Polar Vortex hits California housing market: California home sales fall over 10 percent on an annual basis. 2014 off to a drought in real estate.

The blame game is now out in full force for the slow start to housing in 2014. Nationwide, we’ve been hearing about the polar vortex impacting real estate. Unfortunately it cannot be applied to California given that we’ve been in a full on drought. Winter never came to SoCal. I can’t remember a year with such little rain but hey, who needs water when you can purchase a World War II Cracker Jack box for $750,000 right? Like in most manias, the folks on the ground are the last to get the memo and many are still going out for ARMs to stretch their already impaired budgets. In 2004 one thought that was inescapable to me was the incestuous nature of real estate that was unfolding. That is agents, brokers, banks, builders, home owners, home buyers, Wall Street, tax collectors, and everyone tied to the machine got a mega-boost thanks to ever accelerating prices hikes. Few thought about what happens when a reversal occurred especially since incomes were not going up.  The same has happened over the last few years in more subtle ways. The economy is weak and a big boost has come from home prices going up. Yet much of this is now driven by Wall Street and hedge funds. Housing is off to a slow start in 2014 and you can’t blame it on the polar vortex, especially here in a sunny and drought hit California.

A very big drop in sales

There has been a very big drop in sales in California. This is important to note given that last year was one of the “best†in terms of year-over-year price appreciation. Of course much of this was juiced by easy Fed money and again I must respond to this like I did in 2006 and 2007. The Fed didn’t stop the collapse of 2008 from happening (or that of the tech bust) so why the sudden assurance that QE will somehow revive the currently weak economy? The data shows that since 2008 the big player in real estate has been the investor class using up easy money from the Fed, not your typical American family.

Of course incomes matter and good paying jobs matter. This is why home sales are off to a very poor start this year:

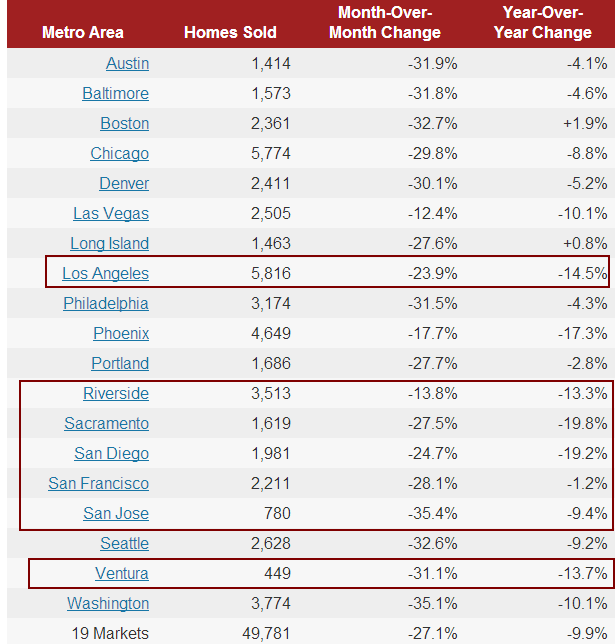

Source:Â Redfin

Nationwide home sales are down 9.9 percent year-over-year. That is a big drop given that home prices had one of their best runs ever in 2013 when it comes to prices going up. If this run was organic, meaning actual incomes and good jobs were growing as well you would expect sales to keep pace. However this run was based on low rates and a fully manipulated market. Keep in mind sales were anemic so you had investors crowding out regular buyers for the little inventory on the market. So of course you would expect this to happen.

You’ll also notice that the most bubblicious areas in California have fallen even harder. Los Angeles is down 14.5 percent, San Diego is down 19.2 percent, and Sacramento is down 19.8 percent. Sales are leading indicators in terms of future home prices.

The media is also being more vocal about the “turn†in the market:

Sacramento Housing Demand Plummets

http://www.sacbee.com/2014/02/13/6156195/home-sales-plummet-in-january.html

“CA Notice of Defaults Rise 53 percentâ€

http://www.centralvalleybusinesstimes.com/stories/001/?ID=25251

Rapid home price gains make renting more attractive, study says

http://www.latimes.com/business/money/la-fi-mo-rent-or-buy-20140220,0,6388101.story#axzz2uAlxC7Ot

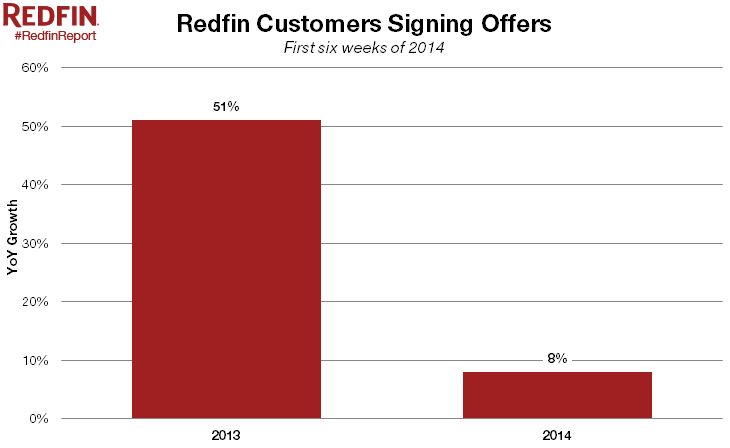

This merely reflects the insanity of what is going on. Going back to the first chart, Redfin covers 19 very trendy metro areas where bubbles have boomed and busted and now boomed again (i.e., Las Vegas, Los Angeles, Phoenix, etc). So it is interesting to see these “more expensive†markets see a big drop in sales activity but also actual buyers making offers:

Last year, six weeks into the year something like 51 percent of Redfin customers were signing offers. For 2014, it is down to 8 percent. Since California is heavily represented in the 19 areas covered, you can easily see that something is turning in the market. It definitely isn’t the weather since fall and winter felt more like a massive spring. Unfortunately sun doesn’t pay the bills otherwise Arizona and Nevada would be the wealthy states in the nation.

This reversal all makes sense. From an article above:

“The median price for a three-bedroom L.A. County house was $417,333 in the fourth quarter. The monthly house payment for such a home rose 40% compared with the fourth quarter of 2012.

To qualify to purchase such a house, a buyer would now need to make at least $95,389 annually, according to RealtyTrac. That’s about $42,000 more than the median-household income and $27,000 more than the income needed to buy the median house a year earlier.â€

Therein is the crux of the issue. I do agree that people merely go by the monthly payment. But that monthly payment just got 40 percent more expensive in general. You have banks now trying to plug the demand hole by going with ARMs and interest only products but that has done very little especially in this low inventory controlled U.S.S.R. style housing market.

As I mentioned earlier, a good part of this boom is incestuous. The big difference this time is the easy money is focused on Wall Street and investors (the results have worked for this tiny group). Yet we are already seeing that this trend is losing steam. You now start hearing odd responses like “equity is real†and people living like paper gains are real in housing. Home equity loans are back up. By the way, you need to pay that back! So all you are doing is releasing more debt hedged on an inflated asset. You have to fully sell to unlock gains. For those in a place like California, that likely means selling and leaving the state. Golden handcuffed baby boomers would rather eat cat food in their homes before selling and relocating to the “other†states in the US. People don’t think this through. Say you bought a $300,000 place and now it is valued at $450,000. Okay. You want a bigger home. So you sell and pay the 5 to 6 percent commission. That leaves you with $125,000 or $135,000 after all is said and done. This can get you a $600,000 home with a 20 percent down payment. However, your mortgage balance went up! You still need to generate a healthy income to make that payment. This is why incomes matter. This is why you are seeing a tighter market for rents and first time home buyers. I’ve heard this line of reason a couple of times that “home equity loans†are somehow equivalent to actual cash. These people are conditioned on believing access to debt is access to wealth. I can fully understand why that is the case in this basket case real estate market.

So look at the above data and income figures. How was any of this sustainable? Riddle me this; if your economy is built on asset inflation what happens when asset prices stall out or reverse?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

120 Responses to “Polar Vortex hits California housing market: California home sales fall over 10 percent on an annual basis. 2014 off to a drought in real estate.”

What about all the regular home buyers who were supposedly outbid by the investors? Are all buyers now just sitting on the sidelines?

“Are all buyers now just sitting on the sidelines?” No but there are a bunch of Unicorns waiting on the sideline. It’s good to know that we have a groundskeeper near by because we need someone to clean up all the sparkly shit once they leave…

I’m one of those unicorns, but I clean up after myself. 🙂 And I think there are only about 11 of us so it should be a quick job.

“Housing Bubble 2.0” …. yes,absolutely. It’s not just ordinary buyers who maybe waiting out this ridiculous run up in prices to end … It’s also the “Rich Dads” who are waiting for this ” BBBubble to Popppp” and when it does… THAT is when I will buy. In meantime all the Stupid Money will wear itself out.

**Anecdotal Information — I spoke with one of those “captive real estate agents” that work for those Investment companies and he says that many of their deals are falling out of escrow … wonder why … because prices are DROPPING. This agent tells me that the Investment company is now regretting some of the House purchases they made and they trying to unload some of these homes that they stupidly and blindly bought.

By the way some of those homes were beautifully Remodeled .. really nice to look at ..but they cannot be sold….. why – because people are coming to their senses.

*** Does anyone remember Black Monday(1987) when the Stock Market collapsed ??

Now … does anyone remember what happened in 1991 and the Decline in the Real Estate Market? Does any of this look similar to what is going on with the TODAY’S record setting Stock Market and the “dark” shadow inventory of defaulted mortgages lurking in the shadows and the millions of homes soon to be dropped on the National Housing Market ???

I am and there must be others…what I experienced was not being outbid by specuvestors (and flippers) per se as I made several offers at or slightly above asking price…my bids were not even considered as there were 100% cash offers on the houses I attempted to buy. Since then prices have gone up $100K + so I’m no longer interested.

When this bubble pops and if it looks like trying to buy will not be a complete waste of time as it was for me in 2011 and 2012 I may give it a shot again.

What? Who has $300-400K in cash? Nobody but the ultra rich and hedge funds, so you were in-fact out bid by speculators!

The speculators and flippers did not offer MORE than me AFAIK so I was NOT outbid…they offered 100% cash vs. my 20% cash and a pre-approved mortgage and that is an entirely different situation…the definition below may help you understand

out•bid (ˌaʊtˈbɪd)

v.t. -bid, -bid•den or bid, -bid•ding.

to outdo in bidding; make a higher bid than (another bidder).

Actually plenty of ordinary people had cash available to buy a home. Many middle-aged middle class folks who haven’t made an utter hash of their retirement planning have significant investments. Not necessarily in cash, but in stocks and/or mutual funds readily convertible to cash. When I was shopping for a fixer I let my realtor know I would be prepared to make an all-cash offer. And yes, I would have expected to get some financing after purchase and put something back into equities. I don’t know if this makes me an “investor” in the dark sense bandied about on this blog – I just wanted to buy a bigger house to fix up and live in.

And, you know what? All that cash didn’t matter. Cash or no cash all the good deals on REO’s and fixers (at least all the ones I and my useless realtor found) went straight to insiders, and my waving a check around for a few hundred grand didn’t change that a bit. Sure I could have maybe had a bit of an advantage bidding on an ordinary non-distressed home, but the supply of those in my area was so limited that I never found one worth putting an offer on.

So maybe I missed the boat on “all the great deals” of 2009-2012, but from where I sat there didn’t seem to be much of a boat to miss – cash or no cash.

Sounds like you’re a saver, not an investor.

I experienced the exact same issues as BLUTO in 2012/2013. Had over 20% down and pre-approved and all the houses I was interested in went to all cash buyers. Now I’m not interested in most of the properties as they have increased by 100-125 in the last 14 months. It doesn’t make sense when prices increase by 30-40% in 1- 1.5 years. I have a feeling another crash is coming in 2014/2015.

It is possible to beat out all cash investors if you do enough research ahead of time and exercise your humanity. I was paying way too much for rent last year so I started researching every house that came up for sale in the area. I focused on houses that hadn’t transferred ownership in at least 15 years. Then I contacted the owners directly (this was a little tricky since I and the various sellers had our own agents). News flash: people (at least those best to engage with) actually respond to sincerity and genuineness! It took several tries before I found the right house and approached the owners. It turns out that what they really wanted from the sale was a nice neighbour for their neighbours, a few months to move their lifetime of possessions at their leisure, and they didn’t want to bother with any repairs. So I offered to buy their house “as is”, zero contingencies, 90 days free rent after close of escrow. The house was generally well maintained as far as expensive itmes (roof,electric,plumbing, A/C). From the comps I knew the house would appraise at the price they wanted and I had 2 pre-approvals from reputable lenders at 20% down). I even threw in “no termite repairs” because I figured I’d just tent it myself if necessary when I did my repairs later. Anyway, they accepted my offer even though there were other offers (including all cash above asking price). The mortgage is about $550 less than I’ve been paying in rent in the same area not counting the mortgage interest deduction, which I really need. The cosmetic repairs needed and the few months of free rent will be recouped in about a year, which is fine with me. I know it’s anecdotal but not everything is doom and gloom in RE, even in this overpriced, crappy market.

I would have been perfectly happy renting indefinitely (if the rent were not so expensive and always under threat of increasing). There is a lot to say for the freedom and mobility of renting. But if you can save money by buying and you want or need to live in the area for a while, do your homework, be creative, assess the risks and just be sincere and genuine with the seller.

I’m one of those “regular buyers” who has been relegated to the sidelines by the investor crowd. Yes, I have enough cash for a 20% down payment in my price range…except that now my price range doesn’t get me nearly as much as it would have only a year ago…and I’m not in the market for some granite lined McMansion…just a simple home that isn’t some flipped crackerbox. I’m not going to go out on a limb for an ARM…I’ve seen too many come crashing back to earth. So

it’s just watch and wait for me. I don’t like renting, but I have no choice when the game is rigged like it is.

Yeah, I should clarify, I wasn’t outbid. I didn’t even bother because conditions are ridiculous right now. Please don’t take my unicorn horn!

A lot of those buyers were survivors from the first housing bubble that were smart enough not to buy back then. We are still smart enough not to buy at the top of Housing Bubble 2.0, and so we wait and wait and wait as more and more lemmings take the plunge as if the same exact thing didn’t happen seven meager years ago.

A lot of those buyers were survivors from the first housing bubble that were smart enough not to buy back then. We are still smart enough not to buy at the top of Housing Bubble 2.0, and so we wait and wait and wait as more and more lemmings take the plunge as if the same exact thing didn’t happen seven short years ago.

Henderson, Nevada 89052

Sales have declined a lot this quarter compared to the same quarter last year in the 89052 area. Even with low inventory, new homes are discounted due to overpriced inventory. Sellers have gone to steeper discounts this year since homes sit on the market much longer. The news outlets in the Las Vegas and Henderson areas have stated that prices have flattened out but the real issue is that sales have declined 25-53% for the same quarter last year in different Henderson, Nevada zip codes. We’ve watched sales decline since June last year and think the market is way overpriced for the economy in this area. We believe we’ll lose if we jump in now.

Reported income for an area is misleading when related to home prices. People come from out of the area to purchase the homes. Brokers say to put up any price and see if you can get a fly that sticks to the fly paper. We are in a new age and market. Old rules no longer apply.

I believe Custer’s last words were “We are in a new age and market. Old rules no longer apply.” This has been said through out history. I am still waiting for the time that it will actually be correct…

What, you haven’t heard? This time is different. Or according to some, this time *really* is different. No, really!

RE trolls and flipper seminar ads on the radio. It sure feels a lot like 2007 🙂 The irony is another crash is the ONLY thing that can boost our economy. Lower mortgages and rents mean DESPERATELY needed disposable income for American consumers. Now ghat the FED is done saving the banks balance sheets MAYBE we can get to some semblance of a real market economy.

What: “I believe Custer’s last words were “We are in a new age and market. Old rules no longer apply.†This has been said through out history. I am still waiting for the time that it will actually be correct…”

It’s been correct many times.

Sometimes the rules are still the same, but sometimes they really are different.

Since you used Custer, a military metaphor, consider…

1. During World War I, many generals thought they were still fighting a 19th century war, one which could be won by charging at the other side. They hadn’t reckoned that the machine gun had changed the rules.

2. Early in World War II, the French thought they were still fighting World War I, with their Maginot Line prepared for trench warfare. They hadn’t reckoned that the German’s improved mobility and Blitzkrieg warfare had changed the rules.

3. During the Vietnam War, American generals thought they were still fighting World War II. They hadn’t reckoned that the VC’s guerilla tactics had changed the rules.

Rules often change. The hard part is knowing 1. Is this one of those times, and 2. What are the new rules?

One thing different this time is the TBTF bailout last meltdown & the uncharted dark waters of the QE abyss. As far as i know, there is no historical equivalent that ended well, and no compass or GPS to guide us out of this economic Bermuda Triangle.

This California real estate market brings back memories. Many have speculated as to what led the Titanic to hit the iceberg. There was likely at the time an atmospheric effect called a “cold air mirage,” which is relatively common in the North Atlantic, and helped prevent the crew from seeing the iceberg until too late. This effect may have also prevented nearby ships from seeing the Titanic’s warning flares, or from discerning that they were signals of distress.

CHIEF MATE: “Captain, we appear to be heading toward a massive iceberg directly in front of us.”

CAPTAIN: “Hmm, maybe it’s a cold air mirage. Or the polar vortex. Just blow some smoke and angle the mirrors at it. And give everyone on board an iPad and some fairy dust.”

CHIEF MATE: “Umm, Captain, it’s really an iceberg. And we’re about to tank hard. Skipper Jim Taylor is pretty sure about it.”

CAPTAIN: “Nah. Not a chance. This ship is like LA westside real estate. We may suffer a couple of nicks and scratches but we’ll never go down.”

The rules have never changed. You are mixing up the rules with the understanding of the rules. The rule of warfare has been the same since our tadpole days, become better than your enemy or you will no longer exist. The rules of economics have never changed. Every boom is followed by a bust. This is actually a law of nature. This time will never be different. We can try to put off the inevitable but we are only changing the time not the event…

Sun, you are correct. I see to many people trying to apply old data to the new world. The consumers mentality has changed because they have seen even their parents get harmed from the housing crisis

@Sun wrote: “…People come from out of the area to purchase the homes…We are in a new age and market. Old rules no longer apply…”

You left out the part of “…rich foreigners carrying bags of money buying property sight unseen pushing the prices of crack houses in Compton to $1MM…” and “…rich Chinese crippled by arthritis from the hundreds of pounds of gold bullion stuffed in their pants pockets…”

I’ll go you one further, Doc. Let’s say I buy in at a lower price level and realize a gain by selling at a higher price level. Then what? If I buy another of at least like kind in the same market that I just sold into, I’m now buying at a higher price level which mitigates the “gain” I made on the sale.

The only way to “keep” the gain is to either buy another of like kind in a different market at a lower price level or rent temporarily and buy another of like kind at the next dip.

Obviously if you buy another of less than like kind, you’re getting less than you started with, which offsets the gain.

Also imagine if one were to continuously roll-over into increasingly move-up properties as the waves are ridden-up. The commissions would be a huge suck. The only way to outpace it would be if prices continuously rose in real terms and you timed every wave just right.

On a side note, I wish that Redfin chart at the least also included Atlanta, Dallas, Houston, Miami, and Minneapolis. Those are important markets when looking at the national picture.

Jim, you just might be right

Thanks Joe 🙂

Is it time for a Jim Taylor blog? The guy has been saying this on every post for the last 6 mos at least.

Quite a few posters on this blog post the same thing over and over again, some even with multiple ID’s, so I think Jim Taylor fits right in.

What is the inventory to sales ratio this year as compared with last year? The area in which I am interested has so few houses for sale it is a joke. And as soon as a decent place comes on the market it is gone. Like this place:

http://www.redfin.com/CA/San-Diego/5505-Lodi-St-92117/home/6235978

I saw this house come on and hoped to have a look. It then disappeared days later, and now is pending. This whole area in San Diego has barely anything for sale and you apparently have to bid on the same day they are listed to have any chance for the decent places. Of course there are houses I visited like this one:

http://www.redfin.com/CA/San-Diego/3751-Martha-St-92117/home/4954441

A candidate for real homes of genius?

And another place:

http://www.redfin.com/CA/San-Diego/3994-Dalles-Ave-92117/home/5150183

This one is particularly amusing. It is a flip, and was put on the market for 560,000 (bought for 410,000). Advertised as 3 bedrooms it is actually 2.

bb, I hope you’re looking at HUD homes, there are some good deals if you act quickly you might be able to name your price. Just enter state and san diego in the county box and see what’s available. They don’t stay on this site for long, but you can get a very very good deal if you find something in an area you are ok with: http://www.hudhomestore.com/Home/Index.aspx?sLanguage=ENGLISH

Unfortunately, the inventory of HUD homes are terrible in desirable areas. I also find neither the prices or quality of homes that good in LA county.

I checked, no HUDs in my zipcode.

Credit availability is determining price. For my area you can put 10% down and get a 546,000 loan. Coincidentally (i think not) the house prices in my area are 600,000 and below. I don’t expect house prices to fall while these are the lending limits. But don’t expect house prices to rise over 600,000 either while these are the lending limits.

Exactly! Compare the ratio of sales to available inventory! I am seeing very few homes for sale. So it makes sense that the sales volume is down.

I told you they were 10% overpriced as we speak, and from then on inverse to whatever rise in interest rates happens. Low and behold its coming true. Lets not even talk about the negative macro head winds thanks to horrible politics.

I told you seeing a Thursday open house was a big deal. Desperation. I saw dozens of open houses today. Haven’t seen any in years.

Its not that hard. Its “grandma wisdom”. They seen this shit before, and history repeats. Im sure in 30 years prices will be higher unless Detroit happens (which is possible) but not worth worrying about. But for the next 5 or more, they will fall. And that will help the economy, its stupid to spend money on housing. Spend it on consumerism and saving for retirement.

I’ve been waiting to buy a home since November of 2013.

The dilemma before was to even have my offer looked at, with properties being scooped off the market that same day they were listed.

Now, I’ve finally had my offer accepted but should I just walk away? This isn’t my dream home. Now on Listingbook, there are 10-20 properties that are being reduced daily.

Before, there was literally nothing being reduced.

If the market really falls 20% in real terms over the next 5 years, how are you going to feel about having lost your entire down payment on a house you didn’t even like that much? How will you feel about having to save another 20% for the right one that will be for sale then?

NotoriousJ correctly said:

If the market really falls 20% in real terms over the next 5 years, how are you going to feel about having lost your entire down payment on a house you didn’t even like that much? How will you feel about having to save another 20% for the right one that will be for sale then?

——————————–

Lousy. I have my 20%, excellent credit score, good to go. I even have a place – my rental. I’m not wild about the place; the main thing it’s got going for it is that it’s cheap.

If Las Vegas pops, my down payment does too. Also, with inventory steadily increasing, there will be more choice.

According to the local RE radio hacks, it’s a great time to sell AND it’s a great time to buy – no surprise there.

Waiting and waiting……walk away. Why settle for a home that you really don’t love ? Would you settle for a partner too ? We also have been waiting and waiting, there is a lot of crap out there and will never settle. Renting is not our 1st choice but it’s better than buying a way overpriced house that we plan on living in and don’t really like.

What? I was curious about your prior statement about housing tracking inflation in CA. If you start at 1973 (Cal median price of $33,410) and multiply the annual rate of inflation (http://www.usinflationcalculator.com/inflation/historical-inflation-rates/), at the end of 2013 you’d have a $309,592 median house, when the actual median was $438,000 at the end of December, 2013 (http://www.car.org/newsstand/newsreleases/2014releases/dec2013sales). That 41% difference is not insignificant, but not the whole story.

Some other data points:

Only two years in the past 40 were the “inflation prices” equal or higher than median — ($285,923 v. $274,960 in ’09 and $298,744 v. $286,040 in ’11).

At its most extreme was 2006 with median at $556,430 and “inflation price” at $265,507 (along with 1990 [below]).

At the end of 1980, CA median was $99,550, while applying annual inflation going back to 1973 you’d have $61,963 (60% differential).

At the end of 1990, CA median was $193,770, while applying annual inflation going back to 1973 you’d have $98,247 (97% differential).

At the end of 2000, CA median was $241,350, while applying annual inflation going back to 1973 you’d have $227,633 (6% differential).

At the end of 2010, CA median was $305,010, while applying annual inflation going back to 1973 you’d have $289,481 (5% differential)

So, the median v inflation price tea leaves don’t bode well for much higher CA median prices after the big run-up in 2013.

Fail.

Inflation would be a good benchmark in a world in which everyone was a cash buyer. But in the world we live in, most buyers have to be able to afford payments, and sound origination limits them from getting in over their head.

Good numbers DFresh. As the numbers show, 2000 and 2010 were good times to buy. With an excel spreadsheet, anybody could have made this calculation in two minutes. Things like this are what people on this blog need to focus on, they seem to get lost in “the fog of war.” As I always say…run the numbers!

“As the numbers show, 2000 and 2010 were good times to buy. With an excel spreadsheet, anybody could have made this calculation in two minutes. Things like this are what people on this blog need to focus on, they seem to get lost in “the fog of war.†As I always say…run the numbers!”

I’ll agree, but I’ll bet quite a few who buy CA RE are jumping with very thin parachutes. Unlike more conservative low cost areas of the US, a huge chunk of Californians monthly income goes toward housing expense. The plan can make perfect sense until someone loses a job, gets sick, etc. Trying to find another job with a comparable salary as the job lost can be a real challenge, especially in SoCal, and especially if someone is over 40. That’s when the wheels can quickly come off the bus. I’ve seen it happen too many times to count.

Just hope the bank that holds the house note is one of those institutions that is really slow to foreclose, or Mom/Dad live in a nice neighborhood with a spacious extra bedroom, kitchenette a plus.

Your exercise is interesting… I guess… but it does not disprove anything because you are using national numbers on one side and local numbers on the other as well as mixing up the cut off of 1987 where the two started to diverge. This is where massive private debt exploded. California and specifically southern California had quite the income boom after WW2 for obvious reasons (aerospace). This is why you need to use income inflation for the same location that you use median home price… Apples to tamales if you know what I mean…

Absolutely true…income “inflation” in the 70’s and 80’s helped justify the delta. With stagnant wage growth the last 30 years for the 90%, the 41% differential we’re at right now is begging to be closed. I just think we’ll be in a slog for many years and not a Tanking Hard.

As for prime/gentrified SoCal areas…now we’re back to the all real estate is local adage and the rise of the 1% and SoCal being a global destination. With the multiple forces causing a strangle-hold on inventory and the deflationary cycle we’re likely in for some time keeping interest rates low, I don’t see any break-down worse than 5% in areas I want to buy in for the next 5 years.

This may get another “duh” from Anon, but the next time when the Regular Joe can get a deal in SoCal will be when people are B.O.R.E.D. with SoCal real estate. I know, crazy, right? Well, it happened from ’92 to ’97.

The way I see it, we may be now be entering a five-year boredom “bubble.”

DFresh – I am very weary of predicting the short term future (aka “Tank†vs. “Long Slogâ€) for a number of reasons. I have been somewhat surprised by every “market†reaction as of late. Latest being the “Taper†actually leading to lower interest rates. I thought that QE was supposed to lower interest rates and would assume (incorrectly) that a tapering of QE would lead to higher rates in the short term. Well because of international investing the stronger (less dirty shirt) dollar is chasing money back to the US putting downward pressure on the 10 year treasury. Who woulda thunk?

I obviously have my concerns about the viability of the status quo so I choose to not participate any more than I have to. I believe TPTB have made a concerted effort to make the “Average Joe†a market speculator with retirement, housing, savings, education, etc. The problem with speculation is that you really have no idea what the outcome will be. It has been my life experience that speculators lose in the end. This might be a California perspective due to a number of people I know who went from rags to riches back to rags.

Housing To Tank Hard in 2014!!

Hey Jim…. I know you meant 2015, right?

No, he means 2014 and he’s already been proven correct. Prices are the LAST thing to correct! Incredibly low sales volume and increasing inventory inform anyone who is looking that the “tanking” is in progress. Furthermore the FED knows that housing dropping is the ONLY thing that can fuel a real recovery you have to give the lemmings an increase in disposable income. QE was about clearing the banks balance sheets, nothing more nothing less. That being largely accomplished the FED cares less about housing than preserving the reserve currency status of the dollar. If the FED gave a shit about the housing specuvestors they wouldn’t be tapering and strongly implying a rate rise in 2015. I’ll admit many of us bears underestimated the FEDs willingness to take extreme measure to save the balance sheets of the larger banks. That was our mistake as those banks are a systemic necessity. An even greater necessity is the dollar’s reserve status. We invaded Iraq because Saddam was negotiating to trade oil in Euros (among other things). In light of that do you really think the FEd will hesitate to throw RE speculators under the bus? Hell they already did it when they popped Housing Bubble 1.0!

Condo’s in the Bay Area…are slipping 10%. I realize it’s not a “House” but everywhere outside of the city of SF and select parts of Santa Clara County they coming down. I’m looking in parts of Oakland, Hayward, Walnut Creek/Concord. Seeing quite a few on the mls for 6-9months and down from 299 to 250-ish. Only thing keeping me out now is the unreal HOA’s….300-500 a month in dumb.

NihilistZerO…………………………….You are so right! The FED cares even LESS about the Southern California market!

the problem is forced inflation….think about it, why did PE, hedgies and MM banks buy foreclosed homes? inflation happyens fast sometimes…some call it hyper because it happens out of the blue

There is a big problem with your hypothesis cd. Ytou can’t have Hyperinflation in the semi-open economy we currently have. The only way the inflation so far has stuck is with MONUMENTAL goverment intervention through welfare. The Rent/Food/Energy inflation trifecta is being held up by QE/Food Stamps/Cash Aid. Those programs are all having their benefits lowered. You can dump money into RE all day and night but if people don’t have the INCOME to pay (either with or without .gov assistance) that asset is going to tank. There’s a reason we bears have referred to residential RE as a ponzi scheme. There is no model that can maintain the exponential increase in prices we’ve seen in Housing Bubble 1 or 2. Bubble 2 has popped, it was always going to pop, and anyone who believed otherwise was either stupid or willfully ignorant. Even a total command and control .gov takeover of the entire economy (which sadly it seems we aren’t that far away from) could not maintain these bubble values in real OR nominal dollars.

I left out my definition of a semi-open economy. As long as the international markets provide downward pressure on wages Hyper Inflation is nigh impossible. .gov has used the only tools they have to get that freshly printed currency to the people through welfare and tax breaks and the best they’ve been able to do is create another more narrow speculative bubble. NOTHING they have done can or will alter the inevitable deflationary period. Banks being saved the FED is going to let the economy run a slow deflationary course to save the dollar reserve currency status. From a geo-political and macroeconomic sense a slow deflationary bleed out over years or perhaps a couple of decades is the only answer. A breakthrough in Nuclear Fusion or some other energy miracle will likely be the thing that pulls us and the world out of the malaise. Unfortunately no one knows when that will be.

Thanks for checking in Jim.

2014, now have to pay taxes on short sales. So, complainers missed a great time to win big with housing.

I think the short sale tax holiday will make a quick comeback. We all know the banks control our congress critters and with Housing Bubble 2.0 rapidly deflating they likely want all the short sales they can get as opposed to foreclosures. Without the tax holiday the incentive for short sales is severely diminished.

Why does everybody think they need to own a house? They are like lemmings to the sea with no understanding of why they are making their lives so difficult. In Germany, only about 40% of the people own homes. Too many people believe that propaganda about the American Dream.

“Why does everybody think they need to own a house?”

Many reasons. One of which is that humans are territorial.

Try living in a condo and sharing a washer/dryer with everyone on the same floor. Even in an upscale condo, with million dollar plus units, you’ll see people descend to the level of apes as they bicker and jostle over access to the washer/dryer.

It’s human nature to want your own space, your own territory. A tiny oasis of personal autonomy where you make your own rules to live by, not answerable to a landlord or homeowners association.

Real estate agents tap into this primeval instinct in their marketing. They know what they’re doing. Most people have that territorial instinct.

Sol-you keep confusing living in a home vs a condo, when the real question is owning a home or condo vs renting a home or condo. You can rent a home and have your own washer/dryer and autonomy. Also, I rented a condo in LA and every unit had their own washer/dryer, plus we had a community pool and gym. It definitely ‘sucked’ having a bunch of girls in their 20s and 30s running around the property at all times. Also, if you own a home, you can be subject to HOAs, as I currently am as we are in a development and we want to keep people from doing certain things on their lawn (park an RV, etc) so your oasis can have restrictions (which could be deemed good or bad by different people). People buy bc they have been conditioned to buy by the media, parents, friends, the govt, society, etc. not sure if there is an instinct to own over rent; moreo an instinct to ‘nest’ by some.

I’ve never known anyone in a condo who didn’t have their own w/d–maybe a stacked unit, but still…

I’m not saying there’s not something to what you say, but I’ve known many condo and apartment dwellers who are perfectly content. If you have ruthless compact that keeps riffraff out, it can be quite pleasant. You can get to know your neighbors over drinks around the pool you don’t have to maintain. Just sayin’.

You are referring to “animal spirits”. Yes, at one time or another(including big corporations) irrationality can take over in decision making. Only in the economists laboratory is reality kept outside. That is why economy is not a real science, but a religion. It takes quite a “seer” to divine what the animal spirit(irrational) consumer will do.

“Real estate agents tap into this primeval instinct in their marketing. They know what they’re doing. Most people have that territorial instinct.”

Noticed just last night the Assoc of Realtors have chnged their tune in regards to advertising.

The past few months their ads on TV have been geared towards sellers “thinking of selling your home? Now might be a good time”.

Last night the NEW ads were on. “Have you been been thinking of BUYING a home?. Now might be the right time”.

Leaches.

ChrisD: “I’ve never known anyone in a condo who didn’t have their own w/d–maybe a stacked unit, but still…”

Based upon my surveys, I think most condos in Santa Monica have community washer/dryers, rather than having them in individual units.

This may be because so many Santa Monica condos are former rentals that have been converted into condos. That’s the case with my building.

Roddy, I think it has to do with several things.

As was mentioned before, apartment/condo renting sucks. Sharing walls, washers/dryers, parking can be a headache. All it takes is one a-hole to screw things up. And there is usually more than one a-hole involved.

Maybe Germany has rent control, landlords here can and will give yearly rent increases regardless of the economy…especially if you are in a desirable area where supply and demand issues exist. After getting hit with $100/year rent increases like clockwork, renters get frustrated and look for alternative. If you are anywhere close to rental parity at that point, buying makes sense. Here in CA, monthly outlays for home ownership is essentially fixed due to Prop 13 (I’m sure I’ll hear moaning about maintenance costs…they need to be spread over the homeownership duration).

Lastly, it is all the intangible things. Trying convincing your wife who has a strong nesting instinct that renting for another 5 years is the way to go. Or if you have kids, stability is key (same school, same friends, same activities, etc). Then factor in all the niceties of owning (extra bedroom and bathroom for guests, your own garage, washer/dryer, ability to customize to your own tastes, etc).

And lastly, home appreciation in CA is a powerful drug (look at the last 50 years). It will likely take a generation or two to see this in a different light.

There are plenty of intangibles to renting as well. For each point stated that owning is better, one could cite an opposing point to state that renting is better. Give it up already on the intangibles argument. It’s such a non-starter.

Good grief, you can just as easily get an ahole neighbor regardless of renting or owning. Additional rooms? Your own appliances? There are rentals offering that as well. There are also ownership opportunities that offer shared walls, shared laundry, and PITA parking.

The bottom line is that there’s no free ride with ownership. There’s no free ride with renting. Both have good and bad points. You can buy or rent a bad situation or a good situation.

I used to think born-agains and reformed smokers were too much to take some transformed renter to owner types are also something to behold. They’ve seen the light. Ignore everything they did and said in the past, this time is different and they finally have the answer.

Anon, buying a home is often an “emotional” purchase, this is why irrational decisions are commonly made.

I agree that you can get the same amenities renting when compared to owning. However, the VAST majority of people who rent are in the process of saving money for a down payment and choose to rent a smaller/cheaper place than what they eventually intend on owning. Sure I can rent a $4500/month Mcmansion, but most will choose the $2000/month 2 bedroom apartment or condo. With this come all the headaches we are talking about.

Speaking of condos with built in washer and dryers. One of my old co-workers was renting a condo that had built ins. His upstairs neighbor would do laundry at all hours of the night. Hearing the W/D clanking away at 2am constantly drove him up the wall. He complained to no avail and stated he would NEVER share walls again…and he has held true to his words. One more reason SFRs hold a premium over condos/townhouses.

I think what you both, lordb and anon, wrote have a lot of truth in it. Anon speaks logic/intelligence, but of course emotion (which might later prove smart or stupid) plays a huge role in the own bs rent equation and the detached vs connected dwelling. LordB-curiously what is your take on the rent to own SFH model by the ‘smart’ money in light of what you just wrote? If the vast majority of people want to live cheap before owning and rent smaller apts (pretty much me and everyone I know), how does this jive with all the SFHs for rent via blackstone, colony, etc that assumes a constant flow of increasing rents (meaning strong demand to rent SFHs)? If that model fails, it is conceivable that the ‘smart’ money may try an exit, possibly around the time banks want their foreclosures out too. Some standard sellers who thought they could time selling the market realize they waited a year too late and they want out too. Who knows. I’ve said it here and what? Says it a lot too-impossible to predict the future, but that seems more conceivable to me then this time is different.

One of the big things, IMO, that has kept sales volume down is that homeowners who are not underwater that want to sell look at the options out there and don’t like what they see. Many refinanced so they look at the overpriced flips, etc and just decide ther house is better than the inventory on the market. Investors are more picky about making the nums rather than finding a home to live in that beats their current one. Not sure what triggers ‘better’ homes making it to the market in some of the better areas. I guess it takes bad events like job loss, etc maybe.

Have you seen rents? That was what drove me into the real estate market. Houses in my neck of the woods are priced to perfection when compared to rents. So, those expecting a big drop are out of line. Rents must fall before house prices fall. When you see that you can get worried.

That said, making a property suit my tastes and purposes has significant value to me. I had not known that until I bought a place, and it is very valuable to me.

So rents must fall? How about if the cost of owning rise while rents stay the same? Doesn’t that give you the same out come?

In other words, higher interest rates will give you a cheaper house price, a higher house payment and A CHEAPER RENT IN RELATION TO monthly house payment.

The same outcome can be achieved via other methods.

Where I lived in Germany, it was FAR higher than 40% ownership… more like 90% ownership. Homes were in families for generations and there wasn’t much of anything to buy. Not uncommon to find homes in Germany that have been owned by the same family for 50+ years.

Maybe you were in an area where there was nothing to buy and the only choice was to rent.

Germany has been at about 40 % for many years. You must have been in a unique area.

When I was a Realtor, I had a line I always parroted when I turned onto the street of the home I was showing. I would say “This neighborhood really shows pride of ownership”. The buyers would get all tingly and couldn’t wait to write a deposit check. Thirty years later I still don’t know what “pride of ownership” is, but it sold a lot of houses. I think it has something to do with people confusing themselves with their possessions. People are automatons-you push the buttons and they do what they are programmed to do. I own a house now, but it’s to keep my wife happy. I could live in a hotel and be very comfortable and happy.

Roddy, I “toured” several Seattle neighborhoods via YouTube, each hosted by the same realtor. She’d drive through the neighborhood, describing it, while her camera recorded the passing streets and houses.

Driving through Queen Anne, she said, “Queen Anne has a strong sense of community.” In the Ravenna video, she said, “The people here have a strong sense of community.” Pretty soon I noticed that EVERY neighborhood she described as having “a strong sense of community.”

“Pride of ownership” worked for you. For her, it’s “a strong sense of community.”

I’ve also noticed from the listing descriptions that almost EVERY house for sale, in EVERY city, is on “one of the most coveted streets” or in “one of the most coveted neighborhoods.”

And I’ve noticed that houses rarely resemble their photo-shopped images. The wood floors are never as gleaming. The walls never as pristine. The grass never as green.

Plus the rooms often look smaller when not seen through a camera’s wide-angle lens.

The first flipper I knew moved in across the street from me in 1958 when I was 10 years old living in Pico Rivera. He and his wife had no children at a time when when there were hordes of children and he never went to work. He said he bought fixer uppers, cleaned them up, and sold them. I thought he was pretty smart. But, that was before everyone got into the act. In my present neighborhood, I have flippers behind me, beside me, and across the street. The guy behind me bought a house that was gutted by druggies and did a beautiful job of fixing it up. But then he tried to sell it way above the market. I think his family financed all the work. He gave up in 2010, moved in, and is now raising his family there. The guy across the street bought his house as a foreclosure. He told me he is waiting for the market to go up, then he’ll fix it up and sell it. He told me he owns ten other properties. The house originally sold for $23,000 in 1962, it’s now valued by Zillow at $370,000 (for whatever that’s worth.) When everyone expects the market to go up so they can get their money out of the property, that’s when I expect the crash will come. Meanwhile, when I drive through the industrial and warehousing sections of Los Angeles, I see empty buildings with for lease signs. The companies have moved to Texas or Nevada. When the Fed turns down the money spigot, and the losses start to mount, this current round will be over. But real estate fantasies die hard in Southern California.

Son of a Landlord…but the one thing that remained constant through ALL of those wars is that young men died by the millions while a few fat cats got rich…tactics may change, but the ultimate outcome of war has been unaltered since the beginning of time.

The Fat Cats get rich because they understand the numbers to look for, know what cash flow means and never buy because of potential “future” numbers… aka speculation on appreciation.

Made a killing off of the idiots by selling off everything back in late 2005 through mid 2006. Got back in 2010, haven’t been able to buy anything since early 2013 that made sense but still holding on what I did buy and not selling. ROE numbers are still better than selling and putting the money somewhere else and plenty of cash flow coming in.

Compare current asking prices to recent sold prices and you’ll see why sales are down so much. Sellers have been hearing about all of the stories of multiple offers and the price getting bid up and think that’s going to happen forever so they have been listing their homes 10% plus above market value.

Been looking and saw in one zip code that current asking prices were on average 24% above solds in January. Pretty obvious why homes are not selling when you look at those numbers.

Investors are still out there looking but we only buy if the numbers make sense and right now the numbers that sellers are asking for are not making sense.

However, when one comes up that’s priced right with the market values, there is still fierce competition — in fact even more than before because there is so few of them.

At the end of the day, it’s all about the asking price and sellers will eventually get realistic.

“Compare current asking prices to recent sold prices and you’ll see why sales are down so much. Sellers have been hearing about all of the stories of multiple offers and the price getting bid up and think that’s going to happen forever so they have been listing their homes 10% plus above market value.”

That is EXACTLY what is going on in my area. Houses that sold in the 700 range a month or two ago, and the next guy listing his near identical property for 850+ just a couple months later. There is a lot of that right now. The big dollar signs in the eyes of everyone who thinks their properties are going up up up and they can ask any price they want.

I have a friend who is going through a divorce and listed her house at 1.250M. That was 6 months ago. Now it’s reduced to around 1M. Houses in that neighborhood have never sold as high as 1.250M. I think the highest ever, during bubble 1.0 was 1.025M. and that was the identical model, only a couple doors down from her house. Soooo…..her house has been reduced, but only because it was priced far above anything reasonable to begin with.

Ownership gives predictability. You know what your monthly payments are and you know the house won’t be sold out from under you.

If it’s done at the right time it can be a good deal cheaper, that is, if you purchased and financed a few years ago you can end up with a fixed and much lower cost than a rental.

A few other nice to contemplates are the option to remodel or upgrade the property as you prefer and the (hopefully) increased value is all yours. Who wants to upgrade a kitchen or bathroom in a rental?

Generic observations about rent v. own are not much more than simple pros and cons without real numbers attached. You say predicability, I counter that with flexibility. You say remodel or upgrade, I say sinking money into maintenance, insurance, and depreciation.

Of course it gives some predictability if you purchase at the right time with a fixed rate within your means and if you plan to stay in your house for a long period of time. That’s how it’s supposed to be. However, these are not the circumstances today. If you overpay in a superheated insane market with unstable economic conditions surrounding it, you are setting yourself up for future misery that is beyond your control. Now that’s unpredictability. If you rent in these conditions you remain flexible, able to maneuver, as situations change or deteriorate. Just run the numbers and then factor in what you do and don’t care about…. NY Times rent v buy calculator is the cream of the crop from what I can tell. Unless you’ve familiarized yourself with that kind of calculator, the rent v. buy discussion isn’t worth having in my opinion.

Over half of marriages end in divorce. Being a homeowner in a divorce is often hell on earth. We live in a mobile country (US) where moving to another state is often part of advancing in a career. If the market has made you upside down in your mortgage, your house may be an anchor around your neck in regards to your career. It really sucks to have to put your life on hold because you would need to put a bank check for $100,000 on the table to move out of your house and not ruin your credit. In the late Eighties I saw a lot of people stuck in this situation.

You really nailed it; the housing pundits keep repeating catchphrases as if we’re in the 1950’s. The shenanigans and weirdness in the market we’ve witnessed since even before the 2008 crash lends credence to the theory that predictability or stability haven’t been a part of any honest equation for quite some time.

All true. I bought a house in a DC suburb in the late 1990s for $30K more than the previous owner paid. He had it for nine years…NINE years. He didn’t even break even after paying commissions and taxes on the sale…any more money he sunk into it was just a gift to me. Hindsight is always 20/20. And the is no way to predict where you will be in ten years (or even IF you will be). Divorce, job change, etc. are all “intangibles” of owning. Plus the timing of buying and selling is key. The guy who sold to me didn’t really time his sale to make money. He retired to Hawaii. Good for him but owning a house didn’t make him any money; in fact, he lost a fair amount. But he did have the so-called “intangible” of being able to fix it up any way he wanted to. So I say, when the market is peaking in cost, that’s a horribly risky time to get in, no matter the supposed “intangibles.” I am looking forward to owning again, but not at these prices. Not worth the risk financially.

I agree with the monkey and the posters beneath. Just wondering though, what % of people do you think agree with us? I’m still thinking the supermajority either want to own a condo or sfh at any cost or want to own a home if they got a little cheaper and/or better inventory came out and/or my 20% down bid finally wins instead of losing to all cash even when higher. The majority are called sheep for a reason and hate any negative talk (why many of us turn here). Long term view you’d think marriage decreases in popularity for a variety of reasons and that’s what you need for home prices to keep going up (or a temporary bs market fueled by QE, investors, etc) along with wage increases…or lower lending standards. 🙂

@FTB. I just love the sound of the sentence, “I agree with the monkey…” 🙂

Having had some recent conversations, I truly believe that 90% of people still think that if you are renting, you are throwing money away, while if you are buying you are “saving and building equity.” And that is pretty much all you need to know about the average renter/buyer. They aren’t even past that yet.

I had a conversation with a good friend who is educated, successful, and a $1M + home owner. I broached the subject that renting is (conservatively) often a wash when compared to home ownership. He thought I was crazy out of my mind and said something along the lines of “oh yeah, it’s so equal that everyone is trying to own…” I pointed him to a few web sites and articles and then to his credit, he came around. On this board, many commentors are super advanced with an excellent understanding of financial topics and economics.

In general, you can’t overstate the ignorance of the average buyer or renter. After all, timeshares are a huge industry aren’t they? 🙂

“Riddle me this; if your economy is built on asset inflation what happens when asset prices stall out or reverse?”

The exact same thing that happened in 2008. It’s Deja Vu all over again.

Asset inflation = income inflation plus debt inflation. Without income inflation we are in for a hell o hurt…

Great post Doc as usual. Just wanted to share this with everyone, thought it would be interesting. I am in the market for a rental or trying to buy and i just spotted this listening that looked familiar when i was going through Truila. This home is up for rent for $3,095. This same home was on MSL about 2-3 months ago listed for 650k, and it sold for a whopping 773k. Doing some simple math, even if this person paid cash for this place he is only getting a return of 4.8% ($37,140/772500) which is gross. This is not even taking into account property taxes/maintenance. The place looks old as well. The best part about this place is the description of the rental: “VIEW Home in prime North Glendale residential area. Freshly painted with major renovations. Very private location”. there hasn’t been any major renovations or anything to this place after he bought it, he just painted the walls threw in some fresh carpet and called it a day(saw the pictures when it was on MSL looks exactly same). I dont know, to me, parking 773k in an asset that gets you only 4.8 percent gross return doesnt sound like a very good investment to me. He will be lucky if he even nets 4%.

Links if you want to check it out.

http://www.trulia.com/rental/3142979472-Single-Family-Home-Glendale-CA-91202#photo-10

http://www.zillow.com/homedetails/1653-Hazbeth-Ln-Glendale-CA-91202/20837892_zpid/

apologize for grammar wrote this quickly. listening* listing.

This is an excellent example of what is happening to speculators. They are not getting the 6-9% ROI they told their investors they would get and it is now often falling below 5% with vacancies and tenant problems. I think this is what has happened with sales, that speculators have largely stopped buying. If their ROIs fall much below 5% and they see sales dropping like this for another few months they may panic and start dumping inventory on the market because they know that falling sales a leading indicator and price drops will soon follow.

What a dump. Seriously.. what a dump. $3095 a month for that pit?

I can’t even wrap my head around it.

I am pretty sure in the fly-over states there is no housing bubble. plenty of houses below 100k for sale.

There’s a reason theyre called Fly Over Stares…

*states

For those predicting a drop in housing – what’s the impetus? Housing in LA, OC, and SD is based on jobs and that is growing, not shrinking. You can blame the Fed on prices through ZIRP, but that doesn’t say that a huge correction is due (and in fact we have at least several more years of ZIRP left). Where’s the recession? I see a topping formation in prices, but probably just a more normal market going forward. People jumped in last year because it was the thing to do.

Inventory is down because people don’t have to sell. To the folks thinking about waiting for a 10% fall? That’s silly if you are going to live there for 30 years. The same folks probably didn’t buy in 2011/12 and thought prices were going to drop even further. I was pulling teeth to get friends to buy back then and they wouldn’t. Now those same folks are calling me and I told them prices are 30% higher.

Until we see ridiculous lending standards, tons of interest only stuff, etc its really hard to call a market top. Housing is just going to be more up/down/normal going forward and not such a boom/bust affair.

Since the top in 2006 we probably had about 20% worth in inflation. Yes, wages doesn’t grow but it doesn’t stop the prices of fuel and food from rising either. So if we gets to 2006 prices, it’s still 20% below in nominal terms. It’s not fair but globalization is causing a reduction in standards of living for the middle class in the developed world. It’s a global economy and many metropolitan areas are very influenced by foreign capital flow. Even if rates go up, investors might not trust government debt so they will go for the lower yield in being a land lord. It’s call accessing risk and being a land lord is safer than taking a haircut or default in bond or a crash in the stock market. That along tells me housing would be okay because it’s now owned by the upper class and no hard crash is coming if they decide to cash in stocks or withdraw capital from banks and buy tangible assets. There are some areas that is bubble like but for the most part we’re back to a normal, though slightly over priced, RE market. And you can have the FED to thanks for the over priced part. Rates go up its either, the economy is good, the debt is too risky or inflation is too rampart. Unless we gets deflation, I don’t see how it can be bearish for housing in the near future. Moving forward I’m expecting lots of sidesway price movement and that is fine.

So many things wrong with your thesis…

Food and Energy are necessities, home ownership is not. Inflation in the former means deflation in the latter in a stagnant wage environment. Witness multi generational households. Your understanding of investing is woefully inadequate if you think a 3.5 to 4% cap rate (if that) is going to keep institutional investors in this game. The only reason we’re in Bubble 2.0 is MASSIVE FED INTERVENTION. This cannot go on forever and the FED themselves has admitted as much. They aren’t going to lose reserve currency status or let Bubble 2.0 expand further, which would necessitate a larger crash. Tell me, how will prices remain sticky when all the Hedges and specuvestors get “margin called” so to speak? It’s ALL other people’s money. S&L crisis, Bubble 1.0, hell even the early 80’s deflation, IT’S NEVER DIFFERENT THIS TIME. Math is math and that Bubble 2.0 party is already over. The QE drunks just haven’t realized it yet.

Exactly- there are much stronger hands this time around. Better qualified home owners purchased foreclosed homes and private equity can hold for years- Blackstone doesn’t have solvency risk lol.

People don’t understand who the all cash buyer is.

Blackstone doesn’t have a solvency risk? Are you daft? The equity they have expects returns number 1, which they are not providing. Number 2 the MONEY IS BORROWED!!! You think these Wall Street crooks got rich playing with their own money? You think their clients are going to be happy with 3% non guaranteed returns over several years on REpeat when treasuries will be at 5% by next year. You position is laughably uninformed.

I can’t see how we would crash unless the interest only loans are back in large number. Right now those loans are only available for the high income folks. Beside FHA, most loans are asking for minimum 20% down and mortgage workers are being laid off left and right causing a really restrictive RE environment. We can only reach the top when the supply of buyers has been exhausted which is not even close at this points. Professional flippers or investors maybe but not the common man many of whom are waiting for the price drop. Just ask yourself, if they sold RE what will they do with the money? Buy overvalued stocks? But money in the bank with rates near zero and future bank troubles looming? Buy treasury or other risky bonds? What Detroit and Greece has shown is that bond holders will get creamed? ROR in bonds do not justify the risks that investor takes. Rent will probably play a bigger value in RE valuation moving forward. The average Joe is broke so he can’t buy either RE or stocks. These two asset class are now in the hands of professional managers. They are capable of creating bubbles too but on average they are much more informed.

You can be certain it is in the best interest of gov to keep RE prices high for tax and to protect the new landlord class which paid those taxes. In many metro areas around the world, RE prices are out of reach for the common man. So Cal is just follow suit. Until prices are comparable to other metros areas around the world, hot money will continues to flow from high to low.

“We can only reach the top when the supply of buyers has been exhausted which is not even close at this points.”

The current data especially in the frothy areas says otherwise.

ROR in bonds do not justify the risks that investor takes. Rent will probably play a bigger value in RE valuation moving forward.

This is laughable RE industry spin. The US has NEVER defaulted in nominal dollars and never will. If a Treasury note is yielding 5%, which it will shortly, no one is trading that for a 5% at best cap rate. You think rental income is more stable than US treasury interest??? Your either trolling or get your economics knowledge from Kiyosaki.

“You can be certain it is in the best interest of gov to keep RE prices high for tax and to protect the new landlord class which paid those taxes.”

Yet another strawman. If so why did they pop Housing Bubble 1.? Why are they ending QE and raising rates? The actions of the FED COMPLETELY contradict your thesis. On top of that since the government is unable/unwilling to create wage inflation it really isn’t in their hands. Banks are about to turbocharge the forclosure process to get the last group of suckers to buy retail Housing Bubble 2.0 prices.

Investors are going to flock to Treasuries next year when yields get toward 5%. Even if the FED pushes rates below that (which I doubt as it goes against their real mission of preserving dollar hegemony) the CAP rates at current prices + vacancy issues still destroys all Bubble 2.0 gains.

If your gonna troll at least come with something more than anecdotal BS.

NihilistZero-

With all due respect- I work in PE as well as my brother and you don’t understand how the trade or business works.

Heh, the only “PE” you and your brother work in is making fat Oompa Loompa looking short squat immigrant pygmy kids run laps after stuffing their faces with HoHos…

I am not seeing much discussion on the effects of the new underwriting and documentation changes under the new “Dodd Frank” rules effective mid-January. The bank where I am employed has fully implemented them and it is having an impact on loan approvals. Most banks and lenders have not fully implemented them yet. It will affect self employed and Jumbo loans the most. It is hard to predict the impact. Maybe 10 to 20% fewer people will qualify in high end areas like LA coastal real estate. Many people will have to file their 2013 business and personal income taxes before getting approved for a refinance or purchase, so this will slow down lending for the next few months.

This will reduce the demand side of the equation for real estate. It will be interesting to see when the realtor lobby will start pressure to loosen lending…..

Yep, I would like to see the good doctor do a deep-dive on DF and implications for SoCal market.

Maybe it’s not getting much discussion among posters because part of the title is “…consumer protection…” and many of us view anything the government creates that has “….consumer protection…” written into the title will have unintended consequences to hurt consumers.

But, in this case, the “consumers” likely to be hurt are those maniacs looking to stretch into an overpriced piece of SoCal real estate.

http://sanfrancisco.cbslocal.com/2014/02/19/palo-alto-home-sells-for-1-6-million-despite-cracked-foundation-nearby-train/

The Palo Alto market ^^^^ as it stands. Get a load of the photo!

Get a load at TSLA’s stock rise. Lots of funny money in NorCal these days.

We hear constant complaining about the socal housing market here. What is happening in the bay area makes this place look normal. You can still buy an SFR here in the South Bay approximatlely 1 mile from the Strand with a 6 handle price. That is bargain basement compared to the madness happening in silicon valley.

“constant complaining”

Why continue to keep coming back for more if it’s just constant complaining?

Complaining about complaining is always a good crack-up.

Anon, I come back here to keep some of the contributors on this blog honest. I will call out any BS…and trust me, there’s plenty of it.

Hence the name Silly Clown Valley…

Robert Shiller giving us his updates:

Home prices nationally posted their best year since 2005, but signs are growing that the housing rebound has stalled.

Prices in the 20 largest metro areas have dropped slightly for two months in a row, according to the S&P/Case-Shiller index, a leading national home price gauge.

Demand is waning because of higher prices and mortgage rates, and home buyers have only modest expectations for price appreciation, said Robert J. Shiller, a Yale economist and co-creator of the index.

http://www.latimes.com/business/la-fi-home-prices-20140226,0,7474451.story#axzz2uQcQVlgs

“…(w)ho needs water when you can purchase a World War II Cracker Jack box for $750,000.” The term is “Cracker Box” in ebonics, a neighborhood that is full of white people, according to the Urban dictionary. From TexAgs, “The techniques developed by the Army in constructing the WWII buildings became the standard for home construction after the war. Millions of veterans were returning from the war, starting families, and looking for homes. Developers all over the nation adapted to the Army model for constructing the one story “ranch style” cracker box housing developments that encircled every city.” I think that both definitions apply.

Zillow revised their estimates for Simi Valley (93065) down from 11.8% increase to 8.1% this year. Also, I’m seeing a decent correction in real rent asking prices. Optimistic investors are going to get the shaft because they are buying based on what Zillow’s Zestimate is pushing but finding that nobody has that sort of coin to pay for a rental. Zillow is NOT the gospel, people. Patient pre-approved buyers will have their day soon. Looking forward to it.

Just anecdotally…I’m in prime coastal S. Cal. for the last 5 months that I have been keeping an eye out, I almost never saw a price reduction. Now, almost every house that is listed has at least one or two price reductions in the last few weeks. Like I said, anecdotal, but at least from the ground view, it appears to be tipping.

I am old enough to remember when a house was a home. Period. It was nice then.

Leave a Reply