National Home Prices Remain Stable While Millions Remain in Forbearance: The Covid-19 Effect on Housing

Home prices remain stable in the face of a global pandemic, record high unemployment, and millions of Americans actively not paying on their mortgages through forbearance. Not exactly a rosy picture. On the surface, the stable prices would seem to indicate all is well. But the reality is more problematic in that millions of homes are off the market right now as people are not paying their mortgage via forbearance. For those wanting to buy a home, they are competing with very little inventory. Selling a home right now just does not seem like the best time given the pandemic we are in. In California, housing prices remain stable while millions are out of work and half the state is made up of renter households. The math doesn’t seem to add up but this isn’t a “market†in what many would think as a free market. Â

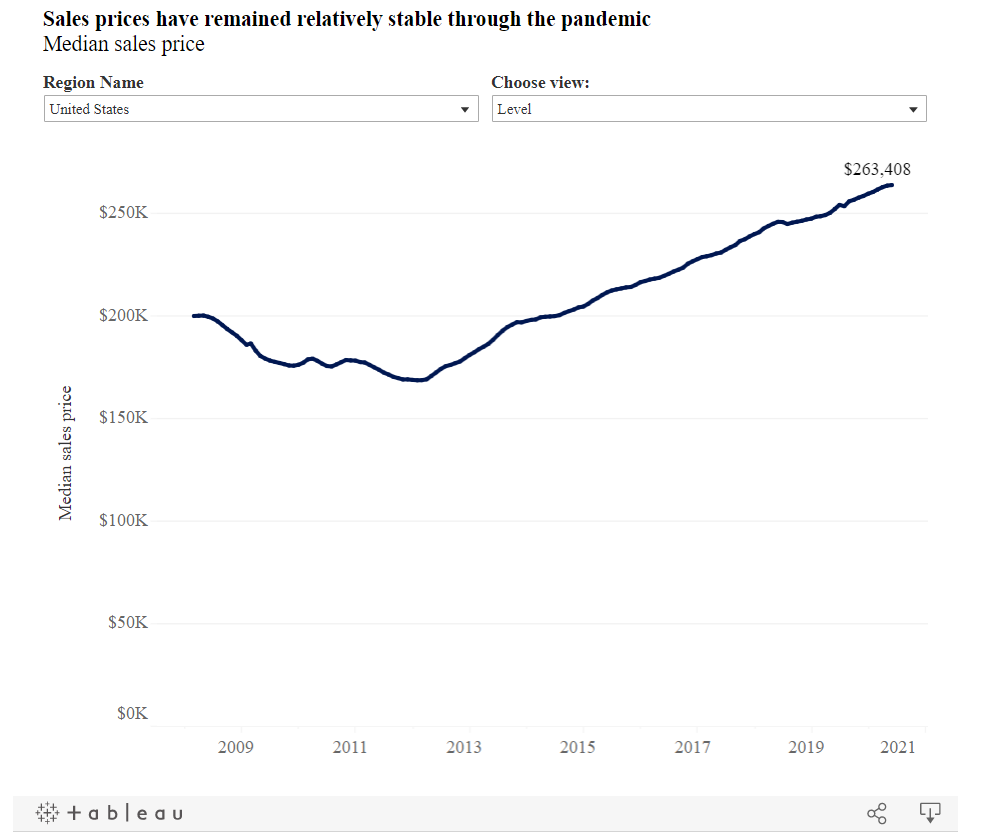

Home Prices are Stable

Home prices are remaining stable despite the flood of negative economic data. Here is a look at home prices:

A few key reasons why home prices are stable despite the negative economic data:

-The Fed is flooding the system with easy money and interest rates are at record lows

-4.1 million Americans are in forbearance so these homes are off the market until things resolve

-Few are selling given the pandemic, so inventory is even lower than it once was

-Home is now the office in many cases sucking funds out of commercial real estate into the residential sector

If you go through each of the points above, these do not reflect a robust and booming economy. It highlights a machine pumping artificial juice into the market. So we are seeing these distorted numbers but like the Great Recession as well, the Fed injected steroids into the market to stabilize it, but once the crisis phase was over, home prices continued on their downward trend in a steady glidepath, not an all-out collapse.

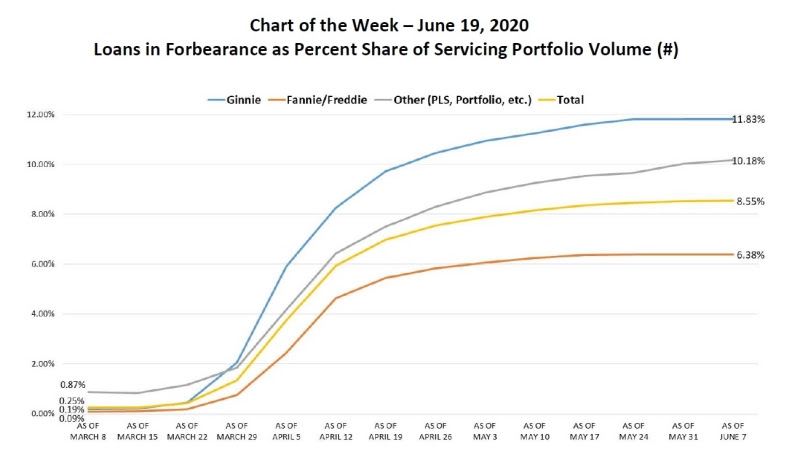

Forbearance

Under the CARES Act, Americans have the ability to not pay on their mortgage if they are impacted by Covid-19 related economic pain. The number of mortgages in forbearance is startling:

These are the largest holders of mortgages and once March hit, the numbers went off the charts. Once the payment moratorium ends, there will be many that will lose their homes. Also, many households now have extra funds to spend in the economy because of this forbearance act – which inadvertently makes other sectors look better than they are. The impact of the pandemic on our US economy is going to accelerate change in many industries and jobs are unlikely to come back in certain sectors.

In large part you get this current housing market because there is so much artificial support propping up real estate. Yet there is no free lunch in life and this stimulus is going to cause issues elsewhere. It is hard to see where it will ignite another economic challenge but many more cracks in the system will be seen once the forbearance windows end.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

371 Responses to “National Home Prices Remain Stable While Millions Remain in Forbearance: The Covid-19 Effect on Housing”

Housing to TANK Hard in 2021

Actually, prices are going up very fast. Experts say it’s because there is no inventory and rates are historic low. I tend to agree with the experts.

Lack of inventory is because of covid. When it is over (which is will be very soon), there will be a glut of inventory. People are also gettng nervous now that this is the top so if they plan on selling, they don’t necessary want to wait. That’s not even touching on the fact that MILLIONS of homes are severely delinquent on payments, and they only reason they aren’t being foreclosed on is due to current forbearance. That will be over at the end of this year. There are also already loads of foreclosed homes waiting in the wings that haven’t been put on the market yet. Get ready, a GLUT of inventory is coming.

I would like to add to the article that forbearance means the owes money will be ADDED TO THE END OF THE LOAN.

Yes….that means you haven’t paid 6 months of your PI and the servicer (in most cases) will be extending the loan by the owed amount.

It’s not like often portrayed by perma depression bears that you owe the amount right when forbearance ends.

Perma depression bears have only one thesis left: when forbearance ends we will see a flood of inventory. They set themselves up for failure. Again and again.

If a homeowner is suffering a financial hardship and can no longer afford the home, then it doesn’t matter where the forbearance amounts are added. The result is a distressed sale. Lost employment and incomes will take years to recover.

@Butch, this is the correct answer. Forbearance works if the jobs and incomes are coming back. I don’t see this happening for everyone.

Forbearance is one year. It takes another year to foreclose.

When I was working for a real estate management during the last recession, many banks refused to foreclose until the HOA threatened to foreclosure to recover HOA dues.

This means we are at least two years away from any type of home price adjustment.

Thanks for highlighting why prices right now are not dropping. It’s not the least bit surprising. What will be surprising is if things stay as “good” as they are now.

If a person can’t resume payments after forbearance ends, what will they do? Cashing in seems like the best way out of that pickle. People have equity, after all.

17% of FHA loans in San Diego are delinquent. Unemployment is 13%. That’s worse than at any point during the Great Recession. This situation is major.

Buying a house in Q1 was one of the best things I have done. The internet depression bears told me I will lose a ton of money by buying. It shows how useless these comments were….housing appreciated significantly in Q2…..the exact opposite of what bears told us.

I agree with the doctor on the reasons:

Historic low inventory

Historic low rates

fED printing money like there is no tomorrow

And: FED can continue to print if they need to. AND they can lower rates to negative if they need to. See Europe…..

House prices can go a lot higher with rates declining.

Now, one scenario the doctor hasn’t mentioned in his article: what if we see significant inflation in the near future? That will crush people sitting on cash waiting for a crash……absolutely crush them.

It will not absolutely crush them That’s an absurd and alarmist statement. You would have to see a very very high rate of inflation to see your cash savings crushed. And if that happens we have much bigger problems than seeing your savings depleted.

@Mark L,

I dunno man you’re kinda underestimating inflation. It’s definitely coming, the FED is actually taking monetary measures to allow inflation to run higher than normal and the FED’s numbers are actually lower than real inflation, that’s a proven fact. They’re always under-reporting inflation figures. Let’s take a conservative scenario to put it into perspective. If inflation over the next 5 years is 5%/year and housing appreciates 5% year then a permabear waiting for this imaginary crash is losing 5% a year in purchasing power and the real estate that he/she is trying to buy is gaining 5% a year for a total net opportunity cost of 10% a year. In a five year time period, you lost 40% in purchasing power towards real estate. There’s your 40% crash, it was in your bank account the whole time.

You think I’m BSing you? Okay no problem. Lets use actual historical data. In the last 5 years inflation has officially averaged 2% a year resulting in a 10% loss in purchasing power in that time frame while housing has appreciated by 30% in that same period resulting in a net opportunity cost of *drumroll* 40%. Permabears are literally strangling themselves with their fear. It’s so sad but the numbers don’t lie and I always use numbers to make investment decisions. Take it from someone who has a proven track record of investment success across multiple asset categories. I run laps around Sad Money Jim Cramer.

New age, they should teach this in school and the good dr housing bubble should write an article about it!

Your post should be repeated and re-posted every month…..it’s so important for people to understand it and most don’t……as you said….it’s sad. Staying in cash has been a losing position and people see how they are getting further behind. Instead of changing their strategy they call for a bigger crash which is impossible to happen in a low interest environment and with all this money printing.

I’m starting to think New Age and M are the same person. Or M is hijacking New Age’s name. Their posts are way too similar.

“I am starting to think…â€

That’d be a first.

@Josh

Oooo I like a good conspiracy! Maybe we are the same person? I’ll let you figure that out yourself. I mean, it could go one of two ways. We’re either the same person or we’re not. If we are, well New Age (me) has been a bull on this blog for a while and that negates the current arguement that M just flipped his position since he’s been a bull this whole time under this name. If we’re not, then we’ll I guess we’re not. I dunno, maybe instead of getting to the bottom of who said what and when who said it you can bring forth some substance? If you don’t agree with me that’s at your discretion but at least give me something to debate here. It was cute when I was reading the back and forth about M flipping his position (as if changing your mind is illegal) but now I’m the target of this petty gossip too? Come on man, you can do better. Give me something worth my time to discuss. Anywho, I’m gonna ignore anything that isn’t on topic so y’all are free to say what you wanna say. Don’t mind me.

Josh and SOL remind me of the fake news media. Always coming up with some nonsense BS instead of focusing on the market and interesting topics. Gets old.

M: Buying a house in Q1 was one of the best things I have done. The internet depression bears told me I will lose a ton of money by buying.

WHO “told you”?

YOU were the TOP “internet depression bear.” YOU were spamming every thread with “perma bear” posts, cut & pasting the same “perma bear” talking points multiple times on every thread, even this past January.

Then within two weeks this past February, you suddenly claimed to have received an inheritance and allegedly bought a house that was still under construction, and were all moved in by April.

Any arguments you had with “internet depression bears” prior to February was with yourself, in your own head. You certainly weren’t arguing with any bears on this site.

Son of landlord you are mixing up a lot of things. To build a house takes 6 month or so. I did see some part of it yes. It was nice….I have picture of the studs….nice to know where they are. If you want I can email you some pics?

SOL – I think it’s time you re-post your epic post that eviscerated M in the last thread. He thinks that now that there’s a new thread, we’ll all forget how much of a fraud he is.

SOL did a great job putting together my timeline. I am actually maintaining the timeline. It’s spot on. Where do you see a “fraud� lol

M – no one takes you seriously because you flip-flopped in the biggest way possible after buying a house. That means you have horrendous confirmation bias, which you continue to prove with your posts to achieve self-validation that you didn’t make a bad decision. So, how is anyone ever to take your opinions seriously if they’re draped in confirmation bias?

X

My posts are exactly the opposite of confirmation bias.

My posts are based on market data. How many times have I posted about the inventory levels, expected market time, interest rates for SoCal?

For SoCal, the data comes from the housing report (Steven Thomas) and other articles.

I did ONE flip: from bear to long-term bull. I admitted I was wrong in the past.

I don’t care less who takes me seriously or not. One sign that your are not taking seriously is when nobody reacts/responds to your posts. Look at poster “realistâ€. Almost nobody responds to his weird perma depression posts. The opposite with me, I have many that agree with my long-term bullish posts and market data. On the other hand you have people that are obsessed with me and try sooo hard to put words in my mouth to “find something wrong with my timelineâ€.

Many also know the data I post reflects the market situation. Many bears actually suffer from confirmation bias and are unable to absorb the market data. People like me who base it on data are on the safe side.

My piti is well below 3000 dollars. I could easily rent this place for well above 3000 dollars.

I have yet to find ONE person that says you shouldn’t have bought this house…..why? Because it was the best thing ever AND the people I meet are usually smart people. Smart people know: in places like SoCal it’s a requirement to buy a house. Trying to time the market is the worst thing you can do. Especially when facing higher inflation.

I post a lot so other perma/ depression bears can learn from my experience. I don’t need to convince myself. I am over 30 and live in a big house in SoCal that I can easily afford….You cannot win much more. The next thing for me will Be investment property.

“M – no one takes you seriously because you flip-flopped in the biggest way possible after buying a house. That means you have horrendous confirmation bias, which you continue to prove with your posts to achieve self-validation that you didn’t make a bad decision. So, how is anyone ever to take your opinions seriously if they’re draped in confirmation bias?”

He’s right about some things (low supply, low interest rates). But, it does seem like his predictions are based on his own current circumstance. Before receiving an inheritance, he was predicting a 50% – 70% drop in prices. That was extreme and perhaps matched his need or desire. When he could suddenly afford the house he wanted, his predictions did a total 180. That seems more like self-justification than rational thought.

If I received a windfall that allowed me to comfortably buy what I want right now, I might. I plan to buy a house I will live in for the rest of my life so wouldn’t care much about value. Would I then start imagining a perpetual peachy economic present and future like M? 18% may be on unemployment insurance, but bears imagine a future that favors them too. Commenters have been expecting a crash for many, many years now.

“I have been Foolish and Deluded,†said he, “and I am a Bear of no Brain at All” – Winnie the Pooh

There is no confirmation bias at all.

I changed my mind.

Just because you were a bear at some point doesn’t mean you have to be for the rest of your life.

I had so much cash that I couldn’t justify not buying anymore.

I am proud of myself and I am celebrating the move. Best move I’ve ever made. I see many posters that had similar views than me in the past. That’s not how the market works though…..

It’s actually very simple. In places like SoCal you buy as soon as you can comfortably afford it. Everything else is noise. Rents and prices will ONLY GO UP IN THE LONGTERM.

It’s that simple

Still waiting for the name of that housing development you purchased in? What is it called? You know the one in coastal SD that doesn’t exist?

I never said I am at the coast. Why would I tell you where I live? Are you telling us where you live? What’s the point? You are too obsessed with me for some reason. Maybe because you were telling me I will lose a ton of money cause I bought at the alleged peak in Q1 you but In reality, prices have gone up? Is that what it is? You are butt hurt?

Why do you keep deflecting? I’m not going to debate what “coastal” is. Don’t you see everyone attacking you because you are full of crap? I’m not asking for your address. I don’t live in a planned sub development otherwise I’d be happy to share the name of it. I think that’s still rather anonymous.

You can’t say the name because it doesn’t exist and would expose your BS and your timeline that SOL has already pointed out. You are the ultimate bear and troll.

Thanks for confirming me.

“Everyone attacking me†🤣 🤣

There are three posters:

SOL: who post my exact timeline which I agree with. Somehow he thinks there is something wrong with it and he tried sooo hard to put words in my mouth to make it look like something is wrong with it. I offered to even send him pictures but he didn’t bite.

Josh: who thinks the timeline is epic and says that timeline shows I am a fraud. Lol?

You: who wants to know where I live but refuses to tell us where you live. Also, you told me I will lose a ton of money because I bought a house, now you change your story and state I didn’t buy a house because I don’t publish my address online. Lol?

It’s mediocre entertainment.

This is a common troll tactic:

M: Thanks for confirming me.

Someone disagrees with M. Whereupon M ignores the comment, and pretends he was confirmed.

It reminds me of that annoying little kid in the schoolyard. After being accused of something, he’d reply. “I know you are. But what am I?”

I guess M was the annoying kid in his schoolyard.

Also, all these fake laughs: 🤣 🤣 🤣 🤣

Anyone can post an LOL or a laugh meme. Doesn’t mean they’re not sweating nervously.

M: I offered to even send him pictures but he didn’t bite.

You want to email me a picture of a house? What would that prove?

There are billions of photos on the internet, of anything and everything. I can download pictures of mansions in Bel Air and Malibu, a private jet, and a yacht, and send those to you. Would it prove that I owned them?

Pictures of the track when it just had the slab foundation, pictures of the studs, pictures of when the drywall was in, pictures when we moved it, pictures now fully furnished.

I know, I have to spell everything out in a little bit more detail. But there is still important details you will miss. You still think I work in IT because I posted That i work for a tech company. 🤣

As I said, you can find pictures of anything on the internet. Pictures of slabs, studs, etc. Doesn’t prove it’s yours, or even that it’s in San Diego. Could be pictures from a development in Florida, or Texas, or Belize.

Why not answer SoCalGuy’s question, and tell him the name of this mythical development.

However, it is odd that on January 31, you were still opposed to buying a house.

Then you claim to have bought a house still under construction in mid February. A house so raw that you were able to take photos when it was still in slab, studs, etc.

And yet, two months later, in April, you were already moved in.

Two months is an awfully short period of time to complete such an unfinished house, get a Certificate of Occupancy, get it painted, furnished, and be all moved in.

Well, if pictures of my house won’t convince you I am afraid you are out of luck. I gotta leave you with your belief. If it makes you feel better, that’s fine with me!

For some reason it bothers you too much that I bought a house and you won’t accept it. That’s confirmation bias which I have no chance of winning against.

M: For some reason … I bought a house and you won’t accept it.

What’s with this “some reason”? I gave my reasons. I’ll give it again.

* January 31, you were still opposed to buying a house.

* Mid-February, you claim to have bought a house still under construction. A house so raw that you were able to take photos when it was still in slab, studs, etc.

* By April, you claim to have already moved in.

Two months is an awfully short period of time to complete such an unfinished house, get a Certificate of Occupancy, get it painted, furnished, and be all moved in.

In fact, it is impossible.

Huh???? You buy a house and move in 2 month later?! Lol f.ing lol. How long does it take you to move Into a house son of a landlord?? 6month? A year?

Is this guy serious or high or trolling? I can’t tell anymore.

In January I was still a bear??? Sooo??? I can be a bear and buy a house…..if you inherit money and can’t justify any longer not to buy….then you throw in the towel and buy….that’s what I did. And now I have a much better time hoping for the market to do well. And if not, okay, then I probably should buy my first rental.

This back and forth is so freakin hilarious. “No, you didn’t buy a home. No you were still a bear on January 16th at 9pmâ€. 🤣

I don’t know how it works in CA but this wouldn’t be an unusual timeframe in Texas for a house that was already under construction. Is California really so much slower? Why in the world would he lie, anyway? Do anonymous people really care about impressing strangers on the internet? I can’t imagine. I think we’re more apt to speak our minds and say things as they are when we’re anonymous.

The only thing I question is the location because what he said about sold out phases and coming soon phases matches Harmony Grove exactly. He said that place was really nice, but no, that’s not it – a little to the west. 😉 Not that I looked at Vista or other places further west. How many communities are there in North County, I wonder – that fit that precise description of phases. I don’t care to check, but I do believe he purchased a home.

Escondido is not so great (nor is Vista or most of Oceanside). All that graffiti close to the nicer neighborhoods is troublesome. But Harmony Grove has that nice back road into San Elijo and Carlsbad (now those are nice places). I’d do my shopping and pleasure out that way. And who knows, maybe Escondido will grow up like Chula Vista did, which now is mostly good or great east of the 805. Too bad it still has a bad reputation thanks to I-5 and 805 only showing people the lesser side.

M: Huh???? You buy a house and move in 2 month later?! Lol f.ing lol. How long does it take you to move Into a house son of a landlord?? 6month? A year?

That’s not what I said. Why are you lying? Why do you misquote me? You can see what I said right about your response.

I said: Mid-February, you claim to have bought a house still under construction. A house so raw that you were able to take photos when it was still in slab, studs, etc.

Yeah, it would take a lot longer than two months.

Turtle: I don’t know how it works in CA but this wouldn’t be an unusual timeframe in Texas for a house that was already under construction. Is California really so much slower?

I’ve seen many homes being constructed in Santa Monica’s North of Montana neighborhood. So much construction going on up there. A new house every few blocks, it seems. Those houses can take years to complete. So much red tape.

Turtle: Why in the world would he lie, anyway?

Good question.

For most posters, I accept what they say.

But M’s (aka Millennial) posts have always seemed troll posts, calculated to goad. Over the years he’s often gloated over the prospect …

* Of Boomers dying, so he could scoop up their homes cheaply.

* Of people losing their homes in the next crash, so he could scoop up their homes cheaply.

* Of tricking his landlady into giving him a low rent, by lying about how poor he was.

* Of trespassing into his neighbor’s pool.

His gleeful tone over other people’s misfortunes, of taking advantage of people when they were down, of hoodwinking people through trickery and deceit, seemed calculated to goad and to troll.

So I doubt M’s announcement of a sudden inheritance and home purchase. It’s just a troll upping the ante, because he’s become bored with his previous antics.

Ironically, M changed his story just before the Covid lockdown and economic distress. Think how much fun he might have had had he kept his old persona.

How to Spot an Internet Troll: https://getkidsinternetsafe.com/how-to-spot-an-internet-troll/

SOME excerpts:

* Offensive and controversial posts or interactions with controversial comments.

* Take extreme political or opinion positions on certain issues and repeatedly focus on them.

* Aggressively Poor Reading Comprehension. … the troll claims you wrote/said something you did not and then using “your own words†against you.

* Theoretical laughter (i.e., M’s laughing face memes).

🤣 🤣 🤣

I feel bad for SOL but also feel entertained. He’s trying so hard and puts many hours into this. At some point he will realize it’s an effort without any hope of succeeding.

M: At some point he will realize it’s an effort without any hope of succeeding.

Succeeding? What do you imagine that am I trying to “succeed” at?

SoCalGuy: Still waiting for the name of that housing development you purchased in? What is it called? You know the one in coastal SD that doesn’t exist?

M: Why would I tell you where I live? Are you telling us where you live?

Well, M, you told us this much on February 19 (8 days after announcing your inheritance, 19 days after you were still posting as a bear).

M: SoCal is a great spot to buy RE. Just signed.

Carlsbad / sorrento valley is a tech hub with great job opportunities.

I found great pockets of value properties with great schools at an affordable price.

Love it here already.

Source: http://www.doctorhousingbubble.com/why-are-californians-moving-out-in-droves-to-texas-a-trend-that-goes-beyond-one-year-a-two-city-example/#comments

Still searching for that “lie†you can’t find huh? 🤣

Sorry, not telling you my address 🙂

So lets pretend that rates go negative and a typical house now costs $2mm.

Riddle me this batman (aka M), how are these folks going to pay holding costs?

Major amount of *cash* money to pay for property taxes, HOA, insurance, maintenance and the like.

Here in my hood (OC, Socal) just the property tax for a $2mm sugar shack is over $22K/year. Add in HOA, and all the rest and a ‘homeowner’ now has to come up with at least $30K+ *cash* each year.

And please don’t tell me that everyone makes $200K/year in the OC. They don’t. In fact employers (mine included) are cutting back by stripping benefits.

Doesn’t look sustainable to me.

If rates for the 10 y treasury yield goes negative, yes we will see mortgage rates for to 1-2%. Which means house prices skyrocket. A house in OC costs about a million. With lower rates the house prices will continue to push higher. 200k for a professional couple is not unheard of. You can’t make it by making only 50k each in California. In that case you got to move. You won’t be able to afford a house here unless you buy with another family. That’s what many Hispanics are doing.

What sort of ROI are you receiving with your recent purchases

A house is not necessarily an investment but it can be later.

On paper a house to live in appreciates above inflation.

But you lock in your payment while rents keep going up over time.

The kicker is that you can refinance.

If there’s significant inflation, Fed will be forced to raise rates and house prices will crash.

So you’re patting yourself on the back for an on paper increase two quarters after buying your home. Congrats to you, I guess!

I know Edge!

I am proud of myself. I did nothing but working and vacation the last two month. Yet, my net worth went up on paper! All while perma depression bears told me that I will

Lose money (a ton of money) by buying the peak in Q1.

I guess as a perma depression bear your just move the peak conveniently to the next quarter and the next quarter and the next….

I wonder how so many houses can be selling at such high prices during a time like this. It just doesn’t make any sense to me. It seems like no matter how bad the numbers look for the economy, housing prices continue to rise and rise and rise. And it’s not just here. It seems to be going on like this all over the country. The housing market continues to be red hot. I’ve been here for five years and there has been no end to it. It’s really a very hopeless situation for my family and me.

Right there with you, Mark L. People are still using cash to buy. Houses that go up for sale in my hood seem to go to corporations that are flipping them. The rich are still rich. East coasters with Porsches seem to be pouring in…

We will still apply for a loan (pre-auth) as soon as we get back to work, but being a homeowner anywhere within 500 miles of our jobs seems hopeless. My husband and I both have specialized jobs that we can only do here in LA. We have pensions, etc; so leaving isn’t in the cards.

However, I am starting to think that using the money we have to buy a place in Mexico might happen before we ever own anything in the U.S. At least we’ll have a beach home with land to retire to? That’s the only realistic outlook I have for the so-called, “American Dream” of home ownership.

Instead of investing your money in Mexico you could ride the tech bubble train. Amazon, Netflix, Apple, Tesla, Microsoft, Nvidia are killing it. Why not invest some money in the stock market? That’s what I am doing, I have so much stuff I want to buy for my house and don’t want to spend my savings….so I decided to put it in tech stocks.

In the northern beach areas of OC I feel like I’m starting to see more listings and some price cuts as folks get the sense that this is not sustainable.

Also, with Newsom having decided to change the reopening standards this week to ensure the economy stays closed until after the election, it’ll be interesting to see how this plays out. I know there are lots of retired people who were living on the income from a rental or two that have been absolutely screwed by the eviction moratorium as renters who were laid off, even if they were working again two weeks later, just stopped paying. The idea that they can all stop paying rent or mortgage for a year with no impact strikes me as folly, but this is all so artificial now that it’s hard to read which way is up.

Anybody that owned a home over the last decade in California made tons of equity. Won’t people cash in on their equity by selling instead of just sitting around not paying the mortgage and waiting for the bank to take over their home? The market is hot right now, everything is selling. Even if they don’t want to sell right now because of COVID- people looking to cash out before loosing there houses should have plenty of time to arrange things, no?

RedondoCondo: I don’t think issues stemming from the pandemic (or plandemic depending on your viewpoint) have been felt significantly for many homeowners, particularly professionals. Therefore, I’m assuming many of them have no immediate need to sell. However, I have to wonder if they will be safe in the long run. It might be just a matter of time before they (I?) start losing jobs as well. Sure, mostly only lower-level workers have felt the sting so far. But maybe some (many?) professionals are next… Ultimately, many professional jobs are closely intertwined with retail jobs in some capacity or another. For instance, if a large retailer goes out of business, they no longer have a need for accountants, advertising firms, lawyers, HR people, etc. I think it will be a while before we know exactly where this all will end up. Selfishly, I would like for there to be a circa-2011 style recession whereby I can keep my job and I can scoop up a decent place to live for an affordable amount of money. I know it probably wont happen, but I can dream.

Investors are currently unloading units by selling to frenzied buyers taking advantage of low rates. They know market conditions are not favorable and are exiting at the top.

they don’t have a ton of equity if they have been draining the equity out over the years and constantly refinancing like most of the people I know.

You bought a house 10 years ago and refinanced and pulled out money. Now you rent it out for a big monthly profit and with the money you pulled out you buy another house.

In a couple of years you refinance to push your monthly payment down. Both houses appreciate over time but the first house provides you with a profit each month now and is paid off by a renter.

Holy smokes…

Thank you FED for making it so easy on homeowners to build wealth! On the other hand it’s unbelievably unfair to renters.

If you’re planning on living off of your property you better be prepared for every possible scenario. As I was working yesterday I was noticing all the homes for sale and at least a third of them had sold signs on them. 2021 is going to be interesting.

Houses are selling like hot cakes to well qualified buyers.

Zillow is telling me my value went up significantly since Q1…..

I made a lot of money with stocks but I have a hard time keeping up with those gains that my house is making…..the market is smoking hot!

M is celebrating the recent tech stock gains. So am I.

Apple

2019 – $200/share

2020 – $500/share.

However, back when I was M’s age, The Renowned Bell Labs was spun out to become

Lucent. What could go wrong?

1996: $45/share

1999: $110/share

2002: 76 cents per share.

Many others tech stocks had the same outcome, Oracle, HP, Agilent, Sun

Moral.

Don’t put all of your eggs in one basket.

Cash in your chickens while the chickens are good.

Bob, like almost always, I agree with you.

Back in the dot com bubble tour taxi driver was telling you how to get rich quick. Everything with “.com†in the name was quickly going up in price.

Today, the Robinhood / millennial crowd is buying Tesla/Apple stocks. However, is everyone including your grandma buying those?

Warren buffets portfolio shows he is heavily invested in Apple but I haven’t heard that from your avg Joe Schmoe. Especially during these times where savings rates are going up. The avg guy is lucky to still have a job.

My entire point is that I doubt that too much stupid money is flowing into tech stocks at the moment. I think it’s driven by money printing and excess cash in the market. No doubt Tesla is in a bubble but the market can stay irrational longer than you can stay solvent. As long as you are not doing leveraged trading I don’t see an issue with putting a significant amount in tech stocks. Especially leading up to the election…..what happens then is everyone’s best guess.

One thing is for sure, when the music stops the stupid money panics and sells. Nothing goes up on a straight line forever. I enjoy looking at my tech stocks and 401k….insane gains Since the March lows. The problem with bears: they don’t buy…..they always wait for a lower low and if it goes up they hope for a bigger crash.

The better way is to dollar cost avg in stocks and forget about market timing….and for RE, you buy as soon as you can comfortably afford it in places like SoCal.

I guess my point above is that buying a primary home should be a priority.

If you don’t own a primary home now, and own tech stocks or bitcoin, it is probably time to sell enough to purchase a primary home. Having a mostly fixed cost associated with a home and diversification are primary reasons.

Stocks can drop to zero forever (Lucent, Enron, General Motors, United Airlines) with bankruptcies. A primary home will never drop to zero. A home may drop to underwater levels but over history, they have recovered within 10-15 years and you are immune to rent increases forever.

Unless you have enough cash to rent for 30+ years, it will be difficult to ever retire comfortably without owning a home.

The question is: Should you wait until the housing bubble pops? The stock/bitcoin bubble will pop sooner and faster than housing so don’t have your eggs in one basket. Look at 2008 or March 2020 as an example.

The bitcoin bubble??? We have been in a bear market since 2018. We just started a new bull cycle for bitcoin. It’s too early to call it a bubble. Bitcoin will trade over 100k in the next 1–2 years. It’s only at 11-12k at the moment. There are a ton of gains to be made.

@Bob

Just cashed in my chickens on Rocket Mortgage just before the close of the bell today. Another 70% return in under one month. Unbelievable. Taking my gains and putting them on WLMT now. A little late to that party but plenty of room to grow for that strong stable company. Too much speculation but then again I said that 2 months ago before I went in yet again. You just can’t lose in this market. Anywho I’m done playing with fire, hopefully I mean it this time. I’ve made millions this year by far the best year I’ve ever had and to think I haven’t touched a single screw or nail flipping homes. That was a good business in 2019 but 2020 is all stocks. 2021 crypto boom? 🤫😈

“Home prices remain stable in the face of a global pandemic”

That is a joke. Prices are going up so fast. If you don’t have a large down payment, sellers are just throwing your offer in the garbage can. I would hate to be a renter.

@JT: What price range are you referring to when you say that “prices are going up so fast?” 350k to 750k? Which area in Southern California?

I’m not seeing this in the 1 mil plus ranges in West LA/Valley area. I’m seeing inventory increasing and price drops.

Exactly, SDMan. Prices are not “going up so fast” everywhere. In select markets and in select price points, sure. But overall, housing is up with inflation and that’s about it. The $1M+ market is taking a dump. It’s only a matter of time before that trickles down to the lower price point. If the $1.3M house drops to $1.1M, then the $1.1M house has to drop to $900k. And on down it goes. This is EXACTLY how the 2008 housing bubble popped – it started at the top, people (like M) ignored it. Lower priced homes kept climbing as higher priced homes were dropping. And before you knew it, even the lower priced homes started dropping too.

This is how boom/bust cycles work, and it’s designed to be this way. Those in power want and need as many suckers (like M) as possible to turn into true believers (housing always goes up, fear of missing out, etc). Then it crashes, the banks get a bailout, and huge corporations get to buy foreclosed homes for pennies on the dollar. Rinse and repeat. People need to be smart and time the market (it’s called a market for a reason), and not buy into this ridiculous notion that the Fed cares about home values or homeowners. Idiocy!

“People need to be smart and time the marketâ€

Alright genius, let us know when you buy so we all know how we should have done it…..

Best of luck to you Einstein!

South Bay beach cities, as well as Orange County beach cities are selling like wildfire with big big price tags … millions.

The clock is ticking on these when time runs out- Home Debtors are Fooked, especially if you live in CA.

-The Fed is flooding the system with easy money and interest rates are at record lows

-4.1 million Americans are in forbearance so these homes are off the market until things resolve

-Few are selling given the pandemic, so inventory is even lower than it once was

-Home is now the office in many cases sucking funds out of commercial real estate into the residential sector

Remember, great weather solves everything, especially if you are homeless

please stop talking about the non-existent “pandemic”.

it is a SCAMDEMIC, a PLANNEDEMIC, a hoax by the people

who want a one world totalitarian government. it is just the

normal, annual, seasonal flu that kills about 1 in 1000 people.

no “SARS Covid-19” virus has ever been isolated and identified.

the inventor of the Gold Standard PCR test, kary mullis, says

the test is “useless” for any virus, much less a corona virus.

Through FEAR, you can control most people and you can implement the most draconian forms of control to the point that people willingly trade freedom for safety; in the process, they lose both. Fear is what will bring the most fascist form of government which will bring the most concentration of wealth and power in the hands of few tech executives.

Power corrupts and absolute power corrupts absolutely.

The markets and politics are moved by two forces: greed and fear. If you understand these two forces and how they are played you understand almost everything. FEAR being such a strong component in the politics dynamics, and this year being an election year, you can understand a lot of what is happening with all the lawlessness in the big cities and the corona virus politics. A lot of this will tone down after November unless the globalists regain the power.

Actual number of Covid deaths in the U.S. (i.e., deaths of people who did not have pre-existing conditions) is under 10,000: http://www.freerepublic.com/focus/f-news/3879022/posts

A shark ate a man who died on covid.

If you have stage 4 cancer and have covid they will call it a Covid death.

They politicize the shiat our of covid until the election. Then magically covid will be gone.

“They politicize the shiat our of covid until the election. Then magically covid will be gone.“

Kinda like the brown-skinned caravans of 2016 that magically disappeared when trump didn’t need to scare anyone anymore after he was elected.

No, those caravans couldn’t get far since they were stopped at a wall and by armed men with automatic rifles at the border.

If these caravans don’t scare you then you haven’t been in Europe in the last 5 years. They call these people “rapefugeesâ€

Europe is turning right wing very quickly since they have massive problems with immigration. Be happy and thankful you live here….

Rich – you must be a CNN type always watching the lying mainstream media. If you actually dug for the truth, you would find that these migrant caravans were the lowest of the low looking to take advantage of a situation and other people’s resources. The people of TJ even disliked them and it caused a bunch of unrest in the area. The people in these caravans spiked crime, tensions, left trash everywhere, etc. Why on earth would we just let them in to effectively steal our resources and disrespect our lands / people. These are not good people. Yeah maybe some good ones were sprinkled in, but we have laws for a reason and people need to be vetted. This has nothing to do with skin color. I have no problems helping people if they take the initiative and want to be proud americans. I have great respect for those who come to this country and do so the right way and follow our way of life. On the other hand I have zero tolerance for those that don’t and won’t take any personal responsibility. A rising tide lifts all boats. That is what made America the greatest country on the planet.

Incognito,

Great post! So true….

I have seen it in Europe….the Muslim immigrants/caravans have no interest in adapting and accepting western values. They get free healthcare and get unemployment money. They came without papers in many instances and have now multiple ID’s, collecting unemployment under several identities. This isn’t a conspiracy theory….it’s the sad fact that people have no problem coming to your country and finding ways of abusing the system instead of being thankful that you gave them a new home.

It really is disheartening. I was born an American but my household is 75% immigrant. Legal immigrants. We’ve done everything the right way. We’ve waited, kept every law, paid for it and so on. When you do it this way, you agree not to be a burden on society, to not use government benefits. You can’t. The sponsor (me) agrees to support the immigrant. That’s how it should be. Legal immigration is generally a good and productive thing for America.

So, to see politicians (Democrats) encouraging lawlessness and the spending of legal immigrants’ tax dollars on things they themselves are not even eligible for is frustrating. California is insane when it comes to illegal immigration. Completely insane.

Depending on which biased source you are reading depends on the number of Covid deaths.

The ridiculous ones I’ve seen lately are:

1) MN man gets on his Harley and bikes to Sturgis.

2) Bikes all the way back home and finds out he has Covid.

3) Dies in the hospital on a ventilator due to Covid.

4) Right-wing media claims he had a pre-existing condition so it shouldn’t count as a Covid death.

No idea on what the Pre-existing condition was but if he was well enough to ride his Harley to and from Sturgis, the pre-existing condition shouldn’t count. Or stupidity should be the cause of death.

roger mason: I think that there’s an adequate amount of data to debunk the rumor that PCR tests can’t detect the virus. Kary Mullis has been dead for a year, by the way. While I believe you may be correct that the SARS COVID-19 virus has not been isolated (a gold standard to which the accuracy of the PCR test can be compared), I think there exists an adequate amount of evidence to suggest that the PCR tests for COVID-19 are pretty accurate. Reportedly, the leading PCR tests have been tested on SARS-CoV-2 RNA from infected patients, isolated, and grown in cells in the lab. In summary I believe that COVID-19 exists, and I believe people can and do die from it (though most don’t).

All that said, I think shutting down the economy, shuttering schools, wearing masks, and all other related measures are harmful to everyone, will do absolutely nothing in the long run to stop infection in most people, and are a complete waste of time. My guess is that most people are going to be exposed to COVID at some point or another, shut downs or no shut downs. All the shut downs are doing are delaying the inevitable. We can’t stay shut down forever, and the virus isn’t going anywhere; what difference does it make if you get the virus now or in 6 months after the showdowns end?! Ultimately, the outcome is going to be the same (or maybe worse, since everyone will be older!). We might as well let people carry on with their life as usual and let whatever happens happen. It’s going to happen either way.

^Covidiot

I’d rather be a Covidiot than a Covid Nazi:

http://www.enterstageright.com/archive/articles/0520/covidnazi.html

Is a SoCal tax trap brewing?

ATH RE prices plus a future property tax hike to cover budget deficits could put a strain on household budgets. This, at a time when employment, incomes and spending are in decline, could be a knee on the neck of home prices. Just a thought.

Prop13 is the best thing since sliced bread. Similar to bitcoin. I would actually argue that one bitcoin is even better than sliced bread. I expect one bitcoin to be worth more than 110k in the near future (1-2years).

Back to taxes: we must keep prop13 in place otherwise renters will have a very hard time….landlords will pass any tax increase on to renters.

Renters are the ones that are hit the hardest by this low interest rate environment.

Rents are a product of supply and demand, and ability to pay. NOT costs of the homeowner. You act as if homeowners are charging less rent now than they could otherwise get because their costs are low. Lol just stop. They’re charging the max that the rental market can get them. If their costs go up, it’s not as if renters will suddenly have more money to pay rent. If Prop 13 goes, then many homeowners will be forced to sell, which would drive prices down, which would drive rents down (because then many renters would just buy instead of rent).

Prop 13 inflates home values and helps homeowners tremendously. It DESTROYS renters. You used to post this very same thing. Now that you’re pretending to be a homeowner, you’ve done a 180 on EVERY SINGLE stance you once took.

Honestly, your presence here is a distraction and the good doctor would be wise to ban/block you. You’re a troll and your posts only serve to incite people and create arguments.

Josh,

Supply and demand. That’s correct but you have to keep in mind we have a housing shortage in SoCal. You do know/acknowledge that, right?

So, the limited supply Is met by high demand for cheap housing. Renters who cannot afford to rent close to work have to move further east. I know people in SoCal that pay more in rent than I do for my house. (Because they don’t have a large downpayment).

To say that a landlord doesn’t pass higher costs on to a renter is ludicrous. Have you talked to a real landlord before and asked them how many people call when he has a vacant unit for rent? Hint: it’s much more than one.

Repealing Prop13 is bad for renters and homeowners. Higher taxes are almost never a good idea.

Yes I’ve talked to many landlords, and I was one. Landlords charge what the market will bear, period. Your example of limited supply has NOTHING to do with landlord costs rising. Supply doesn’t tighten if landlord costs go up. And demand won’t go up either. There is no magical money that renters will be able to fork over to landlords for their additional costs. So if prop 13 goes, landlords are FOOKED. Many would be forced to sell and property values would plummet. That’s not even including all of the vampire baby boomers who are benefiting from capped property taxes while younger people pay more.

Josh, you nailed it.

If your hope is that prop13 will be repealed you are setting yourself up for failure.

You were a landlord in the past??? Since you don’t believe that landlords pass higher taxes on to renters it’s no wonder you are no longer a landlord….

I believe in the idea behind Prop 13, which was to keep homeowners from being blasted out of the houses they struggled to buy and pay for, by escalating property taxes. I was an adult when that law was passed in the late 70s, and remember well how many people, elders in particular, were driven out by the double-digit inflation of the era.

However, the law definitely needs to be re-jiggered, for as it is, it is extremely unfair to those not fortunate enough to inherit a house in CA. The law should stand, but no one should be permitted to inherit a low tax base. When the house changes hands, whether through sale or inheritance, the taxes should be re-assessed. The idea behind the law is to protect those who bought the place, not give their heirs an outrageously unfair advantage over a buyer who wasn’t fortunate enough to inherit it.

You know Dr. Housing Bubble, I’ve been a fan of your blog for a while. But its been bit of a chicken little if everyday calling for a housing crash. I use to agree with you, and I still like your reasoning, but the thing is the banks, feds, and every who else doesn’t want housing to fall, and will do everything to stop it. Other than the banks becoming insolvent. I don’t see too much changing with housing. Corrupt propped up market. Even now with all the stimulus given, just going to cause more inflation and guess what house prices are going to go up. Maybe 20 years ago housing would have crashed, but now too the stock market and housing are too over manipulated by the feds.. Fact. Thank you I’m still a fan and enjoy your content, but hopefully rethink or everyday gloom and doom.

I agree with your statements of market manipulation but housing is affected most by stability of employment and income at all levels.

BINGO, and according to that statement, a CRASH is coming, especially in CA.

Employment, we just lost 56 MILLION jobs that are going to take 10yrs to come a back.

Incomes- with inflation, incomes have lagged for years, that’s why the FED lowered rates to historic lows. The jobs of the future will be 40k and less.

Thank you for proving that a crash is coming.

Go outside, enjoy the weather. Yes, thats a Housing Bubble off the coast of CA, pay no attention to it.

Weren’t you perma depression bears saying we will have 25-30% unemployment in the US? What is it in reality? Like 8.4%? Nothing burger?

M, I wouldn’t put too much faith in that number for unemployment (8.4%).

I would trust more the numbers of those actually collecting unemployment, which are closer to 20%.

5 star post! I came to the exact same conclusion!

What have I been saying for years on this blog. The Fed holds all the cards and can generate any outcome they desire. Anybody who thinks they can outlast or outsmart the Fed is delusion. Just like anything in life, trying to time markets rarely ever works. Have a long term when buying a home. Buy a place you can comfortable afford, enjoy your home and tune out the noise. Do not over complicate this!

W

The crash never happens until all are convinced it can not.

We must be far far far away from a crash….

The internet is possessed by doom and gloomers who predict a crash next year.

(It’s always next year)

Most house materials went up 300-500% in a matter of months. The inflation on housing is going to be massive for 4 reasons: higher cost to build, massive shortage of materials will cause very little construction or unfinished homes, very low interest and very low supply. After a big jump in price, the FED will be forced (doesn’t mater what they want) to raise interest rates…A LOT!…. That will cause a crash in prices.

People thought that they can all stay home (because of COVID), collect government checks and everything will stay the same. And, if trillions of dollars printed were not enough, Pelosi wants to spend another 3.4 trillions; whose money???….Unfortunately, money can not buy too much if they are debased….and she is not happy to debased further the dollar with just 1.2 Trillions, she wants 3.4 trillions (my way or the highway).

All prices will go through the roof, but house prices (after a spike) will eventually crash because they depend on financing.

Regarding: interest rates have to go up due to inflation.

That’s what they said In Europe and the US After the Great Depression/QE/money printing. The opposite happened. Rates kept declining.

Raising rates crashes not only housing but the entire economy (consumer spending and business loans are driven by lower rates)

Maybe this time is different but I believe we won’t see significant higher interest rates in our life time. But if that’s the worry on the horizon I am glad to refinance soon at 2.75% for the next 30 years.

material costs

I could not believe cost of lumber on a recent home depot project.

I built a 6 foot high fence, on a span of 15 feet and used treated wood for weather resistance. for one 4×6 and two 4×4 and a few 2×4 and some 1×6 panels, I ended paying over $500 in material.

That’s crazy.

I need to rebuild a fence also. Maybe I’ll wait until this insanity stops.

“After a big jump in price, the FED will be forced (doesn’t mater what they want) to raise interest rates…A LOT!…. That will cause a crash in prices.”

This makes sense but the Fed is run by the big banks. The mortgages today are under 3%. Does a bank want to service a 2.5% mortgage when they are paying 4% for savings accounts?

Likely, the banks don’t own the mortgages. Fannie and Freddie own them and the taxpayer is on the hook. However, nobody will be motivated to sell or foreclose on a 2.5% loan when they are making 4% in the bank and inflation will theoretically also lift their pay.

If interest rates go up, I would be motivated to hold onto my house with a low mortgage rate and enjoy the ride.

If interest rates and pay go up, rent will likely go up. Landlords would be motivated to hold onto their rentals.

The US debt would eventually be inflated away.

However, high savings rates would lure people away from stocks and the stock market may plummet or level off for a long time.

I think higher rates would be a good thing for most savers financially.

It would be a repeat of the late 80’s when CDs were paying 12% and my parents had a 1960’s house with a 6% fixed mortgage along with Prop 13 protections. Their house doubled in value but they had no motivation to sell and move and take out another mortgage at 15%.

You forgot that when rates go up, house prices go down. Remember what happened in 2018? Rates went up by 2% and the whole housing market was struggling. And when valued prices go down, people panic, especially those who just bought. The banks might even ask for more collateral. It’s a downward spiral and this time the Fed might not have any choice.

That’s absolutely correct. Rates go up, house prices go down.

I doubt we will see 5% rates anytime soon. In fact, we just hit another low in rates. Until inflation goes out of hand, we won’t see higher rates.

3 years ago when we bought our house I was so worried that we were making a mistake and buying at the top of a market peak. But even the modest gains over those years means a 20% crash is nothing to worry about. Now we are refinancing and our payment will drop by $700+ per month. Fact is, prices move very slowly in housing compared to the stock market. Declining prices may come next year, but the bottom could take 4-5 years to hit. If you are buying to live, save up and do it when you can afford to. If you are buying as some sort of get rich investment, wait for prices to drop and park your money in some other appreciating asset while you wait. You might be waiting a while.

Great post Mind1! Totally agree.

The only thing I would question is:

“ park your money in some other appreciating asset while you waitâ€

Sitting in cash is a losing position. What other options do you have? The stock market has been fantastic over the last ten years. We had a little hiccup in March but are back at ATH’s now. However, perma bears who wait for a housing crash don’t believe in the stock market either…..where should they park their money?

Maybe bonds or a CD….I think a CD pays now 0.25%.

I guess, Good luck waiting for a crash and sitting on cash…..

I’m not sure he said anything about cash. In any case, it depends what the money’s purpose is. Do you keep your emergency fund in stocks? Look, Tesla is down 8% today and I haven’t even had lunch yet. Cash is the place for a home purchase, unless you’re planning on waiting a long, long time (some here clearly have been). Ally no-penalty CD is at 0.75% and dropping. I locked in a 0.9% a couple months ago. There are no ideal options right now.

“Declining prices may come next year, but the bottom could take 4-5 years to hit.”

That could be, and when that happens you want as much cash as possible. Most of my home purchase cash was in one of my businesses, which I recently sold. Now it’s mostly in a CD. It’d be reckless to stuff that into tech stocks right now. Stocks are for long-term goals, not home purchases – unless you’re a gambler or maybe you live in California and will actually have to save for 15 years to have a downpayment. 😉

“Mostly in CDâ€

Man, good luck! I would put at least some money in the stock market. We just had a nice dip in tech stocks. Those are good opportunities.

The stock market is for long-term goals, like retirement, and I take full advantage of it for that purpose via mutual funds every time I pay myself.

Turtle,

100% Boglehead

Okay that makes me feel better. At least for retirement you are investing in stocks. I think you will be fine. Eventually you will see a dip in housing. My hope is you will but then and not wait for a deeper dip and miss the boat. Best of luck!

Thank you. I’m not waiting so much for a massive drop as I am simply to be in the position you were, which is to buy what I want on my own terms. The timing depends on my savings and/or a price drop. I won’t do anything worse than 50% down and 15 years because I abhor debt. I intend to either live nice in CA or live nice in TX. I won’t settle for less and buy a crap shack for a fortune. I’ll only buy something I love and keep it forever.

@mind1 give it time, prices are going below where you bought at.

Funny how the renters wanting to buy a house are experts in market timing. We (homeowners) must have been doing this all wrong

M: Funny how the renters wanting to buy a house are experts in market timing. We (homeowners) must have been doing this all wrong.

You’re not a homeowner. As has been amply proven.

Well technically, the lender still owns part of it.

When you purchase a home, the lender will give you a loan with a 30y fixed rate that is lower than real inflation. However YOU keep all gains/appreciation on the entire house value!! Buying a house is a no brainer! It took me a while to get it but I am finally on the right side!

M has proven to be a tool. That’s about it.

@whatever

And somehow My guess is we will never see that Proof…

It’s possible, but my house is where I live and I don’t have to sell it to realize any gains or losses. If prices start to decline next year due to the end of forbearance programs, it could take until 2024 to hit bottom. The last decline lasted 2006 to 2011. I was worried in 2017 about the peak. If I had decided then to wait for a crash it could have been 7 years to bottom, and probably $250k in rent down the drain. Don’t try to time it unless you are on your 2nd or 3rd property, just buy when you can afford the payments.

At the moment there are still gains so I’m taking advantage of that to get a better rate on my refinance by having better LTV. If conditions are still favorable in 2 years, maybe I’ll sell and trade up, if not then I’ll stay and build onto my current home. Or maybe I’ll buy a cabin up in big bear while prices are low.

Are house prices likely to rise dramatically between now and next summer? At least in the UK with the end of forlough, end of stamp duty and Brexit?

Ideally I would like to sell my house after Easter and buy a bigger more expensive one at the same time. If house prices were to rise I could still afford the move(Though not ideal) but would struggle with a big rise in prices.

I feel like it would be a gamble at the moment. Also the timing of now is bad for personal reasons.

cromwelluk: If anyone could tell the future, they wouldn’t be here. They’d be too busy counting their money!

@Responder except for “New Age.” He’s “made millions” this year yet finds time to come on here and tell us how he can predict everything that’s going to happen. Lol.

Ha!

Your right it’s just I’ve had a lot of good advice on here that has helped me save money and have a less stressful life.

Josh, when you actually read/understand NewAge’s posts then you would know he’s the real deal and gets it. He doesn’t shill anything but he is open about what he invests in and why. I appreciate that more then most other posters that make blanket statements without any substance. You can actually learn from guys like him and a few others.

@Josh

Sorry for the late reply, been busy counting my money. Anywho, I’m not sure what your reasons are for coming onto this blog but it sounds like there isn’t anything that comes out of your posts that are worth lint. I don’t have to sit here and defend myself like millennial does (although he doesn’t have to either imo). I’ve been encouraging everyone to dig up my posts like guys have with millennial but you guys are too lazy and you’ll probably conclude what haters like you are deathly afraid of which is that I am absolutely winning. Every time I make a move, I post it on here well before it actually materializes into profit. It kinda ties to why I’m on here. I read what everyone says, I debate with differing viewpoints and I make an investment prediction that I can hold myself accountable to. I’ve also been an active reader on this blog since my college days back in 2011ish so there’s a bit of nostalgia to it too I suppose. The thing is, I originally came to this blog to read and learn and in the meantime, I’ve also read and learned on my own and thru some hard work, perseverance, creativity, and a dash of luck, I am no longer that poor college student that I was when I joined this discussion a long time ago. Now, I feel like I have experienced quite a bit and might have something to offer people on here so I like to contribute every now and again. Of course, posters like you have made the comments a bit of a cesspool but that’s okay because it’s safe to say that nobody really cares what you have to say. Individuals that truly want to become professional investors read posts worth the time and effort it took to generate them. Individuals that want to become professional losers read what good ol’ Joshy boy has to say!

New Age: I’ve been encouraging everyone to dig up my posts like guys have with millennial …

Why would I dig up your posts? I don’t suspect you of lying.

New Age: … you’ll probably conclude what haters like you are deathly afraid of which is that I am absolutely winning.

No hate. No fear. And I don’t mind if you’re “winning.”

I don’t care if a person’s a bull or a bear. I don’t care if they’re winning or not. I only mind if they’re lying.

M is lying. As has been amply proven.

From May of 2019 when I was still a “wannabe flipper”

New Age:

Inflation will be the biggest factor in the housing market in the next few years. You cannot ignore it and if you do, you will pay the price in opportunity cost. What most people including millennial fail to understand is that what seems like a sour deal on the outside is actually a steal once you analyze the price with inflation in mind. I just closed on a flipper in Riverside for $400K, about 5000 SF on a acre lot with mostly usable land on top of a hill, three stories a HUGE overhanging deck with 360 degree views of lush forest and city lights. It needs about $70K of work to get it up to it’s maximum potential but it could easily sell in this market for $750K to $800K. My parents 4000 SF cookie cutter house in a standard neighborhood in Riverside peaked at $750K in 2006…that’s almost $1M today. THAT is outrageous. The house I’m sitting on now is a bargain by comparison but let’s assume the bubble deflates which I admit is looking like the case. It’s not overnight so there’s no rush to frantically unload it. On it’s worst day I can put it on the market for $600K and sell it in seconds. Boo flippin hoo. You can’t tell me that there’s no money to be made even in this market. That’s why I ignore doomsdayers and keep racking up my money.

Millenial:

New age, your last post was very telling and is typical for recent buyers. Recent buyers often go on the internet and seek confirmation that buying at the peak of the market was a good purchase and the right choice.

We all have to own our decisions but it can help if someone on the internet tells you good job, I guess. Best of luck to you and thanks for sharing. You did great. Keep buying.

New Age:

I don’t need confirmation from anyone on the internet about my investment decisions. The point I am trying to make is that there is money to be made in this real estate market despite a deflation in assets in the near future. An epic rise brings on an epic fall but a slow and steady rise deflates slowly and steadily as well. I will keep buying deals and steals not just any property and I’ll keep making money while you sit on the sidelines rotting your money away in the bank for 0.5% interest.

Millenial:

You are a flipper in the worst market for flipping. Terribly overpriced. You probably never got a career going and now you have so much time and frustration on your hand that you need to tell us on a housing bubble blog how your house flipping business is making money. Sure! Keep buying! It’s a great time to buy!

New Age:

It’s ok to feel bad about missing so many wonderful opportunities over the years since you’ve been crying wolf since 2013. It’s not OK to take out your frustration on people you wish you could be like. That doesn’t do anything for you, it doesn’t turn back time, the only way to move is forward but your crippling fear is holding you back. Maybe you should see a therapist.

Millenial:

Does this look like I am unhappy?

Let’s see:

Six figure tech job

No debt

800+ credit score

Made a killing in crypto (5,000% in 2017 on litecoin) and stocks and sits on large cash balance

Can buy a nice house now but waits for a nice correction to pick up a Dream house on the cheap cheap

Currently rents 15 min from the beach 2b/2b for under 1400!!

Continues to make fun of RE cheerleaders who try so hard to lure in the last sucker

Dude, i can’t lose by winning. You on the other hand….

New age Says “Buy now†because he just bought a flip.

Buys at the peak of the market and seeks confirmation on a housing bubble blog to feel better about himself.

Josh:

It all makes sense now. New Age bought a flip at market peak, got nervous and Googled “housing bubble†and found his way here. Now he’s trying desperately to convince HIMSELF that he didn’t just commit financial suicide by attacking people on a housing bubble blog website. Classic.

Anyway, you better get to work and sell that thing quick. The crash is underway and the only way your prediction of a 10 year selloff and 50% drop comes true is if EVERYTHING in the economy stays the same. The chances of that are slim to none.

New Age:

@Josh I’m been on this blog for quite some time. If I was panicking, believe me I wouldn’t be on a blog lying to myself I’d actually be mitigating my losses actively. I’m just here to provide some experience and insight.

Anywho, since you’re all probably wondering, the house is almost complete! Should be done next weekend just in time for selling season. Total investment: $525K with a few off market offers of $650K but I want at least $750K for it so I’m in no rush to sell. Not bad for three months of work! Now what were you guys saying again? I didn’t quite catch that…

Millenial:

New age is so full of shit. All the flippers I know personally don’t just hang out on a housing bubble blog to “share their experienceâ€. First you pretended you are just here to tell us this time is different and that the market isn’t overpriced. Now you that we know you are actually a peak buyer and wannabe flipper you have lost all credibility. Who buys high and tells everyone in 500 posts that it was a good purchase?! Your panic screams through your posts.

Fast forward to today and nope, no panic on my end.

People are not fleeing the cities except in a few pockets.

If you haven’t been living under a rock, you’ve probably heard the narrative that cities are dead and that white collar workers, now unburdened by the ability to work from home, are fleeing to the suburbs as fast as they can. Logan Mohtashami, lead analyst at Housing Wire, explains to Real Vision’s Ash Bennington why it is nothing more than an interesting narrative. He goes on to add that, aside from a few pockets in New York and San Francisco, the relative strength in the suburban housing market is being driven by the only factors that matter — demographics and mortgage rates. Bennington and Mohtashami also drill down on the relationship between bond yields and mortgage rates and the knock-on effects into housing demand that you could see depending on different scenarios for those rates. Filmed on August 26, 2020.

https://www.realvision.com/mohtashami-cities-arent-dying-demography-and-rates-drive-housing

The FED…..read this….so unfair for renters and no end in sight.

It benefits homeowners greatly….why torture yourself? If you can’t beat them, join them. That’s what I did. I switched from bear to bullish-long-term.

https://www.ocregister.com/2020/09/02/feds-mortgage-buying-spree-at-1-trillion-with-no-end-in-sight/?fbclid=IwAR3Dnjx767oCAx8W3T1zEc85RJedlAlOOsSqqv8AWh4BY37bMr5ggCuhqyg

Best move I have done so far!

You are a tool and a liar.

M… I have been reading this blog for years and I have never commented one time. I have watched people eat you alive for saying that housing will not bust. Your comments have convinced me to buy. Just got my offer accepted. There is no way the Fed does nor deflate the value of our dollar. Cash is a bad investment. I have been hoarding mine for the last 4 years. Corona has showed me two things, 1. This Fed will stop at nothing from inflating assets (housing included) 2. The gap between Rich and Poor is getting larger. I chose my side. All others will be left behind. Cheeseburgers are going cost $40 in a few years.

COnGRATULATIONS!!!

This is awesome! You won’t regret it….the opposite…..housing will continue to push higher and what better hedge is there against inflation?

Hope the transaction closes smoothly and your got yourself a freakin fantastic rate!!

…..the chances that rates continue to decline are higher than rates going up. In a few years you might refinance at a lower rate. How cool is that? Your piti is already fixed for 30 years but you have the possibility to the reduce it even further thanks to lower rates. No better way to say “F U inflationâ€.

“Your comments have convinced me to buy.â€

Haha, this is hilarious. Which person were you listening to? Millie or M?

This same person flip flopped this year. So obviously you weren’t reading his bearish comments for the past four years in which He used to scorn us all, using the derogatory term of ‘Real Estate Cheerleaders‘ for thousands of posts.

I sure hope this is sarcasm. M did not buy a house, man. If you have any sense, find a way to back out of the deal, otherwise you’re buying at the peak of an impending crash.

But honestly, the more suckers like you that jump in, the better it is for savers like me ready to pounce once this crash happens. Less competition.

Josh,

Why do you think I didn’t buy a house??? That’s the dummest thing I’ve ever heard. What motive does someone have to post about a made up story like this? Do you hear yourself?

I think it’s pretty pathetic that you advise someone to back out of their house purchase just because you are jealous! People buy houses daily and they are happy with it. You are not a sucker if you invest in real estate. This is were people raise their families, have beautiful memories and build equity. It’s also an excellent inflation hedge.

You on the other side believe you can outsmart everyone and time the market…..come on man….give me a break.

Remember when you called a peak in Q1? Since then my house appreciated – according to Zillow. Now you call a peak again in Q3. Are you just going to move the peak every quarter now? In a few years we will hear this is the peak in Q4 2024.

I have lived in SCal, a long time. Owning a house is one of the few ways to accumulate wealth, but it has become a game like poker. The odds favor the house, and over time The House will make the most money. People believe housing in SCal is the way to make money. Because few jobs pay enough here any more. But the game is changing, no middle class person wants to live here anymore, they are exiting en mass like never before. In 5 years Southern California, will start wanting to rejoin Mexico. I speak a little Spanish and I’m O.K with that, read La Opinion, compare it to the LA times. In Mexico you have the very rich and the very very poor, and the Cartels. Southern California is doomed. Take a look at Mexico City, that is SCal future.

FLASHBACK FRIDAY

for those of us who are old timers on this blog, who remembers

REAL HOMES OF GENIUS?

Here we go

For just a little over $1M you too can own a crapshack in the hood of West Adams.

Hope of daily ghetto birds (police helicopters)

Steal this property!

https://www.trulia.com/p/ca/los-angeles/2134-clyde-ave-los-angeles-ca-90016–1012862443

I remember the Real Homes of Genius.

At least this house doesn’t have bars on the windows, trash cans out front, and the nice granite counter tops in the kitchen should stop any stray bullets.

“If I Had a Million Dollars.” – Barenaked Ladies – 2006.

I wouldn’t buy this house. It may be that I’m old or possibly that it sold in for 550K in 2014. Did it really double in 6 years?

However, according the Zillow, at today’s mortgage rates, the PITI would be about 5K/month. It was rented recently for 4300/month.

You could buy it, and rent out the ADU for $1500.month and beat renting in that area by about $800.

Also, at $540/sq ft, isn’t this cheap?

Maybe I’m just an old optimist.

I agree with, Bob. That area is actually pretty nice too. And I’m pretty sure it’s not even West Adams. A very central location close to the 10. Kaiser has a big hospital right there. The ADU makes the price look better. There are many many other houses I would say are overpriced in LA before I picked this one out, especially since it actually has curb appeal.

I remember RHOG from back in the old days. There were a few homes profiled that a true genius ended up buying. I remember we were all laughing at the small shitbox in Manhattan Beach with all the trashcans out front. What idiot what actually spend 700K on a dump like that? That idiot had the last laugh.

I was a little surprised that Street View didn’t show power lines going every which way and an auto shop across the street. Oh wait, look at picture 27. I count six lines, three of which go directly over the back yard!

Holy cow, buyers! Look at a $1M house in Texas or Arizona for some perspective. Anybody spending that much money to buy this house is clearly unaware of the world existing outside LA. This house would be considered a total undesirable dump at $200K in TX. It’s hard to understand how people value pleasant summers at $800,000. They just must not know.

https://www.redfin.com/TX/Frisco/5150-Normandy-Dr-75034/home/33058167

https://www.redfin.com/TX/The-Colony/3720-Millbank-75056/home/109680122

^^^ This is where white collar Californians are migrating to Texas as their companies relocate. Real estate agents are calling it Orange County 2.0 for obvious reasons. A much nicer home for half the price and more disposable income is a no-brainer for many.

I know that area, and of course with Kaiser nearby and other new developments nearby like The Ivy in Culver City and The Cumulus (with a Whole Paycheck Foods) at LaCienega and Jefferson help to spruce up the area.