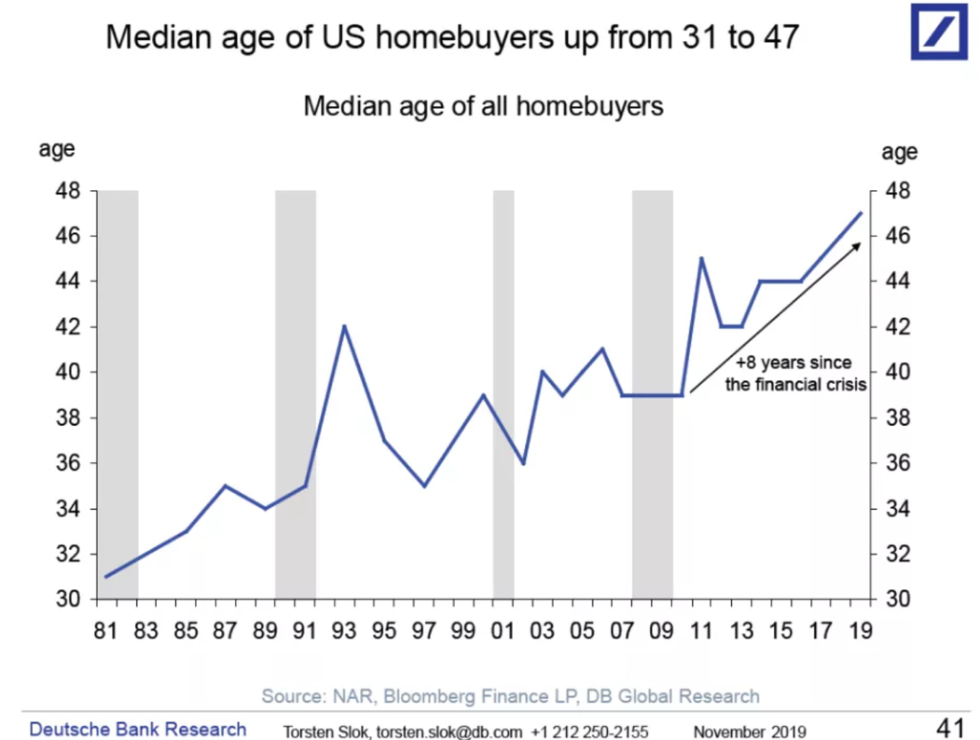

The Home Less Millennials: In 1981 the Median age of a Home Buyer was 31 and Today it is 47

Pre-Covid our cohort of Millennials in California were already living at home in dramatically large numbers. The total was 2.3 million Millennial adults were living at home with mom and dad because they were unable to afford high rents, let alone purchase an overpriced crap shack built during World War II with popcorn ceilings and horrid looking carpet. Flippers think that a little bit of lipstick on the pig is enough to charge $1 million for a piece of junk. It should come as no surprise that Millennials are struggling even more during the pandemic. The bulk of job losses have come from industries where young people dominate. So it is no surprise that the median age of a home buyer went from 31 in 1981 to a whopping 47 today. All of a sudden many of the new buyers are looking like the Taco Tuesday baby boomers that rail against Millennials for not affording a home when they went to college during a time when college was affordable enough to pay with a paper route. Of course many of these older Americans couldn’t program their way out of a paper bag yet rant on social media platforms built by Millennials.

The older home buyers of America

This chart is incredibly telling of the story of home buying in America:

We are basically sacrificing the young at the expense of older Americans. How so? Just look at the average age of our politicians. Many of them can barely get around technology without their younger handlers in the background posting for them and they are increasing the country debt load to a point where this will saddle our kids and younger Americans for a generation to come. But if it isn’t obvious in 2020, many Americans are entitled “Karens†ready to flip out at Old Navy because they are being inconvenienced when our parents and grand parents fought in World Wars where they risked their lives (many did not want to go but did and many never came back). They are probably spinning in their graves watching what is unfolding.

You see this sense of entitlement with housing as well. Tax policy has favored those that got in early at the expense of younger generations. Yet that is changing. In places like California, you already see strides being taken to roll back Prop 13. Why in the world should there be government welfare for homeowners and not renters? This is like giving someone a tax break to buy Google stock over Apple stock. It is a simple preference. Yet this is changing and Millennials understand and see how the game is rigged.

The chart above is incredibly telling showing that the median age of a homebuyer went from 31 in 1981 to 47 today. That is nuts. Normally, home buying was tied to a time of settling down and starting a family. 47 is on the old side to start a family. But given the current structure of the market we are favoring a rentier corporate welfare culture that penalizes work at the expense of gathered and accumulated wealth. Case and point? There are plenty of jobs open in essential jobs that put you at the front lines of the virus. Yet look at the pay. However, we have Wall Street traders and other speculators bidding up Kodak or Hertz, with blatant front running and manipulation and these are the companies we favor with tax breaks? It really reflects the deep issues in our system of financial welfare and somehow beating down the working class and making them feel guilty for not working hard enough.

The massive increase in age for buying a home is also stalling out other industries that rely on this growth. Think of towns that build out retail centers – do we really need those anymore? Many people are now getting comfortable working from home, shopping online, and ordering food to be delivered. Commercial real estate is getting smashed right now. You see the insane debacle of WeWork – not exactly a good company for the current time.

So commercial real estate is getting smashed because there is less demand. So what happens? Prices and rents come down! Incomes are smashed for younger Americans yet somehow people think real estate is going to stay inflated in price? The inflation in real estate right now is tied to all of the tax breaks and welfare we create around it – interest deduction, insurance breaks, and essentially low mortgage rates thanks to Papa Fed. All of this is artificial however. It must hurt with the level of cognitive dissonance some have when they talk about “communism†and “socialism†yet are totally fine with socialism to the next level on home buying.

So we are seeing mega crony capitalism today. The older age in home buyers is a reflection of throwing younger Americans under the bus. A bill is coming due and the massive strife in our system shows that older Americans are nothing like the Silent Generation. We truly are living the Taco Tuesday baby boomer wave of Karens and Kens and maybe in a few years, the median age of buying a home will be well into the 50s.

Millennials are slated to be the next big wave of home buyers in the system yet that is not materializing. The economy just saw its worst quarterly contraction ever. Yet somehow home values are going to stay disconnected from market fundamentals. Well if bankrupt companies can increase by triple digits purely on speculation, why can’t housing stay inflated a bit longer?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

269 Responses to “The Home Less Millennials: In 1981 the Median age of a Home Buyer was 31 and Today it is 47”

Doc, I agree with your assessment, except the support for removing Prop 13. That is the essence of communism – bring down everyone to the same EQUAL level of misery.

A more intelligent and beneficial approach would be to charge the new people who buy homes the same low taxes they charge those people who bought 50 years ago. Now, that would help the young people to keep more of what they work for. Every city has a Board of Equalization who can help assess similar properties at the same value. For the same value, charge the same property tax. Even better, cap all property taxes at a certain amount – i.e. $1,500/year. In many first world countries, that would be the top of the scale. If the government would become more frugal, that would be plenty to meed the need for which the government exist. You can not say the Switzerland does not have good schools, good firefighter departments, good police departments, etc. all with very low property taxes. If they can do it, CA can do it, too. Now, I understand that CA will no longer be able to support sanctuary cities, open borders for millions coming from Central and South America.

If the young people will be smart, they will fight against policies which enslave them with high taxes to support the politicians agendas and fight at the same time for low taxes. The cost of living and prices will also be more affordable for rents (to save money for downpayment), RE prices (to buy) and property taxes (to be able to keep what you buy) – less people means less demand.

Property taxes are not based on income; they are Wealth Taxes. The “elites” these days talk louder and louder about “wealth taxes” for billionaires. That is how they made palatable income taxes for the top 1% in 1913 when FED and IRS were created. They start with the richest and then they extend that to all; at the same time they create loopholes for the richest. Property taxes are a slow form of nationalization. The faster you increase them, the faster you confiscate the wealth of what people worked for and already paid taxes on.

Instead of bringing other people down, why not creating the conditions that all should have opportunities?!?…

A history lesson from the person who thought Democrats were in control of congress when George W. Bush invaded Iraq in 2003? I think you should go study history more and stop making it up. The USA government has been paying out benefits to veterans and others since the founding of the nation. Your weird fantasy that all government benefits are communism and should be cut off has never existed in this nation and never will.

I agree. It’s hard to remember what it was like in California. We left and never look back.

All of this doesn’t even mention that property tax shouldn’t even exist!! You have to have property rights: buy a house, pay it off and it’s all yours. If you don’t pay prop. taxes, it can be taken away from you.

Please don’t tell me property taxes help schools and roads. No amount of money will fix common core and in California, no amount of money in the state ever fixes the 5 or any road. Potholes everywhere….

Housing stays inflated as long as Uncle Sugar underwrites ” conforming ” loans . Last I checked, these loans require a fog-the-mirror FICO, a job/income and a paltry 3% down. Jumbo loans ( non-conforming ) are getting much harder to get. Not a good time to be selling the old McMansion.

Apple had a blowout quarter. Stock is at an ATH.

Similar with the tech company I work for. Q3 is going to be strong. The order book is filled.

As far as housing goes, the doctor says:

“ Yet somehow home values are going to stay disconnected from market fundamentals. Well if bankrupt companies can increase by triple digits purely on speculation, why can’t housing stay inflated a bit longer? â€

The market fundamentals are available inventory, interest rates and demand.

Millennials are the biggest group buying homes today.

Inventory in 08 was 115k available homes in SoCal. 40k in 2019 and 30k today.

We have no inventory….

Interest rates are at 3% ish for 30years conventional loans.

Low wage earners losing their job due to Covid has nothing to do with home buying.

Those people were renters before the crisis and they will be renters after the crisis.

If you are a renter trying to get your downpayment together, consider dollar cost averaging into bitcoin and other crypto’s. The next bull run is coming. Mark my words.

I agree, the fundamentals have changed with respect to the last housing collapse. The banks worked to make sure housing was in, as they put it, “strong hands” and the Fed is buying up the MBS’s. If the Fed can’t stand it, no one can. Is the market being manipulated? Of course, because if it wasn’t we’d already be in a recession. As long as rates stay low along with inventory I believe prices will remain high till the citrus is under control and then it will go higher when the economy swings back full force in a year or so, give or take…

“we’d already be in a recession”

That ship has sailed. We entered recessionary territory about three months ago.

Very good article by Logan Motashami. It makes sense that the housing market remains strong!

https://grow.acorns.com/why-housing-prices-are-rising-during-coronavirus/?__source=sharebar%7Cfacebook&par=sharebar

The problem is NOT Prop 13. The notion that renters don’t benefit from Prop 13 ‘welfare’ is, for a lack of a better word, stupid. Renters complain now about high rents, let’s see their reaction when their rents are through the roof if P13 was eliminated.

EVERYONE benefits from P13. Owners, renters, residential, commercial. Everyone. Well except for those who want to move from renter to owner. If this wasn’t simply a case of projecting by those who don’t have what they want and when they want it, I might give a hoot.

I purchased in 2011 after the market had fallen 40%. NEVER once in the preceding

10 years did I feel like a victim to a rigged system. On the contrary, I saved saved saved, knowing at some point I would purchase…somewhere. Lucky for me, the crash happened and I was able to buy in the same neighborhood that I was renting in when prices bottomed.

On second thought, maybe I’m wrong. Let’s take away the certainty Prop 13 provides and give the current crop of homeseekers what they want…lol

Prop 13 is just “rent control” for homeowners, which we all know doesn’t work well.

And the homes were not built during WWII. They were built after the war. There were severe restrictions on using materials for anything but the immediate war effort.

OC Native,

I’m inspired by your “save, save, save” message. How long did you save? Did you invest your money in the stock market while continuing to save or did your money sit in a bank account?

What advice do you have for others who are preparing for the real estate crash that will most likely occur next year, 2021?

Thank you

If Prop 13 was eliminated, housing prices would drop overnight. Market would be flooded with baby boomers selling their homes. It does not protect renters lol. You act like landlords charge less because their costs are less. Ridiculous. They charge what they can get and what the rental market will afford them.

That’s not true. Property prices would not drop over night.

Rents would go higher as landlords would pass on the higher taxes to renters.

Sadly, giving the government more money is a waste…..governments work in an inefficient Way in most cases

M: Property prices would not drop over night.

Not only did you say that, if Prop 13 were eliminated, property prices would drop.

You claimed that eliminating Prop 13 would lower property taxes for recent homeowners, due to an averaging of property taxes between recent and longtime homeowners.

An (alleged) inheritance does not change one’s opinions on a dozen unrelated matters, especially not overnight. Only trolls flip all opinions overnight.

Yeah, I remember (maybe 1-2years ago).

I was wrong. Prop13 needs to stay. Voting for more taxes doesn’t help anyone.

Prop13 will increase rents. Who cares what i sad as a “bearâ€.

I don’t. What’s important is to keep prop13. A huge benefits for homeowners and renters!

M is right. The landlord always passes his increases on to the renter. That is how it works.

M: Yeah, I remember (maybe 1-2years ago).

Not “maybe” 1-2 years ago. THIS YEAR you were still attacking Prop 13.

On January 31 you wrote: “there is an incredible amount of inventory on the market and much, much more to come. Just obvious that sales and prices fall accordingly.

Most houses sit for 6-8month and end up not selling. The market hit the breaks and came to a full stop.

Boomers need to start paying their fair share. They barely pay any property taxes.”

Here’s the thread: http://www.doctorhousingbubble.com/the-cure-to-the-housing-shortage-may-be-retirement-homes-the-coming-tsunami-of-homes-over-the-next-decade-may-come-from-an-unlikely-source/

Huh! Interesting! Seemed longer ago. Yeah, forget what I said back then. Prop13 is the best thing since sliced bread! I understand this now – being a homeowner!

M, you said that if you ever bought a home, you’d want Prop 13 repealed, because that would lower your property taxes.

Your said that repealing Prop 13 would level property taxes — raising it for longtime homeowners, but lowering it for recent homeowners.

If you sincerely believed what you said, then your (alleged) home purchase would have spurred you to even more emphatically demand an end to Prop 13.

🤣

Anything millennial said forget about it.

I changed my mind. Listen to M

So according to M there is a relation between tax and rent? That’s a weird thought. What a renter can afford is completely independent of tax. Owners are going to max out their profit in any circumstance, and although the net profit goes down with tax, the optimal rent (optimal in terms of height * good occupancy rate) is again independent of tax.

Correct. Higher Property taxes hurt us all and doesn’t help anyone.

A landlord Passes higher property taxes on to the renter.

A homeowner has less disposable cash when taxes increase.

Some renters might love paying higher rent, those renters should vote for higher taxes.

A retired friend purchased his house in the 1970’s and rents it out now. His current property taxes for a 700K house is about $2400/year or $200/month. He charges $4K/month in rent.

His neighbor with a near identical floorplan purchased his house a few years ago and his property taxes are $600/month. They both charge 4K/month rent.

Why would rents go up if my friend had to pay $600/month in property taxes?

Unrelated to your fair point, who is the idiot paying $4K rent for $700K house? That’s not the parity I am seeing in the market. Rent should be below $3K for 700K house. No in CA? Very high HOA?

I love how you know everyone’s life story Bob. You are full of crap and just making things up. If you don’t think rents will go up when taxes go up, you are a fool.

Yes, I have a lot of older friends who are doing very well thanks to Prop 13. I feel sorry for Millennials like M.

My point is that the rent charged will always be at market rates. The long-time Prop 13 owners charge market rates no matter if they have super-low taxes or have a fully paid-off house.

Some may give a better rate to a long-time renter if they take care of the rental and fix little things without constantly bothering the landlord.

If a lower tax rate was applied to the true assessed value of the house, then my friend would pay more and the neighbor would pay less. The rents could fall in this case. The total collected property taxes would be the same. It would be fair.

The tax rate or assessed value increases should be limited to inflation increases. Grandma will be OK because her Social Security check is also increasing at this rate.

You feel sorry because millennials like me who buy homes have to pay higher property taxes?

Don’t tell sorry. At least the property taxes remain stable. Also, property taxes might Seem high now but get inflated away over time. In 20years it will seem very cheap 🙂

The best time to buy a single family house was yesterday. The second best time is today. You can’t go wrong long term.

Yes I have many older friends and co-workers who have retired and are either early Boomers or late Silent Generation.

They have a great gig. They bought rentals in the late 70’s/early 80’s that are now worth millions. Paid them off with rental income so have no house payments, are locked in with Prop 13 with $100-$200/month property taxes They have no expenses other than insurance and maintenance and charge $3K-$4K per month market rate rents to Millennials. And they since it is a business, they can deduct all of the property taxes and expenses on their Federal taxes (Unlike homeowners).

M is right! Buy a rental now and you can be like them in 30 years!

“My point is that the rent charged will always be at market rates. ”

Bob,

You are incorrect for most multi-family units now that there is statewide rent control.

Getting rid of prop 13 will crush most mom and pop landlords, if you wanted it to be fair , they should get rid of both prop 13 and statewide rent control, or leave both in place.

Ha!

CA has a feeble attempt at rent control.

Prop 13 increases are capped at 2% per year.

CA rent control is capped at:

The law limits rent increases to 5% each year plus inflation.

Today, at 2-3% inflation the rental increase cap is around 8%.

So the landlord sees a 2% increase in property taxes while the tenant sees an 8% increase in rent?

Tell me why Prop 13 is fair?

Bob, these past few years, Santa Monica has been limiting rent control to 1% increase per year.

Local governments are empowered to enact their own rent control ordinances, and some do. Berkley is also famous for its onerous rent control laws.

I pay $1,600 a month in rent for a $1 million house thanks to prop 13. Prop 13 helps the people renting houses from long term owners. It would cost me more than double what I pay in rent to buy the house I’m renting. It doesn’t make sense for me to buy.

It sounds like your landlord is leaving a lot of money on the table.

JR,

You must be a great tenant for the landlord to give you such a good deal on rent.

This is the same argument M used before he was visited by the Ghosts of Housing Future.

It is a good argument until.

1) The current owner can’t resist cashing out on that $1M gain and retiring in style.

2) The current owner passes away into the Great California Sunset and their kids either sell or raise the rent to market rates.

Either way, it could be a sudden drastic increase in rent or an end of the lease and eviction at a time when buying a house and market rents are at an all-time high.

Enjoy it while you can and be like Old Millennial and wait for a crash. (Or wait for a sad tragic event and inherit a house and a boatload of cash from a Boomer).

Like I told Our Millennial last year.

1) Make sure you send your landlord a fruit basket every week so they stay healthy

2) Drive and schedule your landlord’s medical checkups to make sure they catch anything serious early.

Who knows, if you do these simple steps, you may keep your cheap rent for decades and as a bonus, added to your landlord’s will.

In my opinion if Nixon did not take us off the gold standard or if the FED did not meddle with devaluing our currency Prop 13 might have never happened. However, i suspect someone would have created a form of it later on depending on the circumstances. Isn’t all the housing policies a reaction to government/FED and house speculation anyways? Just seems if all things remain equal all these housing/finance policies are reactions/complaints by the housing industry not being fair for everyone. There is never a silver lining in all of this as there will never be a perfect system as long as people meddle with it.

First off, “Karens” is a deliberately offensive term. It is a slur on an entire group that is racial, sexual and generational. Shame on you Dr HB.

Second, Fannie Mae and Freddie Mac weren’t my idea. The biggest supporters in Congress of these programs were Democrats. Republicans can be swayed by industry lobbyists, and the RE industry foolishly believes that cheap money for purchasing houses is a long term benefit. The popping of the first housing bubble was proof that this idea is full of holes. But here we are doubling down on it. I do not know if this time, we will get another temporary deflation, or massive stagflation. I’d hedge my bets on this.

Karen and Ken is most appropriate. Shame on you.

Ken goes with Barbie.

Double shame on you.

Not just “millennials:… but if you’re creeping up to age 50, you’d be considered “Gen X”. Many of us are established with good careers and cannot get a leg-up:

2003 – great job lost to market crash.Could not find work for a couple years. Hustled odd jobs. Went into debt.

2008 – finally saving again, with great job? Market crash. Couldn’t find work for over three years, had to start new career, got in a Union

2017 – landlord decides to flip rental we lived in for ten years. Sixty days to vacate, couldn’t find a place to live, (Lots of airbnbs though!). Landed in a friend’s 400sf apt. Been saving for a house.

2020 – find a great non-profit to help us buy our first home. Took years to dial in debt, (freelance) bank paperwork, finances. Credit report at 830. We were at the underwriter and COVID hit Lost jobs (AGAIN!), lender pulled the plug.

And so here we are… now we might have to spend the money we saved for a house on LIFE. If that’s the case, we are LUCKY to have savings. But again, we are not buying a house and how trying to get a bigger rental to sit out a pandemic in. But – we don’t have jobs and people don’t want to rent to us despite our stellar credit and enough money to live off of for another couple years, (we don’t spend on stupid crap because ‘starving’ has become “old hat” at this time). Here we go again…

Not complaining. Just telling our story as we get crunched through the cookie monster housing market of LA. We are the “lucky” ones.

RNTA: That sucks. I can sort of commiserate with you. My wife and I bought a condo in 2009. In 2013, we needed a bigger place because of a kid (rented out the condo, and we rented ourselves). We were too stupid to buy at the time because we were too picky and the baby was a lot of work. We never bought a place for ourselves because prices kept rising (there’ll be another recession any time we kept thinking). So here we are, still renting 7 years after what was supposed to be a very temporary rental in 2013.

Wife just lost her job due to lack of workflow, so here we go again renting until we see that perfect combination of slightly lower house prices and being gainfully employed. The really crappy thing now is that one of us almost has to not work because of child care (no physical schooling for the foreseeable future). It’s going to be rough.

Like you, I’m not complaining so much as sharing our circumstance and our mistakes. Thankfully we have plenty of cash on hand to live many years in a worst-case scenario, but it’s not how we envisioned our future. Oh well, live (hopefully!) and learn.

Good luck to you both this time around.

“The really crappy thing now is that one of us almost has to not work because of child care (no physical schooling for the foreseeable future). It’s going to be rough.”

I imagine this to be a common issue in HCOL places like SoCal. How much of an effect will it have on the demand for homes? “Low inventory” only exists in relation to the demand. Schools opening and staying open seems pretty fantastical to me.

Vaccine, we need you now…

I guess we are lucky that we didn’t get to have kids because of The Great Recession? Yeah, that’s a thing too. The kid-window closed while we were living on $100 a week. I cannot imagine having to deal with what the universe has thrown at all of us – with kids. I’m sending you guys extra power there!

But hey! At least those with jobs/money can keep living their luxurious lifestyles – while just buying up any real estate that an average middle class income can afford. I am starting to feel like being in LA – even with our dream jobs, pension, etc – is becoming too much of a bummer. The culture has changed so much that I’ve fallen out of love with the city.

I guess that we will be all-the-wiser; again. At least we aren’t screaming at grocery workers in viral videos, amIright?

All the best to you guys. From where I sit? I don’t know if we’ll ever be homeowners in the city where we work.

My personal opinion is that Los Angeles is a horrible place to even visit for a day, much less live. After my wife graduated and was looking for a job, I told her the only place I wouldn’t consider living was Los Angeles. Pollution, traffic and anger abound beyond anything I’ve experienced elsewhere.

My point is, there are greener pastures (in and out of CA). Maybe you’ll find one that suits you?

In a dozen years of reading the Dr., this is one of the best. Socialized profits for the financial class and free market shock economics for the working class.

And yes prop. 13 is a blight that only an self congratulating turd would promote as good. It gutted public education and keeps people in homes they cant afford while inflating the market.

Only stupid avarice would support something so systemically vile.

“Socialized losses” due to Government diktat? HARDLY.

New York STATE is deadly serious about “rentier classes” not just New York City and for good reason: you can always raise the rent no matter the state of any economy and indeed one must raise the rent in any particularly bad collapse such as this. I will sell my gold at the right price though!

20 billion US Buckys sounds good to me BUT I WANT CASH.

YOU WANT YOUR NON NUKE SOCIETY OUT THAT WAY NO PROBLEM.

Everything else is just like Clint Eastwood said: PAINT IT RED TOWNIE.

New York STATE is deadly serious about “rentier classes†not just New York City and for good reason: you can always raise the rent no matter the state of any economy …

No, you can’t always raise the rent in New York City, due to strict rent control and rent stabilization laws.

Santa Monica’s Rent Control Board often allows only 2% annual increases in rent, and more recently only allowed landlords a 1% annual increase in rent. Well below the rate of inflation.

And they recently extended the Covid-19 eviction moratorium by another few months, in response to Newson’s second shutdown.

Expect even more pro-tenant laws as tenants increase as a percentage of voters.

Prop 13 was designed to keep grandma and grandpa in their houses after they retired and now live on a fixed income (social security) with fixed inflation adjusted increases… but SMART investors have taken advantage of this social policy and SMART investors will do well despite the policy change. Only grandma and grandpa will be thrown under the bus when their property tax rises faster than their social security tax.

Prop 13 is not the enemy, INFLATION is the enemy. The government should target an inflation rate of 0%, but they aim for 2% Inflation Rate so that your income rises and your TAXES rises with it to give compounded government raises. INFLATION exists so that the general masses who are bad at math cannot estimate the true value and costs of things like houses. That way investors who CAN calculate the true value and costs of things can buy cheap and sell expensive things (houses) from the general public.

I disagree that Prop 13 is not part of the problem. It has created situations where two homeowners with homes valued at the same amount can be paying vastly different property taxes which is simply unfair. Secondly, it encourages absentee ownership which artificially decreases inventory and decreases the value of the neighborhood when absentee owners only maintain their houses at the absolute minimum level required to continue renting it.

Hello Doctor,

The chart you based your article upon shows the median age of ALL “US Homebuyers.”

Could you please explain how Kali’s Prop 13 managed to dictate the median buyer age in the other 49 states?

Casper

Please look up Dunning-Kruger, please.

Tbone

Casper Shipp it is easy math:

Take this list of hypothetical median home buyer ages: 29, 30, 33, 47, 47, 47, 47, 47, 49

47 is the median.

California is the largest state by population by far. So, if there are a lot of 47 year olds (or older) that are first time home buyers in CA that would push the median for all home buyers in the US up.

This statistic seems highly plausible to me, and I’m sure it would be even more extreme if you were to adjust for all the kids who get money from someone else (parents, grandparents, etc.) for a down payment. If you remove those the vast majority of buyers would be senior citizens.

Eric Post has it correct.

“Prop 13 is just “rent control†for homeowners, which we all know doesn’t work well.”

It is the worst rent control imaginable.

Rent control typically caps increases to the inflation rate. The Republicans who wrote Prop 13 capped the tax increases to 2% while inflation was at 12%. Even fixed income Social Security recipients made out like bandits because SS increases with inflation. Schools and services suffered because the income from taxes was so far below inflation.

You typically cannot pass your rent controlled apartment to your kids, grandkids, great-grandkids. Prop 13 allows you to build a feudal dynasty for all of your heirs forever. Heirs inherit the tax rate.

Prop 13 would be fair if the tax rate increase was capped at the inflation/Social Security increase. Also, this is the US and not some feudal aristocracy. You should not be able to inherit tax rates.

However, Flyover has it correct that property taxes must have some limit. Before Prop 13, the CA tax property tax rate was at 3% while home prices were rising above inflation rates. Government spending should be limited to inflation rates plus some factor for population increases. Colorado does this.

You typically cannot pass your rent controlled apartment to your kids, grandkids, great-grandkids.

You can in New York City, where you have dynasties of renters.

As tenants increase as a percentage of voters, expect more pro-tenant laws in California as well.

Correct. Both NY rent control and Prop 13 are both truly horrible. Except Prop 13 tax increases are capped at 2%. NY rent increases are capped at inflation.

Prop 13 is worse than NY rent control.

Bob: NY rent increases are capped at inflation.

NYC rent increases are capped to whatever the state legislature decides. They might say they’re using this or that metric. But that “objective” metric is influenced by tenant lobbying.

Furthermore, rent control hasn’t lowered rents for new tenants. Many legacy tenants barely live in their apartments. They keep it sublet most of them time, often illegally, at market rates.

My late father, a NYC landlord, occasionally hired a private investigator to see if longterm tenants were actually living in his rent stabilized apartments. An investigator once gathered evidence that the tenant had actually moved to New England. My father was very happy, since the evidence in court helped evict the tenant.

His building had been converted to co-op by then. A “non-eviction conversion,” which means that tenants can choose to buy their apartment, or stay as tenants. But if they don’t buy at the time of conversion, then once they leave or are evicted, the landlord can sell the unit as a co-op.

Another time, he was fined by the city, because an inspector determined that the tenant had illegally divided the unit (with curtains) and sublet portions of the apartment. This is apparently a common practice among Chinese immigrants.

Such is the life of a NYC landlord.

Here is a chart of the S&P Index Real Estate component compared to the whole S&P 500 and GLD (gold ETF):

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Index&symb=XX%3ASPXEREUP&x=43&y=20&time=12&startdate=7%2F4%2F2007&enddate=8%2F3%2F2020&freq=2&compidx=aaaaa%3A0&comptemptext=GLD%2C+%24SPX&comp=GLD%2C+%24SPX&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=64&style=320&size=4&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=13

Note how RE sector has lagged the total index and crashed harder this spring. Notice how GLD shrugged off the virus crisis, with the low carrying costs of gold in a near zero rate environment. The RE stock index does not mirror the sales of existing housing, but would have an effect on new supply I would think. Maybe a leading indicator?

Thanks for posting! I love charts like this. Construction never really took off during this cycle, maybe that’s why? Or they weren’t as greedy about buying back their own shares? I subscribe to an investing firm that is bullish on REITs now though.

Here is a chart of the S&P RE Sector, the S&P and iShares Home Construction ETF (ITB):

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Index&symb=XX%3ASPXEREUP&time=12&startdate=7%2F4%2F2007&enddate=8%2F3%2F2020&freq=2&compidx=aaaaa%3A0&comptemptext=ITB%2C%24SPX&comp=ITB%2C%24SPX&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=64&style=320&size=4&x=49&y=15&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=13

Note that the home construction ETF is much more volatile than the RE Sector or the whole S&P 500. You could make some serious money if you knew when to get on and off this rollercoaster ride.

This link gives the 46 components of this index:

https://www.ishares.com/us/products/239512/ishares-us-home-construction-etf

Actually, after I posted that I went and found the components of this index, and most are not homebuilders. It’s a pretty good model for a wide variety of real estate investments.

See here:

https://www.barchart.com/stocks/indices/sp-sector/real-estate

If the sector is a good buy or a falling knife, I cannot say exactly.

I’d be for repealing prop 13 is it was written in a way that the landlords that have benefitted from low taxes for years get caught up with a fair tax bill. Own a Santa Monica property for 50 years and paying $2000/year tax while your new neighbor is paying a $20000/year tax? Yep its time you pay up buddy. That’s not “socialism” thats called being fair.

As for RE, the forecast is looking stagnant price wise for the foreseeable future. If interest rate moves down to 2% you’ll see some price action upwards. If it shoots up to 4% obviously downward price action. Cost to build is still kinda high but once inflation takes full swing, it should bring REAL (not nominal) prices down to a level that makes building lucrative. I’m a civil engineer by trade and I mainly specialize in large scale transportation projects but I’m going to be self teaching land development in the next few years and getting into the building boom that I will bet my life will happen by mid decade. SFH and MF only. I wont touch a commercial project unless its a weed dispensary or a cultivation facility 🥴🤣 Until then I’m watching from the sidelines!

Where is the building boom going to be? Palmdale/Lancaster? Inland empire? OC and LA are otherwise already built!

I think the bldg boom WILL be in LA and OC.

it will be changes in zoning to allow high density such as this project which was once a radio station owned by Cumulus and now it is 1,000 apartments. Once Whole Foods moves in, then ‘there goes the neighborhood’ 🙂

https://cumulusdistrict.com/

Look at other countries regarding the building boom/zoning.

Skyscraper next to skyscraper. High density living in tiny apartments.

You think we have bad traffic now? Have you been to major cities in other countries?

Not saying this can happen over night but if we start replacing SFH’s with skyscrapers it will happen over time.

No one is going to build or want to live in high density housing post-pandemic.

@Post Pandemic

Very foolish assumptin. High density housing doesn’t mean you’re sharing bathrooms and kitchens in tiny 200 SF studios jam packed with 10 other people.

@Responder

You know those giant malls and expansive parking lots with spider webs on them? You’re not going to believe what’s going to happen to those! This gives me a great idea…maybe i should invest in demo contacting too! Get paid twice on the same project 😎

Prop 13 was designed to keep retirees in their houses after they retired and now live on a fixed income (social security) with fixed inflation adjusted increases… but SMART investors have taken advantage of prop 13 and SMART investors will do well after prop 13 is removed. Only certain retired old people will be thrown under the bus when their property tax rises faster than their social security income. But that is no problem, let them work until they are 90 or until they die – whichever comes first.

Prop 13 is not the enemy, INFLATION is the enemy. The government should target an inflation rate of 0%, but they aim for 2% Inflation Rate so that your income rises and your TAXES rises with it to give compounded government raises. INFLATION exists so that the general masses who are bad at math cannot estimate the true value and costs of things like houses. That way investors who CAN calculate the true value and costs of things can buy cheap and sell expensive things (houses) from the general public.

Exactly, prop 13 is not the enemy.

Also, do you really want to force grandma out of her house because she can’t afford the taxes??? If prop13 falls we are all fu****

Rents will go up and people on retirement may face hardships.

In Texas, folks over 65 can opt out of property tax until they’re dead (then their estate pays it with interest). Does California have anything like that to protect grandma?

Nah, Prop 13 is wrong. However, market-price-based property taxes are wrong too, which is what Prop 13 was trying to fix in a bastardized way. Property taxes from 30 years ago paid for expenses 30 years ago, not for today. Taxes should be equally levied based on needs of today.

The old “keep grandma in her house” is total nonsense. Prop 13 is a bonanza for corporations, investors, landlords, etc. Rather than complain and bellyache, why not just profit from it. The key is owning a home for the LONG TERM and you too will benefit from Prop 13. Not rocket science we are dealing with here.

Me and my siblings inherited our parents home which was given to them by my mothers parents. last sold 1955 for $16K.

Todays value about $3M. our prop 13 tax base is $2800 per year.

Whoever buys that house when we sell it will pay approx 10 times the taxes.

Prop 13 didn’t end with just the folks who had a house when the proposition came into effect. Someone who bought a house eight years ago when things crashed benefits from it, too, even though he may have spent $300k for the house instead of $30,000 or $3,000 that Mom and grandma paid. When that neighborhood hits $3 mil everyone will still complain that things aren’t fair.

Prop 13 sent shockwaves through CA government that they can’t just keep raising taxes and expect people to simply say OK. More laws like Prop 13 are needed to reign in these tax spending nimrods up in Sacramento. For starters, I’d push for school vouchers as a way to decimate the public school unions, and that’s just for starters. Never never do away with something that puts caps on how much these people can take.

Also, CA housing prices were rising fast before prop 13 and continued to rise fast after prop 13. What in the world makes anyone think prices will suddenly drop if prop 13 is repealed. There’s still is no where near enough units being built in this state as what’s needed. In fact, CA has been in a major deficit for decades. And, I can guarantee you, landlords will pass the expense on to the tenants.

LMAO, Tell Me Again How CA Real Estate is Doing So Great Again?-

From Socket Site in California. “With inventory levels in San Francisco having just hit recession-era levels, the number of homes on the market which have undergone at least one official price cut has ticked up another 20 percent in the absolute over the past two weeks to over 400. As such, there are now nearly 300 percent more reduced listings on the MLS than there were at the same time last year, over eight times (8x) more than there were in July of 2015, and the most reduced listings since the end of 2011.â€

Nothing to See Here, Move Along and Enjoy The Weather

Anecdotal I know.. but 4 of my old coworkers and friends have just purchased homes in the last month in Los Angeles area. Townhouse, home, and all for $700-$850K. Their ages range from 33-40. They all work in entertainment industry, or atleast 1 spouse does. I’m a 2011 los angeles home buyer… who is about refinance into a 20 year 2.5% mortgage. I don’t envy the current buyers though. I was nervous buying our home in 2011 for $395K. Now it feels like a steal where we are sitting on $400K in equity and refinancing the payment down to half what rent would cost. Amazing the difference 9 years makes.

I’m very cautious about any further gains in housing.. and i’m a little shocked so many of my friends are rushing to get into the market right now. Most are life event driven.. recent marriages and wanting to have kids. One of the biggest perks of buying in 2011 is my Prop 13 tax base is half what everyone buying a home today is. But even if that changes in the next few years and Prop 13 goes away… all the refinancing I’ve done will take the sting out of the monthly payment increase. Just hope the entertainment industry in Los Angeles comes back strong this fall or winter.. or recent homebuyers are in trouble.

Burbs,

Buying in 2011 was an absolute gift. On a monthly basis, it was one of the best times to buy socal RE EVER. Many people didn’t crunch the numbers and missed out big time. And here we are a decade later. Property values went straight up and owners paid down boatloads of principal with the lowest rates on record all while getting the Prop 13 gift. Renters saw rents skyrocket in the same time.

If home prices rise rapidly, Prop 13 limits your property tax increase to 2%/year. If home prices crater, you can have your home assessed at the cratered price. It may not be fair, but why not just accept the facts and profit from it. Doing anything otherwise is just swimming upstream against a powerful current.

“Be fearful when others are greedy. Be greedy when others are fearful.†-Warren Buffet

In 2011, millions had already lost their homes to foreclosure. Even though prices were stabilizing, fear was still strong.

Many thought on this blog even in 2012 that home prices would crash even harder (Jim Taylor).

In retrospect, as Lord Blankfein said, it was the best time to buy.

As General Motors stock plummeted in 2008, many said the same thing.

“As goes GM, so goes the Nation” is attributed to Charles Wilson, CEO of General Motors 1953.

In retrospect today, if you purchased a house in 2011 you have done very well. If you purchased GM stock, you lost everything in 2008.

Who knows what will happen next year?

My crystal ball is broken but I think I still have a little luck. I’ll need the luck.

Governments tax property in many ways other than “property taxes.” Prop 13 does not prevent increases on the following:

* Parcel Taxes. Taxes on the square footage of the land, rather than on the property’s assessed value. Seems every election, Santa Monicans vote for yet another parcel tax “for the children.”

* Transfer Taxes. Taxes that must be paid when a property is sold. Another way to make it more expensive to buy a house. Both Santa Monica and Culver City are planning to increase their cities’ transfer taxes, the issue to be on the November ballot.

* Capital Gains Taxes. Obama raised the top rate of the federal capital gains tax from 15% to 20%. California taxes capital gains like normal income.

Transfer and Capital Gains Taxes are only due upon the sale of a property. But new Parcel Taxes hit all homeowners, and hit them equally.

What about “School Bonds”? Aren’t they added on the property tax? In WA they have few of them added which almost double the regular property taxes.

I don’t think it’s done like that in California.

Parcel taxes often go to the schools. There’s always a “reason” given for this is that parcel tax.

But school bonds, like all bonds, are paid out of the general revenue.

47 and you get a 50 year loan on the over priced crap shack? Baby Boomers must be so happy they could stick to each other’s children. Remember growing up how all the kids were the supposed to be #1 in society? Apparently it was all a ruse.

k,

Anyone over 50 who goes out and gets a 30+ year mortgage at these rates should have their heads examined. That is a serious bet on massive inflation. A deflation would kill them. 15 year rates are rock bottom. My Millennial Daughter just re-fied at 15 years for way less than 3%. With me (Boomer), my kids and grandkids ARE #1. But there are plenty of Boomers peeing away they savings and equity. I won’t get a mortgage unless it is an investment property that can support the payment (hedged financing). Like you, I’m waiting for the right time.

The download from Redfin have been really SLOW for me these past couple of weeks.

Anyone else notice a severe slowdown in Redfin downloads?

Purchase application data is now 22% up year over year.

Very strong demand year in 2020. No way we see a crash this year.

2020 turned out to be a great year to buy. Prices didn’t skyrocket but interest rates went down to historic lows. Buying real estate is also an excellent inflation hedge.

Millie,

I’ll go one step further. Owning a primary residence in socal in a REQUIREMENT. Long term rental strategies here are nothing but financial suicide.

If you can comfortably afford the payment and plan on owning for the long term, go out and buy. Hoping, wishing, praying for a crash and putting your life on hold for an indefinite period all for an uncertain outcome is lunacy. The deck is stacked against renters in CA, accept the fact and do something about it.

You said if home prices drop you would buy an investment property. Why not buy one now if you are so bullish? This is not a dig. I seriously would like to know your thoughts. Thanks.

Thanks Butch,

Yes, if prices fall I will def buy an investment property. I keep looking for a fixer uppers. There is barely any inventory out there. I can take my time to select a good property as a rental but the issue is that decent properties are being bought up very quickly.

I am sure I will find the right object within the next year(s).

I will make sure to keep you all posted.

No, not this year thanks to forbearance. Hopefully employment will recover in time and we’ll have a vaccine sooner than later.

There is an old, yet very true saying that before you open your mouth (or write on a blog) they can only THINK that you are stupid.

1. Houses built during WWII – very few, and only where absolutely necessary for the war effort (eg, Los Alamos, NM).

2. Popcorn ceilings did not occur in any large numbers until the late 50’s and later during the “second house” boom for the boomer’s parents.

3. You are guilty of “Cherry picking” your data.

Median Age may have been 47, however AVERAGE first time home buyer age was 32.

It’s true that people don’t stay in homes as long as they used to. That inflates the average buyer age. Still, it’s quite a change.

P,

You are right! The house I grew up in was a modern from1950 and didn’t have popcorn ceilings. The ranch I live in now was built in 1962 and had them until we took them out. In WWII, my Dad spent some time at Sawtelle and some of the buildings there are from WWII, but that is a VA facility. Everything was for the war effort. This was one of Dr HB’s poorer efforts. There are a lot of Boomers moving to homes for retirement (often smaller), and a lot of Xers moving to a bigger place that skew the median.

Financial stress index remains below zero. Sry bears, no depression in sight!

You sound like Trump tweeting for his re-election. 😉

Market Running Out of Suckers- Homebuyers Step Back As Mortgage Rates Plunge To Record Lows

But, despite record low rates, potential homebuyers are becoming less active as total mortgage application volume fell 5.1% from the previous week according to the Mortgage Bankers Association’s seasonally adjusted index.

https://www.zerohedge.com/personal-finance/homebuyers-step-back-mortgage-rates-plunge-record-lows

Shit Storm Off the Coast, Enjoy the Weather.

ZeroHedge – the flagship of gloom and doom news.

https://loganmohtashami.com/2020/07/28/real-home-price-growth-still-stable/

Alright guys I’m back on my BS 🤣🤣

After giving up on acquiring properties and selling my homebuilding stocks/ETFs I saw a pretty golden opportunity on the one part of RE that i think is robust and is not letting up anytime soon: consumer mortgage finance.

Wednesday night I’m reading Quicken Loans is about to hit the stock market and slashed its IPO from 35 to 18 a share. I have always known that the mortgage market is strong and they aren’t going anywhere but didn’t know how to turn that into an investment opportunity until I got word that the nations largest mortgage financier is hitting the market. I set my TD app to auto buy at 19.05 thinking there’s no way I’ll actually get IPO price. Wake up the next day and all the shares I requested to buy we’re in my portfolio at 18! Two days later im up over 35%!! I invested half my gains this year so if it goes to zero i couldnt care less but this one’s doubling guaranteed! I just cant quit RE man its in my blood ðŸ˜ðŸ¤£

Congratulations!!

Pls give me a heads up next time you see such an opportunity…..I totally missed out on that!

Most definitely will but there is so much lag time between the time I comment and the time it posts so I’ll try! Just keep your eye on the ticker RKT and see where it goes for now!

Eviction moratorium extended and $400 additional unemployment benefits.

Sry depression bears

M: Eviction moratorium extended

Which eviction moratorium? I already reported on Santa Monica’s moratorium extension, and predicted more extensions to come, weeks and even months ago.

Indeed, for many years now, I’ve been predicting ever more tenant friendly laws. Their votes are increasing, so naturally, the laws will reflect that.

Which eviction moratorium extension are you talking about?

As for what this means for housing prices … I have no idea. We are entering increasingly chaotic, uncertain times.

It’s a drop from $600, but it’s something. Can’t wait to see the Dems try to block it and boost Trump’s popularity.

Read the details of the executive orders. Complete joke.

In other words, unemployed people just lost $800/month.

Not I, but neither do I buy individual stocks. You have a better chance with Bitcoin and cherry-picking stocks than gambling at Vegas, but owning the whole market and playing the long game gets most people more over time than those with your investing style. With that said, I hope you make out like bandit. A few do.

I recommend The Little Book of Common Sense Investing by Bogle.

Three articles in the OC Register on the economic impact of Corona virus. One is on the home ownership divide. Inland counties have a higher percentage of owners to renters than coastal counties. Sacramento shows a gain in home ownership, possibly because Bay area renters with good incomes were able to move there and work from home. We know that the tech companies are mostly willing to continue this post-Corona virus.

The second article is on Mom & Pop landlords. Eviction bans can eviscerate profits for small business landlords. The author proposes tax credits to alleviate the loss of income.

The third article is on renters moving back to relatives’ houses, and the problem facing renters who lease. The terms of the lease then become important. It is unlikely your lease has a pandemic provision. Rental insurance provisions also need to be read in detail. There are laws that a landlord must try to rent out a leased property right away. The author suggests being active in trying to find a new tenant for them and keeping track of whether or not the place is re-rented (nosy former neighbors can help). Subleasing is often banned or requires permission. And you may still be liable for damages. A substandard building can be a cause for breaking a lease, but the landlord gets time to make repairs. The article quotes Zillow that 2.7 million adults moved in with relatives in March and April, so this was not uncommon. They don’t state whether a large number left town or the state to do this.

Just wait until this crisis is over and the Fed needs to reel in all the inflation they created, and mortgage rates start rising longer term. Housing will be crushed because it’s not about where rates are historically, but where they are going relative to where they’ve been.

Hunker down and refinance at the lowest rates in recorded history.

If you are a daredevil, refinance in October before the election. Trump will continue to borrow to push them down until then. Who knows what will happen after the election with the winner.

Despite the low rates, I’ve been reading and hearing about refi bait and switches. ie 0ne week before closing, they need extra points or fees to close. A rate lock does not mean a fee lock and is contingent on the borrower having saintly status. A rate too good to be true, probably is.

Also, I have heard that some of the large lenders are taking over 2 months from the rate lock to the closing. The amount of refi applications and the inability to find an appraiser are the typical reasons that I have heard.

In Switzerland mortgage rates are below 1%. In Germany they are 1-2%.

Not saying this happens over night. But why would they go up in the US and go down in Europe?

I believe lower and lower rates are our future as well. Good for asset holders 🙂

You had better move fast on any refi.

Fannie Mae and Freddie Mac added a 0.5% fee to all new refi’s starting Sept 1st.

That killer 2.9% 30 year refi will now be effectively 3.4%.

Strangely, this fee only applies to refi’s and not to new loans.

The Fed will have to crank it up and lower rates another .5% to compensate.

https://www.marketwatch.com/story/refinancing-your-mortgage-will-cost-more-thanks-to-a-new-fee-from-fannie-mae-and-freddie-mac-2020-08-13

I got a pretty good rate. But I am Actively looking at the end of the year or beginning next year to refinance. Rates will go lower I believe.

Always something to do as a homeowner…..looking at solar at the moment….. And I want a pool.

Who else besides me has invested quite a bit of money in bitcoin and other crypto’s?

M,

A little too risky for me. My riskiest investment this year was a little in VXX, the VIX, index. I bailed out too soon due to fear. Bitcoin crashed over 50% in March. More than most of the volatile stocks. It is back now. For now.

Too many players in Crypto and very volatile. IMHO, Like investing in VXX, it is a gamble, not an investment since nobody knows who will win in the Crypto space or if anyone will win at all.

Put 5% of your portfolio in crypto and hold for the next bull run.

I put more in it as I am very bullish on crypto for the next couple years.

We’ll see

NYC extends eviction moratoriums until “end of the pandemic” — which could mean years: https://www.syracuse.com/coronavirus/2020/08/no-evictions-until-gov-cuomo-declares-end-to-covid-19-pandemic-new-law-says.html

I don’t know why M thinks tenant eviction moratoriums are bad for bears. Moratoriums mean that renting become cheaper (for free), and the value of rental properties plummet.

I expect more such moratoriums and extentions to spread across the U.S. There is no “pandemic.” There IS a calculated attempt to destroy the economy, create chaos, and tighten the control of the Deep State, Globalist, Neocons. But the whole thing might blow up in their faces. Troubled times ahead.

Excellent observation! That is what I call critical thinking.

“ value of rental properties plummet.â€

Fantastic! Wake me up when rental properties fall by 5%!

I am looking to buy my first investment property.

So far I haven’t seen prices come down in my area (SoCal, north county SD) at all.

I actually gave up on looking for an investment property for now.

Purchase application data is still 22% YoY.

No inventory and very low rates but high demand. Tough market.

S&P500 nears an all time high. Lol

I guess the depression bears no longer tell us this is a dead cat bounce 🤣

Just remember, the weather is really really nice- A report from the Los Angeles Times in California. “In downtown Los Angeles, rent for a 566-square-foot one-bedroom at the Eighth and Grand luxury apartments would have set you back at least $2,286 at the end of January, according to Zillow. As of Thursday, the same size unit at the building with a Whole Foods on the ground floor was advertised for as low as $1,771. A few blocks away, at another luxury building, monthly rent for the cheapest 1,284-square-foot, three-bedroom unit has come down $385, to $3,870. Walk a bit more and you’ll find more discounts, often with extra goodies such as two months’ free rent.â€

“The declines appear concentrated in the top end of the marketplace, according to multiple data sources, but there are signs rents are falling slightly on the lower end as well. ‘The pain is landing at the top,’ said Steve Basham, an analyst at CoStar.â€

“CoStar data show the largest rent declines in the Mid-Wilshire area and downtown, where rents have fallen 10% and 8%, respectively, since March. Those areas, which are more expensive than the city as a whole, have also seen a flood of new, luxury apartments. Estimates didn’t take into account the expiration of the $600 in additional weekly unemployment benefits. ‘It could be a pretty dramatic downturn in the coming months,’ CoStar analyst Basham said.â€

The North Bay Business Journal in California. “State and local governments that continue to allow renters in this pandemic era to delay payments are raising concerns among property owners and managers. Their looming question: If tenants don’t pay their rent to the landlords, how will property owners pay their mortgages? Some have already answered that question — by selling off properties.â€

“Keith Becker, general manager for DeDe’s Rentals and Property Management of Santa Rosa, said that of 500 tenants Becker’s company rents to, four have stopped paying, negotiating and communicating. Eleven renters are attempting to pay but have fallen short. The loss of tenant income has resulted in 12 units leaving the rental market. Eight units are on the market, and property owners plan to sell four.â€

“‘I can’t tell you we’re doing great. In the last three months, the number of properties rented have consistently flat-lined, and the clients are unsettled,’ he told the Business Journal.â€

“Property owner Jennifer Coleman knows the territory far too well. The Sonoma County landlord has sold two single-family homes and a townhouse to scale down the number of properties she rents. ‘It’s the draconian evolution of laws. I wanted to lighten my risk. It frightened me,’ said Coleman, who has rented her own space for 19 years. Owing debt is hard enough for a homeowner owning one house, much less multiple locations. ‘It’s a gamble, but this is my retirement,’ she said.â€

Nothing to see here, go outside and enjoy the shit storm coming to CA

Proposition 13 is not welfare for homeowners. Property taxes are theft by government bureaucrats most of whom are corrupt Democrat socialists in California. They steal from homeowners to pay off their cronies and to provide benefits to their illegal alien and welfare voter base.

The Real Estate crash of 2021 explained by Ken McElroy

Change my mind

https://www.youtube.com/watch?v=hF1H1qfW15Y&inf_contact_key=25abb629f342935523f081d58996ad4e680f8914173f9191b1c0223e68310bb1

My friend at Uhaul in Poway said all long-distance trucks have left California. Because of the truck shortage in California, rental rates are extremely high. One last jab from CA before you leave, I guess. Moving companies are also charging premiums, said another friend that moved to Phoenix last month.

Income instability will worsen over the next 1-2 years. Unemployed statistics are somewhat easy to track and are kinda accurate but employees are also facing cuts in pay, bonuses and hours. Not so easy to track that data.

Not looking good.

Reasonable. It depends on how employment (or more accurately, income) recovers by the time forbearance expires. He points out that even forbearance could be extended. I hadn’t considered that possibility because it’s lunacy to me. But, this is the federal government we’re talking about and neither party seems to care about future financial consequences. One of the commenters called it, “extend and pretend.”

Democrats, if they win control of Congress in November, will probably be eager to extend and even increase every benefit. All these handouts are starting to look like universal basic income.

Anyway, his shirt says “At some point, your timing is right.” 😉

Real Estate is doing great as long as the bank doesn’t require people who can’t afford it to make a payment on the home they bought. Yeah, great economy with it’s all time high stock market and 15% unemployment(mostly McJobs lost anyways). What next? Don’t require people to think in American and give the population an average IQ of of 160?

Bottom line is we need Rent Control and a Cap on Profits for Real Estate Investors. This is normal in more balanced Democratic societies and will happen here as well.

Sammy…Have you been feeding at the “Entitlement Trough ” again ? This is a REPUBLIC , not a democracy . You were promised 12 years of education for your primary education , and now you say somebody has to take care of you through entitlements such as rent control and a cap on profits for Real Estate investors. Just what have you risked it all on and taken the risk of success or failure ? True , Life isn’t fair , but if you are not willing to take a risk, you will never really succeed. You will just be another 60 year old person standing on the corner asking what just happened and when did it happen. In the meantime , I will be the guy you call to fix problems around the rental because you don’t know how to fix or repair anything. Just where will you be in 10 years, owning a house or home , or still renting from your evil landlord and still complaining about the rising rent. Renters who take weekend vacations and rent/lease fancy vehicles to impress their friends are the reason I can take extended vacations and be financially secure. The helping hand you are seeking is located at the end of your arm, do for yourself.

“Essential healthcare workers have plenty of jobs available but they expose them directly to the virus ”

Social LVN nurse here ( not a RN know it all Bob, there’s a difference) just took a job on a covid floor at a hospital for the experience and increase in pay…. whopping $28 hour! Over priced crap shack I still can’t afford here I don’t come! God bless America the greatest country in the world!!!!

Side note: boomers are the worst, most selfish, entitled generation of all….were waiting for the world to be a better place once you all die off….looks like the rest of the world is to….looks like covid is going to help speed that up.

Oh yeah the virus isn’t going away, there’s no cure for the flu guys. Get ready for flu season this winter guys….its gonna be worse than lost time and another shortage of supplies.

I apologize again for offending you, Nurse.

I thought you were an RN who earned enough to afford a house.

What is the difference between an RN and LVN?

2 years of college?

A solution for you seems obvious. It is not the Boomers fault you can’t go back to school for 2 more years. Is it?

whopping $28 hour! Over priced crap shack I still can’t afford here I don’t come!

You sound pretty entitled yourself.

were waiting for the world to be a better place once you all die off….looks like the rest of the world is to….looks like covid is going to help speed that up.

And you’re a nurse? With that attitude toward your patients, I’d say $28 an hour is way more than you deserve.

Pretty soon, the discussion on Prop 13 will become a mute point. The wealth tax advertised by the BIS (the central bank of central banks) for many years now, will land in CA first, due to its leaders who are all globalists in the pocket of BIS.

https://eastcountytoday.net/first-in-nation-wealth-tax-introduced-by-california-state-lawmakers/

That wealth tax will be assessed on any type of wealth you might have – precious metals, stock, bonds (IRA and 401K) on top of RE which had a wealth tax anyway – property taxes. Therefore, you’ll pay property taxes twice – as part of normal RE taxes plus as wealth tax. It looks that the communists became greedy – they are not happy to nationalize your property at a slow pace; they want to increase the speed of your nationalization.

Buy more RE in CA because the Democrats need more funds to support the illegals. The housing, medical, food stamps, judicial system and eduction (indoctrination) of millions of illegals from S. and Central America are not cheap. You should thank a democrat for open borders and sanctuary cities/ state. Isn’t that great Bob??!!!…At the same time the sanctuary cities are in place, the democrats no longer see the need to fund the police. Next time, when your house is burglarized, don’t call 911 – call your social worker or mayor; hopefully someone will answer your call and talk to you while your house is burglarized. If they leave you alive, make sure you lobby your democrat politician to give you permission to buy a gun for your protection (recognize your 2A right). Hopefully they will let you buy bullets, too – after all, Pelosi and Maxine are free to have them; maybe they will not be so selfish and let you have the same right in the spirit of EQUALITY that the communists profess.

0.4% on assets over $30 million. That affects about 30,000 people according to the article.

Prop 13 is still going to help millions of people. Relax man.

For now I am relaxed – I don’t live in CA and I don’t have over 30 millions. However, that is beside the point. My point is having a wealth tax on top of RE taxes.

That is how it starts to get maximum support. They don’t want to have everybody up in arms tomorrow. Are you familiar with the history of income taxes? They started in 1913 with 1% to convince most people to accept it. Once that was established, gradually they had everybody in bondage while the rich created loopholes for themselves. Don’t think for a second that they will not do the same with wealth taxes. Most people will say that it is OK because it doesn’t affect me. They are too stupid to realize that as the rich flee to other places (they are the most mobile), that upper limit will decrease gradually to the masses and the percentage will be increased gradually like the income tax to steal the wealth and pensions from most people. The same thing happened in France when they put a wealth tax on millionaires. Most flew to UK.

Mark my words. You will see what I explained above gradually affecting most people who are disciplined to produce, save and invest. Don’t be the frog that get boiled by gradual increase in temperature. Jump while there is time. Be ahead of the curve.

I agree with Flyover.

Property taxes are wealth taxes. If your house is appraised at a higher value and your income decreases or stays the same, you are forced by the government to sell.

Any rewrite of Prop 13 should limit this wealth tax increase to the inflation rate so any retiree surviving on SS, the increase is capped at the same rate as SS.

Income taxes and Sales tax are fairer since the individual controls how much tax they owe.

Wall Street Capitalists already impose a wealth tax on investments. If you look at your investment statements for mutual funds and index funds, you are charged a percent fee for your entire wealth in that fund. The percent fee is the same whether the fund manager makes money that year or loses money on the entire value your investment. That is not capitalism. That is very similar to a wealth tax and should be outlawed and switched to an incentive based % fee on the gains for your investment. If the fund manager loses money, you should not owe them anything.

Bob, yes, you are correct, but it was a communist democrat from CA who proposed it (always the democrats). Communists are in this nasty business of nationalizing your house, your business or whatever wealth you have after working for it your whole life and paid taxes for it. For me, communists and social democrats are the same, practicing the same theft from people who produce wealth. They do that for 2 reasons: to enrich themselves and to buy votes (using crumbs to get power) from low IQ voters.

The poser with the moniker “Nurse” is not a nurse at all. Normally people in

that profession do not have the maniacal sadistic attitude displayed in that post.

It’s probably someone working in the medical field but in a junior or assistant position.

Or just a troll. The grammar is another give away. “can’t afford here I don’t come”.

Again, nurses generally have more than an 8th grade education and can actually

speak and write in English. So what is this poser doing on an RE site ? Who knows.

Lonely maybe ? Certainly isn’t able to contribute to any RE discussions.

Prop 19 to limit Prop 13: https://www.dailybreeze.com/2020/07/04/proposition-19-is-latest-assault-on-taxpayers/

Prop 19 will …

1. Limit parents’ ability to pass on Prop 13/58 protections to their children. Children who inherit a house will have the valued reassessed to full market value, unless the house is their primary residence.

2. Increase portability of Prop 13 protections between counties (i.e., if you sell one home to buy another within California).

3. Money raised through Prop 19’s increased taxes will largely go to firefighters. This is to buy support from the firefighter unions for Prop 19.

4. California Association of Realtards supports Prop 19, as they think it will encourage more sales. Homewwners will be able to move while keeping their Prop 13 protections. And kids will not inherit those protections, thus giving them an incentive to sell rather than rent the house.

This is interesting.

In my opinion, 1 and 2 are fair and much needed.

1) Nobody should be able inherit a tax rate. The only exception of being a primary residence covers special needs kids who have been cared for their entire lives in a home.

2) This will allow people to move within CA without affecting their taxes. They can move to be closer to their children or for medical reasons without being adversely affected tax-wise.

3 is questionable. If CA receives a windfall in taxes, the purpose of these taxes should be directed by popular vote and not through union or corporate lobbying.

The Turd (Real Estate) is circling the Bowl (CA)- From Pacific San Diego in California. “Rent in San Diego County is down for the first time since the Great Recession. It is notable because rent hasn’t dropped in the county since the third quarter of 2010 and any talk of a reduction at the start of the year was unthinkable. Experts say the once-unstoppable rise in rents in San Diego County has been halted by large job losses, or income reductions, related to COVID-19 and a lack of people signing new leases in the region’s most-recently opened luxury buildings.â€

“Alan Nevin, real estate analyst at Xpera Group, said the actual rent price with special offers — sometimes called the ‘effective rent’ — is probably a better way to look at what is happening. He said many of the luxury buildings are offering one to two months of free rent. That way they don’t have to lower rents and then be prevented from raising them substantially later under statewide rent control passed in 2019. CoStar said the effective rent was closer to $1,830 a month in the second quarter.â€

“‘What they would rather do is have it free upfront so they can maintain their pro forma rents until things get better,’ Nevin said.â€

“Joshua Ohl, CoStar managing analyst, said some of the newest apartments are marketed with high rents because of gyms, pools and other features that had to be closed to prevent spreading the virus. ‘If all those things are closed, what are you paying for?’ Ohl said.â€

The SFist in California. “Nowadays, it’s somewhat common to spot sub-$1K Craigslist ads for single-room rentals in areas like the Lower Haight, Inner Sunset, and The Castro — all neighborhoods where you would be hard-pressed to find anything remotely close to that price before, pre-pandemic. For the first time in over a decade: San Francisco’s now home to both a renter’s and buyer’s market, with home prices steadily on the decline as the Bay Area’s real estate market continues reeling from lackluster business.â€

“The recent (and widely publicized) exodus event in San Francisco was highlighted by Zillow, showing that their real estate inventory for the city had a 96 percent year-over-year spike as unoccupied SF homes went on to the market in huge numbers, unlike any other metropolitan area mentioned in the study.â€

The Daily Mail on California. “Today, Los Angeles is a city on the brink. ‘For Sale’ signs are seemingly dotted on every suburban street as the middle classes, particularly those with families, flee for the safer suburbs, with many choosing to leave LA altogether. Danny O’Brien runs Watford Moving & Storage. ‘There is a mass exodus from Hollywood,’ he says. ‘And a lot of it is to do with politics.’ His business is booming. ‘August has already set records and we are only halfway through the month,’ he tells me. ‘People are getting out in droves.’â€

“Veteran publicist Ed Lozzi says: ‘People are taking losses on the sales of their homes to get out.’â€

Enjoy the Weather

Sounds like a ZeroHedge post.

Rents and home prices have fallen how much ? 10% so far.

First drops since 2010, whoop de doo.

I real worry is what happens when eviction moratoriums end. Plus on top of that is that the ekonomy IS still unraveling, just ask the CEOs as their revenue pipelines continue to show the light at the end of the tunnel is a train of pullback in consumer spending.

god help us.

Realist doesn’t have the financial means to buy a house so he dreams of a 70% crash. Lol

Sry, keep lying to yourself that the market will crash and you can buy a dream home or start investing in stocks and bitcoin. You will have a downpayment ready in no time.

I bought at the peak on Q1 and I couldn’t be happier….

Fresh from the press: home builder sentiment reaches record high.

Yep folks, the depression must be just around the corner.

In the meantime my stocks went up and we are close to an all time high on the SP500

For all non-perma/depression bears: no RE crash in sight.

“The nine most terrifying words in the English language are: I’m from the Government, and I’m here to help.” – Ronald Reagan

Oh boy, prices are up 9.6% YoY in California. So sorry perma depression bears!

And That Was Wiped Out by The New INCREASE in Taxes, LMAO Enjoy the Weather 🙂

Cherry picking again, M. Let me share more details with he group.

https://www.car.org/en/aboutus/mediacenter/newsreleases/2020releases/july2020sales