Why are Californians moving out in droves to Texas? A trend that goes beyond one year. A two city example.

For all of the glamor and glitz and notion that California is indestructible, there is a net migration of California residents out of the state. And why is that? Affordability continues to be the driving force for many families looking at a state that has become a renter’s paradise and for those wanting to own, paying $750,000 or a million dollars for a crap shack simply does not make sense. So people are moving out in droves and the numbers back this up. California lost 190,000 residents based on the 2018 Census data. With the new Census taking place this year and housing prices once again being unaffordable, there is going to be a continuation of this trend. And when you look at the actual prices of houses, rents, and local area incomes it becomes an easy decision for many. Let us look at the figures.

Goodbye California, Hello Texas

There is definitely a sunshine tax that we pay for living in California. But for many looking to own a home the “drive to qualify†mentality just doesn’t make sense. I’ve known many people that work in LA County and purchased nice homes in the Inland Empire only to have a 1.5 to 2 hour commute each day (each way!). And by the way, the weather isn’t all that great in the Inland Empire. You might as well buy in Arizona or Nevada if you are doing a mega commute. People are coming to this realization and the net migration figures show this very clearly.

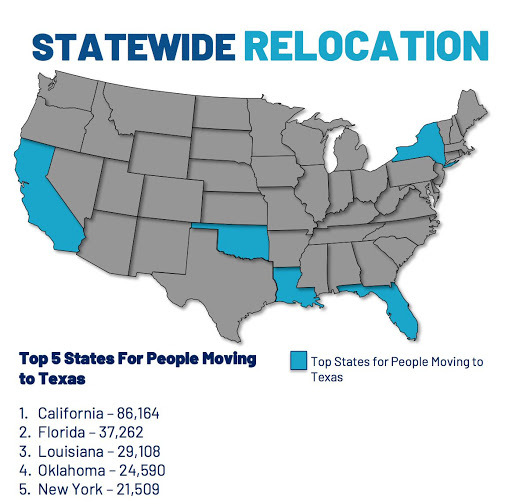

Take a look at this chart:

Texas is seeing a lot of growth for a variety of reasons:

-Low income taxes

-Growing cities

-More flexibility to build

-Cheaper housing

-Economic growth

What is interesting is that Texas has high property taxes which isn’t such a bad thing. If all other taxes are low, property taxes being higher would make sense. Having these reassessed each year also makes economic sense given these go into local area items – schools, etc. So if you live in the area, everyone should pay a similar rate. California is hellbent on keeping taxes artificially low for those that bought in the past using the “granny†argument. I’ve seen people buying a place nearly identical to their neighbor and one is now paying $10,000 a year in property taxes and the other is paying $1,000. That just doesn’t make sense and ironically these are the people who want government to stay out – yet they want the government to protect them when it comes to artificially keeping property taxes low. Texas, a state that is anything but liberal and is geared to smaller government has very high taxes and somehow has big economic growth and affordable housing. Probably something to think about and there is now momentum to undo parts of Prop 13 given most in LA County now rent.

Let us show this with examples to add some color. Take a look at a couple of rentals in nice areas:

Basic home in Culver City renting for $5,200 a month. This home sold for $1,425,000 last month and is now up for rent. It looks like it was listed for $5,400 but it got dropped. As a real estate investor, not a good return on your investment.

Take a look at this home in Plano Texas:

The home is assessed at $233,000 for tax purposes. So do the math here. The home in Plano is renting for $1,850 (and is 3 bedrooms versus 2). Just calculate the cap rate or gross rent multiplier here. This is how out of whack things are.

There are plenty of ways you can compare and measure. For those that don’t know, people in Plano do rather well on an income perspective. Based on Census data Culver City median household income is $92,687. Plano Texas median household income is $94,306. This is very relevant when you are looking at investment properties or rentals. Sure you have some households in Culver City doing exceptionally well but the median number tells you a big story that is missed most of the time.

You can run this analysis on multiple cities and get similar results. There is a great series on PBS called Lost LA and I recommend people watch it. You will realize how quickly we turned a wild west area into a glamor market with a little bit of Hollywood glitz. You will also realize how quickly we pave over gargantuan economic failures and somehow ignore any lessons in history for Instagram filtered realities. Yet the above numbers are real and the fact that many people are voting with their feet should tell you something.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

182 Responses to “Why are Californians moving out in droves to Texas? A trend that goes beyond one year. A two city example.”

Although not knowing a whole lot about Plano, TX, I’m a bit surprised it costs that much to rent in Plano, TX. Plano is about 20 miles outside of Dallas.

A quick search of the schools for the above Plano house yields 8/5/7 rating on GreatSchools for the elementary/middle/high schools, not great. The Culver City house has 10/7/8 school ratings.

I would guess there are higher paying jobs in Culver City than in Plano.

A fair comparison may be look 10-15 miles outside of Culver City, where there are decent schools. My guess is California would still edge higher, but the rent comparison wouldn’t be so extreme.

Also, look at a home for rent in a good area of Austin, TX (78746), which will set you back a decent chunk: https://www.zillow.com/austin-tx-78746/rent-houses/

If you look in the areas with really good schools close to jobs in Texas… housing prices are very high.

Almost as high as CA, but then you throw in property taxes that are 3% of value and forget it.

You can live for cheap anywhere far from jobs with not good schools for cheap.

You can still by a house in southern California for $300K if you don’t care about being close to jobs or good schools.

Agree with NoTankInSight,

SoCal is a great spot to buy RE. Just signed.

Carlsbad / sorrento valley is a tech hub with great job opportunities.

I found great pockets of value properties with great schools at an affordable price.

Love it here already.

I think everybody is underestimating the cost of living in nice areas of Texas. If you want to live near the good jobs in the metro areas with good schools and safety, you will pay. And don’t forget to add in the high property taxes and cooling a large property for good part of the year.

In case anybody hasn’t been paying attention for the last decade, CA has a massive housing shortage that likely won’t get resolved anytime soon. This is driving up home prices and rents in many areas. Many of the desirable coastal areas are changed forever. It is different this time!

I moved from Plano, TX to Newport Beach, CA to retire. Why? Utility bills are much higher due to usage, not rates. Summers are unbearable and you need 3 to 4 a/c’s going all the time. Property tax rates are about 3 times what they are in California, though you get much more home for the money in Texas. Gas prices are lower in Texas, but you can’s go anywhere without using a tollway, which adds $3 to a gallon of gas(.16/mile to use tollway). Other than that, Texas is great to raise a family.

Marka3: what neighborhood did you move to in Newport (Newport Coast, Port Streets, Eastbluff, etc.)? I live in Newport as well (renting currently) and prices here are crazy for anyone who doesn’t earn $400K per year. The best we can do currently is a 3-bedroom condo for $1M. Needless to say, we’re waiting to see what will happen in the future…

Wow, Millennial finally bought a house. Good to not wait for a crash. If a crash happens, the fed will just print more money to keep the prices from falling. The banks will buy a lot of houses. It goes on and on.

20 miles outside Dallas doesn’t mean much. The DFW metroplex is massive. You can drive 50 miles easy and never leave the area. There’s no real “Dallas” anymore, just one huge sprawling area with several cities inside of it.

Plano is also a big tech center now, lots of well to do tech workers live and work there. Hence it’s expensive.

The post to which I am replying cites “lower income taxes in Texas.” Texas has NO state or city income taxes. Rents are expensive because folks moving in from out-of-state are making cost comparison with the states from whence they came. The cost of buying a house is cheap. My previous 2,200 square foot two story brick home cost me $168,000 a few years ago. It was located in a prosperous community adjacent to Houston (“The Woodlands”). Selling prices have increased recently due to the influx of people moving from California and making offers based on property costs in California.

There are some hot women in Texas … not a bad move.

Yes, but the hottest women in Texas — including their beauty queens — move to Los Angeles or New York City, to become actresses and models.

That’s why L.A. and NYC has many of the most beautiful women in the U.S. These two cities attract the prettiest women from around the country, and around the world. The women settle in these cities, and if they don’t make it, they often marry rich local men.

It’s like a “brain drain,” only its a “beauty drain.”

Where do you find the hottest women in Texas? In Los Angeles. (Or New York City.)

You think every hot Texas woman wants to be a movie star? LOL

Dude, get some perspective.

Mr. Landlord, where did I say “every” Texas beauty wants to be a movie star?

The fact remains, there is a “beauty drain” into Los Angeles and NYC from around the country, including from Texas. But there is no great “beauty drain” in the opposite direction.

It was a Ben Stein article that drew my attention to this phenomenon, many years ago. Stein noticed the high percentage of genetically beautiful women in the pricier parts of L.A., as opposed to other parts of the country. He theorized that these women were the descendants of all the beautiful, aspiring stars that came to L.A. over the course of several generations.

It makes sense.

Dude,

your comment is so inappropriate for this blog.

Andrea, it is absolutely appropriate. If the women are not decent, then you don’t want to buy a home there. Real estate 101.

YEAH whatever. Who wants to deal with those beeatches wannabe models and actresses. You can find the most beautiful girls in small towns just living a great simple life working normal jobs.

Ehawk, small town girls … can’t beat that.

“What is interesting is that Texas has high property taxes which isn’t such a bad thing. If all other taxes are low, property taxes being higher would make sense.” – Dr HB

If we had other tax rates like Texas, then repealing Prop 13 would make sense. But we don’t so it doesn’t. Unless a repeal included a lower cap on income tax and business taxes. But we know that in California, that isn’t happening when the voting public wants something for nothing (even though we should know that it is impossible).

BTW, I know of some folks who a few years back decided that Kansas was a good alternative, so they bought a house there and moved. The whole thing was a mess so they walked away from their Kansas house and moved back. They rented until their credit was back and bought here in the IE. (One of those not so nice towns on the edge of the desert. ) Now they’re talking about moving to Texas.

If Prop13 can be repealed than the other tax rates in CA can also be changed. Doing either would require tremendous political effort and really doing 1 would almost require doing the other at the same time.

After all CA’s high sales tax and such are mostly due to Prop13 suppressing property tax revenue.

There has been some talk of modifying Prop13 so the old folks who bought 30-40yr ago get to still use it but businesses and rich people would be excluded which really would probably be fine.

“Can” and “will” are two different things. This states addicted to Big Government, and that takes ever increasing piles of money. Taxing businesses does strange things. The attempt to force Uber and Lyft to pay benefits to drivers has backfired on a large number of gig workers who are seeing gigs dry up. Cindy Shea of the Mariachi Divas was on the radio today talking about how AB 5 is drying up gigs she and her band can get. This band has played Disneyland and the Shrine and won a Grammy.

@Joe R

““Can†and “will†are two different things.”

Recent major talk and efforts at amending Prop13 have come from the Lefty/Democratic side of things though. Not the Repubs.

Repubs were the ones responsible for Prpp13 in the first place BTW as part of their ‘tax revolt’ back in the late 70’s.

“This states addicted to Big Government, and that takes ever increasing piles of money.”

This is broadly true of every state, its a meaningless platitude at this point.

CA is one of those that gives more to the govt. rather than taking more unlike some.

“The attempt to force Uber and Lyft to pay benefits to drivers has backfired on a large number of gig workers who are seeing gigs dry up.”

Which is good.

Work that doesn’t allow you to survive on it is pointlessly exploitative of workers. People do not exist to enrich Uber, Lyft, or any other mega corp and no one with half a brain cares about the well being of those companies either.

Unemployment numbers are also low enough that whatever negative effect it had on gig jobs its small enough to be considered negligible.

“Cindy Shea”

Who in their right mind cares what that person says?

That’d be like taking advice from someone who says they lower their wages purposefully because they don’t want to be in a higher tax bracket.

KNX radio (1070) apparently felt Cindy Shea was worth interviewing on the effect of AB5 on local musicians. She is somewhat typical of non-pop star musicians who make a living playing gigs around town. My neighbor is one of those who is even less well known than her (she has a grammy and he doesn’t). However, he probably is a better musician than a lot of members of well known rock groups who pack them in. AB5 shows the law of unintended consequences. Some gig workers really are gig workers who are better off working for themselves. Whereas Uber and Lyft drivers are really taxi drivers working for a high tech taxi routing service that figured out a way around local taxi laws.

Like all socialist experiments it will end in economic disparity, mass suffering and collapse. Its perfectly natural to try and get away from these situations if you can see them and have the ability.

I dont think there is any doubt that Ca and the U.S. as a whole is are playing from a socialist playbook and the inevitable results are coming to surface.

The total tax burden in Ca. for the “good” of all, property, income, gas, sales, workers com?, etc. is at best grossly mismanaged and becoming overwhelming, people and business’s are going to start migrating away from this train wreck en masse. And that’s what were seeing.

So go already if you don’t like it, you are free to go at any time. The number of people leaving is minimal so how about 5 to 10 million of you whiners pack up and go?

Not a whiner just aware of how bad things are (not conditioned yet ) and how this is most likely to end. I’m riding out the rest of my career as a contractor here in Ca, where I was born, then I will have to go, can’t retire with $397 a month property taxes. Leaving the country is still being considered. I heard Chile is a good spot but after seeing the riots over transit fare increases I’m having second thoughts. Hopefully have another 5/7 years to work, save and figure it out. Unfortunately Ca just isn’t an option. DP, have you thought about how many millions of dollars you’ll need to retire here for 18/25 yrs?

Russell, don’t go to Chile. I went there twice as well as in many south american countries. While I agree with you that Chile is the nicest and the most developed and civilized in S. America, it can not compare with many nice places in US. Many nice places in US are very inexpensive, especially if you don’t need a job. While Chile since Pinochet was the most right politically in S. America, it is still a socialist country relative to US.

In conclusion, relative to the rest of S. America, Chile is the best. In competition with US, US wins by far.

Russell, don’t go to Chile. I went there twice as well as in many south american countries. While I agree with you that Chile is the nicest and the most developed and civilized in S. America, it can not compare with many nice places in US. Many nice places in US are very inexpensive, especially if you don’t need a job. While Chile since Pinochet was the most right politically in S. America, it is still a socialist country relative to US.

In conclusion, relative to the rest of S. America, Chile is the best. In competition with US, US wins by far.

The property tax rates in TX may be three times as much but the homes in CA cost three times more, so there’s little difference in what is actually paid by today’s buyers. All other taxes are less or nil. We’re able to live mortgage free plus save more than $1,000/mo in taxes by moving from CA to TX. It is hot, though.

Don’t forget TX has no state income tax.

CA is nice if you are rich.

Dr. is correct in saying CA lost 190,000 people, but the more accurate numbers are we lost a lot more than 190,000 wage earners and tax payers, if you consider CA gained a huge number of homeless people from other states.

The ones who left were tax paying workers, and the new population is homeless.

Had the WISE, anti-tax Howard Jarvis organization not spearheaded the prop 13 freeze on property taxes, the tax-gouging Democrats bent on destroying California would have jacked them to the moon years ago. Your comparison is out of whack because the neighbor paying higher taxes has much to do with the excessive housing regulations driving up construction costs and government mismanagement. Need examples? $1.26 per gallon state taxes added to every gallon of gas. Vehicle registrations in the hundreds$$. Cp to those in Texas. Giving CA Democrats ability to raising property taxes would finish the state, which is already failing badly, suicidal..

Truth!

“$1.26 per gallon state taxes added to every gallon of gas.”

I just came back from Houston – last fill up – $1.97/gallon. So many things are WAY cheaper, plus they’ve got HEB and Buc ‘ees!

California is the 5th biggest economy in the world. Failing? Get real.

Housing costs in Calif. Ex. Required FIRE SPRINKLER SYSTEMS add about $10,000 to the cost of new homes, this is just one of many crazy Democrat laws here. School taxes add around $40,000 more. Who is paying to educate and eve feed, free healthcare the illegal invaders? -taxpaying citizens do. And Calif. Democrat politicians have stolen, misused, and diverted taxes from their intended purposes time after time, while neglecting infrastructure, new dams, and roads. Dems have a “Super Majority” dictatorship.

Also you need a full PV solar install on all new builds.

Just spoke with my local suburban/rural SoCal planning dept. Even new ADUs (Accessory dwelling units) now require $olar panels and anything over 750sf (who is going to make a ADU smaller then 750sf?) now require $15,000 Developmental Impact fees. What’s really stupid is that a ADUs are a max 1200sf FOR ALL STRUCTURES including a garage. This means people will max the habitable space and avoid making the garage which equals more cars on the sidewalk. I moved out of the city into the suburbs so I wouldn’t need to drive 45 minutes for a street parking.

Just spoke with my local suburban/rural SoCal planning dept. Even new ADUs (Accessory dwelling units) now require solar panels and anything over 750sf (who is going to make a ADU smaller then 750sf?) now require $15,000 Developmental Impact fees. What’s really stupid is that a ADUs are a max 1200sf FOR ALL STRUCTURES including a garage. This means people will max the habitable space and avoid making the garage which equals more cars on the sidewalk. I moved out of the city into the suburbs so I wouldn’t need to drive 45 minutes for a street parking.

California politicians don’t care about the middle class. There is an endless supply of people that will come here from other countries that will tolerate whatever is fished out to them in terms of high taxes, homeless, bad schools and high crime. Plus when you get fed up and leave they can reassess property taxes higher for the next sap.

Actually Property taxes are wrong. You pay off your house and you are still tied your a payment of sorts. There was a reason for Prop 13. There is already income tax and high sales tax in California.

There is an endless supply of people who are willing to come to California from abroad and tolerate the high crime, high taxes, bad schools, and homeless encampments. The politicians here hope you leave so they can reassess your homes property taxes and get more out out of the next person

Agreed, there are too many people in CA. But unfortunately the majority of those leaving are middle-class looking for more affordable housing. While the majority of those coming in are either ultra-poor or ultra-wealthy. This creates a third-world class system where the ultra-poor survive by serving the needs of the ultra-wealthy. The future of such a class system is not exactly rosy. Having lived in LA for the better part of 20+ years, I have seen the once beautiful City of Angels on the coast turn into a cesspool filled with homeless, illegals, garbage, crime, and poverty. And it’s getting worse! At one time you had to go downtown to see homeless encampments, now they are easy to see all over LA under freeway bridges and overpasses, parks, dried up riverbeds, etc. As property values skyrocket the city deteriorates as water mains break, sidewalks and streets crumble, and property crimes become common place. What do are leaders in Sacramento do? Give free healthcare and handouts to illegals with our tax money while providing sanctuary from prosecution. If this is not a magnet to invite more poor people from across the border to CA, then I don’t know what is. And remember these are the same people that are competing for the same rental properties. RANT OVER.

Too much truth for the liberal heads here!….They will explode :-)))

CA needs cheap labor for gardening, landscaping, maids, housecleaners, dishwashers, fast food servers, busboys, home repair, etc…

This is primarily to support the tourist industry. All of those Texans flying to visit the beach and families need to stay and eat somewhere.

i guess you could say Texas tourist dollars are supporting hotel and restaurant businesses which support illegal aliens.

People moving out of CA are middle class people. People moving in are upper middle class and above, along with dirt poor illegals. CA is turning (and in many areas has already turned) into Brazil. A place with a small slice of rich mainly white people surrounded by dirt poor brown people. And with nice weather and beaches.

If California is turning into Brazil, how do you explain that homes now even in Mid-Cities part of LA are selling for $600K? and 1 bedroom apartments in downtown LA are leasing for almost $2K and thousands of these new apts are being built and rented out in downtown LA each year. Over 3,000 residents are moving INTO downtown LA each year at unbelievable high rental rates.

Try finding a decent home/apartment in Rio or Sao Paolo for under $1M. You’re making my point for me. There is a small sliver of people who can afford these prices. And the rest of the people live in favelas. And CA is turning into that, with homeless people everywhere as well as 10 people living in 2 bedroom apartments.

I am in San Diego and in my neighborhood, the average home price is close to 1 million.

I see a lot of cars parked in the street and a 3 BR/2BA home would house 6 adults , basically multiple generation living tog.

I also see a lot of people sharing 3 BR house with strangers to lessen the burden.

Yes, QE, Los Angeles as you describe it, is exactly like third world cities- the mega-rich, and a small, nervous upper-middle class, all mostly white living in ginormously overpriced luxury housing in gated communities, surrounded by hordes of dirt-poor people living packed 20 to ratty slum apartment that costs $1000 a month. NYC has been this way for a long time, but even 20 years ago, housing was not too unreasonable in Los Angeles, and in the truly golden years, the 1960s, it was cheaper to buy a house there, then a comparable in a Midwestern city like St Louis.

California is a very expensive place to live.

Imagine it would be cheap to live here….we had even more people and more traffic.

You obviously never go to the beach. If you did and used it you’d find it cold and polluted (from illegal encampments, dumping, etc.) fairly often. Weather – youre kidding, right? Yeah, I get that its sunny and mild almost everyday, where do you get your water? You know, that stuff you drink, bathe and cook with? It doesnt fall from the sky in socal much, so you have to get it from very sketchy places hundreds of miles away and treat it so its practically a poison. I laugh at socal types talking up the fantasy – you have no grasp of reality. Yes I lived there – 17 years, but I made my escape to some place 100x better. Those places do exist!

Can someone explain to me WHY 37,000 Floridians moved to Texas last year? What’s the appeal Texas has versus Florida? What am I missing here?

In the Summer time, the weather in some parts of TX is a little bit more bearable than FL. Many cities in TX have more jobs than FL.

You need to get out and see the world some more if you think FL and TX are the same thing.

“Texas, a state that is anything but liberal and is geared to smaller government…” this is no longer the case. As more and more Californians flee to TX they bring with them their same liberal values, turning TX into the same place they are trying to escape. Austin for example is considered one of the most liberal cities in the US. As time passes, Houston, Dallas, San Antonio will follow.The grass is always greener until you plant the same seed on the other side of the fence. Then it becomes the same mess.

It doesn’t matter because California politicians know that there is an endless supply of foreign born workers that will gladly buy your home, tolerate the high taxes, crime, bad schools, and when you leave they can reassess the property taxes higher .

Continuing on an earlier thread on boomers.

Don’t count on boomers leaving their big homes as they age.

The theory goes like this: Senior citizens historically will downsize into smaller houses as their children leave the nest. This allows younger families with starter homes to expand into larger houses. That in turn allows first-time homebuyers to buy starter homes that the younger families are moving out of.

But since the financial crisis, this cycle of homeownership has come to a halt, and baby boomers who “won’t move,†particularly those who live alone in houses that could otherwise be home to multiple people, are often blamed. This chokes off the number of available homes for sale, the homes that are for sale are subject to bidding wars, and the price of housing rises as inventory drops.

“As supply has not kept up with demand, people who already own their homes who would normally trade up or downgrade or whatever it is, they’re finding it harder to move across the tiers,†said Cheryl Young, an economist at Zillow.

“We don’t see as much mobility as what people would normally go through during a life stage.“

An old man in a turtleneck holding a cane serenely riding a stair assist machine up a floor. Illustration.

Boomers are staying in their houses longer because they’re living longer and more independently than previous generations. They’re also working longer, so they have the income to stay in a large house if they want to. They’re also more likely to have a child still living at home than seniors did prior to the housing crash in 2008, meaning they still have a need for larger houses.

https://www.curbed.com/2020/2/13/21122603/seniors-housing-affordable-crisis-living-alone

A lot of the ones leaving California weren’t born here and didn’t live near the coast in So Cal. I’ve lived in Oklahoma and Texas when I was in the military. The winter in Oklahoma is going to be a big problem for anyone who isn’t familiar with living in cold weather. Also, the insect problems in Oklahoma are much worse than So Cal near the coast. It’s not big deal to move if you weren’t born in So Cal or if you lived inland California. In fact, I don’t see why anyone would want to live in the valley when you could just move to Nevada or Arizona and have the same weather with less taxes.

JFC enough about the weather. If the difference is live well and deal with 2 months of winter or live in poverty and not deal with 2 months of winter, the choice is pretty obvious. And with the money you save by not living in SoCalm you can take a few trips to the Caribbean during those 2 months if you really need to get away from it.

You still taking cruises after the coronavirus outbreak on those cruises in Japan and California?

We voted with our feet about 5 years ago. My husband and I both loved LA but with a growing family the economics of it all just didn’t make sense. We now live in a suburb of Houston. Bought a 4 bed, 2.5 bath house at $280k. Big yard, garage, community pool. Excellent schools. Our incomes are also very similar to what they were in LA but obviously go much further due to lower housing costs. I’ll also add that our house is a more recent build so less costly to maintain than some of the 100 year old closets they’re selling for half a mil. Unless you have to be in LA because you’re an actor/entertainment type, the numbers really don’t add up. Due to the low cost of living were also saving more than we ever have. We can actually build wealth here whereas California felt like a big debt hamster wheel.

I think Y’all need to look at the situation from an aging Baby Boomer perspective.

If I am an aging Boomer and have a paid off house a block from the beach in S.CA that I bought in 1976 for 45K, it might be tempting to look at cashing out the house at $1M+ and moving to Texas. I’d also consider signing up for My Lottery Dream Home and be on TV! After all, I won the Prop 13 lottery those Tea Party fanatics enacted in 1976.

However, after deep thought while walking my dog on the beach, I reconsider.

I am on Social Security with a nice corporate pension (Those Republican fanatics got rid of those for all younger people).

Income:

SS: 2K/month

Pension: 2K/month

= 4K per month.

Expenses on my beachside home.

Prop 13 property taxes: 150/month

Insurance: 60/month

CA income tax with all of the deductions, 48K/year is poverty: $0

Total expenses: 210/month

If I move to Texas for a 400K house.

Mortgage: 0. I used the the 800K in gains (after taxes) to buy the 400K house.

Texas property taxes at 4%: 1,2K/month

Insurance in a Hurricane zone: 400/month

Texas Income tax does not exist: 0/month

Total = 1.6K/month.

My total expenses are now 45% of my income. Never recommended.

I am also in total fear that a Texas appraiser will double the value of my house forcing me into foreclosure.

And no more beach.

You’d have to be a crazy Republican to move to Texas in this case.

To sum up what you said: “I am doing great thanks to those “evil” republicans who took care of my property taxes when they had power in CA. Without them, I would be homeless due to democrats charging property taxes on 1.2 million.”

It’s easy to bash republicans when you live a life of luxury thanks to them. Don’t worry, I don’t envy you since I also do excellent thanks to the same “evil” republicans. If communist Sanders wins, we have to get ready for “Gulag Archipelago”.

Unlike evil Republicans, I think about other people and society. Republicans are just selfish oligarchs who only think of themselves now, and not for the future of society.

IMHO, if you give people enough money, the majority will spend all of it. This includes government spending of other people’s money. I agree with you on this. It also includes large capitalist corporations where if a manager is given an amount of money to spend in a year, they are expected to spend ALL of it. Otherwise, they lose their budget for the next year. There is often an inefficient large spend at the end of fiscal years with managers buying useless items just so they don’t lose next year’s budget.

To your point, Prop 13 was good that it rolled back housing tax rates from 3% back to 1%. This prevented the politicians from spending wastefully. However the Republican greed didn’t stop there. They realized that inflation would raise the cost of essential government services but they locked in THEIR property tax increases to very much below inflation. That was blatant “I got mine and the future generations can pay for my services”. Republican evil. And because they are oligarchs and believe in feudalism, those evil Republicans said that their heirs could inherit the same property tax. This is the definition of feudalism.

If you look at history, especially Russia, Cuba, and other communist countries, the rise of communism and socialism was the result of feudalism. Oligarchs owned most of everything and the Republican lords said “Let them eat cake”

The Feudalist Republicans were so short-sighted and only thought of themselves that they often got beheaded when the disgruntled majority turned on them.

Is the US there yet? If Bernie is elected, then we are. The blame will lie solely on the Republicans for allowing feudalism and oligarchies to flourish for so long. History repeats itself, and I shake my head because we have seen this all before.

Prop 13 was good to roll back taxes for all but bad to throw all future generations under the bus.

Do you think this government favoritism for anyone who owned a house in 1976 is good? From my example above, it is a reason why silent generation and older Boomers are not selling their houses and moving to Texas. It is evil Republican government favoritism. Very much like the Russian communists did for their party members. I hope you are against this given your experience.

Bob,

The problem with Prop 13 is that it was pricing people (especially retirees) out of their homes. For instance, if you were lucky to buy a house North of Montana in Santa Monica for $75,000 in the 1960s you had made a great investment by 2005. However, if you were on a fixed income during retirement you would have likely had to sell that house without the passage of Prop 13 as the property taxes would have been reassessed on a regular basis and been too high for someone on a fixed income. There is no fairness in that, unless you have a Logan’s Run approach to society wherein the old folk have a duty to just go away.

Bob, if you have a guilty conscience, nobody stops you from selling your over million dollar house and share with the poor and the less privileged. Same goes for Sanders with 3 million dollar houses he obtain living all his life on the hard earned money of the taxpayers. It goes the same for Buffet, Bloomberg, Gates, Bezos and other democratic hypocrites.

To steal from the middle class to offer to the poor to alleviate your conscience (Robinhood) is plain wrong. Those people are for the most part worse off than you and Sanders and struggle to pay their mortgages, massive amounts of taxation at all levels, save for their children’s colleges, etc.

If you don’t see the picture from my posts, read the Observer’s post above – he explained it very well. You also said it how the government is spending money just to make sure the next year they get the same amount. The young can not even afford to rent or to marry and have children because of the massive taxation by the democrats; and you support all of that.

Sorry to break it to you, but NOBODY is going to tax the rich – they make the laws and all the democrats and republicans with power are rich. The rich and poor, ALL feed on the middle class and that is very wrong. Without a thick middle class, everyone is worse off, and the democrat taxation eliminates the middle class. Yes, the GOP does the same but “LITE” – not to the same extent like the Democrats. ALL the tax credits for children and all decreases in taxes (as low as they were) were passed by GOP – NEVER by the Democrats who claim they care about the poor. The Democrats don’t want the poor to succeed, they want them dependent on them to beg them for crumbs, otherwise, when they had power so many times, they would have eliminated all taxation on the poor and middle class; they NEVER did.

It is easy for you to criticize, when your existence and ability to survive and live in your house depend on those “evil” policies from the republicans of old. I agree with you, that they are unfair because the same level of property taxation does’t apply to ALL homeowners. The solution is simple – reduce the size of the state and county government to “ESSENTIAL” personnel ONLY and eliminate all property taxes, or worse, cap them at $1,500 per property like in Switzerland. If the personnel is not “ESSENTIAL”, then there is no reason to hire them in the first place. If still not enough, sent all the illegals home; they use billions of dollars of millennial taxes every year. The middle class in CA can not afford to sustain everyone from S. and Central America like another socialist proposes (AOC).

The problem and inequalities in CA can be easily fixed if there would be the will. CA democrats have ABSOLUTE power – they can pass ALL the laws they want – they have super majority. However, the vast inequalities are promoted by the Democrats and they have zero desire to fix them.

In CA you would pay income tax on $48K if it were regular income, and your deductions would not be enough to offset it (no mortgage). But CA doesn’t tax SSA income, so you’re actually being taxed on $24K. Some states do tax SSA income but some have income caps or a retirement income deduction:

https://www.kiplinger.com/slideshow/retirement/T051-S001-states-that-tax-social-security-benefits/index.html

Texas doesn’t tax income so it may be a good place for higher income retirees. People have to factor in all the tax and weather related costs of moving, as well as welfare and medical support systems (if handicapped, especially).

JoeR,

I agree, if you are making a boatload of money in retirement, Texas does not have any state income tax. CA income tax is high. You can do well in TX.

Just don’t buy a nice house in TX. TX has super-high property taxes.

Property taxes are wealth taxes. Income taxes are dependent on income.

Observer,

I agree with you that Prop 13 saved the Seniors by rolling back taxes from 3% to 1%.

However you will have a diffiicult time explaining why those evil Republicans limited tax increases to 2%. Which was well-below SS COLA increases. They should have tied it to SS inflation increases. But they are just pure selfish evil.

Or why those Oligarch Republicans allowed heirs to inherit the taxes on their homes????

The last time we saw this was in Feudal Europe before the commies took over and kicked poor Flyover’s family out.

Republicans were pure evil for these reasons. And are the sole reason why Bernie will be elected.

So how come all billionaires live in Blue states?

Or why those Oligarch Republicans allowed heirs to inherit the taxes on their homes????

The wealthiest oligarchs in California are Democrats, e.g. Mark Zuckerberg, Sergey Brin, David Geffen. IOW, the people who own Hollywood and Silicon Valley.

These oligarchs talk like “progressives,” but the Democrats in Sacramento bow to their will and protect their financial interests.

Republicans have no political power in California. The Democrats could have eliminated Prop 13 by now, if they wanted to. But these “progressive” Democratic oligarchs don’t want that.

Mark Zuckerberg, Sergey Brin, David Geffen are new oligarchs. They did not purchase S. CA homes in the 1970’s or early 1980’s for 45-100K. They leveraged the Pro Clean business environment and pro-immigrant policies starting in the 1980s

to become what they are. If you are a tech person from anywhere, you tended to migrate to CA to feed this growth. China and Mexico inherited the low wage manufacturing businesses.

The Boomer majority voters did buy during this time and would be foolish to sell now. That is why Prop 13 will not be overturned in the near future. It is a third rail for politicians. These voters will not stand for their 1K/year property taxes to be increased and will vote any efforts to do so.

As the 1970’s and 80’s boomer migrate into the CA sunset, Prop 13 will be more susceptible to an overturn. Unless heirs inherit the same property taxes to propagate into dynasties.

The weather where I am in Banning is excellent. If it wasn’t for all the litter and sketch people it would be an ideal place to live. IE has a lot of potential!

Dude I’m staying in SoCal. Pretty soon I’ll be able to from Bakersfield to Merced (or Modesto, some shithole town) by built train.

Socialism is where people at the top empower people at the bottom to pull down people in the middle. It’s a win-win for the top and the bottom in the short run. Those at the top help pass laws favoring themselves. Those at the bottom get freebees. And those in the middle leave taking their value system with them. And in the long run the socialist state/country loses. Because those at the top have no incentive to work hard or innovate. And those at the bottom have no opportunity.

Good bye SB 50, hello to LA Chamber of Commerce.

The state couldn’t get it done. Now, it’s the turn of players in the city to take a shot.

In the wake of the death of high-density state housing bill SB 50, the Los Angeles Chamber of Commerce is strategizing a plan to double the permitted density of residential buildings on commercial streets and in areas zoned for apartments.

https://therealdeal.com/la/2020/02/19/la-chamber-of-commerce-explores-doubling-density-of-resi-buildings/?utm_source=internal&utm_medium=widget&utm_campaign=feature_posts

Existing home sales are up over 9%! Inventory is very low!

https://www.calculatedriskblog.com/2020/02/comments-on-january-existing-home-sales.html?m=1

Millenial, so now you’re a RE cheerleader? Congrats on putting on your big boy pants and entering adulthood by purchasing property. But that is no excuse for being the biggest hypocrite on this forum. For years you’ve been advocating people wait for a 50% crash and now you buy at the near top? I feel bad for the schmucks that have been listening to your BS for years. Oh well, better late then never.

The best time to buy property is when you can afford it. PERIOD.

Awesome, Millennial!

You’ve turned so fast that even I’m dizzy from your head spinning.

I guess on a housing bubble blog that nobody thinks there is a bubble, if you can’t beat them, join them.

I’m beginning to think that Mr. Landlord is right. This is Milli’s performance art.

Milli’s conversion is too sudden, and too complete.

Within a few weeks, he’s inherited money and is already signing the papers on a new house? Probate and home sales don’t work that quickly.

And if he really believed that we were due for a 50% to 70% crash this year, why not wait a year, then buy two or three houses at year’s end? Or were his previous claims an act? Or is he acting now? Or both an act?

I tried to ignore most of his BS posts over the past anyway, skipping over many of his comments. This is someone who seems to be responding to posts all day while claiming to be a RE expert who has never bought or sold a single thing. Someone who posts that much probably doesn’t have a job and lives in their parents basement. I just hope no one visiting this forum missed out on a opportunity because of his repetitive ignorant comments.

You guys are being trolled so hard.

Just before the good Dr started this thread on Feb 16, I posted this on the previous one (with one small edit to correct a bad entry):

“Jonathan Lansner’s Bubble Watch column in the OC Register today is on foreclosures. The SoCal rate of court default filings was 1 out of 20 during the crash but was 1 in 333 last year. That was off 20% from the year before. He gives the foreclosure situation today one bubble on his 0 to 5 bubble scale.The 4 SoCal counties in the LA metro area (LA OC SB & Riverside) made up 11% of 2009 filings in the US but 4% today. There just isn’t a lot of bad loan making out there.”

JoeR,

I think this Gray Swan will be different than the 2008 Gray Swan.

Of the people who are buying houses, my guess is that they are pulling down payment and income numbers for loans from their stock portfolios.

If you look at equity prices, they have been to the Moon! More people have been able to “afford” houses with stock equity.

My prediction is when the stock market super-bubble bursts, housing will fall twice as fast.

More houses have been bought by middle and upper class owner-occupiers since the crash. Rentiers bought a lot too, so except in low cost interior areas, working class buyers have been frozen out. It was working class owners that were foreclosed in 2008-2010 for the most part, and some speculators who bought at the top. Job loss was the big driver of foreclosures, and that was worst among the working class.

My 900k home is paid for and my expenses are low, my retirement income is high, so why should I leave the Burbank climate(Toluca Lake) to go to Dallas? I have no HOA or mello roos in Burbank. I pay 5k a year in state income taxes. Life is good in the “Media Capitol”.

There’s a simple way out for CA politicians who want to raise tax revenues without changing Prop 13. Pass stringent rent control/eviction laws. Will force landlords to sell their rental properties and pay capital gains tax. It may also result in fall in house prices. But the property tax revenue will rise because the sold houses will be assessed at market value. As for those houses which are not sold, the market value is unlikely to fall below assessed value because many houses have been in same hands/family for several decades.

Well being a California, I say be gone already. Too many people here, dumb people too.

Another good article. I have not been to this site in 8 years. Pulled up the old link and boom, the site is still kicking. One of a few that kept me out of the entire HOA boondoggle.

ACG, also kept you out of turning a $50K down payment into $1 million in 8 years… but yeah, good thing you didn’t have to pay $300 a month for an HOA.

When is the next housing bust going to happen? After the 2020 election?

I just updated my charts and it appears that the best time to buy real estate will be about Jan. 2023. Therefore, all of 2020 should be a good one for real estate. This makes sense because the TPTB (The Powers That Be) are likely to do everything possible to keep the economy going until after the Nov. 2020 Presidential election. I expect to see many poor quality loans to be make in the coming year.

California housing may be getting cheaper soon if Coronavirus hits the state hard. It’s a 15%+ fatality rate for anyone over 55 with heart disease or other ailments. The global economy is headed towards another great recession and may be there by the ides of March.

Come on … you know better than that. If home prices ever drop again, the FED will hit the negative rate button and you will be pissed again.

Either that or the house prices will skyrocket because of fleeing HongKongers. A condo in HK costs USD 16000/sf. I believe. CA is dirt cheap in comparison. However I doubt China will allow HKers to sell their real estate and take out their money

Kent – I dont believe any glitch in the matrix, (virus, earthquake, etc) will make a dent in LA home prices.

The ONLY thing that will cause a crash is a … wait for it…. job-loss recession.

The virus could kick start the job-loss recession, but will only be the kindling on a giant dumpster fire waiting to happen in the ekonomy.

Corona virus is about as deadly as influenza, which has been here for years. They kill the same target group. China’s healthcare is like MediCal for all. The virus will not kill many of the owner occupiers of middle and upper class houses who have good medical care, but may kill a lot of elderly folks who survive on their SSA check in a rented apartment. I know someone who was a fireman in the slums of LA. He had a lot of frequent fliers to deal with (like an 800 lb man). People like that are always in danger of dying from the next epidemic.

China is getting a high fever from this but the US will probably just get a cough, especially if this virus behaves like the flu and is seasonal. ‘The market can stay irrational longer than you can stay solvent’ said Keynes, so overly leveraged people may feel some pain in this one, but not me. And probably not you either.

Statistics show Coronavirus is about 20x worse than flu. It’s about a 15% mortality rate for people 60+ years old who have any heart disease or other ailments. If it’s just as bad as flu why don’t you write the President and congress to tell them to calm down and not worry? Why don’t you tell the Chinese and everyone else doing quarantine to stop since it’s just as bad as flu and no big deal?

You sound like that guy a few post ago who was telling me how wonderful it is to invest in gold. I told him it’s a bad investment because you need a 50% profit to cut even after taxes and trader fees. Today gold had its worst drop in a decade. https://www.latimes.com/business/story/2020-02-28/gold-drops-coronavirus

From internet search:

How many people actually die from the flu each year?

Flu results in “about 250,000 to 500,000 yearly deaths” worldwide, Wikipedia tells us. “The typical estimate is 36,000 [deaths] a year in the United States,” reports NBC, citing the Centers for Disease Control.

There are many strains of flu, some worse than others.

Wikipedia

“The 1918 influenza pandemic (January 1918 – December 1920; colloquially known as Spanish flu) was an unusually deadly influenza pandemic, the first of the two pandemics involving H1N1 influenza virus, with the second being the swine flu in 2009.

The death toll is estimated to have been 40 million to 50 million, and possibly as high as 100 million, making it one of the deadliest epidemics in human history. ”

My family tried to escape the 1918 epidemic by moving inland to a relative’s house but it didn’t work. They survived anyway. By comparing it to flu, I’m not downplaying Corona virus. When a vaccine is developed, we’ll add it to our yearly flu vaccination. I get mine every year, and the year of the shortage I stood in a 3 hour line so my daughter could get one (high risk).

From LiveScience:

“Editor’s note: Updated Feb. 19 with the latest information on COVID-19.

The new coronavirus outbreak has made headlines in recent weeks, but there’s another viral epidemic hitting countries around the world: flu season. But how do these viruses compare, and which one is really more worrisome?

So far, the new coronavirus, dubbed COVID-19, has led to more than 75,000 illnesses and 2,000 deaths, primarily in mainland China. But that’s nothing compared with the flu, also called influenza. In the U.S. alone, the flu has already caused an estimated 26 million illnesses, 250,000 hospitalizations and 14,000 deaths this season, according to the Centers for Disease Control and Prevention (CDC).

That said, scientists have studied seasonal flu for decades. So, despite the danger of it, we know a lot about flu viruses and what to expect each season. In contrast, very little is known about COVID-19 because it’s so new. This means COVID-19 is something of a wild card in terms of how far it will spread and how many deaths it will cause. ”

We can’t extrapolate to the US from the current Chinese statistics. You may be right or you may be wrong. But please don’t wish for the worst. People with good health are always more likely to live through this sort of thing. Maintain your health because I would miss your posts.

PS Gold Bugs deserve to get hammered every so often. But gold can have a place as an inflation hedge. It worked in Weimar Germany. Gold ETFs have much smaller cost spreads than physical gold bought a few coins at a time, but gold bugs love to hold it in their hands.

JOE R talking about FLU is a red herring. It was first brought up to calm fears. You think it’s no big deal to add another virus on top of flu that is more deadly than the flu? You sound like those hill billies who jump into DNA genetic discussions and say “race is a social construct.” They think that sounds so intelligent when, in fact, they’re only trying to derail the conversation. Race is a social construct, but no one was inquiring if it was a social construct. It’s like when people are talking about a subject and some idiot interrupts the conversation with some bizarre statement that has nothing to do with what two people are talking about. That’s exactly what you and everyone like you is doing when they start talking about flu during a conversation about coronavirus.

k…,

Calm down. I quoted an article from a website that was giving a synopsis of the problem by giving a comparison to influenza:

“That said, scientists have studied seasonal flu for decades. So, despite the danger of it, we know a lot about flu viruses and what to expect each season. In contrast, very little is known about COVID-19 because it’s so new. This means COVID-19 is something of a wild card in terms of how far it will spread and how many deaths it will cause.â€

Like influenza, there are more than one corona virus strain and this one is new to the medical community. I took coursework in microbiology and DNA technology while I was in college so I’m not uneducated in the subject. What I’m saying is don’t put the cart in front of the horse. I’ve met scientists from states generally considered to be the home of “hillbillies”, and I’m pretty sure you can’t hold a candle to them. So don’t be a bigot. There are even left-wing nut cases back in the Hills. That article from a non partisan science website brought up a comparison of influenza and corona virus, so obviously it is a good case study to draw from.

Influenza is a good example of a disease that burst upon the World in a massive epidemic and then settled in to wreaking havoc on susceptible individuals for multiple generations. I personally doubt that COVID-19 will kill millions and millions of people for multiple reasons, including the difference in antiviral drug science between 1918 (none) and 2020. I guess you think you know more than Dr Anthony Fauci:

“It could be really, really bad,” he said about corona virus. “I don’t think it’s gonna be, because I think we’d be able to do the kind of mitigation. It could be mild. I don’t think it’s going to be that mild either. It’s really going to depend on how we mobilize.”

My main point is that good health is the best protection against new diseases like corona, so work on getting healthy and stop worrying about the unknown. How can you argue against that?

JOE R the WHO has said in the last couple days that coronavirus death rate is now upgraded to 3.4% It’s a pandemic. In that old folks home in Kirkland, WA they have had 26 deaths. About 100 people are living in the home. If another dozen or so die we could be looking at a 50% death rate for anyone over 70 with underlying health conditions. The articles you posted on the flu are written by idiots.

Kent, don’t believe everything the government says.

That mortality rate is a bogus number for this reason: there are 3 categories of people: without corona virus infection, infected by the virus but no symptoms and with a virus and symptoms. NOBODY knows how many are infected and no symptoms. NOBODY knows how many are infected with symptoms because some of them never went to the hospital (mild form for symptoms) or never called and some who did, found out that the hospital does not have any testing kits. If you divide the number of deaths to a smaller total, you get an unusual high number for mortality.

I am very suspicious on MSM publishing numbers without questioning their validity.

Well its’ the ides of March and here we are. Fed just cut interest rates to 0% and started a 700 billion dollar quantitative easing program to save the global economy. Now you know who here is right and it’s me, not my naysayers. Look at my comment from Feb. 24th.

Perhaps Millie is tired of trolling this site and is looking for a way out ?

There’s nothing easier than declaring you’ve turned over a new leaf and

then fade away. Of course, he can always jump back in under a new or

even his old handle. Or like Landlord says: Pure performance art.

Millie’s posts never drew my attention. A total troll along with his 5 other handle names on this site. Anytime you read someone who is living at parents home waiting for crash, or waiting for recession or posting drops in home prices, was Millie.

I liked Our Millennial’s posts. He was the only person on this Housing Bubble blog who actually thought there is a bubble in housing. Well, besides me.

I will carry your torch, Millennial!

Thanks bob!

Sry I disappointed you. I became a moderate housing bull (long term) the minute I inherited and decided to buy a house.

Now I find myself rooting for lower rates lol

That was a second gift or pure luck!

Cheers, your millennial

Oh Wow!

How many of you predicted, a virus epidemic would cause home prices to fall?

I guess there is a benefit to being confined to crap shack, if its worth $$1-$2 Mill. At least people can waste away with a view, pool, and master en-suite. Oh yeah, don’t forget to collect your rental income from those infected tenants!

I’m just sayin’ owning property won’t keep us safe from you know what.

Best wishes to All!

Some say that the virus will cause price drops. All other things being equal (which they are NEVER in real life), that might be the case. However, that could cause lower and lower mortgage rates which can put a floor under prices as long as people have jobs. If people lose jobs, regardless of how low the interest is, they can not get loans unless the NINJAs are back.

I am curious of what this will do. To be honest it could be devastating. It’s too soon to tell but it doesn’t look good. If it’s not wrapped up soon the effects are going to continue growing more severe. With today’s record drop in the stock market I think it’s time to prepare. That Jim tank hard soon guy that used to post might be right, I only hope he didn’t just buy….that would be serious irony

I could be wrong, but I think the effects of this virus are way overstated. Way too much panic.

Yes, it’s bad for the relatively few people who die from it, but people are talking as if it’s the zombie apocalypse. It isn’t. Most people won’t get it, and most people who do will recover.

This stock market panic is just that, a panic. When reason prevails, and people see it’s not the end of the world, the market will recover.

This is a good buying opportunity. Buy now, before the panic abates and the market recovers.

The panic is what always causes the most harm. It is the panic I am preparing for not the unstoppable virus.

The Governor should close all public schools now for the month of march. He will however wait till wee have an outbreak in the schools before doing so.

Miss – it wont do anything significant or long term to home prices. Has an earthquake or any other background noise ever caused a sustained drop in home prices?

The only event that will cause a crash in LA market is a job-loss recession and if it is major, then you will see the all-cash investors swoop in buy – rent out – repeat.

So Millie finally buys his home (at the peak) and the economy suddenly crashes because of virus, causing Millie to immediately lose 50-70% equity in his new home.

The irony is almost too much to handle.

buying a house with inheritance money is a no brainer….my PI is super low, rates are mega low and my multi-gen unit rents for a good amount that should absorb the property taxes.

we could very well get a 50-70% crash…..if the Coronavirus turns into a zombie outbreak. 🙂

Before the coronavirus news, there wasnt much wrong with the economy. In fact, a lot of the housing data is at cycle highs! The stock market correction/crash could turn out to be a fantastic buying opportunity.

Thanks, your millennial

Where’s the crash?

I went to three Open Houses in Santa Monica last weekend, two houses and a townhouse. All three now have offers:

https://www.redfin.com/CA/Santa-Monica/1217-Yale-St-90404/unit-104/home/6763055

https://www.redfin.com/CA/Santa-Monica/2215-California-Ave-90403/home/6769374

https://www.redfin.com/CA/Santa-Monica/326-9th-St-90402/home/6771522

The stock market is just down to where it was several months ago. The housing market is booming. Democrats are running around yelling fire because they think that will get Trump out of the white house. What a bunch of idiots. You should try to get a deal on a house with the super low mortgage rates.

Agree! Timing could not have been better for me. I am going to lock in a super low rate for my first house! Originally I wanted to pay down over 60% but I am going to take advantage of these low rates and keep some inheritance cash on the side.

Also, stock market is going to offer the biggest buying opportunity once we have a vaccine. No 50-70% crash unless it turns into a zombie outbreak.

Cheers, your millennial

Agree! Your timing is horrible.

Had you bought several years ago (you said you could afford to), today you would have your inheritance, PLUS at least several hundred thousand in additional equity, AND lower property taxes.

Yes! The last few bull years have been fantastic. Stocks and crypto did great!

Now I am adding real estate with rates under 3%!!

We are very excited. It’s pretty easy to pull the trigger on RE when you get free money (not just the rates but the inheritance).

Inventory is very low and fundamentals are strong.

jt,

I think you may be fiddling while Rome is burning. Sadly, they just announced the first death this weekend. More are expected but it is unknown how many. Mike Pence just said the “common” citizen doesn’t need N95 masks (Since the elite need more for themselves).

The rates are not as low as Oct 2016 yet but if the bad news continues, the Fed will react by lowering rates well beyond this point. The stock market will continue to be pummeled for at least the next week.

If the panic continues, we will be able to pick up rates well below the 2016 low and likely purchase stocks at far lower.

If you survive, it will be a good time to refi and buy stocks.

Good Luck!

Markets need a long term view. Here is a chart of a gold ETF vs the S& P 500 since just before the first big crash:

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Index&symb=%24SPX&x=42&y=9&time=100&startdate=3%2F1%2F2006&enddate=3%2F15%2F2020&freq=1&compidx=aaaaa%3A0&comptemptext=GLD&comp=GLD&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=64&style=320&size=4&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=13

Gold dropped when the stock market started to take coffin 2011 and 2012. The Stocks plateaued at the end of the Obama admin. and gold started to climb again. It started to accelerate last year along with the S& P 500 but has not dropped as much in the current situation. China likes gold as a crisis hedge.

“take off in” not “take coffin”! Spell check can have a weird sense of humor?

@JT: Booming? Which region? Los Angeles is not “booming” any longer, but then again, it’s not crashing either. Well priced/top quality properties go quick. Rest get reductions or sit around for a while. Super low mortgage rates are here to stay as long as we’re on QE infinity. Hence, your advise to “get a deal” with super low mortgage rates is something I don’t agree with. Interest rates will not be going up anytime soon IMO and there’s only so much room left for going down now. We saw what happened with a <1% increase in mortgage rates in early 2019. It was amounting to be a significant correction and was bad enough that the FED immediately reversed course again and reduced rates.

@son of a landlord: Stock market may recover in some weeks/months and the Coronavirus panic may even be overstated, but the supply chain disruptions, slow downs in trade, and most importantly, the psychological effects that this started worldwide may last longer and continue to create a reduction in market confidence and demand.

The liberals have gone mad

https://www.thegatewaypundit.com/2020/03/communism-101-democrats-in-ohio-california-and-portland-push-laws-that-demand-private-property-owners-allow-homeless-to-camp-on-their-land/

Prop 13 and continuing to follow the Europe trend by slashing interest rates towards zero/negative will help keep asset prices bloated and the economy artificially stimulated.

Now my concerns: Debt Levels. Mortgage debt, Student Loan, Auto and Credit Card debt all at very high levels with no sign of stopping. The Trump administration touted a stronger than ever US Consumer living in America during SOA speech. Yes maybe a stronger than ever US Consumer that’s buying crap on an 18% interest rate credit card. But I beg to differ that this strong US consumer is one with a strong savings rate that is making practical purchases. Rather these consumers are making non-practical purchases with money they don’t have. And are both homeowners and non-homeowners who will never become homeowners. I have to think these debt levels will eventually cause problems that will have a negative impact on the housing sector.

W2 income is the most common form of income in this country and also the most inefficient way to build wealth. The new tax law limiting SALT deductions to $10,000 and elimination of businesss/personal deductions is a further blow to W2 income earners. The new Tax Law makes W2 income an even more inefficient way to build wealth. I see this as a negative to homeowners trying to pay their mortgage and balance monthly budget. And I also see it as a negative for future homeowners trying to save money to become homeowners. Banks want W-2 income with stable employment history to write loans. Cash is now tougher to come by under new Tax Law for Upper middle class W-2 income earners. All the Pro-Trump supporters who want to argue this and tell me that tax rates have fallen, you are correct and you have fallen for his trap. His new tax law is actually a tax INCREASE in disguise for upper middle class W2 earners. He can tout to the world that he lowered tax rates therefore touting a tax decrease. But by limiting/eliminating all of the deductions it actually ends up increasing taxes paid even with the lower tax rate. (Specifically this will hit the Family’s in the $250,000-$650,000 range very hard in comparison to how it was before. My family falls just under the middle of this range and will forever be wishing for the old tax law back If you are a small business owner or 1099 income earner than you are good. Chances are your tax liability is very low or you are barely paying any taxes. But banks don’t love writing big home loans to 1099 or business owners with no W-2 income. We are only in the 2nd cycle of this new tax law. I expect to see a negative ripple effect after 1-2 more cycles.

The 2 bed 2 bath home in this article renting for $5,200 per month means a W-2 earner will need close to $10,000 in gross wages just to handle the rent and utilities that come along with that rental. Let alone the other monthly bills like food, car, childcare, etc. And I guess there just continue to be thousands of renters that can get it done and support these pricing levels for SFH rentals. And tens of thousands of buyers with six figures cash in the bank to support 20% down payment on a home $600k+.

The CA real estate market continues to defy my logic and I accept it will continue to defy my logic. But I feel strongly that at some point just from concerns listed above that eventually some cracks might be formed. Not sure that it will be enough to cause a break though due to housing shortage, Prop 13, and zero interest rates. If I were a first time home buyer right now and had the down payment necessary I would try to make aggressive offers but I would buy a home that I would plan to spend 25 years in and not get caught up in crash talk.

It’s very likely that Interest rates will continue to go down over time in the US. Don’t fight the FED.

A huge benefit that we have in the US compared to other countries is the 30y fixed rate. In Europe for instance they see 15-20y fix. To be fair, there isn’t any risk in Europe that rates would go up, but who knows what happens 20 years from now?

Prop 13 isn’t going anywhere – hopefully.

Your first house isn’t necessarily an investment. It can become one if you choose to rent it out later (or sell, which I would rather rent out RE than sell).

If you think long term, you are fine either way.

It’s much more fun to be a bull than a bear. But keep cash on the sidelines for buying opportunities in stocks and housing and dollar cost avg into something highly speculative like bitcoin. I am hoping we are getting another huge bull run in cryptos the next 1-2 years.

Cheers, your millennial

M: Prop 13 isn’t going anywhere – hopefully.

Why “hopefully”?

You claim you just bought a house. And you had SAID that if Prop 13 is removed, then the state will raise property taxes on old time buyers, but LOWER property taxes on recent home buyers (you).

Have you changed your mind on that too?

Mr. Landlord is correct. You’re a troll. Nobody makes a complete turnaround on so many issues, so quickly.

“Millennial” is a fictitious character. Performance art.

Prop13 protects us from a corrupt government. And I will never say a bad thing about boomers again-ever.

The last thing we want or need is higher taxes.

People can change their mind especially when they become homeowners!

Regarding Landlord, I hope he comes back. Every time the stock market goes down he is on a long “vacationâ€. This virus seems a bit over hyped and might be a great buying opportunity. Interesting times!

Interest rates are getting lower and lower 🙂

Cheers, millennial

M: People can change their mind especially when they become homeowners!

Some people change their behavior after an inheritance — they do NOT change their opinions on unrelated matters.

* You claimed that inventory was high. Not you say that inventory is low. Yet inventory is unrelated to an inheritance.

* You claimed that eliminating Prop 13 would lower taxes for recent home buyers. Now you say that Prop 13 benefits recent home buyers. If you ever believed the former, an inheritance would not change those beliefs.

* You claimed that REGARDLESS of how much money one has, it’s better to rent than to own, if rent is cheap and houses are overpriced. “Buy low, sell high, it’s a no brainer,” you said. If you ever believed the former, an inheritance would not change those beliefs.

* You claimed that one should disregard Fed policy, and all else. That RE cycles were inevitable. That it’s never “different this time.” An inheritance would not change one’s views on RE cycles.

Your sudden “change of mind” on so many matters, that are unrelated to an inheritance, makes no sense — unless you never believed anything you posted. Then or now.

I don’t believe you have an inheritance, or that you bought a house. I now doubt that you have a neighbor with a pool, or that you “house hack.” You troll for fun. Pure performance art.

Son of a landlord,

The house you live in isn’t necessarily an investment. It’s where you raise a family, create memories and have family parties and in my case: have a built in multi-gen unit that you rent out. It’s not better to rent than to own in general! You build equity when you own and you have a stable rate. Rents go up over time and there are other uncertainties too: what if your landlord sells the place or wants to move in/kicks you out. Real estate should be part of your portfolio. If there are real estate downturns, great. Buy an investment property!

Also, it’s not a good idea to fight the FED. We won’t see higher interest rates anytime soon and there is only limited land available (near the coast/tech jobs).

Inheriting a huge amount and buying my first home made me a housing bull. I did not like the idea of using my own earned money to buy a resale that benefits someone who bought decades ago. Buying a newly build house with money I did not earn works very well though. And it completely changed my perspective. I was always meant to be a RE cheerleader I just didn’t know it until now!

Cheers, millennial

M, based your posts, you seem to have inherited money, cleared probate, bought a house, are refinancing, and have changed all your views on everything, all within the span of a few weeks. Life doesn’t work that fast.

The problem with The Millie Show is that you need a longer character arc for the story to be believable. You should have spaced out the plot points, the dramatic events, and the development of the Millie character, over a longer period of time. Say a year, or six months at the very least.

That’s a problem with many in your generation. Short attention span. You want a quick resolution, and so you condense too many dramatic events and character changes into too few episodes. The drama plays out too quickly to feel real, thus reminding us that it’s only fiction.

I am curious what the endgame plan will be for the homeless?

I am going to throw my 2 cents out there that the possibility City/County and State governments will probably find small town(s) that may need to meet certain requirements to not upset the tax paying mob. You are already see the homeless being segmented out into small sections to contain them. Hence contain the spread. If a small handful of small towns are to be the new norm to relocate these people to I guess that may be one solution if people don’t want to continue to see the plight. Just seems with the way things are going this may end up being the direction the government is going.

Move them to small town like where? Small towns will be overwhelmed so that will resist. So I doubt they will be moved. General public will just get used to their presence and become inured. That’s what happens in third world countries. Mansions and slums exist side by side.

Too warm in LA for coronavirus to be much of a problem. Mortgage rates are going down, down, down. That means home prices going up up. If you don’t already have an LA beach home, you better get one tomorrow.

The story even gets better. The G7 and the worlds centran banks have this. Super low rates right in time for the spring housing market. Exciting times.

Prices in LA hit another strong pace for 2020

The median price of a single-family home in Los Angeles County was $650,000 in January, representing a sizable 8.5 percent increase over a year earlier, according to new sale numbers from real estate tracker CoreLogic.

A median-priced condo cost $515,000, a more modest 1 percent uptick over January 2019.

The good news for prospective buyers is that prices actually dropped off a bit on a monthly basis—by nearly 5 percent for condos and 0.5 percent for single-family homes.

Unfortunately, the number of properties on the market is dwindling.

According to real estate listings website Zillow, only 14,216 homes were listed countywide in January—a drop of nearly 22 percent since a year ago. It was only the sixth month since 2013 (when Zillow began tracking) in which the number of homes for sale fell below 15,000 in LA County.

“Low inventory is going to mean a couple things,†says Zillow economist Cheryl Young. “One is there’s less out there. You many not find what you’re looking for right away.â€

https://la.curbed.com/2020/2/28/21157988/home-prices-los-angeles-report

Rates continue to slide and inventory is sooo low. Unless there is a job loss recession you won’t see prices dip.

Cheers, your millennial

This morning, GLD (gold ETF) is up 1% and $SPX (S&P 500) is down 1%. It’s just noise after a big drop and a big rise in the stock market. Can’t get too excited either way. We’ll see what comes of this in the next 3 months as the impact of the corona virus can be measured both here and abroad. It looks like the Chinese delayed sounding the alarm long enough to start leaking virus cases all over the world.

Purchase applications up 10% YoY!

Housing market looks strong!

Cheers, millennial

This latest rate drop by the fed has me a little concerned. At this rate how much ammo is the fed going to have left when sh*t really hits the fan and we have a full blown recession? Are we going to go zero or even negative like parts of Europe?

IMO, there are too many unknowns right now….virus, election, recession,etc. I’m not a buyer of RE right now. Better to wait and see. I believe the opportunity for significantly lower prices may be on the horizon.

Right now is a great time to buy! Rates are low and you have very little competition. Sure, inventory is low, but the avg joe is running to costco to buy 5k worth of toilet paper, water and hand sanitizer. In other words, there won’t be a second offer as a lot of people are panicking (for no reason).

Trump will get re-elected and we will have low interest rates for the next decade.

We can still have fiscal policy changes and QE when SHTF.

Btw, before the virus outbreak, what was fundamentally wrong? Not much…