Young Americans Moving Back Home Because of Covid-19: Nearly 40 Percent of Younger Millennials Say the Pandemic has them Moving Home Again.

The pandemic has made it harder for younger families to purchase homes in a few ways. Inventory has been severely depressed for a few years and that continues to be the case today. The pandemic has also disproportionately hit younger Americans hard while homeowners are doing well thanks to record low interest rates, tight inventory, and a sudden shift to home being the place for all things. All of this has combined to create a strong market in terms of price but Millennials are being pushed to live at home with older parents for economic reasons. Nearly 40 percent of younger Millennials said in a recent survey that the pandemic has them moving home again. What does this mean for these new households with older parents and adult kids who would like to own but simply cannot afford to do so?

Millennials are still being left out of the housing market

Real estate continues to be the biggest store of wealth for American households. So with Millennials being hit on two fronts with the Great Recession and now the economic carnage from the pandemic, they are largely losing years when their wealth could be growing.

“(CNBC) At the end of the day, younger generations shouldn’t beat themselves up if they’re not exactly where they want to be financially right now, Rebell says. Most are struggling — and it’s OK. “Unlike previous recessions, this one came on out of the blue and shut down entire industries overnight. No one is safe,†she says.â€

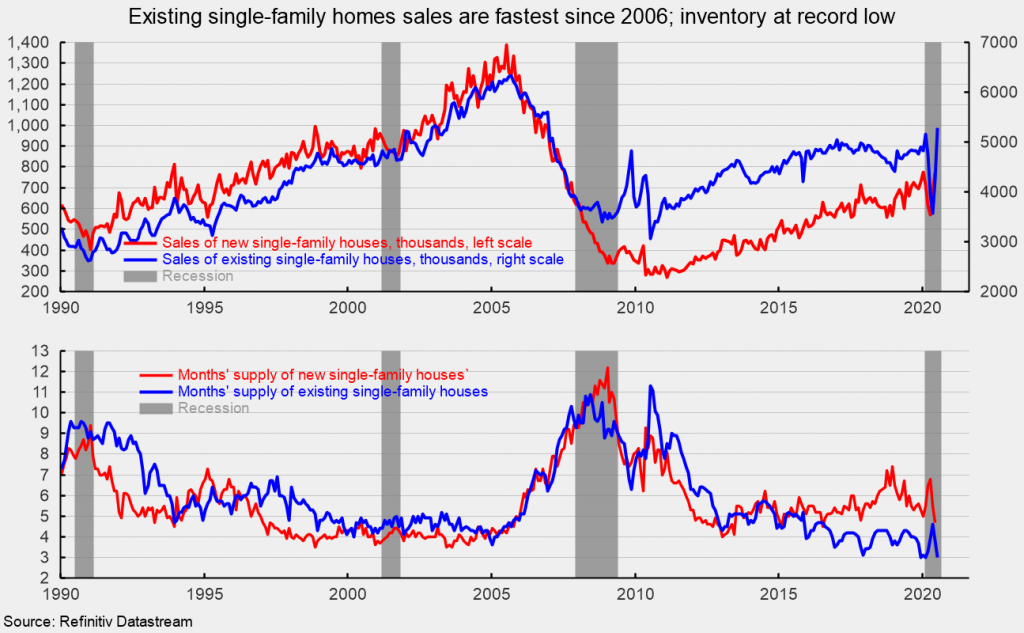

First, it might be helpful to take a look at home sales volume:

This chart is important to examine. First, home sales have rebounded but you can see they are far below the peak sales volume reached in 2005. We have never come close to that peak which was reached 15-years ago. But you will also notice on the chart below the low level of inventory. There is still very little inventory out in the market. Add into this mix the Fed pumping funds into the economy at unprecedented levels and low interest rates and you can see this perfect formula that will make it tough for younger Americans to jump into the housing market in the short-term.

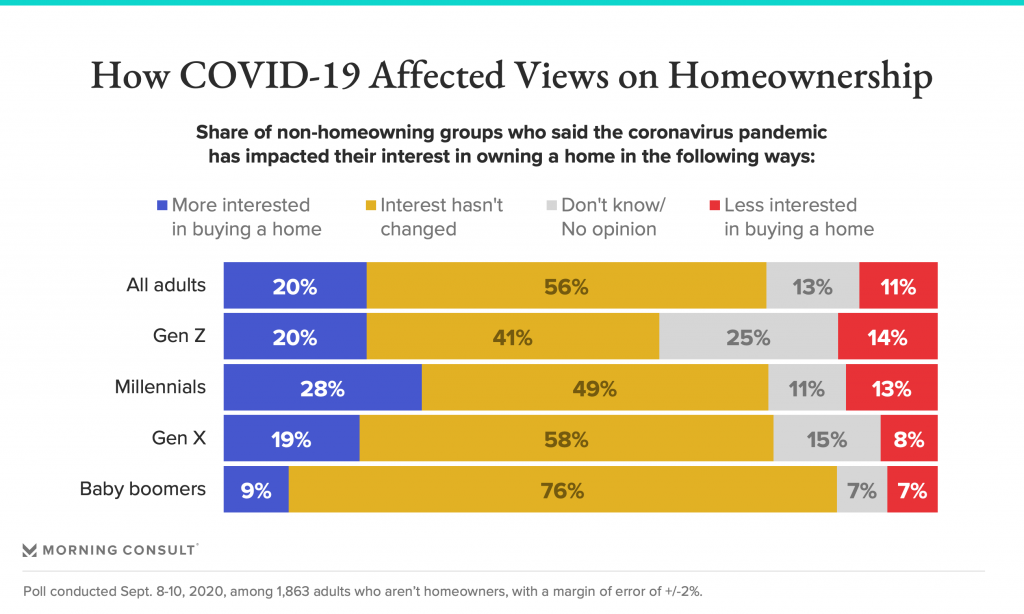

Home buying views have changed a bit thanks to the pandemic:

It should come as no surprise that Millennials have shifted to wanting to buy a home in larger numbers than other groups but wanting to buy and being able to buy are two different stories. I’m sure millions of adults living at home with mom and dad have a variety of reasons for being home. Yet sky high prices are giving way to a reality that living at home may be the only option in the short-term especially since the economy outside of the stock indexes is not all that great. We still have very high levels of unemployment and a country that is incredibly divided. There is much to be worked out over the next decade and we are going to have additional challenges that may dwarf the topic of housing.

What can we make of all of this? Millennials will be the next large cohort that will be buying homes. But that would assume that there is a steady level of inventory hitting the market. So far, this is not the case. Home builders have not been building at a steady pace and areas that need more inventory like in high priced California cities have strong NIMBY policies that will lead to more New York City style living – very few homeowners and a very large number of renters.

This will have voting and policy implications and people need to realize we as a country are in deep debt and the Fed cannot sustain the current path they are on. They are doing this during a global pandemic but what about the next move when things open up? What 2020 should be teaching everyone is expect the unexpected.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

261 Responses to “Young Americans Moving Back Home Because of Covid-19: Nearly 40 Percent of Younger Millennials Say the Pandemic has them Moving Home Again.”

I agree with the doctor

“ Millennials will be the next large cohort that will be buying homes. But that would assume that there is a steady level of inventory hitting the market. So far, this is not the case. Home builders have not been building at a steady pace and areas that need more inventory like in high priced California cities have strong NIMBY policies that will lead to more New York City style living – very few homeowners and a very large number of renters. â€

So glad I bought a house in Q1 2020 and stocks in April & may while so many perma depression bears cheered for a crash. 🤣

M, I’ve been reading the Doc’s for about a year. You may be a smart guy but the repetitiveness of your messages about the place you bought in Q1 2020 lacks any intelligent content. I am here to read the educated opinions of others about the housing market. Your content-less replies about your home purchased in Q1 2020 decrease the quality of this blog. Please focus on sharing valuable content.

Homeowner, do you realize I have posted stats over and over in the past few months?

Active inventory on October first was 25.5k in SoCal.

Last year in October you had 41k.

The last time it was this low was 2013…that show tell you something.

Plus, rates are now below 3% for a 30y fixed mortgage and demand is 25% higher this year compared to last year. In other words, demand is as strong as it was in 2012.

Expected market time is at 38 days, last year it was at 81 days.

Freaking sizzling hot market.

Prices can only go up until trends change and we see an inflection point.

For perma depression bears none of this matters. It’s like speaking mandarin.

Perma depression bears only have one answer: crash is coming soon.

You do realize that NYC real estate is crashing, right? Lol

You do realize that tiny island with circumstances exclusive to that tiny island is not representative of this giant land mass called the United States right? Do you just blurt out whatever fits your misinformed narrative to sleep better at night or are you really that naive?

M referenced “New York style living” to justify his stance that CA real estate prices will keep going up. Hence why I pointed out that NYC real estate is crashing. Try following the conversation first before making yourself look stupid.

Josh, pls don’t become like realist.

The doc said

“ (…) high priced California cities have strong NIMBY policies that will lead to more New York City style living – very few homeowners and a very large number of renters. â€

This is totally true. Just ask SoCal citizen if they are in favor of new developments.

It’s called nimby (not in my backyard). The majority of Folks don’t want more housing which causes traffic And destruction of open land. SoCal has a housing shortage since years.

Nothing that we see for SoCal housing indicates a crash. Look at the stats I continue to post. The market is sizzling hot.

Josh Logic:

*Mentions having New York strip steak for dinner last night*

YoU rEaLiZe NeW YoRk Re Is CrAsHiNg RiGhT?!

Are you glad you bought Q1?

Housing Bubble Collapse in 2021

Sure!

Crash in 2017, then 2018, then 2019, then 2020, now 2021!

In the meantime, my stocks are exploding and I live in a beautiful house.

Since you love talking about your alleged house, why don’t you answer SoCalGuy’s question and give us the name of this alleged “new construction development” in San Diego?

It’s not like anyone’s asking for your street address.

PS: A string of LOLs and smiley faces is not an answer. It merely suggests that you have no answer.

I just picked up a place in the s.valley. Stocks are up and people have way too much cash.

The housing development doesn’t exist.

Yeah, I’m glad I bought Q1 also…. in 1998. Thanks M for paying all my property taxes so my kid can go to school. What are your property taxes?? Like $10k/yr???! Looooool.

CaMillennial!

Congrats! It’s a great time to buy with low rates and in this environment. Stocks continue to skyrocket and the economy is improving.

House prices can only go up for now.

Sol, not a Chance. It’s much more fun to see you keep asking. You gotta do a bit more investigating. I gave so many hints. Work for it bruh.

98??? 🤣😂 Holy smokes, how old are???

I wouldnt be too proud of being a dinosaur. Yep, my property taxes are close to 10k. It’s like a third of my annual bonus which stinks. On the other hand, my bonus keeps getting bigger and the prop13 taxes remain the same. You gotta love prop13!

If we get some nice inflation, the property taxes will feel like 5k soon 🙂

Thanks M. Markets not going to pull back for awhile. If it does, then millenials will just buy a rental.

I bought while still in college. Wrap your head around that one. $189K and a 1/2 mile from the beach. It’s been a rental since 2008. Do the math. You’re likely only a few years behind this “dinosaurâ€.

Nothing you say is impressive. Learn some humility.

10+ years behind the dinosaur. Not that much time, you are right.

I guess that “40% of younger millennials moving home” explains where all the people in the industries that have been shuttered are going. Honestly, I don’t see how this “everything bubble” can get much bigger, especially after the election. It’s going to be very interesting once the eviction ban is lifted and forbearance ends.

Yeah, it’ll be interesting to see what happens if the jobs situation doesn’t improve by mid-2021.

Just wait until the forbearance period is over… that’s when we will have a FLOOD of houses being foreclosed upon by banks and will see a large increase in inventory. In addition, once all the stupid “moratoriums” on evictions end (which have no legal standing, by the way) and small mom and pop homeowners are sick and tired of the government forcing them to use their rental property investments as the new Homeless Shelters, they will exit the market and also list their houses for sale.

No small time investor can afford to give FREE rent to some random jerks who refuse to pay the rent… and many people are in fact gaming the system and deliberately not paying to take advantage of these moratoriums, when they could easily pay the rent, or at least a portion of it. I had a jackhole try this on me. Fortunately in Arizona, the courts uphold the rule of law, and granted me an eviction regardless of the moratorium in place by our dimwit governor (who certainly won’t be reelected). He was swiftly removed from the property for not paying after being late a couple weeks.

The CDC moratorium is a joke, they have absolutely no jurisdiction to intervene with private contracts, not under any pretense. There is already one lawsuit against them, and I’m sure many more to follow, if not a class action, for the ridiculous exertion of power they do not legitimately have.

Sadly, as of now, housing prices are SOARING in Arizona. I purchased a new build last summer which completed during winter 2019… already up $45,000 in equity in under a year (didn’t even put in a backyard yet).

I’m in process of building my second new home which I entered contract over this summer 2020, and it’s already up nearly $35,000… and it’s just barely in the framing stage! I may end up with $60,000 to 80,000 in equity by the time the home is finished being constructed next spring. Ironically, I’m not particularly happy about that because it means houses are just that much more unaffordable for people in my generation to buy. I’m blessed enough to have a very high income and can afford at these prices, but most of my friends and family can not.

The demand in Arizona from out of state buyers is SO strong that new home builders are literally having “lotteries” to decide who can and cannot have the privilege of buying one of their overpriced new homes. One builder (Taylor Morrison) told me that they only allow 4 sales per month, per community. They had 25 people show up the day they released lots, and only 4 random lucky people got the opportunity to buy. Everyone else had to wait another month for the next 4 lots to be released.

Another builder, DR Horton, just told me yesterday that they now ONLY sell spec homes, and stopped allowing people to pick the lot and the floor plan, because the demand was too strong to keep up with. They said they have 300 people waiting for their new phase 2 to open, in LAVEEN! Do you know Laveen is one of the ghettoest, crappiest parts of Arizona where shootings regularly happen, next to the large jail in south Phoenix? There’s no commercial activity, and yet the prices START at $289,000 for the smallest 1,600 sq foot TWO STORY house on a tiny lot. The only thing they have is the new 202 loop extended to go right through their town, which makes it much more accessible. But it will be at least 10 years before any major commercial activity is developed over there. It’s mostly farmland still.

I can only imagine how much worse it is in democratic strong holds, except for the fact that tens of thousands of people are fleeing these states, DROVES, and are moving to Arizona and buying up all our property with their inflated sale prices. This is terrible for Arizona.

Californians, New Yorkers, Chicagoans, GET OUT OF ARIZONA and STOP COMING HERE. We don’t want your liberal policies and inflated money jacking up our real estate market any more!

THE TETRAHEDRON

Like I’m gonna listen to you if I decide to bug out of CA for Payson or Prescott!

PS The one family we know who moved to Prescott are a cop’s family and not anything like what you think of Californians.

Nailed it.

Reality will come knocking.

None of this is natural.

It appears builders are using the “night club” sales strategy. Form a huge line out front for everyone to see and they’ll think there is good fun to be had inside. I’m happy to enjoy cheap drinks at a dive bar.

LENNAR SUPER-SPREADER MODEL HOME EVENT THAT WAY!

Saw a Taco Shop doing this in La Jolla last time we visited CA. That was an interesting trip because we were staying in an Airbnb next to a $4M house so close to the beach that you could hear the waves from inside the unit. Yet, there were drunks up and down the street and the roads bumpy as can be (tax dollars, hello?). I hope California sees a revival someday.

Butch, now I know that you actually have no idea what’s going on.

The builder don’t have to use any strategy. If you are a builder and you have inventory right now you are lucky….. I just talked to a former realtor who is a sales rep for a new development. She said the last phases sold within 30min after they released them. Builders are increasing prices as there is so much demand. Just visit a new development and let them show you the waiting list and what’s left. Then visit them a week later. You don’t do yourself a favor by fooling yourself.

M, You’re the fool for believing the sales rep. Always a good time to buy!

Dude, just do yourself a favor and visit a new home development. Just do it. Take a pic of what’s available for sale. Then go back there two weeks later and compare. If you don’t believe the stats published online then check it yourself and see how Home builder inventory is flying off the shelves. You don’t have to believe the sales rep. Just look for yourself. I assume you are not that crazy that you believe the people moving in are all staging high demand and it’s all a big conspiracy just to lure you in? If that’s the case I probably can’t help you.

Realist, I had positioned myself so that I would have a large amount of money to invest in about 12 months. However, it doesn’t appear that any decline in home prices is possible for many, many years–with forbearances, a freeze on foreclosures, etc.–so I have begun to shift money into 5-year CDs as fast as possible. Buying investment properties outside of California looks like it is the only real estate investment option available at the moment. Which states/cities look the most promising for real estate investing in the near future?

Forbearance will end. Many people will sell quick before they foreclose to capture any equity they still have. Foreclosures will definitely take some time. It might take years to see the bottom but I think we’ll start seeing the knife drop within a year after forbearance ends, if employment hasn’t recovered by then – which I’m not sure is likely given that COVID still hangs heavy over us.

I don’t think there’s anywhere worth investing in real estate right now. Maybe places where people are fleeing to from California. But even Texas is no longer considered a place for affordable real estate anymore. Idaho is almost as expensive is the Inland Empire (but with horrendous winters). Phoenix and Las Vegas are going to tank hard when SoCal hits the fan – major bubbles.

I’m holding my real estate cash in a CD also. The situation is not ideal but no doubt cash will be king when reality hits so all the best to you! It sounds like you’ll do great.

The GSEs bought or back 95 percent of all loans since 2009. They won’t foreclosure on anyone. They will just extend forbearance until the pandemic is over and them some. The GSEs will come up with some gimmick programs so they i’ll not have to foreclose. I

No worries

Wait! If 95% of the mortgages are owned by the US government and 62% of all homes have mortgages, that means 59% of all US homes are owned by the government.

Trump is really a communist?

Gary, I’m not sure how long you’ve been on this blog but you’re better of taking financial advice from a chimpanzee than from Realist.

I like the boring midwest markets. Good cap rates, less volatile market cycles, honest hardworking people who don’t have anything against Californians. Gotta go east of the Rockies to get any deals IMO.

20% drop in Home Prices once Interest rates recover from negative Rates. SeeSaw Effect.

Sweet, wake me up when prices go down5%. Looking to buy a rental. Thanks!

With cash, or you gonna hold two mortgages?

2 mortgages of course! Why tie up cash if you can take advantage of 30years fixed rates at 2.5% and the renter pays the mortgage?

Fair enough, matches your risk tolerance. All the best to you.

I have been waiting for housing to drop since 2014.. Back in the Jim Taylor days. Looking back I wish that I had bought house then and been able to refinance. Oh well, lesson learned.

My Daughter and her husband sold a townhome they bought half-way through the crash and bought a big house on 1/4 acre in 2013 (spring). In 2014, prices were going up. They actually sold the townhome a couple of months after they bought the house and made maybe $30-40K for doing that. You were already late to the party in 2014.

2014 is only 6 years in the past. When it comes to the CA housing market, 2014 is an eternity. Somebody who bought back then likely has seen 30-40% appreciation, has paid down 6 years of principal and can refinance into absurdly low rates and a shorter term. I’ve seen 15yr refi rates around 2.25%.

Listening to Jim Taylor and waiting for the big tank that never came was not a good move. If you can comfortably afford a place and plan on owning for the long term, you really should get out and start looking. In the year 2030, we’ll be looking back at the bargains from 2020!

I think we’ll be looking back and laughing at the itch-scratchers who paid $1m for 2 bed, 1 bath urban crap shacks draped in power lines. Especially if Boomers aren’t eternal.

agreed w/turtle.

Looking to see all these boomers with their mortgages and multiple houses + rentals + pensions age with all the mass unemployment.

I recently landed a job around 200k, working (as usual for me) remotely – in a field that should be good for a little while.. (although I personally do not support it…). I will hold onto my cash, move in the next 6-8 weeks to a low-tax state and see how this housing bubble continues. Esp with all the boomers and today’s hitters so into following the mask mandates and vaccines. Esp with the rising AOC’s war against property ownership and landlords (think reform is only for gun ownership?)

Something will be changing – and its only going to get uglier. This will be affecting everyone – regardless of your equity, cash or salary. It will all come down to evaluating your usefulness in the upcoming society – and those fields are hiring right now – at good wages. The long-term plan is not going to be nice.

“Housing to tank hard soon!†Hahaha i remember that guy. Never take financial advice from internet strangers. He had me for about a couple years but then I did my own research and never looked back.

This is Bill Murray’s best impression of our dear M. 😉

https://www.youtube.com/watch?v=7ErQUYNeYfM

Lol perfect

This is John Cleese’s impression of M explaining all the inconsistencies in his overnight inheritance, sudden purchase of a new construction house, and quick move-in:

https://www.youtube.com/watch?v=F2s3oZLrHgU

Overnight? It took like a year to get the first payout. I still haven’t gotten the second payout! Do people post as soon as someone in their family dies just because they get an inheritance? I don’t! But I also don’t post my address on the internet (even though SOL keeps asking for it 😂)

Quick move? It wasn’t quick!

Sudden purchase? You must be kidding!! I have looked at houses for years! I posted countless times how I spend time on weekends to look at open houses. 🤣

It’s sad that you spend your time with spreading false information! At the same time you call teachers names and attack them (so random and weird). Seems like a bitter/single person who is jealous of SFH owners!

M: Overnight? It took like a year to get the first payout. … Do people post as soon as someone in their family dies just because they get an inheritance?

* January 31 — You’re still posting bear comments, demanding an end to Prop 13.

* February 11 — You announce your inheritance.

* February 19 — You claim to have just bought a house (as if you received the money about a week after announcing it).

Now you claim you knew about the inheritance for a full year before the first payout. So you learned of your inheritance in early 2019?

In which case, why were you still a bear throughout 2019, and calling for an end to Prop 13?

If you really got an inheritance (you didn’t), it would have changed your attitude upon learning that you had money coming in.

I post: “It’s not like anyone’s asking for your street address.”

M’s response: “I also don’t post my address on the internet (even though SOL keeps asking for it”

I say I don’t want his address.

So M accuses me of asking for his address.

Intentionally poor reading comprehension is a sign of a troll.

Once again M, nobody wants your address. Just the name of this “new construction development” where you claimed to have moved. SoCalGuy says there are no such developments.

Nope, just because you expect money from

An inheritance doesn’t necessarily change your mind. It was freaking hard for me to make the decision to buy because I believed it to be overpriced. I used to be a bear for years.

But with a certain amount of cash it becomes unjustifiable not to buy. It’s like this: you have that much cash that you are like, f this, even if it crashes I don’t care anymore.

Yes, I am not giving out my address. Telling people on the internet where exactly I live is dumb. Your attempts are too cheap .

M: I bought stocks and a nice house in Q1

Internet guy: show us your social, name, birthday, address and screenshots of your bank statement

M: 🤣

Internet guy: I don’t believe you because you can’t prove it

M: do I look like I care what you believe?

Internet guy: give me your address

M: no

Internet guy: give me your address

M: no

Internet guy: give me your address

M: no

….

Why do you keep lying, M?

No one ever asked for your address.

I specifically said I DON’T want your address. Just the name of this mythical “new construction development.” It’s like asking for the name of a community.

M: show us your social, name, birthday, address and screenshots of your bank statement.

Huh? Who asked you for any of those?

Why must you lie?

Why must you put words into people’s mouths?

Because you can’t win against what they actually said?

Sol, still not giving you my address 🙂

Internet guy: tell us where you live! I just want to know. Not your address, just tell us where you live!

M: no, not giving you my address

Internet guy: don’t lie, I don’t want want your address I just want to know where you live. If you don’t tell me, you lie.

M: no, not giving you my address

…

Btw., why would I care if some random guy on the internet thinks I lie? 🤣 he keeps using this line as if it’s supposed to bother me.

No reason not to feel great. So much to be thankful for!

On top of that I live in a brand new house in beautiful SoCal!

Honestly, you come off kind of crazy

Nailed it. M is the top commentator on this Housing Bubble Blog by 2x. Think about that for a minute lol.

I thought about it a minute and it makes sense to me.

Just because a housing bubble log exists doesn’t mean there is a housing bubble.;

Do you actually read the dr housing bubbles articles? If you would take 30 minutes and fact check the stats I continue to post you would know that there can’t be a significant price drop in housing without inventory increasing sharply or demand dropping drastically.

It’s important to continue to post these stats to help people…..waiting 10 years for a crash is financial suicide. As soon as you can afford to buy you must buy in places like SoCal.

Since people (and perma depression bears) have a hard time understanding that you just keep repeating it.

M states a $30k annual bonus but for some reason, he needed an inheritance to purchase a home. Hmm..

“Yep, my property taxes are close to 10k. It’s like a third of my annual bonus which stinks.”

That is correct. I needed an inheritance because I could not pull the trigger…. I was a bear waiting for a collapse. I just could not put my hard earned money into a house which I believed to be overpriced……when I inherited I had so much cash that I couldn’t justify anymore NOT to buy. I admit I was wrong the last few years…..I should have just bought earlier. Buying makes sense as long as you can easily afford it. Trying to time the market is a losing strategy. Just look at my case: I thought I bought the peak in Q1……and so did tons of people on this blog. They cheered and called the top. Especially with covid. Now fast forward until Q4 and here we are: stocks recovered and housing just went straight up. The builder increased prices on every phase and I am already sitting on equity gains. I would have never ever thought this could happen during a pandemic…..

If I wouldn’t have inherited I probably wouldn’t have bought…..I got lucky. And it changed my view and actually my life. Now it’s easy for me to say: buy when you can afford it. Don’t time the market. I tried the exact thing – for years.

M, I completed understand your situation now. You crossed that threshold of “more money than brains”. And OPM as well. Congrats!

I think M is saying that with an inheritance and savings he could buy where he wanted to live for 10-15 years. I understand this and is a good choice due to the length of time he wants to live there and the low mortgage rates

Most of us aren’t so lucky. We have savings to buy a crapshack on speculation that we really don’t want to live there for 10 years. DO NOT DO IT!

You need to want to have saved enough to live where you are buying for at least 10 years. Or, you will lose it all when you walk away. This isn’t the boom times where you could sell with a 15% increase over one year. You will lose it all, become homeless, and live in a trailer in Victorville with your 20 cats, while sucking on the gubmint teat until Trump performs a mastectomy and until you die of some strange cat related disease. Don’t expect a proper funeral since your 20 cats will have eaten your disease ridden face. Nuff said.

10-15 years, People!

Seen it before, bob,

Not just 10-15 years. Why would I ever sell. If I want to buy another property, I just do a cash out refinance and put a renter (hopefully a good one) In your Place. Then take that cash out refi money as a downpayment for the next place. With 2-3% loans you have access to almost free money. I can’t wait to buy my next place, hopefully prices go up slow and steady instead of this sizzling hot market.

Butch, now you got it. It still took “brains†though to land a great job at a tech company. It also took brains to buy a quality house (great location, good school district etc).

If I were dumb as a rock I probably would play video games or drink all day instead of reading stats about the housing market and sharing it with you and the other crash bro’s. The below average people also read zerohedge and think that a RE crash will allow them to buy their dream home at a cheap price….just saying 🙂

M,

“Not just 10-15 years. Why would I ever sell. If I want to buy another property, I just do a cash out refinance and put a renter (hopefully a good one) In your Place. Then take that cash out refi money as a downpayment for the next place. With 2-3% loans you have access to almost free money. I can’t wait to buy my next place, hopefully prices go up slow and steady instead of this sizzling hot market. ”

2008, home prices plummeted 30-50%, rents plummeted 30-50%, Equities plummeted 50%.

1) People lost their tech jobs. No income to pay the mortgage.

2) Homeowners were underwater. No cash out refi’s and no sale possibility without closing with lots of cash to pay the deficit balance.

3) Stocks plummeted 50%. No equities to pay the mortgage.

4) Rents plummeted so if you wanted to rent out your home, you lost money.

History does repeat itself. We’ve seen it all before.

I recommended the book “Nomadland” to Millennial. Millennial said he would read it. It is now a movie. It documents a set of people very like you who bought a house in 2006 and experienced all of the above. M should read it.

Just hold some cash to ride it out. The people that walked away are living with 30 cats in a trailer in Barstow. The people that had cash and were able to continue to pay their mortgage 2008-2010 are currently millionaires with a paid-off house and retiring early.

Have cash. Not Bitcoin. Cash. You know your fixed ultra-low mortgage payment for the next 15/30 years. Hold 2 years worth of cash and don’t walk away no matter how bad it looks out there.

If you are still employed, do what the brave people did in 2008-2009. Take the cash and buy a rental. Not many had the courage to do that when the tide was out, their primary home was underwater, their 401K was half, and their employers were still massively laying off. That is the time to buy. I bought in 2014. A few years too late but I was fearful. Probably due to Jim Taylor. Blackstone did it with other people’s money.

Bob,

You gotta have bitcoin in your portfolio!

This next bitcoin bull run will blow your mind.

Square, PayPal, Venmo and another nasdaq listend company, Microstrategy have invested millions and millions in bitcoin and crypto infrastructure. What are they seeing?

To dismiss bitcoin and not invest in it is a huuuge mistake. You’ll see!

Millennial kids are moving back home to Boomer parents to weather this storm.

What does this mean?

1) Millennials can’t afford to buy a home. Less demand

2) Boomers can’t sell and downsize with Millennial kids moving in. – Less supply

3) The Fed and government are deficit spending trillions to bail out banks, corporations, renters, and homeowners. This is unlike 2008 when banks were bailed out and the homeowners were thrown out.

4) The pandemic will eventually end like it did in 1919. The economy entered the Roaring 20’s for nearly 10 years before crashing hard in 1929. Will history repeat itself? When the pandemic is over, will the kids become employed, move out and buy a home? Will the parents sell and downsize? Will this lead to a second Roaring 20’s?

What will happen? My crystal ball broke in the 1994 Northridge quake.

My crystal ball-less financial advice: Sit back and accrue 30% cash and hoard popcorn. Be prepared to get out of cash if inflation ramps to double digits and go into a Bogle index fund or buy a primary home. If a 20% crash occurs in housing or equities, be prepared to use/invest half your cash in a primary home or a Bogle index fund.

Re-evaluate 2 months after the election.

“The investments and services offered by us may not be suitable for all investors. If you have any doubts as to the merits of an investment, you should seek advice from an independent financial advisor.”

Excellent advice. Very risky to rush into buying right now but I suppose those super-low interest rates are making people excited. Wait and watch. Save cash in the meantime. Reevaluate next year. Make sure you’re diversified. Half my California home buying resources are in Texas real estate, the other half in a CD. I’m comfortable with whatever happens and will make my move when it makes the most sense. Glad I didn’t buy Q1.

LOL! Nice snark at the end there.

Forget crystal balls.

You buy when you can comfortably afford it.

In other words, if you are in a position to buy, the best time was yesterday (or in Q1), the next best time is today.

M is the classic REIC troll. That’s their favorite line too LOL

Maybe second to NOW IS THE BEST TIME TO BUY!

It’s actually true though.

If Trump wins I’m paying all of my property tax bill for 2020/2021 this income tax year. If Biden wins, I’m paying half. For Trump, I need a bigger deduction for my state taxes, since I don’t have enough deductions to itemize Federal with the large standard deduction. For Biden, Federal taxes are going up and we may revert to pre-Trump Federal standard deduction. Save money on taxes whenever you can.

Biden will likely eliminate the 10K cap on deducting state and local income taxes

I suspect he will since most of his base wants this. It is double taxation.

I doubt he will lower the standard deduction. Too many people want this. However, it was a wash for most taxpayers since Trump also eliminated the personal exemption.

The current higher standard deduction is simpler than having a lower standard deduction and personal exemptions.

Biden will likely re-instate the tax rates for the higher income brackets. He will also likely either raise capital gains taxes or modify the holding period for long term gains. ie if you buy and sell within a millisecond and make a million dollars in gains, you will likely pay a higher tax. He may make a transaction tax to fix this.

I don’t high speed trade and I tend to hold long term equities. My state and local taxes plus interest will still fall below the current standard deduction. I didn’t benefit much from Trump’s lower higher tax brackets. I am one of the remaining middle class. I don’t think anything that Trump or Biden will do to taxes will affect me.

I do all trades inside IRAs. The non-IRA accounts all have long term holdings. I’m still working full-time so I am not withdrawing from IRAs. The new law that postpones IRA mandatory withdrawals, and the 2020 inherited IRA forbearance should help. You are a good source of information on this sort of thing. Since nobody actually knows what Biden will do (except his inner circle), I’m going to hedge.

Thanks for the compliment, Joe R.

I’ve been doing my own taxes since I was 16. Every year they get more complex due to mostly things of my own doing. ie getting married, buying a house, having a home office, having kids, renting out a room in a house,…… These last few years have been a little simpler due to Trump’s higher standard deduction (I don’t itemize anymore) but I have actually paid a little more in taxes due to Trump capping the SALT deduction and the elimination of the exemptions (12,000 in exemptions in 2017 for me (about 3500 in tax savings)

SALT is the sum of property taxes, state income taxes, and automobile registration taxes for me . The max deductible cap is currently 10K deducted off of income.

In 2017, before the new law went into effect, I prepayed my 2018 property taxes in December 2017. They were due in February. Since the Std deduction was 13K in 2017, I could deduct both 2017 and 2018 property taxes on my 2017 taxes. That was worth about $1200 for a tax refund in 2017 with a 25% tax bracket.

In 2018, the std deduction went to 23K, and there was a 10K cap on SALT. I couldn’t deduct enough to itemize in 2018 or 2019.

With a 10K cap on SALT, you need to exceed 14K in mortgage interest and charitable contributions to exceed the 24K 2020 std deduction to itemize. With low rates and late in the term on a mortgage, mortgage interest is almost nothing at this point.

If Biden revokes this 10K cap on SALT for 2021, I may prepay my 2022 property taxes in 2021 to exceed the 24K standard deduction and itemize again. I would save about 1K in taxes by paying my property taxes a few months early.

Trump somehow did a tax change without the majority of the House, so Biden may also be able to change the taxes if he is elected.

It is only 1K in tax savings but it supports my yearly avocado toast habit. 🙂

I should also add:

The comment by Lord Blankfein above is correct. If you buy now and hold for 10-15 years, you will not be sorry. Make sure you have enough cash to not lose the house during any temporary downturns. If you have a 15 year loan at the absurd rate of 2.25% now, you will have no mortgage in 15 years and can retire in peace.

If you can wait a few months, the pandemic dynamics are distorting the market.

You may be able to get your dream home in the city center now for 15% off. Go for it! You may pay 15% more for a rural or house in the suburbs. It won’t matter in 10-15 years if you hold the house.

Bob,

Biden can not change anything on the taxation front if he doesn’t get both, the senate and the house – highly unlikely.

Trump did so it is highly likely

Most of my millennial friends and I in the silicon valley have enough cash to purchases homes. If the market pulls back a bit, most would buy a rental property.

Personally, I like “Crash Bros” better than “Perma Depression Bears”. Snappy.

“The forbearance crash bros spoke too soon”

https://www.housingwire.com/articles/the-forbearance-crash-bros-spoke-too-soon/

I feel good, I feel great, I feel wonderful. I feel good, I feel great, I feel wonderful…

16% unemployment in California. California economy is going down and will take home prices with it.

https://finance.yahoo.com/news/these-states-are-suffering-the-worst-employment-picture-144235273.html

My good man, that is horrendous! 16%. Attributable to Newsom’s well-intentioned (?) but mistaken approach.

It’s interesting that Newsom locked down like crazy while Abbott hardly did anything in Texas (whatever you heard in the news was unenforced in nearly every city). Yet, California’s number of new daily cases is only a little lower than in Texas.

I know hindsight is 20/20 but it really wasn’t worth wrecking millions of people’s livelihood. I’d rather risk the flu for a week with slight chance of complications than go through months of anxiety and financial drain. I experienced that in the last recession and feel terrible for the millions of people going through it now.

Kudos to Trump for leaving closings to the states (and kudos to the states like Texas who left it up the the counties). I tremble at what kind of blanket Biden would [try to] throw down over the whole country.

Traffic is back on SoCal roads…..people are spending and working.

It was nice during March/April. Air was clean and roads were empty. Now it’s back to normal. We need schools and youth sports back at a 100% as well.

M, Back to normal? Do you have stats to back up your speculation? Maybe people are out driving around to find work?

🤣

This isn’t 1950 anymore where you go from business to business and ask if they are hiring.

Who finds a job driving around town and wastes a gas tank? Do you do this? Maybe that’s your problem. I don’t think I have ever even thought about driving around town to find a job. You can do this with 2 mouse clicks.

M, You still haven’t provided data to support your claim that “Now it’s back to normal”. Your deflection was unsuccessful as well.

Butch, That’s like saying I need to provide data that the sun is shining today.

Nobody needs data for this. All you need to do is come out of the forbearance crash bunker and take a look outside.

You are the one that said the people driving outside are looking for a job which is the most ridiculous statement ever. I understand 2020 is a bit crazy but that doesn’t mean jobless people can’t use their mouse for 5 min and apply for jobs online.

M, Your localized observations and speculation provide no real value to this forum. Put up some data or shut up.

I constantly provide data and articles.

You said new home sales are dying 🤣

There are several articles that show new home sales are up over 30%

Instead of trolling us you should start reading.

But the funniest comment this year def came from you when you said traffic is only back because people drive around town looking for work.

Literally nobody does that. Traffic is back because stores are open and people spend, spend, spend. We also never got the 30% unemployment our perma depression bears told us about.

🤣 🤣

Not sure if the data is correct. There are hella jobs available. The shutdown hasn’t really affected much in the silicon valley and LA.

Low paying jobs got hit the hardest. Those that could afford to buy before covid. Now they are in an even more challenging position.The tech company I work for is hiring left and right.

If jobs are back in CA then there must be an awful lot of fraud going with 16% claiming unemployment benefits.

Unemployment is LA is 16% as well. You speculators need to support your statements with real data.

https://www.latimes.com/business/story/2020-09-18/california-unemployment-rate-dips-covid-19-restrictions

House to tank hard in 2021.

House to tank hard in 2021. so be careful you guys out there.

House Prices will rise by at least 1.5-2% in 2021 and bitcoin will hit a new all time high.

Mark my words!

And the NASDAQ will double, and Apple will quadruple, and Tesla will octuple! Man 2021 is gonna be such an awesome year for all assets! Especially the ones that have left the burden of sound financial principles on Earth as they reach even higher to the stars.

We shall see. You def want to be invested with some money in tech stocks and bitcoin/other crypto’s. Don’t miss out!

Haha, Tesla probably will octuple. That is an interesting one.

Well, I think it’ll start declining by end of 2021 with forbearance ending and 16% in California unemployed today, after how many months now? Not to mention, unemployment benefits end faster than forbearance. It’s hard to imagine anybody really being able to comfort themselves with reports from the housing industry.

My crystal ball is broken, too. Actually, I never had such a wicked device. I’m guessing is all. Things could really work out if employment recovers fast. Prices could keep going up. I’m not being facetious. Who knows! Save cash, wait and see.

Just bought a house near the beach in a great neighborhood in South Redondo. I can afford the payments and it’s very safe and a great location. We plan on staying for 10-15 years, so I’m not too concerned about a drop in the next year or two.

Congratulations! And great area!!!

Great time to buy! Most homeowners don’t care about a drop in prices. Some actually prefer that so they can add a rental unit to their portfolio.

If what you say is true, you will NEVER have to worry about the value of your house. South Redondo is one of the best (if not the best) place to own in the South Bay. It was less than ten years ago that you could buy a home on one of Avenue streets between PCH and Catalina for 800K. That’s what we call winning the real estate lottery. My personal favorites are Avenue streets above PCH.

Congratulations on your purchase!

Congrats! I just bought a house in San Jose. Closing this month. Not concerned with the payments and should be able to weather any pullback.

Nice man!!! Congrats of getting a house in San Jose! That’s awesome!

Thanks.

Devastating article for our bubble forbearance boys

https://www.housingwire.com/articles/the-forbearance-crash-bros-spoke-too-soon/?fbclid=IwAR0NrPjei-NJNMDXGSZq6ZN2UB9QxlAXxviI10yghQ7jDhVBH8w8vxe8gpM

Their last hope is a forbearance wave of foreclosures.

Hah, I shared it first! 😛

Forbearance is not a factor if unemployment rates keeps increasing.

M has the perfect timing.

Buying in Q1 was pure luck. I didn’t know what will happen. I would have never expected the housing market to become so hot this year. Never, ever!!

I did buy stocks when the market crashed and I wish I would have bought even more.

Buying a house was a must for me. I couldn’t justify it any longer not to buy.

No one really knows what will happen next. Markets are not free anymore and heavily controlled by the government. Crash might not happen at all since bad mortgages are consumed by government and it can make you mortgage payment whatever… stretched into 40 years or make interest even lower. New laws in California coming January 1st you can have equity 300k in a primary residence and file for bankruptcy and tenant will have a priority in buying foreclosing property he lives in. Game changer.

Now that’s a fact. The free market is dead. Totally messed with and that is sad.

Nobody knows! A bunch of guessers, we are.

The Millennial that lives in my home is actively looking at condos to buy. I will give him the 20% down payment to get him started in property ownership. Not only will this get him out of my home, he plans on renting a spare room to a friend. This will give him the experience and knowledge that he needs when he inherits my properties.

Must be nice for him to be able to get the 20% from you. I had to save myself to get it.

Growth going forward is highly suspect, without sustainable income:

Real gross domestic product per capita/Real Disposable Personal Income: Per Capita

https://fred.stlouisfed.org/graph/?g=wKzX

Been reading this blog since I first bought my condo on a short sale 8 years ago. Just about to sell it and get more back than what the sale price was. With that said us Millennials who decided to work and were determined to not let Covid wreck us got ahead. Millennials who have a career, and plan, can afford a house. The key is don’t listen to the media or the hype. Run the numbers and see how much that 30 year fixed rate loan is lower than the rent for the property you are purchasing. If it’s 2/3rds lower that’s called rental income or a good living situation.

Great post Alpha!

I am millennial too. I need to get my hands on rental property or buy land and place tiny homes on there. Need to research what the smartest way of doing it is.

Why sell your condo? Refinance and cash out some money and reinvest that money in another property?

I agree. Its not too difficult to purchase a home and maintain the upkeep. Most of my millennial friends have homes and are not starting to purchase rentals.

FACTS R FACTS- Housing Collapse 2021- A report from National Mortgage Professional. “‘Four months into the pandemic, the 120-day delinquency rate for July spiked to 1.4%,’ said Dr. Frank Nothaft, chief economist at CoreLogic. ‘This was the highest rate in more than 21 years and double the December 2009 Great Recession peak. The spike in delinquency was all the more stunning given the generational low of 0.1% in March.’â€

“CoreLogic also reported that all states logged annual increases in both overall and serious delinquency rates in July. The company also predicts that U.S. metros that were hit hard by job loss in the oil and gas industries such as Odessa, Texas, are projected to leave millions of jobs unrestored throughout the remainder of the year.â€

From Yahoo Finance. “‘The 120-day delinquency rate stood at 1.4%, up from 0.12% in July 2019 and the highest level since Core Logic started tracking delinquencies in 1999. ‘What we’re seeing is a ‘pig in python’ effect with a spike in June for 90-day delinquencies and now in July with 120-day delinquencies,’ said Dr. Frank Nothaft, chief economist at CoreLogic. ‘I think it’s a big concern especially as the CARES Act provided forbearance, but homeowners will still have to owe every payment.’â€

“All 50 states experienced an uptick in seriously delinquent mortgages, those characterized by payments 90 or more days late. But some bore the brunt more than others. In New York, that rate climbed to 10% in July, up from 4.3% the year before. New Jersey’s rate hit 9.6%, up from 4.5%, while the delinquency rate in Florida increased to 8.6% from 4.1% in July of last year. ‘If there continues to be financial stress we can see at least 2 million loans seriously delinquent by the end of 2021,’ Nothaft said.â€

Better enjoy that weather CA, a shit storm is coming off the coast 🙂

“‘The 120-day delinquency rate stood at 1.4%”

And….so what ? Of course it’s more, remember Covid, lockdowns ?

What is conveniently not discussed is that these delinquencies

are mainly handled thru forbearance by adding delinquent amounts

to the loan principal. This does not create distressed sales, which would

have a market impact. In M’s words, “Sorry bubble forbearance boys”.

Crash and burn again. It might help if you’d start looking at the whole

of an issue instead of just the part that makes you feel warm and cozy.

Please call us “Crash Bros” instead. That’s the industry term and I like it.

“It might help if you’d start looking at the whole of an issue instead of just the part that makes you feel warm and cozy.”

I think we’re all prone to this. For example, when an ardent bear predicts 50% – 70% crash receives an inheritance and buys a house they “believed it to be overpriced” then suddenly becomes an extreme bull. “I feel good, I feel great, I feel wonderful!” (repeat).

The “the whole of an issue” in this case includes the fact that people don’t have to pay their rents, don’t have to pay their mortgages, get unemployment plus extra unemployment plus thousands of dollars in the mail… all while there is still a pandemic and 16% on unemployment in California. I’m not saying I know what will happen but this isn’t a pretty picture, especially if unemployment is still in the dump when forbearance wears off in 2021.

In looking at the whole issue, forbearance is assistance to those that have had an income loss or reduction. If the income loss becomes permanent, then the forbearance becomes a default and then a distressed sale. Jobs and income are the ultimate factor of a healthy economy and growing home prices.

I don’t disagree but if you are going to argue about it in a condescending tone, you need to bring more than “mainly handled” to the argument. I bet you have no idea what percentage of the loans don’t qualify for forbearance.

You know how easy it is to get a mortgage forbearance? You just zoom call your bank and tell em you want one, no proof of loss of income necessary. If I had a mortgage you better believe I would do that. Nobody wants to talk about how many of those people make up that “staggering†figure. And how many of those will materialize enough to add a significant amount of inventory to the market that will bring housing prices down? Quick answer: don’t bet on it.

Bears just don’t get it. They keep regurgitating the same copypasta post after post with no real substance. They have no solid facts to support their claims because those facts don’t exist. Psychologists theorize that when a human being is so traumatized, they create this alternate reality in their heads as a coping mechanism. These bears are so traumatized that they missed out on the last crash that they just keep hitting the repeat button in their heads thinking it will happen again and they’ll get their shot at wealth once more. But every passing year they couldn’t be farther from the truth and every passing year they’re that much closer to driving themselves to insanity.

Someone go check on Realist, I’m getting concerned 😟

I know too individuals that are on for forbearance. First I was concerned about their jobs. They both told me the same, nothing has changed. They just take advantage of the program. In other words, they just save that money which they expect to be added to the loan at the end. Both still work at the same place, they just have now a lot more savings.

I haven’t looked into it yet. I don’t know the impact to my credit score and ability to get other loans or refinance once you are in forbearance. I don’t really need to do this but agree with new age that many of those people just take advantage of this option even though they don’t face a hardship.

Crap, now that I have agreed with a non perma depression bear again, “realist†will tell us new age and M are the same person. 🤣

For those of you interested in the Prop 15 topic here in Cal.

A bit in depth, but you may enjoy.

https://www.youtube.com/watch?v=jqIKxBmC0R8&feature=youtu.be

Too many posts are wrapped up in irrelevant details and trying to predict the

unpredictable. No matter how many delinquencies there are or what the bank’s

forbearance terms are, etc. they are not yet producing a wave of distressed sales.

Nor does any pundit have any real evidence that they ever will. It’s all speculation

at this point. Back in March I was reading how Vulture Funds were amassing big bucks

waiting to swoop into the hard hit retail sector. So far, I haven’t seen that happen. Most

are still sitting on funds. And given that at least one vaccine has applied for FDA

emergency use it appears that the economy might be opening up early next year.

Again speculation, but there’s growing evidence to support it. Anyone making long term

predictions is just full of BS. Cautious short term predictions based on some evidence, sure.

Can you call a downturn based on one indicator, delinquency rate, over a mere several months.

No, you can’t.

PS – If this is a “condescending tone†by all means find yourself a “safe space†and curl up. I’ll supply the binky.

Certainly “not yet” because people still don’t have to pay their mortgages. But *when* they do have to resume, if they don’t have a job (employment is the big “what if” in 2021), there will be sales. Who knows if it’ll be enough to affect prices downward.

You’re right about speculation. That’s all we do here. Speculate. Anybody’s guess is as good as another’s. But things are clearly not peachy right now in America so I’ll keep sitting on the money and saving even more (thanks, Texas) while I wait and watch before buying in SoCal.

At some point Uncle Sam stops “saving” everyone with his fake money. He never completely solves the problem and this one is a doozy especially in SoCal thanks to Newsom’s big shutdown with 16% still claiming unemployment benefits in CA.

Turtle

Homeowner, free and clear

2021 Housing Collapse 20-40%, “January Is Going To Be A Mess” – A Tsunami Of Evictions Expected Across US

https://www.zerohedge.com/personal-finance/january-going-be-mess-tsunami-evictions-expected-across-us

That weather isn’t looking so good anymore, always got skid row though. Enjoy:)

Its amazing how manipulated the stock market is right now by the FED and banks, but no one seems to care as long as their 401K is safe. These are the same people who claim to be conservative.

It is best for people to have their retirement in 401K equities, housing or gold if inflation blows up. Equities and houses tend to track inflation..

Hold cash to buy a primary house or to wait for a 20% crash in equities. Be prepared to move out of cash if the enormous Trump deficit spending or the Fed inflow of cash during the Trump “Greatest economy ever” blows up into massive hyperinflation.

Take the hint.

IMHO, if we have the greatest economy ever, there should never be massive deficit spending like we are seeing. I am voting accordingly. Republicans used to criticize Obama as he deficit spent to get us out of the Great Recession. Not a peep from them as Trump doubled the deficit spending during his “Greatest Economy Ever”. So Disappointing.

Bob, I said it before and I will say it again – Trump is not a fiscal conservative. Many of the GOP senators are fiscal conservatives, but many are not. That is why, Trump and Pelosi can not get anything passed through the senate – there is too much resistance.

A Biden White House and somehow the Republicans holding the Senate majority would be best case scenario for this absurd deficit spending to end. Most of the Senate Republicans will magically become concerned about national debt again and won’t give Biden any extra ammunition to help stimulate economy.

Sickened by the fact that we live in a nation now that when equities start stalling out, calls come from all over the place for the government to print more money to help give a boost. Over the next 5 years our country is going to become dependent on these boosts unless we cut off this ridiculousness immediately.

Liberals and Conservatives invest in stocks and bonds in 401Ks because that (plus money market) is what is offered in most 401Ks. In other investment accounts, Economic Conservatives invest in Bitcoin, and Social Conservatives invest in gold. Both are an obvious reaction to the Fed. What’s in your wallet?

“Both are an obvious reaction to the Fed. What’s in your wallet?”

Good point. Not in wallet but in the garage: Vintage cars. Kind of risky like everything else, but at least I can drive them once in a while, much more fun than gold or bitcoin.

Downside is the storing cost and of course being physical items instead of just bits somewhere. Not really profit, just maintaining investment is the goal here.

For profit you’d need to predict future classic, buy one now cheap and store/keep it 20 years and then you’ll know if you were right. I’ve accidentally one of those and then others which aren’t. Kept price along the inflation, so not really loss of investment either.

But all of them are fun to drive, I can live with that.

You have to be at least a bit car nut (or, as they say, “collector”) to go this way, but I believe you’ve already guessed that.

Vintage cars are primarily a nostalgia play. Some cars are referred to by the public as “Classic”, but there is an association that has a defined list of classic cars. (this is different than antique cars, which are much older). The Classic Car Club of America has this list:

https://www.classiccarclub.org/approved-classics

I know a guy who worked for the guy who drives around town in a mid-30s Auburn. I also knew a guy who had the last year of the classic Lincoln Continental which had been stored in a farmer’s barn. I don’t know what his widow did with it. If you have anything on this list, you’re doing pretty well.

“What’s in your walketâ€

Cardano, Litecoin, ethereum, bitcoin. All on hardware wallets.

To buy you can use Robinhood, coinbase or Binance. Now PayPal is offering it as well.

It’s going to be massive!

Sometimes I wish Ron Paul had won. Not that Congress would’ve changed their spending habits. I remember Trump saying before 2016 that interest rates should go up. He’s become a bit of a politician now, hasn’t he? We’re living in a “fantasy” and have been for some time. It’ll come back to get us someday. But for now, extend and pretend! Big time.

How is it manipulated? Price goes up because demand exceeds supply. More people are buying stocks than selling stocks. Why? They believe in the strength of the US! Some companies book record earnings this year. Tech, life science industry, online stores are doing phenomenal. Get on the train and Buy stocks and crypto.

More people buying stocks than selling them? Thats downright hilarious.

Actually, that’s how markets work. Supply and demand.

Why stocks go up

Why housing goes up

Why bitcoin goes up

M, Retail trade volumes are higher than last year but size of trades are smaller. Most likely the result of the Robinhood day traders and free Fed money. Looking at just supply and demand is short-sighted. Looking at factors causing supply and demand can help to prevent long-term losses.

Now we are getting somewhere

Free fed money is right! With all that money printing you will get some inflation.

Factors of demand? How many times have we posted this now?

Historic low rates, money printing like there is no tomorrow, chronic housing shortage in places like SoCal. Btw, some companies are showing record years in revenue (biotech).

M, You meant to say there are more bidders than sellers. Not “more buyers than sellers”. One buyer and one seller in a transaction. That was the hilarious part FYI. You would know that if you bought a house in Q1.

Huh?! Bidders?

Muahahabahahaha

You clearly have never ever bought a brand new house!

With new houses there aren’t bidding wars. The price per phase may go up though.

You are on a waiting list and you put a deposit down. The sales rep callS and goes down the list when the phase is released. My luck was that during covid we didn’t have 100s of people on the waiting list…..this changed quickly though and each phase saw price increases. Instant equity for us!

We were originally talking about stocks. The price goes up when more people buy than sell. Obviously I am simplifying for you here.

I am talking to a guy who thinks that traffic on the street means people are looking for a job (your words). So, you got to dumb it down for your discussion partner. I am going super low here on this blog so the avg perma depression bear can follow.

Lol f.ing lol (more traffic=more job searchers) that’s the best one this year!

So, the FED and banks manipulate the market (which is true) and then you blame it on conservatives. There is nothing conservative in what the FED and the banks are doing.

All conservatives (100% of them) are against the FED because it undermines the free markers and you can not have capitalism without free markets. Conservatives are for free markets and against socialism. Socialists want to pick the winners and losers. The banks are all for Biden and Democrats winning the elections and they contribute far more to the democrats than they do to GOP. They stand to benefit the most from the stimulus – the bigger the stimulus, the more they stand to benefit.

Conservatives are against government debt and deficits. Trump is not a conservative and he never was. All his life he was a card carrying Democrat. He is not fiscal conservative and he is not a fiscal conservative. Is he better the Biden? Yes, but only by comparison, because the DNC always nominates bad candidates.

You can be a republican, without being a conservative. For example, McCain (dead now), Bush, Romney and Trump are republicans but not conservatives. Trump is better than the others because he is less of a globalist than the others. He is surrounded by many globalists, but he is not a big promoter of globalism like the others. Biden is a globalist through and through. That is why Bush endorses Biden – they are two peas in the same pod. All big banks and the FED support globalism and the NEW World Order. All conservatives are against NWO. Biden supports it.

It is a good idea to understand these groups and what they want. Otherwise, you create confusion.

M: “Sol, still not giving you my address.”

But M, you invited me to your house.

On May 10, you posted:

M: “Now, as a homeowner I will get my own pool and as a good neighbor I will invite nice neighbors to party with me.

I would even invite son of a landlord.”

You were willing to give me your full address, but you won’t even tell me the name of your community?

Source: http://www.doctorhousingbubble.com/housing-market-has-come-to-a-crashing-stop-1-3-of-tenants-not-paying-rents-great-park-in-irvine-drops-to-almost-no-sales-and-socal-housing-collapses-to-6-year-lows/

M wakes up daily from nightmares about SOL lol

🤣 sure josh! Because a random guy on the internet thinks that I didn’t buy a house. Big deal

🤣

Of course I invite you to me house!

But you may wait a loooong time until I give you my address 🤣

But I told you where I live. I posted it several times over the years.

I live in Santa Monica. On Ocean Blvd. Between Wilshire and San Vicente.

Now, you might say I’m lying. But you know the place exists.

SoCalGuy says he’s familiar with the area you mentioned, and there are NO “new construction house developments” in that area.

Is that why you can’t name this new community you live in? Because it doesn’t exist?

🤣 🤣

“But I told you where I liveâ€

As if I give a flying crap where you live 🤣

“SoCalguy said there are no developments in your areaâ€

hahahahahaha hahahahahaha

That is the funniest comment since a long time.

I just lost the last bit of respect for this guy. You can’t take this seriously anymore.

Sol: Tell me where you live. I told you where I live

M: 🤣

Sol: you don’t live in your own house, your Development doesn’t exist. Because, because, because another guy on the internet said so.

M: 🤣 I can think of at least 4 builders that have built new developments recently. 3 out of 4 have multiple developments. Maybe you should learn how to google things? Do you really have to show everyone how silly you are?

Not my actual words, M.

I always quote you verbatim, and provide the date and link for the quote.

I provide logical arguments for my claims, using your exact words as evidence. You respond with fictitious conversations and happy face memes (indicating you have no logical counter-arguments).

I live in the San Diego area as well, since 2001 actually. So Cal is absolutely right, there are ZERO new developments where M says he bought. NONE. He is completely full of crap.

It was the funniest comment and I thank you for it!

“There are zero new developments. None�

Who in their right mind takes guys like this seriously?

That’s like saying San Diego county has no gas stations. None. And no beach access. None. 🤣

Not only do we have several new developments in every single city. No, you can google this within a few mouse clicks. Go to any large home builders website and put in a SoCal zip code. It will show you and it will show you nearby developments.

This is the same guy who told us about the upcoming RE crash. Instead we have an expected market time of 35 days in SoCal. 🤣 for those who don’t know what that means: it’s a sizzling hot sellers market!

M: This is the same guy who told us about the upcoming RE crash.

Actually, that would be you.

You are the guy who talked endlessly, more than anyone else, about the coming RE crash.

You were king, president, and grand poh-bah of perma depression bears.

You were still posting as a perma depression bear on January 31 — though you now claim that you knew about a coming inheritance a year earlier, and so your “sudden” (alleged) home purchase in February wasn’t really all that sudden, because you were planning for it, though you were still posting as a perma depression bear. Or something like that.

Hard to untangle your conflicting timelines and rationales.

Huh? Sudden?! Of course it wasn’t sudden. I toured open houses for years, talked to probably 30realtors over the years (not even exaggerating) and familiarized myself with good locations/schools/traffic/potential for years. Nothing about my purchase was sudden. I had so much cash that I couldnt justify not pulling the trigger.

You expect me to post the minute someone’s will is released (that benefits me) and you expect me to post my address online. Sry bud. Not gonna happen. The only two things I can tell you is that bitcoin will most likely hit 150k per coin and that I buy a rental when the market dips.

Cheers!

M: You expect me to post the minute someone’s will is released

Lying again.

I specifically said, several times, I do NOT expect you to post that you were expecting an inheritance in early 2019.

I DO expect your opinions about buying to change upon learning of the inheritance (early 2019), rather than upon receiving the inheritance (early 2020).

M: and you expect me to post my address online.

Lying again.

I several times posted that I do NOT want your address. Merely the name of this new development community.

Sry SOL,

Still not sending you my address. Also, I would never send out Infos about a potential inheritance. I will however let you know when I buy a rental.

Right now it’s tough…..the market is very hot. Despite the perma depression bears telling us the market will crash this year.

M: Sry SOL, Still not sending you my address.

Lying again. I did NOT ask for your address.

M: Also, I would never send out Infos about a potential inheritance.

Is that why you talk incessantly about your inheritance?

Thanks. But I still don’t send you my address.

Goldman Sachs has moved it’s total position to 85% cash assets. Central banks are net sellers of gold for the first time in a decade. Hmmm, I wonder if they know something?

On the other hand we have M who pretended to buy a house in a make believe subdivision in San Diego, telling us that housing goes up forever. I just don’t know who to believe… Lol

Josh, Why would you think it’s a make up subdivision? It’s called north county San Diego.

What you state is absolutely right. Long term, housing only goes up. Dips on the way are rare and impossible to time. Buy when you are ready and you will be fine long term.

Everyone who has invested in real estate will tell you the same. Just stay off zerohedge, wolf street and others who sell bad news.

@dan (lender knows OC) @other lenders here

Can you share how Forbearance works? Can people pretty easily claim hardship and go on forbearance even though they didn’t lose their jobs?

I know two people that told me they did exactly that….I assume they are not lying to me.

What are the disadvantages of going on forbearance if the word money will be added to the end of the loan?

When I bought early this year I was told the market will crash, I will lose a ton of money and I bought the peak. Fast forward to Q4 and we see this:

Existing-Home Sales On Fire

6,540,000 Home Sales Print

Point of this is don’t listen to the forbearance bubble boys. Unless you like to miss out.

Extend and pretend, bro. The goings up you (and myself) are experiencing right now are artificial like everything in this joke of a “free” market these days. You probably will start losing value after forbearance ends if so many are still unemployed in CA next year. Look at the insane percentage still taking benefits in CA, not the fake rate (which is still pretty horrible).

I don’t know who expected prices to drop instantly, but not me. This is real estate! Prices are slow and sticky like molasses. We’re all just guessing. In any case, your payments are good and you’re living in it long-term, hopefully. I may end up selling one more business and buying high if all else fails. Nothing like a good windfall! But 2021 will be a year of watching and saving for me.

PS. Forbearance can be claimed through Dec 31 now. It was going to end this month. I guess there’s still a huge problem if they had to go and do that! But three months isn’t much difference. It’ll be interesting to see what happens when people have to start paying again mid-2021 but also curious about January to see if the folks who need forbearance but can’t get it will start selling to escape with their equity and survive in something cheaper.

“In 2018, 42.8% of all persons between age 16 and 24 were not enrolled in school”

I am shocked, shocked I tell you, at DHB’s headline!

https://www.youtube.com/watch?v=h56S5BA7AyI

Latest video from Ken McElroy on explaining the coming housing crash and why/how/what will happen. Really insightful.

Jonathan Lansner’s Orange Co Register column states that this summer quarter was topped for increases in price and sales numbers by only 8 quarter since 1988. As his last reason for this boom, he states the obvious, that “cheap money matters”.

@butch,

Sry bud to butcher your narrative that sales rep lie and therefore new home sales aren’t on fire.

https://www.inman.com/2020/10/26/new-residential-home-sales-increase-32/amp/

New home sales are up 32% YoY! Holy guacamole!

So glad I bought a new home in Q1….

M, The link is dead and new home sales are dying. See link below from Realist. Thank you for at least trying to support your claim with data but you failed, maybe on purpose.

Mhm wonder what happened with the link. I mean all you need to do is google “new homes sales are up 32%â€

Here is another one for you:

https://www.msn.com/en-us/money/realestate/new-home-sales-dip-in-september-but-are-way-up-in-the-pandemic/ar-BB1apske

Do you think this is made up? Still haven’t visited a new development haven’t you?

Every Bubble in the History of mankind eventually pops, this is NO Different, ACCEPT THAT CA WILL GET CRUSHED!!!! So enjoy that weather, a shit storm is coming.

New Home Sales Tumble In September As Average Price Hits Record High

https://www.zerohedge.com/markets/new-home-sales-tumble-september?fbclid=IwAR2CIr26zNtEZF-RB0q6pw8W6bzw1SpCppY-BIH5PPtDUC4ac9zCx0TLdwU

Reston, VA Housing Prices Crater 25% YOY As Crime And Foreclosures Envelop Fairfax County And Northern Virginia

https://www.movoto.com/reston-va/market-trends/

As one Fairfax County broker explained, “We have thousands of excess, empty and defaulted houses for sale…. just sitting and rotting.â€

On the other hand, home sales up 32% YOY

https://www.housingwire.com/articles/holy-smokes-new-home-sales-are-up-32-1-year-over-year/

Today new home sales are up 32.1% year over year and are up 16.9% year to date. Details from the Census Bureau/HUD report released today:

Sales of new single-family houses in September 2020 were at a seasonally adjusted annual rate of 959,000. This is 3.5% below the revised August rate of 994,000, but is 32.1% above the September 2019 estimate of 726,000.

The median sales price of new houses sold in September 2020 was $326,800. The average sales price was $405,400.

The seasonally adjusted estimate of new houses for sale at the end of September was 284,000. This represents a supply of 3.6 months at the current sales rate.

Yep! New home sales are up 32%.

😊😄ðŸ‘â¤ï¸

Here’s Sept data for CA:

https://www.car.org/en/aboutus/mediacenter/newsreleases/2020releases/sep2020sales

Thanks for sharing the article.the market is very hot.

Glad I bought in Q1

So would you care to explain this and if it will ever change and when?

https://www.housingwire.com/articles/no-seasonal-slowdown-this-year-as-real-estate-agents-report-a-busier-than-usual-fall/

No housing market slowdown as real estate agents report a busy fall

Realturds = LIARS

Hi Psalm

It is easily explained.

Demographics – US has a huge lump of 24-32 year olds moving through the demographics of this country. Many are well paid IT, and many lived in mums basement saving up money.

Low Interest – have you seen the insanely low interest rates?

Low inventory – boomers ARE STILL NOT SELLING THEIR HOMES, even though the bears for over a decade have said that when boomers retire they will sell off their homes and downsize NOT TRUE. Boomers are letting their children move in, their grandchildren move in, renting out their homes, renting out rooms, etc.

Other reasons – potential buyers are doing their homework online during covid. meaning potential buyers are highly educated from internet research on the neighborhoods they want to live in. SO, when a properly priced house comes on the market they move quick to buy it. no bulshitting around. Many buyers are waiving contingencies – thats how hot this market is.

Of course, it should all come to a stand still in 2021

Extend and pretend. Forbearance is in full force. It’s keeping the market tight. Wait ’til it ends and see what happens if employment is still perilous at that time.

M: do I look like I care what you believe?

For someone who claims not to care whether strangers on the internet believe that you bought house, you sure expend a great of energy reminding strangers on the internet that you bought a house.

I am an example and people have short memory!

I used to be a bear trying to time the market. It doesn’t work. When you at ein the position to buy do it. Especially in places like SoCal. Long term renting is financial suicide. I do like to brag a bit about buying during covid. Just because so many bears cheered and called the top 😉

Exactly… doesn’t care what “random internet people” think but spends a lot of time trying to convince other people his opinion is correct. Oh, and did you hear he bought Q1? Maybe we can get a autograph.

When/if the market turns, he’ll post that he decided to sell everything before the downturn and invest in gold. Buffet is having lunch with him next week looking for some tips.

there is our dinosaur!