Total value of U.S. homes is $31.8 trillion – Los Angeles homes now valued at $2.7 trillion, the size of the U.K. economy. Chinese home buyers in the U.S.

Housing values in the U.S. have reached a new peak. In total, U.S. homes are valued around $31.8 trillion according to Zillow. That is 1.5 times the GDP of the U.S. and close to three times the GDP of China. Crap shacks in Los Angeles are now worth $2.7 trillion, which is more than the United Kingdom’s GDP. What is very telling is that real estate values across the country in virtually every large metro area are near peak values. In places like San Francisco, they are in a new stratosphere. The allure of real estate is now fully engulfing the nation and flipping rates are at decade highs. People want to get a piece of the action. You also have many ex-pats now taking their money abroad and retiring in more affordable countries where they can stretch those Taco Tuesday dollars while money from China is flowing the other way and boosting prices in some areas dramatically.

The housing market is peaking again

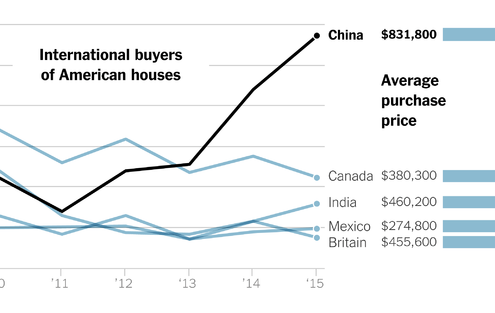

Money from China is rushing back into the U.S. via real estate purchases, businesses being bought out, and overall investment. So it is no surprise that hints of trade war will send the stock market into a dive.

Here is the growth of real estate values in the U.S.

Source:Â Zillow

Home values are once again near a peak. And this growth has occurred in nearly all metro areas. Yet money from abroad is flooding the market:

Those that live in places like San Francisco or even parts of SoCal understand the power of this money on local real estate values. It is very clear that buyers from China are buying in prime areas. Taco Tuesday baby boomers like to believe their crap shack in a marginal area is suddenly going to be worth $1 million but alas, that is not the case. In some areas however $1 million will get you a tiny box as zip code chasers are out in mass in this market.

The question becomes, are prices inflated? Bubbles are hard to spot but it is clear that real estate is now a boom and bust industry. There was a time when real estate was a boring hedge that barely kept pace with inflation. Now, the amount of house horny euphoria courtesy of HGTV shows and infomercial math is making the public delusional on home prices yet again.

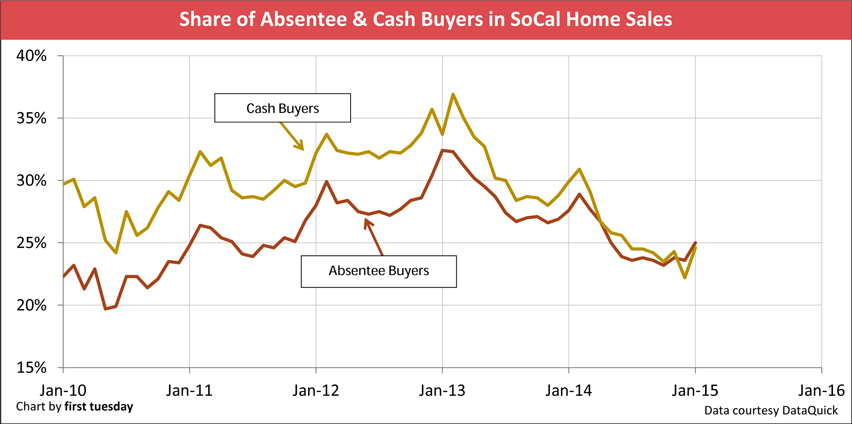

25 percent of homes in SoCal are still being bought with all cash:

Compare this to nearly 10 to 15 percent in more “calm†times but of course this is anything but calm.

Sales volume continues to be low because home builders are not building new homes since they know that broke Millennials are looking for rentals, not single family homes. High income households and foreign money in some markets is all that is needed to keep prices inflated on low inventory. But that doesn’t really explain why places in marginal areas are priced so high. These are the markets to monitor when the inevitable correction arrives because there is always a price to pay for a party (the hangover).

While real estate values nationwide hit a peak, sales volume continues to be weak. The homeownership rate continues to trend near generational lows. And foreign money flooding into the market is at record levels. But at least we have social media to distract us and once again people are flocking to housing cheerleaders like moths to a light. This always ends well.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

400 Responses to “Total value of U.S. homes is $31.8 trillion – Los Angeles homes now valued at $2.7 trillion, the size of the U.K. economy. Chinese home buyers in the U.S.”

“The question becomes, are prices inflated?…25 percent of homes in SoCal are still being bought with all cash”.

As long as the rentier class is buying, inflate away!

Gotta have some place to put all the SoCal homeless and spend those vouchers!

The current appreciation from the great recession just isn’t the same as the run up from 2001-2007. Tons of cash and all purchases are based on income. In the great housing bubble run up in prices all you had to do is fog a mirror to buy a house with 0% down. People were paying for mortgages with HELOCs.

We won’t see a true bubble until those people are allowed to buy again.

All these morons on here acting like they know when the market is going to crash so they can finally afford to buy. It is supply and demand folks. Simple as that. There are so many damn people in this world. If you did not or do not buy while interest rates are below 5%, you will look back in 10-20 years and wonder while you had your head stuck up your ass and didn’t take advantage of 5000 year low mortgage rates. Wake up morons. Real estate in Los Angeles is actually undervalued. Mortgage application restrictions have never been tighter. Supply has never been less, and demand has never been greater. So many companies are in the business of owning single family homes and renting them out for year. Invitation Homes – case and point. You are all living in the past if you think we are in a housing bubble. Enjoy renting for the rest of your life!

Thomas,

Artificial low interest rates push house prices higher. Higher interest rates put pressure on prices- a great thing if you want to buy half off

And The prop13 scam pushes house prices higher.

Also, the housing market is about cycles and we are nearing the end of the current cycle.

Most people who follow the RE market know that house prices move in cycles and will go down after artificial inflation.

I don’t blame you for not knowing these things. If you continue being on this blog you will learn this very quickly.

If you are in the market to buy and you don’t care about educating yourself-please go ahead and buy. Every bubble needs suckers to buy at the height of the bubble.

Well, I read a liberal demographer that wrote about an interesting trend, places like LA are growing at a sail pace while somewhere in the south or Midwest population is growing more rapidly since its cheaper to live. Also, Trump supported tariffs on China which will turn off Chinese from the US,watched San Gabriel Valley and Irvine get hit,

You are drunk.

Thomas,

You are the one behaving like an all-knowing moron. There is a problem with the housing market and this is very obvious. Pre prior housing market meltdown, those that had skin in the game sounded exactly like you. Angry and all knowing.

REALITY: There is a major problem when hard-working professional families (that probably bring in more cash than you) cannot purchase a home unless they have a fat trust fund sourced down payment to lubricate things.

This Santa Monica townhouse seeks over a $1 million markup (over 100%) after 5 years: https://www.redfin.com/CA/Santa-Monica/829-14th-St-90403/unit-2/home/6772302

Sold in 2013 for $989,000.

Offered in 2018 for $1,999,000.

I know it’s been remodeled, but still, it’s a townhouse. A condo. No land. And built in 1979.

That Santa Monica townhouse is an awfully nice place, with beautiful upgrades. It’s spacious, too. I daresay that something like this would sell for nearly the same price in Chicago’s prime zip codes. People are getting awfully steep prices, from $1.2M to $2M, for 120-year-old A-frame worker’s cottages in neighborhoods like LIncoln Park, Bucktown, or Wicker Park. Lincoln Park I understand- that is a totally top tier neighborhood, but Bucktown and Wicker Park still have elevated crime profiles, and, IMO, are totally lacking in charm, and the architectural distinction I expect in a city like Chicago.

Leave it to a dingbat from Shitcongo to proclaim that townhouse is an awfully nice place.

It’s a freaking 1970’s era poorly built stucco townhouse. Look at that tiny concrete patio with a view of a wooden fence/concrete retaining wall with the neighboring apartment building looming above which blocks out the sun.

Almost $2M and $529 monthly association fees for that 1970’s era dump in the Peoples Republic of Santa Monica with hordes of homeless right outside your door? No thanks.

That place is a dump. No land, stuffed, no way to commute to any place of work, not close to the ocean, minuscule patio, ugly architecture.

2M and your neighbors can hear every grunt and moan during coitus.

Its even worse this time around.

It is ultra premium location. It does not have to play by regular economics rule

Whoever bought it for a mil 5 years ago obviously did not listen to anyone on blog like this

Will come out like a champ – it will go for asking

That townhouse makes no sense financially. But I realize that some buyers can afford not to care about financial sense. They look for a nice place to live, and care not about price.

I would say a premium is in order if that townhome is close to work and everything that a person wants to do so they spend time living, not commuting. The 2013 price could be considered somewhat reasonable based on that. Now, not so much. But maybe someone who made a bunch of money from the China/QE/ECB inflation of all assets wont trip – easy come easy go and they’re buying a lifestyle for right now and not worrying about growing their assets.

Just back from a beautiful Saturday in Santa Monica with a friend raised there who wants to return but finds prices too high. I told her how even a water-damaged unit in an oceanfront building sold recently for $506K, 27 percent over it’s asking price of $399K! She then said that a little known fact is that the Northridge earthquake didn’t just do great damage in the Valley but that buildings lining Santa Monica’s Ocean Avenue along the California Incline were mightily damaged too….but, of course, such facts don’t seem to be readily disclosed and now I’ve got a feeling it’s probably better to live farther inland away from that bluff.

https://www.redfin.com/CA/Santa-Monica/101-California-Ave-90403/unit-103/home/6781167

I live in Santa Monica and was here during the earthquake. Damage was extensive throughout the city. I saw one four storey building with its entire front fallen away. You could see the apartments inside.

Rent control was partially to blame. Landlords didn’t want to invest in retrofitting older buildings. But now the city is forcing them.

Santa Monica also sits on a prominent fault, named for it.

You’ll note from this map that ocean front buildings lie in a high risk zone for landslides: http://gismap.santa-monica.org/GISMaps/pdf/geohaz.pdf

Facts (of some probability of risks) are presented to supress feelings of missing out

Lets not forget, that townhouse is in the Franklin School District, a coveted school where the wealthy move to just to send their children to a good school. Therefore it is one of the neighborhoods that will stay somewhat isolated from market crashes as well.

https://www.niche.com/k12/franklin-elementary-school-santa-monica-ca/

Looks nice. Ive seen people buy worse in not as nice a ne8ghborhood for about that. On the other hand I see rentals in that area for 4-5k/mo so…

At least it had grounded wiring in 1979.

Many make the generational mistake of not purchasing a home early in their life. These people often point to a declining stock market as the trigger which will bring the house market crashing down … a housing crash is their wet dream.

However, if you look at history, you will find that sometimes when the stock market declines, the housing market declines. Lest often, when the stock market declines, the housing market “DOES NOT” decline.

So what will happen this time? If the economy and the job market stays on solid footing, and at this time there does not appear to be a problem, then the housing market will stay strong. If the economy slips into recession, then the housing market will fall.

My opinion is it will be regional. I could see some areas weakening while most do well. I think Southern California will do just fine because of the big big military spending component in the budget signed Friday … a lot of that $$ will flow into aerospace. I think the Bay Area could see some trouble if the shine comes off of the tech sector, and it appears to be coming off fast. Just look at Facebook. Something like that slows venture capital and down goes the bay area housing market. I think the east coast will do very well, with the exception of DC which is getting a lot of government job cuts.

“a lot of that $$ will flow into aerospace.” – This isn’t 1983.

He way overstates the aerospace sector’s impact on SoCal. Semi and Internet tech like the Bay Area is playing a bigger role than ever before.

How about ‘ a lot of that money will flow into Silicon Beach’ rather than aerospace.

It could be aerospace R&D but not manufacturing. Manufacturing left in the 80’s for Seattle, St Louis, Dallas, etc.

I just checked … it appears Southern California is still the largest beneficiary of defense spending in the nation.

From what is on the web, it appears the the south bay of Los Angeles has the highest number and percentage of aerospace engineers in the nation. The only other area that was in the same category was an area up in Washington state. A whole lot of what is going on in the Bay area is startups building stuff that makes no sense and on only getting built because the central banks have been wastefully printing money and investors have been wastefully investing that on startups that do not pencil out. Now that the central banks are pulling back, watch how a lot of those junk bay area startups fold. On the other hand, aerospace is real and since Obama came in it was cut so far back this county was putting itself in danger. Trump gets it and the money for aerospace is being restored to what it needs to be. Los Angeles will benefit from the return to sanity.

Sometimes I wonder how a few people on this board are. A few months ago, I mentioned the stock market was headed for rough waters. Many jumped all over that post and said I was nuts. You have to admit, that was a great call. Some people can’t see what is gong on and they follow everyone like lemmings.

Thanks for checking. Yet there remains no guarantee in sight that defense spending makes or breaks the RE market in SoCal.

you’re right it’s not 1983……..and the defense budget just past is $700,000,000 ….think about that for a seconds. The USA has no real enemy and yet we are going to spend almost $1 trillion dollars on defense…….this is corporate welfare on a grand scale.

good work, if you can get it.

interesting: and the defense budget just past is $700,000,000

It’s passed, not past.

It is 700 Billions with a “B” not millions.

Surge,

“Millie, have you actually tried to get a loan yourself? In 2018. I mean actually try to get it. Not feed us a history lesson from 2005-2007 era?â€

I was in escrow in 2014 and backed out. Thank god. The process opened my eyes. Happy to share the story/details. Since then I understand the scam/game.

Have I “tried†since then? Oh please, are you one of these people pretending it’s somewhat hard to get a loan? Lol. It’s the easiest thing in the world. Why would it be? Banks/lenders can give out loans to virtually everyone since they have no risk. They simply sell the loans to fanny and Freddie. The risk is on the tax payer side.

In 2014, we had already no rental parity and the loan officer told me that “You can afford a much bigger houseâ€.

Now, I understand how this works. They would sell you a house that’s way over your head. Because they can. Nothing has really changed compared to 2005-2007.

They are in business to sell you the biggest house and sell the risk to Fannie and Freddie right after. People get in way too much debt and run online to the housing bubble blog to justify their purchase and convince everyone else to do the same!

They hate the idea that the RE market could go down again and millennial buys next door for half off.

There is an incredible wealth transfer happening. Millennials are going to inherit all that wealth eventually. So, you can wait a number of years to inherit? Of course you can. But inheritance aside you can easily buy a nice house half off during the next crash. The RE housing bubble game is pretty simple to play and win. All you need to do is save money and have patience. Those who get suckered into buying at the height of the bubble will be screwed financially. Just ask those 7 millions who lost their homes due to foreclosure during the last crash. Today, People are up to their ears in debt. Easy to see that during the next crash we will easily get more than 7 million foreclosures.

So, if you don’t care about money and love to be in financial trouble you buy now. All others who care about money and can perform simple math will wait for the upcoming RE crash.

Millennials are going to inherit all that wealth eventually.

No. Only lucky millennials (like you) will inherit. Unlucky millennials will inherit only debt.

Unless those unlucky millis vote to confiscate your inheritance, forcing you to “share the wealth.” Which, should the unlucky outnumber the lucky, could happen.

“Those who get suckered into buying at the height of the bubble will be screwed financially.”

How exactly? Lending standards are appropriate now, unlike the last time. If you can afford the mortgage of an overpriced home now, you’ll still be able to afford it when the home’s value is down 30%.

I know, you think lending standards are a joke. Banks are in the business of making money, they know a qualified buyer when they see one, and for the most part, the small shady lenders are using the big bank standards now. Someone with a back end of 40% and a conventional mortgage is not going to default unless they walk away. Those are the foreclosures you’ll be seeing in the next crash.

“Today, People are up to their ears in debt.”

Not the ones who are qualifying for a mortgage.

Yes, there will be a lot of foreclosures. At least get the reasons right.

John,

I am glad you asked.

“ Lending standards are appropriate now, unlike the last time. If you can afford the mortgage of an overpriced home now, â€

What makes you think they are appropriate? What makes you think you would know? And what makes you think you have any idea how an appropriate standard would look like?

You have the mindset of most sheeple. You think that if a lender tells you that you can afford it you actually think you do! The reality is that most people can’t even come up

With a 1000 bucks in savings but somehow they “know†what house they can afford?

Buying a house that is 6-10 times of your annual household income is not affordability it’s insanity. Lenders will tell you, you can afford it, you believe it and during the next recession you lose the house, your job and reality will hit you.

As you said, lending standards are a joke. They can give an insane loan to almost anybody and they know these people have a high risk of default. These lenders make money and sell the loan to fanny Mae and Freddie Mac. No risk on the lenders part. It’s the tax payers risk that’s behind fanny and Freddie. You don’t believe me? I know you want to the research so Just wait for the next recession and see for yourself.

Bottom line, just because lenders tell you standards have changed and you afford it does not mean that’s true. Not at all. They are not here to help you…they are here to make money. Once you learn that you are way ahead in life.

Hey Milli Vanilli guess what will happen in the next crash…. the investors, all-cash buyers and flippers will come out of the woodwork and snatch up all those homes, like they did in 2008-2009 probably all the way to 2015. When I purchased a home in 2012, homes that I were interested in had multiple all-cash offers the day of the open house. I did get lucky though. Anyway, normal loan-approved buyers had their dream homes snatched out from under them every step of the way. I am not including the back-room bank deals either, in which companies like Blackstone bought tens of thousands of homes sight unseen. If you are waiting for the next crash… when will it start, when will it end… how will you position yourself?

Millie, have you actually tried to get a loan yourself? In 2018. I mean actually try to get it. Not feed us a history lesson from 2005-2007 era?

QE Abyss,

Buying a house is not rocket science. Buying a house for 55% below today’s prices is not rocket science either. Saving lots of cash and having patience is not rocket science. Waiting for a crash (who cares when exactly it will happen) is not rocket science.

If you are overwhelmed by the market or if it strsss you out too much maybe let your wife handle it?

I got cash and I got patience. All I need to do is wait and be entertained on this blog until it happens. Every bubble pops. Again, not rocket science.

Why do you continue to miss the painfully obvious? If you read this with actual comprehension in mind, you might learn something.

“What makes you think they are appropriate? What makes you think you would know? And what makes you think you have any idea how an appropriate standard would look like?”

Because I can do math. Because I’ve been through multiple purchases and refis. Because banks don’t grant loans expecting to lose money. Because they are specifically designed to ensure only those with low debt, long and stable careers, and good credit will qualify, and only for a mortgage that they can afford based on a set of rules that have been demonstrated to have a positive outcome literally millions of times. Do you even know what it takes to qualify for a conventional loan? Or do you just stare at crypto candlestick charts all day long?

There are two aspects to qualifying – affordability and credit. They are two very different things.

The back end ratio ensures your income and debt responsibilities will enable you to make the payments. Again, this ratio has been proven in practice by thousands of lenders and millions of mortgages.

The credit requirements show that you have spent years being responsible with debt, and because it takes so long to build up good credit, the bank will know that you will most likely continue to be responsible AFTER the loan closes.

Because the income requirements went out the window in the runup to the last bubble, buyers were able to take out loans they could not afford, which means that even with good credit they would get in trouble.

Lenders are once again enforcing both requirements, making this a very different time for buyers.

“They can give an insane loan to almost anybody and they know these people have a high risk of default.”

NO, THEY CANNOT. It is against the law.

“These lenders make money and sell the loan to fanny Mae and Freddie Mac. No risk on the lenders part.”

They have to follow the law. The lenders don’t decide the minimum requirements – but they frequently modify them to make them MORE strict.

“The reality is that most people can’t even come up With a 1000 bucks in savings…”

These are exactly the people who WOULD NOT QUALIFY FOR A MORTGAGE. Is this clear to you yet?

“Buying a house that is 6-10 times of your annual household income is not affordability it’s insanity. Lenders will tell you, you can afford it…”

They will only tell you if you meet the qualifications, and if you do, it does mean you can afford it in your CURRENT situation AND are likely to continue making the payments afterward. Your example doesn’t include a vital piece of information, which is the down payment. If it’s enough, you’ll meet the back end requirement, which means yes, you can afford it. The lender will also want to know exactly where you got that down payment, and will follow the paper trail until they do. Getting pre-qualified is easy. The actual underwriting process can take weeks and make you feel like you’ve been through a financial blender.

The people who get in trouble are those who HELOC the crap out of a house AND run up credit card debt AFTER the purchase. Considering the strict qualifications these days, that’s a lot less likely to happen with modern buyers.

John,

You seem Very disconnected from reality.

“Because banks don’t grant loans expecting to lose money. â€

Banks can give out insane loans because they have zero risk. They simply sell the loan to Fannie Mae and Freddie Mac. Behind Fannie and Freddie’s is the tax payer. The notion that somehow loans are given to people who can afford overpriced crapshacks is total BS. You will see that once we hit a recession and will see similar foreclosures than last time around. We saw 7 mio foreclosures during th last bubble. Since this bubble is much bigger we will probably see 10 million foreclosures. Don’t buy now. Don’t be one of them. Wait until prices are down 55-75% from today’s prices.

John D.

I don’t think you are totally right. Most banks are not making loans for themselves to hold on their books…the real lender is Fannie and Freddy. The banks are just servicing the loans and do not have any skin in the game. Also…many home buyers now are the boomerang home buyers. These are the ones who were foreclosured on in 2008 and 2009 but 7 years have past and they have good credit ratings again

“Banks can give out insane loans because they have zero risk.”

My God you are thick-skulled. Banks have to follow the requirements laid out by the law, period, whether they plan to immediately sell the loan or not.

There is no other way to word it that will make it more clear, so now I know you’re either special needs or trolling.

John d.

Just look at RU82’s post. He is spot on.

Also, these requirements you are talking about allow the lenders to give out insane loans that will cause a crisis. Somehow, you think that requirements mean the system works in a healthy way. The system is designed the way it is for a reason.

I know you like to disregard facts and try to pretend everything is awesom so I will help

you out.

Low interest rates. Easy credit. Poor regulation. Toxic mortgages.

These were just a few reasons regulators gave for the collapse of the US housing market a decade ago. Since then, regulators have improved the standards that lenders use when Americans apply for mortgages.

But today increasing danger lurks in the mortgage market, and economists say it could put the financial system at “even greater risk” when the next recession strikes or too many borrowers fall behind on their mortgage payments.

A growing segment of the mortgage market is being financed by so-called non-bank lenders — financial institutions that offer loans to consumers but don’t provide saving or checking accounts.

Borrowers with poor credit have increasingly turned to these alternative lenders instead of traditional banks. The alternative lenders are subject to far less regulation and have fewer safeguards when borrower defaults start to pile up.

http://money.cnn.com/2018/03/08/news/economy/housing-economics-nonbank-lenders-brookings/index.html?iid=EL

Ru82 – Many, if not most, lenders turn around and sell your loan within a few weeks of closing. You still have to qualify for the loan, which is a lot harder this time. No “stated income”.

You didn’t even read the whole thing, did you?

The point of the article was this – “non-banks may have fewer resources to weather economic shocks to the mortgage market, like a rise in interest rates or a decline in house prices.” In other words, it’s about the danger to the non-bank lenders, with a bit of sensationalistic nonsense thrown in for page views.

I did enjoy how you included the part that seems to back up your argument, except it doesn’t – those “borrowers with poor credit” mentioned still need to meet the minimum requirements. Look up the loan requirements for Fannie Mae and Freddie Mac. I dare you.

THERE ARE NO MORE STATED INCOME LOANS.

“THERE ARE NO MORE STATED INCOME LOANS.â€

As if that would mean much. And it doesn’t mean more by yelling it either.

It means everything if you’re a strawberry picker with an annual income of $14k and you qualified for a $720k house. That actually happened in the last bubble, and you’re trying to convince us that things are the same now.

That’s bs. The strawberry picker making 14k a year did not buy a house. He did not have to. He is here illegally, does not even have a bank acct and drives around with an expired driver license from Mexico. Met many of those guys. Those guys did not buy and foreclosed. The avg joe bought into the lie buy now or be priced out forever. It was a mania. Similar to nowadays. The majority of foreclosures were actually on conventional loans. That 14k income buying a 720k house is a myth to make us believe this time is different. It’s no different at all. People buy high, are way over their head loaded with debt and are just one recession away from losing their job and the house. Just wait, save and watch. Be ready and buy when the tide has turned.

I’ve never encountered anyone with their head buried so deep in the sand.

http://www.doctorhousingbubble.com/yearly-income-14000-purchase-of-house-720000-have-we-all-lost-our-minds/

“It’s no different at all”

https://en.wikipedia.org/wiki/Dodd%E2%80%93Frank_Wall_Street_Reform_and_Consumer_Protection_Act

See Subtitle B – Minimum Standards for Mortgages.

“In effect, this section of the Act establishes national underwriting standards for residential loans.”

Grow up.

Millennial really lives up to the stereotype doesn’t he? He thinks he knows everything about everything and only his opinion matters. I wonder how old he was when stated income, interest only loans were the norm in the last bubble, 15 maybe? He really doesn’t have a clue about what happened and only sees it through his narrow minded view that supports his 55%-75% crash.

I distinctly remember seeing ads for homes in crappy parts of the Bay Area (San Leandro, Union City, Pittsburg, Antioch) for homes in the $600k-$700k range showing payments of less than the rent of our two bedroom apt. These payments were based on interest only no down loans and the ad stated that.

You know why I remember this? I remember showing my wife the ads and telling her these people were going to get burned when the payment resets and they have to pay principal as well. Sure enough, we all know what happened.

After the crash there were lots of articles about questionable people obtaining loans for homes way out of their range and then defaulting. Instead of being narrow minded go do some research.

I used to be just like you until I realized that things this time around are different. I thought we were doing ok financially until I realized there were way more people here in the Bay Area willing to spend a ton of money to live here. We’re talking tech folks making $200k to $400k combined salary as well as ones with deep pocketbooks at the bank of Dad to fund the down or the entire purchase. I personally know a few of these types.

Your 55% to 75% crash may happen but there will be a lot of collateral damage. Don’t expect to get off unscathed dude. Plan for the best but be prepared for the worst.

“Many make the generational mistake of not purchasing a home early in their life”

Most people make the major mistake of choosing poor parents, therefore not getting a house given to them in their teens while parent’s ‘move up’ to bigger house.

It’s easy to believe that jt doesn’t belong to this group.

The only people I know who have a house that are in their 30’s either A: have a government job or B: inherited the house.

p.s. I sure which there was an edit functionality on this site. Many like to jump an each and every typo.

Well we own house at our 30’s not because we have wealthy parents nor government jobs. We both are software engineers. I believe there are many people.own their house not getting one cent of freebies, like us.

@interesting Well we own house at our 30’s not because we have wealthy parents nor government jobs. We both are software engineers. I believe there are many people.own their house not getting one cent of freebies, like us.

Dude I owned my first house at 22 but I wasn’t stuck in an overpriced area such as SoCal at the time. But I know people in their 30’s that bought in SoCal in the past ten years without gummet jobs nor help from parents. Bottom line it’s a relatively shitty place to be a normal income earner and also want to buy a decent property. Been that way for a long time yet people still want to believe it’s the center of the universe and suffer as a result of such dim witted thinking.

Millie, maybe “they†are in the biz of selling you a bigger home, but ultimately you control how large of a home and how much you spend.

Millennials hatred toward Prop 13 is completely baffling to me.

He is expecting prices to drop 55% yet he doesn’t want to benefit and be protected with Prop 13???

If you look at actual data points for Prop 13, 2% annual increases produce minimal discrepancies in real life.

For people who bought in 1990 they may be paying $6000 per year versus the new buyer who is paying $9000 per year. Not to mention the fact that most people who bought in 1990 have likely already sold the house and bought another house.

If you get Millennials 55% per drop the new buyers will actually be paying less than the people who bought in 1990 and be locked in…. so why would Millennial want to eliminate Prop 13? It’s because he has never lived anywhere and owned a home where taxes can go up at the will of the government. I have, trust me it’s not fun.

The most extreme example of Prop 13 inequities are from purchases in the 1960-1970s.

But these people are either dead or about to die… and guess who may benefit from Prop 13??? That’s right the Millennial inheriting the house.

Millennials thought process is completely baffling and misguided. Unless he doesn’t actually believe prices will drop 55%…. and he is ready to buy at a 20% drop…. Nah… no way!

It’s not about him. It’s about you. You want to keep your handout at his expense. You need new blood like him to capitulate in order to keep your subsidy. They’re getting tired of carrying your cargo. It’s fine to relocate or fight the government if you feel overtaxed, but you can’t expect other people to subsidize you for long without them pushing back at some point.

Well of course you are pretending you don’t understand the prop13 scam. You are a beneficiary of prop13 so you don’t want it to change. Prop13 can easily be explained in two sentences. Prop13 is designed to screw younger generations by putting the property tax burden on them so that older people don’t have to pay their fair share. If a millennial buys a small condo the property tax burden is ten times higher than for the old fart next door in his big mansion. If prop13 will be repealed most boomers will say, wow I can’t believe we got away with this scam for so long.

For those who don’t like paying their fair share or can’t maybe it’s time to GTFO of here? Screwing younger generations out of greed should not be your way of life.

Millennial, I pay market rate taxes.

I’m only a beneficiary of Prop 13 in the rationale sense that my property taxes can’t go up at the will of the government. I have seen this before owning homes in other parts of the country. You are a complete fool if you think repealing Prop 13 is good. Move somewhere and experience property taxes going from 2.5 to 3% when the local government decides it wants to spend more money.

Also every thing I said about the 1990s purchases versus you buying at your 55% dip is absolutely true. If that happened you would be paying less taxes than the person who bought in 1990.

The vast majority of homes are bought and sold within 5-8 year time frames. As I said the most extreme examples of Prop 13 inequality are those who bought in the 1960s / 1970s.. Let’s try not to forget that they paid property taxes for 50-60 years and built the damn community you benefit from paying no property taxes. Now some Millenial benefits by inheriting with Prop 13. Wasn’t that your backup plan?

Sometimes we say the same thing! The gall of these freeloaders. It’s like hitting a dog and being surprised when it bites back in defense.

You should reconsider the idea of moving out of the insane asylum. These people aren’t going down without an ugly fight where everyone suffers collateral damage. No matter which side you choose, it’s not going to end nicely.

That is the definition of a baby boomer, take all you can and send the kids the bill.

Millennial:

Very well said ! Yes, Prop 13 is a scam. It does hurt the younger generations. Two houses on my street. Both 1200 square feet and very comparable in every way. New (2014) buyer pays over $7k/year in property tax. Old buyer pays about $1700. #timesup!

NoTanKInSight,

As you can see from the responses…..younger generations will catch up on the prop13 scam and we will change it. The time of free lunches for boomers is over. You boomers who pay next to nothing in property taxes can scream all you want, prop13 has to be repealed and replaced. I am fine with boomers paying more and younger generations paying less so that you meet in the middle. How is that not that right thing? If you don’t even pay what younger generations have to pay you shouldn’t even have such a big mouth. 😉

You and John D are masters in making up sob stories why boomers need to continue paying next to nothing in property taxes. The truth is YOU are just geeedy and see no issue with screwing younger generations and taking government subsidies as long as you can. If property taxes for older owners increase they will finally downsize and House prices will go down as well!

Your property taxes on a $1m house (today’s prices) with prop 13: $11,000

Your property taxes on a $700k house (prices after a 30% correction on the coast) without prop 13 or any other protection: $21,000

Your property taxes on a $700k house with a prop 13 REPLACEMENT including a .5% cap: $3,500

Take your pick.

Marc C

That is 5k/year or roughly $450/month.

If this makes you wave a hashtag flag, you are not ready for home ownership, both financially and psychologically.

AMEN. Prop 13 favors people who bought long ago at the expense of the young/new residents. Time to go!

John D. Is losing his mind. Lol. He must be one of the beneficiaries of prop13 and does not want to change it. He is fine will boomers paying next to nothing while the tax burden is solely on new buyers. Can you blame him? His entire generation lived life like that by Blowing up the debt based bubble on the expense of younger generations. Enough is enough. Repeal prop13 and end the free lunch for boomers!

You gotta love freeloaders like John D. Says you should take your pick although you can’t make a pick because scroungers like him already have the lack of your choice set in their favor. Your only option as a first time buyer TODAY is to pay multitudes the amount of tax in return for the exact same level of services and benefits with the hope that the scheme lasts long enough for you to recover the difference (it won’t last).

He knows it’ll be coming to an end. They all know. They’re desperate to continue to freeload off of you even though they won’t admit it. Just like you’re not confident that prices will “crash” they aren’t confident the gravy train won’t come to an end soon enough. That’s why you’re both here. To convince each other that you’re going to be right because you’re both afraid of being wrong.

And you want to stay in California in the company of these scroungers all over the place? Good lordt.

Prop 13 isn’t perfect but think of it another way. How much do you like your taxes going up by a few thousand dollars every year even if your income stays flat? Because that is what places like Dallas Texas are going through right now. Their property taxes are high and they can adjust up by 10% on a homestead every year depending on a yearly reassignment.

In those situations older people on fixed incomes can get forced out of their homes simply because property values beyond their control are rising to fast. It is reasonable to attempt to prevent this.

Property tax in California even for new buyers is really low as a percentage of value. The true point of contention here is that prices are too damn high. Property tax has prevented no one from buying a home in California. We need to fix our prices, a small part of that may be improving taxes on property so that they don’t inadvertently discourage home sales.

Beyond that, could it be considered fair to have younger workers pay more into taxes than retirement age folks? Absolutely. Why? Because everyone was young once and had their turn at contributing to the labor market and paying the bulk of their taxes. As people move out of the work force and their tax burden goes down there is nothing wrong with avoiding extracting more taxes from people on fixed incomes.

You need to look at a life time share of taxes paid, not at a particular age groups current tax burden.

“You need to look at a life time share of taxes paid, not at a particular age groups current tax burden.â€

Pathetic. That’s easy to say for old farts who did not pay tution fees (and if they did it was a joke compared to now. Back in the day California’s universities were tution free).

Also, when boomers bought houses the prices back than were not ten times the avg household income. Back than you could easily buy a house with ONE income.

Boomers never had to pay as much property taxes as millennials because houses were way cheaper back than. The tax burden is solely on millennials.

Don’t pretend boomers somehow paid their fair share. They created the biggest mess/debt burden in history. 20 trillion in debt that millennials need to pay back. Prop13 needs to go and taxes for these old farts needs to be dramatically increased.

“John D. Is losing his mind. Lol. He must be one of the beneficiaries of prop13 and does not want to change it.”

“You gotta love freeloaders like John D.”

I bought last year, paying the full amount on a 4,100sf house, and I’m a freeloader? Nope, just smarter than you, in that I recognize the long-term benefits that you can’t admit are there for new buyers too. I notice you didn’t reply to my post encouraging you to do the math – afraid prop 13 will benefit you? Because it definitely will – by as much as several hundred thousand dollars over your lifetime. I would prefer you never buy, though. I’d rather see you whine for years about how unfair it is.

“Repeal prop13 and end the free lunch for boomers!”

Will never happen without a suitable replacement. Prop 13 is a sacred cow. Even talking about it is bad for a politician’s career. (And of course, you get the free lunch, too – the second you buy. You need to be able to see further into the future than the next Xbox release, though.)

Changes needed:

1. Eliminate inherited benefits. Tax gets reset at assessed value.

2. Eliminate commercial property benefits (this should get on the Nov 2018 ballot and has a chance of passing).

3. Eliminate benefits for rentals and second homes.

Number 3 will be tough to pass. There are a lot of people with a lot of money who enjoy this.

Nice to have:

Tax based on assessed value, but cap it at .5% for everyone.

OR

Tax based on purchase price, and limit annual increases to something higher than it is now – e.g., 3-4%. Cap it at .7% (or whatever) of assessed value.

^These are the tough sell. I can’t see either one happening anytime soon.

They’re actually trying to expand it:

https://ballotpedia.org/California_Proposition_13_Tax_Transfer_Initiative_(2018)

(I’m sure all you senior-haters will have a stroke over that)

Remember that Californians base their voting decisions on emotions and advertising, not facts, which means the group with the most blatant lies and the biggest wallet wins. See “browndoggle” for a perfect example.

John D – I’m sorry, you’re an aspiring freeloader. Too bad Prop 13 won’t be around long enough for you to achieve the dream. As for my personal situation, I’ve been a real estate owner for two decades while not so dim witted to realize that gravy trains are counterproductive, so you can suck on that fat dick, pal.

Milli won’t benefit financially by repealing Prop 13. But he will benefit emotionally.

Milli’s property taxes won’t decrease. But your taxes will rise to Milli’s level. You will suffer as much as Milli does. This will provide Milli with enormous emotional satisfaction.

It doesn’t matter that Prop 13’s repeal will require Milli to pay a bit morethan he would have in the long run, because you will pay a lot more in the long run.

Milli will happily suffer more, provided that no one suffers less than he does.

Nailed it

Property tax parity across the board would raise revenues which should put downward pressure on property prices. In that regard he could potentially benefit financially because guess what – he would be paying full freight on taxes anyway and to the extent that prices go down, his tax basis would be lower. He could also benefit on the consumption and income side if Prop 13 repeal took upward pressure off of these other taxes and fees. It’s a leveling out. That’s why the freeloading beneficiaries are so against a change in this status quo – they get higher prices on the profit side and lower taxes on the expense side. I mean who the hell wouldn’t love that deal?! Problem is someone else is paying for it and inequities like this always have a short shelf life.

Lordt B: Property tax parity across the board would raise revenues which should put downward pressure on property prices.

Wrong. If Prop 13 were repealed, any “downward pressure” on property taxes would be more than offset by “upward pressure” from California’s huge government employee retirement health & pension liabilities.

Any “leveling” of property taxes would come solely from raising everyone’s taxes to an equal level. Everyone‘s property taxes would rise, including recent buyers’, because the 2% cap on annual increases would also be off.

California has enormous “upward pressure” to raise every and any tax to the highest level possible. Any “downward pressure” is swallowed and disappears into nothingness.

California’s debt obligations are a giant tsunami heading eastward. You think that by standing on the beach with your toy paddle, splashing little waves westward, you can offset the coming tsunami.

Lordt B is one of the smartest posters here. Reminds me of prince of heck and Hotel California.

Millennials who pine for the repeal of Prop 13 are blinded by their desire for instant gratification. Rational young people can see that if they buy and remain in their residence, after ten they will enjoy the same benefits and peace of mind that comes with knowing their property taxes will remain under control. I’ve been in my home for 20 years now and I was paying more taxes than my neighbor back then — now I pay less than my new neighbors. Time marches on, but many Millennials are incapable of recognizing that fact.

John D he didn’t nail anything.

What is a Gen X? 🙂

Prop13 favored older people who are already benefitting from the gousung bubble. It’s s Scam that weds to be repealed. Boomers in big 7 bed room houses pay next to nothing in property taxes compared to a millennial who bought a small condo next door. It’s a joke.

Boomers are free loaders who don’t want to pay their fair share. That will stop now. They tell millennials: “you can’t save for a downpayment because you buy too much avocado toast.â€

How about we tell them, let’s see if you finally downsize once you have to pay in property taxes what a millennial has to pay today?

GenX and John D.

Unfortunately, you don’t understand what prop13 is. Let me explain it in a simple example.

A millennial buys an overpriced condo during the current housing bubble for 400k. His property taxes are over 4K. (1.1-1.2% of purchase price).

Next door lives an old fart in a 6bedroom mansion and pays 2300 dollar for his million dollar home. His property taxes were locked in when he bought a loooong time ago. Thanks to the prop13 scam.

The tax burden is on new buyers no matter how small their houses are.

Older farts don’t downsize because their property taxes are a joke. They don’t pay their fair share.

You can easily change this. The millennials should probably pay 1k per year and the million dollar home owner should pay like 10k-20k.

The state would have more tax revenue and the tax burden would be allocated in a fair way. (Based on size and value)

Right now, older farts get a free lunch for no reason. If they can’t afford to pay their fair share that would be even better. They would finally be selling their million dollar homes and get out of here. House prices would fall. What’s not to like? Luckily time is on our side. Boomers get older and older 🙂

Millie, one thing you utterly fail to recognize is that NO homeowner benefits from a housing bubble. If you bought for 100k 20 years and now it is worth 1mil -> there is no benefit. Because if you sell for a mil, yes you get 900k in profit, BUT the only thing you can buy is just another similar home.

I would argue that crypto holders are the ones greedy ones, because you can really invest 1 house worth into crypto (way back) and get 10 houses out of it.

This is why:

1) prop13 is genius as it protects people who own homes as utility.

2) Exemption from capital gain tax (up to 500k) on home price gain -> Genius, protects people’s capital if they have to sell due to moving, etc…

In fact, if you would display more foresight, you would target federal interest tax deduction. This one is most questionable one to me (even though I benefit from it) and this is the one drives home values up more as if compared to prop13.

Surge, pssss don’t say that too loud…I totally agree with this:

“Millie, one thing you utterly fail to recognize is that NO homeowner benefits from a housing bubble. If you bought for 100k 20 years and now it is worth 1mil -> there is no benefit. Because if you sell for a mil, yes you get 900k in profit, BUT the only thing you can buy is just another similar home.â€

However, most older RE cheerleaders here and everywhere else tell you how they are millionaires on paper thanks to the housing bubble. When it comes to property taxes though they scream “poor grandmaâ€. All I am saying is, great you like to brag about being a millionaire and retired with the age of forty. That means you can easily afford higher property taxes. At least as much as millennials pay already. 1.2% of the current “valueâ€. So for all these millionaires here it should be a piece of cake to pay 10k and more in property taxes.

“Luckily time is on our side. Boomers get older and older”

What you’re STILL NOT GETTING is that it isn’t just the boomers. People buying today get the same benefits. In 40 years, the idiot 20-somethings of that era will be voicing the same complaints about the millennials who bought in the 2010’s. “Why should we have to pay $2,000/month when the freeloader millennial next door only pays $500??”

“Unfortunately, you don’t understand what prop13 is. Let me explain it in a simple example.”

LOL. Get lost, troll.

Yea, that couldn’t be further from the truth. Millennial who buy today pay 1.1-1.2% of the purchase price. The prices are artificially inflated and so is the property taxes. So a new buyer has all the tax burden while the old fart next door pays next to nothing for the same house and same services. Prop13 was designed to screw young buyers and put the tax burden solely on them. Pretty selfish by old farts who benefited from the housing bubble. Prop13 needs to be repealed and taxes for seniors need to be increased by at least 4-7 times.

Funny how you prefer 2-3% on current value instead of 1% on purchase price.

Regardless of how financially impaired you are, it will never be repealed. Enjoy your benefits when you finally do buy 🙂

Well, Prop 13 will almost certainly be modified. Investors have owned apt buildings for years and raise rents to market while there property tax payment increases are capped. they refi cash out tax free and its been a sweet ride in Socal for decades (with a few nasty bumps). I’d say there is a strong basis for this along with commercial, industrial and other investment properties. Watch for owners cashing out $2MM condos in Santa Monica and moving to other states buying say 15 or 20 THs and living in one. In Nevada, an additional boost for non state taxes or in TN no tax on retirement income (or low taxes I forget).

Mr Landlord. Good points. My partner retired in 1994 from Cali and moved to WA. He sold a custom home surrounded by avocado Grove. A close friend is selling a $2MM home in SD County and building a home in Montana. Another is moving to another mountain state. The ability to work remotely will be tough on California. I had a tenant in a unit for 19 years straight and raised her rent twice. Over that time, her GROSS rental payments summed to over 80% of what I paid for the property. I can review reports while anywhere in the world…. I also hear from 30-40 yo with chillrens – they are getting badly squeezed.

Prop 13 is basically rent control for homeowners. You’re paying less taxes the same way renters pay less rent because they got in first. It doesn’t take a genius to figure out rent control isn’t a good thing unless you are the lucky one to get in first.

It just inflates the cost for everyone else.

“But these people are either dead or about to die… and guess who may benefit from Prop 13??? That’s right the Millennial inheriting the house.”

Millenials are the grandchildren of these people, not children. So the benefits, if any, goes to previous generation, not millenials.

Also saying 2% annual increases “stop the huge disrepancy” is laughable when prices (and therefore taxes for new buyers) raise 15 to 25% annually.

Basically it guarantees tax free housing for those who bought in 70s, the old people, while dumping the burden of paying taxes to millenials. You know, _someone_ has to pay them taxes.

“while dumping the burden of paying taxes to millenials.”

So… a millennial paying 1% has a burden, but a millennial paying 2-3% does not have a burden, as long as everyone is suffering equally.

After 3 years on this site, the many agonizing sleepless nights, probably 100s of open houses, getting outbid by cash buyers, was offered some ok places in late 2015, passing on housing in q4 of 2015 because I thought it was the top, regretting it…I am in escrow on a house in Los Angeles. Had I bought in 2015 I would be sitting on 150k of equity or more. Got scared because of rising interest rates and outbid everyone else on a home in a blue chip neighborhood…wondering if I am making a big mistake, sort of feels like 2006. Hate renting, and my payment will be about 1200 a month more than my rental. Still feel like this is not a great time to get into the market….

I would never endorse buying over rental parity.

When you say $1200 over your current rent, are you comparing apples to apples? Or are you buying a 4 BR house with a yard and it will cost you $1200 more than a 2 BR apartment?

Buying $1200 over a comparable rental would be a mistake.

On the other hand if you are buying at rental parity you are making a good decision. The “Millennial” who post here constantly wouldn’t know rental parity if it smacked him in the freaking head.

Buying at parity (in strictly cash flow sense) is impossible.

You need to put 40-50% down

If you go by this rule, 15year mortgages are stupid.

Rental parity Never was except in 2009-2013 timeframe

As in any investment, you will suffer some “negative†cash flow initially

No way around it

Fear only if you are really stretching your finances or if you have to move/sell (or if your job is unstable

1200 more a month more compared to rental is nothing. It does not include tax deduction and the fact that you are also paying principal. Plus over time rents will catch up

My guess you bought at 850-950k range

Do not worry if you are can/willing to go long term in this neighborhood

OP could have said payment will be $12000 more and Surge would say oh that’s nothing here’s some tax benefit even though he knows nothing of your tax situation.

If this was $12,000 more and all of it was principal (and affordable) – then yes, it would still be Ok. As long as you can maintain monthly payments.

People do take out 10 year mortgages and there is no way there is rental parity there.

And about tax situation, don’t be stupid. If you take out mortgage you have a taxable income and write-off. Different rates of course, but write off is there and likely in 25% range total.

Please do not be stupid and provide hypothetical alternate situations – they do exist but so rare they are irrelevant.

Please be a little more intelligent than this.

Your mortgage payments don’t change but guess what does? Property taxes, insurance, and maintenance costs. At some point they’ll dwarf your mortgage payment because they rise with the local cost of living.

Yes, but it will take 20years for taxes/maint/insurance to exceed mtg.

But yes, makes a bigger case for long term RE ownership

“Your mortgage payments don’t change but guess what does? Property taxes, insurance, and maintenance costs. At some point they’ll dwarf your mortgage payment because they rise with the local cost of living.”

You’re not a homeowner, are you? Property tax increases are capped at 2%/year in California. Homeowners insurance is very cheap and doesn’t rise anywhere close to the rate of health or car insurance. Maintenance varies depending on area, climate, square footage, lot size, and quality of big ticket items, but generally goes up with inflation. Averaged out, $2,500/year for a small SFH is typical, which might be something like $3,500/year in 30 years.

If all these items “dwarf” your mortgage at any point in the next 30 years, congratulations, you’ve got a tiny mortgage.

I’ve owned the same house for over 20 years,

My property taxes are 2500/yr, insurance 800/year, and maintenance about 2500 /year. That is about 6K per year or 500 per month.

When the mortgage is paid off, I expect the costs to be about the same.

I can survive for the next 50 years on 500/month even if it goes up with inflation.

My poor neighbor is now paying 3K /month in rent. Rent has been going up faster than inflation.

Yes John, I am a property owner in other states. My parents’ house took about 15 years for the repairs + taxes + insurance + landscaping to overtake the mortgage. Indeed inflation nearly doubled in that time, but it is something to be aware of (most new buyers don’t think about it).

Dan, these guys are full of grade A horse shit. There are tons of beach close so-called desirable areas full of deferred maintenance hovels. I’ve lived amongst them for years. People who can’t afford to move within the same area. Roofs and foundations in huge need of basic repair. Freeloading neighbors who are being subsidized BIG TIME by technocrat newcomers no thanks to the unsustainable prop 13 mess. They buy these shit shacks and have to sink tons of cash into modernizing them if a flipper already hasn’t. Gut rehabs in many cases. Best thing any of these holdouts could do is take the money and run to a more reasonably priced locale lest they want to live out their lives in increasing overcrowdedness and social strife. Nothing says desirable like proximity to homeless people pooping on sidewalks.

If over those 3 years you thought carefully and came to the decision that it was best for you to buy, then don’t lose any sleep over it. The most important thing is that you can make your payment/prop tax/maint and still have enough left over to support yourself, including building a 6-12 month emergency fund in case of financial difficulty.

jt, good point RE the spending bill…however, regardless of military spending/jobs/handouts, the vast majority of households are WAY over burdened with debit. This is a very big difference between Bubble 1 and Bubble 2. Add to that the fact that the average starter home is unattainable price wise (and trashed) and the stagnation of ‘move-up buyers’ one could easily assumethe property ladder is cracking…and we are overdue for a recession..

https://www.zerohedge.com/news/2018-03-23/peter-schiff-theres-big-problem-economy-americans-are-broke

https://www.zerohedge.com/news/2018-03-23/new-home-sales-tumble-3rd-straight-month-worst-streak-4-years

The comparison of GDP to the value of houses is a non sequitar. GDP is a measure of income whilst the value of housing is a measure of wealth.

Exactly. It’s like comparing a balance sheet to an income statement, when in fact the two have absolutely nothing to do with each other. But I hear people confuse the two often, even by supposed “finance” reporters in the MSM. And people wonder why nobody trusts the news anymore…..

Is my math off? We, California, have 12% (40mil/326mil) of the total US population, but our homes are valued at only 8% (2.7tril/31.8tril) of the total US home values? If our real estate is so overvalued, why do these numbers not reflect that? My only guess is that the number of homes we have per person is a lot less than other states.

$2.7 trillion is JUST LA area not the entire state. Now do you see how crazy this market is?

The 2.7 trillion is only for the Los Angeles (area I assume) which has about 5% of the US population, depending on how exactly you draw the boundaries. Even with that the ratio is a little less skewed than I would expect as well.

Based on this article, Chinese money play a large role in CA prime areas. With the new trade war and possible hot war around Taiwan and China Sea, how is that going to impact SoCal RE prices????…..

With continuing interest increases (3 this year), how is that going to impact RE prices?

With QT in full swing, how is that going to impact RE prices?

With a softening stock market and venture capital market (more risk adverse investors) what is the impact on RE prices going to be?

Lots of questions and I don’t claim I can assess the full impact of all of them combined. I just pose them as food for thought.

Interesting question, nobody knows for sure

Intuitively, trade wars create instability and US real estate has been a great hedge for overseas money. Of course, capital controls might tighten on both sides. We will see

Read my posts for the past few years and it’s on track. Housing NEVER went down as I predicted. And I am very certain SoCal will ever be below the lofty levels we see today. In 10 years expect them to be 50-100% higher than today in prime areas. The growth will slow but the lack of inventory and number of buyers grows by the day. But waiting for a price drop to buy is a fools gamble.

I’m not a realtor, but I know better than to listen to the foolish advice of Jim Taylor. He is a permabear or likely a slumlord looking for lower prices.

The facts are simple, no inventory, no plans to build. Wealthy buyers, foreign investment, multi family, and stable economic growth.

Nothing short of a war and a global crisis will be able to move the SoCal market down in the future. In which case you will just be happy to be safe.

The hard part now is catching up with all of the wealthy people who can buy these homes like candy. If you are not in the top 5% or you don’t earn enough money then walk away with the others leaving. Don’t worry you will be back filled by someone with enough money as there is no shortage of rich people who decided LA is the new place to be. You can thank social media for making SoCal far more glamorous then the movie industry ever could.

This may sound harsh and most people hate to hear the truth. It sucks missing out or being priced out when you had a chance to buy low. But that train has left the station. Question if you can afford a ticket on the current train? Or if you need a bus ride to flyover country.

it’s different this time.

And buy your measure a Frisco home will be $3,000,000 in 10 years? If I thought like you did I would be buying RE as fast as i could.

And this is the 4th “bubble” I’ve seen in socal RE and during that time all the same arguments were made at every bubble peak.

I used to go hang out in Venice when I was a teen to watch the freak show. Then I left before dark so I didn’t get stabbed or shot. Now I see 3 million dollar homes everywhere in Venice/Mar Vista with people rolling around in lambos. It’s still full of homeless camps and people living in RVs who dump their waste into the streets. But Snapchat moved in and things went nuts.

Los Angeles has billions of dollars of investments pouring in… I don’t know if we’ll ever be as big as Silicon Valley but Silicon Beach has room to grow.

Maybe it will, maybe it won’t.

But, 20 years ago if someone would have told that condo in Frisco would cost 1.2mil in 2018, most would have thought you were nuts.

In reality, it does not matter how much the housing will be in 20 years. It matters how much it will be in 3-5 years from moment you buy (for downside equity protection).

Your problem is that you are fixated on absolute gains…1.5mil to 3mil OR 1.5mil to 700k. This is a very narrow and short term view for housing. But in the end, no matter how much you sell your home for in X number of years, you will be able only buy similar type of home.

This really limits your thinking and outcome range. I am not saying you should or should not buy, but when you think only in absolute gains, the tendency is to be way more bearish than you need to be.

Surge,

I’m not focusing on any “gain” i’m focusing on the insanity of it all. My problem is I haven’t had a fucking raise in 20 years…..that’s the problem with these prices.

Jim Taylor aka Millennial Jr, has been repeating the same line over and over for the past 7 years and each year he has been deadly wrong. He hasn’t posted on here in a while and I believe if memory serves that he was actually doubting his faith in tanking a little while ago.

Curious if he still believes in the hard tank. If he had bought around the same time he started saying there was going to be tanking he would be up a significant amount and have a huge amount of equity.

Trying to time any market (RE, stocks, etc) is next to impossible. When buying RE, stick to a few simple rules:

1. Buy a place you can comfortably afford.

2. Minimum 20% down.

3. Plan on owning for at least 10 years.

4. Have a nice rainy day, emergency savings fund.

Stick to the simple rules, enjoy your home and tune out the noise.

Precisely. This stuff isn’t rocket science and virtually anybody can do it.

Same with investing in stocks. Don’t try to chase performance or time the market. Keep it simple. Bi-weekly investments into ultra low cost index funds, with dividends re-invested. Set up an automatic investment schedule and forget about it. Then in 30 years you’ll wake up one day with several million dollars.

Yeah it’s so simple there’s this blog. Let me guess you’re only here for the entertainment like Millennial.

It’s mind boggling to me how liberals here hate rich Asians coming to America and buying homes, paying taxes and contributing to society. Yet they have nothing but love for poor Mexicans / Central Americans coming here who pay no taxes (since they work illegally), consume welfare at astoundingly high rates (especially ones with US born kids) and contribute nothing to society.

It’s a weird phenomenon.

“It’s mind boggling to me how liberals here hate rich Asians coming to America and buying homes, paying taxes and contributing to society. Yet they have nothing but love for poor Mexicans / Central Americans…”

No, it’s very simple: Increase in rich people rises the prices for everyone and poor do the reverse.

Of course that’s not the only thing happening but very easy to see it that way. Especially when it fits into ideology.

When giving advice about buying RE, stick to a few simple rules:

1. Use vague subjective parameters that vary wildly depending on the person.

2. Define a minimum DP that’s only reasonable for most people outside of expensive coastal areas while being a promoter of expensive prime areas.

3. Provide a expected ownership timeframe that’s beyond the average.

4. See number one.

The original advice basically minimizes the need for accurate crystal ball.

“1. Use vague subjective parameters that vary wildly depending on the person.

2. Define a minimum DP that’s only reasonable for most people outside of expensive coastal areas while being a promoter of expensive prime areas.

3. Provide a expected ownership timeframe that’s beyond the average.

4. See number one.”

1. They weren’t the least bit vague or subjective, and of course the numbers will vary depending on the person.

2. If you can only afford 20% down in alligator country, that’s the only place you should be buying.

3. An average is just that – an average. Those who sell sooner may be trading up, and if that’s the case, it’s usually because they can afford it. If they don’t plan on staying long-term, what’s the point in buying, other than speculation? If it’s an investment, CA is not currently the best bet.

John D is quite the comedian. Wants us to believe that “afford” and “comfortable” aren’t vague nor subjective! And he proves my first point by dithering on details for points 2 and 3. John D would now like his reach around, Lord Blankmind!

Yep.

Very good advice.

I would also avoid starter home (something you plan to sell in few years to take advantage of appreciation). There might not be too much appreciation left this cycle, but long term this is a best advice

Very true, this is the guide I followed.

Only comment is on #4, what do you consider a sizeable emergency fund? 12 mos reserves? 18? 24?

Dan, I think a minimum 12 month liquid reserve fund is the way to go. Back in the old days 3 to 6 months was normal…way too risky today!

It’s funny seeing some of the responses to my original post. What Millie and others never mention is that they likely won’t have a job, will be scared to death or won’t get financing if the 50-70% doomsday drop comes. Ultra strong hands call the shots in any market. And there are plenty of them out there as stated that 25% of socal RE sales were all cash.

I just bought. I maintain 6 months cash liquid reserve and this does not include severance of few months if I get laid off

I understand for many it is much more difficult and more stretching is required. At some point it wil become too risky and not worth it

My personal take:

6 months of liquid reserves (housing + everything), and not counting severance I would get (few months) if I lose my job. 12 months is a target. But I have family and would like to stay where I am.

I understand this might not be achievable by everyone. So higher risk might be taken if one wishes to buy.

Above all, the key is to be able to CONTINUE to accumulate liquid funds after the purchase (grow emergency fund, etc…). If you are always break-even, you are always at liquidity risk. I think this is the most critical thing.

I would recommend at least 4:1 rule -> For every 4 months of work, you increase your liquid funds pool by 1 month worth of expenses.

Ways to mitigate this:

1) Stick to 1/3 rule mortgage/income rule (the more you earn, the easier it is, since it is easier to maintain cost of comfortable living without overspending)

2) Rent out a room (Lifestyle hit) – but practically passive income.

3) Earn more

2 largest risk to home ownership:

1) Forced to sell (in case of forced move, plan to rent out, even if at cash flow loss)

2) Inability to consistently grow liquid reserves after the purchase (house poor)

Lord,

Here is the thing with Mille; he’s a doomsdayer so even if the unlikely of events happen and properties dropped 50% overnight; he would be on here cheering for 20% more, meanwhile all the cash buyers and house horny organic buyers would be buying hand over fist pushing prices right back up to the cliff from which they fell. Then he would be on here saying; they’ll drop 80% next time and then he’ll buy!

Surge just bought but he’s hanging out at a housing bubble blog trying his damndest to feel good about his decision lol

Yeah, I just want to argue a bit about RE topics (in math) to get it out of my system (since it was a bit difficult decision to reach). Just to hear out what people are saying – listening to noise after the fact. And what are YOU doing here? Want to keep convincing yourself RE will crash?

Lord Blankfein,

“What Millie and others never mention is that they likely won’t have a job, will be scared to death or won’t get financing if the 50-70% doomsday drop comes.â€

That’s my key point!

Here is the difference between the two of us:

Lord B: buy now, buy now. (Pssss I already bought long time ago but I love prop13 and the housing bubble prices as it inflated my book value )

Milli: why should I buy an overpriced crapshack now? I might lose my job and house during the next recession? I rather rent a cheap apartment, save money and buy when prices drop after a crash. Way less stress, way less money and way less property taxes I have to pay.

Dan,

What makes you think I am a doomsdayer?

2017 was an incredible year in terms of investing. If we will have anything like this in 2018…boy that be sweet.

Yes, I expect a crash in RE. But that’s not a doomsday. That’s like Christmas and birthday together. Crashes in stocks, crypto and RE are healthy. That’s when you buy back in. If you are young and sit on cash.

How can a crash be a bad thing for someone who is desperate to invest his cash in?

A crash is only bad for someone who bought high and struggles already making ends meet. And for realtards. They make more commission if the house value is highly inflated.

That’s why you have so many realtards here on this blog along with people who just bought. Somehow they need to tell themselves it was okay to buy high otherwise they lose their sleep (mind).

Thro Gir,

So what? I bought recently approximately 6 to 7 months ago and I hang out on this site so what’s your point?

Millennial,

This line shows me you really don’t know the real market, “realtards push values to make more commission”. Actually it is a seller that determines the final sale price the realtor only makes recommendations and actually the opposite is true because the realtor wants to move the property as fast as possible the longer property sits on the market the more stale it becomes and the less likely it sells so if you haven’t unrealistically High listing price it will fit which means no sale and no Commission.

Therefor a realtor always wants to list or Price the property competitively so that it moves quickly so what if it’s one to 2% below the high price you think they’re trying to list it for if the difference is it goes into Escrow in 2 days versus sitting 2 months. The commission on an $800,000 listing going into Escrow in 2 days is superior to the commission on an $825,000 listing that sits and sits and sits. Got it?

Dan, i totally agree with everything you said.

The only thing I would add is that the realtard pushes a price based on a comparable sale. In your example the realtard will go with the 800k sales prices to sell it quicker. In my world, I am telling the realtard that 800k is way overpriced. I would pay 400k and will pay 400k during the next crash.

Just because a sucker bought high next door does not mean I have to do the same. We are light years away from rental parity as you and surge prov over and over again.

So, that’s what I meant. Will it sell for 800k eventually? Sure? As you can see on this blog there are many dumb people. The bubble goes on until the last sucker bought.

Dan, I agree with you on the comment on RE agents selling price and commission. I talked with countless RE agents and all think the same. Who cares about the commission on the additional $25,000 when you risk to lose the commission on $800k?!!!…If the property doesn’t sell fast, s/he risk loosing the listing to another agent who is more aggressive.

On top of that, appraising is not an exact science. 3 different appraisers will come up with 3 different values (close but different). In a smaller town, the values oscillate even more, especially for unique higher value homes. In the end, the true market value is the meeting of the minds between buyer and seller. It is also true, that this “value” is also heavily influenced by the FED and government but the RE agents have almost zero influence on prices. People who say that, never worked in RE or never had someone close to them working in RE.

You buy a house when 1) You’re ready to put down roots (hard to do in today’s job market and 2) You can afford it. 1/3 income rule. Yes, that was a rule for 100 years before baby boomers Jazzercised their way into the housing market. Subsequent generations have followed suit.

Even a heart surgeon would be priced out of some of these neighborhoods.

We’ve had asset price inflation and there will be a correction. The median income in LA county is $55,000. Let’s say it’s double that. You still have problems.

When even a quarter point Fed increase crashes new mortgage applications, you know the extent of the madness.