Flippers in Burbank and the logic behind down payments. Flippers are now making their way into many cities in the region trying quick flips for six-figure gains.

Flippers have targeted favorite areas like Silver Lake and Culver City for many years. Silver Lake in particular has brought in a larger number of flippers that are catering to the hipster crowd. One big change I have noticed in the past decade is the lack of consideration for a down payment. There was a time where a person or a couple actually tightened their belts for a few years to come up with the 10 or 20 percent down payment required to purchase a home. Today, with low down payment loans like FHA insured products I rarely hear this conversation. You buy when you feel like it. Think about it. For a $500,000 home you would need $17,500 for the FHA portion. That is it. So this part of the market has certainly transformed. Yet I’m noticing flippers all over the place now including Burbank. The asking prices are now very similar to what we saw during the mid-2000s. Today we salute you Burbank with our Real Homes of Genius Award.

Flippers in Burbank

Today our example leads us to Burbank. I saw this home pop up on my radar because when it sold in August, it went for $415,000 and had four bedrooms:

1510 N Pepper St

Burbank, CA 91505

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 4

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Square feet:Â Â Â Â Â Â 1,235

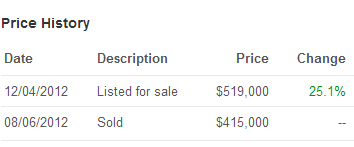

Given the size and the current market, it was no surprise that it sold in August. Yet it popped back on my radar recently. Take a look at the pricing history:

The home was listed only a week ago and is now priced at $104,000 higher. By the way, the typical household income for this zip code is $60,000. So what exactly was done on this place to justify a $100,000+ hike in a matter of a few months? Let us look at the ad first:

“PRICED TO SELL!!! Celebrate New Year’s Eve in this newly renovated fabulous home!!! Great open floor plan. Granite counters, stainless appliances, dark floors and cabinets give this charming home a modern feel. New energy efficient windows and doors. Large covered deck is perfect for entertaining all year long. Wood burning fireplace in living room for cozy winter nights! Fourth bedroom converted to den. Check out the competition and see what a bargain this property is ! WON’T LAST LONG!!!â€

Well we can check-off the granite counters and stainless appliances. Seems like standard upgrades. It also shows two things about Los Angeles. The first is how incredibly high construction costs are and/or how out of touch people are with actual middle class family income in the state.

We can take a look at the place prior to the upgrades:

We can also take a look at the kitchen here:

And this is definitely a flip (if you had any doubts) because the stove still has the sticker on it:

Now this is a fairly standard entry level home. Nothing special. Certainly nothing dramatic. Yet it is priced at well over half a million dollars. Or, over 8 times the annual gross income of a household in this specific market (versus 3 or 3.5 in the US). People have lost a tremendous perspective on the value of money because they are betting that the Fed can keep interest rates low deep into the future. People also comment that you have to live somewhere. As we discussed in a previous article many Californians have moved out of the state. Those wishing to stay are now competing with very little inventory, flippers, big money investors, and also foreign money. What is happening is that more and more income is being consumed by housing in California.

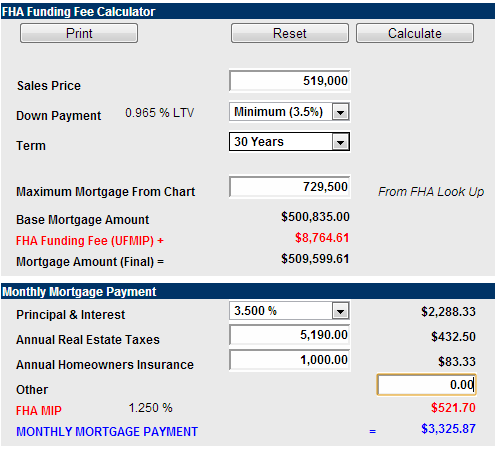

In this particular zip code of Burbank, the median price is $471,000 and is up 17 percent from the previous year. Now assume you buy this place with a FHA insured loan:

The monthly payment is going to run about $3,325 for this place. Unless you go in with 20 percent down ($103k for this place), these FHA insured loans are now becoming expensive. This is a hefty sum and I doubt the $100k crowd is looking for these places or is willing to go through the years of saving $100k (the sales trends point to this especially with financing). Yet leverage is the name of the current game. When it comes to housing in SoCal we are meeting the new boss, very similar to the old boss.

I’ve also noticed more frustration in the comments. This is merely a reflection on the data of middle class Californians leaving the state. I’ve always viewed this from an economic stand point. Even when I received e-mails during the bubble about people looking to buy with various scenarios, there were some that simply had a massive itch to buy even if it meant going into deep financial leverage. The same applies today. Capitulation is happening but this trend is all depending on low rates and low down payment products. I think what is now a stark realization for many is that it is tremendously difficult to be middle class in California at least when it comes to owning a home in certain counties (Riverside and San Bernardino actually have some decent figures but these have been pushed up courtesy of investors). In the status driven SoCal many people are driven by this. Most of the country with nice sized median priced homes going for $180,000 a working couple can plant their roots very quickly. That is simply not the case here.

At the same time, this is a choice. People are willing to leverage here in California. We are a boom and bust state. So is Florida. We are in another boom here. Income has not gone up but what it is doing is eating up a larger portion of a household’s income. Those FHA loans as we highlight above are adding tons more beyond the principal and interest. Taxes? The state benefits from higher valuations. The fact that FHA loans are facing such high defaults simply reflects the fact that many people were not ready to be homeowners. The down payment itself isn’t the mission but what it makes people do financially. You have to have your financial house in order to save up for a sizeable down payment. But when you tell people that all you need is 3.5 percent down and you can pay higher premiums just to squeeze in, then you are essentially providing maximum 30x leverage. As many of you know you can easily walk into a luxury car dealership today and walk out with a new car with a giant loan payment with very little down. Yet your disposable income is locked for years to come. We’ve already pointed out that buying at this point makes sense only if you plan on staying for a long time and data shows the current US homeowner will stay 6 to 8 years.

One rule of thumb to always follow is this, “can you comfortably afford your total housing payment for 15 years?â€Â This is probably a good rule to follow for a variety of reasons but also, make sure you factor in new changes (i.e., shifts in income, owning a home expenses, etc).

Interesting to see flippers going for $100k gains in a few months in Burbank. This brings back a lot of memories. Today we salute you Burbank with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

55 Responses to “Flippers in Burbank and the logic behind down payments. Flippers are now making their way into many cities in the region trying quick flips for six-figure gains.”

Supply/Demand is a beautiful thing to watch:

Total resale inventory (SFR & condo’s) in December, 2012 for Burbank is 79 properties, which is down 12% from November, 2012 (90 ppty’s); down 53% from December, 2011 (167 ppty’s); and down 70% from December, 2010 (266 ppty’s).

Median List Price in Burbank, 12/12 is $549k versus $469,000k in 2011 (up 17%) and $489k in 2010 (up 12%).

http://www.movoto.com/statistics/ca/burbank.htm

You mean FALSELY CONSTRAINED supply, and hyped/subsidized demand, eh? Helicopter Ben has succeeded in distorting away most of the real-world costs of holding props in shadow inventory. And the NAR RealTards (and lobbyists) couldn’t be happier.

Are you sure Yun et al at NAR is happy about restricted inventory? When supply is down 53% yoy and prices are only up 17%, card-carrying realtors aren’t getting nearly the total commissions they would receive with more normalized inventory levels and more affordable prices.

Let’s not forget about the #1 beneficiary of this falsely constrained inventory: California home”owners”:

1) Most of Californians “own” their homes (down from the peak, but still above 50%)

2) “Owners” are a wealthier, infinitely better connected constituency than renters in the eyes of CA Legislators

3) Current “owners” couldn’t be happier seeing new suckers leveraging up to squeeze into a home in their immediate area

4) Protected to infinity by Prop 65, even “owners” who rent their homes are enjoying the commensurate rise in rents caused by constrained inventory/higher home prices

Yeah, Bernanke wants to keep the party going, so he’s tinfoiling the windows, setting back the clocks and spiking the punch with LSD, hoping nobody’s the wiser.

I don’t think most are.

A few months for 100k? Try ten days. Then again they did add some wood floors so I guess that makes up for it.

http://www.zillow.com/homes/734-East-Baseline-Road,-San-Dimas-_rb/#/homedetails/734-E-Baseline-Rd-San-Dimas-CA-91773/21649426_zpid/

Bonzo- I just looked at the previous MLS listing…..that’s the same wood flooring, same kitchen, same bathrooms, etc they did NOTHING to the home, just bought it cash and put it back on the market for a $90K higher. If that sells at the new price that would be insane. The only thing they did was wash the driveway with a hose….

Try this one in San Clemente: purchased for 580k as a short sale one month ago, now already in Escrow for $650k after 2 days on the market, probably to an FHA sucker. Without any visible upgrades!!!

http://www.redfin.com/CA/San-Clemente/5216-Vista-De-Olmo-92673/home/5818364

Flipping without doing any work – doesn’t get better than this!

…after looking closer they painted the exterior, opened the blinds, and had a professional take some better pictures of the home….still not worth $90,000 increase in price

Apparently that paint job is worth an extra $10k as they just upped the price to $349k. This is simply getting nauseating. When this ends (and it will) no amount of TARP 2 will stop what’s coming.

Wonder if the paint is even dry yet?

1510 N Pepper St Burbank, CA 91505 – they bought this as a dated fixer…put max $25,000 in rehab into the house and it might sell for around what they are asking. It might take 2-4 weeks to sell the house but they will get around $510k+ I bet

1837 N MAPLE St sold to a conventional buyer in 21 days for $539K (within 1 mile)

912 NAOMI sold to a conventional buyer in 18 days for $555K (within 1 mile)

1817 N KENWOOD St is pending at $499K and it’s not as nice as N. Pepper (within 1 mile)

1236 N AVON St is bank owned and is pending at $549,900 but it has a pool (within 1 mile)

comps support a $510K+ price for this area

The chickens are about ready to come home to roost!

Check out this link to NY Times story about FHA trouble. The good old dr. has been ahead of the curve…

http://www.nytimes.com/2012/12/13/business/study-shows-a-pattern-of-risky-loans-by-fha.html?hp&_r=0&gwh=2D2D58D6FF8567DA735CBC3F321E2E95

Good article.

Just one worry…..what if the FED opens the discount window to FHA or simply buys FHA assets, the nonperforming ones of course?

I made the mistake of counting on the rules of the game finally setting things straight, I won’t make that mistake again.

These two boxes near me look like they were both done by the same flipper. It may be that they got them both for ~$300K (since they are on adjacent lots) and did a lot split, in which case they shouldn’t care too much that they aren’t selling. If not, looks like a big, oops.

http://www.zillow.com/homes/San-Luis-Obispo-CA_rb/#/homedetails/2084-Hutton-St-San-Luis-Obispo-CA-93401/15387230_zpid/

http://www.zillow.com/homes/San-Luis-Obispo-CA_rb/#/homedetails/510-Sandercock-St-San-Luis-Obispo-CA-93401/2118761720_zpid/

By the way, these are not “downtown”, but in the second least desirable part of town. I don’t get how these could even begin to sell for over half a million. The collective perception of value in CA is quite skewed.

That ugly house would sell for 40-60,000 here in Bella Vista, Arkansas. And it would be one of the ugliest houses in town.

Kuddos to that Mr. Don Barness…..Besides, probably only 10 minutes

away from hunting and fishing. Nice to be in Central parts and see all the

dust stirred out Wsst.

Great data and commentary, as usual, sir!

I remain resolutely on the sidelines here in La Jolla, renting, as I have since ’04.

In my opinion, this run-up in SoCal home prices is unsustainable. It will prove short-lived (Fed quits printing as inflation gets out of control next year) or will be overshadowed by the run-up in gold and silver (Fed continues printing, and their capping of gold and silver falls apart).

So, I happily keep my money in gold and silver.

you and I are in the same company sir.

It does get trying at times to sit tight and be right but I refuse to play a fixed game.

Unfortunately, its a tragedy waiting to happen again, the feds most stop subsidizing the real estate industry.

It’s easy money taking out insurance policies, backed by your own counterfeiter, on nice young couples that you know will get murdered soon.

Apropos analogy! Spot on.

That’s some definite crazycakes kind of home flipping, no doubt. But I don’t know if this bubble is going to pop anytime soon – all of the powers that be want the game to continue until the last card is dealt.

I suppose the flipper is hoping its true that “a sucker is born every minute!”

I guess the hipsters will buy anything, yaks.

Just realized that the condo unit down the hall sold and immediately had a crew in there the next day (Redondo Beach).

This same place recently had some upgrades (although IMHO it wasn’t a full gut, just kitchen and bathrooms utilizing the original floorplan) so it’ll be interesting to see what happens. Haven’t seen or talked to anyone besides the crew so I’m guessing it’s a flip.. which is sorta odd considering it already sold on the high-end at 525k.

Sep 09, 2002 Sold (Public Records) $389,000

Apr 09, 2003 Sold (Public Records) $452,000 29.5%/yr

Jun 16, 2011 Sold (Public Records) $444,000 -0.2%/yr

Nov 15, 2012 Sold (Public Records) $525,000 12.5%/yr

IF it hits the market again I think this one is RHGA worthy. Interestingly, from ’04-’11 it was used as a rental, and had a revolving door of tenants during that time.

Just to clarify the math a little bit on the Pepper house. If they sell for $520k, the commissions, sales costs, and operating costs will be at least 8%, which takes about $42k off the top. Subtract another, say, $25k in renovations. Subtracting the purchase price of $415k gives a profit of $38k. Still quite nice, but nowhere near the $100k + the good Dr is trying to shock us into believing.

First of all this house is butt UGLY, second, 40-60K in Arkansas would still be too high. Should be about 20K (before the added nice features) add 10K in a fix up and you have 30K house. This is nuts and it all has to do with, 1 the government/banking partnership, and 2 the change in banking laws in 1999 that allowed banks to lie to investors to fund loans and hawk the borrowers Note in MBS’s and rake in 100’s of times the value of the borrowers Note via derivatives. The underlying house asset is meaningless. It is the borrowers signature on the promise to pay that holds all the value and the borrower is duped into putting up the house. It’s called fraudulent inducement.

(So-Fla Bubble Zone checking in… please fill in the So-Cal details for me. Thanks in advance.)

Seems to be not near any freeways, BUT… right IN LINE with the main North-South runway at Bob Hope, just 1.2 miles away! No extra charge. According to FAA, that runway (15) is the predominant TAKEOFF (max. noise) runway due to prevailing southerly winds. I know it’s not LAX, but still, regional jets and turboprops are just as loud.

Sadly, Duh Flippers have down-graded this house, making it both uglier and less livable, as evidenced by the Google drive-by pic (yr. unknown, but probably 2006 or newer). They replaced the attractive wrought iron porch columns with some bland generic crap, and the period-correct airfoil awnings have been stripped and replaced with non-functional (New England?) faux-shutters.

This house faces due West, and thus the street elevation gets blasted by the sun ALL afternoon long. NOTE the effective window shading provided by those “old” awnings in the Google pic, taken @ ~2:30PM. Flippers made sure to take their pic earlier in the morning. Upgraded windows are not going to make up for that sun load. Lawdy. Do these type houses have ANY air-conditioning?

And 1235 sq. ft. carved up into a 4/2? Themz some TINY rooms going on there.

A Google drive down alley behind 1510 N. Pepper shows that the next-door neighbor is not only very close, but some kind of redneck junk collector; i.e. Code Enforcement is non-existent in Burbank, HOW can this be good for future property values? RHoGenius indeed.

The lot is deep, and the access alley is a plus, so I guess that’s the “value” here, i.e. future McMansion site… or multi-family rental, as seen across alley.

I’m an investor who used to flip alot of homes in Burbank but it is now saturated with new investors that do hardly any work and want to make $100K.

Deals are hard to come by but people are still buying.

Until people change the way they look at housing… the cost of money is cheap and they’ll but w/ FHA all day long…

Doc. Thanks for this post!

Jeff Coga

p.s. If anyone wants to see how we literally transformed a home in Burbank by adding 500 sq ft (most homes in Burbank is “small” – 2/1 etc) take a look at the video below.

http://www.youtube.com/watch?v=NpoHH5PlhAs&feature=share&list=PLBF6B8DAB5268C290

Phoenix—The best time to buy!!!!!

The Burbank remodels look very similar to the houses I am looking at (with intention to own/occupy, not flip). They appear on the market with nice hardwood floors but mediocre quality new bathrooms and kitchens and recessed lighting and then cost about $100K – $150K than prior sale but some span over 1-2 yrs rather than months.

Some of the remodels are really wonderful others feel of a HomeDepot crew.

Here is a nice remodel but lousy floorplan and overkill on a spa tub in the masterbedroom

http://www.trulia.com/property/3020846870-3555-S-Muirfield-Rd-Los-Angeles-CA-90016

This area of LA, 90016 has some nice areas between LaBrea and LaCienaga and between Jefferson and Baldwin Hills.

“I’ve also noticed more frustration in the comments. This is merely a reflection on the data of middle class Californians leaving the state.”

Yes. What comes to mind is saving California wages and buying out of state. Rental parity in my area is a $150k house. The minimal price within driving distance of my work is about $250k and even so there’s going to be competition on it, or there will probably be damage on it if it didn’t get sold immediately.

Drive a bit and you find $50-100k houses in Nevada, or places a few hours away from major metros. I’d rather take a wage hit and telecommute, as long as income is in line with prices.

$39,900 a year JUST in mortgage payments…..BTW doc. you don’t mention what income is needed to qualify for a loan like this…..

Remember when Flipper was a Dolphin?

Anyone else remember when Flipper was a Dolphin?

Burbank is a great town to live in. We have our own airport, trains, subway, electric and water company(includes state of the art electrical power generator). We have our own school, police and fire departments. Burbank is much better than Los Angeles and Glendale(very crowded people and traffic.). The homes are purposely small so a bunch of illegals don’t live in one home, like they do in L.A. and kill each other and burn down the homes. Only 1-3 people live in a home so the traffic is not so bad. There is plenty of entertainment near by(Universal Studios, NBC, and Warner Bros., as well as Griffith Park). I could go on, but this is just a sample. I am still at the studio. Early in the morning, you might see me on the street.

You have a train and a subway? Where do their routes go? And the part about homes being “purposely small so a bunch of illegals don’t like in one home…” Have any stats supporting that statement?

It’s a ludicrous comment based on the modern wave of illegal immigration. The house was built small either for WWII industrial worker or in the 50s boom after the war. It’s size has zero to do with illegal overcrowding. By the way they would move in and jam the house full except smaller homes and apartments are plentiful in the west valley and south Los Angeles.

Burbank has the metro train system that runs North to Santa Clarita and East into Ventura county. I’ve lived and worked in the area and neither seen nor heard of any subway – unless he meant the restaurant. I have had false traffic code incident with and seen corrupt police behavior in Burbank. Not bashing police just stating facts since he’s bragging about having cops.

Trains and subways and busses make no difference when I consider a neighborhood. I like the idea of public transportation but the reality, is you’ll be rubbing shoulders with the lowest life forms and you can’t see the juicy wet spots on herculon upholstery.

You either stand or, wear rain pants if you want to sit. You might be wandering around the rest of your day wondering if that was soda pop or piss you sat in on the train. If your pants get stiff , that’s the sugar from a soda drink. If the fabric of your pants doesn’t stiffen as they dry, it’s piss.

Until the courts and the ACLU stop coddling the bums, I’ll drive my car.

Thank You

After a decade of hell (we sold at the beginning of this nightmare) we’ finally bought a one-story fixer, closing in late Sept 2012. $70K later (interior only & roof) we’re almost ready to move in. With a long term eye disease facing us, we paid cash for the house to deal with one income (smaller one) going forward. Our timing makes us feell blessed. Housing is a place to live. The paracites (flippers) sucked 4 years of our lives, pricing the comps to the moon. So Ca is FUBAR.

We like stable property taxes. We’re not happy about the manipulation of this market.

I love Burbank and So Pasadena, but didn’t want to carry a mortgage.

You no longer Mad as Hell?

No longer MAH.

Fish Breath.

We took our housing proceeds, bought no

cars for 10 years, ate 99C food, and lived

frugal for a decade. We earned this house

by saying no to many things, including no

holidays for years. Then my other half gets diagnosed

with Glaucoma and an Eye Virus, and our lives changed forever.

Fish Breath, you are a heartless sub-human. Go away.

Why are you complaining? You made out like a bloody bandit. The very asset bubble which facilitated your all cash purchase of a home + 70K in repairs/interior decorating is the same scourge that created the flippers you so loathe.

It’s not like you sat and saved that money for four years, priced out by the flippers. Maybe then I’d feel your pain.

Oh and fish breath

We looked for our home after waiting out this market 6 yrs, only to be priced

out of the market another 4 years by comps comparing themselves to lipstick on a pig flips.

We lived in a dump, lived modestly, both of us got laid off, and our lives were full of a lot of sh*t. We aren’t spoiled easy money making a-holes. We got caught up in the biggest housing/financing scam ever. We got to this sweet spot by not letting our guard down. Be happy decent folks got some justice. It’s a good way to live life. Doesn’t happen to often.

Manipulated markets can last a long time, but do not end well.

DHB,

Is there any way to tell what fraction of newly purchased homes are owner-occupied? Is it a case of outside investors buying from flippers, or are real people buying these things?

If legislation was passed repealing prop 65 how high would property taxes rise? This seems a likely outcome given lack of wage growth & pension shortfalls for the public employees who run the state.

fwiw, my guess is property taxes will rise parabolically (to infinity & beyond). any comments? look what Calpers is doing to San Bernadoo. the public employee union pensions funds need your money & property taxes is a captive source of funds. can’t afford to pay? that’s your problem pal, pay me.

Prop 65 was the Safe Drinking Water and Toxic Enforcement Act of 1986 JT. Repealing it shouldn’t have much effect on property taxes. The 2nd half of your post is equally uninformed.

I hate California. I hate the Fed. I hate realturds.

Nothing more to say.

You don’t hate lawyers?

I think part of the problem is that many have an expectation that the $US is going to be sharply devalued, and so it’s smart to be short in it. Metals may be over-priced, and they’re not making any more land.

this seems a legitimate concern as full time jobs vanish & are replaced by part-time hourly wages (to avoid having to pay the medical benefits). Coupled with lower marriage rates, sky rocketing student loan debt, & an increasingly over-leveraged younger population, who is going to buy these flipped homes besides foreign investors?

It’s possible that foreign investment alone might keep the Cali real estate market afloat indefinitely. It won’t be the traditional market of younger couples starting families.

ok – whatever prop it was that tied the hands of the legislators (prop 10 or whatever, who cares?), where is Cali going to get the $ to pay its public employees if not from homeowners? I don’t really see anything on this board that seems to bake this into home ownership.

The state has a pension shortfall in the hundreds of billions. It already has the highest state income tax in the nation, the highest sales tax in the nation, but property taxes are relatively sane thank to legislation capping what the rates can rise to.

Given the constraints on income & sales tax (already # 1), & given the lack of a downside to the democratically controlled legislature (hell wil freeze over b-4 they lose power), why won’t they uncap property taxes?

Maybe I’m uninformed but could somebody please tell me what’s to stop them? And why?

I’ve always wanted to live in San Diego & could probably afford to spill out $350k for a decent 2 b/r condo but seriously doubt the property taxes won’t go to the moon within the next few years.

I’ve about given up on buying anything decent anywhere near where I work here in San Diego. So I’m staying in my sardine-can rental and saving up a wad of dough. A few more years and I can move back to my home town in Michigan and buy a place cash. The only reason I haven’t gone yet, is I am loathe to leave my current job which has a very nice workplace culture.

Leave a Reply to DFresh