to keep this insanity going no matter what us “geniuses” think will happen to the Economy. Truth is I just spent 2200x 5 years=$132000 waiting for nothing except even worse insanity than before. Prices here are down a bit…whoop t do…I have zero equity, and pulling in big bucks on that savings account (couldn’t put the money in stock since the “big crash” was coming).

Just shoot me.

Now I gotta hear “yeah prices are down, but there are multiple offers on homes, bidding them back up to the stratosphere.” Because our socialized free market economy allows banks to hold the inventory creating low supply. This is not gonna change guys. Bend over and grab your ankles, they won.

I wouldn’t give up CC. For every person like you, there are a handful of others who bought homes and are now crazy underwater. They would 100% be envious of your position. For the last 5 years, you probably didn’t worry about maintenance, taxes, what if you lost your job and had to move, etc. You paid for a roof over your head and lived within your means, eventually it’ll pay off.

As for the stock comment, are you really mad that you missed out on the runup to Dow 13,000? It could have easily went the other way. In other words, it’s all just gambling so just be happy you still have all your funds in tact – not gaining much is better than losing all day any day. Look on the bright side. You are mobile, responsible, saving money. Now you just have to learn to enjoy it. I know tons of people who are upside down, fear their financial situation daily, etc. It eats at you.

CC, you should count your blessings you didn’t buy 5 years ago in 2007. There is no doubt you’d be upsidedown in a big way today. Sounds like you’ve been prudent and saved some money, like the other poster said…you are in much better position than most people.

Regarding the stock market. We are almost exactly where we were 4 years ago in 2008. In hindsight, it would have been great to sell everything at Dow 13K in April of 2008 and then go all in at Dow 6.5K in March of 2009. If you did the old buy and hold strategy, you haven’t gained anything in those years. Wall St. has turned into a casino, I’m not brave enough to throw my entire life savings in there and “hope” for a certain outcome.

Hang in there, it could be much worse!

Don’t give up CC! It seems dire, but you could be feeling alot worse.

True story – I sold a house in the East Bay Area in 2009. I took a small loss on the home, selling due to job loss. According to zillow.com, which has been notoriously stubborn about dropping estimated values on their website since the start of the crash, the folks who bought my home paid $75k more than it is worth today. And given zillow’s inflated values, it could be more like $90-100k. So for the last 3 years, not only have those folks been making mortgage payments of ~$2.5k per month, their entire down payment (they paid 20% down) is wiped out, and they are underwater.

Hang in there. The government & fed will eventually run out of bullets.

Thanks for the words of encouragement guys. One just gets to the point of capitulation. I have a young son, and would like him to have a home he will live in for the next 14 or 15 more years. Something I could pass to him, and give him a better leg up than I had. I just feel that no matter how prudent we are the “house” has the odds in their favor. I’m just facing a market where it’s a sellers market again. MultIple offers on any decent house driving the price above list. There is no evidence this will change any time in the near future. The banks have no reason to release a sudden flood of foreclosures on the market, and even if they did unless you are a Knowledgeable investor you can get severely burned. No move up buyers, and retired boomers facing declining assets and nowhere else to move that’s more affordable. Hence low inventory will prevail.

Patrick.net has a couple of entries today that mention a second wave of foreclosures on the way. I think it said 9 million of them. We have a long way to go.

The bankers and politicos are assholes for sure.

This:

http://www.zerohedge.com/news/second-foreclosure-tsunami-coming-and-about-kill-any-hopes-housing-bottom

Leave a Reply to martin