Inventory slowly creeps back into the California housing market: Homes for sale in Los Angeles up nearly 18 percent year-over-year and price gains stall. Cash sales still a big part of market.

Inventory is finally starting to show up in the California housing market. The main motivator of this growing inventory is the delusional prices being asked by sellers are no longer generating massive amounts of sales from house lusting buyers.  In other words, sky high prices have caused many homes to sit on the market longer thus allowing for more inventory to accumulate like a queue forming at a Disneyland ride. Can’t blame the sellers if suckers are lining up to hand over their cash for a mortgage albatross. The rapid increase in prices uncoupled from wages has left many California household unable to afford current prices. House lusting Californians are either hot or cold on real estate. Rarely are emotions in the middle in this manic state. The market has been sizzling for the last few years mostly because of speculators and Wall Street hot money flowing into the market. Sales volumes are incredibly low thus reflecting a distorted market. Those lusting for houses will simply dive in regardless of larger macro-economic trends and are largely chasing past gains as a predictor of future trends. It is no surprise that inventory is rising and prices are stalling out. Those “all cash†sales still remain a big part of the market.

California housing inventory

There is little surprise that inventory is picking up this year and we are seeing more homes sit on the market for much longer durations. In certain markets, house yearning buyers are so motivated that they will still dive in regardless of the larger trends. Some areas will always carry a premium. Yet the overall trend is unmistakable.

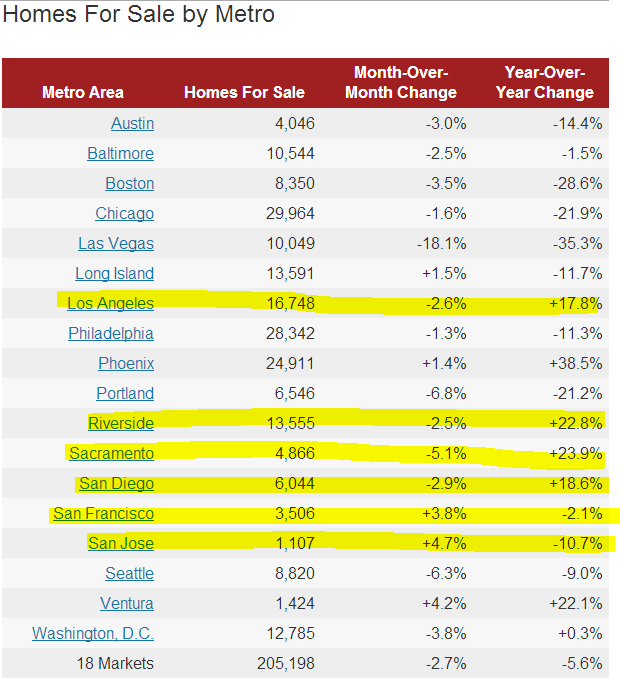

Take a look at the rising inventory across California:

For Los Angeles, inventory is up a solid 17.8 percent year-over-year. Riverside is up 22.8 percent. Sacramento is up a whopping 23.9 percent. San Diego is up 18.6 percent. Ventura is up 22.1 percent. In other words SoCal has a growing share of inventory. The Bay Area is bucking this trend with inventory actually down year-over-year.

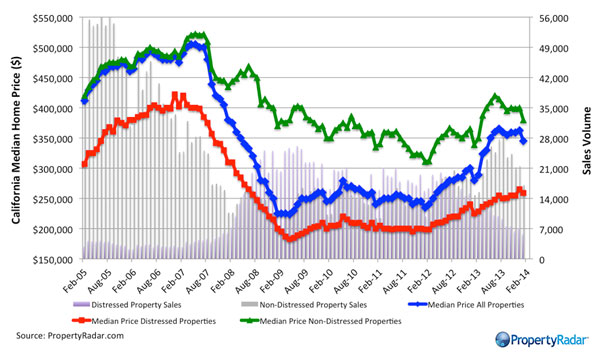

A big reason for this is the fast rise in prices in 2013 coupled with low inventory:

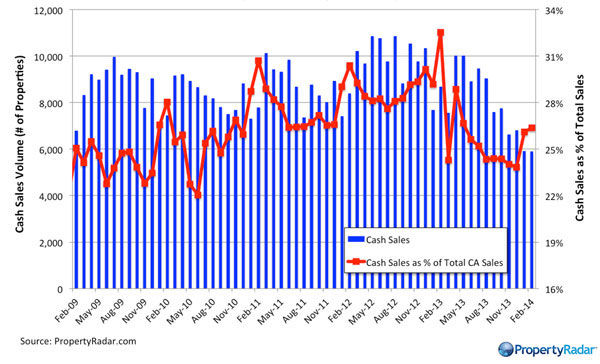

Based on the data above, California home prices went up roughly 30 percent from 2012 to the current price level. Yet look at sales volume above showing a very weak start to 2014. The trend is definitely softening. Cash sales remain a big part of the market but overall the nominal number of transactions is falling:

At the peak over 10,000 cash sales a month were taking place. Today they are below 6,000 (a 40 percent drop in overall volume). However, cash sales remain a big part of the overall percentage of sales still making up over 26 percent of all sales in the state. I was speaking with an investor and he mentioned that most of these data sources are based on MLS transactions. That is, sales done off the books are not registered here (i.e., many auction deals). Most of the big cash sales may happen via auctions or deals negotiated with banks hence the discrepancy in cash sales figures between different sources. Based on that, it is safe to say that cash sales remain between 30 and 35 percent of all single family home sales in the state but certainly are dropping from their peak.

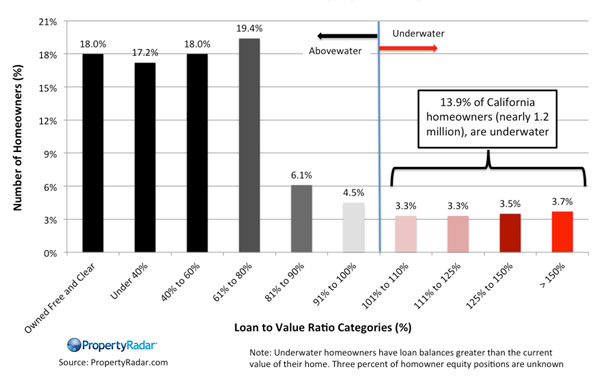

The underwater home owner

California still has a large number of home owners underwater on their mortgages:

1.2 million home owners are underwater in the state. It is very likely that home prices will stall and likely fall year-over-year statewide by the end of the year if the current trend continues. How this will impact the fragile psychology of California buyers and sellers is yet to be seen. Lust and rejection seem to be the two temperatures for California housing.

There are a few signs of tipping points in markets. One is rising inventory coupled with falling sales. Check. Another is prices stalling out or reversing. Check. Another is euphoric asking prices on condos which usually tip over first before single family homes.

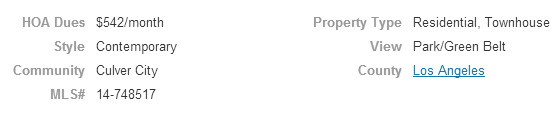

Condo in Culver City

5111 Bounty Ln, Culver City, CA 90230

3 beds, 3 baths 1,743 square feet

Culver City has reached a new peak in terms of prices. Inventory has been tight since 2009. The above condo is listed at $699,000 (to show up on those search engines below $700,000). Condos typically are the last resort for house lusting buyers to sneak into prime markets. So you want to buy this place? What is it going to cost you?

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $139,800Â (20 percent down)

Closing Costs:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $8,500

Total cash needed:Â Â Â Â Â Â Â Â Â $148,300

PITI and HOA:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $4,019

You can rent a similar place for $2,700. Here we are assuming of course a big 20 percent down payment which is rare for first time buyers which I assume would be the audience for a condo purchase. I usually get market analysis from investors but these have dried up over the last year. This place is not a good candidate for a flip. To buy for appreciation? Doubtful. Zillow already has this area at a new peak:

For someone shelling out close to $700,000 for a condo you would expect a professional family with a solid household income. But again, this is a condo. People forget about HOAs on these places:

I love how people forget or omit “minor†things like this. Say you pay this place off in 30 years. You still have the HOA, insurance, and taxes. Even today, these few items will eat up $1,270 per month sans a mortgage. This kind of pricing is typical and is fully reflective of a bubble. The fact that inventory is creeping back in, prices are stalling out, and sales volume is so low tells us something is shifting in the market here. Plus, California is stock market happy so we better hope that 170 plus percent rally in the overall market continues from 2009 since a big portion of tax revenues come from capital gains and tech companies (which is a big boost for the Bay Area).

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

163 Responses to “Inventory slowly creeps back into the California housing market: Homes for sale in Los Angeles up nearly 18 percent year-over-year and price gains stall. Cash sales still a big part of market.”

It is painful and instructive to read this forum. You got the largest real estate decline in the history of this country. It simply wasn’t enough for many of the powers that be. Therefore you sat on the sidelines 2 or 3 years ago b/c it had to get “even worse.” Sometimes you don’t get a second chance at a first impression. I can’t tell you where house prices will be 10 years from now or 6 months from now. I can tell you that the dime cup of coffee is not coming back. Sorry. So keep pounding the pavement about how ridiculous it is. You had your chance.

Yes, yes, we all had our chance and we all will get another chance – the early 80s, most of the 90s, and the turn of this past decade taught us that.

BTW I did take the chance and bit the bullet at the end of 2011, even though I thought the market would continue downward for anywhere from another year or two to bouncing along the bottom for quite some time. By my calculations I figured at worst it would lose another 10% at most from my purchase price, but it didn’t affect me because I put down a lot (30%) and got it at about 40% off of peak “value”. I bought at the post bubble peak/pop bottom for my neighborhood, at least thus far.

But I wouldn’t go and bash people who waited and didn’t jump in between 2009 and 2012 or so, as nobody could have predicted the massive scale of ridiculous government interventions that for all intents and purposes fucked the little guy over and then some. It was the greatest transfer of wealth, assets, property et al. from the common man to insiders i.e. theft in human history. While there is no true free market and capitalism and never really has been, the system was rigged beyond anything that virtually anyone in this country could imagine.

“It is painful and instructive to read this forum.”

Yet, here you are.

You missed instructive.

I didn’t miss anything.

April Fool’s Day was yesterday, “Buddy”. You’re a day late and 2 scoops of ice cream short of a milkshake.

Nope, not nearly that simple…I wasted a year trying to buy in 2011/2012 (in Norcal, Sonoma Co.) and did NOT have a chance, everything I bid on went to a 100% cash flipper or specuvestor. Had an excellent job and credit, could have put up to 50% down, had a preapproved loan for much more than I needed and none of that mattered as all my offers (at full price or slightly higher) were ignored. Have retired in the meantime and MAY give it another shot when this bubble pops and if it does not look like a complete waste of time. I did buy before in 1997 in a normal market and it was relatively easy…looked at about 10 houses, made two offers, one was rejected and one was accepted…sold that place in 2007 thanks to following some blogs that are similar to this one and predicted the pop quite accurately. I bought that place to live in, not as an investment, and if I buy again it will be for the same reason…

I hear this all the time. “I couldn’t beat the cash buyers.” I bought in SoCal last year. Beat 20 offers, 7 all cash, on a hard to find property. We had 20% down. The offer you make has to make your loan as good as cash, ie, 100% probability of closing. 1.) Negotiate a reduced fee with the buyers agent (hopefully you know someone with a RE license), this means more money to the seller 2.) Talk up a relationship with the loan agent ex “In my years working with agent X I saw her and the appraisers at X company make deals happen after the big banks dropped the ball” 3.) 2nd loan run in tandem with 1st loan (eat the appraisal fee) (yes I did that. Was able to leverage loan two with better terms against loan one. Loan two ended up rejecting the deal due to the massive unpermitted structure…but loan one didn’t know that) 4.) Waive your appraisal contingency up front and state, showing proof of funds, that you can make up any difference between sale price and appraisal. 5.) Have the best offer, offer price 6.) State why the house is special to you. A flipper can back out for petty reasons during inspection or ask for unreasonable repairs because he can just get another place. Lie and say your mom lives one street over. I had a great lie in my letter. Why do buyers pay real estate agents? RE agents need to work way harder for buyers with loans. I should work as an agent again.

Decline from what? The worst, most destructive housing bubble in human history?

Dummy.

Largest decline halted by a one two three combo of first time buyer credit jab, fed rate golden parachute powerpunch, and banks holding mark to book properties forever hay maker hook.

The decline that got knocked out by market manipulation.

“Largest decline halted by a one two three combo of first time buyer credit jab, fed rate golden parachute powerpunch, and banks holding mark to book properties forever hay maker hook.

The decline that got knocked out by market manipulation.”

Perfect, pithy summary. Only thing I can’t figure out is how long they can keep it going. Looks like forever right now, but I didn’t predict the manipulation so I can’t expect to foresee how things are going to end.

Hi Buddy,

I know you got plans to sell your shack and retire and no longer have to do real work. But, oops, looks like that ain’t gonna happen. Better run out and sell that house now before you chase down the market.

Hey Buddy, eat your heart out. I’m in a rent control area and saving lots of money. I put some of that money into various stocks and made more than I would have in real estate. Now I’m putting my money into other investments. I don’t need Southern California real estate. When I buy real estate it will be somewhere else. I already have a few places spied out.

Over $500 in HOA fees. The place is beautifully landscaped, but wow. The location backs up to W. LA College and an oil field. But, I can’t see this location losing value any time soon.

Think about this. The U.S. will add 60MM people by 2050, I think. What will the value of this condo be in 30 years?

My guess is $2.5MM. Who wants to take the over or under on this? What say ye, Dr. HBB readers?

Ill take that bet. Ill bet u anything u want that it wont even be near 2 million, let alone 2.5 million. Your making assumptions that 60mm people will be added to the US? YOur point? Are these 60mm people going to have jobs? We cant even find jobs for the 11 million unemployed right now, and you think by adding another 60mm people its going to increase housing prices. There is only so many resources to go around, and the economy needs to grow to add more people to the work force. No job no mortgage no house. You dont even know if California can solve its drought problem, and your looking into 2050? Your assumptions are total off base and ludicrous. Finally, since your nostradamus, i would like for you to give me the lottery ticket numbers for next week since you know exactly whats going to happen in 2050.

Sheesh. I was mostly just kidding around.

@Chris D., kidding or not, L.A. County has one of the worst U-3 unemployment rates (10%) and U-6 underemployment rates (20%) in the U.S. for 2013 (see: http://www.bls.gov/lau/stalt.htm). Even Nevada, Florida, Arizona, and Michigan (home of Detroit), had better employment rates in 2013 than Los Angeles County.

Also, local government spending is out of control (Culver City: http://publicpay.ca.gov/Reports/Cities/City.aspx?entityid=179&fiscalyear=2012) (Torrance: http://publicpay.ca.gov/Reports/Cities/City.aspx?entityid=239&fiscalyear=2012) (Pasadena: http://publicpay.ca.gov/Reports/Cities/City.aspx?entityid=218&fiscalyear=2012). These SoCal cities pay salaries that make Silicon Valley companies like Facebook, Google and Yahoo look positively fiscally frugal.

At some point, I expect Culver City, Torrance and Pasadena to join the likes of Stockton, Vallejo and Riverside County in the bankruptcy court system. Their public pensions are going to be horrendous. The only way these cities can pay their future public pensions would be to bleed their residents dry. If they do that there will be a mass exodus of golden handcuffers throwing in the towel, selling off their homes and leaving SoCal.

2m would be close if housing followed historical inflation.

OC went bankrupt 20 years ago and it had little affect on the residents or their housing prices.

You’re making a categorical error of the first magnitude.

Real estate prices are set by the ability to finance the deal.

In most markets, in most times, the marginal buyer has to use financial instruments/ time payments to purchase his own home.

Population growth, per se, actually has nothing to do with that metric.

It’s the kind of soft thinking used to gull proles by hustlers an real estate agents.

A century and a half ago America tolerated wide open immigration. There was no such thing as an illegal immigrant ( ownership exception: the Yellow laws — California in particular )

Real estate prices scarcely moved. Instead, the newbies were crammed into slums — up and down the East Coast.

Like today’s (Mexican) ‘clown houses’ the immigrants were just jambed in, ‘hot racking’ when necessary.

This repression of common wages occurred in the time of the robber barons.

It didn’t end until WWI — and Henry Ford. ($5 per day) (1912) (This wage ramp went national.

It’s critical to note that in 1912 Ford could not get away with hiring immigrants for his assembly lines. He needed native born Americans that understood practical mechanics and had a working command of English. (– even if mom and dad still spoke the mother tongue back home.)

This stood in marked contrast to the dis-assembly lines of Hormel and Swift: the packing houses.

(The assembly line as we think of it started with the packing houses — not the manufacturers. You can understand why. They were mimicking the nations rail roads!

The difference being that they used an over-head monorail scheme and rolling meat hooks. That simple scheme was enough to increase any butcher’s efficiency rather remarkably. You could spin the carcass around while cutting. Absolute newbies (immigrants) could be trained to cut just this or that in very short order. And, after a fashion, cutting is cutting, sawing is sawing.)

Henry Ford knew from the ground up that he couldn’t use immigrants. They were all ex-farm boys — from a nation that had no mechanical gear on those farms! He needed to stay with natural born mechanics who picked up a fair level of skill with mechanical harvesters on American farms. By 1912, an entire generation of American boys had that seasoning.

%%%

Which brings us to illegal immigrants today. They can’t fit in in modern American assembly plants. As ever their primary ‘calling’ is to cut up chickens and cattle. The dynamic is unchanged in a century.

Which means that they’re not destined to rapidly rise into the middle class — even when generations pass.

Keeping them second class by way of legally sanctioning a Latino sub-culture amplifies every ill. In economic terms, we’re permitting neo-slavery. The rationales used two centuries ago still echo today.

However, lacking the required per capita income, these modern neo-slaves will end up in clown houses and slums time and again.

Real estate prices will NOT move up because they’re simply deserving, nor because they want better habitation.

If life is bad in southern California for undocumented aliens, they will leave to another state or back to Mexico, whose economy is doing well and where they have family and so many other good things. The undocumented aliens will only stay in southern California only so long as it offers a better place then elsewhere. The problem is the liberals who talk a good talk, but don’t pay all their workers a living wage. Support the SEIU for a better California.

Thanks for the ree-ply, blert. It’s been a while. I’ll assume you’re taking the under, which is the wise course.

I had a boss who was once in PR for Iowa Beef Processors. He used to tell me about all the innovations in meat dis-assembly, as you say. Fascinating stuff.

As a student of American political history, I’ve always said, “Never underestimate the power of giving people someone to look down on.” Establishing a perpetual Latino underclass will be the perfect palliative for middle class Americans’ frustration with the 1%.

Phoenix really shot up, many underwater are trying to break even or maybe take a small loss. Buyers who check public records will find a bargain is out there and now is the time to offer these folks a way out, ( buy them out of their headaches)?

The rest of Cal. consider the sheer size of the place it is always about the local zip code there, it still looks like buyers are not in the driver seat yet, especially in the top zip codes.

As for you robert, why dont you take your insecure comments and go to the housing “always goes up” or the “location location” or the “my house is the best investment in the world” blogs and gloat about how wonderful housing is and what a great investment it is. You just come one her spew garbage and troll about how u think housing is such a great buy. “Buy them out of their headaches”(didnt you just prove that buying a house is not a good idea right now since people bought during the peak and are barley got back to even. Now they are trying to get out before its to late?) LMAOOOO. Yeah, lets go buy an overpriced phoenix house so the rest of us can end up like them holding the bag? I bet you are one of those phoenix people hoping people on this blog jump in and buy your overpriced piece of garbage.

You’re close, but small r robert aka “bobby socks” is some Phoenix shill R.E. agent or realtor, ex used car salesman. He’s no doubt trying to drum up business to get the suckers he sold into debt slavery the last go around out of their headache and pass that migraine onto a new batch of suckers. Double ending the deal, of course, to fuck sans lube the previous owners i.e. the sellers this go round for the second time and the new owners i.e. the buyers for the first time. Then in a few years he will again go for the second fucking on the new owners. Assuming of course one of his disgruntled clients hasn’t had him driven out into the desert and put a couple slugs in him by then.

Let me just take you back in time, Dow 7,500 I said buy because it is going to 18,000 in late 2014, of course I’m crazy at it stands it is 16,500.

I’m not RE agent but a residential and commercial investor and former part owner of a Infiniti dealership. I think I know a little more then the most because I have played with the big boys in the financial world and I understand capitalism and cycles of life.

It is with deep regret many can’t afford a home, but nobody is going to feel sorry and give the public a 50% discount because life isn’t fair and neither is house prices or anything else?

It is 2014 not 1974, houses, cars, eggs, spray paint etc are not going to be where they once were.

CraigLister…When it gets to name calling and threats I like that, I know I got you thinking now, maybe this guy isn’t off is rocker, I can’t let him know that but just maybe a different take isn’t so bad.

Stats are just that, a team can roll up 600 yards of offense and guess what they lost, housing can change on a dime either way really, all it takes is more good news then bad or vice a versa. What the stats say today as a investor needs nothing to me today went away, it is just a number, buying and selling is a state of mind, if the public perceives things are getting better they will buy.

Little “r” – You know nothing about the “big boys” if your life is part investor in an infinity dealership and dicking around in RE investing. I have 20 years in corporate finance with fortune 500 companies and I know very little. I guarantee you know less than the little I know. You are no different than all the clowns of the dot com boom who thought they were geniuses because they made money no matter what they did as long as it was long/buy. You really are adding nothing at this point to the conversation. You are getting a little tiring hence the ad hominine attacks.

What? I think we’ve smashed robert to the point of boredom the past few threads 🙂 I’ll most likely ignore him going forward. He’s not even a “fun” troll at this point…

NihilistZerO – Agreed. We should treat little “r” like a child where ignoring him would be the best punishment.

rOBERT says:Let me just take you back in time, Dow 7,500 I said buy because it is going to 18,000 in late 2014, of course I’m crazy at it stands it is 16,500.

Peak Bubble 2.0: The Market Is Now Exactly As Overvalued As It Was At The Last Bubble Peak

http://www.zerohedge.com/news/2014-04-04/peak-bubble-20-stocks-are-now-exactly-overvalued-they-was-during-last-bubble-peak

hello robert,

love your insightful comments. i think the car business will miss you. your comments should most definitely be posted here: https://reg.realtor.org/roreg.nsf/pages/MyAccount?OpenDocument&Login

It’s April second, but the fool robert is still here.

I miss Jim Taylor…

As an agent I really hope that prices and or rates drop. Payments are currently too dam high for people to buy and feel proud that they got a good price for their home. In the end the value of a home and its interest rate will not matter since the banks know how much you are willing to spend on a home. They will adjust….

As an agent you are only getting paid for closed deals and completed transactions. Sounds to me, given you are hoping for price and rate drops, that things aren’t going very well right now i.e. sales have dried up.

Looking a LOT like 2007 – market peaks, asking prices continue to be sky high and beyond the realm of reality, sales suffer a huge hit, market stalls as sellers and buyers each wait for the other to blink, sellers begin to drop prices a few months later as inventory builds and builds…

Agents are hoping for price drops because lower prices will increase the pool of able buyers. Many agents are stuck wasting time with buyers right now and these broke buyers cannot afford the inflated prices. Additionally they cannot compete with the cash buyer horde. In my market area, the sellers are still holding all the cards.

That being said, the market has reached its peak once more. It is starting to feel a lot like April 2007 again 🙂

It’s nothing like 2007 YET… first of all.. Did all cash buyers make up 35% of the market in 2007? NO! Were liar loans and ARMS making up 70% of the market in 2007? YES.

Except in fortress areas.. home prices still are a good 30% from peak 2007 prices. There’s still some room to run… but not much room for a crash. The wealthy fortress areas… no one is letting go of that ALL CASH home purchase.. or mortgage rate of 3.5% 30 year fixed. only from their cold, dead hands.

@ nothing-

multiple things point to a market top. read the data. although some areas are well below the “07 bubble top” now that was a fake top based on fake financing. affordability is at an all time low. you said it yourself, cash deals and that’s what has driven the market up. no real organic buyers, first time buyers or move up buyers driving the market. now look at blackstone and the other buy to rents, starting to sell that big book of rentals that were supposed to pull 15% returns, lucky if they get 4%. on top of that we have new UW rules and rising rates. highest i’ve seen in some time were actually today 30 fixed conventional @ par is at 4.375.

the similarities to 07 are striking.

Having bought a 3/2 in South Torrance in 2005 and being forced to sell in Aug., ’07, I can tell you that this market feels a lot like mid-2007….earlier in 2007 we almost had a couple on the hook for $70k higher than we eventually sold in 2007. By mid-’07, buyers had started to cruise just to peruse, waiting for a better deal. We ended up selling for same nominal price as 2007 (minus improvements). Mass specuvester psychology was a real driving force in RE then as it is now. Buyers and sellers now in zero gravity weightlessness after terminal velocity has been reached?

If you are a real estate agent then why should you hope prices drop? If they do, when is the real estate industry going to drop their commissions to 4%?

You can’t fig. that out? Sales volumes are at 2 year low. A realtor would rather sell a house at 700k and move on than have multiple open houses for a 1 mio house.

Seriously, this is checkers, not chess and you still failed.

I’m a broker. I take and sell listings @ 4% all day long. I explained why agents would want prices to drop above.

There are some ethical realtors/brokers out there who legitimately care about the health of the market and also want a good deal for their clients. Being in RE doesn’t inherently make one unethical or completely selfish.

I argue with some of my friends in the business (I’m not in the business) over our relative bull vs. bear views, but in a few cases I really do believe their heart is in the right place. I certainly know a few who are just in it for the money.

That said, there is also self-interest in wanting a livelier market. As others have noted 3 easy sales at 400k/each will net a better commission than 1 (or worse, 0) at 700k.

Rate pop, price drop and hopefully the fedlers will let whatever crap the banks still hold on their balance sheets turn with a less controlled RE market.

Probably not, the reserve board banksters gotta have people to hobnob with in the Hamptons and they ain’t in the 99%.

They aren’t setting rates for the working and middle class. But they can sure keep the people scared with “you don’t know how bad it will be if the FIRE TBTF goes down in flames.”

If we look at homeowners who can’t sell, we should add the homeowners who are above water but have less than 20% equity, as the cost of selling would wipe out most of their profit or require that they bring some cash to the table. And of course they wouldn’t be able to buy another house.

You need to separate SoCal from NoCal. Two very different worlds. We pay the tax and fund the government. You people(peeps) in SoCal eat our money. Separation is called for. You will notice that the market is hot in Google land and running cold in SoCal(Aztlán).

Okay, let’s split. You get Fresno.

Pricing is hot for a bunch of morons that equate their home to social standing. You’re buying a pile of sticks and going broke doing so. Bunch of fools.

Don’t you mean “Bunch of women?”

Homes are bought by housewives.

That term of art is revealing in and of itself.

The urge to have a nice nest is profound — and is a feminine imperative.

Men will tolerate terrible sleeping arrangements — a legacy of the ancient hunt.

Women want, will always want, the best nest that they can attain.

It’s a law of the human condition.

&&&

The current social nightmare is that young wives today are being shoe-horned into homes smaller than that of their childhood… all too often.

That makes for bad marriage karma.

If she’s unhappy, no-one’s happy.

Where would Twitter be without Hollywood?

Twitter has it’s uses. All my feeds give me info as fast as Reuters/bloomberg w/o having to pay. The ZH feed is excellent as well as others. There’s also the social unrest movement.

Dr. HB, how about some articles featuring Real Homes of Genius (TM) contenders. No shortage of properties on the market (and recently sold or pulled properties) that could compete for the championship title. Readers could vote on the worst “deal”.

I’m seeing prices being lowered on many existing properties in North San Diego County where I’m looking.

Look, it is understandable many can’t afford the American dream even if wages do rise many will have a difficult time with 20% down and closing cost etc.

I can say this with certainty, if there was affordable housing with little down payment guess what, you are still going to have foreclosures with these folks. It is just the facts.

Many people are lets say are not good with money, have poor credit, and always have debt.

Most want a neighborhood of responsible homeowners, not folks who barely got in and can’t afford the HOA let alone dead grass in the front yard, that is what you get with cheap housing and creative financing ie very little down payment?

Affordable housing? You’re making the home buying process sound like waiting your turn for Section 8.

Your logic is of a brain salad.

The single metric that shifts with easier financing is the transaction price.

It goes straight up.

At the margin, homes are sold to housewives based upon the husband’s ability to finance a mortgage.

Prices keep moving north until the market (developers) has saturated all of the demand that can be financed.

So there will never be a time when some homeowners are not ‘on the bubble.’

Reducing the downpayment shifts the risk straight back to the lender.

At this time, that lender is Uncle Sam, via various front institutions.

This is a terrible development because in our modern money system, the money supply is (largely) determined by real estate lending. (in normal times, eg: 1933-1998)

This is so because modern American money — in normal times — is created as a real estate debt backed instrument. (mostly)

[Strictly speaking, any commercial lending expands the money supply; any repayments shrink it. The size of the ticket and the length of the maturity make mortgage linked debt-monies by far the dominant source.

Ordinary swings in non-real estate lending are the fulcrum of classic recessions.

When a massive swing in real estate lending occurs the contraction is termed a depression. Forget all that stupid propaganda about “Great Recession.” We’re in the Greatest Depression. It’s far larger, will last longer, and affect more nations than the 1930-1940 Great Depression. The next leg, Red China’s super contraction is just now beginning. It figures to be epic, by any standard. Massive contractions in Canada and Australia are coming very soon.]

As this mega-contraction unfolds, an astonishingly large fraction of the population will find that THEY can’t hang on to their homes. Prices will retreat and jobs will be lost.

At this very time, many, many, jobs are make work — and financed by wealth taxes spewed forth by the central governments of this world.

Enough folly X Enough time = Shattered dreams.

So what to do to prepare for this Greatest Depression? Given that the vast majority of people are not big fish insiders, how does the little guy go about protecting themselves? Buy physical gold, silver, and other precious or semi-precious metals as a means of protecting one’s wealth? That didn’t work out too well for the little guy in the last go round when FDR issued confiscation orders for privately held gold.

Your take is that the shit will hit the fan big time…so should one be or become a “prepper”, buy some self sufficient land i.e. farmland out in the country somewhere?

Blert, you’re scaring me.

How’s Sonoma County ranchland going to fare through this ?

Actually this is one of blert’s rare coherent moments. He must have found his meds. As far as predicting the future, I am not convinced that anyone has that great of power at this point. However, I believe that even incoherent blert would admit that every boom in history has had an equal and opposing bust. There are so many booms in current society that I know that something has to give in the near term regardless how much debt/funny money is created.

“At the margin, homes are sold to housewives based upon the husband’s ability to finance a mortgage.”

This statement is incorrect. By far, most homes are purchased by families reporting two incomes. The single income family was actually an anomaly and even then severely circumscribed by class, race, region.

Not your central point but couldn’t just let that go.

blert,

that’s something serious about the modern money system that money supply is backed by real estate lending. This is the first time I read that. Really interesting.

By the way, our beloved elected and non-elected leaders have found the secret sauce to fix this: to buy all the real estate assets such as MBS to keep price from falling. This can happen in all other countries too. Who is going to stop them when they are in charge?

Agreed with What that this is one of blert’s more coherent comments. Nice and concise. It demonstrates why comments that point to differences between now and 2007 being the reason why “it’s different this time” are misguided. The underlying problems were never solved. blert points out the cause instead of focusing on effects – a critical distinction.

Prices are starting to exceed what most can pay and that scares people pretty quickly. A pull back is in order as rent parity is now in the rear view mirror.

Pheonix up 38%…..Lots of people looking to get outta Dodge at the price level that was driven up last year. This is real overhang.

Also, frankly I think a lot of people are simply getting tired and fed up with this bullshit.

The bounce is always biggest off the bottom. Digestion of some of these gains will take time. That is different than the people on here calling for a wholesale collapse again. Fighting the last war. That doesn’t mean you should buy today or in CA for that matter. Just dispense with the doom as it is not helping your cause. Group think is a nasty thing. The truth is somewhere in the middle

Leave the poor straw man you’ve constructed alone. Most on here are not expecting another 40% drop. It’s the irrational recent run-up that occupies most of the landscape on this blog.

Thank you. Can the recruitment agenda by the housing status quo benefactors possibly be any more transparent? Their formula is distract and label alternative perspectives as doom, repeat as needed.

Group think is what caused the housing bubble in the first place. Math was trying to win out, but group think when prices are going UP UP UP like in 2005 and today is hard to reason with.

Math is telling us again that prices are unsustainable, but again, house mania group think is tough to reason with….but HEY, maybe THIS time it’s different!!!

We never hit the bottom in real estate. We never cleared the market. As Timothy Geithner said “we are foaming the runway for the banks.”

We are witnessing the greatest monetary experiment in U.S. financial history which is distorting asset prices by design. So far, we have been rewarded by playing along. So far, we have done what Ben Bernanke encouraged us to do. The question that we must ask ourselves is “what’s all of this going to cost, and will we ever have to pay?” My belief is that we as a country won’t make that decision.

This. The market was prevented from finding its natural level. Problems didn’t get solved – only symptoms were treated. A dam was constructed and now there’s cheerleaders out doing everything they can to recruit more folks to build downstream. Anyone with the sense to say “look out below” gets labeled as a doom and gloomer in ad hominem fashion.

Some people are commenting that housing prices are down except in popular areas. That’s true, but wages are also way way down in those areas too. Wages are just down, and that’s average wages which includes older people who are established in their careers. What will the data show when these older people retire and it’s just the younger generation with their low wages? How low will average wages appear then? Will housing still be over-priced?

What isn’t yet commonly understood is that wages and wealth for 99.9% of us are basically down. Only the top 0.001% have seen gains. And those gains have been massive. Thanks to the Supreme Court, that 0.001% is being handed greater and greater power to influence policy-making to further ensconce and enrich itself (“itself” instead of themselves, for, “it” is a monolithic power/influence block) for generations to come.

Also, check this out. Expensive housing is causing educated people to leave major cities

http://blogs.wsj.com/economics/2014/04/04/soaring-housing-costs-driving-educated-people-from-big-cities/

“What isn’t yet commonly understood is that wages and wealth for 99.9% of us are basically down. Only the top 0.001% have seen gains”

Not quite. It’s close to the top 20% have seen gains, the middle 30% stagnant and the bottom 50% declines.

These days it’s going to be the top 20% that buys RE anyway, and they have so much additional cash, they’re buying multiple properties.

That’s why comparisons to median income are misleading, since the median income won’t be buying homes in metropolitan areas. Median income/median homes prices are best used for places where there’s constant supply of new construction being built to compete with resale homes.

Thanks Mark for your insight.

Dr Yellen at the Fed has assumed the mantle of pity for the common man alleging tapering,whilst within a 24hour period of her speech,sprayed $113Billions to the banks via bonds.Hundreds of billions of dollars given the banking elite who are regarded as somehow superior to you or I just reminds me a tad of Wat Tyler of the English revolution,which failed because the aristocrats were not beheaded,and the French revolution which was a success,depending on your position of course,were aristocrats were beheaded.The lesson seems to be behead the aristocrats although how that is decided today is quite worrying as the POTUS has told us those earning more than $250K are the rich and by default aristocratic.

Now what effect will this largesse have on property?Karl Denninger has pointed to the massive deflation in bonds that the Fed is determined to be never accounted for.Whilst the accountants whore themselves to a gun toting elite via FASB157,how will price discovery occur?

Here in London with the threats of Russian sanctions property in super prime areas are selling to Russians,Ukrainians and Turks like hot cakes whilst the Chinese are unloading,what gives?Out side the super prime area property is struggling no matter what our bought and paid for media says.Post our 2015 election bankruptcy awaits property builders who will again be propped up by the peasant tax payers and now we are back at a Wat Tyler figure 700 years late again!

Only problem is, prices continue to steadily rise. The biggest mistake one can make is delaying a home purchase while prices are rising.

The slower sales is just a distraction. While inventory levels are up a little, they remain very very low. The slow sales is just a result of little for sale.

And, while one can always find some overpriced homes where price reductions occur, this is also a distraction.

If you want, you can wait another 10 years to purchase … you will land up paying much more for a worse location.

Lets take a look at today’s data, fresh from Redfin:

The number of homes for sale in LA County is up 10% vs last year, while the number sold is down 17%

The number of homes for sale in Orange county is up 33% vs last year, while the number sold is down 15%.

So, inventory continues to rise while sales continue to plummet. Sounds like a great time to buy, right?

From the THEORETICAL point of view if you are a contrarian investor, yes, you do buy when everyone wants to sell and nobody wants to buy (less competition). It must be a serious reason to have a depressing psychology for most. It takes “steel” nerves to go against the flow under the “serious reasons”.

That said, I am a “bear” and believe SoCal is in a bubble; but that is my opinion.

The biggest mistake a person can make is delaying a home purchase while prices continue to rise? No, I’d say the biggest mistake a person can make is overpaying for a property in general, the most extreme case being purchasing at or near the height of a bubble (and/or leveraging themselves beyond their means such as with creative financing).

My rules for making a home purchase:

* What is the house Worth? By which I mean, what will its likely resale value be when you might want (or need) to sell it? Will its value at least hold up from what you’re paying?

* Related, will the Neighborhood hold up? Is it a safe neighborhood? Is it gentrifying? Whose likely to move in? People with the money to pay for upkeep and property taxes? Or people requiring government assistance, who’ll import crowded households, loud parties, drunkenness, drugs, crime? This is not strictly about race, just that rich neighbors are better than poor ones. Even if the rich have social ills, they keep it indoors.

* Can you Afford the house? Does your home purchase still leave you with a financial cushion in case of job loss or business failure?

* Do you Want to Live there? If the house’s value goes down, can you still afford it, so that you’ll be living in a neighborhood you like? In which case, it doesn’t matter if you’re underwater. You have a nice place to live that you can afford.

It’s not about over or under-paying. It’s about finding a house that you like, that you personally can afford, in a neighborhood in which you want to live in.

For most of the L.A. area house prices I see, I’d offer LESS than the asking amount. Which means I’ll likely not get it.

That’s okay. I’ll probably move to Seattle or Portland this year. I already did some house-hunting in Seattle last December. I’m prepping to go back.

jt is right everyone! Quick buy now or forever be priced out! Real estate can only go up! God ain’t making anymore land. You gotta live somewhere. This time is different…

This is why “no one” saw it coming the last five million times. They don’t want to see it. You will see what best suits your personal survival. It is just the monkey/lizard brain doing what it is programmed to do. Convince yourself that everything is ok continue to eat sleep and mate until the lion shows up and then you remember “oh yea, I am prey not predator”, piss yourself in fear and run!!! Then, if there is a then, you will eventually convince yourself you are safe and start all over again…

About 18 months ago, everyone on this blog was singing the same tune. Prices are too high. Incomes are not rising. Everyone is waiting to unload their homes. Rental parity.

18 months ago, original 3 bedroom homes in east Manhattan Beach were available for less than 750K. Now, they are running about 1.3M, if you can get your offer accepted. And, everyone on this blog is saying the same thing.

It is clear something is wrong with your analysis. Multiple offers on decent properties are still the rule.

The monkey/lizard brain has extreme negativity bias. It acts faster and more strongly than our more developed pleasure/approach brain so that if that rustle in the bushes actually is a lion then we’ll live another day to enjoy that meal or romp.

jt – I was also wrong when I was pleading with my family members to lower their exposure to the dot com bubble when everyone was telling me that it can only go up because of all the new money coming from investments in 401k’s. I was wrong to sell all my stock in the company I worked for at the time as I vested. The partners where telling me that I was leaving a lot of money on the table. I was also wrong when I refused to buy in 2006 when everyone was telling me that I was a fool for having so much money in cash and that I could make tons in a purchase of a home. The real problem with my thinking is that I base it on history and math versus what happened 15 seconds ago. Yes I use my frontal lobe when making money decisions and I will tell you that I have NEVER lost money and have made a good nest egg with all my bad decisions. All the other smart folks lost all of their “savings” via dot com bust 2001, housing bust and stock market crash 2008. Yes I made the mistake of holding my 25% net worth in the stock crash rebalanced when I felt comfortable and sold the bull market up. All really bad decisions…

” I was also wrong when I was pleading with my family members to lower their exposure to the dot com bubble when everyone was telling me that it can only go up because of all the new money coming from investments in 401k’s. I was wrong to sell all my stock in the company I worked for at the time as I vested. The partners where telling me that I was leaving a lot of money on the table. I was also wrong when I refused to buy in 2006 when everyone was telling me that I was a fool for having so much money in cash and that I could make tons in a purchase of a home. The real problem with my thinking is that I base it on history and math versus what happened 15 seconds ago. Yes I use my frontal lobe when making money decisions and I will tell you that I have NEVER lost money and have made a good nest egg with all my bad decisions. All the other smart folks lost all of their “savings†via dot com bust 2001, housing bust and stock market crash 2008. Yes I made the mistake of holding my 25% net worth in the stock crash rebalanced when I felt comfortable and sold the bull market up”

Wow, tell me you bought into the Dot-com bubble in 1997, bought a house in 2000, bought stocks in 2009, and I’ll be more impressed than someone who can always spot the “down cycles”

Most of the people I know were really bearish about housing in 2009 also stayed cash-only during that period, missing out on both the housing and stock market run of the last 5 years.

Perhaps you haven’t been following this blog long. I’ve recently posted several examples of diverse inventory throughout L.A. city that’s been sitting for months with reduction after painful reduction. Anyone who is seriously watching the market in L.A. knows this is the current truth of the matter.

Also, it is possible the reason you might think home prices are too high is because your income is too low. If you are under 35, your best option might be to advance your education such that your income boost would allow you to qualify for a loan on your dream home.

It seems some are hoping for the opposite. They are hoping home prices fall such that their current income will cover a home purchase. That is a long shot.

And now you’re advocating people pursue further/higher education, which is another bubble scam industry in and of itself, in order to hopefully increase their earning power.

Unfortunately, there are virtually no guarantees that *ANY* job will be waiting for them, unless they pursue *EXTREMELY* expensive post graduate degrees from top schools AND rank in the top 10% of their class (and even then it’s not a guarantee for a better paying job). Countless MBAs and JDs who have passed the bar are jobless or vastly underemployed. And many of them have tacked on 6 digit student loan debts as a result, leaving them even further away from buying that overpriced shitbox than prior to pursuing that higher education.

I generally agree with CL, and I work in higher education.

At the individual level education gain can be advantageous, but at any macro level it’s largely meaningless. For example, there are slight to moderate shortages in certain engineering fields, but if even 0.5% of the population rushed off to and trained to join these fields the market as a whole would be flooded and you’d have unemployment and lower salaries.

The legal field is a living example of this – a decade ago the theory was that you couldn’t lose with a JD in your pocket. That didn’t work so well. Across the board wages only go up when there’s demand for labor, and right now it’s pretty hard to see where any increase in labor demand comes from outside of a few select fields.

Speak for yourself. You’ve no idea what personal circumstances others here have. Sounds a lot like Lord Blank who tended to paint everyone else with the brush that was used on him.

I think jt is the new little “r”. You have no idea what you are talking about.

But jt is an expert! He went out and started buying beach town bungalows 20 years ago, when things in SoCal were at their worst and properties were dirt cheap, and thinks that luck of timing and subsequent result of success was somehow business savvy.

Housing will top out once the banks unload their inventory of foreclosures, then real estate will crash. This whole recovery in housing is all about the banks unloading their junk loans.

It’s not even clear they need to unload everything (otherwise we’d probably see more inventory pushed onto the market), but are just carefully cutting their losses.

Bingo. They’ve cleared the trash off their books, but no doubt kept whatever quality there is or was, or kept it in the hands of their spun off and “arms length” subsidiaries, funds, etc.

It’s flippers get it ? houses bought in 2007 through 2013 are now being put on the market as flips. See that here in Oregon!

Are we , perhaps, looking at an “echo bounce” rebounding back up after the precipitous fall in ’08, then to only fall again? Of course these things don’t happen on their own but the psychology of the buyers and sellers would make a fascinating read. The anxiety to buy and or sell in ’07 and early ’08 followed by the fear and grief of the fall only to have anxiety and greed raise their ugly heads again in ’09-’11 as buyers see an opportunity and upside down sellers just want to leave. It plateaus as economic realities prevent pricing into the stratosphere but even now sellers are hoping to sell and get out while they can with their (hopefully) profits and buyers are trying to jump on while they can thinking prices are reaching for the Moon again. I guessing we will see this repeat a few more times absent outside intervention with a gradually reducing peak and trough until employment picks up and ’70’s style inflation rears its ugly head thanks to QE and $19T of national debt.

You can’t rent a 1750sf place for 2700 unless you’re in the hood in Culver. My BHA condo would go for near 3500/month these days in the same size and with LA zip code.

I’m not saying I like that condo in particular, but rents are higher for nice, big places. I believe that condo is in a desirable school district as well propping up the price. Not to mention being on a lake/pond.

After reading this blog for 3 years, I finally have to comment on the dooms day group think phenomenon going on here. I waited and waited and waited, sitting on the sidelines for the big adjustment in prices to occur. Today, with a good job, good income, great credit, great down payment, I find the market to be inaccessible even in decent areas like Tarzana or Woodland Hills based on my single income. In hindsight I should have bought in 2012. Specifically, several forecasts made here that baby boomers would sell off and downsize, and that indebted younger buyers would be unable to afford mortgages, have been offset by the influx of investors, speculators and foreign money. My point is that the truth lies somewhere in the middle. SoCal RE will not return to 1990 prices no matter how hard we wish for it. Just my observation and experience.

No one said housing is returning to 1990 levels or anywhere close for that matter. In fact commenters on here would pimp smack that statement into oblivion had anyone made it. Also, had you attempted to purchase back in 2012 you would likely have been outbid by a cash buyer so don’t blame contrarian sites for your failure to luck/time the market.

But hey, look on the bright side. You have a good job and income, so you can probably go buy that house from said cash buyer TODAY (with only a 35% markup). What a deal, right?

I think you should head for your American dream now, before you forever lose the opportunity to own a home.

That all depends on what you mean by 1990 levels. If you mean nominal, yea probably unlikely. If you mean real, then I will raise my hand and vote that in my lifetime that we will see 1990 levels again. Ok, give me your best shot.

1000% right Sideliner, though again you are on a perpetual bearish housing website. So don’t expect the crowd here to like what you say.

You must be an only child. We only children have a tendency to talk to ourselves…

Weren’t you on here earlier commenting under the handle “Buddy”?

But it does seem like we’re going into or have been in an early 90’s economy, so why wouldn’t prices go down to that level as well?

Furthermore, there have always been rich people, trust funders, and foreign buyers. This time around are those types much greater than in times past?

I really appreciate this blog– as one of those “housewives” that kept my family out of the housing market here in 2006-2008 when we were being offered ridiculous subprime mortgages. Then for awhile it looked like we might get out of OC, so we did not buy in 2009-2011, when friends got a great deal on a short sale.

Now we have two little ones, and it looks like we will be here for the duration. Sure, I’d love to buy a house. But not now. I’m watching a lot of south OC properties go for under asking, and as a lifelong California resident, it just feels like we are close to another peak.

It’s great to come to this blog and check to see if my instincts are accurate or not. We will buy but probably not for at least another year or two. Our rented house is $2900/month and we’d be paying closer to $3350 a month at current prices if we bought now with 20% down. We will wait til we are closer to parity, or I’m working again, or both.

P.S. Went to an open house weekend before last. Nice place, bought by an investor for $610k a year ago, now trying to flip it for $680k. The agent told me they had already rejected two $640ish offers. I was honest and told her that $650k is out upper limit.

She called me a day later to say that the sellers would go $665k knowing that we don’t have our own agent and could use their agent as she would lower her commission. (I don’t think the agent was lying about that being the sellers’ idea as she gave me zero pressure to write up an offer).

I politely declined saying it just wasn’t doable for us. She came back another day later saying the sellers wanted to know what was the upper limit of our comfort zone. I again told her $650k.

This all went down without us lifting a finger to write up an offer or even get preapproved.

Kind of a big indicator to me that the market is softening up now in this area!

Nice! Be sure when the agent/real-turd real-tard comes crawling back within a few days or weeks once the inves-turd is desperate and tells you that they will do you the “favor” of taking your $650K, be sure and tell them that your life situation has now changed and the most you will offer is $600K take it or leave.

Then in a few months when they come crawling back for $600K to stem the inves-tard’s losses, tell them you’re no longer interested and bought a better place for less.

Oooh. That *would* be fun and satisfying. But sadly, this being OC, someone might actually buy the place at the current list price. If not, then it would surely be snapped up if the seller actually lowered the price to $650. That is one of the frustrating things about even considering buying a house here. There seems to be a lot of stupid money. Which I don’t really understand, but evidence of it abounds.

@ sideliner, here you go, I’ll even give you some free data fresh off of MLS to make you feel a little better

Tarzana Median sale price 3/2013: $811K

tarzana median sale price 3/2014: $797,500

Sorry i can’t post the chart so you can see it more clearly. The pace of appreciation in most markets has slowed or gone negative. I know because i market to sellers and you really have to cherry pick the data to show the trend as increasing. It is mathematically impossible for prices to continue to run up as they have.

Most market I watch are still very active. Prices are not dropping. What you are looking at is a seasonal price trend.

Name the markets.

“seasonal”????…..

I thought prices in the Spring go up not down….!!!!!!

What are you talking about?

OMG. You know sales prices from spring sales will not show up in the statistics for several more months. The numbers you see were sales from the winter. That is seasonal. But, in the beach cities, prices are moving up steadily.

Tarzana in April 2012 median was $477500. it has passed its peak and looks poised to decline if you look at the 24 month chart. Too bad you never had a shot financing as a buyer in 2012.

Yahoo Finance reports loosening credit standards: Wells Fargo is now offering mortgages to subprime borrowers with credit scores as low as 600, down from 640. (The median credit score for 30-year fixed mortgages had been around 730.) And non-bank lenders such as Carrington Mortgage Services are moving into that territory. Carrington has dropped its minimum credit score to 550.

Haven’t been back to the SFV in years, is south of Ventura Blvd holding up or like many of the old stomping grounds old and run down looking?

Housing To Tank Hard in 2014!

Not enough exclamation points. You must be a fraud…

I miss the real Jim Taylor…

Still waiting…

Here’s what’s going on, roughly analyzed, along with a prediction of the RE market in the coming years.

1) before the great crash in 07-08 real estate didn’t have the greatest attention of investors. It was mostly growing in value at the same rate as inflation. The middle class could afford a decent house in a decent area. And by the way, “decent areas” grow in size along with the population, and jobs generally grow in line with the population as well. In Los Angeles the large industries are in fixed areas with a limited number of positions. The best people will be competing for these, putting pressure on home prices in areas of close proximity. Again, inevitable. Only real money gets you in. Or at least that’s how it used to be..

2) introducing sub prime loans, easy credit, low interest rates… Now people who dared to dream, and perhaps lacked the intelligence to realize what a mortgage really means to ones economy, could get into huge debt and start playing with the big boys. Their friends didn’t want to look any weaker, and quickly followed suit. Suddenly everyone wanted in. Prices shot up and a new mentality was born. The mentality that this economic pressure was great for real estate prices and that it could only go up, so why not just finance all of it, get an even bigger house even closer to work? Banks happily created the credit, and the rat race picked up pace like never before. Then of course came the day of reckoning and the party was over. Massive foreclosures as people finally understood that it had all been artificial wealth creation.

3) banks repossessed the homes, people went back to renting in less attractive areas. Then the government decided to intervene and create more money in order to keep property values from plummeting completely and avoid underwater home owners. This of course only postponed the problem. Meanwhile, homes are exchanging hands. Normal people/families lose their homes to investors at relative bargains. Some cash strong single families buy homes in good areas from distressed sellers, but they were in the minority. The investors know it’s only a matter of time until the psychology will change again. The Feds promise to keep the interest rates record low in all perpetuity. The buyers will come back.

4) recovery is announced. Investors hold off while normal people play it out in the real estate market. Hardly anything moves. It’s harder to get a loan now.,less people qualify. Less homes shift ownership. Rates remain low. Stocks start gaining traction. The government reports job growth. The market reacts positively. Investors get ready to start unloading as buyer confidence increases on the basis of seemingly improved stock exchange numbers (remember, stocks are bets on future value, nothing but psychology and semi-informed predictions). Buyers start getting house horny again. Realtors tell people interest rates are gonna go up and nows the time to buy. Banks and investors start unloading slowly, saving their best properties, and listing the worst first. People pass as inventory is crap. More houses come on the market. Better inventory, higher prices. The rat race is on again. Yellen promises tapering of QE. The psychology is that this implies that the economy is improving. The market buys into it. Prices keep increasing. Foreign investors buy from other investors, and/or banks, all cash offers pushing prices even higher and forces people to overbid and over mortgage themselves for fear of losing out on the appreciation fest that’s coming. Private households don’t list their properties at this point. They are already sitting pretty, waiting for more good news.

5) there is no good news. People are again overextending themselves, and investors control the market. The moment we hit the threshold at which ordinary people cannot extend themselves any further, prices will stagnate and property values will start declining again. Since we will hit this level long before all investment properties have been unloaded, private investors will take a big fall along with banks. There will be another wave of foreclosures but not as big as last time. At this point a lot of European countries will have a healthier economy that can take higher interest rates. America cannot keep interest rates low any more without endangering the dollar and QE is not an option any more. With no remedy left there can not be any other outcome than to let it fall. It will quickly go into free fall and real estate will lose all gains since 2012 and then some. At first investors will catch a soft landing as inflation keeps prices seemingly high but purchasing power will go down and wages will remain the same, thus putting inevitable pressure on home prices yet again. Investors sitting on the majority of the desirable inventory but no qualified buyers will be forced to drastically reduce prices. There will be another influx of foreign investors buying up large amounts of these properties as US consumer confidence will be at an all time low, the dollar weakened, and US stocks undesirable. Then, as prices normalize and stabilize, people will start buying homes again, this time from a new group of investors. Soon a rat race will ensue again, but high interest rates will keep it from getting out of hand.. Until one day all is forgotten, and

6) history repeats itself.

So how can you protect yourself from this coming economic massacre? Cash is no good as long as it is in dollar, but it is slightly better than real estate. European and Asian stocks in companies that produce necessities at low cost and export to the US. History shows that in depressions people buy cheaper alternatives. Cheaper cars, cheaper gadgets, etc. Foreign currency is also good. Gold is risky because it has been confiscated before, and it has less intrinsic value to people in depressive times. As an industry component it is of relatively little interest, and as the need for cheaper alternatives arise, other precious metals etc may take its place. But whatever you do, don’t buy into the current wave unless you have the balls to gamble on getting out before it turns around.. The underlying factors of the economy scream house of cards, and the symptomatic treatment is only masking it..

Now, before you call me a doomsdayer, consider this: I don’t have anything to gain in predicting doom and gloom. If the economy was healthy, I.e we had normalized home prices, true job and wages growth, low employment rate, healthy interest rates, income/debt ratios, a decent national budget, good global export/import relationships and some government frugality then I would have no problem with growing real estate prices. As long as they grow proportionally to population growth, job growth, wage growth and inflation. The truth is they have been out of whack for well over a decade.

I pretty much agree with most of your “history/prediction” except “At this point a lot of European countries will have a healthier economy that can take higher interest rates.” These countries have worse demographics than we do (see Japan).

There has been a lot of chat on this blog about the increase in foreign, esp, Asian buyers. Here is an article from LA Times —

“..In a deal that underscores a Chinese home-buying spree, real estate website Zillow Inc. said it will partner with a Beijing firm to market U.S. homes in China. The Seattle company said this week that it has joined forces with real estate website Leju, an affiliate of E-House China Holdings Ltd. The companies plan to launch a co-branded website this summer to offer Zillow’s national home listings, data and more in Chinese.

“Brokers and agents with listings on Zillow are now able to reach Chinese home shoppers who are ready to invest in the U.S. market, with no additional cost or effort,†Errol Samuelson, chief industry development officer for Zillow, said in a statement.

The Wednesday annoucement comes as Chinese citizens pour money into the U.S. housing market. Many see U.S. real estate as a cheaper and more stable investment as fears over a Chinese property bubble grow amid other political and economic concerns. Others have sought out cleaner air and good schools for their children.

Chinese buyers bought 12% of all U.S. homes purchased by foreign citizens last year, up from 5% in 2007, according to the National Assn. of Realtors. More than half their home purchases were in California. And more than two-thirds of them paid cash, the trade group said.

In the San Gabriel Valley, a hub for Asian culture for decades, the investment is immense. Overseas money has pushed home prices in many valley neighborhoods above the peaks seen during last decade’s housing bubble…”

http://www.latimes.com/business/money/la-fi-mo-zillow-chinese-20140402,0,4820992.story#ixzz2xt6xG2yB

FYI: Chinese “baby hotels” are still popping up all over OC. For instance, one entire wing of a luxury apt. complex near Irvine Spectrum is dedicated solely to Asian “prego-wives” whom habitually shop at all the high-end retailers. There’s plenty of Chinese-speaking retail employees working at Louis Vuitton, Coach… et al at Irvine Spectrum, South Coast Plaza & Newport Beach’s “Fascist Island”.

So, once their precious “US Citizen,” is popped out, they purchase a home over $500k they so they will automatically qualify for a guaranteed EB-5 Card which is a basically av”fast track to U.S. Citizenship”card for the new Baby Daddy/Mommy. (Ikea Costa Mesa resembles the international wing of LAX!)

So, Zillow is just “capitalizing” on our mandated Federal laws & inept governmental policies which habitually pimp out America out like a cheap whore… (Btw, Canada has now terminated their $800k “loan” to their Government program (i.e. basically buy your Canadian citizenship card), so it only makes “cents” that even more Chinese will now buy in the U.S instead of Toronto.

Here’s what’s going on, roughly analyzed, along with a prediction of the RE market in the coming years.

1) before the great crash in 07-08 real estate didn’t have the greatest attention of investors. It was mostly growing in value at the same rate as inflation. The middle class could afford a decent house in a decent area. And by the way, “decent areas” grow in size along with the population, and jobs generally grow in line with the population as well. In Los Angeles the large industries are in fixed areas with a limited number of positions. The best people will be competing for these, putting pressure on home prices in areas of close proximity. Again, inevitable. Only real money gets you in. Or at least that’s how it used to be..

2) introducing sub prime loans, easy credit, low interest rates… Now people who dared to dream, and perhaps lacked the intelligence to realize what a mortgage really means to ones economy, could get into huge debt and start playing with the big boys. Their friends didn’t want to look any weaker, and quickly followed suit. Suddenly everyone wanted in. Prices shot up and a new mentality was born. The mentality that this economic pressure was great for real estate prices and that it could only go up, so why not just finance all of it, get an even bigger house even closer to work? Banks happily created the credit, and the rat race picked up pace like never before. Then of course came the day of reckoning and the party was over. Massive foreclosures as people finally understood that it had all been artificial wealth creation.

3) banks repossessed the homes, people went back to renting in less attractive areas. Then the government decided to intervene and create more money in order to keep property values from plummeting completely and avoid underwater home owners. This of course only postponed the problem. Meanwhile, homes were exchanging hands. Normal people/families lost their homes to investors at relative bargains. Some cash strong single families bought homes in good areas from distressed sellers, but they were in the minority. The investors know it’s only a matter of time until the psychology will change again. The Feds promise to keep the interest rates record low in all perpetuity. The buyers will come back.

4) recovery is announced. Investors hold off while normal people play it out in the real estate market. Hardly anything moves. It’s harder to get a loan now.,less people qualify. Less homes shift ownership. Rates remain low. Stocks start gaining traction as an alternative to real estate. The government reports job growth. The market reacts positively. Investors get ready to start unloading as buyer confidence increases on the basis of seemingly improved stock exchange numbers (remember, stocks are bets on future value, nothing but psychology and semi-informed predictions). Buyers start getting house horny again. Realtors tell people interest rates are gonna go up and now’s the time to buy. Banks and investors start unloading slowly, saving their best properties, and listing the worst first. People pass as inventory is crap. More houses come on the market. Better inventory, higher prices. Sales pick up. The rat race is on again. Yellen promises tapering of QE. The psychology is that this implies that the economy is improving. The market buys into it. Prices keep increasing. Foreign investors buy from other investors, and/or banks, all cash offers pushing prices even higher and forces people to overbid and over mortgage themselves for fear of losing out on the appreciation fest that’s surely coming again. Private households don’t list their properties yet at this point. They are already sitting pretty, waiting for more good news.

5) there is no good news. People are again overextending themselves, and investors control the market. The moment we hit the threshold at which ordinary people cannot extend themselves any further, prices will stagnate and property values will start declining again. Since we will hit this level long before all investment properties have been unloaded (a simple factor of human greed and impatience), remaining private investors will take a big fall along with banks. There will be another wave of foreclosures but not as big as last time. At this point a lot of European countries who did not swallow the QE pill will have a healthier economy that can take higher interest rates. America cannot keep interest rates low any more without endangering the dollar and QE is simply not an option any more. With no remedy left there can not be any other outcome than to let it fall. It will quickly go into free fall and real estate will lose all gains since 2012 and then some. At first investors will catch a soft landing as inflation keeps prices seemingly high but purchasing power will decrease while wages remain the same, thus putting inevitable downwards pressure on home prices yet again. Investors sitting on the majority of the desirable inventory but no qualified buyers will be forced to drastically reduce prices or rent out. There will be another influx of foreign investors buying up large amounts of these properties as US consumer confidence falls to an all time low and US investors seek refuge in safer investment instruments abroad. With the dollar weakened, and US stocks undesirable, inventory will grow, and along with less demand, will press prices even further down. Then, as prices finally start to normalize and stabilize, people will start buying homes again, this time from a whole new group of investors. Soon enough a rat race will ensue again, but high interest rates will keep it from getting out of hand. Until one day all is forgotten, and

6) history repeats itself.

So how can you protect yourself from this coming economic massacre? Cash is no good as long as it is in dollar, but even dollars are slightly better than real estate because wages can’t move radically in either direction in a globally controlled import/export economy. I would buy European and Asian stocks in companies that produce necessities at low cost and export to the US. History shows that in depressions people buy cheaper alternatives. Cheaper cars, cheaper gadgets, etc. Foreign currency is also good. Gold is risky because it has been confiscated before, and it has less intrinsic value to people in times of depression. As an industry component it is of relatively little interest, and as the need for cheaper alternatives arise, other precious metals may take its place. But whatever you do, don’t buy into the current wave unless you have the balls to gamble on getting out before it turns around.. The underlying factors of the economy scream house of cards, and the symptomatic treatment is only masking it for the time being.

Now, before you call me a doomsdayer, consider this: I don’t have anything to gain by predicting doom and gloom. If the economy was healthy, I.e we had normalized home prices, true job and wages growth, low employment rate, healthy interest rates, income/debt ratios, a decent national budget, good global export/import relationships and some government frugality then I would have no problem with growing real estate prices. As long as they grow proportionally to population growth, job growth, wage growth and inflation. The truth is they have been out of whack for well over a decade, thanks to the Feds and their special kool-aid. Soon the effects are wearing off and the hangover sets in. More hair of the dog that bit us isn’t gonna do us any good this time around.

Interesting Tb. Before you move your money abroad consider this: There are actually Boom Towns in this country (think shale and nat gas). The only thing that will turn them in ghost towns will be a major decline in the price of oil. If the U.S. Economy crashes again the effects will be Global. The U.S. dollar will get stronger in that scenario. Safe Haven Investing is tricky so keep an open mind, do your research, and choose wisely…

Its funny the sellers continue to make this high pressure pitch. Realtors often work both sides for higher prices. At least here there are some honest ones that sometimes write in. Everyone benefits from lower prices. Don’t confuse quick short term gains from the benefits of a stable market. If you think you are going to get rich quick then you aren’t.

Please understand this; Fannie Mae and Freddie Mac are not there to give cheap loans to people. Thy are there to offload bank risk onto the taxpayer.

Salli Mae isn’t there to give loans to students needing money for college. It is there to shove loans onto young people who can’t afford it and protect those loaning it from repercussions of default because bankruptcy won’t free them of their debt.