Forget about the 2012 Apocalypse Movies because California has Enough Problems in 2010. 10 Charts showing why there will be no Economic or Housing Recovery for California in 2010. Unemployment at 12.5 Percent and $21 Billion in Deficits don’t Help Either.

In the last few days, we have gotten a better picture of macro trends impacting the California economy. You would think that a bad overall economic climate would at least temper the bullish attitude of some folks that think California housing is somehow going to have another blowout year. This week the non-partisan California Legislative Analyst Office announced that California will be dealing with $21 billion in budget deficits in the current and next fiscal years. Keep in mind that back in July when we patched up $60 billion in deficits, the government was projecting a $500 million surplus in the general fund for the current fiscal year. The new update is showing a $6.4 billion gap that is as wide as the Grand Canyon. Today, we also find out that the California unemployment rate is up to 12.5 percent; if we look at the underemployment rate it is now up to 23 percent. The job losses keep coming but what is more troubling, the “help wanted†signs are not going up.

Without a doubt, Alt-A and option ARMs are already causing problems internally on the balance sheet of banks:

Since 58% of option ARMs are here in California, this combined with the fiscal problems of the state will prove to put housing into a precarious state for the next few years. Let us look at 10 charts as to why the California economy and real estate market will see no recovery in 2010.

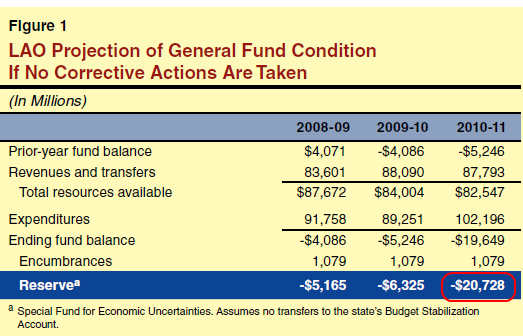

Chart #1 – $21 Billion in Budget Deficits

Without a doubt, these are enormous budget deficits that we need to contend with. In the last cycle, the state had to cut spending and also raise taxes. There were also many gimmicks in the last fiscal budget since the state government was hoping for a Hail Mary pass that the economy would somehow recover in a few short months. That didn’t happen and the gap has opened up again. Combine the current fiscal year and the next, and we are looking at $21 billion to patch up. Where is this going to come from?

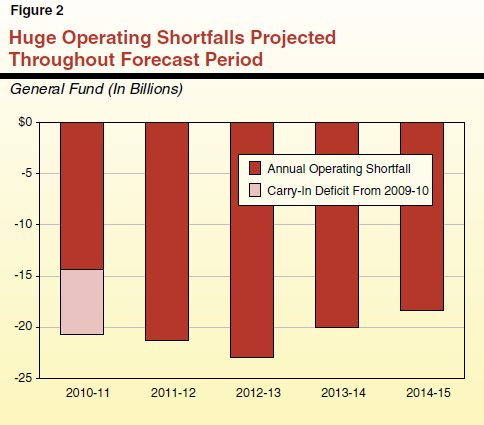

Chart #2 – Deficits for Many Years

One of the large issues in the latest fix is cuts that were supposed to happen but didn’t. For example, the correction system is over budget by $1.4 billion and Medi-Cal spending is over by $900 million. If you don’t adhere to a budget, then problems will occur. But this is more kicking the can down the road budgeting yet the reality is, California hasn’t improved much in the last year. In fact, unemployment is now up to a record keeping high of 12.5 percent. Is this good news for the California housing market?

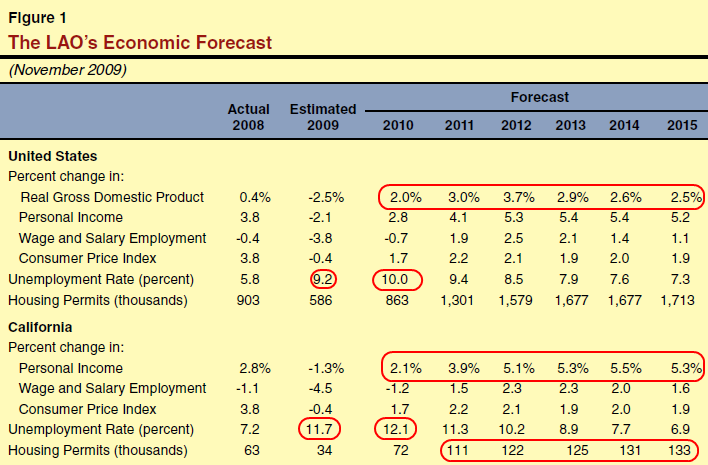

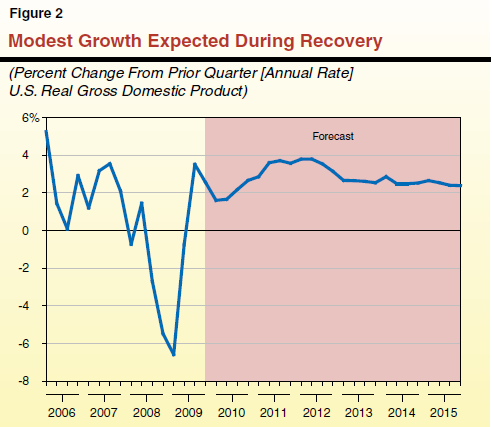

Chart #3 – Optimistic Outlook

The California LAO does a good job at looking at data but their forecasts are a bit optimistic. If you look at the above chart, the peak unemployment rate for the U.S. is 10 percent and for California it stands at 12.1 percent. We are already beyond those points. Given, these are yearly averages but so far the trend is moving in one way. You will also notice that for California, the LAO sees a doubling in housing permits for 2010 and nearly a tripling by 2011. So far, we have seen little reason to assume this is going to happen. With many more foreclosures coming in the future through Alt-A and option ARMs, we are assured more inventory in the next few years.

Chart #4 – U.S. GDP Moves Sideways

The above is the optimistic scenario. In fact, even the LAO is bringing up the Japan lost decade as a possible outcome. I’ve talked about the Heisei boom and bust in Japan and mentioned this as a possible outcome for us. Given the current government measures and actions, we will be lucky to have a Japan like outcome. At this point, the Fed is trying everything it can to keep any audit from occurring since so much toxic financial waste is being funneled into that balance sheet. So much for transparency. What the Fed is basically saying is if you take an honest look at what they have, the economy will implode. How is that for confidence? The Fed will make Bernard Madoff look like a small town bank robber.

The above flat lining or “V†shaped recovery is not going to happen. It is simply too optimistic.

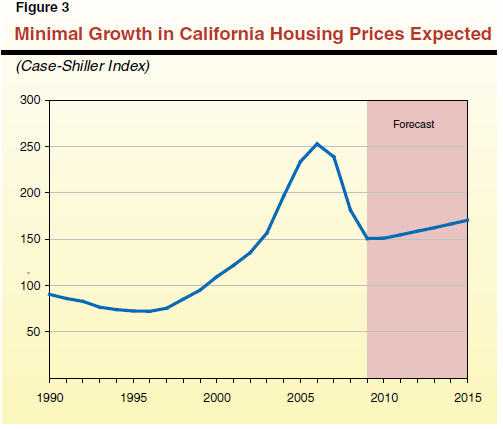

Chart #5 – California Weak Housing Price Growth

You would think with budget deficits until 2015, unemployment at 12.5 percent, and a political system that resembles a developing nation, that all of that might throw a wrench into the housing growth crowd. No way! It is the immaculate housing recovery. Who needs jobs for the stock market to go up 60 percent? Like Wall Street, some people think that housing can recover even if the economy is in a mini-depression. And in the current budget that we enacted, revenues are a problem but spending is the bigger issue.

In the July budget it was assumed revenues of $84.1 billion for 2008-09 and $89.5 billion for 2009-10. So far, this year revenue is lower and LAO expects revenues of $83.6 billion for 2008-09, $496 million less than budgeted and $88.1 billion in 2009-10 and that is $1.5 billion less than budgeted. Yet areas like corrections are over budget by $1.4 billion and Medi-Cal coming in over by $900 million.

So what does this have to do with housing prices? A lot actually. There is only a few ways to balance this out. More cuts (higher unemployment), higher revenues (taxes), or more likely a combination of both. With elections next year, you can rest assured candidates for Governor are going to be focusing on the economy as issue number one. Either way, the average Californian is going to have less money one way or another. The Alt-A and option ARM problem is unique. This housing bubble is unique. We have no historical parallel. How can it be assumed that this will simply disappear with no repercussions like dirt being swept under the rug? Some think that HAMP or other gimmicks are going to stem the losses. An unemployed person is not going to be able to cover a $200,000, $300,000 or $400,000 mortgage (fixed, Alt-A, option ARM, subprime, interest only, etc) so how are prices going to go up?

Prices are going up right now for the following reasons:

=Tax credit

=Artificial lowering of inventory (big shadow inventory)

=Moratoriums like HAMP

=FHA insured loans – 2% in SoCal two years ago now nearly 40% of all purchases

We already know how disastrous FHA is becoming. Defaults are flying off a cliff. The median down payment for FHA insured loans is 3.5 percent. Are some putting down more? Yes. But half are not. Plus, California is in a total mess:

“(LA Times) The credit information supplier says that during the third quarter, nearly 10.2% of home loans in the Golden State were 60 days or more past due. That was up from 9.7% in the second quarter and 5.8% in the third quarter of 2008.â€

Nationwide things are equally as bad:

“(UPI) In records going back to 1972, the delinquency rate in the third quarter was an all-time high, breaking the previous high of 8.86 percent set in the previous quarter.

The rate does not include loans in the process of foreclosure which, separately, was 4.47 percent in the third quarter. The combined delinquency and foreclosure rate was 14.41 percent, also a record, the MBA said.â€

In other words, 1 out of 7 mortgages is in some form of distress. So the government is left with hard choices. FHA insured loans are imploding because of the pathetically low money down required (3.5%). FHA is going to need a bailout in the next few months. But some are going to expect a pound of flesh. The only way to combat this is by increasing the down payment requirement to at least 10 percent. No one is saying eliminate FHA but come on, is 10 percent too much to ask for? Do that, and the California market is done. Yet the median nationwide home price is around $177,000; all you need is $6,195 to buy a home! In Southern California, that can be your first month and last month deposit on a leased place. Without significant changes the nation is going to have to bailout all the additional failed mortgages coming from California that have a much higher average balance. This isn’t speculation, this is already happening.

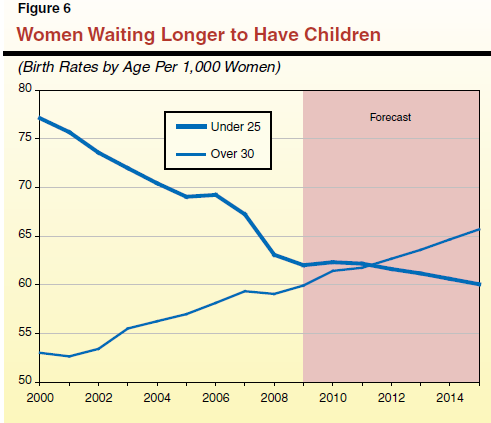

Chart #6 – New Demographics

I talk to many younger couples and many are waiting to have families. The above chart merely verifies this trend. “Family forming†is a big mover in people buying homes. No longer does the couple feel like their apartment is big enough for a child so off they go to buy a home. But if people are waiting longer, it is expected that many may not have that rush or desire to buy sooner. People are hunkering down. In fact, in some areas of the country people are lining up outside of Wal-Marts at the end of the month waiting for paychecks or government funds to clear just so they can buy food.

So people are shifting priorities. In fact, just from speaking to many younger couples, they are perfectly fine in waiting. Their primary concern is trying to survive through the recession first before making the biggest purchase of their life. So this throws another factor into the bullish housing argument. Many couples don’t “need†to buy a home because they are delaying having kids. Nothing wrong with that.

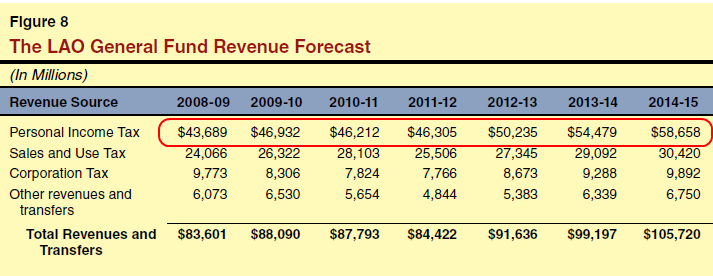

Chart #7 – Revenues from Volatile Sources

We have discussed that California receives revenues from very volatile sources. Over half of all revenues for California comes from personal income taxes. So with unemployment going sky high, it is no stunner that the state all of a sudden isn’t flush with money. California has been artificially stimulated for two decades. We had the tech bubble followed by the housing bubble. There is no other bubble this time so we are basically fixing structural problems that have been decades in the making. The forecast is dismal but as you can see, we suddenly see a miraculous recovery sprouting out like a card from David Blaine’s hand. The LAO does a great job dissecting the numbers but doesn’t tell us what industries are going to make up for the lost income.

Also, the LAO is factoring in that COLAs are not going to happen for workers until 2015. More reason to believe housing is going to go up right?

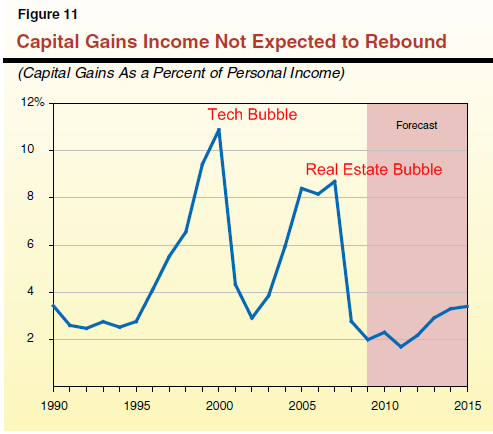

Chart #8 – Capital Gains

Within the personal income tax revenue section, a big portion of money comes from the wealthy, many who depend on the stock market casino. If you look at the above chart, you can see how much money can come from capital gains. During the tech bubble the state was pulling in 11 percent of the total PIT from capital gains! It peaked over 8 percent in the real estate bubble but is now down to 2 percent. The U.S. Treasury and Federal Reserve have juiced the stock markets because clearly the average American is not feeling any of the trillions in bailouts. Their belief is that crumbs will fall from the plates of the banking oligarchs and trickle down to the middle class. It is hard to believe that with the wild California housing market, cap gains didn’t match the tech boom.

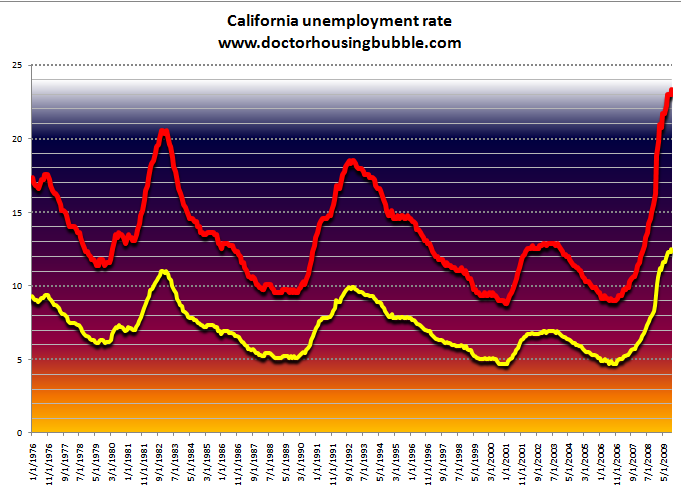

Chart #9 – Unemployment

Good luck finding any real estate analyst that connects housing prices to employment and income. Like Wall Street, the real estate market doesn’t depend on income and jobs anymore according to this new version of the economy. The official unemployment rate is 12.5 percent, a record keeping high. If we look deeper into the data, 23 percent of the workforce is either unemployed or underemployed. If you are working at a local retail store after losing your good paying job, you are considered fully employed. If you are working 10 hours at your local Wal-Mart to pay for food but want full-time employment, you are not part of that 12.5 percent.

Employment is such an obvious data point in terms of looking at any housing price movement. Recent data is showing prime mortgages defaulting in mass not because mortgages are toxic like Alt-A and option ARMs, but because people have now lost their jobs or have seen their incomes fall by the wayside. Until employment stabilizes, housing recovery talk is nonsense. People right now are focused more on taking care of their immediate needs as they should. Yet where do we focus our energy? Banking bailouts, cash for clunkers, and home buying tax credits. I’ve been living in this Alice in Wonderland world long enough that being in this sunny rabbit hole we call Southern California, nothing else really surprises me.

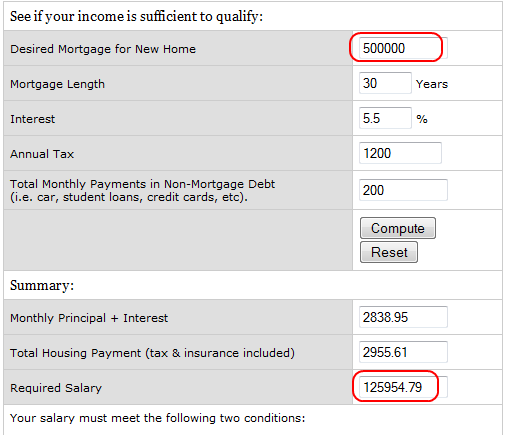

And one thing people miss even with FHA insured loans is the amount of leverage that is now gone because of Alt-A and options ARMs:

Take for example the above case. Say you are looking at a good area like Culver City since I’ve discussed that area over the last year. You are looking at a nice place that is going for $500,000. The required household income is approximately $125,000. Not out of reach for a working class couple. So you can buy a home that is roughly 4 times your annual gross income. Yet during the bubble, it was common for people making $50,000 to take on $500,000 mortgages. Countless Real Homes of Genius were purchased like this. But that leverage is now gone. And keep in mind, if employment keeps faltering what if one couple gets hours cut back or fired? FHA is providing roughly 4 times annual income leverage versus the ten (or even higher) during the bubble days.

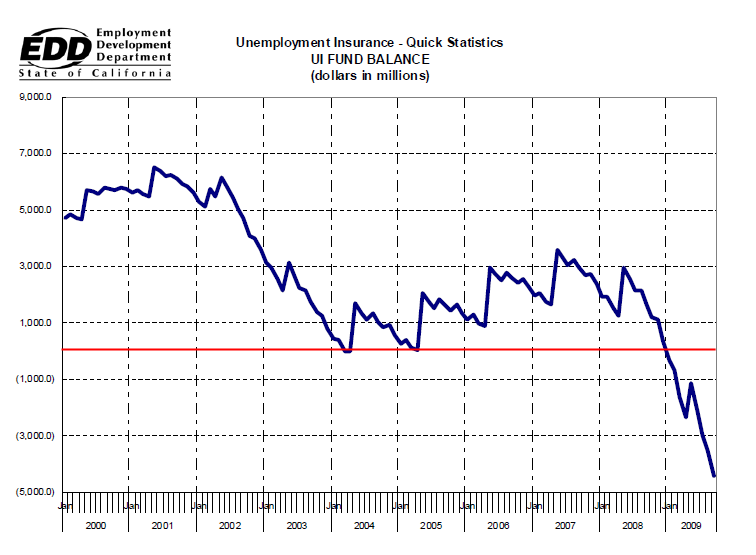

Chart #10 – Unemployment Insurance

With so many people unemployed, the unemployment insurance fund has been running in the red for nearly a year. We are in the hole to the tune of $4 billion. The money is coming from somewhere:

“Because of the insolvency, EDD obtains federal loans on a quarterly basis to cover projected fund deficits. To date, the state has borrowed about $4 billion, permitting California to make benefit payments to UI claimants without interruption. Federal loans lasting more than one year generally will accumulate interest charges of about 5 percent per year on the outstanding balance.â€

More debt and more borrowing. We are loaded up with so much debt, that by 2015 the general fund is going to go to debt service and retirement benefits.

All this of course is somehow good for the housing market. Yeah right. No need for apocalypse movies when our budgets are this bad.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

17 Responses to “Forget about the 2012 Apocalypse Movies because California has Enough Problems in 2010. 10 Charts showing why there will be no Economic or Housing Recovery for California in 2010. Unemployment at 12.5 Percent and $21 Billion in Deficits don’t Help Either.”

Doc! Thanks for the shot of reality. I am very tempted to purchase a home but also very hesitant for obvious reasons; waiting until home prices are more “reasonable” in the OC. On PBS last week the special covered the days before the crash of 1929. In no way am I an expert in economics however several events before the 1929 crash is uncanny to what our current economy is going through now. The similarities are uncanny.

From what I understand the Unemployment numbers are gathered via a poll of households where as the employment index (I think it is called) comes from hard employee tax data and actually shown the employment to be gaining in SoCal which match what I see with my own two eye as well.

The Decline: The Geograpy of a Recession by Latoya Egwuekwe

Unemployment Rates by County

(Jan 2007-Sep 2009 interactive time-lapse map)

(Especially brutal from Fall 2008 to Sep 2009 – last data available)

http://cohort11.americanobserver.net/latoyaegwuekwe/multimediafinal.html

I will put money the following……

When the FHA goes begging to Congress, rather than increasing loan standards, Congress will just give them more money to keep up “their good work”.

When push comes to shove, the Federal Government will bail out any state that is on the edge.

Bernanke has said they will do “whatever it takes” to keep the economy going, and he is proving it.

With the Government spending so much money there is no way what so ever for it to ever pay it back. The only way out is for inflation.

Bailing out states, unending unemployment insurance, unlimited help to housing fools and on and on will ignite the inflation the Fed so desperately wants yet so vehemently denies.

O! I hope young couples don’t wait too long. You really don’t need a house just because you have kids. They will love you just the same. The cuddles and kisses and ‘I love you’s’ are always worth it. I’d take a kid over a new house or car or TV or fancy clothes any day.

I wonder when California raised the sales tax by 1% earlier this year if it caused further economic deterioration or it would there be even greater budget deficits now.

Comment by martin: I don’t agree with the inflation talk. We are in a deflationary market. You can’t have inflation with high unemployment. If employment hiring dramatically rebounds in the next 18 months, then I would agree inflation will take off. However the unemployed will not find the same paying job they had. They will take lower paying jobs just to make ends meet.

And in past famines, many otherwise sane people ate their babies when they were starving. This will happen in America.

Assets on the Feds Balance Sheets

Article

My wife and I spent last Sunday night in San Francisco. On Monday, we went to Union Street, a upscale shopping district, with trendy botiques, yuppie parent toy stores, trendy restaurants, and toney clothing stores.

Two or three years ago, there were NO vacant stores on this street.

Today, about 30 % of the stores are vacant. Many stores that are still there have “for lease” signs in the window, probalbly indicating that they will make it through Christmas, and then disappear. I feel sorry for all these people who have lost their dream. This is definitely NOT the time to start a business in California.

An Ohio study proved that whenever the city, county or state raised it’s taxes by 1%, they lost 3% of their GDP. Now this was during the better years, I wonder how much they lose in GDP during the Greatest Depression.

Love your work Dr. H. As a fifty year resident of socal, I’m ashamed at the fools running this joke of a state. Speechless back in May when voters told Sacramento to stuff it, by 66%, and they still don’t get it.

thanks for your reporting

To Matt:

Inflation is generically defined as the increase in money supply. PRICE inflation is the upward pressure on the price of goods and services. They are not directly correlated and have varying consequences. Martin is talking about inflation, you are talking about price inflation.

The current unprecedented inflation of the money supply, on a global basis, will have consequences that we cannot anticipate because such an economic gong show has never occurred in recorded history. The US is inflating its money suplly at an astounding rate, but so is every other county in the world. It’s almost as if the global currencies just had a 3:1 “stock split.” There’s 3x as much money in the system, but nobody got any richer or poorer…we just got more paper. The countries that can reel it back in the quickest without crushing their economies will come out on top in this mess. By the look of things, we are not leading the pack in this area. In fact, we are heading to the back of the line by adding more entitlement programs that will cost hundreds of billions of dollars every year.

When Paul Volcker says the time is right, interest rates will triple in 12 months…he did it 20 years ago and everyone praised him for it. He is an advisor to the Big O and heads the Economic Recovery Board. Bernanke adores him. Geitner makes him pancakes every morning. Volcker is the man behind the curtain and he will do the exact smae thing he did before.

Hello 12% mortgage rates! Goodbye CA housing!

To Jeff2:

Actually, inflation is generically defined as price inflation. The inflation you’re talking about is called monetary inflation, and you’ll rarely see an economist use the word “inflation” by itself to refer to monetary inflation, unless the context makes that really, really clear.

O.k. I am utterly flabbergasted by the corruption going on with Foreclosures and Short Sales. I have a friend who had her offer on a Short Sale accepted in Calabasas. The guy bought the house for around $350 and then HELOC’d his way to well over 1 million. He wanted not only $739K for the house but an extra $45K in CASH (from the buyers) for his “Furniture”, of which there was no value at all. His Real estate agent was completely complicit in this fraud. The deal fell apart because he was able to get someone else to make a slightly better offer and put more cash in his hand. His mortgage is with BofA (DUH!) Not sure whether BofA will ultimately take the deal, however knowing how stupid this institution is they probably will.

Oh, and to put icing on the cake, he has lived mortgage and property tax free for well over 18 months and still no Foreclosure on him.

Seriously, this fraud is widespread with these Foreclosures and Short Sales. What is going on? Why is this being allowed to happen?

Matt…

Gee…..What happened here in the 70’s with high unemployment what about the inflation? What is happening in Zimbabwe today with massive unemployment.

It is ridiculous to believe we are impervious to inflation because we have high unemployment when we have endless monetary printing.

I am well aware there are deflationary forces at work at Walmart for that plastic garbage can made in China, or that flat screen TV from Korea.

Did you hear about the 30% increase in tuition costs? How about the numerous copay increases my Fathers Medicare is having or medical costs in general? Or water rates in San Diego about to go up 10%?

Housing, was never used to calculate the CPI so it going down is mute at this point. The government considers housing an “investment” and it is neither inflationary or deflationary when it moves. Rent on the other hand is part of the calculation but with so much manipulation with the housing market, market signals are mixed up.

So, the things we buy at walmart are the real deflationary force at this time, outweighing everything else and that won’t last.

By the way, China has tens of millions of unemployed and they have 8 percent unemployment. How is that possible? If there inflation continues, gee, I wonder if that plastic garbage can from China will go up?

Now I won’t even get into how the CPI is even calculated in the first place but I will ask the older posters here…………….Remember when you could buy a blender (just one small exaple) that would last 15 years for 75.00? Now you can buy that same blender for 30.00, HUGE price reduction captured by the CPI. Only one problem, the 30.00 blender only lasts 1 to 3 years and is not captured by the CPI.

Just one example of the CPI trickery. http://www.shadowstats.com/

Wave of Debt Payments Facing U.S. Government

The ultralow interest rates the U.S. has been paying on its colossal debt may not last much longer, and the White House estimates that the tab will exceed $700 billion a year in 2019.

How do you figure $1200 in annual taxes. I think you’re about 4 times too low!

Leave a Reply