A tale of two California economies – Large budget battle looming in November. Los Angeles County has 38,000 properties in the shadow inventory with 16,000 of those having loan balances above $400,000.

There seems to be a divergent amount of information flowing out of the California economy. The headlines seem to indicate stabilization for the economy yet tax receipts are well below estimates and the unemployment rate is back to 11 percent. The lower tax receipts and weak employment market guarantee a tax measure on the ballot for November. We keep hearing about the lower available inventory of homes for sale yet the distressed pipeline is still high.  Half of home sales last month in California came from the foreclosure pipeline or from short sales. The perception is always that California has a large number of wealthy households (according to the Franchise Tax Board 14.7 percent of households make more than $100,000 a year). Given real estate prices in many areas, this is not enough income to justify prices. Californians have also been using FHA insured loans enjoying them like candy although they have now become much more expensive. The story of course is much more complicated then what headlines portray.

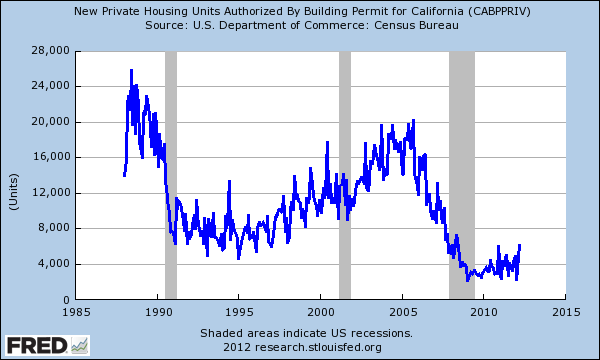

New home permits up but will construction follow?

Permits for new housing units have started to move up. Yet this is only a first step since the true measure of a recovery will come from actually hiring construction workers to complete the project. The growth is slight:

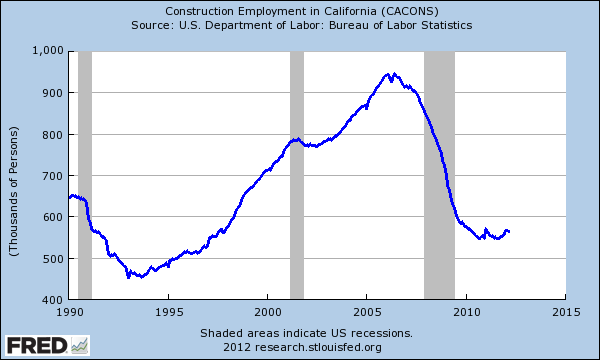

If we then look at the actual hiring, not much has changed. I think some builders are hedging their bets here waiting to see how things trend out in the following year. Construction employment is still in the doldrums:

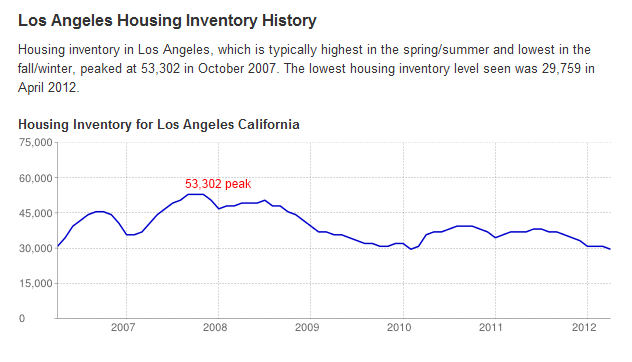

Those on the ground realize that the declining inventory isn’t necessarily a sign of a booming market but one in which banks have restricted the flow of shadow inventory. Take for example one of the biggest markets in California, Los Angeles. Inventory has been moving lower since the peak in 2007:

Source:Â Department of Numbers

The above is only for Los Angeles. If we look at the entire county, we will find 27,000+ non-distressed properties listed for sale. The pipeline is also moving slightly up as lenders become more comfortable moving inventory:

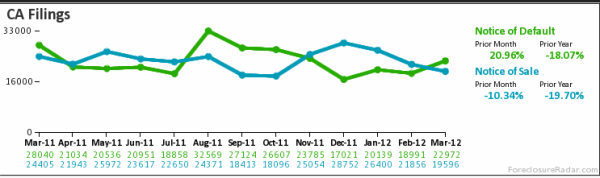

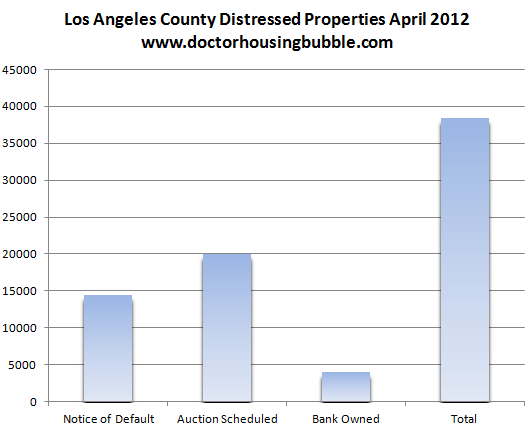

Yet distressed properties are still a big player here:

Over 38,000+ properties have a notice of default filed, are scheduled for auction, or are bank owned in LA County. Since people seem to think that these are only broken down fixer uppers with small mortgages, I decided to run a query on those 38,000 homes. How many have loan balances above $400,000? Try 16,000+. How many have loan balances above $500,000? Try 9,000+. There is a large number of quality homes in which people are living in properties without making a mortgage payment. So the low visible inventory is partly an illusion of a successful housing market. Couple this with low mortgage rates and low down payment FHA insured loans and you can see why a false sense of recovery has taken hold:

Source:Â Mortgage-X

Part of this equation will get more expensive as FHA insured loan defaults soar and mortgage insurance premiums have increased sharply this month. This will take one to two quarters to show up in the home sale data. There is little doubt that this will impact first time home buyers. The above low mortgage rates are simply artificial with the Fed buying time but this cannot go on forever and massive levels of debt reach tipping points as we are witnessing in Europe. So the plan is for the Fed to buy up trillions of dollars more in mortgage backed securities just to keep home prices in California inflated? I doubt it. Prices nationwide are already starting to make sense with current market figures.

The government, both local and federal is going to get hungry this year and deficits do matter. The mortgage interest deduction has been on the table for the last year. I doubt it will go away but there is no reason for it to subsidize inflated states like California where a million dollar home can garner massive tax benefits to a high income buyer while most homeowners around the country gain very little benefit since the standard tax deduction usually trumps out the interest on a standard mortgage. I’ve noticed that the Franchise Tax Board is now going to come down heavier on Mello-Roos since many Californians are writing this off as a deduction even though it is not. The seeking out of dollars is becoming stronger because government balance sheets are not looking good. The housing market is largely being held up by smoke and mirrors. Lower inventory in other times would signify a healthy market but today it is hard to call what is going on with housing a market.

I think a good number will dive in during the next few months just like they did two years ago with the tax credits. Since then home prices have fallen further and better quality inventory has entered the market. The push now to buy is the fear of lower inventory and the case example of bidding wars. In essence, similar issues that led us into the housing bubble yet people are driven by these impulses. Household incomes and the quality of jobs should be leading indicators of a healthy housing market and not the other way around. Ironically some are competing with amateur investors that are overpaying for perceived cash flows. Think about it, if incomes are stagnant and taxes are likely to go up, where will additional disposable income come from? California is going to have a major ballot battle this upcoming November because of a poor economy and uncertain trends.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

38 Responses to “A tale of two California economies – Large budget battle looming in November. Los Angeles County has 38,000 properties in the shadow inventory with 16,000 of those having loan balances above $400,000.”

What about cities in CA like Costa Mesa that have piggy back mortgages lif you make less than (approx) $105,000 per year? You don’t need FHA . If you make over that amount you have to go FHA and pay mortgage insurance if you have little money to put down.So if you make $120k you have to compete with lower income people for the same home and pay much more for that same home because you have to pay the mortgage insurance. run rabbit run….

Could you give a little more info? As far as I know, no one is doing the piggy backs anymore that let you avoid mortgage insurance. Links please?

No way will Californians vote for a tax increase. We’re tired of paying for illegals.

Fred, don’t say “no way” will Californians vote for more taxes. You have a huge population in California who are permanently on the dole. They don’t pay taxes anyway so they’ll be voting for more so you can pay them and their freebies will continue. And don’t forget we’ll soon hear the ads, “it’s for the children and education and public safety, etc, etc, etc.”

NO to any new taxes in Califorina. We don’t have a revenue problem, we have a spending problem.

That my friend is dependant upon voter turn-out (who shows up) Folks on the dole love free stuff, and dont have a job, so they have all day Tuesday to make it to the polls, a luxury those who are footing the bill dont have!!

I follow the investor market very closely and they are reporting bidding wars on property all over the state. Even on the court house steps. Inventory is being released at a trickle pace as investors and owner-occupied buyers are thinking the bottom may be in and are eager to buy.

I think your take on the home builders is spot-on….they’ve started the permit process just in case things get going. That’s just a prudent business move and doesn’t show economic commitment.

High unemployment and a govt hungry for money is a bad macro-economic mix.

I also work the court house steps and the Wall Street big money is here, ruining my business. Flippers could make money a few months ago but no more. One WS$ group has stated that they plan to buy 25,000 rentals in Riverside and San Bern this year. WSB$ are soaking up inventory. I ask, who are all these renters? What is the demographic that wants to rent a 2,000 sq foot house in Murrieta?

Hello Doctor, I just wanted to say THANK YOU for continuing to publish your always excellent column. Through many months of reading your blog posts, I have become about a million times better informed about the housing market that I would have been if I relied only on news and ‘real estate industry professionals.’ Please keep up the good work!

Jeff, it’s amazing what you can learn on some of these housing blogs. You get facts and many pieces of information you will never ever see from a media outlet that is essentially a mouthpiece for certain industries or political groups. Just this weekend I heard two of my friends say the “housing market has bottomed, XXX MSM article told me so.” And remember most of the country did not have a huge housing bubble that we experienced here in coastal California. Just because prices in Iowa or Texas have turned the corner, does not mean trendy parts of LA or OC are anywhere close to the bottom.

Read an interesting article this morning on the ochousingnews website, depending on how you calculate it…there is between 5 and 8 years of distressed inventory in the OC pipeline that will need to work itself out. I pity the person who thinks this problem will be solved by banks withholding inventory indefinitely. The more layers of this rotten onion are peeled away, the worse it looks inside. After reviewing all the facts, I will wait to buy when it makes sense!

http://ochousingnews.com/north-oc/fullerton/8-7-years-to-clear-orange-county-distressed-inventory-at-stable-liquidation-rate

Thanks for the link to another great article that won’t be reported in the mainstream media!

Banks have apparently gained the authority to keep reo as rentals as long as “mark to fantasy” accounting allows AND to have those rentals count for all purposes of satisfying that they are taking care of “minority” home occupiers (so that presumably, it counts for making up they refuse to make further loans in redlined neighborhoods?). So that “investor” company that is mixed in with all the other new investors using all sorts of anonymous names, doing rentals? Yeah, it may be that’s really the bank acting through one of its subsidiaries. They don’t even have to make believe they are trying to dispose of the reo as long as they have a “plan”.

http://www.federalreserve.gov/newsevents/press/bcreg/bcreg20120405a1.pdf

Now, THAT changes everything. How this will impact California versus Chicago, or Atlanta, may vary dramatically. Good luck getting accurate information on the extent this will be going on (this is truly a desperation move by the FED and possibly, with the urging of the FDIC). Oh, and the banks get to use any REO fantasy accounting they feel like in each bank and changing as they feel like, from time to time even within the same bank!

I think it is hard to extrapolate from construction industry hires unless you are somehow able to take into account the vast numbers of illegal immigrants who used to work on these projects off the books. That said, I enjoy this blog immensely, but I wish those commenting would be less insulting to each other.

The comments here are the least insulting, most insightful, I run across. Most blogs’ comments are so moronic, I completely skip them. This is the blessed exception. 🙂

And, for what it is worth, from my perspective, Phoenix is no better. My house — big, nice neighborhood, right next to mountain park — has dropped 40% in four years. Prices continuing to drop throughout the HOA …

King, you should forward your comment to the AZ realtor who came on here just a few days ago proclaiming that the wonderful and just super – awesome AZ market was ripe for picking. The time to buy is NOW, of course.

The media and data crunchers say Phoenix is pretty hot right now? No pun intended.

What happened to Enzo DiMimo in FL?

Bought another fire-sale quad-plex, near the beach, busy rehab’ing it… Yet Another inherited prop that the (alcoholic) heirs ran into the ground, to the point they were being sued by the municipality… call me a savoir, lol. New landscaping just thrives this time of year.

I’ll be cash-flow positive by July. I’m a hero to the neighbors already. ;^)

err, would that be “savior”… perhaps with savoir faire?… lol.

The US homeownership rate is lowest since 1997.

” It will be lower by 2017. It will be lower by 2020.”……says Pimco’s mortgage securities boss.

http://www.bloomberg.com/news/2012-04-30/homeownership-rate-in-u-s-falls-to-lowest-since-1997.html#

This is a bit off the topic, but the following link has the 10 cleanest and 10 dirtiest cities in the USA.

http://www.theatlantic.com/health/archive/2011/04/americas-10-best-and-10-worst-cities-for-air-pollution/237974/#slide1

Salinas and Redding are the ‘clean’ group, but they are pretty small cities. On the other hand, LA/Long Beach, Fresno, Bakersfield, Visalia, Hanford, and Modesto are all on the ‘dirty’ list.

Why would anyone in their right mind buy a house in one of these dirty cities, at any price? I can see taking a temporary assignment, out of economic necessity, but that is what one year leases are for.

I used to live in Bakersfield, and my lungs can still feel it, 15 years later, lol. I also lived in Oxnard Shores and Ocean Beach (San Diego), but those costal areas are prohibitively expensive for most folks.

I’m sure this comes as no surprise to anyone who follows DHB:

Sinking U.S. house prices drag new buyers under water

http://business.financialpost.com/2012/04/26/sinking-u-s-house-prices-drag-new-buyers-under-water/

“More than 1 million Americans who have taken out mortgages in the past two years now owe more on their loans than their homes are worth, and Federal Housing Administration loans that require only a tiny down payment are partly to blame.”

What a complete and total surprise. Who would have ever thought that 3.5% down loans are NOT a good idea. If the old 20% down rule were kept, the bubble may have never existed in the first place. Too late now, to keep their slimy bankster overlords happy, the US government has now went into business doing low down subprime lending with taxpayers on the hook. Why are we not hearing more outrage when it comes to this? I have long known that our government is corrupt but they don’t even try to hide it anymore. What a bunch of disgusting individuals!

Neighbor across street just folded her hand. 5 years into a $248000 mortgage on a $100000/yr income. 2.48 : 1 ratio looks good….except she saw value fall to less than the build pice of $138000 in 2001.

So even when they CAN pay….they don’t.

That’s good, they should walk away from something like that. Staying would be foolish.

Bankruptcies and ways out were created to aide the free market and encourage risk. Important disclosure here – FRAUD ASIDE – there is nothing wrong with doing what the system allows legitimately. Would you pay the note on $248k to get 1/2 back? No.

that’s an individual decision to make. She will now pay the landlord every month instead of a bank and live a lifestyle different from before. It may make sense for her financially for now. She also loses her deduction in taxes.

We have a nation with enormous debt we cannot pay fully, and we have prominent economists advocating higher inflation to inflate the debt away. We have constant inflation higher than what CPI will indicate. Over time, the dollar will lose value, and the stuff you can touch will appreciate in value. that’s just IMHO.

You have to differentiate discressionary spending. As food and fuel continue their rise, along with interest rates potentially, that pressure housing downward on a bad day and flat on a good one.

Let’s not forget what Obamacare may do to taxes and wages as well. I hear toilets flushing…

As I’ve said before…if your zip code is priced around 3X income, it’s probably stable. Add a 1-2X premium for some LA/OC locales.

She didn’t have a tax deduction on loan that small with a $100k income unless she was self employed and taking many other deductions. The mortgage deduction credit is really over blown. I did the numbers for myself with almost the same amounts. $300k mortgage, 4%, $100k income and still the standard deduction for a married couple is greater.

Nothing wrong with that. It’s just an easy number crunching exercise, if the numbers aren’t in your favor just walk away or quit paying. The loan contract says if you quit paying the loan, the lender will get the collateral (house) back and you will likely get a lower credit score. Looks like your neighbor is just exercising one of her financial options. There is nothing moral or ethical involved here, just a business decision.

RE developers do this all the time, and guess what? They suffer no dings to their creidt and can just borrow again and again.

Never underestimate the stupidity of the clowns in Sacramento. They have now mandated that all health insurance cover pregnancies.

Blue Cross is raising our rates because of this.

My wife and I are in our 60’s.!

We now have to pay much more for health insurance, for something that we can never use.

It all equals out, I pay thousands per year in premiums and maybe go to the doctor once or twice a year. I’m sure in my 60’s and 70’s, I’ll be going a lot more.

Our babies birth will be covered 100%, but I believe that’s from my companies health insurance choice, and not a Gov mandate.

Yeah, I know how you feel. My insurance company is forced to cover cleft palates, I will never use it yet my insurance premium is now higher than it would have been otherwise. Why can’t I get a policy that excludes cleft palates?

My insurance is forced to cover hysterectomies, and being that I am a male, will never have one, yet my premiums are now higher to cover those who need that procedure.

Oh, wait a second, maybe that is what insurance is all about? Maybe it is supposed to cover almost everything because you can never be sure what might happen? Do you think?

Maybe it is called, spreading the risk?

That’s a good point, but along with spreading the risk it would also help enormously if everyone had real skin in the game as well. That would mean a return to the old insurance model of 20/80 for all medical expenses, where the policy doesn’t kick in until the subscriber ponies up the initial 20% deductible. I’m old enough to remember my first health insurance policies reflecting that structure, and I was very careful in reviewing my medical bills (as well as scheduling procedures and visits). Most folks have no idea what medical expenses actually cost these days, high time for a re – education.

Cali has an spending, and an overpopulation problem. There are plenty of jobs out there, and plenty of big buildings with names on them and workers inside making lots of money.

Problem is, outside those buildings, there are more people than the state can handle. Thus, poverty, social services, etc. If all the poor moved away and only those employes stayed, it would solve a lot of problems.

Wow, this is a great idea – get rid of the poor and unemployed and you’ll instantly bump up the median household income and slash social services costs, ha ha

But where do you want to send them to? To Foxconn in China to make more iPhones?

If you lost your job, would you agree to leave California as well?

Untrue, the commercial vacancy rate is on the rise, and even at six-figure income, the gas for commute back to the suburbs is killing them!!

What about the piggy back loans for people making less than 6 figures subsidized by the state ? They don’t have to pay PMI and they are leveraged higher than anyone else. PMI is a fraud. Banks should simply charge higher interest for risky buyers.

Things will work themselves out just like the good doctor says. When the state is on the brink of collapse, budgets will be cut. To all the discouraged renters/savers, don’t be so eager to jump into the fire. You’ll be able to put half down on a house soon.

Leave a Reply to Brian