Real Homes of Genius: Calabasas million dollar foreclosure and multiple foreclosures on La Mirada block with shadow inventory. Home sellers competing with invisible sellers. $500,000 and $2 million home purchases with 100 percent financing deals.

The second wave of foreclosures is now selectively hitting higher priced regions in California. Some areas remain more resistant to price adjustments but given underlying fundamentals, it is merely a matter of time before they face price adjustments as well. The California economy has shown no sign of recovery so to speak of a real estate rebound is premature at best. The real problem with the current market is the amount of artificial and shadow inventory competition with MLS properties. I’m not convinced that the public is fully aware of the enormous amount of shadow inventory. Even if the best case scenario occurs and we have a trickle of properties for years, this assures either stagnant prices or even lower prices for many cities. Why? For the most part, these homes are massively overpriced so when sold, will show a dip in price and this will reflect in the Case-Shiller repeat home sales figure. The median price is subject to more volatile sales in the short run. As long as you are aware of these points, you can use both to determine market trends.

Take for example the Calabasas community in Los Angeles County. The current median price is $1.025 million which is down a stunning 43 percent from one year ago. This is a prime area and home to toxic mortgage ex-superstar Countrywide Financial. Prime areas and mid-tier areas are now starting to look like more shaky areas back in 2007 before they hit major pangs of price adjustments. Today we’ll look at Calabasas and La Mirada closely to see what is occurring in prime and mid-tier markets. Today we salute you Calabasas and La Mirada with our Real Homes of Genius Award.

Buying time in Calabasas

Our first home leads us to Calabasas. The above home is not on the MLS. It is currently in the pre-foreclosure stage which as we all know, can drag out like a boring movie the way current banks operate. Now this is an interesting property to analyze. This place has one sale point in public history data:

Sales history:

June 2006:Â Â Â Â Â Â Â Â Â Â $2,172,521

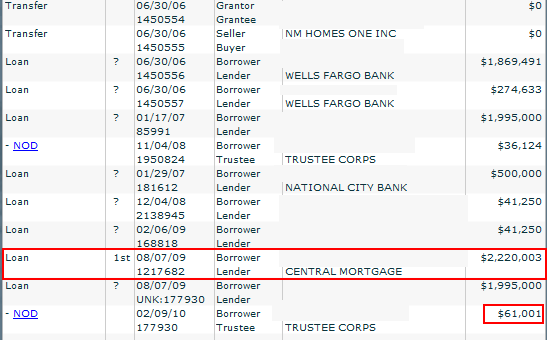

When we look at the sales history, it looks like prudent lender Wells Fargo went near 100 percent financing on this place:

When you get to see data like this you can really understand the insanity of California housing. These kind of active loans show us why banks are still delusional just like sellers back in the days of Alt-A and option ARM financing. Look at the history carefully. A notice of default was filed back in November of 2008 meaning at least 3 payments had been missed at that point. Go back three months and what do we find?

Listed for sale:

August 2008:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $3,275,000

So while these homeowners were in the process of getting a NOD, someone actually listed this place for a 50 percent increase from the purchase two years ago! This is the kind of mentality in California that has led the state to the current fiscal disaster point. Expecting a profit of a million dollars just for sitting in a place that you missed payments on! Hard work at its finest.

As you can see from the loan history, Central Mortgage actually places a $2.2 million mortgage on the place in August of 2009 which makes absolutely no sense given the track record here. Either way, it should come as no shock that in February of this year another NOD for $61,000 was placed on the home. The carousal has been going on since August of 2008.

Look at the metrics for this area and you can see why there will be many more problems ahead:

Calabasas median home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1.025 million

Calabasas median home price/sq. ft:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $387

Calabasas Foreclosures on MLS:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Calabasas distress shadow inventory:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 173

The home is listed as having 4,800 square feet and has 6 bedrooms and 6.5 baths. Highly unlikely it will fetch anything above $2 million.

La Mirada foreclosure and shadow foreclosure

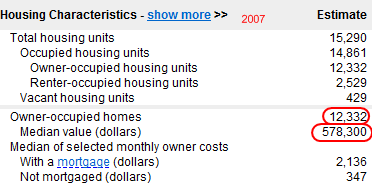

La Mirada is certainly no Calabasas but it isn’t a massively hard hit area like the Inland Empire….yet. As much as people don’t want to believe that major price declines can occur, they are happening. The current median price for La Mirada is $380,000. This is a far cry from the $578,300 peak reached in 2007. But even with that major price adjustment, the problems are only starting to creep forward.

Even at the current median price of $380,000 it is too expensive since the median household income is $77,000 (and this is based on 2007 data which is inflated). And the argument of a large renter population doesn’t really apply for this area:

Source:Â Census

Since roughly 17 percent of housing units are occupied by renters, we get a good sense of the actual homeownership market here. We know incomes will fall in this area once we get new data but even with the current price, it is inflated. Even if we use a high 4 times median income metric prices need to fall by a large amount:

$77,000 x 4 =Â Â Â Â Â $308,000Â (a decline of 18 percent from the current price level}

Let us look at our first foreclosure example that is listed on the MLS:

Sales history:

October 1988:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $132,000

February 1998:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $146,545

March 2004:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $350,000

According to the ad, this is a “perfect starter home†and “needs work†so who really knows how the inside looks. Either way, you can see the sales history above. But in the data we find the history of a previous bubble in California. The home sold for $132,000 in October of 1988 and then sold for $146,000 a decade later! A 10 percent increase over 10 years! So much for rushing out to buy a home because of being priced out. Think prices can’t move sideways in California? Here is the proof. Of course in March during the delusional days this home sold for $350,000. This is a 4 bedroom and 2 baths home listed at 1,741 square feet. A place like this back in 2004 – 2006 would have been snatch up in days. Now it sits for 115 days on the MLS with price reductions galore:

Price Reduced: 03/19/10 — $374,000 to $349,900

Price Reduced: 04/20/10 — $349,900 to $329,000

Price Reduced: 05/26/10 — $329,000 to $299,900

Someone actually listed the place for $374,000! After that absurd attempt, it was set at a breakeven price of $349,000. Clearly that didn’t work and now we are down to $299,900. Apparently dropping the price by $74,000 in 3 months is the name of the game now.

Yet this home has competition just a few homes away:

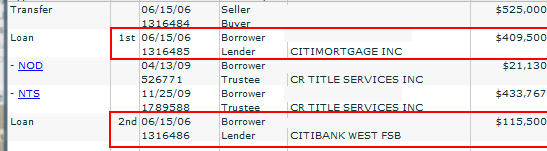

This home is 1 minute away yet doesn’t show up on the MLS. Now the home that isn’t on the MLS is a 4 bedroom and 2 baths home listed at 1,110 square feet. It is scheduled for auction on June 15, 2010 which is coming up next week. If we look at the data, we see some familiar action:

Home was purchased for $525,000 back in 2006 with 100 percent financing just like the Calabasas home. $500,000 or $2 million it didn’t matter when Alt-A and option ARM products were raging like wildfire. Of course, this home is now in foreclosure and schedule to hit the auction block soon. Do you think the bank will recover any of that money when a bigger home just a few homes away is selling for $299,900?

This isn’t some past event or rehashing of history. This is the market as of today. These are the properties out there for sale. And you think things are recovering? Today we salute you Calabasas and La Mirada with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

20 Responses to “Real Homes of Genius: Calabasas million dollar foreclosure and multiple foreclosures on La Mirada block with shadow inventory. Home sellers competing with invisible sellers. $500,000 and $2 million home purchases with 100 percent financing deals.”

Another fantastic article and a great slap in the face to the oversized McMansion crowd.

But Doc, I was hoping you could take a look at this comment from a poster on redfin, because he makes an interesting argument that it was the earthquake (on top of the recession) that really did in the LA real estate market back in the mid 90’s, along with nobody having any access to cold hard cash unlike nowadays.

Thus, he feels that outside of some cataclysmic act of God, the FHA jumbo conforming lending limits of 729K in our areas will keep prices propped up in any good areas and create a floor around that amount. Of course, the recession of the early 90’s really is nothing compared to the pain we are seeing today (although again, it was far more severe in SoCal due to the defense industry layoffs).

I’m just so damn tired of seeing the absolute worst garbage properties, teardowns and super fixers and the asking prices are as high as the peak, in the good areas. Million plus for shoeboxes, starter homes, and homes that should be red tagged and torn down.

California greed must weave some magic spell for anyone to pay more than the 1998 price Doc listed for the La Mirada home. No yard – no trees – tiny lot – no privacy – and probably noisy as well. Maybe this are the results you get when money is “free”.

Great article. The economy will not recover until housing costs are only a third of your monthly take home pay after taxes. The sooner the housing market bottoms the sooner the economy can recover. Unfortunately, FHA is still giving outrageous loans and California are giving tax credits. When will the public learn to live below their means?

I’ve been tracking the inventory for South Orange County for the past several years and have seen a interesting trend up in the last 5 weeks. I track mls inventory for homes up to $800,000 for Laguna Niguel, Laguna Hills, Aliso Viejo, Mission Viejo and Lake Forest. Five weeks ago we bottomed out at 832. As of this morning it stood at 1002…and this during the prime time of the year for purchases. Seems to be mirroring what the good doctor has stated regarding increased inventory for Orange County. Keep up the good work. I always direct my homebuyers to your website to help validate the true story of Southern Cal Real Estate.

I’ve heard that hedge funds have been starting to buy nonperforming loans from the banks. And projects that were only partially constructed when the market got hit. This may soak up some shadow inventory out there. Short sales may also rise and the banks are probably figuring out that it’s a better deal for them that foreclosure.

One large group of Calif home buyers have been off the radar screen and that is the RE investor crowd particularly those buying rentals taking negative cash flow and counting on appreciation to create a winning investment. Sooner or later this deflationary RE price spiral has to impact this group and it will be interesting to see how long they can hang.

I think part of the problem is the fed pumping in billions-well actually trillions at practically 0% . The big banks and their investment arms have access to this cash and I think it is them that are buying. What does it matter if the real estate tanks further-it is govt money-they will simply default and walk and still get their multimillion dollar bonus.

It seems clear to me banks are trying every trick in the book to minimize their losses while trying to offload their inventory. It is a dirty rotten shame that our govt is funding the banks gamesmanship. I am sure plenty of folks are seeing the control banks have over disposal of these homes and will cave to these tactics. And yes, the banks will offload their crap over some time and may even get another govt bailout to help with their more reality-based cashflow problems (as in mark-to-market reality check). Plus since Fannie and Freddy are 96% of today’s lending pool, the banks have no worry about how much buyers pay for their overpriced crap. I believe that as long as long as banks still have distressed inventory on their books interest rates will remain absurdly low allowing people to buy at grossly inflated prices. But I also believe that as soon as the last of this inventory is offloaded, interest rates are going to rise- and not just by a little bit either. What do you think would happen to housing prices if interest rates rise to say, 10%, or 12%, or 17%? Do you think the banks care if home prices fall if they have no home loans in their portfolios while these prices are going in the toilet? All in all though, prices do need to come down out of the stratusphere. In my humble opinion if you could point to one single factor that has made the US less competetive in the world is our high realestate prices.

Doc, I don’t know if you care or not, but you often might as well just print the fulladdresses of these properties. It took me only a couple of minutes to find that $299K house on Google Street view, my only clue being the number painted on the curb. Tell me if I’m right: 13034 El Moro Avenue?

“Comment by CPA in Fort Worth

June 8th, 2010 at 10:47 am

California greed must weave some magic spell for anyone to pay more than the 1998 price Doc listed for the La Mirada home.”

I have $146,000 cash and I would not throw it in that gutter. 4 bedrooms in 1100 Sq ft? In 1998 I could have bought a much better house than that in the Santa Clarita Valley. $146,000 for that is like $6,000 for a 1998 Four Runner with 210,000 miles. Both are money in the toilet. Well the house will actually still have value in 10 years. But I would not give my money to live in that.

Also I need to point out one error in your article Doc. The house one minute is NOT selling for $299,000. It is offered for that. I wouldn’t give my 150K for it either.

@Foolio – I remember all of that, def ind layoffs, earthquakes, LA riots. In those days, LA was seen as a hellhole and everyone wanted out. The problem with the comment you are referencing is that the high-paying jobs the def industry supported never came back to the LA area. What large scale industries have come to LA in that time? As a comparison, look at SF bay area and jobs created by companies like Yahoo, Google, Apple over that time. What industries have gotten smaller in LA? Music industry is a shell of what it once was, film/tv production has shifted since that time to Canada and other places. Where LA accounted for 90% of production pre Runaway production, it’s much less now. How can incomes support these prices? They can’t. Many people I know are moving out due to job’s being offered in SF, NYC, and abroad or from layoffs and people leaving to live with family. Also, the generation leaving college these days won’t end up with incomes to support $700K houses, and in 10 years or so, these houses won’t be able to find buyers.

4 bedroom and 2 baths home listed at 1,110 square feet?

Sounds spacious.

Doc, you forgot to mention the LA County Sanitation (Dump), just west of CALABASAS (Agoura Hills). The wind usually blows from west to east so those “Million Dollar Homes” are right at the path of of the toxic emissions. To make matters worse, the dump is a man-made mountain of trash very discretely disguised as a power generation plant for that community…Not only are they inhaling refuse from surrounding cities, but also the burnt fuel from the high priced “Reused Green Energy” generators are emitting.

But, as long as the RE Agents gets their big commissions, who cares!!

YEP, YEP–Real Home of Genius!!!!

Wow. This is a terrific site. I wish I could find a similar site dealing with real estate here in Massachusetts.

How could people NOT realize that real estate had become an insane bubble when prices had risen so astronomically while wages had, well, not?

Thank you, Doc, for these fascinating and enlightening little case studies.

You know, what really are the limits to fiat money. It’s not possible to quantify the breaking point. It might be happening right now or it might be 40 years from now. Since it’s all fake money and just faith in the fake, who’s to say they can’t print a quadrillion and just keep rolling. It’s crazy, but we’re in uncharted territory. Everyone with an IQ over 50 knows th US and world debt are spiraling out of control, but the number infinity is always approachable but can never be reached. Maybe we all get a million bucks to spend on liposuction or whatever the heck we want to waste it on, just to keep the economy rolling.

Matt says: “The economy will not recover until housing costs are only a third of your monthly take home pay after taxes.”

We can look at the government statistics and see that 2010 prices in SoCal are way above 3x times reported income. I guess the question is: How much higher are actual incomes than what people report to the government? Also, how much wealth sloshes into SoCal from other parts of the world?

Wow, this makes my teeth ache.

~

The failure of all the statistical/quantitative models is something we’re up against here, though it’s hard to make an argument of that sort, since most people can’t even calculate a 10% tip without using a calculator.

~

In other words, there was a glory time when people with a little arithmetical or mathematical acumen could game the system for profits. But that gaming has run the whole system into a wall. Particularly since more and more people learned to do that gaming, and then even automated it with computers.

~

Google “Wolpert’s theorem” (inside any universe, quantities exist that cannot be inferred by someone in that system, no matter how much they know about the system), Godel’s incompleteness theorem, and Turing’s halting problem.

~

The problems we face derive from economists and banksters and other numbers crunchers having serious limits in their counting models that are part conceptual, and part the nature of any complex system. On this we gamble life on earth and our own survival. Crazy.

~

rose

Had coffee with a friend who was telling me that houses in our old neighborhood of Van Nuys 91411 are selling like hotcakes at high prices again…..

Yeahhhhh right…. So in a couple of years when these new buyers are underwater, do the prudent have to bail them out again?

Seriously, I just want to live in a frickin’ tent on a beach…. oh yeah, BP is making sure that that option is not on the table!

Don’t worry, by this time next year the oil spill will have contaminated all beachfront properties from the Gulf Coast to the eastern seaboard. And it will get continuously worse. (sigh) Millions will need to relocate, some will have big bucks, and California will be their destination. Of course their wealth will be mostly destroyed by trying to offload their toxic property, so it’s now like they can sell out and invest here. I only hope I’m wrong, but I fear that things are all lining up is such a way that I now no longer scoff at those who called for end times in 2012.

Re 91411…………

Thats interesting because MLS listings have spiked big time in that area, and a number of homes are currently being renovated.

However, I haven’t seen anything sell since April.

Leave a Reply to caboy