Coronavirus impact on California housing market: Escrows tumble and 1 million Californians file for unemployement insurance.

So much for COVID-19 not having an impact on the housing market. It is mind boggling how some housing bulls are so locked into their delusional world that a global pandemic that is putting billions of people under lockdown somehow seems to be good news for housing or is going to have a minor impact on home values. People need to realize that housing was already incredibly unaffordable for most people and professional couples buying homes, many working for hot tech startups that will now get smashed, are going to see their incomes slashed. Not everyone is going to return to work when things return. The frontline was hit and we saw that with a mind boggling 1-million Californians filing for unemployment insurance in the last report. To put this in perspective, we didn’t even come close to this during the Great Recession. So it should come as no surprise that escrows are tumbling just two weeks into this shut down.

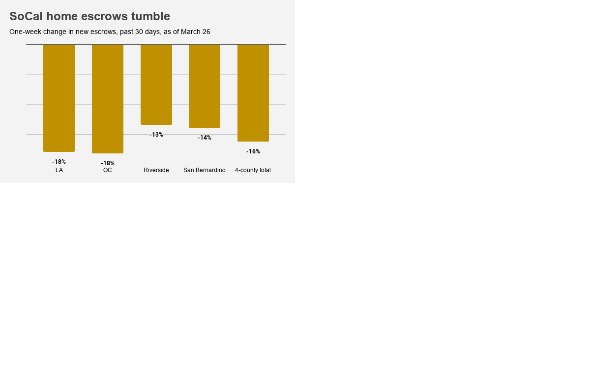

Escrows tumble across SoCal

This outbreak is going to last longer than people expect. You see it on the faces of people now having to “home school†their kids in LAUSD and trying to juggle the market tanking while being effectively locked into their property. Many parents used places like Disney, Knott’s Berry Farm, or other venues that are now in essence closed. What is telling is that many people I spoke with thought the lock down was only going to take two weeks and all would be back to normal. “Sure LAUSD is closed but we have spring break anyways and then we’ll be back in April.†No. LAUSD is closed at least until May 1st and probably longer.

So reality has shifted for most and we’ve been on an 11-year bull run and people need to realize this shutdown is shifting life as we know it. Why would anyone make the biggest purchase of their life at this uncertain time?

So of course it is no surprise that escrows took a hit across the region:

This isn’t really a surprise given that the markets are taking a big hit and so many people have lost their jobs, had their hours reduced, or are effectively working from home and juggling multiple duties. Buying a home is probably the last thing people are thinking about at this point.

The unemployment claims that came through this week are startling. California alone was 1-million of the claims of more than 3-million. This figure is unheard of since most Americans alive today have not lived through something like this. How quickly things can change. Even with low mortgage rates, you still need income and a steady one to service the mortgage on a house. And homes in California are already very expensive.

So the tumbling of properties in escrow is expected. The shock has hit and now people are scrambling. This is not going to be over early in April. This is a longer term battle that we are undertaking.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

193 Responses to “Coronavirus impact on California housing market: Escrows tumble and 1 million Californians file for unemployement insurance.”

Okay and? This is real estate we’re talking about not tomatoes. If there’s no demand, people won’t sell. Last I checked, houses don’t go bad if they don’t sell. Sure you’ll get some foreclosures that will sell for a slight discount but I guarantee you will not get a 2008 style crash or anything close to it. Inventory is low and it just got lower. Demand was high and it inched lower. Will prices climb like they have been? Absolutely not. But will they drop? 10 to 15 percent AT BEST. If interest rates rise to the 7+ range then we’ll see some action but no indication of that at all. I’m not a housing bull, I’m a realist. Take the gradual rise of hard assets over the last 11 years as a hint/leading indicator of the rapid inflation that’s right around the corner.

There is NO Shortage of homes, supply side has 10’s of 1000’s of homes on and off market. Stick a fork in Housing is done. The problem below the surface that no one is talking about, FHA, Non Prime. A report from Bloomberg. “As America heads into a deep recession, the $11 trillion residential-mortgage market is in crisis. Investors who buy home loans packaged into bonds are dumping even those with federal backing because of panic that millions might not make their payments. Yet one risky sector had started to show cracks long before the coronavirus pandemic sparked the worst financial meltdown in 12 years: the federal government’s largest affordable-housing program, whose lenient terms are geared toward marginal borrowers.â€

“As real estate prices soared in recent years, working-class adults everywhere have increasingly relied on mortgages backed by the Federal Housing Administration — and U.S. taxpayers. Since 2007, the FHA’s portfolio has tripled in value to more than $1.2 trillion, almost 11% of the market. While private lenders make these loans, they are packaged into Ginnie Mae bonds, common in mutual funds and pensions.â€

“Before Covid-19 started roiling China, a November FHA report found that 27% of borrowers last year spent more than half their incomes on debt, a level it describes as ‘unprecedented.’ The share of FHA loans souring in their first six months has doubled over the last three years to almost 1%.â€

As jobs are lost homes will come on the market. Those who have bought in the high market of the last few years won’t be able to make their payments. Those buyers who were fortunate to buy for cash won’t be able to pay the huge property tax bill assessed on the over priced homes. The market will collapse again as 1989, 2000 and 2008. I have been a real estate investor since the early ’80s. Saw them all , lived through them all, made money and lost money.

California RE prices have gotten way out of line. When that happens they tend to correct. Don’t bet against history.

Can we look at facts or are we going to keep dreaming in la la Land pretending that 2008 is going to repeat itself? Lets ignore the unique factors that affected that market vs the unique factors at play on this market. Let’s ignore the massive oversupply and risky lending back then that is absent in today’s market. Let’s ignore the fact that historically mortgage rates have averaged 8% and we’re sitting at 3.5% today. Do you even understand the massive impact rates have on home prices? Have you done the math? Did you know that overpriced house in Riverside on the market for $400K/$80K down at 3.5% is the same monthly payment if it were priced at $290K/$80K down at 8%? Suddenly that house is now “affordable”. Don’t get used to looking at nominal prices if you want to find value in real estate but let’s not get off topic.

The inventory gained from the very small amount of foreclosures will be offset by potential sellers delisting their properties so don’t expect much of a change on the supply side. And all those service sector employees that lost their jobs who couldn’t afford to buy a house in the first place will not affect the overwhelming demand. Don’t expect that to nudge much lower so that’s why I say if you see a 10% discount take it and run because by the looks of it prices will most likely freeze for a year then climb right back up. There will not be a crash. Repeat that 10 times a night before you go to sleep so you don’t dream about it.

“… Last I checked, houses don’t go bad if they don’t sell…”

New Age, you might want to double check where you have been doing your checking.

Houses *are* are a lot like tomatoes in that they all have holding costs.

Consider property taxes, insurance, maintenance, HOA fees, security and the like.

If a ‘owner’ doesn’t have *cash* to cover these costs, they will sell.

I live in Socal Orange County. You would be amazed how many supposedly ‘rich’ households are living on the edge.

Remember, here in Socal, its all about convincing your neighbor that you are a lot richer than they are.

If you live in the house and are reasonably handy, you can do OK if you can meet the taxes and mortgage (best if no mortgage like me). But rental real estate is a drag on your wealth if it sits unoccupied. Not just from vandals, but time and nature can do wonderfully strange things to an unoccupied house. In cold wet months, you need to keep it heated (burning money, so to speak). You would make more income if you had sold it and put the money in bonds. Finding a non-vandal tenant becomes very important, I can tell you from experience. ($5000 in damage from a marijuana grow room in an upstairs bedroom.)

There was an old owner-built house near where my family lived back in the woods, that totally collapsed within ten years of the owner’s being sent to an institution (he was a bit loony). The hippies salvaged old weathered boards from it to help fix up their place.

Another SoCal way is to rent out a room to a stranger to make ends meet.

Imagine renting out two rooms….and that’s how you generate 1500-2000 bucks more per month.

Also, they might extend forbearance. Imagine you avoid 6 month of PI and add it to the end of the loan? Cheers, millennial

The housing marketing in Los Angeles was propped up by international money. Now that money has gone and we are about to see the greatest depression of our modern time. It will affect the WHOLE world. There would be NOTHING propping up the housing market. It’s current being propped up by air. I expect to see it go back to the average housing prices adjusted for inflation.

The housing marketing in Los Angeles was propped up by international money. Now that money has gone and we are about to see the greatest depression of our modern time. It will affect the WHOLE world. There would be NOTHING propping up the housing market. It’s current being propped up by air. I expect to see it go back to the average housing prices adjusted for inflation.

Maybe people haven’t been keeping up with current events but normal has been canceled. China clearly lied about how many deaths happened from this virus. 840,00 landlines disappeared in Chin as well as 21 million cell phones, crematoriums hundreds of them were burning bodies day and night, and now they are receiving 5,000 urns full of ashes daily, in many locations…This virus is just getting started here and multiplying logarithmically. I work in healthcare, we won’t get through this for at least 18 months. Don’t expect western capitalism to be the same…This government is 225 Trillion dollars in debt…There will be a guaranteed income for the survivors..And lots of vacant houses.

You do realize the folks who levered themselves to the gills and were living on a shoestring to pay their mortgage are absolutely ruined. Check back in 3 months. Your post will not age well.

If you do not realize this is going to be much worse than 2008, then you are clearly not seeing thing clearly. This is going to be a full blown economic depression the likes of which have not been seen since 1929.

Jdog,

I know that in 1929 we had the FED. However, back then, did we have the mountain of debt and derivatives and uncovered liabilities???!!!!!…..I think it would be disastrous enough for the money supply to stop increasing; try a massive deleveraging either by paying some of the debt down or bankruptcies.

Most of the money created lately went to the 0.0!%. What are they going to do with them? Pay back some of their debts or invest to create good paying jobs? I don’t know, put probably you have an intuition.

It is impossible to know all this. Number predictions are a complete waste of time. If there is demand shrinks you will still find properties for sale. There is the current inventory and Realtors need to make a living. Demand isn’t the only factor when deciding to sell. Some sellers will withdraw their properties, but buyers will be waiting for price the anticipated price declines that come with a recession. When prices come under pressure there will likely be a wave of sellers coming on line. This may play out over several months, or even years. In some locations home prices surpassed the 2007 housing bubble in nominal terms. Affordability in these locations has become a real problem. While borrowing rates may remain historically low that won’t necessarily prevent a sizeable correction. Over-bought assets develop a life of their own once certain conditions converge and fear sets in.

Hey New Age, let me have some of that kool aid I could not find any at Walmart. Will see you in July when millions go in foreclosure. Lol

It’s interesting to see the responses that contradict my predictions on where the RE market is headed. I can honestly say that I WISH I am wrong. But I’m not going to lie to myself and ignore all of the unique factors at play, I’m going to keep my forecast as realistic as possible whether I like where it’s heading or not.

Just some food for thought, listings dropped 34% YoY so the supply side just got tighter. Will there be any foreclosures to offset that drop in inventory? Let”s look at some facts:

1. Government programs and banks are trying to keep homeowners from going under, it won’t keep ALL foreclosures at bay but it will have a measurable effect.

2. Lending post 2008 recession was super tight. No loose lending = far fewer defaults. That’s the BIG difference between 2008 and now.

3. Most unemployment stem from jobs that are directly impacted by this pandemic. Hotel staff, airline staff, dine in restaurant staff, them park staff etc. The vast majority of these employees are renters. Sure you might have layoffs in the high wage earning sectors but that’s much less than the 2008 recession impact on the whole job market.

4. Do you know how many people are salivating for real estate right now? Everyone’s talking about how they can’t wait to buy a home for “50% off” as if homes are something you find on the clearance rack at Walmart.

5. Last but definitely not the least, INTEREST RATES!!!! The single biggest factor in the market is interest rates. They are not going up. Don’t even dream about it. Money is cheaper than ever before and we all know (or should know by now) what cheap money does to assets.

So as you can all see, demand will inch down a hair (if at all) while supply is tighter than ever before. Please someone explain to me how this translates to a massive 2008 style drop in the market?? Please!! I’m dying for facts here!!

It appears the government is hoping that people won’t be forced to sell. Once the price of housing goes down we’ll see people stop doing remodels, which will be the death of the construction industry. Then people who got reverse mortgages will be in trouble. Then they won’t be able to repay their credit cards. Then the banks will be in trouble as they were in 2009.

Only way to save this economy now is to be very inventive and hope the coronavirus gets under control, which won’t happen until they can test about 80% of Americans at least once a week.

No I agree with the good Dr. this is going to hurt, and perhaps a lot. We have no idea what the world is going to look like in a few more months. There are going to be major changes after this. The moratorium on mortgages may actually increase the problem, those payments will have to be made at some point and if the business they worked for is gone, it’s only going to get worse.

We can hope it’s only 10-15 percent of a drop, but most economists see it being much greater. Once people start to panic….we know what happened with toilet paper…

The inflation can take place only if the average Joe has more money in hand than before. I don’t think that will be the case.

If the 0.01% print trillions for themselves to retire some excessive debt, then you don’t have any inflation; it is a wash. Every time you create debt, money supply increases. Every time you pay down debt, money supply decreases. Are the rich going to borrow more based on the newly “printed” money or just pay down debt? Given the level of uncertainty, short term, most likely they will pay down debt, which means decrease in money supply, which means recession. Recession can cause deflation which can again attract some buyers and leverage, which again will increase the money supply.

So, most likely, in the next 2 years we’ll see deflation, followed by higher inflation, all other things being equal. In real life we have too many variables to guess the future. Therefore, we can talk about the future only in terms of probabilities absent more black swans. There is also a very high probability of war with Iran in the second term (if Trump wins). That will raise price of oil, which cause more inflation and higher interest rates. Higher rates would be negative for house prices.

So, I gave up long time ago to predict the future, because it is just a guess with no certainty. Nobody can predict the future, and if some try and succeed, it is pure luck. Too many actors and possibilities for any accurate forecast.

I think Iran is a paper tiger. They won’t do anything too rash without Russia’s permission. They are now going through one of the biggest Covid-19 epidemics anywhere. There are those who believe that the “Spanish” Flu actually stopped WW I. The American troops on the Allied side just pushed the victory in that direction.

Their “retaliation” for the killing of their military boss was mainly to shoot down (accidentally) a Ukrainian jetliner full of Iranians. They are using their Iraqi proxies to do what they’ve been doing for years. Hit ad run terror attacks on our forces, and the forces inside Iraq that oppose them. Iran uses proxies, but in a way, they themselves are a proxy for Putin.

Like, you said, Iran is a Russian client state, which means they can have heavy backing militarily, technology and information (logistics) from Russia, which is a supper power. If Iran is doing their dirty work, they can be heavily backed by Russia to weaken US. Also Iran has more than double the Iraq population and is covered mainly by high mountains (vs. almost flat for Iraq). It is much harder to fight a war in mountains (think Afghanistan on a much larger scale and the cost on US over the years). Russia fought in Afghanistan for 12 years and lost after they ruined their own economy.

I don’t doubt the US would not win. The question is at what cost and implication on a weaken US economy; also how many thousands would die?!!

Regardless of who wins, my point was the spike in oil prices in case of a conflict when more that half of world oil needs floats through a war scene. That is a guarantee.

Joe, I was not talking about the usual skirmishes with Iran; I was talking about a full blown war with Iran, the same way we had with Iraq (a war of occupation). It was super hard for Trump to resist the pressure in the first term, hoping to win a second term, but I think he will give in to the pressure in the second term when he doesn’t have anything to lose. I hope I am wrong, but my gut feeling based on all the puzzles put together, tells me that I am not. As a president you can have only so much power when all the power brokers behind the scenes align against you.

Flyover:

What is oil going for now? less than $22/barrel! And on this Iran is going to fight a war? I agree with a lot of folks on this blog that the economic recovery won’t be rapid and oil will not go up very much before the election. I’d make the over/under of oil in November at even odds for $35 per barrel. Iran gets frisky at $60 per.

The Iranians are going to be more worried about Covid19 round two next spring than going toe to toe with the Donald. DT has been reducing the US role in Syria, which is what the Russians want. The Tartus naval base is a big deal for the Russians in the Mediterranean. The Syria conflict is now more or less Russia, the Alawites and the Iranian proxies VS Turkish allies and Turkey. In Iraq, the Iranians can easily overreach with the Sunnis Kurds and anti-Iranian Shiites. The Iranians will continue their current strategy there because it has been working out so far. They really hate Saudi Arabia, and will try to stir up trouble in Arabian Peninsula Saudi allies with Shiite populations with what money they have left.

First of all… home prices can’t drop without sales. No one is selling in the next 6 months unless they are insane. And no foreclosures since the government is halting them. If people stay put… 3 weeks we will reach peak deaths. Then recover by mid-summer. Everybody goes back to work… we develop a vaccine before the 2021 2nd wave and this will be a scary drill for a much deadlier future pandemic.

I just did a quick search of new homes on the market, there are a lot. The scary ones are the beach houses going up for sale for the first time since the sixties and seventies. These boomers didn’t sell during any of the last crises and their kids aren’t jumping on the house. People are selling, entrenched people are selling.

Tammy, Can you send me links to some Beach front homes for sale … for under a Million? If its more than a Million then its NOT a news … an Average Joe like me could not afford those earlier and could not afford those now or in future.

Good logic except someone always has to sell – new job and forced relocation with a cash flow negative house, parent passed away and the kids want the cash not the monthly expense.

And when that person sells at a discount that’s your new comp. Unless you can get your neighbors together vigilante style to force people to stay or get Zillow and Redfin to not list sales prices

Some people always have to sell – job loss, death, divorce. Jingle mail is also a strong possibility, since low-money-down loans have been very common. All this will drag the prices down, causing marginal sellers, such as investors, to panic and start selling to cut the losses.

Residential real estate has been off-scale high (compared to average or median household income) for many years in coastal CA, NYC, Boston, etc. Not so much in Tulsa, Detroit, Kansas City, etc. Real estate ask price in both sets of markets will likely decline, with the high outliers declining the most. Trouble is that the government spending in outlier places depends so much on high pricing, that they will do anything to keep prices notionally high, including deliberate and intense price inflation inflicted on everything.

Coastal California has not been in any sort of an honest market for a long time. If Tech, Hollywood, and government are hit as hard as it looks likely they will be, Katy bar the door. Press one for Spanish….

That comet ATLAS may have something todo with this overwhelming virus scare. It’s experiencing an energy gain inside our solar system, possibly it will be past our area after Easter.

IF I was paranoid I might think this flu straw was grasped as a way to extricate us from a rough AI controlling the stock market. The corporatization of factory farms that swept Europe after EU formation has run its course, the immigrants are returning home, and there will be no reformation of land borders in the Middle East. IF this fall does continue, perhaps genuine home ownership, like a 20 year pay off for the land your home sits on, will be the norm instead of this unstable greed and hubris ruling today.

Property values are not going to fall much, The Federal Reserve announced QE Infinity this week, and they mean it — unlimited MBS purchases, and direct purchases of corporate debt (kinda illegal, but what the heck) through the new SPVs. There will no liquidity crisis, except maybe in extreme junk (and they are buying BBB-, which really is junk). The Fed even set up an SPV fund to purchases car loans funds and stick the taxpayer with the price of all the inevitable defaults.

The Fed will not tolerate deflation of asset prices and it has the power to essentially purchase every security on earth if it wants to. Housing is a corporate asset class now, like everything else. So, yes, there will be some minor price fluctuations, but there will be no reset, no return to affordability.

People who’ve been saving their money to buy on a downturn are going to eventually realize that they’ve been saving credits that the Fed can create infinitely, and will create infinitely, to support current price structures. America is a corporate oligarchy and that oligarchy runs the money supply to their benefit. You just live here.

Brixton, you might be right theoretically, but you assume that the FED wants people to have higher wages in order to service higher amounts of loans. I believe that the vast amount of money will go the banks, as usual and the average person who has to support this pyramid scheme, after this recession will be even less able to make the payments.

If you believe that the average person will be even more well off financially after this recession, what can I say – you are an optimist.

If the cost of everything goes up (i.e. food, utilities), taxes will go up to service twice as much debt as before, what will be left to service the debt on mortgages?!!!???….I don’t know; do you?

I think you are missing the point. The Fed does not care if wage earners can service the loans. Unaffordable housing and foreclosure is a feature, not a bug, of the post-2008 system.

The Fed can create an unlimited supply of money to buy bad housing debt from the intermediaries (banks). The bank that made the bad loan is made whole. The asset gets stripped from the buyer and everything continues as before.

Just last week you saw how the Fed put a floor under stock prices with QE to Infinity. That action also put an effective floor under housing. So, if defaults get going a little, cash-rich corporations will come roaring in (they just got made whole by the Fed) to buy at a modest discount. The fact that the houses are still relatively expensive historically will not matter because the money being used to buy them is coming from the unlimited pool of money sitting at the top of our society (Fed credits). It’s an oligarchy, in case you hadn’t noticed.

The point for the Fed, though, is to maintain the basic price structure of the assets, to avoid deflation. That means the Fed has to ruthlessly destroy middle-income savers that have no way of keeping up with the QE’s upward pressure on assets. In other words, labor can’t catch up in this race, and it’s not supposed to.

Brixton, I did not miss the point. I am very well aware that the FED never cared about middle class and I said so many times on this blog.

That being said, in 2008 did the FED wanted to have assets drop 50-70%? I am sure they didn’t. Like you said, they want to maintain high values for the bank assets. However, wanting to keep the prices high and actually succeeding to keep them high are two different issues. All those trillions in mortgages have to be serviced, regardless of who owes. Will they be able to service them out of an economy in shambles????!!!! In WA state the governor wants to keep people out of work till after middle of May. Are they going to be able to service the debt with the extra $1,200 offered? More than half of the people can not work online. How are they going to survive and make payments on mortgages? Some can get unemployment (which is not too much when you have to prioritize between food, health and housing) but many can’t (if they are independent contractors for one business or another). Yes, not all are affected the same, but there will be tens of millions affected badly by this lockdown business.

I am talking in general. I am in a good position with everything paid off; zero debt and money in the bank.

Finally someone with some sense on this blog!!! This guy knows exactly what’s going on. It’s a NEW AGE people!!

This time is different! Mofo

There sure seems to be a lot of glass-full commenters. My glass is pretty much empty. Airline traffic is down ~70%. Hotels down 80-90%. Commerce has stopped in Los Angeles. Those lucky enough to be salaried employees will go back to work and it will look like a hurricane blew through. Companies will be forced to have further layoffs once the dust settles and many small businesses will realize that bankruptcy is the only way. There are millions of people in LA that have basically run out of money. Many have decided to skip rent for April so they can have a little security and food if this drags out. Do you think someone making $40k/year can just easily makeup one months expenses? Two? Is McDonalds and Ralphs and Uber going to get generous and start paying everyone a living wage for LA?

There are currently ~14 SFH in El Segundo with recent closures at a mind-boggling $1000/sqft. There’s another dozen flips and new construction in process. The flippers will start to cut bait at any expense. Then those already in process that have to sell because of potential jobs in other areas. Then those finally deciding that the struggle to live in SoCal isn’t worth it. Who’s the marginal buyer? Who’s willing to step in now and drop their life savings on an illiquid asset?

The freeze of mortgages in the UK has banks asking for 40% down to open escrow! Take a look on twitter and read about the flood of AirBNB entrepreneurs world-wide that are in a panic.

This will change our economy forever. I hope I’m [not dead] wrong.

This will be very interesting to see how it all plays out. Anybody barely scraping by in this city (the majority) are going to get hurt bad. Many of these people were already on government assistance in one form or another. I do think the prime areas will hold up well. Unless you move out of the area, you need to live somewhere. And as I have said umpteen times, owning a primary residence in socal is almost a requirement. Having a sanctuary to hold up in (your home) may be viewed differently going forward. Stay diversified, owning a primary residence in a good part of socal should be part of your portfolio.

do people that make 40k buy houses in el segundo? no? then whats your point?

There are always 2 real estate markets: the mortgage real estate market and the cash real estate market. In boom times the financed real estate drives up the “price”, but in the downturn, it reverts to the cash price. If you own real estate outright, it really doesn’t matter that much., especially if you’re living in it. Rents may come down to what is realistic for the cash price, and this can squeeze owners who are too leveraged. But if you own outright, you can do a 1031 exchange for a comparable property and that way, the real estate can be somewhat liquid.

Study all we want like with the stock market the unknown is still there .

But folks are selling as recently as last week saw a bidding war of 6 offers on a place my friend looked at. Can we tumble down in housing pricing, it could be a lot worse than 2008.

Study all we want like with the stock market the unknown is still there .

But folks are selling as recently as last week saw a bidding war of 6 offers on a place my friend looked at. Can we tumble down in housing pricing, it could be a lot worse than 2008.

That ridiculous condo 3/3, $700K with the $500 a month hoa coming to and end now. Lol, oh 1300sf.

As a first-time buyer with no debt who’s been waiting on the sidelines to buy in LA for some time, I’m so glad that housing is about to tank hard. Knew it would happen sometime, just not in this manner…

You’re going to be hearing a lot of people saying that the underlying financial situation of the USA economy is sound and things will be find once the coronavirus pandemic levels out. Don’t believe it because all the people saying this are just trying to cash in on your stupidity. The entire financial situation is on thin ice right now and with the fed slashing rates to near 0%, they don’t have much left they can do to the house of cards from crashing again. Over the next few months things will seem OK because the banks and Gov’t conspired to help people out by not doing evictions for mortgage payments that have went unpaid, but that money may dry up. What’s the Gov’t going to do? Print 2 trillion every two months to keep things looking normal? Even the $1200 a month isn’t enough for people living in high expense states such as California and New York. It’s great if you’re living in Alabama or Missouri. This is worse than 2008 and will take longer to get out of once the banks and housing market crumbles.

Kent your comment along with a few others finally is showing some reality of the situation this is the time is to get out of the denial mode into preparation for a serious deflationary recession , most businesses will fail and millions in California alone will be unemployed likely for years all the debts servicing is much greater than 2008 will never be paid .This is a serious deflation on its way likely worse than the 30s.

The simple reality far too many businesses ( airlines , Boeing, auto cos. shale oil ) were riding and creating the stock and economy bubble and not setting cash reserves aside and same situation for millions of Californians . Debt was seen as a quick way to wealth but with world wide debt at such a level many times greater than 2008 the default rate world wide will be huge and I agree how much money can you pump into the system to offset it?? This is at least 5-7 disaster and hopefully a reset to correct the bailout and the lack of regulation of wall street , corporate interests and outright manipulation of free markets!

I started planning for this 7+ years ago but I like everyone else will not escape some financial injury I live outside the US and had a policy of accumulating silver coins monthly for years and gold coins to a degree bought farmland here and have bought mining stocks save 1/2 retirement income into high yielding mm accounts.I am almost 71 and have seen this same scenario several times before in every decade but this time will be the worst !!

Coronavirus job losses could total 47 million, unemployment rate may hit 32%, Fed estimates.

https://www.cnbc.com/2020/03/30/heres-who-wont-qualify-for-beefed-up-coronavirus-unemployment-relief.html

The government is going to be printing a trillion dollars a month for at least the next six months. The so called fiscal conservatives are outspending the democrats as they have under George W. Bush. At this rate the deficit will be 30 trillion by the time Trump leaves office.

https://www.dailymail.co.uk/news/article-8172767/Donald-Trump-touts-2-trillion-bill-saying-spent-infrastructure.html

Kent,

Is Nancy Pelosi a “fiscal conservative”????!!!!….As far as I know, the House has the power of the purse and ALL laws originate in the House. FYI, the president does not make laws. He takes what comes from the House and says “YES” or “NO” and signs it. It was the same with Bush – the House was controlled by the Democrats. I NEVER heard of a president to say I don’t want to spend money in an election year, did you???…And it doesn’t mater if they have a D or an R after their name.

That being said, I agree with you that none of the three, Bush, Obama or Trump are fiscal conservatives. After 3 years, with all the bad things Trump did, he is still better than Hillary. There are still lots of things I disagree with Trump, but I could not agree with Hillary on anything. I did not nominate either one of them and I did not vote 3 years ago. I might vote this year, but I am not sure.

Flyover – Nancy Pelosi never claimed to be a fiscal conservative. We know what the democrat agenda is. I was listening to a Coast To Coast with Art Bell done in 1996. He was crying while saying “With Clinton in office we’ll be unable to pay the interest on the national debt.” Let that sink in. This was in 1996. Has this ever come true? Not yet. It’s one of the right wings #1 meme until this day.

When looking back we can see it’s the Republicans who have been the big spenders of government/taxpayer money. They keep giving it away to their billionaire buddies through tax cuts and loop holes in the tax code.

I recall in 1999 when Clinton intervened in Kosovo the Republicans were crying “We’re spending a billion dollars a year. We can’t afford this.” Then when George W. Bush gets elected and invades Iraq we’re spending a billion dollars a week there and you don’t hear a peep from Republicans about it.

Every time Republicans have claimed they’re the party of fiscal responsibility, so they have a lot of claims to live up to. Obviously, they have failed miserably. You’re claiming Hillary would have been worse than Trump and now that I think about it, I disagree. I disagree because Trump let the contract for the service to those ventilators expire. The federal government has thousands of ventilators that don’t work. What a disaster. Illegal immigrants kill people, but the Trump admins negligence has killed a lot more.

I voted for Trump and knew the polls saying he wouldn’t win were a manufactured. As of right now I’m telling you Joe Biden will be our next president because Trump won’t be winning Michigan after their high death rate from coronavirus. Trump will be losing a lot of states.

Also, remember during the presidential debates when Trump said “I’m going to get a federal prosecutor to look into Hillary if I become president.”? Then after he got elected he says “Hillary is a good person. I don’t want to have a federal prosecutor go after her.” He’s a conman.

Also, your claim the democrats were in control under Bush isn’t fully true. The congress was controlled by Republicans for many years under George W. Bush.

“Also, your claim the democrats were in control under Bush isn’t fully true. The congress was controlled by Republicans for many years under George W. Bush.”

When the Iraq War was declared, the Congress was Democrat. Also, when the massive bailout was proposed at the end of Bush era, the Congress was also Democrat (in the last 2 years, Bush was a lame duck president). These two were the most damaging to the US economy; they happened under Bush (a neocon and RINO globalist) with all the support from the Democrats. These are historical facts regardless of your opinions or mine.

What I stated is also the REAL Truth – ALL laws originate in the House, which currently is Democrat. Regardless if Pelosi declares herself a fiscal conservative or not (it is irrelevant), all bailouts have to be approved by the House first (they have the power of the purse). All Trump can do is to say Yes or NO and sign it. You can blame whoever you want to blame, or both of the above; that doesn’t change the FACTS I stated.

Flyover – During 2003 when the Iraq War was declared the Senate and House were controlled by Republicans. Why didn’t you look this up before claiming democrats were in control?

In fact, Trump and George W. Bush are sharing something very much in common. Both of them during their first two years past a massive tax cut with loop holes for their billionaire friends. Trump might as well be George W. Bush’s third term.

The One Hundred Eighth United States Congress was a meeting of the legislative branch of the United States federal government, composed of the United States Senate and the United States House of Representatives from January 3, 2003 to January 3, 2005, during the third and fourth years of George W. Bush’s presidency.

House members were elected in the 2002 general election on November 5, 2002. Senators were elected in three classes in the 1998 general election on November 3, 1998, 2000 general election on November 7, 2000, or 2002 general election on November 5, 2002. The apportionment of seats in the House of Representatives was based on the Twenty-second Census of the United States in 2000. Both chambers had a Republican majority.

https://en.wikipedia.org/wiki/108th_United_States_Congress

Kent, personally I am against all imperial wars, regardless of who starts them – pick your poison, R or D. You can not have imperial wars without big central government. I am against both “big government” and “centralized power”.

flyover were you one of the ones who though it was cool the last 10 years every time the federal government got closed down over budget disagreements? Imagine if that happened now. How many more would be dead from coronavirus right now if the federal government was closed down? 10,000?

I remember listening to Mark Levin and other libertarians saying closing down the federal government was no big deal and a good thing. Now it’s evident these type of people are complete idiots. We need a federal government. You’re living in some imaginary pre WW2 mentality. 1776 is long gone and has been since 1865 and won’t be coming back.

“1776 is long gone and has been since 1865 and won’t be coming back.”

Sadly, you are correct!…Enjoy the new overlords and the slavery they brought. It would take a very dramatic even to throw off the new feudalism.

Personally I am not going to cheer for the plantation owners. If you like them, enjoy!…

The elephant in the room is the rental market. Shit boxes will be renting for $1500 a month and not $3000 a month. Think it can’t happen? Think again. This is the beginning of a depression. Lots of high and dry investors/speculators who saw a sure thing and a cash cow with 80s formica counters, and a faint smell of old of cat urine in the living room corner. The cash cow just fell over stone dead. Stick a fork in the landlords. They better have low, serviceable mortgages, or preferably no mortgages to survive the next few years. Houses are going on the market one way or another. Not to mention Taco Tuesday boomer who just had his 401k beaten like a Grand Canyon mule. Time to unlock rapidly declining equity, and pull up stakes for (insert Phoenix suburb).

The other day I told my son that there will soon come a day when it will be difficult to give homes away. His friend looked at me puzzled and said “Huh?†I replied that it’s becuse very few people will have enough money to pay a mortgage, plus taxes, insurance, utilities,etc. I believe that housing prices will fall up to 80%, even more in some markets. Many Americans will struggle just to get by and find enough food. We are living in a changed world. The massive “everything bubble†has finally popped. The housing market will become flooded with inventory as prices fall and people are no longer able or willing to pay their mortgages. Housing is going to get crushed. Decimated. I’m telling you – it’s going to become difficult to “give homes away.†Mark my words.

I will mark your words. Please refer to New Ages reply above to hear the truth without coloring your thoughts with worst case scenarios. This too shall pass and things will snap back by the end of summer. IMO.

Oh man this has got to be the most absurd comment I’ve ever read on this blog! Real estate falling by 80% wow!! I hope to see that day!! The day people can no longer afford homes is the day that America becomes a 21st century feudalistic society which is definitely coming I agree with you on that. But have you ever thought that real estate will be concentrated in the hands of the wealthy and we’ll just be renting from them? That’s where we’re heading but prices will not come down in that society, prices will skyrocket, hence, why the average person will be renting. I keep saying and saying it again. It’s a NEW AGE! Mark MY words!

I learnt a major lesson in’08. I got a great work offer in Texas, at which time I put my SoCal house on the market. Like the young fool I was, I turned down many offers waiting to get “my price”. In the end I lost the job offer and barely managed to hold on to my house. Learnt many lessons on the way. Two months ago, finally managed to pay off the house. Now I’m moving back to Texas. Found myself a real affordable place in the town I grew up in.

Most important lesson I learnt? As soon as the lockdown here in SoCal is lifted, I’m listing my house at 30% below comps. Hopefully that lets me unwind this albatross.

80% crash in housing? I would already jump in again when houses go down by 10-15%!

For houses to lose value you need more supply than demand.

Do you see more supply? I see less. I see sellers pulling their listings off the market.

If you have mass layoffs of high paying jobs you will see an increase in listings but who is getting laid off? A ton of people can work remotely from home. The army of waiters, hospitality staff, Stewardesses, customer facing sales reps, manufacturing staff that produces non essential goods etc are getting laid off. Those aren’t selling homes because they were renting or living with their parents. And It’s easy to hire them back – except for businesses that didn’t do well before (retail for instance). Obviously if the shutdown continues for 6-12 months we are in big trouble but is that really going to happen or is it more likely the country will re-open gradually within the next couple of months?

Sure, there will be less demand but where is the surge of new listings?

Cheers, millennial

The wisest bird I know of is the mockingbird. They defend their turf tenaciously against any size opponent and do it in a way such that the opponent can’t retaliate. Holders of homesteads are as tenacious as mockingbirds. The NIMBY crowd is as noisy as a gang of mockingbirds attacking a cat. Unless we see massive depopulation, your prediction will not come to pass.

For Joe S., a quote from Mark Twain:

On the sale of his house (the Hartford House): “For the Lord Jesus H. Christ’s sake sell or rent that God damned house. I would rather go to hell than own it 50 days longer.â€

Be careful about buying a house in Texas right away. I worked in Fort Collins, CO (building the Anheuser Busch plant) in 1986/87 when the oil patch went bust, and we got a lot of out-of-work Texans applying for jobs with us. The housing market went to hell back then. And the oil market is bad right now.

I’ll buy houses long before you have to give them away, and many like me will do the same. My price point is 12 times the annual rent, and I will pay cash.

WOW!!!!!….

Reading these comments in the last 2 days, I see the whole spectrum of opinions. Interesting!….People look at the same data and conclude all the possible outcomes from the most bullish to the most bearish.

My opinion is somewhere in the middle – bearish for the next 2 years and bullish long term (3+ years). Bullish, not necessarily in real value increase but keeping up with inflation (nominal increase).

I am in your boat. Neutral to a little bearish. It depend on how long this virus thing lasts.

People will get to delay their payments as long as this virus crisis is in effect…maybe longer. The GSEs back so much of this debt, they can take the loss and the FED will by the bonds. But people out of work will take its toll.

Then, because there was so much money printed, this liquidity will need to find a home. If they keep interest rates at zero, there will be a lot of investors buying up homes. Just like Wall Street did after the housing bubble. It will be a mad rush because it was such a great investment the 1st time. Who knows, that may put a floor under housing.

This will be inflationary for Single Family Homes. People who cannot afford them will move into small apartments and condos. Just like in Asia.

Then, because of all the debt the government owes and business, combined with the need to roll over, they will be stuck at ZIRP interest rates for years. This would be inflationary for any physical asset like homes and stocks.

IMHO

Look at Macerich real estate company stock. It’s back to where it was in 2008. This isn’t about to rebound anytime soon either. They closed down SEARs at the local Macerich owned mall before the state of the Pandemic. Don’t believe anyone who says things are going to be OK anytime soon.

https://www.google.com/search?client=firefox-b-1-d&q=macerich+stock

You cited a company that owns malls and other commercial property which is a dying market. Do you see you bias?

The future could be brighter or darker, but it will be different. I’ll go out on a limb with some predictions:

This virus may be worse in wealthy communities because the wealthy are more likely to be world travelers. Plus the average age of wealthy communities is older. I don’t see this affecting real estate prices too much as a lot of high end properties are self-financed. Also wealthy people can afford top rank medical care.

It will be a bicoastal epidemic with some problems in the hinterlands where low levels of social distancing are practiced.

The massive stimulus may well cause some inflation instead of deflation. Especially if the US economy bounces back more rapidly than other world economies. Some repatriation of manufacturing due to disruption fears about China will happen soon. That is good for the US and bad for China. However I don’t see a big recovery of oil prices any time soon because of the world economy and global politics especially Russia vs Saudi Arabia. So we’ll have cheap gas in a recovery instead of price increases due to demand outstripping supply which isn’t happening this year.

Real Estate will stagnate due to decreased mobility and fears of round 2 of the virus. People will take advantage of rent and eviction holidays which may have repercussions in the rental market making rental real estate less profitable. Fewer buyers and sellers is what I see in both rental and owner-occupier markets as people hunker down for the short term. The one thing that could cause a big crash in California would be a massive repatriation of foreigners to their home countries, but I don’t see that happening. California isn’t that much of a special case anyway except for that part of the equation. That is true of a lot of other hot markets as well. So I see a market that is treading water for another year.

I like your viewpoint Joe! Cheers Millennial

Glad you liked my predictions. Starting with the first prediction:

On KNX radio today they were talking about the high rate of COVID19 in the wealthy LA communities. From the Daily News:

“The cities with the most confirmed cases relative to their populations are West Hollywood with 19 per 10,000 residents, Palos Verdes Estates with 13.2 per 10,000 residents, Beverly Hills with 13 per 10,000 residents and Manhattan Beach with 12.2 per 10,000 residents.”

I don’t think there are enough cases there to kill enough rich people to hit the RE market there. besides, there may be a lot of rich foreigners who will fill the gap. But this goes to show you how risky foreign travel can be. I haven’t been outside the US since 9-11.

The other day I said to my son, “Before too long, its going to be difficult to give houses away.” My son’s friend looked at me and said “Huh?” I explained that very few people will have the money to pay a mortgage, taxes, insurance, and utilities. I believe the housing market will decline by 50 to 80% at a minimum. This is going to be devastating to housing and to our standard of living in the U.S. Unemployment will also be a major factor. Imagine when the housing market is flooded by baby boomers dying and/or downsizing, plus the deluge of housing from people who can no longer pay their loans.

Yes, I believe one day in the next 5 years, it will be extremely difficult to sell many homes. Other homes will have no buyers/offers. Housing markets nationwide will be devastated by this crisis.

I am thinking with this correction governments and citizens are going to rethink where they get their resources from and who manufacturers them. With this unforeseen event it will put things into perspective for the next several years or longer and likely will bring back more manufacturing to our shores. Service jobs will likely be replaced with more manufactured goods jobs instead which I think is what needs to happen. Service jobs in hospitality and tourist attractions might be hurting for a little while due to the dependency on global dollars. However, a solid manufacturer base could change that for all of the U.S..

All of these issues could be easily solved with automation. People are so afraid of “robots taking over” that we ignore how automated technology coupled with the human element will boost us into an unrivaled economic powerhouse. I imagine after this is all said and done we’ll invest heavily into that kind of tech and become the worlds #1 manufacturing hub but maybe that’s wishful thinking.

An automated world means a few smart artists, managers, and tech people at the top, and the unemployed masses living on a universal basic income (and no self-esteem) at the bottom.

Kurt Vonnegut described this dystopia in his early 1950s novel, Player Piano: http://www.hollywoodinvestigator.com/2005/player.htm

A decade later, there was a Twilight Zone episode with the same theme.

the unemployed masses that will be on UBI, will be happy to be there………as they are currently working low paying jobs to be in the same position. The same amount of expendable income a month while not having to work? along with free housing and food? Just as good as they could never afford to buy that house anyways. Cant afford to rent it even.

Oh yeah, it seems many have forgot about the student loan debt, many will not be making payments their either.

Looks like Made in America is coming back..

https://www.politico.com/newsletters/morning-trade/2020/03/30/battle-continues-over-buy-american-order-786469

Stick a fork in it, it’s done- Mortgage Lenders Demand Fed Bailout… After Blaming Fed For Forcing “Staggering, Unprecedented” Margin Calls

https://www.zerohedge.com/markets/mortgage-lenders-demand-fed-bailout-after-blaming-fed-forcing-staggering-unprecedented

I have a colleague that is a real estate investor. He had a significant income from several properties that are listed on Airbnb. His bookings have evaporated. He is highly leveraged and very concerned. There are some very tangible risks out there for the apartment, housing, and commercial real estate. The future of these are highly interrelated.

There are entire 4 story new buildings in my town whose sole purpose was for airbnb rentals. They are going to have to turn to longer term rentals (who will qualify now?) or sit vacant indefinitely

Who cares! New Age said there is no expiration date on houses. Your friend will take it up the ass and like it

https://news.yahoo.com/rent-strike-idea-gaining-steam-170345369.html

Rent strike… people are going to take advantage of the situation. I fear many landlords are about to get clobbered and a lot of inventory will suddenly hit the market. Nevermind AirBnB/VRBO property owners… they’re done.

Just think, people were clowning Andrew Yang a few months ago about his socialist idea of universal basic income and giving everyone a grand a month. Now we are sending out checks and paying people to sit home on unemployment.

If I was homeless, I’d book an AirBnb and then refuse to leave. What are they going to do? Evict me? No one in the country is even looking at eviction papers for the next few months. At the very least I’ll have solid 2 months to live in a place for the price of the first night haha!!

Don’t pay your rent, end up in collection and burn down your credit and ability to ever get a rental again. Smart thinking there.

Yes, people are trying to get a freebie by not paying rent this month and maybe longer. I saw on FB people sharing their template with others. It’s a standardized letter to their landlord (notification to not pay rent due to the corona virus). Do you think if they miss paying rent for a couple of months that they are going to back pay their landlords in Q3? No way.

Cheers millennial

The government should be giving landlords tax breaks and bail out money. Even the city of Los Angeles says they won’t be shutting off anyone’s power or water if they don’t pay the bill.

I have a single rental property and have had the same tenants for about 7 years. We are very good to them- we don’t bother them much, and have never raised their rent (mostly because we are lazy and don’t want to deal with new tenants, but it’s mutually beneficial, so whatever). In any case, if they try to screw us just because they can, they’re out of there as soon as it’s legal to do so. Thankfully we’re fairly financially secure so we can whether the storm either way.

I don’t think it will be wise for tenants to try to screw their landlords, because ultimately, they’ll only be screwing themselves.

I agree. Most tenants won’t risk getting evicted when this blows over. Not paying their rent is a violation of their lease and could result in immediate eviction when this blows over.

However I know my tenant well enough to ask how they are doing food, finances, etc.

If they tell me they have to choose between food or rent, I’d try to give them an extension.

As long as this stay-at-home order stays in effect, I’d continue to ask them every month.

Thanks for the reply. I feel like if I ask them how they’re doing, then that could be construed as an invitation for them to not pay. I think I’ll take a wait-and-see approach and take it from there. Thankfully, it’s not a huge deal either way. I was just giving my perspective as a (very) small-time landlord.

As the stock market goes steadily up, it’s important to understand what has happened here. America is run by a corporate oligarchy, and that oligarchy has gained control of the money supply itself (The Federal Reserve).

Whatever Mr. Market does wrong can be fixed by endless infusions of new cash from the Federal Reserve (directly, and indirectly through the SPVs). The Federal Reserve is now authorized to purchase (through the SPVs) an UNLIMITED amount of BBB- (trash) corporate debt.

This means that endless, highly leveraged, bets are being paid off by the American people. The entire financial market is being effectively nationalized. Mind-blowing amounts of cash is pouring in at the top. The ONLY purpose of this cash is to keep asset prices stable or rising.

So, it’s sweet that you youngsters want to save up and buy a house and blah blah blah. The Fed will turn all of those youthful aspirations into rental realities, because it will not tolerate asset deflation in homes or 401ks. And even if you squeeze into some crap-box, it will never be the goldmine that buying in 1980 was.

Consider this the final revenge of the Baby Boomers. You laughed at the Taco Tuesday crowd, but they going to the grave with your future in their up-leveraged 401ks.

Sorry kids.

The Fed Reserve is talking about getting congress to allow the Fed to buy stock in companies. So the Baby Boomers not only will be leaving the real estate market in the hands of the banks, they’ll own all the companies they want too.

Worst first quarter on record for the stock market today.

Dow futures fall 300 points after market posts worst first quarter on record

https://www.cnbc.com/2020/03/31/stock-market-futures-open-to-close-news.html

Wishful thinking on your part. It looks like you are invested in the bubble and you keep repeating this “The Fed will make it all go away!” mantra to sleep better at night. The Fed manipulation delayed the crash – it won’t prevent it. The Fed is out of ammo. The Federal government is out of ammo. The consumers and small businesses are in debt up to their eyeballs. The system won’t handle dried up cash flows well. The bubble was popped. Stock market crash, followed by real estate crash…

Haha

Stock market is indeed going up like the housing market

Finally it took a pin like coronavirus to burst the all bubble of all time

The fed is trying hard to keep the bubbles inflated

Let’s see how thing look when the actual numbers start coming out in few weeks

1000% this. People are not seeing the big picture and the market manipulation at play here. Do I believe houses are worth what they’re worth on the market? Absolutely not but I can’t ignore the factors that got them there and will continue to keep this charade going. All of this debt will be paid off by the almighty dollar by assigning a dollar value to the debt and then deflating the value of said dollar.

A very dumb but illustrative example is that I own a medical supply company that can get a near infinite supply of the high demand goods necessary in this environment, face masks, barrels of sanitzer etc. I approach a guy who will build a house for me $300K but I make a deal with him to pay him with $1M worth of my medical supply stuff based on the current market value. He agrees and moves forward. At first, he’s making a ton of money selling him my goods on side, over 3x what he would’ve made if I just paid him in dollars! But then demand for my supply drops and the value drops to 90% of the previous value and now he’s making 1/3 less and in the long run I managed to swindle the guy for cheap labor and materials. The dollar will see the day that all of this catches up to it and people holding it will pay a steep price. All of the hundred of thousands of dollars saved waiting for the right time to invest in a real asset but holding off because “it will crash” will be worth a fraction of the value it has today. All of those hours and days spent at work, forgoing vacations and working to the bone will be worth next to nothing. All of that work will be taken and applied towards corporate debt then deflate the value of that debt using currency manipulation and you’ll be the fool left holding the bad apples. You’ve effectively become a slave and you didn’t even know it this whole time. Did you invest in assets or did you save save save waiting for the perfect time “just like last time”? When the music stops, will have a chair to sit on or will you be eliminated from the game?

Wishful thinking. The Fed is not as powerful as you think and they are out of ammo. Considering how inflated all assets are (undeniably bubble) and considering debt levels out there, this will be a major depression. Stock market and real estate will go to their historic trend levels or below, which is way below where we are now. COVID was just one of the bad things that could gave drained the bubble.

I was not for a moment claiming that the Fed can rescue the underlying economy. This is a classic crisis of demand — folks is broke! Most Americans have nothing.

However, the Fed CAN rescue equity prices because it has an unlimited amount of money. It simply cannot run out of ammo. The Fed has already put a floor under the stock market and, if that turns out not to be correct, then you can expect Congress to authorize the direct purchase of ETFs and stock.

The housing market price structure, which is the focus here, is already supported by the Fed though the purchase of MBS. So, let’s say lots of people stop paying rent, and then the houses go into foreclosure. Well, those loans will be with the Fed, and the Fed will then sell the underlying asset to some corporate entity that benefited from the Fed/SPV bailouts that have already started. It’s a big loop.

I’m not saying you might not find some nice discounts. But, there will be no deflationary reset where houses return to selling for 2.5 times median household income, which was the norm prior to this modern era (Greenspan on) of Fed manipulation.

I don’t mean to be cruel about this, but Mr. Market and the Fed have discovered that they only need each other. They don’t need working people. Working people are a drag on asset prices.

Socal is special and this time is different

Real estate in socal can never go down

Also you forgot to mention an extremely important fact…the Federal Reserve (private bankers) are finally under the control of the U.S. Treasury as part of the Stimulus Bill. The new Federal Reserve boss is Donald J. Trump.

$6 trillion ($4 trillion Federal Reserve) is a stop gap measure until safer at homes are lifted in May or June across the country. The FDA approved Hydroxy-Chloroquine and z-pack will save many lives and end this pandemic soon.

All that debt the Federal Reserve will buy is trash. Along comes President Trump later in the year and declares that the debt is cancelled. Problem solved. Back to business!

Matt: I’m sort of unclear on what you’re asserting. To my knowledge, Trump cannot simply “cancel” debt to the federal reserve (Fed) or anyone. Do you really think that the government can simply cancel its debt to the Fed? Not only would the Fed not likely allow it, but it would likely result in the erosion of people’s faith in the U.S. monetary system, and things would probably further deteriorate from there.

Correct me if I’m wrong about anything here, but the U.S. cancelling debt to the Fed is just not going to happen.

Yes, the stock market is going up and up

the socal real estate would never go down because it is special and this time is different 🙂

Baby boomers are very lucky.

We certainly had the best music. But we are lucky because we saw the very best of America. It was a golden age, for sure.

d

Wow! This Blog has finally become a housing BUBBLE blog.

Mr Landlord has disappeared again.Probably hiding in his bunker for the last month. Son of a Landlord has just entered his bunker after siding with Trump that this is all a Democratic MSM hoax. SoCalGuy has pointed out that Trump has become a raging Commie by sending free money to everyone

Lord Blankfein continues to be a stable commentator. I trust the Lord.

We still have our hero and long-time contributor, Flyover, to defend this capitalist system. Thank you, Flyover! We do respect your stable opinion based on experience.

Our Millennial just bought a house with free money (Thanks to the stepping up of basis and 13M in forgiven inheritance tax) Our Millennial has finally learned to play the game and is fortunate enough to have rich parents who died. I’m sorry, that was rude. I’m sorry for your loss, Millennial. You can now be a feudal baron and turn into Mr Landlord when you grow up.

I try to look at history to point out what could happen when there wasn’t Science, the Fed, or Wall Street to save us all. We have seen it all before.

What happened before, means it will likely happen again. We have our hero now, The Fed, who is working to save us all so the outcome may not repeat again. Or it may be worse.

What bunker?

Still more evidence that this coronavirus threat is overblown: https://www.wnd.com/2020/04/shocking-list-killed-people-2020/

Coronavirus is at bottom of list compared to everyday killers

This “pandemic” is being used to tank the economy and thus justify increased state controls. In the meantime, it will reap billions in profits for the well-connected, via insider trading, pump & dump stock manipulation, and bailout money.

I would have left all stores open. Inform the public about safety tips, but let them decide if they want to shelter in place, or close their businesses. Then, we all tough it out.

People die every day from all manner of causes. You don’t compound a pandemic with an economic depression.

“I would have left all stores open. Inform the public about safety tips, but let them decide if they want to shelter in place, or close their businesses. Then, we all tough it out. ”

This is exactly what NYC did for 2 weeks in March when CA, CO, MN were shutting down.

Now NYC has 500 deaths per day and growing from Covid-19.

The US should have reacted faster and imposed more restrictions just as the South Korean government did.

At the US Federal level, there still isn’t a shelter-in-place order. South Korea imposed one immediately.

Because that, and completely open borders, the death toll will continue to double every 3-4 days in the US (It is now 1200 deaths per day). It doesn’t help CA when the borders are open and people are fleeing from states where the pandemic is raging.

SOB

“People die every day from all manner of causes. You don’t compound a pandemic with an economic depression.â€

Your true colors are coming out with each response. I’m sure you saw what the Nazis did to the Jews in WWII was simply a “casualty of war†and par for the course. You keep linking to right leaning sources that puts profits over people. This virus is bad and magnitudes worse than the flu (unlike the false equivalency argument you are trying to make).

In China, you might think they are open but their economy is still severely restricted with people being tracked left and right. Italy? In a mess. Spain? Deep problems. France? Ramping up. So yes, this is “someone†on the left trying to tank the economy. Funny how it is a conspiracy when it goes against your views but when it aligns with it, it is the “free market†working great magic. Hypocrite.

For someone like you, how about you go to a state that thinks like you, say Alabama, and you’ll fit in, right at home. They don’t seem to believe this thing is a big deal and you can go to the movies, lick the sidewalk, and enjoy large gatherings. Let everyone else here try to minimize the damage so we don’t kill off grandma and grandpa although you’d probably like that since it would save money long-term for Social Security and Medicare.

SOB, please stop arguing with the voices in your head.

I never said anything about a “conspiracy.” Nor did I say anything about the “free market working great magic.” And aren’t there enough Nazi analogies on the internet without you inventing yet another one?

The flu kills tens of thousands every year. Cancer and heart disease, hundreds of thousands each. Yet we don’t shut down the economy for those. We don’t ban private cars (exempting only emergency vehicles), even though that would save tens of thousands of lives every year.

A major economic depression doesn’t just hurt “profits.” It inflicts much human misery: an increase in suicides, substance abuse, domestic violence, murders, and all manner of other sufferings.

SOB, you don’t have to look at the issue ONLY from the lens of an economist or doctor. Sometimes, you have to use common sense.

Common sense thinks in terms of cost benefit analysis. Yes, that applies even to lives. One life is not worth more than another, therefore we have to think in terms of numbers and keep perspective. For example, if you ruin the economy and kill 10 millions in the process, that cost is too high to save 2 million from the virus.

This common sense approach is missing from politics these days. ONLY two politicians show common sense in this crisis – Ron Paul and Massey (KY).

You can use quarantine in high density cities like NY, Chicago, LA, etc. That is not so much needed in North Dakota or Nebraska. Yes, use lockdown for those over 65 (most don’t have to work to make a living) and let those young and healthy to make a living in order to provide for their families. Politicians don’t care – their pay is the same. Those who work at home on the computer don’t care, their pay is the same. However, some people have to be out in the fields or swinging a hammer to create wealth and provide for their families. If they were independent contractors, they are not eligible for unemployment benefits and they can not live on $1200 provided by the government.

See, one size does not fit all. Government has to be selective in the approach they take.

If you read international news, you will see the numbers of people dying from this disease. I personally know of several people of all ages groups here in the U.S. who are currently battling it. A friend’s neighbor’s son died of it at 33 years old.

The tricky part of it seems to be the asymptomatic individuals who can pass it on from spittle from speaking and as top U.S. Health officials have noted “it is highly contagious”.

Just saying……

Much ,much worse this is true insanity to paraphrase doing the same process over and over again and expecting a different result.

This a repeat of a decade ago only worse with a much greater debt to service and a president that believes in debt and default .

What could possibly go wrong except no cash reserves speculating with the whole bundle stock buybacks making CEOs and the Wall Street banks rich again what me worry the government will bail us out again and again disaster in record breaking time and it will continue with a brief upward adjustment but down and down again .

Don’t forget SoCalJim. I don’t think he is hiding though. Too busy selling hot dogs to supplement his negative cash flow rentals and his realtor business

Yes Bob, I am still defending the capitalist system, because with all it’s faults it is better than anything else. I’ve seen it all before. Or, I should say, not ONLY “seen it”, I lived under socialism/communism and I’ll take capitalism any time. Maybe it is time for you to live, not just “see”, how “wonderful” life is in N. Korea, Venezuela, Cuba or China; not as a tourist with those “capitalist” money in your pocket, but actually to live and work there and “benefit” from that socialized medicine (“free” health care) with its death panels. In those “free” health care countries, the first thing they ask if you call for an ambulance is your age. Oh, you are 65? We don’t have enough resources, you can die.

That being said, we have socialism for the 0.01% and capitalism for the 99.99%; in other words, crony capitalism, known from history books as fascism (marriage of the largest corporations with the state). When I say “state”, I mean both R (for the most part, not ALL) and D. That capitalism for the 99.99% still keeps us on top of the world in terms of standard of living – it is not a perfect situation, but better that all existing alternatives. This system is not going to be reformed by the D or R, because each one of them care about their own survival as a party; that comes first. To survive, you need money and you have to please the FED who “prints” them (I am using the word in generic terms not technical). If they get power as a party, is the second priority (like any individual). You have to survive first.

For that reason, if this lockdown is extended, we might see riots, or even worse, a civil war; it depends how deep of a depression they cause – sometimes the cure is worse than the disease.

New study finds that coronavirus is far less deadly than previously thought: https://nypost.com/2020/03/31/covid-19-death-rate-lower-than-previously-reported-study/

The coronavirus may not be as deadly as previously suggested, according to a new study that accounts for cases that were not diagnosed.

The study published Monday in the medical journal The Lancet Infectious Diseases estimated that the death rate will be 0.66%, which is much lower than figures between 2% and 3.4% that have come out of Wuhan, China, according to CNN.

Researchers said the lower coronavirus mortality rate was determined by accounting for cases that went undiagnosed — possibly because they were mild or had no symptoms. …

Son of a Landlord is discounting the pandemic. He obviously has not seen the disaster unfolding in Italy. Ignorance is bliss I guess.

The numbers out of Italy are misleading: https://www.lifesitenews.com/blogs/why-coronavirus-stats-can-be-misleading-resulting-in-overblown-projections

But what accounts for the alarmingly high percentage of fatalities?

The elderly are particularly vulnerable to the virus, and Italy has the second oldest population in the world. The median age of Italy’s coronavirus patients is 67, while China’s was a much younger 46.

But there is another factor at work as well. According to Professor Walter Riccardi, who is an adviser to Italy’s minister of health, the high number of fatalities attributed to the Wuhan Flu may be largely a coding error.

Prof. Riccardi explains: “The way in which we code deaths in our country is very generous in the sense that all the people who die in hospitals with the coronavirus are deemed to be dying of the coronavirus. On re-evaluation by the National Institute of Health, only 12 percent of death certificates have shown a direct causality from coronavirus, while 88 percent of patients who have died have at least one pre-morbidity–many had two or three.”

So, at the present moment, it’s probably best not to be too alarmed by the numbers coming out of Italy, which may be exaggerated by a factor of eight. Correcting for this would put the actual Wuhan Flu death rate a little above one per cent of those who have been tested.

In 2011, I remember seeing condos for sale in Orange Co. for $1.00. No one believes me, but it happened. They were selling like timeshares. Owners were tired by paying HOA fees, maintenance costs, utility bills, property taxes, etc. for an asset was constantly dropping in value. Will this happen again?

April Fool Joke

Tomorrow every American will get

$1,200 each month for the next 12 months.

I’m not getting a penny.

Are banks going to excuse the lapse in employment history when writing loans for home purchases? A lot of new potential W2 earners will have had employment history disrupted. Self employed small business books will have been disrupted as well except if you are a manufacturer of N95 masks or own a liquor store. Most banks want 2 years of tax returns, and the last 3 pay stubs as a start to the process. Then they come back and ask for more and more. Everyone is discussing low rates but writing loans will the most difficult in my opinion. Brixton is correct though, the powers at the top are doing whatever they can to keep asset prices bloated. So they are doing whatever possible to try and counteract what naturally should and wants to happen which is a correction to housing and stocks.

A friend of mine here in LA has 3 AirBnB rentals. They are all units on a property he owns so he has no mortgage. He told me that he had about $60,000 in bookings over the next 4 months. All of them have cancelled within the past 2 weeks. He is not going to suffer much however, it just gives me some insight as to the financial tsunami headed our way.

What I’ve been hearing is that a lot of loans are suddenly being retracted during the escrow process. Escrows have been cancelled because of this. Some loans have been pulled that have gone all the way up to the day before close. In other words, liquidity has dried up. It doesn’t matter how low the rates are if you can’t get the money.