The question of housing affordability – 17 US markets near potential price bottoms. Two are in Southern California. Southern California also has counties where mid-tier cities are overpriced and continue to correct.

Housing affordability matters. One of the biggest line items used to qualify home buyers is your household income. This is why it is hard to understand why some people simply choose to ignore the most important factor in sustaining housing markets. Household income drives rental prices and also drives household values historically. Should these ratios get out of whack because of exotic mortgages or imprudent lending then prices will rise but as we are seeing, will adjust lower back to more historical trends once the unsustainable trend pops. Some arguments hold very little water in the current landscape. Many markets in the US may be near market bottoms and we will highlight 17 of them. They all have very similar characteristics and some are here in California. Other areas are still over priced by historical measures. Let us examine the markets where price bottoms may have been reached.

17 US markets with potential bottoms

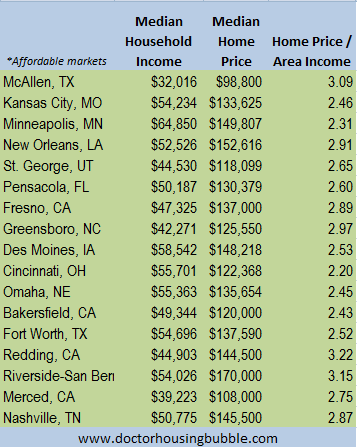

In many markets of the US if you have a solid job buying a house looks to be a good financial move. Yet some people are so niche focus that they forget that the US is much bigger than say Culver City or Burbank. Some may argue that lower interest rates may change the equation but keep in mind low rates apply to the entire country so wouldn’t these income to home price metrics adjust everywhere thus pushing prices up evenly? Of course but this is why some markets may be stabilizing while mid-tier markets in Southern California fell over 5 percent in 2011. Let us take a look at a wide range of markets where home prices may be reaching bottoms:

The list varies across the country. I’ve included a handful of California markets as well. In these areas if you have secure employment and would like to settle down, there is likely to be very little reason not to buy. This isn’t a question of being a bear or a bull. It is a question about understanding home values in a historical and local context.

Home price to area income ratios absolutely matter. You’ll notice one key element here as well. Even with low interest rates a historical home price to income ratio holds steady. Each one of the affordable markets above has a home price to median household income ratio ranging from 2.43 in Bakersfield California to 3.15 in the San Bernardino and Riverside markets here in Southern California. You mean we have some affordable homes here in SoCal? Absolutely. In these markets buying makes sense if:

-You have secure employment

-Plan to stay long-term (i.e., 7 years or more)

The cross section above is extremely diverse. You have markets in areas like McAllen and Fort Worth Texas that had almost no bubble even during the craziness of the housing mania. Then you have markets like Pensacola Florida and Merced California that have collapsed so bad that home values are coming back in line with local area incomes.

Where the bubble still roams

The above list includes 11 states and we can include many more as well. The nationwide median home price is close to $150,000 so in many areas, home prices are looking attractive. Los Angeles and Orange counties are not two of those areas.

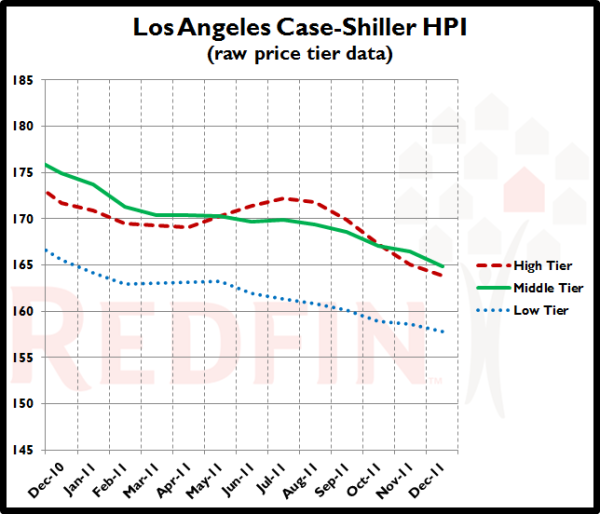

The Los Angeles Case-Shiller data includes Orange County. For the year of 2011 prices continued to move down in these markets:

December 2011 (latest data)

Month to Month: Down 1.1%

Year to Year: Down 5.2%

Prices at this level in: August 2003

Peak month: September 2006

Change from Peak: Down 40.8% in 63 months

Low Tier: Under $289,982

Mid Tier: $289,982 to $474,017

Hi Tier: Over $474,017

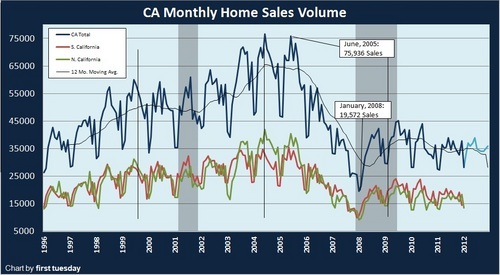

If home prices were viewed as cheap don’t you think sales across the state would be soaring?

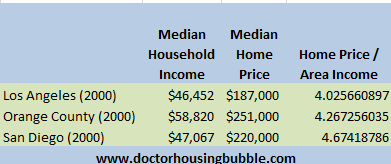

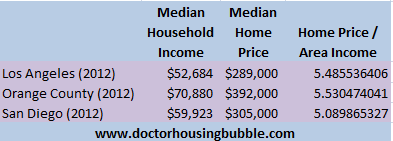

So why are prices still inflated in these markets? Let us go back to 2000 when the bubble was already starting and look at three California counties:

I would argue that the housing bubble in Southern California started in the late 1990s but we’ll be conservative and use 2000 as our baseline. When we look at the metrics above a ratio of 4 seems to hold for home price and income. So compared to our affordable list above, this translates to one more year of household income tacked on to the median home price. As we stated before, low interest rates help the entire nation so why is it that the majority of markets across the country still maintain stable ratios even today while these markets remain inflated? The fact that home prices in mid-tier regions fell over 5 percent in 2011 tells you that yes, home prices in relation to incomes do matter and that is why prices continue to fall.

Home prices in these markets today are more inflated than they were in 2000. If we look at incomes and home prices today versus the baseline of 2000 we realize that these markets have gotten more expensive even with prices of today and slightly higher incomes:

Where nationwide it takes roughly 3 years of household income to buy a home, in these three counties in 2000 it took roughly 4 years of household income. Today it is over 5 years of household income and the economy is doing more poorly than it was in 2000:

California unemployment 2000:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 5 percent

California unemployment 2012: Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 10.9 percent

What should you take away from all of this? Home prices in a large cross section of the country look to be affordable. Prices in Los Angeles and Orange counties are still inflated. For home prices in these regions to get back even to their 2000 ratios, prices would need to adjust lower by:

To reach 2000 ratios

Los Angeles:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â -$78,264

Orange County:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â -$108,480

San Diego County:Â Â Â Â Â Â Â Â Â Â -$65,308

Since most first time home buyers are going in with 3.5 percent FHA insured loans, the above gap is likely to wipe out any down payment. To buy in these counties a tiny amount is needed:

FHA 3.5 percent down payment

Los Angeles:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $10,115

Orange County:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $13,720

San Diego:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $10,675

Yet some want to get the green light to buy. Look, if you have an absolute need to buy and your life is completely unfulfilled until you buy in one of these mid-tier markets, go ahead. No one is stopping you. In fact, the banking controlled government wants you to overpay. But if you look at this from a purely investment perspective, many other US markets do make sense on every front. For Los Angeles and Orange County mid-tier markets they do not.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

56 Responses to “The question of housing affordability – 17 US markets near potential price bottoms. Two are in Southern California. Southern California also has counties where mid-tier cities are overpriced and continue to correct.”

A median home price in SD county is $305K? I guess you’re including condo’s as “homes”?

If the govt weren’t so deeply involved in home price subsidies, both legal and financial, prices would be much, much lower.

I don’t know doc. Houses don’t cost much in those cities for a reason. Have you ever spent a week or two in Bakersfield or Fresno? Nobody in their right mind would want to live there for 7 years (your metric). And what happens if interest rates go up faster than incomes? Mortgages aren’t transferable, like they used to be. 7 years could turn into forever, lol.

Pensacola, FL looks tempting, but I think there might be a military base there skewing the salary data. It is also many hours from the nearest big city. The ideal for a small city is to be about two hours from a big city, I’d say. That is where Bakersfield lies, but it has too many other negatives.

Can you be specific about the negatives?

Bakersfield is no worse than Riverside and in my experience safer. Bakersfield is only 90 minutes from Hollywood if the 5/14 interchange isn’t plugged. Heck, I’ve made from SD all the way up to Bakersfield in under four hours before.

The biggest problem with Bakersfield right now is over building. Several of the big boys built heavily on spec during the boom and way overestimated the growth potential. That market is no where near build out and the number units, lots and raw buildable land way exceeds demand.

I’m no booster for Riverside, but at least it has major airports within one hour, as well as any medical specialty you might need, is closer to the beach and desert resort areas, and has acceptable shopping options. I know it gets hot in Riverside, but I’ve never been anywhere in California with more oppressive heat than the Central Valley, including the desert. I guess it’s all about what’s important to you.

I’ll do it! I’ll cheerlead Riverside! Here’s my opinion…

Los Angeles proper is the entertainment and (parts of it) weather capital of the world. No other city has such diverse food, shopping, and things to do. Staying west of the 5 tends to moderate the weather although yes parts of the Valley, Glendale, etc. still get toasty but not Riverside toasty.

Being an IE lover, here’s what I see. I see a competely normal, self sufficient city in Riverside. It has it’s own downtown, malls, entertainment (lower tier), etc. What throws Riverside off for many is PERCEPTION! It’s next to L.A.! Trust me, travel to the suburbs of Denver, St Louis, Minneapolis, Portland, and you will see a lot of what you see in Riverside. Strip malls, houses, franchise restaurants, all that crap. I think Riverside gets a bad rap because it’s too “normal” compared to LA/SF/SD.

What I see in Riverside, Rancho, Upland, Norco, Corona…are middle class working folk. You have married couples that make $15, $20, heck even up to $40/hr thus median household incomes in the $60k to $150k range. Not rich, but not poor. Not enough to live a white picket fence lifestyle in L.A. County and probably don’t have the taste or desire to live in more cultural areas like Highland Park or Silverlake. So they move to the suburbs.

You got a lot of trash in the IE too but I’m focusing on the quality areas only.

Riverside is commutable – people do it. Bakersfield is not, IMHO.

To be honest, Hank, I haven’t lived in Bakersfield in over a decade, but the I’m sure the 2 hour drive to the beach (Ventura or Pismo) is the same. But the price of petrol is up a bit, lol.

There is still a lot of oil production,and related good paying jobs, but it is a declining resource. They aren’t going to find any more oil in that area, so it is all downhill from here. Every city in the world is trying to lure new industry, but most companies aren’t expanding now.

If I took an assignment there, I’d rent. Why risk getting stuck in a city where there’s nothing to do, and the weather sucks except for February to mid-May?

Riverside is the absolute WORST county to live in if you hate smog, heat and/or have allergies.

LOL at PapaToBe’s “cultural areas like Highland Park or Silverlake”. My folks moved from Silverlake to Highland Park in about 1950, and that’s where I grew up. “Cultural” if you think Vato Locos are high culture, I guess! Took my new Bride to visit a friend down York Blvd and had a window shot out with a BB gun by some yahoo. HP sucked in the ’80s when that happened, and to me it still sucks!

There was a good article in the NYT on Saturday, March 10 entitled “the go nowhere generation.” It highlights the atitude that life is random & full of luck, so that working hard & planting routes in a different city from where they grew up may not result in longterm prosperity.

One of the interesting side bars involves the use of the internet, facebook in particular rather than self exploration as earlier generations went through. This included the fact of lower numbers of teens who are getting their drivers licence, 80% in 1980 vs 65% in 2008.

On the housing front, will these people want to be homeowners? Or will they be more risk adverse & rent or just live at home for a longer period of time.

Economics will force them to be less mobile. Yesterday I went riding in hungry valley, which is almost to bakersfield, and burnt $$$$ gas money. As my buddy and I drove up we noted we are “living the dream” (& over 40yrs old) , because in our youth we wished to be able to afford the gasoline, and maybe our own dirtbike, to make trek to “Gorman” Poor youthful bastards…must sacrifice, and accept the consequences of money printers and lawyers running our economy.

I’d like to see a ratio that is based off the monthly payment. While the income to price ratio is a great starting point, interest rates and taxes should really be factored in. Comparing now to 2000 works ok, because interest rates were relatively similar. However, over time the monthly payment is a better metric…after all, that’s what the banks use to determine if you should be approved for the mortgage. I know property taxes right now are still in a bit of a bubble in many places because they lag a year or two behind market values. Not to mention, states are so broke, they are trying to keep the higher tax revenue for as long as possible.

Again – for this article, the ratios are ok in this context. But I know I always hear the 3x your income rule thats been around for years. When interest rates were 12% in the 80s, you can’t really compare house prices to now with interest being almost 1/3 of that.

Dumb money buys overpriced assets with cheap money.

Sure, but you can’t assume interest rates are going to stay at their all time lows forever either can you? And when they correct to historic norms, your monthly nut will double or more than double for many homes, and this will push prices through the floor.

Of course, this assumes that the Fed doesn’t start ignoring inflation and everything else to keep interest rates low to keep interest down on the debt of the U.S. – a policy I could see coming into play as part of a conscious devaluation strategy.

Zillow is nuts. Do not believe their “Zestimates”.

I have been following my mothers house and the houses on each side for over two years. While my mom’s house and one of them goes down every month by five thousand or more, the other house, goes up each month, In fact it went up 60k this last month.

He bought the house at 1.3M in 2005. Last year it was down in the 800’s and right it is listed by Zillow at 1M. Which means, according to Zillow, that house has appreciated 200 K in the last year, while my mom’s and the other neighbor’s house has gone down over 100K in the last year.

Mind you, there have been absolutely no rebuilding or remodeling on the house, it just continues to go up many thousands each month. I repeat, pay no attention to Zillow, they are completely insane!

Yes i too believe zillow is wrong. Our friends just bought at house in Irvine for 450000 and same house on zillow is estimated at 480000 and neighboring house for 520000. They have the same upgrades. One of our other friend bought a house in quail hill in 2009 and till 2 mnths back zillow estimated their home price same as what they paid in 2009. Whole orange county prices have fallen since 2009 but for zillow they haven’t.

Let’s assume median income does matter, although it is far from the most important factor, in price setting in the home markets. The odds of any random 2012 home buyer even thinking about, let alone researching, present and future local total employment, wages, and especially “median” local incomes or neighboring area median incomes, I would wager is not a tenth of one percent of all buyers. Note also, the median wage for any one US full time wage earner is about $26,000. (two earners equals one household, often). That means these buyers either think that fate is random, or, more likely, they still utterly believe that real estate will almost inescapably lead them to riches and inflation shelter, plus some chance to take a big tax write off which they think matters. Then again, the same fools buy time shares, 95% of which are financial folly.

Thanks for posting these markets doc. I am still waiting for No. S.Diego County prices to even out so I can buy. Still here in west l.a. and seeing 7,000 sqft lot 3/2 with pool at 865K down from 890K nov ’11 list and not taking the bait.

What about less developed “fabulous” areas like Joshua Tree or even Palm Springs? Not too far form LA and nice wide open spaces.

I’ve actually considered building out there. Any thoughts, I’d really appreciate it.

(It’s a dry heat!)

Go to Yucca valley, and take some people with you, the coastline is too crowded.

Surftard — you are stale.

The Coachella valley has some bargains if you want to live out there. Appraisers are the only thing holding back and upward price correction. Our houses (vacant, investor owned) literally fly off the shelves, only to have the price down revised when the appraisals come. We always try choose large down payment / cash offers over FHA, but 90% of all buyers are FHA 3.5% so sometime we have to take an FHA buyer.

Part of Palm Desert are nice, charming mid-century feel. North Indio has new built stuff that is ridiculously cheap. Sold a house for 30% less than it would cost to build, place was 5 years old, appraisers screwed us that one too.

just a tip……stay out of Southern California Edison service area and go with Imperial Irrigation – I think mostly Palm Desert and south – much lower electric bills!

Spend a week there in August and then revisit your dry heat thesis again

pffffttttt……Try finding an “affordable” house in Westchester County, NY, without an inheritance in your pocket.

Mike,

You might want to school these Cali’s in what the average property tax rate is in Westchester Co ,NY and Bergen County, NJ. IIRC, I was paying 2.2% in NJ. People in Cali have no idea of what real property tax rates are. Even TX is above 2%.

You’re right. They do have higher property tax rates, but in Texas, residents do not pay state income taxes. In addition, in places like Texas, the price is lower than places like LA that the extra 1.5% on a $150K home is pretty minimal especially that you don’t have to pay the Franchise Tax Board!

JCQ, there are people paying 30,000 in Scarsdale. 30 grand! Of course, these are very nice homes in the seven figure range, but, still. I read an article in the NYT last year focusing on this problem, and there are some very well to do retired “executives” that are moving out because they just can’t stand it anymore.

Some areas will have a high price to income value because of foreign money. Should we just accept that or hope the ratios will come back in line with incomes? Is it better in the long term to rent in OC?

We are still in recession, and but for the FED spending 10% of GDP to prop things up, we would see reality all too easily. There is no recovery in any market based on reality and not hopium. What happens to housing prices as rates ultimately move higher when the FED is exposed as the fraud that it is? I believe the price of housing moves down so that people that no longer qualify based on income can buy the house they want. I must, as the seller, move my price lower in order to counteract their loss in purchasing power to make the sale. How does this square with a bottom in any market?

What about Ventura County specifically Oak Park, Agoura, Westlake Village? Inventory in the past two months has become very low, it seems like the westside is much more inflated than these areas, any thoughts on this?

Renter

T.O. is our hood right now, and we’re looking for a cash and close primary residence in the east Ventura County area. We are amazed at the overpriced cr*p that is selling, due to the lack of inventory. Of course, the 3.5% downers are probably the ones buying, knowing they will walk eventually. The market stinks.Extend & Pretend is getting old.

TO is seeing some correction now. We’re also watching the same area and are amazed at how over inflated some areas are. Example: Westlake, Agoura Hills, Oakpark, etc. Reality is about to bite some of these guys in the rear in the next year or two. The good news is that rents have been coming down in the same areas this year.

DHB, I understand using 2000 to be conservative, but I firmly believe the housing bubble started in 1997. I was shopping for my first home in late 1996, entered into contract on January 1, 1997. While in escrow the market started taking off. It was a small home in the East Bay Area town of Castro Valley, about 20 minutes southeast of Oakland and about 40 minutes from San Francisco. I paid $217k. While in escrow I remember thinking I would never live to see the home reach $300k in value. It reached that level by the end of 1997. I would like to see incomes, home prices and ratios for 1997. I believe that is more likely the level the market will ultimately settle around. Hopefully it doesn’t take 20+ years to get there like Japan.

Taz,

There has been exactly 41.2% inflation since 1997. That means all assets will be atleast 41.2% higher than 1997 prices.. .which puts them at around 2000 prices.

Also EVERY year that passes, the inflation rate increases. Eventually assets will hit the rock bottom of standard 1-3% inflation rates and sit there for awhile. They aren’t going BELOW the inflation rate in CA. That’s the HARD bottom.

So 2000 prices are pretty accurate as a worst case scenario price for the overall market.

This overall inflation rate includes the giant bubble in home prices so it is skewed. The largest item in calculating inflation is housing. What was the typical household wage inflation rate over this time? Something tells me that since 2000 wages have not gone up by 41 percent. In fact, real wages have gone stagnant in real terms over the last decade.

Hard bottom? According to who? Please point to some data especially on wages to support this claim.

Too bad incomes haven’t gone up 41.2%

More money spent on food, gas and healthcare leaves less to be spent on housing. Perhaps 1997 prices are even too high.

Back to normal inflation trend lines for “worst case scenario”? That would be back to normal…worst case scenario could be very different.

RE: “That means all assets will be at least 41.2% higher than 1997 prices.”

Where did you get that information from? It couldn’t be further from the truth and fyi here in Vegas prices are down to 80 levels in some areas. The houses that were used in the banks swindle of equity over leveraged the assets by trillions. Assets do not automatically go up with inflation. Sorry.

Correction: The Federal Govt. and not the FED is deficit spending 10%+ of GDP in order to keep up appearances of the supposed recovery. It’s Treasury issuing paper to the FED who distributes it in an auction process with it’s Primary Dealers. Just wanted to be crystal clear on my thought.

This reminds me of an article in yesterday’s Philadelphia Inquirer:

“According to the Center for Housing Policy’s annual Housing Landscape report, the affordability of housing for America’s working households actually worsened between 2008 and 2010 for both working renters and working owners, despite falling prices.

Although median housing costs for working homeowners declined modestly between 2008 and 2010, their incomes declined even more, driven in large part by a decrease in the median number of hours worked per week, said the report, released in late February.

Working homeowners saw the largest decline in income, dropping from $43,570 in 2008 to $41,413 in 2010 (in nominal dollars) – about 5 percent.

The center reported that nearly one in four working households spent more than half its income on housing….”

For more:

http://www.philly.com/philly/classifieds/real_estate/20120311_On_the_House__Despite_low_prices_and_rates__housing_costs_overwhelming_many.html

The media is in a frenzy about all of the NEW JOBS BEING CREATED!!!! But the reality is, most of those jobs pay $12.00/hour or less. That’s not enough to afford a rental in a ghetto neighborhood, let alone a mortgage…which is why people are increasingly doubling and tripling up.

“But if you look at this from a purely investment perspective, many other US markets do make sense on every front. For Los Angeles and Orange County mid-tier markets they do not.”

In your data you include San Diego… but in the statement above, you do not. The data seem to suggest SD is also still deflating?

It all boils down to this: There are just too many SPOILED BRATS out there who want everything they really cannot afford. Just look at all those new cars on the street (you can tell by the license plate number) even if many of them are leased. They want te same thing in their houses. Just plain old spoiled brats, all of them. They are trying to make $2,000-$3,000 per month rent/mortgage payments with income that only warrants $1,000-$1,500 . . . if that much.

Dick Dennis

I unfortunately agree with your assessment of part of the problem with housing and debt in our society. If people can REALLY afford their lifestyle more power to them. As far as the “toppers” (you say or have, and they have beter) they deserve their fate, and the wanna be’s, I’m paying for your arrogance. I agree Dick. Spoiled Brats aren’t my flavor either.

This is a controlled collapse. If home prices would revert to 2000 prices, I would be happy.I looked up a home we liked (but the pool was too big for the yard). It sold for $275K in 2002, and went out at $425K 8 months ago (paid full list). We will not see equilibrium for a long time. I use to lie to myself. Now I look reality right in the face.

Thanks. Can you please pull data for San Francisco Bay area as well?

People will always pay a premium to live in desirable areas. No one wants to live in the areas on the list and thats why they are in line with employment. If we still live in bubble in LA and the OC it sure is popping at a slow rate because of overwhelming desire/demand for top tier areas. The bubble popped in Riverside ect. because they were not that desirable to begin with…they were plan B. Those plan B. areas become very expensive in terms of gas and utilities so they hit rock bottom first. Wages were lower in those areas also. Gas, food and utilities affect the bottom line in a greater percentage in lower wage earners than higher wage earners. I hear everyone on this site trying to time the market in desirable areas. No one is throwing in the towel and moving to Riverside. The only thing that will burst the bubble in desirable areas is a major stock market crash. We are due for a correction even though Jim Cramer wants you to keep on investing. The market has been doing great with the injection of cash from Qe1, Qe2 and Qe3 in the wings. No one is earning anything on their savings accounts and even the more conservative retired folks are forced to keep in the market to keep pace with inflation. Everyone is all in-what happens if we have another major drop? Who is going to want to risk their savings for a third time? Tolerance for risk becomes an issue. We have the boiling frog syndrome going on in California. We are technically already cooked. College grads can’t buy our bubble homes, wages are flat and the jobs that are added to the economy are not going to afford a bubble house. Baby boomers retiring and wanting to downsize. Who are they going to sell to? We have all made a bet to put it all on red…pray nothing happens to our stock market!

Check out Fillmore…”the last, best, small town in southern california”. No kidding, that’s the tagline. I have checked it out and it’s great and affordable for Ventura County…

Filmore is a drive into a job corridor for most of us. Grimes Canyon is a dangerous road. We use to live in Moorpark, and I hated it. Way too many yuppies, and the commercial district is fugly. Yeah, newer shopping centers in a butt ugly part of town.

We use to live in the southern hills.

Filmore has a greatfun train sector, and that’s about it to me. We must like different flavors. Neither good or bad, just different.

(Moorpark has perfect climate, as well as Filmore I suspect.)

Christie C: Overwhelming demand does not equal qualified demand. I’m tired of the pent-up demand/desirable areas meme. Desire in one hand and _______ in the other and let me know which one gets fulfilled the quickest.

This was my point yesterday.

Balestra Capital: “If Government Programs Were Cancelled, The Economy Would Collapse Back Into Severe Recession”

http://www.zerohedge.com/

I’ve lived half of my life in West LA and the other half in Fresno County and am hoping to eventually purchase a home on the coast. I purchased a home in Fresno in the late 1980’s and it is now back to late 80’s prices–now worth approx. $185,000 and had it appraised for $450,000 during the height of the bubble. I have a friend that paid $600,000 cash for a retirement home in Fresno after selling her home in the Bay Area and now it is worth approx. $200,000. Although I am waiting for home prices on the coast to decline, there is a downside to living in an area after homes bottom. Here in Fresno County, the unemployment rate and underemployment rate is extremely high and I don’t see any recent improvement. There is empty commercial property everywhere, crime is way up, local government revenue is way down impacting schools and essential services and there is a population with very great needs along with massive layoffs of government workers. I am now retired, but half of the professionals in my department have since been laid off with more to follow. It seems like an unending cycle and a good many businesses are either not doing well or going out of business. Even the health care industry is hurting and nurse friends have not been able to find employment. You can now purchase a beautiful house at a low price, but the quality of life has declined for almost everyone.

Affordability depends on the neighborhood. Areas where banks stand to lose a lot of money, the prices are artificially inflated, as they are not being forced to foreclose. The lack of easy funding does not support the current prices on the Westside. Throw in people squatting on million dollar homes and why would someone pay those mortgages. Don’t be fooled, especially going into an election year. Prices will not appreciate anytime soon, as even if we were at the bottom, they tend to drag out for years. If you buy within the next year, it better be a place you love and be prepared to be there for a long time.

I couldn’t agree more. I did some analysis in Santa Cruz County and I was able to see where the banks are slowly feeding the foreclosures to market, where they are holding (shadow inventory) and where they are not serving notices of default (based on lack of NOD and REO). The median home price to median income ratio is highest (over 8 times) where the banks are holding and lowest (a little above 6 times) where they are slowly feeding the shorts/foreclosures to market. It is pretty obvious what is going on when you do a little analysis…

In certain markets investors are buying low tiered properties – at least in VEntura County. a realtor friend told me they only have about 2 months of inventory left now. And sure enough I checked and they are bidding prices up around Channel Island Harbor. I suspect something like that is happening in some neighborhoods in San Diego. If they are planning on flipping these properties they are in for a shock OR do they know something we don’t. There were a bunch of decent priced condos on sale in the Seabridge development and suddenly they are all sold. Any comments?

In E Ventura county, I see the same. Zillow and Redfin show sales for lots of properties at all price points (even into the 1M range) from Nov ’11 to Feb ’12. I think that many are betting that the bottom is near. I agree with the doc – this market has a ways to slide yet, especially in Ventura County. Good news is that rents have been coming down for the last few months.

i bought nice fixed up 3 houses in lancaster for 145k total

rents are decent

returns are high

and i am waiting for the qeIII to push the inflation rate up.

Leave a Reply