Investor exhaustion with investment properties hits: Blackstone’s acquisition pace has fallen by 70 percent from peak last year. Running the numbers on rentals in high priced markets.

Existing home sales had another weak month and the blame continues to be on the notorious polar vortex. On the other hand, California is in a record drought and we are in an endless summer yet sales have hit multi-year lows as well. Could it be that over paying for a pre-World War II house is not exactly fitting in the budget of the regular local buyer? It is one thing to speculate but another to see what is happening on the ground. The granddaddy of rental investors, Blackstone has tapered off its investment buying binge dropping in acquisition volume by 70 percent from their record highs from last year. These are folks that run the numbers in bulk. I speak to many local investors and many have not purchased properties in SoCal since early 2013 since the numbers simply did not make sense then and they certainly do not make sense now for cash flow opportunities. The rest of investors are the late comers and the speculators, otherwise known as flippers. It is interesting to see the mindset shift once again similar to 2006 when the volume was turned up so high that even uttering the words “correction†labeled one as a “doomer†or some other attack not based on numbers. Unless you see real estate going up forever, you are basically camping out in a nuclear war shelter counting your stockpile until the end of days. Yet numbers matter. In many states and in certain markets, prices do make sense and have room to grow. Not so much in California at least in the short-term. This is why as we mentioned a site dedicated to housing data Zillow has reached 70,000,000 unique readers a month. Apparently “setting it and forgetting it†does not apply to housing. Let us run the numbers assuming you were looking for cash flow properties in Arizona and California.

Looking at investment properties in Arizona and California

In SoCal $500,000 gets you very little especially in L.A. and Orange Counties. It might get you a nice condo in a sought after market. As an investor, you are looking at cash flow on a variety of fronts. Tax benefits are overplayed in many cases and most long-time investors understand this. In fact, most seasoned investors will tell you to allocate close to 50 percent of your gross rents to costs outside of the regular mortgage payment. Many investors that I know are not your Blackstone’s. They are folks that buy properties with at least 25 percent down and finance the rest through conventional banks or through other lenders. They do put a large amount of skin in the game so the numbers absolutely matter.

So let us take an example of two markets right now with Arizona and California. It is very doable to find a $150,000 property in Arizona that will rent for $1,500 and a $500,000 condo in California will get you close to $2,500. This is very common. For some $500,000 in SoCal seems like a great deal so we’ll run with that. I think people assume that this unlimited investor buying spree is going to continue deep into the future. We are already seeing near record low sales volume even though prices went crazy in 2013.

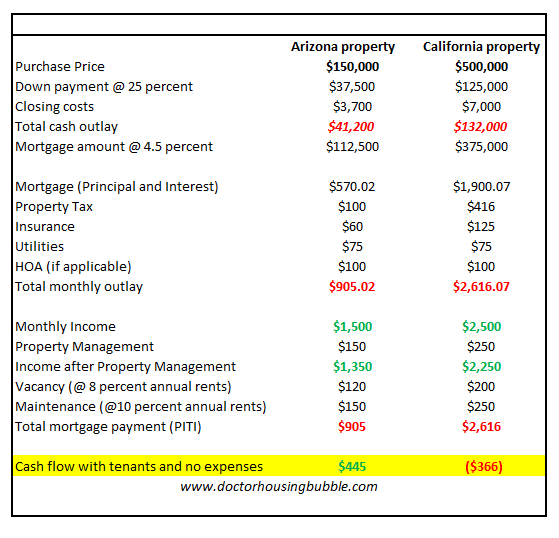

So let us put together some figures here:

Sure, some will tell you to close your eyes and simply pick a place and buy since real estate always goes up in certain markets. But for investors, numbers absolutely matter and if Blackstone was optimistic on the future they would be buying up these high priced properties but they are not. I think the above numbers highlight why investors are balking big time. Novice investors will throw out figures like “that $2,500 a month in rent on that $500,000 home is great!â€Â $30,000 in gross rents seems great when you don’t crunch the numbers. They fail to mention that you will fork out $132,000 of cold hard cash and still have a $375,000 mortgage as well. I was very optimistic on the low HOAs above because in some areas in Orange County HOAs of $300 and higher per month are routinely common especially with condos.

You’ll notice that even in Arizona that $150,000 investment property with 25 percent down is going to bring in something like $445 per month assuming no vacancies, maintenance, or other unforeseen costs after your outlays are factored in. Your tax benefits will absolutely depend on your tax bracket but if you are shelling out this kind of money, you are probably already at a very high tax bracket so any rental income you get is going to get taxed nicely. Something tells me Blackstone is not a poor organization.

But look at the figures for California. You are running in the red with a 25 percent down payment here. This also assumes you are fully rented, no monthly expenses, and you don’t need to do any major repairs. People are waiving contingencies on these crap shacks and fail to realize that a roof or slab work will likely eat up a few years of profits. Plumbing work? Flooring? Labor is not cheap in SoCal.

What about appreciation? This is where speculation dives in and this is why a correction is very likely to occur. You pay rents from net monthly income! Investors are 30 percent of the market in SoCal. If they are seeing these crude numbers is it any shock that they are slowly pulling back? So when the year-over-year gains go stale and even negative (which is very likely) do you think they will ramp back up? The current pace makes no sense for investors already. The only reason to purchase would be to flip and this is practically the definition of a mania if we are not seeing underlying incomes increase. It is also why California is largely becoming a part of the new renter nation.

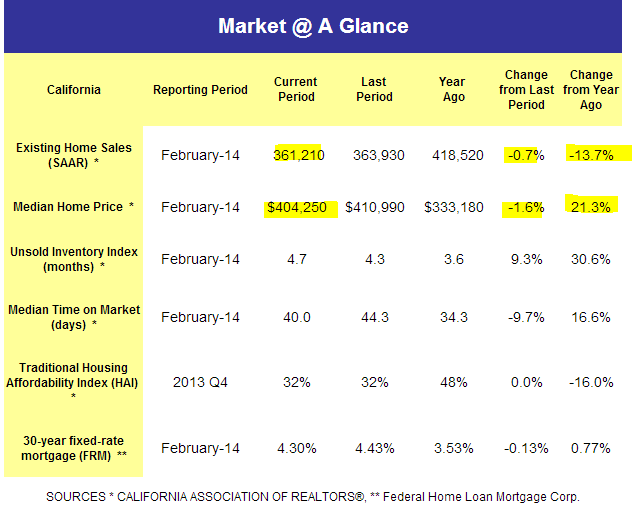

As an investor seeking out rental cash flow you can see why investing in California overall is a poor proposition. The momentum we see today comes from the 21 percent jump in the median home price in 2013:

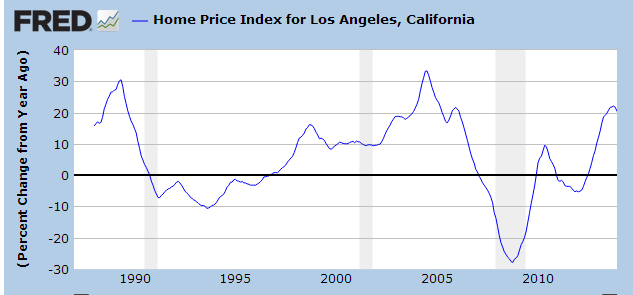

It is interesting to hear those that talk about gains not actually putting their money where their mouth is. If you assume that prices will go up, go for it and buy that house in Culver City or Pasadena. Why not? This is a sure bet from their perspective. Make it a rental and reap those unlimited rewards. As I mentioned from talking with investors that are deploying their own hard cash, California is not even on their radar. The flippers on the other hand are still out there. Whether you rent or buy, you should understand the nature of running the numbers especially on the biggest purchase of your life. California for a generation has been nothing but boom and bust. So it is interesting to hear these same people talk about a permanent plateau as if this was the history of SoCal:

The facts show boom and bust. Just the reality of our market. I’m sure the 7,000,000 folks that lived through a foreclosure wished they ran the numbers.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

62 Responses to “Investor exhaustion with investment properties hits: Blackstone’s acquisition pace has fallen by 70 percent from peak last year. Running the numbers on rentals in high priced markets.”

Housing To Tank Hard in 2014!!

Fuck yeah, Jim Taylor coming through with the quickness!

Thanks for checking in Jim.

Let’s go global meltdown, let’s go!

Real Estate Tanking Hard RIGHT NOW!

Price statistics and the lemmings to catch on to this fact in 2015 🙂

Shout out to my dog Jim Taylor

If you dont understand why real estate is overvalued, it’s because you dont have savings of over $250k. It makes less and less sense to leave large sum of money in a CD, losing value against inflation. Yes, many of those with over $250k savings won’t invest in real estate, but some will, and it only takes a percentage of them to move the market. It’s called diversification, and the new trend for diversification no longer includes safe instruments such as CDs and bonds. So you have a wealth transfer from safe instruments to stock market and real estate, inflating the latter asset classes. It’s that simple. But will this last forever? Of course not. “The Great Default of 2017” is inevitable.

It all comes down to risk tolerance and if you are interested in very actively managing your money or not. The money I made selling my house in ’07 is indeed floating around laddered crappy investments like CDs. I have been interested in using some of it to buy another house, but the value just isn’t there. So my tolerance for potentially losing all of my down payment (assuming Jim is right and housing tanks) is nil, which leaves me stuck getting measly CD returns. But I am not risking losing it all in a housing market that is so manipulated and subsidized beyond any semblance of a “market.” I think plenty of people with over $250K think the same way.

Yep. Lose a couple percent in a treasury, cd, money market or lose 1/2 of a $250k down when rates bump and the market staggers and falls. Inflationary devaluation never looked so good.

It’s all about Return on investment. If you can your $250,000 and buy a rental property that gives you a 5-6% return on investment, then it makes sense to diversify.

The problem is that most people think that investing is buying a property, renting it out for a negative cash flow that you have to feed and hoping for a gain in price.

It’s all about cash flow

Bingo. Soooo many clueless wannabe RE moguls and “investors” think buying and holding is the way to go in LA and SoCal, meanwhile they will be negative cashflow every month for years if not decades, if they manage to hold on.

5 or 6% cash flow on a rental property is a bad idea. Too many things can change overnight. Property taxes can be raised, so can the HOA. A major repair can wipe out youir cash flow for years. Also, if house prices drop only 5 or 10%, you are losing some serious money.

My first lesson in buying any type of Asset (classify it as an Investment or NOT, doesn’t matter) … the FIRST LESSON is BEFORE YOU BUY SOMETHING … CAN YOU GET RID OF IT “WITHOUT TAKING A LOSS” ??

YES — that means can you at least break-even when you finally sell it ?

If you don’t feel confident about getting your money back to its nice, comfy bank account … then your money will be in the other guy’s pocket ..forever and ever … SO SO SAD .

BUT THE OTHER GUY WILL BE SMILING AS HE BUYS HIS LEXUS WITH YOUR MONEY 🙂

With liquid assets (T-bills, some Bonds, CD’s, good ol’Cash), you will get hit with some type of discount whether you sell the asset or inflation eats into your real buying power.

But you will still have your money .

Problem with Real Estate is that :

(1) It has a large recurring carrying cost — Property Taxes, Insurance, Repair/lawn maintenance.

(2) Unknown Risks like a horrible neighbor, fire hazard, rain damage (oops there goes my roof).

(3) Land-lording has a RISK: Unlawful detainer, Slip and Fall, Vandalism, Repair, Paint,

lawsuits from your neighbor because your Tenant has a huge, loud party …. etc.

(4) You have to “Work” the property – Advertising — that means finding the Tenant when it is Vacant, screening the Tenant and hoping to get the RENT PAID ????

I still don’t understand why there is such a Love Affair with Real Estate ??

The only good news with Real Estate is that it is NOT a Stock (that EVAPORATES) in the NYSE, NASDAQ that will TANK when we find out that the Company’s management are either STUPID, INCOMPETENT or just CROOKED ….. Example: Take a look at today’s headlines about Hewlett Packards gigantic multi-billion dollar Acquisition Disaster ( Autonomy “scandal”).

It’s GOOD to have a NICE CHUNK OF CASH …. it feels good to look at it.

It’s not about loss or gain with real estate. It’s about where you park your money when you have millions in savings. Many successful business owners can’t find a safe place to store their savings. Stock is a bubble. Bond is a bubble. Government debt is spiral out of control with $17 trillions in debt and another $220 trillions in un-funded liabilities like retirement fund & welfares promised to senior citizens. The bank is unsafe and can take your money like in Cypruss. FDIC only has $250 billions in fund, not enough to ensure just BofA that has trillion in deposit. U.S dollar is no longer backed by gold. It will no longer backed by oil in the near future. All jobs are shipped to China and 3rd world countries and never come back. When this fiat dollar collapses, you will sit at home and stare at a pile of worthless paper. Look at history. UK was a reserve currency for decades. It eventually collapsed and the US took its place. We’re on trajectory to collapse. Rich people in China come here and buy real estates too because they got no where to park their money.

I haven’t seen any bargains out there since 2012, and was quite surprised that Blackstone kept buying as prices went up. I don’t know how they could make a profit on rentals, since their overhead must be much higher than mine. The higher acquisition cost also means a higher property tax base. I hope that they weren’t counting on capital gains or rent increases, as I don’t see that happening in the short term.

You are right, Paul

2012, the numbers worked. 2013, they went crazy again.

The difference between lettuce and garbage is timing

@Paul A: Blackstone did not buy in metro Los Angeles, much less Pasadena nor Culver City. Blackstone bought in the Inland Empire where real estate was technically reasonable.

Blackstone, being the smart money they are, recognized even the Inland Empire was no longer a value and shut off the spigots in 2013.

Blackstone invested in some commercial real estate in DTLA in 2013 but for the most part has stopped investing in SoCal.

As they say, the party is over. SoCal peak real estate was May 2013 when interest rates where in the sub 3.5% range. When interest rates started to climb in June 2013 that is when prices stagnated and sales volume crumbled.

“haven’t seen any bargains out there since 2012, and was quite surprised that Blackstone kept buying as prices went up.”

Blackstone kept buying so they could boost the value of their asset portfolio by bidding homes well above appraisal. Obviously this was easy because the volume went down to practically nothing. Low volume makes it easy to manipulate any stock or even a market. Residential real estate in select areas of the US? A walk in the park.

http://blogs.marketwatch.com/capitolreport/2014/03/20/investors-retreat-from-housing-market-as-prices-heat-up/

“We think a lot of the big pop in housing has gone out,†Stephen Schwarzman, chief executive of Blackstone Group, which has bought at least $7 billion worth of houses, said Wednesday on CNBC. “For us an exposure in the $7-to-$8 billion range is big enough.â€

Worth posting again:

Existing-home sales slowest since July 2012:

http://www.marketwatch.com/story/existing-home-sales-slowest-since-july-2012-2014-03-20

Southern CA number for Feb 2014:

http://www.dqnews.com/Articles/2014/News/California/Southern-CA/RRSCA140312.aspx

Volume has plummeted while average price is up.

Interesting tidbits from the dqnews article:

– Foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 6.8 percent of the Southland resale market in February.

– Absentee buyers – mostly investors and some second-home purchasers – bought 29.0 percent of the Southland homes sold last month, up slightly from 28.2 percent in January and down from 32.3 percent a year earlier. The monthly average since 2000, when the absentee data begin, is 18.6 percent. Last month’s absentee buyers paid a median $320,000, up 25.5 percent year-over-year.

– In February 6.2 percent of all Southland homes sold on the open market were flipped, meaning they had previously sold in the prior six months. That’s the same flipping rate as the month before and it’s down from a record 7.0 percent a year earlier. (The figures exclude homes resold after being purchased at public foreclosure auctions on the courthouse steps).

– Buyers paying cash last month accounted for 30.9 percent of home sales, up from 29.1 percent the month before and down from a record 36.9 percent in February last year. Since 1988 the monthly average for cash buyers is 16.4 percent of all sales. Cash buyers paid a median $340,000 last month, up 28.3 percent from a year earlier.

-Last month 12.9 percent of Southland home purchase loans were adjustable-rate mortgages (ARMs) – more than double the ARM level of a year earlier. Last month’s figure was down a bit from 13.5 percent in January and up from 5.6 percent in February 2013. The January ARM level was the highest since April 2008, when it was 16.4 percent. Since 2000, a monthly average of about 31 percent of Southland purchase loans have been ARMs.

– Jumbo loans, mortgages above the old conforming limit of $417,000, accounted for 27.2 percent of last month’s Southland purchase lending. That was up from 26.7 percent the prior month and up from 21.1 percent a year earlier. In the months leading up to the credit crunch that struck in August 2007, jumbos accounted for around 40 percent of the home loan market.

“-Last month 12.9 percent of Southland home purchase loans were adjustable-rate mortgages (ARMs) – more than double the ARM level of a year earlier. Last month’s figure was down a bit from 13.5 percent in January and up from 5.6 percent in February 2013. The January ARM level was the highest since April 2008, when it was 16.4 percent. Since 2000, a monthly average of about 31 percent of Southland purchase loans have been ARMs.”

Scary. Hope those who took the ARMS are ready for their nut to grow when the rates finally jump and home values drop – a bad bet indeed.

13% in ARMs isn’t a lot. Hate to break it to you. ARMs also are popular on condos as folks assume they will buy a house at some point.

ARMs aren’t inherently evil like some on this blog think.

Doc, you can scratch out the utilities line item and maintenance on the condo should be lower in the aggregate. Of course, the HOA fees make up the difference. Problem with condos is the permanent non-fixed HOA line item. Special assessments are especially biting. At least with a SFH, you have flexibility in that you can make repairs and improvements without a committee of competing interests.

At the end of the day, you might come out a bit ahead on the AZ SFH, but the rental market is not as robust as it is in L.A. so vacancies could be a bigger issue there. OTOH, more landlord friendly regulations can make the difference too. In certain cases, a net loss can have tax advantages that outweigh the loss – but not too much of a loss as the IRS is no dummy and there’s no free ride.

I guess what I’m saying is that the numbers on their face only tell part of the story. Land lording and doing it right is no walk in the park.

Look up their business strategy.. every one of these funds is planning a 5-7 year exit. Counting on a heavily optimistic outlook, I would say we are already in year four. AHFM is the only one that isn’t heavily leveraged.

It’s about to get interesting. Don’t buy now.

Good analogy, Chris

Any insight as to what their exit strategy might be? I can’t imagine offloading tens of thousands of houses all at once is what they have in mind. Maybe offloading the whole company through an IPO?

Heading out this weekend to find my realtor for No. San Diego County. Prices where I’m looking are heading down slowly, and some still unrealistically high – some people think their house is a palace and they deserve to double their money. The reasonably price homes fly off the shelf there

The US economy good never with stand another housing collaspe, banks and major business in general will pull out all stops to avert a depression again in housing.

Yes mortgages will rise later, but so will hiring and wages, creative mortgages will make a major impact, big business and the Gov’t both have a huge vested interest.

In autos it was the leasing of cars that saved the industry years ago, every person on this site should hope and pray that their grave outlook of housing doesn’t come to being.

America would see a depression that would make 1929 look pale in comparison, we possibly may never recover for many years and for sure the world as we know it would change our standing in the first half of this century as a fianical leader and power?

“Yes mortgages will rise later, but so will hiring and wages…”

Due to what? Are you thinking we are going to “deglobalize”? You will not likely get that genie back into the bottle. Real/nominal wages can only go down as globalization marches on until the poorest Cambodian has the same standard of living as the poorest American. The wage inflation hopium is truly the drug of the Fed but I think even the hacks at the Fed have realized that we can only have price inflation crowding out each other which gets us nowhere…

I was watching the TV series Chuck on Netflix last night and the villain’s plan to ruin the US was to drop one trillion counterfeit dollars into the US economy. I laughed my ass off. Really? Drop a trillion new dollars into the US economy will bring it down? I am not sure anyone would notice because the Fed has been trying for years and hasn’t succeeded in getting anyone’s attention…

“Yes mortgages will rise later, but so will hiring and wages…†???

I agree this statement might prove naive. Why are hiring and wages so traditionally low? If it is totally due to fed policy then lets have PZIRP “Permanent Zero Interest Rate Policy”. I don’t think anyone has a single widely accepted answer.

To me interest rates have to rise for other reasons than economic robustness. Technology has been deflationary. The aging world population is deflationary. Current economies depend on growth and low inflation. We are stuck unless we figure out new avenues for growth. When you see the birthrate go up we will grow again. This might take 2-3 generations. In the meantime it would help to have low positive interest rates. We should encourage some saving instead of a singular focus on spending. Peoples fetish for housing appreciation just ensures the decline. Western Civ has been here before.

The only place I would be comfortable investing in rental housing right now is in the oil and gas boom towns of the Dakotas and Pa. and other places that are attracting way too many high paid workers relative to housing. If Blackstone started a fund concentrating on those markets, deal me in. California? Nope.

As the good doctor states, much is dependent upon no vacancies for the numbers to work. But, who is lucky enough to find tenants who are that reliable and consistent? Do you know any landlords? They’ll tell you that a good tenant is gold, and hard to find. I have read recently that the big funds investing in this stuff are only looking at 75% rented. Doesn’t sound good to me. On top of that, they were pitching these funds claiming that they could rise rents 5% a year in some cases! Sure they can. I haven’t seen a rent increase in six years, because my landlord loves the no hassles and the check s flowing in on the first like water out of a faucet. If he raised my rent 5% a year, he wouldn’t have a tenant in this place.

And when the boom is over when oil & gas run dry, then what happens to housing demand? Everyone moves out and you are stuck with a unit that is not bringing in any income to cover expenses.

IMO I think the best places to invest are in big cities where there is demand. Prices will naturally be higher, but there will always be demand for rent.

Save up, buy the best that you can afford assuming the metrics line up and meet your goals and buy there. Location is key, and a property in a good location will always have rental demand, which would be a risk in smaller and less familiar towns. You also have to learn to landlord if you want to become a TRUE investor, so you need a unit in close proximity.

“And when the boom is over when oil & gas run dry, then what happens to housing demand? Everyone moves out and you are stuck with a unit that is not bringing in any income to cover expenses.

IMO I think the best places to invest are in big cities where there is demand. Prices will naturally be higher, but there will always be demand for rent.”

Okay… let me get this straight. We should all run to the “big city” when “oil & gas” run dry? Ahhhhh how do you get all the food to the big city without oil & gas to grow and transport it? I would say buy a farm with wind and a well. Don’t forget the shotgun and hound dog because you’ll be needing them…

“And when the boom is over when oil & gas run dry, then what happens to housing demand? Everyone moves out and you are stuck with a unit that is not bringing in any income to cover expenses.”

Well, you sell it then. You’ve probably made a ton during the boom, so, no need to carry it anymore. Sure, you’ll take a paper loss, but, I certainly hope that 2000 a month rents in the middle of nowhere were invested well, and I’m pretty sure you could work it to your advantages at tax time with the loss of capital.

Being a landlord is no fun in Los Angeles. The courts are not friendly. Same goes for the tenants.

I covered the same yesterday and ask who will pick up the slack to keep the housing “recovery” going?

This assumes financing/leveraging. For the many investors who are all cash, the numbers change favorably. Care to comment? Also, thoughts on how this calculation plays out for foreign investors?

http://www.zerohedge.com/news/2014-03-21/stunning-history-all-cash-home-purchases-us

Anyone for a $700K SFH falling dagger? They always go back up. Don’t worry if your household income is $120k, in a couple years you’ll be sitting on a brick or equity.

And the ship of fools sails on while big money laughs.

Foreign investors/buyers are different as many have stated. For the overseas Chinese it is about education and location.

“For the overseas Chinese it is about education and location.”

Can you prove that statement with empirical evidence? At least the part about education. To simply state “location” is so broad as to be practically meaningless. What’s the context for location? A good location for a speculative play or something else?

Chinese come to California for many reasons. One reason, is for the gold. The generous taxpayer benefits are a major draw. Why wouldn’t they be?

I am seeing a couple of short sale scams in my area that are keeping lower priced properties off the market. The property is put “on the market” and listed with the wrong address, misleading photos, and no way for anybody to contact the listing agent or make an offer, then goes to pending within 12 hours, and then the same thing repeats a year later. The house involved in that has sat empty for nearly 3 years and it is in an area where families need housing. How do I report this kind of fraud? BofA doesn’t seem interested in hearing from me.

Are you sure there’s no one living in those houses? How do you know?

Hello:

I am responding to Dave’s posting which is copied below.

If there is any R.E. Agent or R.E. Broker that is falsely posting

properties on the MLS or any other R.E. Website and/or

offering any property for sale anywhere – and that Agent does NOT have

a LISTING AGREEMENT for — that is Real Estate Fraud.

If any Agent/Broker is helping people SQUAT in properties

and keeps posting FALSE “For Sale” notices in any VENUE,

it doesn’t matter what/where/etc … that is Real Estate Fraud.

Get all the information on the Property Listing and

the Agent/Broker’s License Numbers and complete

the California Bureau of Real Estate (CA-BRE) “Complaint Forms”

with your print-outs and attachments and send in the

complaint . Keep a copy of what you are sending and

follow-up with the CA-BRE to make sure they investigate

and prosecute the Agent and the Broker.

REAL ESTATE FRAUD is KILLING the So. CAL Market.

====================

Dave – March 21, 2014 at 10:40 am

I am seeing a couple of short sale scams in my area that are keeping lower priced properties off the market. The property is put “on the market†and listed with the wrong address, misleading photos, and no way for anybody to contact the listing agent or make an offer, then goes to pending within 12 hours, and then the same thing repeats a year later. The house involved in that has sat empty for nearly 3 years and it is in an area where families need housing. How do I report this kind of fraud? BofA doesn’t seem interested in hearing from me.

=====================

If these A-holes of Blackstone have stopped buying… beware, They got all the people in the back running Modelings and derivatives to no end…

Rents and Housing has to come down some… people are pinched. I was talking to an owner of a Mexican restaurant, and he said that it is harder now… the price in supplies went up and he Can NOT raise prices on dishes because people will jump ship…

this is food: the number 1 thing. Most people don’t think twice before eating out at low-key burrito selling place…

too much money goes to RENT, Taxes, and Gas.

Now, it will be interesting in the summer in Cali, all those people that need AC for their homes..

Most people in the lower bracket have been spending their TAX refund in the merchandising and just Shiite… when that money dries up for the lower earning peoples… 3rd Qtr numbers for retailers will be interesting!

What “TAX” “refund”, HomeSugar. It’s disrespectful to even call it a “tax refund” for “those people” in the “lower brackets” because they are a net drain particularly when it comes to tax time. Can’t call it a “refund” if they are getting back more, often a LOT MORE, than they paid in, if they paid anything in at all in the first place. Can’t call it a tax because, again, they didn’t pay it.

My Bad….but You know what I mean… the free money they get to spend from other people’s pocket courtesy of the Fed….. and don’t even get me started on this. I gotta go do my tax return this weekend. I know I gotta write a check to uncle Sam.

This free money they get the spend it quick on useless shiite, but it stimulates the economy… you know. the stock for best buy and the Gap gotta go up.

2-3 familes in one house… WHO care if rents are high… just saying

As someone who has many illegal-alien and/or recently legal in-laws and friends, I can assure you that this is the very BEST time of the year for them. Despite earning garbage wages, getting a tax return of ONLY $4,000 is considered SHAMEFUL, as in you didn’t do it “right”. Getting 6-9K in the mail is more like it…and it’s not uncommon. Shoes, purses, iphones should all be doing well in Mexican-heavy cities these last two months. I pray that the gov’t and/or IRS will eventually stop this madness!

MEANWHILE, BACK IN THE HOMELAND/ON THE MAINLAND…

The Chinese sham economy and its notorious shadow banking is finally beginning to show signs of serious problems and collapse.

http://www.zerohedge.com/news/2014-03-20/chinese-stocks-enter-bear-market-following-2-more-defaults-overnight

http://www.zerohedge.com/news/2014-03-18/pboc-denies-it-will-bail-out-collapsed-real-estate-developer-while-chinese-property-

http://www.zerohedge.com/news/2014-03-19/music-just-ended-wealthy-chinese-are-liquidating-offshore-luxury-homes-scramble-cash

This could be a perfect storm in SOCAL, the Asians are getting ass fucked on margin calls back home and as the “forever homes” they’ve been buying up and down the West Coast could suddenly become for-sale at big discounts. The PE funds have pretty much stopped buying in CAL. Small investor / flippers are still trying to flip with each other but sooner or later they will get spooked. The regular home buyers have all but stopped shopping as the affordability is horrible and with a shaky economy the $100K combined SOCAL households are not taking on a 750K home loan. Finally the fed is slowing the bond buying, the new PMI / qualification rules make it more $$$ plus the FED is talking about stopping new inflows into Freddie and Fannie making the fucking banks or bond holders eat the shit MBS. I can’t wait for the stick to break this camels ass and watch all these bankers and investors get ass raped again but this time no bailouts!!!

Oh and, so much for the petrodollar and US Reserve Currency status:

Russia and China are set to announce a huge deal cutting out the dollar…

http://www.zerohedge.com/news/2014-03-21/petrodollar-alert-isolated-west-putin-prepares-announce-holy-grail-gas-deal-china

The BIG MONEY crowd is not interested in recent production.

They are interested in Bread and Butter SFH that sit on land that represents a decent percentage of the purchase price.

They are okay to buy only if they are acquiring assets at a significant discount to replacement costs.

This crowd does not need the habitation for personal living space. So it’s no problem for them if they back away, entirely, from the market.

That’s something that real estate agents don’t have to face with housewives — who buy 98% of all SFH. (The husband is only along to make the payments on the nest.)

It’s highly significant that the hedge fund crowd is NOT building new apartment complexes.

Further, they are not buying second-hand apartment complexes. They don’t want to be slum-lords. (Bad politics.)

It’s only natural that sales volume should collapse as massive blocks of Bread and Butter homes ( the starter series ) moves under ‘professional asset management.’

This bias must be overlaid upon the natural swings in the brokerage trade. I can easily imagine a holding period — for this class of investor — stretching out to fourteen-years. Instead of conventional finance — look to see massive portfolios issuing short-term paper — saving on the yield-curve — in all normal markets.

When currency depreciation combines with their cost of finance, the hedge fund managers are sitting pretty.

The scale is huge, the scheme is simple.

“The BIG MONEY crowd is not interested in recent production.

They are interested in Bread and Butter SFH that sit on land that represents a decent percentage of the purchase price.”

blert – bread and butter, bread and butter, bread and butter… I get it next topic please. You are sounding like our friend LB with the meaningless rental parity mantra. Tim Jaylor and Jim Taylor housing to or not to tank is at least a little entertaining…

Doctor Housing Bubble is spot on as usual. Investing is soCal is for stupid money, which there appears to be an abundance of. The illusion is created by it feeding off itself. If you are aware of that, you can can profit from it. On the numbers side, I think DHB is being optimistic. All things being equal they are accurate, but my experience is that 10-20% of your portfolio will suffer a rogue tenant, or a rogue agent, or items an inspection didn’t make known, or any number of unpredictable events. These events can be so costly, that even if you are a cash buyer, you can make a loss on all your portfolio for the year. Bonds, CDs, and even shares are easier in so many ways. If things right themselves, cash will move out of RE and back into conventional investments.

Twenty years ago, when I was just out of college, the story was the same. Many ran around with their calculators claiming it was smarter to rent. So where are these renters now? While, they are bitter 40 year olds living in giant apartment complexes usually filled with the losers of the world. That is how it is.

It is a shame to watch the next generation under me making the same mistake. I guess no one ever taught you about inflation and real estate, and also how the FED policies always result in inflation. Nothing ever changes.

Making sweeping inferences that renters are losers seems quite bitter. Notwithstanding the age reference, that doesn’t come across as much more mature than your typical high-schooler.

Anyway, yes we all know about general price inflation, nominal vs real measures, and so on. The topic these days – twenty years later – is that wage inflation didn’t keep up. Are you reading the same blog as the rest of us? Relevant and current details – that’s what most of us are looking at.

I dare you to do the same calculation as in the article above for a house in Southern California in 1994. I think it will be illustrative to what has changed.

Not true. The calculation always gives the false answer that it is smarter to rent. It did then, it does now, and it will after the prices double again.

http://www.zerohedge.com/news/2014-03-22/imfs-property-tax-hike-proposal-comes-true-uk-imposing-mansion-tax-soon-year

Another foreboding sign to put up on the wall, Prop 13 days are numbered. Everyone will pay one way or another – even gloating coastal prime re can never lose exceptionalists. You thought you found a shortcut, but they will still find you.

It will be delicious.

I don’t know … The SF North bay area still has a wide selection and inventory in the $300Ks-$500K range. I was in Petaluma the other day and noticed far more range rovers and seeming higher end folks doing daily type errands & shopping.

I came to the N bay from LA and bought a former dairy ranch, and I am sensing that more and more folks are wanting to get out of the cities, but within close enough proximity to be able to come and go. Looks to me like SFers and Marin-ites are moving North and picking up those semi rural half acre to 2 acre pieces while they’re still reasonable by City standards. Sac is still a ways away for that crowd, so I see the area from SF up to even Healdsburg as remaining in demand. Land and homes with larger parcels provide more than just a psychological benefit, they allow for onsite recreation, hobby, retreat, or utility that people in typical SFHs simply can’t achieve.

The Emerald Triangle has great climate for raising medical Cannabis. Mendocino is great. Colorado is in short supply. The City people have plenty of investment money. I could go on, but they told me that I talk too much. I am a farm advisor. I really have a green thumb. I don’t smoke(bad for the lungs and heart, according to the Surgeon General), I invest my money in the vineyard in Sonoma. That is for another post at another time.

Too many easier ways to make money, being a landlord is too much grief for what you clear, not to mention that tenants have all the rights, especially here in California.

We thought about changing our current residence into a rental, but decided it’s not worth the hassle, and will sell it and live off the profit for a few years, then go on Social Security in a modest little trailer trash place, and travel to our hearts content.

Blackstone sees the Housing Bubble Collapse is coming again. First Rats off a sinking ship swim the furthest!

The value of an average house in 1990 was also enough to live a modest life for 10 years. Today, the value of an average house can easily provide a modest life for 25 years.

The pendulum is way out of whack. Going forward housing will under perform all asset classes.

My good friend here in Santa Monica bought a 2B condo in West Hollywood in 2003. He lived in it for a few years, and then moved into a condo he bought in SM at the absolute bottom of the market here (smart guy). So for 4.5 years now he has had a tenant in the weho place, who he finally just evicted.

He summarized the whole experience: Rent was paid late, with penalties, maintenance upkeep etc ended up (luckily) far less than expected. There were hassles in the end getting the guy out, and 2 weeks of no rent in the end when he overstayed. Then 2 weeks of repairs to the place.

Anyway, net net, he made about $85/month over 5 years. Of which he lost most in the end with the eviction and turnover costs. SO even though he cash-flowed he really didn’t make that much money month to month, and he had hassles to boot.

But here is the main point, and why his investment is sound, in the long run, and this is the point that I think this discussion is missing: The terrible renter has been PAYING THE MORTGAGE for 5 years on this condo. Eventually, the place is paid off by renters, and then it becomes similar to an annuity, right? Year after year, paying him money after he retires, and gets rent money in current dollars or new dollars or whatever the currency is. He also can sell the place to cash out. The real investment is the long-play, and it looks like a great way to hedge or diversify your retirement plan when you consider that renters will pay off the condo.

Leave a Reply