California Housing Market Forecasting Errors. Making Million Dollar Mistakes and Predicting the Future. 12 Percent of Mortgages with Balances Higher than 1 Million Dollars are now 90 days late.

The predictions for the 2010 California housing market are rolling out in mass. Predicting the future is never easy or even possible in many cases. I am reminded of the Black Swan events in Nassim Taleb’s excellent book where extraordinary events shake up years of imagined stability. The real estate bubble is a perfect Black Swan event. Sure we had mega regional housing bubbles like Florida in the 1920s but the generation that vividly remembered that event is no longer with us. Why was real estate a Black Swan? Well it falls into the category of stability simply because of a long history of gains. Yet this does not imply continued gains. One powerful catchphrase during the bubble was, “housing values have never gone down on a nationwide basis.â€Â This was true until it wasn’t.

Manias of this magnitude do not happen often. We have examples in history like Tulip Mania in Holland during the 1600s, the South Sea Bubble, and more recently the technology bubble. Yet in many previous bubbles the events were largely localized to a group, city, or country at best. This massive housing bubble went global reaching cities like London, New York, Sydney, Tokyo, Barcelona, and Los Angeles. The amount of money involved is also historical.

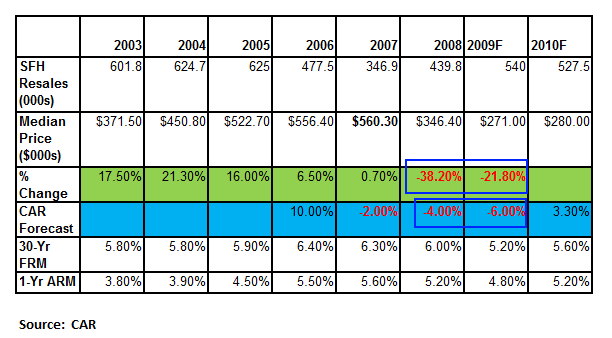

But to predict the future of housing values is now largely thrown into a game of speculation. And this is a new twist. It was largely assumed that housing for nearly a century tracked inflation. Yet during the past decade, because of the mania people started concocting wild stories as to why real estate was appreciating in the double-digits year after year. The “New Normal†was constant double-digit returns. An astute reader sent me over the California Association of Realtors’ prediction for 2010. He also managed to pick up a few of their previous predictions. I have compiled some of the data on the chart below for easy reference:

The green row is the actual price drop for each year. The blue row is the CAR forecast for each year. What the above should tell you is that one massively bad year can wipe out years of steady gains. In 2006 the CAR forecasted a 10 percent increase and the market went up by 6.5 percent. Not bad but understated the actual gain. This is when the median California home was selling for $556,000. The next year it predicted a price drop of 2 percent but the market nudged out a 0.7 percent gain reaching its annualized peak of $560,000. Then the market imploded. The CAR’s forecast for 2008 was a drop of 4 percent when in reality the market lost 38 percent. This is how off this one year prediction was:

CAR Forecast

$560,000 x 0.04 = A drop of $22,400

Actual Price Drop

$560,000 – $346,400 = $213,600

That is a massive miscalculation. This is like saying tomorrow is going to be a sunny day but in reality having a category 5 hurricane hitting. You can have 10 years of sunny days but one massive hurricane will wipe all of those days out. You would think that people would be more cautious the following year with their predictions. Let us see how it did the following year:

CAR Forecast

$346,400 x 0.06 = A drop of $20,784

Actual Price Drop

$346,400 – $271,000 = $75,400

That is a sizeable difference in my book. Given that the median U.S. household income is $50,000 making this kind of prediction error is rather large. Of course the 2008 forecast was off by nearly $200,000.

Now why is the above important to analyze? Price is hard to predict because markets are largely unpredictable. But there is one thing that is certain in bubbles when they pop. Prices collapse. California has many wildcard factors like shadow inventory, option ARMs, and failed moratoriums hitting the market in 2010. What impact will this have on price? Price predictions in a bubble are nonsense because they follow no logic or economic fundamentals. Prices will go as high as the speculation and gambling gene will allow people to go.

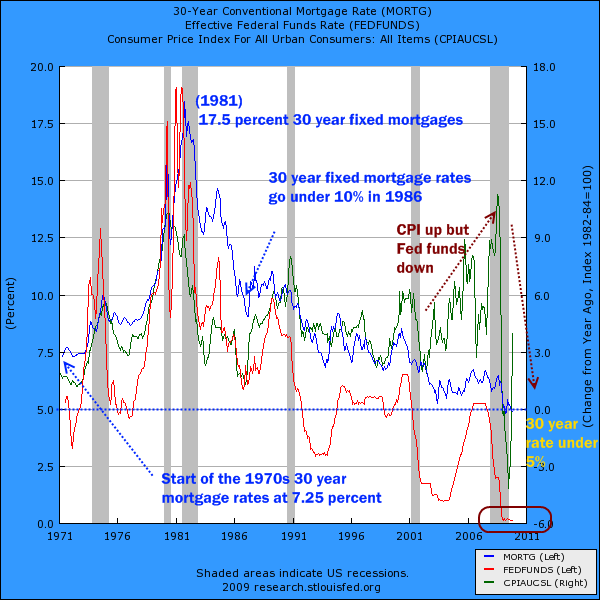

So what else do we know? Look at the chart above one more time. Look at the 30 year fixed rate mortgage. It was extremely stable even during the peak years. That is because in California much of the price inflation came from Alt-A and option ARM products. These items are now gone for the most part and option ARMs are now banned. FHA insured loans are now taking over the market because of the low 3.5 percent down payment but there seems to be a cap being hit at roughly $300,000. Why? Because incomes simply cannot support any higher prices. Take a look at the 30 year fixed mortgage history:

Now the above chart shows another Black Swan event hitting with mortgage rates touching a 17.5 percent high in 1981. Did people see this coming in 1977, 78, or 79? Probably not if they were being honest with you. Right now people are assuming mortgage rates will stay artificially low just because they have been low for a decade. But right now the only reason rates are this low is because the Federal Reserve has bought up over $1 trillion in mortgage backed securities. Can the Fed keep this up? It can only keep this game going as long as foreigners keep buying up our debt but the U.S. dollar’s wild swings show a major event is bound to happen. When? Who really knows but this path is unsupportable.

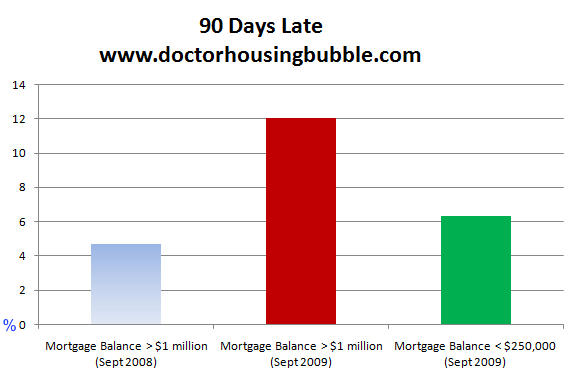

And now, the high end market is facing major pain. Take a look at mortgages that are $1 million or above:

12 percent of mortgages with a balance of $1 million or more are now 90 days late. Last year, this number was 4.7 percent. If we look at mortgages with a balance of $250,000 or less we find that 6.3 percent are in distress. Now this is a stunning piece of data. You would logically think that those with higher mortgages would have lower distress rates simply because they have higher incomes. But the math at least with monthly cash flows is simple. Spend less than you earn. If you bring in $25,000 a month and spend $30,000 you will have problems. Now if you bought a $2 million home that is now worth $1.25 million, will you continue to pay? Many of the California option ARMs and Alt-A loans are connected to these high priced properties.

And as you would probably figure out on your own, a loss on a million dollar loan takes a bigger hit than a $100,000 loan:

“(Bloomberg) Luxury home prices probably will drop another 5 percent before reaching a bottom in September 2010, according to Sam Khater, senior economist at First American.

Those declines may lead to losses on jumbo mortgages that dwarf the “haircut,†or discount to full value, that banks take on short sales or foreclosures of moderately priced homes, said Rodriguez, the agent with JM Group in Miami.

“When the bank takes a loss on a $3 million property it’s a lot bigger than the loss on a home with a $150,000 mortgage,†Rodriquez said.â€

This market is completely stalled. Even with FHA insured loans going up to $729,750 that is not enough for some of these million dollar toxic loans. And why should it even go higher? The median price nationally is $173,100. The only reason to increase anything is to allow the upper crust to have another exit hatch (as if they need another one after the massive banking bailouts).

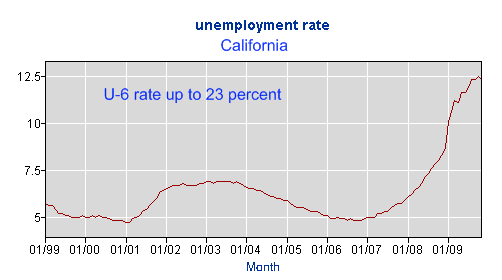

And the economy of California is still in shambles. The current employment situation is deeply troubling:

This is really where I find it hard to see any major price jumps for California housing. How can we predict housing gains when unemployment is still near its peak? Also, we have a $21 billion budget deficit starring at us squarely in the eyes. What that means is higher taxes or more cuts. Either way, this will be a drag on the economy.

The fact of the matter is housing prices in California are still too high relative to the actual economy. Those spiking million dollar loan delinquencies basically means we are moving onto the next phase of this bursting housing bubble. The mid tier will also take a hit. But to try to put an actual price is more for entertainment value. As you can see from previous forecasts use them at your own peril. The California housing market is as volatile as a chemistry set and 2010 is sure to bring us things that we simply have no way of forecasting.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

35 Responses to “California Housing Market Forecasting Errors. Making Million Dollar Mistakes and Predicting the Future. 12 Percent of Mortgages with Balances Higher than 1 Million Dollars are now 90 days late.”

The sub-prime tsunami is mostly over. I thought that the next tsunami will occur in the mid-priced areas. But in light of this new information, I am beginning to think that the next huge price drops will occur in the over one million dollar homes. But, like Yogi Berra said, it’s hard to make predictions, especially if they are about the future.

I never thought the California state government deficit really matterd, especially to me, because we recieve no government aid.

I have heard recently though that my sons gradeschool may close, or they may close a nearby grade school and send some of those pupils to our sons school, which may over crowd it.

If that happens it will really sour our opinion of our area, we live in Santa Clarita. We will probably move to a new area. Our main interest these days is to lower our housing payment while still remaining in a decent school district, we rely heavily on a good school district.

The funny thing though is the tax base of our area in Los Angeles County is 1.25% on property taxes, and we passed a school bond for several hundred million dollars two years ago. The extra .25% goes to the schools, and they are still facing a multi-million dollar deficit.

I should add that one of the reasons for the school closures that was cited was a declining enrolement. This may show that more people are leaving California, especially the white middle class, which populates our area.

On a national basis the property tax rate in California is great, cheap compared to other states. I believe we payed 16% when we lived in Illinois. The trouble is that most of the public schools in Los Angeles are terrible and you can’t send you kids to them.

From my point of view, what people are trying to do is find a window of opportunity to save some money. Affordable house payment, a good public school so you don’t have to pay for private school, and still have the job base that is in LA.

I havn’t found an opportunity to get that combination in LA county. I don’t think the way the government is propping up the real-estate industry is helping that situation either.

Without fiscal reform at the state government level, California’s best days are in the past. The State pursues preposterous tax-spend-regulate policies that have driven business and capital away for decades. This trend is only accelerating in the wrong direction.

The fiscal situation at the federal level is no better. ShadowStats.com is my favorite site for alternative economic data that ignores official reporting bias. According to this site the feds have racked up a $65.5 trillion negative net worth as of 2008.

Without reality setting in to our policy makers and the voting public we are doomed to continue the wrong set of actions have can only lead to financial bubbles and ultimate impoverishment.

The highest correlation to housing prices in CA over the last 60 years has been the unemployment level. The sensativity level is ~7%. U-6 at 23% tells me we have a very long way to go before prices will rise again. Also very interesting to see sub $250K loans headed back into trouble. This party is just getting started.

Phillip Niemeyer | Picturing the Past 10 Years

Boom and Bust correctly noted.

MattEchoes said…

This article shows what percentage of foreclosures come from the upper tier markets: staggering – Zillow Blog

California unemployment is improving, but conditions vary throughout the state according to this heat map:

http://www.localetrends.com/st/ca-california-unemployment.php?MAP_TYPE=curr_ue

Happy New year, Doctor. Keep it up.

All I want to know is: Inflation? or Deflation? We’re at a fork in the road.

“Can the Fed keep this up? It can only keep this game going as long as foreigners keep buying up our debt but the U.S. dollar’s wild swings show a major event is bound to happen. When? Who really knows but this path is unsupportable.”

The above is not entirely correct. Foreigners have continued to buy American debt, but not nearly at the percentages compared to that issued as in the past few years. Presently, the Federal Reserve is buying approx. 65% of all treasuries issued and 90% of all agency debt issued. How long can this continue? I dunno.

Two words: Agenda 21. This is the publicly available detailed plan from the UN for the future of mankind. Read up on it and learn. Private property will be a thing of the past.

If the Fed backs off treasury purchases in 2010, the rates will have to rise. Unless the markets tank and everyone runs to treasuries for safety. But they would probably still not buy any bond duration over 5 years. Wanna see home prices plummet? Try 7.5% mortgages.

Fannie: “Prior to the conservatorship, our business was managed with a strategy to maximize shareholder returns, while fulfilling our mission. However, in this time of economic uncertainty, our conservator [the US government] has directed us to focus primarily on fulfilling our mission of providing liquidity, stability and affordability to the mortgage market and to provide assistance to struggling homeowners to help them remain in their homes.”

“As a result, we may continue to take a variety of actions designed to address this focus that could adversely affect our economic returns, possibly significantly, such as: increasing our purchase of loans that pose a higher credit risk; reducing our guaranty fees; refraining from foreclosing on seriously delinquent loans; increasing our purchases of loans out of MBS trusts in order to modify them; and modifying loans to extend the maturity, lower the interest rate or defer the amount of principal owed by the borrower.”

http://emac.blogs.foxbusiness.com/2009/12/28/fannie-and-freddies-end-run/

I think the mid-tier will take a considerable hit as well. By virtue of being in the “middle”, the mid-tier homes will reduce because both the upper and lower bounds will have shifted down.

If you look in mid-tier zip codes, their incomes do not reflect current prices either. With all the factors DHB has mentioned: unemployment/underemployment, future interest rate hikes, stringent lending practices, and alt-a/option arm implosions; we’re definitely headed for lower prices.

The real estate pyramid scheme in California is now being eaten away from the top and the bottom due to defaults and unemployment. Nobody in their right mind would buy now, instead of renting on the sidelines. Looking at the big picture, we are probably less than half way through the housing collapse with mid and high level tiers next to fail. Why should people pay, when banks don’t foreclose, people can bank their mortgage payments and possibly walk away with little or no skin in the game? This is what really worrys he govt as they wrestle with TRYING to re-inflate the housing bubble. The sinking of the U.S. Dollar will ultimately be check-mate as foriegn investment flees. One can only wonder what neighborhoods in Santa Monica, Brentwood, Malibu, Bel Air etc… will look like, once strategic defaults become the mainstay.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

My wife and I frequent the central coast in Calif. In Jan,2009, there was a one year old condo for sale,2 bedrooms, granite, stainless, etc. nearly oceanfront, terrific ocean views, listed for $1,300,000.

No takers.

It is now listed as a short sale, for $795,000.

Excellent as usual, the only thing I would point out is that the nature of percentage gains and losses can be especially deceiving.

The Dr. points this out in dollar values, but I would like to add that if you also think about it in percentages, you will note it takes a 100% gain to make up for a 50% loss, so losses are twice as potent as gains.

As a result, it would take a subsequent 76% increase in housing price to make up for the loss in 2008 alone!

With the unlimited taxpayer blank check provided to Fannie & Freddie thanks to RahmObama – the GSEs will now takeover from the Fed and keep buying all the MBS in sight. I will not be surprised as election day nears that the GSEs will buy up all the mortgages on underwater homes at a premium from PIMCO and Wall Street and will then forgive principal keeping homeowner voters happy and smiling on election day.

The next “black swan” as in sure thing is the blowup in credit of the USA. When that happens is something that is difficult to predict but if math means anything then a $12 trillion national debt growing by $1-2 trillion annually and a $75 trillion unfunded liability in social security, medicare and federal pensions also growing at the rate of trillions annually with a $14 trillion economy growing at best at 5% annually to pay all the interest and principal is not going to happen at some point.

Then what happens? Print more or debt repudiation.

@Mike M:

“Inflation or Deflation?”

Both. That is the problem, the two are valens seperate–they both are occuring simultaneously. Demand pull is largely deflationary–we are consuming far less of everything. Currency destruction is inflationary–dollars are worth less. You can easily pay $5 for a box of cereal. Credit is collapsing and that is deflationary. Creating money from thin air does not create inflation unless someone uses that money to pay more for something than it is worth. Excess money is used to buy out other companies, which then lay of major fractions of the work force. Inflation by creating massive debt obligations. Deflation by laying off staff that no longer buy as much stuff. The bottom line is we are working harder for a lower standard of living, unless we go into debt, for the most part.

You might also cite the l887 real estate crash in Southern Ca. It was caused by the Santa Fe railroad breaking the Southern Pacifics monopoly on transport to S Ca. Due to various factors fares from Chicago to La fell to $1 for a day. Everyone decided that S Ca was a great place to live (This was when the San Gabriel valley communities east of Pasadena were founded all the way to San Bernadino.) It was lucky though that this crash was 5 to 6 years before the 1893 national crash. Various books are online about this crash.

You might mention the 1887 localized real estate meltdown in Southern CA. Everyone and his brother got into the real estate business. This was when the towns from Arcadia to Nearly San Bernadino were founded along what was the Santa Fe railroad. Suddenly the boom collapsed, and real estate went thru the floor in price.

1 of 7 houses now distressed in CA……….your numbers r off.

factories r closing like wildfires………politicians do not care,

unemployment San Bernardino 13%

Des Moines, Iowa 6%

The regulatory/tax environment is destroying business.

Signed ..political person that woke up too late

I realistically don’t see things getting better for 10-30 years. The destroyed industrial and economic infrastructure will take that long to rebuild and only if we decide to continually invest (obviously now at a deficit) over those next 20 years or so. Thus even this “rosy future” of 30 years is highly dubious and questionable.

The inverse relationship between employment and CA real estate noted by @CAE is dead on. This is the problem with what pretty much everyone agrees will be a jobless recovery (at best) – it won’t help real estate prices.

And it’s largely hidden because of the bogus methods used to count employment – jobs may be gained but not at wages that allow new sales and probably not even at wages that let folks tread-water with existing debt obligations which is why foreclosures and bankruptcies are still rising like crazy. Yes. It is a _depression_ no matter how much lipstick the government tries to put on the pig.

@Mike M

You can have both. The joys of stagflation. Inflation for any items you have to import. Deflation on anything produced here because no one outside (or inside) the US wants or needs what is produced. I travel outside the US a great deal and what I’ve found is that US prices for just about anything are completely and unsupportably higher than the same products sell for outside the US – even accounting for exchange rates. Basically the side effect of being a “knowledge/service” economy is that we are all only middlemen and mostly not delivering any value-added for the privilege but certainly charging a premium as if we did.

@cdcrez

Foreigners are *not* buying US treasuries. The Fed and T dept are creating a churn to make it look like foreigners are still buying. Cash-for-Clunkers was created because China wouldn’t accept US$ for interest payments any more – only scrape steel from cars which they could actually use with/as value.

Greg in LA and others might enjoy the recent SF Weekly article

~

The Worst-Run Big City in the U.S.

Spend more. Get less. We’re the city that knows how.

http://www.sfweekly.com/content/printVersion/1786487

~

It comes precisely to many of the same general conclusions that more awake people have these past X years, including Greg’s point about schools closing not because there isn’t enough money per se, but the middle class is abandoning CA.

~

The conversion of toxic mortgage debt into “securities” bought up by global central banks and traded globally has got to be one of the most dimwitted acts of financial alchemy since Sumerians invented banking.

~

But it does have one thing going for it: the monetarization of shelter at a hitherto unheard of scale, thanks to the automation of banking/finance.

~

Big Pharma is trying the same thing with “health care reform.” I.e., the wet dream of turning the basic need for medical care and health support into a monetarized, fiscalized corporate profit stream backed by government force and fiat.

~

Alan Turing’s thinking machines are, in my view, way out of their league.

~

rose

There are alot of ignorant people that think this is the bottom and are jumping in as we speak. 99% of the people I have spoken regarding housing do not understand why prices went up and why they are crashing down. When you bring up the historic fundamentals which have controlled home prices they still don’t agree. I have printed out many charts and stories from your website to win a couple of arguments and to convince people to sit on the fence. The longer we sit the faster the crash.

Where did you get the data source showing 12% of mortgages over $1.0M are 90 days late? And was that for California or U.S.?

To Mike M.

IMHO:

The price of things people need – continued price inflation. The price of things people want – deflation. In many cases the increased price of the needs will prevent people from enjoying the declining prices of the wants.

Inflation or Deflation: Both.

Spiraling demand destruction deflation and currency destruction inflation. Interest rates are targeted at ~0 because demand is trending downward for everything from granite countertops to Tiger Woods golf shoes, and especially petroleum. So how come no demand-pull deflation? Currency destruction. It’s not a tug of war between one salient entity. It’s a matrix of conditionals, skewed by massive government intervention on a scale that would make FDR faint. Folks are afraid of dangerous schools so they will pay anything to live in a nice area, so instead of gang violence the kids get designer drugs and eating disorders. Some things are elastic but pricing basically ratchets up until forced to go, then it crashes. Most people that have working husbands still spend like crazy because they are irresponsible Americans that think saving is getting 30% off at Belks. Don’t expect us to make rational choices until we have no choice.

Actually, the real estate bust does NOT fit Taleb’s functionality for a Black Swan.

I know of hundreds of people who were talking about the real estate bubble, before it happened, during the bubble, and as it was getting ready to pop.

To be a Black Swan – it can’t be predicted. I have people ask me all the time: “Is this going to be the Black Swan?”

To be a Black Swan, you can’t point towards it before hand. It is ‘true randomness’ to quote Taleb.

Greg in LA, you are really talking about two separate things. The school bond you passed is for the modernization or construction of your schools, and by law, none of this money can go to operating expenses, such as administrator and teacher salaries, books, supplies, and academic programs. The class size/combining schools issue is directly related to operating expenses, which is given in a complicated formula from Sacramento based on the attendance at your schools. The reason they would combine schools is to lower the operating expenses for the school district. Again, the bond money cant be touched. I would hope your school board and superintendent is savvy enough to look for additional sources of revenue.

Declining enrollment is happening nationwide, not just in California. The children of the baby boomers have gone through the system and now you have the children of Gen X and Gen Y adults. Not much you can do about this. There is one upside for public schools as part of the economy. Public schools will attract more kids than in good times that would go to a private school, but by economic necessity, now must attend public, which means more state funding.

I feel for you in your predicament, but there are two things you can do:

1) give until it hurts to your local education foundation, which supports enrichment programs that have been cut back.

2) if you really dont want to stay in Santa Clarita, either apply for a permit for your kids to attend another district, or sell your place, find the city where schools are better, and rent your next place.

Just remember that a few extra kids in the classroom wont impact their education that much. It’s only when class size at the elementary school level goes about 28 or 29 when learning starts to suffer. It’s likely you arent there yet.

California Average Daily Unemployment borrowing from Nov 3rd to Dec 2nd – $12,515,861.92

California Average Daily Unemployment borrowing from Dec 2nd to Dec 29th – $31,590,492.10

Percentage Increase – 152%

To put that in perspective – Average daily Sales Tax Revenue (30% of California’s total tax revenue) has averaged $75 million per day since July 1st 2009.

California percentage of the total borrowing from Nov 3rd to Dec 2nd – 18%

California percentage of the total borrowing from Dec 2nd to Dec 29th – 23%

California began unemployment borrowing on January 27, 2009

Total unemployment borrowing in December as of Dec 29th – $1,041,000,000.00

Total unemployment borrowing as of Dec 29th – $5,914,584,870.70

Accruing at 5% interest! Doesn’t show up in the General Fund budgets as it will come directly from unemployment tax on businesses.

http://yophat.blogspot.com/2009/01/californification.html

@CompaJD

Unfotunately, you may want to be careful what you hope for. Prices may come down at the point of capitulation, where the destruction that wasteth at noon day may be the result of the situation fracturing into a scenario where you may not want to own a house in the twilight zone. If the Politbeaurea can keep the charade up this long, than they will continue–until they can’t. Then prices may not tinkle down the next time–it may be all out war, with a truly chaotic crash. Or not. If the free market had been working, none of this would have occurred. Obviously USGov will not take any measure off the table to let the crony system fail. Don’t expect normal market operations to correct this. Only the next big wave will, and as DHB has pointed out, it will likely be Alt-A, Option Arm, Jumbo, and conventional due to job loss and debt reckoning–all at once. Kicking the can down the road is a dead-end street. And CA is on the street of broken dreams. You may pull the rest of us down with you.

Love the blog, fundamental insights are right on the mark and supported with a lot more real-world stats than most I-Bank research I see.

Unofrutnately the I-Bank rsch I beleive in currently forecasts long-term i.e. 10-year treasury rates to rise to 5.0% by end-10 (which implies mortgage rates of 6.5%). Admitedly, what everyone is trying to figure out is the new true equilibrium of LT interest rates (both nomial and real) post the huge increase in deficits. We were shielded by this in 2009 by quantitative easing i.e. the Fed buying the equivalent of the deficit in mortgage backed securities. In theory, the degree of deflationary pressues on the economy (like the obvious point that there is no need to build new residential or commercial reale state for a long-time to come) should mean that forward-looking inflation expectations remain low as does the alternative use of funds due to a lack of inv opps in the economy. There is a lot of genuine uncertainty on where rates are going. It seems to me if mortgage rates get north of 6% again in 2010, housing prices will sink at least another 10-15% in 2011 and another self-reinforcing liquidation cycle will emerge. That could eventually put large parts of CA in a Las Vegas type situation where virtually everyone begins to consider walking away from their homes as credit-ratingd are not worth the 200K-500K hit over the ntext 10 years to maintain them. The follow-on next iteration of gov aid and money printing would probably undermine all hope that the current level of deficits are cyclically high and can be managd lower over 5 years. When that # becomes 10 years, see the Chinese and their 1 trillion hoard of treasuries run….

What happens when LT rates i.e 10 year bond rates rise due to high US gov issuance? Seems to be the a rise in mortrgage rates from 5% to 6% would imply a 10-15% drop in house prices ceteris paribus and trigger another self-reinforcing liquidation cycle. The Vegas phenomenon where enough people are under water than the societal attitude towards walking away from loans completely shifts to paying off a mortgage that is underwater as a sucker bet is not too far away for large parts of CA.

Just so you know… It appears EDD has begun denying all unemployment claims without even calling the claimant. My fiancee got fired for a shady reason… she made a mistake on her timecard once…(lunch was off by 30 minutes or so). And she got fired for “falsification of documents”… along with 40% of her department on the same day. the company has not tried to hire any new employees since the mass firings. EDD didn’t even call my fiancee… they just denied her benefits automatically. We are appealing… since her firing is not misconduct by definition. Misconduct has to be INTENTIONAL.. and they can’t prove intent. A mistake is incompetence and by EDD rules you are entitled to unemployment. They are just hoping people don’t appeal… and tying up the appeals in court. It’s a nightmare scenario. Employers are resorting to firings instead of layoffs… to save on paying rising unemployment insurance premiums and EDD is complicit in allowing them to do so unethically. If she doesn’t get a fair appeal we are going to the local news media outlets.. blogosphere, youtube… and plan on making lots of noise.

Unemployment is much higher than the numbers show…. I personally know 8 people who are unemployed and being denied unemployment for shady reasons.

“This is really where I find it hard to see any major price jumps for California housing. How can we predict housing gains when unemployment is still near its peak? ”

Well, this is yet another variable in the equation…and where one would need to be able to PREDICT whether we are indeed at the unemployment rate peak (and, therefore, would begin to see the unemployment rate start going down). This may, in fact, be an argument that those who believe that “it’s a good tie to buy” might use. However, I would imagine that the possibility (likelihood?) of further cuts in municipal and state work forces could keep downward pressure on home prices. Also, along with those cuts in municipal employees, one would expect concomitant cuts in municipal services…necessitating additional cash outlays by the average homeowner (i.e., higher HOA fees, in CA) to make up for these cuts.

As you say, though…it’s not easy to PREDICT economic trends.

Leave a Reply to bp