The Forbearance Tsunami: 4.1 Million Mortgages are in Forbearance with many on Extensions.

A startling number of American households are currently not paying their mortgages. This number is at 4.1 million and this data was before we entered what now appears to be a second shutdown as cases of the Coronavirus spread across the country. Yet somehow, people think the housing market is going to be perfectly fine. The reality is, there are massive systemic shocks that are hitting the system and housing is always a lagging indicator. In California, the unemployment rate is at 16.3 percent which is the highest since the Great Depression. The forbearance issues run deep since missed payments are now compounding on top of each other meaning many households now owe multiple payments to keep up. Many missed a payment because they are unable to make one payment so now that people need to make 3, 4, or more payments all at once, there will be challenges. Yet more importantly, think of places in Los Angeles with good schools. Many are moving to online delivery of coursework this year so that premium on good schools is not worth it if you are essentially paying for a virtual learning model where your student is taking classes from their laptop. The housing market is facing challenges but you wouldn’t know that by simply looking at price.

The delusional crowd

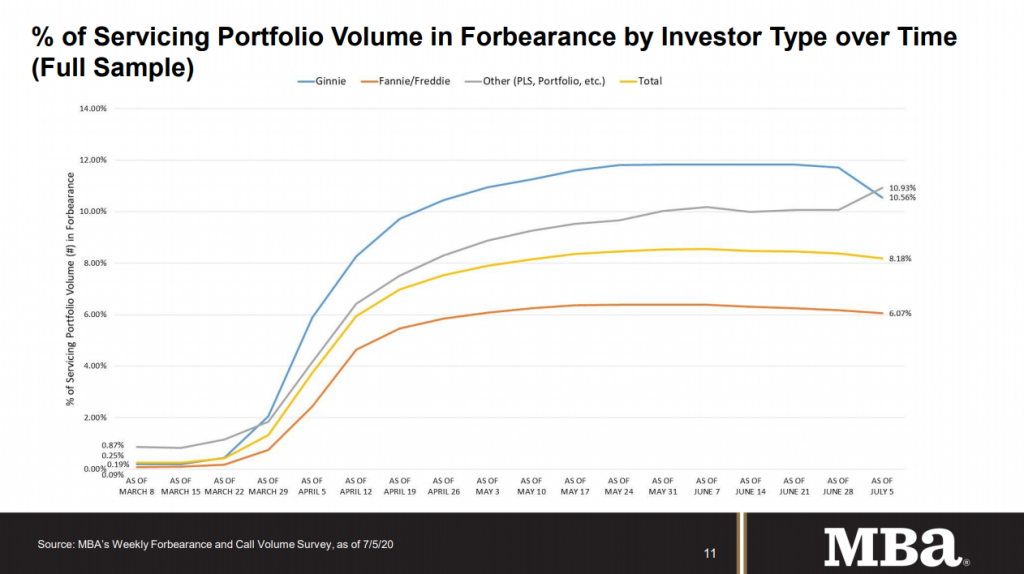

First, let us look at the number of mortgages in forbearance:

A stunning 4.1 million mortgages are not being paid – over 8 percent of all mortgages in the market. This is significant. These are similar figures from the Great Recession although people will be quick to talk about NINJA loans but the reality is, the vast majority of foreclosures came with vanilla 30-year traditional mortgages. The boogie man is the NINJA loans but the end result was that people just couldn’t pay their mortgage when they lost their jobs. What does it matter if your monthly payment is $1,500 or $5,000 if your income stops?

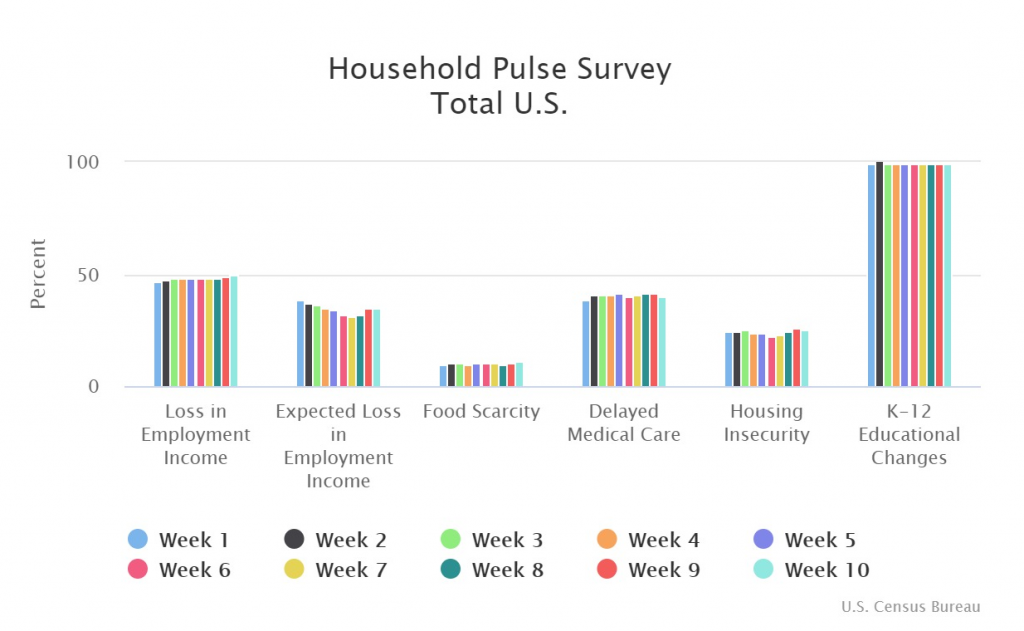

Another startling figure is the amount of Americans that have seen someone in their household losing income. See data from the Census:

Roughly half of Americans have lost some amount of income within their household. This is incredibly high and problematic. The initial job losses came in retail and face-to-face fields but now we are seeing white collar jobs being cut since many of these companies have tech departments, accounting support, and other ancillary functions that need funding from the actual business in the community. Expect more of this if the pandemic continues to create lockdowns.

There are large implications here and many of the measures taken are essentially stop-gaps:

-Unemployment insurance

-Forbearance programs

-PPP

Like is the case in most economic downturns, many businesses that did not need bailouts were actually recipients of programs like the PPP. Many owners of restaurants for example are still struggling and having a tough time getting back on their feet.

From looking at the language of these programs and their essence, it seems like they were built for a 3-month crisis. As we enter our fourth month, this economic and healthcare crisis is not going to be a short one contrary to what some have been saying. Just think of Los Angeles County where schools were set to go remote for the remainder of the year. How are working parents going to teach their kids at home and go back to work at a high level of productivity? This is not a judgment call here, but the fact of the matter is we are going to see substantial loss in business activity which directly ties into housing.

There are some significant challenges facing the housing market and those thinking there will not be some sort of correction are simply not looking at the larger macro impact of this pandemic.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

201 Responses to “The Forbearance Tsunami: 4.1 Million Mortgages are in Forbearance with many on Extensions.”

Here we go!!! Rates have fallen below 3% for 30t conventional loans!!

Wohooo

https://www.wsj.com/amp/articles/30-year-mortgage-rate-reaches-lowest-level-ever-2-98-11594908357

M is only pretending to be excited. He has a history of saying the opposite of what he (later claims) to have believed.

Throughout 2019, M said he would never buy a house before an epic crash, yet he (later claimed) he did buy a house that very same year (putting down a deposit, watching the house being built, etc.).

M said one thing, while simultaneously doing the opposite. This is not a change of mind. This is lying.

Yeah, I guess that’s kinda true. In 2019 I was a little bit more bearish. In Q1 of 2020 I bought a nice, new house. Now, looking at the data, I must say I am a bit more bullish.

A few reasons:

Expected market time is at 40 in SoCal. That’s extremely hot. Meaning a sizzling hot sellers market

Purchase application data Is now 33% higher year over year

Inventory is extremely low

Interest rates are historic low

As some point you have to admit you are wrong when looking at that data (and if you are still bearish). Buying a house will likely be the best investment you’ll ever make. Look at me, I am a lot happier in my new house compared to the cheap apartment I rented before!

Good luck everyone

Of course he’s full of it. He’s a troll. Prob doesn’t even own a house.

🤣 socalguy

Yeah, whatever you need to tell yourself.

Btw, weren’t you the one that said I will lose a ton of money by buying stocks and a house in Q1? So far I see nothing but appreciation 😊

@son of a landlord : That’s what I saw play out as well over the past year that I’ve followed.

M,

You’re a fraud and a bad liar to say the least. You’ve already been called out by multiple people.

“In 2019 I was a little bit more bearish”

Here’s your quote from Dec 24, 2019

“Not sure if you are new here or not. RE experts have been talking for a while about the state of the California housing market. Most RE experts (me included) forecast a 50-70% crash. Soon. The advice would be to wait until you can buy at a huge discount. Don’t waste your money by buying now. Let us know if you have questions. Cheers”

“As a RE expert I have a proven track record.

Called the peak in 2018.

RE shills were saying there is no inventory and prices will skyrocket. The opposite happened and I called it.

RE shills were saying the Chinese millionaires are lining up to buy your crapshack. I called BS and you see now that was just another sales pitch/lie.

RE shills were saying “this is the year millennials will go out and buy in droves†I called BS.

The list goes on and on and on. RE cheerleaders don’t like me being here recording their lies and call

And I am calling a 50-70% market crash soon. If you buy at the peak you are screwing yourself financially and will never recover. Just look at the people who bought in 2005.”

I don’t know how you could be any more bearish without predicting a meteor was going to strike.

So these “little bit bearish” comments were at the end of 2019 and then you bought a house Q1??? The problem with liars is the devil is in the details. You told us you were looking at the dirt lot and suddenly you got your certificate of occupancy, moved in and found a tenant within that time frame (Q1)? Lol, ok dude.

I never said you were going to lose all your money in stocks or your home if you bought Q1. I just called out the fallacy of “you only use when you sell” which is regurgitated by amateurs to keep themselves from blowing their head off when their 401K’s drop 50%. That’s a whole another argument when talking about losses, realized or not.

You keep trying to take out-of-context words and deflect (what liars do) the fraud you are and always was on here. You did the same thing to son of a landlord when he pointed out your lies that make absolutely zero sense.

The jig is up dude.

M: In 2019 I was a little bit more bearish. In Q1 of 2020 I bought a nice, new house.

Not only in 2019. You were still a bear in Q1. On January 31, to be specific.

Millennial (January 31): there is an incredible amount of inventory on the market and much, much more to come. Just obvious that sales and prices fall accordingly.

Most houses sit for 6-8month and end up not selling. The market hit the breaks and came to a full stop.

Boomers need to start paying their fair share. They barely pay any property taxes.

Still anti-Prop 13 in Q1. Then a mere 11 days later:

Millennial (February 11): I won’t say a bad thing about boomers anymore. Ever again. I inherited from a boomer. A lot. Thinking of buying property. ? I have a very nice house in mind.

Huh? You already have a house in mind?

It takes months, sometimes years, to clear probate. Yet all this money suddenly plopped into your lap, 11 days later, and now you’re buying a house?

If your story is true, you must have known money was coming. In which case, your opinions on housing would have changed long before you received the money.

Later you claimed you watched the house being built. But if you moved into your house in Q1, you must have watched it being built in 2019, if not 2018. You later “explained” that you only “put a deposit” on the house in 2019.

But then, why were you still mass-posting in Q1 that no one should buy a house before the epic crash?

Your story is full of holes. The timing of your claims is contradictory and not possible.

Here’s the thread in which you made your sudden switch: http://www.doctorhousingbubble.com/the-cure-to-the-housing-shortage-may-be-retirement-homes-the-coming-tsunami-of-homes-over-the-next-decade-may-come-from-an-unlikely-source/

Socalguy, don’t put too much time into making things up 🤣

People are so mad that I turned from a little bearish to more bullish. Just be happy for me that I bought a house. I learned an important lesson. In places like SoCal you buy when you comfortably afford it. Period.

@Socal Guy @son of a landlord

Ok ok do me next! Pull up my comment history PLEASE. I’m one of the few OG housing bulls that have REAPED the huge rewards from the housing market in the last 5 years 😎

2019 was best year too. Pull up what I said in Q1, I’m telling you guys I AM on the only real doctor on this blog. Whatever I say, you can take it to the bank it’s worth 10x it’s weight in gold 🤑

I don’t know if I’ve ever seen an individual get so thoroughly dismantled as M has here by SOL and SoCal. Wow. Lol just wow. Great work, gentlemen.

NewAge – you seem like a smart guy. It would be wise to not align yourself with M. You’re close to becoming irrelevant here as well.

And when had “Josh†ever been relevant?

Btw, what do you mean by dismantling? I have seen one example yet.

@Josh

HA! I don’t align myself with anyone! If anything, M aligned himself with what I’ve been saying for years on this blog. We were going back and forth last year but now I’m glad he sees it. I respect M for putting pride aside and flipping his position and prospering as a result. That’s what I do, help people drown out the noise and help them prosper. I’m the most relevant contributor to this blog. My post history is available for everyone to see. I called everything in this market down to the detail and put my money where my mouth is. People come here to read to take notes and read when they read what I have to say. Get that part right.

Side note: Home building stock portfolio is up 54% in the last two weeks. What have I been saying for last two months? Yep, exactly. I’m not smart, I’m a GENIUS 🤑

New Age, the issue is not whether M is right or wrong. The question is whether he believes anything he posts.

His rapid and extreme flip on all opinions, in a period of under two weeks, indicates that he doesn’t believe anything he says.

* Old M mocked Spokane, where Mr. Landlord lives.

* New M praised Spokane as a very nice place to live.

Why would an inheritance change his views on Spokane? It wouldn’t. M is doing extreme flips of opinion for the sheer fun of it. From Fake Bear to Fake Bull.

I’ve nothing against Bears or Bulls. I can converse with Democrats or Republicans. But I do require that the person actually believe what he claims to believe, and be who he says he is.

Yep, I believe what I post.

I believe you should buy RE in places like SoCal as soon as you can comfortably afford it.

I was wrong to try to time the market.

I was wrong on a lot of things but had a hard time getting out of my bearish shell.

Iam finally on the right side.

It doesn’t really matter if you or others believe me. I will continue to post market data and how happy I am to finally live in my first home.

Either you’re old or very naive. ‘M’ is not ‘millenial’. Millenial was either banned or left the building. M is from SoCal millenial is from the Bay area. Remember? You’ve been told

many times. You’re being trolled. Sheesh.

What are you wohooing? Are you buying a house anytime soon? Sounding like a propagandist from the NAR. Realists nemesis.

SD man,

Lower rates help buyers and me as a homeowner! I Will refi:)

Minor changes in rates don’t matter when the price is too high.

Its like you learned nothing from the previous bubble.

Minor changes??? A full percentage point makes a big difference in your monthly payment on a 800-1M dollar house. Do the math!

No it doesn’t.

The price is already too high at that point. Especially for the sorts of homes that now go for that price in CA or just about any other major coastal city at this point in the US.

If it wasn’t then prices would’ve never busted EVER in the prior boom.

Tts,

Have you heard about the 10x rule?

Take a 500k house in 2018 at 4% interest for a 30year loan.

Let’s say you pay 10% down. You pay about 2.9k piti with pmi.

Now, interest rates are 3% thanks to Covid. The house price goes up because for 2.9k you can now afford the same house at 550k. Take a mortgage calculator and see for yourself.

10x rule: the interest rate goes down by one percentage point, house prices go up by 10%.

This works in reverse as well. If rates go up, prices fall.

Do you see risk in interest rates going up anytime soon with the ten year treasury yield at 0.6%?

There is no 10% rule.

Prices do not automagically go up or down instantly and perfectly in line with any and all rate changes.

The market is far FAR more complex than that. You might as well believe in astrology if you believe in a “10% rule” as a means to judge prices and affordability.

The drivers for the housing market are demographics (basically demand), interest rates ( basically affordability) and available inventory.

Go back to 2018 (spring). Interest rates went up and the market hit a wall.

Right now: in the midst of a pandemic, the market is sizzling hot. Why? There is no inventory and rates are historic low.

Take a 700k house with 5% interest rate, 10down.

4400 is your monthly payment including pmi and property taxes.

With 3% it’s 3700.

It’s all about monthly payments. You can see every day that people buy those homes and believe me when I say, buying has not gotten easier. We don’t have liar loans/ stated income anymore. They vet/source every penny to make sure you can afford the home.

>>>>The drivers for the housing market are demographics (basically demand), interest rates ( basically affordability) and available inventory.

Interest rates aren’t a measure of affordability. Rates for instance were sky high in the 80’s but prices were also much much much lower so it was still possible to afford them given the wages of the time.

Affordability is based on prices vs income. And that is it.

Anything is is bubble/boom BS that ignores reality.

>>>>Go back to 2018 (spring). Interest rates went up and the market hit a wall.

If the market hits a wall with a VERY minor rate change, that is still below historical norms, than that is a sign you’re in a bubble FYI. Minor rate changes will only cause minor changes in a healthy market.

>>>>Take a 700k house ….

Now factor in avg. wages for that given area. Factor in their DTI’s BEFORE house debt too. The average new car can cost as much or more than the average person’s yearly income and that has been true for over a year now BTW.

>>>>>It’s all about monthly payments.

That is the exact same thing people were saying at the peak of the previous bubble back in 2005/2006. And it still busted.

And yes you absolutely do still have liar’s loans. They’ve drastically dropped down payments + are playing games with DTI’s that never would’ve 30yr ago to make the loans look good on paper. All that stuff is going to fall apart since the prices are going up MUUUUCH faster than wages and have been for years now.

This isn’t rocket science to figure out all.

Also if it was false it’d be easy to show it as such because no boom would’ve ever busted and yet they all do eventually.

M is rejoicing because now he can take advantage of all of the Boomer benefits that we have enjoyed over the years.

In my case:

1988 11% mortgage – 200K house

1994 8% refi – 300K house

2004 6% refi – 500K house

2013 4% refi – 600K house

2018 – paid off – $1M house.

following this pattern, M will see:

2019 – 3.75% – 700K house

2020 – 1% refi – 1.5M house

2022 – negative 1% refi – house= infinity. The more you buy, the more the banks pay you.

Crazy times.

Bob, you may be right about what happened in the past, but your future assumptions are 100% flawgic.

Bob you’re right if M is telling the truth as long as he can make the mortgage payment he’ll be fine. As far as the Chinese not buying homes. They’re still snatching up real estate my wife works in mortgages at a large Chinese owned bank and they haven’t slowed down one iota.

@Seen it all before, Bob , OK thanks for sharing your vision of the future fresh out the crystal ball. I’m taking a screenshot to see how well your ball works. Will report back in 2022.

I like that term, flawgic. Thanks I will use it in the future. As in “They are flaunting their flawgic.”

One disclaimer: My crystal ball fell off a shelf and broke in the 1994 Northridge quake. All data is now based on me seeing it all before.

I admit, I was in a bulllish mood when I posted this. Here is an update the boomers experienced in the past:

1988 11% mortgage – 200K house

1994 8% refi – 300K house

2004 6% refi – 500K house

2006 no refi – 700K house – Bubble peak

2009 no refi – 400K house – The bottom of the crash

2013 4% refi – 600K house

2018 – paid off – $1M house

I had 3 co-workers who panicked and foreclosed in 2009. They missed out on the next run-up since they couldn’t get mortgage again until 2016. Others, like myself, rode the rollercoaster and did much better. One co-worker lost their job and had no choice but to foreclose so sh*t happens.

The lesson here is to not panic and have a 1-2 years of payments in liquid assets to ride it out. Buy a house for the long term 10+ years. This may happen again this year.

Know when to hold em.

As far as the future:

2020 – 1% refi – 1.5M house. Our President and the Fed are pushing rates down during this Covid pandemic. They are already below 3% which has NEVER happened before in the history of the US. If the economy continues to drop, I would expect 1% rates in October. The average mortgage rate over the history of the US has been 5-6%. The reason they are so low now is the Fed intervention. This means if the Fed decides they should be 1%, then they will be 1%. We are no longer in a free market and have entered the Twilight Zone.

2022 – negative 1% refi – house= infinity.

This was an exaggeration. a negative 1% rate would mean that the banks pay you 1% on the principal amount so your payments would drop by 1% since you still need to pay back principal every month. Negative rates would effectively be a taxpayer funded discount on any house price since the Fed would loan banks money at negative 3% and the banks would loan money for mortgages at negative 1%. Effectively it would be homeowner welfare and the Fed trying to drive up housing prices by offering a discount.

The other thing negative rates would do is force people to pull all money out of their savings accounts and spend on stocks or housing. Otherwise, any cash held in a bank would effectively have a fee for holding it there.

President Trump announced in a press conference this month that he is in favor of negative rates.

As the deficit grows, eventually someone will have to pay it back. Hopefully at negative rates.

Forget the happy talk. We are in a depression with big changes in taxes and politics. Lock and load. Nobody knows the future, so things slow down. I have a 9 month supply of food and plenty of ammo.

I look forward to your posts and could not agree with you more. There is absolutely no way that this pandemic and other factors will not affect housing prices. I believe we were heading for a correction before the pandemic and we certainly are headed for one now. It may take a while — but the bottom is going to absolutely fall out with all of the money the government is printing — we will have to pay for this in some way — I see things being propped up through the election but not after that — I think in 2021-22 we will see the effects on r/e regardless of supply being low and demand high —

but the bottom is going to absolutely fall out with all of the money the government is printing — we will have to pay for this in some way

The decline and fall of the American Empire. Neocons and Globalists can say good-bye to their dreams of world domination.

I completely agree!

However thanks to the Republicans, workers can man the government money printing presses overtime without any minimum $7/hour overtime. The dollars are spewing out with basically very little labor costs to the Federal government. Paper is cheap. However coins seem to be a problem since they are made with costly copper metal.

Win-win for M!

Democrats agenda:

– No Cops

– No Jails

– No Borders

– Unlimited Free Stuff For Unlimited Illegals

With the democrats agenda you can say middle class good bye…and Bob still blames the republicans for trying to use common sense.

Ive been reading this board for years now and never said a word. I am no real estate expert nor financial expert. just a regular guy learning and reading and have found many useful posts and comments. But rich, I completely agree. No matter the numbers, no matter the graphs, no matter the index of anything. I agree. there is no way in hell this economic halt, unemployment, business closures, and forbearance wont have an effect on real estate. No way. I am looking to buy, have been for a couple of years, but am still waiting and will wait till things settle out. Prob at min another 6-8 mo before I am comfortable again. But thats just me a regular person, taking a wild guess

Some groups have strong incentives to maintain the “crisis” for as long as possible.

* Government teachers receive full salaries, just to stay home. Why wouldn’t they want the school shutdown to continue? No brutal commute. “Work” fewer hours, in your pajamas, doing online stuff. No unruly, at times violent, kids.

* Consider the people who, because of the $600 a week extra on top of unemployment, are making MORE staying at home, doing nothing, than by returning to work. Their hope is to have the $600 a week extended and the lockdown continue.

* Then there are the politically motivated who want to destroy the economy, hoping it will cost Trump the election, and perhaps usher in other globalist goals.

I do agree with the doctor: As we enter our fourth month, this economic and healthcare crisis is not going to be a short one contrary to what some have been saying.

this statement is affecting more people than you think….our essential healthcare workers, Nurses/LVNs (licensed vocational nurses) are making more now through unemployment and the extra 600 a week than they are working…….so yes, our essential healthcare workers would prefer to stay home, not work, and make more as well. I dont want to return to work, im getting 1000 a month more now not working, then working…..and I have nothing but free time. Going back to work for less, and loosing my free time is going to suck.

* Consider the people who, because of the $600 a week extra on top of unemployment, are making MORE staying at home, doing nothing, than by returning to work. Their hope is to have the $600 a week extended and the lockdown continue.

SOL- BINGO! What a world we live in. If you give a mouse a cookie… I fear for our future big time.

It looks like the new stimulus bill will NOT have the additional $600 a week unemployment benefit: https://www.dailymail.co.uk/news/article-8560721/Mnuchin-Virus-aid-package-soon-1-200-checks-August.html

Treasury Secretary Steven Mnuchin said the next coronavirus relief package will scale back unemployment benefits to get rid of $600 bonus

I think Fox News and Republicans don’t understand basic addition.

Here is the breakdown:

1) MAXIMUM unemployment benefit = 450/week

2) Cares Act 600/week

Simple addition shows that this is 1050/week or 4200/month. (~50K/year)

At 4200/month you qualify for a 1400/month rent or mortgage. Can you find rent or a mortgage at that amount? That is about a 250K mortgage PITI at 3.5%

So with the $600 bonus, you can barely survive in LA.

Without it, you will, at a maximum receive 1800/month. So you qualify for $600/month in rent. The food lines will be long and more renters will default once the $600 weekly CARES bonus is removed. At least wait until most of the businesses are open again. LA minimum wage is $12/hour or 1900/month. People can barely afford rent and feed themselves at minimum wage.

Meanwhile, doing a quick search online, there are ads in ZipRecruiter for RNs for $60K-$170K/year at Kaiser. Nurses are not making more on unemployment. My friend is a nurse.

157 LA Nursing jobs open here:

https://www.indeed.com/jobs?q=Nurse+&l=Los+Angeles%2C+CA

Wow, how in the world did anybody survive with their entry-level jobs in the past? How did people survive on standard unemployment in the past? You’re right. Money grows on trees. Print more. Pay more. Spend More. Somebody will eventually pick up the bill. Forget the American dream. Forget our freedom. Let’s just rely on the government forever… I’d love to sit with you for coffee and learn how the heck you got here. Or honestly, anybody who thinks like you. What do you do for a living? Do you work for the government? Are you benefiting from the unemployment boost, stimulus, or other government assistance? Try earning more. Building more. Start a company. Watch how hard it is to turn a profit. Maybe you’ll understand that it takes a lot of hard work and financial responsibility to even get through year one. Let alone to start breaking even. I’m pretty sure you’re an older gent, but it seems like you really don’t get it. It’s easy to blame republicans and Fox news if you like your hand outs. If you like you money, freedom, and pay your fair share you start to lean a different way.

Unfortunately bob, you are too stupid to realize there is a difference betwen RN’s and LVNs. My post was in regards to LVNs. Its great your friend is a RN and you know so much about nursing…….I dont know someone who is a nurse. I am a Nurse…….a LVN to be exact…….a LVN in Socal to be precise……..and as I previously stated……..LVN’s in southern california are making more on UI than they are working. RN’s are typically paid about double what LVN’s are. a RN stands for Registered Nurse……LVN stands for licensed vocational nurse……..go ahead and do your research again and you will find I am right and you are wrong.

heres some numbers for you bob, demonstrating the differences in pay between LVNs and RNs.

LVN

https://www.indeed.com/career/licensed-vocational-nurse/salaries/CA

RN

https://www.indeed.com/career/registered-nurse/salaries/CA

I apologize Nurse. I didn’t mean to offend.

I know the difference between an LVN and an RN. You had said nurses above so I commented in general.

An LVN requires a 2 year AA degree. An RN requires 2 more years and a BA degree

It seems the difference between an RN wage where you can likely afford a house and an LVN wage where you are working at poverty wages is 2 years of college.

Just 2 more years of school and you can afford a house like my friend.

If $600 is motivation not to go to work, the job is not paying enough. $600 buys you nothing.

Look, I’m not going to try too hard to paint a rosy picture of the economy. Nonetheless, housing is VERY sticky. Most people in forbearance, probably just ran the numbers, and even though they could pay, they took advantage of forbearance. For instance, my wife’s student loans went automatically in forbearance and we’ve socked away thousands of dollars, because paying a loan that is 0% interest when you don’t have to is moronic. We are hoping for another year of forbearance on her loans come end of September. That would put almost $10 grand in savings in our pocket over the next year. Then when the 0% forbearance period is lifted.. and if our jobs are solid, we’ll through that wad of cash at the loans. But until then, forbearance is free money. I have a feeling, a decent percentage of housing loans are the same situation as us. (We didn’t mess around with forbearance on our home loan though… we just refinanced to 2.75% 30 year.. which is kinda like free money.

Here’s an article from a big investment firm about forbearance and how it will be a “good” thing for their clients (who have invested in mortgage packages).

https://advisors.voya.com/system/files/article/file/Forbearance%20Blog_April%202020.pdf

I get that it beats foreclosures and outright defaults, but I’m not sure it is as rosy as they say.

Also, Federal Banking laws allows banks to keep foreclosures off of the market for a period of up to ten years.

The can can be kicked down the road until 2030, if not longer.

Imagine you buy a house. You have a fixed payment for probably the next 30 years.

Now imagine that you can refinance your entire loan for 30years for a lower rate.

Imagine that rate decline to historic lows.

That means, by just signing a few papers you lower your payment for the next 30years. Just like that.

The best thing is, it’s not an imagination. As a homeowner you can do this. Rates are now

Below 3%!!!!!

https://www.housingwire.com/articles/average-u-s-mortgage-rate-falls-below-3-for-the-first-time/

Now imagine you are a renter. Your rent is likely to go up over the next 30years. At some point you pay more rent for an apartment than someone who bought a house.

It’s not fair.

A millennial couple I know are refinancing again this year (second time in 2020 is what I mean) to a 15 year loan with a rate well below 3%. Their equity is well over 50%. They will get enough cash to redo the outdated kitchen. Each time, they are paying a lot less in interest over the life of the loan.

That’s how you do it! Take advantage of the system!

Let’s say I have 50-70% equity in my house. My payment is much lower than comparable rent. What if I want to buy another house? I refinance, pull out money from my existing loan as a downpayment for the new house and push the existing loan back to 30years. My future renter will pay off my first house, and I will either still make money on my first house (rent-expenses), or break even.

Over time, a owner wins by increasing his net-worth

Over time, a renter loses by having to pay ever increasing rent. Lower rates doesn’t do anything for the renter.

And to add to Millie’s point. Most Americans are horrible savers. Buying a home is nothing more than forced savings, especially at these ultra low rates where huge amounts of principal are paid. Add in sky high rent and the severe housing shortage we have in socal, buying a primary residence is a requirement. Being a long term renter in socal is financial suicide. You will own nothing at the end of the day and the vast majority will likely have no savings. Where as a homeowner will be own a paid off house and have small monthly expenses going forward. Anybody still wonder why there are so many rentals in socal?

This is not rocket science. Buy when you can afford it and plan on owning for the long term.

LB,

You are absolutely right, but as a forced savings program it only makes sense if you can get a big tax deduction for interest OR if interest rates are so low that they are below inflation and you are quickly making huge principal payments (which are a form of savings). So right now, the main downside risk is a housing value crash. I don’t see it coming, except maybe in inflation adjusted dollars. Since we aren’t paid (for the most part) in inflation adjusted dollars, the current situation favors getting into a residential property if the payment is low enough that you could easily handle it with your current income, and you are able to save some on the side for a loss of income. Each family should assess their loss of income potential before moving forward with a low interest mortgage.

Most people commenting here understand what is going on with housing and are preparing for it. It’s your neighbors that aren’t that will effect your house price.

Every time you refinance you start your 30 year term from the beginning paying broker fees, how many time you want to start over? Perhaps government will be buying out all those forbearance mortgages and basically create a new government housing program. Otherwise it’s just a snowball of problems.

I don’t see an issue with refinancing A few times (3-5 times maybe). Until your monthly rate is super low. Imagine you give 3 houses to your kid when you die and there are still 10 years left to pay but the rate is 1-2k per month? By that time (consider inflation) it’s like hundreds of dollars in today’s value. Comparable rents will probably be like 5-10k by then.

Also, imagine I want to buy the next house and rent the current one out. I need a super low mortgage in case one of my renters stops paying or moves out and I have a vacancy.

Got to take advantage of the system…..

I am an exception.

I ReFi’d after 4 yrs into my 30yr mortgage.

Cut total loan amount value by 3% and cut monthly payment by 15%.

From $1950 to $1650.

The 30 loan does not “really†start over.

If you are good in math and financially disciplined, you recalculate a payment of your choice which are comfortable with, something that is lower than what you paid prior to refi but higher than your current loan amount, and it has to be higher enough to not only trim the 30 to 23 or 24 years to match the years left on your original loan, but also higher enough to cut it by another year at least.

So you refi and you have lower payments and less years left than you originally did.

Forbearance does come with a cost. Wells Fargo is burdened with some it now but will most definitely do what is possible to recover all or most of it. Loan modifications? Bailout? Layoffs? Bake sale?

“Wells Fargo had a net loss $2.4 billion over the three-month period, marking its first quarterly loss since 2008. Much of the slide was fueled by a record addition to its loan loss reserves. Wells Fargo increased its credit loss reserves by $8.4 billion to $9.5 billion, topping the $4.9 billion estimate from economists surveyed by Bloomberg.”

Those losses by Wells Fargo are unrealized losses, i.e. paper losses. Realized losses, actual losses, do not occur until the home is sold, foreclosed on or the loan is sold to another party.

Wells Fargo is a member of the Federal Reserve Bank. They can kick the can down the road for a long time.

God, to think that something like 50% of Americans (when surveyed) couldn’t come up with $1000 in an emergency. Many strecth themselves to the limit- living paycheck to paycheck for a wildly overpriced house and a new fancy car they can barely afford. Outwardly living a nice “rich” lifestyle, but no money leftover at the end of the month. Debt and mortgage to the eyeballs. For the working poor, they work 60hrs per week to bare afford a run down studio in the hood and no money to save either. All it takes is a minor fluctuation in the economy, an illness, a layoff etc and the entire house of cards comes crashing down. No social safetly net- they’re royally screwed. We’re probably going to start seeing some mass evictions and foreclosures in the coming 6 months. There’s going to be an immense amount of pain for many millions (all over again). Will we be seeing mass homeless camps out on the street in front of empty apartment buildings?

I agree.

Just walk into a cell phone store and see all the uneducated consumers making $10 or $15 an hour buying a $1,000 phone and then stopping off at StarBigBucks to get their $6 mocha drink.

Hell, Im 60yrs old doing well in life and have a $300 phone and dont buy starbucks.

My Wife hates Starbucks’ coffee. I don’t drink coffee. So we’re safe.

Wow!!!!! San Diego, expected market time is now at 36 days!

On average it takes 36 days to sell your home if listed today. Insane! The market is so freakin hot. There is no inventory…..

Check out California home sales….. 🤣

It went up 42% from May to June!

https://www.prnewswire.com/news-releases/california-housing-market-claws-back-past-two-months-of-losses-in-june-as-median-home-price-sets-another-record-high-car-reports-301094970.html

June 2020 is 2.5% higher in price year over year.

Guess the peak isn’t here yet 😉

We have some close high school pals in Clovis trying to escape California for good, and move to Montana or Idaho. We escaped in 1994, lived in several states and have since retired in east Oklahoma. We hope they can sell their home in Clovis quickly. How is the market in the Central Valley around Fresno and how will this forbearance issue effect them?

Central Valley? Fresno? What? I’m not sure I understand you….

Are you are on the right blog dude…..?

I know of at least 3 families that are moving out of California now that a lot of employment is work from home and most companies are keeping their employees away from the office. The last straw for one family was Newsom declaring that private schools couldn’t open to appease the public teacher’s union since private schools were showing just how grossly inept and incompetent the public schools are.

California is losing its middle class tax base. This is going to accelerate the trend in California of creating a 2 class system. California is going to end up with a small population of the very wealthy who like the weather and don’t mind paying the taxes to get it, and a large population of poor people. If you own in the right rich neighborhood, your property value might go up. Everywhere else, it’s going to drop as people flee the coming decline.

It will also be interesting to see what happens when all the Chinese money moves out of the US market. The current US stance with regards to China doesn’t bode well for them maintaining their current real estate portfolios and the inevitable future crisis with and in China will force mass liquidations of Chinese owned properties. People seem to have forgotten that the Chinese bought these houses as a way to move and save money offshore. At some point, they are going to need to sell in order to access that money.

Interesting idea about bifurcated markets in CA.

However I don’t see the Chinese dumping US RE assets. They’re obviously not repatriating any of that money domestically (to China). Yes they could go through the huge hassle of flipping into another country, but who wants to do that? And I don’t think the US goes so far as to kick them out and create further sell pressure on key domestic asset prices. That’s way down the list of New Cold War priorities.

Live in Clovis in a nice neighborhood. Homes selling very quickly at close to listing prices or higher.

M is not Millennial, and if he wants to prove it go back and post under Millennials ID

If you purchased in CA, you are FOOKED

Realist, you really are that silly?cheers, M

M is Millennial because he has the exact writing style, personality and way to express himself – there is no doubt there. Now, about the content, that is a totally different story.

M/Millennial could be the same person, but I could easily mimic their writing style after reading their crap for years.

My bearish posts were crap. I used to think that you have to be a market timer in order to win this game. That’s crap. In places like SoCal you buy as soon as you can comfortably afford it. Demographics and interest rates are the drivers for housing. The virus can’t kill those two. I used to think if the avg joe can’t afford a house, prices must adjust evt. That’s crap, lower sales doesn’t mean lower prices.

Look at europe, the vast majority will remain renters for the rest of their life. That’s the sad reality. Way too many people and not enough land/affordable housing.

For our generation it means, accumulate houses by taking advantage of lower rates and be able to refi for 30 years. Let renters pay off your houses. Having investment property is a relatively easy way to increase your net worth. If you have the skills to do labor (remodeling/fixing) yourself, it pays bigly (sweat equity).

Almost all of my views have changed over the years.

“Almost all of my views have changed over the years.”

Typo:

Don’t you mean:

“Almost all of my views have changed over one month in January.” ?

I apologize.

You had excellent points as Our Millennial when you were a Bear. You have excellent points now a Bull as M

Given, the timing of this change, it reminds me of the movie I watched in December over the holidays.

Were you visited by the Ghosts of Housing Past?

Bob,

I was a perma bear that wanted a house but couldn’t pull the trigger. I inherited a considerably large amount and couldn’t justify NOT buying real estate.

M: I inherited a considerably large amount and couldn’t justify NOT buying real estate.

So much so that you had the money clear probate, bought a house still under construction, watched its completion, and moved in — all within a few weeks!

Within Weeks?? Rofl. What are you smoking?

I agree with Flyover. M is Our Millennial based on writing style and spelling.

He has the same flair with expressing his current opinion.

He should have been a lawyer or Broadway actor.,

The bubble is bursting in some places. Work-from-home will become the standard for a lot of people and it looks like zoom learning is the last nail in the coffin. Places where people bought a lot of properties in the recent past to rent them (especially in California where in some places the rents were incredibly high), are now selling big time! Where I live, I’ve noticed a tremendous amount of condos and houses popping on the market in the past 2 weeks at prices you couldn’t dream of a few months back. It will get ugly.

Could you at least give us the area or zipcode?

I only track SoCal and here we have a sizzling hot sellers market. Right now is the “spring marketâ€, delayed by the covid shutdown. In a few month, housing should cool down.

Cool down means, inventory should increase a bit and demand should slow down. It’s usually what happens in the second half of the year. But There is no crash in sight whatsoever.

SFH homes In the burbs will probably hold or drop very little in value for the foreseeable future. Condo owners with shared pools and HOA that gives you no amenities will fall hard.

Condos are only worth having if the land they sit on is actually worth something. My Daughter bought a stand alone townhouse in a condo development during the housing crash. The value went down some, but by 2013, they got a little bit of profit out of it when they sold it and bought their huge house on a huge lot. That condo development is popular in a good freeway-close suburban location. The townhomes hold value much better than the attached condos there, but the community pool was nice. Now they have their own pool and no condo fees, just pool maintenance costs.

Condos by the beach aren’t like condos in Fontana. Just as houses by the beach aren’t like houses in Fontana.

People don’t like liars and frauds.

🤣

Those are not attacks! It’s just two clowns that can’t stand that you bought a house and changed your views.

I think “forebearance” is a legal term meaning “it’s yours.” The Bank is basically no more. Nor is the finances of the respective 50 States.

The US Federal Government has zero interest in paying for anything other than the debt used to finance their War. Property is abandoned, prices fall, liquidity dries up and people turn to coinage for money rather that paper currency.

Great time to be long oil.

Real Estate in energy producing rich States like North Dakota is doing great.

What “economic money” is watching is how the response to sustaining the US Airline Industry works as relates to “new cash” in the market (physical cash buyers).

You can buy a skyscraper right now for one US Dollar in the USA and indeed globally given how the USA has suddenly become the World’s dominant energy producer. All that Middle Eastern, Russian and South American save Panama City Panama has totally crapped out. Technically it’s not the homeowner defaulting in a forebearance but the Bank. You’ll start seeing all this shit sold at auction for a dollar as we haven’t even had the recession bite as of yet.

You and Realist should get beers together. You’ll keep each other in good company 🤣

“ You can buy a skyscraper right now for one US Dollar in the USAâ€

I think I’ll sign that deal. Do you have a link?

More proof of bubble prices

https://www.trulia.com/p/ca/sacramento/1700-adonis-way-sacramento-ca-95864–2086005329

The above home sold for 483k less than a year ago and now is listing for almost 400k more now. How da heck does a home expect to increase by almosr 400k in less than a year? As much as I hate renting and want a home, I believe that only stupid idiots would buy now at these inflated prices. That is why I patiently wait and pray for crash to come next year or soon.

We don’t know the circumstances of the price history. Call the agent and ask him.

The 850k price Tag seems reasonably for what you get in Sacramento:

$850,0005 bd5 ba3,440 sqft

1700 Adonis Way, Sacramento, CA 95864

The pool alone and the huge backyard is worth quite a it of money.

The inside is spacious, not my style but custom

And nice.

No way this house should sell for 400k less. You pay already 500-600k for 1700 sqft in Sacramento.

M: We don’t know the circumstances of the price history. Call the agent and ask him.

But you said realtards were liars. Nothing they said could be trusted.

How would an inheritance change your opinion on that?

That would be like saying “cops are badâ€. One out of 100 probably is. The rest is fine.

No, realtors can be very useful. Just because some aren’t doesn’t mean they all are bad.

Don’t ask the real estate agent for the price history. Go to the county Recorder of Deeds site- it should be online- and you should be able to see all prices at which the property sold, and any mortgages, liens, or other claims against it, as well as its current and past ownership.

Don’t trust anything a real estate agent tells you, unless she has proved trustworthy in past dealings with you. And even then, she doesn’t know everything. Do your own due diligence always.

1700 Adonis Way, Sacramento, CA 95864? It’s in Sacramento County in the Arden-Arcade neighborhood. Go down Arden Way a few blocks and you’ll see homeless encampments everywhere. It used to be a nice area but it’s become a high crime area in the last few years. (Democrats now control the county) Only a fool would pay $850K for it. No thanks.

There are a few things funny about that house.

1) The house across the street sold for 480K in May. However, it was under half the size.

2) All of the houses in that area are listed in Zillow for in the 350K-480K range and are 2X+ smaller than this house.

3) All of the houses in this neighborhood are half the size and were built in the 1950’s. This house was originally built in the 1950’s but the listing says 2000? Was it scraped and rebuilt?

4) If you dig a little deeper, the sale last year, 486K was between people with the same last name. Divorce? Discount for the kids?

It is a very nicely upgraded house. I like the house but not for the location.

Without digging deeper or seeing it closer, I’d say the seller has drastically overbuilt for the neighborhood and is now trying to recover some of the money. They can ask whatever they want, but we’ll see what they get for the newest, largest, and best house in the neighborhood. They are pricing it 2X over all of their neighbors. The price per sq foot matches their neighbors but IMHO, it is overpriced for the location.

Nice research Bob!

In 18th and 19th Century Ireland, wealthy landowners employed starving workers during famines and economic hard times in the building of elaborate Follies, large gates or monuments that served only to employ people and show off the wealth of the owner. They are now tourist attractions, which is the only economic benefit they have. Overbuilding a house for a neighborhood results in a Folly, but unlike the Irish landlords, the owners of these Follies don’t necessarily realize what they have built.

Santa Monica extends eviction moratorium: https://www.smdp.com/eviction-moratorium-extended-to-september-30-for-residential-and-august-31-for-some-commercial-tenants/194327

Eviction Moratorium Extended to September 30 for Residential and August 31 for Some Commercial Tenants

As I predicted, expect more tenant protections as the number of renters increase in California. Stricter rent controls. Harder to evict. Harder to raise rents.

That these redistributionist laws are economically destructive is irrelevant to the socialist elite running our government. They’ll keep pushing the envelop on their leftist agenda until they collapse the whole system, much like they did in Eastern Europe.

Consider this Santa Monica house: https://www.redfin.com/CA/Santa-Monica/819-Berkeley-St-90403/home/6762313

Listing says it was built in 1966. Yet there is no property history. No indication of when, or for what amount, it was ever sold.

I do remember that this house was listed a few weeks ago. That previous listing has also disappeared.

I guess there were no offers, so the realtard delisted the house, erased all past sales history, then relisted it as a new listing.

And New M advises us to “ask the agent” when we have questions.

“Realtard†isn’t a very nice word. You should stop saying that.

A good agent can be extremely useful. I know a handful good ones. They are turning houses into homes for people. If you have a good relationship with them they provide you with insightful stats about neighborhoods of interest. Just because you have found one bad apple doesn’t mean they are all the same.

It’s kinda like cops. One is bad out of a 100. I would say 2-3 agents out of 10 are very good.

“Most realtors were not able to get a real job. And if they don’t make it as a used car sales man they end up in real estate. Virtually anybody can print out real estate papers and pretend to be an agent. One out of 20 realtors is useful. Now, that the market is crashing a significant amount of realtors will disappear.”

I have seen houses like this. No price history on Zillow or Reffin.

My Mom’s house was like this. No price history since she purchased it before they kept records. They likely have records somewhere in a moldy box in the basement of the courthouse and haven’t moved them online.

The reason I think this is the 2019 property tax on Zillow was $3,883 /year. It is a Prop 13 house likely purchased in the 70’s for around $80K before they kept records.

The current owner Prop 13 taxes were $3,883/year. The eew owner Prop taxes will be near $40K/year for a $3M house.

Though, I would trust RE agents for any truth other than what is on record. ie what the new taxes will be.

Maybe you can trust RE agents sometime.

The listing actually says the original family has owned this since the 1960’s. The realtor told the truth in this case.

Prop 13 rolled the assessments back to 1976. and limited the property tax increases to 2% per year. It also allowed heirs to inherit the same tax. This house was probably assessed at 80K in 1976 and the property taxes have reached $3883 in 2019.

It is also possible due to the feudalism clause in Prop 13, the grandchild of the owner has inherited the house and taxes and is now trying to sell for over $3M.

It might have been M’s grandma!

@son of a landlord: That’s totally crazy. I’m also noticing a lot more houses that look like flips yet they haven’t been sold for 20 years. Have you found a way to get price history that’s deleted from Zillow and Redfin? I mean, besides digging through public records.

Will housing crash this year, perhaps not.

excerpt:

Purchase application of new homes up 54% year over year, according to MBA.

At some point in the future, home prices will fall and sales will decline year over year, but even when this happens it will not constitute a bubble crash anytime soon.

Today, we are on an upswing. The U.S. housing market is undergoing a V-shaped recovery, but until existing home sales hit 5,770,000 again, the full recovery in existing home sales will not be complete as that was the number we hit earlier this year

https://www.housingwire.com/articles/its-official-the-u-s-wont-see-a-housing-bubble-crash-anytime-soon/

We are two to three years away from a home price crash in SoCal. Home prices are sticky. Rent is fluid. The population is declining in the SoCal area. Historically prices on 1 bedroom condos will typically crash before three bedroom SFR’s. Two bedroom residences have the higher demand on condos, homes and rentals. The forbearance will allow twelve to eighteen months of nonpayments. Many banks will chose not to foreclose immediately to avoid taking a massive loss in SoCal on the super jumbo mortgages. This is not the case in flyover country.

CA will be hit the HARDEST- Economics professor Richard Wolff warns housing crash would be worse than Great Depression

https://thehill.com/hilltv/rising/507499-economics-professor-richard-wolff-warns-housing-crash-will-be-worse-than-great

The owners of homes who continue to make mortgage payments are going to be hit with double/ triple property taxes. Many won’t be able to pay those taxes….more foreclosures. Calif will repeal Prop 13..wait for it.

Numbers don’t lie, RE will crash hard in 2021

It really is difficult to ignore the avalanche of data contradicting a v-shaped recovery and sustained home price increases.

“JPMorgan Chase & Co. set aside $10.47 billion to cover potential losses on loans to borrowers hurt by the coronavirus pandemic, cutting its second-quarter profit in half.”

https://www.wsj.com/articles/jpmorgan-profit-drops-51-as-bank-sets-aside-billions-for-coronavirus-loan-losses-11594725161

Richard Wolff is a Marxist. Of course he is saying that the system will fall, because he wants it to.

Before they repeal Prop 13 we have to vote on this:

https://ballotpedia.org/California_Proposition_15,_Tax_on_Commercial_and_Industrial_Properties_for_Education_and_Local_Government_Funding_Initiative_(2020)

Repealing prop13 would mean rents have to go up. Landlords would pass those extra costs on to the renters.

M: Repealing prop13 would mean rents have to go up. Landlords would pass those extra costs on to the renters.

Yet you said that landlords were unable to set whatever rents they wanted. That rents were determined by tenants’ wages.

Your alleged inheritance also changed your mind on the economics of renting?

Commercial Mortgage Delinquencies Near Record Levels

https://www.zerohedge.com/economics/commercial-mortgage-delinquencies-near-record-levels

Nope, nothing to see here, other than a collapse in the commercial market.

The Four Horsemen Of Disinflation: The Coming Rent-pocalypse

https://www.zerohedge.com/markets/four-horsemen-disinflation-coming-rent-pocalypse

Nope, All is Well, Move Along.

“Pent-Up Supply” Floods San Francisco Housing Market, Most Since Housing Bust

https://www.zerohedge.com/economics/pent-supply-floods-san-francisco-housing-market-most-housing-bust

So Much For The Housing Short Fake News, All is Well. Enjoy the Weather, Housing GOING DOWN, Especially if You Purchased in CA.

Loomis, CA Housing Prices Crater 15% YOY As Sacramento Area Construction Costs Slip Under $50 Per Square Foot

https://www.movoto.com/loomis-ca/market-trends/

As one Sacramento broker shared, “The cost to rent a house is half the monthly cost of buying it but that’s something we just don’t discuss openly.â€

Nothing to see here, move along.

With 25 million excess empty and defaulted houses out there and prices cratering, is this a surprise?

Housing prices and rental rates are cratering everywhere.

Palm Springs, FL Housing Prices Crater 12% YOY As Median Price Slips Under $150k

https://www.zillow.com/palm-springs-fl/home-values/

As a distinguished economist stated, “A house is a rapidly depreciating asset that empties your wallet every day it owns you.â€

But Hey, The Weather is Nice in CA. lmao

This is what I get when opening realist’s link:

“Palm Springs Home Prices & Values

ZILLOW HOME VALUE INDEX

$178,820

5.7% 1-year change

-1.2% 1-year forecast

MARKET TEMPERATURE

Very Hotâ€

Lol, he should re-name himself to “alternate realistâ€

“A house is a rapidly depreciating asset that empties your wallet every day it owns you.â€

Rotor-Rooter came out yesterday to unclog my bathtub drain. It was a 15 minute job. Charged me $369.

I will try to get reimbursement from my HOA. But we condo owners are often responsible for our unit’s expenses.

Invest in an electric drain cleaner and watch a youtube video. They are about $100 at Harbor Freight. My wife’s hair constantly clogs the tub so I bought one of those drain hair catchers. I periodically clean all the drains as a preventative measure. Basic plumbing / electrical skills is necessary for any home owner.

SOL,

Two things come to mind.

Get a “snake†and unclog yourself. Saves over 360 dollars, or

don’t shave your hairy legs in the tub

SOL, putting up with a clogged drain or otherwise is a small price to pay for home ownership. Just doing some simple math, my home value has increased by over $100 per DAY for almost a decade. I’ve had the pleasure of living in it and paying down boatloads of principal. And you wonder why people want to become homeowners at any cost…

I have a friend that is in forbearance with Wells Fargo. The first three months were April May and June. She called them back up and asked and was given three more months July August September. From my understanding these missed payments will be placed on her balance and her loan will be extended. So when forbearance ends she will only have to make the payment for that particular month not multiple payments due at once. Who know the fed can forgive payments for years as we saw in the last recession.

That’s right. The missed payments are added to the END of the loan. (Extension of the loan).

Many fakers here (like socalguy) painted a different picture: That after forbearance ends the homeowner would have to pay the missed payments. Bad news sells better. So if you miss 3-4 months you are facing an enormous re-payment amount in the 5th month. Which most would not able to pay and default.

It’s just Doom and gloom BS but has very little to do with reality.

Adding missed payments to the END of the loan is a nothing burger. In 20years those dollars from today are basically inflated away.

I have a good friend who has worked at Wells for several years and dealt with compliance issues during the last recession. A couple months ago he told me that Wells will grant you a 6 month forbearance for anything “covid” related without any proof on your part. You can then call and get another 6 months if needed. They will tack the payments onto your existing loan effectively extending your original loan terms. There will be no balloon payment.

He also believes the federal government will enact a law that will impose this rule for all mortgage servicers.

I think it’s in the bank’s best interest to offer this type of arrangement regardless of any laws. Massive foreclosures like we experienced during the last recession only hurt the bank’s balance sheets.

A lot will depend how many borrowers’ missed payments will be tacked onto the end or not. It’s up to each lender, you know. Not everyone will qualify for loan modification. And one-third of loans aren’t federally backed to begin with. We’ll know in a year.

A report from Variety on California. “The Los Angeles historic cultural monument known as the Samuel-Navarro house has a notable new owner to chalk into its colorful history. Nearly four years after screenwriter Dale Launer first put the idiosyncratic Art Deco-meets-Mayan Revival masterpiece up for grabs, the home has finally sold for about $3.5 million. Launer picked up the property in 2014, for $3.8 million, before selling at a hefty loss.â€

Less money than 6 years ago…Nothing to see here, move along. Enjoy the weather

Luxury market has little to no impact to the sub 1m houses many compete for.

Most people just need/want a decent home to raise a family. Look how hot the market is in San Diego for anything below 800k. Same in OC for anything below 1M.

Multiple offers and bidding wars….. look at yourself, are you looking in the +3M range or would a 700k on your target list?

Remember, CA has got great weather- Mortgage delinquencies double in Southern California in coronavirus era

Census poll: 9% of L.A.-O.C. borrowers worry about next payment, 22% in I.E.

File photo: Michael Goulding, The Orange County Register

By Jonathan Lansner | Orange County Register

PUBLISHED: July 20, 2020 at 9:28 a.m. | UPDATED: July 20, 2020 at 11:09 a.m.

Coronavirus-linked business shutdowns have more than doubled the number of Southern California homeowners who are missing mortgage payments.

CoreLogic reports 6% of borrowers in Los Angeles and Orange counties in April were late 30 days or more with their mortgage payments vs. 2.3% delinquent a year earlier. In the Inland Empire, 7.1% of borrowers were at least up 30 days late vs. 3.5% in April 2019.

“Stay at home†orders began throttling the economy in the late winter, forcing many employers to cut jobs. Southern California unemployment was 17% in May.

It’s not just a local surge of tardy payments. Nationally, the 30-day delinquency rate rose after 27 consecutive months of declines to 6.1% of mortgages, the highest since January 2016.

“SoCal is still faring relatively better than some parts of the country where delinquencies spiked to over 10% in April,†said Selma Hepp, CoreLogic’s deputy chief economist. “Nevertheless, the future trajectory of mortgage delinquencies will depend on the trajectory of the COVID-19 crisis. Recent spikes in new cases will have an impact on local economic outcomes and the ability of unemployed to return to work.â€

Thanks to historically low mortgage rates and government stimulus efforts, early summer’s homebuying pace in the region is back to near 2019 levels.

Real estate got a boost as mortgage lenders were required by various government actions to let most borrowers impacted by the pandemic delay their mortgage payments. Such “forbearance†programs, so far, have prevented a flood of foreclosures activity.

Hepp added that “the mortgage industry has learned a lot from the last crisis and are being very proactive in ensuring that foreclosure is not the final outcome. Foreclosure is generally the most expensive option for mortgage providers. Also, data suggests that almost 50% of loans in forbearance are now in an extension following initial forbearance.â€

US Housing Market booming per June figures, unreal.

https://www.bloomberg.com/news/audio/2020-07-22/u-s-housing-market-most-outperforming-sector-in-world-radio

As a recent homeowner I couldn’t be happier hearing this news.

You Ever Hear of The Term ” DEAD CAT BOUNCE “, 2007-08 All Over Again.

If You Live In CA, Go Outside And Enjoy The Weather.

Realist – the dead cat bounce of 2007-2008 never occurred as I recall.

The market crashed in 2008, house prices dragged downward till about 2010. Then stayed there till about 2012.

It was in 2012-2104 that everyone said a dead cat bounce would happen. It never happened.

If you look at home prices from 2010-2020 they continually rose upward. NO dead cat bounce.

IF we have a market crash it will be 2021, not 2020

“What has been largely overlooked are the mounting problems of wealthier homeowners with jumbo mortgages. They have also been slammed by the lockdowns. According to Black Knight, 11.8% of all jumbo loans were in forbearance as of June 16. That is more than double the rate as recently as April. In a mid-June MarketWatch article, the CEO of Caliber Home Loans stated that 42% of their customers who requested a forbearance were self-employed. Keep in mind that the CARES legislation did not say anything about jumbo mortgages. Lenders were under no obligation to offer forbearances to any jumbo mortgage borrower.”

https://www.marketwatch.com/story/the-feared-jumbo-mortgage-debacle-is-here-thanks-to-the-coronavirus-and-ready-to-pound-the-housing-market-2020-07-22

Sry realist. The housing market is stronger than before covid.

Maybe in a few years we will are a 5-15% reduction.

https://www.politico.com/amp/news/2020/07/22/housing-market-boom-coronavirus-millennials-379084

https://www.marketwatch.com/amp/story/here-are-5-reasons-why-the-pandemic-hasnt-crashed-the-us-housing-market-2020-07-22

Impressive. I guess it’s done and we can stick a fork in it (to steal realists line)

LOL

Five reasons why this will be best road trip ever (while driving towards a cliff):

1) Everyone else is driving in the same direction

2) This time the drop from the cliff will different … much softer

3) The Fed will pave over the abyss

4) This time we have brand new tires

5) Only poor people get killed while driving off cliffs

Lol such a great and perfect analogy. These permabulls are brain dead.

Josh…but wealthy….and we can refi at a lower rate.

Thanks to the FED

https://fred.stlouisfed.org/series/STLFSI2

At Louis financial stress index is below zero. It spiked during covid and is now at “nothing-burger†levels.

It doesn’t matter for the perma depression bears. The end of the world is just around the corner.

M’s cousin in Florida?

https://www.nbcmiami.com/news/local/sw-florida-woman-broke-into-neighbors-pool-multiple-times-for-skinny-dipping-deputies/2261854/

Remember Q1? Millennial (me) bought, the top is in! Market crash coming! 20-40% decline in house prices.

Fast forward. Here we are at the beginning of Q3. Earnings are coming in.

A V shape recovery in housing and Stocks. Housing appreciated in May and June YoY.

Bears: dead cat bounce, it will crash. We are in a depression.

Bulls: you missed out. Again. You could have made a ton of money by buying stocks in March and April. Housing will continue to push higher

lesson learned:

forget about trying to forecast and time the market. Nobody knows. Nobody KNOWS. Nobody could have remotely known that housing will be so strong during this pandemic. Nobody could have known the dow will go from 29k to 18k and back to over 25k in a matter of 3-4months.

Dollar cost avg in stocks and buy a house when you comfortably afford it. If you are not there yet to buy a house, stop spending for unnecessary items. Save, save, save and buy in a good location when you can. After years of being on this blog, years of monitoring and researching the market this is my simple advice.

From 2009 to 2012 I was more interested in getting out of certain real estate holdings that were causing me trouble (out of state, nearly 1000 miles away) then in buying real estate. The value of my holdings fell so low, and buyers just weren’t there that I ultimately stopped trying. In 2013, we helped our Daughter get into a much bigger house in a market where you needed large cash downpayment to get anything. I also was tired of being a landlord for houses that weren’t making me much money at all. So I passed on an obvious buy situation.

Today has a different feel than 2006-2010. The effect of forbearance is way different than the effect of foreclosures on the housing market. Foreclosure caused a wave of short sales and bank sales that swamped the market with cheap properties. The adjustment of the stock market to the corona virus has been rapid, with the S&P 500 now down only around 5% since the peak in February. The stock market from early 2008 went down down down for over a year. This crisis has not caused the collapse of investment banks, and has mainly hammered the travel industry. Small business has borne a big share of the loss. The poorest service workers are the ones without jobs, and they for the most part never had a prayer of getting into a house of their own. The government spending is unprecedented, and whichever party wins in November, will probably go up more, especially just before the election.

I am now bearish on the US Dollar. Groups like “Better Than Cash Alliance” are pushing to eliminate cash, which will hammer small business even more than the corona virus. The economy has always been stronger than the numbers because of the cash economy which is hard to measure. So I now need something to put dollars into. So do a lot of people even if they don’t know it. Real Estate?

Here is an article from Reuters:

https://www.reuters.com/article/global-markets-themes-idUSL8N2CX5IT

This is mainstream British media, not some doom and gloom site.

I don’t see any difference between a Trump Fed and a Biden Fed on this point. They may differ on fiscal policy, but on monetary policy, I believe both are cut from the same cheap cloth. The elimination of cash is necessary for NIRP to work. If you have cash available, when a bank starts charging you to keep your funds, you simply take out the cash. With NIRP, there will be an additional “tax” on every cent you make, as you are charged interest to keep money in the bank. You’ll need to have the money from your pay sent somewhere other than a bank if that will even be allowed. Welcome to the world of the Government/Bank/Big Tech Complex.

In Europe they are pretty much there (NIRP).

The ten year treasury bond yield is negative in Germany etc.

The good news is, you can refinance your home there at 1-2%!!

Rates are poised to go lower. Good for asset holders. Stocks and housing benefits from it.

LMAO, if you think Housing isn’t going to collapse, you live in a fantasy world, CA will get CRUSHED.

Stimulus Checks GONE, Millions Face Eviction, RECORD Level Store Closures! Where To Hide?

https://www.youtube.com/watch?v=nroKHlDKRjQ

M’s Relative- From KCRW in California. “KCRW speaks with Evelyn Garcia, who manages a seven-unit apartment building in South LA. Her father owns the building and lives in it too. KCRW: Tell us about this building. How did your father come to own it? Evelyn Garcia: ‘My father got laid off. And he went ahead and refinanced his home and decided that perhaps this was something he could get himself to keep himself busy while he stopped working. … His regular employment … was sheet metal. And he decided to purchase this. … This is his only source of income. Yes, he went ahead and purchased it with the funding from his primary home and his retirement savings.’â€

“Did anyone stop paying the rent in your building? ‘Yes, they certainly did. A lot of my tenants were unfortunately unable to pay the rent because of COVID. It’s been affecting us, but we’re willing to work with our tenants, and we’ve been really flexible with them.’â€

“Are you working out mortgage payments out with the bank? ‘Yes, we’ve already spoken to the mortgagor. And thankfully we got a six month extension. And since our bank isn’t federally owned, or it’s not Fannie Mae or Freddie Mac, unfortunately it’s a private bank. Everything is kind of up in the air. And I know that they have no obligation to assist us. I just don’t know what’s going to happen after six months, because we haven’t gotten a straight answer from them. So anything could happen. We could go into foreclosure after six months from now.’â€

From Socket Site in California. “Back in 2007, the 1,670-square-foot, two-bedroom unit #27C in the St. Regis Museum Tower building at 188 Minna Street quickly fetched the $2.75 million price at which it was listed, financed by the Hong Kong-based Bank of East Asia. The unit returned to the market priced at $3.08 million in March of last year. Reduced to $2.7 million [in June of last year], the luxury unit was then withdrawn from the MLS at the end of [2019] and re-listed anew in January with a (further reduced) price tag of $2.53 million and an official ‘1’ day on the market.â€

“And the sale of 188 Minna Street #27C has now closed escrow with a contract price of $2.3 million, representing a 16.4 percent ($450K) drop below its 2007-era value on an apples-to-apples, versus ‘median price,’ basis.â€

Enjoy the weather in CA, it’s sunny out, pay no attention to the housing tsunami off the coast.

Commercial real estate, especially storefront real estate and office space, is in for a nasty ride. A seven unit apartment complex is pretty small, and as you point out, would be financed by a local community bank that can’t offer forbearance forever. But foreclosure is a pretty bad way to go for those banks also. Kind of a Devil and the deep blue sea scenario. I doubt that the government will bail them out because these types of business don’t fall into the too big to fail category.

Two things will affect this in the future: 1) how rapidly we come up with a way to stop COVID and 2) how quickly we move to an inflationary environment due to massive government spending. #1 is a win win, and #2 is a lose lose.

@Joe

Inflation is fine so long as wages follow it upwards at about the same rate and the rate of inflation isn’t hyperinflationary. If they don’t than yes its bad and yes hyperinflation is bad too but there is no sign of that.

The bond market is still happily buying US debt at VERY low rates even after trillions of new debt was just issued.

If you see bond sale failures or if the US has to start raising its debt rate up pretty high than yes you can start to get worried but otherwise until than no. And given that the market didn’t even blink at trillions more debt its unreasonable to harp on about this sort of thing at all right now.

t,

I’ve looked at my employment income over my lifetime, and since the big crash, it has not kept up with inflation. So in theory, inflation might be good for the economy, but in practice it robs you blind.

That isn’t a inflation issue.

That is a employer issue.

If they don’t do COLA’s every year than they’re effectively cutting your wages by ~2% yearly.

That is why I mentioned in the previous post that wages have to go up with inflation. If they don’t then yes its bad but wages (except for minimum) aren’t set by the govt. They’re set by your employer.

t,

So inflation is good but I’m not because I work for a big international foreign owned corporation that stiffs their workers because they can get away with it? When the company was a small independent company, my wages went up more than inflation because of my productivity. Nowadays, only Government workers seem to get inflation adjustments annually. If inflation gets high enough, you’d need monthly or weekly adjustments anyway.

>>>So inflation is good but I’m not

Basically yes.

That is why in my original post I gave the qualifier that wages have to go up with inflation.

Historically, for what its worth, prior to the 1980’s wages DID track inflation (and even in the 80’s sort’ve did) so this is not some unheard of impossible thing to do. Companies just don’t want to do it because they’re greedy and quite frankly they don’t care about their workers anymore.

Your best option would be to try to switch employers to someone that paid better if they won’t give you COLA’s or raises.

Yes this can be a fairly lame and possibly impractical option to try to go with to say the least depending on your personal circumstances, especially in this economy. But it can be done. I did it, took me years to find a half way decent employer mind you, but it was eventually doable.

And no I don’t think its fair or right that you (or I) should have to switch jobs and struggle to find a decent employer who’ll pay you properly. But I was also speaking broadly about the economy with my earlier comments to you.

>>>Nowadays, only Government workers seem to get inflation adjustments annually.

I work in the healthcare biz and I get COLA’s yearly. They don’t call them that and they in fact tie them to ‘performance’ (which boils down to if the boss likes you or not) but a small-ish ~2% raise yearly is normal at my job.