Will there be a steady supply of homes for sale from aging baby boomers in this decade? Who will they sell to and at what price?

From 2010 to 2020 we are going to have a large number of baby boomers entering into their retirement years. Many will look to downsize and the projections have been, that this would add a steady supply of housing. Issues like negative equity have kept many potential homeowners from actually listing their homes on the market for sale. It is also the case that a younger and less affluent generation is going to struggle to pay top dollar for many of the properties hitting the market. Many are resorting to using loans that are insured by the FHA that allow 30x leverage just to get their foot in the door. It is interesting to see this trend unfold because there is nothing that can be done to stop the momentum of age. Banks can alter accounting rules and hold off inventory to create artificially low supply but there is nothing that can stop our inherent biological aging process. Some interesting data is coming to the surface regarding baby boomers and the demographic changes that will impact housing. Will baby boomers add a significant number of homes to the market in this decade?

Baby boomers and impact on housing demographics

Some interesting research on the demographic shifts in housing:

“(The Atlantic) In the coming years, baby boomers will be moving on (inching further through the python, if you will). “They will want to sell their homes, and they’re hoping there are people behind them to buy their homes,†says Nelson, director of the Metropolitan Research Center at the University of Utah. He expects that in growing metros like Atlanta and Dallas, those buyers will be waiting. But elsewhere, in shrinking and stagnant cities across the country, the story will be quite different. Nelson calls what’s coming the “great senior sell-off.†It’ll start sometime later this decade (Nelson is defining baby boomers as those people born between 1946 and 1964). And he predicts that it could cause our next real housing crisis.”

The big challenge will be at what price will future buyers purchase these homes for. For the moment, about 30 percent of the market is being sopped up with gusto by Wall Street and investors. However yields are now being squeezed. There is no way investor demand will stay this hot. So what other group is going to step in? We’ve also had the FHA insured buyer making up another 20 to 25 percent of buying for the last few years but the FHA is having financial issues. The assumption of course is that we’ll somehow have another baby boomer wave that will have the same buying habits as prior generations:

“Ok, if there’s 1.5 to 2 million homes coming on the market every year at the end of this decade from senior households selling off,†Nelson asks, “who’s behind them to buy? My guess is not enough.â€

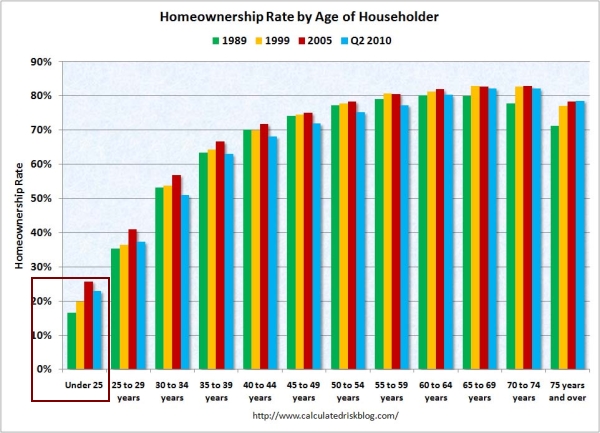

This is a key point. First, let us look at homeownership by age:

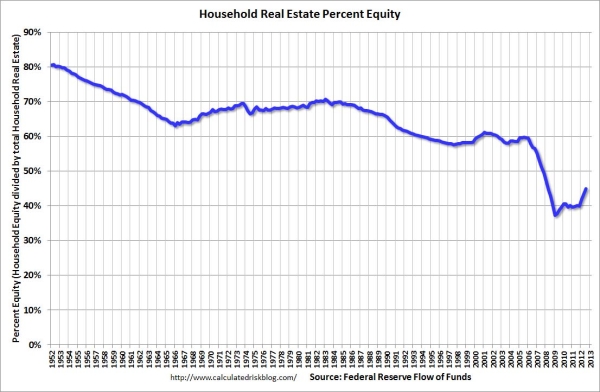

What you’ll notice is that you will have to hit the 35 to 39 age range before you have a 50 percent homeownership rate. This means you “own†a home and not that you have it free and clear. It is more likely that those with free and clear properties are those 55 and above. We know that about 29.3 percent of American homeowners actually own their home without a mortgage. This group obviously can sell at any price point and make a profit. But Americans have very little equity in general when it comes to housing:

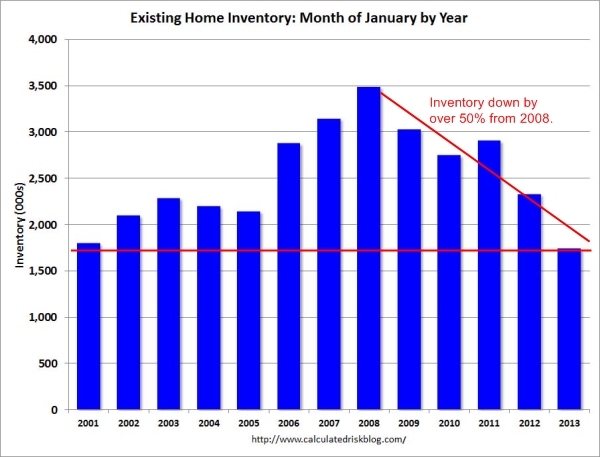

How big will this demographic change be? Housing markets as we all know are made at the margins. At any given point only a tiny portion of inventory is available for sale and at any given point, only a small part of the population is looking to buy. Historically, a 6 month supply/sale ratio has indicated a normal housing market. Today in California we are in the 2 month range. This low rate isn’t being driven because of record sales but because of historically low inventory out in the market.

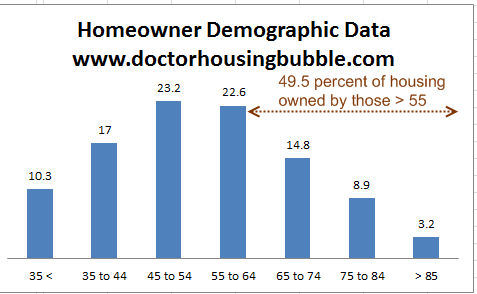

The best way to figure out how much potential supply will come from this group is to first look at all the data regarding baby boomers (and older Americans) that do own a home. This data is hard to come by but I dug this out of recent Census data breaking down the percentage of all homeowners by age range:

Source:Â Census

So essentially 50 percent of all owner-occupied homes are owned by those 55 and older. This means that 37 million homes are in a rapidly aging population. More important, is that you have roughly 27 percent of all owned homes in the hands of those 65 and older. Now considering that inventory is so low, this is a potential pipeline:

Obviously the older the homeowner, the more likely a home transaction will take place either to transfer over to family members or to actually sell for medical treatments or retirement living. Some baby boomers seem to underestimate how expensive old age is in the United States. And yes, as people age they do tend to move for a variety or reasons. Some of the research on this does point to some challenges ahead:

“Roughly 7 percent of over-65 households move each year, and as people get older, their likelihood of moving from owning to renting gets higher and higher (it’s about 79 percent for households over 85). By 2020, there were will be around 35 million over-65 households in the U.S. That year, Nelson calculates, seniors who would like to become renters will be trying to sell about 200,000 more owner-occupied homes than there will be new households entering the market to buy them. By 2030, that figure could rise to half a million housing units a year.â€

Home equity won’t pay the hospital bill or feed you for the month. You need to sell and unlock that cash. Of course the market is always focused on the short-term. People have forgotten the days of 2003 to 2007 and the mania induced buying followed by the bust of 2007 to 2010. We are having bidding wars, ridiculous offers over list prices, large investor demand, and flipping is back in fashion. The fact that so few people are paying attention to this is troubling. We do know that people will age and need to sell to a less affluent and younger generation at some point and this new generation of buyer has different housing tastes (i.e., close to metro areas, smaller square footage, etc) right?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

65 Responses to “Will there be a steady supply of homes for sale from aging baby boomers in this decade? Who will they sell to and at what price?”

The CBO projects in 2020 it will cost tax payers approximately 3.5% of GDP to service the debt. As of 2005 there were 140 million or so tax payers, only about 100 million actually had any tax liability. Let’s be generous and say GDP is 18 trillion in 2020 * 3.5% is 630 billion / approx 110 million tax payers = $5,727.00 per tax payer, per year – just to service the debt. It time start talking about generational housing.

Three generation households will surge, for some it will be the only thing that makes sense. I also predict that kibbutz style living will be an answer for many seniors.

In California we already have 3 generational housing. Me and my husband(and children) live with my parents. They take care of the kids. Federal cash benefits-Most states offer programs that use a Medicaid waiver to allow direct federal payments to family caregivers of old parents for their services.

California, for example, the care recipient must apply for and be granted admission to a personal assistance program. Payment comes directly from the state . (see the AARP website) There are so many government programs for madre and padre(and everybody too) Three generational housing is great. You can get some big homes for cheap in the “Inland Empire”. All the government cash benefits can practically pay for the mortgage. Just watch whose name you put the property in and etc. Don’t want to get caught like my cousin idiota Carlos.

“this new generation of buyer has different housing tastes (i.e., close to metro areas, smaller square footage, etc) right?” Burbank houses fit the bill. They are smaller square footage, next door to that failed city of the Angeles. Burbank has their own power plant, police and fire, schools, and of course the Airport and the train station. Take the shuttle bus a couple of miles to NoHo and take the Redline tube over the hill for the adventurous. The old folks in Burbank can hear them calling them, so they are packed and ready to go(hopefully not to St. Joe’s). Burbank just passed a new school bond for the couples with kids. Y’all come.

While I think this is an issue, I don’t think we’ll be seeing an overwhelming number of long-term residences finally come on the market.

– Interest rates today are making it possible for those with a mortgage to refi and possibly pull some money out at the same time. Some of these people may be planning on another 20+ years in that same home, even if some rooms stay unused (or they simply live downstairs).

– Given the above, and a low (or no) mortgage payment, what is to stop a recently retired, otherwise healthy couple from renting out that large home and renting somewhere smaller within the area? They might end up a few hundred/mo, can travel with limited responsibly and maintain equity (just in case). It seems like a safe bet to me.

– I think the 35 and under (first time buyer) crowd will bump into Boomers moving into those more urban, smaller sq footage homes (condo/townhouses included). It sucks, but the condo complex I currently live in is packed with Boomers who have already downsized. This is also the only ‘affordable’ housing in the area, but it’s been gently ticking upward over the last two years. I haven’t seen one open house that has anyone under 40 taking a tour.

Any way I slice it, I don’t see an opening here..

As always, I point to the awful Florida market as evidence that the Boomers simply can’t sell. With 10,000 Boomers turning 65 every day since 01/01/11, you would think there would be a flood of them bargaining for the incredibly cheap homes down there, maybe even starting bidding wars. Isn’t happening. Sure, sure, some will say that “I’ll never live down there”, and, I agree, I wouldn’t unless I had to, but, out of those millions of aging Boomers, even a smallish percentage would move the Florida market. No state income tax, no heating bills, no need for a big winter SUV, great winter weather, fantastic geriatic health care, many of your age group, and early bird specials. Nobody but rich Brazilians and Euro trash buying up Miami condos, otherwise, no market movement. Must be awfully depressing for all of those down there who counted on them buying their palaces.

Maybe it will happen, eventually, because of property tax inflation up north, and, well, just survival, as the Boomers who lose their jobs have to opt out for the cheapest place to die, because they have no money saved, and little home equity. We’ll see.

I’m not sure Boomers are as broke as we like to imagine (or at least, with the info we’re given). Most I know are still gainfully employed and plenty of the divorced ones have been pairing up with others over the last five-ten years.

I think they are doing pretty well while claiming to eat cat food and ‘scrape by’. I guess they actually learned something from the greatest generation..

@Chris

It’s not imagination. The average retirement account for Boomers is about $50,000. It’s skewed to the high side for that group, because the median is $110,000, and half of them have nothing at all. Zero. And, it’s not as though 110,000 will get you far. Sure, as you say, many are “gainfully employed” because they have to be. If they stop working, either voluntarily or not, they will instantly fall into a life of poverty that will not include BMWs and golf. Hell, it may not even include a car.

The average net worth of a 65 year old right now is $210,000, most, or, maybe all is home equity, of course. That money is highly illiquid, because, hey, you gotta live somewhere. I would expect to see levels of senior poverty within the next decade surface that will rival the carnage we saw in the thirties. Nobody has any money, and, they are still piling on debt, even the debt for their children’s and even grandchildren’s education by co-signing. It is not going to be pleasant for many who don’t have a job, and, that is going to be a lot of them. You can’t work forever.

I would look at the time contrast. LOTS of boomers buying second homes/retirement properties in 2003-2007 period. Now very very few. Cheap credit is back (albeit fraud is a lot harder) and pricing is far down. Did demand suddenly change, maybe some. I think a more realistic appraisal of the situation is that boomers are now looking at their balance sheets, value of primary residence and all the debt sitting on it/them and either have no flexibility or are being more realistic about their flexibility and not wanting to overextend again as the clock is ticking and job market is not great (very hard to replace a good income).

Hell, I’m late 30s and with a more portable travel oriented consulting job I consider moving to Florida due to taxes, weather, and ocean. Problem is culture you are raising your kids in and in many areas you are wedded to private schools (still the tax move is big enough to compensate that). The fact you don’t see boomers snatching up retirement properties is very telling in my mind. They are overleveraged already and their time horizon for risk is getting shorter and shorter.

The amount of debt most boomers are carrying around and the lack of retirement savings many are facing has been pretty well documented. Google “baby boomer debt” and you’ll find countless articles covering this issue, many with irrefutable data to back them up.

There is a huge segment of this group that is counting on Social Security and home equity to carry them through retirement and for many, this will not nearly be enough – not if they expect to main their current lifestyles.

Many of us know plenty of boomers that are doing well, and had the foresight to plan ahead. The reality is (if hard data and research are to be believed) for each one we know that is “OK” there are several that are not.

Chris – point taken, but could you please provide some evidence for those assertions? Every number I see now confirms the paltry level of retirement savings for both retirees and soon – to – be retirees. Most of those studies also include the home equity factor – so if there’s anything you’re seeing that contradicts those assumptions, I’d honestly like to see it.

Average income dropping and family formation with it. Who will they sell to??? Their kids, at a steep discount.

Good info and good thoughts – the other alternative to unlock their equity is a reverse mortgage. We may see a reverse mortgage resurgence… I would prefer they sell though…. : )

I suspect that if the market price is inadequate to fund retirement, then the house will be kept as a rental: generating cash-flow to live on, and eventually passed on to the heirs (with Prop 13 tax-rate intact, no?). This works even if the mortgage isn’t paid off yet. The house becomes an annuity, inflation protected to boot.

On another note, my 91 year old grandfather was able to extract equity from his Marina del Rey condo by refinancing. Meaning, somebody is giving out a 30 year fixed refi loan to a man unlikely to live 5 more years….

My 92 year-old grandfather just refinanced his home as well. If we weren’t having a serious discussion about the housing market at the time we probably would’ve had a good laugh about that one.

“Meaning, somebody is giving out a 30 year fixed refi loan to a man unlikely to live 5 more years….”

Not only that, but, they allowed him to cash out some equity! Amazing.

Age discrimination is illegal when lending for a refinance. (As it should be)

Come on people, if their is no heir to the property, the bank gets it for hardly nothing by foreclosing after death. Think about it. If their is an heir, the bank will get their money.

I wonder how this factors in with the ‘deals on foreclosures disappearing’ and ‘spectacular job growth’… huh?

http://www.businessinsider.com/tight-supply-hits-foreclosure-discounts-2013-3

Who will be buying the baby boomer’s homes? Perhaps this is an answer:

“Most impressive is the fact that the percentage of immigrants who own rather than rent their homes is projected to rise from 25.5 percent in 2000 to 72 percent in 2030.”

http://www.americanprogress.org/issues/immigration/report/2011/11/14/10583/assimilation-tomorrow/

A liberal think tank says that 70% of immigrants will on their homes in 2030. Is this legal or illegal immigrants? All immigrants? These are the same people who deny that illegal immigrants are destroying our emergency system and school in LA and deny that illegal workers take jobs from legal workers. I wouldn’t count on selling my house to any newly minted legal from illegal immigrants.

sales are to whomever has the cash, Just ask Al Gore

On the previous Dr. HB article a poster posted a video about the Chinese housing bubble leading to an eventual burst. I think the same it inevitable in Canada. I wonder, since the economy is global and financiers could care less who they get their money from, if housing will ease up in the U.S. when those bubbles burst.

I think there will be an eventual bust up north, but Canada’s in much better shape financially than their neighbor. Their federal budget is currently running a surplus, and they suffered far less economically than we did after the financial implosion.

keep in mind the debt to income ratio in the US was 125% when our bubble burst. The debt to income ratio in Canada in over 145% so they could fall even harder when their bubble bursts as we all know it will. It is not a question of if, only when.

Yes, and all their mortgages are required to be insured and are ultimately backed by…drumroll…the Canadian government! Let’s see how long those budget surpluses last.

http://www.nationalpost.com/opinion/columnists/story.html?id=734ff73e-1f8c-4bfd-b3de-5e468913e8be

Wonder how many will do reverse mortgages?

I am 52 and husband is 56. We have worked since we were 15 years old. I stayed home and reared respectful hardworking sons for twenty-five years. We have lived frugally , but early on in our marriage spent more and made some dumb mistakes particularly in housing. We reeled in the finances and have plugged away at our mortgage and savings, little by little. The dissing of the baby boomers gets old. Why diss your elders just because they are 25 to 30 years older than you. it’s weird to me, but the offspring of some baby boomers seem really covetous. Were you raised like little rich kids and can’t deal with doing without and living frugally, while wishing decent people would die and decrease the imaginary surplus population as Ebenezer Scrooge did? Make your own way with your circumstances and when you quit blaming others, you might be happy.

Kerri, thank you. I am 59, have worked all my life, never owned a home — as a matter of fact — or made a dumb mistake that someone else had to pay for, have no debt, cleaned up a lot of mess left by my Greatest Generation parents including taking in a younger sibling, AND am really sick and tired of the boomer bashing by people who know no history. I think that using a “generation” as an organizing principle is a flawed model. No one thing is true for everyone born in a given period (they don’t even all die at the same time). This is especially true of boomers. And as you may have heard, we didn’t start the fire.

So, take it from me young’uns, because I’ve done it: You can live a full rich life without ever owning a house. In fact, I recommend it. Start by stopping the whining. I recommend that, too.

Your condescending advice of “make your own way with your circumstances…you might be happy” sounds great and dandy when you ignore the facts that your circumstances involved the ability to buy a reasonably sized house at a reasonable price in comparison to income and mine do not. Also, ignoring blame of your generation for part of this problem is great but it does not eliminate the fact that blame exists. I certainly was not part of the frenzy and run up of the housing market (and I have no evidence you personally were either) but you cannot deny that your generation did not play a part. Your indignation that us “little rich kids can’t deal with doing without and living frugally” reeks of “Do as I say but not as I do.”

Life isn’t fair, we get it, but your comment basically throws it in our face and says, I’m entitled to what I have because I was lucky enough to be born when I was and you weren’t, deal with it, and please pay no attention to the reasons why this is the case because I have a vested interest it everything remaining the same.

Sorry beson and chris if I hurt your feelings and came off condescending. I understand your trying. Sadly, the collusion between the government, banks and parts of the real estate industry just seems too manipulative to overcome sometimes, while they lie to the public about how they are smoothing things over and saving the economy for our benefit. That is really annoying. The government just wants people to borrow no matter what no more rules and guidelines to keep the show going.

I wouldn’t say we’re dissing our elders, or wishing harm upon them. I actually have great respect for what my family has been able to accomplish over a few decades, and I hope they continue to do so forever.

If we’re sitting around here grumbling about housing today it’s because we missed a “sweet spot” in Real Estate that ended about 15 years ago, back when it was possible to swing a home with a single-income, frugal-but-comfortable lifestyle (as you proved).

The increasing reality (at least in the parts of SoCal where it’s safe to live) is that the first-time, single-family homebuyer is now in contention with all-cash flippers and investors, not to mention ‘downsizers’ who have cashed out of a larger home.

I understand that it comes off as whining, but at the same time the knee-jerk “Buck up, Buttercup” response out of Boomers can be a little bit irritating when the paradigm has shifted and made your own experience completely irrelevant. Trust me, we’d love to follow your example, but it’s simply not possible today (maybe in the future, which was the original intention of this DHB post).

The issue is that government policies have worked to enrich the incumbents in the marketplace, namely the Boomer generation that already owns homes and bought said homes at a time when an average income could purchase an average home. Now, imagine that the home you bought for an average price in the 80’s is not unaffordable to even those with above-average incomes and savings. Or to put it another way, instead of a 1% yearly appreciation rate, government and banking policies enriched you with a 5% yearly appreciation. Also, since most Boomers have no retirement savings, and the government knows this, it chooses to inflate the incumbents housing wealth to make up for the lack of retirement savings. That’s where all this talk of housing is the best investment blah blah comes from. They’re hoping you tap equity or sell and pocket the gains to fund your retirement since they are trying to find ways to reduce Social Security spending with all kinds of ways to reduce the COLAs.

You say, “This group obviously can sell at any price point and make a profit.” Not so fast, that’s magic math. Suppose someone bought 30 years ago for 400K. Assume 20 percent down. Loan is 320K, 30 year fixed at the average over the last 30 years which is around 8 percent. Over the life of the loan, they would have paid 525K IN INTEREST ALONE, plus taxes (maybe 100K?), insurance, maintenance, repairs…and the principal of 320K. Just PI is 845K! So they may “make money” depending upon where it is located, etc. and yes, people have to live somewhere, so they are paying rent (which could have been considerably cheaper, albeit probably not as nice)…but don’t make it sound like the money they get from selling is all “profit.” Think also of lost opportunities of taking that 320K, buying tech stocks 30 years ago….they would be sitting on piles of cash had they bought MS, Apple, etc. back then instead of sinking into a depreciating asset that may or may not net them money after 30 plus years!

Im a boomer and it disgusts me that the arrogence of some boomers (as witnessed above) reeks of “Im better/ smarter than you and has an attitude of greed and ungratefulness. shame on you and Ill apologize for them all. I have some nabors like that and I totally stay away. they should learn humility and cut the shit with the argumentative attitude. they probably never were cool. what Im seeing here in sun city is a lot of younger boomers buying homes ..some are renting out the other one (in MN WA OR IL IN CA Canada ) cuz they cant or wont sell.

Florida isn’t all that bad

http://campaign.r20.constantcontact.com/render?llr=t6qceacab&v=001bX0lc4lcuhOJVXmt7yyF95n9o9Dgu-e77Bba1jr1esCUxoDZPOtUxeOjnfQYaOhPwKPQKj8psWfIoYmU-Fbl5u6eZF9gLxf4YgwcIzW6Nic%3D

By 2025 those 65+ are expected to increase by roughly 28M.

In the same time frame those 20-64 are expected to increase by 31.5M.

There is a shifting demographic, but the increase in overall population mitigates the overall impact. It is not as if there will suddenly be no one to occupy homes nor can we attribute long term buyer tastes to the current trend of younger buyers preferring closer to cities and smaller properties to nothing other than their age and lack of income. There is no reason to believe once their earning power increases (or real prices come down) they will not choose larger suburban homes. Especially as the cost of ownership decreases with inevitable technological improvements in alternative energy and efficiency.

We must also take into account the fact that the Boomers are living lives at 75 that the previous generation gave up on at 60.

There are a lot of factors at play and with the current level of Govt manipulation of the markets its difficult to decipher where we stand today, which makes it impossible to truly analyze the future.

Data Source: CRS computations based on data in the U.S. January 21, 2011 based on the Census – http://www.fas.org/sgp/crs/misc/RL32701.pdf

The vast majority of Economists didn’t see 2008 coming, at least not publicly. So what’s new about today? Nothing. Remember, we don’t live in a vacuum, and what happens globally affects us regionally. With all that being said, on my opinion we’re in a short term Real Estate bubble. A lack of inventory/product almost always increases the price of any commodity. But what happens when you have less discretionary income due to less Government spending or higher taxes or when eventually the interest rates climb again. Now whats my home worth?

Boomers will stay in their homes longer because their health is better than past generations. Some will sell in 10 years but they will stay put mostly till they have to move which won’t be till they are in their 80’s.

I don’t feel sorry for boomers. They had a job market where any idiot…yes, idiot could support their family on one income and could work their way through higher education without taking out huge loans.

So what if they have to take a hit on profits when they sell their home to downsize…it’s all upside for them. They get Social Security and Medicare…they are set as far as I am concerned.

Let’s stop worrying about Boomer retirement…they are much better off than Gen X and Y. We need some KY for all the problems we are left with.

Not so fast, Christie. I was born in the peak year of the baby boom. I graduated high school in the recession of 1973. I worked as a janitor, in a factory, doing shipping and receiving and driving a delivery truck as I worked my way through college. I graduated into the recession of 1981 and was not employed using the skill I learned until April, 1984. In my first professional job I saved my employer about $18,000,000/year. That was the first time I blew a whistle. For my trouble, the CEO gave somebody who assisted me a $50 award and insulted me in announcing it. 8 years later i was punished by not getting an offer from Jackson, MS where everything was headed. I left the industry in 1993 and started over. In 1996, Bill Clinton and Congress destroyed the industry with The Telecommunications Act of 1996, eliminating every job in the industry. Meanwhile, I had become a programmer and was beginning to do well when Bill Clinton and Congress signed the American Competitiveness and Workforce Improvement Act of 1998. As a direct result of the events on 9/11 I was out of work and could not find employment for 2½ years. Once employed again I was making between 40-60% of what I had previously been making untill 2007, when TARP made a bank hire Americans of people on foreign work visas. I was there for 2 months, until the bank was able to escape the requirement to hire Americans, but I was able to find another job wher I was paid OK. I am finally back to the financial positino I was in before the Clinton Administration destroyed my livelyhood. This housing bubble was caused by the Federal Reserve’s easy money policies. They were trying to spark growth that was not occurring because of NAFTA, WTO and cheap foreign labor policies. Federal Government market intervention and demographics are the reasons why I could never afford a home. Now if I live frugally, maybe I can make my child’s life turn out better and maybe he can own a home one day.

There is much more that I do not wish to get into right now. I feel bad for the young people today. I have been there and admit this economy is worse than the one I inherited, but don’t blame me because I am a baby boomer. I didn’t cause the mess and tried everything in my power to prevent it.

In

Hi Christy

I agree… my aunt who is in her late 60’s rented out her home in Taos NM and herself downsized into a 1 bedroom apartment in the same area. ie: her small house rented for a high enough rate to pay her rent in her apartment and her living expenses. Also, my mother, in her 80’s is also renting out her Santa Monica home for about $5K per month and is downsizing into a 2bedroom apartment.

Both owned their homes free and clear – so I dont see a glut of retiring boomers selling their homes.

Not true, Christie.

The baby boomers came of age 1966-1980, at just the time that the post WW2 “high” era was ending.

I graduated high school in 1970, the year the boom of the 60s ended, and became the bust of the 70s. The first decade of my adulthood was a time of gas lines, oil embargos, insane inflation, and the loss of hundreds of thousands of mid-to-high wage jobs to foreign markets as our manufacturing moved offshore- a process well underway by the late 60s, though it wasn’t visible till 1973, the year of the first oil embargo.

By 1975, you could not support a family with one income unless you were in the top 30% of earners, at least not in any comfort (decent used car, decent housing in untroubled-but-far-from-prime neighborhood, some savings). It was at this time that people ceased to save because inflation rendered it worse than pointless- a dollar saved was thirty cents lost to inflation, so you’d better buy that car or house NOW because next year it will cost 10% more at least. 1979 saw the start of the first housing bubble, insignificant compared to what we’ve witnessed since, but enough to make housing much more expensive and encourage irresponsible borrowing.

Then came the 80s, the “morning in America” that brought dropping incomes, more losses of jobs and manufacturing, and vast increases in personal debt as incomes ceased to keep up with inflation.

By the 90s, overborrowing to support a lifestyle once thought ordinary became the norm. There was more deterioration as more jobs fled the country and we became a “service” economy in which finance became 40% of the economy. The income gap grew wider.Meanwhile, the cost of medical care and education inflated insanely, far outpacing any other product or service.

You can’t make an argument on demographic shift by just looking at one segment of population (retiring seniors). What about population growth, immigration growth, new household formation. My parents are retired. Their house is paid off and they can use reverse mortgage for income if needed. They don’t have to sell and will live there until they die. Meanwhile, my brothers, sisters are all married with kids and are looking for houses to buy. Got the picture? New families are formed everyday and lots of immigrants with money coming into this country. This is the source of buyers.

A lot of boomers were very fortunate in life, but what I envy about them is that they had opportunities that later generations no longer have. I’m sure boomers had to struggle to buy a home and move up in the world when they were first starting out, but if they were smart about it, these were very achievable goals. A college education was worth more and cost less. They didn’t have to move to the exurbs to find an affordable home. There were a lot more jobs that paid living wages, or perhaps it was that living was not so expensive then. They even got decent interest on their savings!

My generation has had a different experience. I’ve worked hard in life too, but I can’t buy a house and I live under the constant fear of losing my job. I pay for my own health insurance. I’ve never had a job with full benefits and I’ve accepted that this is reality. Since I was unable to buy a home before 2002, it seems I have been locked out of the real estate market. I have two degrees and actually make decent money, but I’m not wealthy and it seems only the wealthy can buy homes these days.

It’s sort of pathetic that we would actually look forward to the demise of an older generation simply to have a chance at buying a house. It reminds me of the adage of people looking up obits in New York to locate a vacant apartment. Sure, I dream of buying the perfect fixer-upper once owned by a little old lady, but some investor group is going beat me to it with a cash offer. So much for my desire to gain from my own ‘sweat equity’. My generation doesn’t have that opportunity either.

Heathen, move to Texas, the promised land, where you can get a mansion for 250K and get your Ford F150 to go along with it. You all stop your whining. If you really want a house, come on over to Rick Perry land. (Heathen, but you will have to come to Jesus down here and drop the Heathen label)

HELL NO! While I’m sure I’d be welcomed as a Caucasian person in Texas, I’m also sure I’d be burned at the stake for my radical inability to stomach American style Christianity and ‘family values’. The only part of Texas I’m remotely interested in is Austin, but that isn’t really Texas, is it? Ironically my family almost moved to Texas (Baytown) in the ’80’s – because of work and the lure of very reasonably priced golf course-adjacent property. I’m not sure why we cancelled the move, but I’ve been forever grateful not to have relocated to the land of stifling humidity and giant cockroaches!

All this crap about Boomers being broke is just that: crap. My grandparents, 75, have somewhere in the neighborhood of $1.6M from what we can gather on their “slipups” when they talk (so precious, the pre-financial crisis attitude, isn’t it). Anyway. They still get pension checks, SS, their savings and investment grew (til 08) and their $225k Midwest home is long long paid off. They built it for $50k in 1979.

Trouble with them is, they grew UP in the Depression. Didn’t have much at all except hard work as kids. Reason they have anything now is they don’t spend it, still scared. Too extreme if you ask me, you can’t take it with ya. But I digress…

I believe I mentioned it before, I know a whole lot of 55-75 year olds with a whole lot of cash and assets. They are the “golden generation” of 55 retirement and grandeous pensions.

Papa, I agree with your assertion regarding boomers. We hear the numbers of only XX K net worth (cry me a river). This includes all the people in Podunk, fly over country who had minimal education and corresponding low earning power. The boomers here in desirable parts of California have been truly blessed. Like you said, fat penisons, 401Ks, SS, unimaginable property appreciation, plentiful jobs throughout their careers. The costs of higher education, energy, healthcare were for the most part negligible. I do NOT see boomers who live in desirable parts of CA all of a sudden decide to sell their gold mine and downsize. Their home has truly been the goose that laid the golden egg. If anything, these boomers will stay in their homes much longer or leave it to their offspring. Housing in certain parts of CA is truly a bizarre case study.

If one would have just bought, like, $10,000 worth of Coca-Cola stock in 1980, that would be about $500,000 (not including dividend reinvestment) today. The equivalent of about $27,000 today would get you started pretty good on retirement back then. I wish all I had to do was drop $27k on KO, $27k on MCD, and $27k on JNJ and say, “Ok, now I just wait 30 years, and I’m set”.

Three generation households will pick up alot of the slack, here have a house and in return take care of me in my old age. People might call them the “greatest generation” but they wernt very nice to their kids, that’s why boomers don’t live with their parents, the same doesn’t ring true for children of boomers. My mom lives with us, contributes to the mortgage payment, doesn’t judge my life or parenting style. It’s great, plus it’s a live in babysitter!

@Candace – “People might call them the “greatest generation†but they weren’t very nice to their kids”.

You are right about that. They were a tough lot, that generation…very emotionally checked-out. And their kids took the brunt of it. So, yeah, I’m 55 and I can think of no friend or family member who wants to live with their older parents.

So, I’ll chime in that….all the “woe is me” carrying on by the younger crowd is really tiresome and, frankly, a f**king waste of time.

Deal with the hand you’ve got — like everyone else in history has!!!

Boomers who don’t have enough savings have little choice but to retire later in life and keep working. Just increasing the retirement age by 3-5 years dramatically increases their retirement income, and hopefully some of them will have used the additional years of work to payoff their homes.

The mass retirement of boomers should help bring down unemployment and increase wages as demand for replacement employees increase. That means the kids of boomers and even illegal immigrants whom hopefully will become amnestied in the next decade will find gainful employment.

It’s ridiculous to look at the retiring boomers in a vacuum when the overall population of US citizens is still projected to increase (albeit slower than the last few decades.

Illegal aliens are taking jobs from Americans, lowering wages by their very presence and raising rents. Flooding the market with cheap foreign labor is an old strategy for creating subsistence wages. Read how it was done in the great depression in Grappes of Wrath. Flyers were sent all over the country with promises of picking jobs in California. When the Joads got there, they quickly found that they were being used to suppress wages. Sure the wages were OK, but the Joads learned they only had time to shop at the company store and had to pay the company rent, which ate up all their earnings. We are all Joads now.

I do not think that retiring Boomers will be replaced in the job market. I know quite a few who have a low skill-set but their places of employ just keep them around due to inertia. When they leave, their employers realize that they didn’t really need them and could replace their productivity with computers or with outsourcing. Vast legions of administrative and workers who process documents are not replaced – many Boomers I know are in these types of fields. I know of a few that had careers in some type of administrative office job that got laid off. I don’t think they ever found new jobs, and I doubt younger workers will replace them. For instance, I know a laid of legal librarian who made enough to buy a home in an expensive area. With cloud storage, a part-time temp admin could be hired for $10/hour to do the same job except that this temp won’t ever make enough to buy a home.

Location, location, location might be the operative factor for the ‘senior boom’ housing market too. Trying to sell you home in Toledo, Ohio or Lansing, Michigan to move to the sunbelt might be tough. OTOH if you have a house in Phoenix or Sarasota maybe not.

Coastal California may have a flood of ‘senior boomers’ trying to downsize or move to cheaper locales over the next 20 years which could pressure prices but they won’t have a problem finding buyers like those in less desirable parts of the country.

Let’s face the facts, the fundamentals tells us that housing prices should head down for the next 10 to 15 years (demographics, income to mortgage, etc….). But let’s also face the fact that the Federal government, The Fed, the big banks, Wall Street, etc…. will do whatever they can to push home prices higher and higher.

I used to be a big housing bear. But let’s face it, we don’t have a free market economy. It’s only free market economics in the works when Wall Street, big banks, etc…. are right. If they are wrong then the marketplace gets manipulated in their favor.

If you thought hard work and honesty got you ahead in life. You are wrong.

You pretty much nailed it. The more wealthy you are, the less market risk you face. ‘Free market’ is just a subject for propaganda and scholarly theses. I’m sure if one studied it enough, they might be able to make a case that the wealthy use free market ideas to rape the non-wealthy, whilst administering protectionist agendas for themselves.

The small category one could call ‘new savers’ might actually benefit from our current arrangement, though: If home prices stay the same for 10 years, savers don’t have to chase yearly appreciation when saving up for a home. Though I have to admit, the current situation has pushed all the ‘normal market’ appreciation up front, so instead of running up a hill, one is climbing up a cliff side. But at least a saver sort of knows what to aim for.

I agree with Stan a lot of lower skilled immirgants can not afford to buy the housing. For example, home ownership in Santa Ana a city with a lot of low skilled immirgants is only 43 percent versus about 70 percent in whiter native born Mission Viejo. I think illegal immirgation to LA and OC is slowing down since they are cheaper places to go and in La in particular lower skilled immirgants are agining as well since about 400,000 or more qualify for Reagan’s leagziation process which means they are 40’s and 50’s and some 60’s. High income Asian immirgation is starting to replaced the low skilled hispanic but the Hispanics have the advantage over birthrates.

Illegal aliens are taking jobs from Americans, lowering wages by their very presence and raising rents. Flooding the market with cheap foreign labor is an old strategy for creating subsistence wages. Read how it was done in the great depression in Grappes of Wrath. Flyers were sent all over the country with promises of picking jobs in California. When the Joads got there, they quickly found that they were being used to suppress wages. Sure the wages were OK, but the Joads learned they only had time to shop at the company store and had to pay the company rent, which ate up all their earnings. We are all Joads now.Well, that was done in La, Anaheim or Santa Ana. Hispanics were done about the garment industry jobs in La and Santa Ana in the late 1970’s or other simple factory work. Then places like Anaheim brought them in to do lower skilled maids jobs in Hotels. Get the picture, both large Blue and Red States are guilty on this. Ca is number one and Texas number is number two.

Think you are wrong. It’s the non-immigrant Anglo-corporate owner that lobbies to have the government pass certain laws that enable everything to go oversees and to globalize all trade, leaving the workers behind. It’s, again, the Anglo-corporate owners that love to hire the “aliens” you mention. This is the bigger picture.

What’s real estate going to be worth in 10 years when most people from the Boom are in retirement age? They could do a reverse mortgage, if they still exist, but the constant downward pressure on wages will be tough on people trying to get a mortgage. Even if rates are 1.5%. Like in Japan. The stats say that over 70% of Boomers have nowhere near the amount of money they’ll need to retire. If Social Security goes to means testing, why would they sell their house when they can’t get another? I bet they keep the house and rent it out.

I see large homes being converted into duplexes (and more). Consider a 3000+ sqft home in the Inland Empire (I mention this area because most homes in Orange County, LA and SD are on average much smaller in comparison but there is a number of such homes there too). Plus, Inland Empire homes are newer, usually have upgrades (due to spending binge of the mid 2000’s), and generally cost less.

So what I see happening is a home (of say 3000 sqt) converted into 2 or 3 (or even 4) smaller homes. Now the rent from this home becomes much greater and there is a higher availability of housing.

Alternatively, an extended family can live in this home (as a whole, without dividing) and pay this higher rent, especially since this home is now a day care too (where older folks act as babysitters).

This has been done in Canada to a great extent. I see many benefits to doing it in SoCal as well. Right now, dollar is still the king, but that is about to change. We won’t be able to build as many houses anymore, and these huge houses will be the new housing mecca for downsizing Americans.

Future prediction is a very dicey game. Look at the predictions of Dr Paul R. Erlich! He admits his failed predictions, but now claims that his alarmist rhetoric helped stave off the disasters he assured an audience that I was a part of were a certainty for our future.

My Father died at 85. He smoked, and was born in an awful Eastern European hell-hole in the 19th Century. My Mother died at 96 and she lived most of her childhood in deep poverty in a part of the United States where ice storms can snap off rows of telephone poles. I’m in my very early 60’s. I have a modest suburban house (paid for). My Wife is helping our Daughter and her Husband buy a nicer house than ours which is less than a mile from here. They will close in 30 days. They’ll be selling the town home that now is almost back to what they paid for it 5 years ago. With my Grandkids within walking distance and this inland Orange County weather, you think I’m going anywhere soon? Dream on.

As for the rest of you and your futures, I have no idea what is going to happen.

“As for the rest of you and your futures, I have no idea what is going to happen.”

A smug attitude won’t save you or your family from what we’re all in together.

When SHTF, everyone feels it to some degree.

My greedy boomer dad took all the will money from my grandmother after she died and didn’t give me a penny of it. I’m struggling to raise a family in a broken down condo and he lives in a lush 3500 sq ft 4 bedroom house in Southern California, in a really nice area.

It wouldn’t be a terrible thing if he helped me out a bit to put a down payment on a real house. He always was a selfish man…

Leave a Reply to Good One