977,000 Mortgages in California are Toxic Waste: The Misleading Headline Numbers and New Home Sales Increase because of a $13,000 Price cut.

With any more spinning we would be in a financial carousel. New home sales data was released on Monday and showed a “whopping” increase in sales. This is the primary headline on all mainstream reports. Little is mentioned that the median price of a new home fell to $206,200 in June from $219,000 in May (small caveat). A drop of over $13,000 in one month apparently is not important enough to discuss.

This is pure economics with prices falling you will expect new home sales to increase especially in the spring and summer months which are normally stronger. So even if we may be reaching a bottom nationwide in terms of months of inventory the coming wave of Alt-A and option ARM toxic waste will guarantee that we have years of pricing pressure on the downside. In the last 2 weeks, the S&P 500 has rallied by over 11 percent. What would constitute an above average year in terms of gains was accomplished in two weeks. Not because of spectacular earnings but because people want to believe in the financial idols of Wall Street. Mixed earnings is not reason enough for this massive rally but Wall Street as you may have noticed does not reflect main street reality.

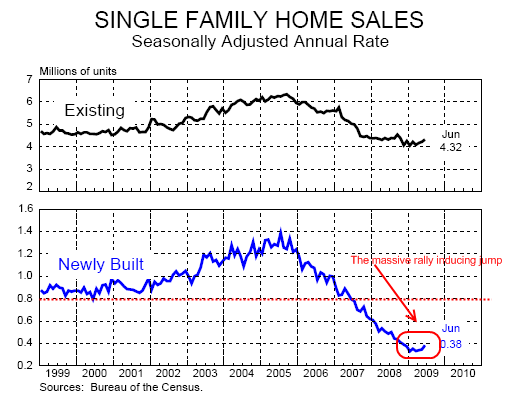

Let us however focus on housing. The increase in sales is good but is largely being driven by massive price discounts and foreclosures which dominate in many markets including California:

A couple of things we should highlight. Existing home sales make up the bulk of sales at any given point. Existing home sales look like they have stabilized but keep in mind that 30 to 40 percent of all homes sold for the past few months have been foreclosure resales (in California the number is more like 40 to 50 percent). So prices have been falling like a lead balloon and we have yet to experience the Alt-A and option ARM hit that will take down more prime locations in areas in California but also in places like Florida. The next thing to understand is historical context. The jump in new home sales is largely a price driven jump based on tax incentives and a deep cut in prices. Even with that, you can see from the chart above that the jump merely highlights that we aren’t starring into the abyss. Yet this increase does not mean happy days are around the corner. It is simply a reflection that housing prices aren’t going to fall to zero yet many market observers somehow think we are back on solid ground. What about rising unemployment? Over $3 trillion in commercial real estate debt? State budget deficits? All minor trifles to the Wall Street crowd. You have many states like California with budget deficits that are being patched up for the short-term but will only solve the issues on a temporary basis.

The headline on Monday should read:

“New home sales increase because of steep price cuts.”

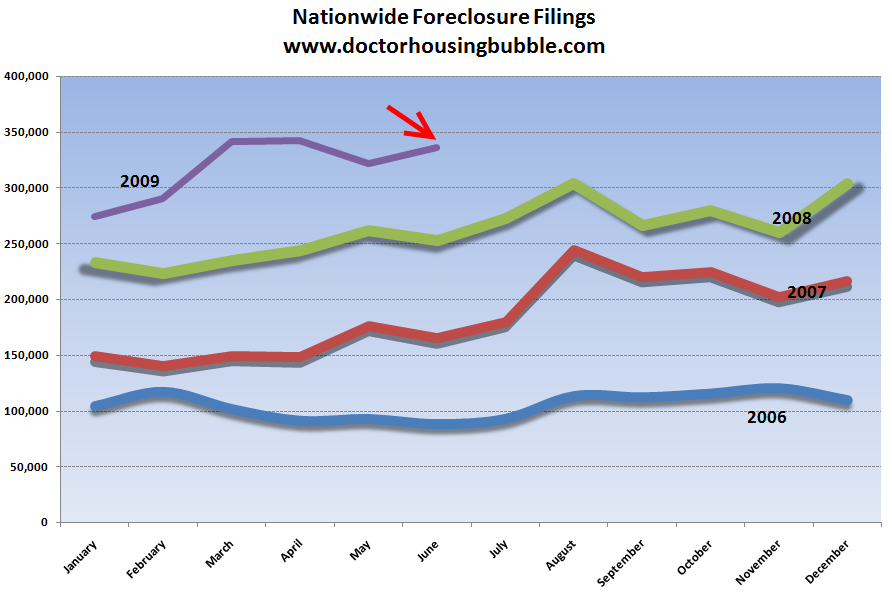

But that would be honest reporting. There is nothing more distressing to the housing market than foreclosures. And nationwide foreclosures are still in record territory:

What we are seeing is foreclosures keeping a lid on any sort of pricing power on the upside. Foreclosures are the kryptonite to any housing recovery. And until the foreclosure situation stabilizes, it is much too premature to call a housing bottom especially in a state like California. As we have highlighted, the foreclosures are now starting to hit higher priced homes in more prime locations like:

Santa Monica , Culver City , Palms , Rancho Park

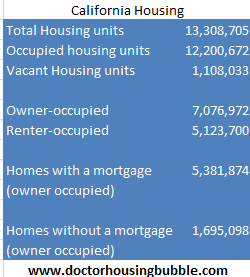

And much of this has to do with the Alt-A and option ARM wave that is now striking. Let us first take an overall look at the California housing market:

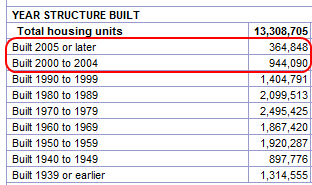

First, 76 percent of owner-occupied homes have a mortgage. This is higher than national data which comes in at 68 percent. Also, there isn’t a large amount of newly built homes in the state. In many of the prime areas homes are multiple decades old; in some cases homes were built prior to the Great Depression. So the dynamics of the California housing market are unique. But what is also important is to look at the makeup of those 5,381,874 mortgages. Let us dig deeper:

Subprime loans still active in CA:Â Â Â Â Â Â 345,505

Average balance:Â Â Â Â Â Â Â Â $321,745

Alt-A loans still active in CA:Â Â Â Â Â Â Â Â Â Â Â 632,215

Average balance:Â Â Â Â Â Â Â Â $443,223

Total toxic mortgages still active:Â Â Â Â Â Â 977,720

This is where you should take pause. 18 percent of all current mortgages in California are toxic waste or near toxic waste. That is a gigantic number. This isn’t including the many jumbo “prime” mortgages out in the market which are equally at risk. So when we talk about the Alt-A and option ARM tsunami this is what we are talking about. The only place you will find a new home in California for $200,000 is out in the Inland Empire or Central Valley but those areas unfortunately are facing massive economic problems. The state itself is in tatters but these areas are reeling. That is the new home market for California and it is a small subset.

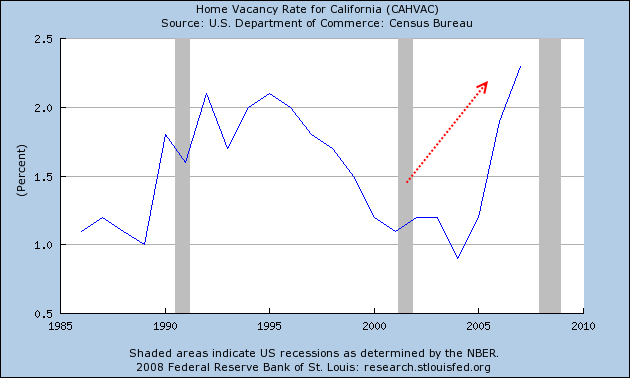

And the home vacancy rate for California is still trending higher:

The vacancy rate is the highest it’s ever been for California since data was first tracked starting in 1985. So that trend is unmistakable. This is in large part due to the massive amount of foreclosures the state is seeing (or not seeing depending on how lenders are hoarding inventory). Either way, the data is rather telling. California home prices will be falling for mid to upper priced regions in the upcoming months. But don’t expect to read that in the headlines.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

33 Responses to “977,000 Mortgages in California are Toxic Waste: The Misleading Headline Numbers and New Home Sales Increase because of a $13,000 Price cut.”

Thanks for the dose of clarity once again,, Dr.

Unfortunately most buyers are emotional, and don’t pay attention to the foreclosure numbers, unemployment numbers, etc. We went looking at homes yesterday in OC. Some of the homes were foreclosed upon and buyers are still willing to pay 200k over what the investor bought it for. They think it’s a steal since realtors and lenders tell them it’s 30 or 40 percent off the peak price.That peak pricing argument is a scam. I guess we’ll have to wait a while longer and hope that this flood helps bring more inventory.

Thanks again Doctor… Your writing gives me the best, clearest idea of what’s going on… I’m someone with a child (and 2nd on the way) and would be ready to buy a house, but things are too crazy… And yes, RpvRenter, it is an emotional decision and even someone like me, who reads all this stuff and knows how unsustainable things are now, has trouble not considering buying… And I could afford a starter house, by any definition, but couldn’t ever get comfortable buying a place that I know will lose 6 figures in value over the coming few years… But there’s always external pressure (and internal – need to live in a nice place, good schools, etc) pushing in the other direction…

So once again, thanks Doctor, for helping to keep me sane…

The new Calif. State Budget is going to draw out this recession for another year or two. If the Legislature had actually balanced the budget, it would be like tearing a band aid off- painfull, but it is done. Instead, they borrowed, fudged income numbers, delayed payments, and used every accounting trick in the book.This is NOT a balanced budget, and further painful cuts will come in 2010 and 2011.

And local counties and cities will have to contribute millions more, in order to meed the retirement promises to government employees, after CALPERS has lost billions.When a fire chief in Orinda,Ca. can retire with $240,000. in annual benefits, something is very, very wrong with the system.

Education is the most powerful weapon which you can use to change your world.

Thank you for blowing the trumpet in the wilderness of California’s Housing bubble. I too read the headlines in reference to the sales of homes.. and like a mantra for positive thinking, I saw the Drs. repeated underlined Alt A ,Option arms

explaination flash brightly in my mind! So bright that the realtor whom I havent spoke with in some time called to ask Where are you? Havent heard from you. Proudly stateing my reasons to wait caused an angry response from her. Hang in there house hunters!!! We don’t want market value.. we want a deal!!!

I am noticing that more and more high-end houses going on the market in CA are listed at a ridiculous price, and then about two months later the price is dropped. This happens both with houses priced to sell and rentals. It is so common that I am virtually convinced that this is a concerted ploy by real estate agents to try to trick people into thinking they are getting a bargain. It is like the stores which mark up prices right before they announce a sale, and people rush in thinking that they are really making out. People look at the original listing of the house, see the reduction, and think they are getting a great deal, when they really are not, and the price would fall another 20% at least, if people just held out.

Now we have the misleading headlines about housing, all designed to both help the stock market, and to create another mini-bubble, where potential homebuyers are panicked into thinking that they had better step up before it is too late. I agree that based on people’s actual earnings and savings, prices should fall a good deal more. In no way do these prices yet reflect reasonable ability to afford a mortgage over 30 years.

I’ll feel your pain Joemama. We have two little ones and want stability too. We sold our house in Palos Verdes, have some cash, and are eager to buy again in OC (more kiddie friendly). However, for us, patience and discipline must overshadow emotion since we’ve already done the starter home thing twice and now are looking to settle for good. We’re fine with renting a one bedroom pad and waiting it out.

Watching all the happy talk now on CNBC…..You’d think the recession was a minor blip and we’re off to the races again. They’re profiling the Newsweek cover declaring “The Recession Is Over!”

Good interview to put it back into perspective.

http://www.pbs.org/nbr/site/onair/transcripts/nouriel_roubini_of_nyu_090722/?ref=patrick.net

And remember what we’ve learned recently about who defaults – the very long process that eventually turns both toxic and normal mortgages into foreclosures begins when prices decline to the point that the owner goes underwater and just gives up.

It’s a self-feeding vicious cycle, because as prices decline, more folks who bought earlier in the bubble start to owe more than their homes are worth and their houses will therefore, in due time, start to flood the market as well. Declining prices pull in more and more people from farther and farther in the past, which puts more pressure on inventories and depresses prices further until, at last, the market clears where most people’s incomes in an area can actually afford the price of a local home.

I figure it’s going to be a while until that happens.

Dear DR.

I wait for your posts and read them with fervor, I am with joemama, I have a one year old just beginning to walk and our rented place is getting smaller by the day. We did not buy a few years ago when we were offer one of these “dream” mortgages. We did apparently what not many others did and used a calculator! Now we sit on the sidelines watching our counterparts in their large pretty houses live rent and mortgage free with seemingly little consequence. The fact that inventory is low in all fifty states as nod’s and foreclosures are so high is of great concern. I think there will be some explanation coming down the pipe that may further frustrate us. I think it is a possibility that the banks are waiting because they have been informed of a new federal program yet to be announced.What that could be to stop this next wave I do not know. If you have any thoughts we would love to know.

Its not just the real estate agents and the buyers who are unrealistic, its the sellers. Here in SW Ohio we’ve had 30-40% plunges in home prices depending on the area, and yet some areas are holding up well. Its the starter (more affordable?) homes that are holding up, the homes around 100K. I sold my home in the city about 3 years ago now, and that home has already been sold again. The young couple that bought it was too far in debt to make the taxes on the place. A quick check today revealed taxes went up 100% in 5 years there – a trend I had noticed and was quick to bail out of. I have a friend who is in the rental business, and of course, she can’t keep stuff rented right now, and she is going under. Her one house fit to put on the market is priced accordingly by a popular local realtor. Her comment to me today was “they are saying 20% less, I don’t believe it”. So eventually, when the rug does get jerked out from under her, and the cards collapse, it won’t matter how much the market has deflated. We might all be in the bread line before this is over and done with. But you can guarantee there’s still going to be “someone” who is uninformed telling it like they think it is, not the reality of the situation.

The agents and buyers just feed on that stuff. I’m telling everyone to sell and get OUT and those who are looking to rent. I think they think I’m crazy.

These price declines are the major footprint of deflation at this point. There is no reason to expect, for the reasons given, that deflation in housing will stop or reverse. In fact there is no natural frontier for deflation any more. By this I mean that we could deflate all the way back to the 1932 dollar and not stop there. The 1932 dollar was backed by gold, which has some value. The current dollar is backed by the promises of politicians, which have no value. I am not a gold bug but once deflation gets going there is no clear stopping point. Therefore we may see repo housing in California in the five digit range in a year or two after the stock market crashes again.

best,

Art

Who is sitting on trillions of US dollars? – China

What are they worried about? Inflation

What are they doing about it? Trading dollars for hard assets

What’s a hard asset with a return in cash flow? Rental property

Does income from rental property have some protection against inflation? – Yes

I’m just saying that any “free fall” has some point where other factors will kick in to readjust the market. There are self-crorrecting factors that will restore some balance.

At what point will renting and owning come back into balance? Where will personal income make housing a bargain? Answer those questions and you’ll find your bottom.

The move by the Chinese to dump dollars will put dollars back in the US economy. That will help China by allowing Americans to buy Chinese goods again.

Harmony. Balance.

Just take a deep breathe and let the market work.

There is some nice data there, but I don’t think you have connected the dots as to why specifically the more expensive houses will start to decline.

Also, I think it is very difficult to determine how much of the Option ARM loans are still “toxic”. These loans were made in much higher interest rate environments. It is true that borrowers of the remaining Option ARMs will have a difficult time refinancing their loan, because of the steep decline in home values. However, many of these loans are being modified by the institutions that hold them into loan types with lower interest rates, taking a lot of the toxicity out of these loans. How much? I don’t know, but we’ll find out soon.

Would you rather have a headline House Prices Drop $13,000 and Sales Continue to Plummet? The Fed said they are committed to keeping these LOW interest rates for 2 more years. That should allow the Toxic loan crowd to refianance at a very affordable rate.

on the mortages that are having problems, it would be interesting to know: How many of them were for cash out refi or equity versus first time mortages? what would be the dollar amounts, total for each class. how many of each class are in default?

I read an interesting story today in the Journal News a local newspaper here in New York. It related to the drop in ridership on Metro-north RailRoad. I bring this up because housing prices are amung the highest in the entire region. Unlike most Metro areas, New York commuters use transit to get to & from work & if those numbers are down then jobs are vanishing as well as housing values. It is an interesting dinamic.

I have noticed that here in the Santa Clarita Valley where I am looking to buy eventually every house on the market within my price range have back up offers and I mean every single one! Why is that? Like so many people I am too trying to waited out but that alone makes think if I am doing the right thing by waiting? Dr Bubbles advised me to rent until the house market stabilizes so that’s I am doing, People think I am crazy for having all the trust on him but I don’t care because I have all confidence on him even though all the back up offers on all those homes scares the hell out of me LOL

One thing that is missed is that this was not just a housing bubble but a giant bubble bath:

The stream of money created giant checks for agents and the whole den of thieves related to the industry–they won’t be back for a few years, maybe a generation.

The state and municipal budgets were obviously bloated because of the spike in ponzi revenue. Turns out supply-side Arnie wasn’t a financial genius after all, and he still isn’t. That won’t be fixed in this generation without bailout, and in case you didn’t notice, only NYC and DC get bailouts–not CA, FLA, NV, AZ; there’ll be about 37 states after we sell of the stupid ones to the Chinese.

The bastard son of the housing bubble, commercial real-estate will come crashing soon.

The Alt-Apes are running out of bananas, and the deniers have about exhausted all their smoke-and-mirror stall tactics. Those won’t be green shoots you hear–they’ll be redwoods falling left and right.

What do you do with 12-million illegal aliens in a nationwide re/depression (semantics at best)? We dang-sure to find out. There’s only so many cheap restaurants needed, and if you’re not paying the mortgage, why pay to keep up the landscaping?

Graduating class of 2009? At least we will be able to speak with relative ease to the fast-food cashier, but even an MBA will forget to put your fries in the bag…

This when much of our population was duped out of their retirement by Wall Street and will have to keep working until they keel over. Job market? What’s that? How old will you be when you pay off your 50-year mortgage?

Is this the bottom? I write and repair software–economics and real estate don’t use logic–just catch-phrases. My main mantra is: THINGS CAN ALWAYS GET WORSE.

This stuff will just roll off your granite countertop, break on your Italian floor tile, and wind up as a photo-op for your RHG trash-can home ad.

The problem is that these people cannot do not have 20 – 30% equity to qualify for refinancing.

Lucy,

Real Estate markets are very regional in nature. It all depends on what price range you are looking to buy. I think anything below $700k in silicon valley in decent school district won’t fall much – since there are tons of jobs, dual-income families and single earner making north of $150k (including bonus and stock options). With low interest rates, people are getting qualified and still buying like crazy. I am not telling you should buy, but consider all these factors and make your calculated decision.

Ouch–good point Scott…

There was once a city called Constantinople that was surrounded by a tremendous wall. They were sieged but held out as long as they could. There is a wall around inflated real-estate prices that and the debt holders are under siege. Their very survival depends on it. There are also foreign dollar holders wanting something tangible besides Ben’s “You have my word on it” (Most of you old enough to remember the Isuzu commercials?) $700,000 to live where it’s safe. Probably a great idea cuz I hear if you can’t make the payments, you can live rent free for a while and steal the plumbing fixtures on the way out. Must have one of those non-furlough state government jobs, because there ain’t a lot of guarantees in the private sector these days. Especially when everyone figures out Apple and Starbucks are mostly marketing ploys akin to stick-on fake mobile phone antennas in the 80’s. I think I had one on my Isuzu but the chicks were still not impressed. Get the house, pay the giant tax bill, plunk the 140k down on figure on eating a lot of Rice-a-Roni for the next 30 years.

According to the National Association of Realtors, “Pending home sales show a sustained uptrend, rising for four consecutive months with very favorable housing affordability and a first-time buyer tax credit boosting activity.”

I think housing market would finally improve when the unemployment rate decreases. The unemployment rate in the nation, which stands at 9.4% currently, may even increase to alarming double digit number making the financial situation even worse for the borrowers to repay. The layoffs of many workers have been permanent and hence, their hopelessness in recovery of the jobs or helplessness to repay loan amount over time looks bleak and they resort to foreclosure than choosing to invest or borrow more money on something that they are not sure whether they would be able to afford in the long run.

Read More: http://www.housingnewslive.com/is-the-housing-market-recovering.php

The last chart shows vacancy rate at ~2.3%, yet by calculation from vacant housing unit / total housing unit (1.1M/13.3M) vacancy would be 8.3%. Why such large discrepancy?

Ajay, I am posting this for the second time since it didn’t take the first time…..Thanks for your input, I am assuming that you think I live in the bay area up north, I am in the southern part Santa Clarita Valley is located 35 miles north of LA, Homes prices here have dropped dramatically here, A very nice home now goes between $375, 000 and $450,000 and up to millions on the high end, I am in the low end middle class, Middle class homes a couple years ago were at least $700,000, Homes here are not as high as the Bay area but I still think they will drop another 30% in the next year or so and that’s why I am holding of buying, I think a lot of people are rushing into buying in today’s economy but that’s just my opinion, In 2006 I sold my previous home for $465,000 in another area due to relocation and now is only worth $263,00, I feel horrible for the people who bought it but that was value of the home back then.

Thanks again 🙂

Ajay–

As of 2006, the median household income of Santa Clara County (Silicon Valley) was $95,457, and has not increased appreciably since. Historically, good financial sense suggests a median price of no more than 3.2 times that amount, or $305,462. Of course, there are homes in higher end neighborhoods that will cost significantly more, but these houses are far above average in both square footage, lot size, and build quality. Anyone making $150,000 per year contemplating the purchase of a 1500 square foot home on a 6000 square foot lot, even in a decent school district, has no understanding of due diligence, and further contributes to the economic woes of the country. Unfortunately, your assessment is probably correct–prices will not fall much, because the majority are too impulsive to make rational financial decisions. Nevertheless, until prices are consistent with historic income ratios, our country will revisit this economic catastrophe repeatedly, though the aftermath will be that much worse.

I love the fact that everyone is looking for one thing to go a little better than completely screwed so that they can call and end to our current crisis. I explain it like this :

If you get in a car accident and break both arms and both legs you are in really bad shape. If 2 months later one arm gets better are you ok? NO YOU ARE STILL SCREWED with 2 broken legs and a broken arm!

Mendota: a town scraping bottom

The fact that the unemployment rate in Mendota, 38.5 percent, is the highest in California doesn’t even raise an eyebrow here. The anguish, frustration and hunger are visible in every corner and on every face of this town of 7,800 people 35 miles west of Fresno – and nobody sees any relief in sight.

Chain of disasters

First came the national housing meltdown, which led to hundreds of foreclosures in Mendota and halted construction on thousands of units of housing and commercial developments in the area. More than 2,000 people moved out of town in the past two years, and the loss of both residents and workers able to buy goods sent sales of everything from chain saws to groceries plummeting.

Then water deliveries from the Westlands Water District to Mendota farmers were cut to 10 percent of normal, with federal officials blaming the three-year drought and the need to protect delta smelt and other threatened species.

In short order, the Spreckles sugar plant on the edge of town, a furniture store and several restaurants shut down. The main bank announced it will soon close. Even the 99-cent store and the two thrift shops, the types of places that do well in hard times, are empty of customers most days.

Now, as harvest season begins in earnest for tomatoes, corn and the melons that have made Mendota the self-proclaimed “Cantaloupe Center of the World,” hope is as hard to find as a shady spot in a cotton field.

SPIN METER ‘Help Wanted’ counting stimulus jobs

How much are politicians straining to convince people that the government is stimulating the economy? In Oregon, where lawmakers are spending $176 million to supplement the federal stimulus, Democrats are taking credit for a remarkable feat: creating 3,236 new jobs in the program’s first three months.

But those jobs lasted on average only 35 hours, or about one work week.

Your data shows 13 million housing units, with 1 million vacant. This is a vacancy rate of about 7.5%.

But the graph further down tops out at 2.5% vacancy rate.

Why the difference??

Whitehall wrote: Who is sitting on trillions of US dollars? – China What are they worried about? Inflation What are they doing about it? Trading dollars for hard assets What’s a hard asset with a return in cash flow? Rental property

Whitehall get your facts straight. China is holding $772 billion in US Debt. No, inflation will not happen. We are in a deflationary market. All the borrowing will cause interest rates to rise which will further drive down house prices with 30 year mortgages going at much higher rates. Ask how many landlords are losing money on vacant apartments and houses due to job losses. There are 20 million vacant houses in this country. The best hard asset is cash.

I will never for the life of me understand how they could have shut off the water to the farmers. It is absolutely outrageous and you don’t hear

anything about it on the news.

They are treating people as though we are trespassing on this earth…

Just wait till all vegetables will have to be imported from Mexico and

China and there is a salmonella outbrake… they will never find

what village it came from… and if the price of oil goes up how

much it will cost us.

Outrageous! I don’t waste and I am energy efficient and all but I’ve had it

with the “green people.”

Pretty amazing Graphical Depiction of California

Comment by Art Horn

July 27th, 2009 at 1:55 pm

These price declines are the major footprint of deflation at this point. There is no reason to expect, for the reasons given, that deflation in housing will stop or reverse. In fact there is no natural frontier for deflation any more. By this I mean that we could deflate all the way back to the 1932 dollar and not stop there. The 1932 dollar was backed by gold, which has some value.

___

GOld DOES NOT have an intrinsic value other than what it is worth to someone for a piece of jewelry.

>>

You can’t eat gold. You can’t wear gold. You can’t use it for shelter. In fact it is one of the more useless substances being limited in functionality to jewelry or some types of electrical circuits. Can’t use it for anythig else.

>>

Gold ONLY has a representative value of other objects (cows, bushels of corn etc.) Of course it could be seashells (currency of exchange in the South Pacific), copper (Bronze Age), silver (until mid-late 19th century) or anything else – includng pieces of paper – that a bunch of people decide to use as a standard medium of exchange. It is a lot simpler to say “I want 10 seashells for those 10 cows” rather than saying “I want 10 bushels of wheat, 2 loads of firewood and 1 pig for these 10 cows.”

>>

If you don’t understand what ‘representational value’ means in the context of the development of currency, I would suggest that instead of posting comments, you go way back to the beginning and read The Wealth of Nations and the explaination of how “money” developed.

>>

Anyone who thinks that ‘gold’ has some kind of magical inherent fixed value IS a ‘gold bug.’ Gold is no different than houses or bushels of corn – it is only worth whaat some fool will pay for it on that given day at that given moment.

Good Comment again, Ann

That is what first won me over at DHB, was that he scared the hell out of you and didn’t try to sell you gold at the end of the blog. I don’t see any ulterior motive here–just a voice crying in the wilderness. ‘Course now all the bubble-heads on TV seem to say they saw it coming. Right, and I can tell you what last week’s power ball numbers were too. Predicting the future is much more difficult, particularly with Booyah-blinders on.

It has occurred to me that low-demand deflation and currency-destruction inflation are happening simultaneously. Either that or I’m becoming very powerful because I can easily carry $100 worth of groceries to the car…

Leave a Reply to David Cooper