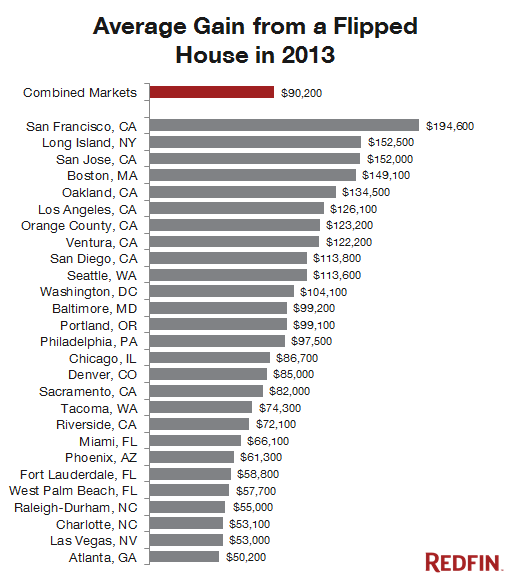

The flipping real estate problem: Flipping is another factor inflating real estate values in many markets. Average gain from 2013 flips in San Francisco is $194,000. Stock market wealth impacting real estate.

Making money during the first housing bubble was virtually fool proof. And even if you were a fool, you had plenty of do-it-yourself television shows to hand hold your way into real estate riches. You were dumb not to participate. If the working stiffs in America live in households were $50,000 is the typical income, having your California home “appreciate†by $50,000 or more per year simply by the magic of house lusting, then owning a home seemed like a no-brainer. Flipping was so rampant that it became comical and in many cases work was shoddy since it was done in haste and the quality was slightly better than your first grader’s Popsicle house. In many hipster markets it is safe to say that every other house has some influence from the cable television home beautification shows. Over the last few years, flippers have been capturing some nice gains as glassy eyed home buyers are willing to pay any price for a drywall shack with one pooper just to say that they got a piece of the American Dream. There was some good money to be had selling into the herd mentality in 2013. The average San Francisco flip in 2013 brought in a gross profit of $194,000. Sure beats working a 9-to-5. Apparently working is once again delegated to the realm of the suckers.

Flipping is so easy, even you can do it!

Flipping a house is a rather easy process. You buy an ugly house in a good neighborhood, slap on some paint, granite countertops, throw in some stainless steel appliances, tear out the carpet, put in some recessed lighting, and add in some plantation shutters and you are good to go. See, I did learn something from watching those house flipping shows. Oh, and make sure you sell into a market experiencing a mania. Oh, and make sure you time it right. In other words, you better have some luck and timing on your side. 2013 brought on a different sort of mania. A mania brought on by a lack of supply and investor demand.

Redfin pulled up some interesting figures on average gains from flipping in 2013. When you are making more on one flip than the typical family makes in one year combined, you know something else is going on. Take a look at average gains on flips in various markets:

Source: Redfin

Of course the public is always late to the show and this market is already facing an inflection point. Your regular average buyer will have a hard time finding a fixer upper in San Francisco and then turning it into a worthy flip without having some solid working capital. This game is largely left for the big players. Word on the street however is barely reaching the plebs and many want a piece of the action. This is why we see crap shacks going for absurd prices and sellers not giving buyers the time of day in some markets.

Of course looking at the chart above, you’ll notice that most of the top markets are in manic California where people flush logic down the one working toilet in their future drywall sarcophagus. The average California flip in 2013 grossed over $100,000. No wonder the market went bananas and those cable shows are back with a vengeance.

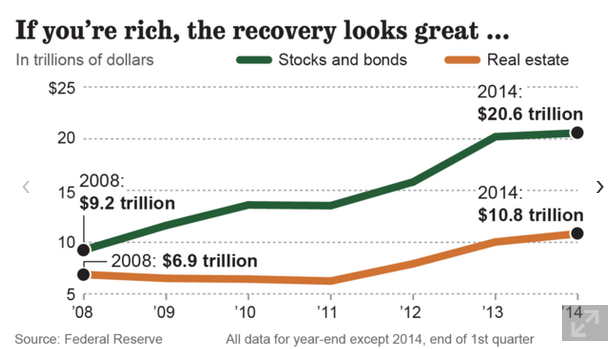

You have to wonder how much wealth is running from the stock market into the real estate market:

Source: LA Times, Fed

I’m always surprised how out of touch some in the real estate industry are when it comes to true wealth. Most of the wealth in this country is in stocks and bonds. Stocks and bonds account for over $20 trillion in household wealth while real estate accounts for $10 trillion. What is more telling with the chart above is that stocks and bonds produced more net worth gains than real estate did. Of course this has to do with the impressive bull run we have had since the lows in 2009. How much of this money is flooding into real estate? In places like Northern California the impact cannot be denied. But it also makes you wonder what will happen when the inevitable correction hits.

We are now seeing flips languish on the market. The days of having infinite numbers of buyers coming to your open house with novels about how much they will love your home are slowly starting to wane. I assure you when markets turn, you can save your poetic juices and simply right your offer on a napkin and have their real estate agent draw up the paperwork. No happy faces required. Many working and middle class families have been fully priced out of the market and many have left to other neighboring states including Texas. The power to own a home is strong enough for people to uproot their lives and go elsewhere. You also have peanut butter and jelly eating baby boomers holding onto rundown million dollar shacks in prime areas trying to keep up the pretense that they are balling courtesy of their zip code. The problem with the mindset of sinking every penny into real estate is that it usually shuts off any other planning for retirement or income streams when you actually do enter old age. This is when you see those folks in their 50s trying to act like they are in their 20s and loading up on taco Tuesdays. They are largely trying to recapture something they never had like buying a tiny beat up place in a pricey zip code and thinking you are going to have a Leave it to Beaver lifestyle. Those people didn’t have life altering technology to contend with or ravenous hoards of investors chasing yields. In the end, they are taking on a mortgage albatross for a fantasy but hey, this is the land of Hollywood so it is rather fitting I suppose.

Flippers are also like a canary in a coalmine. They are usually the first to taste the cold shoulder of a turn in the housing market. You see this when days-on-market (DOM) start increasing with no bites. You also see the monthly, then weekly price reductions setting in. Flipping is a tough job but someone has to do it, right?

Any noticeable flips on your radar?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

113 Responses to “The flipping real estate problem: Flipping is another factor inflating real estate values in many markets. Average gain from 2013 flips in San Francisco is $194,000. Stock market wealth impacting real estate.”

This is a flip gone bad in Sherman Oaks: http://www.redfin.com/CA/Sherman-Oaks/3933-Pacheco-Dr-91403/home/4887829. The seller is playing games of de-listing and and re-listing the property to bring attention to it in the MLS and other real estate sites. You can’t see the price history here, but it started off in the high $800K’s, I believe, and is now at $729K. This place was a dump before the flipper bought it.

I’ve seen several of flips gone bad in L.A. this year, but the large majority are successful and typically generate over $100K in gross returns. The 90035 zip code is really booming for flips, particularity in the area South of Pico, between Robertson and Fairfax. This area is bordering on the hood, but it’s supposedly one of the “hottest neighborhoods in the country” right now. The entry point for a starter home is getting close to $1M now. God Bless America!

The whole sordid price history (including a recent price increase!) is visible on Zillow.

This Sherman Oaks flip sold for $580k just FOUR MONTHS AGO — and is now offered for $850k: http://www.redfin.com/CA/Van-Nuys/13803-Milbank-St-91423/home/4854179

Isn’t successful flipping dependent on a majority of improvement suppliers giving product for free or at great discount for the Advertising or Name-Placement they will receive on the staged TV program of the ‘flipped’ house…

too much saturation will foul the small pond is the result

I would be less irritated by flippers if I thought they found unfinished gems on the market and redid them. It seems to me that doesn’t happen very much. I don’t see well-priced houses in need of updating hit the market at all. I suspect that realtors hand over such properties to cronies, in much the same way that banks hand over properties to investors. It’s a corrupt process that needs to be addressed.

The discovering agents are usually principals in the deals.

Nicole Curtis (Rehab Addict DIY Network) is backed up — financially — by obvious real estate agents in her deals.

Even so, she’s struggling on many a house. She takes on real disasters — but at least they’re generally in the right neighborhood.

(Her Minneapolis gambits benefit from the College Certification Guild…ie runaway college expenses translate into associate professors snapping up her efforts. Mini-StPaul is a college nexus almost as intense as Boston.)

Sitations please.

Take a look at this scary stock market comparison graph from 1928,29 and the last 2 years here: http://www.moneynews.com/MKTNews/Massive-wealth-destruction-economy/2013/06/20/id/511043/

It’s not a question of if there is going to be a stock market crash, it’s when. My guess is in the next 6 months. 2008 was just a warm up. When it happens, home prices will plummet. Many of the leading investors have been quietly liquidating their US stocks that rely on consumer spending. It’s coming.

The graph on this article is 3 months behind reality, and the DOW did not follow the pattern in March by having another leg down; in fact it has done nothing but continue to rise. While this in itself may be alarming, I would say that the pattern has been broken. http://finance.yahoo.com/echarts?s=^DJI+Interactive#symbol=^DJI;range=2y

I agree this seems by all fundamental measures, to be completely unsustainable. But WHEN is it going to crash? When? And what is going to be the tipping point that sends it over the edge? The experts mentioned have been saying this for years now, and yet up it goes, along with real estate.

And if the stock market goes down the tubes, how will that affect housing?

Believe me I want housing to go down so I can buy at a bargain. I’m renting, waiting it out, and now MY rental I live in is being sold – landlord is mom & pop outfit, informed me Friday the house is going to be put on the market.

I will not make the same mistake as 2006-2007 – millions of people who leveraged themselves to the hilt with ARMs for POS crapbox money-pits. I’m not that desperate but I’d like to buy someday – at the decent price. As I mentioned in a previous post, overpriced crapboxes are selling in 2 days in my area (Sacramento) and “buyers” are living up elbowing themselves in to sign on the dotted line. Average increase in my area over the past 18 mths? 40%. WHY?

Calgirl says the average increase in her area of Sacramento over the past 18 months was 40%? What part of Sacramento is that?

Trulia says that the median sales price for homes in Sacramento CA for March 2014 to June 2014 was $220,000 which represents an increase of 15.8% compared to the prior year.

Zillow says that the median home value in Sacramento is $247,400 and that Sacramento home values have gone up 19.1% over the past year.

The Sacramento Bee reported on June 12th that Sacramento housing sales in May 2014 fell below May 2013 levels.

I really dislike these extreme “we’re all gonna die!” sites and I don’t think The Donald knows much of anything except the art of owing so much money everybody has to give him credit or they’ll lose what they’ve invested with him. He’s gone bankrupt how many times? Three? His advice only serves the interest of Trump. The US market is world-based, these mega-corporations are world-based. As long as the corporations hold mostly US$, the market will retain value. The American economy is being deliberately depressed by “we can’t afford it” policy put in place by the purchased neocons. There is suppressed energy in US going under the radar, un-reported because it’s not in the interest of the megas – they can’t profit from it directly – so they don’t report it, don’t acknowledge it, but it’s there waiting for the grasp of megas to slip slightly to take off.

Such analysis by analogy results in an epic error: prior to 1933 the US dollar was linked to gold.

By current standards, the era had tight money.

Today’s markets are dominated by the fulsome debasement of the fiat currency.

This has three dominant impacts:

1) Balance sheet debt is being debased.

2) S&P GAAP earnings are being hyped 100%. (ZIRP repression of corporate interest expenes)

3) (Labor) Cost of goods sold is in full on retrograde — as labor inputs are imported (Red China) — globalization generally; computers are replacing ‘decision labor.’ (Many blue collar and white collar jobs existed solely because it took a human being to turn off the valve/ throw the switch/ stir the pot.

( The railroad industry used to have cabooses trailing every freight train. Their crews used to throw switches (British: points) and monitor car malfunctions. (hot brakes/ dragging brakes) America had 250,000 souls employed a century ago doing this duty. Today, none.)

(This elimination of routine labor is now rippling across even minor labor niches at this time. Think of PLCs. (Programmable Logical Controllers — discrete computers for industrial and robotic processes. They are everywhere now. Google Arduino for a bare-bones PLC core sold as a toy for nerds.))

%%%

Another market development is the contraction in Red Chinese demand for commodities. She is in recession. (Financial sector is dialing back.)

The result is softness in all of the major commodities. While a curse for their producers, such price declines are a boon to manufacturers — which dominate the S&P.

$$$

The market HAS to be adjusted for the debasement of the currency. Once you do so, the record highs begin to evaporate.

The real scare is the fake-out the ZIRP is providing to the entire planet.

Even the powers that be (BIS) are being led off a cliff.

&&&

The system has left the map. We are in truly uncharted territory — caused by fulsome corruption of market logic.

Fake government statistics

Fake currency stability

Fake unemployment stats

Fake interest rates

Fake commodities demand (an attempt to hide from currency gambits skews all)

Fake mortgage markets

Fake (cartel) pricing in the Medical-Pharma-Insurance-Legal (hyper) cartel/ guild

Fake (cartel) pricing in the College degree space

Bizarro pricing in the MIC space (F-35) is being priced to the moon to hide dark spending on yet other stuff — think ABM defenses)

###

FYI: Dark spending = secret projects

Most of the NSA — starting from the beginning was ‘dark.’ Hence the sobriquet No Such Agency.

The U-2 and the SR-71 were entirely ‘dark.’ On the public budget they came ‘free.’

Our over head assets are entirely ‘dark.’

These monies are vectored away from the touted costs for BIG line items of public notice. This is the SOLE reason why the Abrams tank had an insane price tag explosion thirty-years ago. It’s public price was re-jiggered upwards once it was sure to pass.

Our frightfully expensive aircraft carriers are also falsely priced. Ditto for all other naval vessels. There is NO vessel built that doesn’t carry a load from America’s dark spending.

The ramp in the official F-35 price tag is right on schedule. The plane is now inevitable. Our allies are being informed that their actual fly-away costs will be (astonishingly) reduced by rebates under this or that military aid program. It also absorbs dark expenditures.

The Soviets/ Russians know all about this. They know that our actual expenditures are set in a fun-house of mirrors.

This kind of spending has a MAJOR impact in certain industries. Only the players know that their star is about to rise.

Naturally such surges move stocks — such moves not following ANY obvious rationale.

Taken all together, this is a market that is broken away from fundamental analysis.

Sorry.

Resales in May had a nice increase, if June and July come in with good numbers then it will signal a nice return to a more stable market.

Seems like most of the recovery was in the ultra rich range. Hardly a healthy recovery if you ask me.

http://www.zerohedge.com/news/2014-06-23/guess-who-propping-us-housing-market

Peek….How do I explain this, well yesterday’s $350k house is today’s $750k house. Yesterday’s $5.00 hamburger is today’s $10.00. So in a short and sweet phrase, the $750k house isn’t returning to $ 350k, so $750k house is not ultra rich it is keeping with the times, everything is higher.

Please don’t start with the wages aren’t higher, they are, it is that Americans never saved now they can’t come up with at least 20% down. Buyers can buy, flippers need to move into other investments, the gov’t wants flipping done away with, some folks will get hurt, but in the long run this is how normal housing should be, buy because you want to, not to make huge profits?

“Robert everything is higher” and that’s including Robert, thus he’s explain everything in (kindergarten like) terms. There are still 9 million underwater homes in California! Last years 38% of home purchases were cash buyers by institutions.

“Please don’t start with the wages aren’t higher, they are…”

robbie,

I just can’t seem to find any statistical support for your retarded statement…

http://www.bls.gov/news.release/realer.nr0.htm

http://www.advisorperspectives.com/dshort/updates/Household-Income-Distribution.php

http://www.epi.org/publication/a-decade-of-flat-wages-the-key-barrier-to-shared-prosperity-and-a-rising-middle-class/

http://www.uri.edu/artsci/newecn/Classes/Art/306a/Outlines/BasicQuest/inflation_adjustments.htm

“Resales” yes in the million plus bracket.Everything else is in a slide.

Watch out below.

LG…. Went to two devlopments over weekend, both homes from $ 395k to $549k, one had 4 houses left in a 122home tract the other had 7 left in a 80 home development. Many under 50 folks looking and asking about loans.

No question over $1m market is hot, because many of these people are buying out underwater sellers in many case $ 200 to over $500k under. These are great buys for the folks that can buy them, for others, their are buys just have to dig harder, or maybe it won’t happen and renting is the only option for them.

Hey, impostor LG, get your own username! It’s SO lame to appropriate someone else’s username for yourself. Just want everyone to know, the person who is now commenting on this blog isn’t me (I was the one who posted in response to the buyer seeking advice).

LG, I kinda like the impostor better than the original in this case…

Gosh I don’t know what to say what? Labor stats say avg. pay $24.33 in April, in May $24.38?

Uh that’s a increase, now do your spin and write a novel on why the Bureau of labor is wrong again? isn’t it fun throwing bombs at such a successful man who is a retard like me?

“Gosh I don’t know what to say what? Labor stats say avg. pay $24.33 in April, in May $24.38?

Uh that’s a increase, now do your spin and write a novel on why the Bureau of labor is wrong again? isn’t it fun throwing bombs at such a successful man who is a retard like me?”

You are making my point little robbie! Do you know the difference between “nominal” and “real”?

Hahahah,

Another good one Robert. Wasn’t it CoreLogic that had to point out to the NAR that they were fabricating their sales numbers for a decade?

http://njrereport.com/index.php/2011/02/22/shocker-nar-lied-about-home-sales/

Isn’t it now Dataquick that is pointing out SoCal sales are down 15% in May?

http://www.dailynews.com/business/20140611/southern-californias-housing-market-loses-some-steam

Keep the laughs coming though.

Home sales never ever go down in May or the summer months…oh wait! nevermind…

@Robert, historically recessions happen every 5 years. Historically California home prices crash every after each recession is in full bloom. 1st QTR GDP revised just printed at -2.9% (a big huge negative), all economists and the Federal Reserve were expecting a positive 2.5% growth. The last recession ended in 2009 which means the next recession is due now

2nd qtr GDP will likely also be negative, which means: r.e.c.e.s.s.i.o.n. The stock market will start tanking by late summer and then home prices start crashing by early 2015.

The current high rent and mortgage payments on overpriced real estate is pulling money out of other areas of the economy.

The collective intelligence of the forward-looking market disagrees emphatically with your negative-print GDP prediction. We’ll soon see who’s toking on the proverbial crack-pipe.

@DFresh, The collective intelligence of the forward-looking market predicted solid GDP growth for the 1st quarter.

Not one member of the collective intelligence of the forward-looking market predicted the economic collapse of 2007. The collective intelligence of the forward-looking market failed to predict the stock market crashes of 2000 and 1987, the housing crash of 1990, the housing crashes of the early 1980’s, and the two thousand Savings and Loans that went belly-up in the 1980s.

The collective intelligence of the forward-looking market has failed to predict every recession or economic turmoil for the last 120 years.

But hey, who’s counting? As long as the collective intelligence of the forward-looking market gets to pillage the bank accounts and slay Muppets, all is good.

Sales are still down YoY and price support is mostly on the high value houses. Gains aren’t what they seem since the dollar valuation has merely shifted to clear the debt through asset inflation. The Fed gave us a clear green light on this. Now comes the tricky part. Good luck flippers you’ve had the wind at your back. Now are there headwinds or noise?

CA. real estate is so diverse it plays by different rules and logic then any other state. It must be calculated location by location one size never fits all, so when people talk about recovery and bubble CA. has to be dealt with as a single enity in the conversation.

Filipping in CA real estate today is tall cotton, only for the movers and shakers, flipping in other parts of the country has no correlation to CA. Real estate.

“Many under 50 folks looking and asking about loans” So were all those sales purchased by mortgagees or cash buyers?

Point taken, but there needs to be an understanding that when there aren’t really that many options to move up finantially, some will resort to risky ventures like house flipping. The banking system we have today almost insures if you want to make REAL money, you either put your money in stocks wich mostly have very high P/ E’s or real estate.

Some reading this may be thinking – you forgot about gold – that is as risky today as flipping houses if not more so. Real estate maybe the least risky over the longterm if the numbers pencil out, YOU do your homework & don’t get bitten by the flipping bug.

I believe GOLD will be less volatile and offer a better return longterm than stocks and housing over the next 10 years.

Housing to go up 30% in 2014!!!

Did you forget your mantra?

Also CASH will be strongest play for next 6-12 months.

Tanking to house hard in 2014!!!!

“Also CASH will be strongest play for next 6-12 months.”

Based on what scenario?

I some what agree with you…get out of debt, keep cash, sell out of stocks, have some gold or silver (this won’t get you rich) just a long term hedge if there is a dollar collapse, keep cash on hand for the next large market crash/housing crash and do it like the banks do…buy when things are crashing not now when we are at new highs…the banks want to suck you in so they can profit off you, take whatever they can from you, it’s all pretend money that they loaned you in the first place. All upside for them if you default or keep up with the loan terms, they never met you in the middle with any real capital to loan you, it’s all imaginary money that they record in a ledger. The banks are the original slave masters.

Well said Christie.

You think flippers do shoddy work in their quest for cash, you should look at average joes open houses…the places are disasters…sometimes no effort to clean and comical repairs done by the man of the house. That’s why flips sell, they usually have a cohesive look that does not distract with junk, family photos, toilet seats up, closets crammed with clothes garages filled to the rafters. Flips sell the dream…regular houses show the reality of too much stuff in too small of a space. Also a flip works for buyers who do not have remodeling cash…which is almost everyone. So many poorly maintained houses out there, makes a flip home an easy sell. Flips will become less and less as prices level but they sell because the average homeowner has no decorating sense and think their photo walls, wall stencils of family, home, love, ect. adds to the appeal of their home. Sell your home like a flip, sell faster and for more money. Fresh paint, de-clutter…hell get rid of everything you think is “cute”, fresh landscape, pick one color and work variations in each room…your house should not have a split personality. Most people don’t know when to sell out of stocks so they likely won’t know when to sell their house either but if you do decide to sell, sell like a flip.

Yawn…

I totaly agree. I’ve lost count of the filthy, cluttered, seriously badly “decorated” dumps I’ve looked at. Bad everything – flooring, paint, landscape, window treatments, kitchen cabinets. Visually apparent at first glance lack of maintenance, and broken messes.

Yet they still want top dollar.

Sad part is in my zipcode they are still selling within days.

Outskirts of Sacramento for crying out loud. Not exactly Silicon Valley or LA/OC. I’ve seen for sale signs go up in the morning and in the afternoon car after car of buyers pulling up for a tour. 2 days later the MLS says “Sale pending”. Each one the price is higher than the last. I look at the MLS pics and the cash ching chings start rolling around in my head. This needs replacing, that needs to be torn out, OMG that is so bad, etc.

I don’t get it.

Yes, Calgirl. Maybe you should hire a lawyer to help you determine whether to buy or not. You know, like sellers should hire lawyers and all…

Christie S: “the average homeowner has no decorating sense and think their photo walls, wall stencils of family, home, love, ect. adds to the appeal of their home.”

What I find especially distasteful are those garishly painted children’s bedrooms. Hot pink walls painted with huge flowers, animals, and cartoon characters. Bright blue walls painted with sports paraphernalia and cartoon characters. Neon yellow or orange or green walls painted with a full jungle mural of grinning monkeys and lions and elephants.

I know I can paint over it, but still.

When I was a kid, in the late 1960s/early 70s, my bedroom walls were stark white. My father would have freaked at the thought of painting the walls a primary color, much less painting images on the walls.

I guess decorating styles have changed.

The overly-colorful kids’ rooms don’t bother me so much.. I mean, they’re for KIDS, and I can just paint over.

I try to look past the bad decor, but what bothers me is the dirt and disorder that I see so often. I wonder, do these people want to sell these places? Could the agent stage the place just a little bit.. you know, close the toilet lid (my pet peeve) clear the crap off the kitchen counters and for godsake get yesterday’s shirt off the back of the kitchen chair and clear the 1500 magnets off the fridge?

Layered dirt and general disorder are tipoffs that much worse in the way of deferred maintenance may lurk below the surface. As it is, artful staging can conceal a lot of defects that even gimlet-eyed home inspectors miss. There’s ALWAYS some flaw you don’t discover before you move in, so why even bother with something you can tell is a deferred-maintenance nightmare before you even bother to tour it?

I see the RE agent CAB has still not educated himself on the benefits of using an attorney vs. a RE agent.

Look into it, when you do you may be tempted to find yourself another “career”.

Here are a couple for BayAreaRenter, two flips in Marin:

http://www.redfin.com/CA/Kentfield/25-Bridge-Rd-94904/home/842039

40 days on the market in Kentfield is not a good sign.

http://www.redfin.com/CA/Larkspur/260-Tulane-Dr-94939/home/1273834

47 days on the market in Larkspur, even worse.

There was a similar example of a Sherwood Forest home in the Northridge area with a flip that went negative. The investor purchased a 1947 home that was deteriorating so the investor completely demolished. They purchased in Jan 2012 for $422,000 and later listed to $1,489,000 on June 2013. The investor overbuilt and had a hard time selling so they resorted to the same tactics of delisting and finding a new agent. It was later sold in May 2014 for $1,120,000. Based on construction estimates, it appears that the investor may have lost somewhere around $300K but that info will never be truly known. But its a good example that flipping is a lot harder now. Very few distressed properties at fire sale prices available to flip to the greater fool.

http://forums.redfin.com/t5/Los-Angeles/Northridge-Home-Flipped-for-1-Million/td-p/412359/highlight/true/page/2

I believe the cable TV DYI/Flipper/Reno shows are dramatized infomercials to depict renos being quick, easy, and doable for all as long as you spend a bunch of money on the latest trendy Reno crap from Lowes.

“peanut butter and jelly eating baby boomers”. Peanut butter is my favorite food and I have lots of stocks and bonds in my trust funds. Before you used to say about the cat and dog food. That is more appropriate. Never degrade the most luxurious peanut. Even a bag of peanuts, you can’t just have one.

Friskies eating baby-boomers was a good one too! LOL

You put your savings into peanut butter???

That’s small time. I’m fully leveraged into peanut brittle futures.

Robert – Congrats on the profits on the Simi Valley properties you purchased while touring the area on your dinasour. You must have done well and still have some crack stored away.

Long time reader, first time poster (2nd actually, had to reply to Robert). I don’t understand how all the blue collar boomers homes are going to be replaced in Suburbia at $800K plus prices. A couple in their 30’s would have to be earning $200K+, likely on a dual income to support that debt. Which is fine, but how is the top 5% of wage earners going to replace all these homes? I’m looking in Ventura County (Westlake to Thousand Oaks). Anyone have any thoughts on that area?

I’ve lived there for 25 years. Eastern Ventura County is a boringly homogeneous whitebread upper middle class bedroom community for LA. Lots of rich folks here too – I’ve run into Ozzy and Sharon at the local movie theater and Tommy Lee at the Oaks mall. There is a LOT of money floating around the Conejo Valley and I wouldn’t expect any precipitous price drop. When the crash hit in 2008 there were a few foreclosures among the older cheaper properties, but most folks just had the financial wherewithal to sit it out and wait for prices to come back. I’m sure they’d do the same and inventory would vanish if we saw any significant decline.

Best bet in the area is the slightly cheaper adjacent communities like Simi Valley / Moorpark / Camarillo. These towns do have some very expensive neigborhoods too, but there are still places where you can find something decent for ~$500K.

Jaz..PS is right Simi-Moorpark is your best bet. Nice family area between TO and Simi-Moorpark. I prefer East Simi because Simi schools are a little better in the East side. Closer to SFV also via the freeway. Houses are decent in the $400 to 500k range.

good luck

Flipping costs money. A good flip on a 1mm home can easily cost $100k in materials and labor. Add in the time value to carry the 1mm loan for 6 months to a year and the $50-100k left over in profit isn’t bad but it’s not getting rich. To make money flipping it is very important to buy low and that isn’t easy in this market. Every crap shack is selling for mansion type prices.

I would personally like to see less flips and more tear downs. I don’t know if the city makes it hard but most remodels still smell of old homes. Its makeup on a pig. The new homes should have to fit a neighborhood style but if done correctly it would be much cheaper long term to own a new home. Everything is up to code, energy efficient, fire code met, sprinklers, etc….

It’s a myth that old homes are better. Most are at end of life. And if people believe a remodel fixes that they have a big surprise waiting for them with home ownership.

That said…

A million dollar home still costs about $6000 month to purchase over 30 years with a sizable down payment. To attain $6000 you need earn $9000 month. So there must be many families who have $108k year income to put 100% towards a home. Personally I dread thinking about owning that every month. There is a strong fear of being house poor. Sure, even if you have a home with value, it’s not the ATM it used to be.

Doc , what you call a plebe I call a prole. But it means the same thing. Poor and stupid peasants who can’t think one week into the future let alone retirement.

Why flip houses when you can just flip CONTRACTS on houses?

http://www.zillow.com/homedetails/444-Kyle-Rd-Crownsville-MD-21032/36011486_zpid/

(In “description” it reads: UNIQUE OPPORTUNITY FOR THE SAVVY INVESTOR. SELLER IS CONTRACT PURCHASER. PROPERTY WAS [BOUGHT] AT FORECLOSURE AND SELLER IS ASSIGNING CONTRACT.)

Was thinking of buying this place last fall. Somebody else beat me to it. Sold for 480K on 9/27/13. Remodeled and listed for sale at 1.5 million on 4/20/14. They have backed down on the price recently…lol http://www.redfin.com/CA/Long-Beach/5433-E-Anaheim-Rd-90815/home/7589919

Chotzo Thanks for posting that home. It will be sad if someone buys that dump. Note how Zillow has recalculated the value of the home to be in range of what the buyer is asking for the home well above $1 million and way out of range of Eppraisal. What a rigged system.

No problem. The house is in a relatively ritzy part of Long Beach called Park Estates. I was unable to act on the property at the time. It was undervalued but was also a wreck. I thought it would be worth around 800K with remodeling over time. The company that did this flip is good. The remodel isn’t bad…but not 1.5 million amazing. It’s selling point is that it is mid century modern in style. Some people, like myself, love that. But come on. I’m amazed they could turn the job around so fast. It took me 6 months just to get my small galley kitchen replaced from Lowes…lol

I’ll leave the conspiracies to conspiracists, but I find it interesting that with the Fed bond buying tapering coincides with civil unrest in Southeast Asia, Ukraine, Middle East and parts of Africa and the cut in Argentina’s ratings.

It seems all these factors would help encourage bond seekers to purchase U.S. bonds (debt), which in turn allows mortgage rates to stay below 5%.

Looking at homes in OC it seems they cost about $150 sq foot in 1999.

Today 15 years later they are about 3X the cost at $450 sq ft (2014).

Does does everyone feel that in another 15 years they will be 3X the cost again at $1350 sq ft in (2029)?

Based on a 2000 Sq Ft home the prices will go as follows:

1999 = $ 300,000 – Check

2014 = $ 900,000 – Check

2029 = $2,900,000 – TBD – Seems like a lot – but I bet $900 seemed like a lot in 1999.

Typo = 2029 should have been $2,700,000.

Prices are only going higher and higher in OC. Soon the average starter home in Garden Grove and Santa Ana will be $30 Million dollars!!!! Median household income will be $50K per year. But don’t let facts interfere with reality.

“Prices are only going higher and higher in OC. Soon the average starter home in Garden Grove and Santa Ana will be $30 Million dollars!!!! Median household income will be $50K per year. But don’t let facts interfere with reality.”

Exactly!!! Somebody who actually gets it!!!

Sean… Who knows, I do know even though it drives some bloggers nuts, the correlation of auto’s to housing, but 1993 fully loaded BMW Z3 cost 33k, today same BMW (don’t change much really) a Z4 cost about 71k.

Oh well, who ever thought a apt overlooking traffic and skyscrapers complete with no parking in so called swank side of NY cost 20m, crazy but true.

Well a car at $33K in 1993 is worth $54.3K in todays dollars. Add a few tech improvements, bloated Western Salary and benefits, and a high Euro/dollar exchange and you get into the $70Ks. Everyone knows this. Nothing new here. You might enjoy the car and I can’t tell you how to value that. Still is this a good investment? Houses are not traditionally thought as the same class of investment as an auto. Except in 2014 more people might be living in cars compared to 1993! A 1993 circa fool and his 2014 counterpart aren’t of interest to me.

obviously, you guys have no idea what you’re talking about. the last line of the last paragraph made me chuckle….

http://www.businessinsider.com/housing-report-quells-yellens-concerns-2014-6

“Our advice to you is to buy a house if you can find one at 213 thousand dollars. The economy is better than you think, and home prices have nowhere to go but up. Bet on it.”

Well, there you have it. A bunch of nervous Nellies around here, if ya ask me.

Polo…Old saying in life -‘When the cat can’t get to the cream it says it’s sour?”

“Polo…Old saying in life -’When the cat can’t get to the cream it says it’s sour?—

Even older saying… A fool and his money will soon be parted…

“When the cat can’t get to the cream it says it’s sour?”

Such as your narrative that things will only get worse for those who wait. Sort of works against you.

Ca$h buyers and investors are buying at “wholesale” prices. They fix it up and put it on the market for retail price.

Since most occupant buyers aren’t buying with all cash, investors don’t buy at retail, mortgage apps are down and the median household incomes are nowhere near the buying power for the median home price, how can prices keep going up or even sustain current market prices regardless of shrinking inventory? It can’t.

Brace yourselves, folks. The big money has already left the area.

Bubble Pop… I have lots of experience in CA. real estate, big money “never” leaves CA.

it parks itself waiting for the next opportunity.

Silly robert, RE money is already leaving California. Time to quit fooling yourself. Just because you have 25yrs experience in one market means nothing since this market changes so much every decade. Too much experience in one place leaves one blind to things that are blatantly obvious to outsiders.

When the cats begin to speak to you robert, it’s time to check out.

#never

You seem to be down on drywall, as in drywall shack. Drywall has been in use for the last 50 years and it is modern construction. It is half the cost of the old lath and plaster of the older homes. The lath and plaster homes require true craftsman in the work. Anybody can put up a plaster board, hence the saving in cost. It is true that the hard wood lath really holds the house together, along with the plaster, but most people don’t know the difference between drywall and lath and plaster and most everybody is happy.

Bubble Pop…gee don’t know, still see cash deals for very poor houses in San Jose, the money hasn’t flown the coup there?

Bay area and SoCal are markets with different drivers of buying, lil’ robert. When idiot VC’s stop pouring tons of money into useless mobile apps and Wall Street gets tired of Silicon Valley, watch it slow down and home prices fall. Granted, they won’t fall as dramatically as LA or OC, but they will feel pain.

C’mon lil’ robert! You’re not sounding all that wise for your years and self-proclaimed success.

Lets see gang:

New home sales boom in May

Consumer confidence up again

Resale’s up in May

Shiller report, housing prices will not drop and returning to normal

Interest rates to rise in mid 2015

In other words buy now, make your best deal with underwater sellers or take advantage of new builder incentives this summer at 4% mortgages why wait and lament 5.5%, I should have bought in 2014?

Everyone who could buy and wanted to buy has already bought. Sales are down year over year despite increasing inventory. We have wiped out demand for the next couple of years. People realize that rates are going to rise because they are already rising year over year and have chosen their lot.

Remember prices are about where they were in 2006, that was 8 years ago. No appreciation for 8 years!!! Are you really sure you want to gamble in this market? A drop of a few percent can destroy your leveraged portfolio or at least lock you down in a region eating peanut butter. The fed acted before but what how many times will they subsidize bad decisions. Everyone is locked at historic low rates for 30 years, if there is slip in price who do you blame now?

Can you survive 8 years of no appreciation in a market where housing stock is so limited you can only buy a crapbox that you probably would want to vacate in around 5 years? Give me the money Fed, but I won’t plow it into housing to double down on a broken market. If I buy then I realize I will have to sell it later on to make money. Who will buy these hot potatoes? Who is the greater fool?

LC….8 more years of no appreciation? don’t think the powers to be will allow that. All new administration in 2015-2016, watch for a new surge in demand and consumer confidence. Companies can’t play the won’t hire routine because they will get new tax breaks in turn for a upswing in hiring. Scratch my back, scratch yours.

Bank interest will be at at least 4% and baby boomers will rejoice they can spend, they will leave the part time job market and young folks will take up the slack at ($10 hr). Colleges will provide better tuition plans reducing the debt for the students.

The world will settle down, the G8 wants a stronger West, they will get it, inflation will be a issue but wages and new revival of American business will mean a much better USA by 2017-2018.

That is why I say buy now, deal on the very underwater properties they will be all gone soon so will 4% mortgages. Housing and construction is America, a house is the American dream still, plan for it today, wait and be priced out even further.

The dollar didn’t fold during the worse of times, it is and for the very long future the standard of the world, that is why I’m not worried about America.

“Everyone who could buy and wanted to buy has already bought.”

This is probably the most ignorant statement in this entire thread.

“LC….8 more years of no appreciation? don’t think the powers to be will allow that. All new administration in 2015-2016, watch for a new surge in demand and consumer confidence. Companies can’t play the won’t hire routine because they will get new tax breaks in turn for a upswing in hiring. Scratch my back, scratch yours.â€

What planet are you from? The “powers” did allow that. On earth there is not a supernatural force protecting your vision of the future. You think a new administration will matter? People in business want to make money in any political climate.

“Bank interest will be at at least 4% and baby boomers will rejoice they can spend, they will leave the part time job market and young folks will take up the slack at ($10 hr). Colleges will provide better tuition plans reducing the debt for the students.â€

What is this magic 4% you talking about? Are these the same boomers that failed to save a dime? Couldn’t they just hunker down and collect for their eventual retirement? If this happens then they won’t leave the job market just compete with other job seekers for $10/hr. Hence, they put downward pressure on wages. You really believe colleges will drop tuition? I think the opposite is happening.

“The world will settle down, the G8 wants a stronger West, they will get it, inflation will be a issue but wages and new revival of American business will mean a much better USA by 2017-2018.â€

You mean the G7, or has the Ukraine problem been worked out? Your theory is inflation becomes a problem and is magically worked out with higher wages? Wouldn’t higher wages make inflation worse? I doubt a new American business wants to pay exorbitant costs for raw materials when they can’t pass the cost on to the consumer. Ralphs will be pleased! How was the stock market of the 70s?

“That is why I say buy now, deal on the very underwater properties they will be all gone soon so will 4% mortgages. Housing and construction is America, a house is the American dream still, plan for it today, wait and be priced out even further.

The dollar didn’t fold during the worse of times, it is and for the very long future the standard of the world, that is why I’m not worried about America.â€

I agree with you on that the dollar won’t fold. However, to me that means the dollar will still be a currency worth something. A cold housing market would not kill the dollar. In fact a smaller cohort of “investors†would be impacted. Not as sad as 2009. The sky might not be falling, yet housing may. I understand your argument to be: Buy a house at whatever cost because the economy is controlled and they want it to grow now. Alternatively I think your view on the US economy is: There will be a recovery because America is great. These are reckless assumptions not an investment strategy.

You might look more into current numbers. The existing house sales are down year over year on increasing inventory. Last year the numbers for existing houses were better by May. Thus the trend is down, though the season is by no means over. New home sales did increase, but the number of sales is a fraction of a “normal†market. The job market has firmed and it is likely we are at or close to full employment. Wages are still down though they likely could rise adding to inflationary pressures. This will prompt action from the Fed. Housing will cool. Other sectors of the economy look like brighter spots for investment, even given your scenario.

LC…Just that there is no better place in the world, it is not American arrogance, global players want America to succeed, we are good for world business.

The Western World wants us to still be the financial capital on this planet, I would say

our future is brighter then ever?

I guess robert is predicting low rates with wage inflation. Who knows what will happen but we could just as easily end up in a scenario of higher rates with wage inflation. If that happens, there would be downward pressure put on home prices.

He never specifies real or nominal, so it’s difficult to know if those concepts factor into his predictions.

“There will be a recovery because America is great.”

I’ve mentioned it before, this guy’s comments remind me of Don King.

Ill wait for 8% interest rate…and 30% down in house prices…I will still pay the same monthly…that does and will never depend on the interest rate. It depends on the median income.

Interest rate up=house price down so that the median income can afford the mortgage.

Pinocchio…You have a long wait if you remotely think houses will decline 30% or more. I have a long history in RE Estate, opportunities were in 2008-2010 and started slipping away after that.

You take advantage in life,waiting for your dream date, you don’t have the nerve to make a move on her, she slips away?

This. I suppose I should stop pointing out the short sightedness of purchasing at a high price level on low cost leverage or else there might be too much competition once the tables turn.

Flipper’s remorse:

23392 Saint Elena Mission Viejo, CA 92691

Sold in January of this year for $520K, upgraded, not occupied, listed for $689K in April, pulled, re-listed, pulled again and now listed for rent.

I have been a Hard Money lender/loan originator in the SoCal market for many years. The Redfin Chart on Flipping Gains is very misleanding. Most So Cal flippers in the SFH market I have seen look to make 10-15% of resale price as net profit. The chart must be showing gross profits and larger properties. Flipping is never easy – just easier at times. Yes, the insiders (agents, asset mgrs and their friends) get the best deals that never hit the general market – what’s new? So, just seek to be an insider. You can do it. Make friends.

What I find most suspicious about Redfin are all those Realtor testimonials about “What It Takes to Win an Offer near Crappy Town.”

The ALL talk about how tough it is, how even when the buyer bids way over asking price, they were unable to “win” the house. All these testimonial encourage a bidding war mentality, prepping buyers to bid high, don’t give up, keeping bidding higher and eventually you’ll “WIN.”

I’m sure SOME buyers must have gotten a sweet deal after a seller was forced to cut their price, but you NEVER read about it on Redfin.

Here are some actual Redfin Realtor testimonials, from the Valley and the Westside:

* With lots of competition we went in way above asking and beat out all other buyers.

* Palisades home in the Highlands that had multiple offers within the first week on the market and went for over the asking price.

* Offer requested [sic — I assume she meant “rejected”] due to multiple offers and buyer only had 5% down payment.

* Knowing this updated architectural condo would get multiple offers, we submitted an above asking all cash offer with 7 day inspection period. Competition was tough and even though we were the only all cash offer there was at least 1 other offer with a large down payment. We raised our price $30K to seal the deal.

* We came in with a competitive offer but after receiving 20 offers the Seller chose to only respond to the four ALL CASH offers. [They’re italics.]

* My buyer came in with a 30% down payment on this townhouse in Marina Del Rey. Unfortunately, the price they were willing to pay wasn’t enough and another buyer well went above the asking price.

* Buyer submitted all cash offer subject to interior inspection. There were multiple offers and the seller chose another offer that was more favorable.

“So, just seek to be an insider.”

Of course, why advocate for a more just system when you could instead join the collusion?

Isn’t it interesting how we have Don King robert singing the greatness of America while looking the other way as rent seekers contribute moral decay to the fabric of our society.

Of course, why advocate for a more just system when you could instead join the collusion?

Maybe it was my manager who told me the first day of pro ball, kid “play for yourself,

this is a business to you now, the next guy wants your job understand.”

BS….”Just system” has nothing to do with the reality of life, I suggest you keep watching:

Wonder life every Christmas, if you really think that fantasy exists in a capitalist nation?

in a capitalist society.

BS…While on the subject of renters? the old Soviet Union was a nation of renters remember, the gov’t gave them free to low cost apt’s, how did that work out for the Russian citizens???

In my business I employed three Russian immigrants, first time I interview them, how

long before I can afford a house they said, never want to rent anything again.

Renting is a means of a short term place to acquire enough money to put down on a

home or investment to make money.

Renting is not ownership, when you own something you are free to sell it, rent it to

someone else, or do nothing, just walk around your property in a free will of expression.

Try a fee will of expression renting, the music to loud Harry, your car is in my space,

I want to party tonight Hilda to bad they have to bang the walls to stop us?

Or just try renting a house and change the color of the walls without landlord

permission, that is always a fun visit or move in 30 days, I sold it to my grandson?

r:

“advocate for a more just system” is not the same as “there will be a just system”

Key word here is “more.”

“rent seekers” are not the same as “renters” Look it up.

Details and nuance requires reading comprehension, I suggest you keep learning.

When the easy $$ dries up, and it will in the near future, many RE investors will go down with it

The real fun begins when debt plagued US has to fund a second bailout and interest rates spiral higher

Fed will be tapped out too, or have diluted the currency so far it doesnt matter

Flip gone right.

In March, I looked at a flip – not because I could afford it but because I was curious.

4/3 house that sold in Oct. for $550K – how, I don’t know, since 3/1s in the same neighborhood had already sold for over $800K. (I’m guessing it was sold at auction because I don’t recall seeing it on Redfin but I could be wrong.)

To say it was fantastic would be an understatement. Yes, granite counters, big new fridge, etc. But what struck me was the quality of the workmanship. No different style in every room. It all hung together. The painting was professional, even around the windows. Not a sign of mildew, mold or rust anywhere. Even the shelves in the closets, kitchens and bathrooms were flawless. (I generally see split wood, grime, etc.).

Even the garage was in good shape. One could keep 2 cars in the driveway and convert the garage easily, and at very little cost, into a storage room or carpentry space or whatever.

Structurally, I can’t say. They hadn’t repainted the exterior, but the flaws were minor. It could easily go another 10 years without repainting. As for the roof or seismic stuff, I have no idea.

It listed for $700K (obviously below market value for the neighborhood) and sold for 1.1 million. So even if the flippers paid $200K for the do-over, that’s one nice profit.

So, let’s say it needed seismic refitting and/or a new roof. I’d say the new owners still benefitted from the flip (although I do think, given its location, 800K would have made more sense).

Why? Well, speaking as a lifelong renter, I would have no idea whom to hire to do that kind of work: painting, new bathroom & kitchen fixtures, new shelving, etc., etc. More than a question of professional workmanship, it’s a question of design. Choosing things that work together, treating the rooms as part of a whole and not independent entities. And I have heard way too many horror stories of home makeovers, even just a kitchen or bathroom, that were disasters: projects producing dust and dirt and noise for months on end, finished long after the due date and for way more than estimated. The buyers, in this case, spared themselves all that angst. They got a home that, on the inside, needed no work of any kind.

I think about that house. What if we had bought it for $550K? We’d have been totally lost. No contacts in the industry, no (to be perfectly honest) particular interior decorating sense. Sure we might have been able to reproduce what the flippers did, but I suspect that we would just have likely wasted hundreds of thousands of dollars on shoddy work to say nothing of months of discomfort and annoyance.

So I’m very ambivalent about flippers. They are able to buy houses sight unseen because they have access to a LOT of CASH. And not all flips are equal. I recently saw another one, ask of $800K, that was obviously a fast, superficial, cheap fixup.

It bothers me that the underwater houses, the foreclosures can’t be bought by ordinary home buyers who lack the financial resources to take the risk on houses that can be inspected only visually. But if one has a choice between a million-dollar house that needs a couple hundred thousand to make it livable and a million-dollar house that doesn’t, well, for that class of buyer, this kind of flip can be a good deal.

“Structurally, I can’t say.”

“But what struck me was the quality of the workmanship.”

“They are able to buy houses sight unseen because they have access to a LOT of CASH.”

Usually borrowed money, not cash.

Anyway, an important point is being missed. The quality of the flip shouldn’t be the primary question being debated, although it is of reasonable concern. What’s galling is the risk the system is exposed to by the government largesse being leveraged to enable dealers (flippers) profits through the actions of the addicts (typically financially stretched and imprudent purchasers adding moral hazard to the system).

Not much different than new homes and non-flips backstopped by the taxpayer (forced user of U.S. Dollars), but additionally annoying in the manner that flips pervert the marketplace – “the foreclosures can’t be bought by ordinary home buyers who lack the financial resources to take the risk on houses that can be inspected only visually.”

“What if we had bought it for $550K? We’d have been totally lost. No contacts in the industry, no (to be perfectly honest) particular interior decorating sense. Sure we might have been able to reproduce what the flippers did, but I suspect that we would just have likely wasted hundreds of thousands of dollars on shoddy work to say nothing of months of discomfort and annoyance.”

Hire a general contractor and you take on the risk. There is the rub – a consumption fueled sense of entitlement (must have everything fully loaded today to boost a feeling of self worth in the eyes of the Joneses) to not taking on individual risk and “discomfort”, so let’s roll it into the loan as long as we can get the bank (ultimately .gov) to approve the monthly payment.

I don’t see how a sense of entitlement or keeping up with the Joneses factors in.

If one ignores the market distorting effects of flipping, which I do think are both serious and negative, a good flipper (from a construction perspective) turns a “used” home into a “new” home.

I applaud those with the time, energy and skill to refurbish an old home on their own, spending evenings and weekends for years because it gives them satisfaction. Others look at the costs, in time and money, of hiring contractors, designers, etc. vs. a “ready-made” home and decide they’ll get a better deal by managing the process themselves.

But others want a home they can simply move into, be it a new home in a new development or a used home that has been renovated by the current owner or a flipper. They know they are paying a premium but have decided that they do not want to spend months of theirs lives either fixing up a home or hiring people to do the fixing for them.

This is no different than the decision, except in scale of course, to buy one’s clothes rather than make them or to order a computer from Lenovo rather than build one from scratch.

We all value our time differently. As for the mortgage, well, about 1/3 of the home buyers in this area are paying all cash so there is no bank to be indebted to. As for the remaining 2/3, mortgages are the way that most homes are and have long been paid for in the U.S. Calculators exist to weigh the cost of buying vs. renting based on market conditions, personal financial considerations, and the length of time one expects to live in a house. We assume that the people who bought that flipped home for 1.1 million had the financial resources to do so. (2 professionals with a joint income of $250K, not all that uncommon in the Bay Area, with a reasonable amount of current debt and a good down payment can afford that.)

Renters always live with uncertainty: every increasing rents, landlords who defer or refuse to do required maintenance, new owners who want to evict current tenants for any number of reasons. 30 days to pack up and find a new place to live. Maybe not difficult if you’re a 20-something, living in a market with a decent rental vacancy rate, whose possessions will fit in a van; not so easy if you’re a family with kids in school. A home one can afford provides security that a rental can’t. I don’t see that as an issue of “keeping up with the Joneses” or as an “entitlement”.

What I find disturbing is a housing bubble that prices homes out of the range of average families who simply want a nice place to call their own.

If you don’t “see” the connection between government encouraged lending, people spending borrowed money beyond responsible means for wants above needs, and the profit motivated feedback loop – then you’re in good company with most of the nation.

By the way, the uncertainty argument is a non-starter. There’s plenty of uncertainty to go around on both sides of rent vs buy.

I looked at a few flips on my search in No. San Diego county. They seemed structurally OK but the sameness of the paint colors, tiles used and finishes was deeply depressing. As some of you may remember, I’ve bought a place, and it seems like just in time. I was wondering why the market hadn’t had any new listings – well, the fact is there have been, just not in my price range (450-510K). Turns out there are lots of new listings, but in the 525-650K range! It looks like the property I bought is already worth more than I paid for it and escrow isn’t closed yet! Not saying this to brag AT ALL, but to show that it’s getting crazy again even in this small out of the way market. For all I know, next year it could be worth 350K instead of the 500K I paid. I’m in for the long run (15-20 years and it’s in my trust) so doesn’t matter to me – made the payments easy on myself so don’t give a fig. Glad to be out of the housing race and talking with my fruit trees.

Blert is right on. We are living at the terminus of the grandest debt super cycle the world has ever known. The rhetoric espoused here in is a symptom of a neo culture conditioned to consume. Designed to deny spiritual principles cast asunder as old ways.

The I devices dominate our culture. Change is inevitable but our values and our dreams

don’t have to change. I pray that either owner or renter you have shelter, and the joy of the Father in you.

DHB, I just saw a report from Trulia asking whether homes today are over-valued. According to their analysis, some experts believe that the national home prices are actually under-valued, but when you take a closer look at their data it shows that So Cal prices are over-valued by as much as 17%.

I also heard a radio report on KNX 1070 the percentage of new home sales are up by as much as 10% in southern California. However, it did not mention anything about the number of new home construction.

I’d like to get your take on this recent info.

itwasntme … That is the spirit, you like the home and area, stay and enjoy!

The more significant point is “I’m in for the long run (15-20 years and it’s in my trust)”

itwasntme isn’t one of the “house horny” that Doc writes about. The debate isn’t really about folks like him.

Leave a Reply to Gary