Welcome to the United States of Foreclosures – California lists 99,000 foreclosures for sale on the MLS but 372,000 homes are active in the foreclosure process. A startling look at SoCal and $500,000+ foreclosures on a map.

Getting lost in the numbers is an easy thing especially with the magnitude of numbers being tossed out by Wall Street and our government. I think many in the country have just become apathetic to “billions†or “trillions†of dollars being thrown around as if this was a common part of daily dialogue. When California had its first budget fiasco with the housing market imploding a few years back a few billion dollars captivated the attention of the state for months on end. Today, even the prospect of a $28 billion deficit hardly seems to garner any attention. At a certain point people want more bread and circuses even if nothing has really changed in the underlying fundamentals of the economy. 1 out of 5 mortgages in the US is either underwater, in foreclosure, or modified but not making any payments. In fact, today we have the largest number of distressed properties on the books. The only reason the numbers have fallen is because of the “dirty current†mortgages that are modified and are now temporarily in the performing bucket. Yet these default at 50 percent or higher rates so it is more can-kicking behavior. If we even do a cursory look of MLS foreclosures on a US map we realize that housing problems are still largely present.

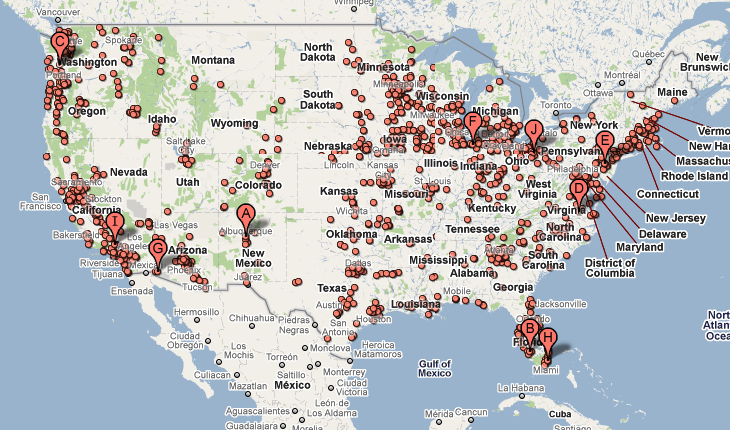

Here is a map courtesy of Google showing active foreclosures:

Google now offers this great feature that can overlay onto Google Maps and allows for the mapping of MLS active foreclosures. What are you looking at above? What you are seeing above is 5.2 million Americans living in homes that are now 60, 90+ delinquent, or bank owned.  The above is the equivalent of a MRI scan on the housing market. Nationwide things are as bad as they have ever been. So you have to ask where all those trillions of dollars that were supposed to help the housing market go?

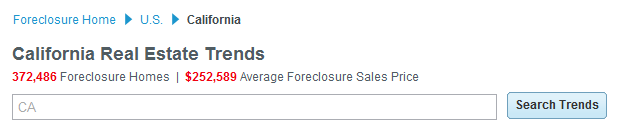

But I wanted to focus our attention on California and the current state of the foreclosure market. As of today, California has 372,486 homes in the foreclosure process:

What is interesting is the MLS lists:

For sale by agent:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 201,000

For sale by owner:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 477

New construction:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3,360

Foreclosures:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 99,000

So 273,486 homes are in the foreclosure process but flat out don’t appear on the MLS. Now some don’t appear for obvious reasons because they might be in the notice of default stage or are scheduled for auction. But we know that banks are merely dragging their feet and these will hit the market at some point. What you are feeling right now is the transformation of our banking system into Japan. The attack of the zombie banks. It was one thing for academics to look at Japan and their lost decade(s) and think they would be able to avert something similar here in the US. Instead, it looks like we have now turned our banking system into a mirror image of Japan. Heck, we’re even doing Quantitative Easing and they pioneered this practice! Banks are allowed to pretend that homes are still worth their peak prices while a slow intravenous transfusion of taxpayer dollars is pumped out from most Americans.

One thing I find amazing is how some economists in the US claim “well look at Japan, they were able to hold unemployment down to below 5 percent for all this time so it wasn’t that bad.â€Â That is absolute distortion. First, Japan has nearly 1 out of 3 workers employed in what can be considered a part-time or contractual basis. In other words, they are similar to our “part-time workers†that are seeking full employment but can’t because there are no jobs. That is why we now have 9 million Americans working on this status versus 15 million officially unemployed. And many that are being hired in these last few months for retail season will be let go in early 2011 as is the case every year. Yet when the tide recedes will there be real jobs there?  In fact many are going after same day loans simply to tide them over.

I bring this up because it is important to realize the economy is not recovering at least not in the sense of what many would expect. A good jobs boom is nowhere to be found and in past recessions this was usually the case when we emerged into recovery. Right now you are seeing banking and corporate profits skyrocket because employers can hold wages lower or simply sell to now booming economies like Brazil overseas. You should always remember this when you think of where the bailout money went that was supposed to help the typical American and support the domestic economy. Money knows no nationality yet banks played on the “if we get no bailout the American economy is doomed!†mantra and managed to rob the public blind. Just look at the foreclosure chart above! Can it be more obvious where the money went (or didn’t go for that matter)? Do people even care?

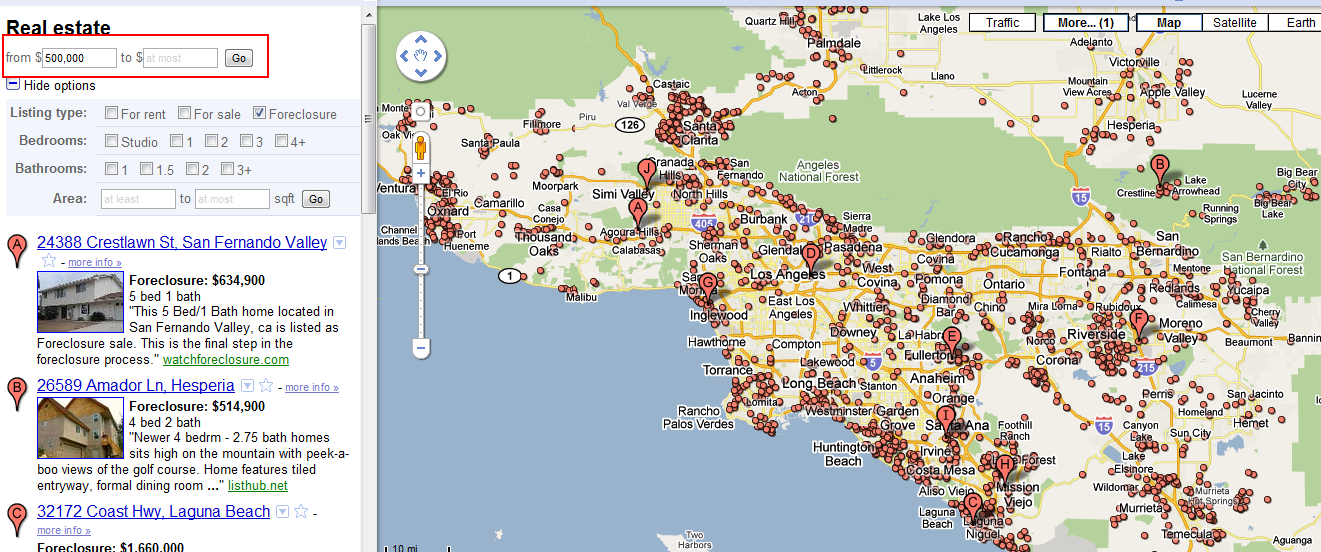

It is amazing how quite the “real estate is recovering†crowd got after the gimmicks and tax credits ran out for housing. Of course here in California home sales have collapsed in similar fashion to what we saw in the early months of the housing implosion. Home prices are going to fall. That is all but certain. The question that remains is by how much? I get into this debate with a few colleagues that think that in high priced markets everything is okay because people are still cruising around in leased BMW M3s or Mercedes AMGs. We have shown time and time again that foreclosures are now popping up like pimples on a teenagers face in these markets. If you want a visual, the fantastic Google Map foreclosure options now allows you to see foreclosures for a certain price range. Let us only look at foreclosures above the $500,000 price point in SoCal:

And this is only for MLS listed properties! Hell, your neighbor might be one of those dots. The odds are 20 percent nationwide and in California, it is closer to 3 out of 10 mortgage holders. You know why there is little good news on the housing front? Just look above and take a wild guess. And if you think a bunch of people working retail or part-time jobs are going to soak up that $500,000+ inventory then the above maps and data are probably meaningless to begin with.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

31 Responses to “Welcome to the United States of Foreclosures – California lists 99,000 foreclosures for sale on the MLS but 372,000 homes are active in the foreclosure process. A startling look at SoCal and $500,000+ foreclosures on a map.”

so, assuming a 30 year at 6% int rate, how far does the LA mid tier market need to fall in % terms to reach “fair value” in terms of historical measures?

It really depends on wages. At 6%, assuming 20% down, 30 year fixed, and allowing for 1/3 gross income to pay for a mortgage, every $10,000 of annual wages can support the mortgage payment on about 30-40K borrowed. If by mid tier, you mean median value, and assume that the median value house should be affordable by the 60th percentile income, most “nice” neighborhoods shouldn’t be much higher than $400K That would be stretched to the max at 80-90K income, leaving little to no room for new cars or retirement savings.

So do you mean that if your gross household income is $100K per year, then you can afford a $300K-$400K house? Is that the purchase price, or is that the loan balance after down payment? I never really understood how to calculate affordability. I’ve heard the “2x or 3x your annual income” rule, but is that gross or aftertax income? Or what about the “mortgage payment should not exceed X% of your income” rule? Is that just P+I or is that PITI? And is that gross or net income? These rules of thumb are confusing.

How are the banks going to rationalize on holding homes and not selling when mortgages go to 6 2/3%? If mortgages go from 4% to 6.5%, potential buyers lose 25% purchasing power. At 8% it’s 35% purchasing power.

I see nothing but price drops.

Cancer, now that’s an interesting analogy. Having worked in the radiology department of a hospital for a while, it does remind me of a Nuclear Medicine scan for Mets. We generally treat cancer by bombarding it with substances that are toxic to the entire body, or just surgically cut the sucker out, but I’m not sure that would fly in our case.

I do think the map is misleading, though. It makes California’s housing issues look relatively benign compared to everything east of the Mississippi, when, if I recall, (thanks to DHB) almost half of all ARMs originated right here in CA. I guess you can only fit so many blips on a square inch of map.

Similarly, everything looks all peachy in the center of the country, when my guess is that it’s probably not, because simply not many people live there.

What might be more useful (and less misleading to the layman such as myself) would be a map showing intensity, like % of units in foreclosure or something like that.

As is, though, I can see it being fodder for another ill-informed “This is what happens when your state goes blue,” zombie argument.

Just my two cents.

Check this out http://hotpads.com/search#lat=39.09596293630547&lon=-96.416015625&zoom=12&listingTypes=foreclosure&pricingFrequency=once&loan=30,0.0525,0&areaBorders=heatMapForeclosurePerHousehold

I am not sure about the details of the data, e.g., if it is authoritative and all-encompassing, but it comes from RealtyTrac, so it seems rather legit.

When considering middle-America, you do have to take into consideration that sparsely populated areas are not going to be quite as affected by the development spasm pushed by free money and fraudulent riches. Underdeveloped regions did not quite see the same level of development as more developed ones.

The level of the mortgage problem is probably (as I have not formally tested it, but all the data looks it at first glance) an exponential function of prior level of development development.

@[i]I can see it being fodder for another ill-informed “This is what happens when your state goes blue,†zombie argument.[/i]

No, of course not, AZ and NV (and even FL) being “redder” than CA. BUT… as Dr. HB points out–in his trenchant and NON-partisan manner–the CA STATE BUDGET DEFICIT, resulting from Sacramento’s very left-of-center, cozy/crazy relations with unions, etc., has created a very real and ADDITIONAL HEADWIND to a housing recovery. Of course, per usual, Cali’s losses will be forced onto the other 49 states.

I’ve been wanting rates to go up for quite a while now. Every zombie home crazed buyer says, “you have to jump in now while rates are low!” Here’s the thing folks, you can always refinance and get a better rate down the road, but you can’t renegotiate your principle. I’d rather have a lower priced home and a higher rate than a low rate with an overpriced home.

Let the rates go up and we’ll see the housing correction speed up.

Exactly – I wish rates would skyrocket to 10%…hell even better, the rates of the 70’s and 80’s in the high teens. All the better to shake the properties out of the weak hands and into strong hands.

Logically, rising rates will necessarily reduce the amount mortgage that can be serviced by a given income, and all other things being equal, it is reasonable to expect that higher rates would likely push prices down. It would also follow, then, that if we reach a philosophical market bottom then rates increase, we would see ever lower prices. However, increases rates will depend upon the withdrawal of federal money from the mortgage lending industry and no matter what your opinion is on TARP, stimulus, and QE, it would be difficult justify the claim that the wind-down of these programs will be measurable in anything but years.

The bank may be putting people into foreclosure, but they sure don’t seem to be taking back homes at a reasonable pace. I have posted from time to time on this blog for over 2 years and my house has been in foreclosure the entire time. I have moved, shut off the power, and informed the bank of everything. Yet they still refuse to complete the foreclosure… They are stuck paying $5000 a year for property taxes(mela roose) and somehow they don’t want the property off their books. I tried to do a short sale and had 5 different offers that were easily what the house was worth, but the bank refused. The collection department calls me 10 times a day and that also has some cost to it. Its a minimum of 5 years before you can get another loan with a foreclosure and this is from the completion date. With how slow the bank are going it may well turn out to be 10 years and while I’m sure no one will shed a tear for us keeping so many people out of the market will keep prices low for that much longer. Maybe this is a good thing. I’d say we are more like The United States of Foreclosure Limbo. I don’t know what I have got to do to make the bank complete the foreclosure.

I’ve read your posts over the last couple years and think that it’s pretty uncool for the bank to put you in that position. Have you contacted a newspaper to try to have them tell your side of the story? It sounds like the way that you handled it was admirable and that you just want to move on with your life. If the MSM news sources wont tell your story perhaps a number of bloggers could. Maybe if you emailed Mish, Patrick, Denninger, Larry Roberts (Irvine Renter), Dr HB etc etc you could get some coverage. Just an idea.

DG, thanks for sharing. You raise valid points and the answer is out there, somewhere. As a buyer, I have observed banks’ behavior, too. Utterly bizarre, but then, those mortgages were likely to be securitized, right?

There is a 2,000 ft home which hit the MLS at $ 100 k. then again at $ 76,900. My cash offer was 3% les, no inspections (the previous people tore out all doors and heating 7 cooling etc. and this is in Yucca Valley). 6 weeks = SILENCE. Then a deadline, requiring disclosures to be signed (still no counter offer or an acceptance of my offer). threats of letting it go to auction.

OK, let’s talk in 6 weeks…

Bank of America has a nice house. It fell out of escrow twice and I offered $ 125 k, about the same it fell out for. Took them 4 months to reject. Another 2 months to accept. Then I changed my offer to $ 115 k.

My broker says he is no longer even having someone to talk to. he submits offers on a website.

And fannie Mae – recipients of $ xxx bn aid, allow agents NOT to submit offers below the listing price. Makes sense, huh? 6464 Rome Ct, also in Yucca Valley. listed @ $ 129,900. I offered $ 125 k, then $ 122 k after yet another burglary. Then I found another investor whose offer was not submitted either months earlier.

The agent managed to have some buddy get the place for $ 117 k based on tax records. This is your tax Dollars at work. go figure.

Everyone,

To be clear, the banks’ behavior, although at first appearance seems irrational, is, in fact, guided very precisely by executives who are making huge bonuses. Although the behavior doesn’t seem to add up to us, here’s a very simple explanation:

At the beginning of every quarter, execs will sit down with their financial analysts, look at projected profits (without foreclosure write-downs), and then “plug-in” a specific foreclosure pace that still allows them to walk away with a nice profit level. Why? It’s very simple. They appease Wall Street and therefore keep their stock price in-check, they keep themselves in a nice cushy job, and, more importantly, they ensure that their annual bonus stays intact. It’s actual very, very logical and very easy to understand. How that affects DB and everyone else who is waiting in limbo is really irrelevant, from their perspective, because if they let these types of concerns get in the way then they won’t be able to afford their new Mercedes SL63. It’s really that simple.

If it wasn’t for the MILLIONS of lobbying dollars and cash envelopes that existed in Washington then this wouldn’t be possible, as banks would have to write down their inventory to real levels and they would all be broke. But, all of those ATM fees, overdraft fees, etc, go towards the lobbying dollars that perpetuate this cycle. I’m sure everyone hates to read this but it’s the truth. And I would know – I have an MBA from a top-tier school who puts out the MOST Wall Street and Bank execs in the US every year (I’m keeping the name off the records for obvious reasons) and, although I’m not the guy in the “cushy job” – I am a full-time investor – I have no doubt that many of my alum are both the execs and analysts…

So, there you have it. There’s no need to keep guessing why banks are acting “irrationally” because they’re not. It’s just that their rational behavior has nothing to do with serving their customers and everything to do with serving themselves. You can thank Washington and your tax dollars for this…

I noticed something really funny. Look at the correlation between the dot density on that nationwide foreclosure map and the last few election results at electoralmaps.net.

I mean, I’m not saying anything but I’m just saying…

Veeeeeeery funny!

I see what you did there.

Like this one : http://electoralmap.net/2010/2008.png ??

Sorry for the double post, but one more thing. My house has been in foreclosure for 2 full years and listed as a short sale since July of this year. I don’t know if you are using google maps, but my house doesn’t show up as a foreclosure or short sale on either one. How many other properties are in this state and don’t show up on most maps? I know in my neighborhood overall 80-90% of the homes have been through foreclosure and some have even been through multiple foreclosures in the past 3 years.

Well if your home isn’t showing up in the foreclosure or short inventory, then it must be in the black hole inventory. Why did you ever move out? You could stay there indefinitly! Profit.

DG, from my experience, google maps doesn’t show all foreclosures, notice of defaults, bank owned, short sales, for sale, etc…. It only shows a partial list. Realtytrac shows a lot more (they have a feature where you can view the homes by map) than google maps but even they don’t show all of the homes for sale in the market place.

I’m in So. OC calif. I haven’t made a pmt on my house for over 2 yrs. I moved out a yr ago because I thought the bank was going to foreclose. I could have saved so much money had I stayed there. I know at least 2 more people in my area with same thing. No one would ever know my house was not being paid ($675,000 home in very nice neighborhood) I believe it just has to do with the CEOs of these banks just wanting the banks to look good for their stocks and they will keep their bonuses.

WOW!!!!!! Fun stuff. I checked out the 91381. I rent in this area and it is the home of the 700k and up foreclosure. A house in my cul-de-sac is now a 700k foreclosure!! It’s a nice neighborhood, but I doubt that all my neighbors make over 200k per year. There are even several that are over seven figures. California has a loooonnnnggggg way to go. We live in BUBBLE LAND.

Another fantastic post from the good Dr!!!

As he pointed out Wallstreet is making money. And to the people who have not paid their mortgages, don’t think those banks are going to forget. In my opinion to many people get caught up with the politics of it, not to say they don’t play a part, but its mostly misdirection.

I think the oligarchy want they majority of us to be serfs. And they are well on their way.

With what is happening every American should be in the street, but we are not.

Most of us are more interested in what is happening on the latest reality tv show.

Another thing I have noticed is young people just wanting to be famous.

The Chinese will be buying homes in your states soon.

Up here in the Bay Area – Silicon Valley in particular – foreigners, especially Asians are almost all one sees at open houses.

BTW, what happened to Zillow’s methods of trending and estimating market prices? Last i checked their estimates seemed wildly out of line with the listing prices.

URGENT need for Lawmakers to act! Foreclosure lawyers are officers of the court. Lawyers are required to know applicable laws and civil procedure; this knowledge is not required from mortgage lenders, nor loan servicers. Lawyers are the ones who file those inadequate or questionable foreclosure which lead to useless property deeds and impediments to real estate sales; title insurance companies reluctance to cover foreclosed properties; mortgage default claims disputes due to defective foreclosures.

Scores of HOMEOWNERS DO NOT CONTEST FORECLOSURES BECAUSE:

1. They don’t have knowledge of the law in order to recognize which aspects of foreclosure are legally challengeable or even fraudulent.

2. And even those who identify wrongdoing lack funds to pay for attorneys to represent them.

3. Homeowners are told to come to foreclosure auctions with $$$$$$$ that they do not have, SO THEY STAY AWAY from foreclosure auctions.

These homeowners are oblivious about sometimes “straw buyers” and sometimes lawyers in charge of foreclosures, obtains ILLEGAL ownership of people’s homes; and pay literally nothing through “credit bids;” and that those recorded deeds from such auctions are null! For these very reasons, there needs to be a probe of lawyers who file foreclosures. http://chn.ge/eU2zAm

Also, the average lay person doesn’t know about legal REQUIREMENTS of “standing” that prevents their homes from being repossessed via non-existent lenders or via lenders which have no ownership of promissory notes.

Yet, COURTS ARE SUPPOSED TO ENFORCE STANDING and compliance with established laws! Illegal, defective, fraudulent foreclosures are the cause of useless property deeds for real estate sales; title insurance companies refuse coverage on foreclosed properties –and more!

Further, after certain foreclosure auctions (via simulation) result in fraudulent – NOT LENDER ACQUISITIONS, by lawyers or straw buyers, the common scenario becomes property flipping, neighborhood blight, rodents, and so on!

*Sample of fraudulent foreclosure acts:

–Deliberately use defunct lenders, lenders without “standing†for false civil and bankruptcy foreclosure proceedings.

– Create and conceal malpractice foreclosure delays and engineer billable litigation.

– Orchestrate sham foreclosure auctions; property never acquired by lenders, but ‘straw buyers’

– Commit actionable wrongs (unfair debt collection, fraud, various torts) that create lawsuits

– Self-dealing foreclosures which certain lawyers themselves obtain foreclosed properties for flipping.

–Foreclosures naming defunct lenders, illegally recorded property deeds, flipping, blighted communities.

– Unconscionably create false deficiency judgments against property owners after straw buyers acquire homes for pennies on the dollar.

– Intentionally false BANKRUPTCY COURT “Motion to Lift†and “Proof of Claim†on behalf of non-existent lenders which conceals fact of “NON-SECURED†mortgage debt.

–Involved in fraudulent collection of property damage insurance, as well as mortgage-default insurance.

–Fraudulent foreclosures abet loss of property taxes to city revenue, rodents, vagrants

– Thousands of families made unlawfully homeless from null foreclosure proceedings.

*MORE info: Request for Congressional Foreclosure Panel to Examine Foreclosure Lawyers

http://www.change.org/petitions/view/request_for_congressional_foreclosure_panel_to_examine_foreclosure_lawyers#

Jerry Brown says the state budget is in fantasy land. Hey Jerry, there’s a lot more fantasy in CA than just the state budget.

I know this is off topic somewhat, but you guys know more about RE than I do. My 62 year old sister is near death, she has pancreatic cancer. She has no Trust or Will and she is in no mental or physical capacity to create one. She has a tiny home in Apple Valley, CA that she bought in 2000 for about $65,000. She has an FHA loan and her mortgage is about $500 a month. She pays through Wells Fargo. My brother and I will be the heirs. We do not want the house. From what we have learned, her estate will be “in testate” for a few months. She does not have much in savings,( luckily she has no cc debt or car loan,) I’m not sure of the amount, maybe $40,000. I think it will go to probate court. Do any of you know the process? I wish we could just let the bank take the house but do we actually have to sell it? If someone could shed some light on this or give me a link to pertinent info. that would be great. Right now we have to focus on her remaining days with us….

My best advice would be that if you haven’t already, get in touch with a qualified lawyer who specializes in family and probate law. A consultation might cost a couple hundred dollars but they will know what questions to ask to determine what would work best for you particular situation, and the advice you get should be far better than anything you’ll get from the armchair experts in internet forums.

If you are in Pasadena or the SG Valley, I suggest a friend and honest attorney, Larry Davis in Porter Ranch. Larry is a Certified Specialist in Estate law and he will represent in Probate Court as well.

Even though in the attached pdf, he states he represents those with $500k+ estates, he will do smaller estates too.

http://bruinprofessionals.com/onesheet/Davis_1sheet_4432.pdf

Best to you and I extend my sympathies to your sister, you, and your brother regarding your sister’s illness.

~Misstrial

Hey, DG, sorry to hear of your plight. I’ve tried to buy homes from banks in a couple of recessions and it has never been easy–that is unless you want to buy 100 at a time. I know people who have quickly sold on a Short Sale, and some who are living in the house without making payments for the past two years.

One thing I would like to point out for discussion is the number of foreclosures (372,000) represented on this forum–or in some form of financial distress leading to foreclosure–is a number that represents roughly 3% of households in California. How does the percentage relate historically to other housing bubble bursts?

Leave a Reply to Enzo MiMo