Housing inventory heads back to the 1990s: Housing inventory reaches decade lows and causes unusual trends in the housing market.

The story in the housing market continues to center around inventory. More to the point, the lack of inventory. This is a nationwide trend but in many parts of California inventory has fallen by 50, 60, and 70 percent in the last couple of years. A good part of this is driven by sales but the modest increase in sales does not reflect the significant drop. Historically, in normal markets, you would have a steady stream of buying and selling. This was embedded in the process. Someone selling a home would typically move to another place causing a dual reaction (a buy and sell). Stable prices also created a market where virtually every homeowner was above water on their mortgage. So selling was a matter of life decisions versus economic considerations in many cases. That seems to be lost today in many markets. A big part of the market right now is being driven by investor money and low down payment buyers. The little inventory on the market is being fought after like a group of hyenas trying to wrestle away a carcass from a lion. In essence, that is our market today. Historically low inventory being fought after by big Wall Street funds and those seeking to buy. Where does inventory stand?

Current inventory figures

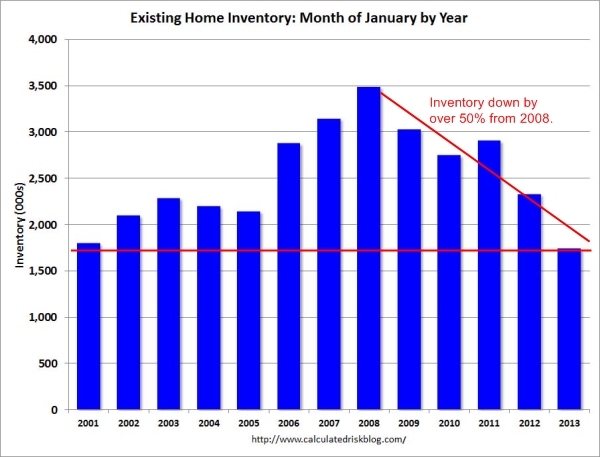

It helps to put the current inventory numbers in perspective:

This is the lowest number of homes for sale on the market in well over a decade. Keep in mind that we have added 34 million more Americans since 2000 and we have virtually the same number of homes available for sale. In more targeted markets the drop in inventory is more startling. Let us take a look at three areas in SoCal.

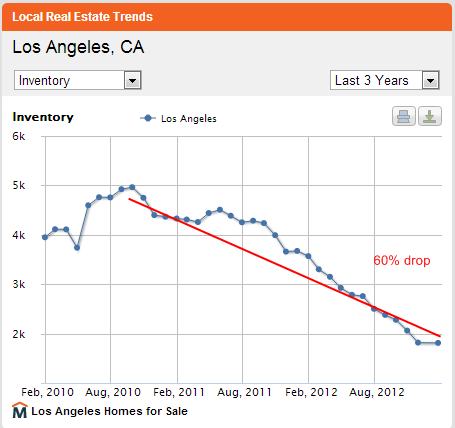

Los Angeles

The city of Los Angeles has seen inventory drop by a stunning 60 percent since 2010. The decline accelerated dramatically in 2012. Take a look at a couple of other niche areas:

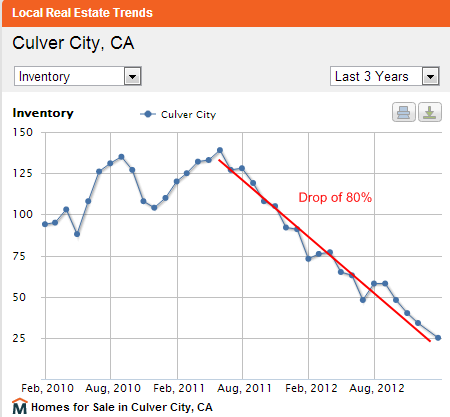

Culver City

Inventory in Culver City has fallen by a whopping 80 percent. This is a dramatic decline but also highlights why it is so difficult to purchase a home in today’s market if you are a normal family looking to get in. There are limited numbers of properties available and you are competing with big funds that have heavy target numbers. That is, some are told to buy a certain number of properties in certain areas and given the limited number of places available, many of these funds choose to bid generously and push prices higher. There is a preference in the market for all cash buyers given how clean these close through escrow. A few agents have e-mailed me discussing this trend.

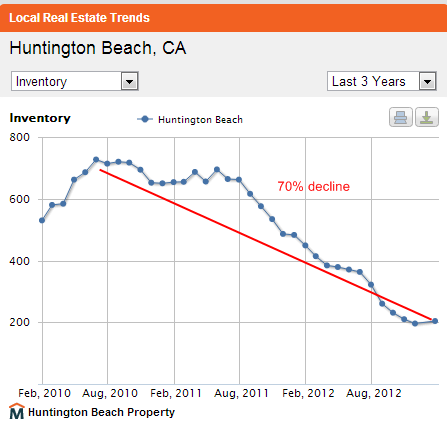

Take a look at a larger city in Orange County:

Huntington Beach has seen their inventory fall by 70 percent in the last couple of years. This is a fascinating trend because it is clearly unsustainable. It seems that we are in a perpetual boom and bust cycle here with California real estate. This trend is very much likely to continue this year but how long can it go? At a certain point, the regular home buyer will dive back in. It is no coincidence that where easy money is targeted by the Fed (i.e., QE3) there is all of a sudden a surge in activity from big money.

Middle class in California is six-figures and up. How many households make more than $100,000 a year? 26 percent. So it should come as no surprise why so many households feel pinched when they are looking to buy. It also helps to explain why only 54 percent of households in California actually own their home. With all the current investor buying, it will be interesting to see if this pushes the renter percentage up as single family homes are pulled off the market as income producing assets. As we discussed in the opening of this article, the buy-sell reaction of a typical sale is muted with these all cash buys. You have one action (buy) and then the property is locked up either as a rental for years or as a flip in less than a year. This part of the calculus is a big reason why we don’t see a net add for each home that is sold given the giant number of investor buying over the last few years.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

78 Responses to “Housing inventory heads back to the 1990s: Housing inventory reaches decade lows and causes unusual trends in the housing market.”

Longtime listener, first-time caller.

Dr.HB – you’ve been covering this “investors are buying everything up” trend for several months now. I’d really be curious to hear if/when/where this sort of trend has happened in the past, maybe in another country? And what was the eventual result of this type of action on the market, where institutional investors were replacing individual homeowners in the market due to stagnant incomes.

Outstanding question. Doctor?

Well, I’ll presume to answer for the Doctor and say that It never has happened on this scale ever, because we have never seen a situation with so many single family units on the market, or, simply, in existence before. As we all know, suburbia is a modern post war phenomenon. Before the war, most of the population lived in multi family buildings or on farms. And, since the war, we have never seen such a crash in values and a flood of foreclosures as we are experiencing now. This is all new, and something historians will be hashing over for decades.

Thank you for sharing the insider information!

I’m really frustrated, I have been following this blog for 2 years. In Oct 2012 I held off with the promise of shadow inventory, now the $425,000 entry level house is $550,000. I feel priced out and we make $150,000 a year household. After the last inflation update I feel like I have to buy into this mess to hedge myself from inflation. My rent went up 10% last year. I pay $1850 now. How high can the rent’s go?? do I take the plunge even though may be expensive the uncertainty is keeping me up at night. Is there a excel sheet that lays this out including the tax benefit. I appreciate any input, Im scared if I try to wait this new bubble out it could be 10 years and every government force out there will do everything to keep home prices up.

Patrick – the deck is stacked against you. Do not underestimate the lengths to which the government will (continue to) conspire to keep real estate artificially inflated. The Banks, the Treasury, The Federal reserve and the crony capitalists that run this country are all in. Our national debt is at 16.5 trillion. If the last 5 years of public policy aren’t enough to convince you the system will protect home owners “by all means necessaryâ€, what will? If you can get in for anywhere near what you pay to rent – do it. Sure, there are areas like Culver City, Manhattan Beach and Santa Monica that are still ridiculous overpriced, but there are areas in So Cal that have reached rental parity.

Well, for one it’s kind of an oxymoron…You’re on a blog looking for advice but they say never take anyone’s advice and think for yourself!

For two, I’m in a similiar boat. Don’t make quite as much but waited this game out as you did, only to see prices rise.

All you can do is look at the facts, and your personal situation (job security, etc) and decide what’s best for you. Some of the facts are government manipulation, and new foreclosure laws that make it much harder to get homes on the market. So the bottom line is low inventory and low interest rates. Yes this could change in the future but we don’t know if/how.

For us east of the 605, it’s cheaper to buy than rent. And every month spent waiting is more rent spent, period. Looks like for you renting is still cheaper by a few hundred a month, so if you are disciplined enough to save that $300 to $400 every month, keep renting until you are ready to buy.

I was going to post, but you said it!

Papa, I think it’s a bit disingenuous to say you came about that decision all by yourself. I remember a couple months ago you were adamant about waiting for the bubble to pop and not being able to buy and I helped talk you down from that tree with some numbers in the Rancho area. Even though you’ve decided to buy in Rialto or Fontana (despite my warnings) you are in fact looking to buy somewhere and you didn’t come about that on your own.

BlahBlah, help is appreciated and advised but I came about my own decision, in my own mind, on my own…

Ive been following this blog since around 2009 and there is definitely a lot of good information here. Despite that a lot if followers and the Dr. Himself will tell you that home values are overpriced, in the end they are based on standards we may never return to. I bought a home back in spring of 2012 just before the market really started to pick up again. It was a tough decision but I factored in what my losses could be in the next few years and whether I’d be willing to settle down on the home for a long time. So far so good but I never forget about the downsides. In the end you have to do likewise. This blog is all about fundamentals but

The market is a little nuts right now. Lots of investors, all cash buyers and flippers out there, running prices up, and causing multiple offer situations. It IS frustrating. I’ve been in Real Estate since 1987 – and I have seen a lot of markets. The 90s were bad, but the scope of this is mind boggling. What we’re seeing is the artificial inflation of buyers, caused by years of holding back, investor speculation, and short sales and foreclosures on the market – fueled, of course, by the staggering loss of value since the peak of the market. Even people NOT in financial trouble have short sold, or walked away from their properties, simply because the idea of paying on a $500,000 mortgage for a house worth $250,000 is unpalatable.That being said – the laws of economics are GOING to catch up. The economy isn’t growing, jobs are NOT being created, the dollar is losing value, and credit is getting tighter. Additionally, all the people who short sold or had their properties taken from them are NOT coming back in the market any time soon. So many of these houses are the result of the destruction of the credit and savings of the homeowner who lost it, and they will NOT be moving up. Therefore, there are a shrinking number of qualified buyers. This cycle will burn itself out, too – and when it does, IF you have good credit, you will be in the catbird seat. I believe we have about a year left on this property grab – and then it will be those who have the funds or the credit, and that’s it. So, sometime within the next year, the combination of cost of credit and price of home will make it worthwhile to jump – because as “Papa” said, you either lose money on rent, or you “lose” value on your home. Either way it’s the cost of living in a certain location.

are you kidding me? there are still many places that you can get in for an equivalent of 1850/mo for a 3/2, 1600sf… of course, it depends where you want to live. there are a few places in pasadena that are decent, san gabriel, monrovia, altadena, glendale, even in southbay too… paying monthly $1,950 @ 4.25% on a 30yr can get you a 395k home… even buying a fixer would get you more bang for your buck… of course, there are a few inconveniences, but you can find a reliable GC w/some homework and references…

ya, we definitely missed the bottom (for now), but it’s not THAT hard to get – depending WHERE and what… and no, you don’t have to go ghetto to get into a good property.

@Patrick Ballas

Please elaborate on the home you fancy and the one you are renting. At $ 1,850, you might still be getting the better deal. Can you do some math? Let’s see. Taxes? Usually about 2 months’ rent. Insurance? 1 month’s rent. Repairs? Not sure – but 10% PM fee. Now think how much the mortgage would be. I haven’t followed the market. 4%ish for a long fixed one? Q: What;s the FMV of your rental? Say $ 400,000. That would be $ 16,000! Your landlord isn’t doing so great after all, unless he can enjoy appreciation. But he DOES enjoy huge after tax benefits and writeoffs!

It’s a matter of how you handle your high income. Is that gross or net? Buy a soda machine. Change the aircon or heater settings by a few degrees and wear less or warmer clothes. Every little helps.

Patrick, here’s a very good ‘Buy vs. Rent’ resource:

http://www.nytimes.com/interactive/business/buy-rent-calculator.html

Note: Be sure to use the Advanced Settings.

Good luck! Patrick D.

Patrick,

I completely agree with you. I have been following this blog for over 4 years and have waited. Completely bought into the arguments the Doctor has made on why it is not a good time to buy. It all made sense. However, this it’s a completely different market and his arguments are not relative to our current housing market – the artificially inflated market is the reality and something we have to live with.

I have decided it makes sense to hedge my money by buying a high price home with a low interest rate. All I see is inflation in the future and my money devaluing every year.

Good luck.

LOL, you missed the bottom, welcome to the club. To much time shopping online and not enough time in the real world pounding the pavement and this is what happens.

I called the bottom here and others talked about the future great collapse and the coming doom. These people want to buy a home for Midwest prices. It’s not going to happen. SoCal is full of very wealthy people and not everyone flaunts it. The 400 price range is over for he home you are looking at. It’s back in e 500’s and don’t be complaining here again when it’s in the 600’s. you have need warned.

The Federal Reserve and U.S. government have thrown everything and the kitchen sink to reflate the housing bubble all to save the banks who stupidly and crookedly loaded up on junk paper backed by fraudulent mortgages.

I’m close to having suffered a lost decade thanks to this fraud. What I would recommend anyone who lives in a non-recourse state like California do is buy with as little down as possible. A loan of $500,000 at today’s artificially low rates and is about $2,250 per month. In a sense, the minimal down payment acts as a call option on real estate. If Bernanke can somehow avoid another housing crash (yeah, right) pay your mortgage and enjoy. If housing corrects heavily again, be ruthless and walk away.

Of course, this is easiest to do if you’re not the kind of person who needs credit. Once you walk away, the banking system will trash your credit rating. Still, better a thrashed credit rating than being underwater by a few hundred thousand dollars.

Your rent is less then 15% your income and you are complaining?

The nest housing meltdown will truly be epic, here’s why

investors,

what’s gonna happens will be a glut of rentals coming on line over the next couple of years driving DOWN rents but all this institutional buying will still drive up prices.

at some point one of these big players will cash out, a little at first but at the first sign of price weakness the dump will start and the whole lot of them will start dumping properties as well, remember these guys aren’t banks and don’t plan on being landlords for 20 years. there will no reason to slowly sell inventory as the last one without a chair will be BK.

and that will be the time to buy. ……my .02

“next housing meltdown” >:-[ sometimes spell check is useless

How many of those rentals that investors are buying up were empty or new construction? Not many.

People will need someplace to live whether they own or rent. Unless the investors are buying new homes they’re not adding to the total housing inventory and therefore a “glut of renters” will keep pace with the “glut of rentals coming online.”

Fact is, unless we start relaxing zoning and building laws in metropolitan areas there will always be a shortage of affordable housing for renters or buyers.

according to my contractor friend most of them, that’s been his core business for the last 15 month, fixing up vacant homes with just enough work to make them rentals again….he’s done 100’s AND according to him many of his competitors are doing the same…..AND i seriously doubt that someone who’s not been making payments for years is suddenly gonna rent the house back when it’s been sold from underneath them..

I gave up on buying a month or so ago. Today I looked at 8 rental properties. 7 of them were empty. 5 of those looked (and smelled) like they hadn’t been lived in for some time. One I know was REO and the agent is *trying* to find out if the owners will paint the interior. Wondering if I can find out from my agent whether the new owners bought with cash or how much % loan. They have done nothing to prepare the house for the rental market. THe walls and bannister were still covered in the pen and crayon pictures of the previous owners kid. Or maybe it was the previous owner. Going mad. Clearly they didn’t give a damn about how they were going to leave the property for the bank. There was also a turtle in the backyard but not sure where he comes into the picture.

I think the asking rents seem a tad high. I might go around and low ball for a little bit until I have to get serious and actually get a place. So have a few weeks yet. Am seeing better priced places snapped up. Going to see one tomorrow that is owned by one of these investor groups who have been buying up in CA, AZ and NV. They have been asking $400 more a month than an identical place in the the same complex that just rented.

I’m looking in OC. Agent told me to just sit back and relax and don’t even think of buying in the next year. Made a nice change from the usual fear-mongering of buy now or forever be priced out that I had been dealing with in the past few months. She told me that unless we have at least 50% down then don’t even bother. Said even that isn’t enough sometimes and the cash buyers are duking it out amongst themselves. Hope they know they have to rent to schmucks like us who only have a wage to live on and not the seemingly unlimited cash world they live in. The rents are certainly too damn high.

Riddle me this –

What’s the difference in someone buying a home and seeing the value fall $18k to $25k in one year, vs. someone paying $18k to $25k in rent per year?

What’s the difference in buying a home (regardless of price) and paying it off before retirement vs. buying a car and eventually the car is worthless? (As in, people buy depreciating assets all the time.)

Assuming that you are not making mortgage, taxes or maintenance payments, there is no difference. =^]

Her’s the difference. First, is your life experience. Secondly, as Papa says, eventually you pay the dare home off for your senior years. All in all, homeownership (even with all its warts) surpasses rentership. We rented during bubble 1.0 10 long yearsand are owners (no mortgage on this final modest home) for bubble 2.0. Life is so much better (warts and all), and this house cost serious bucks to bring up. It’s finally our HOME. Now the curb appeal is coming together.

Humans are depreciating assets. With advancing technology, most humans are more like horses…. They need feeding and care all the time, yet are needed for production less and less. The irony is, there’s never been more humans on the planet than there is right now.

This is a huge divergence in fundamentals.

As Louis Armstrong answered when he was asked what jazz is: “If you have to ask…”

I can’t believe you would ask such a silly question.

For the first years of your mortgage your paying mostly interest and if your house value drops $25K then you are not in good position. You actualy bought mortgage debt for overvalued house.

It takes quite a few years to knock down $25K from your mortgage debt principal.

House prices are artificially higher and overpriced today and I see them coming down another 30% -50% across the US.

I don’t believe they are going to drop any in areas where people stick to 2.5X income/purchase ratios, such as parts of the Midwest and South. Economic conservatism is the prevailing wisdom. I believe my Fathers house dropped a whopping $6k for 1 year and bounced right back up, and has been since 09.

The other problem people keep FORGETTING is the unprecedented hyrbid mix of fascism and socialism that has been enacted in this country. People seem to keep having capitalistic outcomes in their predictions and thanks to TPTB, those are now false.

This is uncharted territory.

You are not living in the 21st century. We just bought a house last summer and 40% of the payment goes to the principle. This is why we bought. I calculated that I could easily cover a 2% house depreciation with the principle buy down every month. This is the beauty of the 3.5% mortgage. The fact that our house payment is $700 per month less than our rent not accounting for taxes is an added benefit. We did have to tie up $130k to do it, but we were not making anything on that money anyway.

You’re presenting two extreme positions — looking at a single year-over-year gain (or loss) and keeping your home for 15-30 years until it’s paid off.

The reality is that most families who are in the midst of their career life will move several times.

So, yes, the transaction costs of selling factor in greatly in the rent versus buy proposition.

There is no argument about whether or not the forces of supply and demand in real estate are being manipulated in such a way that’s never been seen before. Why would anyone in their right mind enter into a 30 year commitment under such unfavorable price circumstances? The only reasonable answer is that you have near certainty that your income will be consistent or rising over the next 30 years and that you will not need to move.

Strange – rhetorical – question. The renter is saving big bucks on taxes, insurance and repairs. He gets the right to give notice and then leave, while a homeowner cannot sell a home like a stock. It may take many months and he would have to pay for inspections and stuff.

Whether you rent or own, a certain amount gets used up. The DIFFERENCE matters, as well as your long-term views. Say your income ias $ 150 k and stable for the next 15 years. You WANT to own – and you sacrifice, using a HP business calculator which will show you how much you will save by making extra repayments early in the mortgage payment cycle.

We squander money all the time. Daily. So you use $ 30 k p.a. to own – that’s just some $ 6 k more vs renting. If that’s a house you love, it might work out if you ignore what happens in the market and just keep paying.

Personally, I’m convinced that the low rates are not sustainable. Subsequently, I’m certain of a bloodshed in bonds as well. Locking in very low rates might indeed be a clever move. But I’m unable to predict the all important WHEN.

“Locking in very low rates might indeed be a clever move”

since when has everything became all about interest rates? this is the same monthly payment game TPTB try and sell us on daily, i’d rather pay 8% on a $150K mortgage than 3% on a $300K mortgage, one i can pay off much easier than the other.

Just considering that one year, the difference is the opportunity cost, mostly regarding your down payment. If you drop in 50K for a 250k house and mortgage the rest, you’re stuck paying down 200K. But if the prices drop 25K and now you can get a 225K house with a 50K down payment, then you’re stuck with a 175K mortgage. Which is better? Depends on the difference in interest rates between the two years. Obviously, in the ‘wait-a-year’ scenario you’re not paying as much on property tax and insurance per year, because in the example, the value has dropped, so that difference in interest rates better be big enough to be worth it.

Then in a longer term scenario, that down payment of 50k could be earning interest/gains somewhere else. I have this one CEF that is invested 80% in utility company bonds, which pays me something like 7% per year in dividends. I got in when there wasn’t a premium so i’m not that worried about loss for now, plus that fund has been stable over the last 10 or more years, regarding equity (sure it had its 2008-9 dip, but recovered). In fact, the value of that particular stock could drop like 15% and i would still break even regarding my initial investment, plus i’d get to keep the dividends….

Papa

You nailed it below in your post about the unchartered. As a responsible adult, I am livid about the two headed snake called R&D’s (aware of the central banks). This housing nightmare has robbed us of the most precious asset we humans have, TIME!

(this is a post second attempt)

Cards are stacked against you in CA unless you are an illegal immigrant or You are Rich.

Joe Blow, don’t leave out the Strategic Defaulters who gamed the system by lawyering up and squatting in their “home” while pocketing monthly payments, who are now first in line with cash in hand to bid up their next “home.” Soon, as “owners,” they’ll be looking down their noses again at the “renters” living down the street.

http://finance.yahoo.com/news/bailed-homes-now-want-back-174153631.html

Inventory is tiny in some places. A rapid bounce in prices on small inventory? Hmmm, sounds like speculation to me. I would not spend more than rent parity for a house at this time. If you work for the federal govt, you’ll probably have a job until the whole thing implodes.

It’s all about the underwater “homeowner”. Even with these rising prices, most underwater mortgage holders are still stuck, eliminating millions of homes from the market.

I consider the so-called ‘Housing Recovery’ in America to be a fraud, a secondary bubble designed by Ben Bernanke, with his friends in the bank, to trick Americans into rushing back in to a deflating Housing Bubble and get burned a second time. The Housing Bubble will not bottom until interest rates are high; and until no one gives a damn about flipping houses for a living. The Fed stomping on interest rates and keeping them at zero is a picture of the opposite of a housing bottom. The Fed is shameful. They do not care about Americans being caught in a debt collapse. Their only interest is in saving the banks that hold toxic debt on America’s overpriced housing, which still needs to come down 30-50%.

Wealthy investors DEMAND high annual returns and they WILL get those returns one way or another. We know what they are capable of.

Yes, housing prices will take another leg down, but not until the maximum sustainable value of housing assets have been reached, then I think the dump will happen very quickly, since the action will be coordinated by fund managers, rather than incrementally by home owners.

Then the cycle repeats with diminishing returns for the wealthy investors, until the housing market is finally exhausted and goes into a proper recovery.

In retrospect, it looks like the inventory graph in the article shows that the time to buy during the next cycle will be at the first sign that inventory is declining.

For more on the Fed’s shenanigans see this story about the Fed going into losses in the near future. I don’t know what would happen but it won’t be good.

http://www.businessinsider.com/fed-losses-could-harm-public-perception-2013-1

Also, I think pretty recently they said they would keep interest rates low until unemployment reached 6.5%. This is going to take a long time because discouraged workers will start to come back into the work force, but it will happen, and when it does…

“Also, I think pretty recently they said they would keep interest rates low until unemployment reached 6.5%. This is going to take a long time because discouraged workers will start to come back into the work force, but it will happen, and when it does”

UE @ 6.5% = booming US economy.

booming US economy + rising interest rates =/= falling RE prices proportional to the rising rates

Just an aside. Banks are now changing their policies in regards to lending for purchases of single family homes. Now, this may be driven by Fed actions as well as state law; however, acknowledging the frequency of the “all cash” transaction, banks will now place a loan on the purchase of a residential property as if that loan was used to purchase the property if the loan is approved and closed (I think this is the criteria) within 90 days of the close of escrow. This is important as the loan qualifies as a “purchase money” loan, and thus the interest is deductible as mortgage interest and the buyer is protected in case they have to walk away from the property in the future (there will be no personal liability on the balance of the loan).

I live in the Folsom/Sacramento region. Inventory is real tight, everything coming on the market goes pending within days, even in the middle tier $350 – $450 k range.

What I have noticed is many, many more rentals (same middle tier move up homes) coming on the market and not being rented for months. Its like people just aren’t prepared to pay $2300 a month in rent anymore for a 3 bedroom house in Sacramento, even in Folsom.

The owners/investors/landlords start the advertised rent price at x amount, it sits empty for a month then the rent reductions start. $50 at a time, then $100 at a time, and then “pets allowed” hit the listing. AND they do nothing to these properties to make them attractive to rent. The ones I check out are dog ugly inside and out, dirty and in need of some TLC.

I think they overestimated what their new rental “investment” was worth. So if they can’t rent them to cover their carrying costs, what then? They start selling again?

It’s not as simple as pure capital appreciation or rental income for these investors. Many of these homes are being wrapped into new REIT instruments (rental REITS) and pawned off on unsuspecting investors chasing yield in a low interest rate environment. Some of these REITs are projecting 8% returns on your money, which if you’re a small landlord, would sound absurd because it’s hard enough to get 8% on a home down the block you may have bought and done most of the work on yourself instead of hiring a distant manager out of a cube in Wall Street or Greenwich, as many of these homes are managed. These guys could care less about being landlords – it’s all about short term gain, as always, and, once they have the rube’s money, they’ll head for the exits and invent a new scam. But, that’s when homes are really going to be cheap, as they come on the market again. I hope.

Yes, I think you’ve called it about right. Being a landlord is a tough and often unprofitable business. At least in the first 5 years. These REIT’s will have a hard time managing all the SFR’s they got in their portfolio trying to show a yield worth their price.

Then they will unwind their positions as well.

I have seen a lot of these REIT owned homes/condos/apartment complexes pop up around the Bay Area. They do a pretty good cosmetic upgrade of the place + a little bit more, then jack up the rent to 1.5X to 2X the rent of the places next door. Usually they are in ghettos, transitional neighborhoods or areas that were formerly considered bad neighborhoods. My experience has been that these places sit on the market for a long time as no one with the income to rent them would rent in those areas and those currently living there lack the income to rent the REIT-owned places. I have seen many people move out of the REIT-owned condo/apartment buildings as they charge very high rent for low quality construction. A lot of these landlords also nickel and dime tenants in every way imaginable. As I mentioned before, these are mostly in bad neighborhoods, but IMO it’s just a matter of time until foreclosures in good neighborhoods start popping up in the REIT-owned pipeline.

These “landlords” charge high rents to chase yield but their yield gets blown to hell after finding no tenants or extended vacancies. Even a few months of negative cash flows when you expected positive cash flows is enough to sink an investment’s yield.

The thing with many REITs is that they’re publicly traded and you can read about their historical performance as well as their expectations of the future.

EQR: Rental income grew 13% from a year ago… expenses were up 8% from a year ago.. operating income increased 23% over the prior year

AVB: company expects rental revenue to grow, operating expense to increase 3.5%, while a 4.75% surge in NOI is expected during the full year 201

UDR: Both the bottom line and rental income surged 2.3% and 7% compared to the prior year

If you truly believe REITs are mismanaged and don’t know how to manage their properties, you can make a bundle by shorting them.

The lack of move-up or replacement market (sellers buying new houses after selling to investors) convinces me that most ongoing sales are banks/investors selling to another investors, to hype up prices, create scarcity and most importantly to suck in amateurs (first time landlords, flippers and homeowners).

So those who lost out to cash offers, don’t feel bad, because those properties were never meant to go to average Joe’s. They are lost leaders intended for investors (working as team) to hype up prices and create scarcity.

And those who felt they missed out, just wait patiently for next crash, when amateurs get sucked in and over their heads with debts. Unfortunately it might not come up until the big money make their profitable exits; with Fed/USG/banks/media helping of course.

I tried to sell my somewhat expensive house last summer and got no offers at $1.15MM (purchased for $1.24MM in late 2007). My realtor called me up yesterday and told me that houses like mine in coastal San Diego are getting 12 offers in the first week now. Where can I find the inventory charts for my area? It would be interesting to see. I am considering putting it back out there, but perhaps I should wait a bit and let things warm up for a few more months.

I don’t see how these price spikes/inventory drops are going to last with interest rates creeping up over the next few years. Is this a moment in time for sellers or is this a developing trend?

I’m thinking of buying a crapster condo in Santa Monica with an FHA loan just so that my boy (who is 2) can get into a good school system.

Found a true dump in a bad part of town (for Santa Monica anyway) listed at 275K for a 600 sqfoot one bedroom. property tax and hoa add up to about 600 a month. I figure I can rent it out for 1200 or so and lose a few hundred bucks a month for years.

But at least my son can go to a good public school. that is worth a few thousand a year in crappy condo holding costs . . .

wouldn’t private school for one kid be cheaper?

Our one kid goes to pvt school, it’s about 14k a year…got to pull her out nxt year, it’s a crap school and we can’t afford it…it’s South OC.

You’re crazy.

Buy an investment property if you think it’ll cash flow, but don’t buy one to help your kids education.

#1 You kid is still 3 yrs away from going to school. What’s the rush?

#2 Why SM school district if you biggest concern is ‘best schooling’?

#3 Magnet/Charter or private schools are always a possibility

#4. You have to be a RESIDENT to attend SM/Malibu district. Ownership is not enough.

I’m in Beverly Hills, and know at least 10+ families from when kids were in school that live outside but own/rent condos in BH, then rent/sublet to someone else (older and don’t need schooling) while using the address to send their kids to BH schools. All you need to prove residency is a copy of utility bill and some type of ownership/rent record (deed or lease agreement).

If you are going through all these troubles for your child(ren)’s education, a better question to ask is, can you send your kid(s) to the best elementary school in SM (Lincoln)? On westside there are other good districts, I don’t mean just elementary but K-12, including Manhattan Beach, Palos Verdes, Beverly Hills and even Culver. UCLA area has good elementary (Warner or some charter schools but at high school level it drops off miserably with Uni and Pali).

If any of you took the time to check the.market for jumbo loams of #650,000 plus is nothing like the starter home market……if I was any of you I would do whatever it took to raise the price of home you are looking to buy…..you will experience hardly any competition and you will assured yourself of buying a home with the lowest interest rates in history

…..with our country debt as soon as we are sign of the economy picking up interest rates will any rocket.

Yes, the $650k and up market might be languishing because the ROI isn’t there for investors and there aren’t enough qualified buyers. But who cares about lack of competition for over-priced POS homes at 3.8%? It’s still a POS.

What would homes cost if we were not allowed to take out loans and not allowed to rent the place out? In other words, what’s the value of just having a place to live?

For the last 17 years, I’ve lived in a place that gave me me some clues. Co-Ops in Tucson, AZ, are subject to the above restrictions. Recently, I was involved in the sale of a 2 bedroom 800sf unit that sold for about $13,000 with a monthly fee of $175, which covers water, trash, property taxes, cooler repairs, pool maintenance, and more. Currently the cheapest 2 bed is listed for $25k in the MLS: http://www.ziprealty.com/property/1776-S-PALO-VERDE-AVE-TUCSON-AZ-85713/81129661/detail

Co-Ops exist in California, too. In 2000, I considered buying one in the San Fernando Valley. It was either in or very close to Canoga Park, and prices then were about 4-5 times higher than in Tucson, so I think a 1 bedroom was going for around $45,000.

Today, real estate in central Tucson (where the Co-Ops are located) is rather expensive for what you get. Multiple offers and declining inventory have been an ongoing theme for over a year now. However, while people are eager to “make money” and “invest”, few are interested in just a place to live. Studios and one bedrooms are wanted the least.

There’ll be a 450sf studio coming on the market soon, for probably well under $10,000. If that happens, I’d like to nominate it for the True Homes of Genius award.

I had my place on the market between 2000 and 2004, for 4 years for $9,500. I never changed the price. Nobody wanted to buy it, so I moved back in. Then in 2005, I think, suddenly everybody wanted to buy it. I had people knocking on my door, asking me to sell. Prices had suddenly doubled and tripled. Even today, many people still hope to sell it for the bubble price. For years now, there has been a disconnect between the MLS list prices and the actual sale prices, but I think the list prices have come down substantially over the last year at the same time that list prices as well as sale prices for all other homes have gone way up. Still, some want to sell, but are waiting for a better market. When the economy improves, Co-Op prices will pick up again (they hope).

We may thank the Federal Reserve for the disappearing inventory:

#1: From April 5, 2012: http://www.federalreserve.gov/newsevents/press/bcreg/20120405a.htm

“…in light of the extraordinary market conditions that currently prevail, the policy statement explains that banking organizations may rent residential OREO properties within legal holding-period limits without demonstrating continuous active marketing of the property for sale…â€

Summary: Banks are now allowed to become landlords. The old policy forbade banks from renting out foreclosures. Banks do not have to list foreclosures for sale.

#2: The legal holding-period limits (referenced in #1) are defined by: Federal 12 U.S.C. § 29

http://www.gpo.gov/fdsys/pkg/USCODE-2011-title12/html/USCODE-2011-title12-chap2-subchapI-sec29.htm

“…the title and possession…of any such real estate by such association for a period longer than five years, but not to exceed an additional five years, if (1) the association has made a good faith attempt to dispose of the real estate within the five-year period, or (2) disposal within the five-year period would be detrimental to the association.â€

Summary: Banks are allowed to hold on to foreclosures for 5 years, and up to 10 years if selling the property would harm them in any way.

Here’s the real problem with the Federal Reserve:

1.) All nationally chartered banks (i.e. Wells Fargo, Bank of America, Chase, Goldman Sachs, U.S. Bank) are required by law to purchase non-transferable shares in their regional Federal Reserve bank. That means that all national banks are equity owners of the Federal Reserve.

2.) The Federal Reserve is also the regulator of many banks in the U.S.

This means that the Federal Reserve is actually responding to the voices of the share holders of the Federal Reserve (i.e. the nationally chartered banks). So in essence, the fox is guarding the chicken coop. This is a clear conflict of interest.

The decline in inventory started around September 2011. The Federal Reserve changed the policy on banks being able to rent out foreclosures on April 2012. No doubt about it, the banks were pushing for this policy change well before September 2011 so they began pulling inventory off of the MLS in anticipation of the Fed’s April 2012 REO rental policy change.

Question: Where is the missing shadow inventory since these REOs are not being marketed on the MLS?

Answer: The missing shadow inventory are now REO bank rentals.

Thanks Ernst. Your research has provided the best possible explanation for the lack of release of shadow inventory. Currently, the Fed is winning the game, but history teaches us that in the end market manipulations lead to crisis and to an over correction of asset prices.

Thanks for all your replies: I live in an apartment complex, 2 bedrooms $1850, Although we have a household income of $150k we are planning a family Day care at $1000 per kid assuming 2 really adds to the equation. Also, the schools in afforadble areas are bad and that adds $500 per kid to the figure. It really about a manageable payment and a house I could stay in a and grow a family. Buying low with a higher intrest rate, while investment sound would not help as all the replacement home would move up as well. As I hope that the bubble burst, most investors once settled into residential housing will be pretty satisfied, even if returns are 3 or 4% percent they are paying down a mortage, and have long term appreciation not to mention diversification. if you have a net worth of 4 or 5 million whats a couple million in real estate. How many lawyers and Doctors do you know that have a couple rentals. They tend to sell when in their late seventies. If the reits start to dump, what makes anyone think they will tank the market. It just seams that California is just very desirable. And with the largest transfer of wealth happening in the next 10 years people will be getting a chunk of change from their folks and plop it down on a place in the sun. Us Californians that have no inheritance will be moved out. How many working joes buy a place in SF or NYC. Not to mention competing with multi generational families with 4 incomes in a house compared to our 1 or 2. I wish it was diffrent, I have a few rich friends that have picked up a few 300k homes with 10 year interest only, it generates $300 to $400 month and their stock brokers beacuse the only want to to 50% stocks and 50 % real estate. thanks for all the ideas and advice it most helpful to know im not alone in this

Patrick,

I was in your shoes recently and shared the same frustration, I was actually one of the biggest bears on this blog. I ended up buying 6 months ago because it made financial sense. With the super low rates, anything under 500K is at rental parity…it’s that simple. Blogs like this are great, but they all focus on historic trends. All these blogs missed the most important item from the last 5 years: manipulation and intervention by the government and other powers that be. It has been made abundantly clear that the housing market can not fail and all stops will be taken to prop it up…this will not change anytime soon.

You pay 1850/month in rent. And your landlord showed their hand regarding rent increases. You’ll likely be paying 2000/month in a year or two. With your 150K income, you can afford quite a nice place. A conforming 417K loan @ 3.5% equates to a payment of 1872/month (and 35% of this goes to principal). Before buying, ask yourself the following questions:

1. Do I have a stable job…highly subjective?

2. Can I stay in the house at least 10 years?

3. Can I keep housing DTI under 25%?

If you answer yes to all these, go out and buy! I imagine you have good credit and a downpayment…so it all depends how much you are willing to put down and how much of a mortgage you want. My advice is to buy in the most desirable neighborhood you can afford.

Buying a house in California sucks, but it’s been boom or bust for most of the last 25 years here. And we are competing with foreign buyers, investors, Prop 13 bandits, multi-generational households and it gets pretty competitive. Have all your ducks lined up in a row before buying. Good luck!

Huntington Beach has seen their inventory fall by 70 percent in the last couple of years. This is a fascinating trend because it is clearly unsustainable. It seems that we are in a perpetual boom and bust cycle here with California real estate. This trend is very much likely to continue this year but how long can it go? At a certain point, the regular home buyer will dive back in. It is no coincidence that where easy money is targeted by the Fed (i.e., QE3) there is all of a sudden a surge in activity from big money.

Middle class in California is six-figures and up. How many households make more than $100,000

Well, Huntington Beach doesn’t appeal much to Asians, so I’m surprise here. It may be investors converting into rentials as well.

I think CA has 25% of the households earning $100K/year or higher. Considering 30% of pre-tax going to mortgage, that would sustain a $600K loan at 30 years and 3.5% interest.

So, at 20% down, theoretically, these households could be buying homes costing over $700K. In my SF Bay Area suburban town, a $750K house rents for about $2700/month. So , it’s close to rent parity.

Illegal immirgants don’t have a great deal here since they can get the same pay and less rent in states like TexAs. Personality, I think a lot of Anaheim and Santa Ana illegals that rent with several people like an ethnic enclave. Santa Ana and Anaheim have high unemployemnts are 11 perecent and 9 percent. Santa Ana only 43 precent own home.

According to foreclosureradar.com, there are about 100 houses in Culver City zip codes, 90232, 90230, and portion of 90066, in some stage of foreclosure. On the MLS, 27 houses are for sale. Auctions keep getting cancelled or reschedule (kicking the can down the road). There is your shadow inventory.

Totally UNSUSTAINABLE. The real market ultimately trumps all. Just a matter of time. The longer we go at this rate, the greater the catastrophe in the end. It will be epic.

http://www.westsideremeltdown.blogspot.com

Off topic:

‘Iran sentences 4 to death in biggest bank fraud case’

http://www.presstv.com/detail/2013/02/18/289652/iran-sentences-4-to-death-in-scam-case/

Notice, in the comments field under the article, the extreme favor given to Iran’s decision in the matter.

I find their (presstv commenters) lack of creativity appalling. All you have to do is punish bank fraud with sentences like 20 years working at McDonald’s. It’s unthinkable because it’ll be worse than death for those guys.

I need to move in the next 6 months and sadly all i can see on the horizon are 2K+ rents. We are trying to put an offer on a home that would be $1850 PITI on a street where one comp home a few yards to one side sold for 282 six months months ago, and another home to the other side sold for 550 3 months ago. Clear as mud comps… Now we can’t even get a hold of the realtor to submit our offer for this short sale because they are probably already busy buying it for a relative. Fun times indeed… Sadly it’s looking like we’ll be spending 2K on rent soon.

Is this ‘all cash’ -trend a glorious opportunity to launder billions of drug money or is it just me who thinks this way?

Surely seller is not asking where the cash came from when you have suitcase full of bills?

Saying ‘It comes from investors’ doesn’t really mean anything and it would be really efficient way as normal moneylaundering methods typically lose 40% of capital.

Actually, DR HB was pretty accurate in calling the bottom if you go back and look at his original articles on option arm implosions ect. I think he originally predicted a bottom around 2011… But kept pushing that date later when prices were not falling fast enough compared to wages. I bought in late 2011 like he originally recommended, and ignored his revisions. So far, so good.

I checked a house listed in my area of interest listed at approx 230K today. It showed as having sold in Jan for 155K. Nice flip if you can get it. Rip off if you are an owner occupant. For years I have said they have done to housing what they have done to the used car market. I had some thoughts on the housing market as a result of what’s going on and recent articles. When I was a child the majority of people bought a lot and hired a contractor to build their house. Then through the decades developers took over and controlled the new housing market. As that progressed and young professionals couldn’t buy homes the mega apartment complex and condo world blossomed. From what I read now, including this current article with it’s reference to wall street and giant investors the moneyed boys are working to take over the existing homes market and turn it into a program like the mega-apartment scheme. Endless cash flow into their pockets while people go through life with no hope of becoming mortgage free even in old age because they’ll only be able to rent. It’s a return to serfdom but through the monthly payment model… a very depressing outlook for ordinary working people.

Here is the big picture:

what is the value of all things of value located in the united states

answer 234 trillion dollars

what is our current countries debt

answer : 16.5 trillion

what is the fed currently doing:

monetizing our debt

how long does it take on average for 1 dollar to be worth 50 cents

9.2 years

and so …mathematically speaking

the fed will continue to feed money into our system from the treasury by supplying cash to financial institutions at near zero interest rates and governments to artificially prop up our financial system while buying debt

this increases home values while devaluing the dollar which also increase home values

the fed will try to monetize the majority of our countries debt by the end of b-rocks term

the key to this scheme is to increase the value of all things in the US by the increase of money supply and devaluing the dollar and keeping interest rates near zero while buying debt.

this gives all the leverage to the financial institutions and government

this has been occurring for 2.2 years and will continue if powers be for 7 more years

(go Hillary go)

end result

fed will have monetized 50% or > which it potentially could relieve at any time of any portion which could be used to help stabilize the system if a meltdown were to be attempted

b-rock , with the assistance of mass media will continue to try convince the country that stagflation is not occurring although everyone from the honest ill informed to the well informed already knows we have medium inflation to high unemployment and if you look at housing prices high inflation

this will make our government and these financial institutions incredibly more powerful

which in the right hands would be great however…

b-rock with the help of wall street will continue to buy votes from the uneducated (I want my Obama phone), well educated fantasy dwellers(college professors), union thugs who will continue to try to make more money in retirement than while they were working for the government. _aka Greece) and those blinded by race religion sex etc.

while taxes on the middle class will continue to rise-not to make the feds more powerful although it does- but to make the middle class weaker and more dependent on government

and so distressed homes will take 4 years to sell, wow, coincidently the same time it will take the fed to monetize half of our debt and yes-the entire length of b-rocks final term -wow math is great

wall street will continue to find investments for owning and renting most likely with the help of some new federal regulations giving them breaks for whutevr

final answer

home prices will continue to rise for the entire b-rocs term, if people need food they will get food stamps rent welfare etc and will continue to not work!

and so the value of all things in the US will be higher

our countries debt will be higher

our dollar will be lower

unemployment will be higher although to counterbalance this will be new inventive government statistics countering this.

inflation: see unemployment

real wages : lower

home values: higher

middle class : most on some sort of government assistance

and this is the unvarnished truth

a few will own everything from Boardwalk to St Charles place and when your top hat lands on park place with a hotel- b-rock will shine his grace on you and say “i’ll let you slide this time son” to the let game continue -but remember you owe me one -as you look down at your crumby green house on Baltic ave

I forgot

after b-rocks term, depending on several factors, the fed may dissolve government debt, devaluing currency but by how much, they will test the water I believe through public perceptions/opinion polls because the debt value will be less than 10% of the total value of all things of value in the US which- forget GDP which is utterly meaningless in this scheme- so they might shoot for 1 trillion and see how that goes and do a balancing act from there by increasing interest rates on everyone one but the federal government. it will be a juggling act of trying to create excitement of debt relief over dollar devaluation but I think that is the future.

Leave a Reply