The baby boomers forgot about their kids: Do we have any housing bulls in their 20s and 30s, the traditional age of first time buyers in high priced areas?

Baby boomers with their infinite housing lust have largely forgotten about one thing on all those blurry tacos Tuesdays. What about the kids? Many boomers in high priced California cities find themselves house rich but cash poor. The notion that somehow your home valued at $700,000 or $1 million is throwing off cash is counter to what most investors understand. You have taxes, insurance, and your regular upkeep on a property. And how many boomers sniffed the HGTV fumes and upgraded their homes with granite countertops, stainless steel appliances, and polished off hardwood floors? Home Depot isn’t successful because people frugally maintain their homes. In large part, boomers in their golden sarcophagus have forgotten about their offspring. Recent data continues to highlight the growing divide in wealth disparity. California led in the growth of millionaires but also those on food stamps. Sales reach a multi-year low last month yet 12 zip codes in So-Cal reached non-inflation adjusted highs in prices. Boomer wealth versus those in their 20s and 30s coming to terms with being part of the renter generation.

The generations by names

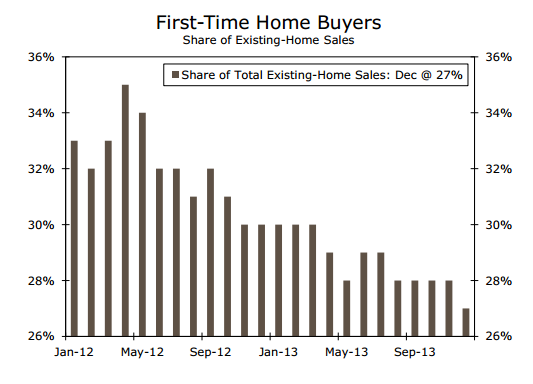

The generation that once fought the “man†has largely become it. Policies simply reinforce high prices for those already in the party but you need to sell to someone. So far, investors have picked up the slack. There is a reason for the record high number of young Americans now living at home late into their 20s and even 30s. Across the country in more “affordable†places your late 20s and early 30s is the typical time of first-time home buyers. But even across the nation given the jump in home prices caused by a flood of investors, first-time buyer rates have plummeted:

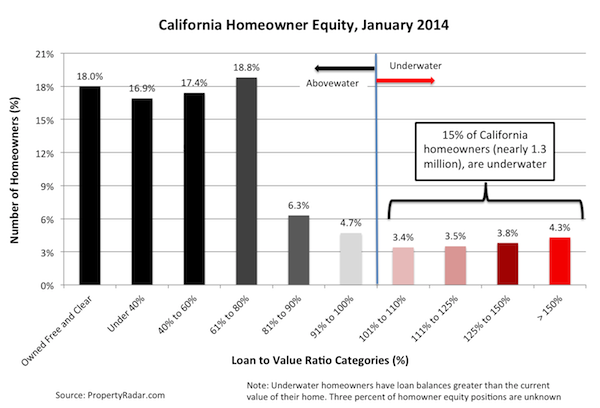

The rate fully collapsed with the rally in 2013. Higher home prices with stagnant incomes is no good unless you follow the louder drum of those simply preaching that buying is always a great decision, in the long-run. As Keynes said, “in the long run we are all dead†and some see this as a rallying cry to buy and take on a big mortgage while others decide to rent and keep a larger portion of their income free (many at this point have no choice even if they want to buy). In the graveyard of the 7,000,000 foreclosures I’m sure you will have some that carry a more nuanced view on purchasing real estate but why ask them? Let us talk about the person that bought that beach property and suddenly is a real estate millionaire! Let us only talk about the person that bought Google at IPO and not AOL at the peak. People have a massive tendency to confirming their own bias. The audience on this site is largely baby boomers so I may be saying something that people already know in that many are house rich and cash poor. Those trying to get in right now face a very inflated market. The Fed has made us all speculators given that they now own the mortgage market. Not by a little, but essentially make up the entire market when buying mortgage backed securities. So yes, when making your biggest purchase you should think a little (remember that since the crisis hit a stunning 7 million homeowners have faced foreclosure). Even in California we still have 1.4 million homeowners underwater despite the rally:

So yes, you should run the numbers (and think) before making this massive leap. Recent sales figures show that many cannot satisfy their housing lust and not because of a lack of burning desire. I take it that most readers that frequent sites like this modest one are thinking individuals that rather not follow the herd. I love it when some readers have their conversion moment and suddenly the argument is done. Checkmate! I bought therefore you should go out and buy that piece of crap $700,000 home. Inspections? Contingencies? Who needs a job with double-digit annual appreciation forever! Make sure to lock your car door and don’t pay attention to the fumes of the freeway in your backyard. Don’t you know that ex-“hood†is now the next Newport Coast?

The generation window looks like this:

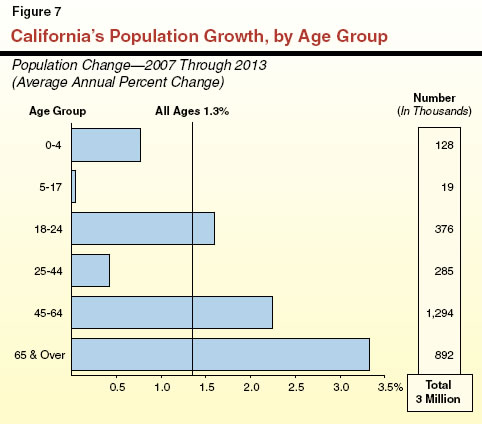

Baby boomers were born between 1946 and 1964. In general, we are looking at those with ages between 50 to 68. It should be no surprise that this is the fastest growing segment of our population since you can’t escape time in spite of all the plastic surgery:

The trend isn’t escaping California. It isn’t uncommon for a baby boomer to own their home or with a modest mortgage yet be cash poor because of blowing all their cash throughout time. I know many that are well into their 50s and the only asset to their name is their house. Little to no retirement funding but a home that is “worth†nearly $1 million. However, they have no desire to move and unlock that wealth. So then what? You tap that equity out and the bank once again owns your place. Heck, even those with paid off condos in California need to generate something like $500 to $1,000 a month simply for taxes, HOAs, and random upkeep.

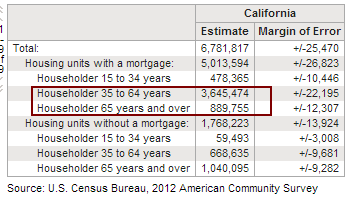

Most home “owners†in California carry a mortgage. It should also be no surprise that older home owners are also highly leveraged:

Culver City recently hit a $700,000 median home price in the 90230 zip code. You can buy with 10 percent down ($70,000) plus you will carry a healthy $5,062 monthly payment after you include taxes, insurance, and PMI. Those that think that 20 percent is common are not looking at the stats. You have all cash buyers, move up buyers, and those massively stretching their budgets (i.e., ARMs, etc). Plus, how many of those in their 20s and 30s can save up $140,000? Not many and that is why you see many in their 20s and 30s moving back home with mom and dad. Last month 30 percent of all purchases in SoCal came once again from all cash buyers.

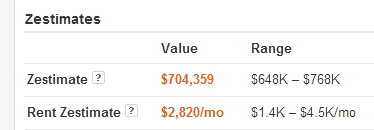

I was curious to see what $700,000 would buy us in the 90230 zip code today. Let us take a look:

11232 Segrell Way, Culver City, CA 90230

3 beds, 2 baths – 1,082 square feet

This is what $689,000 will buy today. Like I said, go in with 10 percent down (more realistic than $140,000) and you are facing a $5,000 payment for 30 years. Miss a few payments and enter the 7,000,000 club. The rent estimate on this place is $2,820:

A $5,000 nut or $2,820 a month for rent? Heck, let us even say you have the 20 percent down. Congrats! You now carry a $4,000 nut.  I highly doubt that a young professional couple is going to buy this place without stretching to the max and plus, this is 1,000 square feet! Even a boomer with equity is unlikely to make this big move. Speculation is rampant and those speaking about rental parity need to realize that this is a sword that cuts both ways. Right now there is absolutely no rental parity here. So then what? Either incomes race up or prices adjust, right? It isn’t like you bought and your point in time is suddenly the rental parity nucleus of all-time. Of course some will simply increase the down payment until they “find†rental parity. All cash buyers are beyond rental parity from day one. Does that mean it is a good time to buy?

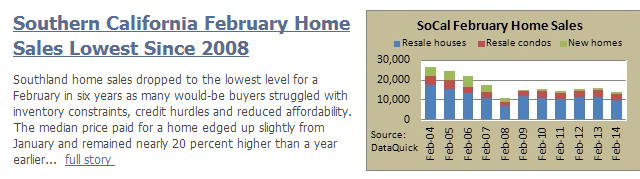

This is why sales are coming to a screeching halt:

Source:Â DataQuick

I’ve gotten numerous e-mails from house lusting people in their 30s itching to buy mostly because of biological reasons (i.e., pressure from family, setting roots, etc). Some are drinking the Kool-Aid. Ironically people hold property for seven years on average so the nostalgic idea that somehow this 1,000 square foot place will be the place you live in “forever†is a powerful marketing myth. Once you own, you suddenly drink the Kool-Aid of the day and it is on to the property ladder races!

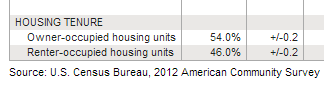

I have no horse in this game. If you want to buy and a bank is willing to throw a giant mortgage your way, go for it. You might even run the numbers and it will make sense. Great! But in many areas take a look at what it will cost to rent versus what it will cost to buy. If you are speculating (which you are) then run the numbers for the stock market and alternative investments. To think housing is this safe investment is nonsense. It is safe if you can carry the nut 30 years forward but the nut is large enough to crush the squirrel (the 7 million foreclosures don’t lie). But to think that it is a simple decision especially in this insane market is delusional. Keep in mind in California only 54 percent actually own their property (i.e., most with a mortgage of course):

Boomers are going nowhere so many will be living as I have said, in a golden sarcophagus. They will fill their bowls with Purina before selling that World War II lottery ticket. Taco Tuesday For Life (TTFL). Everything has a balance and many of their children are coming back to fill those nests.

I’d be interested to see your anonymous situation if you are in your 20s and 30s and stand in a situation where you are considering to buy in this market. Feel free to post in the comments. We have a nice balance of folks on both sides of the fence here so you may even get some sage advice.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

188 Responses to “The baby boomers forgot about their kids: Do we have any housing bulls in their 20s and 30s, the traditional age of first time buyers in high priced areas?”

Hello Doc. I have taken the liberty of posting the original article on those ’12 zip codes where home prices are now higher than during the bubble peak’ from LA Times a couple days ago:

Housing prices surpass bubble peak in some Southland ZIP Codes. Most are in the San Gabriel Valley or on the Westside, markets driven by Asian buyers and the tech industry. Still, many areas remain well below their pre-recession highs.

By Andrew Khouri March 12, 2014

In some corners of the Southland, it’s as if the housing crash never happened. Home prices in a dozen Southern California ZIP Codes have passed their peaks during the housing bubble, according to research firm DataQuick. Most are either in the San Gabriel Valley, a magnet for buyers from Asia, or on the Westside, where the technology industry is booming.

Across the region, home prices remain far below their peaks despite an explosive run-up in the first half of 2013. But nominal prices in some affluent neighborhoods have entered uncharted waters. The return of bubble-era pricing could foreshadow a spillover effect, experts said. As buyers get priced out of prime areas, they may look to adjacent neighborhoods — juicing demand there and pushing up prices.

Many other regional markets have stalled since last summer. Higher prices and mortgage rates, along with a shortage of homes, have turned off many would-be buyers. Sales have tumbled overall, but they continue to climb in wealthy communities.

Of the 12 ZIP Codes where the non-inflation-adjusted median price has passed its bubble-era peak, six are in the San Gabriel Valley and one is in affluent Irvine. All are hubs for buyers from China looking to move to the U.S. or invest here. Another is ritzy Los Feliz, where homes near Griffith Observatory command top dollar.

4 other areas are on Los Angeles’ Westside: in Venice, Palms, Mar Vista and Culver City. Buyers from the area’s burgeoning technology industry — known as Silicon Beach — have fueled price increases, along with broader gentrification.

Despite steep prices, experts don’t see a bubble forming in these areas. “There are important, fundamental reasons that prices moved up,” said Stuart Gabriel, director of UCLA’s Ziman Center for Real Estate.

The neighborhoods are near job centers, the urban core and, often, good public schools, Gabriel said. The areas have also recovered faster because prices there simply didn’t fall as steeply as in other areas during the crash. And each has unique factors driving the current price growth.

In the San Gabriel Valley, an influx of Chinese buyers has shifted the market into overdrive, real estate agents say. Many Chinese see U.S. real estate as a solid investment, cheaper and more stable than in China.Others buy homes with their children in mind, seeking cleaner air and solid schools. An epicenter for previous waves of Asian immigration, the valley is a natural landing place.

In Arcadia’s 91007 ZIP Code, the median sale price for a previously owned house reached $1.33 million last quarter — 30.5% higher than its peak in 2007. In the city’s 91006 ZIP Code, prices are 23.7% higher. Other areas with nominal prices exceeding their peaks, though less dramatically, are Walnut, Temple City, San Marino and a ZIP Code that covers parts of San Gabriel and East San Gabriel.

“It’s crazy,” said Pamela Rose, a San Gabriel Valley real estate agent. “We are experiencing a lot of overseas money.”

On the Westside, the arrival of hip cafes and other amenities catering to tech industry workers has, in turn, attracted others to these areas. In rapidly gentrifying Venice, the median price in the fourth quarter of 2013 was $1.34 million. That’s nearly 3% higher than during the bubble and 84.4% more than the bottom during the crash.

“There is a tremendous amount of demand from the tech industry,” said real estate agent Tami Pardee. “It’s really driven up the prices in Venice, which has driven up the prices in Mar Vista.”

That spillover is welcome news for current owners looking to build home equity. Some have cashed in, selling to developers who have built larger, new houses with affluent buyers in mind.

Fuck them.

Which ones? Or, do you mean all of them?

Fuck them all. LA Times, the writer, the buyers, the sellers, the mortgage brokers, the escrow companies, the realtors/agents, the neighbors too.

“buyers from China looking to move to the U.S. or invest here”

Would love to know the true breakdown between those actually moving to settle here and those who are simply spec- oops I mean, investing here.

Virtually to a family, the Chinese are buying a homestead for their kin.

With thirty-years of market ‘experience’ in Vancouver and Australia — the persistent habit is persistent: they buy to own and occupy.

Barron’s — long ago — noted how that the Hong Kong crowd were consistently buying up the single most expensive, exclusive residential properties in that city — only to promptly RAZE THEM TO THE GROUND. There were apparently no exceptions.

Not uncommonly, the Hong Kong buyers paid beyond top dollar to snap up the adjacent property.(ies) It was, of course, razed and combined with purchase number one.

Then a new super-home was erected — totally in the Chinese style: with the walls oriented towards the dawn for the master bedroom, etc. etc.

Then the extended clan moved in — on the strength of their British passports.

I’ve never read of a SINGLE Chinese immigrant/ alien buyer who held their purchases out for rent. As a practical matter the issue is resolved: the Red Chinese are not investors. They buy and hold forever, and ever. Flipping, rents and selling never enter into their calculus.

But, that’s tradition for you.

This is not to say that Red Chinese don’t speculate in real estate. They certainly do. It’s just that they only speculate where they’ve got a shot: back home in China.

Flying in on a jet, making a pit stop, they know they don’t have a handle on California real estate. These aren’t dummies. Their typical IQ is way up there.

(Fools and money are soon parted — everywhere.)

What the Red Chinese won’t usually do is buy property based upon price.

For them it’s location times infinity.

If you’re in the wrong part of town you won’t even see them drive by. And for the Chinese, the ‘wrong part of town’ is anywhere that doesn’t already have a Chinese footprint.

You’ll see something like this when Americans buy retirement homes in Costa Rica. By their standards, Americans are paying two to five times as much as a local would — per square foot — and a tremendous premium for design and materials.

The American retirees look upon Costa Ricans as ‘giving it away’ — even at such prices.

In both cases, the buyers represent the upper end of their native income and asset distributions.

A variation of this occurs when mainland Americans vacation in the Hawaiian Islands, (Could be Virgin Islands) To the Islanders, it looks like everyone is loaded. What they don’t see is that years of savings are being blown in a two-week binge.

Islanders have a cost of living so high that there is no prospect of them saving a dime. So it never enters their heads that such a thing is going on.

Since Americans are not, and never have been, subject to Capital Controls, they can’t wrap their minds around how difficult it can be to get wealth out from under Big Government. This means that posters on this blog still can’t tumble to the frantic nature of this Fright Capital.

Red Chinese real estate purchase monies have to be set ENTIRELY aside from the rest of the market. They truly stand alone.

While those are interesting anecdotes, I’m still waiting to see the quantitative data measured at the source. As far as I know, it doesn’t exist.

http://www.zerohedge.com/news/2014-03-15/how-smuggle-money-out-china

Since you’re asking for a metric that can never be obtained…

Here is a blurb that is timely.^^^^

“Many card users follow their money abroad. Since the mid-1990s, an estimated 16,000 to 18,000 Communist party officials, businessmen, CEOs and other individuals have “disappeared” from China, according to a separate PBOC report prepared in 2008 – taking with them some 800 billion yuan ($133 billion).”

Since, practically by definition, this is all Fright Capital, no-one reports nothing.

%%%

The better query: Does anyone, anywhere and at any time know of any Mainland Chinese real estate buyer of residential properties that has bought them as passive investments?

The obvious answer is: No.

It’s impossible to run a real estate investment portfolio from Red China.

If someone of that character were to do so, it would never show up on the ledgers as being Chinese money in the first place. They’d have to route it through some tax haven. You, me and the next guy wouldn’t even make the connection. Such fundings must be entirely outside the scope of the matter at issue: Chinese super-bidding at retail.

If there are 1.3 billion Chinese then they have 13 million 1%ers. If only 10% of their one percent desire a place in SoCal then there would be 1.3 million buyers. What about their 2%’s and 3%’s etc?

As you can see the boomers aren’t stupid. By moving all our of manufacturing to China they were ensuring that they would have a wealthy elite to way over pay for their stucco shacks when they were ready to flee the mess they’ve made.

Blert, you’ve missed the point entirely, which is that the question is rhetorical. Obviously we won’t know exactly what the breakdown is, so all of the claims made about the reasons behind Chinese purchasing of RE is simply guessing.

>> On the Westside, the arrival of hip cafes and other amenities catering to tech industry workers has, in turn, attracted others to these areas. <<

I hear this so often. That "hip cafes" and "trendy restaurants" are magnets for young people with money. Is that so? Are the young and upwardly mobile so obsessed with "hip and trendy" eateries?

I like Starbucks and a good 27/7 diner. Denny's is fine. Those are "hip" enough for me, a Boomer.

@son of a landlord,

Totally agree. It seems that someone–whoever it is–is forgetting that the west side has *always* been a magnet for people with money and has always been “hip.” Tech, entertainment, law, medicine, whatever. Nothing new there. It was like that when I was a kid 60+ years ago. The fact that it’s still so is not news.

“Are the young and upwardly mobile so obsessed with “hip and trendy” eateries?”

Yes, they are!

there’s nothing more irritating than a food snob

@Paula – what is your definition of “the west side”? I was born and raised in Santa Monica and I can tell you Santa Monica was a dump when I was a kid except for north of Montana. The city was mainly filled with labor for aerospace Hughes, Mac Donnell Douglas (which was on Ocean Park), Lockheed Martin, etc. Venice was a ghetto where no one in their right mind would go through day or night. Mar Vista was not as bad as Venice but not far off. Palms, Culver City, West Chester, most of MDR, West LA, where lover middle class at best. Back when I was young the rich lived in hills of Beverly Hills, Bel Air, parts of Pacific Palisades and the rich recluses\oddballs lived in Laurel Canyon. Malibu was middle class, Topanga was old hippies. So, no the West Side was not “always” hip/rich.

@shellz – then you would hate me. Wife owned a restaurant at 23 and now is a food blogger. We hang out with the old manager of the Fish Market in Santa Monica and a organic farmer or two as well as a couple of chefs trained in Spain. So we are big time food snobs. Feel free to hate because I love good food and the wife make everything from scratch for the blog and I get to eat it. I consider myself very lucky. No MD’s for me…

36. Came into my prime earning years right when Housing Bubble 1.0 began. Rode it out made an auction offer on an East SGV place in 2012 that made sense for me and missed by 15K. Since then it’s been nothing but insanity.

Unlike many I want a house not for starting a biological family, but for roommate rental streams. Have always lived with family and friends and I enjoy the camaraderie. Love being able to stick it to the high cost of living as a group. Share space chores an cooking. Everyone has more disposable income for weekend entertainment an savings. If anybody has a downturn working part time is still enough to cover their share. 4or 5 people in a 2500 SqFt house gives you MORE room than cramming into 3 small apartments. Only one set of bills to pay. Sure there’s the human dynamic, but we all deal with that in some way every day. It’s the best family environment I’ve ever had. I’ve got about 80K backed by an available private equity loan to make me a “cash” buyer, waiting to get into the right property. Plan to look at North Upland, CA starting next year. With mortgage rates likely above 5% and many more foreclosures coming through the pipe, I’ll be anyone here dimes to donuts that we overshoot the 2011 trough by a good 10%. It may somehow be followed by yet another echo bubble but for now 2015-16 is my window.

Expendable income is so nice. I’d rather rent where I want to live than own where I don’t. Maybe I’ll die of exposure at the age of 68 for lack of a house, but I’ll shake my fist at the housing gods. “You never got me, you bastards!” I’m not saying I wouldn’t buy a house if the right thing came along at the right price. But, otherwise, who cares? I just think that America’s lemming-like approach to home buying is fascinating to watch. If it works out for them, great. If the entire economy collapses…well, that will be interesting, too.

More or less same for me. The first point I was in a position to buy was 2003-04 and by then the fundamentals already didn’t make sense to me. Should I have rushed to be in 2003 anyway? Maybe.

Arguably could have bought in 2011 at a price I could have lived with (though I was pretty sure the bubble hadn’t fully deflated, I could have swallowed it), but I ended up being between jobs for a few months. By the time that was square, prices had already surged back to the danger zone.

Lots of family/friend pressure to buy. Many of my peers either moved into higher paying careers, or were 2-3 years ahead of me on the curve and bought in just before the price surge.

Many of them do now tell me I’m a fool if I don’t buy now, because hey, “our market can only go up! It’s so awesome here!” Oddly, I hear it most from spouses who married wealthy and have less pressure on them to work/earn.

At some level I think the reality is that really engaging with the real estate market takes a lot of effort and some sophistication. Much easier to let the media (via whatever NAR spokesperson is their expert of the month) tell you that “Rates are going up! You should buy now!.” Except when they’re telling you “Rates are going down, you should buy now!”

And if you have bought and you’re heavily leveraged, it’s too scary to think about losing your equity (often the most significant asset young families have) – much better to reassure yourself that the media is right, and the market can only go one way. Because population growth and demand and stuff!

47 and selling my condo in downtown long beach which i bought in nov 96 for less than 40,000. looking to get at least 170,000. moving in with my 73 year old mom to help take care of her. no wife no kids. happy and content to have deposable fun coupons to enjoy life which is easy

disposable …. i work for the state of calif and i will be paying off my mom’s mortgage with my windfall

Doc you did not post the first part of my entry. I said I was selling my condo in downtown long beach which I bought in nov 96 for less than 40.000. Happy and content with my easy job and easy life. I have disposable fun coupons to enjoy life because I have no kids and no wife. I am 47

My husband and I are both 27 and looking to buy. We have more than enough in the bank for 20% down on 600k house.

Having a healthy DP is great, but it’s our incomes that hurt us. Realistically we qualify for about a 290k loan on one income. My parents (baby boomers) made their fortunes in real estate..buying and selling rental properties and they advocate to buy. We don’t want to use every penny of savings we have on a house..especially since it feels like buying a house is speculative right now.

We are looking in the nicer neighborhoods in Santa Ana, my husband works in newport and he doesn’t want to commute too far. We’re also set on a SFR, which makes our options limited. If we had been looking 2 years ago we could’ve bought something in Costa Mesa, but that ship has long sailed.

We hope we’re making the right descsion in buying a house. It’s just so hard to tell anymore!

“Nicer neighborhoods in Santa Ana”?!? There are nice neighborhoods in Santa Ana?!? And $600K, I’d imagine you could buy swaths of Santa Ana for $600K

they must be referring to “North Tustin” as some call it….it’s still Santa Ana city and zip but they feel better calling it north Tustin

you are right, you can find a 4 bedroom 1400 SF in hood Santa Ana for like $375K, but I don’t know Spanish so that wouldn’t work for me

I live in Orange Co near the Santa Ana border. There are some really WOW neighborhoods with Santa Ana addresses. Some are actually in unincorporated North Tustin (92705). Other parts of 92705 are in Santa Ana limits but not too shabby, like the neighborhood west of Tustin Ave near the Jewish Temple. Then there is French Park ( http://www.frenchpark.org ), which seems to be going to a “hipster” neighborhood, but a little too close to the lumpen for my taste.

Then there is Floral Park… http://www.floralpark.com/

Houses on Heliotrope or Victoria have to be seen to be believed. This is the “old money” area of Santa Ana. Interestingly, there aren’t any houses for sale on Zillow on those two streets today. Nearby parallel streets have less pricy homes, and a few are for sale.

We went into one of the houses there about 25 years ago when it went up for sale. It had been built in the 1930s by a Maharajah we were told, and frankly, you couldn’t get a house with all of the high quality workmanship in that house for the kind of money they get for houses in Floral Park anywhere else in Orange Co.

Some houses on the north edge of Santa Ana are in the Orange school district, like the neighborhood where that man had a house full of starving snakes that made the news a couple of weeks ago. That’s nice for families with kids who can’t afford private schools.

Rent or buy, Santa Ana may have something for you, but as I like to say, caveat emptor!

You’re 27 years old. Do you guys want kids any time soon? Factor in either staying at home with your child and making mortgage payments with just one income, or factor in working but having a chunk of your paycheck going to child care expenses.

Can you still comfortably afford it?

Kids aren’t cheap.

I bought in 2009 and ready to move up the Ladder but I cant cos house prices spiked %20 to %30 percent in between 2012-13 and my income has not!!

I am still making close to what I was making in 2011,12,13. I am in no rush till prices drop to 2010-11 level.

I am waiting for drop to buy again. Realistically, %20-25 drop would be good for the housing market.

“Taco Tuesday For Life (TTFL).” :))))))))))

34, wife is 32 with 1 kid. $130k total income with wife working part time.

Nice post DHB.

Long time lurker on your blog but given your last paragraph I thought I’d chime in. This isn’t meant to be a brag post but just to add another perspective.

My wife and I are in our late twenties, no kids, both with stable, professional jobs. Our income is decent but not great (low six figures between the two of us). No student loans or consumer debt. Financially speaking I’d guess we’re in the top 10% of our peers.

In 2011 we bought a house not too far off in terms of size/condition than the one in the article, but in the bay area. This was accomplished through a down payment gift from family, a 30 year mortgage borrowing the maximum the bank would loan us, and a second mortgage from family to cover the balance. The monthly nut between the two mortgages, plus property tax/insurance, is about half of our combined take home. Since 2011, the value of our home has gone up by about 50%. Buying was obviously very risky but it worked out for us. I’d like to think my superior timing was responsible for this but in reality it was just pure dumb luck and familial generosity.

Buying our house today would require a six figure down payment and a payment equal to a full professional-level salary (pre-tax!). Of those in my age group that I’ve talked to, virtually none of them could swing that. This includes many couples earning close to 200k with substantial savings. Many are getting visibly desperate in the face of the trend of house prices rising 5-10k per month but only being able to save 1-2k, tops.

The housing market is starting to feel a bit like 2005 to me, minus most of the hinky lending games, and I simply don’t see prices rising at their current rate for more than another year or two. When DINK couples with healthy incomes and no debt can’t even afford a crummy starter home, there simply won’t be anybody for the boomers to sell to. These properties can’t even come close to earning positive cash flow if rented. My guess is we see values come down a lot, and soon. My wife and I are now looking to sell and rent for the time being until the market regains some sense of normalcy. In hindsight I’m very glad we bought when we did but the buying proposition just doesn’t make sense anymore.

You’re in your late 20’s and you were in tune with the market 9 years ago? If you say so.

We actually bought in our 20’s back in 2005. By 2011, we were way underwater in a townhouse with the worst neighbor in the world, and we had to get out. We had to fork over a bunch of cash, but we got out and started renting. We had one kid with another on the way…and there was no way we were staying there.

So for the last 2.5 years we’ve been renting in a really nice area, saving up, and waiting for the other shoe to drop. In the meantime, our son is going to an awesome school, we have awesome (and quiet!) neighbors. We’ve been signing a new one-year lease every summer (I like the peace of mind knowing we won’t get a random phone call during the year). How long will we stay and rent? I’m thinking when the kids are out of daycare, this current bubble to burst, and when we have a big fat chunk of money saved up.

I am in 31 years old and I’m no bull here. I have 100K down-payment cash, + only about 10K in brokerage acct with stocks… no credit card debt, no student loans. I do have a car note for 15K left.

in 2010 I saw acquaintances get into homes with the 3.5% which they borrow from mom and dad… now they act like they’re economic geniuses, with the house going up in value and refinancing…now they’re buying benzos and such..

back in 2010 I did not have the money. I’ve saved most of my money in the last 2 1/2 years working hard 50-60 hrs per week, + consulting. Go to work and gym to workout to get energy to work more and harder. No going out to $80 sushi or steaks or $50 and up bar tabs… NFL or NBA games damn tix are like $100 and up a pop, + where ever you eat…it’s insanely expensive… I brown bag it to work, except fridays.

my point is that On could save money, if you don’t fall for the consumerism that Is suffered in college and mid-20s. now I have girlfriend and we might get married in late 2015… so if housing in CAL does not have a correction by 2016… I can take my 150K(projected savings) and move out or I don’t know… it takes 80K down-pay for a 400K house that is shiite… anyway I just want a starter home, I could care less abour granite counters… in fact… fuck the granite counters.

simple home 3bd 1 1/2 bath with garage…nothing fancy…

“…so if housing in CAL does not have a correction by 2016…”

Don’t worry my friend, it will. We’re over 2 years into the mania, the last mania was 2004-6 with 2007 being the flat year before the collapse. 2014=2007. I’m seeing THE EXACT same comments coming from the Housing Bulls as last time. The debt loads are WORSE than 2007. The FED has no tools left stay a decline in prices. Besides, with the big banks saved from nationalization they don’t really want to. Residential RE prices NEED to drop to preserve what can be of commercial RE. The only way commercial RE can remain solvent is to get the shopping centers full of consumers so the tenants can pay rent. The FED knows lower rents and mortgages help the commercial RE still on the big 4 banks books. They’ll throw residential RE under the bus in a minute to save the paper backing commercial RE loans.

Between the new monster mortgage payments, cost of everyday living and crazy inflated rents (up at least 15-20% in Long beach and Lakewood area in the last 18 months, what was $1750 is now $2300+ for a 3+1 1100 Sq Ft stucco box) the consumer is cash strapped, there’s nothing left over for themselves…….you are 100% right that the banks will throw residential RE under the bus to save big dollar commercial paper…., besides the banks will make money on REO’s just like they just did the last time around, PMI insurance will pay out the full hit if they default and they then sell the asset on to an investor/hedge fund buddie and the whole circle starts all over again….

34, wife is 30 with 2 kids. $150K total income with both of us working. Not from the area, so our Boomer parents own in the Southeast. We rent in South Bay (not close to the beach) for $2200, would like to buy for school district stability. I pay attention to the neighborhood prices, but haven’t seriously looked because we are priced out.

Like that house in Culver, prices here are no where near rental parity. Houses that were $550K in 2012 are now going for $700K. If I stretched my family that far we would be living on Ramen. We could start shopping in rougher areas I guess, but then we would have to pay for private school. If prices ever become affordable again we’ll consider it but in the meantime I’ll take the cheaper rent.

I’m 35, and wish I could be bullish about buying, but as is commonly proven, it’s cheaper to rent. At least anywhere nice. Plus one can always rent, save, leave CA, and a buy a place for cash else where in the USA. Which has many wonderful places to live.

I moved to the Bay Area from Michigan in May 2001, signed a 1 bed rental contact for $1100 in Walnut Creek and when I got her my rent was dropped to $1000 without my even asking. It was only last year that my rent for another one bedroom finally reached $1000 again, in nearby Pleasant Hill. This is despite the increase in rents one can read about. I think it only went up because property taxes and utility fees went up and everyone knows, the renters pay for any increases in those expenses.

I’ve remained in the area much longer than I ever imagined. Perhaps might have been slightly better off now, buying a home for $300,000 when I first got here. I doubt it though. Plus they’re effort and an expense. Finally I’m barely home at all with work and my fun filled life, I don’t know what I’d use a house for as I am.

On a side topic. My gf lives in her parents basement despite making $55k/yr and her older sibling wisely refrained from buying a place in the south bay for $1MM and opted to continue to rent. I see the trends discussed on this blog played out in real life everyday.

Nice article but I think you are missing one perspective from some Gen X/Y folks. A couple years back I was talking to a recent MBA graduate and he stated that house ownership isn’t compatible with modern life. He went on to relay how important moving was to get a good job, and how people only stay at their jobs a short time. If you bought every couple years you loose transaction costs. If you rent you are more flexible in getting that better job somewhere. Considering the current job market how many 20-40 year olds want to be locked into a geographic region. Also, since many of these higher earning professionals aren’t eager to form traditional families they aren’t under the same pressures to buy that the boomers had before their first divorce.

That’s generally true in my profession. The truth is I make well above median compared to state/national/city medians, but compared to most of the other posters on this board (130k, 150k etc.) I’m a veritable pauper.

There are a few 6 figure jobs in my field, but by and large getting one requires some luck on timing and mobility. It’s only worth buying if I could really make it work on my current salary. And the jobs that do pay at that top tier don’t usually come with any long-term security.

The jobs that pay 40-60k do tend to have security, but in this market, buying on that even with 15 years of savings just isn’t viable, or at least would require financing up the nose.

My wife and I are considering buying now… I am 31, she is 28. We are expecting our 3rd child in a few months. I have an MBA and make a bit over six figures… but we just can’t find anything that we can afford (we are in OC), so I feel like we will rent forever. Like you said, saving 20% is a big stretch for us, shoot so it 10%. I don’t know how anyone our age is buying.

The older generation is merely taking advantage of the consequences of irresponsible actions of the fed and government on all levels. You can’t blame them for accepting the deals that are presented to them, whether it’s at the cost of the our generation or not. A lot of people here talk about the real reason behind the bubble but what is troubling is that you rarely hear it from mainstream media.

The older generation created the advantages. The Baby Boomers and Me Generation (think Yuppies) are in power at all levels of gov’t and have been for years. They can’t blame their parents anymore. Clinton (boomer), Bush #2 (boomer), Obama (Me Generation) and their cohorts have held the reigns since the early 90’s and have made deal after deal to short me (Gen X, born in Feb. 1970) and everyone else at every turn. Newt Gingrich (boomer), Hillary (boomer)….. all of the longterm media hacks and political pundits are Boomer or Me Generation. They have all, regardless of party, had one agenda: spend and don’t pay.

And now another entire generation of idiots has been raised buying into ‘diversity regardless of ability’, ‘perpetual dependency on gov’t and family’ and whatever other cause of the week they are told to support by the Huffington Post or Jon Stewart….. other than the 2 wars their parents got us into of course….. some other kid can fight those.

I’ve owned 3 homes since age 29. They are a succubus, but I do all of the work on them myself, like my grandparents did. My parent’s couldn’t swing a hammer but by God they ‘needed’ a new kitchen every 10 years and that convertible as a 3rd car because “I deserve it!” Go on Google Books and look at old issues of Popular Mechanics from the 40’s-60’s and you’ll see the spirit of real do-it-yourselfers. Of course now you can’t legally do stuff yourself because the nanny’s of the Boomer Generation have made it illegal. As the Doc said, they ARE the Man now, but in reality they are still children.

You differentiate between Boomers and Me Generation?

I’m the same age as Obama. I thought we were Boomers.

I do. Boomers cling to the wanna-be hippie ideology of the 60’s and the Communist inspired do as I say, not as I do ideals it brings to the table. They are the ones that mandate crap like ‘Green at any cost’ and ‘One world’ idiocy that is shown to be falling apart all over the planet.

The kids of the Wonder Years (Me generation) didn’t grow up as hippies, they turned into Yuppies, the Gordon Gecko generation that is more than willing to sell souls for cash so long as “I got mine”.

The ‘Greatest Generation” as dolts like Brokaw call them, weren’t all 18-25 when they came home from war, that is an idea the Boomer’s assume because the ‘Nam vet’s all left home at 18-21 and were back 2 years later. The draft in WW2 started at a higher age bracket and worked it’s way down as the war progressed plus men of all eligible ages volunteered so you ended up with ‘older’ men returning form the war and having kids.

My parent’s generation (and every kid I grew up with’s parents) was married and popping them out at 18-20 and was done with kids by age 28-30. You can regularly find large numbers of Boomers who were born to parents in their 40’s and even early 50’s. Many Boomer’s like my mom were born to people who suffered terribly through the Depression. My grandmother lost 3 kids before my aunt and mom were born in the 40’s because medicine wasn’t as advanced and the nation overall was much poorer. Loosing kids pre-birth or in the first couple of years was commonplace before WW2. Many of my grandparent’s friends delayed having kids because of the Depression.

While the 20 year timeline is seen as the norm for marking Generations that is just taking the easy way out. I have much more in common today with someone born in 1964 (the last year for Boomers they say. I was born in 70) than someone supposedly also of Gen X who was born in 78-80. A world with out cable tv, microwaves, answering machines, dual income parents, etc. Even my sister who is 3 years younger than me has little in common with me or my older sister who is 3 years older than I am.

In my view the Boomers=wanna be hippies, Me Gen=cocaine and disco. Both have done everything they can to steal from the next generations via tax policies, regulations, profit over all else labor/business practices, foreign policy based on desire not threat…… and as I said to Mike the cab driver guy on the last post: the chickens are coming home to roost. Every single person my age (mid-40’s) down to the mid-30’s I know is already telling mom and pop ‘tough shit’. Sell the house, the toys, move to Florida because I’m not spending my entire life making up for your lousy planning. You took, you gamed the system to always favor you and now you want more…… but you never saved one red cent…. and that is somehow everyone else’s fault. Um, nope.

I see that you haven’t shot yourself yet.

Beware the Ides of March……………

Still waiting for the Ides of March to correct/pop the bubble that is the Arcadia/SGV area.

So tomorrow everything falls apart. Can’t wait…

It’s today. Nearly 8 hours into the Ides. Sun still shining here in Santa Monica.

I have noticed an increase in listed houses in some desirable areas — Culver City, Pasadena — these past two weeks. But that could be a typical start of the Spring buying season. Listing always go up in Spring.

I’ve also noticed some price drops in those areas over these past few months. But that could just be a leveling off — prices having reached a ceiling — rather than a tanking.

And I’ve noticed quite a few listed houses that were last purchased only a few months ago. Flippers who came late to the party. A lot of those houses aren’t moving. Again, it could just be that home prices have reached a ceiling, and are leveling off rather than tanking.

This time is different…

32, wife 31, with a 10 month old son. We are both professionals working in the bay area, I am an engineer and she is in the medical device industry. $155K income with only some student loan debts and about $25K in savings. We found a cheap in-law unit to rent in a very exclusive town between both our jobs. We lucked out with that since we have a large dog and rents are out of control. We are able to save $3-4K a month.

We really want to buy but I am not willing to sacrifice our financial stability by stretching ourselves to the max for a 2 br 1 bath bungalow or some crappy home 1-2 hours away from our jobs. Many of my engineering coworkers, most in their 30’s, are in the same boat constantly talking about the madness of the market and prices our generation face in CA. It really is discouraging and we don’t plan to stay long term. Why be relatively well paid (not doctor, lawyer, finance salary) and be house broke or wasting hours of your time commuting each day when we don’t have anything tying us down here. I feel that eventually the market will come back down to fundamentals but currently the majority of the voting populace and the government are Boomers and Late Generation X which are most likely to be home owners and thus will do all that’s in their power to keep this house appreciation madness going. Until the bubble bursts we have happily (most of the time) decided to wait and keep saving.

Also as with the cost of housing everything else is going up in price faster than inflation and wages. I mean my wife and I are fortunate and in a good financial situation but I’m the last 15 years:

-gas 4x expensive

-state tuition 3x more expensive

-healthcare ~10%+ a year increase

-easily spend $80 on two bags full of groceries

-Disneyland now $99 a ticket

-sking $85+ a lift ticket

-Utility bills more expensive

-companies not contributing to 401k

Where is the leftover money gonna come from to pay for that $800,000 60’s home?!?

It doesn’t make much sense and I start to feel like we are all taking crazy pills!

Ok. End of rant, it’s Friday night!

Married for a couple of years, no kids (yet?), husband and I are both mid-30s. Approx $350K HH income, mostly from me. By the time I finished grad school and started making money, in 2006, L.A. was near the peak. I felt uneasy at the time with housing prices, and stayed out of the market. Instead I paid off student loans, invested, bought a moderately fancy car with cash. We’re approved to buy well in excess of 1M and have more than enough cash to cover the down payment, but… I still feel uneasy. Basically for the same reasons that you describe above – if we buy a place like that, who will buy it *from us?*

Currently we’re renting an approx 1000 sq ft condo in Palms for $2K including utilities. We don’t want to be there anymore. We want to be in Culver (esp. if we have a kid), we want a proper dining room to host our family for the holidays, and a damn backyard! But when the choice is between buying a house that very well may get us stuck, and keeping a nice sum of “F-you” cash in the bank in case we ever have enough of our jobs, it’s hard to justify the former.

It’s incredibly frustrating for logic and emotion to be so at odds. Not to mention, we’re paying an insane amount of taxes, since we can’t deduct hardly anything. I’ve never been so pissed at the boomer generation, they’re downright robbing from my generation. It’s really fun, too, when you see these places in Culver that are on the market for “the first time in 50 years” – old people and their families cashing out on nearly a million bucks in equity, paying $1K a year in property taxes due to Prop 13. Then the next buyer pays $12K/year for the same place, except now they have a crazy mortgage on it as well.

It’s easy to say, “well, just move out of CA.” But… his family is here. I have a very lucrative job and am licensed in a profession where the barrier to entry in other states can be significant. And we do truly love it here. We’re just at a loss at what to do.

>> I’ve never been so pissed at the boomer generation, they’re downright robbing from my generation. <<

I'm a Boomer and I never took a dime from you. Really, when have you ever put money in my pocket?

If you want to blame someone in California, blame the public service employees unions and their lucrative pensions and free medical care. That's where mush of the taxes are going.

And it makes sense for young families to pay higher property taxes than for seniors to do so. Property taxes pay for schools. Seniors don't have kids, young families do.

Wrong targets, guys. How about the NAR, Wall Street, the FED, the banks?

SoaL how much do you write-off on your Federal and State taxes? Any kind of credit you get on your taxes is a form of government funded welfare and is the kind of thing CAperson is talking about.

Are you kidding me? Your generation voted for Prop 13, which gutted the CA public education system – after you all benefited from it, of course. Have you been paying attention to how much more expensive public university tuition has become? It has vastly outpaced inflation. BTW my dad is a boomer, and completely agrees with me. He worked to pay for college in the 70s – because it was actually possible to do that.

Young couples should pay 12x more tax than old people for property that’s worth *exactly the same,* because young couples are more likely to have kids? That’s ridiculous. Also, I’ve been maxing out on social security since my mid-20s, so actually I am paying for your retirement. You’re welcome.

It’s not an either/or thing here though. I agree that certain aspects of the public sector in CA should be reformed, but that’s a bit of a red herring. My generation is starting off in the hole because of the choices that your generation made to subvert the public good in favor of private gains.

^^^^^ AMEN CAperson!

Prop 13 was voted in by the SILENT GENERATION.

Most of the Liberal policies that everyone loves to hate were put in place by the SILENT GENERATION.

The legislature writes the laws. They — all of them — are governed by seniority — and massively so.

Even at this late hour, most of the critical positions are held by the SILENT GENERATION.

Ted Kennedy (1932), Harry Reid (1939), Nancy Pelosi (1940), — Silent Generation — every last one.

Gingrich (1943), Hastert (1942), — Silent Generation.

Boehner (1949) is the very beginning of the Baby Boomer Generation as Speaker of the House.

Similar results are obtained for Sacramento, with Edmund Gerald (Jerry) Brown (1938) being the ultimate re-tread Silent Generation politician. (8 years 1975-1983 plus 2011 and currently Governor, plus Gray Davis (1942) 1999 – 2003 — his former chief of staff and acolyte.) Most of the current ills of Sacramento were made patent by Gray Davis — who was Brown on steroids.

AT NO TIME has the Baby Boomer Generation been in charge until Arnold came along. By that time Sacramento had become a One Party (D) town.

Virtually all of the policies that are now being complained about stem from Liberal Democrats. The days of Edmund (Ed) Brown (Sr.) are long, long, long dead.

Prop 13 was universally popular because it held the purse strings tighter against Sacramento.

And because, it resolved the disparities in school funding between the wealthy Anglos in the ‘burbs and the Latinos in the sticks and the Blacks in the big city. This latter aspect is completely overlooked by the ‘modern kids.’

It was mandated by the Courts.

Capping the property tax rates stopped inner city rates from driving businesses and residents away.

Detroit is THE case study showing what happens when property taxes are not limited — and the ‘system’ is allowed to spend what it deems proper on education… scratch that… spends on unionized, politicalized, civil servants… ultimately absolved of accountability.

At the end, it’s a war zone.

Gray Davis started a ramp in pensions and payroll that the State of California can’t afford. He crafted legislation that proffered Silicon Valley style compensation for the unionized civil servants. At the end of that road, every ‘burb must become Vallejo: bankrupt!

Anyone who is blaming these evils on the Boomers is lost, lost, lost.

Liberal Democrat Party politics has driven all of these events.

You get what you pay for. Consequently, California is getting more indigent immigrants — legal and illegal.

Taxation drives off that which is taxed. Consequently, California is losing enterprises and talent to the rest of the nation.

One goes bankrupt slowly, and then, all at once. (cf Greece)

Blert,

Agree with you about Gray Davis really screwing up the pension system. Two things,though:

1). The biggest beneficiaries have been cops and firefighters. Some civilian government employees benefitted but if you want to find the largest pension increases look no further than public safety, including prison guards. CAs prison industrial complex is insanely expensive. And it was not all liberal Democrats who did this. Do you remember 3 strikes? The war on drugs? Both dubious experiments. These were conservative Republican policies that swelled the prison population and started the ball rolling. Once more prison guards were hired the unions got stronger and then the deals with Democrats started. Please don’t try to let Republicans off scot-free.

2) And what about conservative Republican businessmen jumping on the Prop. 13 bandwagon and including commercial property (as opposed to strictly residential property to keep seniors from losing their homes) for tax breaks? This has taken billions (and I mean lots of billions) from the State over the years that could have been used to pay for schools and to make sure the pension system had a brighter future. Don’t blame it all on liberals.

Why not rent a house and see how things go? You get the formal dining room and backyard, all the while hanging on to your savings.

We are thinking about it, actually. Need to crunch the numbers and account for the intangibles (e.g. annoyance of having a landlord, rental housing tends to be crummier). There’s still a macro problem of being high income people in our age demographic and relegated to renting.

Oh pleeeze. Your father & mother (those miserable boomers) gave you life, you whiny, misguided, entitled child! But somehow the hypocrisy of blaming your parents’ and “me” generation for ruining your generation’s chances of having the lives your parents had – which they got by voting for their own interests which is what everyone does, isn’t it??? — completely escapes your overpaid and under-wise pea brain. Let me spell it out for you: try voting instead of spending all your time twittering and F-booking and Pinteresting and playing Candy Crush and use the internet instead to mobilize the vote for your own interests. The last time I checked, the handful of people in your generation who bothered to vote voted for Obama, and those who stayed home complaining on Tweeter & F-book instead of voting have no grounds to complain.

Truth is, the hugely successful of your generation (e.g., Zuckerman et al) don’t have your generation’s interests in mind any more than the generations you excoriate but instead act only in their own self-interests. You spew your hypocritical hatred and venom at entire generations but guess what? It didn’t work out so well for any generation anyway as the vast majority of ALL generations is in the 99% that have been screwed royally by TPTB, TBTF, Wall Street, ZIRP, QE, etc. etc., etc. If you don’t like the way things are, quit whining and mobilize your vote. Or move where you can afford to live like the entitled whiny self you come off as.

Wow, guess I hit a nerve! You know, you might want to try practicing what you preach. Read my post, then read your post. Which one sounds more hateful, eh? You know absolutely nothing about me, and surprise – you got a ton of it wrong. I’m not even a millenial, I’m Gen X; and I’m very politically active. Take a few deep breaths and calm down before you hit “submit comment” next time. Others might take you more seriously if you tone it down and cut out the ad hominem attacks. But thanks for being entertaining, I guess.

I recommend that you watch Inequality for All, Robert Reich’s new film (a boomer, natch!) You can keep making excuses all you want, but the facts don’t lie. Policies enacted in the 70s, 80s and onward have done remarkable things to concentrate wealth and decimate the middle class, who used to be able to live pretty nice lives even when just one parent worked outside the home. You’re on the losing side of this argument, buddy. Of course not *every* boomer agreed with those policies – but apparently, the majority did.

BTW, let’s talk a little about Mark Zuckerberg. He and his wife were first among large donors to charity last year. That’s some cause for optimism at least.

“Oh pleeeze. Your father & mother (those miserable boomers) gave you life, you whiny, misguided, entitled child!”

Exactly what the parents of the Boomer’s said to their lazy, stoned hippy kids. Except those people actually worked for the improvement of the nation, suffered through depression, war and rationing, built everything from corporations to unions to cities. The Boomer’s imagine none of us X and Y folks care about politics but they are wrong….. and they are scared. A generation of cowards, they pat themselves on the back for doing nothing. “I deserve it!” That will be on your tombstones. Wait, you can’t have tombstones because graveyards aren’t ‘green’. And we can’t cremate you because the air quality board forbids it. Maybe we can have you stuffed and mounted. Which tie dyed shirt do you want to wear for eternity?

Here is to a future of dodgeball, firecrackers, no helmet laws, drilling for gas everywhere we can and guns for everyone that you didn’t raise to be batshit crazy.

We deserve it.

CAperson & JustaGuy obviously you are not interested in the facts because you got them wrong. Read Blert’s post for a little history lesson. You act as if TBTF, the voracious military industrial complex, a series of very expensive & unnecessary wars, ZIRP, Wall Street, QE, public pensions, NSA & defense spending, income inequality and all the other political and economic forces at play were all the work of the evil boomers, those dastardly devils. The fact is, NONE of us had any power or control, no say over any of it. It was done to all of us, that is to the 99% of us, by the rampant greed of the 1% and the bought-and-sold folks in Congress & the WH, none of whom represent you or me. But who cares about the truth when it’s so much easier to believe your own fictions. I imagine you should get some smug satisfaction that the generations before and likely those after yours are just as screwed as we all are. So blame away and comfort yourself with uninformed revisionist theories about the big bad boomers who “did it” to you. That will surely make things better. Oh, and what about those 85 richest individuals in the world who own more wealth than over 30% of the world’s population combined. Must be all boomers! The last time I checked, there were more than 85 boomers still kicking, at least until your pal JustAGuy hunts us down. And then YOU take a deep breath and explain to me again how the boomers and “me” generation are the evil geniuses that orchestrated it all. You are barking up the wrong tree with your cockamamie misplaced blame.

In a different reply I discussed how the assignment of generations using the 20 year mark is foolish. But I enjoy seeing Boomers self segregating when it makes them look good. Claim Teddy when he was championing your causes, drop him when it’s time for the blame.

Your generation has, on a national level, held power since 1992; what have they repealed to make the middle class stronger? What have they done to increase freedoms or move gov’t back to the States as our Constitution was designed to do? Did they come up with every bad policy? Maybe not. Have they fully embraced and even expanded them? As the idiot from Alaska says “you betcha!”

I watched the Robert Riche movie tonight. Lots of charts but not one mention of immigration or trade policies. How convenient. How typical. It was them….. and you…. but never ‘me’. Oh, and he is short and needed to add a bit of boo hoo backstory in there too, about the bullies and his pal getting killed down in Rebel Yell territory and how that made him fight for the little guy, no pun intended (he does have a good sense of humor). He also claimed the Republican’s moved right but naturally doesn’t mention the Democrats moving left and always wanting to expand gov’t at the federal level. I guess presenting facts wasn’t enough for him Just seeing how overcrowded the ‘class’ he was teaching was should infuriate anyone who paid to take it. That wasn’t teaching, that was proselytizing to a captive audience. Or is he not a Boomer and doesn’t count against your team?

Your generation wasn’t in power for the EPA (Nixon) so no more claiming that according to you. Your generation wasn’t in power for the women’s Rights movement so no more claiming that. Nam? Guess you had nothing to do with that ending.

So if I have read you right, nothing is to blame on your generations (Boomer/Me). What are their accomplishments? Educate me.

For the record, I view both parties as scum, the real 1%, who’s alligence is to their party and not to the Constitution. That is why I am for gov’t at the very lowest level possible and in accordance with the Constitutions of the USA and the Sovereign States that it consists of. The lower the level of gov’t the less power political parties can wield and the more contact the average citizen can have with politicians to seek redress. I am a lifelong registered Independent and vote in everything I am allowed to, from school board and budget votes to the cluster we suffer through every 4 years.

I’m sorry, were there no boomers of voting age when Prop 13 was passed in 1978? And have boomers had no power since then to enact new laws to deal with its highly negative side effects that took some time to come to the forefront? Or is it that you all are just fine as long as you’re riding the wave of home equity, thinking you’re entitled to pay 1/12 the amount of taxes as the young couple next door, just like son of a landlord?

Anyway, watch the Robert Reich movie and get back me. Prop 13 is only one in a series of many policies that *began* in the 70s and continued through the 80s that got us to where we are right now.

I do not “hate” people on the basis of the generation to which they belong. Certainly no more than you do. But you’re really one to talk about finger-pointing and Gen X and Y “whining” and apathy, when you absolutely avoid all responsibility for the negative effects of the policies that were enacted when you were of age to get engaged in politics yourself and make different choices. Truly rich that you blame some faceless “Wall Street” and “the 1%” for all of the world’s woes. One percent of people cannot win an election. So which is it, were you voting your self-interest with a full understanding of the issues, or was your “pea brain” being manipulated? You can’t have it both ways.

This is the last I’m going to post on this thread because I think we’ve now beat it to death, but i think it’s funny how “justaguy” and I obviously don’t share very much about our worldview (our posts must have been under moderation at the same time, b/c his wasn’t there when I responded) but still agree at some level about how we got here.

So, what are we going to do, going forward? How are we going to change things? (Rhetorical questions, I’m not coming back to debate even more…) I want to be optimistic…

CAperson & Justaguy: You are “lost, lost, lost”. CAperson, your obsessive focus on Prop 13 as “proof” of how the boomers destroyed your generation’s chances is so off-base I don’t know if I have enough time or space here to explain it to you.

Most boomers did not own homes in 1978. I was still in college with my head buried in books. The last thing on my mind was buying a home. When I finally bought my first home over a decade later, I was paying nearly 15% interest on the loan and interest on credit cards was over 20%. Inflation was on hyperdrive during the 1970’s & ’80’s and incomes were not keeping pace. The top income tax bracket was 70%, and everyone’s taxes were higher. This was the world I walked into as a young college grad. I remember thinking I would never in my lifetime be able to buy a house — just like you. Jerry Brown was Governor (aka “Governor Moonbeam”). There were gas crises and water crises.

Prop 13 helped my parents get by and clearly helped all other homebuyers during those inflationary years when housing and all other prices were increasing exponentially, way out of pace with incomes. But Prop 13 also hurt universities, which faced draconian cuts (or had to raise tuition). For that reason I and large groups of undergrads and grads campaigned at university against Prop 13.

But Prop 13 is not the source of the problems we face now, it is just one of the many symptoms. If Prop 13 were the problem, repealing it would solve the matter. Obviously, it won’t and you know that.

You blame your parents’ generation (BBs) for systematically destroying your generation’s chances. You sound just like me in 1978. Unfortunately your generation doesn’t have the numerical base to change the way things are without cross-generational collaboration. So you really may want to rethink your strategy, if you even have one.

And again, TBTF, the voracious military industrial complex, a series of very expensive & unnecessary wars, ZIRP, Wall Street excess, QE, public pensions, NSA & defense spending, income inequality and all the other political and economic forces currently at play were foisted on all of us without our vote, against our will, absent public approval. But you will probably never let go of your simplistic and childish “the boomers did it” fantasy. So there you have it.

Now if you’ll excuse me, I have a cabal of evil genius boomers to meet with to map out our next assault on our children and grandchildren’s generations. There, I ended with a fairytale that matches your level of understanding.

You didn’t answer the questions. If I concede that the Boomer’s started with those born in 1945 and went to 1964, they are all 50 years old or older.

What have they accomplished to make America a better place?

What laws/regulations have they removed to make America a better place?

You also failed to recognize that Gen X and Gen Y are in the same boat their numbers trump that of the Boomers. You can separate them by date, much like the ‘GI’ and ‘Silent’ generations, but those two groups also had similar life experiences, making the distinction pointless (same as with Boomers/Me Gen…. the Me Gen doesn’t even exist according to these made up definitions).

Justaguy: what did boomers contribute? Let’s see. How about the 56K modem which made the internet accessible to ordinary households via their PCs. Without that initial major shift you wouldn’t be spewing your nonsense on this or any other site. There’s also:

-Apple Computer & their products (Jobs & Woz – hippie boomers)

-Microsoft, Q-DOS followed by MS-DOS, windows etc. (Gates – college dropout boomer)

-Yahoo – David & Jerry both borderline boomer/”me”gen

-Google – Sergey & Larry are both “me” gen

-Amazon- ever buy anything from that little site? Bezos is a boomer

-Ever watch a Spielberg movie?

-go search iTunes and check out the music boomers/”me” gen made

-a long, long list of scientific and tech breakthroughs and “toys” which you benefit from every second of every day you miserable, whiny hypocrite

-Jim Kent (hippie boomer) key player in mapping the human genome completed in Clinton’s admin (hmm, DNA testing any benefit to you or society?)

-Space exploration expansion & discovery of black holes

-Sexual harassment laws in workplace: yup we got those recognized as a Title V11 violation. (Before that, CA employers and their male employees had a heyday harassing female employees & co-workers — judging from your comments, you would probably count this as one of the bad things boomers did)

-equal pay for equal work, breaking glass ceiling

-universal health care (just wait until you need it…)

-expansion and enforcement of civil rights and anti-discrimination laws, including outlawing discrimination against gays

-AIDS research funding & treatment

-gay marriage

-anti-hate crime legislation

-anti-bullying legislation

-Oh, and what boomer couldn’t recount stories that would get their parents’ investigated by Child services today? Child abuse as we know it today was simply part of normal parenting.

-wikipedia (yep, both guys borderline boomer/”me” gen which you claim is the same demo)

-internet education (some for free, from top universities around the world – you could learn a lot by frequenting them instead of blogging nonsense)

– CEQA enforcement and expansion (environmental quality) – when we were kids growing up in LA there were smog alerts sometimes daily that kept us indoors. We’d wheeze & hack from the thickness of pollutants in the air, similar to what Beijing is experiencing now on a bigger scale. Don’t believe me? Look it up. Which leads us to hybrid and electric cars, alternative energy, reduction of dependence on foreign oil.

-the first major collaborative reduction of nuclear weapons arsenals since the build up began -end to Cold War

This doesn’t even begin to scratch the surface, just like you’re probably now scratching your head in wonder. You spend so much time hating boomers (or at least your own parents for not being smarter) that you’ve convinced yourself of your own lies. Grow up. Go online to some of the educational sites that are there for free and learn a thing or two. It might just add a wrinkle or two to that short, smooth noodle between your ears.

no black holes discovery – that was inserted to see if you were paying attention

“Oh pleeeze. Your father & mother (those miserable boomers) gave you life, you whiny, misguided, entitled child!”

HA HA HA HA! WHAT A TYPICAL RESPONSE FROM A PIECE OF SHIT BOOMER! THIS IS EXACTLY THEIR MINDSET. ALL BOOMERS HAVE AN ATTITUDE THAT JUST BECAUSE THEY “GAVE YOU LIFE” THEY SHOULD BE WORSHIPED–WRONG! AND THE SELF-ENTITLED ATTITUDE IS 100% BOOMER. NOT X-ER.

“which they got by voting for their own interests which is what everyone does, isn’t it???”

AND ANOTHER ONE: “IT’S WHAT EVERYONE REALLY DOES, ISN’T IT?” WRONG YOU GREEDY SELFISH POS BOOMER — IT’S WHAT BOOMERS DO!

EVERYTHING YOU’VE SAID IS BOOMER-SPEAK TO THE “T”. “ME ME ME ME!”

YOU MAKE ME CRINGE.

***MOVE***

Here’s why: Because life is SO MUCH BETTER away from California. Yes CA *used* to be a great place to buy a house, raise a family and retire, but not anymore.

Do not let any of these old timers make you feel guilty for expressing the truth. Because who really will buy your house 20-30 years from now – and at a profit at that?

NO ONE

Because no one will be able to afford the price that are being asked for them already. Can you imagine what they will have to be priced to make it even worth your while to fix anything up???

California (especially LA) is for very young kids in their 20’s who have aspirations of becoming the next Tom Cruise (and good luck with that because the studios are NOT here to stay. Just ask Pittsburgh or Atlanta, etc.), or for a Hispanic or Chinese person this will be a place to call home. Maybe if you are a tech person who has developed the next ‘big thing’ in apps, but good luck with that – the reality is not many people DO get super rich from that. (Don’t let the paid media fool you) But for anyone else? Forget about it.

The only reason people on this forum try to say that it’s worth it to buy here is because THEY HAVE A HOUSE TO SELL. There is absolutely no other reason to be positive about this state.

If you were to leave now and go to a state that will actually make it worth your while to work, you will have plenty of time to find the right location, have kids, live your life fully, have family visit and STILL have money left over to save. California? Not so much.

As far a “the perfect weather.” *cough cough – bullshit – cough cough*

When I read through these posts it seems like NO ONE has EVER lived anywhere else.

I recently moved from Nashville (moving back soon – never sold my 1.5 million house that would EASILY fetch 5-6 MILLION here) and I am originally from NYC.

Anyone who tells you that Texas sucks, or the South is full of racists are racists themselves. The truth is – unless you move to Alabama, Mississippi, or Louisiana, chances are you won’t run into rednecks. The South is now made up of people from all over the United States and guess where MANY of them are from??? CALIFORNIA. Why? Because they didn’t want to be the ones holding the bag.

Who the hell wants to pay a million or more 2100 square foot house on a 5000 sq ft lot with zero lot lines that needs to be completely gutted??? In a neighborhood where there are 4-5 families living in the same house or don’t speak English and have absolutely NO INTENTION of EVER assimilating. Who wants to live in the largest Chinese enclave in the United States (IRVINE) so the entire population there can ignore you and shun you? Who wants to live next to janitors after going getting a masters degree?

THAT is the reality that is California now.

No thank you – I’d like to live where I’m not grossed out driving around because the state is so dirty and violent.

At your age you will be able to build a wonderful life and you will never regret it.

Good luck to you. His family will still love you guys – but you will hate your life if you stay. California does NOT pay more than other states. Maybe 20 years ago they did – but definitely not anymore.

Get out while you can.

In my area (nicer outer Sacramento surburbia) housing prices have gone up over 20% in just 18 months. What is driving this I ask? Incomes are still the same.

What I see in my area is: hardly any investor activity. Most houses are bought by people that live in it.

Literally every new person/family who moves into my neighborhood is FROM THE BAY AREA. And they will pay anything. They don’t question inflated prices because its still a fraction of what they left in the Bay Area.

I don’t want to be the bad guy here, but it looks like 20% down puts you right around rental parity for the featured property. Here are the monthly numbers for the 20% down case (689,000 purchase with loan of 551,200 @ 4.75%):

Principal: 693

Interest: 2182

Property Taxes: 689 (assumes 1.2% tax rate)

Insurance: 100

Maintenance: 200

Total: 3864

When factoring in the near $700 principal payment and the tax savings of several hundred dollars per month (totally situation specific). Paying $2820 for rent is likely a wash; thus, we are right at rental parity. As usual, this does not factor investing the hypothetical down payment in Apple stock or gold. And maybe this place will only be worth 500K next year if Jim Taylor is correct. This is the math people need to look at. I would personally never pay 700K for a 1000 sq ft. box in Culver City, but I guess there are some people who can and will.

@Lord Blankfein, I agree with you on Culver City. CC is adjacent to a ghetto (Crenshaw), it’s walking distance to Inglewood and it shares a border with the Los Angeles Del Rey neighborhood (almost like being in Tijuana/Mexicali with lots of Cholos).

If it weren’t for the massive police presence, Culver City could turn ghetto very quickly. Then again the massive CC police presence is why Culver City has been running in the red ink. About 70% of the Culver City budget goes to public safety. When these police (average income $120K+) and fire firefighters (average income $100K+) start to retire, the pensions are going to kill Culver City.

>> CC is adjacent to a ghetto <<

A realtor told me last year that Culver City is "on the way up!" That just as Venice "is rapidly gentrifying" into another Santa Monica, so too will Culver City. Culver City is a good buy at this time, because its home prices will very quickly go UP, UP, UP!

So I drove through Culver City at night, around 3 a.m.

I dunno. I know it's a "desirable" area with a "revitalized downtown" — lots of "hip art galleries" and "trendy bistros" — but I don't feel comfortable risking $800 to $1 Million in CC RE, which is what most decent (one-storey, World War 2 era) houses seem to go for.

Culver is actually rapidly becoming nicer, though some parts are still definitely better than others. It is a weird mix though. I believe the reason you’re seeing the spike in prices is that it’s one of the few places actually in the city/within a reasonable commute of many jobs with a good school district. That’s worth a LOT to people my age with kids. Probably $150K per kid, on average, and depending on whether you’re comparing it to a place with at least a passable elementary school (e.g. some areas of Mar Vista).