FHA insured loans have stepped in to fill a gaping void left from low down payment mortgage products. The risk and consequence for this action is now coming home to roost in a dramatic fashion.

FHA insured loans have stepped in to fill the giant void left by the collapse in low to nothing down mortgage products. A low down payment is problematic for a variety of reasons and as we will show in data presented below, is a creature of the housing bubble and nothing standard to a healthy housing market. Low down payments through FHA insured loans are financing a tremendous amount of current home purchasing but this is not necessarily a positive given that default rates are surging for FHA insured loans. For example, in California of the active FHA loans over 9 percent are delinquent. This is not exactly a positive figure. Yet this is the number one mortgage product for first time home buyers. A bailout for the FHA is very likely given the ongoing issues with low down payment mortgage options. Contrary to what some will say, FHA insured loans have become a big player in the market because of stagnant household wages and the difficulty for households to scour up any savings.

FHA steps in to fill in hunger for low down payments

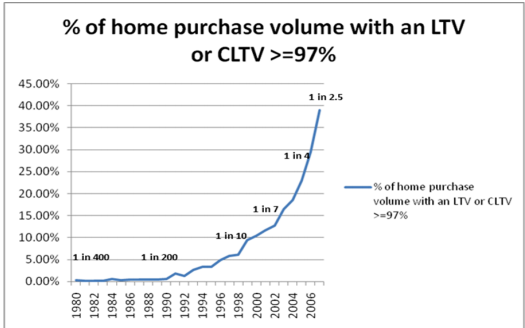

The trend towards low down payment products accelerated in the late 1990s on par with the repeal of Glass-Steagall:

Source:Â Ed Pinto

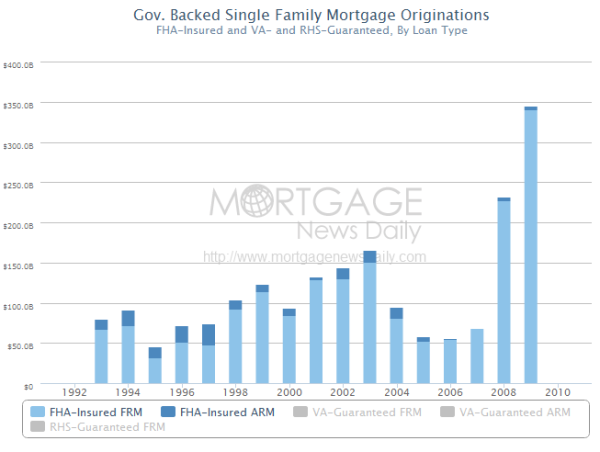

Initially the low down (and eventually the nothing down products) were financially dubious inventions from the financial sector. When the mortgage market imploded and the financial sector was melting down, FHA insured loans stepped in to finance the weak balance sheets of households:

The connection is almost perfect. You’ll notice that FHA loans were a small player until 2008 when it nearly tripled in mortgage originations and has grown ever since. It wasn’t like people suddenly fell in love with FHA loans. What happened is that the government and banks realized that Americans with weak balance sheets and very little savings needed a product to make-up for the lack of toxic mortgages. Instead of the FHA being a small player it suddenly became the product of choice as the chart above highlights.

“(Seattle Times) One big reason: Over the past six years, FHA has been the turnaround champ of residential real estate, offering down payments as low as 3.5 percent despite the recession and housing bust, growing its market share from 3 percent to 25 percent-plus. The program is now financing 40 percent or more of all new home purchases in some metropolitan areas and is a crucial resource for first-time buyers and moderate-income families, especially minorities.

With a maximum loan limit of $729,750 in high-cost areas, it is also a force in some of the country’s most expensive markets — California, Washington, D.C., New York and parts of New England.â€

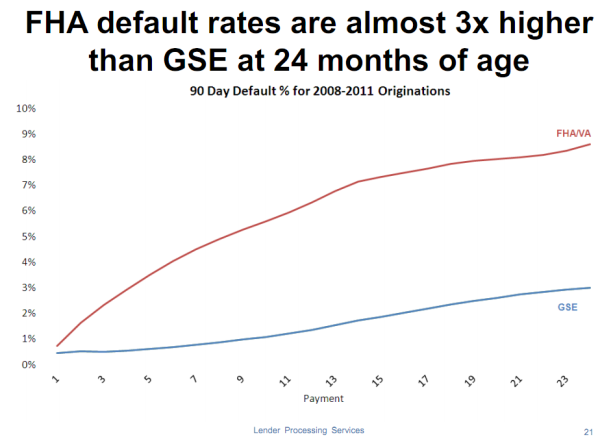

FHA insured loans went from financing three percent of mortgage originations to now financing close to 40 percent of new home purchases. Yet this will come at a heavy cost for taxpayers down the road. The defaults are already surging:

The FHA default rate is now approaching 10 percent. Instead of stepping in we have another Fannie Mae and Freddie Mac on our hands. Why is that? Because home prices continue to fall. With shadow inventory set to begin its purge in 2012, lower priced distressed homes will push prices lower. Many that bought in 2009, 2010, and 2011 have seen their equity washed away especially if they bought with a FHA insured loan and went in with the typical low down payment.

Incredibly the FHA was designed to help support affordable housing but does the exact opposite. Home prices in many regions remain inflated because of products like FHA insured loans. The above data is clear that households have fallen behind in the last decade. Yet home prices in many areas remain inflated. Why? Because of a few major reasons:

-Low down payment products allow many who are not qualified to buy when they should be renting (just look at continuing default rates – many originated between 2008 and 2011)

-Low mortgage rates continue to discount the actual risk inherent in the market

-The government-banking bailout that has allowed the shadow inventory to linger now for half-a-decade

What occurs is that prices become inflated because little skin is required to jump into the market. On one side you have banks being bailed out at every twist and turn. On the other side, you have people willing to buy with very little and treat a home purchase like a call-option. If prices rise then it is great but if they fall as they have, they can walk away with little on the table. The vast majority in the prudent middle end up paying for the true moral hazard players on both sides of the system unfortunately. Yet the FHA is starting to crack in more ways than one. Is this a surprise to anyone following the FHA insured market fiasco?

Nothing down or low down payments used to be a comical method of financing homes for the would-be infomercial real estate mogul. These were pitched to the public more to sell the sizzle than the actual steak. Yet in the late 1990s with full financial market de-regulation, investment banks with an army of grafters created a massive amount of toxic loans to filter into the system in the 2000s through option-ARMs, Alt-As, and subprime loans. Yet this mania covered up the reality that American households were actually becoming poorer. The fact that FHA insured loans went from the inner-city to financing prime cities in Orange County is a complete deviation from their mission statement. Then again, if we didn’t learn a lesson from the biggest financial crisis since the Great Depression should we be surprised?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

58 Responses to “FHA insured loans have stepped in to fill a gaping void left from low down payment mortgage products. The risk and consequence for this action is now coming home to roost in a dramatic fashion.”

Sure the FHA is swallowing up the market and supporting housing prices, but that, I think, is the point. Some in the government believe that banks might, just might, have stopped lending and if they dont add liquidity to the system (directly in this case), the market will seize up and do more than just revert to the mean. In such an environment, the foreclosure crisis will get a LOT worse than it is and strike the pain home even on people who are current on their mortgages or have none at all. Furthermore, it can snowball, as more and more people get underwater and strategically default.

The government, because it can print fiat, can afford to take the short term loss of 10% FHA defaults. I think it may be actually duty bound to do so — because it has a duty to take care of its citizens — to help make sure that the markets make a soft landing, rather than overcorrecting in a bout of hysteria and panic.

I dispute that this is mania, this time around. Certainly prices are not behaving like it is mania.

Ian, I completely agree that the government’s original intention was to create an economic soft landing. I also agree that suspension of mark to market, the changing of conforming loans from around $250,000 to around $750,000 and the lowering of interest rates to 0 was to “soften the landing†for the reasons you state. The issue is that there is a thin line between “softening the landing†and artificially supporting an unsustainable market. The challenge our government has is that the governed believe that the government can wave a magic wand and make the problem go away. And if you listen to the MSM you will hear calls to “fix housingâ€. The real problem is that we were in a speculated housing bubble and all bubbles will eventually deflate. The cost to an economy when a government artificially supports bubbles is a slow and long deflation which drags out the pain over decades (See Japan). The pain will be felt one way or another. There is no way around it.

Devaluing our currency will not solve the problem either. The things we bid for on the world market like food and fuel will cost relatively more of our devalued currency. There will be no wage inflation as long as we have slack in the labor market. Food and fuel will crowd out housing if there is no wage inflation to offset the currency devaluation. I think this is exactly what we are currently seeing.

Interesting comments. Oh what a tangled web we weave when first we practice to decieve….

The original problem goes back to the 1999 Banking Modernization Act overturning Glass Steagall and allowed the banks and brokerages to put their devious derivatives scheme in play. After realizing they ad WAY over sold based on the WAY over valued underlying assets the brokerages realized whoever doesn’t have a chair when the music stops will be buried and so the race to the bottom began.

The underlying assets on the 62 million Notes written in the last 10 years will NEVER be worth the TRILLIONs in what would have been the future equity in all those Americans homes and businesses too (can’t forget about the commercial loans!)

So the theft is long done. Then, to make sure people losing their life savings couldn’t file bankruptcy and have the principle reduced to current market value, the banksters had their stooges in Congress pass The Bankruptcy Reform And Consumer Protection Act (yes it actually proclaims to PROTECT consumers) in reality it took away the right of a judge in court to tell the banks to lower the principle to current market value. Why would that protect a consumer????

I say let the market correct.

Sure it will lower home values but it will be real, and short, and ever low income people can afford a 2

Sorry IPhone malfunction… Just want complete my ending.

Even low income people could afford a 20K house! Let the market self correct! Get the banksters out of government All Over The World!!!! Bring back Glass Steagall and get the attorneys that helped the banks commit their crimes out if the positions if US Attorney General and also the guy who is the head if the criminal division of the US Justice Dept. I refer to Erik Holder and Lanny Breuer both represented the Too Big To Fail banks and helped write Legal Opinion on the Bankster created straw man i.e. MERS and changed over 200 years of mortgage law and practice with ZERO legislative oversight or judicial oversight or administrative oversight. We were robbed period and the wolves are guarding the hen house.

> The issue is that there is a thin line between “softening the

> landing†and artificially supporting an unsustainable market.

To believe that, you’d have to believe that the participants in the market still believe in the bubble. That ship sailed a while ago. I’m not hearing any voices at work, on tv, etc. promising easy riches if only you buy into the real estate market. The housing flipping shows have moved to Canada, etc. Maybe there and in China there is still a bubble, but not here.

Rather, I think the average house buyer is buying a house because they want to buy a house, or think prices are cheap and are looking for an investment. (The investors are probably going to find there is a rental supply side market bubble, but that is a separate issue.) Prices are down quite significantly. The falling dagger has been quivering in the floor for some time.

It may even be time to buy. The front cover of the Economist is openly pondering a … recovery! (Economic recovery, not housing recovery — lets not get ahead of ourselves!) Hiring is picking up. In fact private sector employment growth is back to its peak in 2006.

http://www.calculatedriskblog.com/2012/03/year-over-year-change-in-public-and.html

The stock market is within a few percent of 2006 highs, as well

http://www.calculatedriskblog.com/2012/03/market-update-still-lost-decade.html

The doom and gloom is starting to wear a bit thin! So, check your watch, it is probably not 2009 anymore.

> The challenge our government has is that the governed

> believe that the government can wave a magic wand and

> make the problem go away. And if you listen to the MSM

> you will hear calls to “fix housingâ€. The real problem is that

> we were in a speculated housing bubble and all bubbles will

> eventually deflate. The cost to an economy when a government

> artificially supports bubbles is a slow and long deflation which

> drags out the pain over decades (See Japan). The pain will be

> felt one way or another. There is no way around it.

Don’t think so. I think that bubble has deflated. Check historical Case-Shiller. We have reverted to the mean. I don’t see the point of driving it down further. If the banks wont lend, I see no problem with the government stepping in to take over the role. It would be nice if their underwriting standards were a bit more rigorous, but it is what it is. The FHA was originally intended to serve low income / underserved citizens, so I suppose the loose standards are not unexpected.

> Devaluing our currency will not solve the problem either.

No? Now you are stretching my ability to suspend disbelief! Devaluing our currency would put most underwater homeowners back in the black, and make fixed rate mortgages more affordable. One wages catch up, of course…

> The things we bid for on the world market like food and fuel

> will cost relatively more of our devalued currency.

Drat, we will have to produce more at home!

> There will be no wage inflation as long as we have slack in the labor market.

Devaluated currencies are nearly always good for employment at home. External markets have more purchasing power and exports pick up. It is actually the trade deficit that is slowly impoverishing us. Wouldn’t it be nice to stem that tide?

> Food and fuel will crowd out housing if there is no wage inflation to offset the currency

> devaluation. I think this is exactly what we are currently seeing.

No, what we are seeing is a *failure* to devalue our own currency. Because inflation is low, there is no penalty to keeping piles of cash around, so lots of cash goes uninvested or into dead end investments like T-bills that lose money in real terms, or useless assets like gold. (Read: doorstop) By rights that money should be used to start new businesses and invest in new ones. But, there it sits, in “safe” but useless assets.

The fact is inflation is low, around 2% (http://www.calculatedriskblog.com/2012/03/key-measures-of-inflation-in-february.html) in line or lower than what we’ve had for most of the last 20 years. You need to show inflation is high before you can blame high inflation on whatever you think is wrong with the economy.

Government “has a duty to take care of its citizens”… So disheartening to read that. A silly philosophy with no real definition. Every citizen is to have a house? an apartment? what size? where? a job? a car? never see their home value go down? food? energy? All paid for by a “governement”.

How many people’s lives have been destroyed because they were taught to believe this?

We live in Mulliganland. Borrow money to buy a house, car, whatever…doesn’t matter if it fits a budget, primary concern to Maintain the Lifestyle. If it becomes unaffordable, blow it off…the bank, government will charge it off, write if off, etc. It’s done over and over again, nobody cares. No 2am cutoff at the Debt Club; just a new bartender on duty.

Fresh starts forever, few/no consequences…what’s to lose, really? Perhaps soon we’ll hear of precious metals and diamonds quickly grown in test tubes, easily accessible for all to possess. A daily pill reverting people back to age 21, never age another day, live forever. A phone app allowing users to control weather to their liking…sunny and 70 forever, anywhere, everywhere, every day. Everybody wins and gets a trophy. A Utopia.

Bah. You’re reading too much into that. Nobody was claiming we need to switch over to communism. What I was saying is that in a democracy, the government is not there to just serve its own needs. If you want that, you can go to some tin pot dictactorship and make friends with the junta.

JoeAverage you hit the nail on the head.

Also this talk of recovery is absurd. The only thing keeping this economy going is Bernanke’s printing press. Also if anyone believes inflation is 2% I have a bridge I can Sell you. For the real numbers go to http://www.shadowstats.com. John Williams destroys most phony Govt numbers. This includes also the phony low unemployment numbers. Let’s face it no private lender would loan for houses because they know they are way overvalued. Can anyone tell me why a house should have doubled since 1995. There is NO reason. That is why LOOK out below in many California areas!

Thank you ABOVE Joe Average and to all the great posts, and a big cyber hug to DHB.

I am noticing 90+ days escrows and wondering what’s up with REO and regular sales taking that long. Now my eyes are seeing clearly.

We’re a cash & close for a primary final home. My husband has Glaucoma (stable for now).When we make an offer that’s fair, and are up against the FHA 3.5% future defaulter, they have no issue being talked into paying list or above, and will tack on a 203K loan to fix up the joint. Our last offer, they (other offer-young couple w/ no business buying this home) came in with $12,500 and financed their closing costs, offering list. We’re buying a home, not a FHA deal until it doesn’t work anymore.We walked.

10% down should be the minimum, period.

DHB, THANK YOU for this article. Very insightful.

With banks no longer required to mark to market, shadow inventory can trickle out whenever necessary. And, banks really don’t have to lend. This creates a scenario where prices can slowly decline over years until inflation finally catches up. The real problem is when everyone finally catches on to the gov’t charade and STOPS paying their mortgage (strategically default. Meanwhile, their housing investment slowly gets eaten away as they pay an expensive mortgage, when in essence they are nothing more than renters.

http://www.westsideremeltdown.blogspot.com

Yes, with the idea that the “little guy or girl” NEVER socks it to the banks or big business – the idea that fence sitters were gonna get a big bang for their saved bucks when housing dropped is and was ALWAYS a cruel joke. In agreeing with that idea, my only hypothesis on this was that yes, INFLATION – a devaluing of our currency and very slow leak of housing prices in a very cushioned slow decline would have to be the solution. People seem to shake their head at that – but it’s the ONLY solution I can see here… again, coming from the standpoint and historical reference that the little guy or girl NEVER trumps the casino/house/financial ponzi…

Love the blog here… check it all the time, although us frequent visitors know there’s nothing really to do except wait it out… no inside info or breaking news updates… it’s a long haul and you just keep the mantra: “keep renting and don’t believe the hype” (hopefully the stock market dow 13k bubble isn’t hypnotizing any fence sitters here)

the winners of any cash flow rents and or deep discount area buys will be hedge funds and real estate trusts — the Mr. and Mrs. Smith’s who are either holding cash or FHA types and do buy a home thinking they got in on the upside will really be deluding themselves. As the good doctor has said, their 3.5% down has already been wiped away or soon to be… I agree that the wider hints about the true health of housing can be gleamed by looking at the bubbled 13K dow market, lack of meaningful high wage jobs, and overall FOG of shadow inventory and neighbors who are screwed but are continuing through the motions thinking “it will get better”

The best thing is to talk to friends or family who still sponge their information from mainstream news on the overall health of real estate and finance — it’s the best proof that although it may be shocking to us, they still believe that hope and a return to “normalcy” are right around the corner. But let’s be honest, they have to be, they’ve bought into and are “all in” on this fantasy.

A realistic future projection on this is a very slow cross drift of inflation and cushioned declined housing values over the next 10 years… that will be the only “rescue” homeowners ie: loanowners, can hope for…

One need only look at the tilted table from suspension of mark to market, shadow inventory, and who knows what FED and big bank secret deals on continued liquidity and propping up…

George Carlin’s excellent quote can be applied here: “It’s a big club, and we’re not in it!”

The takeaway on all this is that California has always been a 50/50 renter vs. loanowner state… I look at people who are tethered to a mortgage out here, and their only plan is to basically one day cash out and hope it’s enough pay off all their debts before they head to assisted living or hospitals… They’ll have to liquidate everything because they believed the hype about “equity” ie: use your debt to get more into debt…All the expensive cars they bought on home equity and other bobbles and the house will all get traded back – and need to be – in order to get them back to “zero”… along with most likely, the inheritance (ie: home or other assets) they received from the older generation… and that’s the tragic thing because this “greatest generation” will not be able to leave anything for their own younger generation beneath them — and that’s the tragedy.

Some of us here may go so far as say that has been the plan all along… in many ways the greatest generation was the first and last middle class…

This line of reasoning is symptomatic of what got us into the bubble in the first place. You are absolutely 100% wrong that it is the “government’s job to take care of its citizens”. The citizens have a duty to take care of themselves. If people TRULY “need to be taken care of” (in that they are physically/mentally incapable of taking care of themselves), they should turn first to their families, and second to their local religious organizations, charities, etc. Government exists solely to protect our natural rights (life, liberty, and property interests). Expecting and asking more from government invites only tyranny, mismanagement, and corruption.

Specifically regarding the issue at hand, if banks are unwilling to lend in the current market, shouldn’t that tell people something? I.e., banks are greedy sob’s. We all know that. So, let’s use that as a way to evaluate things. Along those lines, if banks, by and large, don’t think it’s wise to get into the housing mess right now, how good of an “investment” is our government making? Only our stupid government is dumb enough to say “duh, ok, since banks aren’t lending, we will. I’m sure it will work out fine.” Idiot pension-building bureaucrats.

Lastly, you said: “The government, because it can print fiat, can afford to take the short term loss of 10% FHA defaults.” Umm…who do you think finances the government? I don’t know about you, but I’d much rather park 25% of my income in bank stocks than in the schmuck bureaucrats who raised the most money for Obama in 2008 and who are using my tax money to finance 10% (and increasing) losses. And, again, since the banks aren’t lending but the government is, how do you think American taxpayer “investment” in FHA loans is going to work out (hint: read the article to which you commented).

Whatdoyouthink wrote “Government exists solely to protect our natural rights (life, liberty, and property interests). Expecting and asking more from government invites only tyranny, mismanagement, and corruption.”

You are 100% correct in your first sentence. I would say that even in that tyranny, mismanagement and corruption are possible – see the founding fathers thoughts. But that is not the point, no actually maybe it is the point I want to address. The first thing you have to be clear on though are what is encompassed in life, liberty and property interests. Many who study the US constitution say it is designed to protect the individual citizen. Yes from foreign invaders but more importantly from other citizens, organizations and government itself. That is how I interpreted the comment about government taking care of it’s citizens. Not a big daddy hand you a fiver and a sandwich cushion but as the protector of the playing field, the arena of business and life. Perhaps you will deny that the repeal of Glass Steagal, the end of mark to market and the denuding of bankruptcy laws were bad things. But any clear thinking person knows they are.

Slandering mid-level govt workers and Obama is not the answer. It is not the bureaucrats but the congressmen and senators who did all this, with a gift from Clinton and a swindle by Bush. It’s not the first time the titans robbed the American people. Probably not the second but we do know that most of these laws by the “govt to take care of the people” were passed after the last crash following the robber barons roaring 20’s which of course started way earlier. Sadly at this point we are all too caught up in war mania [read The Politics of War about the destruction of the progressive movement via WW I] and pointing fingers at the straw men put up by Faux News propaganda to unite and demand they restore govt protection of our lives and property.

I’m not surprised you are calling bottom. A little research shows that you appear to be quite invested in real estate.

Another good post…

and I think you’re missing the point Mr. Ollmann…

Sooner or later prices will come into line with real incomes. So long as the government continues to distort the market by essentially attempting to support fictional prices engendered by fraudulent lending and appraisals that won’t happen.

Homeowners with current mortgages who bought in the last decade were ALL cheated. In truth, in my opinion ALL such mortgages should be re-adjusted to reflect true market value…

The TBTF banks should be broken up, their Boards fired… and a massive clawback from the entire F.I.R.E. sector in general should be undertaken…

And its at this stage that government fiat money (once credit creation is restored to the government and removed from the private cartel) can be used to fill in the gaps.

Very interesting post, Doc.

Tom, how is Ian missing the point? Prices ARE coming down. They’re just coming down slower that what they would have had their been no government intervtion.

And the solutions you propose involve massive gmvt intervention, too, that really favors only a slice of the polulice. What Ian is advocating actually serves to support the entirety of the population.

A slow, painful, unfair, grinding recovery is bad. A free-falling housing market and subsequent credit freeze and Depression Era ramifications to lost confidence is worse.

Hey, those homeowners who bought in the last decade were enoying their years of “living the American Dream” and quite possibly looking their nose down at the renting neighbor down the street. It’s been a long slog for renters. Our day (year) will come eventually. And, there won’t be a government check or bail-out waiting for us, either. And you know what? That’s just fine with us.

Not so simple.

I bought a house during the “bubble” when things were flying off the shelves back in 2000, found my dream home in 3 months. Sold late 2004.

Now, some 5 years into the “collapse” I have been looking to buy for the last 2 years.

How many 600K fixers that need 150K can I look at before I throw up?

The biggest housing crash in history has brought me to a place where I can’t find a house unless I want to pay a peak price.

This is a direct result of intervention.

Intervention is one thing; but what the Fed and Treasury set out to do was paper over things in order to keep the financial institutions solvent and the markets liquid — this, without any punitive or reformative measures, and at the expense of the taxpayer. That’s it. Every bit of financial or housing policy drafted post 2008 was designed to rescue the financial system — it was never about amnesty for the retail investor/housing consumer.

I get what what Ian was trying to say — it’s not as if we had the option of doing nothing — but bad, unimaginative monetary policy like what we are enjoying today can be just as destructive to a society as the sudden fallout from a burst credit or asset bubble. It upends the lives and plans of middle class American families and creates lost decades; it obfuscates price discovery and encourages speculation and even rentierism; it robs savers and rewards financialization and decimal games/legerdemain.

It sucks.

I don’t think they are driving up markets. I think they are preventing a credit ice age — allowing proper function of the markets.

This is a very strange interpretation or things — so much so that I think you must be forsaking your own lying eyes for your ideology. The Fed’s objective was to free up credit/lending in order to increase spending. The co-objective was to inflate or reflate asset prices. Instead of that happening in housing (where it’s really only succeeded to forestall a rapid correction) the inflation speedball found its way to the Russell 2000.

Nothing has been fixed, and this is not a return to anything even approximating a sound market — though that in itself may be a myth.

Basically, this is what happens in a fascist society. Merging of state and corporate powers is never a good thing. The Gov thinks they can control and manipulate everything, and has that ever ended well in the history books?

What they are effectively doing is “eliminating risk” in an attempt to create a utopia. But who pays? We all do, in our standard of living.

Honestly, I wojld probably take the FHA now too. Why? Why shouldn’t I? A person would be a fool to take the moral high road and do things right, in an environment where it is encouraged to do wrong and get bailed out on top of it.

Market interference by the Government has been very successful. Just a question of who receives and who pays. Those employed in the Financial Sector who have seen its proportion of GDP go from 11% to over 20% could well argue that government management (manipulation) has been excellent.

To big to fail then and now 100% bigger. I smelled a rat when Bush pushed that canard. It’s like the con deal on late night infomercials. Get this today or it’s gone forever.

Ian said, “….to help make sure that the markets make a soft landing,…”

I’m o.k. with that on a stand alone basis. Problem is, it was the government’s actions that led to the giant housing bubble. Clearly, the Federal Govt., and their quasi private central banking system, are incompetent in the management of the economy. They are very unlikely to get it right this time around, as before.

Holding housing prices above fair market prices is not a viable solution. If they were to put in some sort of safety net, then allow the big, final washout that is needed to achieve equilibrium, we could proceed on an honest, supply/demand basis. You might even see builders starting to build the kind of homes that can be justified by today’s salaries: tiny little 2 and 3 Br, 1.5 bath, economical to heat/cool dwellings.

By the way — the notion of a soft landing is a pretty tired canard. Name a single soft landing following a financial meltdown of this magnitude in the history of central banking. If by soft landing you mean kick the can down the road several generations, okay…maybe the perpetual gilts devised in the wake of South Sea bubble somewhat qualify…but were dealing with our fallout in a different way; by trying to encourage and subsidize speculation in the very market that is in the midst of deflating. The opportunity cost for this soft landing is something that rarely gets mentioned, but it’s hard not to think of all the interesting projects that will never happen in the name of keeping SFH sales up.

Not to mention all the progress lost to Homeland Security. All hail the mighty armies of the emperor as they repel the heathen hordes from the north, err I mean the east. Craziest thing about all that is that the former terror out to enslave us now makes all our commercial goods. At least when we were propping dominoes in South Viet Nam …. no I can’t say that – too many dead for naught.

FHA took a giant step very recently in drastically reducing the number of FHA-insured mortgages that will be originated in the future.

What did they do? Raise the down payment requirement?? (Requiring a larger down payment is the #1 way to reduce the number of people who can qualify for a mortgage and is the #1 way to decrease the risk of default) No. That would be way too politically unpopular.

They did something much more subtle, but it is estimated that this one change in their guidelines could reduce new FHA originations by around 30% or more.

Here’s the big change:

The total, combined maximum amount of collections that an FHA borrower can have on their credit report has now been reduced to $1,000. That includes medical collections.

If the buyer/borrower has $1,000 or more in collections on their credit report, they either have to prove that the collections are not theirs and have them removed from the credit report OR they have to arrange a repayment agreement with the creditors and SHOW A 3 MONTH HISTORY OF REPAYMENT ON THE COLLECTIONS before getting a mortgage.

The borrower is NOT allowed to pay the amount of collections down to less than $1,000 in order to get around this rule. (Ex: let’s say that I have $1,400 in collections outstanding. I pay them down to $999 and get around the rule. Nope. No can do!)

This $1,000 max collections rule is going to have a huge impact in reducing the number of new FHA originations going forward.

It won’t do anything to reduce the risk of FHA loans defaulting both past and future (any loan with a low down payment is a high-risk loan, no matter what label is put on it), but it will greatly reduce the number of people who qualify for an FHA loan going forward.

BTW, can you hear the collection agencies signing and dancing in the streets? They should be celebrating! What a windfall this is going to be for them!!

Some people will cheer this change.

Some people will certainly NOT cheer it.

It will be interesting to see if FHA sticks to this rule or if they bow to the inevitable pressure to relax it, once the effects of it become apparent.

Stay tuned…

It’s definitely a step in the right direction but 3 months payment history? Really? That sounds like an easy loophole if you ask me.

Very interesting. I can hear the high fives and back slapping the credit lobbyist are exchanging. This is a huge bonus for credit collections companies. Moreover, it is crazy that a person with collections can get a mortgage.

ROFLMFAO! Yes, please make it harder for those of us who got f#cked to get ANY credit or Lord forbid, buy a house. It’s all good to me because I’ve gone cash, will rent, and never invest in a go$#@#$ thing again. Cash baby…CASH, I guess that makes me the new “terrorist” because I won’t continue to bend over for our corrupt government. F the banksters by definition, usury is evil f em./

Well, who else is going to lend money to broke people so they can buy a call option on rising housing prices?

I love how everyone thinks that a collapse in housing would be so bad. Do they not realize that if we let it all collapse and stay out of the way. We can rebuild from a solid base and not a house of cards again.

Judging by the laws the government is passing, I’m begininning to suspect even they don’t think this is all going to end well.

Also, If home prices dropped 90% from the peak. NO ONE is losing money that purchased a home they could afford to pay off. Only those that can’t afford the home they are living in would be hurt and bad lenders, that’s the way you “fix” things let gamblers and debtors get wiped out so the wise investors can take over.

A couple I know used the FHA 3.5% down to buy a $708K home in the SF Bay Area in 2010. Jeez, they must have a heck of a monthly nut! All on one income too. No thank you.

If they are underwater they can default and stay in the house for several years. I am starting to wonder if I could pull something like this. I am sick of being a sucker. Maybe I can shop a doctor to get SS disability. Qualify for a 3.5% loan on a big house and never make a single payment.

Another train wreck coming, this is the way i see it. No skin in the game means walk. Saving for a down payment is like saving for anything, it requires some discipline. People who have not learned discipline will never have anything. That is why we invented the SS system, for people to stupid and self indulgent to think about tomorrow. But the people who have saved are surly the ones to be punished by low interest rates and from competition in the housing market financed by the government, When will the government loan them money for a trip to the tables at Reno.

This is all made possible by the Federal govt. It’s about this time every year, tax time, that it really hurts to think I help enable this.

Doc! missed a huge point. FHA loans still allow high debt 55% debt to income ratios on gross income. the whole loan process is broken by using gross income before taxes, retirement, medical. we have a serious problem in the way loans are qualified. In example, 90% of the modifcations fail thier net income vs expense test. full income docs, stated income, no income…. who cares when both do not look at the real incoming net income and out going expenses.

I thought with FHA the DTI limits go from the standard lenders’ 28/36 up to 29/41. Nowhere near 55%. Is 55% seriously being allowed?? That’s scary.

Yet, even now when I talk to smart young couples with Ph.Ds. . . They have the fever to buy 700k homes in southern california. I too am buying soon, but at a price point much lower and with 50% down. Mainly because of my wife. The cost is way below my rent, the house is much better than what I am renting, and we will stay in it for as long a we can, could be our final house.

I’m still a bear, I think the house could lose another 20%, after already having lost 40%. However the math is starting to make sense, and I’m not sure we will run our of greater fools. I know couples that defaulted and have already repurchased. These low down payments make the pool of potential buyers enormous. Sad state of affairs, but in the end it looks like the properties will be sold for pennies on the dollar to investors that will rent them. My rent keeps going up, so I take the plunge too. Hmmmmm.

Take an ibuprofin for that fever, don’t waste money on a house. As half of a smart young SoCal couple with a PhD (engineers) I would say that the only other similar couples we know who bought a $$$$ house really are not that smart. I quote a fellow PhD $700k new homeowner, “Don’t let your wife make you buy a house.” We can rent a 3/3 SFR in a nice area behind a gate for $2500 in Placentia. Why, oh WHY, would I pay to own the thing? Invest in something, make money with the down payment, don’t be trapped in SoCal when the market is still falling. What if there is an epic earthquake tomorrow? Until prices really start to appreciate – or rents are substantially more than a mortgage – the smart money rents.

I have a double PhD who rents the glorified shed behind my house. He’s sharp and can talk about Protein structures all night long, but when it comes to basic street smarts…erm…eh…ahem.

IOW, there were and now remain plenty of over-educated Americans who are woefully oblivious and even credulous when it comes to anything outside of their field of study.

Starting to see some cracks forming in the areas I’m interested in…things priced this low get snapped up fast, even if they are total fixers though…

http://www.redfin.com/CA/Los-Angeles/1737-S-Stanley-Ave-90019/home/6904261

http://www.redfin.com/CA/Los-Angeles/946-S-Highland-Ave-90036/home/6912437

http://www.redfin.com/CA/Los-Angeles/1603-Carmona-Ave-90019/home/6904569

http://www.redfin.com/CA/Los-Angeles/643-S-Sycamore-Ave-90036/home/7091891

How about this rehabbed bungalow listed for $500K in a million-dollar neighborhood on 4/9/11 and pending sale the very same day, before anybody could get to it, other than the successful buyer with cash AND soap opera connections. Relisted just two weeks after the short sale completed and sold for a gain of $200,000 several months later! That’s how the top 1 percent do it!

http://www.redfin.com/CA/W-Hollywood/701-Westbourne-Dr-90069/home/6816996

ugh *facepalm*. You are probably correct that these places will probably get scooped up by flippers, rehabbed and placed back on the market at bubble prices. I guess I was a bit naive to think they would go to loving first-time buyers who had been priced out of the market these past years…like me…

I saw some flipping houses sit on the market quite a white too and price deduction after price deduction. I guess as with everything else, it depends on correct evaluation of market & buyers availability from flipper. Some flippers are amazingly profitable and some are not so and nervously watching their investment sitting iddly. And Renting the house isn’t in their model of quick in/out strategy.

Tiny fissures, at best. The 1999 sales price on the one with the dilapidated ceiling sold for 270 in 1999 — a boom year. Why should it be pending for twice that in the middle of a sh*t economy and following a housing bubble? I’ll tell you why: some of the lucky ones who sold in 2005 and walked away with 300K are finally looking to rebury that bone, and like any dog, they always bury their bones in the same place.

The FHA mess is a blatant and unapologetic move to save, and then enrich, the otherwise broke banks and the Wall Street biggest financial interests. The risk of bad home (and even multi-family often) mortgage loans, losses caused by bank imprudence, are all dumped on the taxpayers. The banks are also receiving lifeline income support by having all those lovely new mortgages and waves of refinancings from which they derive sizeable fees (especially the darlings of Washington, the big five banks, which have corralled the market). The realtors didn’t cause Washington to roll back the FHA reduction in coverage; the big banks did, as compression at the high end would cut property values of their existing book of older mortgages (more defaults, etc). The rule is simple: the big banks and Wall Street (and the Defense industry) always win, the rest of us don’t matter except as victimized pawns in their endless exploitations. Fifty million fed by food stamps and not the slightest bit of embarrassment motivating the politicians owned by the banks, to address that by decent jobs, healthy policies and health care, and sound financial rules for exactly those gamblers (it is like MF Global already never happened, isn’t it?).

Low down payment government loans support the banks and their assets. If you let the market correct naturally without government cheap loans,we would have even a greater housing crash but a fresh start for new buyers. There would be massive defaults on worthless home values/loans. At this point people walking away from their homes would look like people trying to exit through fire exits during a fire. Everyone would walk away and start over. The government has prevented this with free flowing mortgage loans. This is a much needed service to all home owners who have loans that did not get caught up in the mortgage crash. This maintains values for homeowners who properly saved and borrowed. Home prices would crash overnight without easy money for loans. Sounds great but the reality would be all out chaos.

BS! I am a saver and I feel like a sucker. Screw you! Screw the deadbeats! You have kept me from getting a decent home at a decent price.

Anyone care to comment on this article?

http://finance.yahoo.com/news/insight-wall-street-gold-rush-132010076.html

Hardly suprising that the big money types are looking to buy at dicounted prices now they think the market’s at near bottom. They can borrow at super-cheap rates, get decent returns from rents, then either sell when prices have risen nicelly, or perhaps look to provoke another bubble.

Pretty easy, risk free money, if you happen to be exremelly wealthy and well connected. Obviously it’s not meant for middleclass business people, or savers looking for decent returns.

The problem began when the government made income from the sale of any property tax free.

All of those in favor of a soft landing must realize that, what you are supporting is a SLOW PAINFULL DEATH. If there is no REAL JOB creation in this country SOON, we will never see a bottom. REAL JOBS and wage growth are stagnant in this country because of goverment intervention. JOBS are what support a healthy economy. Imagine had the gangster goverment stayed out of our buisness, yes we would have seen panic and maham. But just think how much better we would be TODAY. We would have real home values, what banks that are left would be loaning again, investers would be back in the market again growing the economy, creating REAL JOBS. Those jobs start to create income, supply and demand eventually comes back. Almost souds like MUSIC TO MY EARS. Oh well I guess you all can continue to support the liberal way and enjoy a future of stagnation, no or slooow growth, low paying minimum wage jobs, continuing massive defficits. Wow, I think I will just live on paid off properties and enjoy the rental income. Why invest in a toilet.

Check it out:

Bank Of America: Home Prices All Done Falling, Thank You Very Much

http://www.huffingtonpost.com/2012/03/22/home-prices-all-done-falling_n_1372736.html?ref=business

“The Bank of America economists are a little more optimistic, though they still don’t see prices rebounding any time soon. After basically flattening this year, prices will rise just 0.3 percent in 2013, according to their forecast. And it looks like price gains this year will steal from prices in future years: They’ve cut their 2013 price-gain forecast to 0.3 percent from 1.3 percent and slashed their 2014 forecast to a gain of just 2.8 percent from 8.1 percent previously.”

—————————————————————————————————

They thought home prices would be going up 8.1 percent in 2014?

On the other hand we may have an economic pull back in 2013 through 2014. If that happens I expect another 20-30% decline here in Vegas.

Leave a Reply