Will we ever see a return to normal inventory in Southern California? Current February sales weakest since 2008 and the lack of baby boomers listing properties.

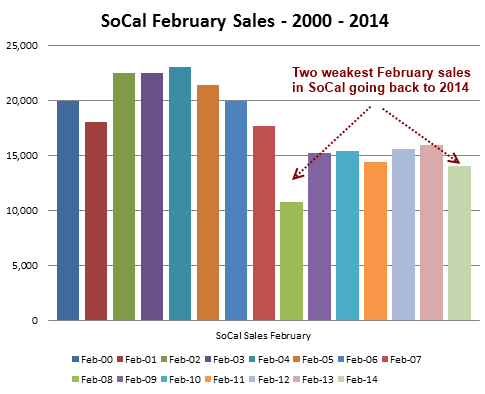

The latest sales figures for Southern California show a market with very little action contrary to all the positive news regarding real estate prices. The latest data for February sales shows the weakest February on record only second to February 2008 when the market was fully imploding. To put this into context, we had 22,484 sales in February of 2002 and 23,004 sales in February of 2004. Last month we had 14,027 sales (a drop of 38 percent from the peak reached in 2004). This also helps to explain why some in the industry, including real estate agents are not all too pleased with this high priced market but with very little churn. Of course the higher prices are coming because of the low amount of inventory and banking manipulation. Capitulation is high and some have jumped in head first into the shark tank and ignoring financial shenanigans by saying “hey, if you can’t beat them, join them!â€Â Initially there were some that were forecasting a flood of homes on the market thanks to baby boomers selling to downsize. As we have mentioned, there is no indication of mass downsizing and many would rather lock down in their zip code instead of cashing in on their golden sarcophagus lottery ticket. 90210 and Purina Puppy Chow? Dog food is easier to digest when living in a prime zip code. Those that proclaim that somehow everything is fine fail to account for the fact that sales volume is abysmally low. Affordability is horrific. Even when we look at mortgage figures we find that many are simply stretching to buy.

The market overview of Southern California

The sales figures for February do not reflect the jump in housing prices that occurred in 2013. Rising prices and sales volume usually indicates a more liquid market. Instead, we have rising prices occurring as investors continue to dominate the market while many potential buyers simply bite the bullet and decide to jump into this crowded play. Investors are still the big X-factor here.

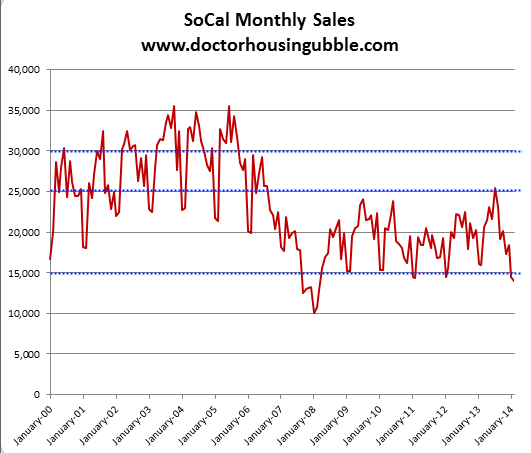

After the housing crash housing sales volume has found a different range in Southern California:

From 2000 to 2007 monthly sales of 30,000 to even 35,000 seemed to happen often. We have yet to have a 30,000 sales month since 2005. In fact, we’ve only had one 25,000 sales month since 2006. Removing easy financing that glossed over weak income growth has created a “new†market and you see what this has done to sales even though California has grown since 2000. Once banks started looking at W-2s and some basic due diligence, low and behold people had very little ability to pay California housing prices. Thankfully, 30 percent of all sales since 2008 have gone to the all cash crowd (a first in history where we have had a 5+ year history of all cash buying outside of traditional mortgages). California had 33 million people in 2000 versus 38 million in the 2013 according to US Census data. Yet look at SoCal home sales above. Let us look at February monthly data going back to 2000:

February tends to be a slower month as the year starts off. Spring and summer tend to be better months for real estate based on seasonal patterns. The chart above highlights how weak this latest month was. This was the weakest month on record beside the epic implosion months of 2008. The days of 20,000+ sales in February were last seen in 2005, nearly a decade ago. Investors continue to buy the currently inflated property hitting the market making up 30 percent of all sales. You also have a good number getting big down payment assistance from family and those with decent incomes scrimping by to put down that 20 percent. Yet this group is small and you can see the impact on sales figures. Inventory is only picking up slightly in the last few months because we are now seeing full on psychosis delusional asking prices from some sellers and homes are simply sitting like an unpopular teenager at prom.

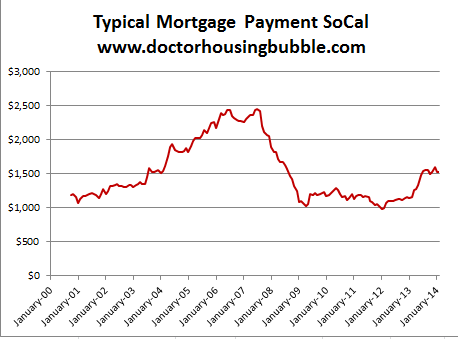

Those going in with mortgages, still need an income to pay the monthly nut:

What is interesting is that in SoCal, the typical monthly mortgage payment for those buying in February landed at $1,528. This is 48 percent below the peak reached in the summer of 2007. What isn’t exactly clear in the data here from DataQuick is how this figure is calculated. Does this include the 30 percent of all cash buyers or only those that committed to buying with a mortgage? What we do know is that Californians simply do not have the monthly income to keep up with current prices and need to stretch their budgets to buy at current price levels. I’ve noticed a few mentioning that the new model for households is the three income model “husband, wife, and X additional source). Some will have this met with their kids boomeranging back (by choice or not) but good luck splitting the mortgage bill with them or convincing your kid to move up the property ladder with you.

Some seem to think that this is the new normal model for SoCal. Low inventory with locked in baby boomers and banks chasing investment properties will only keep prices inflated. Before, it was stretch by taking on whatever crazy mortgage was out there. Today, it is stretch by any means necessary (i.e., parent down payment, additional incomes under one roof, etc) but get into that house before you are priced out. In some areas new price peaks are being reached however the very weak sales volume tells you something else is also going on overall. Will the large pool of investors maintain this appetite once prices stall out or possibly turn negative year-over-year? For now the drum keeps beating and the memories of the last housing market are simply a fleeting memory. Forget about the 7,000,000 foreclosures in the graveyard or the record low sales volume. It is perfectly normal to pay $700,000 for a World War II shack from a flipper or someone that thinks adding granite countertops, hardwood floors, and stainless steel appliances somehow makes you the next creator of Buckingham Palace. The reason many well paid professionals in their late 20s and 30s aren’t diving in is because they know something is in the housing Kool-Aid.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

109 Responses to “Will we ever see a return to normal inventory in Southern California? Current February sales weakest since 2008 and the lack of baby boomers listing properties.”

I’ve been on the sidelines since I graduated in 2000! I just assume everyone is making $500,000-per-year to buy a $700,000 house.

Well given that the median household income in So Cal is what, $50K? And that’s household, not individual.

No. They are making $80,000 and are severley overextended.

Spot on…every other home on the market seems to be a 900 sq ft shack with the full range of cheap, big box store “upgrades”…including the ubiquitous granite and stainless kitchens which already look dated. I’m going to pay a 150k markup for that crap? No thanks….

One of the takeaways from the last post with all of the comments from folks looking to buy was that even though they may have the means, they’re not finding the *value* in today’s market.

I think this is an extremely important point to consider. If a competing product – rentals in this case, offer a better value proposition, then why consume something perceived as as less?

The government is proposing to wind down Fannie and Freddie. Both insure about 90% of conforming home mortgages. A newly created entity will require mortgage originators to retain a 10% capital buffer for losses due to foreclosure before any insurance kicks in. Assuming this change actually transpires, I see much stricter mortgage lending standards coming and more fees.

http://www.zerohedge.com/news/2014-03-18/how-government-will-eliminate-fannie-freddie-one-simple-chart

I am not convinced that moving mortgage insurance from the GSE’s to private insurers will change anything far as the “tax payer being on the hook”. AIG was not a GSE and they were taken over to save the bond market. Why would .gov allow the TBTF finance industry fail next time around.

RE:What

I wouldn’t be so quick to assume a bailout next time or that post Fannie/Freddie loans will lead to a systemic crash. I’ve always had the feeling the Housing Bubble w at one time and seeing if they could master the results. A Fasicim 2.0 5 year plan so to speak. They failed miserably as the greed of the bankers at the thought of a near world wide captive ponzi participation led them to overplay their hand and the bust overwhelmed them. In some ways I believe Bernanke and Greenspan when they say they “Didn’t see things coming”, hubris is a bitch.

That being said I think we are on a relatively quick road back to something resembling a “market” in residential real estate. 2014 (possibly to early 15) is going to be the last gasp at getting the Lemmings on board before the next downturn. I wouldn’t be surprised at 5-6% rates by 2015 with those “private insurers” having some pretty strict under writing standards.

All the twit housing bulls we debate here who when things are going up say “Don’t fight the FED” should take their own advice. The FED and congress have told us all we need to know. QE is almost done, rates are up in 2015 and the GSEs are going away. As ANY analyst will tell you the only way we can have a recovery with escape velocity is the return of the consumer. TPTB know that the consumer is tapped out credit wise and even if they weren’t their memory of 2008 isn’t as short as wall streets. Those HELOCs aren’t being taken out even if they are available. The bulls argument is weak and somehow i doubt they’ll be here to debate us in 2015 when TSHTF. I know they disappeared from Housing Panic and Patrick.net VERY quickly in 2008. I guess they we’re to busy attending open houses 😉

NihilistZerO – I find it hard to believe that during the next housing downturn that much will have changed. Sure we have less sub prime loans but I would bet we would see just as many underwater houses. The fact that the majority of these homes are non recourse loans makes it real easy to walk. I would also wager that we will see another recession during the next housing downturn. I think Ole Yellen will piss her panties and do everything that the Bernanke and Greenspan did in spades. I don’t deny that the Fed believes that the current bubble is more sound and that the financial system is more robust but I really have not seen any changes. The cash buyer myth will reveal itself soon enough and the MBS/REIT funds will go south causing a number of pensions to go south causing the government backstop to go bust etc. etc. etc…

Re: What?

I don’t think the math has changed much either, in fact it’s worse, but what has changed is whose doing the counting. The Big 4 banks have been papered over so completely whatever exposure they have left to residential RE is significantly smaller than 2008. On top of that the $$$ they’ve made hand over fist since in the last 5 years should offset quite a bit of that. I truly don’t see another huge bailout coming. Now you bring up the REIT connection to pensions and I fully admit to not knowing how big that connection is, but I seriously doubt there will be the poolitical will to bailout institutional RE investors no matter who holds their stock. As for Yellen she’s only going to do what her masters tell her (along with the other FED puppets. And the chaos that would come for the FED to so quickly reverse course would be drastic. A FED that is openly seen as out of control of the bond market would have so many unintended consequences I doubt TPTB will risk it. The deflation monster is about to come out of the closet no matter what. I think the FED is going to front run it to maintain what control or illusion of control they have. they’ll bend the statistics to support whatever moves they are making at the time of course. Perhaps I’m being overly optimistic but the FED’s comments of late suggest that there will be policy panacea when the SHTF. Mainly because they know they can’t do anything to stop it anyway. Better to have the markets questioning their decisions (remember David Lereah BEGGING them to stop raising rates in 2007) than it become known to all they have no tools to stop the deflationary cycle that’s oncoming.

The first problem is that the Federal government is the the backstop to the pensions that hold a hole hell of a lot of these REITS. The returns on T bills won’t cut it anymore and the pension funds are mandated to contain certain assets classes and get a certain return. Many of the pensions are local government pensions and will need to be rescued by the pension fund FDIC equivalent…

“Perhaps I’m being overly optimistic but the FED’s comments of late suggest that there will be policy panacea when the SHTF.” I am not convinced that anyone is as smart as you are alluding these folks to be. My guess these are a bunch of hacks in nice suits that look in control in front of a camera. I agree that we have a hell of a deflation to contend with because every boom in history has an equal and opposing bust waiting in the wings…

RE: What

That should have read there WON’T be a policy panacea. I agree with you they are clueless, as anyone would be trying to micromanage a multi trillion dollar economy. They know continued QE and ZIRP kills the dollar system so they’ll throw our whatever BS stats are necessary to justify the less accomodative policy. I expect Yellen to smile and assure everyone that whatever rate and course of action they take is completely justified but the data and ah upturn in (insert your favorite worthless statistic here) is right around the corner. All the while we can drink sweet housing bull tears as 5-6% mortgages, increasing inventory and no household creation crush their assets price. Gains mean nothing until you cash out. Or so I’ve been told…

Re. What?

I agree with the deflation argument. I don’t agree with the comment about the masters of FED being dumb. I see the selfish (all decisions for themselves not the economy) and evil but not dumb.

NZ, I agree that gains aren’t locked in until the property is sold. Then again, homeowner’s monthly payment are also locked in for the next 30 years. Renters certainly can’t say that.

I think there is some misconception from the bears on this blog. I never recall any bulls stating that home price appreciation will go on indefinitely (it sure as hell wasn’t me). As I have said umpteen times, buying is not a bad idea if you are anywhere close to rental parity TODAY. As time goes on, that buyer will be well under rental parity. Why is this concept so hard to comprehend?

Rental parity, rental parity, rental parity, quack! LB always fails to mention that you will need a massive down payment probably in the hundreds of thousands of dollars to achieve this. Keep on preaching the rental parity meme brotha!

RE: NZ & What….

Very interesting discussion you too! Shows there’s a lot for us to think about.

This is the kind of stuff we need on this blog.

@ Old Man. Rental parity should be based on a 20% down payment. The gold standard of RE. If you plan on buying in the highly desirable parts of socal, that means hundreds of thousands. Nobody ever said owning in highly sought after areas would be cheap. Most people want instant gratification, saving and sacrificing for 10 years plus just for a down payment separates the pretenders from the contenders. Quit whining and start saving!

@Lord Blankfein: Thanks rental parity parrot! I’ll get on it and start saving $200,000 to purchase your dump in the South Bay. Oh wait, I already have that. Where did you buy again? Was it El Segundo or Torrance? You sound like an obsessed baby boomer hanging out on the corners yelling at younger people about rental parity. Then you mention the gold standard about 20 percent down? It used to be 3 times your annual income but I guess whatever suits you. We should start a drinking game in your honor on how many times you are going to mention rental parity.

@ Old Man aka multiple handle posting angry renter. Get over it, I don’t make the rules. 20% down has been and will always be the gold standard for normal buyers (aka not all cash). This gets you from paying PMI. Three times income? That is highly rate dependent. A better measure is DTI. Keep housing DTI under 30%, that should be the goal. Quit posting and start saving!

@Lord Blankfein aka one tune old man rental parity – touchy touchy grandpa! So anyone that doesn’t buy your drivel is an angry renter or a whiner? Good stuff. I noticed you mentioned an article ago you would stop posting yet here you are. Posting away the same line about rental parity without adding anything of substance to the conversation. Here is a bet for you. You seem so convinced real estate is a good deal. Why not go out and buy a place and put your money where your mouth is. You can then share with us angry renters how great you are and we will retreat and cry because we are only scum renters. Please, put your money where your mouth is grandpa and make that second home purchase. By the way, what prime zip code did you buy in the South Bay? Not like we can track you on this single item but we can see where prices are in a couple of years. Make that second home purchase since you are so convinced!

Drivel like this is exactly why I plan on leaving the blog. I’ve given more helpful advice here than the standard “housing going to tank hard.” I’ll let you know when I purchase my second home…who knows, I might be in competition with you.

@Lord Blankfein – You think uttering rental parity like a chant since you bought your home is advice? We get better advice and perspectives from posters like Blert that have a much better perspective of the bigger picture. All you have to add is that rental parity with a gigantic down payment is the way to go. You have gone off the edge with ad hominem attacks with angry renter and whiner chatter ever since you bought your place. Look in the mirror grandpa. By the way, why don’t you post your precious little zip code. We can then track it and you’ll show us how wrong we are.

Yawn. You make me tired!

Please show me one example where buying at rental parity didn’t work out. I’ll be waiting anxiously for your reply. I’ll give you a little hint that during the bubble days of 05 thru 08, we weren’t anywhere close to rental parity. Now do you understand the significance of rental parity?

You want my ZIP code. Sure. 90210

Old Man, you correctly point out that the rental parity comparison is useless if it’s presented as a two-legged stool, which is the way it’s ever so often put out there by housing cheerleaders. The third leg is up front capital. Imagine a two-legged stool propped up next to a bar, inviting its next guest to have a seat. Some might be inclined to plop right down, all the way to the ground. Most will watch it fall to the floor in pieces as they pull it out to position where it stands.

But that’s obvious and we all know that. Most people will at least touch the stool to pull it out before sitting in it.

The bigger issue is that because it’s obvious and we already know about rental parroting (that’s what I’m going to now call it) is a distraction from more important new information. The kind of information that DHB puts out here.

It’s a non-sequitur because it attempts to deflect the conversation off of the more difficult topic at hand and down a dead-end road. That way it’s easy for a housing cheerleader to sort of just sweep things under the rug and save face.

I hope LB and others with similar perspectives do keep posting here. It’s useful for the uninitiated who come across these types of comments to have the common deceits exposed for what they are.

I live in an average suburb of San Francisco. When a house goes on the market in our area on Saturday, it is sold by Sunday night, usually for well over listing price.

Sellers here don’t even bother to clean anymore. Houses are selling with dirty carpets,cobwebs in the corners, and dirty bathrooms.

Why bother to clean? The new owners are going to remodel, anyway.

I’ve been checking out condo’s on Redfin and the like…outside of Berkeley they are coming down in prices…Looking in Lake Merritt, El Cerrito, Albany and San Leandro. Just a little but they are dropping them 10-30K, I assume those like me with no kids and modest incomes looking at these are scared away by $300-500 month HOA’s….that is what I want to see…$50-150 HOA’s.

good luck with that

death, taxes, and rising HOA fees are the three absolutes in life

It’s completely insane to me to see condo’s going 200-250K with HOAs at $350+ month….I’ve read horror stories on people losing their place to the HOA and being completely up-to-date on their mortgage with the banks. That is pretty much what is keeping me away from the Condo’s and Townhouses in the East Bay that I actually really like as far as price, style, location and amenities.

The HOAs of $350 make condos unaffordable at the lower end of the market. Where I live you can’t find a stand alone house under $400k. Yet the condos are in the 300s, so when you add the HOA fees you might as well just buy the stand alone house. It makes no sense.

Along those lines, I saw a small one bedroom condo hit the MLS in San Pedro a couple of days ago. It was under $200 K in asking price. I spoke to the listing agent today and he told me it’s already under contract . . . . and the buyer is someone from England, who apparently has $900K worth of cash to blow!!! (At least that’s what the agent was told.)

So, what if affordability means nothing these days, with so many rich and flush-with-cash buyers flooding the SoCal real estate market. In other words, what if there are enough buyers out there that are not your average working stiffs, such that the prices keep getting driven up.

As for low inventory for sale and a larger population in California, it would seem that part of the reason for this is that with that many more people in the state, there are just that many more people that are owners THAT HAVE NO INTEREST IN SELLING THEIR HOMES, but are holding on to them for the long haul (perhaps until they croak.) In other words, the number of “settled” homeowners has climbed, along with the overall increase in population. Hence, fewer people interested in putting their homes on the market and thus smaller sales inventories.

Speculators from overseas tend to be more fickle than those in for the long haul such as native owners with a mortgage. As regular folks continue to be priced out, they will look to other places where there’s less friction. I think that’s one reason why there continues to be so much migration from CA to other states. Those in the middle who are stuck in a marginal situation in CA will be left behind with the poor and rich. DHB has posted about this many times. There’s no free ride.

“Settled” Californians are far out numbered by those hanging on by a string and the shadow inventory behind that. I’ll say it again… It took UNPRECEDENTED FED intervention and investor buying to give us a second housing bubble based on INFINITESIMALY small volume. Prices are a complete illusion. QE and ZIRP are over within 12 months. Housing come down from FED monetary meth will be ugly.

“QE and ZIRP are over within 12 months.” I am not convinced… Yet… but give me time…

So many older folks go so lucky (especially in coastal areas) and ended up with really nice houses for $75,000. I know several living in essentially $750,000 to $1.5 million ocean view homes that they paid 75k and 89k for two decades ago. They have no mortgage (or if they do something laughably low), live in super desirable areas with nice weather, often have family or long term friends near by. Why would they ever move? They paid so little for the house that it isn’t even that hard for them to save for retirement, and if they do need to sell down the road they have so much equity that they aren’t worried. These properties never come on the market, because there is no where else that would be worth moving to, and if they traded up their property taxes would skyrocket under Prop 13.

I am quite curious and have yet to see sales data mirrored to available inventory. How much inventory was available during the same time periods that we are comparing sales to? Clearly sales are down significantly which may be a leading indicator to future price declines. Is available inventory also down significantly compared to the past, if so, how much? I feel it important to determine the sales to inventory ratio and compare this with the past in order to get a clearer picture on what is truly driving sales declines.

According to the Department of Numbers site, February 2008 inventory (homes listed for sale) was over 48,256 versus 16, 196…so a third of the 2008 inventory:

February 2008 48,256 $358,500 $472,475 $660,875

February 2014 16,196 $348,000 $481,238 $759,972

Those are the 1/4 1/2 and 3/4 asking prices for all listed homes. This is for LA

http://www.deptofnumbers.com/asking-prices/california/los-angeles/

Agreed that the two numbers would be better than one.

One piece of information I wish we had readily available was the LTV ratio for the financed sales. In L.A. County, I believe one must go to the recorder’s office to get that information for a fee. Too bad, as that would really help to paint a clearer picture.

If condo growth happens as I discussed why would they need to suck SFH owners statewide with higher taxes. Think about it a couple of quad units in beach prime get replaced with 4 story luxury condos. You tell me which provides the higher tax base? You don’t have to change Properly 13 (which is still politically impossible) when gentrification of so many prime areas continues. I’ll concede the bulls that LA from downtown through tLong Beach and up through Santa Monica is going to look a lot more like New York as time goes on. That doesn’t mean that the valleys, IE and many parts of the OC (a lot of faux upper class hanging on by a thread their) aren’t heading down to meet what current demographics, income, higher interest rates and the popping of Housing Bubble 2.0 will support.

Above was in response to anon reply to me below. Damned mobile r powdered! 🙂

“Some will have this met with their kids boomeranging back (by choice or not) but good luck splitting the mortgage bill with them or convincing your kid to move up the property ladder with you.

Some seem to think that this is the new normal model for SoCal.”

Why not? How can SoCal median income only be marginally higher than national yet SoCal home prices be 2x national?

Income/Affordability time-line in SoCal:

1940’s & 1950’s — US boom amidst global bust allows for 1 income, blue collar earner

1960’s & 1970’s — Women join workforce en masse to goose HH median income

1980’s & 1990’s — Dual incomes, working harder, more productivity (last opportunity for HH median income to buy and the rise of the 10%)

2000’s & 2010’s — HELOC’s, and low interest rates goose median HH “income” and rise of the 1%

2010 and beyond — 1% get richer and richer to gentrify Culver City et al., while children, grandparents, Craigslisters, etc. renting out rooms in golden sarcophagus for the rest of us.

I agree with most of what you wrote except for the part about the 1% gentrifying, buying, and living in Culver City. HAHAHA, the 1% isn’t living in Culver City. Borderline top 10% at best, but probably top 20%.

Yes, this. Just who comprises the 1% and are we talking just income earned or total wealth which includes all assets? As someone who is intimately familiar with Culver City, I don’t believe that there’s much of the 1% crowd there if it were to be loosely defined as the ultra wealthy.

Anon, I’ve made the argument in the past that local median hh income is not a sharp enough affordability metric for today’s desirable SoCal buyers (including CC)…you’ve got to include total available wealth as well.

CLer, with pre-tax income of the top 10 percent hh’s starting at $114,000, I don’t see this crowd plunking down $700k for a 2/1 crapshack in CC. The top 1 percent starts at $394k, which indeed might be too rich for CC. Let’s split the difference and call it an even 5 percenter neighborhood.

Ok, agreed DFresh. And 10% HH income threshold is $114K?!? Is that national, or Los Angeles County/city??? That seems pretty damn low…makes me feel a bit better about my situation although I perpetually feel poor despite doing pretty damn well comparatively.

Tough to feel good financially in this La La Land city full of “fronters”, fakers, and *actual* wealthy, affluent, big ballers etc. This city is ground zero for all that fake TV and movie bullshit and consumerism that is rampant in our society.

@CraigLister,

You may be new here but DFresh seems to be smoking the crack pipe again.

In SoCal, you need a household income of $150K per year to be a top 10%er.

Top 10%’ers don’t move to Culver City. They move to Manhattan Beach, Hermosa Beach, Redondo Beach, Marina Del Rey, Playa Vista, Hollywood Riviera (Torrance 90505), etc.

$114k in LA county will put you in the top 20%

$160k in LA county will be needed to make the top 10%

I am not convinced that $140,000 or even $240,000 HHI gets you into the top 10% in LA. If this is the case, we are in for a whole hell of a lot of hurt. Remember when you get into the higher brackets you are talking about the government taking 40% – 45% of the gross. These guys better have some “off balance sheet income”.

I read something a long time ago that broke down income growth by bottom 90%, top 1% and the 9% in between. They stated that the income of the bottom 90% has been falling, the middle 9% has been flat and the top 1% has ballooned. The total effect of this is that “income” has been flat when in reality it has gone down for the majority of house holds.

DHB is right on. Baby boomers are faced with the same problem as the younger generation. Lower paying jobs and less mobility may force real estate devaluation is some areas of California. In the future we might see more multiple owners per dwelling to qualify to purchase resident property. Perhaps this will be the popular bank lending business model this decade.

The free market would say this is a cycle. We don’t know what the next cycle is but given the masses demand affordability, I would venture to say more, denser units will be built at some point and somewhere. Ontario alone is building 30,000 homes in the New Model Colony. That and flattening prices mean incomes will eventually catch up.

Gonna take a lot more flattening for incomes to catch up. Hell, Zillow shows 350+ pre-forclosures in Ontario, and banks are just revving up… Incomes in the IE aren’t going up. I’m willing to give the housing bulls certain prime areas of LA coast, OC and the Bay won’t get quite “proper fucked” in the next downturn, though they wil adjust as well and Santa Monica, Culver City and the other LA beaches are going to become condo cities. The demographics support higher density housing in these areas so what remains of SFHs are going to have a premium, though not as insane as today. But the IE, eastern 626 and non coastal OC are ridiculous and those that are “just” avoiding foreclosure are going to give up the ghost once this next crash hits. Incomes aren’t going up but for a select few even in the prime areas. this whole “market” is being held together with tape and bubble gum. hell that’s the only thing holding together are whole economy LOL! The solution is right in front of us though. Lower housing costs so consumers will increase spending it’s taking us more years than most of us bears would like to get there but it’s happening right now. QE over. Mortgage rates and other factors killing the flip industry. That first FED rate raise in 2015 will likely be the nail for residential RE sentiment for a while. 2010 prices negative 10-15% accounting for higher mortgage rates, tighter lending standards, etc is my guess.

What you stated about certain areas becoming condo heavy makes sense. In lockstep with that, I bet dollars to donuts that the municipalities will find currently unimaginable ways to suck as much revenue as possible out of the SFH deed holders. Prop 13 won’t save them.

“If condo growth happens as I discussed why would they need to suck SFH owners statewide with higher taxes. Think about it a couple of quad units in beach prime get replaced with 4 story luxury condos. You tell me which provides the higher tax base? You don’t have to change Properly 13 (which is still politically impossible) when gentrification of so many prime areas continues. I’ll concede the bulls that LA from downtown through tLong Beach and up through Santa Monica is going to look a lot more like New York as time goes on. That doesn’t mean that the valleys, IE and many parts of the OC (a lot of faux upper class hanging on by a thread their) aren’t heading down to meet what current demographics, income, higher interest rates and the popping of Housing Bubble 2.0 will support.”

Maybe not statewide, but in those “desirable prime coastal you’ll never lose” areas, you’d better believe that local governments will put the screws to the SFH lots. An SFH next to a multi today, the multi brings in more revenue. Not only will the muni invent new methods to bring the SFH revenue in-line with the multis, they will also find ways to make the SFH deed holder’s life more difficult so that they’ll sell out to a developer who will put up a multi. Hello Santa Monica.

Furthermore, what price can one put on being able to pull out of the driveway within a reasonable amount of time? How about more noise? Even more crowds at the beach? General added friction to just get around and do some shopping or whatever. The costs and ease of living will go up in ways that we don’t typically measure monetarily. That’s why this idea that you can both buy today and lock-in today’s life as we know it in “prime coastal you’ll never lose” areas is so short sighted. Somehow there’s an inference that once you’re in, it’s as simple as a static monthly payment and smooth sailing on out. Ridiculous. You’re forced to pay one way or another, just like those golden handcuffed folks living in > million dollar valued homes with a fixed income that only affords dollar store goods.

In many areas it’ll be tough to get zoning changed to allow for condos in place of SFH. Converting current retail to mixed-use is more likely, but that’s not even a given.

Look at the immense opposition to projects such as Bundy Village. That was a project that wasn’t even purely residential, it would have created jobs, but it barely got off the ground with neighborhood opposition.

That’s one of the biggest differences between LA and say.. Houston.

>> Santa Monica, Culver City and the other LA beaches are going to become condo cities. <<

Santa Monica hasn't been a SFH majority town in some 50 years. Today Santa Monica is 70% renters. Renters have dominated Santa Monica's local government since the late 1970s, via their Santa Monicans for Renters Rights organization.

And that 70% renters doesn't include condo owners such as myself, of which there are many.

In Santa Monica, single family homes are comparatively rare and highly desired. Only North of Montana and Sunset Park are dominated by SFHs, and the latter is close to the airport, making North of Montana all the rarer and desirable. (Ocean Park might also be dominated by SFHs, but I'm not sure — there are also plenty of condos there.)

If you look at a Google satellite image of Santa Monica, you'll see many long residential buildings, which are townhouses, condos, and rentals.

Anon: I agree that buying one of these west side shacks isn’t locking in a lifestyle. I lived off La Cienega and the 10 from 1998 to 2000 and going back to LA now you couldn’t pay me to live there. The traffic is unbearable to me. LA is firmly in the “great place to visit category for me now. Unless your rich I don’t see the positives in paying more for less with LA real estate. I know some do it for employment reasons but you couldn’t pay me enough. I’ll happily settle in the East San Gabriel Valley or Western Inland Empire and enjoy LA’s amenities the few times a year I’m so inclined. I think within a couple of decades West LA through downtown is going to be Just like New York housing density but sprinkled with a few high end SFH.

Let the insane wtf asking price bonanza commence! One of my neighbors just put their 1,700sf dump (no updates) on the market for a cool $1.4 million. The place doesn’t even have a backyard. Similar homes priced at around $800k have been sitting for weeks. Reality is for suckers.

Between this week’s open house and broker’s open, I’ve had approx 40 parties looking at my bev hills adjacent 1750 sf condo.

I think that means demand is quite good, but will update the blog when hopefully offers come.

With 40 lookers….shouldn’t you have already received at least 4 offers? Sounds overpriced, or needs too many repairs Best of luck

Surely some of those early bird, lowballing Persians, Russians, quasi-Eurasian trash you previously mentioned made an offer???

We received 2 offers yesterday afternoon (the day after the brokers open), one a hair over asking- that’s not bad for 3 days of work. We accepted as the buyer was putting down 60% and had 780 credit. We were told he had lost out on 3 recent units by bidding under. We tried to get the other offer to step up to the plate, but she thought we were overpriced as she saw a condo in BH schools for 730k 1.5 years ago (umm, ok lady- you’re officially crazy bidding 10k under despite your comments)

No repairs are needed on my place- it looks stunning right now. Top notch, remodeled, and clean. I think any buyer will enjoy it for many years. 825 S. Le Doux if you want to take a look. We had 3 appts yesterday and another today, so not like demand just stopped either.

As I’ve said elsewhere on this blog, I think prices have pretty much peaked for LA condos and my journey is towards the water, so I’m done with Beverly Hills. But if you want to stay in a place for 30 years and find the perfect spot, locking in a 4% 30 yr fixed mortgage isn’t terrible.

Keith, thank you for sharing. A coworker of mine recently sold his place in the South Bay (a pretty nice 800K ish house). It went something like this: coworker contacts agent saying “I want to sell.” Agent makes a few calls to other agents before listing on MLS. One of the other agents had a client who looked at it the next day. Sold. Full price. End of story. If the location, condition of property and price are in line, selling a house today is incredibly easy.

“If the location, condition of property and price are in line, selling a house today is incredibly easy.”

The question is if fools are parting with their money, not that money is being parted with – important distinction.

The groundhog didn’t come out in SoCal, and neither did the homebuyers apparently.

With the depression in demand (fewer X/Ys, changing living patterns, tightening of mortgage standards, and lower incomes), controlling the supply is the only way to keep the prices up. The shadow inventory is unpredictable. Transferring properties to big monied landlords was a good scheme to keep the properties out of the common market. They want to make a mania to encourage new leveraging. The only risk to the straight to 100% cash buyers is that it slightly lowers rent value appreciation.

There is a reason for all the market manipulation. A collapse in pricing would be particularly disastrous for the economy. Be careful what you ask for. In the US of A our tax system is tied to housing, and in California home sales. A higher percentage of jobs are now in the public sector. Now that interest rates have to go up to protect the petrodollar, enjoy the ride!

Agree – the sickness is plenty bad, but the cure could be worse.

California is boom bust central. We just went through a mini boom and if you missed buying then, no worries you will get another chance. The bust is coming again no doubt. I heard a new mortgage program put out by banks-Wells Fargo-that is suppose to help get more buyers in the market but will be backed by the government. Someone on this blog probably knows what the name of this program is. California is a great market to speculate in. High demand, a place despite the prices people stay and pay willingly. You need to time your buys and sales if you want to play the game. If you are new to this crazy housing minefield you will want to do a lot of research and exercise major restraint in order to buy right. As long as you don’t buy at the top, long term you will be fine. Don’t take an adjustable loan, you will be fine. Buy what you can afford, you will be ok. If you deadset on living in a crappy little house that you max out your income to buy then that’s up to you. Even when prices dropped they did not hit the floor in desireable areas. Everyone is a speculator of some sort if you buy in California prime areas especially. I am look forward to the next bust-I will buy more rentals again.

Always amazing when these rays of eternal sunshine from a mogul’s mind cut through the darkness of a controlled market.

God bless the investor class.

Deflation is a concern of Yellen and many others. Real estate had Deflation in 2009. Boomers should sell now and leave the state before it is too late. I know.

But that wonderful sunshine and beautiful weather makes the Alpo canned dog food and Purina canned cat food taste SOOOOOOOOOOOO good, and SOOOOOOOOO much better flavor here in sunny SoCal.

9/10 house poor, homedebtor Baby Boomers agree, the cat food tastes better here.

The problem with the housing market is that it’s a cluster f*** of scams.

1.) Chicago style politics “pay this and I can make all your problems disappear” DOJ settlements.

2.) Banks have no idea who owns the note on homes that are foreclosing so they are creating false documents indicating that they actually hold the note. Also see: “Shadow Inventory.”

3.) Crooked appraisers are back in business, AND HOW. The state is turning a blind eye for obvious reasons (read: boosted tax revenue).

4.) People who make risky investments, in general, have absolutely no qualms with bankrupting their month old corporation and starting another one under a “friends” name. Rinse and repeat.

Bottom line: Hard working Joe Schmoe keeps on working towards the ever elusive American Dream his parents had.

Buy now or be priced out forever.

You’ll never lose on prime desirable coastal lots.

Everybody wants to live here.

Once you dust off the surface covering of usual cliches, you’ll find underneath it all is a neglected issue. That is even with extremely low supply, the fleeting demand the market has demonstrated.

For example:

Remember the draw-bridge property? They apparently can’t keep this thing under contract.

http://www.redfin.com/CA/Los-Angeles/1832-Alder-Dr-90065/home/7075163

How about that LAX runway adjacent junker in Inglewood, one month later and still no bites.

http://www.redfin.com/CA/Inglewood/5009-W-98th-St-90301/home/6456105

Recall the Mid City L.A. gas station adjacent condo, just “minutes from all of the South Bay.” “FINAL REDUCTION!!!!” Going on five months from initial list and still riding the wave down.

http://www.redfin.com/CA/Los-Angeles/8516-Cadillac-Ave-90034/unit-3/home/6786153

You’ll definitely remember our Lincoln Heights “amazing” Victorian charmer. Also on the stretch to five months out from list and currently sits with a 13% discount.

http://www.redfin.com/CA/Los-Angeles/2125-Vallejo-St-90031/home/6945511

Perhaps the housing cheerleaders can respond with any of the following ad hominem distractions…

You’re just (sour grapes/an angry renter/upset you missed the boat).

This time is different…

True that, What… although I left that out since they’ve been using the “soft landing” rhetoric as of late – you know, prices will go down slightly but level off.

It appears that even they have a hard time shovelin’ their own crap, if it smells bad enough.

Then again, somebody a thread or so back suggested Jesus is the answer. Just gimmie Jesus!

Anon,

We talked about this tear down on the blog a few weeks ago, check out the sold price! Maybe it really is different this time. 🙂

http://www.redfin.com/CA/Manhattan-Beach/104-The-Strand-90266/home/6712526

Well, I can see how it would be different in one sense:

Anyone that can afford to pay $9+ mill on a TEARDOWN in a prime location HAS MONEY TO BURN. Such a person is RICH, RICH, RICH!!!

And perhaps that is the new reality: There are so many members and connected relations of the top 1% out there in California right now, that there are huge amounts of CASH flowing around among them . . . and that’s what is driving prices up.

People like this don’t worry about mortgages. They inhabit a whole different orbit than most of us working stiffs–no matter how “well paid” we may be.

In that sense, maybe things ARE different, in that SoCal’s real estate market is not only unhinged from, but perhaps is now completely independent of such traditional “fundamental” economic factors and considerations as incomes-keeping-up-with-prices, affordability indexes, and the like.

Maybe there are just a whole lot of RICH people in the market that are concentrated in places like SoCal, and they are chasing a very fixed and limited inventory.

seriously bra, ur a lil… hmmm. i’ll refrain. there were plenty of you the last time around ( 6 yrs ago) and i know u wont have ur name on here aftewards.

I’m not sure how relevant of a comparison the MB property is to the others. I used a broad representation of areas and property types across L.A. city. It might be more useful if everyone had millions to burn and wanted to live in MB. My perspective is one of a middle class individual looking for a primary residence near job centers.

The “buy now or be priced out forever” meme is overused, but isn’t every other article here on DR. HB an example of it?

Every time there’s an article about median incomes and housing prices, that’s an example of people that bought into a neighborhood a number of years ago, and would no longer be able to afford their same house if they were to try to buy in today.

You will always be able to find overpriced properties since there’s no huge downside to listing a property with a “make me move” type of price.

It’s a little surprising with the run up in the last 18 months there aren’t more listings of that variety. Perhaps we’ll see more once summer season really kicks in.

I don’t think the examples given are of the “make me move” variety. Two obvious flips, a motivated organic seller, and a Fannie home path. All four of these sellers need to sell now.

I love this 90-year-old, 825 sq ft shoebox in Brentwood – ONLY $749,000 (last sold in 2009 for $458,000 — a nearly $300,000 markup): http://www.redfin.com/CA/Los-Angeles/1120-S-Barrington-Ave-90049/home/6760840

No front yard, just a tiny patch of grass.

No back yard, just a tiny concrete patio — with neighboring apartment balconies gazing down on you.

Great find and certainly one to watch. I believe this qualifies as a real home of genius.

i live in a three income household and because the mortgage is paid off and there are no minors in the house, we have a lot of disposable cash to eat out and pretty much live like the 5% even though our income combined is less than $100,000

It seems with all the sales in Cal by the Far East buyers were have the folks who sold these homes move to?

The market in Phoenix and Vegas is flat so far this spring, and no way the sellers take their small or even large profit and buy back into Cal real estate.

“The reason many well paid professionals in their late 20s and 30s aren’t diving in is because they know something is in the housing Kool-Aid.”

Many? Perhaps. Most? Certainly not…they aren’t jumping in because “well paid” as they might be, they simply can’t afford the down and the monthly nut.

Plus student loan obligations before housing savings…no money for a house.

Both.

There are a lot of highly paid professionals who won’t jump in not because they can’t afford it, but because they can’t see the value.

Who the F wants to compete with stupid money making overpriced cash offers? Who wants to try to sell an $800,000 house when rates go from 4.5% to 6.0%? Who wants to pay 1.25% taxes on an $800,000 house?

It is not an “affordability” issue but a value issue.

Housing to NOT Tank Hard in 2014! April 1st will become known as Homebuyer’s Day no longer April Fool’s Day because housing is going to run up 20% for the year starting April 1st.

Buy now or be priced out forever, or until the next meltdown and bubble pop, whichever comes sooner!

lol that’s a good one there.

To your basic question, my answer is no. After the last census, Calif lost 2 House seats. Business’s are closing or moving out of state. Tesla is looking out of state to build a battery factory. Rocketdyne is closing its Tarzana plant. The plant is to be torn down and replaced with retail and residential. The high schools are giving degrees the the functionally illiterate. The Latin American immigrant is unskilled and illiterate is his native language. Taxes are the high. Gas at my former local station is now $3.95/gal. The people I know that are retiring are going to stay because of family & friends (that may change if Prop 13 ends).

I don’t see any change in the above. Two lessons from Detroit: 1. People will destroy the goose that lays the golden eggs, and 2. Cities, like people, need income.

The Music Just Ended: “Wealthy” Chinese Are Liquidating Offshore Luxury Homes In Scramble For Cash

http://www.zerohedge.com/news/2014-03-19/music-just-ended-wealthy-chinese-are-liquidating-offshore-luxury-homes-scramble-cash

This is mostly why I’ve been stating that hot money neighbors are a double-edged sword. We’ll see how this turns out…

By the way, yes I know this is from the so-called doom and gloom site. More like doom and truthful sarcasm.

Certain things have a way of moving West to East. Much like the way California influences the nation in some areas, wouldn’t it be interesting for China to influence California on haircuts.

From the realtors I’ve spoken to that deal in the “hot” areas of SoCal (i.e., from downtown L.A., through Echo Park, Silver Lake, and the Hollywood Hills), the price appreciation is being driven by the following types of people (most of whom qualify as “cash” buyers):

1. Trust fund babies

2. Wealthy parents and grandparents funneling cash money to their young offspring to help them with their purchases

3. People from New York that have money and are moving to SoCal

4. People who’ve made money in the recent stock market run up

5. People in the film and TV industry that make a lot of money–directors, writers, tech people, in addition to actors

6. Foreign investors (namely Chinese)

(Notice, nowhere in these categories, with the exception of perhaps categories 4 and 5, are the buyers’ abilities to buy dependent upon how much they make in salaries or wages- – – – in contrast to the typical American working stiff.)

Now, to some extent, the abilities of all these groups to continue to come up with cash to buy high and higher priced properties are interdependent (e.g., so long as Wall Street is doing well, parents and grandparents feel a whole lot better about liquidating that stock market bounty and giving it to their offspring.)

However, it will be interesting to see what happens to the other six groups if and when the Chinese economy hits a major hiccup such that a. Chinese buyers flush with cash are not as plentiful in the California or American RE markets, and b. the rest of the world’s economy feels it as well.

I read doom and gloom as it helps me offset the unicorns and rainbows MSM reporting. I think reality is somewhere in between… The funny thing is that I seem to be agreeing with more and more of the doom and gloom articles as of late. I am not sure what that is all about. However, I am not quite ready to buy guns, gold, and canned goods and retreat to my concrete bunker just yet…

Why the mean dog food analogies? In the seventies, some senior citizens did resort to this and it became kind of a campaign clarion call after that.

I am 53, and a tail end baby boomer, for clarification.

I find it is simple math, why a baby boomer is stuck in their “mansion” as you like refer to homes that the happen to own.

Baby Boomers may make you sick but, are we supposed to pay a huge commission and then go find a high price turkey lesser home to buy, to accomplish what? Free up some investment property for “slick” I don’t have a any other occupation real estate investment guys. OR add to Matt Batttiata or Chris Heller the home seller helpers every growing resume of sales

Besides, I think some baby boomer offsrpring are much more disgustingly vapid than their hideously shallow parents.

For the record, we do not eat dog food or hamster food, or yikes cat food, but have always eaten plain and frugally to afford our lives.

Are you jealous cuz your generation is hooked on restaurant sushi and martinis like budding alcoholics.

Blame the dishonest society that elects dishonest politicians and spends more time at casinos than in wholesome activity with their own families

I’ve always taken the dog food reference to be a bit tongue-in-cheek, but this intergenerational conflict is just a big distraction. It focuses on effects, not the causes of our shared broken system.

Exactly! Great point

I feel your pain Kerri. You are not alone. It is not just the baby boomers, but the Asian investors also take their share of blame. We mustn’t leave out our brown brothers to the south as well. Do you feel better now Kerri, knowing that there are plenty of scapegoats. Sit back and enjoy the fun Kerri. Don’t take life so seriously. Invite some friends over(Jim Beam, Jack Daniels, and of course, Johnnie Walker).

“Invite some friends over(Jim Beam, Jack Daniels, and of course, Johnnie Walker).” Now where did I hear this before??? Hmmmm I think our friend “Lee” is a chameleon.

If there is jealousy it likely comes from the fact that the boomer generation was able to afford to buy a home often on one income, at inflation adjusted higher wages, with no debt from college educations that were affordable due to large subsidies by taxpayers, and that those homes were purchased at prices that were much more affordable than is currently the case. Oh, and the fact that tons of boomers are now living in 4 bed 2 bath 2000 sq foot homes on their lonesome while young families are often sqeezing two kids into a two bedroom 800 sq foot apartment because there is 1) no inventory; 2) people who bough the nice 4 bedroom 2 bath homes for 65K two decades ago now want $850k+ (or they rent it out for 4k a month in that fabulous school district and go buy a second home).

You’re right that on an individual level it makes no sense for you to sell and pay commission and trade down to smaller house to keep the prop 13 super low taxes. However, on a societal level this situation breeds a lot of unrest and resentment, and at some point something has to give. It is increadbly destabilizing to project twenty years into a future where scores of homebound seniors who can’t drive or keep up their homes live in sprawling homes in the best school districts, while everyone under 45 crams into 900 sq foot 2 bedroom apartments.

I have been seeing this in my parents neighborhood for the last decade: they used to get hundreds of kids trick or treating and now they get five. The only young families are renters, and most of these larger homes are filled with couples whose kids have left and can’t afford to move back unless it is into one of the many empty bedrooms in the same house. My parents are doing the same as you, and I don’t blame them because I don’t think I would necessarily do any differently. The problem is a policy one: rational individual choices are making a really untenable situation that can’t be sustained long term due to economic policies (tax deductions, prop 13, tax rates for wages vs. investments, etc). I’m not claiming I know the answer, but I do think we can name the problem.

“What is interesting is that in SoCal, the typical monthly mortgage payment for those buying in February landed at $1,528.”

What exactly are you going to get for $1528?

Last time I checked that amount will pay for a $200K home, property tax, and a few hundred dollar association fee. Those homes don’t exist in SoCal in an area I would feel safe. A entry level home in Irvine is about $750K with a $5500-6000 mortgage incl tax, mello, and association fees.

This is why I’d love to know the LTV numbers on new financed sales data. Only way I know to get this information for L.A. County is to make a trip to the recorder’s office and pay, pay, pay.

“The typical monthly mortgage payment Southland buyers committed themselves to paying last month was $1,516, down slightly from $1,528 the month before and up from $1,154 a year earlier. Adjusted for inflation, last month’s typical payment was 36.8 percent below the typical payment in the spring of 1989, the peak of the prior real estate cycle. It was 48.2 percent below the current cycle’s peak in July 2007.”

$1500 will get you 1+1 Apt. in West LA. 36% lower than 1989 and 48% lower than 2007 is surprising.

Housing To Tank Hard in 2014!!

I thought we lost you Jim. Thank God you are okay! You know all that beware of the ides of march talk had us a little concerned…

Existing-home sales slowest since July 2012:

http://www.marketwatch.com/story/existing-home-sales-slowest-since-july-2012-2014-03-20

Southern CA number for Feb 2014:

http://www.dqnews.com/Articles/2014/News/California/Southern-CA/RRSCA140312.aspx

Volume has plummeted while average price is up.

Interesting tidbits from the dqnews article:

– Foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 6.8 percent of the Southland resale market in February.

– Absentee buyers – mostly investors and some second-home purchasers – bought 29.0 percent of the Southland homes sold last month, up slightly from 28.2 percent in January and down from 32.3 percent a year earlier. The monthly average since 2000, when the absentee data begin, is 18.6 percent. Last month’s absentee buyers paid a median $320,000, up 25.5 percent year-over-year.

– In February 6.2 percent of all Southland homes sold on the open market were flipped, meaning they had previously sold in the prior six months. That’s the same flipping rate as the month before and it’s down from a record 7.0 percent a year earlier. (The figures exclude homes resold after being purchased at public foreclosure auctions on the courthouse steps).

– Buyers paying cash last month accounted for 30.9 percent of home sales, up from 29.1 percent the month before and down from a record 36.9 percent in February last year. Since 1988 the monthly average for cash buyers is 16.4 percent of all sales. Cash buyers paid a median $340,000 last month, up 28.3 percent from a year earlier.

Two more from the DQnews article:

– Last month 12.9 percent of Southland home purchase loans were adjustable-rate mortgages (ARMs) – more than double the ARM level of a year earlier. Last month’s figure was down a bit from 13.5 percent in January and up from 5.6 percent in February 2013. The January ARM level was the highest since April 2008, when it was 16.4 percent. Since 2000, a monthly average of about 31 percent of Southland purchase loans have been ARMs.

– Jumbo loans, mortgages above the old conforming limit of $417,000, accounted for 27.2 percent of last month’s Southland purchase lending. That was up from 26.7 percent the prior month and up from 21.1 percent a year earlier. In the months leading up to the credit crunch that struck in August 2007, jumbos accounted for around 40 percent of the home loan market.

In my view, the use of ARM’s is a huge driver of purchases in prime areas. What normal statistics (median incomes, median mortgage size) don’t show is how variable many incomes are in prime areas. People in finance see huge changes in income year-to-year and small business owners who sell see huge one-time gains via capital gains. They then use large 30%+ downpayments and ARM’s to minimize monthly payments but buy $1mm+ homes. I have been bidding (against my better judgements) on homes in manhattan beach and my realtor has told me this is how 50% of all transactions are done. Side benefit is that the ARM structure maximizes tax deduction…

I’ve heard the Obama administration using HUD intends to do some serious revamping of the housing and real estate industry especially where DC sees red lined neighborhoods and apparent racial inequality. I don’t know what this includes but it is likened to Obamacare for housing. Roll out of this program was to follow the 2014 election but now due to the Obamacare disaster the target date will be before the election. Doctor…have you heard anything about this…?

I don’t understand your emphasis on inventory as a measure of the health of the real estate market. After all, people have to live somewhere and if most stay in their homes for 7 – 15 years, then those who bought during the past boom may simply not yet be ready to sell for any number of reasons.

Isn’t a better measure 1) how long a house stays on the market and 2) how much it goes for relative to the asking price?

By that standard, the Bay Area (and I assume SoCal) is booming. There are at most two open houses, a week apart. The bid date is 2-3 days after the 2nd open house. As near as I can tell, one bid is accepted on that date. And it is usually for anywhere from 50K-500K above the asking price.

It is, of course, a miserable market from the buyer’s perspective but it is a great market from a seller’s perspective – and for real estate agents: a fast sell, for a considerable profit (I’ve checked the purchase price in Zillow).

It will be interesting to see what happens when Boomers get into their 70s and need cash. Will they just refinance continually or decide to sell and move to a cheaper part of the country.

Leave a Reply