The insatiable demand for rentals: How being a landlord is all the housing rage. If housing is booming, why are mortgage originations so low?

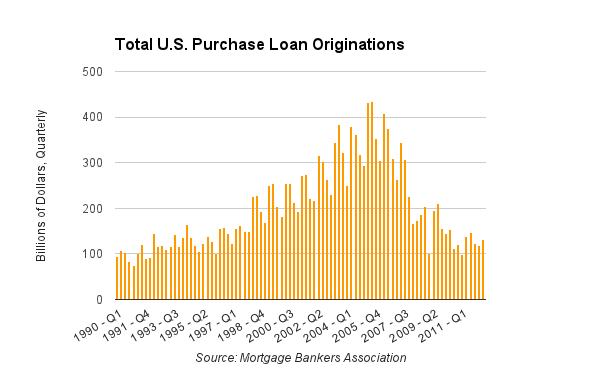

Most people have a hard time with regular math problems, let alone complicated financial instruments like derivatives. So to think that most people are following the movements of the Fed and basing buying decision on this is somewhat unrealistic.  The rush to buy homes today is driven by a different set of factors from the previous mania yet the psychology is the same. Underlying the motivation of many is a fear of missing out on higher prices and jumping in because the time is right. The comments in the last article highlighted many people that recently bought and their motivations. They run the spectrum and are truly valuable. It also discussed many that are actively seeking to buy and how they are encountering manic like behavior from current buyers. There is an insatiable demand for rentals from investors and big money is targeting prime markets. You would think that with all this rage, home sales would be solidly up. In fact, California home sales are down 3 percent on a year-over-year basis for the last month of data. When we look at US purchase loan originations we find the volume and amount being pushed out to be at levels last seen in the 1990s. What gives?

The non-existent home buyers

The housing market is largely being driven by investors. The noise that we are seeing is large money from both Wall Street and foreign money clogging up real estate across the US. Foreign money is more concentrated in targeted niche markets while big money is dominating places like the Inland Empire, Arizona, Nevada, and Florida. One interesting chart shows how distorted this current market is:

“(Bloomberg) With all the real estate investment action, you’d expect the number of new mortgage loans to be shooting upwards. No such luck. Look at the chart below, which shows new purchase mortgages through the 3rd quarter of 2012, using data from the Mortgage Bankers Association. For that quarter, buyers took out $129 billion in purchase loans. Not only is that much lower than the numbers from the boom, but it’s less the post-crash levels of 2009. You need to go back to the mid-1990s to get back to numbers like those (and they’re not adjusted for inflation).â€

The obvious reason for this is that the volume of all cash buying form investors is off the charts. We’re not talking about a handful of buyers but billions upon billions of dollars flowing into the housing market from sources outside of your traditional buyer. Couple this with Fed and government regulations that now allow banks to rent homes out plus the fact that many of these investors are buying to hold for a few years and then sell, you end up simply removing inventory from an already depleted market.

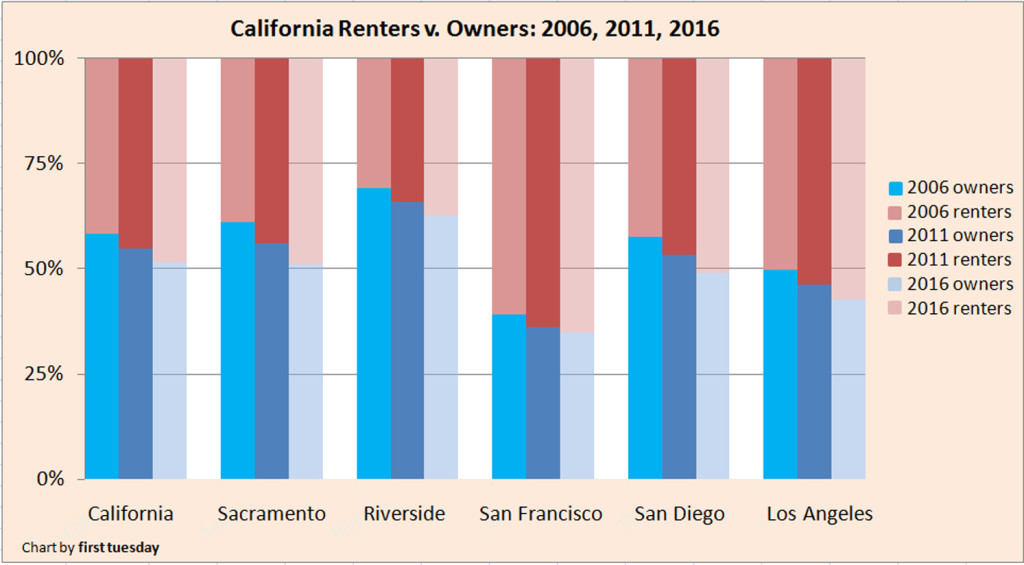

The hunger for rentals is high but there seems to be some market saturation that is now occurring. In California, we have become an even larger renter state since the housing market peaked in 2007:

2011

Owner-occupied:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 6,843,369 (-233,603 from 2007)

Renter-occupied:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 5,625,374 (+501,674 from 2007

2007

Owner-occupied:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 7,076,972

Renter-occupied:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 5,123,700

Source:Â Census

The state now has at least 500,000+ renters more than it did in 2007. We’ve lost over 233,000+ home owners. So the net result is much bigger for the renting side of the equation. This is how the numbers now look:

And the amount of buying from all cash buyers is likely to make this ratio even larger. We noted that last month we had the largest amount of all cash sales in the history of SoCal (some 35.6 percent of all sales). Cash buyers paid a median price of $260,000 in SoCal so this is likely to be a larger pool of investment properties for rent versus foreign money that is bidding properties up in niche markets.

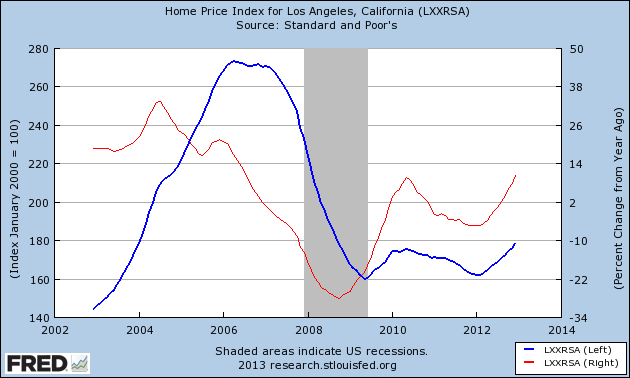

While the median home price is radically up because of the change in mix of home sales, we can look at the Case Shiller to see beyond the noise:

The Case Shiller Index now shows an increase in home prices for Los Angeles of 11 percent since 2009. You can see from the red line that the year-over-year gains have accelerated. The volume of home sales is starting to soften because it really is manic in many areas of California. The low home purchase origination figure is simply an indicator that your average buyer is being out bid by investors.  Last month in SoCal we hit a record amount of all cash buying. When people say that incomes do not matter the bigger picture is missed. It does matter because even with a solid down payment and solid incomes many people are being outbid by the hot money market the Fed has created with big hedge funds and Wall Street money. Some seem to believe that the Fed is targeting prime areas to keep prices inflated. To this, I say that the Fed has bigger fish to fry compared to worrying about hipster markets in Southern California like the stock market and our national economy. In the eyes of the Fed, the housing market on a nationwide scale is picking up.

Remember that 5,000,000 Americans have gone through the foreclosure process since 2007 and a few more million will do so in the next few years. Given the volume of investor buying, the odds are strong that these homes will end up in the hands of big investors. Just like the Census figures show, California gained 500,000+ renters since 2007 while losing over 200,000+ home owners. Every mania has a different story but the sentiment of “priced out forever†or “I have to act now†is back in vogue. Just because people realize something is going on doesn’t mean they’ll successfully navigate it. Entire cities like Las Vegas are built by the illustrious vision of beating the house. Many current home shoppers are in fierce competition with big hedge funds and investors and all cash sounds a lot better than FHA or conventional financing. How badly do you want to own? If you are planning on buying shortly, good luck, you have a lot of big money competition.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

66 Responses to “The insatiable demand for rentals: How being a landlord is all the housing rage. If housing is booming, why are mortgage originations so low?”

Given that the hedge funds are expecting 95% occupancy rates and 5% annual rent increases, I think that they are going to find that landlording a bunch of single family homes is not as profitable as they would like to believe.

^^THIS!!!!!!!!^^

The “It’s different this time” crowd that can’t do math are as annoying now as they were 2005-06… Scratch that. They are MORE annoying as the last crash was just one more piece of evidence that gravity eventually corrects a market (and i use that term loosely) no matter how manipulated!

Agreed. The number of rental units is going to up. Simply supply and demand tells us that the rent prices will plummet (Yes, plummet) in the next year or so.

And what happens when the yield looks more attractive elsewhere? When the big money flees, the devastation could be worse than the tsunami that hit Japan. Also, if Europe/Asia take a dive, all bets are off.

People will be squatting paying ZERO rent for the next decade or more if what you predict happens. You’ll still have to pay rent.. while millions will stop paying their mortgages and there’s nothing anyone could do about it.

Rent prices will plummet in the next year? Is this another statement with an asterik saying “not applicable to desirable areas.” I sure as hell think it is.

Rents might get pummeled out in Vegas, Riverside or Hesperia. Just don’t plan on asking for that one third off special in Hermosa Beach anytime soon. There is no shortage of people who want to live in premium areas and they will pay the going rate based on supply and demand.

Agreed but you are referring to the Demand side only. I was referring to the (over) Supply side. Yes, supply and demand will trump all. However, on average, rents will come down because the supply of rentals will go up so much faster than the demand. “Hot” (demand) areas will have a premium, and rent may or may not come, but the AVERAGE across Southern CA will come down. Yes, part of it will be because of the IE, but other middle class areas will get hammered soon too.

“Rents might get pummeled out in Vegas, Riverside or Hesperia.”

I spent part of this weekend doing research on the investment firms buying up these (now) rental properties. They aren’t in Hermosa, but Vegas, Riverside, a number of areas in Florida, etc.

There are MANY more firms doing this than you think, and mostly in low-to-mid range income spots. Those rents start dropping and we only need one major player to decide this was a bad idea before the ripple effect hits everyone.

I was worried about this continuing trend keeping me out of the market permanently, but it’s going to hit the fan in a very spectacular fashion overnight, and we’re almost at the point where those cap rates are getting miniscule.

Buckle up!

Already seeing it happen in the Bay Area. Homes listed for rent at high asking prices are coming down month by month, week by week as no renters are being found for poor properties. The recent runup in rents was a head fake and landlords raised rents to find no takers at those prices. Rents are coming down for sure, which is an anomaly in the springtime when college graduates start looking for places to rent for jobs. Think the reason is two-fold. 1 – many landlords saw spike in prices and put properties on the market increasing inventory. 2 – high rents relative to other areas are starting to keep entry level workers out of the market. It’s hard to live here on under $65K/year, so why would you do it when you can make the same $$$ in other major cities?

Bear in mind also that hedge funds, as an investment, these days are largely appealing to giant institutional investors, not high-wealth individuals who want more risk and more speculative bling.

http://yale-jreg.org/the-institutionalization-of-hedge-funds/

So, Doc, what do you think–is this the private sector equivalent of nationalizing the housing market? For one thing, a big chunk of those pension funds are for public employees–the only sector whose employment grew post-Reagan, other than burger flippers and nail salon entrepreneurs.

This was a big driver in the Ed Biz run-up as well.

Below, Jay notes a lack of alternative investments, and that too has merit. Trading volume on the Dow is way down, as some of you probably saw at TAE:

http://theautomaticearth.com/Finance/whats-more-important-to-you-italy-or-the-dow.html

And elsewhere.

I’m writing quickly; sorry if this sounds like it. Thanks, Doc, as ever for your ongoing work.

Your erudite contributions have been missed, compass rose.

The Banks are still firmly in control! There has been a number of articles recently decrying that an alarming number of people spend more than 33% of their income on housing. The high cost of housing has wide ranging economic impacts that nobody wants to discuss. Thing of the boom in cars, retail, investments, etc… if housing actually crashed and got cheap. The S&L Crisis (with controlled wind down by RTC) was a huge success (for everyone except the S&L Execs). It is frustrating that one generation later we can’t replicate that.

Home Owner Landlords are Dumb! They can’t and never do their IRR calculations, before, during or after! LIKE DUH!!!

Low taxes on ill gotten gains and fraudulently acquired huge bonuses payed via bail outs = multi generational real estate empires.

I think the sales volume is low because there’s not much for sale. The homes are coming out of the banks in drips and drabs. Throw in all cash buyers and it stands to reason that purchase money mortgage loans would be quite low.

Take a look at the transaction volume in the stock markets since the March 2009 lows as compared to before the crash in 2008. It looks tiny. Yet here we are at new highs.

The same thing is propelling the stock market – low interest rates (cheap money). What happens if rates go up even 1%?

I’m starting to believe that the Fed is worried about the ensuing catastrophe and is going to leave interest rates at this low level for a very long time – perhaps as much as a decade+. Kill the savers – did we learn nothing from Cyprus? 🙁

I think the Fed only has the option in leaving rates low for a very long time. Comparing the US to Cyprus is a joke. The last I checked, Cyprus does not possess the world reserve currency, it does not have the ability to run a 24/7 printing press and certainly doesn’t have the world’s most powerful military. This game can go on for a LOOOOOOOOOOOOOONG time.

You and I are in agreement here. I did not state that the U.S. is like Cyprus. I asked what we had LEARNED from Cyprus in that the SAVERS are getting hammered in the U.S. because of the low interest rates, etc. Savers got hammered in Cyprus for a different reason, but same victims, different weapons (for lack of a better term).

I think you both believe that the Fed has more control of its options than it actually does.

If anything, the Eurocrats are showing their hand and this will be bullish for the USD and short term US treasuries. Which in turn will help keep rates low. I agree, mortgage rates will not only stay low a longer than most think possible, but I think they have a solid chance of heading even lower.

And when all these rentals come online as more of the deadbeat squatters see their homes foreclosed what will happen to rent rates? Not to mention that CA’s economy is still in the poopy bowl and people are making less in both real AND nominal dollars. This is 2005 all over again. Professinal flippers and hot money are making or have already made their profits. The second wave made up of amateur specuvestors and FHA (subprime) borrowers are going tu get burned when Bubble 2.0 turns into crash 2.0.

Anyone thinks you can have continually rising prices in the face of a continually down turning economy is retarded. The FED is pumping 85 Billion a month and all it can do is delay the crash and create an illusionary rise in equities. The crash is going to come all the quicker than 07/08 did as the investors are buying in chunks. When things go bad it won’t be millions of homeowners slowly realizing the SHTF. It’s going to be a few hundred thousand investors rushing for the exits at light speed.

There is no “market” in RE or equities. We are being treated to a dog and pony show viewed through a smoky mirror 🙂 This is going to end just as bad as before. At least this time it will mostly be wannabe investors instead of uneducated home debtors getting the shaft.

merger of banks and Gov = fascism.

private profits and social (taxpayer) losses = socialism.

so why can’t it continue?

It can’t because you can’t defy the laws of gravity forever. You can sell houses to desperate, slick or stupid people for only so long until the next generation of home buyers comes up. Think of today’s students – massive loan debts, shaky careers, late starting careers – how the hell are they gonna buy a middle class starter home for $700K? Even a 3.5% downpayment on that is $25K. Rents, food, energy, transportation are killing these folks. How can they save up that kind of cash? And with mandatory PMI insurance on a $675K borrowed, even if interest rates stay low, these young guys are looking at an extra $500/month on top of just the mortgage payment. We’ll eventually see this dynamic in place and it won’t turn out well for current buyers.

“At least this time it will mostly be wannabe investors instead”

AND just like last time, they will all get bailed out, if you are honest and pay your bills on time, from what i’ve learned, you are a fool and a sucker…

Wannabe investors WEREN’T bailed out last time! All the Kiyosaki sycophants got hosed and lost their leveraged properties. Weren’t you paying attention :-)here will be a test LOL!

So what is the take home message here? The tone at this blog seems to have changed from outright skepticism to something like grudging resignation. That is probably appropriate.

I doubt big money would be so interested in West Los Angeles if the longterm trend here wasn’t moving towards “post-gentrification” or “ultra-gentrification” (it is). After all, aside from San Fransisco or Manhatten, where are the monied class interested in the best city life going to live? Every member of the 1% cant live in Hong Kong or Paris or Dubai.

My conclusion is that the big money is buying here because of an expectation for gradual appreciation, lack of downside risk, and a lack of viable alternative investments. The valuations in Santa Monica and Malibu are so high that you are barely a single on a current cash flow / income basis (but are not actually that bad compared to, say, treasury bonds). But the new goal of institutions is to hit that single, safely and reliably. Their clients are already rich, they just need to stay that way. L

Lots of wealthy investors could do worst than in inflation protected 2 percent return with a gradual appreciation upside, which is how I would characterize West LA realestate. Cant get that with stocks or bonds. Think interest rates are going to skyrocket and drive down prices? Good luck with that.

Plus, there is a Trader Joe’s just down the street!

Sir,

Let me start by thanking you for the time you have invested into your website. The information you have shared with us is truly priceless.

I have been following your blog since early 2008. During this time I was working overseas and have just recently moved to Santa Monica. I am a full time firefighter but have a passion for the real estate market. I have several investment properties under my belt and I am looking to expand my knowledge in this field. What route would you recommend I take that would place me in an environment to further my knowledge and experience in the field? Any information you can provide would be greatly appreciated.

Get your Ca real estate license, work in a C21 office for a year. By that time, you’ll be embedded in RE enough to know which direction you want to take. It’s a wonderful community, you’ll meet new people everyday and be exposed to a world you’d never discover otherwise, and make lots of money in so many ways you don’t even know about now. Good luck!

I say anyone who has bought in the last 12 months should be ok in the long run. Today’s risk, and I mean TODAY, is that an increase in interest rates should inversly affect prices, but the monthly payments will still be the same. If this mini-bubble continues, that would no longer be true. But as I said before, the Fed may turn all debt to 30 yrs and keep interest rates low “forever”. (Our lifetimes)

As a side note, so what’s the solution then? Is renting 5 more years and spending $90,000 to $150,000 doing it the answer? Will home prices drop $90000 inland, and $150k in coastal areas?

$90,000 in rent Vis-A-Vis $75-80K in interest/taxes/PMI means if prices drop just $20-30K you were better off renting. Not to mention the flexibility and freedom to move renting provides sans the downside risks of asset deflation.

Please don’t tell me that housing has bottomed when the Fed is crushing interest rates and flooding the mortgage sector with billions a month. This is a sign that the Fed is DESPERATE to keep the hoarding alive, DESPERATE to try to reinflate the destructive housing bubble of 2003-2008 — in order to save the banks. Another leg down in prices will destroy the banks. And who will save them THIS time?

A housing bottom will happen when no one is talking about housing and the Fed is not squatting on interest rates to keep them at zero. Wait until the Fed lets rates rise, watch housing prices come rocketing down. The idea that zero interest rates make housing affordable is one way of looking at it. Wait until interest rates rise and housing prices are cut in half: that will be another way to look at housing as being ‘affordable’.

Our leadership is morally bankrupt. Bernanke is pumping adrenaline into a bedridden patient, very expensive adrenline, hoping to keep the staus quo intact. It won’t happen. Chaos comes next; and chaos means a new government, and a lot of punishment for those who drove the bus into the sea.

One of the Feds remaining cards is to convert all existing debt to 30 yr. notes. This prevents the interest rate rise you speak of.

I am an estate planning and conservatorships attorney in Los Angeles who is sometimes involved in sales and knows several real estate agents. All agree that almost all successful buyers these days are all-cash investors who have no intention of living in the houses they buy.

bjsheppard

The hullabaloo over American housing is a scam, a last attempt to sucker in more buyers, before the bottom falls in for real. Bernanke should be ashamed of himself. He’s a huckster. He’s a con-man. He’s a front man for America’s corrupt banks.

Our government officials got so used to lying that they don’t know what else to do. Businesses are no better. Our leaders are liars; and they are leading us nowhere. They don’t know what to do; so they make up lies to make us feel better. They are afraid what will happen if we get tired of their stealing our money, and misleading us with slogans, and the easy virtue of a fixed prosperity based on ever-increasing levels of debt. Let the next generation worry about it.

Selfishness, greed, vanity and dishonesty (and hoarding) are all sins, let’s not forget that.

The newest version of the American Dream is toxic. It requires we all become DEBT SLAVES in order to sustain it. It is time to get new leadership. Wall Street leadership has failed us. We do not need ‘more of the same’ — we need a whole new culture of leadership, one that relies on the true roots of Christianity and other ethical religious doctrines, not one that relies on the worship of money and greed. The worship of money and greed has led us to Hell.

So, we just need to cast out the “government officials” and “businesses” (all “leaders”) and turn to Christianity to save us. Whew!

Can’t wait to read the exhaustive list of the “ethical” versus “unethical” religions. What was that one involved in the crusades? The name escapes me…

“Making up lies to make us feel better?” That’s the best definition of religion I’ve ever heard. Thanks for that one.

What about us non-believers who are leading very ethical lives and are living debt free? Religion is a sham to scare/bully everyone into doing what the churches want. We are atheists and raising our kids to be the same. We have no debt, have excellent credit and are active participants in our neighborhood and cultural communities.

+1

http://www.youtube.com/watch?v=IHmTqoLjlXo

Man created God, not the other way around. Duh.

The smell of capitulation is strong. I’ve noted posters creating multiple ID’s on this blog to report on their “home purchase”. Interesting.

I feel so badly for the younger generation. What a mess.

This sums it up pretty concisely:

Economist Anthony Randazzo of the Reason Foundation wrote that QE “is fundamentally a regressive redistribution program that has been boosting wealth for those already engaged in the financial sector or those who already own homes, but passing little along to the rest of the economy. It is a primary driver of income inequality.”

It’s called protecting the incumbents. The people in charge of making the decisions are all baby boomers who own housing and have 401k or other invested savings, so they effect policies to their own benefit. People on the younger scale like me have never owned housing or earned enough to seriously save. Low interest rates have pushed up food commodity prices, gas prices, housing prices and by extension rents making it hard for a person like me to save anything.

LAer…yes, the incumbents are in charge — not only do most of Americans have a lien against the house they live in (aka a “mortgage”), but I’d surmise close to 100% of our elected officials in the “anals” of Congress have said liens. F the renters and F the young. Protect the tax base and protect the installed, motivated “ownership” base…they win elections.

Hey DFresh

Agree on all counts except that I am pretty sure that the millionaires in congress don’t have mortgages. They’re financially insulated from their own poor decision-making.

I was wondering the same thing, but how can you tell?

One example I’ve noted is three different ID’s often posting about a cash and close, “toe tag” home, describing a specific medical issue with spouse. Seems to me too many specific similarities to be three different people?

That makes sense, but unless the blog owner wishes to ferret out imposters and/or sockpuppets, I don’t see any recourse. When I’ve called out some folks previously for this kind of behavior, I’ve been called all kinds of names, which sounds like pure projection on their parts.

I go by a different user name now. After a month+ hiatus from the blog a while back, I stopped by one day, and found that my info in the Name and E-mail fields was gone, where before it was stored, that I didn’t have to think about them or input them each time. Was this a change in my browser, during an update? Was it a change to the blog itself? I have have no idea.

I’m on so many blogs, I can’t remember what I used before. Maybe ‘AFez’, or some variation of that?

That “toe-tag home”, cash and close, spouse with glaucoma is Mad-as-Heck, aka Happy-as-a-Clam, aka inchbyinch. That was easy enough to figure out. But do you see any others? I wish there was a function to click on user names and see the history of their comments. It is interesting to see those who have bought still lingering around this blog reading the posts and leaving comments.

IE’s rental inventory is exploding – all of the reasonably priced houses for sale are back up for rent the day after they close escrow. Rental prices are starting to decline due to the flooded availability.

Continued higher sale prices without corresponding increases in monthly rent will kill any ROI projection, and the investment companies will quickly jump out!

I concur.

6 months ago, good luck finding a 3/2 for less than $1600 in a decent area. Now the $1450’s are popping up, and I’m seeing $100 discounts (>$1500) after units sit on Craigslist for a couple weeks.

one thing about all cash investors is that they have no mortgage to pay. So even if there’s an over supply of rental homes on the market, they will lower their prices and just have less of an ROI than before. But they are not in a position where they will walk away. They just have to accept less of a return. Now, they may cause them to want to sell. But it is not a forced sale.

While they may not be “forced” into selling, another tax increase and/or any unforeseen/unanticipated repairs to their properties may be strong incentives to get rid of their properties quickly. The next 12 months should be interesting, to say the least.

Yes, this is true with mom n’ pop landlords – they keep asking prices high until someone bites – no incentive to lower asking rents.

Corporates and hedge funds are different in that they have shareholders and investors to answer to. If you are a hedge fund and you forecast 12% returns on an investment and actually only get 6% returns, your investors are gonna run to a better set of investments or investment managers.

Blackstone is all over the news hyping their huge investment into rental real estate. I doubt they got to where they are by always sharing their investment strategy with the masses. Securitization of rental property is another red flag.

Wall Street is concerned that things could turn quickly, so they are singing praises far and wide to make sure there are enough investors around when you have to run for the exits.

Doubtful said: “… I doubt they got to where they are by always sharing their investment strategy with the masses. …”

You just stumbled upon what I have been telling people for years. When these investment firms go public with their investment strategies, that is because they are looking for an exit strategy. When Blackstone, or PIMCO, or a hedge fundie is pumping a certain investment, they are doing so because they are looking to unload that very investment on the public.

The #1 rule about these large funds is that they do not advertise what they are currently investing in until they are legally forced to disclose those investments. And if they are continuing those buy-ins they do in a very silent way so as not to attract competitors.

I think the phrase you are referring to is “Talking their book”. Which means they are advocating a position which they have already taken and are promoting that others follow them in an attempt to increase the price. And, yes, I agree. They do not advertise their investment strategy until after they have taken their position.

@CAE

Also, “pump and dump”. I.E. investment house X was “talking their book” earlier this month and did a “pump and dump” when the prices spiked higher.

I would very much encourage you all to give a heavy skim to this:

http://thebrowser.com/articles/back-mesopotamia

A paper issued by Boston Consulting Group in Sept 2011 suggesting the possibility of a one-time wealth tax on financial assets in Western nations. They’re thinking between 11 – 30%, depending on country. And so it begins, now we have Cyprus as our test case. Only there, they just went after bank deposits last week. The BCG paper is referring to ALL financial assets.

It would probably occur in other Euro countries before it hit our shores but, I’m totally exposed right now. I sold my house last summer and have been happily renting while I decide what I want to do next. ALL of my money is in financial accounts…very findable, very liquid, very taxable….if you see what I mean.

So, how many smart, deep-pocketed people are getting their $$ out of accounts that produce 1099’s and investing in real estate and other things (metals, etc) so as to draw down those freezable accounts? It will likely cause me to buy another house sooner than I’d like, actually.

You folks are totally focused on rental rates being strong or soft when some good portion of those cash investors might be positioning themselves to avoid a hammering much more thorough than an ROI a bit lower than ideal.

That’s an interesting observation; what’s happening in Cyprus may cause fear.

However, I don’t think seizing bank deposits will happen in US…QE is the issue. That 64oz container of OJ that cost $5 last year? Now it’s 59oz and costs $6…insurance premium $500/mo last year? Now it’s $600/mo. Last years $50 shoes are now $60 shoes. But are wages rising at the same clip? Hmmm. It’s a slow, stealth way of parting people with their cash. Like a poor hypothetical frog in a pan on the stove with the burner slowly getting turned higher and higher…it takes a while to notice somethings changing…

I wouldn’t look at RE as a safe haven. Taxes, fees, utilities, etc. can be raised. Tenants can only pay so much rent, or double up, downsize, move away, etc. There really is no escape, but I wish you luck.

@Drinks – certainly I can’t know if the US will eventually decide that a whopping one-time wealth tax will occur. (Note the BCG paper is not merely referring to bank deposits. No, no….ALL financial accounts; yes, IRA’s, 401k’s too!) It’s where the money is!

Look, for most people, perception is reality. If some rich types PERCEIVE the possibility, they will adjust accordingly before it becomes more obvious. This is one of the reasons they are rich….they don’t wait til it’s news on the car radio, etc….too late! There are plenty of very smart people paying very close attention these days and they will avoid getting hammered better than the average Joe.

I disagree about a primary residence being a safe haven. If the Feds are going to go after money, they will pick the low-hanging fruit…financial accounts. And you have to live somewhere.

I was a Landlord of a SFR and sold in November. The selling price I received was still higher than comps are selling for today in that neighborhood. Some seller have listed for 10% higher than I sold for then, but are sitting waiting for offers after 30-60 days.

I found there were plenty of prospective tenants wanting to rent. But, 95% of them had bad credit, no credit, High debt ratios, undocumented income, wanting to move 12 adults into a 4 bedroom house, etc. Many nice people having a hard time making it.

Rent was reduced 10% from what it was in 2009-2011. Because real incomes are down it was still very difficult to find a “good” tenant that qualified. This was a property in a middle class O.C. neighborhood. I finally decided I was tired of being asked by perspective tenant, could they make payments over time on the deposit, and could their extended families move in. It was time to sell. When you do the numbers, unless there is significant appreciation year over year in the housing price, SFR rental can be a poor investment. Rents don’t provide a good return on capital. One bad tenant can eat up 1-2 years of profits easily. Not all markets are the same and this was just my experience.

From what I hear from my contacts, rents are down and qualified tenant are become very hard to find. Some landlord are adjusting to the market by letting more people live in the property than they were zoned to have (10-12 people in a 3-4 Bedroom SFR).

They figure they can get more rent and plan on an automatic renovation when the tenants move. 10-12 people Living in a 1800 sq ft SFR doesn’t stay nice long.

How nice for the neighbors who own their houses to have rental with 10 cars parked on the street next door.

I was wondering about this…..with the economy still very weak and all these new homes for rent, what will the selection of tenants be like? Having been a landlord as well, I can speak to a bad or deadbeat tenant really messing up your ROI.

These homes could end up being real management nightmares.

I can only speak for my own neighborhood here in Portland proper, and you see multiple tenants and/or families living in most of the homes here. Only my wife and I live in a small 3 BR home w/2 baths, but our landlord (who owns 12 homes in the city) usually gets inquires for her properties asking for many more individuals per home than she feels comfortable allowing. She also doesn’t allow any pets in any of her homes, due to the wear and tear that many renters cause.

I should add that the rental occupancy rate in the city is approximately 97% – I kid you not.

Interesting. Which city? Curious because we have been looking around at rentals as well as sales. I’m seeing places asking sky high prices in not very good areas with 3 and 4 schools and wondering who on earth is renting these places and how they are affording it.

We were finding landlords to be very picky and a touch arrogant when making inquiries. Things like not allowing our cats even with a deposit and then we watch the property sit for months, still not tenanted. We have 800 credit, good income and references and still we were having trouble finding decent landlords without crazy expectations. That one has been on the rental market for 54 days now.

I’m seeing rentals just sitting in OC. Seeing places not priced right to begin with going for $100-$400 less than asking. We’re done with it all and have turned to that other bad options of buying. It’s lose-lose really!

Me too!

Just moved to a new rental in SF Bay Area and moving again due to crazy b!*%& landlady. The arrogance and inflexibility of some landlords is beyond me. The crazy high rents in just OK neighborhoods as well. Who’s paying $3000/month to live in a rundown shack and how’re they getting the money? I’m asking myself the same questions you’re asking yourself.

just can’t believe that the bubble is increasing again, fed is pumping money for all cost. However people salary did not increase well within the house prices. A new 2007 crisis is waiting for us I guess. Hope I am wrong.

Leave a Reply to DFresh