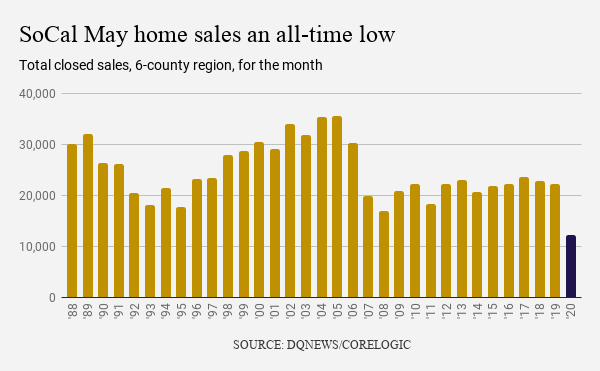

Covid-19 and the impact on housing. SoCal Home Sales hit an all-time low in May and 4.76 million Americans are now actively not paying their mortgage.

Things are so good in the housing market, that the data from May for SoCal home sales hit an all-time record low. That is right, this was the worst performing May in recent memory in terms of sales volume. This is a critical point because sales volume was already very thin even before the pandemic hit. And what is telling is those that are able to buy, older Americans, are the most susceptible group to Covid-19 if it hits them. Case and point? In Orange County, an area where people are at beaches in mass and in most cases not wearing masks, zero people have died between 0 to 24 according to the latest data. However, 87 percent of those dying are 55 or older (56 percent of all housing units in California are owned by those 55 and older). And these are largely the homeowners in SoCal or those looking to sell and buy. It should be noted that in most real estate cycles, first sales go down, then home values. And for those with historical amnesia, after a shock like this, home values tend to lag the sales hit between one and two years. So the cheerleaders overall seem like the anti-fact crowd that want everything boiled down to a two-minute clip. Things in life are just more complicated.

Fact #1 – SoCal just had its worst May in recent memory in terms of home sales

The SoCal housing market just had a horrible month in terms of home sales. The data is hard to refute:

This is rather clear data here. Sure, you can make the argument that this is largely due to a pandemic and people are probably less prone to having an open house when you have a virus that spreads like wildfire, especially if you are in age bracket where you are more likely to die if you catch it – and this is the group that largely owns property in California. Given that we won’t have a vaccine for some time, we will need to learn to live with this. But will older California owners want people just popping in their homes to scope out the place before buying? I’m not so sure.

Then you have younger Americans that have been smashed by this crisis. We already know that California is edging to a renting majority and people will start voting that way. Some people are unhappy about this and are bitter and angry yet it is hard to fight a trend. Plus, we are going to have some tough choices given that local and regional governments are going to see tax receipts implode. And given we are still practicing crony capitalism for the .1%, it is unlikely most will get a piece of this rentier money manipulation aside from a few bucks in their bank account (most of that has already been used up).

Fact #2 – A large portion of Americans have stopped paying their mortgages

Another reality is that 4.76 million Americans are now not paying on their mortgages. That is not good. If someone has a tough time paying one mortgage payment, try doing three or six all at once. So we are going to see the rubber hitting the road even more so late this summer and fall. There is only so much can kicking you can do.

Given how people are interacting with one another, it is clear we are going to see more cases of the virus in our society. It is hyper focused for damage on those that are 55 and older and these are largely the homeowners in our country. Most people when buying a home want to step in and take a very close look at the biggest purchase they will be making in their life. So how are people going to feel about letting people into their property to look around?

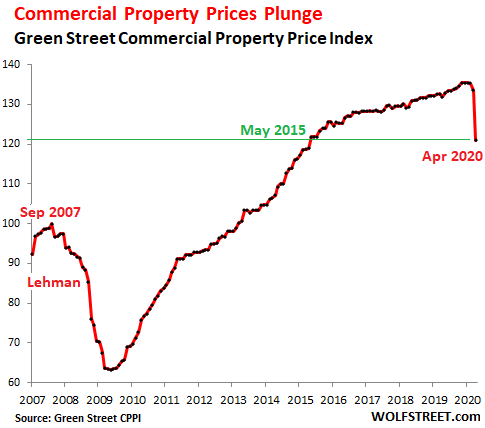

The cheerleading narrative is fighting the battle of the past – that is, home prices are high because you are seeing movement at the margins. Same thing happened when the housing bubble popped in 2007 to 2009. Prices lagged and hit a bottom in 2012 in many locations.

Commercial real estate which is more reflective of business demand is already taking a hit:

Our economy is on a big giant pause:

-Student loan payments are on hold until September for most with government backed loans (what happens after that?)

-4.76 million Americans are in forbearance eon their mortgages

-29.2 million Americans are receiving unemployment insurance

The market is hyper irrational. Just look at Hertz for example. The company filed for bankruptcy and tried to sell more stock into the market because people are just speculating on platforms like Robinhood. In reality, it is likely the stock will be wiped out but there was still demand! This is a textbook definition of the “greater fool†and housing had something like that with the NINJA epidemic – that is, people knew prices were out of control but since some other sucker was willing to buy, why not go for it? This thought process is there today – “hey, just look at these record prices! Therefore it must be right.†That is until the music stops and there are no chairs left to sit on.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

292 Responses to “Covid-19 and the impact on housing. SoCal Home Sales hit an all-time low in May and 4.76 million Americans are now actively not paying their mortgage.”

CA Nightmare – Step right up and get in on the action. 50% off is a myth, 60+% is a fact

https://www.zillow.com/homedetails/2033-Bruceala-Ct-Cardiff-CA-92007/16725255_zpid/

Yah can’t make this up, CA owners will get wiped out in 2021

If you are correct, I will be a buyer. I have often said on this blog that my price point is 12 times the annual rent.

That’s good metric, fairly close to the 10X metric which has been the Mean for 1000+ yrs

that’s close to the metric 10X which is the historical rule of thumb

Really wiped out? I guess none of us have careers or money saved up? You poor fool living in a fantasy land. Renters are more likely to be wiped out than homeowners. Sure many over-leveraged homeowners but not all, I just signed refi documents on Wednesday at 2.75% 30 year fixed with 60 LTV. My mortgage will be cheaper than a 2BD rental and that’s with just me working, wife is a lawyer watching kids at home, she can go back if we need more or I lose my job! Key is I make 5x more than my mortgage with little debt.

2.75%? Can I get the name and email of your loan guy?

Right, because you represent the average home buyer and owner. Most of them I know have so much money they can sit at home with an advanced degree and have only 1 income. That explains the 5M in forbearance.

Walter white, maybe cooking meth with pinkman suits you better than commenting on the housing market with remakes like that…

They don’t give out loans like in 2006. Especially during this “covid crisis†it’s getting harder to get loans. Unless you are a qualified buyer, no house for you.

In my new community everyone has well established careers.

Look them up. United Wholesale Mortgage. Any broker can help. They had as low as 2.5 with some closing costs. I went with zero closing. I didn’t believe it either, previously with Chase and a credit union and they couldn’t match my new rate so I left.

Dude, you realize asking price doesn’t mean much? You think it went down by 50%? You realize the live auction is starting at 1.2M? So close to the beach it might sell for significantly more than1.2M.

M: Dude, you realize asking price doesn’t mean much?

Yet another Milli flip flop. Old Milli would “prove” many of his points by citing asking prices. Others, myself included, told him asking price is meaningless. Now he agrees on that too.

I’ve lost count over how many positions Milli has done a complete 180 reversal.

100% agree!

Take the old Millie, flip it 180 and you have the new M.

Starting price at an auction is meaningless.

Come back to us when the house is sold and THEN lets talk about prices.

It sold for 2.1 million (original asking price 2.5 mil.

Why pay for a rapidly depreciating asset when the Realist will pay your mortgage for you? Don’t be stupid.

Thank you Realist for paying my mortgage!

And the San Diego cpa. Some people just love helping us pay off our assets faster. The best thing is they keep doing it because they will wait until they are 60 for that 50% crash. Lol. We will never run out of renters!

Now is not the time to buy nor sell. Banks are suppose to value their REO to market. I don’t value may house to market, since I live in it and will not have a fire sell. The poor folks in the real estate business will suffer. I just cry for their suffering. We are in a depression.

Same for my stocks. The only value that counts is when I sell every year(4%) for my RMD.

Since I get a big SS monthly checks and a very big CALPERS pension, no worries. The Democrats will print money. My kids will pay the bills. Party on!

Fantastic time to sell. You will most likely get multiple offers / bidding wars!

It’s always a good time to buy if you can comfortably afford it and if it’s your primary residence. You won’t regret buying, it will be the best investment you ever make (most likely).

We’ve been waiting for the crash since 2012 when Jim Taylor first predicted a quick and mighty tank. I’ve already asserted that there’s more money sitting on the sidelines than anyone knew of. There still is. Why. Because there’s so many damn people and a more than healthy proportion have set money aside. A lot of money. So I don’t worry about a cataclysmic downturn. At least not in decent and safe area.

Why would you be waiting for a tank in 2012???

That was the tank, huge drop, 2012 was the best time time buy in the past 20 years.

Now you need to wait until about 2023-2024. You need to have patience.

Hehe, his story changed quickly. Now it’s 3-4 years out….

This year we will see prices actually continue to climb.

Historic low inventory, historic low rates and bidding wars.

There’s no “tank†coming anytime soon. Housing inventory is at all time lows, mortgage rates are at historic lows, and there is do much money and pent up demand on the sidelines to keep in inventory low and prices high for many years to come. On top of that, baby boomers will be retiring and/or dying in the next decade or two and will be passing down approximately $65 trillion to their heirs. Those beneficiaries will almost certainly put a lot of their inheritances into housing. In places like So Cal, where there is no buildable land left, inventory will just get tighter. If you really want to be a homeowner and can afford it, now is probably as good a time as any to buy a home.

+1

Spot on…..glad a few people get it.

Step right up and be the next fool to buy in CA – Business

San Diego home sales plummet to level not seen in nearly 30 years

The median home price in San Diego County is $590,000. This was a home for around that same price on Watson Way last summer.

The median home price for a house in San Diego County is now at $590,000. This was a home for around that same price on Watson Way last summer.

(John Gibbins/The San Diego Union-Tribune)

San Diego home sales continued to slump during the COVID-19 pandemic. Sale price remains about the same.

By Phillip Molnar

June 18, 2020

2:38 PM

Housing sales in San Diego County had their biggest annual drop in nearly 30 years in May as COVID-19 brought the market to crawl.

There were 2,327 home sales in May, down 40.7 percent from the previous year, said CoreLogic data provided by DQNews. Analysts point to a lack of consumer confidence and sellers pulling homes off the market to wait out for a better selling time as reasons for few transactions.

It represents the biggest annual drop in home sales since January 1991 when sales were down by 41.5 percent.

A Fool and his Money are soon Parted, please come again.

Will you be buying my home after I lose it all? Please save me!

You are by far the least educated commenter on this blog. All you do is blurt out a bunch of garbage with zero substance. I’ve been 100% right about the state of the housing market so far and will continue to see things play out exactly how I envision them to because I base my analysis on facts. At this point I only come to this blog to see what wacky zany thing Realist is going to say next. I really wish the Doc would feature you as a contributor on his next blog post. I think you both would make a hilarious team! 🤣🤣🤣

You were spot on…..below 1M in OC is selling like hot cakes

500-700 in San Diego county is flying off the shelves within days.

The market has been this hot since 2013.

A friend of mine (realtor) just made the zip code record. Multiple offers, highest price ever recorded.

And no end in sight…..we have no inventory.

Realist

“ and sellers pulling homes off the market to wait out for a better selling time as reasons for few transactions.â€

I agree with you and the article.

Historic low inventory. Plus historic low rates.

Q1 would have been a great time to buy while buyers were scared. Now, buyers aren’t scared anymore.

For below 1million, expect multiple offers on SoCal.

Good luck!

Here is a chart showing TLT (long treasury Bill ETF vs JNK (ETF for high yield corporate aka “Junk”). See what happened as the virus struck? I say what goes up must come down, and the spread between the two must narrow. TLT = 1.77% yield, JNK 5.66% current yield. (If it doesn’t come up hit DRAW CHART.)

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Fund&symb=JNK&time=9&startdate=1%2F4%2F1999&enddate=6%2F22%2F2020&freq=1&compidx=aaaaa%3A0&comptemptext=TLT&comp=TLT&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=64&style=320&size=4&x=57&y=6&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=13

The fed is to start buying corporate debt, and how much will be high yield, I don’t know.

Pending sales in Southern California are up 6 weeks straight and back to pre-coronavirus levels. The Doc concedes low May sales could be a virus hangover, which seems to be the case.

Pending is like saying you are kinda pregnant, sorta pregnant, just a little pregnant. LMAO, good luck with that.

I think I just lost the last little bit of respect I had for “realistâ€.

What took you so long M? Realist never had any respect. All he does is talk out his pie hole without any substance whatsoever. People with half a brain see how utterly useless he is on this blog.

New age,

You are right. Realist is a lost cause.

For the price of a middle class Brentwood crapshack, you can buy vast mansions in Phoenix or Spokane.

What nearly $2.5 million buys in Brentwood: https://www.redfin.com/CA/Los-Angeles/1015-Amherst-Ave-90049/home/6760643

What nearly $2.5 million buys in Phoenix: https://www.redfin.com/AZ/Phoenix/106-E-Country-Club-Dr-85014/home/101812499

What $2.1 million buys in Spokane: https://www.redfin.com/WA/Spokane/2208-W-2nd-Ave-99201/home/169896227

Brentwood versus Spokane versus Phoenix.

Dont be silly.

Look up the term: Location, Location, Location.

You must be Dr Obvious. Of course that delta exists and it always has. If someone was to offer you a choice of any one of these three houses, your pick, which one would you choose? I can see it now. “ yes, dear, it’s one third the size (one quarter?) but it’s in the affluent Westside. The weather is perfect and did I mention the beaches?†I don’t think anyone, including you, would give Spokane or Wichita, whatever, a second glance.

The layoffs for home owners in CA haven’t even started in earnest yet.

That will happen when PPP is curtailed.

So far the pain has all been felt at the lowest economic levels.

This recession will be far worse than 2008/9.

Housing will take at least 3 or 4 years from now to bottom. You need patience.

“This recession will be far worse than 2008â€

Rofl!!

I agree. The instant gratification crowd is missing the fact that these things play out over a longer period of time. As you said, 2 Years and we are in a solid downtrend and the pendulum swings slowly. 10-15 years roundtrip.

ON the other hand, this home in NoHo was listed at $795K and sold for $815K.

Imagine that, North Hollyweird

https://www.redfin.com/CA/North-Hollywood/5831-Morella-Ave-91607/home/5161647

The house near me is now 38 days on Redfin and is listed as Pending. No longer taking backup offers. It was sold the weekend it was listed. It probably should give the final price by day 45 (one week from now). It is a classic ’60s working class 3 Br on a reasonably big lot (aka crapshack to many of you), and is worth as much (or more!) as a 4000+ sq ft mansion outside Minneapolis.

Nonsense. People over 55 are at risk of getting this fauxflu & are fearful of allowing potential house buyers into their homes for fear of contracting it?? These must be the same fools who wear their masks in bed.

Waiting for a vaccine? Really? People are waiting to take Bill Gate’s vaccine? lol

People are more likely fleeing the cities because they seek an escape from the overreaching, dictatorial policies now being forced upon them by their local governments. Or because they simply cannot afford their homes anymore.

People are more likely fleeing the cities because they seek an escape from the overreaching, dictatorial policies now being forced upon them by their local governments. Or because they simply cannot afford their homes anymore.

Or it’s to get away from all the “overwhelmingly peaceful protests.”

As someone standing on the sidelines in the Bay Area for many years, I welcome news like this. But I am not holding my breath. Sales figures had been trending downward pre-pandemic. But the markedly lower May sales figures are heavily attributable to the shutdown. The fact that liquor sales in bars plummeted during the same time period does not mean we’ve all decided to stop drinking.

As far as the postponed mortgage payments, I believe we CAN kick the can further down the road, and we will. Anecdotally, people stayed in their homes post-2008 financial crisis for years, rent free, as the banks postponed posting a loss on their balance sheets, then got bailed out. If foreclosure was ever undertaken, which I understand was not the usual, that process took years to finalize. The idea that we will see substantial price drops as a result of the pandemic is wishful thinking…this is especially true in the sub $1M range. Please tell me I’m wrong, I want to be.

The supposed flight from the cities? Maybe that will have an effect, but I’m also skeptical. RE agents have been quoted in “news” articles lately, alleging that sales activity is skyrocketing in the exurbs, mountains, etc., due to increased telework and the recent urban unrest. But to me it seems unlikely that qualified buyers have gone through the entire process in that short of a time frame, ie, once the shutdown started, they decided to up and leave the city, list and sell their homes, and purchase a new one in, say, Napa Valley or Lake Tahoe. Can it even happen that quickly?

But to me it seems unlikely that qualified buyers have gone through the entire process in that short of a time frame, ie, once the shutdown started, they decided to up and leave the city, list and sell their homes, and purchase a new one in, say, Napa Valley or Lake Tahoe. Can it even happen that quickly?

Not for most people. But for the super rich, those who can buy expensive homes for all cash, yes, it can happen that quickly.

Per the Dr. article:

“ Therefore it must be right.†That is until the music stops and there are no chairs left to sit on.â€

People need a place to live. They either rent like our SoCal CPA and pay 36k a year to someone else or they buy.

There already is no chair left. Literally. How many houses are for sale in your neighborhood, Your community, Your city, in your state?

Not enough for sale and it gets worse and worse. Homeowners sit on a gold mine.

Unless you change lending standards and let houses be bought by people who cannot afford them you have no issue. Most renters predicting the crash don’t have the income or the 150-200k downpayment to buy that nice house.

They can buy a smaller house further away or they keep renting. Welcome to reality.

In Europe that has been a reality for decades.

Millie, unfortunately I think you are right. I have been pounding the table for almost a decade about supply and demand regarding RE in CA. We are currently several MILLION units short. With an ever increasing population and all the regulations and no or slow growth policies…this is the end result. And for the areas most people want to live in, there is simply no land left to build on.

I welcome the 60% haircut some of these geniuses are predicting. If that comes true, you’ll have even more renters in this state. This people with money will buy up everything, myself included.

“until the music stops and there are no chairs left to sit on.”

Perfect closing remark and pretty much sums up the current economic situation. Everyone with basic reading comprehension and internet access can figure out the recession/depression has started. Right now smart money is dumping assets (example: large hedge funds) and stupid money is buying them (example: Robinhood investor). The music is about to stop playing. One can argue it already did, but a lot of people are making excuses that someone just paused the music because of COVID-19.

The houses will be much cheaper soon. If you are planning to buy, don’t! You will be the one left standing when the music stops.

Just drove through LA.

What a laughable 3rd world country style city this is.

Smog is back. Traffic is back. Homeless everywhere. Gas station has no working bathroom. 7/11 says they don’t have a bathroom. McDonald’s, finally a bathroom.

I would hate to live in LA. Unfortunately I have to drive through it once in a while.

Now you sound like the Old Milli. Welcome back.

My dislike for traffic and density, smog and stuff hasn’t changed. I like it a bit more rural

Chaz3@ “But to me it seems unlikely that qualified buyers have gone through the entire process in that short of a time frame, ie, once the shutdown started, they decided to up and leave the city, list and sell their homes, and purchase a new one in, say, Napa Valley or Lake Tahoe. Can it even happen that quickly?”

People who buy vacation homes in places like Aspen, Lake Tahoe, Park City etc., most of the time they don’t need a loan; they buy with cash. Even if they borrow, the loan might be from a HELOC on their main expensive home. Regardless, they can close within few days if they want. Those houses are millions (i.e. in Park City, UT most SFH are over 5 million). Nobody gets a mortgage there. Mortgages are for working class not for those buying their forth or fifth home to have a place where to park their money.

Fair enough re the ultra wealthy who buy homes with cash in Aspen, but the movements of those people don’t constitute a “mass exodus” from the cities, as has been reported. And the percentage of those people who did not already have a 2nd / 3rd / 4th home, and are supposedly buying now, is smaller still. And Tahoe is not Aspen, let’s be clear about that. (I love Tahoe, BTW)

My frustration is with hyperbolic statements meant to excite or scare or pressure me one way or another. In other words, real estate marketing.

Housing prices are totally fake. They are twice as high as they should be because of past and present fraud. The FBI has sent people to prison for raising entire neighborhoods of homes to triple the value they’re worth. Now we’re told that it’s back to normal when it was never normal in the first place. These scum bag realtors, bankers and government officials are all involved and know it’s wrong.

Kent@ “These scum bag realtors, bankers and government officials are all involved and know it’s wrong.”

The realtors do not have anything to do with real estate prices – zero influence (if you understand how the system works); they are just price takers like you and I. Bankers, unless you are at the very top to be a FED shareholder, again have zero influence. EVERYTHING in terms of RE prices is caused by the FED. Yes, the local authorities play a role with their policies in creating a price difference between various locations. However, overall, for the US market, prices are caused by the FED for whatever benefits the FED. When I say the FED, I am not talking about the federal government, but the Federal Reserve – as federal as Federal Express and with no reserves – the money printers of the largest banks cabal who own the FED. Yes, the FED knows the consequences of their actions, but they are there to serve themselves, not you and I. The best you can hope is to position yourself to be in the right place at the right time financially, so you can benefit from their actions at least a little bit.

Poor realtors are as hopeless are you are to ever buy a house in Belair or Beverly Hills.

From Logan Motashami:

Current housing data doesn’t reflect the true fundamentals of the U.S. market

There should be asterisks on the March, April and May data due to stay-at-home orders

As mortgage rates stay low, I expect a rebound in the existing home sales data line in time. Don’t be surprised if we see a positive year-over-year growth print in the existing home sales report in the upcoming months. Housing data gets softer when mortgage rates get above 4.5% – outside stay-at-home orders, of course.

Full article here

https://www.housingwire.com/articles/current-housing-data-doesnt-reflect-the-true-fundamentals-of-the-u-s-market/

Foreclosure TSUNAMI Coming, Housing to Tank Hard in 2021- Mortgage Delinquencies Surge To Nine-Year High

Property research firm Black Knight Inc. reports total borrowers more than 30 days late surged to 4.3 million in May, up 723,000 from the previous month. This means at least 8% of all US mortgages were either past due or in foreclosure.

As Before, CA Will Be Ground Zero, CrapShacks 40% Discount Coming

Americans Not Making Their Mortgage Payments Soar By 1064% In One Month

https://www.zerohedge.com/economics/americans-not-making-their-mortgage-payments-soar-1064-one-month

If You Purchased A CrapShack in CA Recently, You Are About To Get Bent Over, With No Lube, OUCH

LMFAO

Here Comes The Next Crisis: Up To 30% Of All Mortgages Will Default In “Biggest Wave Of Delinquencies In History”

“This is an unprecedented event,” said Susan Wachter, professor of real estate and finance at the Wharton School of the University of Pennsylvania. She also points out another way the current crisis is different from the 2008 GFC: “The great financial crisis happened over a number of years. This is happening in a matter of months – a matter of weeks.”

Enjoy that weather CA, it’s about ALL you got left.

So Much for Those Application Numbers- Mortgage Market Meltdown: Even The Wealthiest Loan Applicants Are Now Being Turned Down By Lenders

The global pandemic has mortgage lenders steering away from even their wealthiest clients, as fears are abound that lost income could turn the industry’s best clients into its biggest risks.

Jumbo loans, which got their name because they are bigger than most conventional mortgages, have completely fallen out of favor with lenders – a far cry from how they were looked upon just months ago, according to Bloomberg. Availability of jumbo mortgages is down 37% in March, more than double the overall home-loan market. They exceed the limit for government backed mortgages of $510,400.

Rates for jumbo loans were 3.68% last week, which is almost 30 bps higher than the average conventional rate. The spread is the highest since 2013. Jumbo borrowers were previously seen as welcome clients, generally with great credit, money in the bank and collateral to put up.

Tendayi Kapfidze, chief economist at LendingTree Inc. said: “Before this crisis hit us, jumbo loans were pretty attractive. But because they don’t have the government guarantee, a lot of those loans end up on the bank balance sheet.â€

Lenders are charging more for these types of loans than they have in almost seven years. At the same time, they’ve tightened lending standards, requiring almost pristine credit to get a mortgage.

People like David Adler are finding out that refinancing isn’t at easy at it seems, either. David, with excellent credit, went to lower his 3.7% rate on his home but his bank’s rates were too high to help. Adler said: “I told the guy at the bank, ‘I’m trying to use logic here,’ And he said, ‘That’s your problem.’â€

Wells Fargo ranks among the highest jumbo loan holders, producing about $70 billion of the mortgages last year.

Over the last couple of weeks, the bank has stopped purchases from other mortgage banks and limited refinancings to customers who have $250,000 or more with the bank. Banks like Truist Financial Corp. and Flagstar Bancorp Inc. have taken similar steps.

Stanley Middleman, chief executive officer of Freedom Mortgage Corp. said: “Much of this pullback is because investors who’d normally buy these loans no longer want them. Whether the assets are good or not good is irrelevant because there’s no liquidity to buy them.â€

And the banks may be on to something. It turns out that wealthier buyers look just as likely to stop paying their mortgages as and regular buyers. 5.5% of jumbo loans, about 131,000 borrowers, have asked to postpone payments due to a loss of income.

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.

Your email…

But the jumbo market hasn’t totally dried up – it’s just getting more difficult to close loans.

Damon Germanides, a broker in Beverly Hills, says you can fall short of qualifying “despite good credit and owning a business that’s doing well during the pandemic because it’s deemed ‘essential’.”

Borrowers that were ready to put up 20% may now need to put up 30%. “A month ago, he was a no-brainer. Now he’s 50-50,†Germanides concluded.

Oh The Pain, It’s Just Begining

It Just Keeps Getting Funnier & Funnier- 30% Of Americans Didn’t Make Their Housing Payment In June

A stunning 30% of Americans didn’t make their housing payment for June – a figure that is likely going to ripple through the housing industry in coming months. According to a new survey by Apartment List, the rate is similar to May and shows that even though other industries are rebounding, the situation has not yet improved meaningfully in housing.

These figures stood at 24% in April and 31% in May, before falling slightly to 30% in June. One third of the 30% in June made a partial payment, while two thirds made no payment at all.

Yup, Nothing to see here, ISN’T THE WEATHER JUST BEAUTIFUL 🙂

Rents started declining nationally:

https://www.cnn.com/2020/06/16/success/rents-are-dropping-us-cities-coronavirus/?hpt=ob_blogfooterold

This is just a start. The US economy is expected to shrink by 8%, while output across the 19 countries that use the euro could decline by 10.2%. If you think real estate will appreciate in this environment, I cannot help you.

Buying in CA is like Buying a ticket on the TITANIC – From Housing Wire. “California is seeing rents decrease in several areas. According to RealPage, operators in Los Angeles cut rents by 3.3% in May 2020 compared to May 2019. Oakland, California saw an annual loss in effective asking rents of about 3% in May. Bigger cuts were seen in San Jose at 4.4% and in San Francisco at 4.9%, RealPage said. Executed new lease rent has dropped at least 8%, which is double the norm in the U.S., in Boston, Detroit, New York, Salt Lake City, San Francisco and San Jose, California.â€

“In San Francisco, one-bedroom rents have dropped 9.2% since June 2019, according to SFGate. Boston has felt the impact from universities and colleges being out, as about 65,000 students live off-campus, the Boston Globe said, and rent is down 2%. Asking prices have also dropped, for the first time since the middle of 2010.â€

The San Francisco Chronicle in California. “Summer in the Bay Area usually brings a flood of interns, students and new workers who fill spare rooms and snatch up months-long Airbnb vacancies. But this year, the coronavirus pandemic has upended the once-hot Bay Area housing market and kept people at home, leaving landlords bereft — and some renters on the hook for payments from subletters who never showed. A survey from the San Francisco Apartment Association estimated that 7.5% of renters in San Francisco have broken their leases in the past three months, an unprecedented number.â€

“Companies in the business of short-term rentals are also having difficulties. Airbnb laid off a quarter of its workforce in May, and Sonder, another hospitality company headquartered in San Francisco, had major layoffs in March. ‘There’s been a lot who have just kind of disappeared, mailed in the keys, and just vacated, sometimes with furniture left there,’ said Sarah Yaussi, vice president of business strategy for the National Multifamily Housing Council.â€

“The slack summer demand from students and interns likely will evolve into a more serious problem for the rental market as a whole in the fall if students do not return, according to Krista Gulbransen, executive director of the Berkeley Property Owners Association. ‘The summer’s just shot. So for someone to go longer than the summer on a vacancy just to see if the students come back in January is probably not realistic and doable,’ Gulbransen said.â€

From Socket Site in California. “The percentage of homes on the market in San Francisco which have undergone at least one official price reduction is currently running around 21 percent, which is six (6) percentage points, or roughly 39 percent, higher than at the same time last year. And with inventory levels up 60 percent on a year-over-year basis, there are now over twice as many reduced listings on the MLS in the absolute than there were at the same time last year.â€

The Los Angeles Times in California. “Retired football player Carson Palmer has finally sold his custom home in Del Mar for $18 million, according to the Multiple Listing Service. The wood-clad contemporary had been on and off the market since 2015, when it first listed at $24.995 million. In May, the median sale price for the area was $1.439 million, down 23.4% year-over-year, according to CoreLogic.â€

CA slowly sinking into the abyss

lmao, yah just can’t make this up – Housing Rebound? Under Armour Founder Unloads Mansion At 41% Below Asking Price :0

https://www.zerohedge.com/markets/housing-rebound-under-armour-founder-unloads-mansion-41-under-ask-price

You sound like Old Milli. As I’ve often said (and as New Milli agrees), asking price is meaningless.

What’s meaningful is comparing actual sales prices. Is the latest sales price higher or lower than the previous sales price? That’s how to detect if there is a crash, a plateau, or a hot market.

It is Millie… all same person including JamesJim. You’re being trolled.

“…Under Armour Founder Unloads Mansion At 41% Below Asking Price…”

Here is the part I have never understood. If these people are so damn rich, why do they have to unload anything? Fake people with fake money using too much leverage?

Realist, drawing conclusions out of asking prices are very amateur-like.

Take this example for instance:

Buffett sold his Laguna beach house for 7.5M. The asking price was 11M.

So you celebrate and say the market is crashing because it sold 32% below asking?

In reality, Buffett bought the place for 150k and made a killing with his deal – 32% below asking price.

You get the idea here? Asking price doesn’t mean anything. Especially not for luxury properties.

The point to consider is that sale prices are declining not increasing. A significant drop in prices could erode equity for many.

Homeowners can have their property re-assed when prices fall which lowers their taxes?

Homeowners can buy a second home when market prices fall?

Count me in and please wake me up when prices have declined 5%.

Just a few more months right?

The most likely scenario: People can inherit money and build their first home. : )

Don’t see much of a tax savings by reassessing lower property values. I wouldn’t be surprised if all tax rates, including property taxes, are increased to cover increasing government debt.

Very few homeowners will be in a good position financially to purchase a second home regardless of price. Many will be struggling to kept their primary home.

Is the V shape recovery complete?

If so, that tells us that unemployment has killed the working class who arent buying homes anytime soon……or is this guy hitting the pipe to hard???

https://www.housingwire.com/podcast/the-v-shaped-housing-recovery-is-complete/

It’s hard to argue against him as he bases his statements generally on data. He had many articles lately that are worth reading.

Purchase application data, st Louis Financial stress index, inventory, 10y treasury yields and mortgage rates, equity in homes, etc, etc.

Another practical approach is to ask realtors about the current state of the market. It depends on the location.

SoCal housing market for instance is sizzling hot and no end in sight.

M: Another practical approach is to ask realtors about the current state of the market.

You expect realtards (as Old Milli called them) to tell you the truth? For a realtard, it’s always a great time to sell, and a great time to buy.

Pls discontinue to call real estate agents this word. These agents are trying to make a living by turning houses into homes for people. I have learned a lot from real estate agents over the year and they supply me with data and market insights. Try to give them a chance. Finding a great agent and maintaining that relationship over years can make you money.

In the 92115 zip code in San Diego there are very few sfr’s for sale. Every realtor I know is saying the same thing, there’s no inventory. This has a huge affect on the total sales. This isn’t to say things are rosy as they are anything but rosy. People aren’t selling and builders spent the last 10 years building COVID cubes with nice gyms for the millennial crowd. Now that they got stuck in a box for 2 months and had the spouse chirping in their ear the whole time they’re desperate for the white picket fence and swing in the tree. The tards running the cities and states could only think two things, small cubes of people stacked on top of each other and public transit. Once the little millennial misses starts popping out the rug rats she ain’t gonna want to be downtown anymore, too. Of course houses are in demand. No building of them, no existing inventory coming onto the market, inner cities being burnt, and locked up in boxes for two months, what did you think was going to happen?

Millennial here.

Great post Bob. Couldn’t agree more.

A realtor I know just made the all time high for a sale in one of San Diego’s zip codes.

No inventory and historic low rates means prices can go nowhere but up.

I recently bought a brand new construction home in north county San Diego. Commute is short and the beach isn’t too far. Yet, there is no density where I bought.

I compared it to existing houses and found new construction is relatively cheap considering all the advantages a new construction has over existing homes.

I am looking to buy a fixer SFH in a decent area as an investment property. Unfortunately, I have little hope to get a deal. Too much competition. People grew up with HGTV and are more open to buying a fixer and “making†their home the way they want.

It comes down to what has been said thousands of times by hundreds of people over the years: we have a severe housing shortage.

New construction is generally cheaply made and shoddily put together. They are built by piece workers who make money in volume, hurrying through each house quickly, Using shoddy workmanship and Shoddy materials. (Half-inch drywall throughout)

Has been this way for decades. The builders idea is to turn a profit, not to go broke using decent materials. You would have been much better off buying a solid older home, rather than shoddy new construction

Rick, thank you! I needed that laugh!

The house is in fantastic condition and the top line materials were used. We watched it being built which is a cool experience itself.

Don’t be jealous that you can only afford old crappy fixer crapshacks. My new house is top of the line with all the bells and whistles.we couldn’t be happier. Let other people have fun with the bidding wars on older crapshacks. I got my dream home and warranties.

No reason for me to rip out walls, we have an open concept with mega large island and great room, loft, granny flat and 3 car garage. Should I keep bragging?

Haha! I knew you’d take the bait Millie.

Let’s face it, your inheritance bought you a new crap shack rather than an old crap shack and you bought at the peak. Lol. Me thinks thou protest too much.

M: We watched it being built which is a cool experience itself.

Okay, now we know you’re lying.

Early this year, you were still the Old Milli, predicting a crash. Then, seemingly overnight, you announced that you inherited money, bought a house, moved in, and found a perfect tenant. Now we’re expected to believe that you even saw the house being built?

You expect us to believe that, within the brief span of time between the Old Milli and New Milli posts …

* Your relative died. You were informed that you inherited money. The estate went through probate, taxes, and you received the final check.

* You negotiated and purchased a home that was still under construction. You watched the building process, which was still so incomplete that you were able to inspect all the materials.

* The house was rapidly finished, from largely incomplete to move-in ready.

* You then moved all your stuff from your old place to the new house.

* You interviewed prospective tenants and found the perfect one, who then moved in.

All this in the brief span of time between the Old Milli and New Milli posts?

I love taking bait. That’s what I do.

There are those that can afford a NEW home at the PEAK and then there are those that can afford to buy a crapshack when prices fall.

So far everyone loved my new house. Throwing covid party after covid party.

Just kidding. Obviously, every guest is wearing a hazmat suit and we all keep 6tt distance.

Those that say they don’t build new houses like the old ones are actually right.

Nowadays they build much better.

People like Rick can only afford old Cars and tell themselves “see, the old cars are much better, I can still do my own oil changeâ€. While the millennial drives a Tesla that doesn’t even need an oil change 🙂

“Then, seemingly overnight, you announced that you inherited money, bought a house, moved in, and found a perfect tenant. Now we’re expected to believe that you even saw the house being built?“

Dude, what are you talking about? Getting the inheritance money took a year. Why should I post online that I am in the process of getting inheritance money??? btw there is still money tied to one of the houses we are in the process of selling.

If you don’t believe me that we saw our new house being built, sent me your email address and I will send you the pics.

Who said my tenant is perfect?

“Bought a house and moved in†are you okay? What else am I supposed to do after buying a house…. not move in?

M: Getting the inheritance money took a year. Why should I post online that I am in the process of getting inheritance money???

* Why should you? Well then, why did you? Why mention it at all?

* Most importantly, a few months ago you posted that you received an inheritance which enabled you to buy a house which changed your whole way of thinking.

Are you saying that you learned of your inheritance a year ago, yet all this time you retained your Old Milli views, predicting a crash, opposing Prop 13, hating “realtards,” etc.

If your inheritance changed your thinking, it should have changed when you learned of it a year ago. When you learned you could afford a house, and that Prop 13 would benefit you. Instead, you remained Old Milli up until early this year, then changed 180 degrees in an instant.

You know California has rent control (AB1482, which right now doesn’t affect SFH owned by individuals, but Prop 10.2 aims to change that, plus there’s a slew of socialistic policies going after landlords in “the State will take your property” kind of way), and you want to become a landlord in CA?

Either you have no clue, or you like to lose money.

Not sure what your struggle is.

I had a lot of cash and inherited on top of it. I would be flat out dumb to not buy real estate. Yes, it took me a long time to get here and I am no more on the bull side than on the bear side. Making the decision to finally buy changed a lot of things for me and I finally see the truth.

Buying in SoCal is a must. Don’t try to time the market. Buying names ALWAYS sense as long as you can comfortably afford it. Renting long term is financial suicide.

M: Not sure what your struggle is.

I thought I was clear.

Your new financial circumstances should align, time wise, with your new opinions on housing. The former inspired the latter. That they do not align, suggests that you’re lying.

Consider two scenerios:

1. Early this year, you opposed buying a house before a 50-70% crash. You hated Prop 13.

A few weeks later, you announced your inheritance, a change of opinion on all things, and a sudden home purchase.

It’s not possible for you to have inherited, seen a home built and completed, bought it, moved in, and found a tenant, within a few weeks. Ergo, you’re lying.

2. Now you say that you learned of your inheritance a year ago. This allows time to clear probate, buy a home still under construction, view its completion, move in, and find a tenant.

But if that were so, you would have changed your opinions on the crash, Prop 13, etc., a year ago. Not this spring.

Busted.

Trevor, I bought a large house with granny flat. Renting out the granny flat to a single person. Pays a nice share of my PI.

At the moment I have trouble justifying buying another property as rental income.

I am also looking at the IE and out of state.

Will see….eventually I get my investment property.

Reading Son of a Landlord completely and utterly dismantle little “m” has been glorious. What a scam artist m is!

Seek mental help, man. There are doctors and medications for this.

My new theory is that M is the same as Mr Landlord

Mr Landlord disappears and M appears? Coincidence?? I think not.

The friendly banter between Mr Landlord and Our Millennial was just a game last year.

This educated all of us on the Bull and Bear side of the story. Thank you, M!

M is not an engineer but is a famous Broadway actor who was auditioning for his next play. Bravo M! I hope you get it! Break a leg!

“ But if that were so, you would have changed your opinions on the crash, Prop 13, etc., a year ago. Not this spring.â€

No. Money alone did not change my opinion. I already had money before the inheritance. The difference was I worked and saved hard for my money and I couldn’t pull the trigger to buy a house. I wanted a crash to buy low.

But, inheriting a bunch of money made house buying EASIER for me. As soon as I made the decision to buy, my opinion changed. And I think I got this right now. In SoCal you buy when you comfortably afford it.

None of your Sherlock homes investigation makes sense or proves anything. People can change their mind…..it happens due to circumstances.

Bob,

I am not me landlord. Mr landlord is a good weather commentator. He will be back when the stock market is back to an ATH. Mark my words.

I actually share a lot of mr landlords opinions now.

Me landlord did not believe that I bought a house….many won’t. They don’t believe in people changing so rapidly. Inheriting money and deciding to buy high wasn’t easy for me but much easier than using my downpayment money that I saved and worked hard for.

M: “Inheriting money and deciding to buy high”

Well at least he’s admitting he bought high lol.

Son of a Landlord – I think your theory may be correct. “M” is the perfect cover for Mr. Landlord.

I actually said many times that some people can afford to buy high and some people have to wait for a crash. I could comfortably afford to buy in 2020 and had no competition.

But who knows if the market will be higher by year end or not? Right now I see bidding wars and no inventory.

Buy when you can comfortably afford it!

M: I actually said many times that some people can afford to buy high and some people have to wait for a crash. … Buy when you can comfortably afford it!

Actually, you said many times that only idiots buy at peak. That smart people buy low and sell high. Smart people wait for a crash, and rent until then. Good memories and fun can as easily be created in a rental as in an owned house.

But now you claim that you bought a house while it was being constructed, which means you bought last year — the same year that you were claiming that you refused to buy a house until a 50-70% crash.

That is correct!

I watched it being built end of last year and moved in this year.

Yes, I changed my mind. I am now a bull but used to be a little bit more on the bearish side.

Some people can afford to buy new. Some people have to wait for a crash in order to buy their first house. It’s hard for some people to deal with it – I understand that. It won’t change anything. I will continue to provide you with stats about the housing market.

In fact:

Job market is continuing to recover

Stocks show a V shape but have ways to go

Purchase application data up YoY

Expected market time in hot market territory

Very little inventory, historic low rates and high demand means the market can only go up

Etc etc

It’s so much more fun to be a bull!

M: “I actually said many times that some people can afford to buy high and some people have to wait for a crash. I could comfortably afford to buy in 2020 and had no competition.”

Not everyone who chooses not to buy now in CA is unable to. The old you had the right idea, IMO…

Bob: “Actually, you said many times that only idiots buy at peak. That smart people buy low and sell high. Smart people wait for a crash, and rent until then. Good memories and fun can as easily be created in a rental as in an owned house.”

And not everyone planning to buy in CA is renting. Some are owners (mortgage-free, even) in states with a lower cost of living where saving cash is easier.

M – If you had not bought before the pandemic, would you now? Did receiving your inheritance change your mind about buying or were you seeing something else in the data? I’m not sure how an inheritance would change my plan. I guess it would on the amount.

“ M – If you had not bought before the pandemic, would you now? Did receiving your inheritance change your mind about buying or were you seeing something else in the data? I’m not sure how an inheritance would change my plan. I guess it would on the amount.â€

I probably would not buy at the moment if I hadn’t. Unless I would find a good fixer. The turn key homes below 1M have multiple bidders at the moment in my area (greater San Diego county).

The market is a bit too hot. I’d like to see more inventory.

Receiving the money and not buying was hard to justify. I believed the market would go higher. I did not see a pandemic coming. I was also debating if I should put a good chunk into the stock market….thank goodness I didn’t do that.

interest rates started dropping tremendously. I thought, fuck it, I really like the floor plan, location Etc. I am Going for it.

Seeing how less inventory there is and how low rates are, I am glad I bought. And not only that. We absolutely love the house. Had our first party here. If the house value drops so what, we still love being here every minute.

I wouldn’t mind a house market price drop in the next few years. If I continue to be in a good financial position I will go for my first investment property.

Thanks, M. I’m satisfied. And for whatever it’s worth, I believe you. Folks, ask yourselves who would lie about receiving an inheritance? There’s nothing impressive about that. A liar would probably say they generated it all on their own. M reached a point where he was comfortable buying, so he did.

That’s actually how it works for every sane person. In my case, I could manage a CA-sized mortgage but I’ve become accustom to living totally debt-free in TX, so I’ll keep saving and watching prices. At some point prices will drop and/or I’ll have saved enough to be comfortable buying in CA..

The price is not that important if you love the home, you’re planning to stay for a long, long time and you’re not stretching yourself thin. Easier said than done in CA.

Turtle, it’s not the claimed inheritance. It’s not about changing his mind. It’s the multiple contradictions in his various claims and time lines.

I’ve listed many. I’ll repeat just one:

M claims he bought a house last year. Or, as he later claimed, put a deposit on a house last year.

Yet all last year, and into this year, he was saying he’d never buy a house before a crash.

So he was either lying then about his refusal to buy a house (when he’d already bought one), or lying about now about having bought a house.

His tales are full of contradictions, i.e., lies. And if a man’s caught lying about some things, who know what else he’s lied about? His job, his age, whatever. The whole M persona might be fiction.

Son of a landlord,

You are the one being full of BS.

First of all you keep putting words in my mouth that I never said/wrote and second – and most importantly- this was a drastic change to go from bear to bull.

I had to admit I was wrong and that process didn’t happen overnight.

Buying a house was the best thing for me and I am happy to admit I was wrong before.

Reading zerohedge and hoping for a big crash to buy in low doesn’t work during a housing shortage and low interest environment. Not even a pandemic can bring the market down.

Sry buddy. Move on. I start to feel sorry for you.

M: you keep putting words in my mouth that I never said/wrote and second

Which words?

Did you not post, endlessly throughout 2019, that you would never buy a house until there was a 50-70% crash?

And did you not later claim that you were in the process of buying a house in 2019, inspecting materials, putting down a deposit?

This millennial demand you speak of cannot sustain current price levels. These millennial COVID box dwellers did not have the incomes to create any reasonable demand even before COVID pricked the economic bubble,, which was all fueled by unsustainable levels of debt by the way. The demand before all this came from foreign money, institutional money, rich boomers moving into SoCal, millenials inheriting trust funds. A lot of this is gone now. Now you have a weird situation where people don’t have to sell YET, because they think things are going back to normal. They aint. The old normal is gone and people will start selling at big discount, because they will have to.

Could be, but money has always moved to San Diego. We don’t just draw in San Diego millennials but draw in money millennials from all around. No question, though, that these are interesting times. Things will go up for a while but invariably this won’t end well.

I’ve been deep diving on Massachusetts Unemployment Insurance. CA has borrowed $2.7B from the U.S. Treasury (at 2.41% I believe). MA will probably end up owing at least $3B by the end of the year. Paycheck taxes going up next year are a certainty from that alone.

The Fed is certainly trying to buy up any troubled debt, but in doing so has driven interest rates to zero where all debt seems to reside these days, from risk-less Treasuries to muni debt. Lake Wobegon, every debt is below average risk. March told us people ARE thinking 10% is what they want for most bonds. Eventually they’re run over the credit markets again. Can the Fed hold the line again?

In addition to “crap shacks”, many people are holding a lot of “crap bonds”. When interest rates rise they will be pummeled. You’ll have boomers living in houses at 50% of their value in 2022 and their bonds near the same. Millenials will finally have their way 😉 I have kids. So silver lining!

The main point I want to make is the UI data says practically NO ONE is getting their jobs back. When the 2nd qtr earning season hits, I expect 5% white collar workers to lose their jobs. At some point in 2021 I believe we’ll be at 20%+ unemployment.

Like you say, this takes time. I just wanted to point out that you can look at UI debt for a no escape financial stressor. The DOL reports weekly and the U.S. Treasury reports State borrowing daily. As for tax revenues, delaying payments is really a way to hide the damage to the public.

https://maxdatabook.com/massachusetts-ui-borrowing-calculations/

And here’s an article I wrote on Medium if you don’t mind my posting:

https://medium.com/@maxrottersman/get-your-sh-t-together-massachusetts-bf197c51a14b?source=friends_link&sk=70938e2fca0cac9a6f84ce6d4c3a5ba8

A few mistakes you made in your post:

Don’t fight the FED

Interest rates are not rising significantly anytime soon

Low wage earners: it’s fire and hire. They got laid off and can be re-hired in a second.

Take a look at the saving rates during covid. People are “dying†to spend their money.

Have you taken a look around at restaurants, Lowe’s, Costco lately?

I am on vacation in my favorite state (California) at our favorite lake. I haven’t seen it so busy since years. It’s just a matter of time until we have a vaccine. Buy up all the stocks you can when that happens. The FED has printing like there is no tomorrow. We might get some inflation which benefits homeowners and stock holders – greatly!

I don’t think CA housing prices will drop that much in the coming years. Maybe 25% at the most. There is a housing shortage, plus also no one wants to leave SoCal’s sunny weather for less desirable areas. Buyers will always come in to buy, no matter what. I lived in CA over 30+ years. The RE market will just bubble and pop, and bubble again, over and over.

Here’s an interesting article:

https://www.thebalance.com/when-will-housing-prices-drop-again-4773140

It’s definitely cyclical, or at least has been in the past. If 25% is as low as it goes then that’s somewhat reasonable for CA. Maybe a tad high. The weather comfort is indeed unbeatable in the US, except maybe Honolulu for those of us who like some rain and shades of green (wish SoCal had more of that).

“plus also no one wants to leave SoCal’s sunny weather for less desirable areas.”

You might be surprised to learn that people are leaving in droves and have been for a long time now. Cleaner places with good jobs, better homes, less crime, lower taxes and tolerable roads exist. Family and weather are the main reasons we intend to move back. When we fly to SoCal from Texas it’s like we enter the plane in 2020 and exit in 1994. Much of SoCal just looks “old”.

I recommend that everyone who was born in SoCal live somewhere else for at least a year just to understand that while it is a special place, it is not a place that the rest of the country looks at as the pinnacle of civilization. Whatever the movies portray, the opinion of SoCal from outside the state is generally mediocre. It makes sense for people with better than usual means but otherwise you get the short end of the stick overall, IMO.

I don’t think CA housing prices will drop that much in the coming years. Maybe 25% at the most. There is a housing shortage, plus wants SoCal’s sunny weather. Buyers will always come in to buy, no matter what. I lived in CA over 30+ years. The RE market will just bubble and pop, and bubble again, over and over.

Here’s an interesting article:

https://www.thebalance.com/when-will-housing-prices-drop-again-4773140

Nice little article, THAT TOTALLY MISSED IT. This isn’t a recession, its an economic collapse, a depression, one of the likes we have NEVER been thru, SO YOU HAVEN’T SEEN IT ALL.

Buckle up kids, you are about to get slaughtered, especially if you purchased a house in 2020.

Keep telling yourself it’s gonna be ok if that gets you thru the day, I’m sure you saw this coming.

At the age of 19, I worked as a roofer in CA around 1980 before the 2000-and-up run-up. I see what you see. I just went and did a quick calc on my Uncle’s house. I believe he bought for around $30K in 1970. In today’s inflation dollars that’s $200K today. He died, my aunt recently sold for around $500k. Yes, that’s a nice return, but not as nice as people probably think it. He almost lost the house in one of those CA recessions. Was not risk free 😉

What I wanted to point out to you is some economists see small and large debt cycles. Since the Great Depression we’ve been going through small debt cycles. The Pandemic may bring on a reset of the large debt cycle, the last of which was 1935-1940. (coming anyway, even without the virus IMHO).

In short, you, me, may soon see what our grandparents saw, but which we didn’t live through. This pop will be a long-debt cycle POP.

Here’s a nice video on the subject: https://www.youtube.com/watch?v=PHe0bXAIuk0

Back to Reality- Just Another Boom-And-Bust Cycle, Although The Bust Is Happening At Lightning Speed

From Hollywood Life in California. “HollywoodLife EXCLUSIVELY spoke with four experts in the high-end house market. Q: On average, what percentage do you think Kylie and Travis saved by purchasing a home now? Katie: ‘Kylie Jenner’s home was first listed last summer at 55 million and she purchased it for 36.5 million. She did an outstanding business move by purchasing her home for 18.5 million less than the original list price. Travis Scott got his home for a steal when it was originally listed for $42 million and he purchased it all cash for $23.5 million. An amazing decrease of $18.5 million.’â€

“Q: Do you think they (Kylie and Travis) got a good deal? Yawar: ‘One thing I will say about today’s market is that there is room for negotiation. We have literally been in transactions where we have been able to renegotiate terms after escrow has it opened. This really wouldn’t have been possible six months ago. Overall, I would say there are certain sections of the luxury market where someone can save 10 percent-15 percent on pricing since the pandemic has hit.’â€

That 10-15% OFF Is Just The BEGINNING 🙂

Nice try. Your examples were $50M homes whose value is based on the whim of the 1%.

Show price drops on sub Million dollar homes then we can talk. We are not seeing price drops yet of more than 5%.

LATE MORTGAGES TRIPLE IN CALIFORNIA, HOUSING BUBBLE 2.0, HOME PRICES, FORECLOSURES, FORBEARANCE

If you Purchased in CA, You are about to LOSE Your Down Payment in EQUITY

https://www.youtube.com/watch?v=gmzii4Q3tqw

New home prices went up over 4% in May!

https://fred.stlouisfed.org/graph/?g=s8Mw&utm_source=twitter&utm_medium=SM&utm_content=stlouisfed&utm_campaign=eea412d3-63f2-40a1-b273-eb29cc6226d4

The house on my block, one last post:

The new owners moved in and are doing an extensive remodeling themselves. Big dumpster in front and loud hammering and sawing all weekend. Father-in-Law seems to be helping out with it. They paid full asking price. The new kids are playing around the cul-de-sac.

The Los Angeles Times in California. “If you’re feeling cramped in L.A., here are homes with more than 4,000 square feet on the market for roughly $750,000 in Lake Arrowhead, Oak Hills and Fontana in San Bernardino County. Lake Arrowhead: Amenities in this price-reduced retreat include a vintage movie theater, sauna, wine cellar and a garden with a stream and koi pond.In the 92352 ZIP Code, based on 29 sales, the median price for single-family homes in May was $390,000, down 8.6% year over year, according to CoreLogic.â€

“In the 92344 ZIP Code, based on 24 sales, the median price for single-family homes in May was $318,000, down 3.8% year over year, according to CoreLogic. In the 92336 ZIP Code, based on 52 sales, the median price for single-family homes in May was $483,000, up 2.7% year over year.â€

From Realtor.com:

“What Is a Cul-de-Sac? A Dead End That Draws Home Buyers in Droves”

Yup, if You Purchased or Own in CA You Are Fooked- A report from Medium on California. “Jurdon Gold had been a renter almost his entire life. Born Oakland, Gold, like many in the Bay Area, had never lived in a house he or his family owned. That changed in 2015, when he and his wife began looking for a new place to live after their wedding. Originally planning to rent, the couple couldn’t find a place they could afford in the East Bay. As they began looking further afield, and made peace with the idea of commuting, they spotted a townhouse for sale in Vallejo, about 25 miles north of where Gold grew up.â€

“The mortgage that far from pricey San Francisco was something they could afford, too. Without ever planning it, the two became homeowners. ‘We kind of fell into it,’ Gold said.â€

“The couple’s time in their first home would prove short-lived. Gold’s wife got a postdoc position at Stanford University, diagonally across the San Francisco Bay. To avoid a three-hour commute that involved crossing multiple bridges, the two moved 50 miles south and began renting in Hayward. They quickly found a tenant for their Vallejo home.â€

“It was 2019, and Gold was now both a landlord and a renter. Thanks to the insanity of the Bay Area housing market, the rent in his new Hayward home was more than the mortgage payment in the Vallejo townhouse. ‘Our mortgage in Vallejo is $1,440. Our rent out here in Hayward is $2,950. So it’s literally double,’ Gold said.â€

“Then came Covid-19, which, less than a year after Gold became landlord, kicked off the most dramatic face-off between landlords and tenants in a generation. Throughout the spring, Gold watched his social media fill up with friends posting the hashtag #CancelRent and encouraging people not to pay their rent, even if they could still afford to. The posts were often accompanied by tirades against landlords.â€

“Gold struggled to get his feelings straight. He knew a bad landlord could ruin a person’s life, and what the active threat of eviction felt like. Gold also knew another fact to be true. He and his wife would quickly go bankrupt if their Vallejo tenant were to join the rent strike. ‘We’re living pretty much month to month. We wouldn’t be able to afford our own rent if our tenant stopped paying,’ said Gold.â€

“That tension is something Manuel, a young landlord who asked me not to use his real name in order to speak freely from the owners’ perspective, is grappling with. One the one hand he gets the politics of #CancelRent, just as the activists say they are sympathetic toward him. On the other hand, owning property for him feels like a personal accomplishment.â€

“Manuel was able to borrow enough money from friends and family to afford to buy his own place in Oakland. Today he sees the home he lives in as his retirement, and a fulfillment of the dream that brought his parents to immigrate. ‘Personally I’m a pretty socialist person, but I also understand these things in a capitalist way,’ he said. He has a mortgage to pay, and one of his roommate-tenants has been getting later and later on rent. Manuel said he’s been okay floating his roommate for now, but he knows he could lose his Oakland home if the roommate doesn’t eventually pay.â€

“The one thing that could get small homeowners like Gold and Manuel on board with #CancelRent is the way activists have also pushed for a mortgage cancellation. ‘In that case I’d totally be on board,’ said Manuel.â€

From CBS Los Angeles. “This week, both Los Angeles and San Bernardino counties extended their eviction moratoriums for another month through the end of July. While this move provides relief for tenants struggling to pay rent, some mom-and-pop landlords are now struggling to pay their bills. Homeowner Nasario Birrueta and his wife thought they were getting their dream home when they closed on an Apple Valley home back on March 12.â€

“‘We put in a bid of $15,000 over their asking price to get the house,’ Birrueta said. The couple also agreed to a 30-day leaseback so the previous owners would have more time to move out. But when it was time for them to move out, the previous owners sent a text saying, due to the shelter-in-place order, they are not moving out. ‘I offered them $5,000 cash if they want to move out by mid-May, but they didn’t respond,’ Birrueta said.â€

“Now, more than three months after the Birruetas purchased their new home, they still can’t move in. They say the previous owner only paid one month’s rent and hasn’t paid a dime since. ‘There is a very good chance we may end up losing the house to foreclosure if this continues any longer,’ he said.â€

“Mike Shalyapin is one of those small landlords. He owns two duplexes in downtown L.A. and was in the process of evicting one of his tenants when the stay-at-home order went into effect. Now, according to Shalyapin, those tenants have stopped paying rent. ‘I was laid off from my other job, so the only source of income I have right now is from income properties,’ he said.â€

“Tenants in California don’t have to prove economic hardship due to COVID-19 and they have 12 months to pay their rent back once the emergency order is lifted. ‘My credit cards are maxed out. I don’t even know how to pay for my mortgage bill next month, and at the same time the city demands property taxes,’ Shalyapin said.â€

The Los Angeles Times. “It wasn’t until the work was done that Marcelino and Josefina Rodriguez said they learned the truth. They had been signed up for a roughly $45,000 PACE home improvement loan at nearly 10% interest — even though they said a woman working with the contractor told them their new roof and water heater would be free through a government program.â€

“The Rodriguezes contacted the authorities, but the nearly $4,500 annual bill came due anyway — a financial hit for the household of four who scraped by on less than $30,000 each year as garment workers paid by the piece. If they didn’t pay, Marcelino, 67, and Josefina, 64, could lose the Pacoima home they’ve owned since 2001, one that provided them and their sons stability after years of bouncing from rental to rental. So to get by, they started selling food and one of their sons said he exhausted his savings.â€

“It was working — until the coronavirus slashed their incomes. ‘I don’t know how we are going to pay,’ Marcelino Rodriguez said in Spanish through a translator. To lose the house ‘would destroy me.’â€

“As the economy struggles to recover from coronavirus-induced damage, consumer groups are raising concerns of a coming foreclosure wave stemming from PACE home improvement loans. For years, the industry has been dogged by allegations that some home improvement contractors exploit a loan approval process with weak safeguards to mislead people into financing they can’t afford, by telling them either that work would be free or that it would be less than it ultimately cost.â€

“Consumer attorneys say they were seeing PACE-driven foreclosures even before the current crisis and now fear a surge as the recession cuts off economic lifelines for people already living on the edge. ‘Our clients, who were barely holding on financially, are now falling off a cliff,’ said Stephanie Carroll, an attorney with Public Counsel, which is representing the Rodriguezes.â€

“Before 2018, PACE loan eligibility was largely based on home equity with no required analysis of whether the applicant had the income to repay the loan — a step mandated for mortgage loans. Contractors could use lender systems to look up exactly how much a homeowner qualified for, allowing them to pitch products that would strip all available equity. Homeowners could then sign up on tablet computers that contractors handed to them and borrowers didn’t always need to speak with lenders to confirm they understood their financing.â€

“Complaints were particularly high among seniors and people who didn’t speak English. Some homeowners alleged contractors didn’t show them all the documents and even set up fake email addresses where loan documents would be sent and then forged. Nearly 145,000 loans worth $3.4 billion were outstanding at the end of 2017, before the laws took effect, according to state records. And consumer groups say the rules are still too lax, pointing to allegations of fraud such as those made by the Rodriguezes, who received their loan in 2019.â€

“‘Any time you don’t have an ability to repay analysis, there is a greater chance people will be in loans that are unaffordable,’ said Tara Twomey, an attorney with the National Consumer Law Center. ‘What the PACE assessments take away is any cushion or breathing space to handle any setback.’â€

“Public Counsel’s Nisha Kashyap, who is representing the Rodriguezes, said PACE lenders are required to verify a homeowner’s income and the fact her clients received a loan suggests something ‘went wrong in the approval process.’ ‘This loan should not have been approved,’ she said.â€

“Marcelino and Josefina Rodriguez haven’t received a foreclosure notice but have an underlying mortgage and fear they’ll eventually lose their home. ‘It’s been a year of hell,’ Daniel Rodriguez said. ‘The damage that this stress can cause, that’s what worries me the most.’ Marcelino Rodriguez called what has happened to his family an injustice: ‘They always told me everything was going to be free.’â€

I’ve noticed that many home listings are now erasing their price histories. Several properties that I’ve followed on Redfin had price histories going back a decade or more, and suddenly they only go back a few months to a year.

Zillow used to be more complete on price histories, but they too are erasing past histories.

I’ve been noticing this in San Diego for about a year now. I’m sure it’s not because they want to hide anything.

I remember looking at home prices online 5-7 yrs ago and it was common to show price histories.

Then when flipping got hot n heavy (2013-2015) many brokers put in lots of effort to delete price histories in order to hide the house was flipped and hide the fact that the purchase price prior to flip was so low.

Seems that the practice of deleting price history is rampant now.

Because all history – even price history – is raycis?!? Seriously, not happening in my area but I’m seeing many many high end properties come on the market that were vacation rentals and bought within the last 3 years. In a few cases people are asking DOUBLE what they paid. Most are asking 20% or so – even if bought last year! Interestingly, those who bought at the last peak are happy to get out flat or a little off.

With all the competition these people are going to be CRUSHED, mwah ah ahhhh

I just finished reading “The Great Influenza” by John Barry.

This was about the Spanish Flu Pandemic on 1918 that killed 675K US citizens from Spring 1918 to Summer 1919. It killled 20M worldwide.

A lot of similarities between then and now.

1) The US economy shut down. Quarantines, businesses closed due to sick people and fear. Same as now.

2) That flu pandemic killed everyone at all ages. It killed quickly and suddenly. unlike now.

3) Hospitals were overloaded and many died in hospitals without any antibiotics at that time. Better modern medicine and ventilators now.

4) The overall death rate was estimated between 2-5% . The death rate for the native Eskimos in Alaska was 30-50%. The virus was delivered in the mail boats.

Some horrific facts:

1) It killed about 5-10% of all people in Philadelphia. Parents died and since nobody wanted to go into a home out of fear, their children died of starvation in the homes.

2) Federal government did very little but local charities set up food banks.

3) Businesses all closed like now. People were told to wear masks or stay at home.

4) Gunnison Colorado had no cases since they set up armed guards around the town and shot or arrested anyone entering.

5) Someone spread a rumor in Phoenix that dogs spread the virus so everyone shot and killed their pet dogs.

6) The shops that stayed open had an interesting method. Nobody was allowed in the stores in Monument Colorado but you yelled from the street what you needed and it was thrown out the door to you.

7) In much of the US, if an entire family died in a house, police put a sign on the house to prevent entry. Bodies just rotted inside.

Same economic conditions as now but there was no recorded recession or housing crash in 1918 or 1919. People dealt with it and died of it for about a year and then the virus went away.

None of the authors of the early 1920’s mentioned it. F Scott Fitzgerald, Hemingway.

It lasted about a year and was gone without a vaccine with very little economic impact after it passed.

I am betting that the same will happen now since Covid is far less severe than the 1918 Pandemic. It may be shorter than a year if a Covid vaccine is available.

Katherine Anne Porter wrote “Pale Horse, Pale Rider” about the 1918 pandemic. It was published in the 1930s. She wrote in the ’20s but was not well known until much later.

Thank you, joe R.

I will read that next.