Real Homes of Genius: An Economic Investigation of La Mirada. Median Sale Price, Incomes, Trends, Shadow Inventory, and the case for no Price Bounce. Mortgage Equity Withdrawal Home Value from $157,000 to $570,000.

In a brilliant move, the California home builder lobby has won a $10,000 tax credit costing the state $30 million. But there is a major caveat here.  This only applies to new home sales. Of course the industry salivates and is falling over one another in excitement but overall, this should boost sales by another 4,300 buyers. This doesn’t do much to fix the glut of foreclosures in the state but what the heck, why not spend more money on horrible economic policy? In fact, you can combine the $8,000 Federal tax credit with this and you now have an $18,000 tax credit! Senate Bill X3 37 is crony capitalism at its best and is horrible public policy.

It is interesting to note how many people are now slowly becoming cronies or simply apathetic to the entire economic situation. Not sure if this is due to psychological fatigue, frustration, or simply feeling they are powerless against the trend so why not join in the party? At least that is the outward perception. The same sentiment was displayed in 2006 when it was clear housing prices would break yet people kept arguing, “See! Prices keep going up! You are wrong!â€Â And what happened? The median price of a California home dropped by 50 percent and is still near that trough. Remember that. That even in light of this entire artificial stimulus the market is still not seeing massive movements in price. Some folks are so obsessed with one area like Pasadena, Culver City, or other Westside areas that they forget the bubble has burst in many areas and price are clinging to the bottom. For example, if you are looking to buy in the Inland Empire it makes sense in many places since it is virtually the same to buy or rent in terms of monthly cost. And just because the mid tier hasn’t seen downward movement like lower priced areas does not mean it won’t happen. Remember, this bubble was never about buying too many homes it was about buying too many homes at inflated prices.

The market crossing 10,000 and this housing sentiment is fascinating. Where were these people in March of this year? Largely absent of course. Yet here we go again. “See. No flood of foreclosures on the MLS therefore prices will go up.â€Â Really? Based on what data? Prices have stabilized but moving up they are not. I will go into significant detail later in the article carefully analyzing a city in California but suffice it to say that buying right now does not make sense in many California areas. What seems to be happening is you have a group of people that feel they missed out on the housing bubble and want a piece of the action this time around. Forget about local area trends and income data because they are tired and want to play. After all, the bubble grew for a decade so they fear we are in for another decade of bursting prices.

For many their identity is tied to being a homeowner. If you don’t own, somehow this make you less than and advertising has done a great job to create this high school insecurity in many. Yet the fuel of the current decade in California housing included Alt-A and option ARMs and these are now gone. So why rush to buy right now? If you find a home that makes sense economically, buy. Who cares? But the thing is in many areas prices do not reflect market fundamentals. Some are now listening to Realtors about “buying a Real Home of Genius†and then selling in 5 years to your step up home. Same logic as before. Where is the income and job growth going to come from? Notice how no one refutes this point even though it is at the core of the issue of home price appreciation. There is only so much you can inflate an asset with debt.

So let us examine a city in great detail. Instead of looking at a tiny prime location like the Westside, or a really poor area like Compton let us look at something in the middle. Today we salute you La Mirada with our Real Home of Genius Award.

La Mirada California

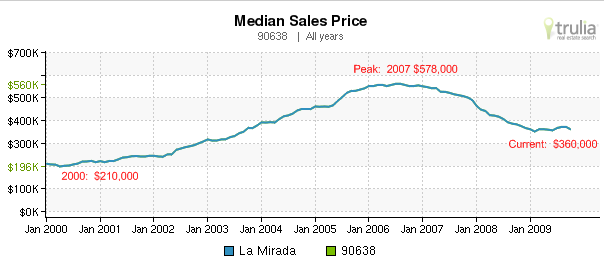

La Mirada is a city in Los Angeles County with over 46,000 people. A relatively nice area. Not extravagant but certainly not a poor area. This city indulged in the bubble and has yet to see any recovery:

Do you see prices flying off the chart? I don’t. Maybe all the bubble 2.0 folks can tell me where the rapid appreciation is happening because it isn’t in this data. La Mirada hit a peak median price of $578,000 back in 2007. The current median price is $360,000 or a drop of 37 percent. In my book, losing over $200,000 in equity is rather significant. For a few months prices have been clinging to the bottom but certainly no major appreciation is happening.

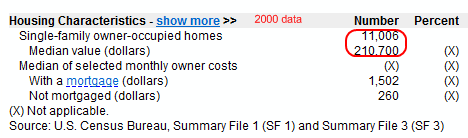

You really need to do some basic math here. Let us look at 2000 data with current data:

2000

Median home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $210,000

Median household income:Â Â Â Â Â Â Â $61,000

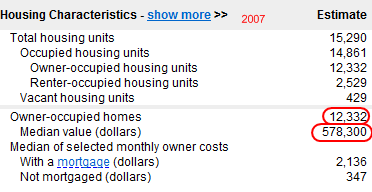

2007

Median home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $578,300

Median household income:Â Â Â Â Â Â Â $77,952

2009

Median home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $360,000

Median household income:Â Â Â Â Â Â Â ???

Keep in mind the last data point for income in 2007 was the peak earning time for Californians. This would capture a solid tax year of 2006 and also the peak home price of 2007. How many of these families had someone that worked in lending, construction, or other real estate related fields? You think the unemployment rate hasn’t grown in this area? It has.

The big disconnect is obvious to see. While the median household income increased by 27 percent over the 7 years of Census data, the median priced home increased by 175 percent! Of course all this was courtesy of Alt-A and option ARM products and other easy money loans. Let us assume that income and home prices were interlinked perfectly. What should the median price home go for in 2007? The price should have been $266,700 assuming a 27 percent increase. Let us pull up the data:

La Mirada is actually a good city to look at because the bulk of housing units are owner occupied. Only about 17 percent of housing units in La Mirada are occupied by renters (in L.A. County over 50% of people rent). From $210,000 to $578,300. Incredible. So of course the $360,000 price tag seems appealing compared to the $578,300 peak price but does this make sense given the local household income? Keep in mind that when we get the 2008 and 2009 data from the Census ACS survey, incomes will fall. But we will go ahead and use the $77,000 figure reached in 2007. Remember, FHA insured loans are now the game so we can’t leverage like gamblers with Alt-A and option ARM products without verifying income.  Let us run the numbers:

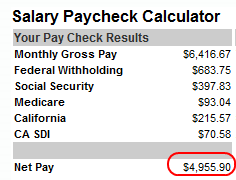

Annual Household Income:Â Â Â Â Â Â Â Â $77,000

Monthly gross:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $6,416

So this is the balance sheet for most families in La Mirada. Take home pay is roughly $4,955 and we are not factoring 401k contributions or healthcare costs. So let us assume this family is buying that median priced $360,000 home and they move with a FHA insured loan:

3.5 percent down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $12,600

30 year fixed at 5.25 percent: $347,400

For the sake of argument we won’t include the $8,000 tax credit because it won’t last forever (that future buyer won’t have your current incentive).

Monthly Principal, Interest, Insurance, and Taxes:Â Â Â Â Â Â Â Â Â Â Â $2,300

So nearly half of the net income is going to the housing payment. This is too high by historical standards. If we are looking at a third of income, we are looking at a payment closer to $1,650 a month. What does that match up with? You guessed it, the $266,700 figure we estimated:

3.5 percent down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $9,334

30 year fixed at 5.25 percent:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $257,366

Monthly Principal, Interest, Insurance, and Taxes:Â Â Â Â Â Â Â Â Â Â Â $1,698

Pretty damn close to $1,650 in my book. There is a reason why home prices link up to incomes. This is how you pay for your mortgage. I know, common sense but currently all this seems to go out the window. In 2000 with the median household income at $61,000 and the median home going for $210,000 you were closer to a real balance. We are still far from a balance. To reach this balance a couple of things can occur:

(1)Â Prices drop by 20 to 25 percent more for La Mirada

(2)Â Incomes go up

It really is a simple equation here. Eventually things revert to the mean and most science minded folks and engineers seem to get this. Does it happen over night? Of course not. Yet California home prices crashed by 50 percent rather quickly didn’t they? Even the speed of the crash surprised me. Yet many Real Homes of Genius will tank like this. The same formulas apply to any city. See, what I have always done is put out the logic behind my argument. Why don’t those calling for a bounce put out their argument? All they can say is “well the government and banks won†and jump on the bandwagon. I am always open to hearing why prices will move up or what industry is going to step in to make up for the lost jobs in the state. Yet I haven’t seen a solid argument so far. And what is even more disturbing, is prices are not jumping up yet people are willing to give into the propaganda! Prices have fallen 50 percent from the peak and overall the state is still there, near the bottom. The inventory is backlogged in the shadow inventory. Just because banks aren’t flooding the market right does not mean you should go out and over pay on a crappy home because of artificial limited inventory. By the way, the defaults are happening. If people are looking for near perfect predictions they need to find their own Nostradamus. But the overall theme is obvious. There will be no significant price appreciation so there is no impetus to buy right now. Look at the price chart above with La Mirada. If anything, prices are moving sideways courtesy of every bailout, incentive, and handout you can imagine. The market now expects these handouts in perpetuity.

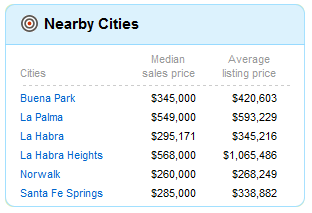

Let us look at some neighboring city data:

You can ask whatever you like but nothing is final until escrow closes. And clearly, people are asking for more than the market is willing to pay. Let us drag out some current data:

La Mirada

MLS homes for sale:Â Â Â Â Â Â 65

Public foreclosure:Â Â Â Â Â Â Â Â Â 7

Foreclosure price range:Â Â Â Â Â Â Â Â Â Â Â Â Â Â $209,000 to $749,000

Short sales:Â Â Â Â Â Â Â Â 33

Short sale price range:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $120,000 to $640,000

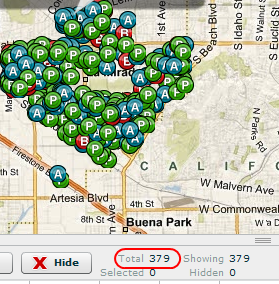

So most of the public data is distress sales. 40 of the 65 homes are either foreclosures or short sales. Last month 29 homes sold and 10 condos. In other words, we have 1.6 months of inventory on the market. Or do we? Let us go into the shadow inventory:

379 sure seems like a bigger number than 65. Plus, the bulk of the hidden data is with notice of defaults. Would you like to see an example?

This home is a home equity machine which is extremely common in California. This is a 3 bedroom 2 baths home listed at 1,500 square feet. Not on the MLS. Interestingly enough the home across the street, another 3 bedroom and 2 bath home with 1,500 square feet is a public short sale going for $365,000.

What is fascinating with this ATM home is that the last recorded sale is in 1989:

01/11/1989:Â Â Â Â Â Â Â $157,500

It looks like it is the current owners on the place. Instead of after 20 years of nearly paying off your home, it now has loans up to:

$440,000 1st – Placed on 2006

$50,000 2nd – Placed on 2007

$80,000 3rd – Placed 2 months after the 2nd!

So it now has $570,000 in loans. The crazy thing is even if this home sold for say $300,000 the conservative Case Shiller Index would show a price increase (i.e., $300k > $157k) even though they were using their home like a piggybank. Loans of $570,000 and a short sale across the street for $360,000. When you drill down, you can see where things are going. So for those of you just rushing for that short sale on the MLS, you can expect this home to be on the market in a few months (and many others according to the shadow inventory data).

Where did all that money go? Hard to say. But looks like some of it went to a pool:

Yup, we all know how much added productivity a pool does for the long-term health of our country. Just imagine folks in Venezuela taking money out of their homes to do something like this. We would think they were mad. But in California it was somehow okay? Obviously it wasn’t and that is why the bubble burst and prices are still near their bottoms even after the government has done everything to try to boost prices.

So what is the bottom line? Prices at some point will need to reflect area incomes.  That is going to happen. The government and banks can do what they like but the eventually historical trend will show up again. You can’t legislate another housing bubble. What got us to the peak was absolute corruption, negligence, and absolute disregard for sanity. You want some more hard facts for Southern California?

“(DQ News) The use of adjustable-rate mortgages (ARMs), often used for high-end purchases, has risen lately but remains far below normal. Over the past two decades ARMs accounted for nearly 40 percent of all home purchase mortgages. Last month ARMs made up 4.1 percent of purchase loans, up from 3.9 percent in August and a record-low 1.9 percent this April. A year ago ARMs were 7.2 percent of purchase loans; three years ago they were 71.2 percent.

A common form of financing used by first-time buyers in more affordable neighborhoods remained near record levels. Government-insured FHA mortgages made up 36.4 percent of all home purchase loans last month, down from 37.4 percent in August but up from 32.7 percent a year ago.â€

California had the most toxic mortgages ever created. Option ARMs. Alt-As. Subprime. Those are gone but their skeletons remain in the balance sheet of banks. These were maximum leverage products. So short of the U.S. government bringing back NINJA loans, you don’t have to worry about prices shooting through the roof and missing the next herd bubble.

And if you want to buy, go ahead. Who really cares? Yet some people mix up their economic theories. Let us look at a wonderful quote:

“(CJ Online) Now is the time for Congress to keep the recovery going by extending the tax credit through 2010 and making it available to more homebuyers,” said National Association of Realtors President Charles McMillan in a recent statement that called for the group’s 1.2 million members to lobby for such legislation.

“We have all seen how the credit has been a spur to bring homebuyers into the market, and have seen the beginnings of a real recovery in the housing market,” McMillan, a Dallas-Fort Worth broker, said. “Housing has always led this nation out of economic downturns, and can do so again.”

Housing for the first time ever, has also led us into the Greatest Recession since the Great Depression. In fact, someone tied to the real estate industry said removing the tax credit amounted to government socialism! Seriously. This is what people believe. If anything, real estate has been in a state of corporate/government socialism for decades. We subsidize the mortgage interest deduction, lower mortgage rates by slamming the U.S. dollar, give out tax credits, and in the end home prices are still lower because the economy for the last decade was largely built on paper. GE recently was hiring 90 people for $27,000 a year for building washing machines and 10,000 people applied.

The problem of course is we are beyond any moral hazard levels. If you bought a home and it dropped 90 percent, that was your choice. You didn’t have to buy. There are plenty of rentals in the U.S. but somehow renting is somehow a thing that peasants do. Tell that to the folks that lease out Malibu homes for the summer. Right now many people want to buy and are trying to find every justification to do so. They won’t find it (at least not by using economic measures based on fundamentals). They can use crony capitalism logic like “well the banks and government won’t let this happen therefore I must buy†but the current market isn’t showing any major price increases. What we are seeing however is stabilization at an extremely high cost to everyone in society. That cannot go on forever. It can’t even go on for many more years because if you haven’t noticed, our currency is hurting. Unlike Japan who was able for 20 years to have a sideways movement on cost of living, our U.S. Treasury and Federal Reserve are going to shrink away the standard of living of most Americans by slamming the U.S. dollar and protecting the banks – this will occur through a weaker dollar and a giant leap in part-time employment. Don’t be naïve to think the interest of banks is in line with your desire to own a home. Just ask the 300,000 people in September that received a foreclosure filing in September how that is working out.

Ultimately people will pay for homes with localized income. That has been the case for decades and will be the case again. We have dug into the income, sales, trends, and home values of La Mirada in great detail. Are you now inclined to rush out and buy? If you do buy just don’t expect prices to increase in the next decade. Some think that prices will stay where they are at while incomes play catch up. The problem with that reasoning at least for California is that incomes are actually going in the opposite direction. Until that changes, we can set that argument to the side.

Today we salute you La Mirada with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

34 Responses to “Real Homes of Genius: An Economic Investigation of La Mirada. Median Sale Price, Incomes, Trends, Shadow Inventory, and the case for no Price Bounce. Mortgage Equity Withdrawal Home Value from $157,000 to $570,000.”

If we have huge inflation, which is a likely possibility considering how much money the gov’t is printing, than people will be paying their mortgages with devalued money. Housing prices will go down in inflation adjusted money, but they will probably go up in nominal amounts. It might be a good idea to buy a house just before inflation kicks in. That way you will be paying for the house with cheaper money. I think this makes sense?

This is another great post. However, what I have been always surprised by are other factors like inflation. In developing countries, real estate is expensive in many places, even though the local population can’t afford the property values. It is partially because it is the only asset that keeps up with rate of inflation. Other assets lose value, and 36,756,666 is census value for 2008 California, and 2000 California level is 33,871,648. So there have been roughly 4 million more people in the state which should cause more demand. There were also, 37,883,992 total housing units in 2008, and 33,873,086 in 2000. We have been building houses approximately at the same level at a population level. There is the inflationary concern, however…

Seems to me that the tax credit really is just an opportunity to increase your debt — that 8k of cash will buy 200k of mortgage debt. That has to be inflating prices.

Awesome post, The money available for mortgages is falling, and house prices will keep falling for some time. The price decline should remind homeowners, and home buyers, that housing should never be seen as a short-term speculation, but rather as a place to settle & enjoy, in the long run.

A survey by the California Association of Realtors found that sales of California real estate have actually increased from the end of 2008 to the beginning of 2009. Survey respondents indicated that attractive prices and low mortgage rates were the leading factors motivating them to buy. The glut of bank-owned properties on the market has kept California’s housing inventory stocked, giving buyers many options. First-timers are leading the market spurred on by record low interest rates and the greatest affordability. Using the internet and area papers, you can soon get an idea of the market worth for different types of homes in the area. Identifying the right market & finding the best property holds the key to success. In fact there is a tool through which you can research, compare & identify best places to invest. Look into http://www.smartzip.com/s/sz/info/offer for more information.

Dr.,

Your logic and brilliance is always perfectly clear, but that won’t stop the scumbag realtors from their lies and bullshit rhetoric.

The real estate and mortgage industries are parasites, and they don’t care if they kill their host. All they care about is their commissions.

The one factor you seem to be ignoring is the very real possibility of a massive inflation hitting here in the not to distant future. If it does, a mortgage at 4.75% to be paid off in rapidly decreasing dollar values, is one of the best investments you can make. Salaries and home prices could triple in the next 10 years leaving all your very logical math calculations a moot point.

I have been looking at this site for a while now. I must say, thank you Dr.!! I was so close to buying a home in Northern California but after reading and doing my homework, i have decided to hold off on my 1st home purchase. Its facts like these that you give out and the way you explain them is what has saved me! Thanks again!

EXCELLENT EXCELLENT write-up as always. You never cease to amaze me on how much content you are able to deliver in such short periods of time. Maybe one thing you can address for us… I understand the basic economic principles dictate that a stock market & house market & employment market crash or large drop is inevitable. However, I’ve failed to reap the rewards of following this fundamental solely due to government meddling every time.

I’m afraid in this event coming up there are 2 very good possibilities for further government intervention:

1) Intentional sacrifice of the USD value in order to prop up the face value of house prices. Sure the house’s true value underlying is worth less but since the label of dollar amount of the home hasn’t dropped, everyone feels better and the task of paying debt back to foreign investors is an obvious benefit.

2) Banks will continue to borrow for free or at a minimal enough cost to not put houses for 2 years or more.

I’d be very happy to hear your thoughts on these issues.

Comment by steve scatchard

October 16th, 2009 at 9:10 am

The one factor you seem to be ignoring is the very real possibility of a massive inflation hitting here in the not to distant future. If it does, a mortgage at 4.75% to be paid off in rapidly decreasing dollar values, is one of the best investments you can make. Salaries and home prices could triple in the next 10 years leaving all your very logical math calculations a moot point.

>>

___

(1) Interest rates have nowhere to go but up. Average rate over the past 30 years is around 9.25%. (And if your feared inflation does hit – though god knows based upon what since incomes are falling – you can bet your booties that the Fed will jack interest rates.)

>>

(2) For every 1 percent rise in interst rates, cut approximately 10% off the house price to keep the payment the same. (And remember incomes are not increasing, are not expected to increase in the foreseeable future since we have too many people for the number of jobs and in fact incomes are flat or falling. Ergo that payment has to stay at least the same if not fall.)

>>

(3) The average length of residence in a house is around 5 years. People move to jobs, because of divorce etc. So much for the 30 year benefit of that low interest rate.

Lance Pitt–

Really? A survey done by the California Association of Realtors you say? Best time to bet the farm is right now? Research, compare & identify the best McMansions available on a janitor’s salary? Just shut up already.

but what country were the 90 jobs in to build washing machines in. bet a .15 cent dollar it wasnt here in the socalled “land o da free”.

I am amazed how riulturtds are engaged in shallow propaganda this days even invading silently Dr HB blog. “avs” is example of this. 36 million housing units usually host at least 100 million people! Where did you get that number, my dear! Just to make the point that we haven’t overbuild for the last 10 years with around 1 million new units ( which host around 3 million people) . Did you get my math? Some 30 million more Californians struggling for housing on top of the original 30 millions? Jeez! Discarding the above BS point I make what is left from you post is “ Buy people , buy , the big inflation is coming!†Jeez, give me a brake!

It seems like the only arguement made for buying a house these days is the possibility of inflation. I agree with Ann that inflation is unlikely, but even if inflation is possible, why buy a home now if your only possibility for appreciation is that inflation may occur? That seems to be massive speculation similar to what got us here over the past few years.

On another note, I believe the salary calculator in this article is a bit misleading. The net income is listed at 77% of the gross. Based on taxes alone, I agree with this. But I took a look at my paystub today and my net is 60% of my gross. Taxes took 24% of my gross and then 401k (I contribute 6%) and insurance contributions brought my net down to 60% of my gross. Based on 60% of gross being available as net income, $3850 is what the theoretical family would have to spend each month. If this is the case, $1698 is way too much to be spending on housing each month.

To make matters worse, my gross is more than the example but I believe health insurance costs are fixed and not a percentage of gross income, so the example family would be netting less than 60% of their gross income. Where is the room in the budget to buy a house, let alone save for a down payment? The average family seems doomed in CA.

I was just reading this article. Seems to go inline with what the Dr. is talking about

http://www.reuters.com/article/gc03/idUSTRE59F3LJ20091016

Im starting to get worried.

Come to Alameda,CA.

The City of Alameda is sponsoring an event to show you how to buy a house with NO down payment.

The City offers loans of $80,000.

Combined with tax credits, you can get a house without using ANY of your own money.

Seminar Oct 21, at Encinal High School, Alameda, CA

Inflation is already here. I know this as I buy materials for my farm, and they are going up on a monthly basis. I just ordered sheet steel for roof for a barn. In one weeks’ time, the price went up 7% overall which of course was passed onto me. I have to pay $100 more for the same order over last week at this time. So yes, prices are inflating and its at the wholesale level.

I think we need to look bigger – China and other growing countries are sucking up what they can of commodities which is going to inflate our prices here (supply vs demand) and we have no say in that. We are in for another oil shock as their economies are growing and will take what they can to keep that rate of growth up.

I do agree that the best hedge against inflation is having a note on a house. However, try to find a good note right now with a bank that will lend. They aren’t stupid. They want YOU to carry the burden, not lose their shirts when inflation really kicks in. The last thing they want is to have to pay out more dollars on their investments and get paid in cheaper dollars in return.

If I were a Californian, I’d move somewhere else, if I could afford it. The rents will stay high and trend higher until the bubble bursts for rentals.

Just because inflation is active doesn’t mean that 30 years down the road your salary will be kept in pace with it either. The trend is to CUT wages and pass on the expenses of healthcare to the worker.

Here is a story about the learning our lesson

http://www.reuters.com/do/emailArticle?articleId=USTRE59F3LJ20091016

J

Salaries are going to triple? LOL, you had me for a second.

The only inflation that drives the price of real estate is wage inflation. Who are the idiots that think that we will see huge wage inflation the next ten years? In what sectors? Public servants? Don’t think so, in fact they are getting furloughs and their pensions and benefits cut. Private sectors? Which sectors will be adding to the payrolls and getting raises?

In fact who doesn’t expect an income tax increase – thereby negating any possible raises? CA had an income and sales tax increase in May and still their revenues have massively fallen. Expect them to try to take more from those still working. And as previously stated mortgage rates can only rise from historical lows.

People clearly don’t understand which inflation increases purchasing power and which takes it away.

What if … just what if 40Year or 50Yr Mortages are introduced? Won’t that reduce the monthly payment to prop up prices? But who will qualify for these new mortgages? Hummmmmm …. Housing is like the Titanic … once it starts going down … the momentum to the downward spiral is incredible … In this case, the rubberband of house prices went up so high … on the rebound down it may get pulled under the mean for some time before rebounding back up . affordability is the key … I think Interest rates are going to start going back up into the 9% to 10% level … in 2011 or so .. that wil obliterate the prices currently …. housing will be a drag for a LONG time … my take … just find a place that you love, make sure you have relatively secure income and live … forget about Fraudamerica ….

People without jobs will have to default on their mortgage at some point. Here is a nice interactive map of California unemployment: http://www.sacbee.com/1232/rich_media/1698037.html

Imperial county has 30% unemployment. Ouch.

Regarding the comments that were incredulous about future inflation, I would like to point out that a lot of people feel that if the gov’t just keeps printing money by the trillions inflation will ensue. Even Bernanke and Geithner say so. They just think that they can pull money out of the system at the right time to stop inflation. Do they have the skill and the political will to do this?

The mortgage bankers association says that 4.3 percent of mortgages are in foreclosure nationwide, and another 8.8 percent are late by at least one payment.

In Q2, the California was somewhere behind Michigan which had a combined rate of 15.8 percent.

Anyone know what the delinquency rates are in Southern California?

http://www.frbsf.org/community/issues/assets/preservation/resources/foreclosure/ca_southern_0409.pdf

Very interesting damage plots of foreclosures and delinquencies by zip code in Q4, 2008.

300,000++ California mortgages seriously delinquent, only 60,000++ going into foreclosure Q4.

Kudos to Max Keiser, my new hero.

Time mark is 4:55:

“Another SUICIDE BOMBERS operation, give us another $ 700 Billion or we are going blow this economy up, you know these bankers in WallStreet are the equivalent of SUICIDE BOMBERS in another countries. They threaten to blow themselves up and blow up the economy in an exchange for huge bailout moneyâ€

http://www.youtube.com/watch?v=pFMgwL-Tq4s&feature=player_embedded

Do not miss part 2:

“WallStreet Jehadist are blowing the economyâ€

“how they can have record bonuses if they did not steal the moneyâ€

“ You are delusionary, prices (real estate) are not bottomed and real estate market has not bottomed. Delinquencies and foreclosure are skyrocketing that is not sign of real estate market bottoming. More wish full thinking and positive spin and justification for bonuses that should never be paid. Unless you want to pay other the terrorist, why do not you pay Osama Benlanden for great work he did in 9/11. I mean that is the same as giving JPMorgan a bonus or GoldmanSches a bonus. They are all terrorists destroying the economy, one is using derivatives one using airplanesâ€

http://www.youtube.com/watch?v=tbAqqLkiUkg&feature=player_embedded

Dr HB – great read.

Inflation and the sinking US Dollar scare me. If someone has a large down payment and wants to buy a property, what would you suggest they do? Savings rates are nothing – stock market is rising, commodities are rising, realestate is up a bit ….. I am just waiting and I don’t know for what. I agree with all the data you provide, but the data says something completely different.

Prices will continue to go down in every different sector, low, mid and high. Once prices start moving sideways, they will stay there for a few years and that will be the opportunity to buy at lower prices. Unfortunately, when that happens interest rates will be higher and most people will not be excited about buying a home. Currently, the excitement is being created by the biggest corrupt institutions, the NAR and FED. If you need a place to live buy or rent, it is always up to the individual, do not let the corrupt folks tell you what to do.

If you are going to let inflation or hyper-inflation scare you into buying a house consider this. Countries that have had massive hyper-inflation the average person spends 90%++ of their money on food alone…. I think owning a home will be the last thing you care about if you really believe hyper-inflation will hit.

Since the banks and the govt are clearly in cahoots, is the govt printing money in an effort to create inflation to prop up home prices in order to minimize the losses (on paper) to the banks? Will the govt tell the american public that inflation is good because it was necessary to protect the american taxpayers’ involuntary investment in Freddie Mac and Fannie Mae? Would it make sense on some level that the govt would take over these defunct institutions and then make them seem profitable by reinflating the real estate bubble via inflation? I have always thought that when someone does something that doesn’t make sense, they are either deceitful of dumb. I don’t think that the people in power are dumb which leaves me with only one option…

Yet ANOTHER reason why foreclosures haven’t hit market. Deadbeat judges and laywers holding up the process in the favor of deadbeat homedebtors.

boston herald link

“I think owning a home will be the last thing you care about if you really believe hyper-inflation will hit”. Most people in this country can’t fathom 10% inflation on a yearly basis, hyperinflation like a country like Argentina has suffered (120%+ a MONTH) is not even imaginable. Right now, most people are in what I call the “post-bust blues” which means they are mulling over how to turn their next quick buck, not survive the debt bomb we are currently in.

I truly believe that it won’t matter how low the real estate prices go, there just isn’t going to be credit to pay for them, or money to put down on them. People have used their homes like Dr. House says ” an ATM” and they haven’t a clue yet how to stop doing it. They’ll remain in bankruptcy a long long time.

And Partyboy, that is exactly what the gov’t is doing. The danger is in assuming that the inflated prices and less robust dollar are going to survive that treatment. Eventually like housing prices, the dollar will have to seek its own level. Despite what anyone does or says.

Thanks again Dr. Bubble. I ran across an article purporting to “debunk” shadow inventory. They’ve done this by redefining shadow inventory as part of a subset of homes that have already been foreclosed upon. This is not how the good Dr. defined shadow inventory. More ostrich behavior patterns from RE shills/goons. To their credit, they do recognize the coming alt-a/arm wave. That, on top of non-existent shadow inventory should about do it. Patience is key.

http://www.foreclosuretruth.com/

Dan, I am not in the real estate business. In fact, I don’t even own any property, but would like to. I have been trying to understand and figure out this housing issue. My original point being, which I probably, could have stated better is that immigration into california could not have contributed to the housing prices….more people buying less houses. The numbers that I gave came from the US census.

Tustin – built in 2009!

Address: 12486 Vista Panorama Tustin, CA 92705

Year Built: 2009

Square Footage: 4644

No. of Bedrooms: 5

No. of Bathrooms: 5.5

Total Rooms: 19

Lot Size: 0.19

Starting Bid: $999,000

Previously Valued To: $2,450,000

Leave a Reply