The financial abyss otherwise known as the California budget – 6 charts showing a challenging year for California housing and economy. Rental vacancy rate adding pressure to buying a home, per capita income down, and lost decade in homeownership.

There was little financial sunshine in the proposed California budget released on Monday. As we have stated before the only way that California was going to start fixing its budget was with cuts and higher taxes. Short of a massive boom throughout the state there has been no magical business sector like technology or real estate that suddenly filled the state coffers. The preliminary budget looks to cut $12.5 billion in spending and seeks to maintain current revenues with a likely ballot measure that will hit in June. There are large implications here and housing is simply one facet of this multi-dimensional puzzle. I find it hard how anyone can view the current California financial environment and somehow think home prices will go up. It defies reason and ultimately home prices will come down in many inflated housing areas that somehow think that the massive state fiscal problems will not impact their tiny city island. Ironically lower home prices will bode well for the majority of the economy since it will free up more disposable income for spending on other goods. First let us look at the California budget and where revenues come from.

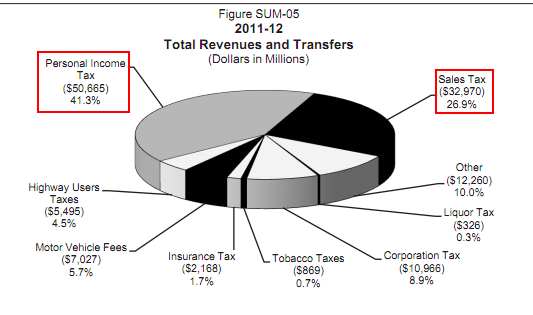

Chart #1 – California Budget

The current state government is coming to terms that we are not going to have any surge in revenues any time soon. So that leaves two options on the table; if we want to keep government as status quo then funding for spending will have to come from somewhere (i.e., taxes). If the people for example vote down the ballot measures in June you can expect more layoffs at the state level. Now in healthier times this probably would not impact the state economy much but right now unemployment is so incredibly high in the state that these are both painful decisions to make. If you look at the above chart you clearly see that over 41 percent of state revenues come from the personal income tax. Now logically you can figure out on your own that with less people working and many working in lower paying jobs that this line item will shrink (and it has).

The second largest line item is from the sales tax. This area accounts for over 26 percent of state revenues. Again in the current financial environment spending has also come down especially with the HELOC machine shutting off in California. These two items make up the bulk of revenues and completely rely on the health of the overall economy.

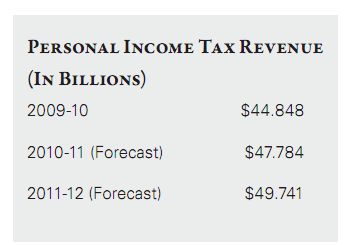

Chart #2 – Personal Income Tax

The above projections have always been much too optimistic and that is why California has always faced reoccurring budget shortfalls. Each year serves as a baseline and rarely allows for any variance in terms of facing a contraction. Now if the state is hauling in money then problems can be plastered over and the tech and real estate bubbles provided this cover for many years. That cover is no longer available.

So you have to wonder where this money is going to come from. You can cut but is there any appetite for additional taxes? We will find out in June when it is put to a vote. Either way much of this does not bode well for the housing market. How can this be seen as positive? If taxes go up then that means less money to spend and if more cuts are made, you shrink an already small pool of home buyers. Basically there are no easy options on the table.

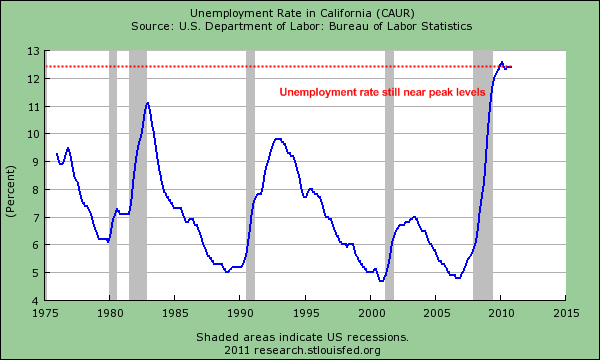

Chart #3 – Unemployment Rate

I’m amazed how little coverage has been given to the California employment market. California is in the midst of the highest unemployment rate since the Great Depression but rarely do you see anyone talking about this. This isn’t some kind of monthly aberration but the unemployment rate has shot off the charts since 2007.

If we really look at the overall depth of this problem, it is much worse. The unemployment and underemployment rate is up to a startling 23 percent. Given the incredible amount of shadow inventory in the state it is very clear that many people massively over extended their budget and really had no ability to pay for their home. Some of this stuff is leaking out into the anecdotal economy in odd ways. I have seen on many occasions BMWs or Lexus SUVs pulling up to recycling centers with giant black plastic bags of recycled cans and bottles. Now I’m all for recycling but the lines have grown and many wait it out for a long time to cash out. I can assure you that in 2005 and 2006 there was no way you would have seen this. Given the above data things are much worse than people are letting on. Only in California will you see someone in a leased $80,000 car and a studio apartment in a bad part of town.

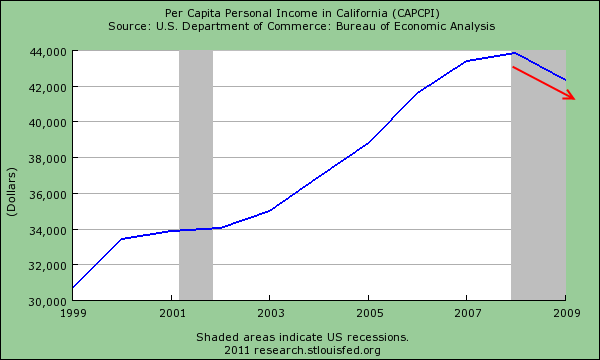

Chart #4 – Per Capita Income

Per capita income has fallen steadily since the recession hit. The latest Census data shows this trend in nominal terms. The above is probably one of the bigger reasons why home prices will continue to fall. If incomes are falling it is likely that home prices will fall as well. The only way home prices go up in this market is bringing back high leverage toxic loans. So far the market seems to have little appetite for being suckered into another giant make believe Ponzi scheme.

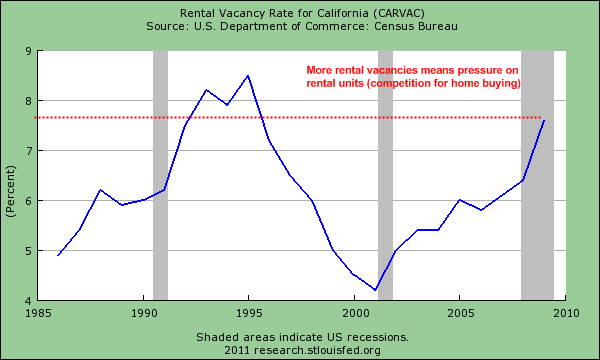

Chart #5 – Rental Vacancy Rate

If it isn’t obvious to you already renting in California is a solid alternative to buying. With the rental vacancy rate at decade highs there are many options for potential renters in this market. The fact that the vacancy rate is high means there are more incentives out there in terms of lower rental prices or more locations so this adds pressure to those on the fence between buying and leasing. As long as certain markets remain inflated inventory will continue to stack up until a slow correction evens out the price discrepancies.

Many younger Californians are also moving back home simply because of the job market. This has actually shrunk the demand for new household formation. More added pressure to the already large amount of inventory lingering. As we have seen in the Inland Empire or Las Vegas low home prices can cause a surge in buying behavior but price reductions have to be substantial.

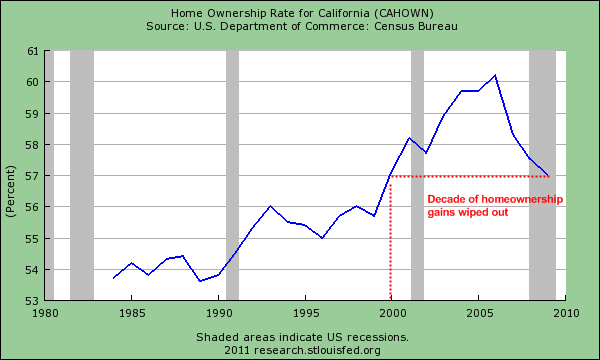

Chart #6 – Homeownership Rate

You know all that homeownership gain we had in the last decade? Well we can pretty much wipe it away for California. We are now back to homeownership levels of 2000 and this is likely to decrease even further given the backlog of distressed properties. Having a high homeownership rate without having a solid and robust economy is like having a nice car shell but having no engine. What is the point? You need something that can actually move and sustain the vehicle in motion (work) and keep it running (a paycheck).

It is a weird feeling looking at the above charts. What was really gained in the last decade in terms of economic progress? Are we better off? If we look at the above in aggregate it seems like we were living in a video game where the ultimate goal was to jump into the McMansion and score a HELOC by refinancing as many times before time ran out. Entire industries were built basically revolving around housing obsession. I remember talking to people who pulled money out of their homes on a yearly ritual as if it were no different than Thanksgiving or Independence Day. It was financial madness. And here we are today with looming deficits as far as the eye can see.

Until we see sustainable and good job growth housing prices will keep going lower. Why in the world will they move up? It defies logic. Many still have a hard time coming to terms that much of all housing price gains in California over the last decade were largely because of a bubble. Strip out the bubble gains and what are you left with?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

46 Responses to “The financial abyss otherwise known as the California budget – 6 charts showing a challenging year for California housing and economy. Rental vacancy rate adding pressure to buying a home, per capita income down, and lost decade in homeownership.”

Jerry Brown is proposing a 10 % cut in pay for state employees. There will also be more furloughs for city, county and school employees. This will reduce the purchasing power of a large segment of the California working population. It seems that wages are going down faster than house prices.

In regards to what the Dr. mentioned about recycling, I’m seeing the same phenomena occurring in my area. There are long lines at the recycling centers, and this is at noon time on a Tuesday. People are definitely finding ways to make extra money.

Much of the dollars paid for recycling is actually subsidized by the govt. Scrap aluminum cans and plastic bottles aren’t worth but a fraction of what the redemption value is. Another govt ponzi scheme, suckers lining up like a soup line que. We all feel warm and fuzzy inside about keepin it green, and a politician sold the program to us for our votes.

That subsidy comes out of the Calif. treasury. All that bottle deposit money used to mostly go unclaimed and was pure profit. No more.

A billion here, a billion there . . . .

Oregon was one of the first states to start deposits. 5cents back in 1972! That is like 30 cents now. A friendly neighborhood kid could make a lucrative living!

If you paid 5 cents, you got 5 cents, any store that sold bottles or cans with deposit were required to buy them back. It wasn’t a big deal because the burden was shared amongst every retailer in the state, not just a few.

Unlike now, here in CA, you pay 5 cents, you get 1.5 cents.

Does anyone know how to get all of it back?

Dang, and here I am putting the recycling out to the curb every week, for FREE… where can *I* get in on the “green” scam? (Preferably at the wholesale level, lol.) How many $10k/plate “fundraisers” do you figure it takes to get an “in” with the faux-green scheme?

Regardless of what Bernanke said, I’d be willing to bet that there will be a bailout of the states. It will be another “Tanks in the streets” speech. His wording of “no loans to states” may be correct as it will have to be flat out gifts IMO.

You can’t cut enough services nor raise taxes enough to get out of this pickle.

All that needs to be decided is what catchy acronym (TARP, TALF, HAMP) are they going to use?

I vote for State Citizens Relief Of Terrribly Underwritten Munis.

SCROTUM

SCROTUM! Bonus points for creativity…. if S&*T My father says can be a sitcom, maybe you could get a job. That’ll help the CA economy.

LMSO!… so you’re saying the rest of us are left holding the… sack, so to speak? ;’)

Crikey, it’s going to take a LOT of gallows humor to get through this… 🙁

ok all the doom and gloom charts, but lets not forget the sun is always shining in California, with such a great climate does it really matter that people don’t have jobs to go to ? who cares about high taxes when the weather is sooo nice ????? Has to be worth at least $25,000 per capita

Yes, but, that is negated by the earthquake scare/brushfires/mudslides/sit in traffic all the time factor.

Who cares. I love So. Calif. I’ll take it warts and all! A native Californian!!!

I almost fell out of my chair yesterday when Jerry Brown said he would pursue a 5 yr temporary tax increase. Not gonna happen, the last temporary increase that was put to a vote was shot down by 65%. There is no chance in hell this will pass in June. I hope they have Plan B ready which is massive cuts to everything…let the rioting begin. And this can’t be good for CA home prices either!

It’s a five year extension of the higher tax rate currently being paid.

i hope you are right. On my way to the gun shop right now.

Unfortunately, the leased luxury car & bad apt analogy holds true for most larger urban cities, where the dupe or dupette thinks recovery is just around the corner. Even before advertising picks up, you will see smaller local paving companies start to accumulate a backlog. So, when a friend who owns a medium sized paving firm noted, all he does is “push snow and patch potholes”, you’d better take notice. They’ve been in biz since 1946, no debt, but he and his two younger brothers have had to cut their salaries by 50% during the winter months. And this guy is so tight that he has never had a phone in his house. If he’s needed he has his Motorola 2-way in his pickup. So much for the recovery, at least in the Carolinas.

Illinois is trying to raise the personal income tax from 3% to 5.25%.

Top income tax rate in CA. is already nearly THREE times what it is in Illinois, and STILL the budget is deep in the red.

What on earth do the clowns in Sacto. spend our money on.??

Oh, I forgot. Every state worker deserves FREE medical care for the family, for LIFE,

and a generous pension at age 55, adjusted for inflation, of course.

Max:

Amen to your comments. I’ve seen it first hand. Its ugly. Most of these people are arrogant about their government positions. I sometimes think its just another form of welfare, but so much more lucrative.

There’s another factor that you haven’t mentioned: health insurance costs, particularly for the self-employed. As you may have heard, Blue Shield is trying to raise rates on its individual policy holders by 59%!!! Blue Cross is pulling similar shenanigans. When you pay 20 or 30% of your income–assuming you even have any–for health insurance–not health *care* but just premiums–you don’t have much left over for anything else. There are lots of self-employed people in California. This nonsense has got to be hitting hard. It’s certainly affecting our family! Add in the ridiculous house prices, and something’s gotta give.

Hey Doc, I don’t know about the state budget but they are still doing the same thing about increasing taxes with out thinking about jobs. Any tax increases is likely not going to generate a straight line increase in revenue. I’d love for the discussion to be about encouraging businesses and industries to move here or stay here but that isn’t in Brown’s notebook.,

I’m still looking at beach area homes. The market is still so inflated. It is just about as bad as 2005 right now. So they have managed to keep prices high for longer. I’d like to fast forward to the end of this.

Right– certain neighborhoods, near the beach, or Bev Hills or La Jolla have international cache… and market demand independent of the local, regional, state or even national economy. I think those particular ‘hoods may be at or near the bottom… And with rates going nowhere but up— now or soon may be a reasonable time to jump in!

Dr. Dave, you SLAY me with your tongue-in-cheek lemming-esque humor! Touche’!

I don’t think Dr. Dave is that far off the mark. High end areas are not going to drop to reasonable values. Most people in Beverly Hills have an income of 500K year plus. Much of that income is from investments that don’t require them to have a job. So to think that average joe is going to be buying in Beverly Hills is wishful thinking.

So stop wasting your time waiting for prices to come down, use that time to figure out how you can earn more money. As you can control your income a lot better than you can control the entire housing market.

Excellent analysis. Thank you.

“The only way home prices go up in this market is bringing back high leverage toxic loans. So far the market seems to have little appetite for being suckered into another giant make believe Ponzi scheme.”

That is my answer to the pundits and talking heads, and, especially, politicians who say “it’s all about Jobs. Bring back Jobs!”. So, if somehow the UE numbers went down into the 6% area, home prices still wouldn’t “recover” to peak levels unless those people got no money down pick a payment loans from the friendly local bank. How else can one afford a half million dollar shack on a WalMart wage? It’s easy to say that won’t happen, but, my cynical side is prepared for it to, but, not tomorrow. Maybe in a few years. After all, a person can walk into a domestic auto dealer these days and drive out in a massive, overpriced pickup truck with no or very little money down, regardless of credit score. (well, maybe 600 minimum) Did you think that would be possible when the stuff hit the fan a few years ago?

Remember, Japanese residential real estate is still way underwater twenty years after their crash. Twenty years, and, their UE is around 5.5%.

Remember though, Japan’s unemployment may be “officially” unemployed, but the perpetually underemployed, part time/temp/contract employment makes up an enormous chunk of the employed. At least a quarter to a third of employed Japanese are just playing a roundrobin game of moving job to job, all transitional, temporary, contractor positions.

Haven’t you just described a large and ever growing “chunk” of the American workforce?

I think the whole CA “depression” is overblown. The local paper features stories about “homeless” or “jobless” who live in hotels, drive BMW’s and keep their wine collection in storage, or live down at the beach with their laptops and iphones. Local news features people in line at local food banks, or for free meals…many are obese. Most “needy” people holding signs asking for money appear to me to very likely have substance abuse issues. I know several unemployed who won’t consider a job unless it pays near what they made previously; “networking” on Facebook ten hours a day is their new career; one can’t work now because she’s “depressed”. Hard times…it’s starting to seem like a joke. I wonder what folks who lived through the Dust Bowl, Great Depression, etc. would think our California Hard Times? Maybe if the Tom Joad from “Grapes of Wrath” lived in 2011, he’d be on a laptop at Starbucks, blogging about how tough life in Cali is between sips of his Caramel Latte.

Home values have fallen 26 percent since their peak in June 2006, worse than the 25.9-percent decline seen during the Depression years between 1928 and 1933, Zillow reported.

California’s unemployment rate of 23% is close to Depression levels.

The Okies came here in the Depression, now is the time for California people to pack up and leave to greener pastures, such as the Promised Land of Texas.

yeah, sipping his Carmel Latte paid for with an EBT card!

I have a solution: More sobriety checkpoints! More tickets! *snicker*

I don’t know about you folks down south, but the cops up north where I am have definitely taken a turn for the worse in the past few years and it seems to me that there’s probably a connection.

The next town over (Petaluma) basically goes on lockdown a few times a month like it’s the Iraqi green zone. While sure, it may pad their coffers a little bit, ironically it also causes a people to simply not go there on the weekends, because they don’t want to deal with the armed tax collectors, lowering their sales tax revenue.

And unfortunately, I don’t see it changing anytime soon.

The weather is nice and the borders to foreign money are open. Compared to the rest of the world, we’re still politically stable and free.

Expect a lot of “safe harbor” money to come in and buy a little piece of America as a backstop base.

That’s what I’m seeing in the SF Bay Area, specifically Silicon Valley.

Ultimately, house prices will rise when inflation hits and hits hard. Houses and real estate are hard assets which are especially preferred over cash during inflationary periods. If one can buy with borrowed money BEFORE inflation sets in, you can pay back in devalued currency.

If you’re a foreigner holding some US currency, now is the time for you or a member of your family to qualify for a government loan for a house in California.

I don’t see that happening, quite honestly. House prices are still too high, as has been clearly displayed for many years by the author of this site. They will continue to fall until a balance is struck between them and the ability of people to finance them. That is, until house prices are down to the range of 3-5 times their neighborhood’s annual incomes, there is no force to cause them to rise. While it is true that inflation may raise wages, two other factors are will likely be stronger components in determining the path of house prices:

-Unemployment. No work = no money to buy a house. Period.

-Wages trail inflation. Even if wages rise, they will be delayed vis a vis the overall inflationary trend, if one appears.

-Inflation means higher APR’s on loans. This will happen more or less in lock step with the inflation. That means less borrowing power, which in turn would not support prices rising.

The last few years of Fed, Treasury, Presidential, and Congressional behavior has shown that they want to ignite inflation on such a level to counteract the deflation inherent to the bubble bursting and subsequent credit contraction. The problem is, by slowing or stalling the crash, you also slow or stall the recovery. Due to the joblessness factor of the current economic landscape, if we do see any significant inflation now, it will likely be in the form of stagflation and not recovery.

“Until we see sustainable and good job growth housing prices will keep going lower. Why in the world will they move up? It defies logic. Many still have a hard time coming to terms that much of all housing price gains in California over the last decade were largely because of a bubble. Strip out the bubble gains and what are you left with?”

Doc:

An entire generation was raised that was showered with all of the benefits that a strong nation can offer its young.

Yes, there are those who learned the value of a dollar and who learned financial prudence and moral strength from their parents and grandparents. Unfortunately they are in the minority.

The vast numbers of the rest of them really do not know anything other than to be sheltered from consequences.

For that generation, its difficult for them to imagine any reality other than the world wherein they were raised and sheltered. To them, their reality is that “real estate always goes up” since that actually occurred over much of their lives.

Now the reality has changed however I think its hard for them to grasp anything other than what they’re used to experiencing.

I think things have to get a lot worse before home prices in safe/desirable areas come down. Remember, these areas have hard-core experienced homeowners that got to where they did through leverage and buying and selling real estate for far more than historic increases in property valuations.

They are not going to go down without a lot of pain since sacrifice is not an action that they were raised to accept. They can afford to wait it out unfortunately.

http://www.generationzeromovie.com

~Misstrial

First, Jerry is not proposing a tax increase, just keep it the same. Like the Bush tax cuts at the federal level, they stay the same. The continued savings in federal taxes will fund the current California tax structure for this year.

California is a $1.7trillion GDP economy. The deficit is insignificant. $25billion out of $1.7 trillion is just in the rounding, insignificant(1.5%). The world is not coming to an end.

In regards to the house prices. They will only go down as much as the bankers will allow, which is not more than 5-10%, if any. Remember who our “overlords” are. I am going to buy a new Lexus this month. Party on. People who have job troubles, can leave and go to Texas, the Promised Land.

Finally some common sense on this site. Thanks for putting it into perspective.

“First, Jerry is not proposing a tax increase, just keep it the same. Like the Bush tax cuts at the federal level, they stay the same.”

Wrong. Bracket creep and the scam of percentages without cognizance of inflation causes a greater and greater amount of your income to be eaten by taxes over time.

“California is a $1.7trillion GDP economy. The deficit is insignificant. $25billion out of $1.7 trillion is just in the rounding, insignificant(1.5%). The world is not coming to an end.”

Deficit is nothing. It’s the accumulation of deficit over time that produces toxic unsustainable DEBT, which devalues the state’s credibility and credit.

“In regards to the house prices. They will only go down as much as the bankers will allow, which is not more than 5-10%, if any.”

Wrong again. Home prices have dropped by 25-30% since 2006.

“I am going to buy a new Lexus this month. Party on. People who have job troubles, can leave and go to Texas, the Promised Land.”

Party on for you. Meanwhile, your state is failing. Wake up chief. It will catch up to you, too, even if you do think you have plenty of cash in the bank to ride it out. It will get ugly when money can’t buy your way out of the crime that washes blood onto your street.

Income drives home prices here is a couple zips: 95409 whiter middle class Northern Calif with medium household income: $64K currently 85 homes for sale with a average asking price of 450K average 91 days on MLS.

94558 medium household income 60K (Napa) 271 houses for sale average of 600K, 164 days on MLS.

Took these numbers off REDFIN active houses in these two zip codes.

Understand that I write this out of sheer frustration. I live in the Northern part of this state and I see no signs of government spending slowing down here. My salary is paid for by the state. There is so much waste where I work that it is beyond belief. My fellow employees talk about it and they are sometimes amazed considering what the state is going through economically. Some of these well paid employees believe their cushy job is an entitlement. I wish I could be more specific, but of course I would have to front out my own situation. I work around some people who can’t get to work on time and many more who are just plain incompetent. Understand, every job comes with retirement benefits, medical benefits, sick leave, retirement and so much more. The unions are untouchable and will never agree to any meaningful change. This mess was created by previous governors and a state legislature that courted union votes and engaged in irresponsible and profligate spending. How is it that this group of privileged government employees enjoy huge benefits while most of the middle class is struggling to make ends meet? What about the 23% underemployment rate? Yes, they get to pay for these benefits while the privileged few live care free. This cannot continue and is not sustainable. Democrat or Republican there is plenty of blame to go around. We can only hope someone with real courage will step forward, identify the problems, and have the wisdom and power to make the necessary changes.

I am a contract worker and I often work for government agencies. When I am on-site they tell me to slow down, and you don’t need to work like you are in the public sector. It’s all about work life balance they tell me. But I think their balance is 25% work and 75% chatting and calculating how long they have to retirement and how much they will get.

The only answer is to privatize many government agencies. But the unions have a choke hold on the state, so it won’t ever happen. It’s a complete fiasco and CA tax payers are getting the shaft.

KG,

Try this website State Government Waste.com. Go ahead tell your story.

I worked for Los Angeles city as Intern for 6 months in a IT department. The group I worked for had 8 people, including me. Off the 8, only 2 knew what they were doing, the other ones none/zero. Couple of them told that they were placed in those IT positions because their old position was removed, instead of laying off. They were just waiting to retire in few more years.

I used to check their openings for Entry Level Technician, the minimum pay was $25/hour. Can you believe that?

PRKali is going to have to cut state salaries (and bennies) more like 20%… or even 25%! Those who “riot”, fired for cause. Next.

You have to love the irony that it’s going to be Left-of-Left “Governor Moonbeam” who ends up breaking the gov’t employees’ unions, LOL!

I have news for the union-bashers on this list: we didn’t steal $14 trillion of your tax money. Wall Street did.

Teachers’ unions didn’t underfund public education for 30 years. Our $1 trillion annual military-industrial complex — an utterly sordid waste of resources, fighting an enemy which doesn’t even exist anymore — did.

States aren’t going broke because of greedy civil servants. They’re going broke because banksters blew a 35-year credit bubble, wrecked the economy, and left us taxpayers holding the bag.

More and more, my country resembles post-Soviet Russia. The US is in the grip of a failed dogma of free markets, precisely where Russia was in the grip of a failed dogma of the one-party state.

Teachers’ unions didn’t underfund public education for 30 years.

What?? Ever hear of Prop. 98? A state constitutional amendment that REQUIRES 39+% of the state budget be spent on K-12 education? We have the teachers’ union to thank for that, and for making us 49th in the country in educational performance.

If you belong to a union, you should be ashamed. Unions are un-American, and have caused most of California’s problems.

Reminds me os a joke going around the streets of Moscow these days.

The citizens of Russia have learned that everything their leaders told them about communism was wrong. And everything they told them about capitalism was right.

Leave a Reply