California home equity hangover – $649 billion in HELOC loans nationwide with most in California. June 2005 92,000 HELOCs in California compared to only 22 in March of 2010. The evaporation of an industry and three examples of refinancing gone wrong in Culver City and Pasadena.

In the last couple of weeks, there seems to be a renewed interest in home equity loans and home equity lines of credit (HELOC). I think many people have put this mutant mortgage out of their mind because in the last few years there have been very few originations with these kinds of loans. You would expect the renewed interest given that many homeowners, especially here in California are massively underwater. These usually come out during the foreclosure discovery process. Yet HELOCs were the virtual credit card that turned a home into a modern day money piñata. If you needed money just take a swing over to the bank and they would cut you a check. I remember colleagues driving up in new cars and taking vacations courtesy of the wonderful HELOC. As we will examine today, these loans are as toxic as they get and when combined with an Alt-A or an option ARM, will cause further deterioration in the housing market especially for California.

HELOCs and California

I’ve had a few good talks with Keith Jurow from the Real Estate Channel regarding the issues facing the California housing market. He has put together an excellent article covering the nuts and bolts of the history of HELOCs especially when it comes to California. I highly recommend taking a look at his article. During this same time I have had countless e-mails from Californians asking about HELOCs on their neighbors homes. Where did the money go? First, let us examine the market in detail:

Source:Â Equifax

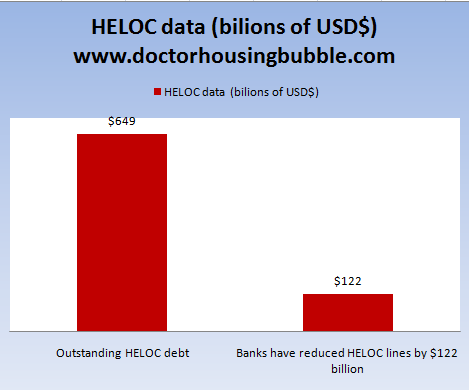

Currently $649 billion in HELOC active debt is floating out in the market. This is an enormous amount especially when you consider a large portion of it is worthless yet banks would like to leave it on the asset column at full face value. To put this in perspective, the outstanding credit card debt in the U.S. is approximately $826 billion. Since the crisis has started and homes have fallen from their peak, banks have reduced HELOC access by $122 billion. That in itself doesn’t do much for that $649 billion still outstanding. These loans are secured by real estate that is likely worth less than the total loan balance even with only the first loan. HELOCs are junior liens and in foreclosure are usually wiped out. What some people also forget is you have some banks being the first and second note holder. These toxic loans were the fuel that kept the economy going for the housing bubble decade especially for California.

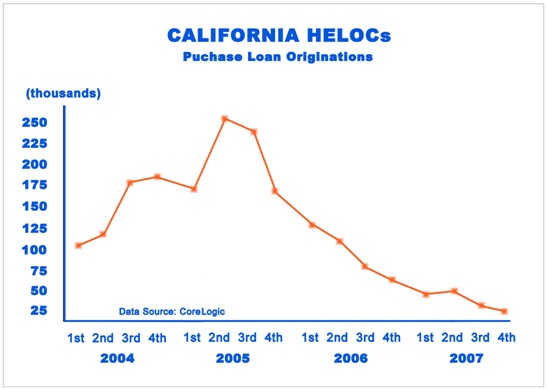

Just take a look at how many of these loans were originated in California during the bubble:

Source:Â CoreLogic, Real Estate Channel

California was pumping out HELOCs like donuts at Krispy Kream. I’m sure anyone that lived in California saw the real world effects of the home equity ATM. Some in middle class neighborhoods suddenly saw their neighbors with nice toys because of the housing boom and all the debt access it provided:

“(L.A. Times) Bernie Doyle, 54, just wants to get back on a building site.

Before he was laid off in 2009 he made nearly $90,000 a year as a construction supervisor on high-end apartment projects in San Diego. He bought a 26-foot boat that he and his wife, Suz’Ette, took out nearly every weekend. He had a sense of pride each time he finished a job on schedule.â€

And this wasn’t only a California problem. People didn’t refinance to save the money. Look at this 2006 article from the New York Times:

“Borrowers no longer “ask me what is the quickest way I can pay off my mortgage,†said Jack Williams, the president of the California Association of Mortgage Brokers and a broker in Orange County. “I haven’t heard people say that for 15 years.â€

Many home buyers, however, say they have used adjustable-rate mortgages to manage their finances in the short run with the expectation of going to a fixed-rate loan.â€

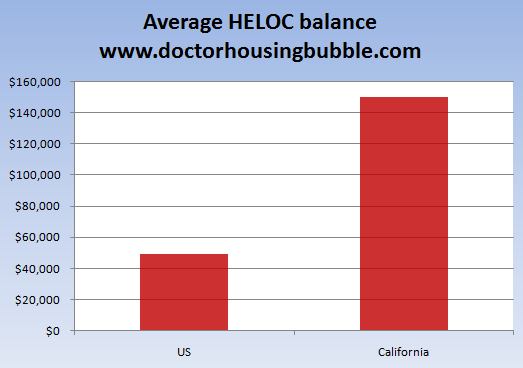

Manage meant “I need money because my car is two years old and I’ve only taken one cruise this year.â€Â This is at the core of the problem. People for decades used to view equity and paying off the mortgage as a goal to go after. The home equity loan is only a recent phenomenon. In this last decade, Americans not seeing real gains in income decided that they still wanted to maintain a growing standard of living and used homes as piggybanks. California was the guiltiest of all the states. Cars, vacations, pools, home upgrades, and those ubiquitous granite countertops all seemed like a new financial right. All that was being done was flushing away any equity that was built in the home. Take a look at the average HELOC data between California and nationwide stats:

The average HELOC balance in California is three times the size of the nationwide average! This is incredible. In fact, the average balance of a HELOC in California is close to the current median price for a U.S. home. HELOCs are probably reason #15 why banks are dragging out the foreclosure process as long as possible in places especially like California. Where other first lien mortgages can be funneled into the trash bin that is Fannie Mae and Freddie Mac, second mortgages are usually valueless and reside in the balance sheet of banks. Many of the too big to fail banks have these sitting on the balance sheet at full face value.

Let us put a real world example out there to see this in action. Let us take a look at a few homes, two in Culver City and Pasadena that played the home equity loan game:

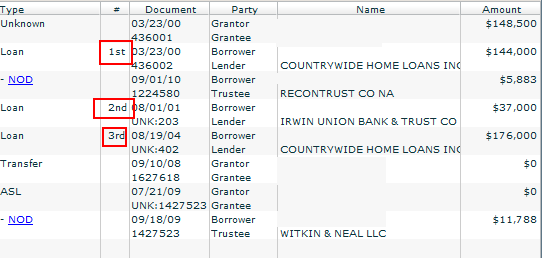

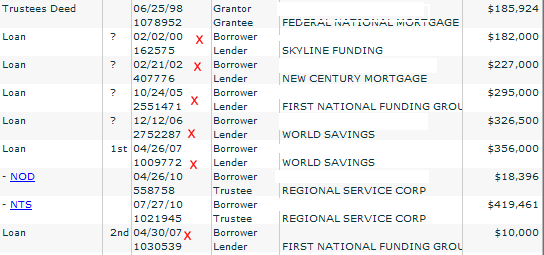

Culver City condo

The above is for a small 849 square foot condo in Culver City. The place was last sold in 2000 for $148,000 (that is the first mortgage). Someone needed a bit of cash in 2001 and took out $37,000. Not that big of a 2nd mortgage right? But then three years later a third mortgage was put on the place for $176,000! The place now has over $350,000 in mortgages while the property is probably worth the original purchase price. You notice who the lender for the 1st and 3rd mortgage is? Yup, good old Countrywide Financial.

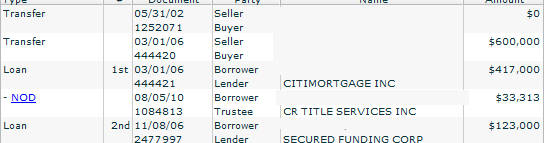

Or take a look at this person that serially refinanced their home:

It looks like every two years, a refinance occurred and approximately $50,000 was taken out each time. Why work when you can earn the median nationwide household income by simply refinancing? Of course that pozni game isn’t going well as you can see above.

Pasadena Home Equity Action

Here is an interesting case of someone paying $600,000 for a home in 2006 and it appears from the note that they initially went in with 30% down. Yet what use is it if 8 months later you yank it out?

This home is a 2 bedroom home with 1 bath. It is listed at 1,169 square feet:

Does that look like a $600,000 home? According to the current default notice, the market doesn’t believe it either.

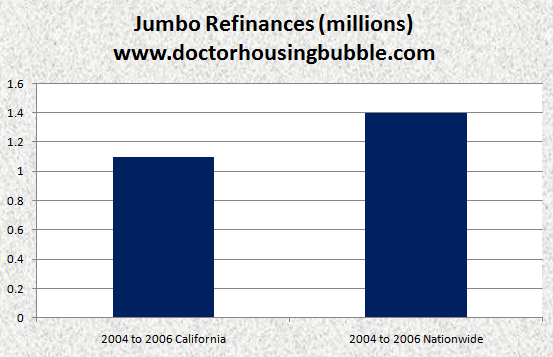

California as the toxic mortgage supercenter also dominated the jumbo loan market:

The above chart leaves me stunned. From 2004 to 2006 nationwide there were 1.4 million jumbo loan refinances. Yet 1.1 million of those were in California! California has the largest nominal amount of toxic loans and when I look at shadow inventory it now crystallizes why banks are moving as slow as molasses on foreclosing. It is a simple crony game if you think about it. Banks have borrowed trillions of dollars from the Fed for close to zero percent and have parked them in U.S. Treasuries. This was bailout money that was supposedly designed to lend to Americans but this is what happens when you trust banks. So the yield on Treasuries is low partly because banks are crowding out the market as a safe haven. 2 to 3 percent might be low to you but this translates into large amounts of money when trillions are at stake. So while HELOCs and jumbo loans fester away, banks are skimming money off the interest and gambling on the stock market to make profits. There hope is that in time, inflation will cause home prices to rise again. That won’t happen because incomes are not rising. Interestingly enough those who have looked at hyper-inflationary cases of Weimar Germany and Chile for example realize that real estate actually goes down during these times even if other items are soaring in price.

Going back to home equity loans and the housing ATM party because this is a big issue for the state. Many ancillary markets like Arizona and Nevada benefitted from California equity giants buying second or even third homes out in the desert:

“(Durango Herald) Phil Satre, chairman of both slot machine maker International Game Technology and utility NV Energy Inc., said he thinks Nevada is at the “bottom of the food chain” in terms of financial recovery, depending on other states like California to drive tourism spending in Las Vegas and other destinations.

“I’m not very sanguine about the prospects of recovery in the near term,” Satre said. “In my view, we have a giant umbilical cord to California.”

At one point in the boom 4 out of 10 homes purchased in Las Vegas came from California money. Since California’s income has been stagnant, it came from home equity funds. People forget that many bought homes with 80/20 or even 90/10 combinations during the toxic mortgage days:

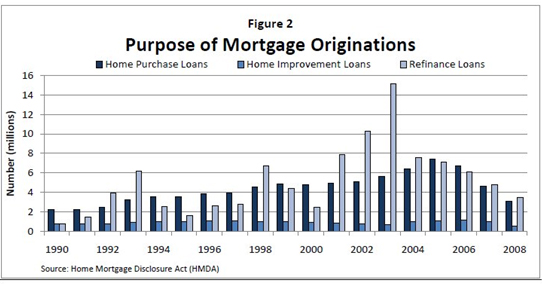

I find it funny how little actually went to home improvements. This is at least on the front end. Yet many did tap out equity and purchase cars, boats, and fancy vacations. That money is gone. That was money that fueled the economy for a good while. Mr. Jurow gives one stat that shows how quickly the HELOC game has come to an end. In June of 2005 nearly 92,000 purchase HELOCs were made. In March of this year only 22 were closed in California.

The fact that $649 billion in HELOCs still remains tells us that we have some major problems ahead. Since most are here in California, you can expect more price corrections for the state and more banks having to make giant write-downs. The toxic mortgage problems will linger unfortunately for years to come.

Do you have any interesting home equity loan stories?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

36 Responses to “California home equity hangover – $649 billion in HELOC loans nationwide with most in California. June 2005 92,000 HELOCs in California compared to only 22 in March of 2010. The evaporation of an industry and three examples of refinancing gone wrong in Culver City and Pasadena.”

I’ve wondered about this. A family on my street did upgrades in the kitchen – – granite, stainless steel, subzero freezer. They also have three newish cars, a MBZ, a BMW, and a Volvo suv. The guy is a doctor, stay-at-home wife, three kids….no thank you!!

??????????????????????

I know at least a couple of student debt burdened, broke assed and over leveraged doctors and lawyers, but all things considered, their income is many times that of the average person.

So the wife stays home with three kids?

They have three cars that may be leased, or they may or may not own outright.

and they upgraded their kitchen with granite and a stainless sub-zero.

But not making the connection.

They are living large or larger than the average bear.

I can show you hundred of homes on the north side of Atlanta where the occupants live this way, and by and large, they have high incomes to support their spending.

To each his own.

But the guy is

I say, more power to ya if you can. This is still America, and part of that conspicuos consumption behavior is what made it what it is today for good AND bad.

Sometimes the posts sound like a little class warfare, which I know is all the rage these days with everyone wanting to level playing fields and redistribute and all.

And remember, you had people like the Oropeza’s, who lived High of the HELOC, and then escaped to Texas to avoid the day of reckoning. Dr. HB discussed this case, HERE. Or the Herrara’s, who tapped the well and and went on the $300,000 spending binge.

Things have a way of balancing out over time. If you have any wealth, you had better find a way to protect it because that rebalancing monster will want to devour anything to correct all the wrong-doing, whether or not you participated in the spending free-for-all.

Tyrone,

Looks like the Oropeza’s have returned to California. According to the Ft. Bend County website the house is still owned by Steve Oropeza but his mailing address is 1502 E Rowland Ave. West Covina, CA 91791-1247.

My parents and one of my siblings took out several of these damnable re-fi’s and now both households are underwater and in debt to a level that from which they will never recover. They didn’t spend the money on any lasting repairs (just vacations, fancy furniture etc.) and now both houses are in desperate need of repair, with no funds left to fix them, and _I_ sure as hell don’t want to make capital investments to houses that are essentially owned by the banks.

My sibling shrugs and says “Well, the bank WANTS us to stay, they could never sell the house for what we owe.” And my parents…well, let’s just say that I’ve started laying awake nights trying to figure out how I am going to find a way to finance their retirement without ruining my health, credit or marriage.

There was a couple on ‘Property Virgins’ on HGTV, that actually bought a house purely on the strength of the backsplash in the kitchen. I never really considered how big a …splash, a colorful backsplash could make in a potential sale. But now I do. Move over granite counter-tops, travertine floors and stainless steel appliances, the backsplash is back, in a big way.

Ugh, I think I saw that same episode…

Geesh!

On the power of a backsplash?? Wow, every year that goes by since Lehman brothers took a dive proves to me that PT Barnum was right- there IS a sucker born every minute, and they’re all buying homes!!

Don’t forget the surge of purchasing Condos in Mexico with Heloc funding in USA

The wise have always dominated the foolish. And the prudent have always payed. Just never quite on this scale.

“Currently $649 billion in HELOC active debt is floating out in the market. This is an enormous amount especially when you consider a large portion of it is worthless yet banks would like to leave it on the asset column at full face value. To put this in perspective, the outstanding credit card debt in the U.S. is approximately $826 billion.”

And, let’s not forget the elephant thrashing around in the other room – student loan debt, which just recently surpassed credit card debt in total numbers. http://blogs.wsj.com/economics/2010/08/09/student-loan-debt-surpasses-credit-cards/?KEYWORDS=student+loan+debt And that debt will follow those poor kids until the day they die – there’s no walking away from a college loan.

Put all those numbers together, and it’s obvious that we are descending into a balance sheet depression which will take years to clear itself of all of this debt.

Yet another fine message and effect to our country. Debt to obtain an education is *never* forgivable, but debt to buy a piece of worthless trash is totally forgivable.

Unbridled capitalism is one thing, unbridled GREED is another, this country has been run by greed for some time.

Well, America won the world over with capitalism, but it forgot about the decency of mankind and freedom. Let’s see how the world ends up now that you have a working class (poor, indentured slaves to banksters/corporations) and the Bourgeoisie.

Student debt isn’t that hard to get rid of (at least it wasn’t recently.) Buy a house, HELOC it, pay off student debt, quit paying mortgage/HELOC. Student debt gone.

As a Realtor in the Palm Springs, CA area, I have been handling Short Sales for years now. HELOC’s are not wiped out in Foreclosure. HELOC’s are considered persona loans and the bank has probably sold your HELOC note to a collection agency which may or may not come a calling. Negotiations ensue to get it settled. In a Short Sale, we try to negotiate this paydown on the HELOC before it ever gets to Foreclosure..at least SOME of the money is paid back!

I laughed last year when Wells Fargo was paying out a bonus to the CEO. They had like 86 billion dollars in HELOC. With probably 60% in California. If they had to mark those loans at fair market value. They would not only have lost money on the year. Their capital might even be below even. But thanks to the new accounting rules. This is only going to uglier in the next few years as the banks keep delaying the real truth.

I’ve used HELOC debt in the past, but only in a manner that would maintain or increase the value of the house. No granite, though. Can’t stand the stuff.

Many credit unions here in New England are still offering HELOCs, usually capped at 75% LTV. Much higher than that and this state-level financial regulator just points to California on a map. Management quickly gets my point.

Yeah, I know a guy that owned 2 houses in Las Vegas and lived in a small apt. in Los Angeles. Don’t know how he did it, but I know he is not legal in this country and also used to sell toys in the downtown area. What I do understand now is how he could afford his nice SUV.

Well, I blush to admit having taken an HEL when I refinanced from fixed 30 to fixed 15 in ’06, in line with our ’01 pay-ahead plan (pay down the 30 to 15 in 6).

The HEL amounted to under 3% LTV, and paid for a new roof and exterior paint job for the house–two things that we felt made sense to pay someone else to do, and faster than we could. Oh, yeah, and we went with the same lender–a snug and responsible local nonagenarian S&L.

So this “financial tool” can be very useful if wielded within a larger context of reason and prudence. We kept saving at our usual aggressive rate during the fat times, and now are paying back the debt at a very low rate of interest.

Our kitchen is the original 1980s one. Ugly but functional. Our one car is small but efficient and not used much. And so on. And so forth.

Around here, the owner-occupant builders are now putting their own and other people’s offspring into these vast luxe barns they built and planned to sell to retiring Californians at the top of the market. These offspring are getting a very sweet deal, whether buying or renting. They are paying under market value, and less even relative to what we in our more modest homes with modest mortgages modestly managed are paying.

It seems odd that these twentysomethings should have 4500-square-foot McMansions as their “starter” houses. And it surely isn’t challenging the perception of deserving everything for having scammed, lucked, or fallen into it, rather than working to save and build. To put it another way, this crash doesn’t seem to be teaching much character yet, does it?

rose

I know the feeling. I’ve been in this house since 1994. She was built cheap back in the 1870s (still “new” for New England) and the 1989 addition was cheaply built as well. She’s never suffered from an owner with sufficient cash to really fix the place. I’ve spent years chasing down and fixing the plumbing and wiring gaffes committed by a host of former owners but when it came time for the roof and the septic system, well, HELOC debt made more sense than raiding retirement & college savings. Besides, I raised the value sufficiently to refi (rate & term only) at well under 80%. Couldn’t quite pull the trigger on a 15-year, but I pay the mortgage at about a 20-22 year pace. Given recent rate reductions, I may need to look again. Next items to tackle are removing the 2 walls of remaining (exterior) asbestos siding and replacing the worst of the old windows that have no R-value whatsoever. As always, it’s a piece-by-piece slow upgrade.

Thank you for this thread – the HELOC curse has hit most of the LA metroplex. Can you do a new thread on Santa Monica North of Montana? My office is in the area and if I want to have a really short commute I need to live North of Montana. Schools are good North of Montana as well. If possible do a thread on how much off the peak houses are

All due respect Stu, can we not infect yet another blog with “the 90402” syndrome? You may care, nobody else does.

I have the 90402 bookmarked on Redfin. I’m watching the lower, 90403 – 05 end crumble by putting the max price at 450K and watching the the price per sq/ft drop as tiny one bedroom condos make price reductions. As this creeps up the hill towards the houses North of Wilshire the bubble immunity theory of Santa Monica will eat away at the houses also. I figure a target floor of 350. sq/ft in 90404 within a year and then the houses will drop. This doesn’t include the 9 mil. houses dropping to 7 mil., but more reasonably priced houses that families live in and not the super rich guys who have too much money to spend.

I think it’s a bit of an oversimplification to say that all HELOCs are evil. If you’re using one to upgrade your lifestyle, then that’s stupid. If you’re borrowing against the “equity” that magically appeared because your home increased in value, then that’s stupid. If you’re borrowing against one with no plan for how or when you’ll ever be able to pay it off, then that’s really stupid.

But there’s nothing inherently stupid about obtaining access to secured low interest rate credit. Actually, as a way of paying for the inevitable home maintenance expenses that you can never plan for in advance and always seem to cost thousands of dollars, HELOCs can be a lifesaver.

We took one out to enable us to pay for the accessibility renovations we had to do to our new home. Since then we have paid it off and now are using it to cover emergency house expenses (new roof last year, a new metal door to the cold room to replace a moldy wooden door this year) and major purchases that we need to make (new fridge when the old one died, etc) that we would otherwise have to put on a credit card.

There is one really smart way to borrow as much as possible against a Heloc, and that is if you are planning on going BK. Sure your credit is messed up, duh, but would you do it if you could make and extra 300K and not have to pay it back? If you made 50K per year, take home 35K and could bank 300K, yea, that doesn’t sound so stupid. I just hope all the countrywide employees who did this saved some of it to get them through the debt hangover the economy is having until they can get another high commission job pushing mortgages again that max the typical families budget.

Many have seen this already, but for those that haven’t, it’s very funny. http://www.youtube.com/watch?v=bNmcf4Y3lGM. Or go to youtube, search “real estate downfall” and click on the first link. =)

I am amazed at a few of the comments relative to the value of HELOCs in covering unexpected home repairs.

a $3000 roof, a steel door?, a new fridge?, some siding etc. Cmon – really?

You mean we’re at the point that if you need a new door or a refridgerator for your house you have to go get a HELOC?

Generally speaking, isn’t this what a savings account is for?

The typical expected annual maintenance for a home should be in the range of 1-3%.

So a true homeowner should be saving on average a grand or two per year with the expectation that eventually a new roof, new air conditioning unit, windows & doors etc will be needed in the future.

While the lowish cost of the HELOC money may seem cheap, the true cost of financing a new roof or fridge, once you include the fees, interest, closing costs etc make it a much more expensive expenditure.

One person posted it was either a HELOC or a credit card. Really? – Those are the only two choices? Not – Well, I guess I’ll have to dip into the ole savings acct.

That’s just plain silly and crazy to buy things like that.

I remember when Greenspan promoted and unleahsed the cheerleader moster post – 9/11.

Originally,after he dropped interest rates to close to 0%, it was porposed as a way for homeowners to lower their payments and have more “disposable income” to juice the economy.

And not the worst idea on the planet, unles you consider most people I knew refi’d a 22 or 24 year mortgage back and reloaded it back into a 30 year term, which I always thought was madness.

Then you had the entire sub-species of humans spring up making 6 figure incomes around the refi and mortgage broker business.

I also remember when they eliminated the interest deductions on consumer installment debt, and it was encouraged that the way aroudn that was to go ahead and buy that car with the equity money. It made smart financial sense they said!

And the banks were only to happy to morph it again by encouraging saps to convert their unsecured credit card debt to..ahem..secured debt using the refi, pay off the ole credit card routine.

But like all things wel lintentioned, it went way off track.

I think to an extent, average, and some below average thinking people were trying to be as financially creative as the corporations and money managers they see engaging in such sophisticated financing.

Problem is, most of the average people who thought they were playing smart with this money were not sophisticated or disciplined enough to manage it.

They got guided by their most basic animal instincts and seduced by the siren calls from Madison Avenue.

Well then, I guess we get the last laugh then. The latest reports are people are much more willing to defult on home loans than credit card loans.

Doc,

I have been a pretty loyal reader since you’ve been doing the blog and don’t criticize it often

BUT, the attribution from the LA times to Bernie Doyle, 54, the construction foreman who made $90,000 a year a construction supervisor on high-end apartment projects in San Diego didn’t really substantiate that he was reckless or abused HELOCS. It sort of smacked of a little schadenfreude.

All it said was that “He bought a 26-foot boat that he and his wife, Suz’Ette, took out nearly every weekend. He had a sense of pride each time he finished a job on schedule.â€

I’m not sure I see any high crimes or misdemeanors associated with a 54 year old skilled construction supervisor making $90,000 (in San Diego no less). That’s not some obscene salary based on a ridiculous housing bubble. He supervises high end apartment complex construction projects. I would think it would be a reasonable salary for a 54 year old with 30 plus years of construction and supervisory skills.

Or as to having a 26 foot boat.

It said 26 foot – not 46 foot. That’s not really much of a huge toy.

It didn’t say it was a 26 foot, carbon fiber, custom offshore racing America’s cup special outfitted with big screens.

Sorry, I didn’t make the connection or get a sense of “I coulda told you so†reading that a 54 year old supervisor who WAS making a decent salary, in a responsible position, probably putting in honest days worth of hard work, with what seemed like a reasonable recreational hobby was a serial refinancer.

The poor 54 year old guy and his wife enjoyed going out on their boat on weekends.

Isn’t that what we used to do for fun in this country before everything went to hell in a hand basket?

Maybe there was more to the story that we didn’t get to see.

But I understand the general point of this post.

California more so that anywhere is overwhelmed with people trying to live the lifestyle they see on their favorite E! show yet trying to do it on their average salaries.

It’s like there has been a gargantuan party for a very long time, and now it’s time to pay for it. This does not look good at all, and it feels like we’re in for an ice age of bad times before this is sorted out…. sigh..

I like to think the economy makes some profit each year that we can use to pay off the debt from previous years. And yes we borrow more each year but we also pay off some of the old debt too. So if this is the case, say borrow 1 Trillion, pay off 100 million, calculated this way what past year’s debt have we most recently paid off? Was it 1972? Have the debts from the years since added up amount to our current balance? And what would this equation look like on a simple graph so we could compare and calculate how long til we get out of this hole and climb back up to a pre 90s style debt load?

.Much as I hate it, but does anyone really want to see one of these “too big to fail banks” actually fail?

I know it’s fun to hate them, but has anyone, including Doc, really thought that through to its logical conclusion?

We are NOT nor have we been in a Depression recently.

But let one or two of the TBTF banks actually fail and we certainly could be.

I’m not sure that all the comments in today’s post are accurate.

You stated that:

Banks have borrowed trillions of dollars from the Fed for close to zero percent and have parked them in U.S. Treasuries. This was bailout money that was supposedly designed to lend to Americans but this is what happens when you trust banks.

That is NOT true.

What you are referring to is generally referred to as part of the FED’s QE.

Not to be confused with what people refer to as Bailouts or TARP.

And to me, I never saw in any of the legislation or news releases associated with these programs where it was legislated that they were to increase lending.

We all kind of crossed our fingers and hoped they would, but any sane thinking person could figure that A- The banks we too scared and scarred to be willing to do much lending, if anything they were going to deleverage, and B – That borrows were either too scared or too scarred to be willing to do much borrowing, and were much more interested in deleveraging.

In order to try to recapitalize the banks, after examining their god forsaken balance sheets and vaults filled with worthless paper, the FED “bought” or swapped the banks garbage for good ole US dollars. Sent electronically to an account. Not real, real dollars – play dollars.

The banks then turn around and arbitrage those dollars, and buy US Treasuries paying as you pointed out, on average 2-3%.

This guarantees them of earning profits even when they would have been technically insolvent.

But that is the point to the exercise.

To try to shore up the banks by offloading some of the garbage they were holding, generate paper profits for them, with the honest expectation that eventually things will begin to heal.

Generally, time does heal all wounds.

Now remember, before everyone goes bananas over the average US taxpayer having to buy this garbage, remember that most of it was generated by average US taxpayers, not some faceless Chinese or Indian home buyers who dumped their mortgage crap on American banks.

I’m no Wall Street master of the universe, but I do not think we would like the scenario of a BOA or Wells Fargo closing its doors on a Friday night and going tango uniform.

If you thought the aftermath of Lehman was bad, having any of the TBTF banks going TU would be cataclysmic.

That would be 1930 ish

Just sayin

True.

A few comments. There is more than $2 trillion outstanding in credit card, HELOC, and student loans. Does anyone really think that will ever be paid off?? Lucky to be able to just service the debt. As someone who has never bought a home I can’t understand why anyone would think it is/was a good investment. You have to take out another loan just to make repairs?

I have a question. With a $500 Billion credit card tab on the books for the family that is California, doesn’t it make sense that until we pay this off there will be no more spending on the stuff that drives the economy. And if foreclosures happen, but the Heloc is at another bank then doesn’t that force the property into the limbo inventory until it’s sorted out. What is that process between the banks and what is the effect on housing inventory of helocs on foreclosures?

Leave a Reply