California Economy and Housing in Depth: SoCal Homes Sales up But Significantly Down from Peak. W-2 Earners Expect a Smaller Paycheck. And Unemployment Insurance looking at a $23 Billion Deficit by 2011.

Things are going so well for California, that the state now facing a $1 billion deficit after just patching up $60 billion in deficits, is now looking to withhold more taxes from your paycheck. Of course this isn’t a tax hike (so we are told and technically, they are correct). This is just a way for the state to patch up more revenue gaps because after all, the economy is booming supposedly. It boggles the mind that people seem to forget these facts. Ask yourself if the state were doing so well, why would they be running so many gimmicks? Not only are they going after withholdings earlier, but they just finished another round of selling bonds (aka borrowing). Either way, the V-shaped recovery crowd is ready to overpay for housing once again. Forget the fact that Alt-A and option ARM loans are still as toxic as they ever were and start hitting in full force in 2010.

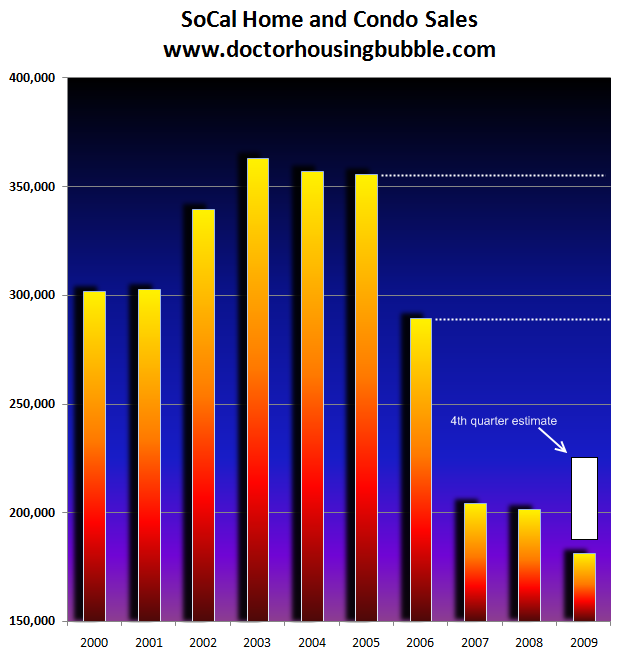

It is always good to put things into context. We can all admit that in 2009, sales did jump up in Southern California. Over half the state lives here, so this is a good overall barometer of how things are playing out. How significant is the sales jump this year in relation to other years during the decade? Let us find out:

At the peak over 362,000 homes and condos sold in Southern California in 2003. Assuming the “torrid†pace of 2009, we are on track for 230,000 to 240,000 sales this year. That doesn’t even come close to any of the boom years. Also, 45 to 50 percent of all home sales in 2009 have been foreclosure resales. So this is another factor to keep in mind. The bottom line is even with massive price drops, the market is nowhere close to the bubble days. Let us break down the data further:

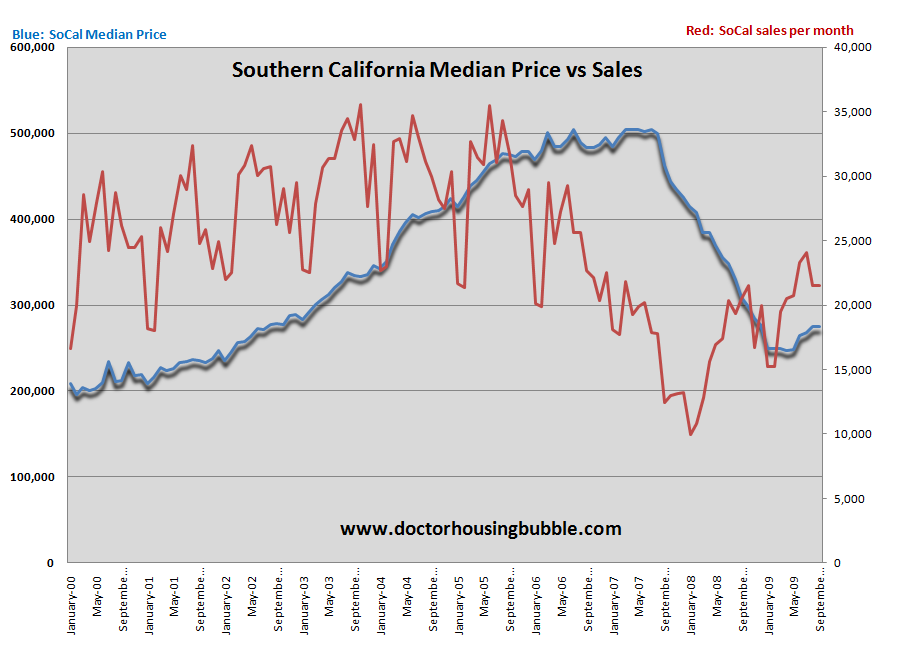

What this chart tells us is that home sales increased because of massive price drops. That is, if half the market is distressed sales and these are sold at markedly lower prices by default (otherwise they wouldn’t be distressed) then we are to reason that the movement has occurred because of lower price points. In other words, wouldn’t you think an increase in price would stifle this trend? Absolutely. The Alt-A and option ARM issues will start resonating stronger in 2010 and this will begin to add pressure on the mid to upper tier markets. Yes, delusional folks who can’t see outside their tiny niche market don’t look at charts like the above that show the median price falling by 50% and still being near the bottom for the entire region. After all, their area is special.

And easy lending has allowed another surge in mini bubbles. People are once again jumping into over priced homes in California. Yet I believe this is merely a false bottom. Why? First, the state is still in a fiscal mess that really seems to go on for a few years. People should gear up for more cuts and tax hikes. Those that believe Prop 13 is sacred should ask Texas and New Jersey how their property tax rates look like. California is a tax happy state. High personal income tax, sales tax, and other taxes so why are we to believe that anything is off the table? I’m not saying this is good or bad but when you box a big tiger like this in a corner, don’t be shocked if you get bitten. And for better or worse, property tax revenues are a much more stable source of income than say, personal income taxes and sales taxes that directly fluctuate with recessions.

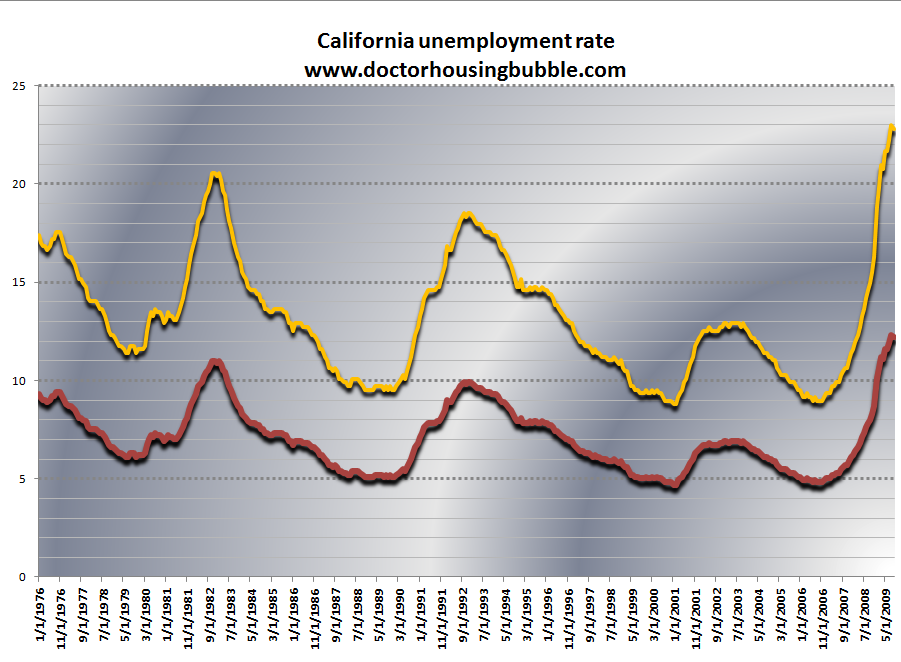

Setting that aside, the Alt-A and option ARM problem is still there. Getting a loan is not as easy as you once thought. Take this for an example. Notice how much fewer credit card offers you are getting in the mail? Well this is because in Q3 of 2006 credit card companies sent out a stunning 2.1 billion in direct mail solicitations. For Q3 of 2009 389 million were sent out. What do credit card companies know that the recovery cheerleaders don’t know? Could it be that defaults are through the roof? Possibly. It could be that 22 percent of California is unemployed or underemployed:

This above rate is unprecedented. So why is it good news that we are lending big mortgages through FHA insured loans in many cases, to people that are stretching their dollar much too thin? Isn’t this what got us into this crisis? Yes. Are we to expect a different outcome? No. And riddle me this. If this economy recovery is legit why are we now talking about a second stimulus and needing to extend the home buyer tax credit welfare voucher? Go by actions, not by words.

California Insurance Fund

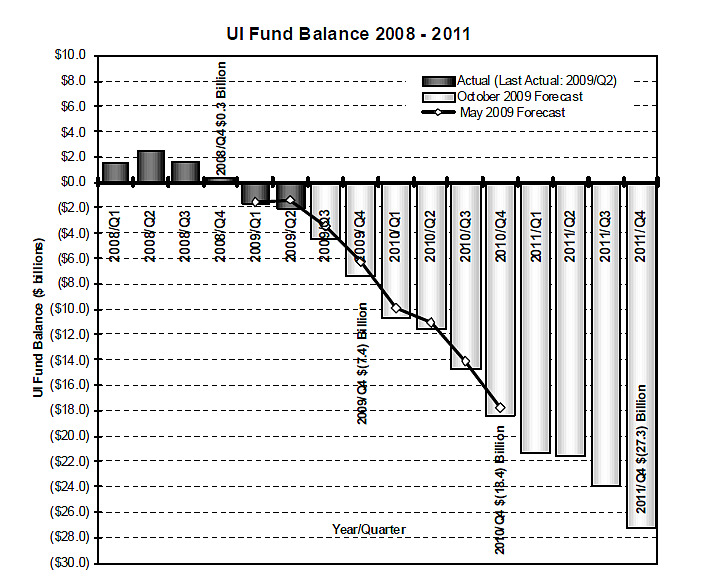

As you would expect, our unemployment insurance fund is bleeding money:

“(OC Register) California’s unemployment insurance trust fund is bleeding money with state officials estimating it will be $27.3 billion in the hole by the end of 2011, according to a new state forecast.

Officials already were projecting major deficits in the fund a year ago, before the full impact of the banking crisis hit in late 2008. The fund’s losses accelerated this year as the country plunged into its deepest recession in 70 years with California’s unemployment rate hitting a modern-day high of 12.3% in August.

Employers, who support the fund through a tax on each worker, are expected to contribute $4.3 billion this year but that is nowhere near the $12.5 billion that is projected to be paid out in benefits. After eking out a $326.2 million surplus in 2008, the trust fund is expected to be $7.4 billion in the red by the end of this year.â€

The federal government will forgive the interest for this year and next but the clock starts ticking in 2011. As if we needed any additional future burdens. Again, data like this shows us that the housing market is now at risk for a bigger risk factor. The actual reality based economy. This is more typical in previous recessions where housing would start declining after unemployment hit. This time, so many toxic mortgages were floating out there that all it took was for home prices to level and the entire Ponzi scheme came crashing down. With home prices declining as they have, it is revealing massive budget deficits. This is to be expected when you plan revenues from nefarious and transient sources. Those are not coming back. Just ask Bernard Madoff how well that works in the long-run.

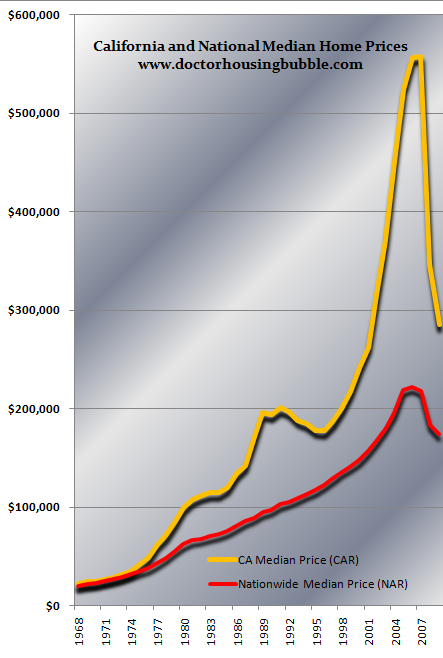

We also have to remember that in terms of prices, Alt-A and option ARMs helped boost housing prices and the ridiculous leverage buyers had in California. Home buyers in California had maximum leverage of OPM (other people’s money) even though incomes did not reflect absurd valuations:

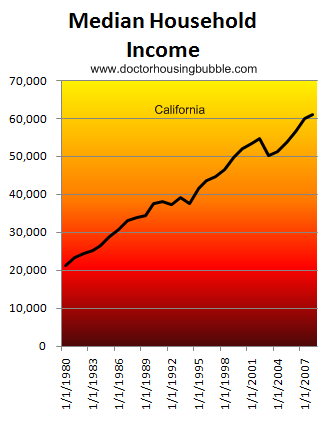

You look at the above and then you throw in the state income and it all becomes too apparent:

How in the world is a $60,000 median income going to support a $500,000 home? At the maximum end, it would prudently be able to afford a $200,000 home (and that is stretching it). The current state median home price is $251,000 but keep in mind, much of this is because of foreclosure resale homes. The next ballgame to look at is the mid to upper tier markets that largely have not corrected based on their own bubbles. Their dynamics reflect more esoteric loans such as the Alt-A and option ARMs.

The Path Ahead?

There will be many odd movements in the market next year. You may see the median price move up because of lower priced mid to upper tier homes moving in larger amounts of volume. That is, someone that bought a Culver City home in 1998 for $200,000 and at the peak in 2007 would have sold for $750,000, is now selling for $500,000. This is actually a significant price increase from the first sale and will show up in the median price but also, the Case-Shiller repeat sale index. So watch for things like this. The Alt-A and option ARM recasts that will happen, will add higher priced distressed inventory on the market. Much of the subprime problems are behind us now. That is why you see homes in say the Inland Empire now selling for $100,000 to $150,000 that only a few years ago seemed impossible.

We can expect the state to have another major budget deficit. Expectations range from $7 billion to $20 billion. But the stock market is up and rich people pay most of the taxes right? Yes. But keep in mind they pay estimated taxes and these are significantly down even after the casino has gone up. Why? Many of the wealthy have accountants unlike the working stiffs that can carry over losses from 2008 over to many additional years. In other words, don’t expect the state to get a 60 percent jump in revenues just because the stock market is up by this much.

So what should you look for in a bottom? Well first, we need to see job growth. Enough of this “job less†recovery non-sense. People pay for bills from wages. Also, if you buy that home today, your future buyer may not have your same incentives. That is, the tax credit can’t go on forever. FHA is now looking at a government bailout and will probably have to become more stringent because they are bleeding money thanks to their near toxic underwriting. Plus, if you haven’t notice, the US dollar is getting hammered because what a stunner, we are simply spending money we don’t have. If even a tiny currency crisis happens and the Federal Reserve is forced to raise rates (can’t go much lower than 0), you can kiss goodbye to those cheap 30 year mortgages (which are at 40 year historical lows – can’t get any lower). In other words, a future buyer may not even be able to afford your home so get comfortable because you might be staying there for a very long time.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

21 Responses to “California Economy and Housing in Depth: SoCal Homes Sales up But Significantly Down from Peak. W-2 Earners Expect a Smaller Paycheck. And Unemployment Insurance looking at a $23 Billion Deficit by 2011.”

True. Of course if you think of a house as a HOME, then you have to ask yourself whether to jump in with a low 30 year fixed and some extra cash from uncle Sammy. Even if prices drop say 10% in Cali in the next few years, if interest rates go up and the incentives go away, the numbers might not look much better than now. That being said, I don’t think there is any need to rush in or much cause to worry about prices skyrocketing like a few years ago.

Doctor – Just a thought: It would interesting to see California Median Household Income information (for the years 1968 to 2009) plotted on the same graph as the California and National Median Home Prices data. (If possible, also include the National Median Household Income data for those same years as well). A second graph having the ratio of the annual California Median Home Prices divided by California Median Househould Incomes plotted along with the same data for the National Median Homeprice/National Median Income for the years 1968-2009 would also be appreciated (if such data are readily available). What’s abundantly clear from your vivid graph is how radically California home prices “diverged” from the national values – beginning just over 35 years ago; and reached median price/median income ratios much higher than the historic national normal values for over three decades; which apparently lead a generation of California homebuyers to believe such ratios could be sustained indefinitely. I suspect these (unsustainable) ratios may have now run their course….. Thanks for the great work you do……

Dr HB, great post as usual. I’d appreciate it if you could give your recommendation on what people should do with their savings (if any) in light of the current economic situations as you so eloquently illustrated. Let’s say one has saved $100,000, what do you recommend to do with that amount in the next few years?

1) put in a U.S. bank account earning ~ 0% interest plus the devaluation of the U.S. dollar?

2) as downpayment toward purching a house and risk being under water in the next decade(s)?

3) put in stock or bond market and risk a double tip?

4) spend in Vegas and hope to hit the jackpot?

5) buy gold, non-perishable foods, bottled water, guns and ammunitions, etc. to prepare for survival in caotic days ahead?

6) whatever you can recommend?

Please Doc (or anyone else) give us a hint or two.

Just so everyone knows – when the Unemployment Insurance fund runs low, ALL employers are hit with a higher rate. This means either higher prices or less pay for the existing employees.

The rate is calculated with roughly two variables: (1) the number of claims a particular business produces – so a company that fires a lot of employees left and right will have a higher rate than one that has a stable work force, and (2) how broke the fund is.

The first variable is in control of each business.

The second variable is totally beyond the control of the business. To give you an idea, the overall fund is given a letter grade, A-F. In 2009, the fund was already so broke they had to think up a new category called F* (F-star, if you will). I can’t wait to see what they will come up with for 2010! F-super-star? FFF?

Mike, you have a valid point here. I think doc’s argument in the past has been that lower loan amount with higher interest rate beats out higher loan amount with lower interest. However, that’s assuming you would have a chance to refi to lower rates. If the interest rates would stay high during your time of stay in the house, the bet is off. This scenario would work better for cash buyers. Then again, if inflation destroys the dollar in a few years, I guess I’m not still not sure which way one should bet. I’ve noticed that doc has been reluctant to directly predict the magnitude between home price depreciation and dollar devaluation. My sense is that doc has been implying that home price would still drop in the coming years even on an inflation/deflation adjusted basis. Doc, I wish you could comment or correct me on this.

Wall Street Journal, 11-4-09 at page C7: Wells Fargo Bank to “exchange” Option ARM loans for Interest Only for SIX to TEN years. Unbelievable.

@ WWang

For one thing, property taxes, insurance, and other similar expenses are primarily based on the principal amount, not the monthly payment. Also, while I’m sure tax laws are prone to change as we go broke, wouldn’t a low principal/high rate scenario give you a bigger income tax deduction than the same house at a high principal/low rate?

@randor

That depends where you are on your amortization schedule (1 year in, vs 20 yrs in…)

That statement about the taxes loss carryover is weird the way I read it. Disclaimer: Not wealthy and currently have no tax loss carry over into tax year 2008.

Sr. HB: “Many of the wealthy have accountants unlike the working stiffs that can carry over losses from 2008 over to many additional years.”

Anyone who has stock market losses can write off up to 3k a year limited to their gains. It does not take an accountant to figure that out either, since I am a working stiff and I became aware of it in good old year 2000 when doing my taxes sans accountant.

Any good suggestions to WWang’s dilemma?

I am wondering about our best strategy for the coming years rather than discssing problems, worries, and etc. over and over. I know they are the causes but where are our solutions? The solutions should vary depending on personal economic situations. Any thoughts?

Here is what I see happening. NODs will continue to go out. Loan mods will continue to be done and fail. Some will make it to Trustee sales to be delayed for a few months and then delayed a few more. Goal is to make it to next fall–October to be exact.

Right now the homeowner credit is set to expire in April 2010–really June because they have 60 days to close. The momentum (including increase in median prices) should get the summer off to a good start.

Interest rates are likely to remain relatively low (below 6% on 30 year fixed at least through the summer). Again, goal is to make it to the fall.

Things will start really going bad next October–why? because the headlines aren’t likely to reach in time before the next election.

I think things really start looking they are going haywire next winter. Many foreclosures will start hitting, another bubble will burst. Interest rates will start going up and prices at this point will go down–sometimes dramatically.

Whattado?

If you find the house that you will be comfortable in for at least 7 years, can somehow squeak out what you feel is a fair price and you get a decent interest rate, go ahead and make the plunge. You’ll probably lose your equity but probably not enough to force you to walk away, and you’ll hopefully have a good interest rate. But you’ll be stuck for a while.

If you don’t find anything, I doubt there is much to worry about. Again, unemployment is going to rise into next year (at least mid). Even if someone finds a job next summer, do you honestly think they are going to be mentally ready to jump into the frey and buy a house (let along is someone willing to loan that person money). Every house you don’t buy takes one competitor out of the market for the next sale. Commercial real estate should start drawing investors out of the residential realm and pretty much any first time home buyer will have bought until the next round saves enough money. But many home buyers were pull forwards, so the extension through essentially June 2010 will take all the new home buyers out of the market for at least a year.

Again, things aren’t going to be looking bad next summer/early fall. The politicians are going to be campaigning and once we have a lame duck congress after the election don’t look for big changes. Next winter it either hits or it doesn’t. I think it will hit and hit hard so that banks and the NAR can lobby congress in the spring of 2011.

Doc, can you comment on WWang’s post on what to do with your savings?

–

I want to protect my down payment – I am afraid my $$’s are going to continue to devalue and be worth less when it comes to buying a home.

Doctor, sounds like you are on board with Bill Gross…the New Normal.

Seems in the coming years the economy will be like driving across Texas. Zzzzz.

Tim;

If you have no stomach for volatility, buy a commodity, like gold. Sit on it and see where that goes for a while. Rent. If you want to so desperately be somewhere, buy a very cheap house in a good area and expect to ride the roller coaster.

Saw this on Denninger’s site…

Fannie Mae to Rent out Homes Instead of Foreclosing

http://abcnews.go.com/Business/wireStory?id=9004624

WTF????

What would prudent ppl think of all this? The ones who sat out thinking we cannot afford this and will wait till it comes down. Looks like the intent is to not let prices fall at ANY cost.

I wonder how much the FHA bailout will cost the taxpayers? It seems nobody cares anymore, numbers are meaningless. The American public is numb.

Stock market will likely rally 200+ points on the news. CNBC anchors will don cheerleader uniforms. CEO of homebuilder will be interviewed, calling market bottom; “there’s never been a better time to secure a property for your family”.

The thing that truly amazes me lately is realizing how far we have got to go in the jobs (or careers) market.

I continue to encounter the refugees from the faux-economy. The realtors salivating at the idea of being able to get back in the game. The mortgage brokers. The home stagers. The furniture sales people who title themselves “Interior decorators”. Pet sitters. Mobile pet groomers. Life coaches. The girl-friday types who call themselves “accountants” for the local builder. And on n on. I am almost shocked if I meet someone who is engaged in a productive, goods producing activity.

Dr.,

These two news stories regarding Fannie Mae were posted on Yahoo within “ONE” hour of each other…

http://news.yahoo.com/s/ap/20091105/ap_on_bi_ge/us_foreclosures_rentals_5

http://news.yahoo.com/s/ap/20091106/ap_on_bi_ge/us_earns_fannie_mae_5

IT SEEMS, THEY GET DUMBER AND DUMBER BY THE DAY!!!

housing prices will remain high in w la,

the fed is screwing over the responsible ppl in order to subsidize fucking assholes.

yes i am bitter and pissed off that I can’t buy a starter home when I make 150k

WWang, my advice is to park your money in a high interest bearing checking account at 2.6-3.5%. Check out City Bank of Texas in Lubbock (3.56%) and City Bank of Taylor Texas (2.65%). Both FDIC-insured and 3 and 5 star CAEL ratings so they are pretty safe. I might also take some money and buy foreign currency CDs/ETFs (I like countries that have natural resources and have positive balances of trade; Brazil, Norway, Australia, and Canada are 4). You can buy these at Everbank or Wisdom Tree. This serves as a hedge against the devaluation of the dollar in case things turn ugly. I would also rent, especially if you are in SoCal along the coast. The downturn never really hit us that hard, so prices are still way too high. If you can hold out 1-2 yrs, you will get more house for your buck (or real, krone, franc, etc)

BZ

What?!!

I can’t believe any bank would be paying such “high” rates. In fact, according to the City Bank of Texas, the most you can hope for is 1%.

Leave a Reply to L