Bank of America and their global banking profits – California negative equity will push many into foreclosure, examination of inflated California zip codes, banks more willing to push shadow inventory into the open.

Politicians like to talk about affordable housing but in reality favor policies that keep home prices inflated. The Federal Reserve has been the most active in suppressing adjustments in the market by keeping mortgage rates artificially low. Since the public is largely focused on the monthly payment, a lower mortgage rate allows home prices to remain higher than the market is willing to pay. If you think about the drop in sales and slow decline in prices in spite of all efforts, it boils down to the reality that good jobs are not being added and people cannot afford homes at current levels. This is clearly the case in California. Banks have started leaking out shadow inventory to the market but the inventory is so large that it will take years to clear out. Home prices at their core need to reflect the immediate local area income. Unlike a stock where being an owner can be global, buying real estate is largely a local matter. This is why California home prices are still inflated given the state’s unemployment and underemployment rate of 23 percent. Let us look at a few counties and see what portions of their homes with mortgages are underwater.

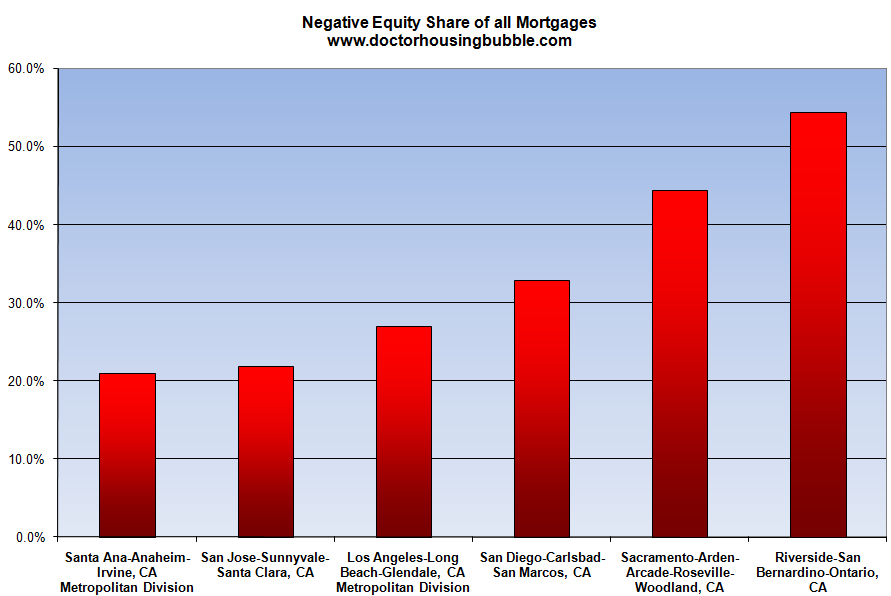

Negative equity

Negative equity is the number one predicting force in future foreclosure. This is apparent if you think about it since a seller with some equity would merely sell at market rates. Yet those with negative equity have two options; keep paying on an inflated asset and hope prices go up or stop paying the mortgage. In most cases the decision to stop paying is largely economic. That is, these owners simply cannot afford their mortgage anymore. The bulk of option ARMs are collapsing and working their way through the system. Over 50 percent of the Inland Empire properties with a mortgage are underwater and nearly one-third of Los Angeles homes are underwater. With prices starting to move lower yet again, each monthly price drop that we see means the negative equity line draws in more people.

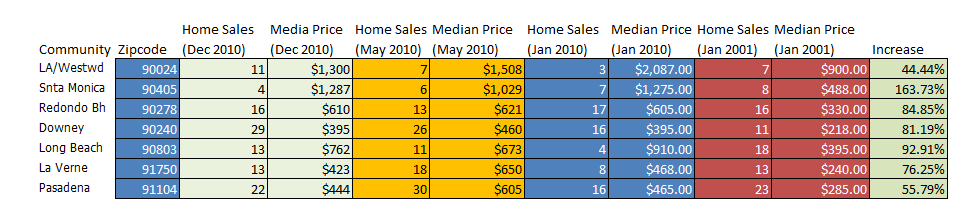

Some areas are still incredibly over priced. As we know home prices track inflation on a historical level. Over the last decade California has had 31 percent inflation in their CPI. Let us look at a few zip codes and see how close they are to this figure:

Each of the above areas is overpriced if we adjust them to inflation. The Downey and La Verne zip code saw a significant price decline from May to December of last year. The Santa Monica and Long Beach zip code saw good sized jumps. The increases occurred in more expensive zip codes but overall is down from the January 2010 price showing that these markets have high volatility based on their inventory. These zip codes have very large and custom homes that you wouldn’t see in an area where homes are all virtually identical. Even with these slight movements, these markets are still overpriced.

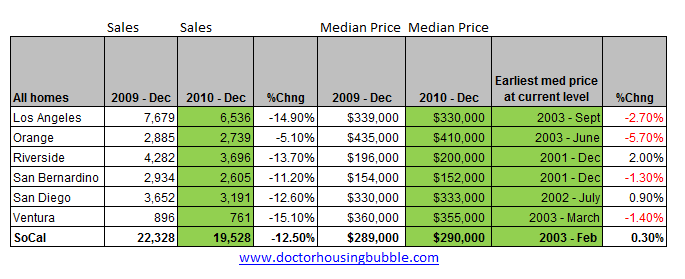

Overall however, prices for all Southern California counties are retreating back to levels not seen in a decade:

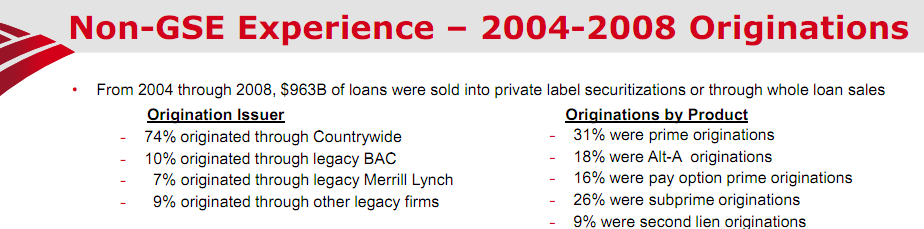

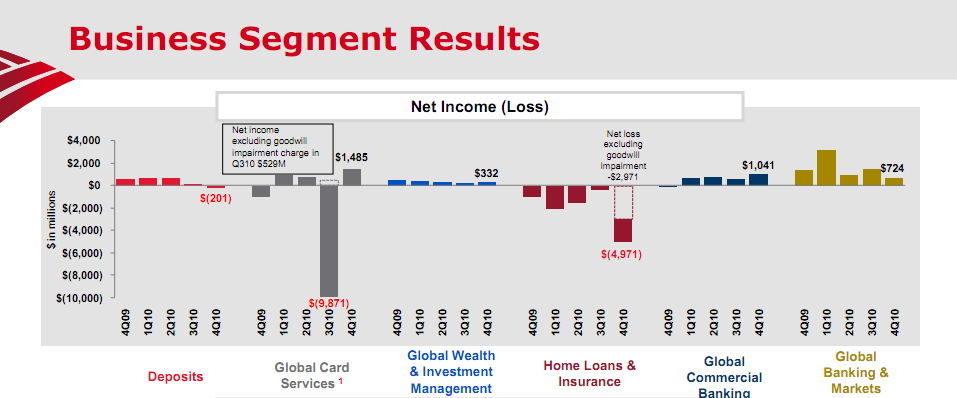

Riverside and San Bernardino prices are now back to levels last seen in 2001. Los Angeles and Orange County are now back to prices last seen in 2003. You can see the significant decline in sales which likely leads to future price cuts. When we look at the junk floating out in the market you realize that it took years to clog up this engine. Just look at Bank of America:

Source:Â Bank of America Investor Relations

Countrywide originated an incredible amount of junk loans. 18 percent Alt-A, 16 percent pay option arms, and 26 percent subprime from 2004 to 2008. From 2004 to 2008 $963 billion of this non-gse toxic waste was sold off. Yet here is the thing, many of these loans are still here in California while the owners are all over the map. These loans are attached to those negative equity markets we saw earlier.

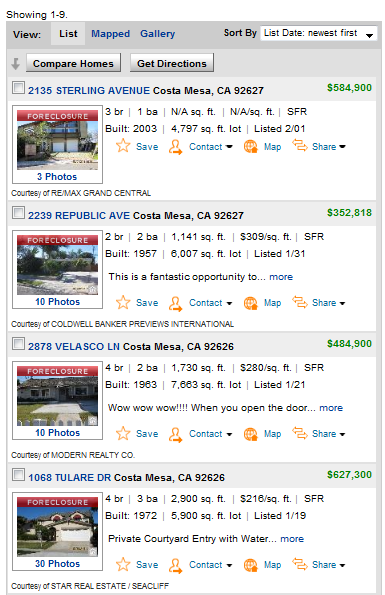

The shadow inventory problem is still large. Take a look at Costa Mesa in Orange County:

The MLS lists 9 single family homes in foreclosure in Costa Mesa. The actual shadow inventory shows us that 397 homes have a notice of default filed, are scheduled for auction, or are bank owned. Just think of how lopsided those stats are. Would buyers jump into a home right now knowing that home prices will fall by 10, 15, or even 20 percent over the next few years? The odds of this happening are large because:

-Home prices reflect local incomes

-Income growth is stagnant

-Good job growth has yet to emerge

-Federal Reserve can keep rates low for only so long

-Foreclosed home sales sell for much lower than non-distressed inventory

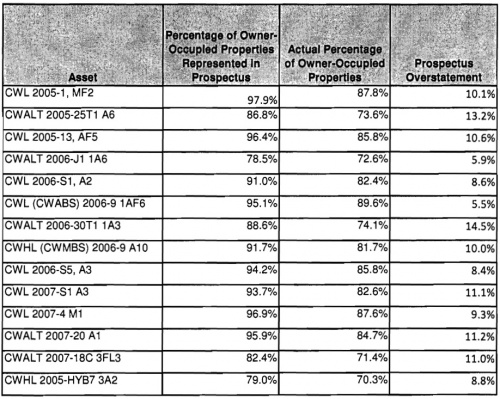

You add all this up into the mixture and you realize that problems will be hitting the housing market for years to come. Bank of America is being taken to court by Allstate based on investments they made. Their allegation through sampling is that prospectus information did not match with actual underwriting from the bank. In fact, they figure that the misrepresentation is high and this is included in their court filing:

Source:Â Zero Hedge

This is significant. But of course with banking graft for year over year and snake oil tactics in selling mortgages it is likely the entire state of California is operating under a similar premise. For the good part of the decade dishing out toxic loans was the name of the game. Incomes did not keep up but that did not matter. Today the same banks that setup the foundation for this mess are trying to obscure the facts by leaking homes out to market and the only reason they can do this is because of taxpayer bailouts and accounting magic. These are the same taxpayers that cannot afford the homes without going into massive debt with these same banks! People are paying for their own imprisonment. So what if mortgage rates are up to 8 percent so long as home prices fall to a level people can afford without going into insane amounts of debt. Just because the government is backing 95 percent of the mortgage loan market does not make it healthy.

A more expensive home with a low interest rate is much more troubling than a low priced home with a higher mortgage rate. You have so many more options with a high rate and low price. If you put $100 more on top of your monthly payment you can chop down your mortgage lower and faster. Yet the government is happy keeping people in debt servitude for the rest of their lives since it is already $14 trillion in the hole. The fact that many are kicking themselves for not maximizing leverage and throwing prudency out the windows shows how rotten this has gotten and has spread to the core of society. People can do what they like financially in a free market but the consequences must be taken by those individuals. Those that took massive risk in buying a McMansion and now can’t pay need to leave the home and find a rental. Banks that made all these bad loans should have gotten $0 from taxpayer bailouts. That is the bottom line. Instead, we are using the same crony capitalism to navigate our way out of this market. And guess what? Banks with taxpayer dollars don’t give a crap about a tiny market in Culver City or Pasadena. Banks area happy making money in their investment branches since we didn’t even bother to break up commercial and investment banking:

Bank of America made the bulk of their money in Global Markets and Global Commercial Banking last quarter. Deposits fell and a large amount of money was lost in home loans and insurance, the more traditional role of these banks. But thanks to the bailouts, our biggest banks are making money abroad while screwing taxpayers domestically. That is why we are seeing more homes leaked onto the market. Banks see these as long-term issues and there is plenty of money to be made abroad so they are now exiting the market. They can do this now since they have built their capital reserves through global banking profits that were leveraged with taxpayer dollars. What a wonderful world of crony capitalism. There is a wonderful sense of irony when you see these global bankers railing against California problems when they were largely responsible for creating the CDOs, MBS, Alt-A, and option ARM junk that allowed this to happen in the first place.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

44 Responses to “Bank of America and their global banking profits – California negative equity will push many into foreclosure, examination of inflated California zip codes, banks more willing to push shadow inventory into the open.”

I’m still bewildered that nothing was done to stop the madness, there have been no prosecutions, nobody has gone to jail…they ruin the world economy and get off scott free.

Don’t be bewildered. Just wrap your head around the fact that they thought this out way in advance and had moles placed in government (e.g. Hank Paulson, Timothy Geithner, etc.) to act as tail-gunners for their getaway car. They are in the position to wave off enforcement; nothing to see here move along folks everything’s fine, go about your business. They are diabolical.

Excellent article Dr. HB. I agree that we will likely see another 10 to 20% correction in prices for the prime, above average areas in LA/OC. With no meaningful job creation in California, the state’s dire financial situation and mortgage rates ticking up…that’s all bad news for housing. This is truly a great time to be a renter. If you are patient and saving money, you’ll be that much better off in a few years when buying will make sense.

The Fed exists to save their member banks. So, keep this in mind whenever you consider what the Fed may do next. Whatever the members need to survive, that’s what the Fed will be doing.

Mark-to-myth accounting was a govt influenced change that also helped the banks.

Together, the govt and the Fed have created an environment that allows these banks a long time span to clean-up their books. This will created a constant downward pressure on home prices for a long time to come…..especially with CA unemployment being so severe.

Getting a 15 year loan is one of the smartest things you can do.

On a 30 year loan, in the first 10 years, about 90% goes to pay interest ONLY.

On a 15 year loan, you can pay off a substantial portion of the house in the same 10 years. You then have either a lot of equity, and can move , or choose to stay, and own free and clear in another 5 years.

Or, you can get a 30 year loan and just pay extra each month.

Well, it’s more like 75% goes to interest for the first 10 years, but I definitely see your point. I know people who recently refinanced and now owe what they originally did 10 years ago. They’re bragging about taking out the money and their power rate, but they just added over $60k in interest they’ll be paying their bank. Plus now their loan’s recourse. Ouch.

With that logic getting a 5 year loan would be even better. Or maybe even a 1 year loan then the most you have paid is about 5% in interest total!

There are many factors that go into getting a loan but for most people it’s much smarter to get a lower payment and pay as much as possible. But people are foolish and they think that mortgage deduction is a good thing. “I saved 10K on my taxes!” But the fool doesn’t realize they paid $40K to a back to save 10K.

People pay way to much to live. My rent is about what property tax runs per month on most homes in LA. Once you factor everything in, you will realize that home ownership is almost NEVER an investment, even when it goes up in value at a normal rate.

The damnable thing is there is both deflation ( wages and housing prices) and inflation ( commodity prices) happening simultaneously. The middle class gets the debt deflation in the form of negative equity and wage erosion making their debt burden harder to pay while the banks get the benefits of the inflation in the form of speculation in commodity markets and by masking the extent of the losses on their loan portfolio. Truly diabolical. The victim is made to suffer the consequence of the bankers ( or should

we say flim flam men) swindle.

You are so right on!

I want to buy but the price in San Diego is stubbornly high. I don’t want to be a renter for the next few years although I am comfortable renting for another year. What should I do?

Flip a coin.

Save your pennies. Earn compound interest rather than paying it to someone else. Buy the house with cash for cheap when next interest rates go up.

In the mean time consider yourself lucky that you rent in a buyers market. The last thing you’d want to have to be doing is trying to sell when you lose your job, in this market.

Went to another open house today and it continues to be entertaining to listen to realtors tell me the market is “hot” and that “now is the time to buy.” I listened to a realtor yesterday tell me that a $760K home in Long Beach was “priced to sell” although it is probably $100K to high. Another realtor suggested I buy a house he had listed even though I didn’t want to buy it because I would never see such a great deal. There people look so professional and act so earnest that it makes them almost believable. I can see why people that don’t do homework or are honest themselves buy-off on some of their stories. Amazing. Probably going to get worse if things stay as slow as they have been.

Welcome back sockpuppet!

Just like the last home you thought was a great buy (The one on the busy street for $400k), I can’t help but wonder why you think that a home that sold for $282,500 in 1997 should be worth $660,000 (instead of the $760,000 crack smoking asking price) today.

“A fool and his money quickly part ways” I just gained new neighbors, they bought for about triple what is reasonable. It makes me feel good to know millionaires live on my street, or are they just debt-slaves??

California is broke, far too many poor people that are settled into the welfair dole.

We had better see that it can’t go on forever. Asking those that have a little to keep paying the goverement for all this is impossible. Think argentia total collapse.

We are already seeing the signs of social breakdown. many of these poor areas

now have squaters living in these unsold homes, in one way or the other by simple not paying and staying in the home or moving out then back in. See it all the time now.

Wheres the rage at the goverment ? wheres the people that have had it? when the checks and food stamps stop we’ll see just how mad america is.

The Calif RE market no longer reflects the growth pattern based on the past 40 years which not only impacts the current mortgage holders but the tax base for the cities and counties these Tax revenue both sales and RE based will continue to decline which puts present and past bond repayment plans in limbo and offers a slim chance that government pensions pay outs can materialize. The dirty little secret is that county and State officials and have used this growth pattern to generate bond issues in the name of growth or good for business but directed by special interest groups for their short term benefits but saddle taxpayers with long term debt.

Drs’ comments have been an illumination for me. His thesis is that real values for houses are based on external factors such as job growth, or demographic shifts. Changes in prices (not values) based on financial markets is unfounded. Those prices will eventually correct. Put a different way, buying a share in a company entitles you to a piece of the profits of that company. A house on the other hand produces no profit. Indeed, houses only produce losses in maintenance and taxes. If there is no increase in nearby jobs or no demographic shift causing increased demand, then no one can expect a sustainable rise in house value. The sustainable price may rise, but not with respect to inflation.

A house is a place to live. It is a liability, not an investment.

It is however difficult to get Americans to save any other way.

No kidding! My darn fascia-board on my place needs re-painting already, and it was all new less than 5yrs ago, and i used high quality boat paint on it!! It never ends, the earth takes back everything we build eventually!!

$1 Houses in Detroit illustrate your point lucidly.

Historically, housing prices track wages. At 5-10% APR on a 30 year mortgage with 20% down, reaching the generally accepted criteria of affordability — 25-30% gross monthly income for housing — places the maximum affordable house price around two and a half to five times one’s annual wage. With the historical norm of wages generally following inflation trends, it is rational to expect housing prices to track inflation. The failing of risk assessment that led to the bubble allowed credit to be granted well in excess of these norms. Had the bubble never inflated, we would be seeing prices between 25% and 40% of what they reached during the peak of the bubble. Where they will fall now is anyone’s guess, as the pendulum rarely stops at center.

26 months and counting with Bank of America non-payment and non-foreclosure. Its easy to have profits when you simply pretend your losses don’t exist. If you are underwater and paying your mortgage just realize if you stop it will take Bank of America over 2 years before they kick you out. Realistically I’m beginning to think it will end up being over 3 years.

Right on DG. I’m sorry you had to suffer for your purchase at the hands of the U.S. which made fraud legal for the banking system. I’ve suffered as well, and as soon as my Chapter 13 is done, I’ll walk from my house as well.

Just think, I *used* to be a law abiding man, but when unjust laws hold sway, the only place for a just man is in prison. Henceforth, I will only obey those laws I deem applicable to my fellow man, not the laws that I’m TOLD to obey. I do hope the government understands just what they are creating here.

I am in the 16 mo. arrears group. This is my Bankers math story: I bought a little 1915 Craftsman in 2005 for $405,000. Put $80K down (20%). I now owe $420,000 and counting. The house is now worth maybe $100,000 on a good day after I have remodeled the kitchen, bath and studio. I feel so lied to by everyone. The mortgage brokers were the worst say, “Inflation with beat out your Neg-Am.”

When will the Banks realize that it just isn’t worth it to service a debt that has no value?

Everyone with half a brain will realized that it is not advantageous for us to continue to hemorrhage money for bank interest only. I don’t even keep my cash in my BofA checking account anymore. The Mortgage industry got my deposit that quickly vanished, so I feel justified for squatting in my own home. As far as I’m concerned, I’ve payed for this house’s value IN FULL! However, living in this jobless town and living next door to an abandoned BofA property is just depressing.

Where is OUR Revolution? Why aren’t we picketing BofA and our Government? The health care bill is getting all the national attention. Health insurance is the last of my worries if I have no place to live.

I’ve written to my Congress person, I’ve applied for the HAMP programs, I’ve written my hardship letters. Nothing is being done to help the homeowners. Most of my friends who did own before the bubble burst have already gone through a foreclosure (like a mid-life right of passage) and are happier on the other side. They gave up on the money they lost, licked their financial sores, and are now all renters.

When my foreclosure comes to fruition, another wake of devaluing will befall this house, as I will rape the home of anything of value. It’s all I can do. I will never have a mortgage again. I think it’s a trap to enslave people to the bankers profits. I am done being lied to. Fool me once – shame on you, fool me twice – shame on me.

Great Article. I believe we will see a bigger drop in values though. i see at least a 30% decline minimum. City’s, County’s, and the State are all in the hole so there will be more layoffs. Let’s look at what is happening now…Inflation is on the rise and will get worse. This is NOT inflation because the increase in jobs, wages, loose credit. This is inflation via the decline or collapse of our dollar. Energy and Food inflation or should i say “Necessities”…..along with this will come higher interest rates. This alone will drop the market 20%. Now let’s throw in Higher taxes and Job Losses….People will think of 1 thing only…..how and where do i get my next meal. there will still be the rich but the middle class will disappear….It is going to get real ugly…..buy Food now while it is still cheap and stock it up. this is not a conspiracy thing either…just REALITY!

There will be a significant frop in CA home prices starting early this summer as the banks finally start to release the first wave of shadow inventory. Supply and demand; the first wave will be gobbled up by the folks who are tired of renting/ tired of open houses and can still qualify for a great rate-let’s face it, this is still Eisenhower era money.

The second wave may not be until end of 3rd 1/4 and will have a more significant impact driving homes further down in price and then we will likely see the mob trying to exit the playhouse when it catches fire and all order will be lost, banks will dump the properties regardless of any eloquent please by Obama to “keep these fols in their homes”. But no one can say %15 or %20 or %22.317 it will also coincide with employment numbers both here and elsewhere; if CA does not start adding jobs and fixing infrastructure people will move to where the jobs are.

3 years without a payment to BofA is PAR. They have announced 2 weeks ago that they have 163,000 loans in excess of 16 months delinquent. So if you have not made a payment for 1 year you are not even in that stat. Pretty clear too now even to the most myopic banks: 24 months in arrears is probably not going to reinstate that loan. Had a gal in my office, 4 years without a payment or property taxes, basically just paying utilities, drives a BMW 7 series, loan is with BofA and she is complaining they finally set a foreclosure sale date. I asked how I could help-short sale? No, “can you help extend the sale date any longer”?

As I have said, this is intermission, if you can wait 18 months you will have a much wider choice of available homes, a much reduced market value for those homes and still fairly good rates historically unless our wheels come of and bond prices fall off a cliff. Overall I am seeing a 5 year delay between now and any kind of mprovement in housing….or better yet, 5 years between the banks flushing the toilet finally and any meaningfull pickup in pricing.

Looking to buy in Upland, Claremont, Rancho Cucamonga Area. Prices are higher here than in other parts of the inland empire. Should I expect prices to fall in this area?

I am in the same boat as you karissa. Inland empire median home prices have reduced dramatically but Rancho Cucamonga, Upland, and Claremont are overpriced. If you do find something that is reasonably priced it is usually gobbled up in the first week by an all cash buyer. I don’t know if this has been discussed but there are quite a few foreign investors that are buying a bunch of houses with cash.

Investors are the driving force in that area of upscale Ranco/Upland Claremont as it was always the better area and so will be last in and last out of price correction land. There is no other place right now to put cash; the Dow is a bubble again as is gold, commodities are at record levels and the dollar now faring poorly against everything else so investors are saying housing at depressed levels with an about to be boom in renters is a good safe bet. Cash flow and eventually appreciation and they like the better areas. When the banks lower the boom on the shadow inventory those folks will be renters probably wanting to stay in the same area and able to rent a similar home accross the street from their foreclosure for less than the modified payment of their old home!

But here is the best strategy: only work with the listing agent and if you have to overpay slightly so what? You are using financed money probably at %3.5 down through FHA against someone who is paying all cash. The greedy listing agent will try and help you over others for both sides of the commission and if you have to borrow $25,000 more to secure the property at these rates over time it is still peanuts. Be carefull you don’t get your wish of a %15 drop in prices that carries a penalty of a %2 hike in rates by the time the prices eventually do fall.

VITAL to remember: no one, ever in CA lost money on real estate by holding on for over 7 years. 2, 4 ,6 years sure but if you hold on long enough and use the house as a home instead of an investment strategy, you know, somewhere to live, you will be fine. I know, I bought in 89 and was an idiot in 94, a genius again in 98 but who cares? I still live there today.

This advice is absurd. And by the way, I have been in my house almost exactly 7 years (bought in early 2004), and it is worth less than what I paid. I imagine it will be this way for a while.

Why would you just make up a statement like that?

Unless you are a local plumber who can be so damn sure to have a company job for seven or more years? Our experience is we change jobs and move to another city every 5 years. So we are out the buyer’s pool.

Your 7 year rule is beyond absurd. Ask anyone who bought in Riverside back in 2004 if their house is worth the same today…7 years later. Chances are they will be upsidedown by around 50%. Places like the IE and Central Valley will likely need DECADES to come back to peak bubble pricing…things got that out of hand!

Sorry, I don’t take advice from people who bought in 89.

The fix is in folks. Don’t look for things to get better. The superrich are not even trying to do things under the radar. Aside from owning almost everything you see, they now own the administration, the congress, the supreme court, and the press. In addition, pretty much every dollar you spend winds up in their pockets in the end. That’s why people like Lloyd blankfein can barely contain their snide sneers when they appear before some congressional committee. Because they know they are just wasting time answering to people they OWN- namely the US government and it’s willfully ignorant and complacent citizenry.

What you are saying is true…but oh so painful.

@ Christian Stevens

Your statement regarding holding onto a home for seven years may be true in some areas, but I think you are very mistaken if you are assuming that this will happen in all areas. It will not. In some areas, it will take much longer. Maybe even into the next century for prices to recover to 2006 levels. Prices increased to unrealistic levels not ever seen before in such a short period of time. 1989 and 1998 were nothing like 2001- 2008. There are still housing bubbles in many areas, so this housing mess is not even close to being over.

Maybe he was confused with the seven year itch? She’s startin to sag, time to trade her in. Human memory and behavior cycles have some corellation to the bussiness cycle…..

The public is focused on the monthly mortgage payment because billions of dollars of advertising and marketing were focused on engineering that mindset into them.

One day in December I turned on the TV for some reason and Hockey Night in Canada was coming on. For about fifty-eleven minutes this dwarf (maybe a child–hard to tell with that lighting) sang both the Canadian and American national anthems at about the speed of James Levine conducting the Metropolitan Opera orchestra in the Vorspiel to /Parsifal/.

On and on it went….and I thought…what a ridiculous use of time! Imagine what could happen if, say, each and every sports team’s game devoted that X minutes of National Anthem Yowling to teaching math and economics basics? Imagine that? “In honor of our nation, a three minute discussion of compound interest.” “In memory of those who gave their lives for freedom, a two-minute introduction to the Rule of 72.”

Oh well. One can dream.

Now that I think about it, the seven year rule will probably not apply for any areas in this country. Prices will continue to go down for who knows how long. This last housing bubble, that we are still in, was like no other housing bubble this country has experienced. Once the cancer of the Great Housing Bubble has been removed, then we can start talking about the appreciation of homes. Until that occurs, prices will continue to decline. Our system is broken, and needs to be fixed.

Advice sought: COndo in Marina del Rey (near beach in Los Angeles). BOught for $790K in 2005, now appraised at $550-600K. INterest only loan 6.9%, fixed until 2014. Never missed a payment, credit score 780.

Bank refuses to modify (despite co-borrower with Leukemia!)

I have enough cash saved up and a loan I can get for a new home, at 2003 prices in Santa Monica, and then walk away from the underwater place.

But many here think prices are still correcting (even in Sant Monica?)

HOwever, the instant I skip a payment, I will lose my credit score and ability to get a loan for at least 3 years…

So should I buy now before I walk, or Rent for a while, saving cash, and letting my credit recover after the short Sale, or Squat in the house, not paying and awaiting foreclosure….

ok, Discuss! THANKS for advice!

YMMV, but I keep hearing that banks let those in default often stay there for a year, sometimes years without any action. Then you could and should demand to see the mortgage holder has all ducks in a row. By then, the choice will be yours, whether to rent or get another mortgage.

Why on earth wouldn’t your bank refi and modify the loan? Who is the lender? Good luck!

Hear, hear! Like in the fairy tale, the emperor is naked and the Doctor deserves praise for shouting this truth! Take FED Chairman Bernanke: http://dailybail.com/home/a-movement-by-the-people-to-prevent-the-reappointment-of-the.html

Now a link to a video about oversight of the FED itself. Very revealing and quite scary:

http://dailybail.com/home/there-are-no-words-to-describe-the-following-part-ii.html

Leave a Reply to Thomas Paine